23 minute read

Engine room autonomy

TAKING SMALL STEPS TOWARDS AN AUTONOMOUS FUTURE

The industry is working to an autonomous future but where and when can we expect to see more autonomy in the industry, or is it something that will never quite be realised, writes Samantha Fisk

The maritime industry has been waiting with bated breath in some respects to developments around autonomy and the autonomous vessel. With the announcement of the Yara Birkland that was under construction and was to be piloting autonomous systems, the industry was poised – could it actual pip other industries to the post with this. However, the early excitement may have been precipitous, as the Yara Birkland is unlikely to operate fully autonomously when it enters service.

But that still has not stopped the industry in working to what is now seen as the inevitable goal of autonomy. While immediate commercial benefits from the research aren’t obvious, autonomy does hold value for the industry. Understanding that value and maximising its potential will be key if we are to harness the power of autonomy.

As Peter Krähenbuhl, Head of Digital Transformation, WinGD explains about automation: “it’s everything and nothing.” It’s about incorporating it into the business model and looking at “what to do with it and the added value that it brings.”

Currently there is a lot in the market in the area of diagnostic systems. Those systems come with a lot of data, Krähenbuhl notes that its structuring all the data and the data collection and then utilising that data.

In the future of autonomy with being able to harness the data it will be possible to look at the development of engines that can self-calibrate. At the moment though, he notes that the industry is still at the preliminary stages with more simple solutions that are being adopted.

Pierre Sames, Senior Vice President, Group Research and Development Director at DNV also comments about the recent developments in the market: “what we observe is more software-controlled systems onboard. Shipowners may not be aware of all the complexities. When there is more software onboard, then it will become even more complex.”

This also raises the question of safety and being able to operate these systems in a safe and secure way. DNV has published a white paper looking at autonomy and the safety issues. Sames notes that the paper highlights how traditional methods of operating may not be good enough anymore and a need to understand systems better.

Current developments in autonomy has seen mainly smaller vessel being trialled for systems onboard. Wärtsilä is also seeing more inland vessel developments with regards to autonomy. Currently it is working on an e-barge concept for the Port of Rotterdam. "We believe that overland transport modes will not be able to absorb the emerging capacity bottleneck for internal container movement. Our ambition is to see these container shuttles introduced into a smart logistics network within the next few years." says Hendrik Busshoff, Business Development Engineer at Wärtsilä Voyage.

It is also working on developing an autonomous, zeroemission barge for the Port of Rotterdam named Project Magpie. The installation for the autonomous barge will include several of the latest Wärtsilä solutions, including SmartMove Suite, which provides a unique pairing of sensor tech with navigation systems for safe, automated ship movement.

Wärtsilä are also seeing the retrofit market as a place where autonomy can also make a difference. Earlier this year, American Steamship Company’s vessel became the largest (and probably the oldest) vessel to perform automated dockto-dock operations.

Currently, there is a massive pre-existing global fleet of over 100,000 ships with an average age of 21.7 years. Wärtsilä

8 While autonomy

developments are currently focused on smaller vessels, a number of projects are investigating applicability for larger vessels.

sees a huge opportunity update these existing vessels with next-generation capabilities to improve safety, efficiency, and productivity on the water.

“We’re not trying to make all the ships fully autonomous tomorrow, but we can retrofit systems that bring new possibilities moving towards less work onboard, less human error and better performance,” says Alexander Ozersky, Deputy Director, Intellectual systems integration, Wärtsilä Voyage.

Despite the recent spate of developments from established OEMs, much of the impetus behind the introduction of new autonomous technologies has been supplied by start-ups entering the market.

Yarden Gross, Co-Founder & CEO, Orca AI comments that: “It’s great to be creating innovation in the market. It’s a collaborative effort between start-ups and existing companies.”

He notes that over the last year has seen an exponential growth of companies now taking up digital solutions. “There is a major shift going on. The maritime industry is very conservative but ships are now becoming more connected.”

Orca AI solution provided intelligent navigation helping to prevent collisions and saving lives. It is aimed at helping to give the captain and crew a better awareness of their environment through real-time data which is further support with AI.

