The official publication of the Massachusetts State Automobile Dealers Association, Inc

Privacy #1

Guardian

Workforce

Create

Safety Stay

Schedule

St A ff Directory

Robert O’Koniewski, Esq. executive Vice President rokoniewski@msada.org

Jean Fabrizio wwwDirector of Administration jfabrizio@msada.org

Auto De A ler MAg A zine

Robert O’Koniewski, Esq. executive editor MSADA o ne McKinley Square Sixth f loor Boston, MA 02109

Subscriptions provided annually to Massachusetts member dealers. All address changes should be submitted to MSADA by e-mail: jfabrizio@msada.org

Directory

2 ethos group, 41 gW Marketing Services, 29 Merchant Advocate, 25 nancy Phillips, 23 reynolds & reynolds, 26 Sprague energy, 33 Withum, 45

rAteS inquire for multiple-insertion discounts or full Media Kit. e-mail jfabrizio@msada.org

Manufacturers Appealing to the Dept. of Justice to undermine State franchise laws

compliance corner – is the Verbal Authorization you obtained Effective?

oPs: My Dealership Has Data everywhere…How Do i Control It?

oPs: the Salesperson’s Playbook – four Behaviors that Drive

UPdAte: nADA President Addresses MSADA Annual Meeting

By Jeb Balise, MSADA President

I want to thank all our dealers who took the time out of your busy schedules to attend this year’s MSADA Annual Meeting on October 10 at the Encore Hotel and Casino in Everett. And for those who brought along a GM or another key manager, thank you doubly for that commitment.

From the feedback I have heard, you enjoyed a thought-provoking and engaging program with your fellow dealers with the strong support of our associate members as well.

We have had quite a few political successes here and in D.C. this year, but there are always challenges to our industry on the road ahead – tariffs, manufacturers’ efforts against the franchise system, data privacy and transactional legal compliance, just to name a few.

I also extend my thanks on behalf of the Association to our Annual Meeting sponsors, who we have also recognized in this month’s issue.

And as always, my sincere thanks to Executive Vice President Robert O’Koniewski and Jean Fabrizio on our Association team who put together another fantastic event. We heard a lot of valuable information, ideas, and opinions in one of the most luxurious spots in the area.

Those moments when we are all in the same room are too few, and it is a crucial reminder that, while we compete day in and day out, we need to present a united front to face the challenges coming at us from all directions.

We have had quite a few political successes here and in D.C. this year, but there are always challenges to our industry on the road ahead – tariffs, manufacturers’ efforts against the franchise system, data privacy and transactional legal compliance, just to name a few. As we come together, we are stronger to prepare for the uncertainties ahead. Finally, November represents the start of the holiday season when our commitment to community and family is enhanced. Dealers are a giving lot and the first to be called upon to help at food banks, community centers and shelters, and hospitals to assist the less fortunate in our cities and towns during the Thanksgiving, Christmas, and Hanukah seasons. So many benefit from all you do in your hometowns, at your dealerships, and for your association throughout the year. I am looking forward to ending 2025 on a strong note as we prepare for an exciting 2026.

Barnstable County

Brad tracy, tracy Volkswagen

Berkshire County

Brian Bedard, Bedard Brothers Auto Sales

Bristol County

richard Mastria, Mastria Auto group

Essex County

William Deluca iii, Bill Deluca family of Dealerships

Paul Bertoli, Priority chryslerJeep Dodge ram

Franklin County [open]

Hampden County

Jeb Balise, Balise Auto group

Hampshire County

Bryan Burke, Burke chevrolet

Middlesex County frank Hanenberger, MetroWest Subaru

Norfolk County

Jack Madden, Jr., Jack Madden ford charles tufankjian, toyota Scion of Braintree

Plymouth County

christine Alicandro, Marty’s Buick gMc isuzu Suffolk County [open]

Worcester County

Steven Sewell, Westboro chrysler Dodge ram Jeep

Steve Salvadore, Salvadore Auto

Medium/Heavy-Duty Truck Dealer

Director-at-Large [open]

Immediate Past President

chris connolly, Jr., Herb connolly chevrolet NADA Director

Scott Dube, Mcgovern Hyundai rt.93

President, Jeb Balise

Vice President, Steve Sewell

Treasurer, Jack Madden, Jr. Clerk, c harles tufankjian

ACV Auctions

Steve Sirko (856) 381-3914

ADESA

Elizabeth Morich (508) 270-5400

Albin, Randall & Bennett

Barton D. Haag (207) 772-1981

Allied Recycling Center

Joseph Castaneda (781) 316-7180

Ally

Maryanne Recupero (617) 997-9574

American Fidelity Assurance Co.

Kathleen Weisenbach (402) 523-5945

America’s Auto Auction Boston

Chris Colocousis (774) 218-8930

ArentFox LLP

Paul Marshall Harris (617) 973-6179

Sarah Decatur Judge (617) 973-6184

Armatus Dealer Uplift

Joe Jankowski (410) 391-5701

Auto Auction of New England

Steven DeLuca (603) 437-5700

Bank of America Merrill Lynch

Stephen Delaney (781) 981-9370

Nancy Price (781) 534-8543

BCI Financial Corp.

Timothy Rourke (860) 302-7127

Bellavia Blatt

Leonard Bellavia (516) 873-3000

Bernstein Shur

Nicholas Higgins (207) 228-7191

Broadway Equipment Company

Fred Bauer (860) 798-5869

Cambridge Trust

David Sawyer (617) 620-3484

CBIZ

Nichole Rene (203) 781-9690

CDK Global

Rob Steele (508) 564-1346

Citrin Cooperman

Ron Masiello (508) 757-3311

Clifton Larson Allen

Nick Chappell (508) 930-2199

Cooperative Systems

Scott Spatz (860) 250-4965

Cox Automotive

Polly Penna (303) 981-1298

CVR

John Alviggi (267) 419-3261

Dave Cantin Group

Woody Woodward (401) 465-7000

Shannon Wischmeyer (636) 293-8038

Downey & Company

Paul McGovern (781) 849-3100

DP Sales Distributors

Andrew Prussack {631) 842-7549

Driving Dealer Performance

Kimberly Guerin (978) 760-0322

EasyCare New England

Greg Gomer (617) 967-0303

eDealer Services, LLC

Tom McKinnon (617) 631-3293

Ethos Group, Inc.

Drew Spring (617) 694-9761

EVready Energy

Chris Nihan (978) 406-1578

Federated Insurance

Kevin Sundberg (559) 547-9694

Fisher Phillips LLP

Jeff Fritz (617) 532-9325

Josh Nadreau (617) 532-9323

Freedom Solar Power

Ryan Ferrero (970) 214-4433

GW Marketing Services

Gordon Wisbach (857) 404-0226

Harris Beach Murtha Cullina

Thomas Vangel (617) 457-4072

Hilb Group

James Pietro (508) 791-5566

Huntington National Bank

Mark Flibotte (781) 724-3749

JM&A Group

Chris “KC” Hwang (954) 415-6961

Key Bank

Tom Flynn (716) 998-6247

M & T Bank

John Federici (401) 642-5622

Maverick Document Signings

Lisa Spring (310) 739-6967

McWalter Volunteer Benefits Group

Shawn Allen (617) 483-0359

Merchant Advocate, LLC

Dan Giordano (973) 897-2778

Mintz Levin

Kurt Steinkrauss (617) 542-6000

Nancy Phillips Associates, Inc.

Nancy Phillips (603) 658-0004

National Business Brokers

Peter DiPersia (603) 881-3895

National Grid

Nicole Caruso-Carlin (347) 426-6331

NEAD Insurance Trust

Charles Muise (781) 706-6944

Northeast Dealer Services

Johna Cutlip (401) 243-7331

OCD Tech

Michael Hammond (844) 623-8324

Performance Brokerage Services

Jacob Stoehr (847) 323-0014

Performance Management Group, Inc.

Dale Ducasse (508) 393-1400

Piper Consulting

Jim Piper (207) 754-0789

Plug In America

Joel Levin (237) 925-1364

Pozerski Hatch & Company

Chris Ernst (781) 953-3627

Pullman & Comley LLC

James F. Martin, Esq. (413) 314-6160

Reynolds & Reynolds

Austin Ziske (802) 505-0016

Rockland Trust Co.

Joseph Herzog (508)-830-3241

Santander Bank

Richard Anderson (401) 432-0749

Chris Peck (508) 314-1283

Schlossberg, LLC

Michael O’Neil, Esq. (781) 848-5028

Southern Auto Auction

Joe Derohanian (860) 292-7500

Sprague Energy

Steve Borelli (508) 768-5252

The Towne Law Firm P.C.

