2 0 2 52 0 2 6 E D U C A T I O N G U I D E

2 0 2 52 0 2 6 E D U C A T I O N G U I D E

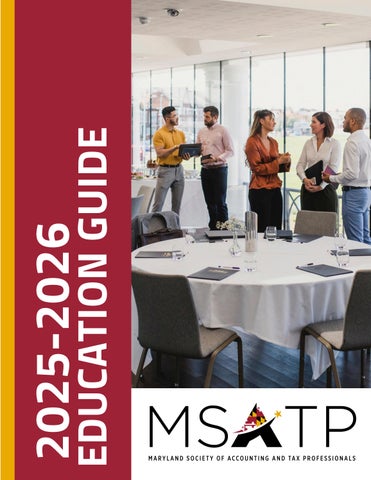

As we present our 2025-2026 Education Guide, I am pleased to share MSATP's continued commitment to providing exceptional professional education in an evolving landscape

The accounting profession has undergone significant changes in recent years, and we've witnessed a consistent decline in in-person attendance since the COVID-19 pandemic. Rather than resist this shift, we are embracing it as an opportunity to innovate while preserving what matters most to our members.

In response to these trends, we have thoughtfully restructured our educational offerings:

While maintaining our signature two-day in-person courses for those who value face-to-face learning, we've expanded our webinar options to accommodate the growing preference for remote education Each in-person course is now available in both formats, ensuring accessibility regardless of your location or schedule constraints

Keeping our education affordable remains a top priority Despite rising costs across the industry, we have worked diligently to maintain consistent pricing for our in-person events, which continue to include full catering services and valuable networking opportunities with peers and instructors

This season introduces several new topics reflecting the evolving needs of tax professionals. From emerging tax law changes to specialized practice areas, our curriculum continues to grow while maintaining the depth and quality you expect from MSATP.

I want to remind our members that we continue to offer free CPE/CE opportunities throughout the year as part of your membership benefits. These supplemental learning sessions provide additional value beyond our core educational programs

For those not yet part of the MSATP community, I extend a personal invitation to join our organization. Beyond education, membership connects you with a network of professionals facing similar challenges and opportunities, creating a valuable support system in our complex and changing field

Thank you for your continued support of MSATP We look forward to being your partner in professional growth throughout the coming year

Sincerely,

Gigi Hawkins

As we begin our 66th year, the Maryland Society of Accounting & Tax Professionals continues to take pride in serving the continuing education needs of over 4,000 professionals in Maryland and beyond Whether you are a CPA, EA, Maryland Tax Preparer, bookkeeper, or CFP®, we recognize that you have many options from which to receive the latest education, and we cherish your unwavering commitment to MSATP Likewise, we remain committed to providing timely, relevant education for all our member and non-member attendees I am thrilled to announce a new partnership this year and inform you of some key changes in our in-person seminars

MSATP is entering into a partnership with Western CPE, this is Western CPE’s first East Coast partnership. We are excited to share Western CPE’s incredible group of instructors through a two-day “Business Taxation Strategies for Success” on September 30 & Oct 1 and a two-day “Essential Strategies for Navigating Individual Taxation” on December 11 & 12. We will also be offering various Webinar-only classes presented by Western CPE throughout the year as well.

In addition to our new partnership with Western CPE, we continue our partnership with TaxSpeaker. Tax Speaker will be presenting a two-day Business Tax In-Depth as well as four two-day 1040 In-Depth classes this year We sincerely value our continued partnership with TaxSpeaker

Due to the ever-changing landscape of in-person seminars along with the conference centers who help us to host these seminars, we are expanding into new venues this season I am happy to announce we will be presenting seminars in Gaithersburg at the Holiday Inn, Greenbelt at Martin’s Crosswinds, and Columbia at the DoubleTree; we will also continue to host at Martin’s West in Baltimore and the Princess Royale in Ocean City Due to the change in venues, some seminars will have limited in-person attendance due to venue constraints; please be sure to register early for any classes you’d like to attend to ensure there is a spot for you!

