Dear Agents,

Insurance Agency Network realizes embracing “technology solutions” can be a big move. Technology should be a great liberator. Freeing your organization to push the limits of productivity and innovation. Empowering your people to work anywhere and at any time. Every minute spent managing your technology is time spent away from your customers and growing your business.

Independent Agents and their staff must prepare for, embrace, and implement the technology of today which embodies simplified processes and procedures for working with insurance carriers, customers and prospects that gets agents and staff out of the business of processing data and answering irrelevant unnecessary questions is now required and necessary. These processes and procedures will enable agents and their staff to work on their business instead of constantly working in their business.

Insurance Agency Network sees tremendous opportunity in the Independent Agency –Company distribution partnership and realizes that the opportunities to be different and succeed have never been greater. Customers and prospects demand instant service and staff require flexibility. You must embrace technology to build new business models, processes, and systems that ensure longevity in today’s digital world. Only those agents who are willing to change and adapt to the new client demographics and consumer buying habits will survive in the new insurance paradigm.

For Independent Agents to survive, they must meet carriers,’ customers,’ and prospects’ expectations and still carve out a window of opportunity. Technology is the tool that will enable them to carve out this opportunity and succeed. Transform today to ensure a more competitive and successful tomorrow.

Sincerely,

Michael F Haller, CIC Chief Administration Officer

AIDCO Hall

of Fame Member

The Digital Path Forward

Digital Transformation

The New Customer

The Future Agency

Technology Solutions

Technology Solutions for Independence

Technology Partners

Logos and Branding

Domains and Hosting

E-Mail and Hosting

Websites and Marketing

Agency Management System (AMS)

Comparative Rating

Personal Lines

Commercial Lines

Digital Solutions

eSignature

Customer Relationship Management (CRM)

Business Phone Solutions

Agency Operations

Back Office Support

Premium Financing

Mergers & Acquisitions

Lead Generation

Business Consultants

Cyber Security

Email Encryption

Endpoint Protection

Customers demand instant service. Staff require flexibility. Embrace technology to build new business models, processes, and systems that ensure longevity in today’s digital world. Digitally transform your agency to enhance customer experience, increase employee retention, and drive more efficient operations and profitability. Transform today to ensure a more competitive tomorrow.

Sixty percent - higher profits for prioritizing customer experience

Source: Salesforce

37% - increase in employee morale.

Source: Altimeter Report

144% - increase in revenue per employee.

Source: Applied Digital Agency Survey

You need to

1. Begin the journey with the end in mind - First determine the ideal end state and create a game plan to achieve goals. Consider the end state, consider customer behaviors and expectations and potential business opportunities to be met and achieved. Set the stage for success by clearly communicating the upcoming changes to your organization, stating the benefits to be gained so that everyone is aligned in a single direction.

2. Adopt digital technologies - Once you have set your end goal, begin to identify the areas of deficiency in the agency’s current technology strategy. Rethink how the business leverages its IT investment, weaving digital technology into the fabric of daily operations to become a digital age. Keeping customer experience top of mind throughout this stage will make sure you futureproof your agency for success in the years to come.

3. Drive the digital mindset - With technology selected, leverage your strategic technology partners to support this change and begin the transformation process by helping key stakeholders understand the digital landscape. Gain internal support to champion this new digital-first mindset, as well as schedule milestones and develop a timeline to review progress. Continue to educate your entire organization on how the change will benefit them and improve business efficiency.

4. Take advantage of existing and new data - Ensure that your technology partners provide the tools needed to capture and translate data into your new systems. Focus on existing and newly captured data and set data standards for your new systems to ensure accurate client management and reporting. Define key performance indicators (KPIs) early in the process so that your business can easily track against business goals and begin to predict customer requirements.

5. Attract and retain digital talent - Establishing the right digital mindset with your current employees supports retention and makes your organization more attractive for potential recruits. Create a clear vision of what a truly digital agency is and develop a hiring strategy that delivers a competitive edge to recruit and hire talent. Meet internally to plan and determine the right fit that will carry your digital transformation forward. Keep everyone engaged with continuous dialogue and feedback.

6. Evolve operations and processes - As you become a digital agency, embrace a paperless operational model, and standardize workflows around new digital technology. Design, develop, deploy, manage, and continually evolve processes to take advantage of all your digital technology capabilities and gain the greatest return on investment. By reducing time previously spent on manual work, you can focus more time on sales to build a sustainable competitive advantage with efficient processes.

7. Innovate products and services - Leverage your new digital technology to make your agency standout by creating new customer service and business models. Utilize new channels and technologies to open alternate opportunities to deliver new products and services. Continuously build on the momentum of your digital transformation to deliver an innovative value proposition and differentiate your business.

Website Optimization

Social Media

Lead Generation

Post Sales Service

Support & Service

Increased Retention Reviews & Referrals

Digital Presence

Managed Services

Network Support

Performance Tracking

Outsourcing

Insurance Agency Network brings agents, technology solutions, and companies together to adopt common approaches to e-commerce strategies and to agent-company work processes that will take better care of their customers and enable them to survive, thrive, prosper, and succeed today and tomorrow. We know if we take better care of our customers, we will survive, thrive, and prosper. Technology empowers our ability to do this and helps reinvent the local Independent Agency. Empower your staff to do their jobs and grow the business by giving them the right technology and tools.

IAN partners with great organizations for Technology Solutions like:

IAN has partnerships with over 75 InsurTech Vendors to provide Associates “state of the art” technology solutions and services, at reduced costs enabling them to build new business models, processes, and systems that ensure longevity in today’s digital world.

It all starts with a Logo & Branding

Because it grabs attention, makes a strong first impression, is the foundation of your brand identity, is memorable, separates you from competition, fosters brand loyalty, and is expected by your audience. You have about eight seconds to engage consumers’ attention, so your logo has to do a lot of work to do in a short amount of time. Your insurance agency logo provides you one shot at making a strong first impression, as you will not get a second chance. You want that first impression to pique consumers’ interest and entice them to learn more. An agency logo is how you introduce your brand to a new audience. Having a logo is an integral part of making your brand a successful one – right up there with having high-quality products and positive referrals.

Let’s take a deeper look at all these points below.

1. It Grabs Attention - Attention spans are short these days – especially consumers. Companies do have much time to convince potential customers that their products are worth any consideration. That short attention span – you know, the one that causes consumers to judge your business by its appearance –can work to your advantage if you have a solid logo to speak for your company.

2. It Makes a Strong First Impression - You have one chance to get this right. A logo is a company’s first introduction to consumers. If designed well, it can pique the interest of the public and invite them to learn more about the company; if not, you have just alienated a potential customer base and tanked your business.

3. It's the Foundation of Your Brand Identity - Successful branding is about telling a story that will influence customers’ emotions – plain and simple. While it is true that logo design is only a part of a company’s brand, it serves as the foundation for the entire narrative on which the brand is built.

4. It's Memorable - Your logo leads the horse (your audience) to water (your company). Logos are a point of identification; they are the symbol that customers use to recognize your brand. Ideally, you will want people to instantly connect the sight of your logo with the memory of what your company does – and, more importantly, how it makes them feel.

5. It Separates You from Competition - Dare to be different with your logo because your company logo tells consumers why your business is unique. Sure, there are fifty other insurance agencies in your city, but yours is the only one that’s committed to sustainability and complete customer satisfaction and your logo drives that message home.