James T. Towne, Jr. (518) 452-1800

TrueCar

Lauren Bailey (703) 909-1625

Truist

Andrew Carmer (401) 409-9467

Twelve Points Wealth Management

Taylor Duffy (978) 318-9500

Wells Fargo Dealer Services

Rich DeFreitas (857) 205-2780

Withum

Kevin Carnes (617) 471-1120

Zurich American Insurance Company

Steven Megee (774) 210-0092

By Robert O’Koniewski, Esq.

MSADA Executive Vice President rokoniewski@msada.org

Follow us on X (formerly Twitter) • @MassAutoDealers

Since the founding of our Association in 1940, arguably the most important event for your Association each year is our Annual Meeting of the Members. At that time, our member dealers and associate members convene as a group and set aside their competitive spirits for a few hours. We do this to listen to a roster of interesting speakers offering varied perspectives on our industry and the current political atmosphere. We also enjoy the camaraderie of our fellow businessmen and women facing the shared challenges today’s economic and political climates present to us. For this one event, we all can truly say we are united as a body to promote the franchised auto dealer system.

On Friday, October 10, your Association convened its Annual Meeting at the Encore Boston Harbor Hotel and Casino in Everett – a fantastic venue that matches the quality and allure of its sister facility in Las Vegas.

This year we had a successful turnout of members, and attendees heard from a diverse group of speakers, including:

• Your MSADA President, Jeb Balise kicked the day off with his perspectives on the current state of our industry and the political environment;

• Massachusetts NADA Director Scott Dube along with NADA President and CEO Michael Stanton;

• Our featured speaker, Jason Stein, Managing Director of the Presidio Group, spoke on “A Crystal Ball on the Road Ahead: From Wild Challenges to Massive Changes”;

• Mark Strand, Senior Director, Economic and Industry Insights, at Cox Automotive, provided an economic outlook for the short- and long-term

situations;

• The Registrar of Motor Vehicles, Colleen Ogilvie, along with RMV COO Niren Sirohi, provided an update on current happenings at the RMV and answered questions from dealer attendees regarding various matters;

• Attorney Terry Flynn, partner at Harris Beach Murtha Cullina, spoke on “Driven to Comply: Recent Enforcement Trends Targeting Auto Dealers”;

• Don Giordano, Business Development, Merchant Advocate, with whom MSADA has an endorsement agreement for assisting dealers in addressing credit card costs and fees;

• Shawn Allen of One Digital spoke on “Reducing Health Care Costs at Your Dealership”;

• Steve Borelli, energy portfolio manager at Sprague Energy, an MSADA endorsed partner, presented on “Take Control of Your Dealership’s Energy Costs”;

• Chris Nihan, President of EVready Energy, presented on “Removing EV Charging Headaches and Reducing Electricity Delivery Costs”; and

• I gave a government affairs report on several legislative and regulatory matters dealers should be aware of for the end of 2025 and heading into 2026.

Following the meeting, attendees adjourned to our cocktail reception sponsored by Harris Beach Murtha Cullina to refresh and rejuvenate before hitting the Encore’s restaurants and gaming tables.

We cannot have such successful events without the strong support of our sponsors. We owe a huge “thank you” to this year’s event sponsors:

Diamond Sponsors

• ComplyAuto

• TrueCar

Platinum Sponsors

• Albin, Randall & Bennett

• CVR

• Sprague Energy

• Withum

• Zurich

Gold Sponsors

• Arent Fox Schiff

• Bank of America

• Cox Automotive

• Wells Fargo

Silver Sponsors

• Armatus

• Cooperative Systems

• DealerPay

• Huntington Bank

• Reynolds & Reynolds

• Santander

Bronze Sponsors

• ACV

• Citrin Cooperman

• EVready Energy

• GW Marketing

• Merchant Advocate

• National Grid

• One Digital

• Performance Brokerage Services

Welcome Reception Sponsor

• eDealer Services

Break Station Sponsor

• Downey & Co.

Cocktail Reception Sponsor

• Harris Beach Murtha Cullina

Wi-Fi Sponsor

• TrueCar

Check out more from our annual meeting on page 16.

On October 14, the Joint Committee on Consumer Protection and Professional Licensure held a hearing on bills affecting the automotive industry, including several that legislators filed for us. Bills we testified in favor on:

• House 406 (Hunt) and Senate 201 (Crighton): An Act Further Regulating Business Practices Between Motor Vehicle Dealers, Manufacturers, and Distributors. These bills would amend several provisions in MGL Chapter 93B, the Massachusetts Automobile Dealer Franchise Law, to address issues that have arisen in the dealer-manufacturer franchise relationship. Every state has a dealer franchise law. First passed in 1970, the law exists to enable the dealership model to ensure robust competition on vehicle pricing and selection but also efficient, highly trained vehicle servicing and repair. Issues arise over time within the franchise relationship that the parties attempt to address with statutory amendments; for example, the law went through an extensive re-write in 2002 and was amended in 2012. The Committee reported favorably an amended version in 2020. These bills would address the following:

• Prohibit a manufacturer from requiring a dealer to purchase goods or services from a vendor designated by a manufacturer, when upgrading their dealership facilities, without making available to the dealer the option to obtain the goods or services of substantially similar quality from a local vendor chosen by the dealer;

• Limit a manufacturer’s requirement for a dealer to upgrade or reconstruct the dealership to once every 10 years;

• Protect dealers from manufacturers that penalize dealers for vehicles that a buyer exports without the dealer’s knowledge;

• Prohibit additional vehicle surcharges by a manufacturer to pay for warranty repairs that are already included in the price of the vehicle when purchased by the dealer from the manufacturer. These surcharges increase the cost of the vehicles for consumers;

• Prohibit a manufacturer from restricting its franchised dealers from selling service contracts not exclusive to the manufacturer; dealer must provide consumer notice that the non-factory service contract is not backed by the

dealer’s franchisor;

• Prohibit a manufacturer from competing with its franchised dealers by directly or indirectly offering leases or subscription rentals of vehicles of the same line-make as those sold by its franchised dealers in the Commonwealth;

• Protect dealers from a manufacturer unreasonably altering the dealer’s area of responsibility and then using that change to take adverse action against the dealer for failure to penetrate the new market within 18 months;

• Require a vehicle manufacturer to provide information to a consumer of any accessory or vehicle function that will be updated or initiated over the air by the manufacturer and the cost to the consumer;

• Require a manufacturer, under the warranty/recall reimbursement section, to provide reasonable compensation to a dealer who performs an over-the-air repair for customer at the dealership on behalf of the manufacturer; and

• New Section 2 would strengthen the current language in law that requires manufacturers to reimburse dealerships at retail amounts for labor and parts in warranty and recall repairs. Recently, manufacturers have begun to engage in efforts to reduce the reimbursement rates, in a manner that does not comply with current law. The proposed language would amend the law to further restrict these efforts to re-affirm compliance with job times, labor rates, and parts costs.

• House 424 (Lewis) and Senate 202 (Crighton): An Act Relative to Consumer Protection on Online Automobile Franchise Transactions. These bills would modernize the motor vehicle purchase process and the three-day right of cancellation statute covering off-site sales to deem contracts, which are executed via an automobile dealership’s online portal, to be considered as executed as part of the dealership’s physical place of business. The Committee reported these bills favorably in the last two sessions.

• House 398 (Howitt): An Act Relative to the Disclosure Notice in the Right to Repair Motor Vehicle Data Law. This bill would amend current law to remove the onus of the consumer disclosure requirement from the dealer and place it on the vehicle manufacturer, who made the vehicle and knows all of its technological characteristics. The Mass. AG began enforcement of this disclosure requirement in June 2023.

• House 342 (Chan), House 365 (Finn), and Senate 271: An Act Relative to the Issuance of a Class 1 Dealer License. These bills would create a process to appeal an allegedly improperly issued class 1 license to a party that is not a franchised vehicle dealer.

• Senate 266 (Moore): An Act Relative to Custom-Built Heavy-Duty Vehicles Sold in the Commonwealth. The bill would restore the treatment of custom-built heavy-duty trucks back to its pre-2020 status under the right to repair law; namely, such trucks built to custom specifications would not be required to comply with the requirement for an inter-operable, standardized, and open access platform. Bills we opposed:

• House 373 (Galvin): An Act Relative to the Financing of Motor Vehicle Purchases. MSADA opposes this legislation as it would prevent a dealer from providing a consumer potentially better financing terms or options than those which the consumer may think he or she has with his or her own sources.

