FAYETTE COUNTY

MARKET UPDATE

Construction Experience You Can Build On

Bowles Rice continues to expand its respected construction law practice into Pennsylvania, Ohio, and beyond. Our senior construction attorneys in Pennsylvania have over 90 years of construction experience between them, representing every facet of the construction industry—from general contractors, subcontractors, suppliers, and developers to design professionals and municipal and private owners. We focus on providing responsive, efficient, and cost effective representation for our construction industry clients. We understand the business, and we understand the law that you will be required to navigate and overcome to be successful.

• Contract Negotiation and Formation

• Project Delivery System Analysis

• Project Management Assistance

• Dispute Avoidance and Dispute Resolution

• Payment and Performance Bond Claims

• Mechanics’ Lien Claims

• Delay, Disruption and Acceleration Claims

• Federal and State Prevailing Wage Issues

• OSHA Compliance and Citations

• Bid Disputes

• Prompt Payment Act Claims

• Employment Disputes

• AAA Arbitration/Mediation Panel Members

Brad Mellor bmellor@bowlesrice.com

Damon Thomas dthomas@bowlesrice.com

Tom Weiers tom.weiers@bowlesrice.com

Attorney: Taylor Frankovitch

PUBLISHER

Master Builders’ Association of Western PA www.mbawpa org

MANAGING

EDITOR

Ben Atwood 412-922-3912 ben@mbawpa.com

EDITOR Jeff Burd jburd@talltimbergroup.com

PRODUCTION

Carson Publishing, Inc. Kevin J. Gordon

ART DIRECTOR

Carson Publishing, Inc.

GRAPHIC DESIGN

Blink Advertising blinkadvertising.com

CONTRIBUTING PHOTOGRAPHY

Archie Carpenter Photography Roy Engelbrecht Photography Fayette County Chamber of Commerce

March of Dimes

Mascaro Construction, L.P. Master Builders’ Association NAIOP Pittsburgh Amy Pischke Photography Shannon Construction West Virginia University Medicine

SPONSORSHIP DIRECTOR

Mary Chuderewicz mchuderewicz@mbawpa org

MORE INFORMATION:

BreakingGroundTM is published by the Master Builders’ Association of Western Pennsylvania, 412-922-3912 or www.mbawpa.org

Archive copies of BreakingGroundTM can be viewed at www.mbawpa.org

No part of this magazine may be reproduced without written permission by the Publisher. All rights reserved.

On the cover: Fallingwater by architect Frank Lloyd Wright, photo by Gerald Zaffuts

EDITO R’S NOTE

I’m from a small town, or rather two small towns. I was raised in Lancaster, PA, which didn’t feel like a small town when I grew up there. My family moved to Lock Haven, PA, when I was 16 and my formative years were spent there. I guess that’s why I think of Lock Haven as home all these years later.

Fayette County is filled with small towns like Lock Haven, towns on rivers or nestled in the Allegheny Mountains that are beautiful, friendly places to live. Those towns are also places that the economy has passed by. The people who remain in those towns, the leaders in Fayette County, love their homes and are working hard to create jobs so their children don’t have to move away from home to make a living.

Moving away to make a living is my story. I don’t know if I would have returned home after graduating from college under any circumstances. My parents and I were happy when I moved out. My father did arrange an opportunity to sell airplanes for Piper Aircraft, which was based in Lock Haven, but I wasn’t interested in moving back after setting my sights on Pittsburgh. As it turned out, Piper pulled up stakes and abandoned its plant and offices in Lock Haven for Florida three years later. By 1985, most of the other manufacturing companies in Lock Haven closed their doors too. Lock Haven became a college town and now even that is in peril.

Part of me looks at what’s happening in small towns like Lock Haven (or Uniontown) and chalks it up to the natural cycle of economic life. The American west is full of towns where, to quote from The Outlaw Josey Wales, “The gold run out. Then the silver run out. Then the people run out.” But my hometown is not a boom-and-bust, gold rush town. It’s a Norman Rockwell, Main Street America kind of town. I can’t fathom letting Lock Haven wither and die, even though I left there 46 years ago. If I lived there now, I’d be fighting to revitalize it. I’m just not sure how that would happen.

The folks in Fayette County are working to revitalize their economy. The towns there are not dying but they are not participating in some of the economic growth that has occurred in the neighboring counties. After numerous strategic plans failed to move the needle on growth, the county’s leaders are taking a different approach, stepping back to find out what the market thinks the best uses for its land and resources are before pursuing opportunities.

And there are opportunities in Fayette County. There is abundant natural gas beneath the ground in Fayette County. There are abundant natural resources. There are employers there working in segments of the economy that are durable and in favor. The housing market in Fayette County is so

tight that almost any new construction would be snatched up quickly. Its largest employers are healthy and in a position to invest in their future.

There are also challenges. Construction costs have risen to the point that it is difficult to build places to live that the average working person in Fayette County can afford. Penn State is closing its Commonwealth Campus in Uniontown. The state and federal governments have fewer resources to dole out to small towns and counties with fewer voters. Regional economic development agencies tend to lose focus the further you get from the Pittsburgh city limits. Most of the solutions that result from Fayette County’s economic visioning study (see page 18) will have to be home grown. Even that will be a challenge, since many of the people who live in slower-paced, less dynamic places do so because they are slower-paced and less dynamic.

So, Fayette County will need help executing its vision. Some of that will come from government resources but some will come from regional resources. Pittsburgh is blessed with abundant philanthropic organizations. There is a history of public-private solutions to problems, although the current focus of many of the vehicles for public-private partnership seems to be away from our more rural neighbors. When you spend time with Fayette County’s leaders and see how exhausting their work is, it’s easy to understand their frustration when one more charitable foundation grants money to revitalize downtown Pittsburgh while many of the storefronts in Uniontown remain empty.

We can help our regional leaders remember that Uniontown is one of our neighborhoods too. Go see the attractions in Fayette County. If you are in a position to influence or communicate with a philanthropic organization, ask if Fayette County’s economic development is on its radar. If the good people of Fayette County decide that a gas-fired power plant or a solar farm is a good thing, stay out of their way. Be a neighbor. That’s the small-town way.

REGIONAL MARKET UPDATE

BY BEN ATWOOD AND JEFF BURD

Pittsburgh’s labor market softened steadily through the summer. The August unemployment rate clocked in at 4.7 percent, marking the fourth straight month in which that figure has climbed, and a growth of nearly a full percentage point since March of this year.

Civilian labor force declined from 1,245,100 in July to 1,237,400 in August, which is nearly 10,000 below the figures from August of 2024. Total non-farm employment declined for the third straight month, dropping to 1,218,900 by the end of the summer, its lowest point since April of this year.

Within the local sectors, manufacturing was at 87,000, up slightly from July and the highest point since September of 2024, but still down one percent year over year. Construction declined slightly from July to August and is 0.3 percent below last year’s figures. The region’s cornerstone education and healthcare services sector softened through the summer, dropping to 267,900 by the end of August, down about 4,000 jobs since the early spring. Despite this pullback, the Eds and Meds sector remain healthy, recording year-over-year growth of 5.1 percent.

The local office market continues its slow but steady devolution. CoStar’s data shows a market wide vacancy rate of 11.5 percent, the highest since the worst of the great recession, but still under the national average which is over 14 percent. The local vacancy rate has climbed by just 0.5 percent over the past twelve months, and net absorption is about 200,000 square feet in the red.

Office leasing activity has kept at a steady pace but running slightly behind 2024 levels and still well below what was seen

before 2020. Renewals have been a big part of the story, with nearly half of the 20 largest deals of 2025 involving tenants choosing to stay in place. One of the most significant was Google, renewing a long-term lease at Bakery Square. Though the tech giant reduced their footprint by about 70,000 square feet, Carnegie Mellon filled in about 40,000 square feet in that same facility.

On the new-lease side, a few submarkets have posted positive levels of absorption. The Parkway West Corridor, Washington County, and Greater Downtown have seen the strongest levels of absorption, with the largest deal coming from Duquesne Light Company, which signed for a 15-year term at Nova Place on the North Shore.