6. It Fosters Brand Loyalty - Say it with me: Consumers crave consistency. As your brand grows, your logo is going to become more familiar to a wide range of consumers, and this familiarity creates the perception that you’re trustworthy and accessible. Trust is built on a well-designed logo, and brand loyalty is quick to follow.

7. Your Audience Expects it - And finally. Your logo is the first thing that your audience will look for when they see any communications from your brand. It should be front and center of all your marketing materials such as business cards, flyers, advertisements, etc.

A distinctive, visually appealing “logo” that shows well and looks professional will enhance your agency’s brand while a logo that does not show well is worthless and may hurt your brand. So, there you go! As you can see, you need a logo; it’s a vital part of building a successful business and brand.

Logo makers and branding toolkits can help you create a unique and effective image to represent your company’s best qualities, but you would be better well served hiring a professional to design your logo.

GoDaddy Airo™ Advanced Logo Generator sets you and your agency apart from the competition with a stunning logo that gives your business a unique look and feel with a logo created in a flash by. Get a professionallooking logo. Stop searching, start creating images. Get a stunning logo to use everywhere, and the ability to quickly create your own engaging images.

No design skills needed - Answer some AI prompts and your business gets a beautiful, branded logo almost instantly — like magic.

Spend less, save time - Get a professional logo almost instantly without having to hire a designer, which saves time and money.

Showcase your logo everywhere - Use your unique logo on your site, in social channels, email, online marketplaces, and offline as well.

• Unlimited logos. Get unique logo options created almost instantly with Airo™ Advanced Logo Generator.

• Customize to your liking. Edit your logo fonts, 3D icons, colors, backgrounds, and layouts.

• Get the right image every time. Airo™ Advanced Image Generator helps you easily create images (instead of spending too much time scrolling through stock).

• Unlimited downloads. Get endless logo downloads with no watermark.

• Pre-sized logo versions. Made especially for your website, social media, email, and more.

• Look great everywhere. Your AI-generated logo will stand out — from online to swag.

Get pre-sized versions of your logo for social ads, browser icon, email, and more — use them to promote your business all over. Save time with your AI design assistant Your personal AI designer saves you time — delivering a beautiful, branded logo almost instantly — like magic.

Looka gives you everything you need to launch your brand and look great from day one. The best part? Artificial intelligence does the heavy graphic design lifting, you have the creative control. Looka Logo Maker combines your logo design preferences with Artificial Intelligence to help you create a custom logo you'll love. All it takes is a few clicks and five minutes.

Looka combines your design preferences with AI to make beautiful logos you'll love. Once you have your logo, use the Brand Kit to access 300+ branded templates, create custom marketing assets, build a website, and launch your business! Design a custom logo for free. Only pay if you’re 100% happy!

1. Start with design inspiration - Enter your company name and select the logo styles, colors, and symbols you like. Looka’s AI-powered logo maker will use these as inspiration when generating your logo designs.

2. Browse and favorite logos - Within minutes, you’ll be browsing 100% custom logos tailored to your business. As you scroll, Looka will generate more designs based on your preferences.

3. Perfect your design - Click any logo design to explore variations and change colors, text fonts, layouts, and symbols. You can also change spacing and sizing.

4. Preview logo mockups - Favorite a logo to preview what it looks like on business cards, T-shirts, and more. As you make changes to logos in the editor, previews update in real-time.

5. Download your files- After you choose and purchase a logo, we’ll send you all of the files a designer would, including high-res PNGs and vector logo files to use online and in print.

Looka’s online logo maker delivers the goods, including vector logo files and color variations. Your Brand Kit includes everything that a logo designer would deliver, and more.

Create a standout social media presence for your brand, with social profiles, posts, covers, and stories available perfectly sized for Facebook, Instagram, YouTube, and more.

TAILOR BRANDS is a free logo maker. You can create your own logo for free and only pay if you love your finished logo design. Online logo creator helps small business owners, freelancers, start-ups, and entrepreneurs make a logo design that’s both high quality and professional. Logo creator uses AI to create custom logos in just a few clicks.

If you want your insurance company to instantly attract clients, a well-designed insurance logo is your best bet. As your clients are putting their assets, and even their lives in your hands, you’ll need to come off as a dependable and trustworthy firm that can properly take care of them.

Do you already have an idea of the type of logo you want to design? If not, don’t worry; TAILOR BRANDS has gathered a selection of insurance logos representing companies of all shapes and sizes, so you can get some inspiration. When you’re ready to get designing, scroll down for best practices to see which logo elements will most resonate with customers in your industry.

1. Provide business details - Enter your company name and type of business, then tell us a little about what your business does.

2. Choose your logo style - Select the type of logo that best suits your business; you can choose from a wordmark (logotype), monogram, or icon logo.

3. Select your favorite fonts - Choose your favorite font styles to help our logo creator understand your brand personality better.

4. Sit back and wait - Our logo generator will go to work and create a selection of unique logos. It takes less than 1 minute.

5. Customize your logo design - Pick your favorite logo and then customize it. You can change the fonts, icons, and colors.

6. Download your logo - Download a high-resolution file of your design – we provide Vector EPS, SVG, and PNG logo files.

Tailor Brands loves nothing more than seeing people bring their logo idea to life. And in the last five years, this passion has helped us become the leading automated logo design tool for side-hustlers, individuals, and small business owners.

Canva builds a unique brand identity, starting with custom logos you can easily produce and use. Redefine the way you create with a suite of AI-powered tools that generate copy in your brand. AI-powered efficiency Leverage AI to create on-brand copy, templates and video-editing. Bring your brand in house with templates for your team to design with. Beautiful approval flows Easily control individual permissions, assign tasks and share your work.

• Thousands of professionally designed templates - Bring your branding identity to life. Browse our customizable logo templates to find a match.

• Millions of free icons and illustrations - Inject uniqueness into your logos with free graphic elements from our vast media library.

• Hundreds of eye-catching font combinations - Finish off your logo design by using the perfect font pairing.

• Free and easy-to-use logo editor - No advanced skills needed when designing your logo on our drag-and-drop dashboard.

• Visualize your logo on any product - Create realistic product mockups using your design with their Mockups integration.

• Resize your logo for any use - Automatically transform a single design for use on virtually any platform with Magic Switch (Pro).

• Share access to your design - Get your teammates’ input by sending them a link to view and edit your design draft.

• Easily get everyone’s comments - Revise with ease. Get your teammates’ and clients’ feedback directly on your design.

• Design on the go - Work where inspiration strikes. Edit on Canva on your mobile, tablet, and desktop devices.

Ensure consistency across all your designs with Brand Kit (Pro). Simply store your logo, brand colors, and fonts to your kit and apply them onto your designs with a single click. Let anyone on your team access the pre-set brand assets and templates so everyone’s always on the same page.

Start designing with Canva

www.canva.com

Domains are the gateway for customers to reach

Securing a “domain name” for your business is essential, even if you have yet developed your web site or settled on the finer details of your online strategy. A domain name gives you an online presence and is the gateway for customers to reach you. Try to align your domain name to the business name as much as possible and make it memorable, short, and easy to remember. If your business has not yet progressed to having a website, you should still secure your domain name for the future! Register a domain name is to protect copyrights and trademarks, build creditability, increase brand awareness, and search engine positioning.