• Senate 259 (Montigny): An Act to Protect Consumers from Hidden Car Subscription Service Fees. MSADA opposes this bill. It is overly broad in scope and is improperly aimed at auto dealers. It is the motor vehicle manufacturers that have begun in recent years to create more additional subscription charges for vehicle functions that were typically included as a standard feature of a vehicle at the time of purchase. As the vehicle manufacturers explore new methods of revenue enhancement, consumers can expect to see more standard

functions moved into the realm of subscription service. Finally, the Massachusetts Attorney General promulgated regulations that took effect on September 2 regulating junk fees, such as improper subscription charges.

• House 472 (Vaughn): An Act Relative to Furthering Dealership Transparency. MSADA opposes this bill as it is unclear the legislative intent. The information that seems to be sought could be found on a dealership’s website, if such information was relevant. It is unclear as to why such information regarding other dealerships should be provided at a dealership.

On October 22, the Joint Committee on Financial Services held a hearing on bills affecting the auto body labor rates and the long-time inadequacy in which insurers in the Commonwealth presently reimburse repairers for labor costs on insurer-paid auto body repair work. We testified in favor of:

• House 1260 (Rep McMurtry), An Act Establishing the Fair Calculation of Labor Rates Paid by Insurance Companies to Auto Repairers in the Commonwealth;

• House 1285 (Rep Philips), An Act Relative to the Calculation of Labor Rates Paid by Insurance Companies to Auto Repairers in the Commonwealth; and

• Senate 797 (Sen Moore), An Act Reforming Auto Body Labor Rates.

The overhead costs of auto body repair facilities have increased substantially, without restraint, in every category of expense over the last two decades. During that time, repairers have seen minimal increases in the reimbursed labor rate, which have not kept pace with all other business expenses. A suppressed rate adversely impacts the vitality of repair businesses in an extremely challenging economic situation. As a result, repair shops have closed, struggled to find skilled workers, or been unable to recruit new technicians. That means vehicle owners across the Commonwealth have a difficult time finding a body repair shop that can do the work and in a timely manner.

After over two decades of legislative

public hearings and the investigations of two special commissions, including two public hearings conducted under the auspices of the 2021-2022 special commission, it is disappointing but not surprising given past history that the insurance companies have yet to acknowledge that a problem exists in this industry. It is evident that, as far as they are concerned, they are quite content with a system that artificially suppresses the labor rate reimbursement amount in a manner that can best boost their profits while keeping overhead costs as low as possible. Unfortunately, those who operate auto body repair facilities, in arguably one of the most expensive states in the nation in which to conduct business, do not have that luxury of suppressing other cost factors in their businesses in order to ensure large profit margins. In fact, based on the current economics of the collision repair industry, it is virtually impossible for any new collision repair entrepreneurs to enter the business with any realistic expectation of success, leaving the arena to the few legacy collision repairers already in the business.

For over twenty years this Association, in tandem with our sisters and brothers in the independent auto body repair industry, has advocated for reform on this subject matter. Years of bill filings and now two special commissions have failed to move the needle measurably on the reimbursed rate, to the point that Massachusetts rests securely at the BOTTOM nationally of the average labor rate reimbursement to repairers. Additionally, it has always amazed us that a system that allows for reimbursement at a level that is a fraction of a repairer’s posted retail rate for customer-pay work is allowed to exist, all to the benefit of the insurance companies, whose profits continue to grow unabated each year. The repair industry, in effect, subsidizes the insurance companies’ multi-billion-dollar profit margins. Meanwhile, customer wait-times to get into a shop and for the repairs to be completed have grown, in the face of increased insurance premiums and as repair shops continue to close their operations. Those delays have,

in turn, forced consumers to face costly car rental fees as wait-times for repairs stretch out from weeks to months.

Coming off the completion of the most recent 2021-2022 special commission, the Legislature passed, and Governor Healey signed into law, in November 2024, the creation of a 14-person advisory board, co-chaired by the state Commissioner of Insurance and the Massachusetts Attorney General and consisting of key industry stakeholders, including a member selected by MSADA. The advisory board is directed to survey auto body shops and assess this issue, including a review of labor rates in neighboring states, Massachusetts body shop costs and labor expenses, vocational-technical school trends and work force data, insurance premiums, inflation data, and any additional information the advisory board requests. The advisory board has held several meetings this year, and it is required to file its recommendations with the Division of Insurance and the Legislature by December 31, 2025.

As a result of this legislative pressure, the insurance companies have started to throw minimal bones to body shops in the form of modest reimbursement increases, to the point that the average reimbursement level is around $45 per hour, which still is well below repairers retail rate for customer-paid work and helps Massachusetts to maintain its status as lowest in the country. Keep in mind, the 10% increase that the insurance industry takes pride in is based on an already woefully tamped down amount; a 10% hike on what was a $40 per hour rate is only $4 as employee, utility, technology, equipment, and other facility overhead expenses far exceed the crumbs thrown to repairer operations.

The creation of the advisory board is a step in the right direction for our industry. However, it is charged with only making a one-time final report, with any recommendations, by the end of this year. Senate 797 would make permanent the advisory board and give it the power to set annually an appropriate reimbursement labor rate for the body shops.

MSADA also strongly supports a sim-

ple solution, as provided in House 1260 and House 1285. These bills would use as a starting point a calculation of the repairer’s posted retail labor rate as the level at which compensation should occur. The calculation is similar to that which is used under MGL Chapter 93B to calculate a dealer’s labor rate for reimbursement by a franchisor for warranty and recall work performed pursuant to a franchise agreement. The proposed process in these two bills is grounded in current statute and recognizes a repairer’s true labor compensation for the work in which they have made considerable investments in equipment, facilities, training, and personnel.

A repressed labor rate is fundamentally anti-consumer and hinders the economic viability of the repair industry. Massachusetts has the lowest labor reimbursement rate for insurance-paid auto body repairs in the country. Our rate here is unilaterally set by each individual insurance company; as a result, the rate has seen a minimal increase over the last 20+ years. The national labor rate reimbursement average is almost $20 per hour more than in Massachusetts. As a result, repair shops have closed, struggled to find skilled workers, or been unable to recruit new technicians. That means vehicle owners across the Commonwealth have a difficult time finding a body repair shop that can do the work and in a timely manner

Beginning on October 29, 2025, under Chapter 141 of the Acts of 2024, which Gov. Maura Healey signed into law on July 31, 2024, employers with 25 or more employees must post pay ranges alongside job openings. Additionally, the new law requires employers with more than 100 employees to file copies of federally required equal employment data with the Secretary of State’s office, which would then be forwarded to the Executive Office of Labor and Workforce Development.

The Attorney General has enforcement authority and can impose fines or civil citations for violations of the law. The AG also

is charged with conducting a public awareness campaign around the new rules. Finally, the law provides protections for employees against retaliation for asking for salary ranges when applying for a job or promotion.

Please reference MSADA Bulletins #143 (10/29/25) and #28 (2/20/25) for additional specifics regarding the law.

[The National Automobile Dealers Association provided the following information.]

The Environmental Protection Agency (EPA) has modified its Electronic Manifest (e-Manifest) system to further phase out paper manifests. By December 1, 2025:

• Small and large quantity hazardous waste generators that ship hazardous waste off-site must register for access to e-Manifest in order to obtain final signed manifest copies and for other reasons. Obtaining a final signed manifest helps document that an off-site shipment of hazardous waste got to its intended destination.

• Most dealerships that ship hazardous waste off-site are Small Quantity Generators (SQGs) or Very Small Quantity Generators (VSQGs). VSQGs generally are exempt from EPA’s manifesting mandates, but many states and most hazardous waste transporters and treatment, storage, and disposal facilities (TSDFs) require manifesting regardless.

A dealership that ships hazardous waste off-site typically can (and should) rely on the manifesting instructions of its transporter.

EPA’s rule also requires that exception, discrepancy, and unmanifested waste reports be integrated into e-Manifest. By requiring hazardous waste generators, including dealerships, to use the e-Manifest system and by eliminating the mandate that TSDFs directly provide hazardous waste generators with final signed copies of hazardous waste mani-

fests, EPA aims to reduce regulatory costs and burdens while enhancing regulatory benefits.

Dealerships that ship hazardous waste off-site should ensure that they are registered for e-Manifest. They also should maintain an account with Site Manager or e-Manifest Certifier permissions to access final signed manifests and to submit post-receipt data corrections and exception reports electronically via e-Manifest.

Check out MSADA Bulletin #142 (10/27/25) for more information.

The Veterans Day holiday, celebrated this year on Tuesday, November 11, is considered a restricted holiday. This means:

• An employee cannot be required to work.

• An employee cannot be punished or penalized for choosing not to work on the day.

• If the dealership is going to be open prior to 1:00 p.m. on the day, a local permit is required.

• REMINDER: As of January 1, 2023, under state law, there is no holiday premium pay requirement. Non-exempt employees, if working the day, need to be paid at least the state minimum wage of $15 per hour for any hours worked the day.

