Technology is the number one external force impacting today’s insurance market. Technologies such as agency management, social media, digital platforms, telematics, and analytics are redefining our market, impacting marketing, distribution, customer service, pricing, and the purchasing of insurance. Insurance Agency Network is bringing a “new” technology platform to our associates and prospects directly or as a service to their agency.

For Independent Agents to survive, they must meet carriers,’ customers,’ and prospects’ expectations and still carve out a window of opportunity. Technology is the tool that will enable them to carve out this opportunity and succeed. Transform and implement today to ensure a more competitive and successful tomorrow.

Vertafore

For over 50 years, Vertafore, the leader in modern insurance technology, has built and delivered best-in-class InsurTech solutions to connect every point of the insurance distribution channel.

Vertafore's ecosystem of agency solutions is designed to power your possible while giving you the flexibility to build the tech stack that's right for your goals and needs. Your goals, your focus, and your clients are unique to your independent insurance agency. Vertafore designs solutions for the way YOU work and empower you to build the tech stack that supports your needs in the four areas of modernization that have been proven to support growth:

• Managing your agency

• Engaging with your clients

• Real-time connectivity with your carriers

• Leveraging data for agency growth and better client service

Brings solutions, partners, and teams together into one integrated platform that connects your entire business. Guided by two core pillars, representing front-end and back-end work, the platform is coming to life.

Bringing solutions closer together to simplify, automate, and improve the user experience.

Intuitive design - Love the software you are in every day. Easy-to-use technology that simplifies everyday tasks so you can focus on what matters to you.

• Inclusive design built for everyone.

• Technology that is easy to learn, navigate, and use.

• Consistent platform experience means you only learn it once.

Connected workflows - No matter what you are doing new business, service requests, renewal processing streamline steps from start to finish across all your products.

• Simplify client handoffs through the policy lifecycle.

• Eliminate duplicate entry with automatic data flow.

• Save time on daily tasks thanks to increased automation.

A 360-degree view - Empowering you to level up and own every client experience and relationship.

• Find what you need fast with advanced search.

• Easily manage clients and surface opportunities with one, comprehensive client view.

• Personalized home experience so you see what matters to you.

Investing and build upon a cutting-edge infrastructure tailored to meet the evolving needs of your agency.

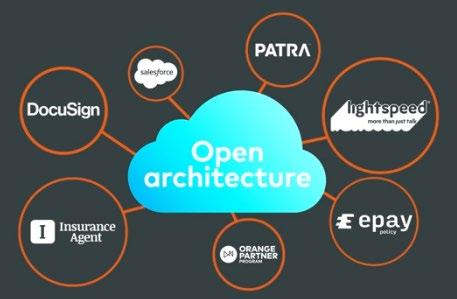

Open architecture - Connect the products you need and want. Easily integrate your favorite solutions and extend the value of your technology.

• Thousands of APIs, centralized in one place.

• Pre-built connectors support your business needs.

• Expansive Orange Partner Program helps you find and connect core technology together.

Unified data - Do more with your data. Always have a pulse on your team, your clients, and your business. Anchor around the data that’s going to move your business forward.

• Make the right move by increasing data availability and accessibility.

• Eliminate data silos and deliver actionable insights.

• Create a data-driven strategy that enables growth and efficiency.

Modern cloud infrastructure - Partnered with the number one cloud provider, Amazon Web Services, for trusted performance, scalability, and security.

• Enhanced data protection and security.

• Innovate faster and deliver more value to your clients.

• Transform the experience for your clients and your team.

Sales - AgencyOne connects sales teams and powers faster revenue growth.

Service - AgencyOne connects service teams and improves both experience and efficiency.

Accounting - AgencyOne connects accounting teams and simplifies financials.

Operations - AgencyOne connects operations teams including admin & IT to help you scale faster.

Leadership - AgencyOne connects leadership, so they always know the next right move.

How will Vertafore transform your business?

Explore Vertafore's ecosystem of agency solutions designed to power your possible.

QQCatalyst™ is an agency management system that provides operational, marketing, and sales pipeline management tools. It enables agencies to strengthen client relationships and ensure effective business management, so they can focus on growing their book of business Simple set-up -Some agencies need a management system that is ready to install and ready to use. That's QQCatalyst®.

• Simple set-up - Some agencies need a management system that is ready to install and ready to use. That's QQCatalyst®.

• Built with the small agency in mind - A sales-focused agency management system that covers the entire client lifecycle.

• Fast and easy - Built for independent agencies needing operational, marketing, and sales pipeline management tools all in one.

• Robust client and policy management- Easy to use and still mighty.

Features you need

• Grow your sales pipeline: With Salesroom, you can identify new business, round out your current accounts, and strategically manage prospect sales cycles with the fully integrated sales pipeline manager.

• Find new business with easy email marketing: Agency Intelligence lets you create email marketing campaigns to better service your existing customers, cross-sell, or acquire new customers.

• Monitor employee productivity to increase efficiency: Employee Productivity allows agencies to track the activities of their employees when using the system, so they can recognize leaders and get insight on how to improve productivity for all staff.

• Provide exceptional customer service and easily manage policies: Policy Management allows you to give both existing and prospective customers a comprehensive summary of all their current and future insurance policies.

• Manage your staff with increased visibility of their status: Employee Time Clock allows agency administrators to track the clock-in/clock-out activity of their employees and indicate which clock-out reasons are payable.

AMS360™ is an agency management system that provides the foundation for independent agencies to grow their businesses and boost their profitability. It helps streamline workflows, improve renewals and retention, and drive new business, resulting in improved employee productivity and superior customer experience.

