RETAIL

MARKET UPDATE

Building Success Starts with Peoples Natural Gas. Why pay more for temporary site heat? Natural gas is cost-effective, dependable, and always ready. Work with Peoples Natural Gas to plan ahead, install your gas line early and tap into an energy source you can rely on.

Scan here or visit Peoples-Gas.com/constructionheat to prepare your site today.

PUBLISHER

Master Builders’ Association of Western PA www.mbawpa org

MANAGING

EDITOR

Ben Atwood 412-922-3912 ben@mbawpa.com

EDITOR

Jeff Burd jburd@talltimbergroup.com

PRODUCTION

Carson Publishing, Inc.

Kevin J. Gordon

ART DIRECTOR

Carson Publishing, Inc.

GRAPHIC DESIGN

Blink Advertising blinkadvertising.com

CONTRIBUTING PHOTOGRAPHY

American Subcontractors Association of Western PA CREW Pittsburgh

Denmarsh Photography

Henne Jewelers

Mascaro Construction, L.P.

Massery Photography

Master Builders’ Association of Western PA NAIOP Pittsburgh

Nala Marketing

Rycon Construction

Shannon Construction

Turner Construction Co.

DIRECTOR

Mary Chuderewicz mbawpa org

MORE INFORMATION: is published by the Master Builders’ Association of Western Pennsylvania, 412-922-3912 or www.mbawpa.org

Archive copies of BreakingGroundTM can be viewed at www.mbawpa.org

No part of this magazine may be reproduced without written permission by the Publisher. All rights reserved.

Bridging Documents and DesignBuild Warranties: Building Bridges to Avoid Pitfalls

for Safety: How Prevention through Design Can Transform the Built Environment

On the cover: Henne Jewelers

PUBLISHER’S NOTE

After looking at the economics of the retail industry for the past month, I get the uneasy feeling that we are heading towards a shift in consumption that could reset the U.S. economy. The fundamentals of retailing are diverging rapidly. On the demand side, consumers continue to have a strong appetite for goods and services. On the supply side, however, things are less stable.

Retailers are facing some difficult challenges. There is a shortage of desirable space to rent. Construction of new space is a fraction of what it was, and of what is needed. Thus far, rents are not growing faster than normal, but that will not be true for much longer if development remains constrained. The other element of supply, the merchandise, is facing the dual challenge of high tariffs and high cost of sales. The current trend for the cost of retailing is turning higher towards an unsustainable path.

Should these trends continue, there will be a tipping point for consumers. If the cost of goods rises by double digits at the same time rents do, prices will push consumers to keep their wallets in their pockets. We will reach a point of imbalance that will be followed by a rebalancing. We call those periods recessions.

Maybe that is where we’re heading, an old-fashioned correction that causes mild unemployment and lasts less than a year. But when you look at the underlying fundamentals of consumption, it is not hard to see how something more drastic could be on the horizon.

The U.S. economy rides on the backs of consumers. While that has been true since the industrial revolution, the degree to which U.S. domestic output relies on consumption elevated considerably during the late 1980s-1990s. In 1960, when the population was 181 million and GDP was $542 billion, consumers accounted for 62 percent of the economy. That share of the economy is almost eight percentage points higher today, when GDP is $29 trillion. More enlightening is a comparison of the consumer share of GDP per capita. Consumer per capita share of GDP accounted for almost $60,000 per person in 2024. In 1960, consumer spending as a share of GDP was less than $2,000 per person.

There are good explanations for why this need not be a problem. Productivity is dramatically higher today. The taxes we pay are also dramatically lower today, leaving us with more disposable income. The median earner paid 30 percent federal income tax in 1960 compared to today’s 22 percent. Those earning $100,000 – or roughly $1 million today – paid 75 percent in federal tax. Today, that rate is 37 percent. Data on household debt shows Americans pay less than 12 percent of their income for loans of all types. The personal savings rate is lower, about 4.5 percent vs. 10 percent in 1960, but about the same as it has been since 1997. Setting aside the difference in social attitudes about consumption today vs. 65 years ago, Americans do not seem to be out over the tips of their skis.

What looms as a tipping point is the change in attitude about free trade, which has sparked the widespread application of tariffs. There are mountains of data that show that Americans are far better off today because of freer trade policies over the past 30 years. But those policies have also led to a hollowing out of the manufacturing base. Millions of U.S. manufacturing jobs moved overseas. That means millions of voters have good reason to be unhappy about freer global trade. It is easy to see how a trade policy that makes it more expensive to buy goods made overseas would be popular.

Throughout U.S. history, high tariffs have not proven to accomplish the goals of imposing them. But let’s assume they do in 2025. Assume that U.S. companies (and perhaps more foreign-owned firms) move operations back to the U.S. Assuming those companies can find workers willing to work in manufacturing (an assumption that does not have great support in reality today), how will that trickle down to the market? How much will a toaster or television cost that was made in an American factory? How much must an American factory worker be paid to produce a $30 toaster or a $219.99, 54-inch smart TV? How many toasters and smart TVs will be made by robots?

It isn’t hard to see a very different consumption landscape by 2030 if tariffs remain in place and manufacturers move more goods production to the U.S. Things will cost more. Consumers will not be able to purchase as many things. That will mean people who have lower incomes will make do with less, as was the case in 1960. Such an environment will be tough on the category-killer retailers like WalMart, Target, and the like. The shortage of Class A space to rent will no longer be a problem.

This is not necessarily an apocalyptic vision of society, although it will require some painful readjustment. It would not hurt to have Americans consume less and save more. Using tariffs as a tax that brings down government debt would ease that burden on future generations, assuming some federal administration stops increasing spending. U.S. consumers would likely demand better quality and durability out of the more expensive goods they purchase. In some ways it would be more like 1960 again.

But getting back to 1960 should not be the goal. Six decades of progress should not be thrown away, even if some of the effects of progress aren’t desirable to you. Tariffs are a tax on consumption, and a regressive one at that. Progress, even when it was messy, has benefitted American society for almost 250 years. Regress seems like a bad policy goal.

REGIONAL MARKET UPDATE

BY BEN ATWOOD AND JEFF BURD

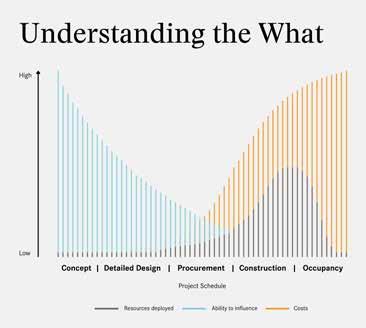

The combination of higher construction costs, higher borrowing costs, vanishing federal grants and support, and general economic uncertainty made the typical late summer slowdown somewhat slower than usual.

Contractors tend to judge the market by the week’s bidding activity, but the current market conditions are not just leading to fewer opportunities to bid. Requests for qualification and/or proposals have slowed. More ominously, reports of layoffs at architectural and engineering firms are increasing in frequency, raising concerns about the opportunities for construction in 2026.

To a large degree, the concerns about the current market are probably overblown. According to Tall Timber Group, there have been $2.8 billion in nonresidential and commercial starts through August 31. Moreover, a number of the highprofile projects that have been on hold throughout the year, especially multi-family projects, are looking like they will get underway in 2025. But pessimism about the bread-andbutter projects in the Pittsburgh market, particularly in higher education and healthcare, is well founded.

The higher education market is somewhat upside down compared to 2023. The region’s powerhouse research institutions, University of Pittsburgh and Carnegie Mellon University, were in the midst of investing more than $1 billion in capital projects at that time, including half dozen projects over $100 million. The numerous small colleges and public universities were struggling with declining enrollment and under-invested facilities. Many observers expected the failure of one or more small colleges during this decade. The fate of the PA System of Higher Education (PASSHE) institutions was uncertain.

Two years later, PASSHE still faces an uncertain future, but new buildings are underway on two Western PA campuses. Small colleges, notably Allegheny College, Grove City College, and Washington & Jefferson College, have seen a surge in giving from Baby Boomer alumni, unlocking what will be more than $300 million in construction projects built in the latter half of the decade.