• For employees who do not work on the holiday, there is no legal requirement to provide a paid holiday. However, be sure to review your holiday policies in your Employee Handbook to determine whether you have previously agreed to paid holidays. If you have, you will need to follow your policies until they are revised.

Our PACs - NADAPAC & NCDPAC

We appreciate the contributions we receive from our member dealers who answer our calls for donations to our PACs. Each year MSADA expresses itself po-

litically through NADA’s federal PAC, NADAPAC, and through our state PAC, the New Car Dealers Political Action Committee (NCDPAC). We depend on contributions from our dealers to keep these PACs strong, as we need to have an active voice in Washington and on Beacon Hill. Contributions to our PACs are an inexpensive insurance policy. Since by law we cannot use our membership dues or other association revenues for political contributions, the PACs help us to remain strong politically as we advocate for our dealers’ interests in the political process.

If you have not yet given to the PACs this year, please contact me at rokoniewski@msada.org and we can make sure your contributions happen. Thank you.

Your Association has engaged several vendors this year for newly agreed upon endorsed services:

• Merchant Advocate works with retailers to analyze the credit card fees those businesses are charged and assessed in processing transactions. The savings can be considerable, as Merchant Advocate uncovers duplicate or unsubstantiated fees from the credit card companies. Over the last several years, they have saved retailers across the country over $400 million.

• Plug In America, through its PlugStar program, works with dealerships to train personnel, including salespersons, to be able to best address your customers’ needs and questions regarding electric vehicles. They presently work with dealerships in over 30 states to assist dealerships in the transition to EV sales and servicing.

• ComplyAuto works with dealers’ compliance efforts on privacy and cybersecurity platforms, FTC Safeguards Rule, advertising, AI-powered sales, workplace safety and OSHA-related rules, and HR policies and employee training.

• Sprague Energy works with businesses to analyze their electric and gas charges in an attempt to provide them with re-

duced charges for such services. Sprague works with a number of Massachusetts dealerships currently in those efforts. In addition, we want to remind you of several vendors who have been long-time partners of your Association:

• Ethos Group, who can improve your F&I products, services, and compliance.

• Reynolds & Reynolds, who, through its LAW Library program, is our partner for forms sales and compliance.

• Withum (formerly O’Connor & Drew), who is our accounting partner.

• American Fidelity, who can assist you with health and other insurance-based benefit products for your employees. Check out the ads for most of these companies in this month’s Auto Dealer magazine. For more information, feel free to contact me at rokoniewski@msada.org.

–Nov. 11, 10am

Join us on Tuesday, November 11, at 10:00 a.m. ET, as we put on our next instalment of our 2025 “Coffee with Coopsys” webinar series from our associate member, Cooperative Systems.

Coopsys works with businesses to increase their IT knowledge and understanding. The “Coffee with Coopsys” program is a series of brief webinars (no longer than 15 minutes for your morning break) we provide to our members to expand upon and improve their experiences regarding IT issues and dealership best practices.

Understanding and Mitigating Insider Threats in Auto Dealerships: Not all cyber risks come from outside hackers. Sometimes the biggest threats are closer than you think. Join us on November 11 for a practical session on recognizing and reducing insider risks in your dealership— from accidental data leaks to malicious activity. Learn how to build policies, train your team, and put safeguards in place to keep your business and customer data secure.

You can register at www.coopsys.com/ msada to secure your spot!

S201

H406

H398

S271

H342

H365

S202 H424

Amendments to Ch. 93B, the auto dealer franchise law.

Rep Chan

Rep Finn Rep Howitt

S291 H474

Sen O’Connor

RTR Law amendment to fix consumer notice requirement.

Creates process to appeal improperly issued Class 1 license.

Sen Crighton Rep Lewis

Modernize on-line vehicle purchase process.

S266 Sen Moore Amends definition of heavy-duty trucks in RTR law.

Sen Velis

Rep Walsh Open safety recalls notifications.

S228 Sen Feeney Protects consumer choice in vehicle service contracts.

S797 H1260

H1285

H1293

H1139 S812

Sen Moore Rep McMurtry Rep Philips

Sen Crighton Rep Hunt Rep Puppolo

Rep Donahue

Sen Oliviera

H3406 S2185 Rep Puppolo

Sen Moore

Creates process to increase the insurance reimbursed labor rate paid to auto body repairers.

Protects consumer choice in vehicle service contracts.

Regulates motor vehicle servive contracts

Creates process to delay ACT.

Joint Committee on Consumer Protection held public hearing on 10/14/25.

Joint Committee on Consumer Protection held public hearing on 10/14/25.

Joint Committee on Consumer Protection held public hearing on 10/14/25.

Joint Committee on Consumer Protection held public hearing on 10/14/25.

SUPPORT Joint Committee on Consumer Protection held public hearing on 10/14/25.

SUPPORT Joint Committee on Consumer Protection held public hearing on 4/14/25. H4284, redraft of H474, reported favorably and referred to House Ways and Means.

SUPPORT Joint Committee on Consumer Protection held public hearing on 10/14/25.

Joint Committee on Financial Services held public hearing on 10/22/25.

Joint Committee on Financial Services held public hearing on 5/13/25.

SUPPORT Joint Committee on Financial Services held public hearing on 5/13/25.

SUPPORT Joint Committee on State Administration held public hearing on 7/22/25.

H2386

H3535

Rep Muradian

Rep Muradian

H3572 Creates process to delay ACC II and ACT.

Rep Soter

S2360

Sen Cronin

H3603 Eliminates initial state inspection for new vehicle.

Rep Arciero

SUPPORT Joint Committee on Telecommunications, Utilities and Energy held public hearing on 5/14/25.

SUPPORT Joint Committee on Transportation held public hearing on 5/13/25. H3603 reported favorably and referred to House Ways and Means.

H3690 Rep Howitt Limit doc prep fee to $400. OPPOSE Joint Committee on Transportation held public hearing on 5/13/25. Reported favorably and referred to House Ways and Means.

H3676

H3677

S2371

S2374

H78

H80

H104

S29

S33

S45

Rep Gregoire

Rep Gregoire

Sen DiDomenico

Sen DiDomenico Establishes requirements for e-titles and e-signatures on RMV and sales docs.

Rep Farley-Bouvier

Rep Hogan

Rep Vargas

Sen Creem

Sen Driscoll

Sen Moore

SUPPORT Joint Committee on Transportation held public hearing on 5/13/25.

Mass. Consumer Data Privacy Act OPPOSE Joint Committee on Advanced Information Technology, the Internet and Cybersecurity held public hearing on 4/9/25. Redraft S2516 reported favorably on 5/12/25, referred to Senate Ways and Means. On 9/25/25, Senate passed S2619. which was referred to House Ways and Means.