Whilst some issues with VSAT technology remain, Gross notes he expects further developments in the area of broadband to simplify the process of data sharing in the future, making it more accessible.

The value of autonomy

Quantifying the financial benefits of new technology is a challenge, particularly when the new products are intangible. However, shipowners and operators are increasingly recognising the cost saving potential offered by optimising operations.

Andre Lazzaro, General Manager Business Development, WinGD explains that demonstrating the benefits of advances remains a process of education for customers. “To make it as easy as possible. Start with a vision and well in advance. They can plan for parts well in advance for maintenance and guide the customer how to use the systems for this”, he explains. Gross concurred, describing technology as a value-enabler. Better data allows shipowners to base their decisions upon more information. Gross highlights a recent project that Orca AI has been working on with North P&I and Petrotec. By enabling full access to the data both companies have been able to benefit further.

Timeline to autonomy

As and when we will see full autonomy is still unclear, with rough estimates pencilled for 10 years’ time.Much depends upon how the technology matures and the pace of adoption. However, the development of autonomous systems is already have an effect on the market, as technology spin offs are already leading to commercial solutions in areas such as automated docking, where Kongsberg Maritime and Wärtsilä Voyage have launched solutions, as well as predictive maintenance.

Krähenbuhl highlights that development of autonomy will start with an autonomous engine to support an autonomous ship. “We expect to roll out first things by 2025, but autonomy will happen in stages.” He also opines that optimisation of costs will drive the adoption of technology and “it will be taken up a lot quicker as of the cost factor.”

A key aspect in adoption of autonomous solutions is the value of the data and the transparency that it brings. Whilst the maritime industry is a conservative industry that doesn’t like to share its details with others there is big opportunities for those seeking to maximise on this new technology.

Sames also notes that the development of IT & automation will evolve around a company’s IT culture, how cutting edge they are and how they integrate autonomy into its solutions. He also adds that: “there is a lot of hype around ship autonomy. Boats will lead the way”, noting the Zeabuz project, “Zeabuz have developed a small autonomous ferry for city transport and are also looking at an autonomous container feeder.”

The industry is also seeing more pilot projects for autonomy starting up that are also looking at trialling new fuels, such as the Ocean Infinity project. However, with the ongoing developments there has also been failures and setbacks. Sames notes that one of the key challenges that the maritime industry will need to conquer in order to see a fully autonomous is vessel is that of navigation. “How as a Class Society can we assure navigation use on a ship. It is a novel time for sensors and software.”

8 MV American

Courage (pictured) is the largest ship ever capable of performing automated docking and dock-to-dock sailing operations.

8 Pierre Sames,

Senior Vice President, Group Research and Development Director at DNV identifies navigation as the key challenge before automation can be introduced

PROPOSED EU FUEL REGULATION ‘BOMBS’ ONTO INDUSTRY

EU plans for regional fuel and emission requirements raise concerns about global impact, Paul Gunton reports

A proposal for a European regulation on the use of renewable and low-carbon fuels in maritime transport landed on 14 July like “a great bomb” that had been thrown into an industry already busy with the many aspects of the IMO's GHG-related activities, Simon Bennett, deputy secretary general of the International Chamber of Shipping (ICS), commented to The Motorship.

Two key initiatives stand out from its 247 pages: the inclusion of shipping within Europe's emission trading scheme (ETS) - which will also include ships on voyages beyond Europe's borders - and the FuelEU Maritime initiative, which would create “a common EU regulatory framework to increase the share of renewable and low-carbon fuels in the fuel mix of international maritime transport,” the publication's opening section explains.

According to the proposal, the regulation will take account of the energy used by ships during their stay within an EU port or on voyages between EU ports, and half of the energy used on voyages departing from or arriving to an EU port where the last or next port of call is in a third country.

The proposal also sets out intentions to review several other European directives, including, the Alternative Fuels Infrastructure Directive (AFID) and the Renewable Energy Directive (RED II).

In a statement coinciding with the proposal's publication, ICS secretary general Guy Platten said that extending the ETS to shipping was “an ideological revenue raising exercise [that] will greatly upset the EU's trading partners.” It was difficult to see, he said, “what extending the EU ETS to shipping will achieve towards reducing CO2, particularly as the proposal only covers about 7.5% of shipping's global emissions.”

