June 2023 • Vol. 36 No. 6 auto DEALER M A ss A chus E tts The official publication of the Massachusetts State Automobile Dealers Association, Inc Our Federal Government Takes No Holiday Our Federal Government Takes No Holiday Dealers Urged to Participate in NADA Washington Conference

Robert O’Koniewski, Esq. executive Vice President rokoniewski@msada.org

Jean Fabrizio Director of Administration jfabrizio@msada.org

Robert O’Koniewski,

e

Subscriptions provided annually to Massachusetts member dealers. All address changes should be submitted to MSADA by e-mail: jfabrizio@msada.org

www.msada.org Massachusetts Auto Dealer JUNE 2023 The official publication of the Massachusetts State Automobile Dealers Association, Inc

A ff

St

Directory

Auto De A ler MAg A zine

Esq.

xecutive editor MSADA o ne McKinley Square Sixth f loor Boston, MA 02109

auto DEALER M A ss A chus E tts Auto Dealer is published by the Massachusetts State Automobile Dealers Association, inc. to provide information about the Bay State auto retail industry and news of MSADA and its membership. AD Directory Burns & levinson, 23 ethos, 2 nancy Phillips Associates, 21 gW Marketing Services, 20 reynolds & reynolds, 11 o’connor & Drew + Withum, 32 ADVertiSing rAteS Join us on twitter at @MassAutoDealers Quarter Page: $450 Half Page: $700 full Page: $1,400 Back cover: $1,800 inside front: $1,700 inside Back: $1,600 tABle of contentS

From the President: government’s reach touches uS All 5 AssoCiAte memBers direCtorY 6 the roUndUP: Full Compliance of safeguards rule required 9 LeGisLAtiVe sCoreCArd 10 LeGAL: employment obligations During Dealership Purchases and Sales 12 AUto oUtLooK 16 Cover Story: our federal government takes no Holiday 20 neWs from Around the horn 22 ACCoUntinG: Warranty reimbursemet — Post Pandemic 24 ACCoUntinG: Putting the ‘tax’ Back in taxachusetts 26 LeGAL: Buyer Beware – oeMs increasingly exercising their rights of first refusal 26 nAdA mArKet BeAt 28 AiAdA: electric Vehicle Push Sparks global trade tensions 29 trUCK Corner: AtD’s truck industry forum and legislative fly-in: What you Missed 30 nAdA UPdAte: Washington conference on the Horizon

4

Government’s Reach Touches Us All

By Jeb Balise, MSADA President

Over the last several weeks, dealers have seen first-hand how our government’s reach – some would say overreach – touches us all, and not in helpful ways. The breadth of government is not insubstantial.

On June 9, enforcement of the long-anticipated Safeguards Rule issued by the Federal Trade Commission in late 2021 went fully live, so all dealers must now be in compliance with every aspect of the Rule.

Also, on June 1, our Massachusetts Attorney General began enforcement of the 2020 amendments to our decade-old right to repair law. Unfortunately for dealers, while the vehicle manufacturers and the RTR coalition continue to battle out the legality of our state law in relation to federal regulations and laws, we dealers must now hand out to every “prospective buyer” – undefined in the law – a consumer notice drafted by the AG explaining the telematics existence in the cars and trucks we sell. Failure to provide the consumer notice can result in a dealership losing its ability to sell and service vehicles as a Class 1 dealer. We are pursuing a change in that law on Beacon Hill.

As all the interested parties await a decision from the federal court judge in the manufacturers’ lawsuit, the National Highway Transportation Safety Administration dropped a letter on the manufacturers detailing how the Massachusetts RTR law conflicts with federal laws and rules. The letter was immediately provided to the federal court as well. Just more gasoline on the fire.

Regardless of the final decision, the ruling most likely will be appealed – thereby continuing the uncertainty of how the manufacturers will treat the initiation of telematic services in their vehicles, which are in place to enhance vehicle safety and other services designed to benefit consumers, our customers.

Further, as you can see in our cover story, there is a full slate of federal matters NADA, AIADA, and MSADA all must confront. Otherwise, our Members of Congress may feel compelled to act unfettered by any input from our industry.

Bottom line: Those in our industry cannot bury their heads in the sand. Government reach, and overreach, are here to stay. We need to be involved with our policy makers to ensure our points of view are heard. When our – your – dealer associations – NADA, MSADA, AIADA – ring the bell to ask you to get involved, please consider joining in our efforts. For example, the next NADA Washington Conference will be here before you know it – September 12-13. Rest assured – What happens in a political vacuum, with no dealer input, is never helpful to our Main Street businesses.

Msada Board

Barnstable County

Brad tracy, tracy Volkswagen

Berkshire County

Brian Bedard, Bedard Brothers Auto Sales

Bristol County

richard Mastria, Mastria Auto group

Essex County

William Deluca iii

Bill Deluca family of Dealerships

Franklin County [open]

Hampden County

Jeb Balise, Balise Auto group

Hampshire County

Bryan Burke, Burke chevrolet

Middlesex County

frank Hanenberger, MetroWest Subaru

Norfolk County

Jack Madden, Jr., Jack Madden ford

charles tufankjian, toyota Scion of Braintree

Plymouth County

christine Alicandro, Marty’s Buick gMc isuzu

Suffolk County

robert Boch, expressway toyota

Worcester County

Steven Sewell, Westboro chrysler

Dodge ram Jeep

Steve Salvadore, Salvadore Auto

Medium/Heavy-Duty Truck Dealer Director-at-Large [open]

Immediate Past President

chris connolly, Jr., Herb connolly chevrolet

NADA Director

Scott Dube, Mcgovern Hyundai rt.93

OFFICERs

President, Jeb Balise

Vice President, Steve Sewell

Treasurer, Jack Madden, Jr.

Clerk, c harles tufankjian

From the President JUNE 2023 Massachusetts Auto Dealer www.msada.org

MSADA 4

t

Associate Members

MSADA A SS oci Ate M e M ber D irectory

ACV Auctions

Steve Sirko (856) 381-3914

ADESA

Jack Neshe (508) 626-7000

Albin, Randall & Bennett

Barton D. Haag (207) 772-1981

Ally Financial

Maryanne Recupero (617) 997-9574

American Fidelity Assurance Co.

Kathleen Weisenbach (402) 523-5945

America’s Auto Auction Boston

Jim Lamb (781) 596-8500

Armatus Dealer Uplift

Joe Jankowski (410) 391-5701

Auto Auction of New England

Steven DeLuca (603) 437-5700

Automotive Search Group

Howard Weisberg (508) 620-6300

Bank of America Merrill Lynch

Dan Duda and Nancy Price (781) 534-8543

BCI Financial Corp.

Timothy Rourke (203) 439-9400

Bellavia Blatt

Leonard Bellavia (516) 873-3000

Bernstein Shur PA

Ned Sackman (603) 623-8700

Broadway Equipment Company

Fred Bauer (860) 798-5869

Burns & Levinson LLP

Paul Marshall Harris (617) 345-3854

Sarah Decatur Judge (617) 345-3211

CDK Global

Rob Steele (508) 564-1346

Chase Auto

Ken Miller (508) 902-8908

Clifton Larson Allen

Rick Parmelee (860) 982-9307

ComplyNet

Adam Crowell (614) 634-8843

Cooperative Systems

Scott Spatz (860) 250-4965

Cox Automotive

Ernest Lattimer (516) 547-2242

CVR

John Alviggi (267) 419-3261

Dave Cantin Group

Woody Woodward (401) 465-7000

DealerSafeGuardSolutions

Doug Fusco (972) 740-8638

DealerShop

Ken Grove (248) 444-6283

Brian Fleischman (716) 864-0379

Downey & Company

Paul McGovern (781) 849-3100

DP Sales Distributors

Andrew Prussack {631) 842-7549

Driving Dealer Performance

Kimberly Guerin (978) 760-0322

Eastern Bank

David Sawyer (617) 620-3484

EasyCare New England

Greg Gomer (617) 967-0303

Electric Supply Center

Jennifer Williams (781) 265-4272

Enterprise Rent-A-Car

Timothy Allard (602) 818-3607

Ethos Group, Inc.

Drew Spring (617) 694-9761

F&I Direct

Sean Wiita (508) 414-0706

Michelle Salas (508) 599-0081

F & I Resources

Jason Bayko (508) 624-4344

Federated Insurance

Matt Johnson (606) 923-6350

Fisher Phillips LLP

Joe Ambash (617) 532-9320

Jeff Fritz (617) 532-9325

Josh Nadreau (617) 532-9323

GW Marketing Services

Gordon Wisbach (857) 404-0226

Hilb Group

James Pietro (508) 791-5566

Huntington National Bank

Michael Ham (740) 815-5085

JMA Group

Chris “KC” Hwang (954) 415-6961

John W. Furrh Associates Inc.

Pamela Barr (508) 824-4939

Key Bank

Mark Flibotte (617) 385-6232

KPA

Abe Cohen (503) 902-6567

LocaliQ Automotive

Jay Pelland (508) 626-4334

LoJack by Spireon

Ashvir Toor and Robin Dukes (800) 557-1449

LotLinx

Giovanna Scognemiglio (310) 526-1463

M & T Credit Corp.

John Federici (508) 699-3576

Management Developers, Inc.

Dale Boch (617) 312-2100

McWalter Volunteer Benefits Group

Shawn Allen (617) 483-0359

Merchant Advocate, LLC

Dan Giordano (973) 897-2778

Mintz Levin

Kurt Steinkrauss (617) 542-6000

Murtha Cullina

Thomas Vangel (617) 457-4000

Nancy Phillips Associates, Inc.

Nancy Phillips (603) 658-0004

NEAD Insurance Trust

Charles Muise (781) 706-6944

Northeast Dealer Services

Johna Cutlip (401) 243-7331

OCD Tech

Michael Hammond (844) 623-8324

O’Connor & Drew, P.C. + Withum

Kevin Carnes (617) 471-1120

Performance Management Group, Inc.

Dale Ducasse (508) 393-1400

Piper Consulting

Jim Piper (207) 754-0789

Pro-Vigil

Sasha Lam-Plattes (408) 569-2385

Pullman & Comley LLC

James F. Martin, Esq. (413) 314-6160

Resources Management Group

J. Gregory Hoffman (800) 761-4546

Reynolds & Reynolds

Austin Ziske (802) 505-0016

Rinn Advisors

John Corcoran (617) 480-6693

Rockland Trust Co.

Joseph Herzog (508)-830-3241

Samet & Company

John J. Czyzewski (617) 731-1222

Santander Bank

Richard Anderson (401) 432-0749

Chris Peck (508) 314-1283

Schlossberg, LLC

Michael O’Neil, Esq. (781) 848-5028

Shepherd & Goldstein CPA

Ron Masiello (508) 757-3311

Southern Auto Auction

Joe Derohanian (860) 292-7500

Sprague Energy

Robert Savary (603) 430-7254

The Towne Law Firm P.C.

James T. Towne, Jr. (518) 452-1800

TrueCar

Pat Watson (803) 360-6094

Truist

Andrew Carmer (401) 409-9467

US Bank

Vincent Gaglia (716) 649-0581

Wallbox USA, Inc.

Sean Ugrin (720) 220-1711

Wells Fargo Dealer Services

Josh Tobin (508) 951-8334

Windwalker

Herby Duverne (617) 797-9316

Zurich American Insurance Company

Steven Megee (774) 210-0092

5 www.msada.org Massachusetts Auto Dealer JUNE 2023

Full Compliance of Safeguards Rule Required

By Robert O’Koniewski, Esq.

MSADA Executive Vice President

rokoniewski@msada.org

Follow us on Twitter • @MassAutoDealers

As we have explained over the last 20 months, the Federal Trade Commission requires dealerships and other businesses to be in full compliance with all pieces of the Safeguards Rule beginning June 9. We have not heard of, nor do we expect, any imminent extensions, so the time for preparation has ended; compliance implementation must be commenced.

Since December 2021, your MSADA and the National Automobile Dealers Association have issued scores of writings and conducted numerous webinars regarding the Rule’s implications for dealerships – so your awareness should not be lacking. But have your actions met the Rule’s compliance expectations?

The Federal Trade Commission first issued “Standards for Safeguarding Customer Information” (the Safeguards Rule) in 2002, under its authority in the Gramm-Leach-Bliley Act, and it took effect on May 23, 2003. On December 9, 2021, after several years of notice, public hearings, and comment, the FTC published revisions to the Rule, expanding many of the requirements applicable to dealerships. Most of these new requirements were made applicable effective December 9, 2022. In November 2022, however, the FTC pushed full compliance with chunks of the Rule until June 9, 2023. That day has arrived.

There is quite a lot that dealers must do to comply with the Rule’s requirements. Compliance with the Rule is complicated and time-consuming. As dealers have learned over the last year or

so, compliance is not a simple task that can be undertaken lightly or quickly, or simply outsourced to a vendor. If you are still behind the eight-ball in your compliance efforts, NADA has made available guides, including a comprehensive Driven Guide for dealers that contains step-bystep instructions for compliance, program templates, webinars, workshop sessions, third-party and governmental resources, vendor services, and more at www.nada.org/safeguardsrule.

Moreover, your MSADA has several associate members with expertise in this realm whom you can contact, all of whom have conducted webinars for our member dealers.

