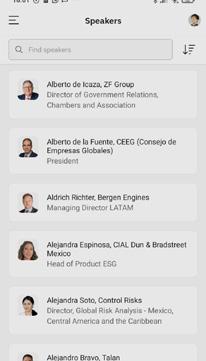

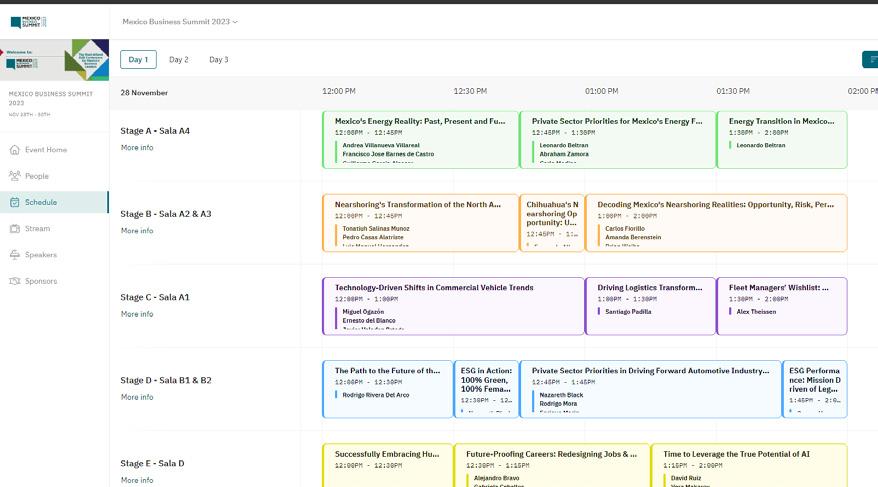

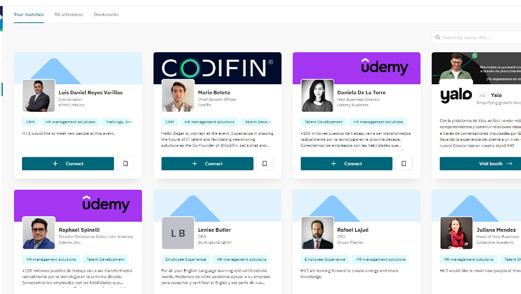

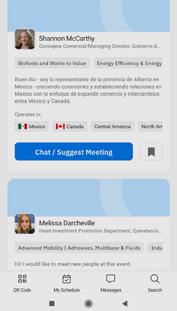

Matchmaking

Mexico’s leading B2B conference organizer uses a customized app to deliver an unparalleled experience

The MBE App delivered AI-powered intent-based matchmaking to Mexico Mining Forum CDMX 2025 attendees

MBE App Impact

269 participants

1,307 matchmaking communications

217 1:1 meetings conducted

34 speakers

15th Edition

Conference social media impact

19 sponsors

11,572 visits to the conference website

Pre-conference social media impact

4, 457 direct impressions during MMF 168, 618 direct pre-conference LinkedIn impressions

20.8% click through rate during MMF 3.4% pre-conference click through rate

28.07% conference engagement rate 6.53% pre-conference engagement rate

Matchmaking intentions

Total

2,398 1,251 Trading 1,147 Networking

• ABB Mexico

• ACD Parts

• Agencia rojas Vela y Asociados

• Aggreko

• Agnico Eagle Mexico

• AIMMGM

• Alliance

• ALN Abogados

• Altos Energéticos Mexicanos

• Anddes

• ANIEr M

• aosenuma

• Applus - Norcontrol

• Area Industrial

• Arnett Engineered Solutions

• Asfaltos G uadalajara

• Ausenco Engineering Canada

• Ausenco Mexico

• Australian Embassy in Mexico

• Autlan

• Baez & Abogados

• Baramin

• BBVA

• BC&B

• Black & Veatch

• Blanco Carrillo, S.C.

• B N Americas

• Bray Válvulas de México

• Business Council of Canada

• Business France México

• Business Sweden

• Cámara Minera de México

• CAMIMEX

• CanCham Mexico

• Capitan Silver

• Castmet

• Catenon

• Caterpillar Inc.

• CDN resource Laboratories

• CEo Bacis

• CEo Strategos

• Cereceres Estudio Legal, S.C.

• CGCTAx

• Chesapeake Gold Corp

• Cimmgm

• Coeur L as Chispas

• Coeur Mining

• Cogenera

• Co MCE

• Co MCE SU r

• Congreso del Estado de Sonora

• Consorcio Minero Benito Juárez Pena Colorada, S. A. de C.V.

• Construcción de Caminos y Proyectos Interestatales SA de CV

• Control risks

• Covia

• Cryoinfra

• CyPlus Idesa S.A.P.I de C.V.

• DB r Abogados

• Delegación General de Québec en México

• Discovery Silver

• DMT Group

• DMV

• Doppelmayr Transport

• Draslovka

• DSI Underground México, S. A . de C. V.

• Dubai Chambers

• Ecodrill

• Elastómero

• Elastómeros Taza, S. A. de C.V.

• Embassy of Canada in Mexico

• Empresas Matco

• Empresas Salgado

• Endeavour Silver

• Endress+Hauser MX

• Energex

• Energía real

• Énestas

• Epiroc Mexico

• EY Mexico

• Eyenesca

• F&Co oilfield Solutions

• falmet sa de cv

• FIFo MI

• Finsolar

• FLS

• Fresnillo PLC

• Frutologia

• Ftech

• Fugro Mexico

• Galicia Abogados, S.C.

• GATX Corp

• Geoservix

• gep

• Gestión Corporativa CK

• GMI Consulting

• Gobierno del estado de Zacatecas

• Grupo Mexico

• Grupo Mexico Infraestructura

• Grupo México Servicios de Ingeniería

• Grupo Multisistemas de Seguridad Industrial

• Grupo NXT

• Guanajuato Silver

• Heiras Abogados

• Hexagon

• HH Consultores Soluciones Ambientales

• Holland House

• Holland House Mexico

• Howden Group

• Huawei Mexico

• Industrias Peñoles

• Intercam Grupo Financiero

• Intercore o peraciones

• International S o S México Emergency Services S de r L de CV.

• Inventa Capital

• Janus Group

• Just refiners Mexico

• Kiewit

• Knight Piésold México

• Komatsu

• La Frutología

• Latam Silver Inc.

• Leica Geosystems

• Lextrategia Abogados

• Luca Mining

• M3 Mexicana

• Maclean Engineering

• MAG Silver Corp.

• Marreg - rentar

• Marsh Mexico

• MB

• MCNet

• Mecanicad

• Megaplast

• Metso Mexico

• Minera C amino rojo

• Minera Cuzcatlán

• Minera Media Luna

• Minera rio Tinto

• Mineralta

• Mining risks Advisors

• Ministry of Economy

• Moody ’s ratings

• Newfields Servicios de México

• Newmont

• NG renta

• Ngrenta

• N or Drive Systems

• NX Buena Energía

• NXT

• Nxtlab

• NXTView

• oca Global

• o ntario’s Trade & Investment o ffice in M exico City

• o rion Productos Industriales

• o rla Mining

• o roco resource Corp

• Peña Colorada

• Peñoles

• PHT Anti abrasivos

• Pontones & Ledesma

• PricewaterhouseCoopers, S. C.