As The Motorship noted on 21 April, ICS commissioned a joint study with the European Community Shipowners Associations (ECSA), which was published in May, titled FuelEU Maritime - Avoiding Unintended Consequences. Yet it had not offered any comments during two consultation phases last year, which Mr Bennett said was because the information available at that time provided no detail “other than that they wanted to do something to encourage the take up of alternative fuel.”

Through its contacts it discovered what the commission was planning, he said, enabling it to prepare its report was planning, he said, enabling it to prepare its report before the proposal was published and this will now before the proposal was published and this will now be distributed “through our channels to the be distributed “through our channels to the different DGs” for them to consider as they finalise different DGs” for them to consider as they finalise the proposal. A response will also be submitted the proposal. A response will also be submitted via the online consultation platform, he said.

Environmentalists were also critical of the Environmentalists were also critical of the proposed regulation, in particular its approach to proposed regulation, in particular its approach to future fuels. One organisation, Transport & future fuels. One organisation, Transport & Environment (T&E), saw a leaked copy of the Environment (T&E), saw a leaked copy of the report ahead of publication and issued a report ahead of publication and issued a statement on 29 June saying that the FuelEU statement on 29 June saying that the FuelEU Maritime law “does not provide incentives to invest Maritime law “does not provide incentives to invest in e-fuels but promotes liquified natural gas (LNG) and biofuels as an alternative to marine fuel oil”, which it said would be “an environmental disaster”.

But The Motorship notes that, although the proposed regulation contains many mentions of LNG and acknowledges that “the GHG benefits of fossil LNG remain modest” it says that “in the longer term, LNG can pave the way to the use of bio-LNG or e-gas, which would also offer climate-related benefits.”

It also refers to e-fuels and in one of three policy options (POs) considered in the report, a factor is incorporated into its application “in such a way that it increases the competitiveness of zero-emission technologies (i.e. e-fuels, hydrogen, electricity used in electric vessels) relative to that of advanced biofuels”, the proposal document notes.

8 Raising transport

costs will impact the competitiveness of EU exports with trading partners in the Global South, such as Angola (pictured)

Non-EU fuel supplies

Practical questions, such as mechanisms for certifying alternative fuels from third countries, remain works-inprogress. “Specific rules should be set up to provide for GHG certification of fuels bunkered in third countries,” using methodology based on “existing practice such as the fuel import certification under RED II [the Renewable Energy Directive]”, the document notes.

Elsewhere, in a section considering the impact of the regulation on third countries, the document says that “bunkering of RLF [renewable and low-carbon fuel] is also allowed in third countries that comply with the certification requirements.” It acknowledges that, under each of its three POs, fuel costs will rise and predicts that three POs, fuel costs will rise and predicts that “the increase in fuel cost ... may also have an “the increase in fuel cost ... may also have an impact on trade with third countries.” impact on trade with third countries.” It is likely to be a long time before the It is likely to be a long time before the proposed regulation comes into force, Mr proposed regulation comes into force, Mr Bennett predicted. This is just one of a Bennett predicted. This is just one of a number of similar proposals affecting a number of similar proposals affecting a number of industries that were released number of industries that were released simultaneously and there will be a lot of simultaneously and there will be a lot of negotiations across the various EU negotiations across the various EU directorates before they can be finalised, directorates before they can be finalised, he suggested. “Normally, it would take he suggested. “Normally, it would take about two years,” he said. about two years,” he said.

8 Simon Bennett,

deputy secretary general of the International Chamber of Shipping (ICS), likened the eff ects of the Fit for 55 package on shipping to a bomb

