I HOPE THIS LETTER FINDS YOU WELL AND THRIVING IN YOUR PROFESSIONAL ENDEAVORS

I AM WRITING TO YOU TODAY WITH IMMENSE PRIDE AND GRAT AS WE COMMEMORATE A SIGNIFICANT MILESTONE IN THE HIS OF OUR ORGANIZATION – OUR 65TH ANNIVERSARY THIS MOM OCCASION SPEAKS VOLUMES ABOUT OUR RESILIENCE, DEDIC AND UNWAVERING COMMITMENT TO THE ACCOUNTING AND T PROFESSION

FOUNDED IN 1959, THE MARYLAND SOCIETY OF ACCOUNTING TAX PROFESSIONALS (MSATP) EMERGED DURING A TIME WHE PROPOSED LEGISLATION THREATENED TO RESTRICT THE USE TERM "ACCOUNTANT" EXCLUSIVELY TO CPAS IN RESPONSE, W STOOD UNITED TO ENSURE FAIR REPRESENTATION AND ADVO FOR ALL PROFESSIONALS IN OUR FIELD. OVER THE YEARS, OU MISSION HAS EVOLVED, BUT OUR CORE VALUES OF INTEGRITY EDUCATION, AND SUPPORT FOR SMALL TO MID-SIZE FIRMS HA REMAINED STEADFAST

AS WE REFLECT ON THE JOURNEY OF THE PAST SIX AND A HA DECADES, WE ARE REMINDED OF THE COUNTLESS ACHIEVEM CHALLENGES OVERCOME, AND RELATIONSHIPS BUILT WITHIN COMMUNITY FROM PIONEERING EDUCATIONAL INITIATIVES T ADVOCATING FOR LEGISLATIVE CHANGE, EACH OF YOU HAS P AN INTEGRAL ROLE IN SHAPING THE SUCCESS OF MSATP.

AS EXECUTIVE DIRECTOR, I AM CONTINUALLY INSPIRED BY TH DEDICATION AND PASSION OF OUR MEMBERS YOUR COMMITM EXCELLENCE, PROFESSIONALISM, AND SERVICE IS WHAT SET MSATP APART AND PROPELS US FORWARD INTO THE FUTURE

AS WE EMBARK ON THIS YEAR OF CELEBRATION, I INVITE YOU JOIN US IN HONORING OUR COLLECTIVE ACCOMPLISHMENTS RENEWING OUR COMMITMENT TO ADVANCING THE ACCOUNTI TAX PROFESSION. TOGETHER, LET US CONTINUE TO UPHOLD VALUES THAT HAVE DEFINED US FOR 65 YEARS AND WORK TOWARDS A FUTURE OF CONTINUED GROWTH, INNOVATION, AND SUCCESS

THANK YOU FOR YOUR UNWAVERING SUPPORT AND PARTICIPATION IN THE MARYLAND SOCIETY OF ACCOUNTING AND TAX PROFESSIONALS HERE'S TO CELEBRATING 65 YEARS OF EXCELLENCE AND TO MANY MORE YEARS OF COLLABORATION AND ACHIEVEMENT

WARM REGARDS,

HE MARYLAND SOCIETY OF ACCOUNTING & TAX PROFESSIONALS AKES PRIDE IN CONTINUING TO SERVE THE CONTINUING EDUCATION NEEDS OF OVER 4,000 PROFESSIONALS IN MARYLAND AND BEYOND. WE RECOGNIZE THE DYNAMIC, EVER-CHANGING NATURE OF OUR INDUSTRY AND REMAIN COMMITTED TO PROVIDING IMELY, RELEVANT EDUCATION FOR ALL OF OUR MEMBER AND NONMEMBER ATTENDEES WHETHER YOU ARE A CPA, EA, MARYLAND TAX PREPARER, BOOKKEEPER, OR CFP® WE RECOGNIZE THAT YOU HAVE MANY OPTIONS FROM WHICH TO RECEIVE THE LATEST EDUCATION, AND WE VALUE YOUR STEADFAST COMMITMENT TO MSATP YEAR AFTER YEAR

