Pending home sales report shows decrease in June

National Association of Realtors News release

WASHINGTON, D.C. — Pending home sales decreased by 0.8% in June from the prior month and 2.8% yearover-year, according to the National Association of Realtors Pending Home Sales report. The Report provides the real estate ecosystem, including agents and homebuyers and sellers, with data on the level of home sales under contract.

Month-over-month and year-over-year pending sales declined in the Midwest, South and West. In the Northeast, pending sales rose month-over-month but remained at year-over-year. The Realtors Con dence Index shows a 4% and 6% year-over-year increase in homebuyer and seller tra c, respectively.

“The data shows a continuation of small declines in contract signings despite inventory in the market increasing. Pending sales in the Northeast increased incrementally even though home price growth in the region has been the strongest in the country,” said NAR Chief Economist Lawrence Yun.

“The Realtors Con dence Index shows early indications of potential contract signings increasing moving forward,” he continued. “Realtors are optimistic that homebuying and selling activity will increase. That con dence is supported by the fact that mortgage applications have been rising.”

June national pending home sales

• 0.8% decrease month-over-month

• 2.8% decrease year-over-year

June regional pending home sales

• Northeast: 2.1% increase monthover-month. Unchanged year-over-year

• Midwest: 0.8% decrease monthover-month. 0.9% decrease year-overyear

• South: 0.7% decrease month-overmonth. 2.9% decrease year-over-year

• West: 3.9% decrease month-overmonth. 7.3% decrease year-over-year

The Pending Home Sales Index is a leading indicator for the housing sector, based on pending sales of existing homes. A sale is listed as pending when the contract has been signed but the transaction has not closed, though the sale usually is nalized within one or two months of signing.

Pending contracts are good early indicators of upcoming sales closings. However, the amount of time between pending contracts and completed sales is not identical for all home sales. Variations in the length of the process from pending contract to closed sale can be caused by issues such as buyer di culties with obtaining mortgage nancing, home inspection problems, or appraisal issues. The index is based on a sample that covers about 40% of multiple listing service data each month. In developing the model for the index, it was demonstrated that the level of monthly sales-contract activity parallels the level of closed existing-home sales in the following two months.

Photo courtesy Greggory DiSalvo / Getty Images

authors guarantees the accuracy or completeness of any information published herein. Home Source, Mt Democrat or McNaugthon Media nor its authors shall be responsible for any errors, omissions, or claims for damages, including exemplary damages, arising out of use, inability to use, or with regard to the accuracy or su ciency of the information contained in Home Source, and are held harmless and does not accept responsibility for any accident or injury resulting from the use of materials contained herein. All rights reserved. No part of Home Source published work may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without written permission from the publisher.

recent signs of weakness suggest that the economy will continue to slow in the third quarter of 2025 and possibly into fourth-quarter 2025. However, with the average e ective tari rate sharply higher than what it was late last year and at the highest level since 1933, consumer prices will likely increase further and in ation will become a bigger issue in the second half of the year. As such, the Federal Reserve could face a challenge between controlling in ation and boosting job growth in the coming months. While dipping below the previous quarter and the like quarter a year ago, mortgage rates continued to stay elevated, keeping borrowing costs near their all-time highs. The monthly mortgage payment

Equal Opportunity Law

All real estate advertising in this newspaper is subject to the federal Fair Housing Act which makes it illegal to advertise “any preference, limitation or discrimination based on race, color, religion, sex, physical handicap, familial status or national origin, or an intention to make any such preferences, limitation or discrimination.” California also extends protection based on age and marital status. The Mountain Democrat makes every effort to comply with these federal and state regulations. We ask your assistance in maintaining an acceptable standard of advertising. While they may seem inconvenient at times, these laws are written to protect you, our readers and advertisers, as well as ourselves. This newspaper will not knowingly accept any advertising for real estate which is in violation of the law. Our readers are hereby informed that all dwellings advertised in this paper are available on an equal opportunity basis. For further information, you can call the Dept. of Fair Employment & Housing at (916) 445-9918 or the State Dept. of Consumer Affairs at (800) 344-9940.Note: Rental ads that contain the phrase “Single Occupancy” refer only to the physical characteristics of the dwelling and are not intended to state a preference of either marital or familial status.

on a median-priced home (including taxes and insurance) jumped 6.6% from the previous quarter but slipped 1.9% from the second quarter of 2024 as the e ective mortgage rate dipped 20 basis points from a year ago.

A minimum annual income of $232,400 was needed to qualify for the purchase of a $905,680 statewide median-priced, existing single-family home in the second quarter of 2025. The monthly payment, including taxes and insurance on a 30-year, xed-rate loan, would be $5,810, assuming a 20% down payment and an e ective composite interest rate of 6.90%.

The statewide median price of an existing singlefamily California home jumped 6.9% quarterto-quarter, partly due to seasonal factors. On a year-over-year basis, California recorded its rst price decrease in eight quarters, as slower demand and improved housing supply led to so er home prices. As the market transitions out of the spring homebuying season, home prices are expected

to moderate further as market competition cools. With more price declines expected in the months ahead, housing a ordability could see a slight improvement in the next couple of quarters.