Finally, as for enforcement, we cannot offer a guess in what form the FTC enforcement actions will manifest themselves. The enforcement risks can come from not only potential FTC compliance actions but also actions by our Attorney General and private rights of action. In the past, for example, the FTC has focused on situations where a breach occurred and was made public and then brought a subsequent enforcement action. The FTC, however, is not prohibited from demanding information about Rule compliance based on referrals, tips, or just plain, good ol’ enforcement sweeps. Since the current FTC administration is undeniably anti-business and anti-dealer, this is not beyond the realm of possibility.

The cost of an action against your dealership can be considerable. This would include FTC penalties as well as actual and punitive damages

6 JUNE 2023 Massachusetts Auto Dealer www.msada.org t he r oundu P

arising from claims along with attorneys’ fees and costs. If I may quote directly from the NADA’s Safeguards Rule Guide regarding enforcement penalties, on page 8:

“The penalties for not complying with the Revised Safeguards Rule can be extensive – and expensive. The FTC can initiate an enforcement action against automobile dealers under the authority granted to them in [the FTC Act]. Penalties may include long-term consent decrees with your companies and sometimes your executives, extensive injunctive relief, and potential monetary fines for violations of the consent decree. While the FTC cannot seek monetary penalties for first-time violations of the Safeguards Rule, it often seeks to identify violations for which it otherwise can seek money. Further, the FTC can seek up to $50,120 per consent order violation, and the FTC can take an expansive view of what a ‘violation’ is, depending on the circumstances – particularly if there are issues involving multiple customer records.”

If, for some reason, you still have not started, we suggest you do not wait any longer to commence this project. You will need to work with your advisors, staff, attorneys, vendors, and other pertinent parties. As we have articulated since December 2021, this is not optional; this is not a mere suggestion for conducting best practices. Begin taking the steps necessary to comply with the new requirements to protect your dealership and your customers.

Unfortunately for dealerships and other affected businesses, there will be substantial initial and annual expenditures for which you will have no direct return on that investment other than the peace of mind that you prospectively have protected your business from incurring large financial penalties and your customers from the consequences of a potentially life-altering breaches.

As in all compliance matters, keep this in mind: What is your level of risk to bet that you will not be the one impala in the herd that the lion catches today for his mid-afternoon repast?

FY24 Budget, Tax Relief Bills Head to Conference

July 1 is the constitutionally required date for the start of the state’s fiscal year – a date the legislature and governor have had a casual interest in meeting over the past decade. This year has an added twist, however. In addition to resolving their differences on each’s competing $56 billion spending plans for FY24, each chamber also has passed tax relief packages that differ considerably.

The Senate passed its version of the FY24 spending plan in late May. The bill does include an outside section of interest to auto body repairers – increasing the reimbursed labor rate – a long sought initiative your Association has pursued over the years. Section 31 of the bill would create a 14-member auto body labor rate advisory board within the Division of Insurance to study and make recommendations annually for a fair and equitable labor rate that insurance carriers must pay to repairers for insurance-paid auto body repair work. The initial hourly labor rate would be required to be set at $55 per hour, which is well above the current average of $37 per hour that is the lowest in the country.

The fate of the various conflicts within the two budget plans, including the auto body labor rates piece, rests with the six budget conferees: Sens. Michael Rodrigues (D-Westport); Cindy Friedman (D-Arlington); and Patrick O’Connor (R-Weymouth); and Reps. Aaron Michlewitz (D-Boston); Ann-Margaret Ferrante (D-Gloucester); and Todd Smola (R-Warren).

As for tax relief, unlike the House, the Senate did not take up its own tax relief package before its budget deliberations but instead waited until mid-June when it could better assess incoming revenue data in the face of April’s funds coming in $2 billion lower than anticipated. The Senate did create a placeholder of $590 million less in revenue for FY24 in anticipation of passing its own bundle of tax cuts and other forms of relief.

On June 15, the Senate ultimately did approve its own tax relief legislation that,

at $590 million, is half the size of the House’s $1.1 billion package, which was approved in April.

The Senate bill, in part reflecting a more progressive approach to tax relief, diverges from the House package in several ways. (We covered the details of the House tax cuts in our May Roundup column.) For example, the Senate bill does not include the House’s cut in the current 12 percent short-term capital gains tax to 8 percent backdated to January 1, 2023, and then to 5 percent starting January 1, 2024. Nor does the Senate legislation contain the language included in the Governor and the House’s bills that would have extended the single sales factor tax formula to all companies that are headquartered in Massachusetts but have income from other states; the single sales factor tax is currently only applied to mutual fund companies and manufacturers.

The Senate’s relief package, however, does embrace the House’s approach on the estate tax by doubling the threshold at which the tax would kick in from the current $1 million to $2 million. (Gov. Healey had proposed raising the threshold to $3 million in her February announcement.)

A conference committee consisting of three House members and three Senators will be appointed to resolve the differences between the two bills. Fortunately, both chambers did account for reduced revenues due to the tax cuts in each’s budget plan, relying on additional revenues coming in from the millionaires’ tax, newly created through a voter-approved constitutional amendment last November.

We will provide updates as they may occur.

Right to Repair Saga Continues

The RTR data access law has more twists and turns than an Ellery Queen novel.

As we detailed in our April Roundup column, with the auto manufacturers’ lawsuit challenging the legality and constitutionality of the November 2020 expanded right-to-repair law (MGL Chapter 93K)

7 www.msada.org Massachusetts Auto Dealer JUNE 2023 MSADA

remaining in decisional limbo in Boston’s Federal District Court, the Massachusetts Attorney General, Andrea Campbell, filed notice with the court on March 7 that her office will begin to enforce the law on June 1.

With the AG’s announcement, dealers could expect the enforcement of the law to include the requirement that new- and used-vehicle dealers provide a form, drafted by the Attorney General to include specific provisions as dictated by Section 2(g) and 2(h) of Chapter 93K, to prospective vehicle owners describing the existence and abilities of the telematics system, including data collection content, in the vehicle. Failure to comply with the law will allow car owners to sue under the state’s Consumer Protection Act for triple damages or $10,000, whichever is greater. Additionally, the dealership could be subject to revocation of the Class 1 or Class 2 license.

The “motor vehicle telematics system notice” for prospective vehicle buyers must include, but is not limited to, the following features: (i) an explanation of motor vehicle telematics and its purposes; (ii) a description summarizing the mechanical data collected, stored, and transmitted by a telematics system; (iii) the prospective owner’s ability to access the vehicle’s mechanical data through a mobile device; and (iv)an owner’s right to authorize an independent repair facility to access the vehicle’s mechanical data for vehicle diagnostics, repair, and maintenance purposes. The notice form must provide for the prospective owner’s signature certifying that the prospective owner has read the telematics system notice.

Further, under Section 2(h) of the law, when selling or leasing motor vehicles containing a telematics system, a dealer holding a Class 1 or Class 2 license issued under Section 58 of Chapter 140 must provide the motor vehicle telematics system notice to the prospective owner, obtain the prospective owner’s signed certification that he or she has read the notice, and provide a copy of the signed notice to the prospective owner. A dealer’s failure to comply with these requirements will be

grounds for any action by the municipal licensing authority relative to the dealer’s license, up to and including revocation, pursuant to section 59 of chapter 140.

However, just before the Memorial Day weekend and days out from the June 1 enforcement date, the Alliance, on May 26, filed papers with the court seeking a temporary restraining order barring enforcement of the law until the court could render a decision in the lawsuit or until the court could issue a preliminary injunction granting such relief. After the court’s May 30 hearing to take arguments on the Alliance’s request, federal District Court Judge Douglas Woodlock denied the Alliance’s request. One aspect the judge took note of was the fact that federal agencies had not submitted comments at any time during the litigation to support the Alliance’s argument that federal law and regulations pre-empted them from complying with the state RTR law.

As a result of the judge’s decision, on the morning of June 1, the AG’s office finally published on its website information regarding the data access law, including the telematics notice for consumers. As stated on the AG’s website: “The law requires a car dealer who sells or leases a motor vehicle containing a telematics system to provide the motor vehicle telematics system notice to the prospective owner, obtain the prospective owner’s signed certification, and provide a copy of the signed notice to the prospective owner.”

Here is a direct link to the notice: https:// www.mass.gov/doc/2023-6-1-telematicsright-to-repair-notice/download.

Dealerships can print the form off the AG’s website at the above link. Please make sure your dealership personnel retain a signed copy of the consumer notice.

Additional information is available at these links:

• https://www.mass.gov/your-car-yourrights

• https://www.mass.gov/info-details/ motor-vehicle-telematics-system-notice-requirement

Then arrived a surprising new twist to the right to repair saga impacting the vehicle manufacturers, consumers, dealer-

ships, and the advocates for the 2020 law, including independent repairers and the after-market parts companies. On June 13, out of the blue and seemingly in response to the judge’s comment regarding a lack of input from any pertinent federal agencies, the U.S. Department of Transportation’s National Highway Traffic Safety Administration filed with the federal district court a letter it had sent to 22 motor vehicle manufacturers informing them that the Massachusetts right to repair law (MGL Chapter 93K) conflicts with, and is therefore pre-empted by, existing federal law, namely the National Traffic and Motor Vehicle Safety Act. In the letter, NHTSA warned the manufacturers not to comply with the state RTR law.

The NHTSA letter to the vehicle manufacturers is available at https://media. wbur.org/wp/2023/06/06-14_NHTSA_ Telematic_Letter.pdf. The letter was sent to general counsels for the following manufacturers: BMW, Fisker Group, GM, Hyundai, Kia, McLaren, Ferrari North America, Ford, Honda, Jaguar-Land Rover, Mazda, Mercedes-Benz North America, Mitsubishi, Porsche, Stellantis, Tesla, VW, Nissan, Rivian, Subaru of America, Toyota, and Volvo.

One leg of the manufacturers’ argument against the law is federal pre-emption. The NHTSA letter provides support for that argument. The NHTSA letter subsequently could serve as an impetus to discourage the vehicle manufacturers from altering telematics systems in the vehicles in a manner that allowed for compliance with Chapter 93K but could put the vehicles in violation of federal law and regulations, thereby creating potentially hazardous conditions for vehicle owners and drivers.

All the parties involved, including our franchised dealerships, await the next step by the AG’s office, especially if it seeks a graceful way to walk itself back from its enforcement activities, until a decision from Judge Woodlock. The AG has made no statements regarding suspension of enforcement as it relates to distribution of the telematics notice to prospective buyers.

Stay tuned for more as this saga unfolds.

the roundu P JUNE 2023 Massachusetts Auto Dealer www.msada.org 8

t

H290 H329 S150 H351

EGISLATIVE S CORECARD

SPONSOR SUBJECT STATUS

Sen Crighton Rep Hunt

Rep Finn Rep Howitt

Sen O’Connor Rep Chan Rep Finn

Sen Crighton Rep Lewis

Amendments to Ch. 93B, the auto dealer franchise law.

RTR law amendments to fix Model Year start date and consumer notice.

Creates process to appeal improperly issued Class 1 license.

Modernize on-line vehicle purchase process.

S199 Sen Moore Amends definition of heavy-duty trucks in RTR law.

S220 H400

Sen Velis Rep Walsh Open safety recalls notifications.

H354 Rep Linsky Allows an OEM to open a factoryowned store, without a dealer, if there is no same line-make dealer in the state. (The so-called “Tesla Exemption.”)

Sen Moore Rep McMurtry Rep Philips

Sen Feeney Rep Puppolo

S2219 H3255 Sen Cronin Rep Arciero

Rep Howitt

Creates process to increase the insurance reimbursed labor rate paid to auto body repairers.

Protects consumer choice in vehicle service contracts.

Eliminates initial state inspection for new vehicle.

Limit doc prep fee amounts.

S2210

Sen Crighton

Safety shutoff for keyless ignition technology.

JUNE 2023

BILL#

S151 H331 S639 H1121 S688 H1095 H1118 S204 H270 H289

SUPPORT SUPPORT SUPPORT SUPPORT OPPOSE SUPPORT SUPPORT In Joint Committee on Consumer Protection; no hearing scheduled yet. In Joint Committee on Financial Services; no hearing scheduled yet. In Joint Committee on Financial Services; no hearing scheduled yet. In Joint Committee on Consumer Protection; no hearing scheduled yet. In Joint Committee on Transportation; no hearing scheduled yet. In Joint Committee on Consumer Protection; no hearing scheduled yet. In Joint Committee on Consumer Protection; no hearing scheduled yet.

OPPOSE In Joint Committee on Consumer Protection; no hearing scheduled yet.

SUPPORT In Joint Committee on Transportation; no hearing scheduled yet.

SUPPORT In Joint Committee on Consumer Protection; no hearing scheduled yet.

OPPOSE In Joint Committee on Consumer Protection; no hearing scheduled yet. H3348

OPPOSE In Joint Committee on Transportation; no hearing scheduled yet.

www.msada.org Massachusetts Auto Dealer JUNE 2023 9

Employment Obligations During Dealership Purchases and Sales

By Joseph Ambash, Jeffery Fritz, and Joshua Nadreau of Fisher Phillips LLP

In a time of increasing dealership purchases, sales, and consolidation, what does your dealership need to know about its obligations towards your current or prospective employees? In this month’s column, we discuss several employment law issues that need to be addressed regardless of whether you are the seller or purchaser.