OVER THE PAST FIVE YEARS, THE LANDSCAPE OF CONTINUING EDUCATION HAS UNDERGONE SIGNIFICANT TRANSFORMATIONS. WE ARE GRATEFUL FOR YOUR LOYALTY AS WE NAVIGATED THESE CHANGES, INTRODUCING INNOVATIVE OPTIONS WHILE MAINTAINING OUR TRADITIONAL OFFERINGS I INVITE YOU TO ONE OF OUR ONE- OR WO-DAY IN-PERSON SEMINARS THIS YEAR, HELD AT KEY LOCATIONS N THE STATE AS SOMEONE WHO BALANCES MOTHERHOOD AND A PROFESSIONAL CAREER, I VALUE THE CONVENIENCE OF WEBINARS HOWEVER, OUR IN-PERSON SEMINARS PROVIDE UNIQUE OPPORTUNITIES FOR NETWORKING, CONNECTION, AND CAMARADERIE, ELEMENTS OFTEN MISSING IN VIRTUAL SETTINGS WHETHER YOU JOIN US IN-PERSON OR VIA WEBINAR, THE SOCIETY HIGHLY APPRECIATES YOUR DECISION TO FULFILL YOUR CONTINUING EDUCATION REQUIREMENTS WITH US

OUR TEAM HAS WORKED HARD TO SECURE LEADING EDUCATION PRESENTERS AND COMPELLING TOPICS FOR THIS EDUCATIONAL SEASON WE HOPE YOU WILL JOIN US FOR THESE UPCOMING EVENTS AND SEMINARS THAT WILL OFFER YOU THE CHANCE TO GLEAN KNOWLEDGE FROM INDUSTRY EXPERTS, CONNECT WITH COLLEAGUES, AND ACQUIRE INSIGHTS INTO THE MOST RECENT TRENDS. IF YOU HAVE ANY QUESTIONS OR NEED ASSISTANCE, PLEASE FEEL FREE TO REACH OUT TO US AT INFO@MSATP.ORG OR BY CALLING (800) 922-9672

WISHING YOU CONTINUED SUCCESS!

WITH APPRECIATION,

HANNAH COYLE, EA

MSATP EDUCATION COMMITTEE CHAIR

Hannah Coyle, EA Chair, Education Committee Hannah CoyleJoin us at World of Beer in Owings Mills for an evening of camaraderie, delicious appetizers, and an extensive selection of beers from around the globe. This is a fantastic opportunity to network with fellow professionals, share stories from the tax season, and kick back in a casual atmosphere

Join us for an unforgettable community gathering at the Cubs vs Orioles game on July 10, 2024 This isn't just any baseball game; it's an opportunity to connect with fellow MSATP members and their families, enjoy America's pastime, and indulge in an evening filled with fun, food, and friendship.

Join us for an enchanting evening where we will explore an array of Linganore's exquisite wines, guided by their knowledgeable staff It's a fantastic opportunity to learn more about wine, enjoy the company of fellow professionals, and unwind in a beautiful setting.

September

Join us at Long Shot’s in the Clarion Event Center in Frederick for an evening of camaraderie, delicious appetizers, and an extensive selection of beers from around the globe. This is a fantastic opportunity to network with fellow professionals, share stories from the tax season, and kick back in a casual atmosphere

November

Join us at Long Shot’s in the Clarion Event Center in Frederick for an evening of camaraderie, delicious appetizers, and an extensive selection of beers from around the globe This is a fantastic opportunity to network with fellow professionals, share stories from the tax season, and kick back in a casual atmosphere.

December

Join us at Long Shot’s in the Clarion Event Center in Frederick for an evening of camaraderie, delicious appetizers, and an extensive selection of beers from around the globe This is a fantastic opportunity to network with fellow professionals, share stories from the tax season, and kick back in a casual atmosphere

October 21, 2024

Join us at Schooners Ocean Front Restaurant in the Princess Royale for an evening of camaraderie, delicious appetizers, and an extensive selection of beers from around the globe. This is a fantastic opportunity to network with fellow professionals, share stories from the tax season, and kick back in a casual atmosphere

December 3, 2024

Join us at Schooners Ocean Front Restaurant in the Princess Royale for an evening of camaraderie, delicious appetizers, and an extensive selection of beers from around the globe This is a fantastic opportunity to network with fellow professionals, share stories from the tax season, and kick back in a casual atmosphere.

January

Join us at Long Shot’s in the Clarion Event Center in Frederick for an evening of camaraderie, delicious appetizers, and an extensive selection of beers from around the globe This is a fantastic opportunity to network with fellow professionals, share stories from the tax season, and kick back in a casual atmosphere

1777 Reisterstown Rd.

Pikesville, MD 21208

Join the Maryland Society of Accounting and Tax Professionals (MSATP) for an evening of commemoration and camaraderie at our Annual Banquet immediately following the Annual Meeting at the renowned Ruth's Chris Steakhouse in Pikesville, MD.

