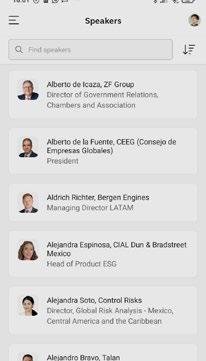

Matchmaking

Mexico’s leading B2B conference organizer uses a customized app to deliver an unparalleled experience

The MBE App delivered AI-powered intent-based matchmaking to Mexico Oil & Gas Summit 2025 attendees

MBE App Impact

313 participants

1,064 matchmaking communications

370 1:1 meetings conducted Matchmaking intentions

2,886 1,267 Networking 1,619 Trading

• ABB

• ABS Wavesight

• Achilles Mexico

• AEI Hidrocarburos

• Agencia rojas Vela y Asociados

• Aggreko

• AINDA, Energía e Infraestructura

• Akali Marine

• Alberta Mexico Office

• All Energies Services

• Alliance

• Alquimia Oil & Gas

• Amcham Saudi Arabia

• AMESPAC

• AMEXHI

• AMGNV

• APPLUS

• Aquapherm PChem

• Aqueos

• Area Industrial

• Audentis Energy

• Baker Hughes

• Baker McKenzie

• BBVA

• Becerril, Coca & Becerril

• Bienes Sustentables

• BioWare

• Black Eagle Logistics

• Blin-co Servicios regulatorios y Contractuales

• Boston Consulting Group

• BP

• Bravo Energy

• Brenntag

• Brilliant Energy Consulting

• CalPro

• Carbon Connect International

• Cargoweld

• Catenon

• Ceragon Networks

• Chamber of Deputies

• ChampionX

• CN Biogas

• COMCE SU r

• COMENEr

• Conecta

• Consultec International Inc.