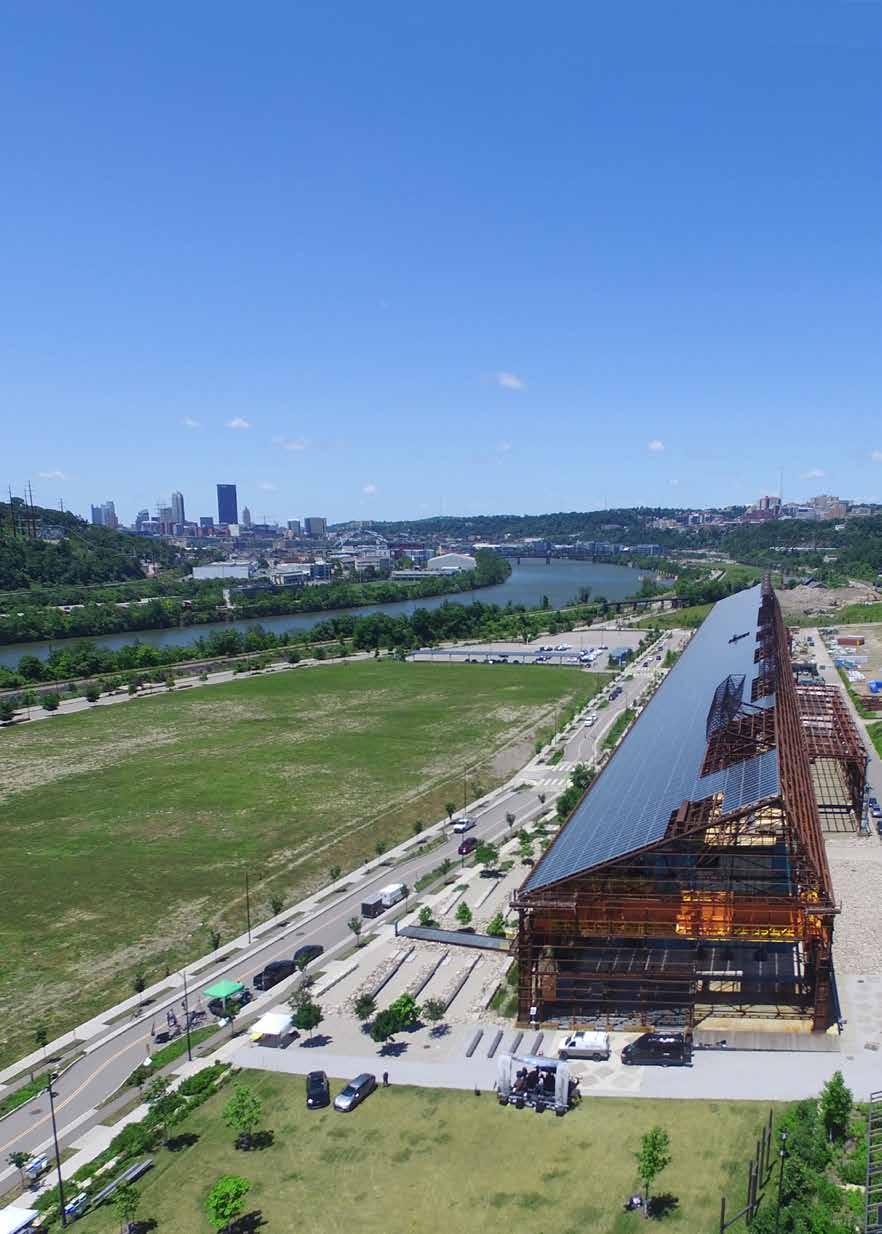

Pitt and Carnegie Mellon have seen more than $200 million in federal research funding cuts, leading both to cut overhead

expenses. Two major projects at Carnegie Mellon, the R.K. Mellon Hall of Science and the Robotics Institute at Hazelwood Green, are still in construction, but the next major project has not been identified. Construction is well underway on Pitt’s Student Recreation Center, Sports Performance Center, Fifth and Halket, and the Bioforge at Hazelwood Green; however, the balance of Pitt’s most recent master plan will likely be reevaluated before any new major project begins. The most pressing need at Pitt, more student housing, is being addressed by private developers. Plans for a mid-campus residence hall on Fifth Avenue are again on hold.

Healthcare institutions have been under financial stress since the pandemic, which was limiting the capital budgets at the region’s hospitals. Cuts in research funding by the Trump administration, along with cuts in Medicaid and potential changes to Medicare, have added more financial uncertainty to the outlook for healthcare providers. Construction at the two major healthcare systems in Western PA, Allegheny Health Network (AHN) and UPMC, is limited to smaller clinical renovations, infrastructure modernization, and parking garage modernization.

UPMC’s $1.2 billion flagship Heart and Transplant Hospital is roughly 80 percent complete, although construction will continue through 2026. No other major capital projects are moving forward at UPMC as the third quarter of 2025 ends. At AHN, progress on its new hospital at the Canonsburg General Hospital site has stalled, as new leadership at AHN reviews the project. If given the green light, construction of the new hospital will commence again in spring 2026. A $48 million parking garage at West Penn Hospital is moving into design but no schedule for construction has been approved.

Against this deterioration of education and healthcare activity, there is renewed activity in other sectors that are offsetting the lower construction volume at colleges and hospitals. The energy sector has been one of the most active in the Pittsburgh market all year. Although the summit at Carnegie

Mellon has generated countless headlines, the uptick in power generation applications for natural gas has activated the Marcellus Shale players to expand their operational activities for the first time in a decade. The combination of limited power availability on the grid and an anticipated surge in power demand from industrial and data center development is creating the need to generate electricity on site, which typically involves gas-fired technology.

This increase in demand for energy generation is rippling through Western PA. GE Vernova has announced a $100 million investment to expand its Speers, PA, electrical switchgear capacity. Cumi America, which has businesses in mining, fusion, and renewable energy, agreed to lease a 90,277 square foot building under construction now at Imperial Business Park.

Unlike many of the mega projects receiving headlines in recent months, there is significant progress on the repurposing of the former Homer City power plant site in Indiana County.

The vacancy rate for multi-family properties has fallen steadily since the beginning of 2024, despite increased new construction, in contrast to the national vacancy rate. Source: CoStar

Construction has begun on the $15 billion redevelopment to create 4.5 gigawatts of electricity for future data centers. Homer City Redevelopment awarded the excavation contract and hired Kiewit Power Constructors as engineering-procurement-construction (EPC) contractor. Kiewit intends to selfperform large portions of the project but has been developing scopes of work for major packages, worth billions of dollars, that will bid to regional contractors. Some of these contracts have been awarded, while most will bid as the project develops throughout the balance of the decade.

Pittsburgh-based International Electric Power III LLC has been meeting with local construction companies about its proposed 1,400-acre data center in Greene County. In addition to the multibillion-dollar data center, Essential Utilities recently announced its Aqua unit would design an 18 million-gallonper-day water treatment plant to support the cooling needs of the data center. No construction schedule has been announced but the gas power turbines are reported to be scheduled for delivery in 2028, with a plant opening in 2029.

National Association

Two of the larger projects in Allegheny County Sanitary Authority’s (ALCOSAN) multi-billion-dollar Wet Weather Equalization Program should be under construction by year end. The authority is taking bids on the $325 million Wet Weather Pump Station on October 2 and is scheduled to open bids for the $750 Ohio River Tunnel on November 24. The two major ALCOSAN projects will add $1 billion to the Pittsburgh

Housing Inventory: Active Listing Count In Pittsburgh

Source:

of Realtors, Federal Reserve Bank of St. Louis POWER

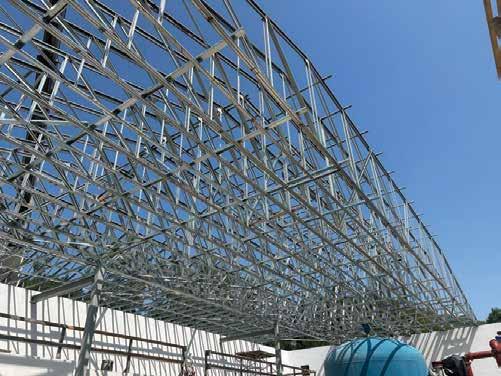

BUILDING ABOVE AND BEYOND

Go beyond. Repeat.

Trust your next construction project to PJ Dick.

construction market over the next three years. Similar tunnel projects for the Allegheny River and Monongahela River are scheduled to start in 2029 and 2031 respectively.

In the K-12 market, several larger projects have been or will be advertised for bids in early fall. Carlynton School District has its $16 million Carnegie Elementary School project back out for bid after a reduction in scope from the April bids that were over budget. Likewise, the $20 million Mars Area Elementary School expansion, which originally bid in May, will be re-bid in late September. Massaro CM Services is scheduled to advertise two projects estimated to cost $30 million combined at Lincoln Park Performing Arts Charter School in Midland, PA. The Event Center and Arts and Science Center should go out to bid in mid-October.

Design is nearing completion on two major projects that have been in the pipeline since before the pandemic. Bids on the $90 million Quaker Valley High School building were scheduled to be taken in November, but delays in permitting have pushed bidding into the new year. Hempfield Area School District reviewed the most recent 3-D drawings for its $150 million high school addition and renovation, which the district hopes to advertise for bids after the year-end holidays.

The fundamentals of the Pittsburgh economy continue to outpace those of the U.S. economy overall. Stable employment and wage growth are supportive of commercial real estate, although the environment for new development is still challenging. And supply constraints are keeping new housing construction from meeting demand.