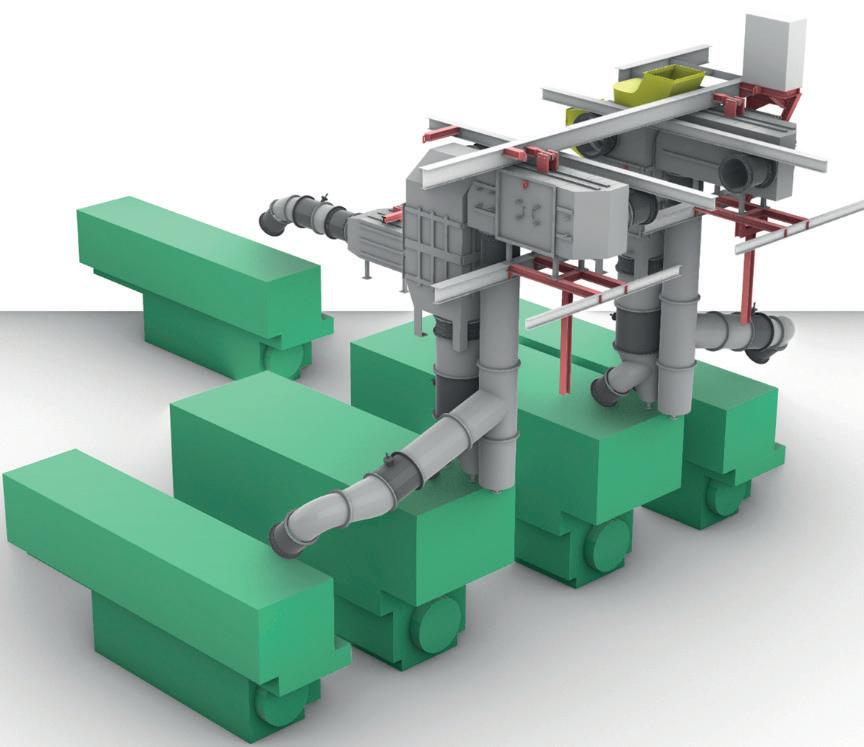

SCR RETROFIT HELPS VESSEL COMPLY WITH TIER III RULES

Faced with introduction of tighter emissions regulations, shipowner Mystic Ocean decided to commission a study to assess how the 27-year old cruise vessel Vasco da Gama could meet the latest standards until the early 2030s and beyond.

The loyalty of the vessel's clientele influenced the decision to extend the operational life of the 1,000 passenger capacity vessel, while the shipowner wanted to ensure that the vessel could continue to operate in the most favoured destinations, such as Norway's Heritage Fjords or the Baltic Sea.

The two regions have introduced stringent air pollution regulations, while the Mystic Ocean was mindful of the impact of upcoming air pollution regulations under MARPOL, such as the Tier III NOx emissions standards as well as EEXI and CII rules.

The viability study determined that Vasco da Gama could become compliant by retrofitting a number of improvements.

A significant part of the project was the retrofitting of a SCR (Selective Catalytic Reduction) system to the vessel's Sulzer twin 12ZAV40S main engines, as well as the vessel's three Sulzer 8ZAL40S auxiliary engines.

The SCR concept involved the design of SCR units for retrofit installation aboard the Vasco da Gama, helping to achieve extremely low NOx emissions, while keeping the exhaust gas pressure drop to a minimum.

TecnoVeritas confirms that up to 82% of the Vasco da Gama's NOx emissions can be reduced, while SO2 emissions decreased by 81.5%. The retrofit of the SCR system also coincided with the overhaul of three engines, while two new turbochargers were installed for the main engines and the others were overhauled.

As a result, the SCR installation, as well as the other investments, will lead to improved fuel efficiency, lowering fuel consumption (and CO2 emissions) by 6% annually.

The viability study suggests that the payback time for the project was less than 12 months.

8 The 219-metre

long Vasco da Gama during dry docking at Lisnave Shipyards in 2021

Automatic control of SCR

The SCR system will be automatically optimised during operation using SCR control algorithms, using a feedback control loop to dynamically and optimally adjust the reactors' operations, based on data from the inlet air temperature and engine load, as well as the fuel quality.

8 The BOEM cloud platform permits remote monitoring of ship emissions

The SCR system control algorithms will also automatically optimise the individual urea consumption of the units. This innovative feature will minimise the consumption of urea, and ensure compliance with potential future ammonia slip regulations.

Project execution

The retrofit was undertaken at the beginning of 2021. The project was initiated in January 2021 when the vessel arrived at Lisnave Shipyards in Setubal, Portugal for drydocking. The engine room was laser scanned and access studies were initiated while calculations based on the engines' exhaust gas flowrates were conducted in parallel. Once the five independent housings spaces were identified, their housings for the new catalysts were defined, their construction started, and engine room cutting initiated.