All in-person seminars will also be offered as a live-broadcast webinar. MSATP is proudly one of the few societies who have a dedicated webinar team to live-broadcast all of our in-person seminars allowing every member the opportunity to attend no matter where they are located.

While our featured seminars are the two-day live events, we have a full catalogue of one-, two-, four-, and eight-hour webinars on various topics scheduled all throughout the year. I invite you to review our schedule online and enroll in a few of these webinars to expand your knowledge (and get your required CPE credits!)

As we delve into a new tax-law, please know that MSATP will be here every step of the way, supporting your learning with new classes as needed to ensure that you are always up to date and ready to help your clients! If you have any questions or need assistance, please feel free to reach out to us at info@msatp org or by calling (800) 922-9672

Wishing you continued success!

With appreciation,

HannahCoyle

Hannah Coyle, EA

HyattRegencyChesapeakeBayGolfResort,Spa,andMarina November2-4,2025

TheBusinessBuildersConnectionConference(BBCC)isapremier eventdesignedexclusivelyforaccountants,CPAs,taxprofessionals, bookkeepers,andfinancialadvisorsthataresoloorsmallfirm owners BBCCismorethanjustaconference it’satransformative experiencethatprovidesactionablestrategies,cutting-edgeinsights, andachancetoconnectwithindustryleadersandpeers

Thisyear,BBCC2025takesafreshapproachwithaworkshop-based formatthatfocusesonhands-onlearningandpersonalized outcomes Attendeeswon’tjustgainknowledge they’llleavewitha focusedactionplantailoredto:

Future-prooftheirpracticeswithinnovativestrategies. Workfewerhourswhilemaintainingexceptionalclientservice. Chargehigherfeesbyconfidentlycommunicatingtheirvalueand implementingradicalpricingmodels.

Ledbyworld-classspeakerslikeJoshuaJenson("JJtheCPA")and JodyPadar("TheRadicalCPA"),theseworkshopsaredesignedto providepracticaltoolsandstrategiesyoucanimplement immediatelyinyourbusiness.

Pricing: $550 Members | $715 Nonmembers

16 Hours CPE/CE

This flagship course provides comprehensive coverage of Form 1040 preparation with the latest tax updates, court cases, and IRS changes. The course includes a 1,100+ page manual recognized as the Top Research Live Course CPE Manual in the United States for six consecutive years.

Learning Objectives:

Properly prepare, report, file, and deduct disaster losses on Form 1040

Determine qualifying credits to reduce clients' taxable income

Advise on education savings and credits for dependents

Handle IRS client audits appropriately

Comply with Circular 230 ethics regulations

Provide tax advice for clients under military special taxation rules

Gaithersburg, MD

Dates: November 19-20, 2025

Location: Holiday Inn - Gaithersburg

Address: 2 Montgomery Village Ave, Gaithersburg, MD

20879

Ocean City, MD

Dates: December 2-3, 2025

Location: Princess Royale

Address: 9100 Coastal Highway, Ocean City, MD 21842

Baltimore, MD

Dates: January 7-8, 2026

Location: Martin's West

Address: 6817 Dogwood Road, Baltimore, MD 21244

Columbia, MD

Dates: January 13-14, 2026

Location: Doubletree Hotel Columbia

Address: 5485 Twin Knolls Road, Columbia, MD 21042

Pricing: $550 Members | $715 Nonmembers

16 Hours CPE/CE

This course provides a detailed analysis of entity selection and formation, with dedicated chapters for each business structure. The LLC section covers recent partnership modifications, compliance requirements, and reporting procedures The C corporation component addresses operational considerations and penalty tax avoidance. The S corporation section examines formation requirements, elections, termination issues, shareholder basis calculations, reasonable compensation standards, fringe benefit planning, built-in gains management, and shareholder transition strategies

Learning Objectives:

Explain the latest business tax law changes to clients and implement appropriate planning strategies

Compare the characteristics and tax implications of S corporations, C corporations, and LLCs to determine optimal entity selection

Apply the correct tax treatment for various business expenses under different accounting methods