Pittsburgh’s labor market showed signs of both resilience and adjustment in July. The civilian labor force expanded modestly to 1.24 million, up slightly from May, while total employment held steady at 1.18 million. Total non-farm employment stood at 1.22 million, about 1.8 percent higher than a year earlier. The unemployment rate ticked up to 4.2 percent, with the highest year-over-year jumps in unemployment, 0.4 percent, being felt in Westmoreland and Washington counties.

Industry level performance was mixed. Construction continued a steady climb in employment through mid-year, despite showing a year-over-year decline, while manufacturing declined. Government also experienced a notable drop, as employment fell to 113,400, nearly 6,000 below March levels. Growth came from professional and business services, financial activities, and particularly education and health services. Leisure and hospitality also posted solid gains, up three percent year over year.

Over the past two years, manufacturing employment in the Pittsburgh metro has edged lower. As of July 2025, the Bureau of Labor Statistics index stood at 85.6, compared to 87.9 in July of 2023. That represents a decline of roughly 2.7 percent over the 24-month period. The numbers suggest the region has not been able to regain momentum, instead showing a gradual easing of employment levels. For context, the index uses 2017 as its baseline year (set equal to 100), meaning Pittsburgh’s manufacturing workforce is now sitting about 14

percent below that benchmark. Month by month, the series has fluctuated slightly over the past twelve months, but no significant upward movement upsets this broader trend. While the declines have been modest, the lack of sustained recovery underscores the headwinds facing the sector.

Though the data oscillates seasonally, the number of active home listings around Pittsburgh has risen noticeably. As of July, there were 5,101 listings, compared to 3,827 in July of 2023, according to the National Association of Realtors. That’s an increase of roughly 1,274, or 33 percent, signaling an ongoing loosening in housing supply. Month to month, the data shows a steady upward trend through 2024 and into 2025, with listings climbing from the mid-3,000s into the low 5,000s by summer. While still low compared to pre-2019 historic norms, this twoyear increase represents a significant shift.

This is not having much of an impact on pricing, though. In July, the median listing price for homes reached $252,278, compared to $242,950 in July of 2023. This represents an increase of nearly four percent in the two-year span. While the gain is modest compared to the double-digit jumps seen during the pandemic, it signals that prices remain on an upward trajectory, despite the influx of listings.

CoStar reports that office vacancies have ticked up 50 basis points in Pittsburgh year over year, and at 11.7 percent, vacancies are at the highest level since the global financial crisis. Year-over-year absorption, a measurement of office demand, is very slightly in the red. Despite being negative, this is a win for the region’s office owners, who saw millions of square feet hit the market post pandemic and is another sign that office deterioration is slowing. Pittsburgh remains somewhat insulated from the broader office struggles due to limited development, so local vacancies remain under the national rate of 14.1 percent.

Multi-family continues performing well. Vacancies ticked up in time with new deliveries but remain firmly under control at 5.6 percent. Modest levels of construction (there are currently 2,800 units underway) will likely cause vacancies to climb over the next 12 months; however, the amount being built will not cause major disruptions to the supply-demand balance. The uptick in vacancies has had no impact on rents, which climbed by nearly three percent year after year. This compares favorably to the national benchmark of one percent and is in line with the ten-year averages for Pittsburgh.

The fourth quarter of the year is typically a leading indicator for the year that follows. Pittsburgh’s two largest projects, the new airport and the UPMC Presbyterian tower, are nearing completion. Those projects have provided a strong foundation for the construction industry since the end of the pandemic, even as the mainstream of the regional construction market ebbed and flowed. Several opportunities for billion-dollar projects are on the horizon that would support thousands of construction jobs. With the global economy slowing, the start of construction at U.S. Steel, Homer City, or one of the data centers being proposed would keep the Pittsburgh market from feeling the worst effects of economic turbulence in 2026. BG

Construction Experience You Can Build On

Bowles Rice continues to expand its respected construction law practice into Pennsylvania, Ohio, and beyond. Our senior construction attorneys in Pennsylvania have over 90 years of construction experience between them, representing every facet of the construction industry—from general contractors, subcontractors, suppliers, and developers to design professionals and municipal and private owners. We focus on providing responsive, efficient, and cost effective representation for our construction industry clients. We understand the business, and we understand the law that you will be required to navigate and overcome to be successful.

• Contract Negotiation and Formation

• Project Delivery System Analysis

• Project Management Assistance

• Dispute Avoidance and Dispute Resolution

• Payment and Performance Bond Claims

• Mechanics’ Lien Claims

• Delay, Disruption and Acceleration Claims

• Federal and State Prevailing Wage Issues

• OSHA Compliance and Citations

• Bid Disputes

• Prompt Payment Act Claims

• Employment Disputes

• AAA Arbitration/Mediation Panel Members

Brad Mellor bmellor@bowlesrice.com

Damon Thomas dthomas@bowlesrice.com

Tom Weiers tom.weiers@bowlesrice.com

Attorney: Taylor Frankovitch

ENATIONAL MARKET UPDATE

BY BEN ATWOOD

conomic distress signals began flashing this summer, increasing concerns about cooling job growth, economic fallout from President Trump’s sweeping tariffs, and heightened inflation.

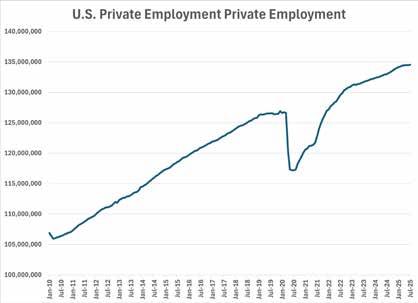

The most surprising was the sudden decline in employment growth and downward revision to prior month’s labor figures by the Bureau of Labor Statistics (BLS). The data showed non-farm payroll rose by just 73,000 in July and 22,000 in August, well below expectations. Additionally, prior monthly job data was revised downward and the unemployment rate edged up to 4.3 percent. Broader joblessness, including discouraged and underemployed workers, also climbed to the highest level since early 2022.

Most of the limited hiring came from health care and social assistance, while sectors like professional services and government shed jobs. Wage growth remained steady, but the household survey showed a dip in employment and a drop in labor force participation.

Private payrolls rose modestly in August, according to payroll processor ADP. The September 3 monthly ADP National Employment Report for the U.S. showed a gain of 54,000 jobs, below expectations.

These metrics point to a slow but persistent cooling of the job market, raising concerns about how much longer the broader economy can remain resilient in the face of trade

tensions. The weak data added urgency to political pressure from President Trump, who continues to demand aggressive rate reductions from Federal Reserve Chair Jerome Powell.

Despite headline gross domestic product (GDP) growth showing strength in the second quarter, the Federal Reserve declined to do so. The board’s meeting notes cited concerns that much of that growth was driven by temporary trade distortions and inflation lingering over two percent, suggesting a fragile economic underbelly.

Soon thereafter, an August BLS data release showed an unanticipated rise in the producer price index (PPI). These rose sharply in July, signaling renewed inflationary pressures that further complicate the Federal Reserve’s path forward. Wholesale prices climbed 3.3 percent year-over-year, well above the Fed’s two percent target. The 0.9 percent monthover-month growth was the largest spike in over two years and even when stripping out volatile categories like food and energy, price growth remained elevated.

This suggests inflation is spreading across a broad range of goods and services, and construction related indexes reflect it. Of the 78 main inputs to construction, 11 rose by more than one percent compared to seven in June, while 43 rose by less than one percent. Overall inputs for construction climbed by 0.4 percent, led by a sharp 4.1 percent jump in energy. Subcontractor costs also moved higher, particularly for concrete and roofing work in nonresidential projects. The steepest increases came in diesel fuel, aluminum mill shapes, and copper and brass shapes.

Year-over-year comparisons highlight broader pressures, with 25 indexes up over three percent since July of 2024. Fabricated steel plates, aluminum products, and architectural metal work posted the largest annual gains, suggesting tariff impacts may be filtering into materials.

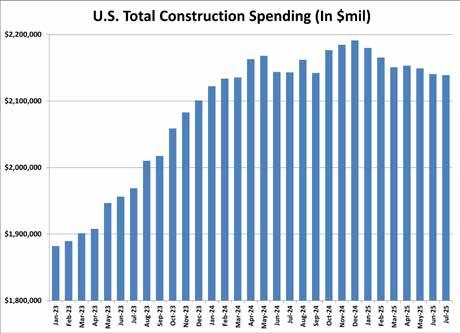

This coincided with another monthly decline in total construction spending. The June release of the U.S. Census Bureau’s construction spending data showed a slippage of 0.4 percent from May to June. That is an annualized rate of $2.14 trillion, and nearly 3 percent lower than a year earlier. Through the first half of the year, spending totaled just over $1.03 trillion, about 2.2 percent below the same period in 2024, reflecting a broader cooling trend in the sector.

Total construction spending in the U.S. has declined in five of the past six months. Source U.S. Census Bureau.