• Consultores de Ingeniería UG21

• Creel, García-Cuéllar, Aiza y Enríquez

• CSIPA

• Cuatrecasas

• Deepocean

• Diavaz

• Digito r

• DNV

• Dubai Chambers

• Ekabel

• Element Materials Technology Monterrey

• Elemental Media

• Embassy of Canada

• EMGAS - Empresa Mexicana de Gas

• Endress+Hauser

• Énestas

• Eni México

• Erciyas Holding

• Er M

• F ruiz y Hijos

• F&CO Oilfield Solutions

• FalconView Energy Products

• FBV

• Fieldwood Energy

• Finsolar

• FishbonesAS

• Fitch ratings

• flusell by Xisema

• Fontis Energy

• Framecrete

• FTI Consulting

• Fueltrax

• Fugro

• Galicia Abogados

• Gasoductos de Morelos

• Gesa Supplies and Services

• Glencore

• Goodrich, riquelme y Asociados

• Government of Tamaulipas

• G rupo CIITA

• Grupo Mexico Infraestructura

• Grupo Mexico Servicios de Ingenieria

• Grupo Protexa

• Gulf Latin America

• Halliburton

• Harbour Energy

• Heerema Marine Contractors

• H F Offshore

• Hikmicro

• Hikvision

• Hokchi Energy

• Holland House Mexico

• ICA FLUO r

• IMP

• Indimex

• INErCO

• INGEFISA

• Instituto Mexicano del Petróleo

• Instituto Tecnológico del Petróleo y Energía

• International SOS

• intesista

• iPS Power ful People

• Jaguar E&P

• JC Partnering

• Johnson Controls

• Kannbal Consulting

• Kepler Oil & Gas

• Kiewit

• Kongsberg Digital

• Kotra

• Kpler

• KPMG

• KUALION ENErGIA

• Kualion Suministradora

• La Frutologia

• Linde

• Linker Energy

• Lukoil

• Marcos y Asociados

• Maxepoxy

• MCM Abogados

• Metal One

• Mexico Petroleum Company

• Mijares, Angoitia, Cortés y Fuentes

• Ministry of Economy

• Ministry of Energy

• Minsa Energy

• MODEC

• MT Soluciones y Construcciones

• Muvoil

• Nabors

• National Hydrocarbons Commission - CNH

• Natural resource Governance Institute

• Newmont

• Ngrenta

• Nomarna

• Norwegian Embassy in Mexico

• Norwegian Energy Partners

• Núcleo Sepec

• Oca Global

• OH Maritime Services

• Oil & Gas Alliance

• Oilmex

• OPEN IT

• Opex

• P Q M edia Group

• Parenco

• PEMEX

• Perenco

• Petricore

• Petrolera de Amatitlán

• Pietro Fiorentini

• Pifusa

• Polioles

• Química Apollo

• r9 Holdings

• relesur

• relyon

• repsol

• rGB Comunicación Multimedia

• S&P Global

• Samson Control

• Sanpetrol

• Santamarina y Steta

• SB M Offshore

• Senado de la república

• Senermex Energia

• Sensia

• Servicio Petrolero

• Servicios Integrales Nuevo Santander

• Siemens

• Sistemas de Infromación Geográfica

• SL Intelligence

• SLB

• SLM

• Smart Fiscal Solutions

• So Energy

• Someone Somewhere

• SPM Oil & Gas

• Sproule ErCE

• STE Consultec

• Steel Alloys & Services

• Stop New Media

• Syensqo

• Techint

• TechnipFMC

• Tequilera de Arandas

• Tethys Energía

• TFMC

• Tiger Offshore rentals

• TMM

• TotalEnergies

• Viridien

• Vista Energy Holding II

• W-Industries México

• WAVE

• Weatherford

• Woodside Energy

• WTS Energy

• WTW

• XWells

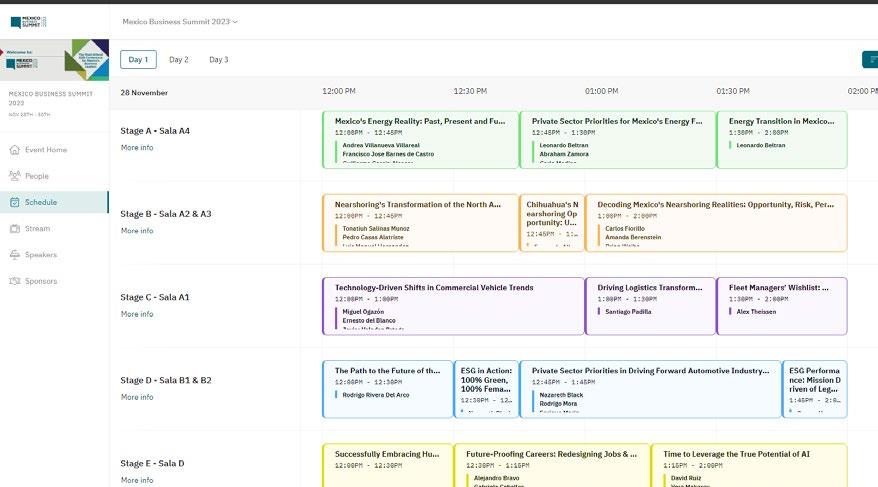

TUESDAY, SE PTEMBER 23

16:30 LEADING THE CHARGE: OPERATOR STRATEGIES FOR GROWTH AND RESILIENCE

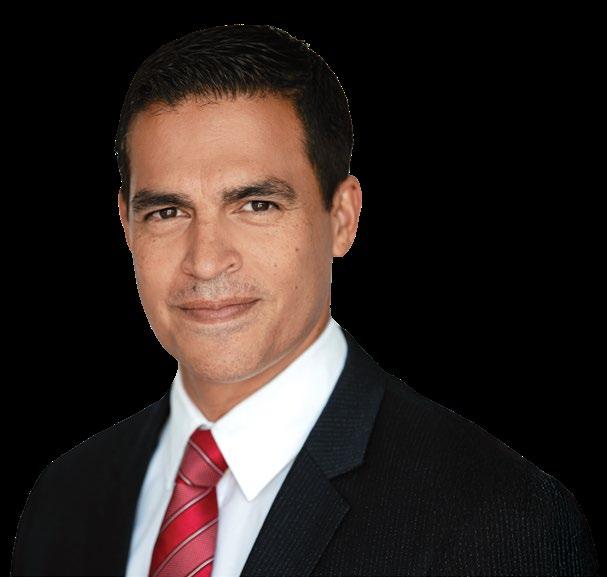

Moderator: Selene González, bp

Panelists: Andrés Brügmann, SL Intelligence

Merlin Cochran, AMEXHI

17:10 OFFSHORE BEYOND 2025: STRATEGIC PARTNERSHIPS FOR MEXICO’S UPSTREAM FUTURE

Moderator: César Vera, Fueltrax

Panelists: Sergio Charles, Grupo Protexa

Anouar Fraija, Halliburton

Luis Navarro, Heerema Marine Contractors

Mariano Souto, Aggreko

18:00 FINANCING, RISK & INVESTMENT OUTLOOK FOR THE MEXICAN OIL & GAS INDUSTRY

Moderator: Javier Mundo, KPMG Mexico

Panelists: Omar Castillo, BBVA Mexico

Chris George, WTW

Adriana Eraso, Fitch ratings

21:00 END OF MEXICO OIL & GAS SUMMIT 2025 - DAY 1

WEDNESDAY, SE PTEMBER 24

09:00 THE FUTURE OF THE ENERGY SECTOR IN MEXICO

Speaker: Rocío Abreu, Chamber of Deputies

09:30 ENERGY SOVEREIGNTY & MARKET ACCESS: NAVIGATING SECONDARY LAWS CHANGES AND POLICY SHIFTS

Moderator: David Enríquez, Goodrich, riquelme y Asociados

Panelists: Benjamín Torres-Barrón, Baker McKenzie Mexico

Carlos de María y Campos, Galicia Abogados

Alejandra León, S&P Global Commodity Insights

Verónica Irastorza, FTI Consulting

10:15 THE NEXT CHAPTER OF PEMEX-PRIVATE PARTNERSHIPS

Moderator: Fernanda Ballesteros, Natural resource Governance Institute

Panelists: Fluvio Ruiz, Energy Expert

Alma América Porres, CNH

Antonio Escalera, Tethys Energía

Manuel Cervantes, MCM Abogados

Sergio Pimentel, Jaguar E&P

Jorge Anaya, Harbour Energy

12:20 PROJECT UPDATE TRION

Speaker: Karelis Holuby, Woodside Energy

12:40 MEXICO’S ONSHORE E&P OPPORTUNITIES

Moderator: Sarai Escandón, Chamber of Deputies

Panelists: William Waggoner, Mexico Petroleum Company

Óscar Roldán, r9 Holdings

Ibis Colli, Black Eagle

Argenis Nieves, Hikvision

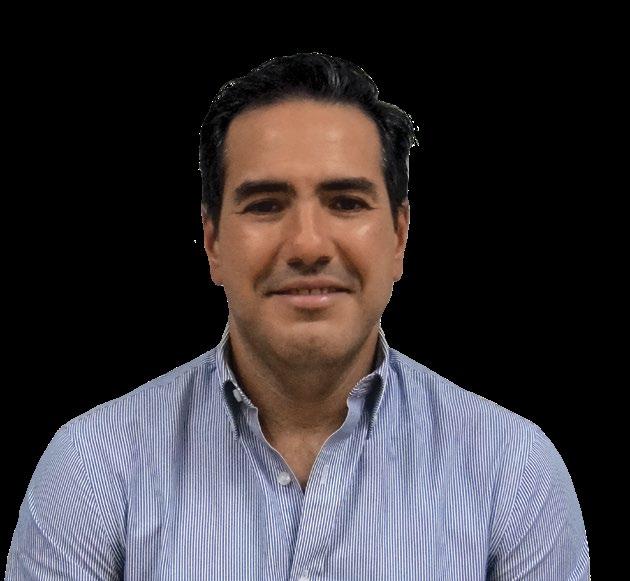

15:00 PROJECT UPDATE KAN

Speaker: Bernhard Siethoff, Harbour Energy

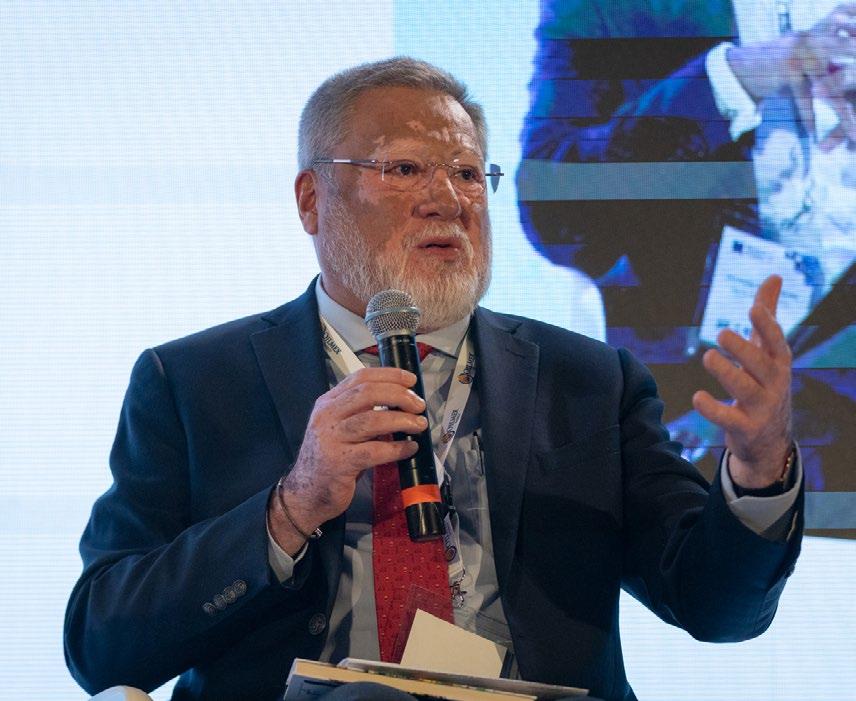

15:30 TECHNOLOGY AND INNOVATION AS DRIVERS OF E&P EFFICIENCY AND SUSTAINABILITY

Moderator: Rafael Espino, AMESPAC

Panelists: Elizabeth Mar Juárez, IMP

Germán Gómez, Baker Hughes

William Antonio, SLB

Sara Landon, INErCO Mexico

Eckhard Hinrichsen, DNV Energy Systems Mexico

19:00 END OF MEXICO OIL & GAS SUMMIT 2025

LEADING THE CHARGE: OPERATOR STRATEGIES FOR GROWTH AND RESILIENCE

Mexico’s oil and gas sector is at a turning point. With rising domestic demand, aging fields, and renewed debate over unconventional resources, the industry faces urgent questions: how to secure supply, modernize operations, and define the role of private partnerships alongside PEMEX so operators can maintain sustainable growth and resilience.

Selene González, Communications Director, BP, highlighted three key elements to watch for: “First, CNH’s dissolution, with the transfer of its powers to the Ministry of Energy and all the administrative changes that implies. Second, the possibility of the new figure of mixed contracts and the investment opportunity that the reform proposes. Third, I would highlight the possibility of maintaining exploration and production contracts, which have governed us over the past 10 years.”

“Mexico has it all.

That is one of the big advantages. Let’s bet on all of Mexico, because to reach the government’s targets we need everyone working in favor of the industry”