Evaluate whether a corporation qualifies for S status election and guide clients through the election process

Navigate partnership tax reporting requirements and compliance obligations for LLCs

Implement strategies to avoid C corporation penalty taxes and optimize operational tax efficiency

Ocean City, MD

Dates: October 21-22, 2025

Location: Princess Royale

Address: 9100 Coastal Highway, Ocean City, MD 21842

Pricing: $550 Members | $715 Nonmembers

16 Hours CPE/CE

This intensive two-day course provides tax professionals with advanced knowledge and strategic insights for handling complex individual tax scenarios, designed for CPAs, EAs, tax attorneys, and experienced preparers.

Learning Objectives:

Implement advanced tax strategies for individuals across various income levels and situations

Properly apply the latest tax law changes to client scenarios

Navigate complex real estate transactions and optimize related tax benefits

Develop effective estate and trust tax strategies for wealth preservation

Design tax-efficient retirement distribution plans

Successfully represent clients in IRS matters with confidence

Structure tax-advantaged solutions for divorce situations

Create sophisticated tax planning strategies for high-net-worth individuals

Greenbelt, MD

Dates: December 11-12, 2025

Location: Martin's Crosswinds

Address: 7400 Greenway Center Drive, Greenbelt, MD 20770

Pricing: $550 Members | $715 Nonmembers

16 Hours CPE/CE

This two-day course provides tax professionals with essential updates and knowledge on business taxation, payroll compliance, entity structuring, and tax-saving strategies Participants will explore key areas such as S corporations, LLCs, partnerships, 1031 exchanges, cost segregation, and payroll tax considerations. The course will also address potential updates on Beneficial Ownership Information (BOI) reporting and C corporation taxation, ensuring professionals stay compliant with evolving tax laws. Designed for CPAs, EAs, tax attorneys, and experienced preparers, this course enhances expertise in business tax planning and compliance.

Learning Objectives:

Apply recent tax law changes to business entities and implement effective tax planning strategies

Navigate complex payroll tax requirements and identify available credits to reduce liabilities

Structure qualifying 1031 exchanges and implement cost segregation strategies to maximize tax benefits

Determine appropriate S corporation structures, including reasonable compensation and optimal distribution strategies

Select the most advantageous tax classification for LLCs and partnerships while minimizing selfemployment tax

Baltimore, MD

Dates: September 29-30, 2025

Location: Martin's West

Address: 6817 Dogwood Road, Baltimore, MD 21244

Staycurrentonkeyfederaltax lawchanges

Exclusiveupdatesfromthe MarylandComptroller’sOffice UnderstandMaryland-specific compliancerequirements

JOIN US FOR JOIN US FOR JOIN US FOR

SCHOLARSHIP SCHOLARSHIP SCHOLARSHIP FUNDARAISER FUNDARAISER FUNDARAISER

JUNE 27, 2025 JUNE 27, 2025 JUNE 27, 2025 7:05 PM 7:05 PM 7:05 PM

$5 from every ticket benefits the Maryland

$5 from every ticket benefits the Maryland

$5 from every ticket benefits the Maryland Society of Accountants Scholarship Society of Accountants Scholarship Society of Accountants Scholarship Foundation! Please share the link with Foundation! Please share the link with Foundation! Please share the link with friends, family, and co-workers! friends, family, and co-workers! friends, family, and co-workers! Use

Accounting for Leases (2 Hours CPE/CE)

Pricing: $110 Members | $130 Nonmembers

May 7, 2025

May 12, 2025

May 15, 2025

May 21, 2025

Pricing: $110 Members | $130 Nonmembers

Accounts Payable Frauds in 2025 (2 Hours CPE/CE)

TaxSpeaker Basis- S Corps & Partnerships (2 Hours CPE/CE)

Pricing: $135 Members | $150 Nonmembers

Best Practices in Cash Flow Management (2 Hours CPE/CE)

Pricing: $110 Members | $130 Nonmembers

TaxSpeaker Medicare (2 Hours CPE/CE)