Agencies using AMS360 have seen up to 26% revenue growth without adding employees

• Send the right communications at the right time: Vertafore Client Communications brings robust integrated emails, campaign, and reputation management in an easy-to-use tool.

• Service and deliver information on-the-go: With AMS360 Mobile you can securely access client information and manage your customer’s accounts from your mobile device.

• Increase employee efficiency: With My Agency Home you can service customers faster with guided workflows and a dashboard that adapts to your agency’s processes.

• Make data-driven decisions to grow your book: My Agency Reports provides visibility into your data, with the ability to drill into details, so you can make data-driven decisions.

• Consolidate carrier documents and messages: Receive eDocs and messaging through TransactNOW with real-time transaction workflows and instant sign-on to carrier websites.

• Eliminate sign-on issues: Securely access all your Vertafore solutions with Vertafore Single Sign On, so you do not have to remember multiple logins.

• Reconcile commission and policy detail: Save time updating policy data, status information, and direct bill commission statements with Carrier Downloads

Core integrations

• AMS360 Messenger: Easily text customers via an AMS360 integrated texting platform.

• PL Rating: Offer multiple competitive quotes in less time than it takes to get one from a carrier website with the leading independent agency comparative rater.

o PL Rating Add-ons: Consumer Rate Quotes, Incident Prefill, Vehicle & Driver Prefill, CoreLogic MSB Home Estimator.

• DocuSign: Earn revenue faster while giving clients the convenience they expect when it comes to eSignatures.

• ReferenceConnect: Diversify your book of business, enhance customer experience, and garner the trust of prospects with information from over 40 trusted insurance sources.

• InsurLink: Provides clients with self-service digital access, 24/7, to the information they need the most.

PL Rating™ is the independent channel’s leading comparative rating solution that enables agencies to offer multiple competitive personal lines quotes from insurers in real time. Over 300 carriers and 10,000 agents rate through PL Rating, closing more business in less time

Features you need

• Multiple quoting capabilities - Easily price a combined auto and home quote, while reflecting multiline discounts from your carriers in real-time. Quoting capabilities include Automobile, Homeowners, Package, Renters and Condos, and (in California) Motorcycle and Dwelling Fire.

• Real-time carrier connection - Streamline your quoting process: with direct access to over 300 carriers, you only need to enter customer information once. Bridge to your carrier partners easily through PL Rating to be able to write more business quickly.

• Management system integration - Save time and increase accuracy by integrating seamlessly with AMS360, Sagitta, QQCatalyst, or your agency management system of choice. Have your customers’ information at your fingertips and provide fast, effective service.

• Flood cross-sell opportunities - Generate an additional revenue stream with zero extra work through flood insurance quotes listed alongside package or homeowners rates through our partnerships with the National Flood Services (NFS), Selective Flood, and Aon Edge Private Flood Insurance.

• Consumer Rate Quotes (CRQ) - CRQ allows you to provide multiple carrier quoting directly on your website and social media. Potential clients can submit their information for quotes, which is captured as a lead for your agency even if the prospect doesn’t complete their request

• Solutions at Quote (SAQ) - Easily validate driver and vehicle information based on address data from LexisNexis’s public database.

• Violation Prefill - Auto populates customer’s’ driving history (including court-based traffic violation data) while saving time and avoiding MVR chargebacks from carriers. Guide your customer conversations with validated customer driving activity before submitting to your carriers to ensure accurate auto rates at the point of sale.

• CoreLogic (MSB) Prefill

Characteristics - Provide clients with the best homeowners’ policy by validating home details through the CoreLogic Interchange property database as part of the homeowners quote workflow and view replacement cost valuations for properties without leaving PL Rating.

Over 75% of all consumers start their insurance shopping process online. Level the playing field for your agency by adding personal lines quoting capabilities to your website or social media pages. Consumer Rate Quote (CRQ) is a powerful add-on component of PL Rating that allows you to provide multiple carrier quoting directly to consumers. Show your prospects a better way to compare and save on personal lines insurance policies.

• Additional lead generation: Attract clients who prefer to shop for insurance by searching online. Even if a quote isn’t completed, the information is still captured as a lead - instantly notifying your agency for follow-up.

• Streamlined quoting: CRQ allows for coverage limits and deductibles to be bundled into options that are customizable to your agency. Not only does this speed up the quoting process for a consumer but it also allows you to emphasize the types of coverages you want to sell.

• Competitive options for clients: Make the most of your marketing generated leads and show them the value of the independent agency system. CRQ allows you to provide potential clients multiple quotes, increasing your chances to convert new clients into long-term renewal customers.

CRQ provides:

• Flexible user experience: Meet your clients where they are: CRQ works in any browser on mobile phones and tablets, including iOS and Android.

• Agency branding: Get your CRQ portal up, running, and customized in minutes. Simply upload your logo, define your coverage options, and create email notifications.

• Agent notifications: Accelerate the follow-up and sales process by setting up instant alerts to your agency when a prospect has completed a short interview on your site.

• Seamless integration: Eliminate redundant data entry for your staff with full PL Rating integration. CRQ seamlessly transfers all the data entered by prospects in your portal directly into your PL Rating client database.

Integrate Insurance to Value (ITV) prefill with PL Rating, powered by the CoreLogic® - Interchange® property database, delivers automated home characteristic data as part of the homeowners' quote workflow. Built-in home valuation from CoreLogic means replacement cost valuations are easily accessible within PL Rating; there’s no need to reference another tool.