MSADA Executive Vice President

RMV Updates

Colleen

Ogilvie

Registrar, Massachusetts Registry of Motor Vehicles

Jeb Balise

Balise Auto Group

MSADA President

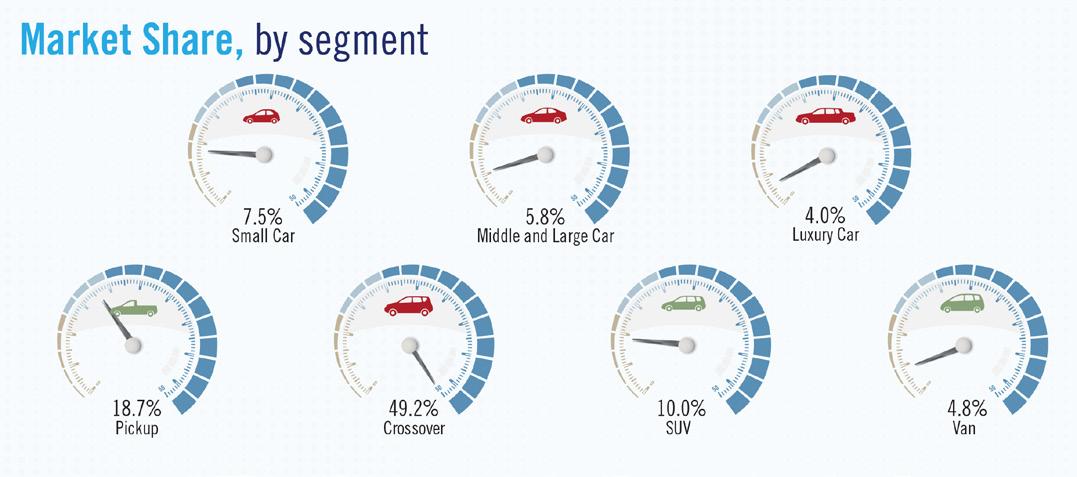

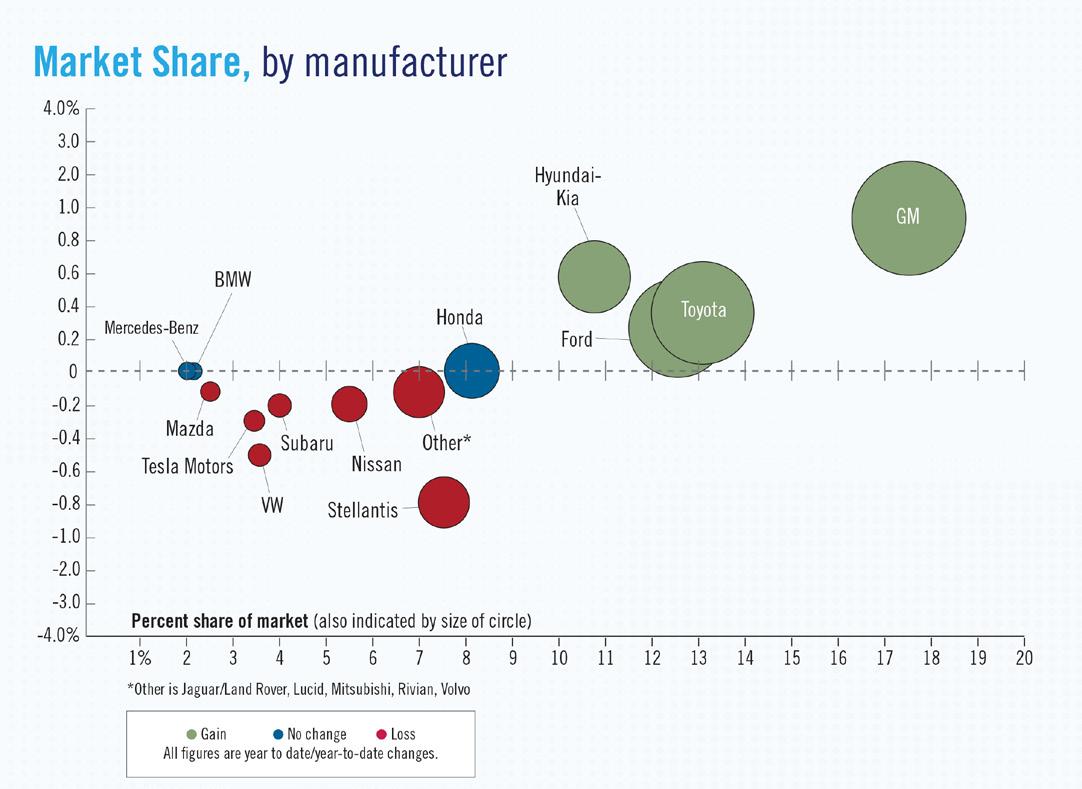

Vehicle Market Update and Outlook

Mark Strand

Cox Automotive – Senior Director, Economic and Industry Insights

FEATURED SPEAKER

A Crystal Ball on the Road Ahead: From Wild Challenges to Massive Changes

Jason Stein Managing Director The Presidio Group

Driven to Comply: Recent Enforcement Trends Targeting Auto Dealers

Terry Flynn

Partner, Harris Beach Murtha Cullina

Scott Dube

McGovern Hyundai Rt. 93, Massachusetts NADA Director

Michael Stanton

CEO &

President,

National Automobile Dealers Association

The Silent Equity Partner You Never Knew You Had Don Giordano

Business Development, Merchant Advocate

Take Control of Your Dealership’s Energy Costs

Steve Borelli

Energy Portfolio Manager, Sprague Energy

Reducing Health Care Costs at Your Dealership

Shawn Allen Managing Principal, OneDigital Legislative and Regulatory Updates

Robert O’Koniewski

MSADA Executive Vice President

Removing EV Charging Headaches & Reducing Electricity Delivery Costs

Chris Nihan President, EVready Energy

DIAMOND SPONSORS

ComplyAuto

TrueCar

PLATINUM SPONSORS

Albin, Randall & Bennett

CVR

Sprague Energy

Withum

Zurich

GOLD SPONSORS

Arent Fox Schiff

Bank of America

Cox Automotive

Wells Fargo

SILVER SPONSORS

Armatus

Cooperative Systems

DealerPay

Huntington Bank

Reynolds & Reynolds

Santander

BRONZE SPONSORS

ACV

Citrin Cooperman

EVready Energy

GW Marketing

Merchant Advocate

National Grid

One Digital

Performance Brokerage Services

WELCOME RECEPTION SPONSOR

eDealer Services

BREAK STATION SPONSOR

Downey & Co.

COCKTAIL RECEPTION SPONSOR

Harris Beach Murtha Cullina

WI-FI SPONSOR

TrueCar

According to Nancy Phillips Associates and Automotive News, Matt McGovern of the McGovern Auto Group has purchased Kelly Ford in Beverly. Kelly Automotive Group has been in business for 60 years and acquired the former Thomas Ford store in 2015. The new owner, Matt McGovern, now represents the Ford brand in four dealerships across Eastern Massachusetts. McGovern Automotive Group ranks No. 46 on the Automotive News list of top 150 dealership groups based in the U.S. Kelly Automotive Group ranks No. 141 on the list.

On October 7, Aida Torres of Ware was surprised with a new Hyundai Tucson for her dedication to providing food to those in need since the COVID-19 pandemic, as recognized by Hyundai’s Salute to Heroes program.

Each year, Hyundai accepts nominations from the community for ordinary people who are doing extraordinary work. The surprise took place during one of Aida’s food giveaways in Palmer.

Being selfless is nothing new to Aida, since the COVID-19 pandemic, she says that God called on her and she made it a reality by doing free food giveaways, three to five times a week in western Massachusetts and beyond. Torres was gifted a new car for her dedication to putting food on many people’s plates. “I take very little. My volunteers know I take very little for myself. But my people come first,” said Aida.

There were over 500 total nominations, and more than 30 of them went to Aida. Nicole Coakley from Springfield praised Torres, saying, “She’s just so amazing, very humble and helpful, always willing to be there and help the community.”

Gary Rome, President and CEO of Gary Rome Auto Group, stated, “A brand new Hyundai Tucson, it comes with all the safety features, also comes with a 100,000-mile warranty, it comes with three years of complimentary maintenance, and it’s also very safe.”

Brian Houser, General Manager of Balise Hyundai, stated, “So fantastic to see all these people here picking up their necessities for their refrigerator, and she gets to win a new car at the same time.”

Aida Torres’s commitment to her community has not only provided essential support to those in need but has also earned her recognition and a new vehicle to aid her efforts. Hyundai plans to feature a picture of Torres with her new car on I-91, celebrating her contributions to the community.

Ford Motor Company recently honored Bonnell Motors in Winchester with a 100-year award. Steven Bonnell, president of Bonnell Motors, received the award from John Cable, Ford Motor’s regional manager, at an event at Fenway Park in Boston.

Boston Business Journal recently recognized OCD Tech LLC, an MSADA associate member, as one of the largest IT consulting firms in Massachusetts. Led by managing principal Michael Hammond, the firm has a total of 10 information technology consultants in the Commonwealth with total 2024 revenue of $7.5 million.

On October 9, Automotive News held its annual ceremony at the Country Music Hall of Fame in Nashville to honor its Top 150 Dealerships To Work For in the U.S. This year, Asbury Automotive Group’s Audi Burlington came in at #102.

The Top 150 awards recognize the leading dealerships that

have built extraordinary workplaces full of enthusiastic and engaged employees. Automotive News partner, Workforce Research Group, collected and analyzed employer and employee surveys to compile overall and category rankings.

In the large dealership sub-group ranking (5,000 or more dealership group employees), Audi Burlington came in at 19 out of 29.

By C.J. Moore, Automotive News

Total employment at U.S. franchised dealerships rose in 2024 to an estimated 1.13 million, a benchmark not seen since before the COVID-19 pandemic, though what employees earned on average fell, according to the National Automobile Dealers Association.

Dealerships’ total employment fell to 1.01 million in 2020 — as dealerships cut jobs when salesrooms shuttered — and has been gradually climbing back as new-vehicle demand has returned to stores, according to the NADA Data 2025: Midyear Report.

“We’re finally back to that pre-pandemic level of employment

around 1.1 million,” NADA Chief Economist Patrick Manzi told Automotive News in October.

Individual franchised dealerships in 2024 also added one employee on average compared with 2023, as operations rightsized hiring to meet the market, Manzi said. The average number of employees per store was 65 at the end of June, up from 64 at the end of June 2024 and 63 in June 2023, according to NADA.

The association report provides a picture of sales, compensation, inventory levels, and more.