A domain is a website address that has three parts, each separated by a dot: the subdomain (www), the midlevel domain (where you can display a business name), and the top-level domain (.com, .net, .org for example). All three elements mentioned above are necessary to create a web address accessible to the public. Because there are so many variations of these elements, it is easy to “create a unique web address” for your company.

Security - Your data is important, and that is why you should choose a domain hosting company that has proper security solutions as well. A domain host that does not pay consideration to your security is not worthy of your investment.

Speed - No matter how amazing your website is, your viewers are going to decrease dramatically if your loading speed is slow. Find an email hosting provider who can make your website pages load fast.

Type of servers – There are 3 types of servers, which include basic server, Virtual Private Server (VPS) and dedicated servers. Consider the type of servers offered by the host and at what cost and even a best domain hosting service provider can help you to take a right decision, as they will have experts to advise you on the subject.

Sure backup - When your site crashes, there is a possibility of losing data if there is no backup. Therefore, make sure that the domain host you choose not only provides full site backup but also ensures restoring of the backup data is simple; a process that you can manage yourself without waiting for the help of support staff.

Get your own domain, register, and pay for it through a

Choose your registrar or web hosting service - Check their hosting policies and pricing. Find, research, and read a guide of the best domain registrars for small businesses.

Search for a domain name - The registrar should have an availability checker which you can use to determine if a domain name is available.

Fill out the forms - You will be asked for your personal information and contact details to complete your profile for the public “WHOIS” database. Choose whether you want your profile to be public or private by opting in or out of domain privacy.

Pay for your domain - Prices for the domain names will come up during the availability check but will range from free to $20 annually.

Link domain and website - Using the domain manager, connect your domain to your website; this will require entering host server information if you have not purchased your domain and web hosting from the same provider.

Confirm your domain is live - Once you have logged into your content management system (CMS) and designed the beginnings of your website, be sure to confirm it is live under your purchased domain.

GoDaddy offers everything you need to create an effective, memorable online presence. GoDaddy is the world’s largest and trusted domain registrar that empowers people like you with creative ideas to succeed online. Buy a new domain and get GoDaddy Airo™, a customizable, AI-powered solution that can easily deliver a website, logo, LLC, and more for your business.

With 20 million customers, 80+ million domains under management in 58 countries, GoDaddy has more experience than anyone and will make sure you find the right domain and that it has a secure home online.

1. Your one-stop tech shop - Forget about jumping around the internet to get all the tools you need to succeed online. Find everything for your online presence in one place.

2. Widest selection on the web - Every time you enter a name in our domain search box, our powerful engine searches the web's largest pool of names. There is no better place to find the right domain name for your business.

3. The technology you need - GoDaddy offers tools for any online endeavor, from websites to email marketing. Best of all, our cloud technology is easy to use — and afford.

4. Award-winning support - If you have a question about a domain name (or anything else that we offer) our web pros are standing by, ready to pick up the phone and help.

5. A worldwide community - A place where twenty million individuals from58 countries can exchange ideas about conquering the internet.

Simple domain set up. You do not need any technical skills.

Up to 100 subdomains create a custom web address.

Real-time monitoring to make sure you are always up and running.

Quick, simple tools to forward your domains to any existing website.

World-class support from our web pros standing by ready to assist.

Business Protection:

• Domain names are safe for up to 12 months.

• Blocks both accidental and malicious domain transfers.

• Keeps your personal details hidden from snoops and crooks.

• Publishes an online business card so customers and partners can find you.

NOTE: Visit the vendor website for additional features, details and current pricing. Tools

IONOS® makes it easy to find and purchase a domain name thanks to its modern and intuitive interface. One can get more than just a domain name. It goes beyond the basics to offer a suite of features that accommodate your business needs, offers great solutions, and they do not try to upsell and annoy the customer. It is very simple, and they listen when a customer presents an opportunity for improvement. They are very responsive to customer needs.

IONOS offers great solutions and helps build your brand by providing domain names that set you apart from the crowd.

While there are generally very few features or inclusions with the purchase of a domain name, IONOS has a lot to offer. Upon making a purchase, domains include a domain name privacy, an SSL certificate, business email with 2 GB of storage and 24/7 support. Register your domain with IONOS and benefit from comprehensive features.

Email - A professional email address (for example: me@mycompany.com) connected to your domain with 2 GB of mailbox space to start, included in each initial contract. Upgrade any time for more space.

Security - For reliable protection of your website visitors and to increase your Google ranking, one Wildcard SSL certificate is included with your initial contract.

10,000 subdomains - Up to 10,000 subdomains to customize and structure your website, for example: news.mycompany.com.

Easy setup - Easily connect your domain with 3rd party services, other IONOS products, and your social media accounts – with just one click.

Domain lock - The domain transfer lock ensures your domain cannot be transferred by unauthorized third parties.

24/7 customer support - Our professional and knowledgeable support team is always available for help and advice, 24/7.

NOTE: Visit the vendor website for additional features, details and current pricing.

Bluehost® is a leading web hosting solutions company providing comprehensive tools to millions of users throughout the world so anyone, novice, or pro, can get on the web and thrive with our web hosting packages. Bluehost domain manager makes it easy to track, update, transfer, purchase, and administer all your domains in one place.

Your domain comes bearing gifts.

Easy domain management - Manage every aspect of your domains from a single, easy-to-use control panel. Change DNS records easily across multiple domains.

Auto-renewal - Protects your domain from expiring and accidentally being lost by enabling auto-renewal. Switch back to manual renewal at any time. Using this service ensures that your website domain names are always protected.

Domain lock - Once you find your perfect domain, lock it down to prevent unauthorized transfers. Unlock it for transfers at any time. Domain name service will save your preferred name and keep it secure for when you are ready.

Domain forwarding - Automatically redirect your domain’s visitors to other desired locations on the web.

Expert support - Ready to come to your aid by phone or chat anytime, for any reason.

1. Lightning-fast search - Quickly find that perfect domain among the multitude of options available.

2. Peace of mind - Have confidence in knowing you’re working with a trusted global domain provider.

3. Domain Privacy - Keep your personal info concealed from possible spammers and identity thieves.

4. Huge Selection - We make it easy to find a unique, creative domain name that helps your site stand out.

5. Geo-location domains - Let everyone know where you’re located right in your domain, for example yourwebsite.uk.

Bluehost supports millions of websites worldwide. Let experts help you effectively build, grow and manage your WordPress website. You can call, chat or email at any time!

NOTE: Visit the vendor website for additional features, details and current pricing. Grab a plot of land and start building

www.bluehost.com

Domain. Com® has made searching for domains easy with AI DOMAIN GENERATOR. Just enter descriptions and keywords, then search. The more information you include about your business, idea, or hobby, the better. The results are high-quality, instant, and totally unique. Use the power of AI to find new and creative domain name ideas.

Custom to you - Because your keywords are specific to your brand, you'll get relevant results that are uniquely made just for you.

Easy to use - With this tool, the work is done for you. Get a streamlined experience that can cut hours out of your domain search.

Made to search - The AI Domain Generator pulls keywords from your query. You'll get options with value, increasing your traffic over time.

Ready to buy - In the past, you had to find purchasable domains on your own. Now you can instantly see dozens of available options.

Choose a name that's creative and unique. This may be the differentiation needed to stand out amongst competitors. Take a domain name like BeanStreet.coffee, for example.