Pittsburgh’s multifamily market remains on rock solid footing. CoStar data shows that the vacancy rate hovers around 5.5 percent, a 50-basis point drop quarter over quarter. This is remarkably tight compared to peer markets across the Great Lakes region and is yet another indicator that new supply within the market can fill rapidly.

Taking a closer look at the region’s housing market reveals that Pittsburgh is experiencing a sharp drop in sales while simultaneously seeing an uptick in active listings. Data from the Federal Reserve shows that the number of active listings throughout the market has hit the highest levels since June of 2020, with over 5,100 homes currently on the market.

At the same time, Allegheny County sales records show that residential sales dropped precipitously in September of 2025, with just under 750 homes trading hands. This is coupled with a four-month downward trend in pricing, which is currently averaging about $283,000.

Permits for new homes increased by 4.4 percent, or 99 homes, year-over-year compared to the first nine months of 2024. Construction started on 2,336 single-family homes in the six-county metro area. Housing starts overall dropped more than 17 percent because of a decline in multi-family permits. Through September, permits for new apartments totaled 1,588 units, a drop of 874 units from a year earlier. Despite a burgeoning pipeline of multifamily projects, it is expected that only another 560 units

Source: Pittsburgh Homebuilding Report

will get underway in the fourth quarter, which will result in a decrease in multi-family starts of nearly 1,000 units compared to a year ago. Demand for apartments remains solid, but higher construction costs and financing difficulties have slowed the progress on most proposed new developments.

Tracking construction permits in the city of Pittsburgh shows an uptick in total project value. Through the end of September, there have been a total of 279 commercial building and building and development applications over $100,000 approved, with a total project value around $723.9 million. If the year’s current trends hold through for the final quarter, there will be slightly fewer PLI permits issued, but total project value will easily eclipse 2024 levels.

Throughout the seven-county metropolitan Pittsburgh market, permits and contracting for nonresidential and commercial construction totaled $3.68 billion from January through September. That represents an increase of $320 million, or 8.7 percent, compared with the first three quarters of 2024. The increase has been driven again by major projects, particularly public and owner-occupied facilities. With the pace of bidding slowing as the fourth quarter began, activity for the full year should total between $4.5 and $4.8 billion.

Notable projects on the horizon include Nippon Steel’s latest investment in the Edgar Thomson plant in Braddock. The firm, which recently acquired U.S. Steel, is preparing to submit an air construction permit for the Allegheny County Health Department for a new $100 million slag recycling facility at the site. Once approved, engineering plans will be finalized with construction expected to begin in 2026.

The project will allow the plant to recycle byproducts of the steelmaking process into materials like cement ingredients, cutting down on landfill waste and reducing air emissions while also generating additional revenue. This marks a significant step in modernizing one of the region’s historic mills, aligning with Nippon Steel’s broader strategy to upgrade U.S. Steel’s North American facilities.

Early-stage construction and contracting have begun on

Homer City Redevelopment’s $10 billion power plant and data center campus at the former coal-fired power plant in Indiana County. Kiewitt, the project’s EPC contractor, has begun moving staff on site. In Springdale, a Davidson Kempner-led group has presented its plans for a $750 million data center at the former Gen-On Cheswick power plant site.

Walmart took a major step toward redeveloping the Monroeville Mall after filing a $7.5 million request through Pennsylvania’s Redevelopment Assistance Capital Program (RACP). The application outlines plans to demolish the existing 1.2 million square foot center and replace it with a modern mixed-use development. Plans call for 780,000 square feet of new retail, restaurant, and entertainment space. The demolition is budgeted at $15,000,000 and their current schedule is to begin demolition work in April of 2027.

Several other RACP grant applications signaled interest in significant redevelopment projects. Commonwealth Development Partners applied for a $7 million grant to renovate the Grant Building. The $85 million proposal would upgrade the lower floors to create more competitive office space and convert the upper floors to residential. Next Tier Real Estate Investors is seeking $15.5 million to assist with a $71 million plan to renovate the former Westinghouse Electric headquarters in Monroeville for a single user. That project is rumored to also include a data center on site.

Point Park University also submitted an RACP request to expand into two existing Downtown buildings. The university is seeking $5.5 million to renovate the former YWCA headquarters on Wood Street. Their plan calls for a full interior overhaul to create new student housing, study areas, and community space. The university is also seeing $4 million to renovate 500 Smithfield Street, a historic former bank that has been largely vacant since the pandemic. Point Park envisions a three-phase redevelopment that would modernize the building and ultimately convert it into classrooms, studios, conference areas, and community programming facilities. These efforts align with the school’s broader growth strategy, which aims to increase enrolment by 30 percent by 2030.

Despite growing enrollments at several regional colleges and universities – including University of Pittsburgh – there are fewer capital projects nearing construction. Pitt is in the process of revising its capital plan. Carnegie Mellon has been cutting staff in response to the cutback in federal research funding, which will likely chill capital spending in the short term. Investment in PA State System of Higher Education universities are frozen while the budget battle continues. One source of optimism for higher education construction is the dramatic improvement in fundraising at some of the region’s small colleges, which bodes well for 2026-2028 capital spending.

BUILDING ABOVE AND BEYOND

Go beyond. Repeat.

Trust your next construction project to PJ Dick.

While there have been no improvements in the funding mechanism – or the funding – for public education construction, there is an unprecedented uptick in major capital projects. Seneca Valley School District took bids in early November for additions and alterations to its Intermediate School that were expected to cost in excess of $105 million. In the queue behind that project are the $130 million Hempfield High School additions and alterations, and a new Quaker Valley High School that is estimated to cost just under $100 million. North Allegheny School District and State College Area School District both have capital programs that include single projects in the $100 million range. On the other side of the state, in Lancaster County, a different Hempfield School District is proceeding with plans to more than double the size of its high school, a project that is expected to cost upwards of $190 million.

The number of permits issued by the cooled in September but is on track to match 2024 figures by end of year. Source: Western Pennsylvania Regional Data Center

These kinds of mega K-12 projects, including the $109 million new Bethel Park Elementary School that started construction in early 2024, are the result of a dramatic jump in construction costs for schools and the financial neglect of the state’s Department of Education for the past dozen years. For the growing and/or fiscally strong school districts that require regular expansion and renovation to facilities, solutions were needed that circumvented Pennsylvania’s inadequate PlanCon system.

Source: Western Pennsylvania Regional Data Center, Pittsburgh Department of Permits, Licenses, and Inspections.

PlanCon, which has been essentially defunct since 2012, was inadequately funded by the legislature prior to Governor Corbett’s moratorium. At the time, new school construction costs were roughly $225 per square foot. Today, those costs have doubled. By pushing capital funding down to the individual school districts, the legislature effectively created two tiers of school districts: those that could only afford to repair facility problems and those that could afford to fund construction that stayed ahead of facility problems. For

the near-term future, the K-12 market will continue to offer primarily small projects, but the major project opportunities have ballooned to the point that they will attract larger contractors that largely avoided K-12 bidding. Whether local school districts have public support for funding $100 million projects remains to be seen.

The region’s energy market is seeing an uptick in spending after nearly a decade of stagnation. In Smith Township, Washington County, MarkWest is expanding its Harmon Creek Gas Processing Plant. The third phase of the plant’s development, the current expansion adds 330 million

Downtown Pittsburgh Construction Permit Count and Value

Pittsburgh Unemployment Rate

cubic feet per day of cryogenic processing. Along with the related processes, the project should cost between $400 million and $500 million.

Gas prices remain low, trading just above $3 per million BTUs, but the expansion suggests that MarkWest and its partners expect (or have agreements for) increased gas demand. This may be in anticipation of the planned growth in gas-fired power generation to provide electricity to the data centers proposed in southwestern PA.