More California households (25%) could a ord a typical condo/ townhome in secondquarter 2025, rising from 24% in rst-quarter 2025 and 22% in second-quarter 2024. An annual income of $172,000 was required to make the monthly payment of $4,300 on the $670,000 median-priced condo/ townhome in the second quarter of 2025.

Compared with California, more th an onethird (34%) of the nation’s households could a ord to purchase a $429,400 median-priced home, which required a minimum annual income of $110,400 to make monthly payments of $2,760. Nationwide, a ordability declined from 37% in the rst quarter of 2025 but increased from 34% a year ago. In the second quarter of 2025, the nationwide minimum required annual income was less than half that of

California’s for the ninth consecutive quarter.

Key points from the Second-Quarter 2025 Housing A ordability report:

• Compared to the previous quarter, housing a ordability in the second quarter declined in 23 counties and remained unchanged in 14. Despite higher home prices, 16 counties showed a quarterto-quarter improvement in a ordability as a result of slightly lower mortgage rates and higher levels of income. When compared to a year ago, housing a ordability improved in many counties across the state with 41 counties experiencing an improvement in a ordability, while 12 counties either declined or showed no improvement.

• Lassen (46%) remained the most a ordable county in California, followed by Glenn (39%) and Tuolumne (38%), where nearly two out of ve households in those counties could a ord to purchase the medianpriced home in their respective county in the second quarter. Of all

counties in California, Lassen continued to require the lowest minimum qualifying income ($73,200) to purchase a median-priced home in the second quarter of 2025.

• Mono (8%), was the least a ordable county in California, followed by Monterey and Santa Barbara (both at 10%), with each of them requiring a minimum income of at least $232,800 to purchase a medianpriced home in the respective county. San Mateo (16%) continued to require the highest minimum qualifying income ($564,800) to buy a median-priced home in second-quarter 2025. Together with Santa Clara (17%), they were the only two counties in California requiring a minimum qualifying income of over $500,000. San Francisco (19%) came in third with a minimum required income of $459,200.

• A near-all-time high cost of borrowing remains a hurdle for improvements in housing a ordability in many parts of the state. In the second quarter of 2025, the housing a ordability index of 23% of the counties tracked by CAR either remained unchanged or declined from the last quarter a year ago. Lassen (46%) experienced the biggest year-to-year drop, falling six%age points. Tehama (29%) and Del Norte (29%) followed closely, with each declining ve points from a year ago. Despite improving from a year ago, housing a ordability remained near its all-time low and continued to be a challenge for both buyers and sellers.

4

You’re

and

near

Perched atop Shingle Springs, views spanning 75+ miles, e show stopping in nity-edge areas are all perfectly positioned or a shop, this custom single-story 3–4 spacious bedrooms including o ce, dining room, breakfast backdropped by those forever sauna with sound system, 39-panel tankless hot water heater remote-controlled fenced orchard, water-e cient horizon. Once you see it, nothing

|

|

| $500,000 Beautifully updated single story home in the heart of Orangevale. Close to school, shopping, restaurants, and Hwy

and Hwy 80. Laminate ooring throughout main areas. Kitchen features marble countertops with gorgeous herringbone tile pattern at backsplash, stainless steel appliances, and wood counter at

Great room concept with cozy pellet stove in

Primary suite with closets and attached bath with dual sinks and doorway to shower/toilet. Secondary bath and decent size secondary bedrooms. Newer wall texture and paint at interior. Backyard is private and is newly re-landscaped, featuring covered patio, covered bbq area and is very low maintenance, great for kids, pets and entertaining. Newer water heater and new condenser for AC. Room for all the toys with extra deep garage and RV access. This is one you don’t want to miss!