Since our founding in 1959, MSATP has been at the forefront of advocacy for accountants and tax professionals. We stood together when our profession faced exclusion, fighting to ensure that all practitioners, regardless of their CPA status, received the recognition they deserved. Our victory was more than a moment; it was the beginning of a legacy.

The evening will highlight the celebration of MSATP's 65th Anniversary, Announce the Induction of Officers to the Board of Directors, and recognize outstanding members within our Society.

Prepare to be inspired and empowered by an extraordinary lineup of industryleading speakers at the Business Builders Connection Conference! We have carefully selected renowned experts at the forefront of the accounting and tax profession to deliver captivating insights and practical strategies that will transform how you approach your business.

June 12 - 15, 2024

Rocky Gap Resort & Casino

Flintstone, MD

Dawn Brolin

CEO of Powerful Accounting Inc. SPEAKER

Founder of 1st Step Accounting SPEAKER

Nayo Carter-Gray

Keila Hill-Trawick

Founder of Little Fish Accounting SPEAKER

Founder of Kapilovich & Associates SPEAKER

Yuri Kapilovich

EMPOWER AND EXCEL: STRATEGIES FOR SUCCESS FOR TODAY'S WOMAN IN ACCOUNTING VIRTUAL CONFERENCE

Sheila Hansen - Empowering Women in Accounting and Tax: Navigating Challenges and Seizing Opportunities

Katie Thomas - Personal Branding and Marketing for the Female Accountant

Jessica McClain - Achieving Work-Life Harmony: Tips for the Professional Mother and Caregiver

Kelly Rohrs - Building and Scaling Your Accounting Firm: Strategies for Success

Leading the Way: Women at the Forefront of Accounting and Tax Panel

23 APR

Join us for a lunch & learn hosted by Blake Oliver on Earmark CPE which is a premier, complimentary member benefit offered exclusively to the Maryland Society of Accountants and Tax Professionals members, designed to enrich their professional journey through continuous learning and development

6 JUN

This lunch and learn provides a comprehensive look into the Maryland Saves Program, focusing on the key elements essential for accountants advising clients who may benefit from or be required to participate in the program

This lunch & learn offers a comprehensive look at the critical components of a Written Information Security Program (WISP) and practical steps for its effective implementation. Through expert-led discussions, you'll leave with a solid foundation to protect your practice and your clients' trust.

This course offers an introduction to the burgeoning field of cannabis accounting. Given the industry's unique legal complexities and rapid growth, there's a growing demand for accountants skilled in navigating its financial landscape

The Third Annual Holiday Soirée promises to be an unforgettable night of joy, laughter, and connection. We invite members from across the Maryland accounting and tax community to come together in a festive atmosphere filled with holiday spirit to raise money for the Maryland Society of Accountants Scholarship Foundation.

The evening will highlight the celebration of the Maryland Society of Accountants Scholarship Foundation’s 2024 Scholarship recipients. Recognizing these outstanding individuals underscores our event's purpose—celebrating the achievements and potential of those who represent the bright future of accounting.

Delicious Food

Enjoy Dinner and Open Bar.

Menu Includes:

Caesar Salad

Slow roasted Sirloin with Shallot Jus

Sautéed Chicken with Spinach, Tomatoes & Parmesan Cream Sauce

Gnocchi with Mushroom Cream, Pine

Nuts, & Sundried Tomatoes

Roasted Brussel Sprouts

Garlic Mashed Potatoes

Truffle Macaroni & Cheese

Auction & Raffle

Bid on exciting items and participate in our raffle for a chance to win fantastic prizes.

5:00 - 8:30 PM

TheMarylandSocietyofAccountantsScholarship Foundation,Inc.ispleasetoannouncethe scholarshipreceipientsforthe2023-2024 academicyear:

KatieBoettinger UniversityofBaltimore

AaronCave SalisburyUniversity

CarolynCoelho MountSt.Mary’sUniversity

JamisonCovey UniversityofMarylandCollegePark

HaydenGourley BridgewaterCollege

CarinaHernandez-Soto TowsonUniversity

JaclynJacobs UniversityofMarylandCollegePark

KaiulaniMacRae TowsonUniversity

KenyaMedrano TowsonUniversity

AaronMincey TowsonUniversity

NaomiPogostkin CommunityCollegeofBaltimoreCounty

AndrewPolun TowsonUniversity

PatelSahil TowsonUniversity

NavjotSekhon TowsonUniversity

AlanaZimmerman UniversityofMarylandCollegePark

Sinceitsbeginningin1987,theMSAScholarship Foundationhasawarded1,200+scholarships totalingover$1,000,000toaccountingstudents.