Because of the major construction projects in the region, Pittsburgh’s top line construction volume for 2025 is likely to exceed the $4.8 billion forecast at the beginning of the year; however, the number of opportunities has declined. This trend will continue into 2026, as another mega project is likely to get underway while the sectors that typically are the bread-and-butter of the market – healthcare, higher education, and public construction – see capital spending that is lower than normal. BG

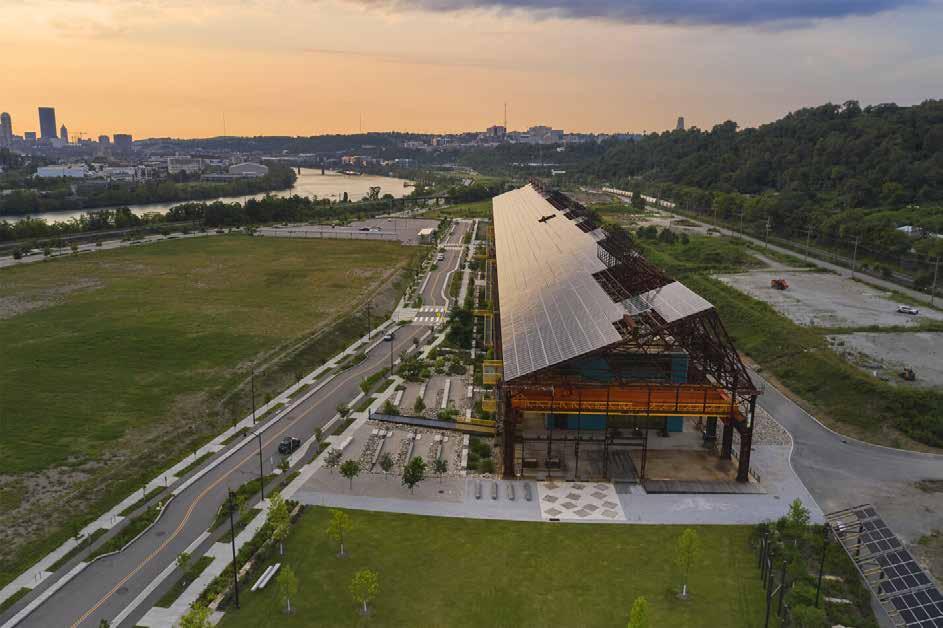

Frick Environmental Center LEED Platinum Carnegie Mellon

NATIONAL MARKET UPDATE

BY BEN ATWOOD

The federal government entered a shutdown on October 1st, after Congress failed to pass a new spending plan. In the short term, the impact is mainly felt in suspended services, delayed projects, and missed paychecks.

A brief shutdown, which is most likely, would have limited and reversible effects. A prolonged one could dampen confidence, disrupt local economies, and add to concerns about U.S. fiscal policy. Each week of the shutdown could shave a small fraction of growth in gross domestic product (GDP), as federal workers cut spending and businesses face delays in contracts, permits, or grants. Uncertainty also builds as key government data releases are postponed, complicating decisions for business and policy makers.

Numerous economic indices have been stalled or delayed at the time of this writing, but the latest data shows a continuing trend of a softening economy. August’s labor market report showed a continuation of the stall that defined the summer months. Total non-farm payrolls increased by just 22,000, marking the fourth consecutive month with minimal growth. Unemployment ticked up modestly from 4.2 percent to 4.3 percent, its highest level since 2021.

The household survey also showed stable if lackluster numbers. The labor force participation rate was 62.3 percent, while the employment population ratio was unchanged at 59.6 percent. Both have fallen by 0.4 percent over the past year. Long-term unemployment remains elevated, with 1.9 million jobseekers out of work for more than 27 weeks, accounting for more than a quarter of the unemployed. The number of Americans outside the labor force who still want a job rose by 722,000 over the year to 6.4 million.

Industry trends underline the narrow base of job growth. Healthcare added 31,000 positions, while social assistance

contributed another 16,000. Goods producing industries were also weak. Manufacturing shed 12,000 jobs in August, while wholesale trade employment declined by 12,000. Federal government employment fell by another 15,000, extending a decline of nearly 100,000 jobs since January. This figure could easily rise in the coming weeks as President Trump has threatened to use the shutdown to cut additional jobs and programs.

Historical revisions showed mixed movement. June’s estimate was revised down sharply, from a small gain of jobs to a net loss of 13,000, while July’s figures were revised upward by 79,000. Taken together, the two months are now reported as 21,000 jobs fewer than previously estimated, reinforcing the narrative of a cooling labor market.

The August Job Openings and Labor Turnover Survey (JOLTS) showed little movement in overall labor market dynamics. Job openings held steady at 7.2 million, translating to a 4.3 percent openings rate. Hires also remained flat at 5.1 million, or 3.2 percent of employment, suggesting employers are showing caution in adding new workers, and opportunities for job seekers are no longer expanding.

Payroll processing firm ADP’s September payroll data backs this up, showing that private payrolls experienced the largest decline in over two years. The firm’s data shows that private employers shed around 32,000 jobs during the month, which flies in the face of Dow Jones economists, who had expected a gain of 45,000. Additionally, ADP revised its August payrolls to a loss of 3,000 jobs from an initially reported increase of 54,000.

ADP’s data revealed that job losses were spread through multiple sectors, with losses in leisure and hospitality (a crucial sector for consumer demand) around 19,000. The overall decline was mainly due to smaller businesses, which

are nimbler and more responsive to shifting economic winds. While large companies (over 500 employees) saw a net gain of 33,000, every other size range posted negative numbers.

These negative numbers do not necessarily indicate job losses, but a reduction in hiring. More likely, 40,000 positions that were open in small businesses were not filled.

The quits rate, a key measure of worker confidence, held steady at 1.9 percent with 3.1 million people voluntarily leaving their jobs. Quits decreased sharply in accommodation of food services (down 140,000) and in arts and entertainment (down 22,000), suggesting that workers in these sectors are less confident about securing new positions or are opting to stay put. On the other hand, quits increased in construction by 56,000, possibly reflecting opportunities tied to ongoing projects despite the broader slowdown in openings.

Layoffs and discharges stayed at 1.7 million, with a 1.1 percent rate remaining flat, reinforcing that employers are not

FULL-SERVICE CIVIL ENGINEERING

Smaller businesses more susceptible to changing economic winds are pulling back hiring.

Source: ADP Employment Report

ramping up job cuts. The BLS also revised July’s data modestly. Job openings were adjusted up by 27,000 to 7.2 million, while both hires and separations were revised down by 68,000 to 5.2 million. Within separations, quits were lowered by 42,000 to 3.2 million and layoffs by 21,000 to 1.8 million. Taken together, the revisions and August’s steady readings reflect a labor market that is not deteriorating rapidly but is clearly past its peak, with fewer job openings, more selective hiring, and employees less willing to jump ship.

Combined with other measures of a slowing economy, this labor market data is likely to push interest rates lower over the next six months. Trading in the bond market suggests that the bellwether 10-year Treasury will fall below four percent by early 2026. That would be a welcome development for commercial real estate.

Unemployment continues its slow if steady upward trajectory, hitting the highest levels since 2021.

Source: United States Bureau of Labor Statistics

Unemployment is typically the factor that tips the economy from slowing to recession. For now, the consensus of economic consultants and investment giants is that consumer

spending will continue to keep U.S. gross domestic product growing, albeit at a pace of 2.0 to 2.5 percent. Forecasters cite the strength of consumer spending in the third quarter despite weaker wage and income growth; however, spending is determined as much by unemployment outlook as by disposable income. Simply put, if you think you will get a paycheck next month you are more likely to spend than if you fear a layoff. And, since the end of World War II, unemployment has always jumped steeply in a short time immediately ahead of a recession. On average, unemployment rose 86 percent in a 13-month period once the economy contracted.

After rebounding early in the summer, consumer sentiment declines for the second straight month. Source: University of Michigan Consumer Sentiment Survey

Policymakers at the Federal Reserve cited the slowing job growth and rising unemployment as the primary factors when voting to cut the benchmark interest rate by

a quarter point to a target range of 4.0 to 4.25 percent at its September meeting. The board expressed concern about inflation and the general uncertainty about economic

Contractors and Local 66 working together to build a better future.