Private construction was the main drag, falling 0.5 percent overall as residential spending declined 0.7 percent and nonresidential dipped 0.3 percent. Public construction was little changed from May, with small increases in education and highway projects.

Intriguingly, broader inflation impacts for consumers remain modest. July’s strong PPI contrasted with a relatively tame consumer price index (CPI), which rose by 0.2 percent from June. Key tariff-sensitive sectors like new vehicles barely moved, suggesting businesses may still be absorbing much of the added costs. This eased some concerns about tariff price pressure on consumers, and reinforced hopes for interest rate cuts. Still, economists cautioned that price increases could build in the months ahead as tariff effects spread more fully through supply chains.

Source: ADP National Employment Report.

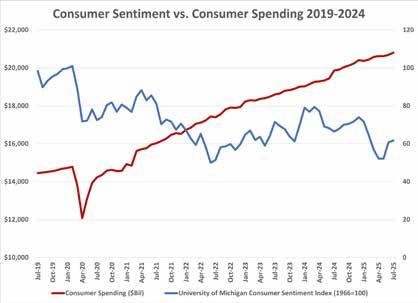

Despite the modest inflation, consumers are getting anxious again. The University of Michigan’s August report on consumer sentiment showed that consumer sentiment slipped for the first time in four months, falling about five percent. The sharpest drop came in buying conditions for durable goods, which plunged 14 percent to their lowest level in a year as households balked at high prices. Assessments of current personal finances also weakened, reflecting unease about eroding purchasing power. By contrast, expectations for future finances improved slightly, supported by modestly firmer income outlooks, though these remain muted overall.

Inflation expectations moved higher on both short- and long-term horizons. Year-end expectations rose from 4.5

percent to 4.9 percent in July, with the increase cutting across demographics and political affiliations. Long run expectations also climbed to 3.9 percent from 3.4 percent. While these levels remain below the peaks recorded earlier in the spring, the reversal ends several months of decline and suggests ongoing anxiety about tariff related inflation seeping into day-to-day life.

Goldman Sachs continues forecasting that this is what will happen in the coming months. In August, their Chief Economist David Mericle defended the bank’s analysis after Trump publicly criticized Goldman and mocked its leadership for publishing a report stating that higher producer prices would filter down to consumers by fourth quarter. The firm’s research suggests U.S. consumers could end up shouldering about two-thirds of the tariff costs, reversing the current trend where companies and exporters have borne the burden.

According to Goldman’s modeling, this shift would push core inflation higher, with CPI expected to reach 3.2 percent by year’s end. That would place it well above the Federal Reserve’s two percent target and raise pressures on households already squeezed by higher living costs. The report also notes that some U.S. producers shielded from foreign competition may take advantage of tariffs by hiking prices further, amplifying the effect on consumers.

Goldman still expects the Federal Reserve to deliver rate cuts later this year, citing the recent weakness in job growth, believing that the labor market will weigh heavily in Fed decision making. Markets are currently betting on cuts at each of the three remaining meetings in 2025, reflecting the expectation that slower growth will outweigh tariff driven price increases in the Fed’s policy calculus.

In early August, Vanguard issued a report indicating that it believes that the Fed’s communication following its July meeting leaned mildly against a September rate cut, but that stance will likely pivot now toward prioritizing employment weakness. With policy rates still roughly one percentage point above what Vanguard considers neutral, the firm expects two rate cuts before year end to cushion the economy against tariff pressures and slowing job growth. They expect the economy to stay on course with modest growth, projecting GDP at around 1.5 percent and core inflation near three percent by the end of 2025.

Vanguard also raised its baseline assumption for the effective U.S. tariff rate to about 17 percent by year-end, reflecting recent trade developments that reduced uncertainty. It cautioned that the ultimate impact would depend on how foreign investment agreements and the delayed pass-through of tariff costs to consumers unfold.

Interestingly, the domestic warning signs coincided with distress signals abroad. June’s trade figures from EuroStat show the European Union (EU) under mounting economic pressure. The EU’s trade posted an $8.7 billion trade surplus that month, down over 60 percent from the surplus a year prior. Imports surged by 6.4 percent while exports remained flat, signaling a structural imbalance. Month to month, the surplus also plunged nearly 39 percent from May to June.

The trade relationship with the U.S. has become particularly strained. Imports from America rose 16.4 percent in June while European exports to the U.S. fell by more than 10 percent, cutting the EU’s surplus with its biggest partner neatly in half. This downturn coincides with President Trump’s escalating tariff strategy, which saw duties raised to 10 percent in April and automotive tariffs reaching 25 percent before the July agreement that imposed a 15 percent blanket tariff on most European goods.

The economic impact is spilling into growth and production figures. Eurozone GDP slowed sharply in second quarter of 2025, expanding only 0.1 percent after 0.6 percent in the first quarter, with Germany slipping into contraction. Industrial output dropped, particularly in capital goods manufacturing, as export orders faltered.

Since April’s sweeping and unprecedented implementation of tariffs, there has been something of a disconnect between the economic fears often expressed in the media and the relative tranquility of each subsequent month’s economic data. Dramatic downward swings in the stock market were quickly negated by rapid growth, while inflation, production, and employment all remained stable.

But the economic data from the past two months indicate a cooling is coming. It’s currently reflected in the upward trajectories of PPI and unemployment figures, as well as in the ongoing decline of total construction spending. Day-today inflation remains under control, but major institutions are forecasting this to rise in the coming months, which would increase the chances that consumption will slow enough to cause a recession. BG

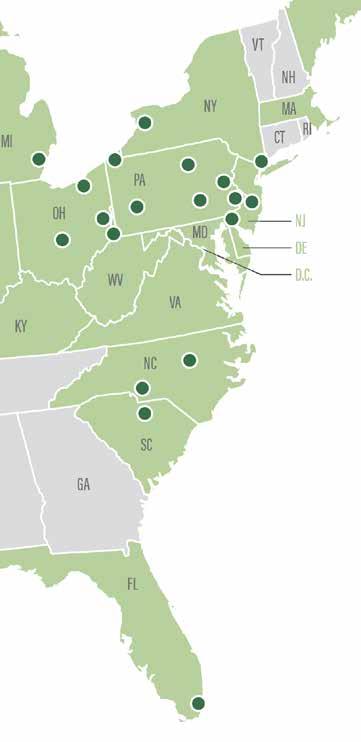

ORGANIC

Rooted in Pittsburgh, our client demand expanded the firm’s reach to 19 offices in 10 states. Call us for construction and surety-related questions.

William D. Clifford & W. Alan Torrance, Jr. Included

412-281-7272

# W e A r e V o l p a t t ustrial institutional

JWHAT’S IT COST?

BY BEN ATWOOD

uly’s Bureau of Labor Statistics (BLS) data indicates that the impacts of President Trump’s sweeping tariffs are potentially appearing in construction pricing.

The most telling sign was the unexpected 0.9 percent month-over-month rise in the Producer Price Index (PPI). This growth significantly exceeded the forecasted 0.2 percent rise and was one of the largest spikes of the past three years.

The PPI series tracks how much prices are changing for the goods and services businesses and suppliers sell and shows how much more (or less) it costs to make or deliver products. When the PPI rises, it typically indicates that upstream costs are heating up and the BLS data shows this happened in July.

Of the 78 BLS indexes related to construction, 11 rose by over one percent from June to July and 43 rose by less than one percent. This is an increase in price hikes from what the data showed for those same series from May to June, when seven indexes climbed by over one percent, and 48 by less than one percent.

Inputs for construction industries climbed by 0.4 percent from June to July, with the largest growth in the energy sector, which saw an upward push of 4.1 percent. Subcontractor prices rose by 2.3 percent for concrete contractors in nonresidential building work, while roofing contractors in that same sector saw month-overmonth change of 1.3 percent.

The largest monthly increases of individual indexes were seen in #2 diesel fuel (11 percent), aluminum mill shapes (seven percent), copper and brass shapes (six percent). Comparing July of 2025 to that same month in 2024 shows 25 indexes have risen by over three percent, with the largest year over year gains experienced in fabricated steel plates (14.3 percent), aluminum mill shapes (13.6 percent) and ornamental and architectural metal work (9.2 percent).

This type of increase hints that the impact of tariffs is on the horizon; however, it remains too soon to tell if this is the start of a trend or just an anomaly. In January of this year, the PPI registered at 0.95 then dropped quickly, declining in April. In 2022, when inflation began heating up, the PPI rose by over one percent in

five of the first six months. Additionally, the consumer pricing index (CPI) remained relatively stable with a month over month change of 0.2 percent, indicating that producers have yet to pass on the costs to consumers.