Pricing: $135 Members | $150 Nonmembers

TaxSpeaker Intro to Social Security (2 Hours CPE/CE)

Pricing: $135 Members | $150 Nonmembers

Cryptocurrency & Taxes – 2025 Update (2 Hours CPE/CE)

Pricing: $110 Members | $130 Nonmembers

Ethics for Government Accountants in 2025 (2 Hours CPE/CE)

Pricing: $110 Members | $130 Nonmembers

Understanding Offers in Compromise: IRS & Maryland Comptroller Overview (1 Hour CPE/CE)

Pricing: Complimentary for Members and Nonmembers

TaxSpeaker Disaster Losses (1 Hour CPE/CE)

Pricing: $90 Members | $105 Nonmembers

TaxSpeaker Nexus-Sales and Income Tax (1 Hour CPE/CE)

Pricing: $90 Members | $105 Nonmembers

Building an IRS Tax Collection Representation Practice – The Tax Procedures You Need to Know (1 Hour CPE/CE)

Pricing: Complimentary for Members and Nonmembers

May 29, 2025

Categorizing Workers & The New Overtime & New Independent

Contractor Rules 2025 (2 Hours CPE/CE)

Pricing: $110 Members | $130 Nonmembers

June 3, 2025

June 3, 2025

June 5, 2025

June 9, 2025

June 9, 2025

June 10, 2025

June 10, 2025

June 10, 2025

June 11, 2025

June 11, 2025

June 11, 2025

June 11, 2025

Pricing: $110 Members | $130 Nonmembers

Preparing the Statement of Cash Flow (2 Hours CPE)

Pricing: $110 Members | $130 Nonmembers

The Secure Acts: 2025 Updated Changes and Planning Strategies (2 Hours CPE)

The A, B, C and D's of Medicare and Retirement in 2025 (2 Hours CPE)

Pricing: $110 Members | $130 Nonmembers

Internal Controls for Smaller Not-For- Profit & Govermental Entities (8 Hours CPE/CE)

Pricing: $300 Members | $465 Nonmembers

TaxSpeaker Social Security & Medicare (8 Hours CPE/CE)

Pricing: $300 Members | $465 Nonmembers

TaxSpeaker Preparations, Compilations & Review (8 Hours CPE)

Pricing: $300 Members | $465 Nonmembers

TaxSpeaker S Corporations A-Z (8 Hours CPE/CE)

Pricing: $300 Members | $465 Nonmembers

Ethics - Reporting Illegal & Unethical Acts in 2025 (2 Hours CPE)

Pricing: $110 Members | $130 Nonmembers

Ethics for Enrolled Agents and Maryland Tax Preparers (2 Hours CPE/CE)

Pricing: Complimentary for Members | $130 Nonmembers

Maryland CPA Ethics (2 Hours CPE)

Pricing: Complimentary for Members | $200 Nonmembers

TaxSpeaker Accounting & Auditing Update (8 Hours CPE)

Pricing: $300 Members | $465 Nonmembers

Pricing: $135 Members | $150 Nonmembers

TaxSpeaker S Corporations Built in Gains Tax (2 Hours CPE/CE)

June 12, 2025

June 13, 2025

June 17, 2025

June 18, 2025

June 25, 2025

June 26, 2025

August 19, 2025

August 19, 2025

August 26, 2025

August 28, 2025

August 29, 2025

TaxSpeaker 1041's for Trusts & Estates (8 Hours CPE/CE)

Pricing: $300 Members | $465 Nonmembers

TaxSpeaker S Corporations Reasonable

Pricing: $135 Members | $150 Nonmembers

Compensation/Owners Fringes (2 Hours CPE/CE)

The Ethical Impact of AI – Conflicts and Pitfalls (2 Hours CPE/CE)

Pricing: $110 Members | $130 Nonmembers

MVLS and Frost Law: What is the Trust Fund Recovery Penalty? (1 Hour CPE/CE)

Pricing: Complimentary for Members | Members Only

Maximizing Business Deductions: Travel & Entertainment Expenses in 2025 (2 Hours CPE/CE)