For over 120 years Local 66 in partnership with our Contractors, have been committed to provide qualified and competent Operating Engineers. The most successful companies are union signatories. We will help you to remain competitive and to gain the marketplace advantage. You will keep your employees and we will work with you to provide skilled training; and as you grow and your needs expand, we can provide you with a qualified workforce. This partnership is a positive approach to doing business. Your company must remain competitive during all economic conditions. We bring positive factors to the relationship – training, reliable workforce, safety, quality and a stronger community presence.

“We partnered with the Local 66 in 2011. Since then, we’ve been able to take on many more clients, more difficult work, due to the contribution of their great staff.”

J.J. Stefanik - President Stefanik’s Next Generation Contracting Co.

”Mascaro Construction Company is a regional general contractor that’s been around for 33 years. Proud to say that 30 of those years, we’ve had a relationship with the Operating Engineers providing us with skilled craftspeople that run all the equipment that we have.”

John C. Mascaro Jr. - President Mascaro Construction

“Working with Local 66, we have had employees that have been with us 25-30 years.”

Bindy Bucci - Owner Golden

outlook and the labor market. The Fed also said it would also continue reducing its holdings of Treasury and mortgage-backed securities.

Speaking in Rochester in late September, New York Federal Reserve President John Williams stated that the signs of a weakening in the labor market led him to support the decision to cut interest rates, and the move was aimed at easing some of the policy restrictiveness to help protect jobs while still maintaining downward pressure on inflation, which remains above the Fed’s two percent target.

Williams emphasized that the Fed plans on proceeding cautiously, choosing to set policy on a meeting-by-meeting basis rather than committing to a pre-determined path. While officials have penciled in additional cuts by year-end, Williams decided to signal his personal preferences for future cuts.

Despite ongoing concerns about inflation, Williams pointed out that some of the earlier risks to price stability have diminished. Tariff effects, once feared as a persistent inflation driver, have proven smaller than anticipated, and there are few signs of new inflationary pressures emerging.

September saw the Bureau of Economic Affairs (BEA) release its final estimate of the nation’s gross domestic product for the second quarter. It was estimated to have

increased by an annual rate of 3.8 percent. This marks a notable turnaround from first quarter of 2025, when the GDP decreased by 0.6 percent.

The BEA attributes this increase to a decrease in imports, which are a subtraction from the GDP calculation, and an increase in consumer spending. Growth was partially offset by decreases in investments and exports. This latest release was a 0.5 percent revision upwards from its second estimate, which they attribute primarily to an upward revision in consumer spending.

The decrease in imports is due to ongoing tariffs. In September, President Trump announced a new round of tariffs targeting the lumber and furniture industries, with a 10 percent duty on softwood timber and lumber and a 25 percent tariff on certain upholstered wooden products. These took effect October 14th, and these measures follow a separate set of tariffs on kitchen cabinets, vanities, and other upholstered goods that took effect October 1st.

The president argued that the policies would strengthen supply chains and revive U.S. manufacturing, but homebuilders warned that the higher input costs could discourage new construction and renovations. Canada, the United States’ largest wood supplier and already facing duties of over 35 percent, is expected to be hit especially hard.

ORGANIC

S&P Global released an updated economic outlook for the fourth quarter of 2025 in late September. The group nudged its outlook higher but still expects the U.S. economy to run below trend, forecasting real GDP growth of 1.9 percent in 2025 and 1.8 percent in 2026. After strong momentum late last year, growth has cooled as consumption softened, housing stayed frozen, and policy uncertainty weighed on activity.

The largest macroeconomic cross current remains tariffs. S&P now estimates the effective tariff rate near 17 percent (from 2.3 percent in 2024) with revenues on track for about one percent of GDP. That likely rekindles goods inflation, keeping core inflation a bit above three percent into mid-2026, and eroding purchasing power. Firms can’t fully absorb costs, supply chains can’t pivot quickly, and manufacturers reliant on imported inputs risk competitiveness hits. Meanwhile, tighter immigration policy (net migration is near zero) constrains labor supply, props up wages in immigrant dense sectors, and explains about half of the downshift from 2024 to 2025. They see unemployment edging to 4.6 percent by mid-2026, then returning to 4.0 percent in 2027.

Tariff related concerns weigh heavily on consumer sentiment. University of Michigan’s latest consumer sentiment survey showed that consumer sentiment dropped from July to August. The figure now sits at 58.2, down from 61.7 the prior month, and the lowest number since spring of 2023.

The Conference Board Index also showed consumer confidence slipping in September. The latest release shows consumer sentiment falling 3.6 points to 94.2, the lowest level since President Trump began implementing his administration’s tariffs. The drop was driven by a sharp decline in the Present Situation Index, reflecting weaker views on business conditions and job availability, as the share of Americans saying jobs are “plentiful” fell for the ninth straight month. The expectations index also edged lower to 73.4, remaining well below the 80 threshold that signals recession risk.

Inflation remains a top concern in survey responses, while worries about jobs also climbed to a one year high. Average 12-month inflation expectations eased slightly from 6.1 percent to 5.8 percent but remained elevated compared to the end of 2024. Financial sentiment weakened notably, with consumers reporting the largest monthly drop in their current financial situation since 2022 and more respondents believing the economy is already in a recession.

As the year comes to a close, 2025 ends the way it began, with dramatic headlines that are not reflected in the data. Though softening economic numbers indicate that this could change, and soon, the long-awaited impact of President Trump’s sweeping tariffs has yet to fully hit consumers, whose confidence is down but whose spending is not. To the extent that this dynamic does not change, and unemployment does not spike, a recession is unlikely.

WHAT’S IT COST?

BY BEN ATWOOD

September was expected to bring a level of clarity to how construction markets were handling tariffrelated cost pressures, whether the summer surge in producer prices reflected the exhaustion of pre-tariff inventories procured ahead of President Trump’s sweeping implementation of tariffs in April of this year.

However, on October 1st, the federal government shut down. At the time of this writing, the shutdown was entering into its third week, delaying the release of pricing indexes from the Bureau of Labor Statistics.

As such, the latest figures to dissect come from August, and do not necessarily reflect the reality of pricing entering the final quarter of 2025.

Though these numbers were less dramatic than July’s showing, when the producer price index (PPI) surprised the market by rising 0.9 percent, there are still indicators that the long-awaited impact of President Trump’s wide sweeping implementation of tariffs were being felt by producers.

The concern amongst economists was that a spike in the PPI, which reflects pricing paid by producers to manufacture and create goods, would soon lead to an increase in pricing for consumers. Though August’s PPI dipped by 0.2 percent from July’s figures, they remain 2.6 percent higher than August of 2024.

Interestingly, the consumer price index, which measures what consumers are paying for finished goods, climbed by 0.3 percent. This is comfortably above the average month-over-month increase seen over the past two years and could indicate that rising producer prices are beginning to pass along to the consumer.

Of the 80 or so regularly updated construction pricing indices, exactly half saw upward momentum in August, with nine indices seeing month-over-month growth greater than one percent.

The metals sector continues to be the most impacted. Most indexes within this cluster experienced month-over-month price increases. August’s largest price hike was in the aluminum mill shapes

sector, which climbed by 5.5 percent month over month and this series pricing has increased by over 22 percent since August of 2024. Steel mill products climbed by 1.5 percent from July to August and have risen by over 13 percent since 2024.

The asphalts cluster was more of a mixed picture, with swings in both directions. Asphalt (at refinery) and prepared asphalt and tar roofing rose by over two percent month over month, while #2 diesel fuel saw a month-over-month decline of nearly three percent.

While the current data offers a partial view, the ongoing shutdown has delayed the release of more recent pricing indexes, limiting visibility into how market conditions have evolved entering the final quarter of the year. Until those figures are available, assessments of tariff impact and price stability will remain provisional. BG

It is arguably the most beautiful county in metropolitan Pittsburgh. The heart of the Laurel Highlands is located in Fayette County, with a spine of the Alleghenies bisecting the county diagonally. The Monongahela River forms Fayette County’s western border, and the Youghiogheny River flows south to north across the eastern half of the county.