Pleaseconsidermakingadonation.

Bob Jennings & Mark Mirsky

September 25 - 26, 2024 | 8:00 AM - 4:30 PM

Details: TaxSpeaker

During the Business Tax in Depth course, attendees receive in-depth coverage of corporate tax issues in 2024, plus a detailed analysis of which entity best fits each taxpayer and corporate formation issues. We include coverage of all 2024 Tax Changes up through the date of presentation! Each type of entity is given special attention with its own chapter. The LLC chapter provides guidance on the latest partnership changes, compliance and reporting issues.

Breakfast, Lunch, and Snack provided daily

Bob Jennings & Bill Leonard TaxSpeaker

Hotel: Clarion Inn, Room Rate $99 per night

To reserve a room, CLICK HERE

October 21 - 22, 2024 | 8:00 AM - 4:30 PM

During the Business Tax in Depth course, attendees receive in-depth coverage of corporate tax issues in 2024, plus a detailed analysis of which entity best fits each taxpayer and corporate formation issues. We include coverage of all 2024 Tax Changes up through the date of presentation! Each type of entity is given special attention with its own chapter. The LLC chapter provides guidance on the latest partnership changes, compliance and reporting issues.

Details: Paper Manual Included Paper Manual Included

Breakfast, Lunch, and Snack provided daily

Hotel: Princess Royale, Room Rate $109 - $159 per night

To reserve a room, PLEASE CALL 1-800-476-9253

TBD GEAR UP

1040 In Depth, Frederick, MD

November 18 - 19, 2024 | 8:00 AM - 4:30 PM

Details:

This comprehensive course covers key tax issues for completing complicated individual returns including family return issues, taxpayers with investments, retirement income, the sole proprietor, and business and rental activity owners. Stay current with in-depth coverage of recent legislation, case law developments, and relevant notices, announcements, revenue rulings and procedures. Speakers are all practicing preparers who share practical tips to help you get ready for this tax season.

Breakfast, Lunch, and Snack provided daily Paper Manual Included

Hotel: Clarion Inn, Room Rate $99 per night

To reserve a room, CLICK HERE

1040 In Depth, Ocean City, MD

December 3 - 4, 2024 | 8:00 AM - 4:30 PM

Details:

Our 2024 course will include detailed coverage, with planning ideas, of the latest changes from the 2024 Tax Acts, court cases, IRS changes and all lateseason Congressional changes up to the day before the class with special focus coverage of pension changes, high risk areas and our annual review of common preparation issues and new court cases and IRS guidance. As our flagship course, we take particular pride in its consistent quality and provision of the most thorough and hands-on individual tax preparation guidance.

Breakfast, Lunch, and Snack provided daily Paper Manual Included

Hotel: Princess Royale, Room Rate $109 - $159 per night

To reserve a room, PLEASE CALL 1-800-476-9253

December 19, 2024 | 8:00 AM - 4:30 PM

Bill Leonard TaxSpeaker

Bill Leonard TaxSpeaker

This no-frills course has been designed to review all changes affecting for-profit taxpayers, combining the individual update with the business update without all of the planning and compliance discussion available in the more specialized updates. Just the facts without the frills! Updated throughout the year for up-to-the-minute rile changes and court cases, the FTU-Ind/Bus course will keep your attendee in the loop for the latest changes.

Details: Paper Manual Included

Breakfast, Lunch, and Snack provided

Hotel: Clarion Inn, Room Rate $99 per night

To reserve a room, CLICK HERE

1040 In Depth, Martins West - Baltimore, MD

January 8 - 9, 2025 | 8:00 AM - 4:30 PM

Details: Paper Manual Included

Our 2024 course will include detailed coverage, with planning ideas, of the latest changes from the 2024 Tax Acts, court cases, IRS changes and all lateseason Congressional changes up to the day before the class with special focus coverage of pension changes, high risk areas and our annual review of common preparation issues and new court cases and IRS guidance. As our flagship course, we take particular pride in its consistent quality and provision of the most thorough and hands-on individual tax preparation guidance.