Understanding the Transaction

How the transaction is structured is the key factor in determining which employment law obligations may be triggered. There are two primary ways a dealership may be purchased: a stock purchase or an asset purchase. In a stock purchase, the buyer purchases the stock of an existing entity and typically succeeds to all of the entity’s assets and liabilities. Conversely, in an asset purchase, the buyer only acquires the assets of the entity, leaving the seller responsible for most existing liabilities. For many reasons, the asset purchase is the preferred method of transaction, as it typically affords the buyer the most flexibility.

Final Wages and Vacation Pay

When a dealership is sold, the parties will typically negotiate what will happen to existing employees and how paid leave balances will be handled. In a stock purchase, this is not typically an issue, as the buyer steps into the shoes of the seller, with little interruption for employees. Asset purchases, however, are technically involuntary terminations. As we all know, Massachusetts law requires that employees be paid their final wages and any vacation pay whenever the separation of employment is involuntary.

On the closing date, employees are involuntarily separated from the seller. While many times the asset-purchaser agrees to re-hire all the existing employees, they are not required to, and, in any event, there is a change in the “employer.” While there is no guidance from the Attorney General or

the courts as to whether an asset purchase where everyone is re-hired is technically a termination, the safest advice is that the seller should pay final wages and accrued vacation balances upon the change in control. Otherwise, there is considerable risk of incurring triple damages, attorneys’ fees, and interest in a class action lawsuit.

Employee Misclassification and Wage and Hour Concerns

Stock purchasers need to be critical of how the seller has classified its workers, because stock purchasers can be held liable for actions of the seller, even when the purchaser had no control over the workforce. Buyers in this context need to be on the lookout for misclassified independent contractors, whether employees are improper-

templating an asset purchase will need to review employee agreements to see whether they can be “assigned” to a third-party. If they cannot, the purchaser would be wise to consider whether existing employment agreements are a priority, or whether it will want to have all of its new employees execute new agreements. Particular caution should be paid to non-competition agreements, especially since they now are subject to a host of technical requirements under Massachusetts law and under intense scrutiny from the Biden Administration.

Employees on Leave

ly classified as exempt from overtime, or whether the seller has complied with minimum wage and overtime regulations. Asset purchasers should also be aware of these issues so they can be immediately corrected but would likely avoid liability for actions that predate the acquisition.

Assignability of Employment Agreements

One of the benefits of a stock purchase is that the purchaser will not have to worry about whether any contractual agreements, such as non-solicitation or non-competition agreements, between employees and the seller will remain valid. This is because in a stock purchase the purchaser now owns the entirety of the dealership. Asset purchases, however, are different. Dealerships con-

In the case of a stock purchase, the buyer again steps into the shoes of the seller and has the same obligation to reinstate an employee on a required leave as the seller would. In an asset purchase, whether the buyer has an obligation to reinstate an employee at the expiration of a leave of absence will depend on whether the buyer is deemed a “successor” under the applicable statute. For example, if the buyer hires all the seller’s employees, an employee on an FMLA leave would likely have to be re-instated unless the buyer can prove the employee’s position would have been eliminated whether or not the employee was on leave. A similar analysis would be used in the context of leave as an accommodation under the ADA or leave under the Massachusetts Paid Family and Medical Leave Act.

Parting Thoughts

Other relevant issues include potential obligations under the federal WARN Act or dealing with the sale or acquisition of a unionized workforce. In sum, it is important that both sellers and buyers conduct due diligence as they approach any deal, so they are prepared in advance for any employment law headaches. As always, dealerships are encouraged to discuss anticipated contracts with counsel.

L e GAL MSADA 10 JUNE 2023 Massachusetts Auto Dealer www.msada.org

t

“the safest advice is that the seller should pay final wages and accrued vacation balances upon the change in control.”