West Virginia University Medicine Uniontown Hospital is the county’s largest employer. Photo courtesy WVU Medicine.

Designed and Built to Get Results

For more than a decade, DFL Legal has provided companies with the most effective solutions in resolving unique construction and engineering disputes.

Our success has been achieved by offering our clients proven, big case experience, along with the efficiencies and flexibility of a boutique firm.

Find out how our experience can be put to work for you.

These are the hallmarks the region’s union construction trades and contractors bring to the jobsite everyday. Our professional tradespeople and contractors bring the dreams and visions of our fast-growing region to life with a dedication that only those who live here, work here, and raise their families here can commit to. It is, after all, our home, our legacy.

We are also committed to providing opportunity for all who share these values and want to pursue a lifelong, lucrative and satisfying career. For more information on building with our union trades and contractors, or to explore career opportunities, please visit www.buildersguild.org where you will find direct links to our Trade Unions, Joint Apprenticeship Training Centers and Contractor Associations.

Loaded coal cars leave an unidentified Fayette County mine, circa 1905-1907. Reproduced with the permission of the Coal and Coke Heritage Center at Penn State Fayette, The Eberly Campus.

The natural beauty attracts the tourism that is the backbone of the economy in Fayette County. The elected officials and civic leaders of Fayette County recognize that a vibrant tourist industry is not the growth engine of the county’s future. They seek to align Fayette County’s economic investments align with the industries that are creating jobs now and in the decades to come.

Like the rest of the western Pennsylvania counties, Fayette County had an economy that was based on production, rather than tourism, until the industrial disinvestment that occurred in the 1980s. While it was not the heart of the steel industry, Fayette County was home to the earliest iron manufacturing furnaces in Pennsylvania, dating back to the 1780s. Later, much of the coal that fed the production of coke came from Fayette County. Frick Coke Company, owned by H.C. Frick, operated in Connellsville and provided almost half the supply of metallurgical coke used nationally, including by Carnegie Steel, and later, U.S. Steel.

Unlike some counties in Western PA, Fayette County’s recovery from the 1990s decline has been slow and uneven. Employment in some of the highest paying positions, like mining, energy, and manufacturing, remains at or above the levels of employment in those industries statewide. But Fayette County has fewer than half the number of financial services and professional management jobs than the rest of the state. There is little new residential development,

which limits population growth. And, in the next two years, county leaders will have to deal with the loss of Penn State’s Eberly Campus.

In the face of these challenges, there is optimism in Fayette County. The current county commissioners recently approved a comprehensive study of the county’s economy that is very similar in intent to the 1993 study headed by Carnegie Mellon president, Robert Mehrabian. That report, “Toward a Shared Vision” became the basis for Pittsburgh’s revitalization. Fayette County’s leaders have identified industries that they think will be the future drivers of growth, but they are prepared to have the research and market feedback steer the resulting economic vision. That vision, the county’s leaders hope, will be the blueprint that sparks growth

Fayette Fundamentals

Fayette County shares most of the same demographic challenges that its neighboring counties, and the metropolitan area, face; however, some of these challenges are more severe in Fayette. Compared to benchmark regions where there is economic growth, Fayette County has a steadily declining population that is older than the U.S. median. From the most recent high-water mark of 162,700 in 1979, Fayette County’s population has declined steadily, falling 23.8 percent during that 45-year period to an estimated 123,941 in 2024.

As of 2024, the median age of a Fayette County resident was 45.4 years, more than six years older than the median U.S. resident, and 2.6 years older than the median resident of the eight-county Pittsburgh metro.

Businesses looking for new locations or expansion prefer sites with growing, or at least stable, population nearby. Site selection consultants note that companies typically look for a minimum of one percent population growth to ensure that there will be ample workforce for a new facility. That threshold often eliminates all metropolitan Pittsburgh, including Fayette County.

“The industrial demand drivers in Western Pennsylvania are either expansion or distribution support of finished product or raw materials for manufacturing operations or servicing of existing buildings and rooftops from a last-mile or middlemile distribution standpoint,” says Mateo Villa, principal at Genfor Real Estate Services.

Digging deeper into the population and workforce demographics, the challenge facing Fayette County’s leaders becomes clearer. Compared to the metropolitan counties that share a border with Fayette County, the workforce in Fayette is significantly smaller. While the civilian workforce is almost exactly half the total population in Washington County and Westmoreland County (and 52.6 percent in Allegheny), the workforce-to-population ratio in Fayette County is only 43.7 percent.

It is not a surprise that Fayette County’s population density is also lower than its neighbors. There are 156.8 people per square mile in Fayette County, according to the 2024 Census Bureau estimates. In Washington County, the population density is 245.3 persons per square mile; in Westmoreland, the density is 341.7 persons per square mile; and in Allegheny County, the density is 1,677.6 persons per square mile. For most residents of Fayette County, that sparser population is a plus; however, for industrial development, it is another hurdle.

“I have not seen much interest in Fayette from people approaching us about building on sites. I can’t really pinpoint exactly why, but my sense is that the county is fairly sparsely populated if you compare it to Washington, Westmoreland, and Allegheny,” says Matt Virgin, executive vice president at SunCap Property Group. “Industrial users and even the warehouse distribution users are running very sophisticated workforce models and if they don’t feel they can hire the people in an area to staff their facilities, that area is discounted very quickly. Confidence in an adequate workforce is almost more important than proximity to highways.”

“Unless you have a reason to locate a big building here to support a manufacturing operation or a more reasonable size building to support a population center that’s within the Pittsburgh MSA it’s a struggle to locate here from a logistics standpoint,” continues Villa. “Fayette County, for better or worse, is not going to experience demand from users that are

RELIABLE PERFORMANCE - INSIDE AND OUT CONTRACT

trying to get product to rooftops or local businesses because of the lack of concentration.”

While concerns about available workforce may be headwinds for commercial development, Fayette County employers are nonetheless expanding. Since the pandemic, Nemacolin has expanded and undergone a major renovation; Boeing has expanded; Advanced Acoustic Concepts added 30,000 square feet; the 27,500 square foot CareHub Outpatient Center was built in South Union Township; Fay-Penn Economic Development built a 100,000 square foot spec building in Dunbar Industrial Park; and Hranec Corporation has built two new manufacturing and fabrication facilities

It is understandable that models reliant upon density or population growth would not be favorable to Fayette County; however, the current workforce data suggests that industrial employers are finding workers. According to September 2025 data from the PA Department of Labor and Industry, 9.2 percent of workers in Fayette County are involved in manufacturing, nearly identical to the 9.4 percent rate for the entire state. Two percent of the employees in Fayette County are involved in mining and oil/gas extraction, a rate that is more than six times the statewide average. Annual wages for the latter are the highest in the county, at $109,766, and are $4,000 higher than oil/gas workers elsewhere in Pennsylvania.

Fayette County has the smallest population of the five counties that originally comprised the Pittsburgh MSA. Source: U.S. Census Bureau. "AGE AND SEX." American Community Survey, ACS 5-Year Estimates Subject Tables, Table S0101, 2023. Data current as of April 2025.

Source: Bowen National Research, Housing Needs Assessment for Fayette County, 2023-2024.

The industries that employ the most people in Fayette County are healthcare and lodging and food service. Not surprisingly, the county’s two largest employers are West Virginia University Medicine (WVUM) Uniontown Hospital and Nemacolin Resort, each of which employs around 1,000 workers. Healthcare workers in Fayette County earned $51,963 annually in September, slightly above the overall median wage for all workers in Fayette County. But that wage was almost $13,000 less than the statewide median wage for healthcare workers. Food service and lodging workers earned about $4,500 more annually than the statewide median wage, but the annual earnings for those workers in

Fayette, $28,892, are relatively low.

The widest gaps between Fayette County and the rest of the state, both in terms of employment and wages, are in financial services, information technology, and business management. In all three of these industries, the share of workers employed in Fayette County is less than one quarter the statewide average, and the wages were slightly higher than half the statewide average.