Price increases are less likely to be passed on to businesses when market conditions are deteriorating. While construction activity has slowed globally and nationally, demand for construction remains elevated. July’s jump in producer prices is certainly a reflection of cheaper, pre-tariff inventories burning off. That may mean that prices will again stabilize between July and August, when global trade deals were set to be completed. It is likely that it will be until the September PPI reading before judging if the construction market is absorbing or passing along tariff-based hikes). BG

Source: Bureau of Labor Statistics. Updated June 12, 2025.

The Dick’s House of Sports at Ross Park Mall was the first of several new expanded stores in the Pittsburgh region.

Retail

By Jeff Burd and Ben Atwood

It was not very long ago that the trouble with commercial real estate was retail. As Amazon (and others) got its distribution network built and its logistics finely tuned in the late 2010s, shoppers began taking advantage of the convenience of purchasing almost all goods online. Within a few years, retailers across the spectrum of products were forced to respond to this new mode of shopping by beefing up their websites, building logistical alliances, and altering their way of going to market.

As might be deduced, this paradigm shift in retail sales led to a paradigm shift in retail real estate. For a time, it seemed like brick-and-mortar retail stores were going to become dinosaurs, extinct even as retail spending soared. But, what emerged was a sort of hybrid approach to retailing, often referred to as omni-channel retail. Brands realized that shoppers still wanted to see and feel some of what they were buying, particularly at the high end of the market. Brick-and-mortar retail was not heading towards extinction after all; however, the retail footprint did change.

This sorting out of the retail industry was happening when COVID-19 turned us all into online shoppers in spring 2020. As stores and restaurants hustled to adapt to sidewalk pickup and outdoor dining, the long-term structural realignment continued.

When the U.S. consumer was liberated from the pandemic’s confinement with the rollout of vaccines in spring 2021, retailing benefitted as much, or more, than any sector of the economy. The inflationary cycle that followed the pandemic recovery led to a steep increase in prime interest rates, which froze commercial real estate transactions and pushed property values lower. While retailing remained healthy, it was impossible for retail real estate to escape the problems of dramatically higher borrowing costs. To some extent, those problems persist today.

All these changes have made a dramatic dent in the supply and demand for retail properties. Some fundamental truths remain intact. Retailers need to be near rooftops. High traffic locations are better than low traffic locations. Triple-net leases still offer reliable income and few hassles for owners. But the makeup of retail property has been fundamentally altered again.

The Retail Market Fundamentals

The root fundamentals that support retailing are again at all-time highs as the third quarter of 2025 winds down. The latest data on retail sales, from July, showed retail spending up 0.5 percent from June and nearly four percent higher than July 2024. Moreover, retail sales were up 4.4 percent yearover-year when spending on automobiles and gasoline was excluded. Despite growing signs of wariness, consumers are maintaining high levels of spending relative to income, as well as higher incomes.

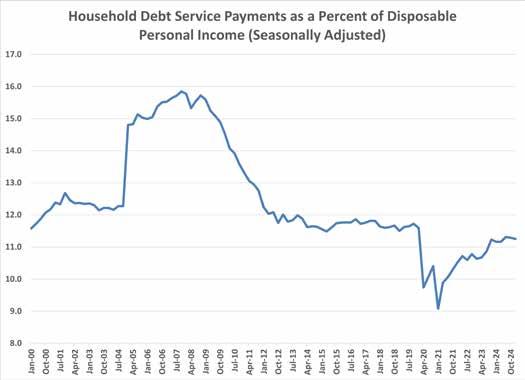

Those higher incomes also support record high levels of consumer borrowing. Consumer debt reached $18.39 trillion at the end of July, according to the Federal Reserve Bank of New York Household Debt and Credit Report. That is nearly 50 percent more debt than consumers were carrying at the peak of the housing bubble; however, household incomes are rising at a similar rate. The Bureau of Labor Statistics reported that median real household earnings rose 0.4 percent from

Posman Books was one of the first of the dozens of retailers occupying the Smallman Terminal developed by McCaffrey Interests. Photo by Massery Photography.

June to July. As a share of disposable income, household debt has remained at 11.2 percent since the fourth quarter of 2023. That is 30 percent lower than in the fall of 2008 and a lower rate than all but five of the past 45 years.

Compared to the durability of consumer spending, however, the physical footprint of retailing remains in flux.

In the 1990s, the big box retailers offered the first hints that the traditional retail delivery system was becoming outdated. Just as massive, covered malls had upended the retail paradigm in the 1960s, big box developments

Source: CoStar

catalyzed a shakeup in shopping malls. That paradigm shift, like the ones before it, was a supply response to the timeless demand from shoppers for the most convenient and least expensive shopping experience. By the 1990s, the so-called category killer – WalMart, Target, Home Depot, Best Buy, Petsmart, etc. – were being developed together as “power centers” to offer open-air shopping centers that allowed consumers the convenience of a mall at better prices.

The size of these power centers, like The Pointe at North Fayette or Trinity Point, were on par with the average covered suburban mall, and those malls were typically on a scale

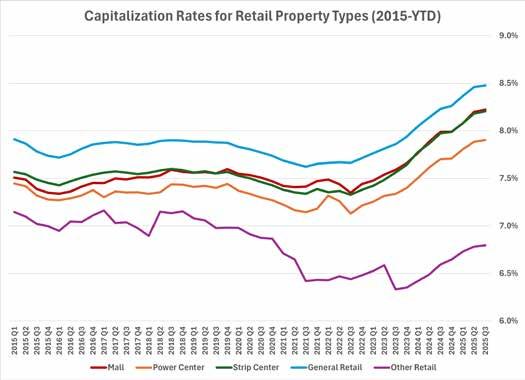

Cap rates for all U.S. retail property types have increased modestly since post-pandemic lows in 2022.

with the large downtown department stores that they replaced. So, while each of these shifts produced pain and opportunity for landlords, the amount of brick-and-mortar space available for shopping continued to increase.

This most recent shift in buying behavior involves shopping convenience and value without a store. The outcome of that shift is still being navigated by both retailers and landlords.

The shift in retail to e-commerce has had a dramatic effect on new retail development in Pittsburgh since the Great Recession. Beginning with 2014, the first year of real economic growth following the recession, new retail construction has fallen consistently, from 590,000 square feet in 2014 to 232,000 square feet in 2019. Aside from the 904,000 square feet started in 2015, when the Block at Northway and Siena in Upper St. Clair got underway, the total square footage of new development topped 500,000 square feet only once (in 2021) since 2014. Last year, less than 145,000 square feet of new retail went under construction.

Consumer debt as a percentage of disposable income is lower than during the first 20 years of this century. Source: Federal Reserve Bank of New York Household Debt and Credit Report (Q2 2025).

strong,” she says. “That’s reflected in the occupancy rates, which nationwide are 95 percent. There just hasn’t been any new construction.”

Doug Herold, principal and owner of Herold Commercial Valuation Services, notes that the value of retail properties has been resilient, despite the spike in interest rates.

Compare those totals to the 1.8 million square feet started in the metro area in 2002, during a recession, or the 2.5 million square feet started in 2007, at the peak of that economic cycle. In fact, the 4.834 million square feet started in 20062007 exceeds the total square footage started in Pittsburgh in the past dozen years.

With few exceptions, the decline in new construction experienced in Pittsburgh has been consistent throughout the U.S. As the years have unfolded, the limited growth of new supply has made the market stronger for the existing landlords in desirable locations.

“Our market is still strong. There is a fair amount of demand on both the leasing and acquisition side,” says Mark Anderson, senior vice president, retail brokerage at Colliers | Pittsburgh. “There is not a lot of well-located product that’s available for lease or sale. Retail is all about location.”

Claudia Steeb, senior managing director at JLL Capital Markets, echoes Anderson’s comment about supply.

“In retail, many stores have closed, and properties have been transformed or sold for other use so that what is left is

“I have done several appraisals comparing values from 2022 through 2025. For office buildings the value fell significantly during that time, but for retail buildings the value has been relatively stable,” he explains. “Yes, the cost of capital has it increased, which theoretically increases cap rates, but I haven’t seen that as severe in retail. Retail cap rates have increased by 50 or 100 basis points. That relatively small increase in cap rate is typically offset by increasing rents.”

With brisk leasing activity and less new construction competition, retail property owners are seeing demand from investors and buyers. The market is not back to pre-pandemic activity levels, but there are businesses in the market. As Herold notes, the gap in perception of value between buyer and seller is not wide, but it does exist. Investor interest in retail is growing again, but they are looking at deals more carefully.

“Lenders are looking for places to lend and are looking favorably at retail. Occupancy is high and rents have readjusted. From an investment standpoint, what is left is good so they’re looking for well-located, well-underwritten assets. We’re seeing activity pick up even though rates still aren’t cooperating,” Steeb says. “Cap rates are higher because interest rates are higher. That’s a problem if the

IN A WORLD WHERE RESILIENCY IS NEEDED MORE THAN EVER,

borrowing rate is higher than the cap rate, because buyers won’t buy the property with negative arbitrage. What we’re seeing is that investors are looking at returns and then backing into a cap rate. That’s hard for sellers to understand, especially here in Pittsburgh.”