Keep your name easy to remember as well. The sweet spot is ideally one or two words that capture the essence of your website. CoffeeLove.club is easier to remember than CoffeeAndCaffeineAddicts.com, for example.

If you're a local business, consider adding your region to your domain name, such as .nyc or .asia, to help your site's visibility.

Consider buying more than one domain. As your site's popularity increases, you don't want copycats to purchase similar domains before you do.

And lastly, avoid numbers, hyphens, or symbols of any kind.

1. A trusted source - Since 2000, we've been focused on helping customers find the best domain name as the building block of their online presence.

2. Everything is covered - A domain name is just the beginning. We'll help you host, design, and manage your site. We'll even build it for you, if you'd like.

3. Simple Intuitive - We integrate seamlessly with WordPress, WebsiteBuilder, and SiteLock, to name a few. We’ll help you get online with ease.

NOTE: Visit the vendor website for additional features, details and current pricing. The total package for starting your website www.domain.com

Email is not going away anytime soon.

E-mail has become a popular way to communicate all over the globe as organizations are increasingly turning to cloud-based solutions for service, data center and application needs. Email is a reliable source of communication that allows for person-to-person virtual delivery and communication to flow to anyone worldwide.

Show you are in business and look professional with custom email at your company domain. Businesses are now considering nimble and versatile hosted “email” solutions for their needs. Features and pricing vary widely across the segment, so we have reviewed the top solutions and considerations to help you find the best option for your company.

• Hosted Email Service - How companies host, store, and distribute their email has undergone a massive transformation. Businesses are veering away from costly onsite email servers and looking instead to the cloud with hosted email solutions. Going with a scalable and secure hosted Software-asa-Service (SaaS) solution with guaranteed uptime that breaks down pricing into flexible, per- user charges.

• Costs and Your Users - Cost is the most popular driver for businesses moving email to the cloud. It is simply cheaper on a per-user basis when you factor in not only the cost of server hardware and connectivity but also add-on security products and the knowledgeable staff necessary to run them.

• Email Usage Patterns Are Changing - Investigate how your users are emailing daily. That is important because it will impact the tools and features you need to look for in your hosted email provider's client software. Microsoft Outlook is still the most popular on-site email client, but there are others, such as Google's hugely popular Gmail. These clients can be very sophisticated and, depending on what your users are doing with email, they can have a big impact on your day-to- day business process.

• Configuration and Compatibility - The cloud certainly makes delivering email to your users easier but, there is still going to be some setup required beyond simply activating the service. At a minimum, a domain must be purchased and configured to point to the new email host. Your next major concern will be compatibility such as integration and mobility.

• Mobility Factor - How often do your employees need to access email via mobile devices? This is an important issue because most email hosting providers deliver web client usable information as a default inbox. A recent survey clearly shows, email is one of the most popular apps for mobile devices across most organizations and even consumers.

• Security and Privacy - Security starts with spam, otherwise known as unsolicited email. Spam filters are getting better every day and email providers tend to deploy the very latest and greatest for their customers. The filters still are not perfect, which means they can catch a lot of "good" email but often vary significantly in effectiveness.

Privacy/Data protection is a key email security concern. Inboxes contain GBs of business-critical and personal data, so not just hackers but also legitimate marketing companies can make big money off mining email data and this sometimes includes the very company that is providing the email service to you. To protect yourself, be sure to inquire about data safety capabilities on the provider's side.

It boils down to a balance between cost, features, and risk. It is always tempting to simply jump on the lowestcost solution, but the fact that email is ubiquitous keeps this from being the smart play. It is impossible to escape using it, which means your users, your customers, and the guts of your business have all come to depend on it in different ways. You need to discover those ways, evaluate them, and then choose a service that either meets or improves on them. This takes time and some investigation; these are steps you do not want to skip. Otherwise, you will pay for it later.

GoDaddy® Professional Email works for all your business communication and marketing needs. Plus, advanced security tools help protect your data. Look professional with a custom email address that matches your domain. Build trust with email that shows you take your business seriously. Promote your brand with every message you send. Show them you mean business.

Set up a custom email address and get started in 5 easy steps.

1. Choose and register your domain name.

2. Select the right email plan for your business needs and add mailboxes for every user on your team.

3. Choose your username and password, then set up your business email account(s).

4. Create professional email addresses that match your domain, like orders@yourdomain and info@yourdomain.

5. That's it! You're ready to send and receive emails like pro.

• Domain-based email builds trust - Customers are 9x more likely to choose a business with a professional email address, and a domain-based email account promotes your company with every message. You can even create additional email addresses like sales@ or info@ that help serve customers better.

• Keep more of what’s important - Our plans have loads of storage for your email, contacts and shared calendars. When you create a business email with us, you’ll always have space and won’t have to delete emails to make extra room.

• Names you know and can rely on - With Microsoft 365 from GoDaddy, peace of mind is built in. Every email plan is backed by Microsoft’s 99.9% uptime guarantee and our awardwinning support.

• Your own personal IT team - Creating and managing your business email is simple with GoDaddy. Our award-winning support team is at the ready to answer any questions, and can even help migrate your old email hosting account to our platform.

• All your devices, all in sync - Your latest emails, contacts, and appointments are always at your fingertips. Microsoft 365 from GoDaddy email services work with Outlook, Apple Mail and other top programs to keep all your devices – from your laptop to your smartphone to tablet –up to date and in sync.

• Peace of mind with every click - A whopping 90% of all online threats originate through email attachments^, and many of these attacks look legitimate even as far as impersonating those you know. Advanced Email Security alerts you to bad actors before you click, so you can stop them before they can hurt your business.

Every Business Email hosting plan includes: Up to 400 email aliases - That's enough for every aspect of your business.

Sync across devices - Instant access to your emails, contacts, and appointments.

Shared online calendars - Manage your calendar and quickly schedule meetings.

7-day money-back guarantee - Buy without worries as you find the plan that works best. +Applicable on annual term purchases only.

Everything you need to get anything done, now in one place.

Google® Workspace can help you get more done with business productivity and collaboration tools loved by billions of users. Work faster, smarter, and more collaboratively than ever before.

• Tools you love, thoughtfully connected - An integrated workspace that’s simple to use, Google Workspace lets you spend less time managing your work and more time doing it.

• Smart suggestions to help you prioritize - Address what’s important and let Google manage the rest with best-in-class AI and search technology that helps you work smarter.

• Flexible solutions for every business - Work from anywhere, on any device – even offline – with tools to help you integrate, customize, and extend Google Workspace to meet your team’s unique needs.

Get Gmail, Calendar, Drive, Docs, Meet and more for business.

Gmail - #1 email used worldwide business email, and so much more - AIpowered, secure, and easy to use email trusted by billions of people and businesses. The latest Gmail makes it easier to stay on top of the work that matters. Stay on top of project work with shared files and tasks — all right in Gmail.

Calendar - Shareable Online Calendar designed for teams - Spend less time planning and more time doing with a shareable calendar that works across Google Workspace. brings all of your calendars together in one place, so you can manage work, personal life, and everything in between.

Google Drive - Store, access, and share your files online - Store any and access every file. AI-powered cloud storage for seamless file sharing and enhanced collaboration. Access files anytime, anywhere from your desktop and mobile devices. Control how files are shared.