Merlin Cochran Director General | AMEXHI

Without a significant increase in investment and activity, analysts warn that crude imports could become necessary within the next few years.

Contract models are shaping the path forward. The government’s reform proposal introduces new mixed contracts that would allow PEMEX to retain a minimum 40% stake while opening the door for private capital in the government’s hope to reach 1.8Mb/d of oil and 5Bcf/d of natural gas by 2030. Operators warn that relying on a single contract framework is risky, however. “We need all available mechanisms. Are mixed contracts going to solve all the problems of every type of asset? I do not know, but I think depending on just one model would be very risky. So what we need here is not ‘or;’ it is ‘and.’ It is mixed contracts and something else,” Andrés Brugmann, Partner, SL Intelligence, said. He added that license and productionsharing agreements have already proven themselves. “There is interest, and they have delivered clear results, both in exploration and in production. We should also look at all the tools the Mexican state has.”

A central challenge is ensuring that mature fields continue to deliver at a time when production decline is accelerating. Experts argue that modernization of existing facilities, including electrification of operations, improved monitoring systems, and the adoption of more efficient technologies, is essential. While global examples of such upgrades already exist, applying them across Mexico’s aging asset base remains a major hurdle. At the same time, drilling activity remains limited compared to other producing regions. Mexico drills only a fraction of the wells developed in places like Texas, making it difficult to offset natural decline curves.

Bankability is also a concern, Brugmann argued. “As for contracts, they have to be bankable. you have to have payment guarantees, interests, and alternative monetization mechanisms. If we are going to ask someone to invest and literally bury their money in Mexican soil where there is no way to take it back out, unless there is a mechanism to make it liquid through the contract, then we have to give some viability to that contract so that it is really attractive and capital can come in quickly.” Brugmann added that the capital is available, but it is competing with other jurisdictions, as Mexico is not in a vacuum, and capital could always go elsewhere if other countries offer better investment conditions.

Brugmann also pointed to the need for a coherent reserves strategy. “We can

produce those reserves that we already have in inventory, but where is the strategy to reincorporate or incorporate new reserves?” He further added that for unconventional or low-permeability reservoirs, the industry needs a different strategy as there is no infrastructure. “We need to work with clusters because clusters are what will give us immediate production at the lowest cost and shortest time to generate that infrastructure. But in the long term we also have to start looking at projects that do require new infrastructure and how we are going to generate it from zero so that it later becomes a hub of development,” he said.

For Merlin Cochran, Director General, AMEXHI, competitiveness requires more than fiscal incentives. “Just because you change and have a lower sovereign fiscal regime does not mean you are already more competitive. you need many other frameworks around it that have to be embedded in your contract.” Cochran added that there are still no clear rules because regulation has not yet been published and the industry still does not know exactly how payments are going to work. “Everyone I know wants to support and move the NOC forward. But the ‘how’ still needs to be clarified,” he added.

Despite the uncertainty, Cochran emphasized Mexico’s advantages. “Mexico has it all. That is one of the big advantages. Let’s bet on all of Mexico, because to reach the government’s

targets we need everyone working in favor of the industry.” He further emphasized the role that unconventional resources can have and the positive signals that exploration is already showing.

Deepwater projects represent yet another frontier, as they also come with amplified risks, higher costs, and complex execution challenges. This raises questions about how operators will balance opportunities in deepwater with the immediate need to stabilize output from onshore and shallow water fields. Financial constraints further complicate the picture, with PEMEX’s fiscal fragility casting doubt on payment flows and contracting mechanisms. The ability of suppliers and operators to negotiate secure schemes will be critical for moving projects forward, as will deeper integration of domestic supply chains.

Taken together, these dynamics underline the balancing act ahead. On one side lies the need to modernize operations, diversify resources, and pursue private investment through new contract models. On the other, PEMEX’s financial fragility, regulatory uncertainty, and the government’s cautious approach to unconventional resources create limitations. What is clear for experts is that decisions made now, on contracts, competitiveness, and the role of unconventional plays, will shape Mexico’s energy future for decades.

OFFSHORE BEYOND 2025: PARTNERSHIPS SHAPING MEXIC O’S FUTURE

Mexico’s offshore oil and gas services ecosystem is recalibrating for the post 2025 Energy r eform landscape under tighter cash cycles, higher operating costs, and ambitious production targets. A new cycle for the country’s oil and gas industry is happening in practice, shifting capital models to ride out payment uncertainty, accelerating technology adoption where it truly lifts recovery in complex geology, deploying autonomous capabilities to de-risk tasks offshore, and reinventing logistics to keep schedules intact despite supply chain friction.

“The industry shares a common objective, and it is evident that collaborative efforts are far more effective than working independently. Moreover, there should be tangible benefits for all participants,” says César Vera, Director, Global reach and Strategy, Fueltrax.