11 JUNE 2023 MSADA

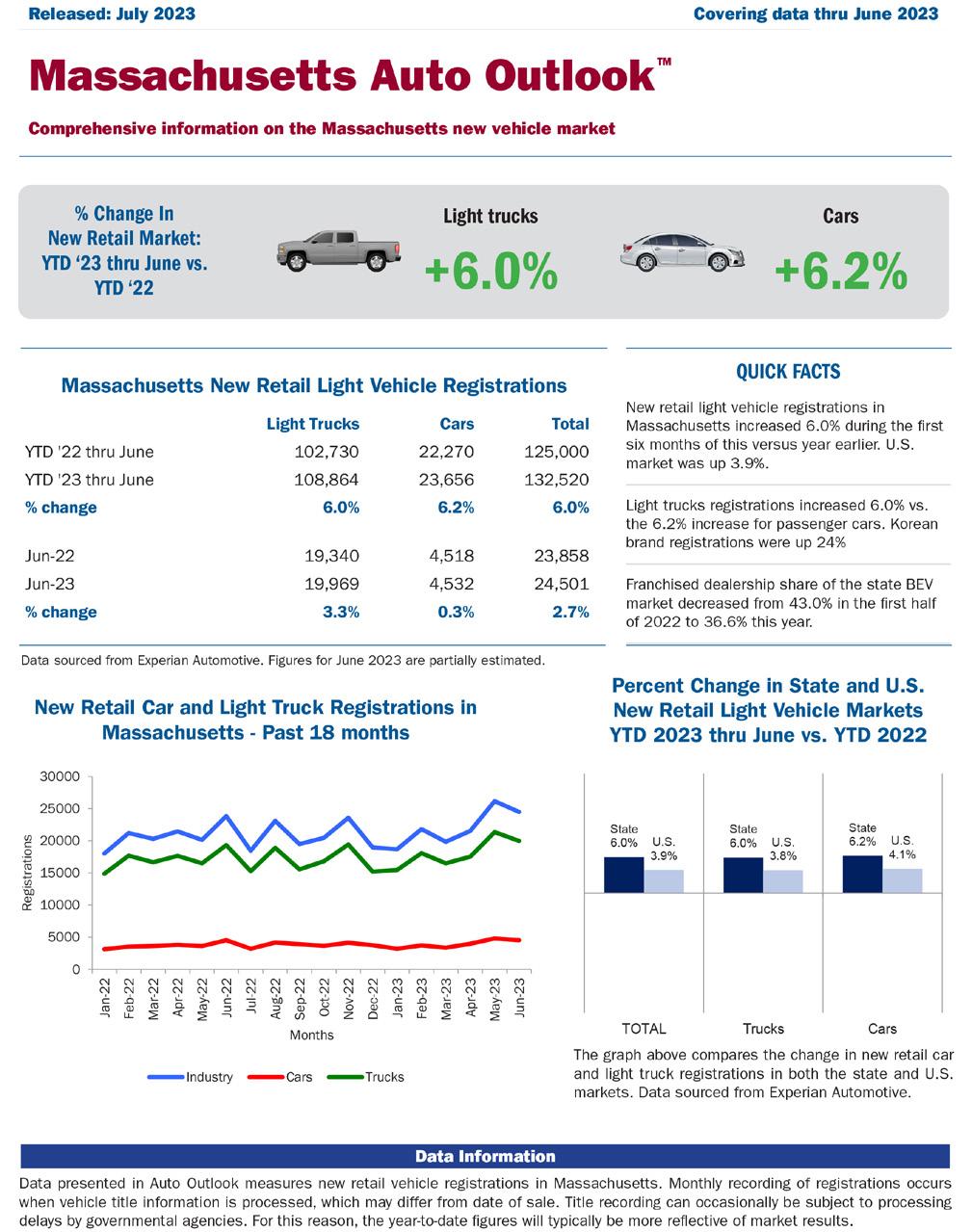

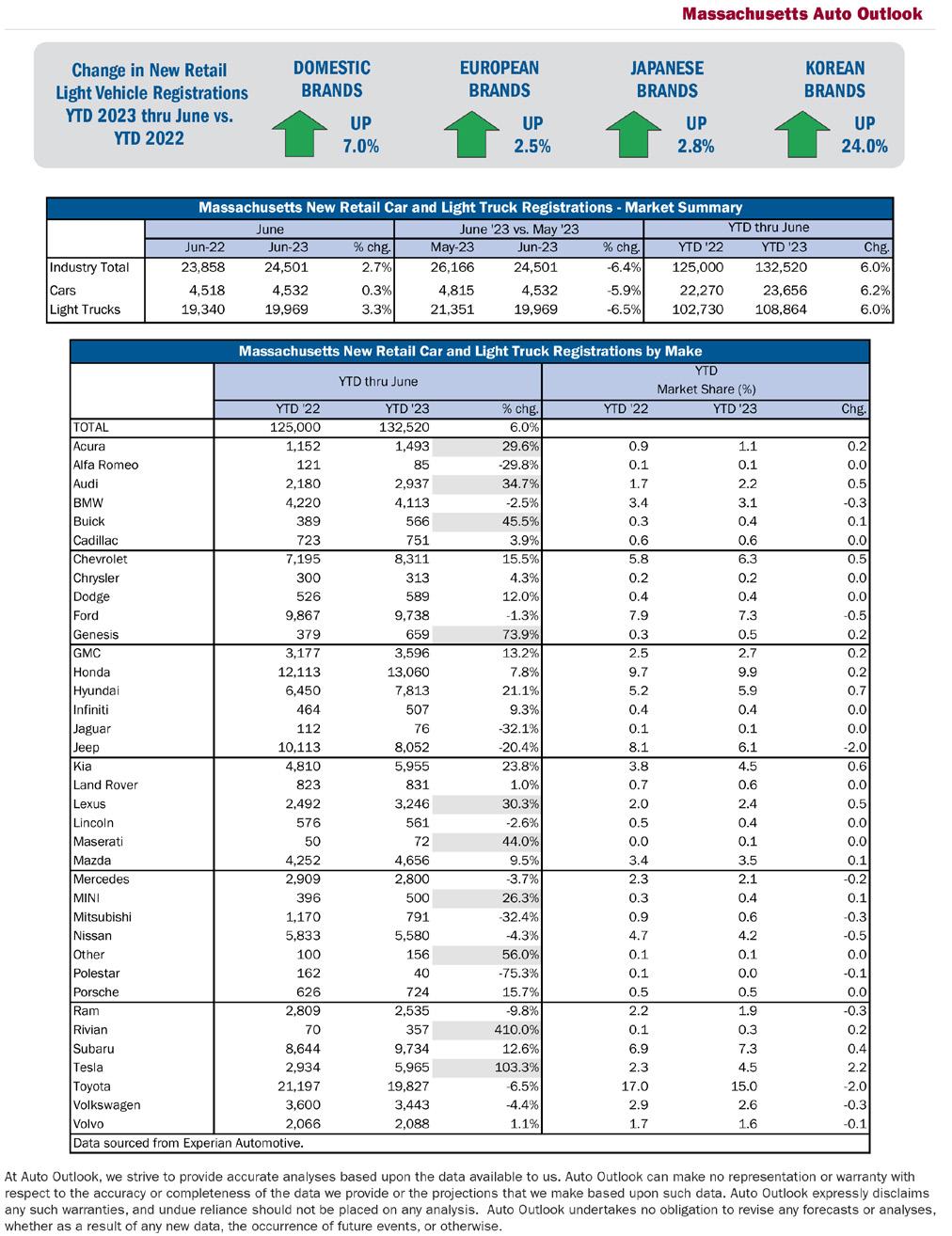

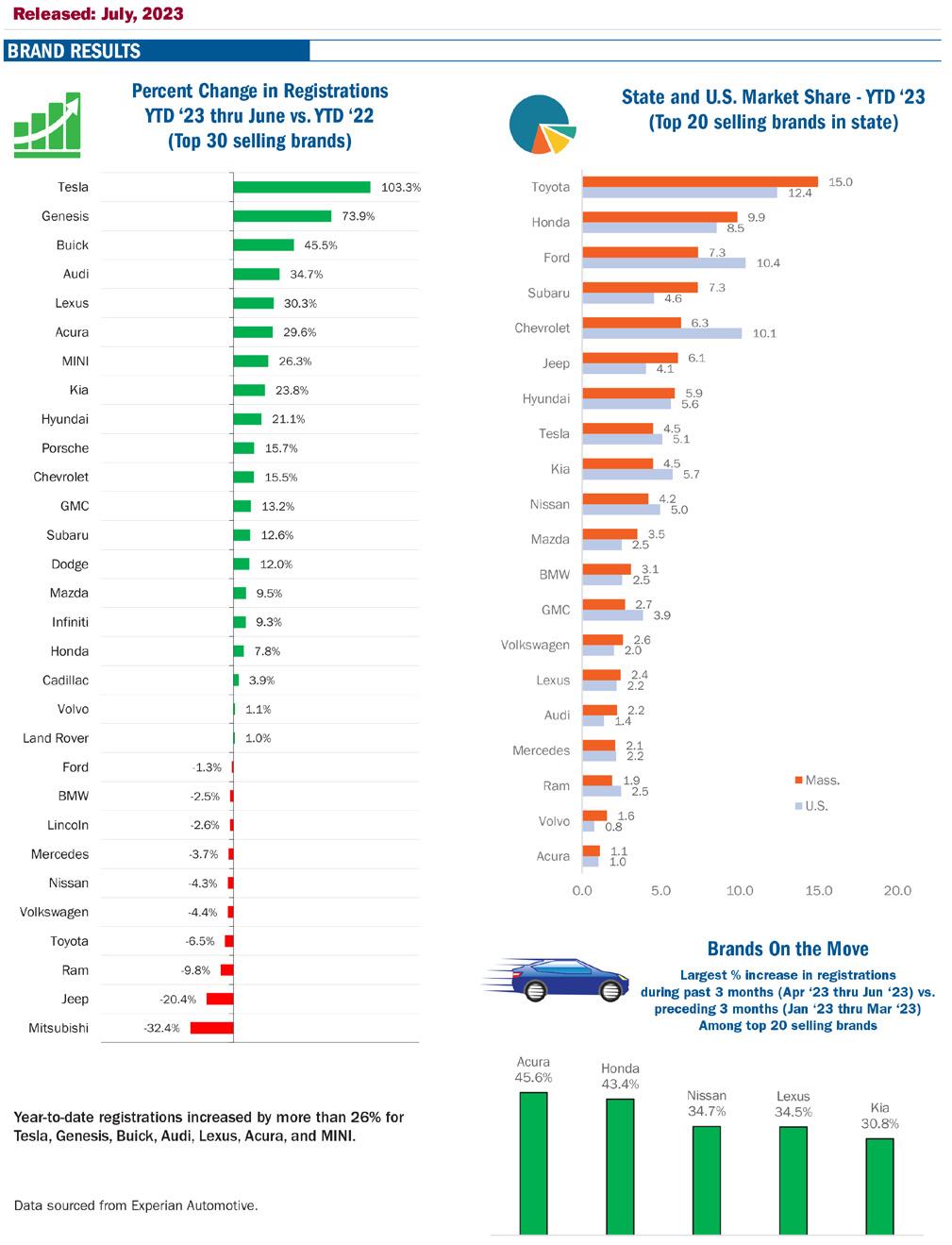

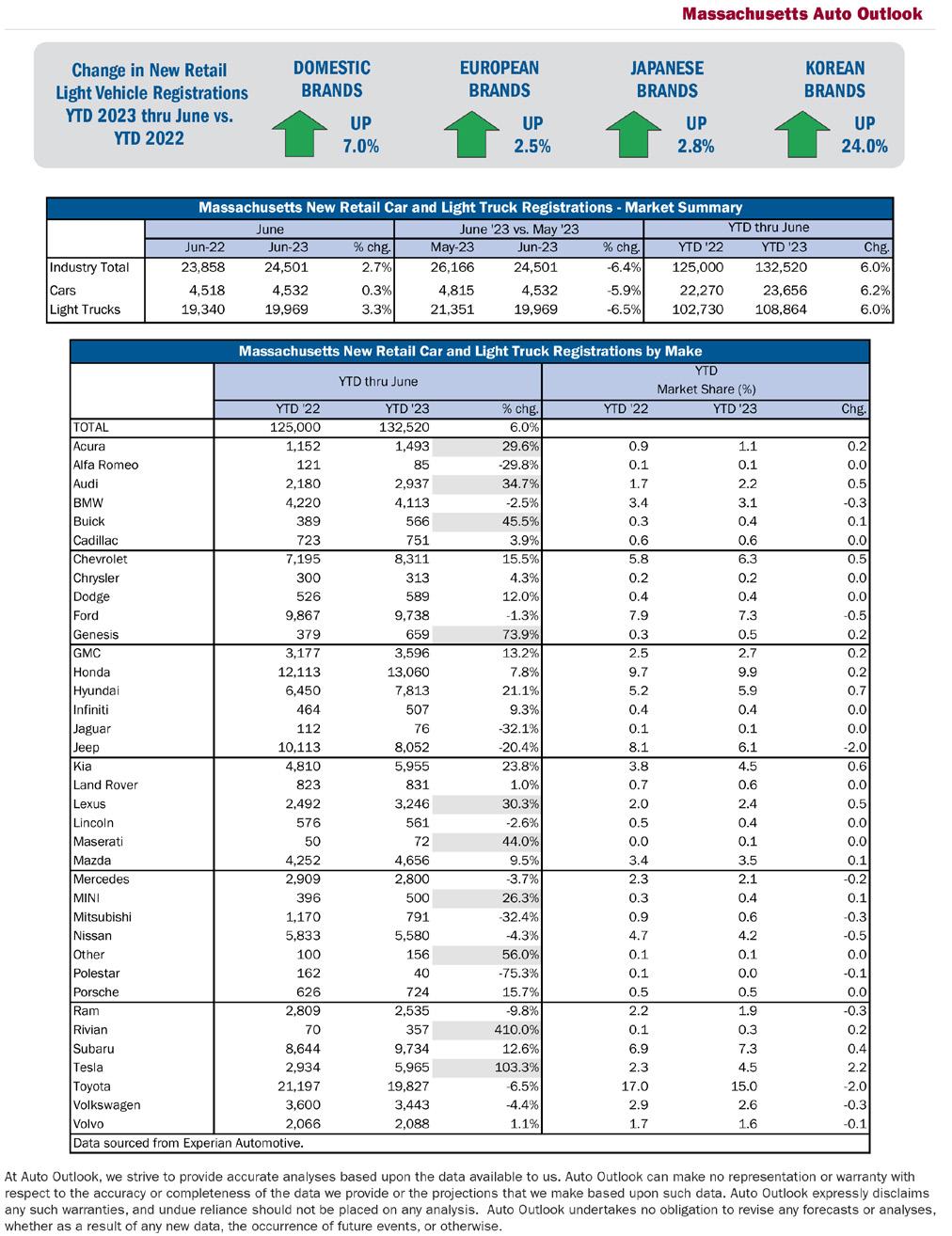

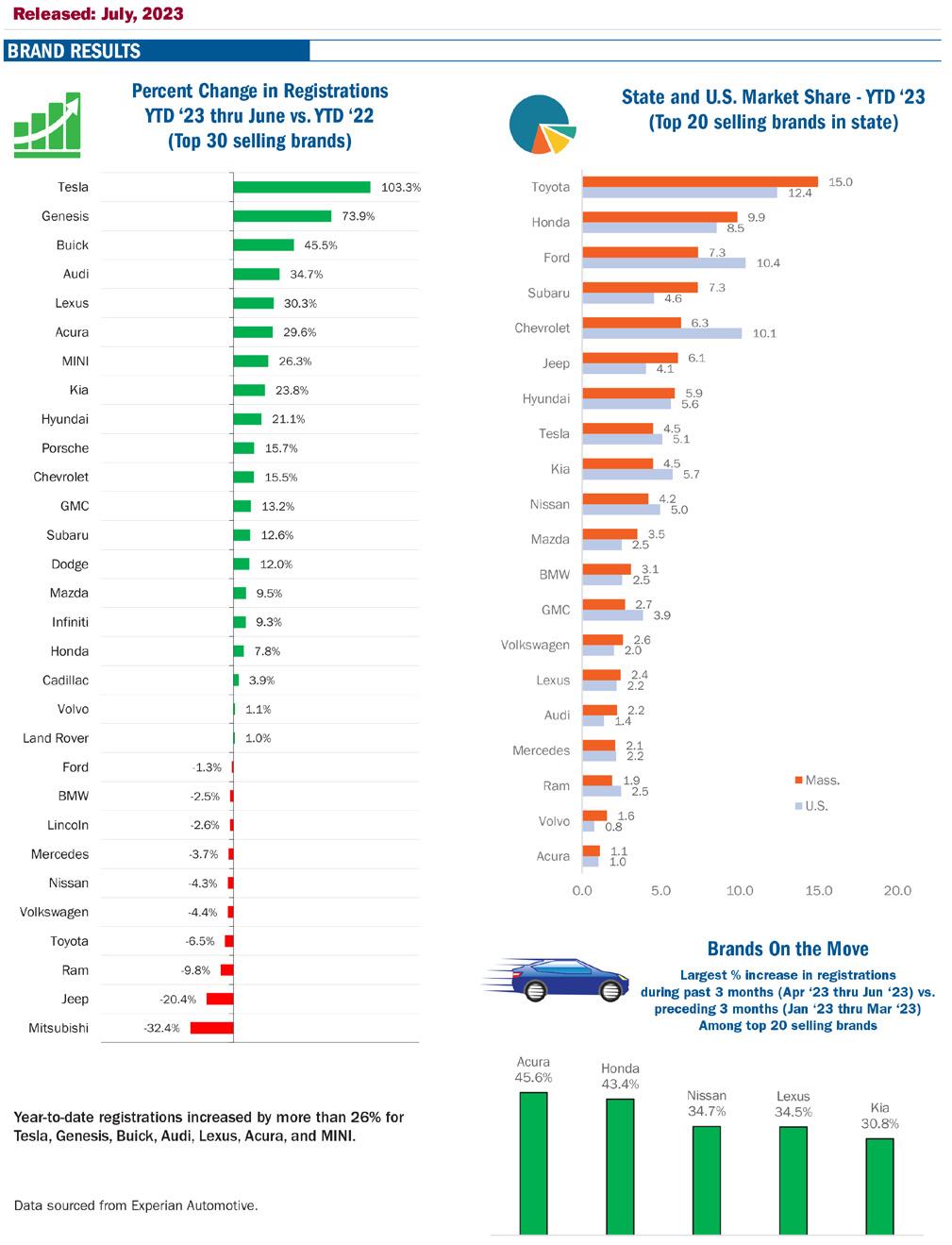

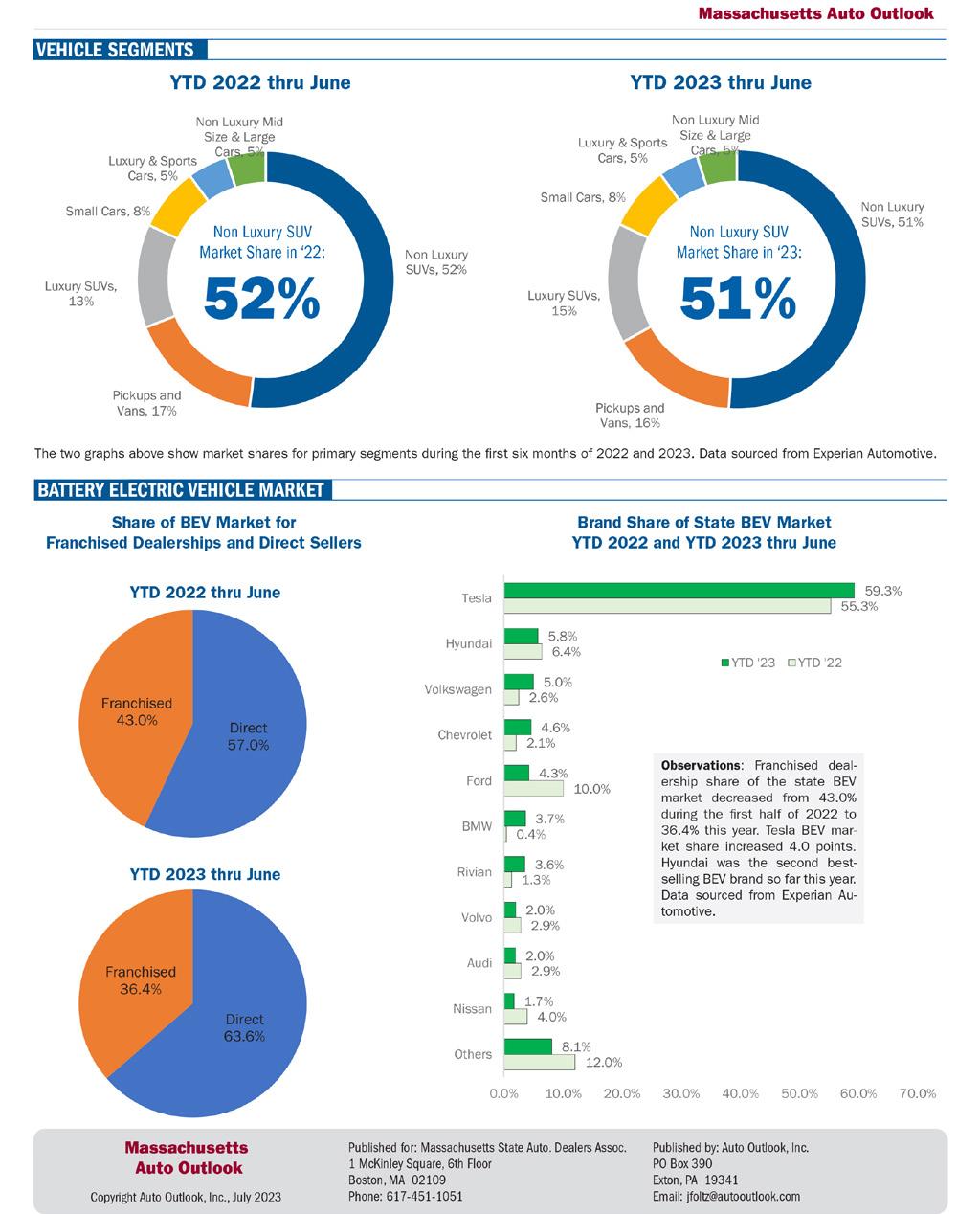

FEBRUARY 2022 Massachusetts Auto Dealer www.msada.org JUNE 2023 Massachusetts Auto Dealer www.msada.org 12 AUTO OUTLOOK

www.msada.org Massachusetts Auto Dealer FEBrUarY 2022 www.msada.org Massachusetts Auto Dealer JUNE 2023 MSADA 13

JUNE 2023 Massachusetts Auto Dealer www.msada.org 14 AUTO OUTLOOK

www.msada.org Massachusetts Auto Dealer JUNE 2023 MSADA 15

Our Federal Government Takes No Holiday

Dealers Urged to Participate in NADA Washington Conference

There is never a dull moment in Washington, D.C. Those who wield the levers of governmental power are always in motion looking for new laws to pass and regulations to approve to affect members of the business community, regardless of size and economic footprint. After all, those in Washington charged with doing the people’s business would not be attentive to their jobs, in their eyes, if they just sat around all day staring out their windows.