Breakfast, Lunch, and Snack provided daily

Hotel: Hampton Inn

To reserve a room, CLICK HERE

Bill Leonard TaxSpeaker

Bob Jennings & Bill Leonard TaxSpeaker

Bob Jennings & Bill Leonard TaxSpeaker

1040 In Depth, Frederick, MD

January 14 - 15, 2025 | 8:00 AM - 4:30 PM

Details:

Our 2024 course will include detailed coverage, with planning ideas, of the latest changes from the 2024 Tax Acts, court cases, IRS changes and all lateseason Congressional changes up to the day before the class with special focus coverage of pension changes, high risk areas and our annual review of common preparation issues and new court cases and IRS guidance. As our flagship course, we take particular pride in its consistent quality and provision of the most thorough and hands-on individual tax preparation guidance.

Breakfast, Lunch, and Snack provided daily Paper Manual Included

Hotel: Clarion Inn, Room Rate $99 per night

To reserve a room, CLICK HERE

"Coffee & Conversations" is an engaging discussion group hosted by the Maryland Society of Accounting and Tax Professionals. This monthly gathering, scheduled every 4th Thursday from April through January, offers both members and nonmembers a unique opportunity to come together in a relaxed and welcoming environment. At each meeting, attendees are treated to freshly brewed coffee, a light breakfast, and an inviting atmosphere conducive to open dialogue and networking.

April 25, 2024 - Owings Mills, MD

May 23, 2024 - Columbia, MD

PART 1: REGISTRATION INFORMATION

Name

PART 2: SEMINAR REGISTRATION INFORMATION:

Company Name

All webinar rebroadcasts and Talking with TaxSpeaker subscriptions subject to a 6% sales tax

PART 3: PAYMENT INFORMATION

REFUND POLICY: No refunds can be given if written cancellation is received less than 14 days in advance of the seminar and is subject to a $50 00 service charge No refund will be given to any Express seminar

TRANSFER POLICY: Any transfer by an attendee is subject to a $50 00 transfer charge as long as the attendee transfers to another seminar of the same value This includes transferring from a free ethics seminar

SEMINAR POLICY: Any individual who registers for a seminar will be responsible for the seminar fee even if the individual does not attend

COMPLAINT POLICY: For more information regarding administrative policies such as complaints and refunds, please contact the Executive Director at (800) 922-9672 or info@msatp org

MSATP reserves the right to publish photographs taken at various events for any purpose including but not limited to: website, social media, publications, catalogs or advertising.

6% Sales Tax

EMAIL POLICY: Emails obtained by MSATP are not provided or sold to third parties for marketing but are used to enhance your professional knowledge

SEMINAR MEAL POLICY: A pre-determined option for vegetarian, gluten free and kosher meals are available upon request at least 14 days prior to an event Any further dietary restrictions cannot be accommodated

WEBINAR TRANSFER POLICY: Any transfer by an attendee from a live seminar to a webinar OR a webinar to a live seminar is subject to a $50 00 transfer charge; transfer must occur at least 14 days in advance of the event

PROGRAM CANCELLATION POLICY: In the event of unforeseen circumstances beyond the Society’s control, we will make every effort to contact attendees via email, social media, website, and phone received in the Society Office

RETURNED CHECK: Any returned check is subject to a $25 00 service charge

PAYMENT POLICY: Payment is due at the time of registration Any individual who submits a registration form without payment will not be registered for the seminar until payment is received Registrations for those paying by check will not be processed until the check is received in the Society Office

WALK-IN POLICY: Any individual who registers on the day of the seminar, will be subject to a $50.00 service charge.

AtMSATP,weunderstandtheuniquechallengesand demandsthatcomewithowningapracticeinthe accountingandtaxprofession Navigatingthe complexworldofregulations,managingclient communications,andworkinglonghourscanbe overwhelming.Findingtherightadvisorsand resourcescanbeadauntingtask.

That'spreciselywhywehavecreatedtheBusiness BuildersThinkTank(BBTT),anexclusivemembers-only programdesignedtotransformyourprofessionallife positively.TheThinkTankoffersasupportiveand collaborativeenvironmentwhereyoucanconnect withfellowprofessionals,discusschallenges,and focusonscalabilityanddevelopment

HowardCounty

MontgomeryCounty

EasternShore

Tojoin,simplylogintoyourMSATPprofile,goto education,andfindtheBBTTyouwouldliketo join.