• Prima

• Pro MPErU

• r B Mexico Law-Abogados

• redcomet AG

• rSM US LLP

• Sandvik México

• Scania

• Secretaría de Economía

• SEMAr NAT

• Sercom

• Serviacero Electroforjados

• Serviall

• Servicios Legales Mineros

• Siembra

• Siemens Energy

• Sika Mexicana

• Sinda E xploración

• Soenergy

• Solensa

• Solum

• Solventa Energia

• Speyside Group

• SPM/ro LE Drilling

• Starcore

• Stefanini Group

• Stratum AI

• Sumitomo Corporation

• Takraf

• TBC&SK Ciberseguridad

• Techint

• Tecmin Servicios

• Tequilera de Arandas

• Ternium

• Torex Gold

• Total Asset Care

• Traxys Mexico

• Tuto Energy

• TÜV N or D México

• U. S. Embassy

• United Nations

• US Embassy M exico City

• Veolia

• Veolia Mexico

• Victualic

• Viz sla Silver

• VP Smart

• WIM Mexico

• Wood Mackenzie

• WorldWise Consulting

• WTW

• Xiamen C&D

• XPD Global México

WEDNESDAY, S EPTEMBER 3

08:30 THE MINING SECTOR’S PROGRESS AND PROSPECTS

Speaker: Fernando José Aboitiz, Ministry of Economy

09:00 192 REASONS TO PROMOTE CONSCIOUS MINING

Speaker: Pedro Rivero, CAMIMEX

09:20 DRIVING PROSPERITY: MINING’S CONTRIBUTION TO MEXICO

Moderator: Karen Flores, CAMIMEX

Panelists: Jason Simpson, orla Mining

Faysal Rodríguez, Torex Gold

Octavio Alvídrez, Fresnillo

10:10 THE FUTURE OF FIFOMI AND MINING FINANCE IN MEXICO

Speaker: Diego Gómez, FIFoMI - Fideicomiso de Fomento Minero

10:30 INVESTOR PLAYBOOK: OPPORTUNITIES, INVESTMENTS AND M&A

Moderator: Diego Gómez, FIFoMI - Fideicomiso de Fomento Minero

Panelists: Joel González, ALN Abogados

Alberto Orozco, Capitan Silver

Ricardo Rázuri, WTW

11:20 NETWORKING COFFEE BREAK

12:00 TOWARDS RESPONSIBLE MINING: SEMARNAT’S ENVIRONMENTAL REGULATION AND PROJECT EVALUATION FRAMEWORK

Speaker: Luz Mariana Pérez, SEMArNAT

12:30 THE GREEN AND BLUE CHALLENGE: CRITICAL SUCCESS FACTORS IN DELIVERING SUSTAINABLE MINING PROJECTS

Moderator: Ulises Neri, United Nations

Panelists: Diego Torroella, TAKrAF Mexico

Arnaud Penverne, Veolia Mexico

Pablo Peñaranda, Black & Veatch

Mark Baker, KoMATSU

13:15 ENERGY TRANSITION IN THE MINING INDUSTRY

Moderator: Leopoldo Rodríguez, Industrias Peñoles

Panelists: Mariano Souto, Aggreko

Diego Arriola, Nxtlab

Juan Paulo Cervantes, Solensa

Björn Tisell, Epiroc Mexico

Paulina Beck, Energía real

14:00 NETWORKING LUNCH BREAK

15:00 REDEFINING STRATEGIC DUE DILIGENCE IN EVOLVING MINING FRAMEWORKS

Moderator: Santiago Suárez, Servicios Legales Mineros

Panelists: Gustavo Alarcón, Fresnillo

Armando Ortega, CoMCE

15:30 INSIDE MEXICO’S MINING ECOSYSTEM

Moderator: José Jabalera, Discovery Silver

Panelists: Gerardo Guillen, Elastómeros TAZA

Salvador García, Starcore International Mines LTD

Rafael Sánchez, Minera Camino rojo

Rene Valle, MacLean Engineering

16:15 PATHWAY TO PRODUCTION: ENSURING SUSTAINABILITY IN THE NEW WAVE OF MEXICAN MINES

Moderator: Rubén Alvidrez, Luca Mining

Panelists: Hernando Rueda, Vizsla Silver

Carlos Silva, Guanajuato Silver

Ian Graham, oroco resource Corp.

17:00 NETWORKING COCKTAIL

19:00 END OF MEXICO MINING FORUM CDMX 2025

MEXICO ADVANCES TOWARD A MODERN, SUSTAINABLE MIN ING AGENDA

Mexico is at a critical point for its mining industry. Current discussions center on two priorities: using dialogue to address existing challenges and creating a regulatory framework to reactivate the sector while ensuring sustainable practices. According to Fernando Aboitiz, Head of the Extractive Activities Coordination Unit, Ministry of Economy, collaboration is already producing results. “We are close to cutting the backlog in half,” he said, highlighting that nearly 50% of pending issues have been resolved.

Environmental protection remains central to the agenda. Authorities, including CoNAGUA, are monitoring concerns related to water, security, and environmental risks. Aboitiz underscored the urgency of addressing water warming, declining air quality, and waste management. “reducing pollution is not just a technical task, it requires social responsibility and shared action. Institutions and communities must work together to build a cleaner and healthier future,” he said at Mexico Mining Forum 2025.

Security is another prominent theme for the administration. Efforts are advancing to strengthen systems that protect both industries and communities through collaboration. “There is no better way to build trust than through open and transparent dialog,” Aboitiz said. The

financial sector is also becoming more involved. Banks are contributing to long-term planning and helping to provide clarity for stakeholders.

Looking ahead, Aboitiz stressed the importance of maintaining a long-term perspective. Current studies and initiatives are beginning to yield results, reinforcing that sustained collaboration is essential for lasting change. “The mining sector should know that the government now has opened the door to private companies,” said Aboitiz. “This is only the beginning of what we can achieve together.”

Toward a New Mining Agenda

Previously, Aboitiz explained that the government is working with CAMIMEX to design a new regulatory framework, expected by June 2025. The framework seeks to streamline administrative procedures, increase transparency, and strengthen engagement with local communities. “The upcoming regulatory framework is designed to address the key concerns raised by mining companies, investors, and communities,” said Aboitiz. “By reducing bureaucratic bottlenecks and providing clearer guidelines, the government hopes to attract renewed investment in mining while upholding high environmental and social standards.”

President Claudia Sheinbaum’s administration is also prioritizing the acceleration of new mining projects. Approvals for several initiatives are expected in the coming months, signaling a more proactive approach to industry development.

To support this agenda, the government is preparing a public-private partnership (PPP) model that will redefine how mining projects are structured. Under this model, the private sector will lead operations while the government provides regulatory oversight. “This approach will foster a more collaborative relationship between companies and authorities,” Aboitiz concluded, underlining the administration’s commitment to modernizing the sector.

THE MINING SECTOR’S PROGRESS AND

The mining sector supports 192 other economic sectors in Mexico, reveals a study conducted by the Mexican Mining Chamber (CAMIMEX) and the Center for research and Teaching in Economics (CIDE). Acknowledging the importance of the mining sector to North America’s economic resilience, the sector is calling for closer collaboration to improve regulations and support for the sector.

According to Pedro r ivero, President, CAMIMEX, the value of mineral-metallurgical production increased by approximately 20% to MX$312 billion (US$16.7 billion). The rise was primarily driven by higher metal prices, despite production volumes remaining relatively flat. rivero detailed the industry’s fiscal contributions, which amounted to MX$45 billion in taxes and duties, and confirmed that the sector ranks as the sixth-largest generator of foreign currency for the country.

During Mexico Mining Forum 2025, rivero also pointed to an improvement in Mexico’s competitiveness, as reflected in the 2024 Fraser Institute survey on mining investment attractiveness. He noted that Mexico recovered to the 49th position globally after falling to 74th in the previous year. Within Latin America, the country rose from ninth to sixth place. Acknowledging that there is still a long way to go in continuing to improve sector performance, rivero noted the importance of fostering public-private collaboration.

rivero highlighted that the mining sector’s extensive value chain includes 26 supplier sectors, 123 sectors that use mining products as inputs, and 43 associated service sectors like logistics and transportation. According to CAMIMEX and CIDE’s report, 75% of the inputs used by the mining industry are from domestic sources.

The study’s main objective was to evaluate the relevance of the mining sector as a strategic axis for the country’s productive development. “It is important to mention that mining today places us in a special position

PROSPECTS

in this discussion we are having with the United States regarding the need to have a self-sufficient North America, a solid North America, and how mining is key to getting us there,” rivero stressed.