• Seamless workflow: ITV Prefill allows an agency to easily create replacement cost valuations for homeowners’ policies that prefill applicable fields, without leaving PL Rating.

• Employee productivity: This integration eliminates the need for agents to obtain information like square footage, age of home, dwelling coverage amount, and other home characteristics from their clients or other resources. Reducing time to quote allows agents to focus on selling.

• Accurate home quotes: Produce a more accurate homeowner quote, pulled easier and faster from trusted resources. ITV Prefill with PL Rating provides subscribers home characteristic data from the CoreLogic Interchange database integrated with the homeowners quote workflow.

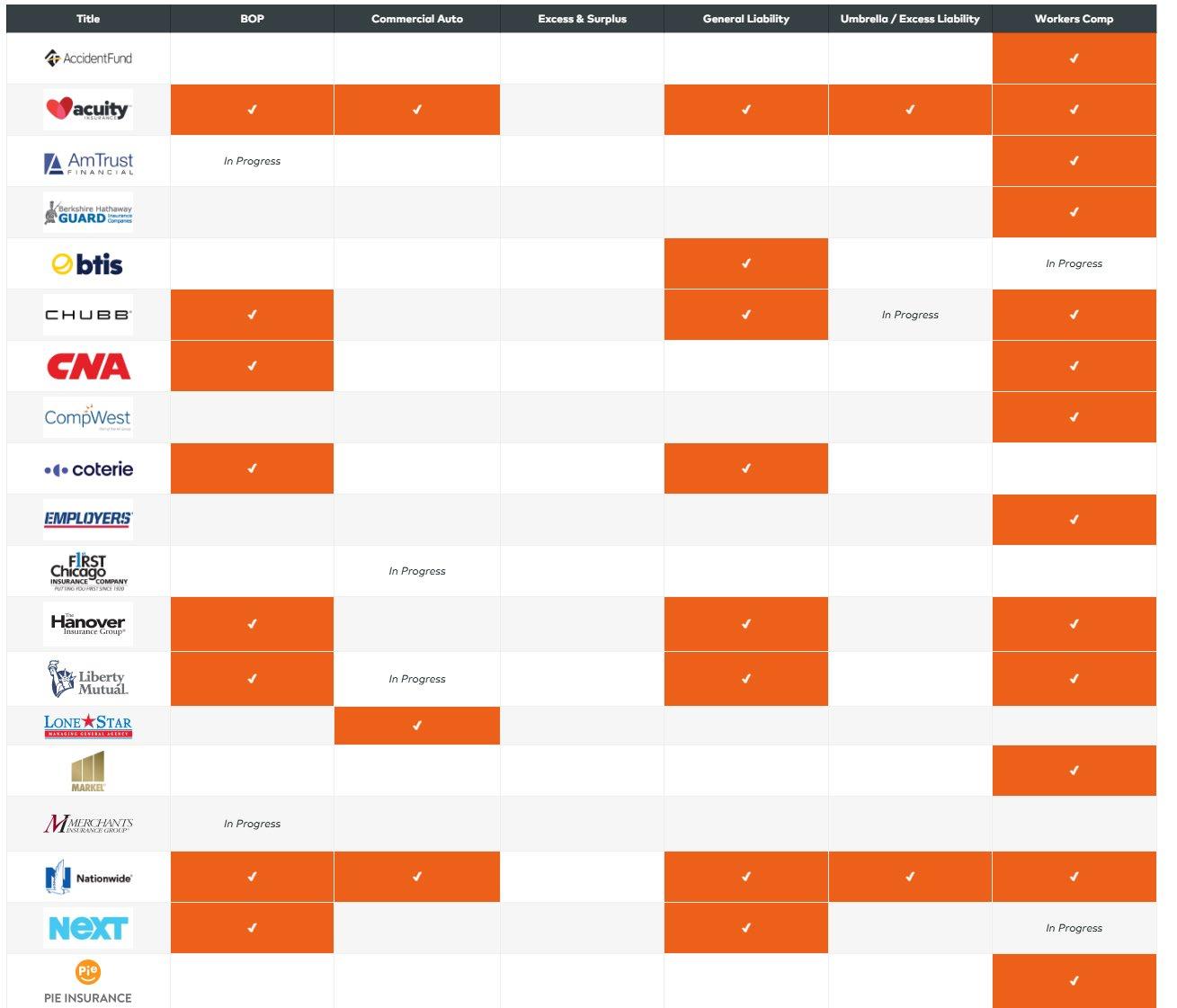

Commercial Submissions™ solution enables agencies to save time and improve profitability on commercial quoting by offering multiple quotes in the time it takes to get one Today, small commercial lines require a significant amount of manual effort for quote requests. Vertafore’s Commercial Submissions turns around business quotes in less than five minutes.

• Simplify quoting. Access 25+ carriers and 5 commercial lines and eliminate duplicate entries with prefill and dynamic questions.

• Reserve your quote in market. Stay ahead of competitors and ensure prospects get the best protection.

• Quote and bind E&S. Place tougher commercial risks with the right Excess & Surplus (E&S) market in just a few clicks.

• Eliminate duplicate entry. Save time during renewals by pre-populating current policy information to quote in a few clicks.

• Let conversations flow. Complete your customer’s quote application quickly and easily with our interviewstyle workflow.

• Say hello to prefill. Third-party data partners can prefill the most updated information in just a click.

• Integrate your tech stack. Easily connect your management system and remove duplicate data entry.

• Get real-time, accurate quotes. Secure integrations with over 25 carriers makes quoting and binding faster than ever.