Nationwide, most institutional investors are now seeking cap rates that are one-to-two percentage points higher than sellers. That is mostly true in Pittsburgh as well, where Steeb says more leases are written without annual rent escalation than are typical in most markets. Fewer large Class A assets are on the market in Pittsburgh, which is why many of the transactions closed over the past year have been small, often stand-alone properties with high cap rates. Steeb explains that what the institutional investors are seeking is infrequently for sale in Western PA.

“Grocery-anchored retail is still the darling, as long as it’s a well-performing grocer. If you have the number four grocer in a four-grocer market it will not do as well as the number one grocer from either a debt or investment perspective,” she says. “The best cap rates go with grocery-anchored properties. In our market that’s Giant Eagle or Whole Foods.”

“The next thing that investors are focused on or what we call essential or e-commerce resistant retail. Those are strips that have Internet-resistant services like a nail salon or quick service restaurant. You can’t go online and get your nails done,” Steeb continues. “Smaller strip centers, which could be only 20,000 to 40,000 square feet, have smaller tenants which is another factor that’s in favor with investors. If you lose a tenant in those centers, you lose a 2,000 or 5,000 square foot tenant, not a big box user.”

“The number of transactions is down from where it had been, but there are still transactions,” Herold says. “Are there transactions for big properties? No. Other than the sale of Monroeville Mall, which was something of an outlier, big sales have fizzled out. For smaller retail properties, there is not a big gap between buyer’s and seller’s expectations.”

Investment sales volume reached $140 million in the second quarter of 2025, the highest level in three years. This was largely driven by two portfolio purchases, the WalMart purchase of the Bethel Park Shopping center for $30.7 million, and Columbus-based Germaine buying the local assets of Babby Rahal Group for $15 million. CoStar forecasts that total investment activity in 2025 will be the highest since before the pandemic. Through August, 471 retail deals have closed. This has already surpassed total retail sales seen in 2023 (384) and is on pace to eclipse 2024’s total of 567.

Leasing seems to be following similar trends in Pittsburgh as the national market. Colliers Pittsburgh reports that vacancies rose in the second quarter, but only by 0.5 percentage points to 4.5 percent. Even with a number of mall anchors and specialty retailers closing, there is sufficient demand to keep absorption strong.

According to CoStar, store closures tied to bankruptcy have weighed on net absorption, with 2.9 million square feet vacated over the past year. That’s a 15 percent increase

“Staffing and cost of operations are

says that all his current tenants with leases expiring are renewing and the outlook for the nine tenants with expiring leases in 2026 is the same. Despite those strong fundamentals for demand, Adventure has no plans to start construction on the retail portion of its McCandless Square project just a mile north of McCandless Crossing.

“It’s hard to make the numbers work. Your site work and utility costs, a lot of which tie back to regulation, are much higher. The government’s interest makes it very onerous,” Dougherty says. “Developers have decided not to do anything because it’s not worth the risk.”

Dougherty, who developed more than two million square feet of retail in Western PA as a partner in Michael Joseph Development in the 1990s, reports that core and shell costs for new construction are nearly double the $65 per square foot that prevailed prior to the pandemic.

With the prospects for new development remaining bleak for 2026, retailers will need to find space in existing properties. Despite the decline in retail construction in Pittsburgh since 2020, there are some pockets of oversupply. In large scale, these exist mainly in closed mall anchors, like Macy’s, J.C. Penney, and Sears stores. On a smaller, but more widespread scale, these are the closed Rite Aid and Dollar General stores. The latter should cause few problems for the market, as there are fewer than 10 stores and the footprint – and rental income – are small. The Rite Aid stores are more of a headache.

Rite Aid estimates that roughly 70 former stores will be on the market for re-use in Pittsburgh. Although they vary in size, most of the closed pharmacy stores are larger than 12,000 square feet. Moreover, Rite Aid typically paid top dollar in rent. Depending upon the location, that could be as high as $40 per square foot. The most widely speculated potential users for the former Rite Aid stores – discount stores or Goodwill stores – would produce income that is half or less of what the drug chain produced.

Thus far, two Rite Aids stores in excellent locations – near the Pittsburgh city limits on Banksville Road and Wenzell and along Route 30 in Hempfield Township – have been announced as locations that Sheetz Inc. will use as sites for new gas station/convenience stores. Sheetz has proposed similar demolition-and-rebuild developments in Chester County and in the Cleveland suburb of Broadview Heights.

The total space vacated by Rite Aid in Western PA approached one million square feet, but its dispersion means that the impact will be isolated. Because many of the stores are in prime locations, the property will be valuable. Some of the Rite Aids in better locations will become Sheetz or GetGo stations, banks, or casual dining locations. Others, particularly those in strip centers or less desirable locations, will remain vacant until the landlords accept the losses that are unavoidable.

During an earnings call earlier this year, Dick’s CEO Lauren Hobart reiterated that the retailer was going to make

Champion City Sports is one of more than a dozen new retail or casual dining outlets built at the Pittsburgh International Airport in the past year. Photo by Shannon Construction.

“significant investments” in its stores. These would include both digital and physical plant investments, as Dick’s has seen increased demand for its experiential concept stores, “House of Sports” and “Field House,” and a surge in e-commerce. It is investing in this omnichannel approach, in which 80 percent of its online sales are fulfilled at store locations.

During 2024, Dick’s opened seven House of Sports and 15 Field House locations, 70 percent of which were relocations or renovations to existing stores. It plans to open 16 and 18, respectively, in 2025. The concept stores, especially the House of Sports, include climbing walls, batting cages, indoor tracks, and golf simulators that increase the customers’ time in the stores, and increase sales. The House of Sports concept is larger than the former large-scale Dick’s store, running 125,000 square feet and more in the Pittsburgh market, and has been located in former mall anchor stores.

The largest new current retail projects in the Pittsburgh region are build-to-suit projects like Dick’s. At Newbury in South Fayette Township, Bass Pro Shops is building a new 100,000 square foot store. Wegman’s will be starting construction in the fourth quarter on its first store in Southwestern PA, a 115,000 square foot development in Cranberry Township. The only speculative retail project under construction is an 18,000 square foot multi-tenant outparcel at Village of Pine. Leasing data from CoStar shows that roughly five percent of the total new construction in the Pittsburgh market is available for rent.

“By and large, you just aren’t seeing brand new spec retail construction the same way you are seeing it in other classes. Retailers aren’t adjusting what they can or will pay in rents,” says Cortez.

Dougherty notes that retailers and restaurateurs are facing unusual challenges that may limit expansion, despite the favorable economic and real estate fundamentals. The severe staffing shortages that followed the pandemic have eased only slightly, and staffing costs are dramatically higher than five years ago. Inflation, and the unpredictable fluctuations in costs that are the result of more protective trade policies, are shrinking margins. Retail owners do not see certainty about the economy in the coming 12-to-18 months, so the calculations about store locations are being influenced by the profitability of existing operations. Trendy may be replaced by reliable.

“Staffing and cost of operations are challenges and if the unit is not paying for itself, it won’t be there long. Anything that was a fad is going by the wayside,” Dougherty says. “The drugstore world which has been turned on its head. They were a robust part of the economy just five years ago. The value in the drugstore is the prescription business, but now the grocery stores and large general merchandisers are doing that. We also lost a lot of specialty retailers. It’s almost to the point where I expect that to rebound.”

Fine dining restaurants, like DelFrisco’s, remain strong operations, but higher costs and economic uncertainty have slowed new entries into the Pittsburgh market. Photo by Denmarsh Photography. Use courtesy A. Martini & Company.

Until the return of specialty retail, the model for success may look something like Jackson Village Plaza, on Route 19 north of Zelienople in Jackson Township. Buoyed by more than 1,300 new single-family homes built in Jackson Township in a 10-year period, Madison Acquisitions developed a retail plaza of seven free-standing outlets totaling roughly 45,000 square feet. The largest of these was an Aldi’s, which is 19,000 square feet. The balance of the center includes a handful of reliable brands –Starbucks, Taco Bell, Wendy’s, O’Reilly Auto Parts – along with a credit union and GetGo. Given municipal approval in mid-2023, Jackson Village was mostly completed within 12 months. The site, within a mile of the interstate intersection and the Steamfitters Local 449 training center and offices, offers a location that guarantees sufficient traffic with minimal risk for the development. Those kinds of opportunities are difficult to uncover.

Going into 2026, the outlook is for a similar mix of build-to-suit development and free-standing expansion for reliable brands. The largest project in the pipeline is the proposed Menard’s, a 250,000 square foot home improvement store that was approved for construction in Hempfield Township during the pandemic. Menard’s recently negotiated an agreement with the township to extend its expired approval to the end of 2025. The retailer did not share whether the extension signaled an imminent start to construction.