Stability calculations for the 5 housings (each of 5 tonnes), and DB urea bunker tank, were also run in parallel, along with other project activities such as the installation of new bunkering stations, and digitalisation system for performance monitoring using the TecnoVeritas own cloud-based software BOEM.

The SCR retrofit project was completed on 22 June, when the vessel returned to water, before undertaking a 6 day voyage from Setubal to Amsterdam for sea trials.

The systems and the project were surveyed and approved by LR, which oversaw the retrofit project. The emissions were tested independently by ECOxy from Norway, on behalf of the Norwegian Maritime Authority (NMA). ECOxy performed the measurements during the sea trials.

By the end of the project, Vasco da Gama was compliant with Tier III emissions standards. The retrofit also involved the application of low friction hull coatings. The vessel was also awarded a new notation from LR, EGCS (SCR).

To EIAPP or not to EIAPP

The Vasco da Gama conversion project also had wider relevance. While ECOxy confirmed that the vessel had achieved Tier III compliance for the NMA, no EIAPP certificate was issued. The issue of issuing EIAPP certification has been responsible for the dismantling of many vessels, TecnoVeritas' ceo Dr. Jorge Antunes maintains.

“This project has clearly shown that it is possible for older

engines to comply with NOx emission standards. In my opinion, there is no doubt that EIAPP certificates should also be awarded to vessels equipped with exhaust gas cleaning systems, such as M/V Vasco da Gama,” said Dr. Antunes.

Meanwhile the shipping industry is beginning to look at the environmental benefits of engine conversions and upgrades as a way of extending vessels' operational life. The project also represents a good example of a Circular Economy approach being applied to the shipping industry.

“This project demonstrates that another life for pre-2000 vessels around the world is possible,” added Dr. Antunes.

By extending the operational life, the unnecessary demolition of a well-built cruise vessel like Vasco da Gama was avoided, with all the scrapping-related emissions that entails, including downstream steel scrap processing emissions. The waste of other materials during scrapping was also avoided, while the greenhouse gas emissions produced during the construction of a replacement newbuilding were also delayed.

A consortium formed by TecnoVeritas and Lisnave Shipyards is now offering similar turnkey solutions, including the vessel digitalisation and energy optimisation, to other shipowners interested in extending the operational life of existing vessels. TecnoVeritas anticipates that the solution will attract particular interest from cruise vessel operators who need to comply with Tier III emission regulations.

8 Exhaust gas back

pressure computer optimisation simulations were conducted as part of the SCR retrofi t project (before and after)

8 The SCR retrofi t

project required extensive 3D project simulation

METIS BRINGS MYTHOLOGY TO TECHNOLOGY FOR AN AI FUTURE

By applying machine learning to data, Greece-based technology company METIS plans to extract technical and operational insights, Paul Gunton learns

What's in a name? For METIS Cyberspace Technology's founders, the Greek goddess Metis - the first wife of Zeus - provided their inspiration. According to Greek mythology, she was goddess of planning, cunning and wisdom or, as METIS co-founder and chief technical officer Serafeim Katsikas put it in conversation with The Motorship, she represents our ability to change things.

It is a concept that reflects the company's ambition, which he said was “to create the ultimate digital assistant” for technical, operational and commercial departments. By using data from vessels and other sources, it provides forecasts and “gives companies useful insights to understand [how they] should optimise their daily operations.”

More prosaically, “it also means 'maritime efficiency through intelligent systems',” he said, a form of words that describes a 21st Century task but was coined to match a millennia-old name.

The words 'intelligent systems' are key to METIS' philosophy, which centres on artificial intelligence (AI) and machine learning to find insights inside the data. And although there is no difference between maritime and shorebased artificial intelligence algorithms, Mr Katsikas said that shipping presents practical differences, not least in “understanding and predicting the performance of an asset [that is] not fixed in one point.”