Who is in charge goes a long way to determine how far the pendulum of pain – or help – swings to and fro. Once the Biden administration with a Democratic Congress replaced the Trump administration, keen observers knew the pace of progressive government was going to pick up substantially, with the economy and the business community in its sights.

Long gone are the days when a Democratic administration respected the virtues of the market economy and the economic benefits it brought to the players, especially employees, and their families. Afterall, if there are going to be spending plans and social programs to smooth out the edges, government needs the revenues to do it. An economy on the ropes helps no one.

This is where groups such as the National Automobile Dealers Association (NADA), the American Truck Dealers (ATD) – a part of NADA, the American International Automobile Dealers Association (AIADA), and your Massachusetts State Automobile Dealers Association step in. Throughout the year – with events such as NADA’s Washington Conference, the ATD Forum, or AIADA’s Fly-In – they engage with the Members of Congress and regulators to confront matters impacting their dealerships and the automotive industry.

NADA Director Scott Dube points out all the time auto dealers have their work cut out for them as Congress continues to back measures that put businesses at risk.

“We can never stop putting effort into making sure our representatives know who we are, what we do, and how vital our contribution is to their districts and our communities,” Dube said. “We may not agree on every issue, but as we have seen proven during the past decade or so, when the chips are down the time put into establishing these relationships can really pay off. It is important to make our presence felt in Washington and through visits. More often than not, seeing is believing.”

“A substantial part of what MSADA does for our members is to stay in touch with our U.S. senators and representatives so that they know that what they are doing, or not doing, has an impact back home at our members’ dealerships,” said MSADA Executive Vice President Robert O’Koniewski. “Our engagement cannot be sporadic. Building relationships through constant communications can help to move policies in certain directions at times.”

JUNE 2023 Massachusetts Auto Dealer www.msada.org 16 COVER STORY

Six months into a new Congress split between a Republican House and a Democrat Senate, with the Biden administration working through the next two years toward a potential re-election campaign, the issues NADA and franchised dealers face are piling up.

“We have our annual NADA Washington Conference coming up in September,” stated Dube. “Many of the issues we are looking at today will be on our agenda. I urge dealers to join us in Washington on September 12-13 when we do our Congressional visits so we can keep our industry at the forefront of policy development.”

FTC Vehicle Shopping Rule

The big picture: The FTC’s proposed Vehicle Shopping Rule would drastically alter the entire process by which franchised dealers advertise and communicate with their customers and sell and finance new and used vehicles and voluntary protection products.

Changes that franchised dealers would have to make under

the proposed rule would inject massive amounts of time, cost, inefficiency, and complexity into the vehicle sales process at a time when the entire auto industry is united behind an effort to simplify and streamline vehicle sales, shorten transaction times, and improve the customer experience.

The FTC absolutely needs to go back to the drawing board before forcing implementation of a series of unstudied and untested mandates that will have significant negative impacts on customers.

What’s next: NADA is urging Congress to use its authority – including oversight and potentially budgetary authority – to highlight how fundamentally flawed the Vehicle Shopping Rule is.

Why it matters: There is bipartisan concern in both the House and Senate over the rule’s lack of evidence, questionable justification, and absence of consumer testing – as well as the FTC’s rush to judgment, failure to conduct any regulatory due diligence, and problematic testimony by the head of the agency, Lina Kahn. NADA is using all available resources to broadcast these concerns and amplify the message that the FTC needs to scrap this proposed rule and start over.

EPA Emissions Rulemakings

The big picture: NADA’s entire advocacy staff has been very active in response to the Biden Administration’s new and very aggressive emissions proposed rulemakings for new light-, medium- and heavy-duty vehicles, which were announced in April.

NADA continues to support the auto industry’s efforts to raise critical questions about the feasibility and impacts of such aggressive targets for EV adoption, remind stakeholders that dealers are ready and essential for any meaningful growth in EV adoption, and emphasize the need for others – beyond auto manufacturers and dealers – to step up and do much more themselves.

www.msada.org Massachusetts Auto Dealer JUNE 2023 MSADA MSADA 17

What’s next: In upcoming comments to the Administration – and ongoing public comments – NADA will explain everything that dealers are doing to get ready for widespread and mass-market EV adoption, including the $5 billion-plus in investments dealers are making in tools, training, and equipment necessary to facilitate a first-tier education, sales, and service experience for EV customers across the entire market and pricepoint spectrum.

NADA also will continue to explain that any meaningful growth in EV adoption will depend on a broad, unified strategy that considers the vital importance of consumer incentives, charging infrastructure, utility capacity, resources for battery manufacturing and the availability to consumers across the country of these newly-produced EVs themselves – just to name a few key factors.

Why it matters: America’s new-car dealers are doing their part on the road to electrification of our vehicle fleet. In addition to being ready, dealers are essential to the broad, mass-market adoption of the EVs that are now beginning to arrive in our showrooms. But others, including government at all levels, need to do their part as well.

Sale and Service of EVs

The big picture: Franchised dealers are ready for EVs and are essential to widespread consumer EV adoption.

What’s next: As the EV market enters the mainstream, EV customers will come to resemble the average car buyer more and more, and those mainstream customers are demanding that dealers play a central role in their transition to electric.

This is why the investments and commitments that dealers are making to prepare for EVs are so vital operationally, to OEM relationships, and politically.

Why it matters: Policymakers, opinion leaders, media outlets, many environmental groups, and other influencers continue to have difficulty accepting the reality that the franchised dealer network is a clear competitive advantage to selling both ICE vehicles and EVs.

EV Tax Credits

The big picture: The EV tax credits that took effect in 2023 as part of the Inflation Reduction Act are far from perfect. But NADA still believes that they are workable in the showroom and for customers. At the same time, it is important to continue down the positive path we’re on in terms of implementation. Policymakers should recognize any further narrowing of the credit, or anything that complicates a customer’s ability to easily understand how the credit works, is only going to limit its effectiveness as a pillar to more widespread EV adoption.

What’s next: NADA will continue working with Treasury and the IRS to address the numerous unresolved issues involved with the implementation of these credits. In addition, NADA will continue to educate dealers directly through the NADA compliance assistance webpage, webinars, and workshops – including at the 2023 NADA Show.

Why it matters: Dealers need to be viewed by customers, policymakers, automakers and the general public as helpful facilitators of available tax credits for the purchase of eligible new and used EVs.

LIFO Relief

The big picture: NADA is still working to see that Congress passes retroactive LIFO relief legislation. The “Supply Chain Disruptions Relief Act,” which provides identical relief to last year’s bill, has now garnered 60 cosponsors in the Senate, demonstrating that this legislation is not just overwhelmingly bipartisan, but also filibuster-proof. Work is continuing to grow the number of House bill cosponsors, which stood at 40 at the beginning of June.

What’s next: While challenges remain with passing this legislation, Congressional leaders have been supportive in securing additional cosponsors, especially in the House, which will help gain favorable consideration.

Why it matters: Many dealers – particularly smaller dealers – are still having difficulty replenishing vehicle inventories. And all dealers should remind Members of Congress that this

JUNE 2023 Massachusetts Auto Dealer www.msada.org 18 GOVERNMWNT TAKES NO HOLIDAY

is technical and noncontroversial legislation that would merely provide relief to these dealers whose inventories disappeared due to an unprecedented interruption of global supply chains.

Dealer-Assisted Financing

The big picture: Despite its clear benefits to consumers, government regulators continue to view dealer-assisted financing with skepticism. And the main focus of that skepticism is whether dealer participation is earned in a manner that violates anti-discrimination laws.

What’s next: NADA continues to promote and stress the importance of the optional NADA/NAMAD/AIADA Fair Credit Compliance Policy and Program as the optimal way to mitigate fair credit risk while maintaining the ability of dealers to discount financing, which is the hallmark of the beneficial nature of dealer-assisted financing to consumers.

Why it matters: The FTC, the CFPB, state attorneys general, and their many allies continue to bring forth investigations, examinations, and enforcement actions against franchised dealers and lenders – all rooted in allegations of discrimination or discriminatory outcomes in auto lending. These cases perpetuate the cycle of regulatory, media, and other stakeholder scrutiny.

Voluntary Protection Products (VPPs)

The big picture: Like with dealer-assisted financing, government regulators continue to express skepticism about VPPs – despite their demonstrated value and the favorable customer satisfaction scores they receive.

What’s new: VPPs are a prime target of the FTC’s Vehicle Shopping Rule. And VPPs are consistently part of enforcement actions alleging discrimination in the F&I office. However, earlier this year, the NADA Model Dealership Voluntary Protection Products Policy – a template policy to assist dealers in implementing a formal policy on the sale of VPPs – was incorporated into a settlement between Massachusetts and a dealership over allegations of price discrimination.

Why it matters: The Massachusetts case is the first instance of NADA’s VPP Policy being accepted as part of a settlement between a state government and a dealership. This demonstrates the broad recognition of the policy’s significant value – to dealerships and regulators – as an effective compliance template. It’s also why NADA highlighted the VPP Policy as a workable alternative to the very problematic provisions contained in the FTC’s Vehicle Shopping Rule.

Military Lending Act

The big picture: In April, the U.S. Court of Appeals for the Fourth Circuit upheld a federal district court decision holding

that a vehicle financing contract with a service member that includes GAP Waiver and other related costs remains part of the vehicle financing exclusion to the Military Lending Act (MLA).

This decision – at least in the Fourth Circuit, and potentially elsewhere – affirms the view that the financing of GAP Waiver does not trigger compliance with the MLA’s duties and restrictions.

What’s next: Regardless of the next steps that may be taken by the plaintiff (DOD) in this case or the government, NADA will continue to explain to courts and policymakers the significant value that VPPs can provide to consumers, and that Congress never intended for service members to be deprived of the opportunity to benefit from these protections.

Why it matters: NADA spent years seeking affirmation that dual purpose financing (financing of both a motor vehicle and related items such as GAP waiver) with a service member fits squarely within the motor vehicle financing exclusion of the MLA.

OEM Engagement

The big picture: NADA is focused like a laser on the obvious shift in the way many OEMs are speaking publicly about the retail process, as well as many of the changes being implemented between OEMs and their dealers. NADA also knows that, despite the fact that they have not been operationalized on a widespread basis, these ongoing references to direct sales, direct and exclusive sale of post-purchase vehicle services, the monopolization of the customer experience, or dealers as agents, etc., cannot realistically be seen by dealers, NADA or state associations as anything other than threats that go to the very core of the franchise system.

What’s next: NADA uses the regular Dealer Attitude Survey meetings, as well as constant engagement at the highest levels, to discuss these issues head on with OEM leaders.

Why it matters: OEMs we engage with appreciate that we are increasingly leaning in to the dealer-OEM relationship. Dealers appreciate the clarity that most OEMs have provided by publicly committing to their dealers and recognizing the competitive advantage dealers provide.

“The perception is that government does not really do anything, especially to help the folks back home on Main Street,” Opined O’Koniewski. “The reality is, if government does do something, we need to make sure that there is no absence of viewpoint from the franchised dealers. It is always particularly easy for a politician to vote a certain way if they never hear from the concerned parties. That is why our upcoming Congressional visits will be so vital. I urge our dealers to sign up and participate.”

www.msada.org Massachusetts Auto Dealer JUNE 2023 MSADA MSADA 19

t

NEWS from Around the h orn

HADLEY

TommyCar auto Group Carries on Their Commitment to academic Excellence

The Tom Cosenzi Scholarship Fund is proud to announce the recipients of its highly anticipated 2023 scholarship. The fund, established to honor the memory of Tom Cosenzi, continues its mission of empowering young individuals to pursue their dreams and achieve higher education.

Since its inception, the scholarship has awarded more than $18,000 to local students. The Tom Cosenzi Scholarship offers funds to graduating high school students who plan to attend a twoyear or four-year college, university, or trade school. The fund is open to two designated schools that are located in the communities where the Auto Group has dealerships: Hopkins Academy in Hadley and Northampton High School in Northampton.

The Tom Cosenzi Scholarship Fund proudly presents the following outstanding scholars:

Daisy Venditti of Hopkins Academy, a standout student from Hopkins Academy, has been accepted to the University of Massachusetts for the upcoming fall semester. Daisy’s exceptional leadership and unwavering dedication shine both on and off the sports field. She has been an integral part of her school’s basketball, softball, and soccer teams, showcasing her athletic prowess and commitment to teamwork. Beyond her involvement in sports and clubs, Daisy’s commitment to community service is truly remarkable. She has dedicated her time to chaperoning children’s activities for the Park and Recreation department, showing her genuine care and support for the younger members of her community. Daisy has also taken part in important initiatives such as the Montes March to end hunger, the Alzheimer’s walk, and a Ukraine dinner fundraiser, showcasing her dedication to making a positive impact on the lives of others.