Pricing: $110 Members | $130 Nonmembers

Small Business Tax Frauds (2 Hours CPE/CE)

Pricing: $110 Members | $130 Nonmembers

TaxSpeaker Preparations, Compilations & Review, Rebroadcast (8 Hours CPE/CE)

Pricing: $300 Members | $465 Nonmembers

TaxSpeaker 1041's for Trusts & Estates (8 Hours CPE/CE)

Pricing: $300 Members | $465 Nonmembers

TaxSpeaker Best of Tax Planning and Retirement Ideas for Individuals (8 Hours CPE/CE)

Pricing: $300 Members | $465 Nonmembers

2025 2 Hour Maryland Update (2 Hours CPE/CE)

Pricing: $110 Members | $130 Nonmembers

TaxSpeaker IRA's, Roth's and Conversions (2 Hours CPE/CE)

Pricing: $135 Members | $150 Nonmembers

September 4, 2025

Avoiding Costly Mistakes – Overview of Foreign Bank Account and International Informational Reporting Requirements (2 Hours CPE/CE)

Pricing: Complimentary to Members and Nonmembers

September 19, 2025

September 22, 2025

September 22, 2025

September 23, 2025

September 24, 2025

September 25, 2025

September 29-30, 2025

October 20, 2025

October 21-22, 2025

October 23, 2025

October 23, 2025

Pricing: $110 Members | $130 Nonmembers

Accounts Payable Frauds in 2025, Rebroadcast (2 Hours CPE/CE)

Best Practices in Cash Flow Management (2 Hours CPE/CE)

Pricing: $110 Members | $130 Nonmembers

TaxSpeaker Real Estate Taxation-A Comprehensive Guide (8 Hours CPE/CE)

Pricing: $300 Members | $465 Nonmembers

Cryptocurrency & Taxes – 2025 Update, Rebroadcast (2 Hours CPE/CE)

Pricing: $110 Members | $130 Nonmembers

Ethics for Government Accountants in 2025, Rebroadcast (2 Hours CPE/CE)

Pricing: $110 Members | $130 Nonmembers

Categorizing Workers & The New Overtime & New Independent

Contractor Rules 2025, Rebroadcast (2 Hours CPE/CE)

Pricing: $110 Members | $130 Nonmembers

Mastering 1120 & 1065 Tax: Business Taxation Strategies for Success (16 Hours CPE/CE)

Pricing: $410 Members | $575 Nonmembers

Preparing the Statement of Cash Flow, Rebroadcast (2 Hours CPE)

Pricing: $110 Members | $130 Nonmembers

TaxSpeaker Business Tax In-Depth (16 Hours CPE/CE)

Pricing: $410 Members | $575 Nonmembers

Maryland CPA Ethics, Rebroadcast (4 Hours CPE)

Pricing: Complimentary for Members | $200 Nonmembers

Pricing: Complimentary for Members | $130 Nonmembers

Ethics for Enrolled Agents and Maryland Tax Preparers (2 Hours CPE/CE)

October 24, 2025

October 28, 2025

October 29, 2025

October 29, 2025

October 30, 2025

November 10, 2025

November 11, 2025

November 12, 2025

November 19-20, 2025

December 2-3, 2025

December 11-12, 2025

Ethics - Reporting Illegal & Unethical Acts in 2025 (2 Hours CPE)

Pricing: $110 Members | $130 Nonmembers

Accounting for Leases (2 Hours CPE/CE)

Pricing: $110 Members | $130 Nonmembers

December 18, 2025

Pricing: $110 Members | $130 Nonmembers

Maximizing Business Deductions: Travel & Entertainment Expenses in 2025, Rebroadcast (2 Hours CPE/CE)

TaxSpeaker Federal Tax Update-Business & Individual (8 Hours CPE/CE)

Pricing: $300 Members | $465 Nonmembers

Small Business Tax Frauds, Rebroadcast (2 Hours CPE/CE)

Pricing: $110 Members | $130 Nonmembers

TaxSpeaker Federal Tax Update-Individual (8 Hours CPE/CE)