As has been the case since at least 2022, most new retail will be infill leases in existing shopping centers. With available space dwindling, outside of the recently closed national stores, the Pittsburgh market is ripe for new construction; however, there is nothing to suggest that demand is strong enough to push rents high enough to bring the kind of low double-digit returns that investors require for new development. The housing market has proven that shrinking supply and strong demand do not automatically trigger new construction. For retail development, including in Western PA, something more of a reset will be required to kick start activity. BG

Frick Environmental Center LEED Platinum Carnegie Mellon University Cohon Center PNC Tower LEED Platinum

PROJECT PROFILE

HENNE JEWELERS EXPANSION AND RENOVATION

Henne Jewelers is something of a Shadyside institution that has endured two world wars, the Great Depression, and two global pandemics. Following the COVID-19 pandemic in 2022, John Henne, president and fourth generation owner of Henne Jewelers, began planning for a major expansion of Henne’s 5501 Walnut Street location.

“The business has been growing. This is our third expansion. We expanded our Filbert Street location in 1995-1996. We moved down here to a larger location in 2003 and even after the move we realized we needed more space,” says Henne. “I had the opportunity to buy the building nine years ago with the intention of taking over the bar [the William Penn tavern] that was behind us when its lease expired.”

The expansion had been driven by long-term organic growth and the need for more space for two integral pieces of Henne Jewelers’ business: its diamond engagement and Rolex watch sales. As Henne began preparing for the expansion, he brought A. Martini & Company on board as general contractor and shared his plans with Rolex. Those decisions proved crucial to the success of the project.

“Rolex is such an important partner of ours and they suggested some changes to the building to remove the center staircase that went to the second and third floors for tenants. That turned out to be genius,” Henne recalls. “I was expecting the project to be very disruptive, but I credit Angelo Martini Jr. with an idea that changed the direction we were heading. I was looking on the street for a temporary location and he came up with the idea of moving into the bar, renovating that for our temporary location. It made a remarkable difference. It helped in many ways. It allowed our alarm systems and safe to remain in place. We still had access to the basement. We didn’t have to move the merchandise to another location.”

“He was going to rent a place down the street, and it was going to be quite expensive. We came up with the idea of moving the store temporarily into the William Penn space,” explains Angelo Martini, Jr., chief operating officer at A. Martini & Co. “We called that phase one. Henne Jewelers worked in that space while we renovated the rest of the building. Once that was completed, we flipped to the William Penn phase of renovation.”

A. Martini & Co. was the general contractor for the earlier

renovation at Henne Jewelers, but the relationship between the companies was also personal. Angelo Martini reckons that he and John Henne have been friends since they were seven years old, and members of his family have been customers of Henne Jewelers for decades. For John Henne, that kind of personal relationship was important, and helped him make a potentially difficult decision more comfortable.

“I have a lot of clients who are general contractors. Some probably heard about my potential plans and expressed interest. It would have been difficult to choose, putting it out to bid and telling three or four other friends no after the bidding process,” Henne says. “The Martinis had done the last build-out and it went smoothly. I knew this was going to be a very complicated project because of the age of the building and I feared there would be lots of change orders, so I wanted somebody I had worked with in the past and could trust.”

The choice of architect was also relationship driven. Angelo and Anthony Martini suggested Chip Desmone, who was also a friend and customer of Henne Jewelers. Henne also consulted with Rolex to seek input on designers with luxury jewelry and watch experience.

“When I presented the project to Rolex, because they needed to sign off on it, they asked who I planned to hire as architect.

They suggested Eric Lewis [of E/Line Architecture in Baltimore] because he had done some projects recently for them. We interviewed him and just instantly liked him.”

Teaming Desmone Architects with E/Line gave Henne a local architect he trusted with extensive experience working with the City of Pittsburgh and its challenges, plus a designer who was comfortable working with Rolex.

Chip Desmone describes the programming and schematic phase of the project as “having a life of its own,” growing over time as the process unfolded.

“Originally, John was thinking that they would just expand to the rear, taking the former William Penn bar and part of the second floor. We ran into an issue regarding code and occupancy of the third floor, so we incorporated the offices on the third floor,” Desmone says. “We ended up taking over what was originally the old Rolliers and two apartments above that. That freed up more space on the first and second floors to create the grand staircase in the corner that gave the entire store a lot more daylight, openness, and grandeur.”

Grandeur was an important goal for the project. Henne had to account for space for five luxury watch brands: Rolex, which was programmed for 1,000 square feet of dedicated space;

and smaller booths for TUDOR, Mont Blanc, Tag Heuer, and Grand Seiko. During and after the pandemic, Henne’s diamond engagement business boomed. Care was taken to design a space that would optimize that shopping experience, which resulted in a dedicated diamond engagement suite on the second floor. Henne was also intentional about building a destination that would become an anchor for the Walnut Street shopping district, which had seen several major national brands vacate storefronts.

“I am a big believer in Walnut Street. I think this is a unique shopping district with a mixture of local boutiques and national chains. It is the only one in the city that is not on a main road with a bus line going down the street,” Henne explains. “The proximity to Shadyside, Squirrel Hill, Oakland, and Fox Chapel is wonderful for our local customers, and it is a regional draw. We see people coming to Walnut Street from Eastern Ohio, West Virginia, and Erie. There is no place in the city where I would rather be.”

Renovating multiple old buildings proved to be as challenging a task as John Henne feared. The complications created challenges during design and when construction began in early 2024.

“It was a challenge to visually connect all the retail spaces. Henne has multiple watch brands in the store plus it’s a general jewelry store,” says Desmone. “During design the diamond

engagement piece of the project kept growing. We ended up making that entire second floor a bridal engagement experience space. That really helped us connect the design of the first and second floor. We could bring all these separate retail brands together under one store connected by the stairs and elevator.”

“It was one of the hardest projects I’ve built because the structural grid was not square. Imagine a chessboard where every corner where the squares meet was not a 90-degree angle. We didn’t discover that until demolition because there was little opportunity to do exploratory demolition until we were into the project,” Martini says. “We expected a column line to run straight through the building and halfway through it jogged two feet to the left or right. There were a lot of meetings on site with the architect and engineer to figure out how to true it up and make things more in line.”

“There was a ton of bracing and back bracing needed to do the renovations,” he continues. “For example, if we needed to hold up the roof to place a beam, we had to brace it on the second floor, first floor, and the basement to carry that load because the third floor could not carry the load itself. There were miles of temporary shoring involved, which is unusual.”

Martini notes that his company’s early involvement in the planning set the stage for the high level of detailed planning and

The second floor was renovated to be an engagement diamond suite.

Photograph: Central Catholic Brothers’ Residence Photographer: Mike Christ

collaboration that would be needed throughout the project. Once construction started, many of the challenges stemmed from the tight urban site at the corner of Walnut and Bellefonte. Work on the roof, for example, meant shutting down AT&T cellular towers and coordinating those outages. Excavation for the new elevator pit was done with a vacuum excavator, which expedited the digging and eliminated any debris on the street. It was imperative that the project created as few disruptions as possible for Henne’s neighbors, so parking and deliveries had to be managed so that customers from other retailers were not negatively affected.

“The other interesting part was working with the out-of-town architect and designers from Switzerland on the Rolex space,” says Martini. “They dictated the pace of the project. It took about 18 months to get the design out of Rolex.”

The project duration was the biggest challenge John Henne cited, as the phasing still created daily logistical and operational problems for a retail jeweler.

“The biggest challenge was the length of time that we were disrupted. We were in the temporary location for essentially 11 months. To take a business that needs to expand and to shrink it to less than half of its size on a side street location was difficult,” he says. “I am here on the sales floor every day, but my office was moved to a house two blocks away. I would walk back and forth six or seven times a day. It was challenging for the team to operate. We communicated regularly and reminded them that this was temporary pain for long-term gain. Now we almost can’t remember the pain, but at the time it was very challenging.”

Henne Jewelers celebrated its grand re-opening on October 19, 2024, with the fully-renovated 7,500 square feet of retail space on two floors. The participants agree that the success of the project turned on the constant communication between the Henne team and the design and construction teams. Martini gives special credit to Dara Henne, John’s wife.

A balcony and monumental stairs were added to bring more light to the interior of the store and for dramatic effect.

“Dara is the backbone of the operation. She knew what she wanted and worked closely with Desmone,” he says. “I’ve joked with her over the years that I want to hire her as a project manager. She has an eye. If something’s out of level or not square, she picks it up. She picked up things, quite frankly, that I missed.”

“The project was successful because we had a client who was determined to do the best possible project he could, given the physical constraints of the building,” notes Desmone. “It was his desire to stay on Walnut Street and make his building an integral part of the retail fabric there. John wanted to make something that was special for Henne and special for Walnut Street.”