The financial backdrop is decisive. Payment delays and reduced activity tied to Mexico’s production decline have forced service providers to rework capital exposure and cash conversion. Halliburton recently flagged international revenue pressure linked in part to lower activity in Mexico, and noted that unresolved supplier payment timing has curtailed operations even as decline rates heighten the need for service reactivation.

“The lack of payments causes capital to shift somewhat away from the country, and companies prefer to invest in emerging

markets that compete with Mexico,” says Anouar Fraija, Vice President and Managing Director, Halliburton.

Mexico’s crude and condensate output fell to roughly 1.64MMb/d in May, sharpening the tension between production goals and working capital realities for the supply chain. In this setting, providers have leaned toward performance-based milestones, shared-risk frameworks, and financing structures that phase cash calls with verified field results, rather than front-loaded CAPEX cycles. These practices are increasingly common in shallow-water work, where decline management is critical, and in deepwater projects that demand multi-year visibility.

Despite the stress, Mexico is still advancing material offshore programs that anchor demand and justify long-dated investments. Woodside’s Trion development in the Perdido area selected SBM Offshore to deliver and lease a floating storage and offloading unit for 20 years, a signal that deepwater infrastructure will remain part of the mix through the 2030s even as shallowwater decline mitigation continues. The NOC has also pursued new appraisal and exploration in Perdido and has approved spending to lift output from mature offshore fields such as Bacab, reinforcing a two-track opportunity set for contractors that can bridge brownfield debottlenecking and greenfield execution.

Within this environment, companies represent complementary levers for uptime and total-system efficiency. Fueltrax, focused on smart fuel management across offshore support fleets, brings a datacentric approach that cuts consumption and emissions while sharpening cost control at the exact moment vessel day rates, bunkering costs, and port congestion squeeze budgets. In Mexico, the company has emphasized fuel optimization as a direct lever to lower logistics costs across offshore and onshore movement, with metering that extends to multiple fluids and provides traceable quality and volume assurance. reducing fuel variance and idling time with vessel-level telemetry can free 5-10% cost on logistics legs that repeatedly drive critical path delays, especially during seasonal weather windows, says Vera.

“We have to transform the way we operate to continue in Mexico, such as working with Mexican companies to gain access to local suppliers, comply with local regulations, and leverage their local expertise”

Luis Navarro

Country Manager Mexico | Heerema Marine Contractors

without immediate payments, and operations in Mexico do not stop,” says Sergio Charles, Energy Director, Grupo Protexa.

On the technology front, the question is no longer whether to adopt digital and autonomous systems, but where to create the largest lift in Mexico’s specific geology and operations. “In offshore operations, we focus on technology and on producing energy as efficiently and reliably as possible. We always look for the best technology, and if we do not have it, we find it,” says Mariano Souto, General Manager, Aggreko.

Grupo Protexa exemplifies the domestic backbone of installation and construction capacity. The company’s energy division highlights a decades-long track record laying subsea pipelines and installing platforms in the Campeche Sound, and has recently mobilized dynamic-positioning class vessels for multi-platform shallowwater EPCI scopes. That blend of local content, heavy marine assets, and shallowwater execution discipline is what PEMEX and private operators need for fast-cycle tie-backs, lightweight topsides, and routine integrity campaigns that sustain plateau targets without the schedule risk of oversized projects.

“We have to be creative in how we finance projects. That way, clients can move forward

Large international integrators like Halliburton continue to push real-time drilling analytics, predictive maintenance, and subsurface imaging tuned to carbonate and faulted plays common offshore Mexico. Meanwhile, autonomous subsea robotics are crossing the threshold from trials to commercial activity in the broader Gulf of Mexico. Tether-less resident systems have executed survey scopes for international operators, demonstrating fewer weather aborts, faster mobilization, and reduced exposure hours for personnel. For Mexico, translating these gains to routine inspection, pipeline route surveys, and light intervention can compress campaign durations, clear backlogs, and lower life-of-field OPEX. The global offshore Autonomous Underwater Vehicles (AUV) and r emotely Operated Vehicles (rOV) market’s projected growth underscores how these capabilities are shifting from specialist to standard across brownfield and greenfield phases.

SBM Offshore’s role at Trion also signals a second digital and autonomous horizon: floating production and storage assets as data platforms. Long-term lease models create alignment for condition-based maintenance, production optimization, and energy management at the asset level. When combined with AI-assisted emissions and power management tools proven in other basins, operators can balance throughput against energy intensity while service providers capture value through availability guarantees.

Logistics is the day-to-day determinant of schedule in the Bay of Campeche and Perdido. Vessel scarcity, weather, and parts lead times amplify small planning errors into multi-day slips. Here, the combination of granular fuel and route analytics, predictive inventory for critical spares, and tighter port call orchestration is paying off. Mexico’s offshore support vessel market is growing from a base near US$700 million in 2024, and that growth will reward operators who adopt telemetry-driven dispatch, just-in-time bunkering, and prioritized berth windows linked to live project controls.

“We have to transform the way we operate to continue in Mexico, such as working with

Mexican companies to gain access to local suppliers, comply with local regulations, and leverage their local expertise,” says Luis Navarro, Country Manager Mexico, Heerema Marine Contractors.

The macro picture supports this pivot to efficiency. Market analysts project moderate growth in Mexico’s oil and gas sector through the next decade, with offshore still representing most reserves and resources. If Mexico’s newly signaled willingness to use additional recovery techniques in complex plays translates into balanced approvals and timely contracting, service intensity will rise in both brownfield and deepwater segments.

FINANCING, RISK, INVESTMENT OUTLOOK FOR THE OIL & GA S INDUSTRY

Mexico’s oil and gas sector faces a pivotal financing and risk moment as 2025 progresses. PEMEX continues to carry the heaviest strain in the ecosystem: its debt load, liquidity pressures, and volatile cash flows shape how banks, insurers, auditors, and rating agencies view the country’s upstream opportunities.

The government has intervened with significant measures to stabilize PEMEX’s maturities, including a dollar bond package and a P-Cap style instrument that together alleviated near-term refinancing pressure; these actions were central to Fitch ratings

upgrading PEMEX’s corporate rating in August 2025 while noting that the company remains below investment grade and dependent on state backing. “The energy industry, despite its huge financial challenges, has the benefit of being supported by the government. They recently announced that they will continue supporting payments over the coming months. It is also important to recall that in July 2025, the government issued a pre-capitalized instrument for around US$12 billion, which is part of the message the government wants to send regarding the financial situation and performance of the industry,” said Omar Castillo, Senior Vice President Energy Industry GTB CIB, BBV.

Beyond headline credit actions, PEMEX’s operating metrics underline why the market remains cautious. The company reported deeply negative free cash flow dynamics and continued high leverage through mid-2025, with total debt near the US$99 billion mark and interest costs consuming a substantial share of quarterly EBITDA.