• Trust your data. Verified third-party data vendors enrich with the highest quality information.

• Real-time quoting - Get instant pricing indications for small commercial lines from leading carriers. Cut the time needed to respond to clients and provide a more comprehensive quoting experience.

• AMS360 & Sagitta Integration - Automatically pre-fill applications with customer data from your management system, saving you time on renewals and new business while improving accuracy.

• Enhanced Appetite Engine - Have clear visibility into carrier appetite with our third-party integration, allowing you to target certain markets for your customers.

• Accurate Risk Classification - Ensure pricing integrity with access to industry data sources NAICS, SIC, ISO and others within Commercial Submissions.

AgencyZoom™ is the industry-leading sales analytics and customer engagement automation solution that meets agencies’ modern needs to grow and service their book of business. Build custom automation, improve customer experience, and close more leads in less time with this simple, intuitive platform. AgencyZoom is equipped with pre-built sales and service pipelines, automation, and dashboards so everything can be customized within a few clicks to match agencies’ unique processes and needs. Built by insurance agents for insurance agents, AgencyZoom provides the tools needed to drive sales growth and client retention.

A modern agency should be obsessed with their customers’ and employees’ experiences. Driving an improved customer experience, automating engagement, increasing retention, and closing leads faster – these are the areas that successful agencies are most focused on. AgencyZoom was built to do exactly this. As a part of Vertafore’s suite of solutions, agencies will benefit from more tools, deeper integrations, and more valuable solutions and services to drive their success.

• A smarter lead manager/CRM - AgencyZoom® is a smart automation solution built expressly for insurance agencies.

• Complete lifecycle automation - Build an automated customer journey from prospecting, to renewals, and beyond.

• Mobile app and pre-built reports - Ease of access to data.

• No more double entry - Integrations with multiple insurtech solutions you use daily to effortlessly sync information.

Features you need

• Lifecycle Automation: Keep customers engaged from day one through renewal with an automated customer journey.

• Lead Automation: Create customized pipelines and sales workflows to track leads and trigger automation as you drag leads down the pipeline.

• Service Center: Manage and track service-related activities with custom workflows to enhance the customer service experience.

• Dashboard and Reports: Manage goals and track productivity to keep your agency and team motivated and performing at their best.

• Google Reviews: Boost your agency’s 5-star ratings after every policy sold.

• Seamless Integrations: Build the ultimate tech stack with solutions you use daily to effortlessly sync information across solutions.

• Video Marketing and Quoting: Record personalized videos for prospecting, quoting, onboarding, and servicing.

• Mobile App: Wherever you are, take your agency on the go.

InsurLink™ agencies can provide their clients with a digital experience through a branded self-service portal. Clients can access information when and where they want, reducing time spent on service calls and improving employee productivity. Customer retention is improved while reducing E&O risk.

Improve clients’ experience and meet their expectations by being faster, more transparent, and more accessible. Free up time by reducing requests so your staff can give advice and round out accounts. Reduce E&O risk using secure communication that leaves a permanent record and cuts the risk of a missed document.

Features you need

A branded website for client access: 24x7 access to your agency so clients can help themselves. Insureds can perform self-service tasks, and securely share files with you when, where, and how it is convenient for them.

• Mobile app: Clients expect mobile access. The InsurLink mobile app gives them the access they expect and provides offline Auto ID cards.

• Time savings: Self-service frees up your staff for higher value client contact, clients can help themselves with:

o Policy information: check limits, premium, or policy terms

o Policy change requests: coverage, changing drivers or vehicles, or coverage limits

o Auto ID cards

o Claims inquiries: status, new, submit information

o Certificate requests: issue or reissue, add a holder

• Logging activity: Keep a record of interactions in your management system, reducing your E&O risk.

• Secure file sharing: Share files from the AMS or WorkSmart, clients also can share documents with you in a secure fashion.

• Real-time updates: Highly integrated with AMS360 and Sagitta, updates are seen immediately rather than loading information into a separate portal.

• Templates: Create unique experiences for specific customers, by CL/PL lines, or other segments.

• Access control for clients: You decide what access your clients get and when they receive it; controlled onboarding for a better experience.

• Cross-sell recommendations: InsurLink utilizes industry leading data to recommend additional coverages relevant to individual clients’ industries, creating a warm lead generating touchpoint with your clients.

Client Communications™, powered by Rocket Referrals. The robust, AMS360 integrated solution that brings email, campaign, and reputation management in an easy-to-manage tool. Send the right communications at the right time to have happier clients and sell more policies. Discover how real-time connectivity and Vertafore Client Communications, powered by Rocket Referrals, brings robust integrated email, campaign, and reputation management in an easy-to-manage tool.

Agencies can quickly build precise segments, add thought leadership content and manage their agency’s reputation to better understand at-risk revenue before they leave. Artificial intelligence ensures the right content is sent to the right person at the right time. Agencies can send emails as needed or use the campaign tool to connect with clients at the cadence they need and track their effectiveness, letting you fine-tune your message content and frequency over time. Investing in reputation management through Vertafore Client Communications means increased customer retention, increased referrals, and stronger connections with clients.

Features you need

• Integration with AMS360: Real-time data synchronization means your information is always current and easy to manage.

• AI-managed communications: Intelligently classifies which communication to send, to whom, and when.

• Net Promoter Score (NPS): Discover your happy clients and who is likely to leave so you can reach out before it hurts your business.

• One-time communications: Selective segmentation allows you to send timely intermittent communications to the right people.