The study also underscores the sector’s role in creating high-quality employment, with 416,000 direct jobs and a total of 3 million direct and indirect jobs. The average monthly remuneration in the mining sector is MX$26,115, a figure that is 2.4 times the minimum wage and 3.8 times above the welfare line.

The study details the mining industry’s role as a major consumer of national goods and services. Diesel fuel is a significant input, representing around 25% of the sector’s consumption, followed by inputs from the wood industry at 11%, and 10% from the energy sector. A crucial aspect of this supply chain is its impact on smaller businesses. r ivero stressed that while large suppliers are a component, over 80% of the mining industry’s suppliers are Mexican small and medium-sized enterprises (SMEs), making the sector a major promoter of local business development, particularly in the remote regions where mines typically operate.

The study also illustrates how the value of specific minerals is multiplied as they move through the production chain. For example, silver, with an initial value of MX$66 billion, generates a final value of MX$1.94 trillion, a 30-fold increase, as it is incorporated into 14 industries, including automotive parts and electronics. Similarly, copper’s initial value of MX$71 billion is multiplied 186 times to a final value of over MX$13.2 trillion across 72 economic branches such as electrical systems and motors. Manganese shows an even greater multiplication effect; its initial value of MX$0.9 billion grows to over MX$55.5 billion as it is processed through the value chain.

To unlock the sector’s full potential, rivero noted that a public policy is required that promotes responsible mining, regulatory efficiency, technological innovation, and community development. The report concludes that mining represents 4.73% of the national GDP and is a key component for 10 industries that together contribute 17% of GDP. “To unlock the mining sector’s potential, which is crucial for the North American supply chain, we need an efficient public policy. We are working to improve the understanding between authorities and the industry to achieve regulatory efficiency, technological innovation, and community development with employment and technical training,” rivero concluded.

DRIVING PROSPERITY: MINING’S CONTRIBUTION TO MEXICO

Mining in Mexico goes beyond resource extraction. It is a key part of the country’s economic structure, supporting technological development and social progress. The government, through Plan México, recognizes mining’s strategic importance and highlights its environmental responsibilities, social impact, and governance framework. However, challenges remain that need to be addressed to maximize the sector’s potential.

“The country needs economic development, and mining still has much potential to be explored. Even projects that are already in advanced stages will contribute to this economic development, to families, and to development through infrastructure”

Octavio Alvídrez CEO | Fresnillo

years. As the country’s sixth-largest foreign exchange earner, mining supports economic stability and regional development.

Under Claudia Sheinbaum’s new government and Plan México, mining is recognized as a strategic sector, essential to the country’s economic growth and industrial diversification. It supplies critical raw materials vital to more than 123 sectors, including automotive manufacturing, renewable energy, pharmaceuticals, steel production, construction, and agriculture. This role in supply chains promotes increased domestic content in Mexican products and supports the core goal of Plan México to reduce reliance on imports.

According to CAMIMEX, the mining industry is a cornerstone of Mexico’s economy, representing 4.73% to the national GDP. The industry drives local and regional economic activity, generating an estimated MX$269 billion (US$15 billion) in annual economic spillover, in addition to paying over MX$362 billion in taxes over the past nine

Marcelo Ebrard, Mexico’s Minister of Economy, emphasized that mining selfsufficiency is vital given the current global geopolitical context. “ o ur obligation as authorities is to be prepared, not reactive, but proactive, to prevent vulnerabilities and seize opportunities to ensure our country’s resilience.” Ebrard highlighted that Plan México clearly prioritizes an increase in mineral production to safeguard the nation’s energy and self-sufficiency, reinforcing minerals as the foundation of Mexico’s economy.

Industry leaders stress that Mexico’s future growth will depend on unlocking mining’s full potential. “The country needs economic development, and mining still has much potential to be explored. Even projects that are already in advanced stages will contribute to this economic development, to families, and to development through infrastructure,” said o ctavio Alvídrez, CE o, Fresnillo, at Mexico Mining Forum 2025. He added that it is encouraging to see the sector’s openness and dialog with the federal administration, noting that companies are also doing their part “not just to align (because we are already aligned) but to be able to generate more and deliver more from mining, knowing all the benefits it brings.”

“Mining

contributes to GDP and to quality jobs located in remote areas of this country, where mining not only acts as the main driver of economic activity but also, in many cases, as an agent for rebuilding the social fabric by providing opportunities for decent employment”

Karen Flores Director General | CAMIMEX

Environmental responsibility: Advancing Sustainable and Low-Impact Mining

Mexico’s mining sector not only ranks among the world’s top producers of 17 critical minerals, including lithium, copper, silver, zinc, and molybdenum, but also plays a pivotal role in enabling development for emerging technologies like electric vehicles and renewable energy infrastructure. This positions Mexico as a strategic hub for the global energy transition and nearshoring opportunities.

r ecognizing its environmental footprint, the sector is actively pursuing sustainability goals that align with the shift to a low-carbon economy. In 2023, 35% of mining’s energy consumption is sourced from renewables such as wind (14.1%), hydro (1.3%), solar (0.4%),

and renewable cogeneration (9.7%), with targets to raise this share to 46% by 2030. responsible water use is also prioritized, with mining representing only 0.27% of authorized water consumption nationally, recycling approximately 70% of its water through advanced treatment systems.

For companies like Fresnillo, sustainability must balance community benefits with longterm business value. “To truly be sustainable in the future, in the medium and long term, efforts must yield results for the company,” said Alvídrez. He highlighted the importance of materiality assessments to identify regional needs, as well as forming alliances with organizations so that “through these alliances, benefits for the communities can be multiplied.”

Concrete examples of these efforts are already visible in the Fresnillo district, where the company operates three of its six mines. Alvídrez described how Fresnillo first invested in building a wastewater treatment plant and later took on two additional plants handed over by the municipality. “We operate them, and in this way we can supply all the needs of our mines with treated water,” he said. At the same time, the company channels mine water into federal waterways, supporting local agriculture. recently, Fresnillo also inaugurated a water purification plant that now supplies around 30% of the population’s needs. For Alvídrez, this demonstrates “how sustainability and benefits for the communities are also aligned with an economic benefit for the company.”

In addition to these efforts, the mining sector has made significant environmental investments, including the reforestation of 2,355ha in 2023 and a total of 14,300ha over the past five years. It also contributes to the protection of 25 species of flora and fauna. Thanks to advanced technology and improved practices, restoration work on mining sites has been successful, with some areas, such as the social and environmental closure of Minera San Xavier in San Luis de Potosi, being rehabilitated to the point that no trace of mining activity remains.

Social Contributions: Community Development, Inclusion

Mining plays a crucial role in driving social development within local communities by promoting advances in education, healthcare, and infrastructure.

According to data from Mexico’s National Council for the Evaluation of Social Development Policy (CoNEVAL), communities connected to mining have experienced a 45% reduction in social marginalization between 2000 and 2020, shifting from medium to very low levels of social lag. Educational attainment in these areas has also seen progress, with the percentage of individuals lacking basic education decreasing from 74% to 45%. Additionally, healthcare coverage has expanded, and housing conditions, including access to electricity, have improved compared to non-mining regions, underscoring the mining sector’s positive social impact.

In remote areas, the mining industry has also become a crucial source of employment, providing over 416,000 direct jobs and an estimated 2.5 million indirect jobs nationwide. Wages in the sector stand well above the national average, 33% higher overall, and 62% higher in metallic mining, supporting quality employment and regional stability. “Mining contributes to GDP and to quality jobs located in remote areas of this country, where mining not only acts as the main driver of economic activity but also, in many cases, as an agent for rebuilding the social fabric by providing opportunities for decent employment,” CAMIMEX Director General Karen Flores explained.