NADA’s data also showed average and median earnings for dealership employees fell in 2024 as payrolls normalized from 2022 and 2023, when sales staff benefited from high new-vehicle demand.

“There wasn’t a ton of negotiating going on between the dealer and the customer, and so those vehicles sold very close to MSRP,” Manzi said. “That can inflate what is paid to a member on the sales staff.”

Average weekly earnings per employee for NADA’s total sample of dealerships — 2,471 dealerships — fell 1.7 percent year over year to $1,897 in 2024. Median weekly earnings fell to $1,463, down 0.1 percent.

“Moving into ’24, we had a much more normal market where inventory was building,” Manzi said. “You had more discounting on the vehicle. What those sales staff were paid on was a little bit less.”

New-vehicle inventory to end 2025 lower than expected

The 16,972 light-vehicle dealerships in the U.S. sold 8.1 million vehicles through June this year, according to the NADA report. The association reported 16,957 dealerships at the end of 2024.

Total franchised light-vehicle dealership sales totaled more than $645 billion in the first half of 2025, up from $613 billion in the first half of 2024.

Dealerships wrote more than 137 million repair orders, with service and parts sales ringing up to more than $81 billion, during the first half of 2025, the association said. That’s up from 133 million repair orders during the same 2024 period for service and parts sales exceeding $76 billion.

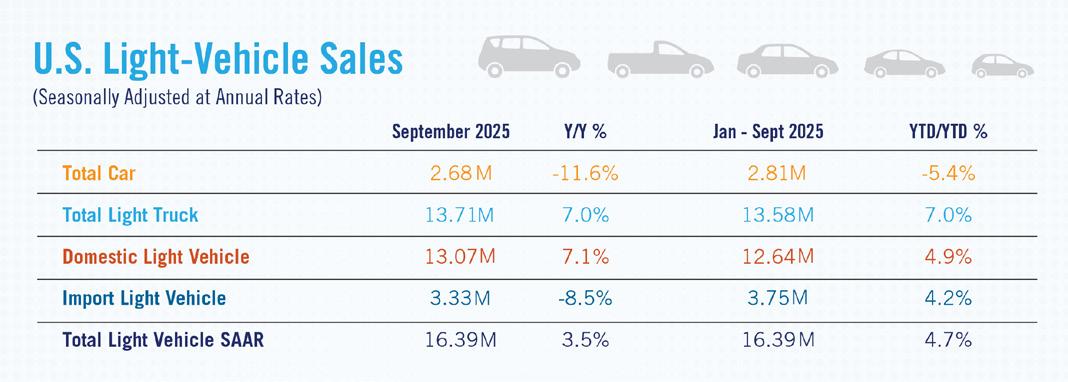

Consumers visited dealerships this spring to make a purchase before President Donald Trump’s tariffs on imported vehicles and parts took effect. Sales rates in March and April were abnormally high as a result, Manzi said in the report.

The average store has seen increased revenue and throughput through the first half of 2025, Manzi said.

New light-vehicle inventory on the ground and in transit was 2.82 million to start 2025 but dropped 6.6 percent to 2.6 million at the end of June as tariffs implementation drove more sales, according to the report.

“Before this new tariff policy, inventory levels were expected to increase throughout the year, but now we expect that new light-vehicle inventory will end 2025 around 2.5 million units,” Manzi said.

By Barton Haag CPA, Albin Randall & Bennett

Electric vehicle (EV) requirements and incentives are in a period of transition across New England. Between shifting state sales mandates, adjustments to rebate programs, and the recent expiration of the federal EV tax credit, 2025 has been a year of uncertainty and change. For Massachusetts auto dealers and financial leaders, especially those with operations in more than one state, it is critical to understand how these developments are shaping customer demand and compliance expectations.

Below is an overview of recent updates in Massachusetts and neighboring states, along with key takeaways for dealers navigating this evolving landscape.

The federal EV tax credit, which has helped sustain consumer demand, expired at the end of September 2025. Many buyers rushed to complete purchases ahead of this deadline, creating a short-term spike in sales. Certain OEMs have stepped up to offset the loss. For example, Hyundai has reduced prices on some models through October, while Ford and GM have acquired vehicles for leasing so they can pass credits along to customers, a proposed activity which has raised politicians’ and regulators’ eyebrows. Knowing what programs are available for your franchises will be key to guiding buyers through affordability questions and explaining which incentives remain at the point of sale.

This Spring, Massachusetts regulators announced that enforcement of EV sales mandates will be delayed for two years, providing manufacturers and dealers with more time to adjust to new requirements.

While easing compliance pressure, the state continues to invest in adoption through consumer rebates and charging infrastructure. The MOR-EV program remains in place, offering rebates up to $3,500, and the state has committed more than $40 million to public charging. Dealers face a softer regulatory timetable but ongoing opportunities to leverage incentives.

Connecticut’s CHEAPR program remains in place, but adjustments in 2025 reduced standard rebates for new EVs after a surge in applications tied to the federal credit’s pending expiration. The state continues to provide enhanced rebates for lower-income buyers. Dealers should pay close attention to ongoing program adjustments, as changes may affect both eligibility and sales volumes.

Maine continues to support EV adoption with a combination of rebates and charging programs. While the state has maintained a supportive policy environment, infrastructure remains uneven, particularly in northern and rural areas. Dealers in these markets should be ready to help customers weigh state rebate opportunities against practical considerations like charging access and range.

New Hampshire has paused a state program to expand EV charging access, citing administrative and funding challenges. This has raised concerns about availability in rural areas, where infrastructure is already limited. Dealers in or near New Hampshire should anticipate buyer questions about range confidence and charging options.

Rhode Island continues to offer rebates on new and used EVs through its statewide program, alongside financial assistance for home and workplace charger installation. These incentives can meaningfully reduce out-of-pocket costs for buyers and should be a central part of the sales conversation for dealerships serving Rhode Island customers.

Like Massachusetts, Vermont is delaying enforcement of its zero-emission vehicle (ZEV) sales requirements, citing infrastructure and supply concerns. These mandates may be reactivated in future years, but, for now, the regulatory pressure has eased.

• Different rules across state lines: Incentive amounts, compliance timelines, and program eligibility vary widely across New England. Buyers may shop in states offering the best deals, so understanding each program is essential.

• Infrastructure matters: In states where charging expansion has slowed or paused, customer hesitancy may impact EV sales more than financial incentives.

• Timing is critical: Federal credit expirations, state rebate adjustments, and delayed mandate enforcement can all create demand spikes or lulls. Dealers should align inventory planning and marketing efforts accordingly.

• Communication builds confidence: Sales teams who can clearly explain available rebates, credits, and compliance rules will be better positioned to close deals and maintain customer trust.

The EV landscape in New England is in flux, with each state taking a different approach to balancing mandates, incentives, and infrastructure. For Massachusetts dealers, the immediate priorities are monitoring state program changes, guiding customers through incentive deadlines, and preparing business plans that account for diverging policies across the region.

Dealership owners and financial decision-makers should take this moment to review sales strategies, update staff training on state-specific incentives, and strengthen communications with customers. Staying informed and adaptable will be the key to navigating this transition and to capturing opportunities as the market evolves.

“Merchant Advocate found a costly error—our software was not passing along all the necessary information—and worked directly with our provider to resolve the issue. We’ve already saved more than $70,000 as a result. I recommend having Merchant Advocate look at your account.”

–Denise Devoe, Corporate Controller

“Not only did Merchant Advocate uncover a significant optimization opportunity, but they also helped us replace 100 out-of-date terminals—for free! We are looking forward to more than $60,000 in savings in our first year. Merchant Advocate took care of everything—the process couldn’t have been any easier for us.”

–Jeb Balise, President

“Within the first two months of working with Merchant Advocate, we’ve saved over $4K in credit card fees across our 9 Merchant IDs! I wholeheartedly endorse Merchant Advocate for any business seeking to optimize their payment processing costs and enhance their financial health. Their vigilant monthly oversight of our statements ensures that we are not subjected to the pitfalls of an unregulated industry.”

–Joe

Bonofiglio,

C o r p o r a te C o nt r o l l e r

There are over 1,500 attorneys in the United State who focus on legal actions against car dealers.

Who reviews your F&I documents for legal or regulatory changes?

What if your dealership had access to a complete suite of documents needed in F&I?

Only the LAW F&I Library™ provides:

A complete set of state-specific F&I documents in both pre-printed and electronic formats.

An industry leading team of in-house and outside legal resources reviewing forms for legally required and best practice updates.

A trained team of compliance consultants who can work with you to manage your compliance risks.