Wesley Parent of Northampton High School, a distinguished student from Northampton High School, has been accepted to Worcester Polytechnic Institute for the upcoming academic year. Wesley’s exceptional leadership abilities were evident as he served as a varsity football captain, inspiring his teammates through his exemplary dedication and commitment. Wesley’s outstanding performance on the football field did not go unnoticed, as he received several accolades, including the

MSADA

title of Most Valuable Defensive Player, recognition as a member of the All-Western Mass Team, and being named a Super 7 player. Alongside his commitments on the field, he also took on multiple jobs, including a notable role as a Safety Village Counselor for the Northampton Recreation Department. In this capacity, Wesley played a crucial role in ensuring the safety and well-being of young children, making a positive impact by being a responsible role model for them.

The Tom Cosenzi Scholarship Fund extends its heartfelt congratulations to the 2023 scholarship winners and wishes them success in their future endeavors. Their unwavering dedication, passion, and commitment serve as an inspiration to all aspiring scholars. The fund remains committed to empowering young individuals and fostering a brighter future through education.

“I am incredibly honored to have the opportunity to give back to our community through the Tom Cosenzi Scholarship,” said Carla Cosenzi, President of TommyCar Auto and Founder of the Tom Cosenzi Scholarship. “I am privileged to play a part in their academic journey and look forward to seeing the remarkable contributions they will make to our society.”

For more information about the Tom Cosenzi Scholarship Fund and its scholarship recipients, please visit TomCosenziScholarship.com.

16

20

JUNE 2023 Massachusetts Auto Dealer www.msada.org

h

Gary rome to awards Holyoke High school student with Brand New Hyundai

Gary Rome, President & CEO of Gary Rome Hyundai, awarded one lucky Holyoke High School student with a brand new Hyundai Venue on May 31 at the dealership, located at 150 Whiting Farms Road in Holyoke. There were a total of 19 finalists given keys, and the one lucky keyholder, senior Mahaya Tabin, was awarded with the car. The parents and/or guardians of the finalists attended the event, as well as the principals, guidance counselors, teachers, school administrators, school superintendent, and Holyoke Mayor Joshua Garcia.

The Gary Rome Academic Achievement Award of a new Hyundai to a Holyoke High School Senior began in 2010. One deserving junior or senior at Holyoke High School is awarded with a new Hyundai vehicle each year from Gary Rome Hyundai. Gary works closely with the principal and guidance counselors to ensure this annual event is a success. The students that apply must maintain a minimum GPA of 3.0 or better and have fewer than six absences during the school year as well as no major disciplinary infractions. Each year, Gary and his team attend Holyoke High School North and Dean campuses for a pep rally to excite the students about the car giveaway.

“I feel strongly about empowering the youth of Holyoke and en-

couraging them to strive for excellence,” said Rome. “It’s important we give the youth of our city, something to be excited about.”

The winner, Mahaya Tabin, is a graduating senior, and she will attend Holyoke Community College in the Fall and major in Criminal Justice.

www.msada.org Massachusetts Auto Dealer JUNE 2023 21

HOLYOKE

NEWS from Around the

orn MSADA

Warranty Reimbursement –Post Pandemic

By Frank O’Brien

Just over three years after the government shutdown the economy due to the COVID-19 pandemic, the World Health Organization announced that the pandemic was over. Automotive dealers, some of the most resilient business owners in the country, navigated the pandemic, inventory supply issues caused by the microchip shortage, and workforce issues to generate record profits in 2021, 2022, and into 2023.

Now, as we head into the second half of 2023 and beyond, inventory levels (for most franchises) have started to build back up, and gross profits related to the sale of new and used cars have waned (albeit slightly). As this trend continues, the profits in the parts and service departments become increasingly important. However, rising costs, especially technician pay rates, have put a strain on those profits. Therefore, dealership management should focus on submitting for labor rate and parts markup increases annually.

Labor Submissions

The amended Massachusetts state franchise law, MGL Chapter 93B, permits dealers to submit for a labor increase once per calendar year. However, the average dealer waits 18 months to 2 years between submissions, sometimes longer. Meanwhile, the service department has lost incremental gross profits that cannot be recovered. Service directors should be

increasing the retail door rate annually and tweaking the labor grid at the same time. The dollar value of each year’s increase should be calculated based on the year-over-year increases in technician’s pay rates, other personnel costs, operating expenses, and overhead on a cost-per-labor hour basis.

• Rate Index Programs: Certain manufacturers (e.g., Ford Motor Company (Ford), BMW of North America (BMWNA), and Toyota Motor Sales (TMS)) will offer dealers an automatic annual warranty labor rate increase based on the consumer price index. The rate is often lower than the rate the dealer can obtain through a warranty labor rate submission through Chapter 93B or other

programs give the manufacturers carte blanche authority to lower the rate as they deem appropriate. We have seen instances in which the dealer’s final approved rate was significantly less than the repair order analysis, because the market rate survey included dealers that had not submitted for a labor rate increase in several years and/or were on a rate index program.

• Discounts: Manufacturers have always calculated the average rates net of discounts. However, we are starting to see certain manufacturers (General Motors, BMW, Audi of America, Porsche of North America) separating labor and parts discounts in their calculations. This could be problematic for those dealerships that take a 70/30 or 60/40 split when allocating labor and parts discounts. All discounts should be prorated based on the value of the labor and parts sold on the repair order.

states’ franchise laws. More importantly, the manufacturer locks the dealer into the program for a period of time (usually 3 years). Management should prepare an analysis to project the average retail labor rate prior to executing any OEM rate index programs.

• Manufacturer Labor Rate Submission Programs: Most manufacturers allow dealers to prepare a warranty labor submission that requires a combination of a repair order analysis (usually 20-30 qualifying repair orders) and a market labor rate survey. Unfortunately, these

• Maintenance Items: Chapter 93B provides a maintenance exclusion in the law but provides little detail as to what constitutes maintenance. Certain manufacturers (e.g., Ford, BWWNA, FCA-Stellantis, Subaru of America, Porsche of NA, Mazda North America, and Volvo Cars of North America) have taken a rather liberal interpretation of the maintenance exclusion and require dealers to include brakes, wiper blades, keys, batteries, and bulbs. These items are often discounted, which will reduce the rate. Additionally, Ford requires dealers to include all alignments, even those done in conjunction with a tire replacement or caused by outside influence. Management personnel for these franchises should ensure that these services are competitively priced but not overly discounted and that the hours paid to the technicians are not above industry benchmarks.

ACC ountin G 22 JUNE 2023 Massachusetts Auto Dealer www.msada.org

O’Connor & Drew + Withum

• Non-Warranty Like Repairs: BMWNA is notorious for including extended warranty repairs in the submission despite the repair being paid by a third party. To avoid these repairs from negatively impacting your rates, management personnel should code all extended and aftermarket warranty repairs as W for warranty. Additionally, BMWNA and Ford take an extremely liberal interpretation of damage. Oftentimes, these manufacturers include repairs that were caused by some type of outside influence. While there is not much recourse for the dealer in this area, dealers should be aware of this tactic to take steps to maximize their results.

• Diagnostic: Certain manufacturers (General Motors, BMWNA, FCA-Stellantis, Porsche of NA, Volkswagen of America) include all diagnostic charges, including those for which the customer declines the repair. As a result, it is critical to bill all diagnostic lines at your retail door. Discounting this line would have a negative impact on your average rate.

Parts Submissions

While annual parts submissions are not common, multiple submissions are starting to become more frequent. We have a number of dealerships (various franchises) that have submitted for warranty parts increases more than once and now have approved warranty parts markups over 100% with some over 120%. Oftentimes, increasing your warranty parts markup from 75% to over 100% will increase gross profit by thousands of dollars a month. Dealers looking to achieve similar numbers should analyze and adjust their parts price matrices to build more profit into the most frequent mechanical repairs. We have an interactive tool to help dealers do that.

• Toyota and Mercedes-Benz: After years of push back and reluctance from Toyota Motor Sales (TMS) and Mercedes-Benz of USA (MBUSA), we have successfully assisted several Massachusetts Toyota dealers obtain retail rates for warranty parts. Additionally, we have assisted Mer-

cedes-Benz dealers in other states with similar laws to Massachusetts.

• Buy/Sell Transactions: Additionally, it is important to note that most manufacturers reset the warranty parts rate to 40% or MSRP after a buy/sell. This requires the new dealer to submit for a warranty parts rate increase to retail. Certain manufacturers will claim that a submission cannot be made in the first year, but that is simply not true. A warranty reimbursement submission (parts or labor) can be submitted under Chapter 93B any time after the closing date. However, the dealership will need to accumulate enough data to submit 100 qualifying repair orders (usually within 60 days).

If you have any questions regarding these issues or any other issues pertaining to the warranty reimbursement process, please contact Frank O’Brien, CPA, CIA, CFE at (339) 255-5358 or frank.obrien@ withum.com.

23 MSADA www.msada.org Massachusetts Auto Dealer JUNE 2023

t

Putting the ‘Tax’ Back in Taxachusetts

By Mike Cronin

O’Connor & Drew + Withum

High Profits and ‘Low’ Taxes

By now, everyone with knowledge of the auto industry is aware of the record-breaking profits that have been taking place across the country for the past few years. What few have realized is that this has also come at a time of historically low taxes. Yes, it may be hard to believe that the significant individual income taxes that auto dealers have been paying can be considered ‘low.’ Still, the driver of increased taxes over this timeframe is due to increased income and not the relatively low tax rate.

The Tax Cuts and Jobs Act of 2017 reduced the maximum individual tax rate from 39.6% to 37%. But much more importantly for small business owners, it allowed a 20% of Qualified Business Income (QBI) deduction. This resulted in an effective federal rate on dealership income of 29.6% (20% from 37%) if derived from a pass-through entity – think S-Corporation or Partnership. The lowest top federal tax rate has not been below 30% in the past thirty-plus years. When combined with the Massachusetts state income tax of 5%, most Massachusetts dealerships’ and related real estate incomes were being taxed at a collective 34.6% at the individual level.

Massachusetts Taxes

Contrary to popular belief, Massachusetts and its voters did not always increase taxes for its constituents. In November 2000, the Massachusetts voters successfully passed a reduction to the state income tax from 5.85% to a flat 5%. Then in September 2021, the Massachusetts Legislature enacted an elective pass-through entity (PTE) tax to provide pass-through entities with the ability to deduct state taxes at the federal level while passing the credit to the

individual owners. The PTE election resulted in an approximately 1% decrease in total individual taxes to owners of pass-through entities, bringing the total tax noted above down from 34.6% to 33.6%. And finally, in November 2022, refunds on personal income tax liabilities were paid due to excess tax revenue collections set by Chapter 62F of the Massachusetts General Laws.

However, the state tax landscape changed in November 2022, when Massachusetts voters passed a law that imposes an additional 4% personal income tax for its high-income earners, referred to as the “millionaires tax.” The result is that every dollar of taxable income over the initial $1 million threshold will be taxed at 9% starting with the 2023 tax year. This means that every dollar over the first $1 million from your Massachusetts dealerships and real estate pass-throughs will be taxed at a combined 38.6% instead of 34.6%. This is an additional $40,000 in taxes per million dollars over the income threshold.

Minimizing the 4% Impact

With the dealership market remaining strong in 2023, there may not be a way to avoid this additional tax entirely, but there are some ways to mitigate the impact.

• Filing Separately: For numerous tax instances, there are benefits to being married and filing a joint return. This is not one of them. The $1 million threshold is the same for both single and joint tax returns. Therefore, if both you and your spouse have substantial taxable income, under current law you could file separately in Massachusetts (while still filing jointly federally) and reduce the burden of the 4% tax. If you both happen to make over $1 million, then this is a way to shelter an additional $1 million of income or $40,000 in state taxes. (Note: The Legislature presently is deliberating an amendment to the law to eliminate this loophole.)

• Selling Assets: If you are planning to sell an asset or group of assets in 2023 or going forward, you might want to consider setting up the sale as an Installment Sale, where you receive the proceeds

over time. In this case, you would also defer the associated gain. Spreading the income for multiple years could reduce or eliminate the impact of the 4% tax.

• Moving Out of Massachusetts: As taxes increase and more work is done remotely, many Massachusetts taxpayers are looking to relocate to low- or no-income tax states. However, a non-resident taxpayer would still be taxed on the income derived from Massachusetts, including your in-state auto dealership.

Tax Day 2024

Even if you can take advantage of these planning ideas, based on the significant profitability in the auto industry that looks to continue throughout 2023, you will likely have at least a portion of your income over the $1 million threshold. And this extra tax money will likely be coming out of your pocket in April 2024. Most auto dealers will be ‘safe-harbored’ on their federal and state income tax estimated payments, meaning they will pay in tax estimates during 2023 based on 2022 tax amounts. However, 2022 did not include the additional 4% millionaires tax, so, likely, this amount will not have been paid in by the time your tax return comes due. Remember this during the year so there are no surprises at the tax deadline.