Pricing: $300 Members | $465 Nonmembers

TaxSpeaker Federal Tax Update-Business (8 Hours CPE/CE)

Pricing: $300 Members | $465 Nonmembers

2025 4 Hour Maryland Update (4 Hours CPE/CE)

Pricing: $200 Members | $200 Nonmembers

TaxSpeaker 1040 Tax In Depth (16 Hours CPE/CE)

Pricing: $410 Members | $575 Nonmembers

TaxSpeaker 1040 Tax In Depth (16 Hours CPE/CE)

Pricing: $410 Members | $575 Nonmembers

Mastering 1040 Tax: Essential Strategies for Navigating Individual Taxation (16 Hours CPE)

Pricing: $410 Members | $575 Nonmembers

TaxSpeaker 1041's for Trusts & Estates, Rebroadcast (8 Hours CPE/CE)

Pricing: $300 Members | $465 Nonmembers

December 19, 2025

December 22, 2025

December 29, 2025

December 30, 2025

December 30, 2025

Cryptocurrency & Taxes – 2025 Update, Rebroadcast (2 Hours CPE/CE)

Pricing: $110 Members | $130 Nonmembers

Ethics for Government Accountants in 2025, Rebroadcast (2 Hours CPE/CE)

Pricing: $110 Members | $130 Nonmembers

2025 4 Hour Maryland Update, Rebroadcast (4 Hours CPE/CE)

Pricing: $170 Members | $200 Nonmembers

TaxSpeaker Preparations, Compilations & Review, Rebroadcast (8 Hours CPE/CE)

Pricing: $300 Members | $465 Nonmembers

Categorizing Workers & The New Overtime & New Independent Contractor Rules 2025, Rebroadcast (2 Hours CPE/CE)

Pricing: $110 Members | $130 Nonmembers

January 6, 2026 Preparing the Statement of Cash Flow, Rebroadcast (2 Hours CPE)

Pricing: $110 Members | $130 Nonmembers

January 13-14, 2026

January 16, 2026

January 19, 2026

January 19, 2026

January 22, 2026

February 12, 2026

Pricing: $410 Members | $575 Nonmembers

TaxSpeaker 1040 Tax In Depth (16 Hours CPE/CE)

Maximizing Business Deductions: Travel & Entertainment Expenses in 2025, Rebroadcast (2 Hours CPE/CE)

Pricing: $110 Members | $130 Nonmembers

Small Business Tax Frauds, Rebroadcast (2 Hours CPE/CE)

Pricing: $110 Members | $130 Nonmembers

Ethics - Reporting Illegal & Unethical Acts in 2025, Rebroadcast (2 Hours CPE)

Pricing: $110 Members | $130 Nonmembers

2025 2 Hour Maryland Update, Rebroadcast (2 Hours CPE/CE)

Pricing: $110 Members | $130 Nonmembers

2025 2 Hour Maryland Update, Rebroadcast (2 Hours CPE/CE)

Pricing: $110 Members | $130 Nonmembers

owningapracticeintheaccountingandtax profession.Navigatingthecomplexworldof regulations,managingclient communications,andworkinglonghourscan beoverwhelming.Findingtherightadvisors andresourcescanbeadauntingtask.

That'spreciselywhywehavecreatedthe BusinessBuildersThinkTank(BBTT),an exclusivemembers-onlyprogramdesigned totransformyourprofessionallifepositively. TheThinkTankoffersasupportiveand collaborativeenvironmentwhereyoucan connectwithfellowprofessionals,discuss challenges,andfocusonscalabilityand development.

DISCOUNTS ON SEMINARS & WEBINARS

MSATP members get exclusive seminar and event discounts to stay current on industry trends while saving on registration fees.

VIBRANT COMMUNITY OF SOLO AND SMALL FIRM PROFESSIONALS

As an MSATP member, you join a vibrant community of solo and small firm professionals who support and empower your practice.