Messaging and team collaboration - Real-time or anytime – Chat helps Workspace users connect and collaborate to get things done. With Gemini in Chat, you have a partner who’s always ready to provide answers, summarize conversations, find files in Drive, and brainstorm new creative ideas.

Google Docs - Online, collaborative documents for teams - AI-powered documents to help you and your team create and collaborate on content. Create and edit professional documents from a few simple prompts and get help refining your content. Multiple people can work at the same time, and every change is saved automatically.

Google Meet - Video calls with anyone, anywhere - Stay connected and collaborate with friends, family, and colleagues no matter where you are. Help your team stay securely connected with enterprise-grade video conferencing built on Google’s robust and secure global infrastructure.

Transforming how enterprises work.

Become one of the five million teams that depend on cloud-based apps like Gmail, Calendar, Drive, Docs and Meet to get things done. Google Workspace plans provide a custom email for your business and includes collaboration tools like Gmail, Calendar, Meet, Chat, Drive, Docs, Sheets, Slides, Forms, Sites, and more.

Microsoft 365® empowers your employees to do their best work with the power of generative AI in the apps they use daily and brings together best-in-class Office apps with powerful cloud services, device management, and advanced security. Microsoft 365 helps your business improve cybersecurity, reduce costs, and empower employees to work from anywhere. Get the tools you need to do your best work with Microsoft 365. Plus, invest in Microsoft 365 Copilot to bring AI-powered experiences to your entire business.

• Reach more customers - Connect with new customers using tools that help you communicate more effectively and deliver more value.

• Build your brand - Develop a strong marketplace presence with branded documents, meeting backgrounds, marketing videos, and emails.

• Run your business - Simplify how you run your business with a solution that helps you create, connect, and collaborate securely from anywhere.

• Scale securely - Safeguard your business data and devices with centralized identity, security, compliance, and privacy protection.

Microsoft Teams - Easily communicate with customers and employees. Create, share, and store files securely from a single cloud-first platform. Brings everyone together in one place to meet, chat, call, and collaborate.

OneDrive - Save, access, edit, and share files and photos whether you’re in the office or on the go. Easily store, access, and discover your individual and shared work files in Microsoft 365 apps from all your devices. Your offline edits will automatically sync the next time you connect.

SharePoint - Create team sites to share information, files, and resources. Streamline teamwork with dynamic, customizable team sites to share files, data, news, and resources. Collaborate with team members inside and outside your organization, across PCs, Macs, and mobile devices..

Outlook - Manage your email, calendar, tasks, and contacts together in one place. Work efficiently with email, calendar, contacts, and tasks together in one app. And with your Microsoft 365 subscription, you’ll be able to share attachments right from OneDrive, access contacts, and view LinkedIn profiles.

Exchange - Work smarter with business-class email and calendaring. Exchange helps you collaborate on your critical documents and gives you a focused inbox that prioritizes important messages and adapts to your work style, so you can get more done–faster.

Microsoft Loop - Co-create and stay in sync with your teammates to bring all the parts of a project together. Included with Microsoft 365 Business Standard or Business Premium. Unlock the power of shared thinking - co-create, get up-to-speed, and stay in sync with your teammates.

Bluehost® takes your email to the next leve. Boost customer trust with professional email that fits your budget. Easily integrate your calendar, contacts, and more. When you choose branded email, you’re going beyond unique addresses. You’re choosing a better experience for your team.

Professional Email - Unite your team with a domain-specific email capabilities.

Custom Inbox - Customize your mailboxes and email templates to stay organized.

Calendar - Manage projects in a few clicks with an integrated calendar.

Contacts - Automatically save information and reach colleagues with ease.

Tasks - Create, schedule, and manage your tasks all in one place.

Portal - Keep recent updates and relevant information top-of-mind.

Drive - Improve your workflow by sharing files with controlled settings.

Documents - Experience an integrated suite of tools for all your work needs.

Security - Defend against a variety of threats plaguing modern business.

Pick the plan that fits your plans.

Look like a pro on any budget with a professional email address that matches your domain. Set yourself up for success now with a plan built for you.

Website

is the center piece of any digital

In today’s digital world, an insurance agent website is an essential tool that should form part of any business and marketing strategy. If you are building a new insurance website or refreshing your current site, knowing how to differentiate yourself is key, and first impressions ALWAYS count. A robust website is a foundational pillar for business success, increasing brand awareness, driving user engagement, and boosting conversions. And crafting that standout platform doesn’t have to be complex or challenging. Whether you choose an insurance website builder, or you hire someone to design an insurance site for you, having a presence online is key. The website is the center piece of any digital presence.

There are many benefits for insurance agents to use carrier websites, to receive subsidies for the first few years for office allowances from the carrier to help get things moving. You also get help for leads, advertising, and technology. While it is easy to let the carrier do marketing for you, it may not have the impact you had hoped. Being proactive and having your own insurance agency website can help you expand your client base and increase referrals.

1. First Impressions Matter - Your website is the first interaction a client has with your independent agency online, and you normally do not get a second chance to make a first impression.

2. Enhances customer engagement - Interactive website features do more than display content, they actively engage visitors, converting passive browsers into leads and, eventually, loyal customers.

3. Showcases credibility and professionalism - A meticulously designed and well-curated website doesn’t just represent your brand, it elevates it.

4. Showcases your company, products and brand - Your website directly reflects your brand, showing visitors who you are and what your business represents.

5. Boosts Your Online Marketing - Harnessing the full potential of digital marketing is pivotal for boosting your website’s bottom line. If you aren’t marketing online, you’re missing out.

6. Increases brand awareness - Every web design detail, from typography to content style, contributes to your brand’s identity and personality.

7. Establishes a competitive edge - A polished website is a crucial differentiator, particularly when marketing a small business in a saturated market.

8. Enables data collection, analysis and insight - Add analytics to your website, and you can see where prospects are coming from and what pages they visit the most.

9. Provides 24/7 accessibility and convenience - Clients do not always have the time to call or email their questions during regular business hours.

10.Evolves with audience preferences - Your website’s structure, from its content and design to its navigation, offers flexibility to adjust as trends and priorities shift, helping it remain relevant and user-centric.

Standing out as an independent agency can be surprisingly challenging. While you may not think that your website is a crucial part of that equation, that genuinely isn’t the case. To put it simply, without a strong website for your independent agency, you are missing out on opportunities. If you are wondering why having an exceptional site matters, here’s what you need to know.

Design Options - Your website is the first chance to make a great first impression. Your website is the hub of all activity. Prospects, clients, and referral partners often search for an agency online and visit a website before you even know they exist. Gain trust and credibility with a clean and modern website design that makes you look trustworthy.

Search Engine Optimized - Prospects and current clients must find your website when they search for insurance on Google. Getting your agency to the top of Google, “IN THE BOX” and other search engines isn’t always as easy as flipping a switch, so you must be serious about (SEO) and implement simple things you are serious about SEO.

Mobile Friendly - Customers must be able to visit your site, request quotes and contact you from any device, anywhere. The more active your website, the more value you get out of it. Your website is so much more than an online brochure and more to reach prospects, better serve your clients, and highlight what makes your agency shine.

Social Media Friendly - Think of social media like opening the front door to your agency. Getting 5-star reviews on Google, Facebook, and other online services helps establish your insurance agency as the trusted, credible solution in your local area. The more 5-stars you get, the higher you’ll be in the search results when people are looking for insurance in your area.