• Email templates: Save time drafting and designing emails through pre-authorized templates while maintaining a consistent brand standard.

• Review integration: Improve your online reputation through collected reviews from Facebook and Google so people will read, trust, and act on them.

• Training Center: Elegantly walks you through key workflows so you can spend less time learning, and more time connecting with your clients.

• Add-ons: Other features include Journeys automation, websites, web chat, ImageRight integration, API access, advanced NPS analytics, text messaging, automated review collection, premium support, and handwritten cards.

Industry retention research shows customers who receive two or more proactive contacts from their agency per year are 10% more likely to stick with their current agency. Agents who average two or more contacts per year with their customers are growing 55% more than their counterparts who are not communicating with their customers.

Proposal Builder™ provides an integrated tool to create professional, consistent, and high-quality customerfacing proposals through your Vertafore Agency Management System. This enables your agency to efficiently build business winning documents to grow your book of business, retain existing customers, and deliver a better customer experience.

Why proposal Builder?

Stand out - Deliver polished proposals customized with your agency’s branding.

Save time - Use data from your management system to save time and reduce errors.

Increase efficiency - Reuse sections and saved templates to increase productivity.

Integrate - Sync in real time with AMS360 and Sagitta to pre-fill policy information.

Work smarter - Enjoy our intuitive digital experience, time-saving tools, and pre-designed templates to do more work in less time.

Benefits:

• Easily build polished and consistent proposals: With an easy-to-use interface, deliver proposals with custom fonts, colors, tables, and images that fit your agency’s brand and help you stand out

• Service customers quickly to provide an exceptional experience: Pull dynamic data directly from your management system to significantly reduce errors and save time manually entering data

• Increase employee efficiency with templates: Help staff increase efficiency and consistency with reusable sections and saved and default templates

Features you need:

• Brand styles: Pull dynamic data directly from your management system to significantly reduce errors and save time manually entering data

o Brand styles based on lines of business, locations and divisions

o Configure your font, agency colors, and table formatting

o Choose a fast and easy Simple Cover Page or robust Custom Cover Page

• Reusable Sections: Create and manage a library of sections to build standardized blocks of content for consistent proposals

o Pull specific policy information directly from your Agency Management System

o Decide which sections can be edited or locked

o Supported content includes text, images, PDF’s, and Excel sheets

• Proposal Templates: Build, manage and publish custom proposal templates for your agency

o Create and segment templates based on the category of your choosing

o Utilize default templates created by Vertafore

AMS360 Mobile™ provides an on-demand tool to access information and manage your clients’ accounts from your mobile device. This enables your agency to build client relationships with more effective client meetings, quicker servicing, and enhanced client experiences.

Features you need:

• Deliver information on-the-go: From an intuitive user interface, easily view client information in AMS360 from your smartphone or tablet to answer client questions or review:

Client and contact details

Policy information and declaration page views

Recent claims summaries

Upcoming renewals

Download documents

Notes

Activities and suspenses

• Service customers quickly: With add/edit rights, you can fully service your clients, immediately update your management system, and reduce duplicate data entry:

Client and contact details

Activities and suspenses

Documents

Certificates

Notes

Claims

• Gain insight into your business: Quickly access ReferenceConnect to better manage insurance research from a single view, and quickly review the health of your accounts with client dashboards.

• Take advantage of mobile tools: Save time on the road with GPS mapping, email communications, photo capturing, and voice recognition for creating notes and activities verbally.

• Available for Apple and Android: AMS360 Mobile is compatible with smartphones and tablets, integrates with AMS360, is free to download, and is accessible by users with VSSO credentials

BenefitPoint™ helps you standardize and automate processes and workflows, report and track revenue, and become a trusted advisor to clients and prospects so you can provide an exceptional customer experience and expand your benefits business.

• A specialized management system - BenefitPoint® was created specifically to support agencies and brokers with a large benefits business.

• Above and beyond - Advanced CRM tools help identify new opportunities and up your customer service game.

• Offer more - Offer more competitive packages and become a trusted advisor.

• Revenue tracking - Matches estimated revenue with actual receivables to help you recover anything missing.

• Efficient + accurate - Flexible, built-in workflows keep things moving while reducing the risk for E&O.

• Business intelligence - State-of-the-art reporting helps you analyze, monitor, and strategize.

you need

• Capture lost revenue: With Revenue Tracking & Reconciliation, you can upload carrier statements electronically and your estimated revenue is matched with actual receivables, so you can quickly identify lost revenue.

• Become a trusted advisor to clients: Plan Attribute and Premium Comparison enables you to present prospects with a comparison of attributes and costs from multiple plans, so they are better able to understand their options.

• Make data-driven decisions: Stewardship Reporting gives you a complete view of your business with executive and financial reporting.

• Gain a competitive edge: Real-time Benchmarking enables your producers to show clients where their benefit plans stand in relation to the industry— or other companies within their industry.

• Plansight: The only end-to-end RFP solution on the market that eliminates data entry, enhances data quality, and provides stunning client presentations and seamlessly integrates all your account and plan data. **

• Uncover 2-6% commission revenue

• Transform your data into actionable information with QuickSight

• Largest pool of aggregated benchmarking data on the market

BenefitPoint is the market-leading benefits solution

• More than 70 thousand brokers and independent agents trust their benefit business to BenefitPoint

• 2.4 Million Active Accounts

• 3.25 Million Current Plans

** This integration requires an account with Plansight.

WorkSmart™ helps your team get more done every day, giving you the security and flexibility, you need to serve your entire workforce – from home to office and anywhere in between. The leading enterprise content management solution—designed specifically for insurance professionals. File-based document management and task-based workflows align work with the right person at the right time. Get more done with WorkSmart!