To learn more about how you can maximize your MSATP membership or if you have any questions, please don't hesitate to reach out Reply to this email or contact our member services team at (800) 922-9672. We're here to help you get the most out of your membership and support your professional success

Discounts on Seminars & Webinars

MSATP members enjoy exclusive discounts on seminars and events, allowing you to stay up-to-date with the latest industry trends and best practices while saving money on registration fees

Exclusive Verifyle Platinum Subscription

As an MSATP member, you receive an exclusive Verifyle Platinum subscription, which provides unlimited digital signatures This feature streamlines your client interactions and simplifies the document signing process

Free Ethics CPE Credits

Maintain your professional designations with ease by earning FREE Ethics CPE credits through MSATP. This benefit helps you meet your designation's requirements without additional costs

Exclusive Discounts on Essential Resources

Enjoy exclusive discounts on essential resources such as Talking with TaxSpeaker, the TaxBook, QuickFinder, and many others These discounts help you access the tools and information you need while keeping costs down

Free Access to CCH TaxAware

Stay informed about tax-related matters with free access to CCH TaxAware, a valuable resource for tax professionals

Complimentary Unlimited Subscription to Earmark CPE

Earn CPE credits on the go with a complimentary unlimited subscription to Earmark CPE This benefit allows you to conveniently maintain your professional development whenever and wherever you choose

Attendance to Monthly Business Builders ThinkTank Groups

Benefit from attending MSATP's monthly Business Builders ThinkTank groups, where you can learn from and collaborate with other solo and small firm professionals

As an MSATP member, you become part of a vibrant community of solo and small firm professionals who offer support, collaboration, and a wealth of knowledge to help you succeed in your practice

I invite you to join the Maryland Society of Accounting & Tax Professionals. MSATP believes diversity fuels innovation and a healthy society that's why we're open to all accounting, financial, and tax designations and demographics.

As a member, you'll have access to a wide range of resources, including: Card Holder Name:

A vibrant community of solo and small firm professionals that offers support and collaboration. FREE Ethics CPE credits, aiding in meeting your designation's requirements.

Complimentary unlimited subscription to Earmark CPE.

An exclusive Verifyle Platinum subscription, empowering you with unlimited digital signatures for seamless client interactions.

Weekly news updates right in your inbox, keeping you ahead of the curve

Complimentary access to the cutting-edge CCH TaxAware Center

Exclusive discounts on CPE seminars, webinars, Talking with TaxSpeaker, the TaxBook, QuickFinder, and many other resources!

We stand tall on the pillars of inclusiveness, collaboration, and community. At MSATP, you will find a welcoming environment to candidly discuss challenges, share wisdom, and celebrate each other’s triumphs.

Sincerely,

Gigi Hawkins

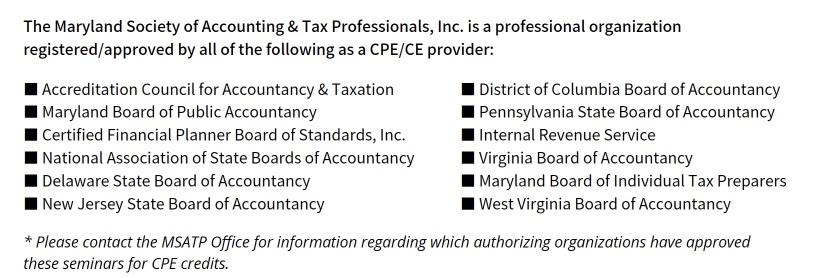

We have entered into an agreement with the Return Preparers Office, Internal Revenue Service, to meet the requirements of 31 Code of Federal Regulations, Section 10.9(a-c), covering the maintenance of attendance records, retention of program outlines, qualifications of instructors , and length of class hours. This agreement does not constitute an endorsement by the Office of Professional Responsibility as to the quality of the program or its contribution to the professional competence of the enrolled individual. Sponsor Number: MFA75

For all taxation and other applicable subjects, the Maryland Society of Accounting & Tax Professionals courses have been accepted by CFP Board Please note, CFP credit applies only to our self-sponsored seminars at the full CPE credit value; it applies to self-study products at half the CPE credit value. Please call (800) 2311860 for more information. CFP®, CERTIFIED FINANCIAL PLANNER®, and the CFP® logo are certi cation marks owned by the Certi ed Financial Planner Board of Standards, Inc. These marks are awarded to individuals who successfully complete CFP® Board s initial and ongoing certi cation.

Maryland Society of Accounting & Tax Professionals is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have nal authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its website: www.nasbaregistry.org.