Fitch and PEMEX’s own reporting point to leverage that remains elevated versus international peers and to persistent downstream losses that complicate the turnaround case unless upstream volumes

and refining margins materially improve. Those structural weaknesses are what keep commercial lenders and project financiers from underwriting Mexican exposure at a premium unless additional state guarantees or credible cash-flow remediation plans are presented. “Even though Mexico has the assets and the right quality geology, it is still lagging. If we look, for example, at a country like Brazil that has been spearheading the industry in the region and has pioneered technology to tap into its most important assets,” said Adriana Eraso, PEMEX Analyst, Fitch ratings, adding that Mexico is 15 years behind where Brazil is.

The production picture is mixed, which affects both revenue forecasts and the bankability of new projects. r ecent BBVA analysis indicates that PEMEX’s production decline has paused in the near term and that certain new fields contributed modestly to liquid hydrocarbon volumes in 2Q25. Nevertheless, exports and conventional export receipts remain under pressure year-on-year. That combination reduces the natural dollar hedge that historically supported PEMEX’s dollar-denominated liabilities and increases currency mismatch risk for contracts and financing arranged in foreign currency. Lenders and sponsors will therefore demand stronger contractual protections and currency hedging mechanisms on any material private investments.

The main concerns around PEMEX’s credit standing ability to support its financing revolve around how to price and insure political and regulatory risk; how to structure capital to survive payment lags and sovereign dependence; and how to prioritize

“Using mixed contracts with private operators will be critical for us to perhaps maintain production, but that is not going to be the way to actually boost the full potential that we have in Mexico”

Javier Mundo

capital allocation toward projects with the fastest, most predictable returns.

KPMG’s advisory and risk work in the energy sector highlights that geopolitical and regulatory volatility rank among the top strategic risks for energy firms and that scenario planning, stress testing, and tax and fiscal modeling are now essential preconditions for greenlighting upstream capital. Professionalization of contracting practices, transparent governance, and external audits play an outsized role in restoring investor confidence. “What we find far too often when discussing insurance needs with clients is the response, ‘Well, it is what we did last year.’ We do not see enough analysis of what the risk profile looks like. We have tried to drive forward the concept of risk analytics to question companies and ask, ‘How much risk can you retain?’ What is the optimal level against your loss and risk profiles?” noted Chris George, Executive Director, Energy, WTW.

Different structures help reduce exposure to PEMEX cash-flow volatility. Those structures include production-linked payments, escrowed receivable arrangements, dollarlinked revenue covenants, and tranche mechanisms that tie disbursements to verified field performance. Syndication of risk across multiple international banks and the use of export credit agencies or multilaterals for political risk wrap can lower the cost of capital for technically sound projects.

For private operators evaluating mixed contracts, where PEMEX retains majority ownership but allows private partners to coinvest, these frameworks can offer a lower entry hurdle while still exposing sponsors to governance and payment timing risk; therefore, careful contract design and escrowed payment triggers are essential. The market will also watch how rating agencies and insurers price government support, since explicit or implicit state guarantees materially change a transaction’s economics.

Head

of Energy and Natural Resources | KPMG Mexico

Insurance and risk transfer capabilities are central to preserving bankability. WTW’s

2025 political risk and credit insurance research finds that political risk remains among the Top 5 corporate concerns globally and that capacity and pricing in the credit and political risk insurance market have been constrained by recent losses and higher reinsurance costs. For investors in Mexico, layering political risk insurance, trade credit insurance, and tailored performance bonds can be decisive instruments to bridge gaps created by sovereign dependence. Insurers will look closely at governance, environmental risk exposures, and contractual clarity when offering cover.

Near-term investments could be the most attractive ventures, such as brownfield optimization, enhanced oil recovery, integrity and maintenance that can cut declines, and midstream projects. However, the lack of payment in the sector could also hinder the

attractiveness of these. Lengthy projects may be less attractive, but with sound contracts, big players could venture into financing these, given certainty and attractive rOI models.

Mexico’s upstream investment narrative in 2025 remains conditional: state support improved headline credit dynamics, but long-term investability depends on durable production recovery, tighter governance, and pragmatic risk transfer designed by banks, insurers, auditors, and rating agencies working together. “Using mixed contracts with private operators will be critical for us to perhaps maintain production, but that is not going to be the way to actually boost the full potential that we have in Mexico,” said Javier Mundo, Head of Energy and Natural r esources, KPMG Mexico, highlighting the importance of working from different fronts.

THE FUTURE OF THE ENERGY SECTOR IN MEXICO

Mexico is advancing a comprehensive overhaul of its energy framework for 2025, with legislative changes, new gas and power strategies, and investment plans designed to strengthen the sector’s competitiveness, said rocío Abreu, President of the Energy Commission,Chamber of Deputies at Mexico Oil and Gas Summit. “At the Commission, we have an obligation to act as a hinge between the executive, regulations, and project execution,” said Abreu.

The Energy Commission of Mexico’s Chamber of Deputies is playing a central role in shaping the country’s rapidly evolving energy policy, especially in light of constitutional reforms, secondary legislation, and the emphasis on state control and regulatory overhaul. Created with the installation of Deputy Abreu as its chair in November 2024, the Commission is tasked with steering initiatives related to clean energy, environmental regulations, and energy reforms.

According to Abreu, there are key strategic pillars guiding energy policy including a renewed legal and institutional framework, an

integrated oil strategy, modernization of the electricity sector, gas integration, energy as a driver of competitiveness, and sustainability as a policy and business criterion.

On the legal front, Congress has enacted 11 laws, including eight new and three amended statutes, to provide clear rules and support strategic alliances for the energy sector. Among them are reforms to the law governing state-owned companies, which reaffirm PEMEX’s role as the state operator

in exploration, production, and refining while introducing fiscal changes to improve financial viability. The new system reduces PEMEX’s overall tax burden from previous levels above 50% to a flat 30%.

Abreu also emphasized the growing importance of gas in Mexico’s energy mix. With declining conventional oil reserves and rising costs for unconventional wells, gas has become a strategic priority for power generation and competitiveness.

“Oil fields are producing less every day; they are much more complex, unconventional wells, and they are also significantly more expensive,” explains Abreu.

Mexico’s gas strategy also seeks to reduce dependency on US imports by incentivizing domestic production and petrochemical development. Current petrochemical capacity stands at 27,500t/d, with investments of over MX$78 billion (US$4.33 billion) projected between 2025 and 2035 in ammonia, fertilizers, and secondary petrochemicals. Four cogeneration plants are planned to add more than 2,700MW of capacity.

The electricity sector reforms grant CFE a 54% production share, leaving 46% to private operators. Meanwhile, CrE has been dissolved, with permitting responsibilities transferred to the National Energy Commission to streamline procedures and shorten approval times. Investment of MX$83.5 billion is projected for transmission lines between 2025 and 2028 to relieve congestion and improve reliability in industrial corridors.