On top of that, dealerships that are set up as S-Corps or Partnerships have been taking advantage of the Massachusetts PTE tax, which results in the dealership paying the Massachusetts taxes on behalf of their owners. The problem is that the Massachusetts PTE tax is a 5% tax and does not consider the additional 4%. The additional 4% cannot be taken as a deduction the same way the initial 5% tax is currently, and the owners will be responsible for the additional 4%.

To summarize, if your taxable income for 2023 is expected to be on pace with or greater than 2022’s and you will make over $1 million, then you should expect to be writing the Commonwealth a check next April – and you will have the voters of Taxachusetts to thank for it.

24 JUNE 2023 Massachusetts Auto Dealer www.msada.org MSADA MSADA ACC ountin G

t

Buyer Beware – OEMs Increasingly Exercising Their Rights of First Refusal

By Tom Vangel & James Radke

Over the past several years, auto dealers across the country have experienced a rather robust buy/sell market. Manufacturers who previously sat on the sidelines and approved proposed buyers are now taking more of an interest in who the ultimate buyer of the dealership will be. Consequently, manufacturers of various line-makes have been electing to exercise their right of first refusal (ROFR) to appoint their favored candidate in lieu of the proposed buyer. Sometimes, where there are competing offers for the dealership, a disgruntled runner-up is able to convince the manufacturer to exercise the ROFR and appoint him instead of the proposed buyer. In other situations, the manufacturer may wish to appoint a minority dealer for a particular location, or it may prefer another candidate who operates other points for the manufacturer.

What does this mean for the proposed buyer? Unfortunately, under Massachusetts General Laws Chapter 93B, which governs the relationships between automotive manufacturers, distributors, and dealers, proposed buyers do not have legal standing to sue the manufacturer for the wrongful exercise of its ROFR. This is consistent with most automotive laws across the country.

This issue of standing was first decided in Massachusetts in 1985 in the case of Beard v. Toyota, which presented an unusual set of circumstances. In that case, approximately six weeks after the selling dealer signed a purchase and sale agree-

ment for his Toyota dealership, he received a better offer for an additional $50,000. The seller convinced Toyota that it should not approve his original proposed buyer, allowing him to accept the higher offer. After receiving notice that Toyota had declined to approve his application, the original proposed buyer sued Toyota for wrongfully withholding its approval.

The Massachusetts Supreme Judicial Court (SJC) determined that the Legislature’s intent in enacting Chapter 93B was to protect motor vehicle franchisees and dealers from “the type of injury to which they have been susceptible by virtue of the inequality of their bargaining power and that of the affiliated manufacturers and distributors.” In other words, the law was intended to protect a Ford dealer, for example, from the unfair and oppressive actions of Ford; it was not intended to protect an unaffiliated buyer from the actions of the manufacturer. Thus, while the circumstances of the Beard case are unlikely to occur with any frequency - with a seller convincing the manufacturer to reject his own buyer - the case established the law in Massachusetts for the past 38 years.

In 2014, the SJC affirmed the principles of the Beard decision in litigation brought against Tesla arising from its direct sales model, finding that only a franchised Tesla dealer (of which there were none) or the Attorney General would have standing to sue Tesla for its direct-to-consumer model. Accordingly, the law in Massachusetts is clear that, unless the selling dealer is willing to object to the manufacturer’s exercise of its ROFR, the proposed buyer will have no standing to mount a legal challenge to the decision to appoint a favored candidate over an otherwise qualified prospective buyer.

Typically, selling dealers are agnostic concerning the identity of the successor franchisee, since the manufacturer’s exercise of the ROFR requires the new buyer to match every term in the asset purchase

agreement and the real estate purchase and sale agreement, including due diligence periods, satisfaction of financing contingencies or lack thereof, and, most importantly, the purchase price and timing of the closing. The buyer appointed by the factory must close on the exact same terms as set forth in the agreements. Consequently, the selling dealer is not at all negatively impacted by the factory’s exercise of the ROFR and is usually just as happy to close with a different buyer. This is particularly true if there is any risk that the manufacturer may not approve the original buyer for legitimate reasons.

The consolation prize for the jilted buyer is that his legal and other out-of-pocket expenses associated with attempting to purchase the dealership must be reimbursed by either the manufacturer or its appointed buyer. A jilted buyer should not be bashful in calculating all of his expenses. Although typically reimbursement is only sought for actual out of pocket expenses for attorneys, accountants, environmental consultants, appraisers, and the like, the statute does not specifically preclude a dealer principal from seeking reimbursement for his lost time associated with pursuing the transaction. A buyer should include that as an eligible expense in the asset purchase agreement with a corresponding hourly rate.

Lastly, it should be noted that certain insider transactions are exempt from the manufacturer’s ROFR. Manufacturers are not permitted to exercise a ROFR over a sale to a co-owner of a dealership, a member of dealership management who was previously approved by the manufacturer as a manager, or an immediate family member of the dealer or co-owner.

Tom Vangel and Jamie Radke are partners with the law firm Murtha Cullina LLP in Boston who specialize in automotive law. They can be reached at 617-457-4072.