In fact, many parameters that affect a ship's performance cannot be completely described in a mathematical model, he said, so “you must use AI”. This is not straightforward; it takes a lot of R&D “to figure out what type of parameters and machine learning should be applied to your model,” he said.

Fortunately, this is not something that the end-user has to do: “all this must be taken into consideration before offering a final solution to companies,” he said. “AI is not just a black box that you can take and use in every situation.”

He shared some examples of the 855 parameters that METIS on-board systems track on a particular vessel and of and the modelling that uses their data. These included a set of equations to describe the behaviour of various main engine parameters while another equation described the reference line of its exhaust gas temperature.

In all, his example vessel has 17 machine learning models, providing, for example, a correlation between the engine's power and the external weather conditions, such as wind speed, wave height and swell, with each mathematical model updated every month. “We must somehow hide this complexity from the end user”, he said, since they need “only the output of all of this analysis.”

New modules

This output can support both technical and operational decisions. In June, for example, METIS launched an Electrical Power Profile evaluation application, which is intended to provide technical departments with an analysis to support feasibility studies looking at electrical power sources to complement auxiliary generators, such as batteries.

In a statement at the time, Mr Katsikas explained that relevant data would be collected from the ship's sensors before a statistical analysis is applied to evaluate, for example, “whether its operations within a port or ECA zone would be made more cost effective by installing a power pack.”

Ship performance data is also relevant for ship financing, thanks to the Poseidon Principles, which offer a framework for financial institutions to lend in line with IMO's GHG reduction strategy. So far, 20 institutions representing more than a third of shipping's global financing have signed up to the principles.

In February, METIS launched a predictive Poseidon Principles Emissions Index that assesses a ship's average efficiency ratio (AER), which is the measure that underpins the principles. The index allows owners to predict “whether their ships would benefit more from investment, a change in operating profile or disposal in response to advancing emissions rules,” Mr Katsikas said at the time.

He also commented then that “exact emissions targets have not been forthcoming” from IMO but since then MEPC 76 has adopted amendments to MARPOL relating to EEXI and CII. Mr Katsikas said that this would clarify the trajectory line used in IMO's calculations and the METIS index will help predict when a ship will achieve that standard. This will support owners decide whether their ships would benefit from investment, a change in operating profile or disposal, the company's February statement explained.

Chartering departments can also use a METIS module

Image: METIS

8 METIS' Poseidon

Principles Emissions Index tracks ships' AER to support decisions on their future operations

Even within some companies, “different departments don't like to share data with each other” ‘‘ and use their own applications. Given the potential commercial benefits that machine learning offers when interrogating large datasets, “I think this is a problem

available since last November to check whether a ship is operating within the terms of its charterparty agreement. Using ship speed and fuel consumption data, coupled with weather data, manoeuvring states and any other factors included in the charterparty agreement, users can “continuously monitor all vessels and identify potential deviation with respect to the specified consumption and speed terms,” the company said when it launched the module.

Both ship and shore have access to the analysis and decisions can be made about whether to speed up or slow down, for example. The data could also be valuable in the event of a claim in relation to the CPA, Mr Katsikas said.

With shipping becoming increasingly reliant on data, is there a risk that ships with insufficient sensors to provide data to systems such as those provided by METIS will become 'stranded assets' as they reach what is effectively a barrier to access emerging digital technologies?

There is a barrier, Mr Katsikas agreed, but it is not because of the technology; it is built on attitudes. Especially as legislation - such as that around emissions monitoring - demands transparency, there is some reluctance to share data, he said. Even within some companies, “different departments don't like to share data with each other” and use their own applications. Given the potential commercial benefits that machine learning offers when interrogating benefits that machine learning offers when interrogating large datasets, “I think this is a problem,” he said. large datasets, “I think this is a problem,” he said.

To overcome this, METIS has established a customer To overcome this, METIS has established a customer support team “to train people in the new concepts to make support team “to train people in the new concepts to make them understand how best to use all the new information them understand how best to use all the new information that they have to improve their daily business,” he said. that they have to improve their daily business,” he said.

8 Many performance Many performance

parameters cannot parameters cannot be completely be completely described in a described in a mathematical mathematical model, says model, says METIS co-founder METIS co-founder Serafeim Katsikas Serafeim Katsikas