By Attorneys Tom Vangel, Jamie Radke, and Lindsey McComber, Harris Beach Murtha Cullina PLLC

As reported by Bob O’Koniewski in the July edition of Massachusetts Auto Dealer, the auto manufacturers are seeking to use the Department of Justice’s newly created Anticompetitive Regulations Task Force to undermine the state law protections for franchised dealers.

On March 27, 2025, the Department of Justice (DOJ) launched its Anticompetitive Regulations Task Force and invited public comment to identify “state and federal laws and regulations that undermine free market competition and harm consumers, workers, and businesses.”

The Anticompetitive Regulations Task Force seeks to identify and advocate for the elimination of state and federal laws and regulations that hinder free market competition for the benefit of consumers, workers, and businesses. After receiving input, the Task Force may then advocate for the elimination of those laws and regulations to “make it easier for businesses to compete.”

In response to the DOJ’s request, auto manufacturers, through their trade association, submitted comments alleging that state franchise laws harm consumers. Specifically, the Alliance for Automotive Innovation (“Alliance”) submitted public comments seeking to have the DOJ scrutinize and repeal state law protections for franchised auto dealers. The focus of the Alliance’s comments to the DOJ includes requesting changes to: (1) state laws restricting the establishment of new motor vehicle dealerships in relevant market areas of existing same line make dealers and (2) state laws setting minimum levels of compensation to dealers for warranty service.

Particularly, the Alliance argued that state statutory provisions protecting the “relevant market area” of existing dealers and allowing for an automatic stay of a proposed new dealership during any

legal process, as provided in some state franchise laws, allows dealers to “protect themselves from increased competition and delay the establishment of a new dealership…without regard to the effects on consumers.”

In addition, the Alliance argued that warranty reimbursement statutes discourage price competition and incentivize higher prices for all service work on motor vehicles. It also argues that statutes incentivizing the use of third-party time guides to calculate warranty reimbursement encourage dealers to inflate the time and resulting expense charged for retail repairs paid for by consumers.

These comments attack at the heart of the protections afforded to Massachusetts dealers under Chapter 93B. Chapter 93B significantly restricts manufacturers from entering into a franchise agreement with a motor vehicle dealer that would operate within the relevant market area (“RMA”) of an existing same line make dealer. Years ago the MSADA fought hard to establish RMA mileage definitions that eliminate the need for expensive experts and protracted legal process to determine the RMA of individual dealers.

Simply put, under current law, if a dealership is located in the counties of Bristol, Essex, Hampden, Middlesex, Norfolk, Plymouth, or Suffolk, its RMA is the entire land mass encompassed in a circle with a radius of 8 miles from any boundary of the dealership. If a dealership is located in the counties of Barnstable, Berkshire, Dukes, Franklin, Hampshire, Nantucket, or Worcester, then the RMA has a radius of 14 miles from any boundary of the dealership.

With respect to warranty reimbursement, Chapter 93B in Section 9 requires that compensation shall be fair and adequate and shall “not be less than the rate and price customarily charged for retail

customer repairs[.]” The statute protects dealers by establishing reimbursement rates based on actual customer repairs rather than using rates and time guides established by manufacturers, which are often viewed as unrealistic and unfair.

In July, the NADA sent a strongly worded response to the Alliance’s submission to the DOJ. The NADA noted that the Alliance’s submission goes beyond policy disagreements and “constitute[] a broadside attack on our members and erodes trust between dealers and manufacturers.” The NADA noted that the Alliance’s comments “are nothing short of an invocation of federal authority to attack the franchise system writ (sic) large.” The NADA further provided detailed analysis refuting the Alliance’s contentions that RMA and warranty laws hurt consumers and are anti-competitive. The NADA pointed out that RMA laws ensure that there is an appropriate balancing of the interests of the various market participants administered by an independent fact finder.

With respect to warranty laws, the NADA noted that warranty repairs and recalls represent a cost to the manufacturers and, therefore, the OEMs are not necessarily incentivized to do all that is necessary to complete that work. Franchised dealers, on the other hand, are incentivized to fully and properly complete this work in order to retain the customer.

We will need to monitor closely the actions of the Task Force and the Alliance over the coming months to vigilantly protect our franchise system.

Tom Vangel and Jamie Radke are partners and Lindsey McComber is an associate with the law firm of Harris Beach Murtha Cullina PLLC in Boston who specialize in automotive law. They can be reached at (617) 457-4072.

By Attorneys Greg Paonessa, Sara Judge, and Paul Harris of ArentFox Schiff LLP

It is a common service department scenario: a customer drops their vehicle off for repairs and as the technician is working through the vehicle, a previously unknown issue is discovered that needs remediation, but you do not have the customer’s authorization. In some circumstances, you may be able to get written authorization in person, via text or email. However, in certain instances, a customer may not respond to text messages or emails, so you need to get verbal authorization from the customer to proceed with the necessary repairs.

While one would think a simple phone call to the customer during which they give verbal authorization should resolve the issue, there is very specific information that must be maintained concerning that discussion or else verbal authorization may not be valid.

For guidance on how to obtain valid verbal authorization to conduct repairs, one need look no further than your trusty Massachusetts Motor Vehicle Regulations, 940 CMR 5.00 (the “Regulations”). Pursuant to Section 5.05(3) (c) of the Regulations, if the repair shop is unable to get written authorization to perform specific repairs, then prior to commencing the repairs, the shop must verbally notify the customer of: (i) the specific repairs to be performed, (ii) the total price to be charged, including parts and labor, and (iii) obtain authorization to perform such repairs. Now comes the important part: memorializing such verbal authorization.

Pursuant to Section 5.05(5) of the Regulations, it is an unfair or deceptive act or practice for a repair shop that obtains verbal customer authorization to fail to maintain written records containing the following information: (a) the date and time authorization was received; (b) the name of the employee receiving oral au-

thorization and the name of the person granting such authorization; (c) a statement of the exact authorization received; and (d) if such authorization was obtained over the phone and the shop placed the call, the phone number called.

Given the standard nature of the information required to comply with the Motor Vehicle Regulations when obtaining

Maintaining and displaying or disclosing the straightforward information required by Sections 5.05(4) and (5) could be the difference between your dealership being paid for repairs performed or potentially having to perform such repairs gratis.

verbal authorization, we recommend a simple form be created and maintained at the service advisors’ station and that the completed form be maintained with any repair order done on verbal authorization.

We also recommend, as a best practice, that you follow up with the customer after obtaining verbal authorization via email or text message confirming the verbal authorization and what services were approved based thereon, including all of the information required by Section 5.05(5)(a) – (d).

While the Motor Vehicle Regulations, and to our knowledge a court, have not addressed such confirmation and whether it is required or would act as a safe harbor if such verbal authorization is later challenged, we believe it is best practice. If nothing else, it creates a presumption that if the customer did not agree, they would respond accordingly.

It should also be noted that, pursuant to Section 5.05(4) of the Regulations, prior to obtaining any written or verbal authorization, the customer must be informed: (a) of the conditions under which the repair shop may impose storage charges and the daily or hourly amount for same; (b) that, upon request, the customer has the right to have replaced parts returned to the customer once the repair is complete, or to inspect such parts if the shop must return same to the manufacturer under a warranty program; and (c) the cost to be charged for an estimate or diagnosis.

While the information or disclosures required by Section 5.05(4) may be provided to the customer by posting same on displays in a clear and conspicuous manner on the repair shop’s premises, failure to make such disclosures is also an unfair or deceptive act or practice.

Maintaining and displaying or disclosing the straightforward information required by Sections 5.05(4) and (5) could be the difference between your dealership being paid for repairs performed or potentially having to perform such repairs gratis. t

If you have any questions regarding whether your dealership complies with these or other applicable Motor Vehicle Regulations, the attorneys at ArentFox Schiff are available to do a full regulatory and compliance review.

Choosing a local dealership broker with a lifetime of experience in the Northeast is your best bet. We will sell your dealership(s) for maximum value. We will sell you a store hassle-free with honesty and integrity. We have the BEST reputation in the Northeast, bar none! We have sold more stores here in the past 45 years than any other broker. National brokers cannot offer you that hands on experience here! To us, you aren’t just another number. Our focus is on your needs. Our mission is to provide the highest level of service to our clients by achieving results in a timely, professional, confident manner.

➥ We have a long term, very close, productive working relationship with VADA dealer members.

➥ Highest level of integrity and Buyer and Seller loyalty

➥ Our clients now include the FOURTH Generation of our original clients

➥ Highest volume of brokered dealership transactions in New England bar none

➥ We are the most experienced brokers

➥ Deals get done using brokers not lawyers or accountants to negotiate the best deals for clients

➥ We are local

➥ No alien broker can compete

➥ No one knows this market better than Gordon Wisbach over 4 decades A preferred broker in New England for 45 years

Contact Gordon Wisbach for

By Nick Reed

Senior IT Security Analyst, OCD Tech

The costs of a data breach stretch far beyond the immediately apparent recovery expenses, such as hiring third-party experts, investigation costs, or even making ransom payments. Considerable attention has been given to the initial stages of a breach, leading many to conclude that the financial impact is nearing its conclusion. However, the aftermath of a breach entails additional costs that can significantly reshape how businesses assess the importance of maintaining a strong cybersecurity program.