• Modernized interface - Make every employee’s job easier within the easy to use and intuitive WorkSmart® system.

• Reduce clicks and streamline workflows - Best practice workflows and key integrations allow your employees to get more done in less time.

• Available anytime, anywhere - Collaborate on workflows remotely and service customers quickly.

• See where the work is - Understand where your processes work and where the bottlenecks are.

• Protected and secure - Relax knowing your data is secure and your software is updated.

WorkSmart benefits

Available anytime, anywhere

• Collaborate on workflows remotely - from home, the office, or in the field

• Service customers quickly with policy and claim information at your fingertips

Reduce clicks and streamline workflows

• Modern, user-friendly interface

• Integrate directly with AMS360, Sagitta and BenefitPoint

• Advanced automated workflows

Built for insurance professionals, by insurance professionals

• File-centric document management

• Big “i” best-practice workflows built in

• Insurance focused roadmap

• Easily navigated, real-time tracking, and streamlined workflows

Protection that follows content anywhere

• Vertafore Single Sign-on (VSSO) – one password across all Vertafore products

• PingIdentity® Multi-Factor Authentication (MFA) – strong user authentication

• Centralized console and streamlined deployment

• Advanced permission controls

• Robust APIs so you can integrate additional business critical tools

• Automatic version upgrades and enhancements keep you current, compliant, and secure

WorkSmart gives agencies a comprehensive view of their workflows

ReferenceConnect® is the industry’s most extensive and comprehensive insurance knowledgebase that is designed to help agencies grow their business by aggregating insurance policy coverage and risk profile information into one easy-to-access location, making you an agent of choice and a trusted advisor to your clients. ReferenceConnect centralizes information from over 40 publications, provides tools to mitigate E&O exposures, streamlines access to carrier information, helps reduce operational costs, and more.

Key benefits

• Mitigate your E&O - Ensure staff can classify and price risks correctly with the recommended appropriate coverage.

• Boost your revenue - See up to 1% increased revenue and cut down operational costs by centralizing all the information you need in an easy-to-access location.

• Stay connected with carriers - Access proprietary content from carrier partners also using ReferenceConnect.

• Accelerate submissions - Enable staff with the information needed to create an accurate and complete submission every time.

• Improve renewals and retention - Accelerate submissions while ensuring risks are covered, thanks to coverage checklists.

• Find information with ease - Access aggregated policy coverage and risk information from 40+ industry publishers all in one place.

• Easy access to the information you need to stay in-the-know - Agency Module comprises publications from over 40 top insurance publishers including ISO, NCCI, IRMI, National Underwriter, and many more, helping you quickly find the answers to business-critical questions. To see which publishers you can gain access to, review our Publications Guide.

• Standardize your training - Reduce the time it takes to ramp up new producers through extensive Risk Profiles and coverage check- lists, allowing your current workforce to focus on making money for the business.

• Identify new opportunities - Provide your producers the ability to research new market opportunities and identify prospects within your region using ReferenceConnect’s Market Lookup Tools.

• Connect with your carriers - Agent Access connects you to your carriers who also use ReferenceConnect, eliminating the need to navigate and login to multiple carrier websites.

• Available anytime, anywhere - Access ReferenceConnect on mobile devices, including smartphones and tablets.

60% reduction in time needed for an internal document search during commercial quoting.