www.msada.org Massachusetts Auto Dealer JUNE 2023 25 MSADA L e GAL

t

Partners at Murtha Cullina LLP, (617) 457-4072

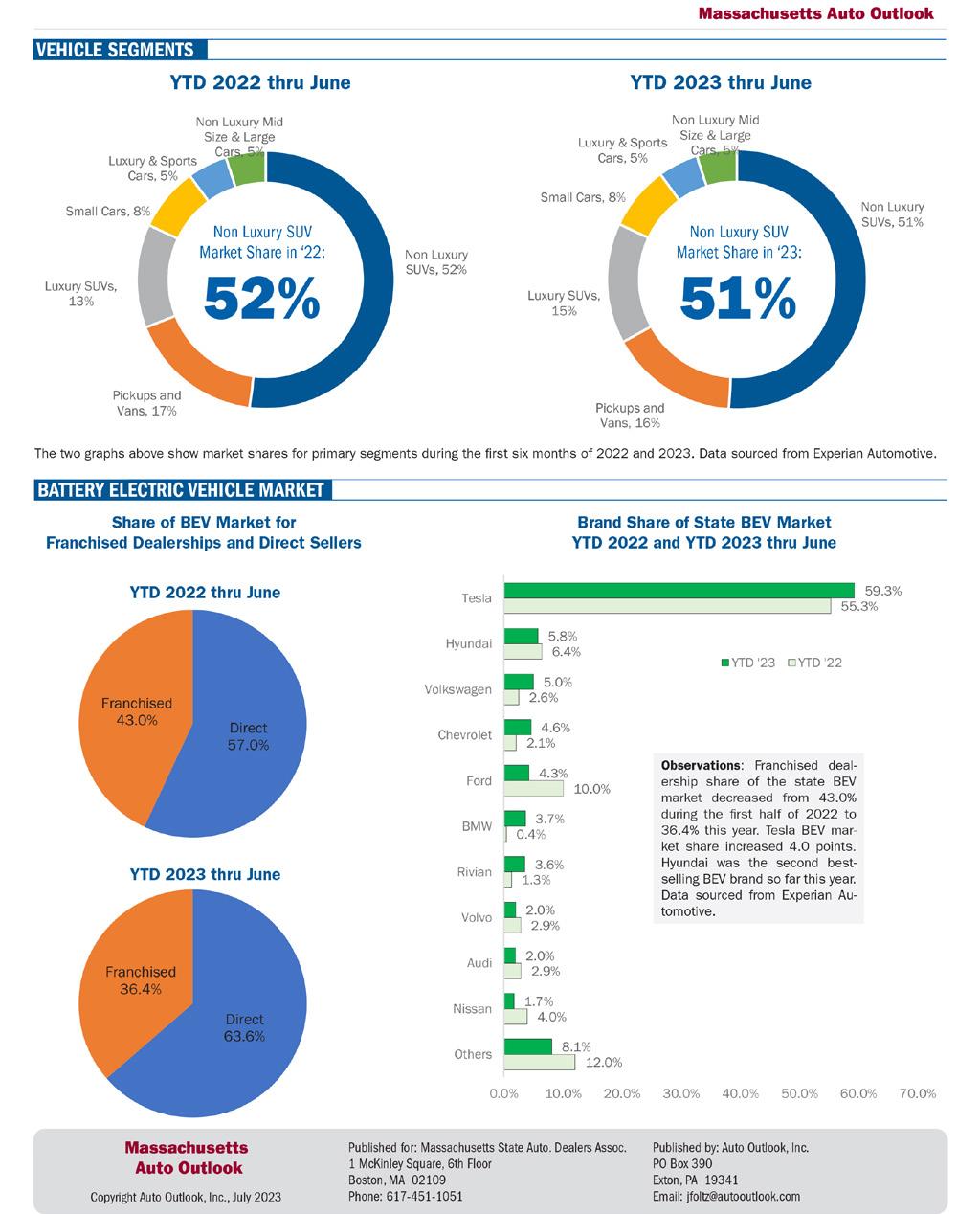

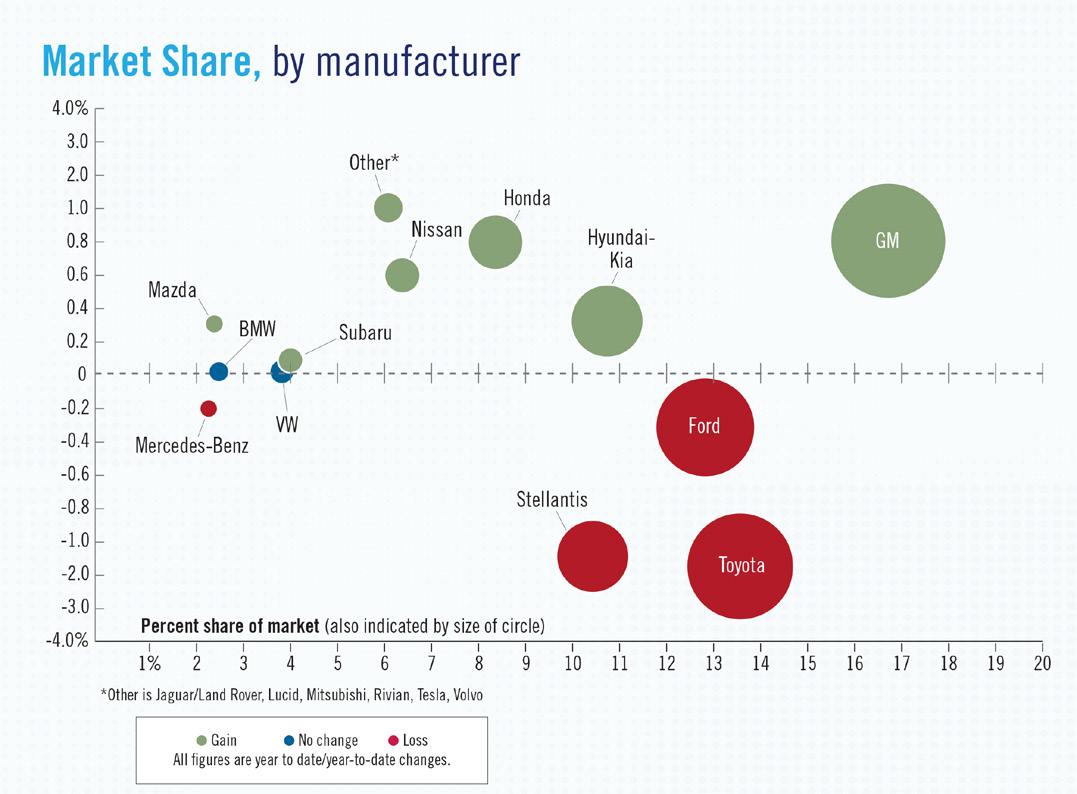

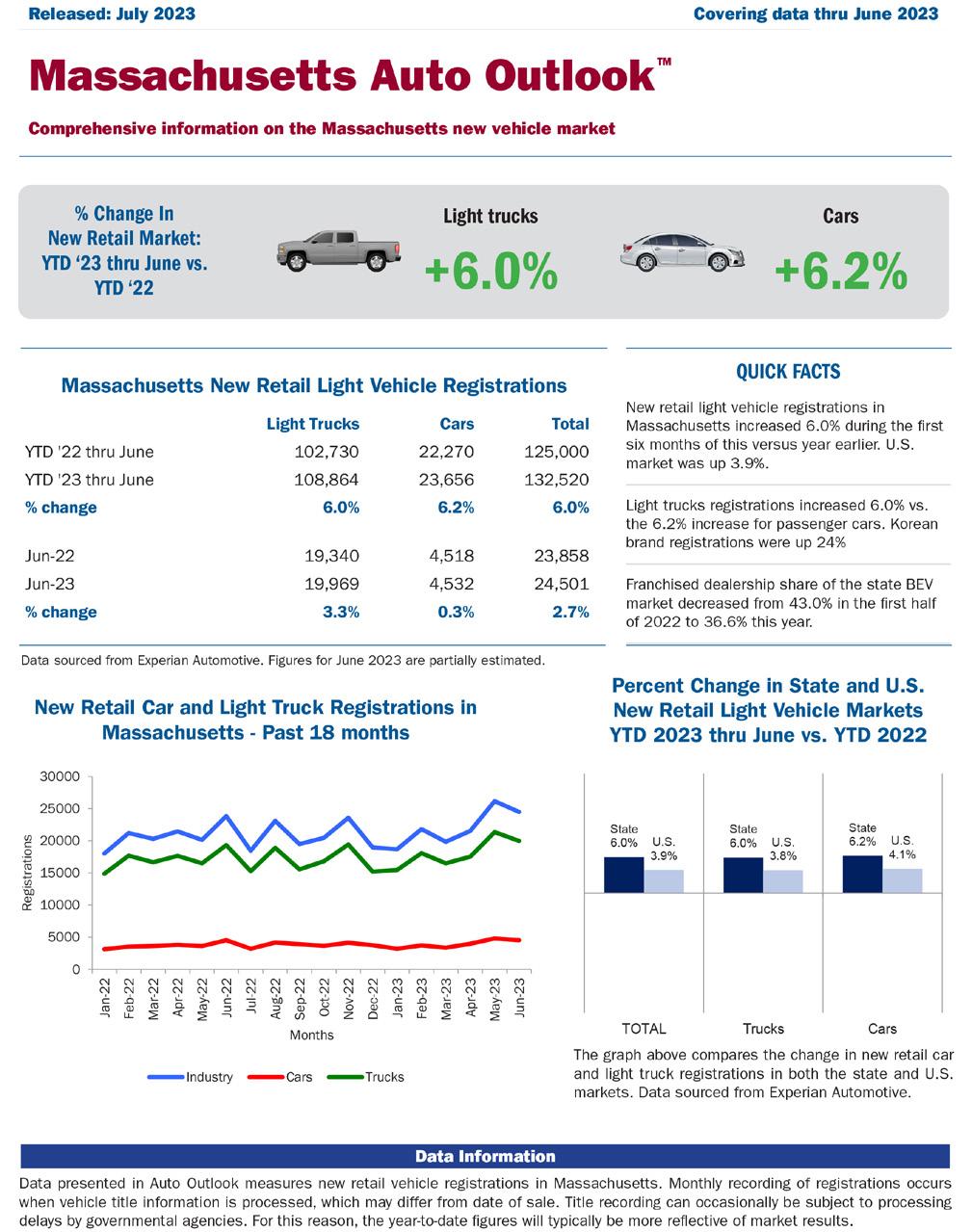

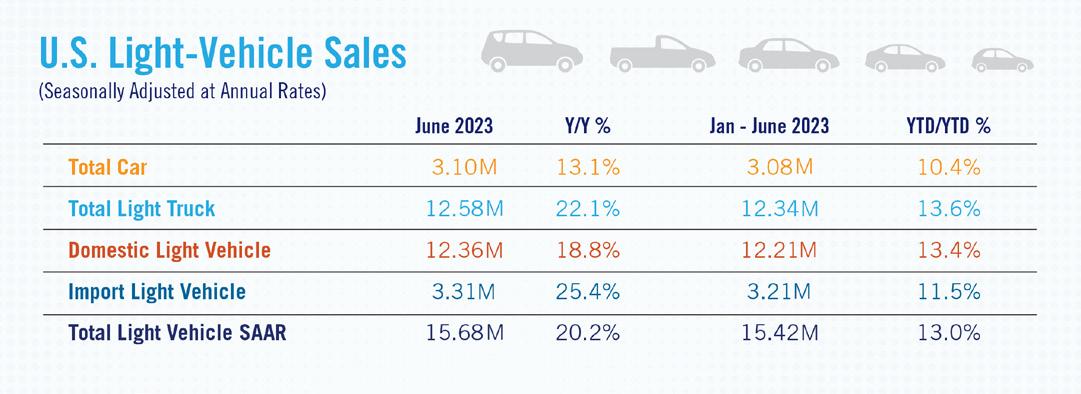

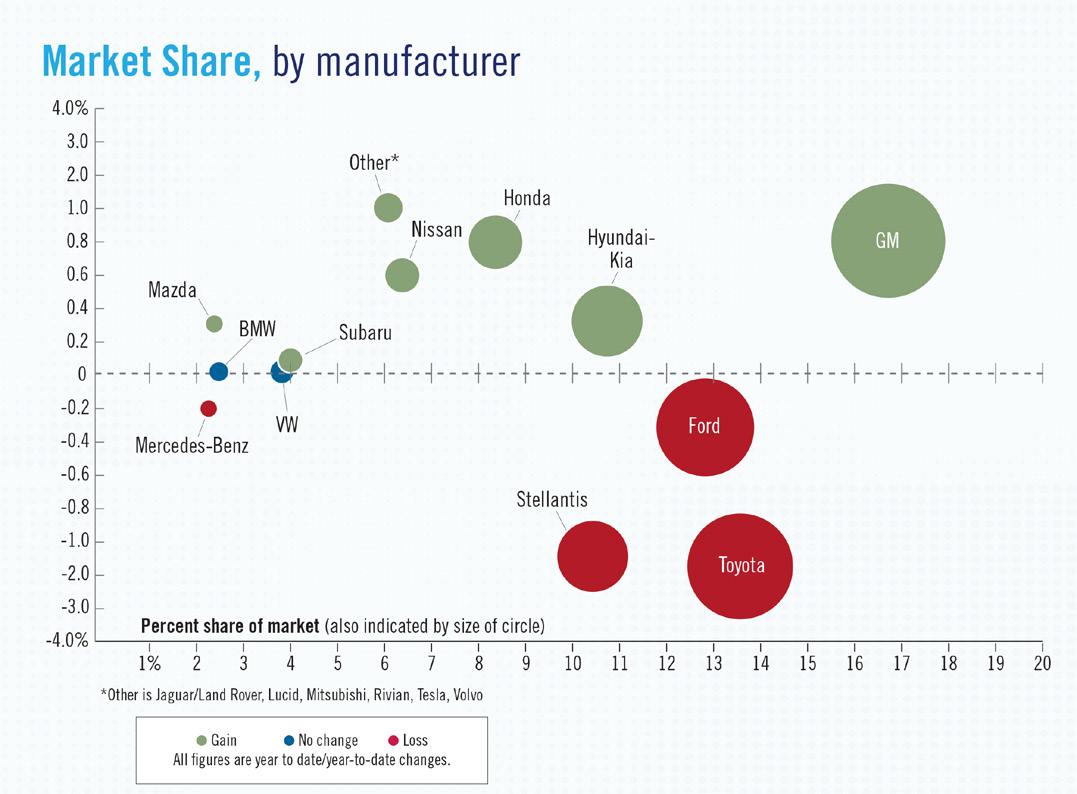

Strong new light-vehicle sales last month helped end the first half of the year on a high note. The June 2023 SAAR totaled 15.7 million units, an increase of 20.2% compared with the June 2022 SAAR. Raw sales volume in June 2023 was 1.37 million units, raising total sales volume for the first half of the year to 7.66 million units—up 13% compared with the first half of 2022. According to Wards intelligence, fleet sales were 18% of June 2023 volume, up from 16% in June 2022. Wards estimates that retail sales increased 7.6% year-over-year the first half of 2023, while fleet sales increased 45% over the same period.

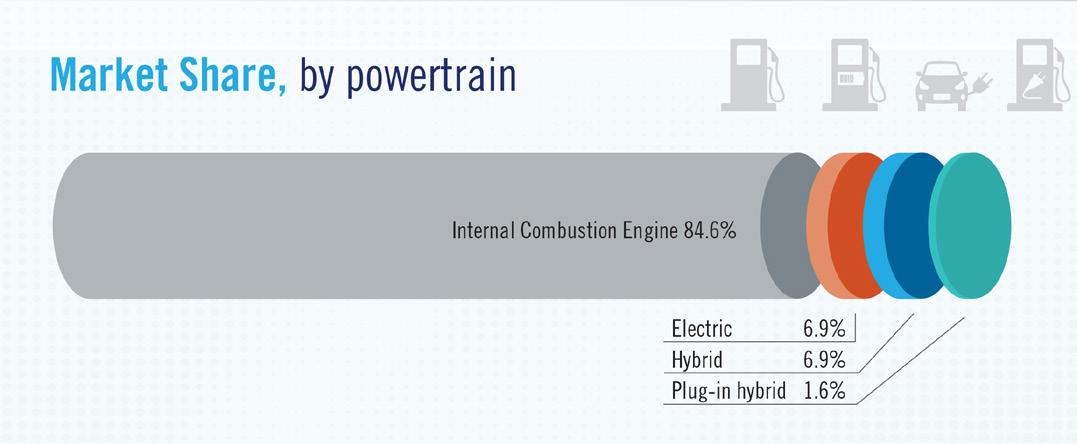

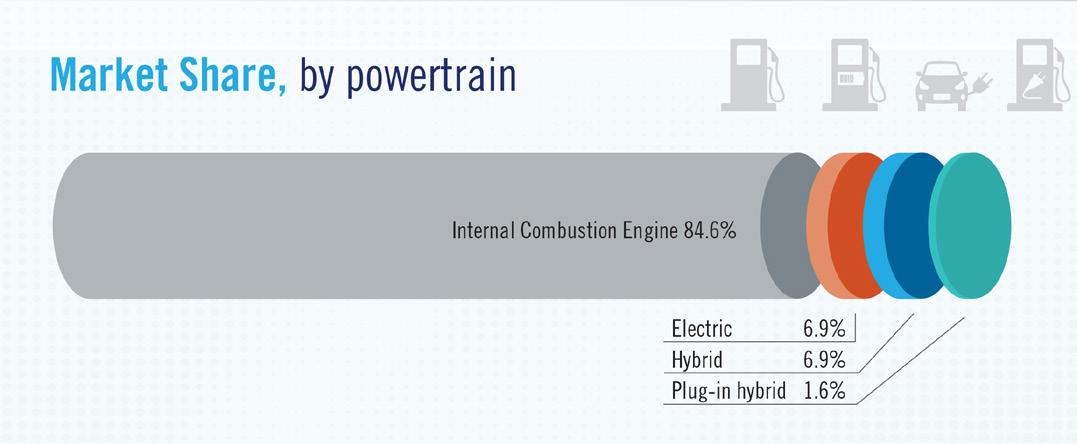

Alternative fuel vehicles gained market share the first half of the year with sales of battery electric vehicles (BEVs), plug-in hybrids and hybrids comprising 15.4% of all new light vehicles sold. BEVs alone represented 6.9% of all new light-vehicle sales, up from 4.9% of sales the first half of 2022. Crossovers — at 46.6% of all new light-vehicles sold during the first half of the year — remained the most popular segment.

Improving new-vehicle availability helped drive the sales increases. New light-vehicle inventory on the ground and in-transit totaled 1.81 million units at the start of June 2023. We expect

month-end inventory for June 2023 will increase slightly compared to the beginning of the month. Manufacturer incentive spending has increased incrementally as inventory has improved. According to J.D. Power, average incentive spending per unit is expected to total $1,798 in June 2023, up only slightly compared with May 2023 but a significant 95.9% increase compared with June 2022. J.D. Power also notes that leasing discounts have improved in recent months. In June 2023 leasing should account for 21% of new-vehicle retail sales, an improvement from the low of 16% in September 2022 but still below the pre-pandemic lease penetration of 30% in June 2019.

After a pause at its June meeting, the Fed has signaled it will increase the Fed Funds Rate further in coming months. These higher rates will be a headwind for new-vehicle sales. But there is still pent-up demand from retail and fleet customers, and high used-vehicle values will help consumers with their trade-in values. We expect new light-vehicle sales in the second half of the year to be similar to the first half. As a result, we have increased our overall 2023 forecast to 15.2 million units.

JUNE 2023 Massachusetts Auto Dealer www.msada.org 26

t APriL 2023

Patrick Manzi NADA Senior Economist Boyi Xu Economist

www.msada.org Massachusetts Auto Dealer JUNE 2023 27 MSADA MA r K et B e At

Electric Vehicle Push Sparks Global Trade Tensions

By Cody Lusk President & CEO, American International Auto Dealers Association

The federal government’s plan to dramatically expand electric vehicles adoption in the United States remains clear as mud here in Washington, D.C., and so it is no surprise that our government’s bewildering and sometimes conflicting approach to green vehicles is sparking concerns abroad.

First, some provisions in last year’s massive Inflation Reduction Act (IRA) spending bill are so blatantly protectionist of domestic electric vehicle production that they have all but forced foreign governments, including some of our closest allies, to threaten reprisals. For example, only vehicles assembled in countries that have existing free trade agreements with the United States are eligible to be included in the EV tax credit program. Currently excluded are the European Union and its 27 member countries and the United Kingdom, just to name a few. In a late attempt to remedy this issue, Katherine Tai, the United States Trade Representative is negotiating smaller, sector specific agreements with other countries to address these concerns.

The global impact of the IRA does not end there. Next year, a provision will go into effect disqualifying any vehicle from the credit if any of its battery components come from a foreign entity of concern (i.e., China or Russia). In 2025, a vehicle can also be ineligible for the credit if any of the critical minerals come from a foreign entity of concern. As there is currently only one active lithium mine in the United States,

industry experts anticipate that this will be a real challenge for manufacturers and suppliers.

So how are world leaders responding to Congress’ exclusionary EV tax credits? About as well as you might expect. Earlier this month, French President Emmanuel Macron announced that France will establish measures aimed at promoting EV purchases and exclusively benefitting European manufacturers by the end of this year, and he called on other EU leaders to do the same. Meanwhile, the European Commission, along with South Korea, Japan, and China, has taken its concerns over the United States’ green subsidies to the