EXCLUSIVE VERIFYLE PLATINUM SUBSCRIPTION

As an MSATP member, you get an exclusive Verifyle Platinum subscription with unlimited digital signatures to simplify client interactions and document signing.

COMPLIMENTARY UNLIMITED SUBSCRIPTION TO EARMARK CPE

Earn CPE credits anytime, anywhere with your complimentary unlimited Earmark CPE subscription, included with MSATP membership.

EXCLUSIVE DISCOUNTS ON ESSENTIAL RESOURCES Enjoy

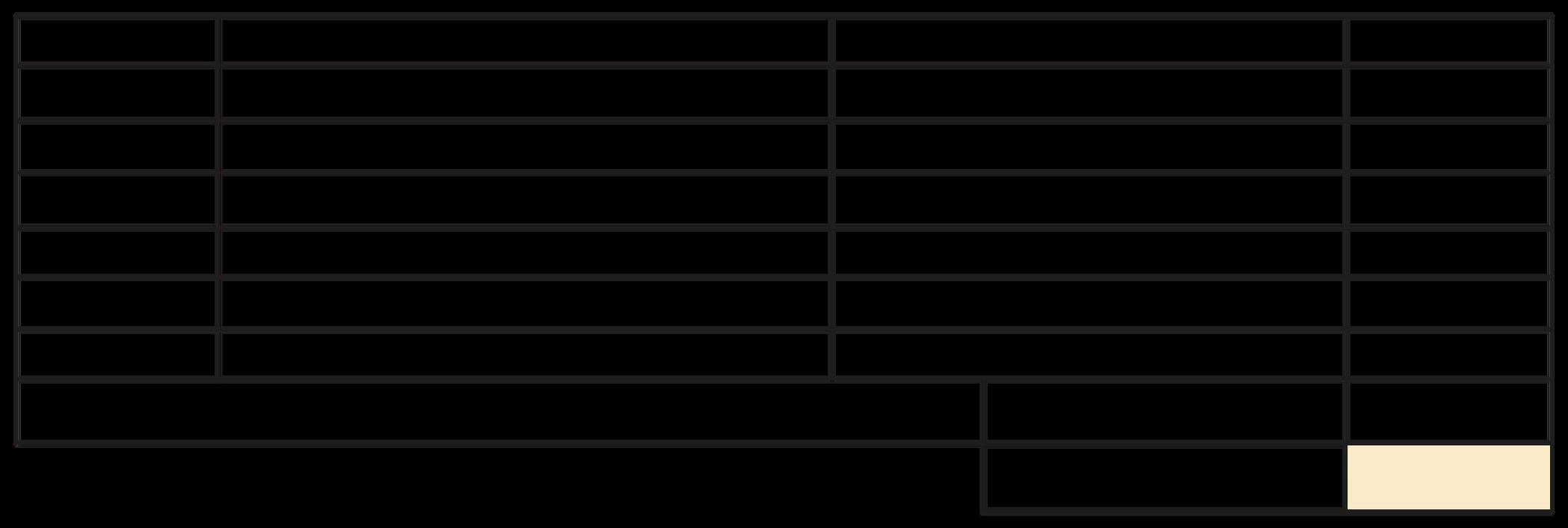

PART 1: REGISTRATION INFORMATION - 1 PER PERSON FOR FIRMS

Name

Address

City, State, Zip Phone

Company Name

PHONE:

I do not wish to accept information on events and legislative updates to the email provided To register multiple attendees, please complete a form for each attendee and submit all forms at one time to receive the group discount

DATE(S) SEMINAR

PART 3: PAYMENT INFORMATION

REFUND POLICY: No refunds can be given if written cancellation is received less than 14 days in advance of the seminar and is subject to a $50 00 service charge No refund will be given to any Express seminar

TRANSFER POLICY: Any transfer by an attendee is subject to a $50 00 transfer charge as long as the attendee transfers to another seminar of the same value This includes transferring from a free ethics seminar

SEMINAR POLICY: Any individual who registers for a seminar will be responsible for the seminar fee even if the individual does not attend COMPLAINT POLICY: For more information regarding administrative policies such as complaints and refunds, please contact the Executive Director at (800) 922-9672 or info@msatp org

MSATP reserves the right to publish photographs taken at various events for any purpose including but not limited to: website, social media, publications, catalogs or advertising.