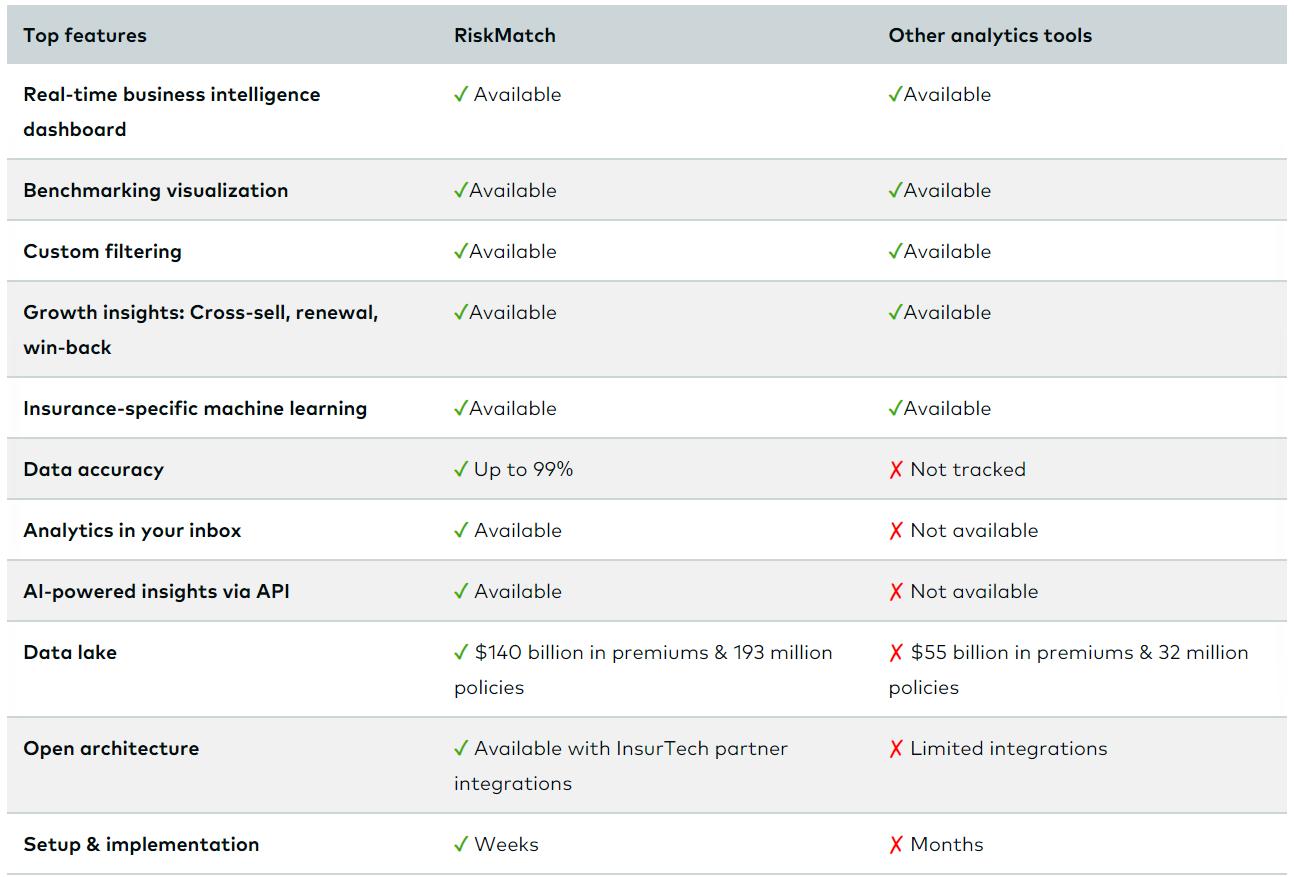

RiskMatch™ is an AI-powered insurance intelligence solution that provides you with the data-driven insights you need to grow your business and stay competitive in an increasingly complex industry. RiskMatch provides tools and resources to expand relationships with insurers, accelerate solution development capabilities, and drive efficiency in insurance placement transactions.

• Trust your data - Through our data cleansing and normalizing process, your data can be up to 99% more accurate than it is today

• Get a 360 view of your agency - Make more strategic decisions based on a complete view. Many RiskMatch agencies have seen up to a 7% increase in their retention rate using features like the Risk Profile Report.

• Turn data into action - Data shouldn't just sit in your system. Make it actionable with features like the Cross-Sell Report and Growth Insights. Using these features, agencies have strategically increased their cross-sell and upsell efforts.

API's - Deliver data from many of these features, such as Cross-Sell, Growth Insights, Revenue Drivers and more, to your desired destination.

Revenue drivers - Explore what’s influencing your revenue streams and develop a business strategy for growth.

Analytics in your inbox - Get actionable insights delivered directly to your email

Cross-sell - Identify coverage gaps and cross-sell opportunities, helping you increase revenue.

Retention prediction - Utilize machine learning to view at-risk renewals and compare your turnover to the market to influence your retention strategy.

Benchmarking report - Create compelling proposals for customers that compare average coverage pricing, limits, markets, and more to demonstrate your value as a trusted advisor.

Potential enhanced revenue - Gain customized insight into your current commission rates for upcoming renewals compared to market averages to identify potential uplift.

Risk profile report - Generate a preformatted, interactive proposal for clients to see coverages they should be considering based on what similar customers have bought and demonstrate your value as a trusted advisor.

Market relationships - Discover which markets have lower shares in your business to drive consolidation decisions and optimize carrier and intermediary relationships.

Growth Insights - Identify competitive advantages and pockets of opportunity based on industry, state, and product combinations to create cross-sell and upsell campaigns

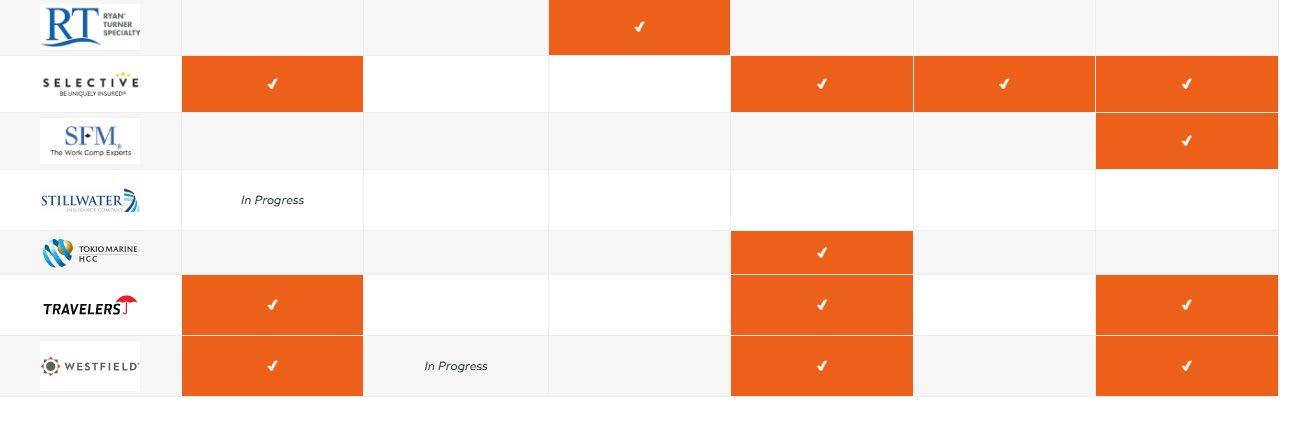

Insurance Agency Network (IAN) has relationships/partnerships with InsurTech Vendors to provide Associates “state of the art” technology solutions and services, at reduced/discounted costs enabling them to build new business models, processes, and systems that ensure longevity in today’s digital world. IAN and Vertafore™ partner with great organizations that leverage open platforms and APIs to create integrations that provide best-in-class solutions to expand and complete the Agency Tech Stack like:

Ivans® is an easier way to connect to your carrier partners. Ivans is the industry’s superhighway, connecting more than 34,000 agents to 450 (and counting) carriers and MGAs to make market access and servicing your customers easy. The best part is Ivans solutions are free to agents just like you.