While regional leaders would like to see more jobs created in these higher-paying industries, one reason that this data reflects more poorly on Fayette County is that many of the people who work in Fayette County do not live there. According to Bowen National Research, which did a housing needs assessment in 2023-2024, nearly one in three people employed in Fayette County live outside the county. The biggest reason for that is the lack of housing.

MICA members are interior contractors who share a common mission: to provide their customers with the highest quality craftsmanship. We partner with the union trades that supply the best trained, safest and most productive craftsmen in the industry.

Alliance Drywall Interiors, Inc.

Easley & Rivers, Inc.

Giffin Interior & Fixture, Inc.

JLJI Enterprises

J. J. Morris & Sons, Inc.

T. D. Patrinos Painting & Contracting Company

Nemacolin Grand Lodge

Precision Builders Inc.

RAM Acoustical Corporation

Schlaegle Design Build Associates

TRE Construction Wyatt Inc.

Interior contractor: Giffin Interior & Fixture, Inc.

Another high quality MICA project

Bowen’s study found that Fayette County’s housing market was extraordinarily short of options, either for rent or sale. It surveyed thousands of apartment units and found an occupancy rate of 99.6 percent. The rental occupancy rate for healthy, well-balanced markets is 94-to-96 percent. Bowen also found that non-conventional rental housing (units that are not in a multi-family apartment) made up 80.1 percent of the rental stock in Fayette County. That compares with a rate of 63.8 percent statewide.

The story is similar for owner-occupied homes. Bowen’s research found that 0.8 percent of privately-owned homes were available, well below the 2.0 percent to 3.0 percent availability that characterizes a well-balanced for-sale market. Fayette’s tourism is a factor in the housing shortage, as many family homes are being sold as short-term rentals to be used by visitors to the county’s attractions.

Of greatest concern to Fayette County leaders is the finding that there were 14,443 daily in-commuters to the county. That figure was updated to more than 15,000 this year. More than half of those are between 30 and 54 years old and 44.4 percent earned $40,000 or more annually.

The problem is one that Mark Rafail, economic development coordinator for Fayette County, feels is critical to address. In early August, the county hosted a housing market summit to get input from developers and builders. The summit attracted the nation’s top builder, D.R. Horton, which has been building in the Pittsburgh region since 2023. Rafail reports that the panel was candid about the challenges of new residential development generally, and in Fayette County.

Michael George is president of Mountain Creek Properties and a board member of Fay-Penn Economic Development Council, which commissioned the Bowen housing assessment.

He sees the challenges facing new residential construction as being mostly beyond what Fayette County can control. George also takes issue with the report’s conclusions about the size of the opportunity to develop, especially in the middle-and-upper income properties.

“Do we have a tight housing market? Yes, we do. We’re 100 percent occupied at all points in time. Where I disagree with the report is that you cannot build today for the rent you can achieve in Fayette County,” George says. “The report assumes that you can get higher rents in Fayette County than are realistic. There is a threshold to what people are willing to pay for rent. We test the market all the time with our nicer units and it’s $1,300, $1,400, maybe you get $1,500. Our average rent in Fayette County is probably $950 to $1,000 per month. The math doesn’t work for new construction at those rents.”

“I don’t know that there’s the bandwidth in Fayette County to develop 150 units at $1,800 in rent for a two-bedroom, one bath with no garage, which is what you have to build to make the numbers work. I don’t think that’s just the case for Fayette County, by the way. It’s the case for any of the secondary and tertiary areas,” he continues.

George suggests that it may take assistance from an economic development agency or fund to prepare sites or otherwise intervene to bring the cost basis of a unit to where the market rents are. Rafail believes that there needs to be more information available about what properties are available or feasible for development.

“I’d like to see something like PA SITES in Fayette County for large scale residential sites,” he says. “We have four areas that we could develop quickly because they already have the infrastructure available to the end of the road. There are 60 lots ready for development in Albert Gallatin School District south of Uniontown. Fay-Penn has property with 100 lots, and there’s a site in Connellsville that could be up to 190 lots if we resolve some zoning issues.”

Like with multi-family, however, there are market factors that make single-family development challenging. Some of these factors are not unique to Fayette County. Construction costs are much higher than before the pandemic. Environmental regulations slow development and add costs across the commonwealth. But the market dynamics in Fayette County are factors.

During the 2010s, builders started roughly 65 homes annually on average, but that number has fallen below 43 homes since 2019. At that rate, it would take more than eight years to build the 350 lots Rafail identified as ready or near ready for development. That is not an absorption rate that will attract higher-volume builders like D.R. Horton or Ryan Homes,

Fallingwater (shown here) and Kentuck Knob, designed by Frank Lloyd Wright, are in Fayette County. Photo by Kirk Thornton.

Pittsburgh’s most active homebuilder. Moreover, the average home price of existing homes for sale is lower than builders would find attractive as competition. Even with the steady price appreciation totaling 22 percent since 2020, roughly two-thirds of the homes for sale in Fayette County are listed at $200,000 or less.

Despite the difficult market fundamentals, Fayette County leaders see the large share of daily commuters to the county as an opportunity for new residential, especially for family homes. It is true that without any large-scale developments, it is difficult to get a true measure of lot absorption. The housing in Fayette County may suffer more from scarce supply than weak demand. That is one of several key assumptions that leaders would like to test with a new comprehensive strategic plan for Fayette County.

Fayette County’s Game Plan

“There is a different – and I hate to use the word – vibe this time,” says Muriel Johnson-Nuttall, executive director of Fayette County Chamber of Commerce.

Nuttall is referring to the expectations for the Economic Development Vision and Action Plan, which was recently awarded to Fourth Economy to prepare. Like the Mehrabian report done in 1993, this visioning effort is expected to create consensus about the economic future of Fayette County.

“We have been laying the groundwork for this for quite a few years. There have been many strategic plans done for the county. Those plans had a purpose. To bring grant money in, we had to have a comprehensive plan in place and for that purpose it was good,” Nuttall says. “Those plans looked at all the areas we’ve always looked at. They considered all the things that we’ve always considered. But, by design, the plan wasn’t set up as a forward-thinking plan with implementable achievable goals. The difference in what we’re trying to do right now is that we’re looking beyond the areas we normally consider. We’re thinking about where we want Fayette County to be 25 years from now or 10 years from now. We’re looking at five emerging primary industry areas to try to figure out where we want to be and develop a strategy to get there.”

Rafail draws an analogy to the steps taken prior to former Horseheads Corporation site in Monaca being selected by Shell Chemicals to develop a polymers plant.

“A market study was done that identified that [chemical manufacturing] would be a good use for that site. We want to do the same thing. We want to know what the

recommended best uses are for all our land, whether it’s downtown Uniontown or it’s the mountains and valleys’ Rafail explains. “This is a commissioner-driven project. They’re supportive and understand that the answers may not be what they expected.”

“We’re going to look at the organizations, the Chamber, the County Economic Development, Fay-Penn, the Redevelopment Authority, Community Action, and all the entities that work together to figure out what each will be responsible for with this visioning strategy,” Nuttall says. “We’re all working well together and working forward, but there are areas of overlapping responsibility. That can be good, but we need to figure out where it’s the best strategy to overlap. We need a map. Several of these organizations are changing leadership so it gives us a moment to make sure we’re all moving in the right direction.”

Rafail says that there are two phases to the project, with a final deadline for the Economic Development Visioning Strategy and Action Plan to be completed just under a year from now.

“We selected that time frame in the request for proposals because we are tired of kicking the can down the road and we have commissioners in place that want to move forward,” Rafail says. “When we talked to organizations about matching funds for the plan, there was no hesitation to pitch in. One reason is that they saw what the governor has done with his economic strategic plan. We are going to go one step deeper too identify the categories that we know will help Fayette County.”