Beyond employment, companies have developed structured community investment programs to extend benefits directly to local residents. Faysal r odríguez, Senior Vice President Mexico, Torex Gold, pointed out that the company operates “participatory community development agreements, where we make investments through committees that are formed within the communities.” These agreements channel around US$5 million annually into projects such as education infrastructure, school rehabilitation, medical clinics, and hospitals. According to rodríguez, these contributions are only possible because “results come from disciplined operations, both operationally and financially. otherwise, there would not be the conditions for investment in social matters.”

on the inclusion front, women’s participation in mining has steadily increased, accounting for nearly 18% of the workforce in 2023, with a total of 74,529 women employed. Mining companies invested MX$618.1 million in training and education programs to enhance the skills of all employees, leading to an average schooling level of 13.1 years among workers, but three years higher than the national average.

Beyond training, health and safety remain top priorities, with MX$6.063 billion invested in 2023 in programs focused on workplace safety, equipment modernization, and accident prevention. Although mining carries inherent occupational risks, companies affiliated with CAMIMEX report accident rates below the national average at 1.33 versus 1.83. The sector remains committed to its ambitious goal of further reducing incidents, striving toward zero accidents.

Governance and Transparency: regulatory Framework, Accountability

Mining is among the most regulated industries in Mexico, governed by a comprehensive legal framework that ensures environmental protection, occupational safety, fiscal responsibility, and social accountability. Art. 27 of the Constitution establishes state ownership of mineral resources, which are exploited under government-issued

concessions and regulated through more than 27 federal laws, official standards, and specific operational requirements covering surface access, handling of substances and explosives, fiscal levies, and special regulations. Mines face an average of 4,000 compliance obligations.

From an international perspective, companies welcome dialogue with the administration on regulatory reforms but emphasize the need for clarity and alignment with global standards. “Many of those changes are absolutely aligned with our philosophy as a company, and frankly, aligned with international standards, and so we welcome the opportunity to work with the administration to advance those changes,” Jason Simpson, President and CEo, orla Mining. At the same time, he cautioned that business conditions must remain suitable to attract investment. “The two things that are important to keep in mind are that the regulatory changes are clear to the international markets, and second that they are followed.”

Transparency initiatives such as Mexico’s participation in the Extractive Industries

Transparency Initiative (EITI) reinforce the sector’s adherence to international standards. Throughout 2023, working groups advanced strategies to maintain compliance, including preparing national reports, addressing previous validation observations, and planning future validations to uphold Mexico’s position in global transparency efforts.

Industry leaders note that good governance is not only about compliance but also about creating conditions for greater investment.

As r odríguez explained, “mining goes where no other industry goes. Without mining, many communities would be destined to live under a quality of life very different from the one they currently have.” He also stressed that accountability requires specificity: “we should put a name and surname to the companies that are not complying… we need to see who is paying low wages, who is not complying with environmental regulation, who is not generating sustainable conditions in the communities, who is not investing enough. And that is where we will begin to build different aspects.”

THE FUTURE OF FIFOMI AND MINING FINANCE IN MEXICO

As the world moves toward cleaner energy, the demand for critical minerals is increasing while investment capital is becoming scarcer.

In this scenario, governments are looking to boost their local mining industries to enhance production, while also promoting sustainable and responsible practices to balance the needs of employment, economic growth, and productivity. In Mexico, this effort is led by the federal government’s development bank, the Mining Development Trust (FIFoMI), which provides financing, training, and technical assistance to support the creation and consolidation of mining projects and their value chains.

According to Diego Gómez, Director of Credit, Finance and Administration, FIFoMI, the bank offers its services to four main client groups. These include mineral producers involved in the exploitation and processing of minerals; suppliers who provide services

such as equipment maintenance, repair, and transportation; mineral processing companies; and distributors and marketers of mineral-based products for sectors like construction.

“The more your business focuses on minerals, the lower the rate. FIFoMI provides financing, training, and technical assistance to help you grow,” said Gómez.

FIFoMI’s support is particularly crucial for MSMEs, which form a significant part of the industry’s base. In Durango, for example, MSMEs account for 97% of all economic units in the sector and 28.4% of its total employed personnel, generating a gross production value of MX$42.1 billion. To serve the industry nationwide, FIFoMI operates eight regional management offices in key industrial and mining hubs, including Hermosillo, Chihuahua, Zacatecas, and Monterrey.

According to its financing programs, FIFoMI offers two main types of credit facilities: simple loans and revolving credit lines. Under the simple loan category, the trust provides financing for equipment with terms of up to 10 years and grace periods of up to 24 months. It also offers simple loans for working capital and for debt payments, both with terms of up to 5 years and grace periods of up to 6 months. For revolving credit lines, FIFoMI provides financing for revolving working capital with terms of up to three years, which are renewable. It also offers credit for Productive Chains programs with terms of up to one year, also renewable. The loan-to-value ratio for these credit lines is typically 1.5 to 1.

To further support MSMEs, FIF o MI is implementing a program to install Beneficiation Plants in strategic, remote locations, primarily in the states of Sonora, Chihuahua, Sinaloa, and Durango, aiming to eliminate intermediaries in mineral commercialization and help regulate the sale of minerals from smaller mining operations. The trust has also partnered with Nacional Financiera (NAFIN) on a Productive Chains Programme, an electronic factoring scheme that allows mining suppliers to access financing by discounting their invoices with first-tier mining companies.

“one of our most important products is the productive chain. Using the National Financial Platform, companies can discount invoices without taking on additional financing. This boosts process efficiency and strengthens SMEs. We are here to help them,” said Gómez.

Beyond financial products, FIFoMI provides non-financial support through Training

and Technical Assistance. This includes site visits to mines and projects to resolve specific technical problems and offering inperson and online courses on topics such as exploration, mineral processing, safety, and environmental practices.

FIFoMI also holds several long-term equity investments. It has a 75% stake in Exportadora de Sal (ESSA), the world’s largest saltworks located in Baja California Sur, which reported net sales of MX$2.22 billion in 2024. It also holds a 50% stake in Baja Bulk Carriers, a maritime salt transportation company established with Mitsubishi Corporation, which reported net sales of US$62.6 million in 2024. A third investment is a 33.3% equity participation in the Fondo de Fondos, a private equity fund focused on emerging market mining companies, which is currently in the process of liquidation.

“our goal is to strengthen companies that generate added value and help them increase their capacity. We recently provided financing to a company producing fluorspar and mining support anchors. We always support every business, staying in close contact to meet their needs. We would love to see more participants in the productive chain.”

According to Gómez, the trust’s long-term vision is the consolidation of MSMEs in the mining sector and their supply chains, amining for these smaller enterprises to contribute more significantly to job creation and increase their investment capacity through improved productivity, organizational efficiency, and greater access to credit, while also improving community relations and adhering to environmental standards.

FIFoMI continues to drive innovation in the mining sector, leading initiatives that promote growth, modernization, and support for emerging businesses. “Through Industry 5.0 and the National Financial Platform, we support SMEs and mining entrepreneurs. We focus on meeting their needs, with projects in key mining states like Chihuahua and Queretaro, providing hands-on guidance and technical assistance every step of the way,” said Gómez.

INVESTOR PLAYBOOK: OPPORTUNITIES, INVESTMENT S AND M&AS

The landscape for mergers and acquisitions (M&A) and new investments within Mexico’s mining sector presents a complex but opportunity-rich environment for savvy investors. As the industry, a pillar of the national economy, navigates landmark legal reforms from 2023 and shifting global commodity demands, a fact-based evaluation is required for successful transactions: one that addresses how to structure deals, perform risk-adjusted valuations, and manage the social and regulatory challenges defining the landscape today.

recent acquisitions have often been driven by the pursuit of valuable mineral deposits that can provide immediate production growth and enhance a company’s portfolio. r ecent successful M&A transactions in Mexico’s mining sector include the pursuit of high-grade deposits, exemplified by Torex Gold’s acquisition of reyna Silver.

According to the Fraser Institute’s 2024 Mining Investment Attractiveness Index, Mexico rose to the 49th position, a significant recovery from its 74th place ranking in 2023. While policy remains a concern, the index shows a modest improvement of 4.76 points and a 61st position in this area. regarding policy challenges, investors expressed increased concern over Mexico’s regulatory duplication and inconsistencies, leading to a hit of 13 points in this index. Uncertainty concerning environmental regulations also grew by

12 points, while apprehension regarding socioeconomic agreements rose by six points.