Forge™ website platform is flexible enough to meet your agency’s unique goals and vision while looking amazing. Forge lets you tell your agency’s story, leverage lead generation, integrate with real-time analytics, and engage and educate with built-in tools. Build and grow your online presence with easy-to-navigate websites.

Docusign® securely sends and signs policy or claims agreements while maintaining a detailed audit trail. Reach policyholders faster with SMS notifications and simplify claims submissions with drawing capabilities. Enhance agent productivity with faster document turn-around time and easy visibility into signing status and Book new business faster.

formstack® Sign is a digital document signing app that lets you eSign documents on any device, so signing documents does not have to be a hassle. An electronic signature (or eSignature) is simply a digitally captured signature. Streamline your document signing process with Formstack Sign. Collect secure, legally-binding eSignatures from anywhere, on any device.

ClientCircle™ helps you create and manage every step of your relationships for a flawless experience for everyone your employees included. Turn prospects into happy customers, and happy customers into promoters. You no longer need to worry about missing a step and you’ll be able to accomplish so much more with fewer resources.

Insurance Agent App® has unmatched features, functionality, value and empowers your clients to handle low-value service needs, building trust through self-service. For enterprise-level features, functionality, and value, there’s no comparison! Your client list is worth a lot of $$$, which is why IA App will never reserve the right to sell your clients’ data.

InsuredMine™ elevates your insurance experience with advanced CRM technology where client information meets automation excellence and innovation never takes a break. A go-to platform for insurance agencies, offering easy-to-use solutions to manage your insurance needs now and in the future. All in one integrated CRM to optimize and grow your agency.

Levitate® integrates with your existing AMS to streamline your marketing efforts. Become a 5-star agency with timely, personal-feeling content for all types of insurance, easy Google Review generation, and your own dedicated Success Specialist. AI innovation with the authenticity of human touch? Nothing artificial here.

Pathway® helps insurance agencies streamline client communication, marketing automation, and workflow management operations. Features include prospect nurturing, document management, quote follow-ups, claims notifications, reviews tracking, insurance policy management, reporting, and facilitates integration with most management systems.

Lightspeed Connect® is more than just VOIP. It goes above and beyond a conventional phone system. The reliable user-friendly system makes staying connected easy to improve client experience, elevate business’s performance, and connect their staff with a fully supported, easy to use, customizable client communications platform.

Bridge™ is a complete communication suite for insurance agents that combines CRM, eSignature, text messaging, live website chat, web forms, automated marketing, advanced VoIP phone system and many other tools. Bridge combines them and lets agents easily document everything in their management system for E&O compliance.

Canopy Connect® is an insurance data intake platform makes it easy for clients to share their insurance information and allows agents to view verified coverages, premiums, limits, deductibles, dec pages and more You provide faster, more accurate quotes that win, so you can spend more time building rapport and guiding them through the coverages they need. epaypolicy® starts with the customizable payment page, branded to your business. Your customers will love the convenience of online credit card and ACH payments, but the benefits don’t stop there. Say goodbye to paper checks and hello to an insurance-centric solution both your clients and your team will love.

Angela Adams Consulting™ is the premier resource for independent agencies providing Trusted Customized Solutions, Real-World Approach, utilizing a strategic and practical approach, to achieve real results that increase productivity at every level. Whether it is short term assistance or a long-term partner – Angela Adams Consulting is the best solution!

Lead Generation

Archway® Computer is a premier IT support company that specializes in providing cutting-edge technology services for independent insurance agencies of all shapes and sizes. Their proactive strategy is designed to preemptively address IT issues before they have a chance to adversely affect your agency.

Capital Premium Financing™ provides financing for insurance premiums paid by commercial enterprises. CPF has an excellent reputation for service, product innovation and is recognized as a leader in service and trusted partner in the premium finance loan industry and complies with all laws, regulations, and contractual obligations pertaining to their company.

FIRST offers features and services that make them different. At first look, premium finance companies may all seem alike. But, beyond competitive rates and terms, Industry-leading paperless process that’s easy for you and your insureds. JUST ASK! policy with flexibility to create custom solutions for your clients. Value-added features to increase your competitive edge. IPFS® helps you generate revenue, automate processes, and provide great service to your insureds. A one-stop source for premium financing paired with easy-to-use, time-saving solutions for insureds. Solutions help agents and insurance providers offer customers improved cash flow and a streamlined payment process - all in One Platform.

Cover Desk® is focused on a single goal: helping independent insurance agencies grow, thrive, and innovate in the fast-paced world of the 21st century. They understand the unique challenges you face in balancing day-to-day operations with the demands of delivering exceptional client experiences and driving growth.

leO™ equips sales professionals, agents, and brokers with the tools they need. Their "Personal AI Sales Assistant" seamlessly interfaces with agency management systems and third-party data sources to give insurance agents easy access to information about existing and potential customers and business opportunities, facilitating the insurance policy sales process.

Let’s discuss what’s possible.