Mexico is also preparing to expand generation capacity by 29,000MW by 2030, with most projects led by CFE but with space for private initiatives. “These efforts align with President Claudia Sheinbaum’s plan for 100 new industrial parks, which will require a reliable power supply,” explains Abreu.

Abreu underlined that contracts signed under previous frameworks remain valid and are being respected, while new mixed contracts with private companies are being introduced to support exploration, mature field development and unconventional projects. She also pointed to ongoing payments of PEMEX invoices under a financing scheme that avoids transferring debt to the state.

SOVEREIGNTY, MARKET ACCESS: NAVIGATING LAW CHANGES, POL ICY SHIFTS

Mexico’s oil and gas sector is entering a new phase of transformation, driven by constitutional reforms, secondary legislation, and administrative restructuring designed to strengthen energy sovereignty. These changes have placed PEMEX firmly at the center of exploration, production, and midstream activities while redefining the space for private sector participation.

Under the new framework, PEMEX holds the lead role in development assignments, with private firms invited to participate through mixed contracts in which the NOC retains at least a 40% stake. This approach underscores the government’s emphasis on consolidating sovereignty over hydrocarbon resources, while still allowing private investment to complement state-led efforts. However, the success of this model will depend heavily

on investor confidence in PEMEX’s financial stability and the government’s ability to ensure predictable funding for projects.

For some legal experts, the continuity of the reform is striking. David Enríquez, Partner, Goodrich, r iquelme y Asociados, argued that the bulk of Mexico’s legal framework remains intact despite political rhetoric to the contrary. In his view, the 2025 package “keeps about 80% of what was established in 2013,” particularly in the treatment of contracts and private participation. “Substantive modifications to the energy market are not very significant,” he said, calling it a validation of the earlier reform’s foundations.

Other analysts emphasized that the reforms are shaped more by fiscal and political imperatives than by long-term planning.

Alejandra León, Director Latin America Upstream, S&P Global Commodity Insights, said the government’s strategy is less about meeting Mexico’s energy needs and more about propping up its indebted state company. “Policy is now geared toward rescuing a national company that needs to generate the resources to guarantee repayment of its enormous debt,” she explained. While León acknowledged that the private contract framework remains untouched and effective, she warned that the new hybrid instruments designed for PEMEX are still taking shape. “It is neither a true association nor fully a service contract, it is kind of its own amalgamation,” she noted.

restructuring has also shifted administrative responsibilities. The dissolution of CNH transferred oversight directly to the Ministry of Energy, concentrating power in one institution. Benjamin Torres-Barrón, Latin America Chair for Energy, Mining, and Infrastructure, Baker McKenzie Mexico, sees risks in this consolidation. “There is a bifurcation between maintaining the political agenda and acting as regulator of PEMEX and the broader sector,” he said. The Ministry is now tasked with both regulating and interpreting PEMEX’s governing law, a dual role that could create conflicts of interest. Still, Torres-Barrón praised improvements, such as clearer definitions of downstream activities and stronger provisions against

illicit fuel trade, but he cautioned that the test will be in implementation.

Mixed contracts are emerging as the primary mechanism for collaboration. There are currently 21 opportunities under review for 2025, with PEMEX announcing that several have already received offers from private companies. If executed, these agreements could add meaningful production volumes and channel billions in private capital into upstream operations. yet, financing remains a challenge, as projects must be structured to ensure returns while partnering with a financially constrained national oil company.

The proximity of the US market also looms large in Mexico’s strategic choices. Verónica Irastorza, Senior Managing Director, FTI Consulting, argued that Mexico cannot be treated as an isolated market given crossborder price dynamics. “We cannot see the Mexican market as isolated,” she said, adding that while Mexico has shale resources, replicating the US model will be difficult given the competitiveness of US gas and the different profile of shale operators. Still, she remains hopeful that the framework will permit at least some private contract participation in unconventional resources, even if only as exceptions.Ultimately, execution will determine whether the reforms succeed. Carlos de María y Campos, Partner, Galicia Abogados, stressed that the legal architecture is less of an obstacle

than political will. “The rules are there and the industry is ready. What we need now is attitude and decision,” he said. After years of stalled permitting, he welcomed signs of improved dialog and more technically prepared officials in the current administration, but emphasized the urgency of concrete action.

“Things are aligning, but we need to start taking steps,” he concluded.

The current landscape reflects a cautious but deliberate shift. The government is consolidating PEMEX’s role, advancing mixed contracts, and attempting to attract private capital under new legal and financial frameworks. At the same time, companies must navigate regulatory uncertainty, infrastructure bottlenecks, and lingering market distortions.

THE NEXT CHAPTER OF PEMEX-PRIVATE PA RTNERSHIPS

Mixed Development contracts are set to become the most consequential instrument for Mexico’s upstream sector over the next six years, following an administration closed to further private development. The new guidelines for mixed development schemes require PEMEX to retain a minimum participating interest, while allowing private partners to contribute capital, technology or operational capacity. The central policy tradeoff is straightforward: preserving national control of the subsoil while creating clear, bankable economics and enforceable counterparty protections that make longterm investment rational.

According to Fernanda Ballesteros, Mexico Country Manager, Natural r esource Governance Institute, there are high expectations for the execution of the new mixed contracts, but also many questions regarding their terms and the processes that have been generated in the last month. She noted that from a business

perspective, PEMEX has received significant government support, with the 2026 budget contemplating more than MX$260 billion for the company, a figure that is larger than the budget for the recently created IMSS-Bienestar and six times the environmental budget.

The fiscal reality driving the mixed-contract agenda is undeniable. PEMEX entered 2025 with one of the highest debt burdens among oil companies globally and with sizable payment obligations to suppliers. The federal government and financial markets responded with targeted instruments, including a US$12 billion pre-capitalized securities issuance that reduced nearterm refinancing pressure, partial funding for upstream investments and supplier payments via the US$13 billion Banobras Investment Fund, and a tender offer of nearly US$10 billion for long-term debt backed by sovereign transfers. However, the company’s leverage and negative free cash

flow dynamics remain material constraints on autonomous PEMEX funding for exploration and large-scale development.

Any mixed contract that anticipates PEMEX as an active cash contributor must therefore be realistic about when and how the state company will meet capital calls; more credible contracts, and those that will attract international partners, will rely on alternative payment and risk-transfer mechanisms rather than on unconditional PEMEX funding alone.

According to Manuel Cervantes, Founding Partner, MCM Abogados, a fundamental issue is PEMEX’s financial credibility and the need for a secure payment mechanism for the private investor, suggesting that the law should permit payments in either cash or in-kind to provide flexibility. “A central point is PEMEX’s financial credibility and the consistency between what it asks for and what it actually delivers. We must not forget that there is a universe of creditors, and among them are potential participants for these mixed contracts,” he noted.