In response to these policy hurdles, when attracting investment and structuring M&A deals in Mexico’s mining sector, key aspects include rigorous due diligence on concession rights and compliance with 2023’s Mining Law. This due diligence must verify the status of all concessions and also assess a project’s environmental and social liabilities. Joel González, Partner, ALN Abogados, noted this process increasingly requires interdisciplinary teams, as lawyers alone are no longer sufficient to evaluate the complex web of risks.

In major acquisitions, for instance, a critical component of due diligence is verifying the status of all mineral and surface rights concessions. Structuring these large-scale deals also requires careful navigation of approvals from regulatory bodies like the Federal Economic Competition Commission (CoFECE) and, once established, with the National Antimonopoly Commission (CNA).

Challenges in Project Appraisal

Accurately assessing a project’s long-term value has become more complex given the regulatory landscape, specifically the 2023 Mining Law reform. The primary challenge stems from the new uncertainty surrounding the duration of mining concessions. Valuations

must now carefully account for the risks associated with the new structure: a shorter 30-year initial concession with the possibility of only a single 25-year extension. This, combined with more stringent conditions for renewal, is a significant departure from the more predictable models of the past.

González noted this has led to the emergence of a new valuation concept: a project’s regulatory and social resilience, or its ability to survive changes in the legal and social landscape over time.

According to industry experts, investment analysis in the mining sector now extends far beyond the traditional evaluation of reserves and technical potential. The process has become a more complex assessment of a project’s liabilities, including its social and environmental legacy, the regulatory stability of its area of influence, and its security situation. High mineral prices are also creating new opportunities within this framework; as noted by Diego Gómez, Director, Mining Development Trust (FIFoMI), the institution has received requests to develop projects that capitalize on historical environmental liabilities, as the current value of minerals now makes processing them profitable.

Mining requires Stricter Considerations

Alberto orozco, CEo, Capitan Silver, notes that the key driver is the acquisition of derisked projects that are already in or near construction, which removes the uncertainty of obtaining initial permits. However, it is still important to avoid common pitfalls like community blockades or legal challenges, which have halted major projects in the past. Experts note that companies must perform due diligence on community relations and land tenure history. Failing to secure a social license to operate remains the most significant, non-geological risk that can derail an otherwise promising investment, according to experts. “Any materialization of a risk brings with it the materialization of a strong reputational risk, which can impact a project’s viability. A risk analysis must also include

crisis management and the management of reputational risk,” suggested ricardo rázuri, regional Leader Mining, WTW.

González noted that a key challenge is convincing both parties of the importance of social and environmental analysis. Sellers, for financial or practical reasons, may rush the process and omit important details, not realizing that strong regulatory and reputational alignment is what adds value to their project. Similarly, buyers can be so eager to ramp up operations that they conduct a less-than-optimal due diligence process.

Looking ahead, the most promising investment opportunities are focused on energy transition minerals, including copper and silver. However, experts note that while Mexico has significant potential in these minerals, access to global capital is affected by geopolitical pressures, while local challenges include stability in regulatory, social, and environmental matters, as noted by rázuri.

Despite the challenges, CAMIMEX reported Mexico received US$5 billion investment in 2024, a 2.1% increase from 2023. However, the chamber noted most of this investment was focused on expansion and maintenance activities, rather than on new developments. Similarly, the sector’s M&A activity, while substantial, saw its prominence slip. According to transactional data, mining fell from fourth to fifth place among all industries in Mexico since 2023, accounting for 13 transactions valued at US$2.693 billion and representing a 7.1% share of the total M&A market.

With producing assets becoming scarcer, analysts believe the next wave of opportunity will be in early-stage development projects. “We have already exhausted the projects that are in production. I believe the opportunity now lies with those projects that are in development and, especially, those in earlier stages. However, I think we are between five and 10 years away from recovering what we have lost in recent years,” orozco noted.

TOWARDS RESPONSIBLE MINING: SEMARNAT’S ENVIRONMENTAL FRAMEWORK

As part of the government’s effort to develop more robust environmental regulations, the Ministry of Environment and Natural r esources (SEMA r NAT) is currently reviewing and updating several of the key official standards (NoMs) that govern mining operations in Mexico, from exploration to tailings management.

Luz Mariana Pérez, Director of regulation for the Mining and Metallurgical Industry, SEMArNAT, notes that the sector is regulated by a hierarchy of laws, beginning with Constitutional Art. 27, which establishes that minerals are the property of the nation. This is followed by federal laws such as the Mining Law and the General Law on Ecological Balance and Environmental Protection (LGEEPA), as well as their associated regulations and specific NoMs. She stressed that SEMA r NAT should not only be seen as an environmental authority but also as “an ally for compliance and a facilitator for ensuring that environmental matters in the mining industry are met.”

During Mexico Mining Forum 2025, Pérez noted that Art. 32 Bis of the o rganic Law of the Federal Public Administration (LoAP) outlines SEMArNAT’s responsibilities, which include evaluating Environmental Impact Statements (EIAs) for mining projects,

which is handled by its Directorate General for Environmental Impact and risk (DGIrA). The ministry is also responsible for regulating hazardous materials, mining waste, and mine restoration programs through its General Directorate for the Comprehensive Management of Hazardous Materials and Activities (DGGIMA r ). To strengthen this role, Pérez explained that SEMA r NAT is reinforcing its internal processes and working closely with the Ministry of Economy to resolve many of the pending procedures that had previously slowed the sector. “The goal is that through SEMArNAT’s initiatives we can guarantee an optimal response time for all. Whether the outcome is favorable or not, the important thing is that companies know it, and that they are fully aware of the status of the procedures that matter to them.”

She added that efforts to streamline processes are not limited to new projects. “All of these regulatory initiatives currently being promoted would not only apply to projects that are about to begin operations but also to processes that are already operating today. We will always seek to ensure that the transition provides adequate space to comply with these initiatives.” DGGIMAr, she highlighted, oversees policies on hazardous waste, registers mining and metallurgical waste management plans, and is responsible for issuing, suspending, or revoking authorizations for Mine restoration, Closure, and Post-Closure Programs.

Pérez also provided an update on the current status of several NoMs specific to mining. The standards for gold, silver, and copper ore leaching systems (NoM-155 and NoM-159) remain current, while the standard for direct mineral exploration (NoM-120) is undergoing a systematic review in 2025. other important NoMs are in the process of being updated: N o M-157 for mining waste management plans is pending publication in the Federal o fficial Gazette (D o F), the proposal to update NoM-141 for tailings dams is under analysis, and a preliminary draft for a new

NoM-147 on contaminated soil remediation is being developed by a working group.

She emphasized that the process of modifying or issuing a regulation is never unilateral but always grounded in technical studies that incorporate the perspectives of different stakeholders. Academia, she noted, often approaches the issue from an ideal

standpoint, while industry brings forward the practical challenges of compliance.

“It is of no use to overwhelm them with regulatory instruments if these are going to be unattainable. It is important to reach that balance, and for that our participation and collaboration with the mining chamber has been key,” she concluded.

THE GREEN AND BLUE CHALLENGE IN MININ G PROJECTS

With energy and water as critical inputs for mining, their management has become a growing focus of legal, regulatory, and social scrutiny. In Mexico, mining companies now operate in a landscape where sustainability, compliance, and social acceptance are essential for competitiveness, making distributors and solution providers central to achieving the highest possible standards.

“Mining, as an extractive industry, has long faced criticism, yet it is also a sector where sustainability is achievable. Advancing in this effort requires not only the commitment of mining companies but also the active role of providers in strengthening water and energy management,” said Ulises Neri, Vice Chair for Latin America, Expert Group on resource Management, United Nations, at Mexico Mining Forum 2025.