EMAIL POLICY: Emails obtained by MSATP are not provided or sold to third parties for marketing but are used to enhance your professional knowledge

SEMINAR MEAL POLICY: A pre-determined option for vegetarian, gluten free and kosher meals are available upon request at least 14 days prior to an event Any further dietary restrictions cannot be accommodated

WEBINAR TRANSFER POLICY: Any transfer by an attendee from a live seminar to a webinar OR a webinar to a live seminar is subject to a $50 00 transfer charge; transfer must occur at least 14 days in advance of the event

PROGRAM CANCELLATION POLICY: In the event of unforeseen circumstances beyond the Society’s control, we will make every effort to contact attendees via email, social media, website, and phone received in the Society Office

RETURNED CHECK: Any returned check is subject to a $25 00 service charge

PAYMENT POLICY: Payment is due at the time of registration Any individual who submits a registration form without payment will not be registered for the seminar until payment is received Registrations for those paying by check will not be processed until the check is received in the Society Office

WALK-IN POLICY: Any individual who registers on the day of the seminar, will be subject to a $50.00 service charge.

TheMarylandSocietyofAccountantsScholarshipFoundation,Inc.is pleasetoannouncethescholarshipreceipientsforthe2024-2025 academicyear:

AkishitaAlousyes

AbbyBenton.

KatieBoettinger

RileyBruce

UrszulaCieslak

PhilipClarke

PatrickGogarty

HaydenGourley

AnayaHarris

CarinaHernandez-Soto

DorianHouston

JaclynJacobs

SharonLee

KenyaMedrano

JenniferOsorio

OyebowaleOyeniran

AndrewPolun

JamesPuii

SamuelQuinteros

TylekSimms

MackenzieThompson

ConnerUtz

KhanhViDoan

WilberVilleda

VanessaVirgil

UniversityofMaryland,CollegePark

UniversityofMaryland,CollegePark

UniversityofBaltimore

SalisburyUniversity

UniversityofMaryland,CollegePark

UniversityofBaltimore

HoodCollege

BridgewaterCollege

StevensonUniversity

TowsonUniversity

UniversityofMaryland,CollegePark

UniversityofMaryland,CollegePark

UniversityofMaryland,CollegePark

TowsonUniversity

UniversityofMarylandGlobalCampus

StevensonUniversity

TowsonUniversity

JTowsonUniversity

TowsonUniversity

TowsonUniversity

UniversityofMaryland,CollegePark

TowsonUniversity

UniversityofMaryland,CollegePark

UniversityofMaryland,CollegePark

SalisburyUniversity

Sinceitsbeginningin1987,theMSAScholarshipFoundationhasawarded 1,200+scholarshipstotalingover$1,000,000toaccountingstudents.Please considermakingadonation.

We have entered into an agreement with the Return Preparers Office, Internal Revenue Service, to meet the requirements of 31 Code of Federal Regulations, Section 10.9(a-c), covering the maintenance of attendance records, retention of program outlines, qualifications of instructors , and length of class hours. This agreement does not constitute an endorsement by the Office of Professional Responsibility as to the quality of the program or its contribution to the professional competence of the enrolled individual. Sponsor Number: MFA75

For all taxation and other applicable subjects, the Maryland Society of Accounting & Tax Professionals courses have been accepted by CFP Board Please note, CFP credit applies only to our self-sponsored seminars at the full CPE credit value; it applies to self-study products at half the CPE credit value. Please call (800) 2311860 for more information. CFP®, CERTIFIED FINANCIAL PLANNER®, and the CFP® logo are certi cation marks owned by the Certi ed Financial Planner Board of Standards, Inc. These marks are awarded to individuals who successfully complete CFP® Board s initial and ongoing certi cation.

Maryland Society of Accounting & Tax Professionals is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have nal authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its website: www.nasbaregistry.org.