To conduct a baseline situational assessment and generate strategies, Fayette County is asking Fourth Economy to organize working groups in five industries: energy, agriculture, manufacturing, tourism, and healthcare. Groups will also look at the growth strategies for housing, education, and land use. Agriculture, tourism, and healthcare are Fayette County’s

An inland barge is launched in the Monongahela at Brownsville by Heartland Fabrication, one of two barge manufacturers in the U.S. Photo by Fayette County Chamber of Commerce.

current major industries. The other two segments are emerging industries in Fayette County. Energy, in particular, looks to offer opportunities for rapid growth.

“The energy industry is one that everyone is looking at. We know we have untapped natural gas below us. We can be leaders, or contributors in energy,” Rafail says. “The study may take a look at all this and tell us we’re wrong. But we’re pretty sure that no matter what industries the study identifies, energy will be a part of it.”

The timing of the strategic planning is good. Development and construction are in something of a lull as 2025 winds down.

Karyn Wallace started as the new CEO of WVUM Uniontown Hospital in June 2025. The new leadership team is assessing the facility’s needs and no major capital projects are in the pipeline now. The new federal budget has expanded the potential for Opportunity Zone development, but the government shutdown and the commonwealth’s budget problems mean that leaders cannot learn where they may be additional Census Tracts in Fayette County beyond the two already identified in Connellsville.

Interviewed in October, Mike Stefan, Penn State’s vice president for government and community relations, characterized the meetings with community leaders as having gone well; however, Fayette’s economic development leaders remain frustrated by the lack of information from Penn State about its plans.

Assuming the Economic Development Vision and Action Plan is completed by fall 2026, it will be immediately useful for Fayette County’s leaders as they deal with the closing of Penn State’s Fayette campus.

On May 22, 2025, Penn State’s Board of Trustees voted to close seven of its Commonwealth Campuses, including Penn State-Fayette’s Eberly Campus in North Union Township. The closure will occur in spring 2027 at the conclusion of the academic year. As the only four-year higher educational institution in Fayette County, Penn State was an asset for local students and local businesses, in addition to being a large employer. The closing of the Eberly Campus creates economic and educational problems for students, employees, and the campus’ real estate assets. Depending on how Penn State executes the closing, whether it allows for a successor entity to assume some of educational offerings or shutters and liquidates the campus, the impact on Fayette County’s economy may be limited or widespread.

Fayette County Commissioners acted quickly, establishing the Eberly Campus Transition Committee to explore what opportunities may come from the closing. Scott Dunn, chairman of the Fayette County commissioners, says that the committee has had discussions with the university staff responsible for the transition, but very little has been decided about the key questions of the future of the students and staff at the Eberly Campus.

“Penn State is trying to figure it out. Until they figure it out, we can’t move forward,” says Rafail. “I understand their dilemma. How many times has a university closed campuses? The problem for us is that the longer it takes them to figure it out, the less time we have to put something in place. I can put something on paper, but I can’t execute it.”

Rafail notes that there is space available for whatever parts of the current Eberly Campus’ programs may be viable to evolve into a new higher education program that is independent of Penn State; however, funding does not exist to build something on speculation. Without some assurance of what programs a succeeding institution might be able to offer, there is little that the Eberly Campus Transition Committee can pursue or recommend.

The leaders in Fayette County seem ready for economic change, even if there is some pain or uncertainty involved. There is a concerted effort to align the county’s resources with what the market dictates. As a sparsely populated county, Fayette County has lots of land where resources and opportunities could meet. At the very least, Fayette’s new strategic plan should give its leaders a better idea of the inventory available for opportunities.

“We have six sites on PA SITES and we should probably have 50,” Rafail says. “We need more cooperation from developers and landowners so that we can have an inventory that is reliable when an opportunity arises.” BG

Photo by Fayette County Chamber of Commerce.

CELEBRATING 50 YEARS OF

CHALLENGING OURSELVES TO EXCELLENCE AND BEING THE LEADER IN THE MECHANICAL CONSTRUCTION INDUSTRY

PROJECT PROFILE

LIVE WELL APARTMENTS

n July, the final certificate of occupancy was issued for the LiveWell Apartments. That milestone marked the successful conclusion of a three-year partnership between Dick Building Company (DBC) and developer Victrix LLC. The $50 million office-to-residential conversion brought new life to a 120-yearold building that had most recently been the headquarters of

The building at 550 Wood Street (also known as 300 Sixth Avenue) has had three distinctly different lives since it was designed by Daniel Burnham and developed by Henry W. Oliver in 1904. At the time of its construction, the 14-story building was a state-of-the art department store for luxury retailer McCreery & Company. By 1956, the building had been renovated several times and was used as an office building, originally as home to steel maker Blaw-Knox Corporation. It remained a multi-tenant office building until GNC acquired it in 1996. From 1996 to 1990, the building’s penthouse was home to the Pittsburgh Press Club.

Following the pandemic, GNC chose to downsize its office footprint and moved to 3 Crossings in the Strip District. New York-based developer, Victrix LLC, acquired the building in 2021 with the intention of giving it new life as a luxury apartment. Victrix

commissioned Strada Architecture LLC to design the conversion of 550 Wood Street. By the fall of 2021, Victrix brought on DBC as the general contractor and construction manager.

“We were interviewed in October 2021 and by the end of the meeting Victrix told us they wanted to work with us to develop a guaranteed maximum price (GMP). Our first meeting with the client was right after the New Year of 2022,” says Jeff Braum, vice president of construction at DBC. “During that pre-construction phase we did pricing, and we did a lot of logistical studies and worked with key vendors to identify long lead time items. For example, we were released to order the switchgear even before we had a GMP in place. Because they were getting historical tax credits, we needed to release the window contract separate from our GMP. They had a six-month lead time, so we had to get that going in June 2022.

“The owner had a well-established design development set when we came on board, so we did selective estimating for them during pre-construction. We were already having weekly meetings. By July of 2022 we were on the street with full bid packages and [Superintendent] Brian Hockenberry was on site doing selective demolition. We were released to start construction in March 2023.”

Photo by Roy Engelbrecht Photography

Getting an office-to-residential conversion of the scale of LiveWell – renovating 314,000 square feet to create 253 apartments –designed and priced in one year would be a challenge under any circumstances; but the particular circumstances of 550 Wood Street added complexity. The previous changes in usage, numerous renovations, and lack of documentation presented challenges before the first unit was designed.

“There are some buildings that are really set up to be apartments, but this building has essentially a single-loaded core. When you think of most downtown buildings, you think of some kind of central core of elevators and stairs, but this building had the elevators and stairs moved to the east side of the building to open the floor plate when there was retail on the ground floor.

From an apartment standpoint, that meant that we had a lot of depth away from the windows,” says Sean Beasley, principal at Strada Architecture LLC. “Each unit is 75 feet deep, which is more than double what we would design in a typical apartment.”

“We took advantage of the floor-to-floor height that is almost 16 feet to bring light into what were really deep units,” he continues.

“We used that height and connectivity from the doorway to the 10-foot windows to allow light to penetrate deep into the apartments and ultimately make them very comfortable.”

The windows became a pivotal point of the scope of work. Victrix was taking advantage of historic tax credits as part of the financial justification, so replacing them was a critical piece of the renovation. Because of the size of the windows, roughly five feet by 10 feet, and the building’s structural system, the window

replacement became a task that influenced several other major scopes of work.

“The windows were enormous and were difficult to replace,” Braum recalls. “Early on, we identified that the window frames could not be maneuvered through spaces that were renovated, so we left a temporary corridor around the exterior of the building and had to fall back and frame the permanent walls after the windows were installed.”

“The other challenge with the window replacement was that we were working from the top down in this building and at some point, we were going to pass the crews that were replacing the windows,” Braum continues. “The temporary corridor allowed all crews to continue working.”

There was also a safety concern because of the weight of the windows. DBC worked with BrandSafeway to develop scaffolding that wrapped the building to protect pedestrians and traffic below. The scaffolding then provided Victrix with the opportunity to clean and restore the decorative terra cotta exterior.

Beasley notes that the window replacement, which was required to meet the historic restoration requirements, reversed a 1970s renovation that included installing dropped ceilings that blocked almost half of the window.