Historically, Mexico’s National Water Law did not differentiate mining from other industrial activities. r eforms in 2023 updated the Mining Law, the National Water Law, and related environmental legislation. The revised framework established a separate concession regime for mining that includes measurement of extracted volumes, a ban on using water to transport mining materials, a maximum 30year concession term, mandatory notification of water use to CoNAGUA, payment of water duties, and requirements to reuse at least 60% of water and prevent pollution.

r egardless of these new obligations, mining currently accounts for only 0.27% of authorized national water consumption, while the industry recycles around 70% of its water through advanced treatment systems, according to CAMIMEX. Solution providers see opportunity in this transition.

“Sustainability

is not expensive, ignoring it is. If we fail to guarantee environmental impact, the project simply will not move forward. Thinking holistically means not only designing solutions for the mine but also for the surrounding environment”

Arnaud Penverne CEO | Veolia Mexico

Water: regulation and Best Practices

According to the Environmental Justice Atlas (EJAtlas), out of 628 global conflicts linked to mineral exploration or extraction, 355 cite water as a central or secondary point of contention. This reality highlights the urgency of innovative solutions and transparent regulation.

Diego Torroella, Director General Mexico, TAKrAF, stressed the importance of early involvement in mine planning. “It is important for us to be involved from the early stages of mine development, making projects not only more productive but also more efficient. That of course includes water aspects.”

A major focus for TAKrAF is tailings filtration, increasingly recognized as global best practice. “It does not generate direct revenues, it is purely about sustainability and requires significant space, but we are seeing companies shift their mindset, choosing to prioritize environmental and social responsibility,” Torroella explained. While filtration is already the norm in other jurisdictions, Torroella said it is expecting Mexico to move in this direction.

Arnaud Penverne, CE o , Veolia Mexico, added that mining companies must rely on expert partners to achieve sustainable water management. “The key is to minimize resource use, coexist with communities, and reduce environmental impact.” He emphasized that the biggest disruption is not technological advancement itself, but its growing accessibility and efficiency. “Sustainability is not expensive, ignoring it is. If we fail to guarantee environmental impact, the project simply will not move forward. Thinking holistically means not only designing solutions for the mine but also for the surrounding environment.”

Energy: Powering Sustainable Mining

Energy is required at every stage of mining, from exploration to refining. Globally, the sector accounts for 4% to 7% of total greenhouse gas emissions. Mining’s carbon footprint is largely driven by Scope 1 and 2 emissions, while Scope 3 emissions remain harder to quantify.

In Mexico, 35% of the mining industry’s energy consumption in 2023 came from renewable sources, including wind, hydro, solar, and renewable cogeneration, with a target to reach 46% by 2030. Mining companies are increasingly turning to Power Purchase Agreements (PPAs), often negotiated over 10 to 20 years, to secure renewable energy and hedge against price volatility. These contracts can reduce energy costs by roughly 15% compared to regulated tariffs.

For remote operations, companies are shifting away from diesel toward solar, wind, energy storage, and, eventually, green hydrogen. Mark Baker, Director General, Komatsu, explained that the company is advancing the development of trucks capable of operating on multiple energy sources, including diesel, hybrid systems, and eventually hydrogen.

Komatsu’s energy-agnostic approach allows fleets to transition gradually as battery technology evolves and hydrogen infrastructure matures, minimizing costs and operational disruption. “This flexibility enables mining operations to progressively reduce emissions without compromising productivity.” To accelerate these initiatives, Komatsu recently launched a decarbonization and electrification division, working closely with mining companies to co-develop solutions aligned with their net-zero targets.

Pablo Peñaranda, Business Development Director Latin America, Black & Veatch, added how innovation in critical infrastructure is accelerating this transition. “We focus on improving material quality to extend maintenance intervals, boost productivity, and lower operational pressures, which in turn reduces energy consumption,” he said. He added that data-driven systems now allow real-time decision-making, predicting equipment needs instead of relying on manual maintenance schedules. “This not only supports operational efficiency but also helps avoid sustainability issues.” Looking ahead, Black & Veatch has also developed roadmaps to help miners transition from diesel fleets to electric or hydrogen-powered trucks.

Providers Leading by Example

Across the sector, providers agreed that the shift toward sustainability requires not only offering green solutions but also implementing them internally. “What cannot be measured cannot be improved. We must measure ourselves as an industry and as companies. We are here to support miners with any needs, providing expertise to drive greener solutions. It is a full cycle, and we are here to serve,” said Penverne.

Baker echoed this perspective, stressing that sustainability must start from within. The company renews its ESG strategy every five years, applying it not only to clients but also to its own operations. “Becoming green starts with ourselves. We understand our clients’ goals and want to be part of this trend.”

Torroella also noted that TAKrAF published its first ESG report last year, underlining that “providers must also lead by example, as mining companies increasingly expect their supply chains to be green.”

ENERGY TRANSITION IN THE MININ G INDUSTRY

Mexico’s mining sector is confronting a dual challenge: soaring energy costs and the operational complexities of remote sites. In response, companies are adopting active energy management strategies that blend efficiency, self-generation, and advanced technologies to safeguard long-term operations.

Energy represents more than 30% of operating costs for many mines, making careful management critical. To mitigate price volatility, especially in isolated areas, operators are turning to long-term Power Purchase Agreements (PPAs) that lock in stable rates and reduce exposure to fossil fuel swings. Meanwhile, experts say adopting mobile and renewable energy solutions can cut costs by 30 to 50%, offering both financial relief and greater operational resilience.

In off-grid locations, self-generation has become the most effective solution. The declining costs of solar technology make onsite photovoltaic projects increasingly viable, especially when paired with Battery Energy Storage Systems (BESS). These systems allow mines to store low-cost solar power during the day and deploy it at night or during peak demand, ensuring continuity while reducing costs. The remote nature of mining makes reliability non-negotiable, which is why many operations already function in island mode.

“Mining can take advantage of being in remote sites that are very large and located far from a robust electricity grid to implement … microgrid projects. You are

going to reduce costs, transition toward cleaner energy, reduce carbon emissions, and move toward decarbonization, achieving ESG goals,” Paulina Beck, General Counsel, Energia real, explained, at Mexico Mining Forum 2025.

Electrification of fleets and equipment has also gained prominence. Beyond emissions reductions, this shift improves health and safety by eliminating diesel particulates, reducing heat, and lowering vibration underground. o perational savings are achieved through decreased ventilation and cooling needs. While the upfront investment is high, industry estimates suggest total ownership costs for EVs are now roughly 17% lower than for combustion engines. Efficiency gains are further enhanced through faster acceleration, improved loading times, and artificial intelligence applications.

regulation and Infrastructure: opportunities and Hurdles

Large-scale projects face complex permitting, but government support for self-generation is growing, including proposals to raise the capacity limit for permit-exempt distributed generation. Structuring a long-term energy supply contract like a PPA requires ensuring price certainty, supply guarantees, and clear penalties for non-compliance. r egulatory risks must be addressed with “change in law” clauses, while securing interconnection and transmission permits often requires close collaboration with CFE.

Yet one obstacle stands out above all others: infrastructure. “The mining industry has developed at a much faster pace than energy infrastructure has been developed. I believe a very viable option is on-site generation in the absence of infrastructure, and what could be better than generating your own energy, where you do not depend on any third party,” said Juan Paulo Cervantes, Commercial Director, Solensa.

At the same time, industry leaders caution that the decarbonization story must be told carefully to avoid overpromising. According to Diego Arriola, Partner, Nxtlab, “there is a significant risk of greenwashing in a sector like this. The granularity of the Mexican market is sufficient to ensure full traceability of energy and to make correct accounting when incorporating new technologies, beyond any one specific technology. I would suggest that as you move forward with integration, you must tell that story correctly to avoid the risks that have already emerged in such a highly scrutinized sector.”

The hybrid model is becoming the industry standard to balance reliability and profitability. It addresses the primary challenge of balancing sustainability, energy security, and economic competitiveness by combining a renewable PPA, grid backup, and on-site BESS to manage peaks and guarantee supply.