Contact Page - More prospects and clients will call, email, or stop by your agency when it is so easy. Ensure your agency’s NAP (name, address, and phone number) is accurately and consistently displayed within online directories and listing sites to improve visibility and help your website’s SEO (search engine optimization). Choose one with great domain authority, you’ll get the best bang for the buck from them.

Online Quote Forms – A call-to-action (CTA) is a prompt on your site that leads your visitors to take a specific action, is a must. Online quoting forms generate leads with multiple quote forms, email notifications and rater integration. The more you actively use your website tools, the more value you get out of it. Your website is so much more than an online brochure.

Photo Gallery and other content - Personalize your website and build trust with your customers and visitors. Get creative, be human, and have some fun! The more fun stuff you post, the more people will get to know your agency and want to follow along with likes, follows, and comments. Leverage your local presence with the latest updates about your agency in the local community.

Insurance Carriers and Product Pages - Boost search rankings and educate potential prospects and clients with content about the insurance carriers you represent and the products you sell. The ability to change or add new carriers and product offerings or remove old ones any time is a must. A Document Library saves time and impress clients with custom documents in a library on your website.

Agency Newsletter - Use a newsletter to give customers updates about your agency. Provide valuable content to your audience so they look forward to your emails and also build a brand recall. When you deliver content that is relevant to your customers, they will get in the habit of opening your emails. When you send them a promotional email, they are less likely to ignore you.

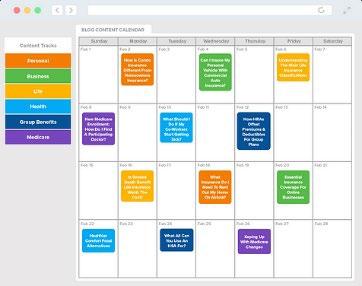

Insurance Agency Blog - Build trust as an industry authority with an easy-touse blogging platform. The ultimate goal in creating blogs is to drive as much traffic to your website as possible. Creating content regularly informs search engines, such as Google, that your website is actively updated and therefore should be checked frequently to see what new content has surfaced.

Customer and Contact Management - Automate, manage customer life cycle, and make the experience excellent, fluid, and effortless. Online customer service reduces in-agency servicing time and satisfies customers with 24/7 customer service and carrier access. Customer Relationship Excellent customer experience has recently overtaken pricing and product as the key brand differentiator.

Email Marketing – Utilize a CRM or build an email program to send clients and prospects regular emails. Email isn’t as glamorous as AI-powered chatbots, Instagram influencers, or other new-school tech, but it is still one of the best marketing and retention strategies around today! The return on investment (ROI) of email marketing is hard to beat.

Marketing Dashboard – Dashboard tracking of traffic, clicks, rankings, opens and more. Monitor search engine rankings, website traffic, and advertising in real-time 24/7. Keep track of what's working and not working on social media. Easy-to-read reports sent by email every month that will show you exactly what is being doing for you.

Client Document Library - Save time and impress your clients with a customizable document library on your website. They allow you to share important documents with clients and offer several notable features which is a huge benefit you can allow your clients to download documents anytime, anywhere they are available, which makes it easier for them to get access to what they need

SSL Website Security - Gain trust and credibility with an SSL certificate that helps increase lead generation. Keep internet connections secure and prevent criminals from reading or modifying information transferred between you and your clients. When you see a padlock icon next to the URL in the address bar, that means SSL protects the website you are visiting.

Advisor Evolved® helps time-strapped, non-techy independent agencies acquire and retain more clients with easy-to-use marketing tools, and a gorgeous, conversion-optimized website that will never be mistaken for an out-dated, online brochure site.

Flexible design that future-proofs your agency website – Their goal is to build each client a website that is unique to them and their agency, and with our flexible design system built on top of WordPress core, we can do just that. What’s more, our system allows agencies to do so many different things. From point-and-click landing pages, to drag-anddrop page designs, your website is a Swiss Army knife of features and control.

Stunning, mobile-first design with unmatched features and usability - Did you know Googles’ index is now “mobilefirst”? This means Google puts a higher priority on the functionality and compatibility of websites at the mobile level. With more than 60% of all web traffic coming from mobile devices, having a mobile responsive website is non-negotiable. With Advisor Evolved, your website will be highly optimized for the mobile experience.

Unmatched Code Quality - With the introduction of Google Core Web Vitals, code quality & page speed matter more than ever before. Many websites may look good on the surface, but a vast majority aren’t built well under the hood. Our advanced code architecture means that your website will be lean, mean, and perform like a well-oiled machine, helping you rank higher in Google faster.

Conversion Rate Optimized - Most clients report an immediate increase in lead volume after we build & launch their sites. With a design process based on user & visitor data across thousands of websites, your website will be a conversion machine as long as traffic is flowing to it. Unlike some competitors, they build websites based on what works, not what looks flashy or gimmicky.

& SEO Compliant - There’s not another agency website developer who knows more about SEO than they do period. They teach SEO to other SEOs and are extremely in tune with what Google deems to be best practices for website development, SEO, and CRO (conversion rate optimization). With Advisor Evolved, your website will rank higher, and faster.

BrightFire® is one of the leading insurance website design and digital marketing providers in the United States. They are committed to providing agencies with customer service they love and solutions that deliver results. BrightFire delivers complete digital marketing solutions tailored for independent insurance agencies of all sizes.

Web designers collaborate closely with you to capture your vision. You only have one chance to make a first impression. That’s why the BrightFire team will tailor your design to capture your agency’s personality to help you stand out. No matter what your dream for your website may be, they can make it a reality.

Sales tools built for insurance agents to engage and close deals. BrightFire has worked with thousands of insurance agents and knows what you need to succeed. They provide a suite of sales tools that help agents close deals and build stronger relationships with clients without leaving their desks.

Support tools built to save you time and provide convenience to your policyholders. BrightFire has worked with thousands of insurance agents and understands the needs of your customers. They provide a suite of support tools to improve your policyholders’ customer experience all while streamlining your agency’s support processes.

BrightFire provides helpful insurance blog content, so you don’t have to. They understand not everyone is a professional writer, so they go the extra mile by providing ongoing blog content covering personal, business, life, health, group benefits, Choose the categories your agency offers, and they manage the rest.

BrightFire manages all the technical aspects so you can focus on your clients. Hosting and managing a website can be tricky business if you aren’t familiar with the process, but BrightFire has your back. They manage your website’s security, updates, web hosting, daily backups, domain name registration, and everything else to keep your site running smoothly.

Take your website even further with a host of third-party integrations. Our platform integrates with numerous comparative raters, customer service tools, email marketing solutions, agency management systems, live chat, chatbots, and call scheduling services. With these and future integrations, your agency can automate tasks and sell more efficiently.

Forge™ website platform is flexible enough to meet your agency’s unique goals and vision while looking amazing. Capture leads and service your existing clients in style with a website that best represents your agency. Forge lets you tell your agency’s story, leverage lead generation, integrate with real-time analytics, and engage and educate with built-in tools. Build and grow your online presence with easy-to-navigate websites.

Get access to the most advanced and proven tools in the industry with a streamlined insurance agency website platform. Show up in directory listings, build your reputation, and stand out on social media with advanced and proven tools that go beyond the website and make an impact.