“When we removed the ceilings, it exposed the original windows and the owner moved forward with replacing those windows with the full glass lights. I think one of the main design features of the building is the amount of light that comes into each unit,” he says.

Photo by Amy Pischke, Zillow Media Experts

Another challenge that was a result of a previous conversion was the restoration of the lower floors. During the 1930s, the building’s owners replaced the original storefront glazing with fewer small windows and installed a glass art piece know as “The Puddler.” When GNC owned the building, The Puddler had been buried in what was GNC’s archive and file room.

“We took advantage of The Puddler and centered our amenities around it. We opened the back of the glass art piece and restored the neon so that it becomes the focal point of those spaces,” Beasley says. “The units on that floor are double height, more than 20 feet high. There are two stories of punched small windows within those spaces. They are unique in that they have very deep windowsills, which gives the ability to inhabit that space.”

The characteristics of the building’s previous iterations were mostly undocumented for renovation. Since the information Strada and its engineers had was incomplete, there was an elevated risk of unexpected costs associated with unforeseen conditions. One of the innovations that DBC employed to mitigate the risk for itself and the developer was what DBC’s chief operating officer, Alex Dick, calls a “dual-phase GMP.” To help Victrix secure its financing during design, DBC developed a guaranteed maximum price (GMP) based upon the design and extensive exploratory demolition. A final GMP was completed when design was completed. Included in the GMP was a contingency that triggered shared savings with the owner at a certain threshold. DBC took its share of the savings to fund

additional contingency, which Dick says helped “de-risk” the project further. At the project’s completion, a typical ownercontractor shared savings occurred.

While the cost risk of unforeseen conditions may have been mitigated, the impact to the schedule and sequencing remained.

“Inevitably, things came up that didn’t match what showed on the drawings because the existing documentation we had on the building was inadequate,” recalls Brady Sheerin, director of construction and development for Victrix. “We used the drawings we did have to complete our layouts only to find that there were busts all over the building in terms of dimensions. We expected things to be in certain locations only to find out when we did our installations that what was supposed to be there was not.”

“We had a great relationship with Strada and the client. There was constant communication between us and Nicole Harkins, who handled the day-to-day issues for Strada and was always available. Any request for information (RFI) we wrote were always confirming RFIs, because we had already figured out the solution with them,” Braum recalls. “Brady and I had a great rapport. We were very open with each other. You can imagine, with all those unforeseen conditions there were a lot of changes to manage. That process couldn’t have been better. We didn’t have loose hands that were the result of indecision.”

“We had to figure out economical ways to maintain the schedule and tackle those unforeseen obstacles. The pre-planning and investigation that [DBC] was able to do helped to mitigate quite

Photo by Amy Pischke, Zillow Media Experts

a bit of that but, at the end of the day, you’re going to run across those kinds of problems,” concludes Sheerin.

During construction, numerous other challenges appeared that resulted from the unforeseen conditions. A staircase connecting the top floor to the roof-top amenity space had to be redesigned because the roof structure was not as documented. The structure

would not accommodate a hoist, so one was installed inside a decommissioned elevator shaft. The sidewalk surrounding the building required re-shoring because the basement extended to the curb. A retail tenant, Key Bank, remained open throughout the project, requiring DBC to keep its space protected from the construction activities. The lead time for the electrical switch gear slipped to 78 weeks. Even though it had been ordered before

“From revitalizing abandoned steel mills and industrial sites into thriving business and technology parks to transforming underutilized land into locations built for job-creating companies, RIDC has created a unique blend of economic development advocacy, community and regional revitalization, and high-quality job creation that could be a model for other regions that were once powerhouses of America’s industrial economy.”

Pre-order from Amazon, Barnes & Noble and booksellers around the region.

The glass window art, The Puddler, was uncovered and used as a centerpiece in the amenity space. Photo by Amy Pischke, Zillow Media Experts

Avison Young creates real economic, social and environmental value as a global real estate advisor, powered by people. Our integrated talent realizes the full potential of real estate by using global intelligence platforms that provide clients with insights and advantage. Together, we can create healthy, productive workplaces for employees, cities that are centers for prosperity for their citizens, and built spaces and places that create a net benefit to the economy, the environment and the community.

there was a GMP, the delay required the existing gear to be used temporarily to power the first phase of apartments to be completed.

“There were numerous things like that. There was a daily rabbit hole that you had to go down to fix a problem,” chuckles Braum.

Victrix’s plan for rolling out the units in phases required unusual flexibility and coordination. DBC completed four floors for occupancy in November 2024. To get a temporary certificate of occupancy for the first 60 units, the team had to fully meet the life safety requirements of both Pittsburgh’s Permits Licenses and Inspections Department and the PA Department of Labor and Industry. That meant building temporary elevator lobbies, complete with finishes, among other changes. They also had to prevent occupants from accessing any areas under construction.

“We had numerous meetings working with the architect and made numerous revisions to the drawings to get it done. That process was done differently from how we would have planned it for one final occupancy permit,” says Braum.

The pace accelerated in 2025, as DBC and its team pushed to get the remaining floors completed for occupancy. A second temporary occupancy permit for the remaining units was issued in March 2025. The parking garage construction and final work were completed in July 2025.

“I was on that job full-time from the end of June of 24 until end of February of this year. It became all hands on deck and between me, Superintendent Emily Golnazarian, and Brian,” Braum says. “Everybody figured out what was needed to get things done. The success of the job came from the camaraderie, the teamwork with the owner and the architect.

“The project’s success had a lot to do with the overall team, from ownership setting up the financing and working with investors, all the way down to the subcontractors who helped execute the project, along with our design professionals,” says Sheerin. “Getting the right team together, all working towards that common goal of implementing problem-solving techniques, made things work.” BG

PROJECT TEAM

Dick Building Co.

Victrix LLC

General Contractor

Owner/Developer

Strada Architecture LLC Architect

Atlantic Engineering Services

Iams Consulting LLC

Structural Engineer

Plumbing Engineer

AJF Mechanical Plumbing

Patrinos Painting and Contracting Painting

Automated Entrance Systems

Crown America International (CAI)

Storefronts & Entrances

Residential Casework

Triple 3 Construction Interiors

Schlaegle Design Build

Custom Casework

Marsa Inc.

Pittsburgh Interior Systems

Abmech Acquisitions

Seech Industries

Window Systems

LL Mechanical Services

Keystone Flooring

Schultheis Roofing, Inc.

Masonry

Drywall/Carpentry

Asbestos Abatement

Structural Steel

Windows

Design-Build HVAC

Flooring

Roofing

Mongiovi & Son Fire Protection Fire Protection

Leone Electrical Contractors Design-Build Electrical

Photo by Amy Pischke, Zillow Media Experts

LEGAL PERSPECTIVE

CONSTRUCTION INDUSTRY ALERT: POTENTIAL RISKS RELATED TO PORTLAND LIMESTONE CEMENT

BY D. MATTHEW JAMESON III, ESQ. AND AARON M. SCHEIBELHUT, ESQ.

There is a growing concern in the construction industry involving the use of Type 1L cement, also known as Portland Limestone Cement. Marketed as a more affordable and more environmentally friendly alternative to traditional Portland cement, Type 1L is gaining traction with regulators and sustainability-minded contractors and owners for its promise of a lower carbon footprint. But behind the green label, recent reports from job sites and courtrooms suggest this new material comes with a set of challenges that can carry serious legal and financial consequences.

are also being observed. These concerns aren’t isolated. In fact, one online resource is actively tracking cases of surface failures and unexpected field performance.

Importantly, many of these failures appear to stem from a lack of awareness about how differently this cement behaves compared to traditional Portland cement mixes. For instance, faster set times can lead to surface damage even when placed and finished with timing consistent with traditional Portland cement. When concrete finishers are not familiar with the unique behavior of Type 1L cement, contractors may be left facing liability for problems they did not even realize they were creating.

Marketed as a more affordable and more environmentally friendly alternative to traditional Portland cement,

Type 1L is gaining

traction with regulators and sustainabilityminded contractors and owners for its promise of a lower carbon footprint.