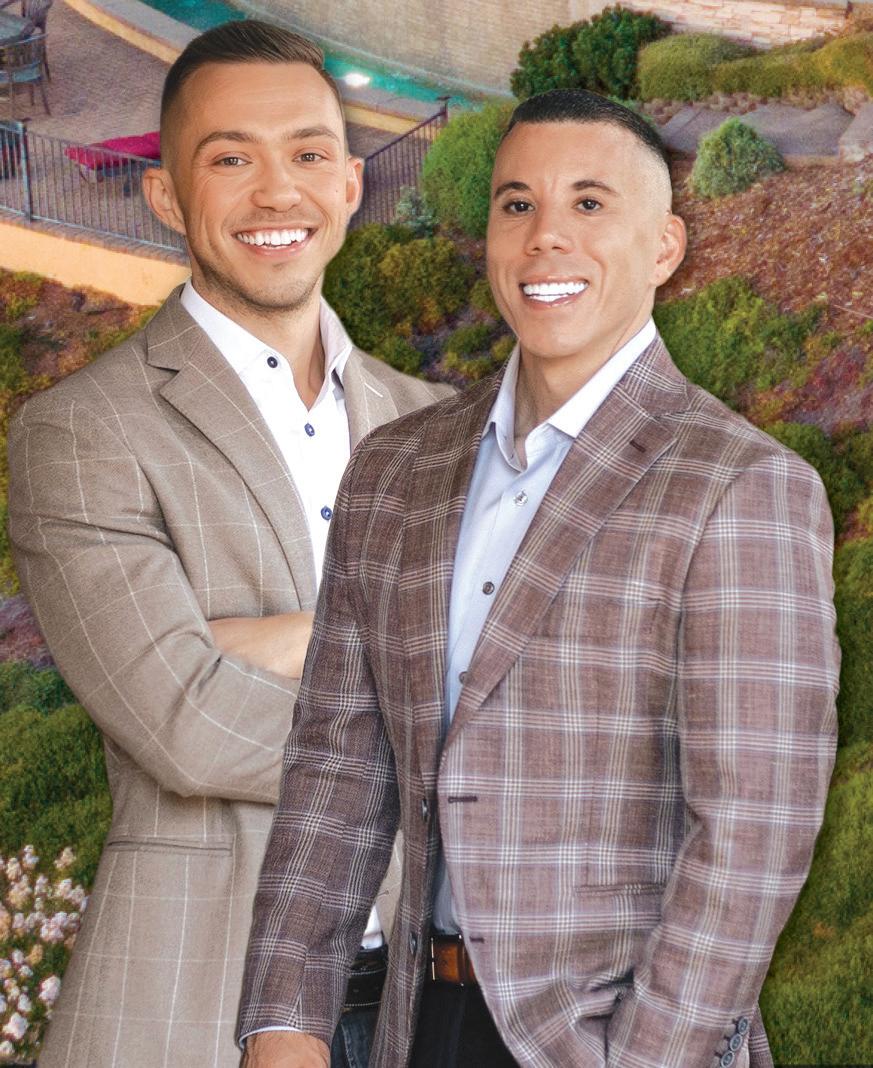

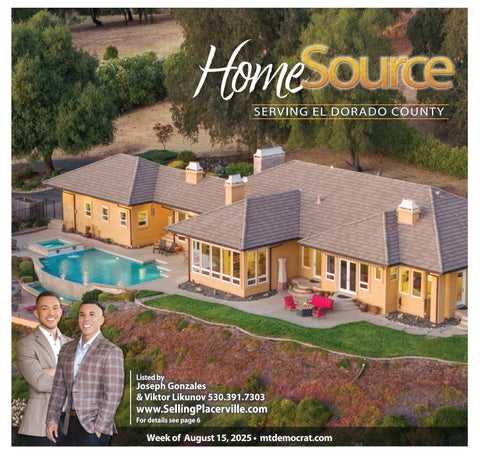

Miles of Views, One Unforgettable Estate

Springs, this spectacular estate o ers jaw-dropping, uninterrupted 120-degree panoramic including Downtown Sacramento, Mt. Diablo, California Coastal Range & beyond. nity-edge pool w/ a swim up bar, 8-person spa, outdoor kitchen, and multiple entertaining positioned to capture glorious sunsets! Set on 5+ usable acres, ideal for vineyards, animals, single-story 3,650 sq home was designed to frame the views from every angle. Inside, enjoy including a luxurious spa-like primary suite, a home gym (or optional 4th bedroom), breakfast area, and an open-concept kitchen that ows into a family room with a full bar, forever views. Additional highlights include a 33x22 deep garage, a lighted koi pond, dry 39-panel owned solar, two dual-fuel generators, Boston Acoustic whole house sound, remote-controlled awnings, water leak detector, newer appliances, raised garden beds, cient drip irrigation systems and more. is is a true entertainer’s dream above the nothing else will compare!

O ered at $1,625,000

STEP INTO REFINED COUNTRY LIVING

$1,197,500

MLS# 225047651

4 Bed | 3 Bath | 3061 Sq Ft | Private In-Law Quarters

Beautifully updated single-story home, where comfort meets elegance. Inside, you’ll nd an open-concept layout with soaring vaulted ceilings and a dramatic wall of oor-to-ceiling windows that ood the space with natural light and frame panoramic views of Marchini Ranch and the rolling Placerville hills. The gourmet kitchen features a spacious center island and brand-new stainless steel appliances perfect for everyday living and effortless entertaining. The home includes a private In-Law Quarters offering 793 sq ft of studio-style living, complete with handicap accessibility and its own breathtaking views ideal for guests, extended family, or a private retreat. Step outside to 10+ acres of usable land, approved for large animals and ideal for horses or livestock. A circular re road provides defensible space and peace of mind. Relax on the covered back deck while soaking in stunning sunsets, or explore the possibilities of the workshop below the home, complete with a roll-up metal door for storage, hobbies, or a home business. Tucked away in peaceful seclusion yet just minutes from Gold Hill Wineries, the South Fork of the American River, hiking trails, and all the beauty El Dorado County has to offer.