Business Texting - Send, receive, automate text messages, connect over text message, and send automated messages to reach people where they are.

Connect or generate a phone number.

Get notifications and reminders.

Integrate Web Chat to your Forge website.

Automate text messaging for campaigns.

Local Listings - Keep your business info accurate and Capture more traffic by showing up across 50+ directory listings with accurate info.

Appear in local searches effortlessly.

Ensure your agency is visible online.

Get listed across 50+ directories.

Connect with clients searching for insurance near them.

Reputation Management - Manage your online reputation and grow your reputation by highlighting, tracking, and following up on client feedback.

Showcase your hard-earned reviews.

Build upon your credibility.

Ask your loyal clients for their feedback.

Gauge client satisfaction.

Social Media - Automatically post to socials and Access a library of social content, automated posts, and customizable options to post.

Connect your agency’s social accounts.

Use our ready-made social posts.

Create and publish custom content.

Set it and forget it content options.

Forge Dashboard - Access a central hub to view form submissions, unlock sales tools, and reach our dedicated support team.

Track quote and service form submissions.

Update pop-ups and website banners.

Publish your agency’s blog posts.

Contact our team for help with bigger site changes.

Interactive Graphics - Forge comes with 50+ exclusive interactive graphics that engage and educate your clients and prospects alike on insurance in a simple, easy-tounderstand way.

Educate in a click to learn format.

Inform about insurance and risk factors.

Engage with visual, interactive content.

Encourage exploration of coverage options.

You simply click the yellow hotspots and flip through the different graphics to use it!

A feature-rich website platform that doesn’t break the bank.

InsuranceSplash® is the #1 Insurance Marketing Website for Agents. It is the most important part of your online marketing strategy, and the first thing people see when they look you up. Most of your clients, prospects, and others you connect with daily will visit your website before ever interacting with you or your staff.

• Clean & modern designs that are highly customizable.

• Site built for you, and they make updates if you want them to.

• Easy drag-and-drop backend system to update site yourself.

• Setup, manage and optimize all important online business listings.

• On-Site original content creation and publication (original blog articles).

• Off-Site content publication for linkbuilding (videos, press releases, etc.).

• Professional branding design layout for all your agency profiles.

• Updates made on your agency's behalf each week.

• Facebook, LinkedIn, Twitter, Google+, and more social networks.

• Monthly Email with all your online content for the month.

• Will send it to you to send or we will send up to 2,500 contacts for you.

• Add subscribers through your website and other social channels.

• Generate leads, referrals, cross-sales and improve retention.

• $150 Monthly Ad Budget for Search & Display Media Campaigns.

• Guaranteed to drive active shoppers from your market on your website.

• We'll setup and run everything for you and report the results.

• Dashboard tracking of traffic, clicks, rankings, opens and more.

• See the results of our marketing efforts in real-time 24/7.

• Monitor your search engine rankings, website traffic, and advertising.

• Keep track of what is working and not working on social media.

• 24/7 Website support system so you can request help at any time.

• Phone support during regular office hours to ask questions.

• Online tutorials for the most common website edits to it yourself.

• 3 Hours/month of website customization, so you do not it.

Stratosphere® understands that the insurance industry is highly competitive. To help you stand out from the crowd, they work to establish your agency’s digital presence and create a unique brand image. With carefully crafted websites and world-class digital marketing techniques, Stratosphere empowers you to leave your mark on the world of insurance. Digital marketing solutions for independent insurance agencies have become essential to reach customers and grow brands. With their design, content, and digital marketing experts on your side, your independent insurance agency will reach its full online potential.

SEO - SEO strategies optimize your website and boost your site’s visibility on search result pages, improve your online presence, and differentiate your brand across the web.

PPC - Campaigns with a strong headline, a concise description, and an appropriate landing page target the people looking for services in a specific location highly effectively.

Paid Advertising - Paid advertising techniques that prioritize your ads to draw immediate traffic to your site, generate more qualified leads, and improve your brand recognition.

Social Media Marketing - Stratosphere helps you manage multiple social media platforms for your insurance agency to establish your brand as customer-oriented, reputable, and trustworthy.

Content Marketing - Content marketing strategies specialize in creating quality content for your insurance agency to attract the right market and provides value to your prospects.

Email Marketing - Email marketing campaigns deliver personalized messages and special offers for a wide range of audiences.

Video Marketing – Quality video marketing strategies to help your insurance agency build brand image, generate leads, and achieve more sales.

Reputation Management - Manage your online reputation and take steps to maximize the visibility of positive reviews and minimize the effects of complaints.

Website Design - Design responsive websites with clean layouts and complete information with lightning-fast loading speed. Good UX ensures each visitor finds the information they need with ease.

Website Development -Web development team helps you create cutting-edge websites, web applications, and portals that will take your insurance agency to the next level.

Web Hosting & Maintenance - Team committed to developing a great hosting and maintenance service, update your website with regular backups, and bug fixes - so one more tedious task is checked off your list.

Agency Website Starting at $199/mo

Marketing Essentials Starting at $199/mo

• Paid Advertising - As a Google Premier Partner, get strategized paid ads fit for your business needs. Paid ads service offers: Starting at $300 or 15% of spend, whichever is higher.

• Social Media - Engage with your audience and enhance your online presence across major social media platforms. Social media service features: Starting at $299/Month

• Blog – Expand your website’s indexed pages with our blogging services to increase organic traffic and engagement. Blog service offers: Starting at $199 / Month

• Newsletter - Monthly newsletter add-on service to keep your audience updated about new developments, offers etc. Newsletter service offers: Starting at $149

• Insurance Agency Success Automation - Boost your insurance agency’s performance with automated user engagement, positive review cultivation, and referral programs.

provide a complete view of customers.

Insurance Agency Management Systems support the day-to-day operations of insurance agencies with backoffice automation and customer relationship management features. An integrated agency management system is at the core of a digital agency and manages a agency’s customer relationships, policy and benefits administration, sales automation, and financial accounting processes across all lines of business and the entire agency in one application. Built on scalable architecture with standardized data, the application enables your agency to seamlessly add new customers, lines of business and locations across multiple geographies to support growth. Open architecture also enables you to seamlessly integrate third-party applications, proprietary systems, and other data sources.

Insurance Agency Management Systems are geared to streamline insurance agents’ tasks via automation and data-driven tracking and control over the storage and organization of the workflow across the entire insurance value chain. Industry statistics reveal that 90% of agencies use an agency management system.

• Prevent siloed data that is scattered around;

• Automate repetitive processes;

• Streamline system procedures;

• Ensure the holistic access and view of all workflows;

• Enhance agent productivity;

• Ensure total control over insurance policy;

• Effectively manage customers’ claims;

• Retain customers and provide a highly positive experience.

• Mitigate risks in the claims processes;

• Identify customers at risk of cancellation;

• Control business efficiency level;

• Ensure accuracy in policy, renewals, claims, and commissions accountability;

• Keep track of agents’ working hours precisely;

• Forecast cash flows and pipelines;

• Assess insurer performance;

• Detect pain points.

Customer experience has overtaken pricing and product as the key brand differentiator. Consumers are imploring agencies to provide an excellent experience, even if it means higher prices. No two independent agencies are the same. The reality is that your technology needs to align with your agency’s everyday functions and procedures to truly impact overall performance.