Structuring mixed contracts to mitigate counterparty risk requires a suite of contractual and financial design choices. Escrowed payment mechanisms, in-kind offtake arrangements, performance-linked disbursements, step-in rights for technical operators, and clear dispute resolution paths are all practicable elements. Sponsors

will also evaluate whether contracts permit cost recovery or profit sharing that is visible and predictable.

Given global lenders’ and insurers’ sensitivity to sovereign and political risk, attaching guarantees, sovereign or quasi-sovereign wrappers, or multilaterally backed instruments can materially lower the risk premium and unlock export credit or insurance capacity. The new guidelines already contemplate that PEMEX need not always make capital contributions and that private partners can fill funding gaps, but legal clarity is required on tax treatment, royalty sharing, and PEMEX’s obligations when it acts as a minority or nonfunding partner.

Jorge Anaya, Vice President of Legal and Business Services, Harbour Energy, explained that investors are familiar with how different models work in other countries and cautioned that the more the Mexican contracts deviate from established international models, the more it could create doubt for investors.

The Natural resource Governance Institute will press for transparency, contract disclosure, and independent auditability so that public interest and investor certainty are aligned. IMP can provide the applied r &D and technical verification needed to quantify reserves, design enhanced recovery trials, and validate engineering schedules that underpin financing models.

Governance and operational integration are set to be core risk mitigants. Alma América Porres, Former Commissioner, CNH, outlined three key governance pillars needed for success: a clear decision-making structure that includes both PEMEX and its partners, detailed contractual agreements covering sustainability and dispute resolution, and transparent protocols for sharing financial and operational data.

At the policy level, locking in taxation, royalties, and environmental obligations for the life of the project, or at least creating predictable adjustment mechanisms, is essential to avoid the type of retroactive

policy risk that deters long-dated capital. The Natural resource Governance Institute and civil society scrutiny can amplify reputational consequences for opaque deals, which in turn affect access to institutional capital.

Independent operators such as Jaguar E&P and international partners like Harbour Energy are likely private sponsors who will test these schemes in practice, offering capital, operational capability, and often the technical innovation that PEMEX needs for complex fields. Each actor’s incentives differ, but a successful mixed contract must be reconciled into a single, executable project plan. “I do not believe the mixed contracts model will be enough to reach the production goals the federal government has outlined. I think there should be a possibility for a hybrid approach: a mix of using mixed contracts for some projects and also reintroducing the possibility of licensing rounds to boost national production and allow companies that want to risk their capital to do so,” said Sergio Pimentel, Legal Director, Jaguar E&P.

Antonio Escalera, Senior Consultant, Tethys Energía, also questioned the effectiveness of a single contract structure for all types of projects. He noted that the cost recovery model for mature fields requiring enhanced recovery might need to be different from that for capital-intensive deepwater or extra-heavy oil projects, arguing that more creativity is needed in the implementation of these new contracts.

Energy expert Flavio ruiz Alarcón argued that the contracts should also be part of

“A central point is PEMEX’s financial credibility and the consistency between what it asks for and what it actually delivers. We must not forget that there is a universe of creditors, and among them are potential participants for these mixed contracts”

Manuel Cervantes Founding Partner | MCM Abogados

a long-term national strategy focused on technology transfer and human capital development, not just a short-term solution for PEMEX’s finances, a goal that previous legislation on this regard also failed to meet. “My criticism of the previous legislation is that although the model seemed promising, in the end was limited. These schemes were conceived as a way to alleviate the financial deficiencies of PEMEX, and not as a way to achieve technology transfer, human resource development, or training in the knowledge of diverse geological challenges,” highlighting PEMEX’s lack of international experience when compared with global peers.

ESG considerations are increasingly nonnegotiable for the private firms likely to partner with PEMEX. Mixed contracts that embed emissions targets, methane and flaring caps, social investment commitments, community consultation processes, and independent environmental monitoring will be more attractive to international investors and insurers. Technical partners and research bodies such as IMP can codify low-emission development pathways and quantify the incremental capital required for cleaner operations, enabling a transparent trade-off between near-term returns and longer-term ESG compliance. If Mexico can demonstrate that mixed projects adhere to international ESG norms, it will be easier to source capital at scale and to unlock reinsurance and export credit agency support.

PROJECT UPDATE KAN

Earlier this year, Harbour Energy successfully appraised the Kan discovery in Block 30 offshore Mexico, significantly increasing its estimate of oil-in-place to 500MMb. The company considers that this discovery could generate significant value for its shareholders and strengthen its position in Mexico, supporting its commitment to regional energy security through responsible and efficient resource development.

The Kan Field is located in the Cuencas del Sureste basin, approximately 20km off the Mexican shoreline. It is operated through a partnership in which Harbour Energy holds a 70% stake and TotalEnergies owns the remaining 30%. The field lies in shallow waters, with depths ranging between 50 and 100m. Its geological focus is on the Pliocene and Miocene plays, with the main target reservoirs situated in the Upper Miocene, where the initial discovery was made, as well as in the Mid and Lower Miocene and the Lower Pliocene formations. “Kan field is the largest discovery after the Zama field in Mexico in recent years,” said Bernhard Siethoff, Vice President of Exploration and Subsurface for Mexico, Harbour.

The Kan-1 exploration well, initially drilled by then-operator Wintershall Dea in 2023, made the initial oil discovery. Harbour Energy began appraisal drilling operations for Kan in August 2024.

The Kan-1 exploration plan delivered promising results, with preliminary estimates suggesting that the discovery could hold between 200 and 300MMboe in place. The drilling encountered a series of complex oil-bearing sands, notable for the absence of a clear oil-water contact, with all sands classified as oil-down-to. Each sand formation was identified as having individual pressure compartments, highlighting the geological complexity of the find.

Building on these results, the Kan-2 delineation plan applied the learnings from the initial well and led to even more

significant outcomes. Estimates of volumes increased to approximately 500MMboe in place, largely due to the identification of a substantial oil column in the lower system. The drilling campaign was also distinguished by its strong performance in health, safety, environment, and security, as it was executed without any recordable incidents or accidents. The well was completed on schedule and at a cost below budget, underscoring both operational efficiency and financial discipline.

The appraisal campaign, which was completed on time and within budget, validated volumes higher than predrill estimates. Based on new data from the appraisal well, Harbour’s updated gross recoverable resources for Kan are approximately 150MMb, representing a 50% increase over initial projections.