“There was great communication between all parties,” says Henne. That was our internal team, which consisted of myself,

my wife, and Kyle Misour, who was the internal project manager, the Martini team of Joe Perri, Angelo, and Superintendent Sean Lewis, and the architects Katelyn Walsh from Desmone and Eric Lewis. We met weekly to be on top of things.”

“John put a good team together. We made sure we bought the proper partners to the table,” says Martini. “I wanted people sitting around the table at the 11th hour who could push it over the finish line.”

“I will tell you that the reception from our customers and new customers has been exceptional. We regularly hear people tell us they don’t feel like they’re in Pittsburgh or that it is like Madison Avenue,” says Henne. “One thing we really wanted to be sure of was that it was high-end and luxury but, at the same time, warm and inviting. It can be challenging to do both, but we have heard from so many of our customers that we managed that.” BG

A. Martini & Company

Henne Jewelers

Desmone Architects

E/Line Architecture

J.A. Sauer

Hanlon Electric

Cuccaro Plumbing

J&J Fire Protection

Marsa Inc.

Modany Falcone

Easley & Rivers Inc.

A.J. Vater & Co.

Eagle Displays

Otis Elevator

Specified Systems

J.P. Phillips, Inc.

Seech Industries

LEGAL PERSPECTIVE

NEW OSHA RULE ON PERSONAL PROTECTIVE EQUIPMENT

BY WILLIAM S. MYERS, ESQ.

The Occupational Safety and Health Administration (OSHA) published a final rule in December on Personal Protective Equipment (PPE) in the construction industry. The rule took effect on January 11, 2025. OSHA State Plans that did not already have a similar rule must implement their own rule within six months of the publication date. It is a small rule change with potentially significant practical effect, being described by some industry commenters as imposing a “monumental task” on employers.

The rule amends the Construction PPE Standard to require that all PPE “properly fits each affected employee.” The driving force for this amendment is the notion that PPE designed for smaller bodies, particularly for women, is not readily available for workers. One example mentioned in the official comments is the size of work gloves, especially gloves used in dangerous work that require dexterity. The official comments also indicate that “properly fits each affected employee” includes PPE that takes into account “workers’ body changes during pregnancy.”

The likely significant impact derives from multiple factors, including the ambiguity of the term “properly fits,” the requirement that PPE must fit “each affected employee,” the difficulty of proving that a particular item of PPE actually fits a particular employee, and the potential for disagreement between employee and employer over whether PPE properly fits that particular employee—an inherently subjective determination in which the employer is at a distinct disadvantage when it comes to proof.

OSHA rejected calls from experts and stakeholders to define the phrase “properly fits,” including a suggestion from National Institute for Occupational Safety and Health (NIOSH), OSHA’s own research arm. To put that in context, OSHA spent 26 pages of three-column, single-spaced, fine print in the Federal Register to explain a rule that results in a net change of 19 additional words in the standard, but it refused to explain what is meant by what is now the core phrase, “properly fits,” or how employers might go about determining the difference between “properly fits” and “comfortably fits” or “perfectly fits.”

OSHA also refused to make any other suggested revisions to its initial proposed language, opting to finalize the rule in the form first published in July 2023.

An additional ambiguity lies in the core requirement of the amended rule, which is framed by the phrase “selected to ensure.” Does that mean “ensures” that the PPE “properly fits,” or does the inclusion of “selected to” allow some room for more standardized decisions by employers about PPE? OSHA ignored this question in the official comments, but its language throughout suggests it will interpret that

phrase to mean “ensures.” When combined with the phrase “properly fits each employee,” it could be construed to mean “tailor made.”

There will be secondary effects of the rule as well. They include the impact on unrelated enforcement action by OSHA, especially following accidents involving employees who were using PPE at the time (compliance officers will be sorely tempted to tack that on as an almost automatic additional violation), as well as employee relations (an enhanced vehicle for alleging employer retaliation), and labor relations (another ambiguity that can become a point of contention with union representatives). All three of those areas have the potential to loom large as tools that can be misused by different players for strategic reasons that have little to do with workplace safety.

The affected standard is 29 C.F.R. Section 1926.95(c). The old and new versions are shown below:

Old rule:

Section 1926.95. Criteria for personal protective equipment. (c) Design. All personal protective equipment shall be of safe design and construction for the work to be performed.

New rule:

Section 1926.95. Criteria for personal protective equipment. (c) Design and selection. Employers must ensure that all personal protective equipment:

(1) Is of safe design and construction for the work to be performed; and

(2) Is selected to ensure that it properly fits each affected employee.

OSHA has not issued further interpretations or other guidance for the new rule since promulgating it, and neither statistical nor anecdotal data is yet available as to how OSHA is interpreting and applying the new rule. Of course, a further question is whether the change in Presidential Administration will affect the agency’s interpretation of the key phrases discussed above. BG

William Myers is an attorney and member at Eckert Seamans Cherin & Mellott, LLC. He may be reached at wmyers@ eckertseamans.com

FINANCIAL PERSPECTIVE

NAVIGATING THE OBBBA ERA: STRATEGIC TAX PLANNING FOR THE CONSTRUCTION INDUSTRY .

BY RYAN BROZE, CPA

The construction industry stands at a pivotal moment. With the enactment of the One Big Beautiful Bill Act (OBBBA), companies now face a landscape rich in opportunity—but also complexity. From bonus depreciation to revised energy incentives, the new legislation reshapes how construction companies approach capital investment, tax planning, and operational efficiency.

A Sector Built on Resilience

Construction has long weathered economic storms—from supply chain disruptions and labor shortages to rising interest rates and tighter credit. OBBBA introduces new tools to help firms not only survive but thrive. The key lies in translating revenue into sustainable profit while sidestepping growth pitfalls.

Tax Incentives that could impact many construction companies include:

100 percent Bonus Depreciation and Section 179 Expense

OBBBA permanently extends 100 percent bonus depreciation and raises Section 179 limits, allowing construction firms to immediately expense equipment, machinery, and certain building improvements. This accelerates cash flow and supports reinvestment in operations.

Expanded Section 179D deductions reward energyefficient design and construction, especially for firms meeting prevailing wage and apprenticeship standards. These incentives align with broader industry goals around sustainability and workforce development.

Qualified Business Income Deduction Becomes Permanent

The legislation permanently extends the 20 percent qualified business income deduction (QBID), also known as Section 199A, for pass-through business income and REIT dividends. This provision also expands the deduction limit phase-in range by increasing the $50,000 (non-joint returns) and $100,000 (married filing joint returns) amounts to $75,000 and $150,000, respectively. The provision eases the impact of the limitations for both specified service trades or businesses (SSTBs) and those pass-through entities subject to the wage and investment limitation.

Additionally, this provision introduces a new, inflation-adjusted minimum deduction of $400 for taxpayers with at least $1,000 of qualified business income from one or more active trades or businesses in which the taxpayer materially participates. This ensures small business owners with a certain qualified business income level are entitled to an enhanced baseline deduction.

Immediate Expensing of Domestic R&D Costs

Since the 2022 tax year, businesses were required to capitalize and amortize research expenses over five years (or 15 years

for foreign research) causing strain on cash flow when the investment did not align with the tax deduction. OBBBA restores the current deductibility of domestic research and development (R&D) expenses in the year they’re incurred in tax years beginning after December 31, 2024. All taxpayers that previously capitalized R&D costs are permitted to elect to accelerate the remaining deductions over a one- or twoyear period, beginning in 2025. This provision will benefit construction companies that utilize new technologies and are trying to innovate or improve building processes, enabling the entire industry to move forward though innovation.

Accelerated Depreciation for U.S. Manufacturing Facilities

Manufacturers can now fully expense the cost of new or improved U.S. production facilities if construction begins between January 19, 2025, and January 1, 2029, and the property is placed in service before 2031. This is a targeted incentive to encourage domestic manufacturing and infrastructure investment. It allows businesses to deduct the full cost of building or upgrading factories, warehouses and other production facilities rather than depreciating them over 39 years.

That’s a massive acceleration of tax benefits, which can significantly improve the return on investment for large capital projects. It also aligns with broader policy goals to bring more production back to the U.S. This provision can bring many new construction projects to the market.

Business Interest Expense Limitation Expanded

Another key limitation from the TCJA fell under Sec. 163(j) for the deduction of business interest expense, which limited the deduction to 30 percent of adjusted taxable income (ATI). The OBBBA restores a more favorable calculation for 2025 and all future tax years. The Sec. 163(j) limitation now uses EBITDA (earnings before interest, taxes, depreciation and amortization) instead of EBIT (earnings before interest and taxes). A new ordering rule requires applying this limitation before the interest capitalization rules for years starting in 2026.

This change increases the amount of deductible interest for many businesses, lowering the after-tax cost of borrowing. Industries such as manufacturing, real estate, construction and distribution, where interest expense is a major cost, stand to benefit the most. An increase to deductible interest means lower taxable income and improved cash flow.