Everyone wants to grow their business and increase their profitability. Yet, the ways you go about accomplishing these goals is different from the way other agencies do. You are unique, so when it comes to an effective management system, there simply is not a one-size-fits-all solution.

Agency Management System Comparison

• Ease of Use: Customers will need to navigate the system when interacting with insurance agents and updating their policies.

• Data Storage: Insurance Agency Management Systems are available through cloud-based or Software as a Service (SaaS) platforms.

• Software Integrations: The number of available software integrations will affect the monthly/annual subscription fee.

• No need to buy hardware (or a server) – When you purchase a hosted agency management system you do not have to worry about where you are going to host your system. The system’s team will be taking care of that for you. In a large data center somewhere or in the cloud.

• No need for backup assistance – When your system is hosted, the company is taking care of backing up all your data for you. No need to worry about a tragic loss!

• Login from anywhere, anytime – With a hosted version you do not need to be in your office to access you agency management system. If you are somewhere with internet access, you are good to go! And if your internet goes out, just link up to your hotspot to continue working.

• Accessible from your Laptop, Tablet, and Smartphone – How awesome it is to be able to pull your tablet out at a conference or the airport to manage your business without the hassle of a laptop.

• Faster & automatically updated – Most of the time Hosted versions operate much faster and provide better service. Not to mention your system is automatically updated to the most equipped version as updates are available, overnight!

• Investment - Insurance agencies must use a Management System to stay relevant in the industry. These systems can come with a hefty cost. Procurement costs can be high, and even the monthly bills can be staggering. However, the benefits of the system outweigh the costs by a huge distance.

• Training staff - A Management System won’t be of any significance if the employees don’t know how to use it. At the time of purchasing insurance software, you must always look for one that provides training on their site or has a training manual.

• Technical errors – A management System can have some tech issues. Issues like bugs and breaches can affect your system while using or even when implementing it. Fixing these bugs is not a huge issue, but this will result in more added costs for your agency.

• Unsuitability - Purchasing a cheap solution might save you a lot of cost, but doing so might not meet the needs of your agency. The features that your agency needs might not be covered if you buy cheap insurance software. Also, having an out-of-the-box insurance system might not be suitable for your agency. Such systems can have outlandish features that may be of no use to your agency.

Insurance Agency Management System vendors charge either a monthly or annual subscription fee per user. The cost of an Insurance Agency Management System can range from $60/user/month to over $300/user/month, depending on the desired feature set. Contact vendors to get specific pricing information and request a demo.

Selecting an agency management system that truly works for your business can seem like a daunting task. It is easy to get lost trying to compare the vast range of features and choices that are out there. That is why it is important to consider what you need out of a solution before diving into the bells and whistles of feature and function. Explore all of your options when choosing an agency management system for your agency. Spend a little more than you budgeted, always go hosted and cloud based.

Applied EPIC® is the world’s most widely used agency management platform. The management system is the backbone of an agency, so you need a system with the capabilities to manage your entire business and the flexibility to grow as you do. Allows you to manage and maintain a clear picture of your entire agency across all roles, locations and lines of business. It is an all-in-one solution that delivers core capabilities for each person within the business to manage prospecting, CRM, market access, quoting, accounting, reporting, and policy admin with ease. Boost the value of your agency by having a flexible system that can grow and innovate alongside your business.

Embrace technology with an open and flexible platform - Using an open and scalable architecture, accomplished through an API and Data Lake design, Applied Epic supports acquisitions and integrations of both Applied and third-party applications to guarantee productivity and profitability as the needs of your business change.

Give your staff a single place to operate - Get more of your agency in the same platform to have a single source of truth for your business. All roles, locations and lines of business – both P&C and benefits – can be managed in this platform while giving flexibility for staff to operate with other applications that exchange data directly with Applied Epic.

Empower your team to work from anywhere - Give employees a simple, intuitive user experience. They can view account and policy details, complete a quote, file a claim, and remarket a renewal. And with on-the-go access to your management system via browser-based technology, you now have the flexibility to empower your teams to work from anywhere.

Work better with your insurer partners - Connect with insurer partners right from your daily workflow to save time servicing customers. Without ever leaving your core system, you can find the best products quickly and easily and exchange policy details.

Give your P&C and Benefits brokers a single place to operate - Get more of your agency in the same platform to have a single source of truth for your business. All roles, locations and lines of business – both P&C and benefits – can be managed in this platform while giving flexibility for staff to operate with other applications that exchange data directly with Applied Epic.

Process Management and Automation - Delight your employees by making work simpler. Automate, adapt and reassign the most frequently used workflows to ensure consistency across all users and locations through business process management capabilities and pre-built workflows with myEpic. By automating their most frequently used workflows, they can get more done in less time.

Accounting -Reduce time spent on finance and accounting with solutions designed to meet your needs. Our systems integrated accounting is built specifically for insurance to make your FP&A teams efficient and reporting easy.

Policy Management - Getting the right policy, with the right info at the right time to customers is crucial. Our platform makes back-office administration easy with real-time access to policy information at each stage of the policy lifecycle, so you can provide quick and accurate service.

Sales Automation and Customer Relationship Management - Stop wasting time bouncing back-and-forth between multiple systems. Your management system is the only place you need to go to view, monitor, track and forecast new business opportunities and renewals. From there, integrate with world-class CRM technologies, like Salesforce, to get a 360-degree view of your customer.

Document Management - Work the way that works for you. Manage, organize and secure documents based on your agency’s guidelines or your own customized process. Keep it simple or create deep folder hierarchies. Search, create reports, track history and/or versions by customer or vendor. It’s that easy.

Market Access and Quoting - Easily identify markets for your risks directly whether you are looking to find a market for a new risk or remarket a current one. Integrated personal lines and commercial lines quoting reduces redundant data entry and makes for more efficient quoting with insurers directly in your management system so you can make sure your customers get the best products at the right price – all with fewer clicks.

Insurer Connectivity - Say goodbye to paper and hello to productivity. With automated information exchange between you and your insurer partners, receive the latest policy-related documents and information via download directly in your management system.

Reporting and Data Analytics - Obtain powerful graphical business insights from your existing management system data. Then use these insights to target where you can boost employee productivity and focus on the most profitable customer and insurer relationships.

Omnichannel Customer Service - Give your customers choice in how they interact with your business. Applied Epic easily integrates with your customer self-service portal and mobile app so that your customers can access their policy information when and how they like.

AI-Powered Email Summarization - Leverage the power of AI to quickly summarize an email into an Activity note when attached in Applied Epic. This new AI-assisted workflow lets you offload the time-consuming task of manually entering notes for emails and focus on higher-value work while ensuring important information is captured and easily accessible.

Epic Quotes Commercial Lines (EQCL) - Epic Quotes Commercial Lines brings single entry, multi-carrier comparative rating natively in Applied Epic® and ensures a single data source for the quoting and application process. This allows your agency to seamlessly remarket or quote new business, present a professional proposal, and simplify the bridge to portal bind experience without ever leaving Applied Epic.

Integrated Text Messaging - Quickly act inside Applied Epic based on incoming customer messages and ensure critical information sent via text by your insured is captured, stored, and easily accessible. Automatically route incoming messages from unique contacts to the proper Account. Receive and attach multimedia messages (pictures, videos, etc.) to the insured’s Account.

NOTE: Visit the vendor website for additional features, details and current pricing.