Looking ahead, the company is moving the project toward development. According to the executive, the plan is to select a development concept in early 2026 from three main options currently under consideration: a standalone offshore development, a tie-back to existing nearby facilities, or building a new onshore

processing facility. Following concept selection, the company aims to reach a final investment decision (FID) toward the end of 2026 or early 2027, to achieve first oil by the end of the decade. In parallel, having recently received approval for an additional exploration period for the rest of Block 30, Harbour will also be analyzing the wider area to identify potential fast, cheap, and safe tieback candidates for the future Kan facilities.

Siethoff stated that this successful campaign reflects careful technical planning, collaboration, and execution, marking a major milestone for the company in Mexico. Sergio Calles, Block 30 Exploration and Appraisal Manager, added that the results validate the quality of the Kan discovery and open a clear path toward potential development.

This outcome strengthens Harbour Energy’s strategic position in Mexico and supports its broader commitment to regional energy security through responsible and efficient resource development. The company will continue to work closely with government

authorities, communities, and stakeholders to align development with national priorities and environmental stewardship.

Harbour Energy in Mexico

In its Full year r esults 2024 and Capital Markets Update, Harbour Energy highlighted strong momentum in Mexico, driven by increased interests in the Zama and Kan fields. The company emphasized that over 80% of its portfolio is concentrated in four key countries: Norway, the UK, Argentina, and Mexico, with “large offshore oil discoveries providing growth options.” Specifically regarding its position in Mexico, Harbour Energy reported being the largest international company by reserve and resource base. Its assets include a 32% interest in the giant Zama oil field and the successful confirmation of the Kan oil field. Furthermore, the company has interests in the potential deepwater area development focused on blocks 29 and 4, and operates production from the onshore Ogarrio and offshore Hokchi oil fields.

TECHNOLOGY, INNOVATION: DRIVERS OF E&P EFFICIENCY, SUSTAINABILITY

Technology and innovation are playing an increasingly central role in how Mexico’s upstream oil and gas sector confronts growing cost pressures, aging assets, and higher expectations for environmental performance. As PEMEX and private operators deal with budget constraints, complex geology, and tighter regulatory demands, cutting-edge tools such as autonomous drilling, AI-driven reservoir modeling, predictive analytics, digital twins, and advanced emissions monitoring are moving from experimental or

“Technology, when properly implemented, is the best ally for meeting EHS standards without compromising business competitiveness”

Sara Landon

Executive Director | INERCO Mexico

pilot phases toward becoming core elements of efficiency, safety, and sustainability.

“Artificial intelligence and other emerging technologies have the potential to enhance efficiency, reduce costs, and improve safety, particularly within industries such as oil and gas,” said rafael Espino, President, AMESPAC.

Commercial technology vendors and service companies are converging on two pragmatic value propositions: reduce cost per barrel and de-risk operations. Baker Hughes is deploying integrated digital and automation suites that combine drilling automation, remote operations, and carbon management tools such as CarbonEdge and Cordant for CCUS operations, demonstrating that major vendors are packaging emissions management with conventional drilling and intervention services. Those integrated stacks allow operators to monitor energy

consumption, optimize well interventions, and plan maintenance with a clearer line of sight on both opex savings and emissions reductions, an essential capability as financial and environmental performance increasingly drive capital allocation decisions.

“We have seen the digital component integrated both in subsurface and surface operations, with no disconnection between them. We have devoted significant effort to the production area as a key focus, given its direct link to decarbonization processes,” said Germán Gómez, Corporate DirectorMexico & Central America, Baker Hughes

Mexico’s research and technical ecosystem has a critical role to play in localizing these technologies. The Mexican Oil Institute remains the country’s primary applied r&D engine for hydrocarbons, from reservoir modeling and enhanced oil recovery methods to emissions measurement protocols and material science for corrosive environments. By partnering with international vendors on pilot deployments, IMP can help adapt tools such as digital twins and AI reservoir simulators to Mexican carbonate and fractured plays, where standard models often underperform without local calibration. That combination of local validation and international technology transfer reduces operational risk and shortens the learning curve for field teams, improving the business case for investment in automation.

“It is important to discuss AI, new technologies, costs, and production within this industry. Despite the availability of these tools, they are not being utilized,” said Elizabeth Mar Juárez, Director General, IMP.

Independent engineering and environmental specialists such as INE r CO Mexico are advancing the practical applications of advanced emissions monitoring and process optimization in industrial settings. INE r CO’s portfolio shows a consistent focus on stack and fugitive emissions monitoring, combustion optimization, and EHS compliance systems that are directly relevant to oil and gas asset decarbonization pathways. r obust, verifiable emissions data from INEr CO-style systems will be a prerequisite for operators that seek to both meet evolving regulatory requirements and demonstrate emissions intensity improvements to ESG-focused capital providers. “Technology, when properly implemented, is the best ally for meeting EHS standards without compromising business competitiveness,” said Sara Landon, Executive Director, INErCO Mexico.

Standards, validation, and system integration are where classification and advisory bodies such as DNV come into play. Digital twins are emerging as a unifying architecture for real-time operations, predictive simulations, and integrity management; DNV’s work on connecting digital twins across the energy system and its guidance on safe,

integrated twins provide the protocols that reduce vendor fragmentation and ensure that simulation outputs are trusted by engineers, financiers, and regulators alike. The Mexican market is already on a fast track: independent research estimates the national digital twin market at roughly US$281 million in 2024 with a projected CAG r north of 25% into the next decade, which implies a rapidly growing addressable market for integrated monitoring, predictive maintenance, and scenario testing tools. That growth trajectory will be meaningful for operators contemplating multi-year digital deployments on long-life assets.

One recent example of how innovation is being deployed in Mexico is the contract awarded to SLB for the ultra-deepwater Trion development offshore. In that contract, SLB will deliver 18 ultra-deepwater wells incorporating AI-enabled drilling capabilities, surface and downhole logging, cementing, completions fluids, and other digitally enhanced services. The use of these technologies is designed to improve well quality and reduce non-productive time in water depths up to 2,500m. This shows that even in ultra-deepwater settings, where the cost and risk are highest, operators see enough upside from automation and digital workflows to invest.

“Autonomous drilling is a reality, it is expanding, and it eliminates the risks caused by human factors,” says William Antonio,

Managing Director Mexico and Central America, SLB. “The dream is to have fully automated oil and gas fields,” he adds.

From a deployment strategy perspective, the highest near-term returns will come from targeted applications that directly lower OPEX and extend economic life. Predictive analytics that cut unplanned downtime through condition-based maintenance, machine-learning (ML) models that optimize choke and lift settings to maximize late-life recovery, and automation of repetitive or hazardous tasks on rigs and platforms all deliver quantifiable upside.

One example of this approach comes from offshore operations. “We developed an ML model to predict the failure of a mooring line for a floating rig. The algorithm learns the rig’s movements under certain environmental conditions and issues an alarm if it detects deviations,” explained Eckhard Hinrichsen , Country Manager, DNV Energy Systems Mexico.