Beyond Established Solutions: Advanced Technologies

The next stage of this energy transition lies in advanced solutions such as microgrids. By integrating local generation, storage, and consumption into an intelligent system, microgrids maximize resilience and give mines full control of their energy supply. Energy storage remains the key enabler of

this shift, particularly for fleets and heavy equipment now moving away from diesel. While natural gas is being adopted as a bridge fuel, biofuels like renewable diesel (HVo) are gaining ground as a drop-in solution that cuts emissions without major modifications.

For companies like Industrias Peñoles, this shift is already underway. “Without a doubt the participation of clean energies is already a reality and one of the main drivers of deep decarbonization in this sector,” said Leopoldo rodríguez, Peñoles’ Head of Energy. “But another big issue is precisely the transition toward equipment, toward electric vehicles, or those that run on gas or biofuels.”

Energy storage technologies also stand at the heart of this change. “Batteries help us enormously to integrate these solutions; they are fundamental for the integration of renewables and also help a great deal with the efficiency of thermal generation … To achieve reliability, we need to be able to have rolling capacity to handle the peaks, and so on. Batteries help us tremendously with that, while providing reliability as the sun sometimes shines, and sometimes it does not,” Mariano Souto, General Director of Aggreko, explained.

Looking further ahead toward deep decarbonization, the industry is exploring the potential of green hydrogen. Produced via electrolysis powered by renewable energy, it is seen as the leading long-term solution for achieving zero-emission heavy-haul trucking. Alongside hydrogen, other derivatives like green ammonia are also being explored as potential clean energy carriers for the future. While their implementation is still in the early stages, these advanced fuels are part of the long-term strategic roadmap for companies to transition to cleaner operations.

REDEFINING STRATEGIC DUE DILIGENCE IN EVOLVING MINING FRAMEWORKS

Mexico’s mining industry is navigating a complex legal landscape, forcing companies to develop new strategies for investment and risk management, experts say. While the 2023 Mining Law is now in effect, the lack of detailed secondary regulations creates an “atypical” environment of uncertainty.

Experts acknowledge that the central challenge in the legal field is the ongoing uncertainty created by the 2023 Mining Law reform, which is now in effect but still lacks the detailed secondary regulations needed to clarify its application. “We have a new mining law, but it is a law that does not have an application that is equal for everyone,” said Armando ortega, President of the Mexico-Canada Bilateral Committee, Mexican Business Council for Foreign Trade, Investment and Technology (C o MCE). o rtega noted that legal advisors are now recommending “practicality and resilience,” urging companies to address the new legal landscape on a case-by-case basis.

“This

resolution has produced the reality that we need to accept and work together accordingly. The New Mining Legal Framework passed in May 2023 is now the only effective and constitutional legal framework for our mining concessions”

Ruben Cano Founding Partner | CR Legal

of future social and regulatory risks. Santiago Suárez, Partner, Servicios Legales Mineros (SLM), added that this now requires interdisciplinary teams, as legal analysis alone is no longer sufficient.

Suárez highlighted the importance of considering the new law’s provisions for mine closure and financial guarantees, expressed in the law as “Financial Vehicle.” While the industry supports the goal of ensuring environmental protection, experts highlighted practical challenges. o rtega pointed to the need for more modern and flexible financial instruments than traditional surety bonds, citing letters of credit as a more practical alternative. “The country has to leave the obsession of regulating everything and focus more on standards and voluntary cooperation,” ortega argued.

Looking ahead, experts expressed cautious optimism. Alarcón noted that while the uncertainty of recent years has been challenging, the Supreme Court’s recent rulings have begun to provide some clarity. Still, he emphasized that the entire industry is waiting for new secondary regulations, which, regardless of their defects, will give more certainty. Armando ortega suggested that a potential renegotiation of USMCA could be a positive catalyst, as it would likely make North American countries to converge on a more stable legal framework for mining, a sector critical for the regional supply of energy transition minerals.

This uncertainty has profoundly impacted how new investments and acquisitions are evaluated. Gustavo Alarcón, General Counsel, Fresnillo, explained that due diligence has become far more complex. “ o ur due diligence exercises have to be more robust; we have to look beyond the document,” he stated, noting that an environmental permit no longer guarantees a project’s viability without a deep analysis

Following the Supreme Court’s June 25, 2025 ruling, Mexico’s New Mining Legal Framework is now fully constitutional and uniformly enforceable. While companies face uncertainties as they navigate the transition to the updated framework, the government emphasizes that the upcoming regulations are designed to address the concerns of mining companies, investors, and other stakeholders.

reform, Impact

on May 8, 2023, Mexico enacted sweeping reforms to the Mining Law, the National Waters Law, the General Law of Ecological Balance and Environmental Protection, and the General Law for the Prevention and Comprehensive Management of Waste. Collectively known as the New Mining Legal Framework, these changes marked the most significant transformation in the sector in over decades.

The reforms redefined concession-granting processes, shortened concession durations, linked approvals to water availability, and made prior consultation with Indigenous and Afro-Mexican communities mandatory. They also introduced stricter rules for transferring concessions, established financial obligations for environmental compensation, and created new causes for cancellation with potential criminal penalties.

Following the reforms, several companies and individuals challenged the legislation through amparos, claiming it violated acquired rights and had been enacted through flawed legislative procedures. The case ultimately reached the Supreme Court, which on June 25, 2025, issued a ruling in Amparo en revisión 391/2024. The Court confirmed the reforms are constitutional and enforceable, revoking a lower court decision and ending the dual system in which some concession holders operated under suspensions while others followed the new rules. The ruling establishes that the New Mining Legal Framework now applies uniformly to all concession holders in Mexico.

The Court clarified that mining concessions are “administrative acts of mixed nature,” combining essential clauses that constitute acquired rights with regulatory clauses that remain subject to change. Acquired rights include the term of the concession, the authorized type of activity (exploration, exploitation, or both), and the specific mining lot and minerals permitted, elements that cannot be modified without due process. regulatory clauses cover obligations such as water use, environmental responsibilities, approval of transfers, and conditions for extending concessions. These rules can evolve without infringing on acquired rights, reflecting the state’s authority to regulate resources and protect public interests.

For concession holders, this distinction has practical implications. Exploration and exploitation rights remain intact, but holders should review their titles to confirm the specific type of concession. Water usage now requires a separate industrial-use concession, as preferential rights have been eliminated. Transfers must be registered and approved by authorities rather than relying on private agreements. Financial guarantees for environmental restoration are mandatory, and mining in protected areas is prohibited. rights related to expropriation or temporary land occupation are no longer automatic and require administrative approval. The Court emphasized that these measures serve broader public interests, including environmental protection and sustainable development.

The SCJN also affirmed that the reforms do not violate the principle of non-retroactivity,

as they affect only regulatory conditions and not the essential elements of concessions.

“This resolution has produced the reality that we need to accept and work together accordingly. The New Mining Legal Framework passed in May 2023 is now the only effective and constitutional legal framework for our mining concessions,” said r uben Cano, Founding Partner, C r Legal. “Keeping concessions valid is paramount, including complying with all obligations in Art. 27 and avoiding any cancellation causes outlined in Art. 42 of the new Mining Law.”

ongoing Policy Updates and Government Initiatives

In March 2025, Fernando Aboitiz, Head of the Extractive Activities Coordination Unit at the Ministry of Economy, highlighted at Mexico Mining Forum PDAC that an upcoming regulatory framework aims to address concerns raised by mining companies, investors, and communities. “It seeks to streamline administrative procedures, enhance transparency, and improve engagement between the industry and local communities. By reducing bureaucratic bottlenecks and providing clearer guidelines, the government hopes to attract renewed investment while

upholding high environmental and social standards,” said Aboitiz.

A key element of the new mining policy is social certification. Aboitiz emphasized the importance of transparency and accountability, noting that past administrative halts were largely due to the lack of structured mechanisms for community engagement and environmental responsibility. This aligns with global trends in responsible mining, where companies must demonstrate sustainability commitments.

The strategy also aims to revitalize exploration efforts to ensure the sector’s long-term viability through the discovery and development of new mineral deposits. All new exploration must be coordinated with the Mexican Geological Survey to meet national standards and support efficient resource development.

To support this agenda, the government is developing a public-private partnership (PPP) model that will redefine mining project structures. Under this approach, the private sector will lead initiatives while the government provides regulatory oversight, balancing economic development with responsible governance and fostering stronger collaboration between companies and authorities.

INSIDE MEXICO’S MINING ECOSYSTEM

The mining equipment sector is entering a period of rapid transformation. In 2024, global oEMs generated over US$66 billion in machine, parts, and service sales. Yet technological disruption, commodity market volatility, and geopolitical uncertainty are forcing manufacturers to rethink strategies.

r afael Sánchez, General Manager, Minera Camino rojo, explained the importance of strong supplier relationships in navigating these challenges. “We understand the supplier value chain and the challenges it entails. Tariffs and regulations are constantly evolving, creating uncertainty. What truly unites suppliers and companies are shared objectives and KPIs, goals that both parties take ownership of. often, we must anticipate needs for critical

parts before they arise. A reliable supplier is like insurance: someone you can trust to deliver under any circumstance, ensuring continuity and stability.”

To remain competitive, oEMs operating in Mexico are investing heavily in technology. Battery-electric and hybrid equipment, smart mining systems, and digital solutions are central to growth strategies, though adoption remains gradual. “our slogan is ‘passion for innovation.’ We are always developing new materials for new applications. We continuously create new solutions with the help of our chemists and engineers, staying one step ahead and anticipating future client challenges so they do not face them,” said Gerardo Guillén, CoFounder of Elastómeros TAZA.

“The solution is simple: communication. Understanding mining needs is crucial because the most expensive spare part is the one you do not have. With tariffs and uncertainties, proper planning is essential. In addition to equipment, we provide specialized training and evaluate both the company and its team. Responsibility for equipment must be shared.”

René Valle Director General | MacLean Engineering

firms to seek alternative suppliers, and volatile metal prices introduce additional financial uncertainty.

Amid these uncertainties, suppliers are adapting to strengthen local production and reduce reliance on imports. “The Trump tariffs taught us that nothing is certain; supply depends on more than just us. In five years, we reduced our reliance on Canadian imports, aiming to maximize national sourcing. Mexican companies do things well, so we look for reliable replacements while understanding their short, medium, and long-term needs,” rené Valle, Director General, MacLean Engineering, explained.

Manufacturers are also evolving their business models locally. Many have expanded aftermarket and service operations. Salvador García, Coo of Starcore International Mines, emphasized the role of communication and trust in these models. “Communication and trust determine how the relationship with a supplier will develop. It depends on the company’s objectives, the supplier’s size, and their expectations. This relationship impacts productivity, efficiency, and profitability. operations must remain open to innovation in this changing world, willing to try new products to reach goals more easily and efficiently.”

Despite these advances, Mexican mines face persistent challenges. Budget constraints affect equipment replacement and refurbishment plans, while skilled labor shortages continue to limit operational capacity. r ising costs for fuel, power, explosives, and other consumables, often exceeding 20–30%, add further pressure. Supply chain disruptions are also prompting

Sánchez highlighted strategies developed by Camino rojo during the pandemic to navigate uncertainty. “Camino rojo was developed during the pandemic, so we know firsthand what uncertainty looks like. We implemented material-only contracts to secure supply and advanced payments to strengthen supplier commitment and minimize price fluctuations. Ultimately, the key to overcoming any challenge is human talent. Without cultivating skilled technical personnel, the industry cannot reach its full potential.”

García added that other proven models can also help companies adapt. “We work with multiple suppliers; the key is not to be tied to just one, so we do not depend entirely on a single source.” He also pointed to sharedrisk contracts as an effective tool. “Everyone can win together, but everyone can also lose together. No one could have predicted extreme challenges like tariffs or gold reaching record highs. What matters most is the willingness to navigate these challenges together.”

Valle concluded that communication is the cornerstone of the supplier-client relationship. “The solution is simple: communication. Understanding mining needs is crucial because the most expensive spare part is the one you do not have. With tariffs and uncertainties, proper planning is essential. In addition to equipment, we provide specialized training and evaluate both the company and its team. responsibility for equipment must be shared.”

ENSURING SUSTAINABILITY IN THE NEW WAVE OF MEX ICAN MINES

Driven by global demand for energy transition metals like silver and copper, growth-focused firms face a dual pressure: the race to enter production swiftly and the need to build sustainable, long-term operations. For 2025’s miners, success is no longer measured solely in ounces poured or tons moved; it is defined by a strategic pathway that embeds financial, environmental, and operational sustainability into the foundation of projects.

A primary decision for companies advancing projects is the allocation of resources to pre-production activities. This includes geological modeling, metallurgical testing, and community engagement. Experts stress that under-investment in this stage can create long-term risks; an inaccurate resource model may affect financial viability, while inefficient metallurgy can impact operational profitability.

Furthermore, the inability to establish agreements with local communities is considered a significant non-geological project risk, as failing to obtain social license to operate could mean the impossibility of operating a mining project. Experts stress that the ability to make people understand the project’s scope, timeline, and benefits, and have a say in how it is implemented, helps differentiate responsible mining from informal operations. Furthermore, a credible and data-supported plan for future scalability is a critical component for showcasing a

project’s long-term potential. “Trust is not gained overnight, and it typically comes from things done for communities as projects progress and scale; they go hand in hand,” says Ian Graham, President, oroco resource.

Hernando r ueda, Vice President of operations Mexico, Vizsla Silver, notes that organizational structures must be designed with a big-picture mindset in terms of caring for both the company’s employees and the community.

Given market volatility and Mexico’s evolving regulatory landscape, a component of investment pitches for these projects is a focus on operational and financial resilience. For investors, this often means demonstrating a low all-in sustaining cost (AISC) profile that can withstand commodity price fluctuations. “Long-term success will be measured by how we balance sustainability, profitability, and regulations,” says r ubén Alvidrez, Project Director and Board Member, Luca Mining.

An ESG framework is also a key part of this presentation, especially amid increased competition for capital across all sectors. ESG performance is increasingly used by investors to assess operational management and longterm risk, with many prioritizing projects that meet high environmental standards. An Accenture survey found that 59% of investors expect miners to lead decarbonization efforts, while 63% would divest from or avoid companies that fail to meet those targets.

Furthermore, according to Carlos Silva, Coo, Guanajuato Silver, companies need to have credibility in terms of growth and cash flow generation for stakeholders, demonstrate social development for the community, and comply with laws for the government. “The first thing that must be done once we know exploration is going to happen is to work very closely on social matters, because this will provide us with support when dealing with all authorities across a project life cycle,” Silva added.

“Long-term success will be measured by how we balance sustainability, profitability, and regulations”

Rubén Alvidrez

Project Director and Board Member | Luca Mining

The criteria for supplier selection are evolving from a primary focus on upfront cost to include factors related to long-term value and operational support, as well as their social and environmental footprint. Key considerations now include a supplier’s ability to provide on-the-ground technical support to minimize downtime, which is particularly important for remote operations. Long-term supplier relationships are often defined by an alignment on safety, efficiency, and sustainability standards, shifting the dynamic from a transaction to an operational collaboration. rueda notes that clusters can play a relevant role, as they map trusted suppliers and help to develop new ones to meet the industry’s needs.

The path from a developing operation to a larger project is often guided by a phased approach to expansion. This blueprint was used by companies like Guanajuato Silver. The first phase focuses on achieving stable, cashflow positive production, such as its strategy of processing low-cost, above-ground stockpiles at the Pinguico project in Guanajuato. A subsequent decision often involves reinvesting that cash flow into brownfield exploration, exploring near the existing mine, to expand the resource and extend the mine life.

The pathway to production in modern mining is no longer a linear process. To stand out as responsible investments, companies must align with modern investor expectations on ESG and build a foundation for scalable, long-term growth. The companies that successfully navigate this landscape will do more than just bring new production online. They will create a positive spillover effect in the communities where they operate, while also providing the critical minerals essential for global industrialization and the race toward the net-zero goal