This article examines the often overlooked and misunderstood costs of a data breach by exploring factors that arise after the initial crisis has passed, ensuring businesses are well-prepared.

According to 2023 NADA data, the average car dealership sells approximately 1,000 new vehicles per year. In parallel, the average dealership likely receives 1,000 unique customer records annually. Although this amount may appear minimal, representing only one year of customers, their exposure can still have a substantial impact.

Nearly half of all U.S. states have comprehensive data privacy regulations that require credit monitoring in certain cases. Massachusetts law, for example, mandates credit monitoring if a breach compromises Social Security numbers.

Under the Massachusetts Data Breach Notification Law (MGL Chapter 93H), the breached entity must provide at least 18 months of free credit monitoring to affected individuals.

As a starting point, credit monitoring costs around $10 per month per customer, but discounted pricing for volume is typically available for businesses. Over 18 months for 1,000 customers, this amounts to $180,000.

Now, consider the additional costs of breach notification. At the time of writing, sending letters to 1,000 individuals costs approximately $1,000 in supplies. An additional cost to consider is the time required for addressing, filling, and mailing these letters. This project will necessitate a number of employee hours or expenditures for outsourcing to a third party.

After breach notification is made, you might think the worst is over; systems have been recovered, and the fallout from notification is being managed. However, now that customers are formally notified of the breach, the business is likely to face class action lawsuits from customers alleging mishandling of their data. Recent dealer breaches show how swiftly these situations can develop, with lawsuits being filed only days after breaches are publicized.

With the caveat that I am not a lawyer and that these cases are not directly comparable, given that they involved large corporations and many plaintiffs, historical data from some of the nation’s largest breaches suggest an average payout of approximately $150 per individual in class action settlements. Conservatively applying this figure to our scenario, 1,000 affected customers would result in $150,000 in compensation.

If the breach is not deemed egregious and a moderate payout of $150 per con-

sumer is awarded, legal fees for opposing counsel could match or exceed that amount. Opposing counsel’s fees are typically calculated as a percentage of the settlement, ranging from 25-50%. This could easily add another $75,000 expense. Retaining counsel on behalf of the business in Massachusetts costs an average of $300 per hour. While the total number of case hours can vastly vary based on the complexity. Assuming a single attorney works 50 hours, given that cases of this nature often span months, that would add another $15,000, bringing the new total legal costs to an estimated $420,000.

When consumers suffer financial losses because of the breach, the legal situation drastically shifts and expenses surge. A 2022 data breach at a dealer in the Southwestern U.S., which impacted nearly 1,000 customers and closely aligns with the presented scenario, provides valuable insight into potential costs. Consumer losses in this case fell into two categories: ordinary and extraordinary. Ordinary losses, such as travel expenses, lost wages from time spent addressing the breach, or bank fees, resulting in settlement amounts ranging from $500 to $1,000 per individual. Extraordinary losses, where fraud or identity theft occurs due to the breach, lead to a significantly higher payout of $5000 per affected individual.

Given the parallels between the 2022 dealer breach and the example case, these figures serve as a relevant benchmark for estimating potential legal exposure. In this scenario, assuming no losses occurred, the potential costs will not be speculated on. However, it is important to consider this data as a key factor.

The FTC Safeguards Rule mandates that dealerships implement cybersecurity

allocating a portion of the budget to effective cybersecurity practices is generally more economical than dealing with the financial consequences of a data breach.

practices that align with crucial security practices, with penalties for non-compliance reaching up to $43,792 per violation. While the FTC has not yet indicated any enforcement actions under this rule, the penalties are steep enough that if enforced, they could have devastating effects on a business.

In addition to federal regulations, businesses must also consider state-level requirements. In Massachusetts, breaching the 201 CMR 17.00 Data Protection Standards can lead to civil penalties of up to $5,000 per affected individual. The standard imposes similar protections to the Safeguards Rule.

Certain factors of a breach are difficult to quantify, yet they can have substantial consequences. Cyber insurance premiums

often increase significantly after a data breach. Premiums can rise by double digits, depending highly on specific situation details and the insurance carrier. These increases can strain budgets and complicate future planning.

The loss of business and the potential damage to public relations must also be a consideration post breach, many customers may lose trust in a dealer. While some customers may never return, others may be quick to forget the breach, especially if the company demonstrates strong remediation efforts.

Additionally, reputational damage can have long-lasting effects on a company’s brand. Even if a company works to restore its public image, the breach may still linger in customers’ minds. The cost of rebuilding trust is often difficult to measure but can be substantial, in-

volving marketing campaigns, customer outreach, and possibly even a complete rebranding.

A comprehensive cybersecurity program involves recurring costs; however, allocating a portion of the budget to effective cybersecurity practices is generally more economical than dealing with the financial consequences of a data breach. The expenses associated with a breach typically surpass those of maintaining a robust security program, which can also offer other benefits in addition to preventing breaches. It is prudent to invest in a small recurring cybersecurity cost than to risk the massive financial impact of a breach, which can have the potential to drive businesses out of operation.

By Scott Spatz CEO, Cooperative Systems

If you manage or work in an auto dealership, you know how much information flows through your business on a daily basis. From customer contact details and sales agreements to service records and parts inventory, data are everywhere. And we do mean everywhere.

It is tucked away in your DMS, saved in spreadsheets on desktop computers, floating in the cloud, attached to emails, and stored in software platforms you forgot you were even using. It is not hard to imagine how that can become overwhelming…or risky.

So, what is the solution? How do you gain control over your dealership’s scattered data?

Let us say your service manager uses one system for scheduling, your sales team uses another for CRM, and accounting has their own process entirely. Then you have shared folders on desktops, personal flash drives, archived emails, third-party vendors, and maybe even someone using Dropbox or Google Drive on the side.

That is not unusual, and it is not your team’s fault. Dealerships evolve, new tools get adopted, and over time, the data just...spreads. But as that happens, your risk exposure increases. You cannot secure what you cannot see. And you certainly cannot manage access, ensure compliance, or protect your customers’ information if you do not know where it all lives.

This is not just about cleaning up your digital workspace. Poor data control puts you at risk for:

• Security breaches – especially when sensitive data is stored without proper protections.

• Compliance issues – particularly with new regulations under the FTC Safeguards Rule.

• Operational inefficiencies – like employees working off old versions of documents or spending time searching for the info they need.

• Reputation damage – customers trust you with personal and financial data. If you lose it, that trust is hard to get back.

Getting a handle on dealership data might seem daunting, but it is doable and incredibly worthwhile. Here is a practical approach that works.

1. Identify Where Your Data Lives. Start by mapping out where data is stored across your dealership. That includes local servers, workstations, cloud apps, personal devices, and external vendors. Work with your IT team or provider to build a clear inventory of systems and file locations.

2. Categorize the Data. Next, separate your data based on sensitivity. This helps prioritize what needs tighter controls. For example:

• Public – marketing materials, job postings;

• Internal – training docs, general procedures;

• Confidential – employee records, sales contracts; and

• Highly sensitive – Social Security numbers, financial info.

3. Limit and Monitor Access. Only give access to the people who need it for their role. Avoid shared logins and make sure you review permissions regularly,

especially after someone changes roles or leaves the company. And yes, turning on multi-factor authentication (MFA) for key systems should be non-negotiable at this point.

4. Consolidate Where You Can. Using fewer platforms makes life easier for everyone. If you are using multiple systems that do similar things, it might be time to standardize. This improves security and streamlines training for new staff.

5. Put a Plan in Place. Once you have organized things, document your approach. This is key for both security and compliance, and it also helps when onboarding new employees or working with vendors. Set policies for:

• Where different types of data should be stored;

• Who is allowed to access them;

• How often systems are reviewed; and

• What happens in the event of a breach.

You do not need to fix everything overnight. But taking steps now can save you time, money, and a major headache down the road. Think of this like organizing your garage. Start with one corner, one shelf, one system at a time. Over time, it will come together.

At Coopsys, we help dealerships assess and manage their data environments, tighten security, and simplify operations. Whether you need help auditing systems, locking down access, or aligning with FTC guidelines, our team is here to help. Your data should not be running wild across your dealership. Let us help you take the wheel. Visit us at coopsys.com/ msada to learn more.

By Tim Marbut

Ethos Group

Every winning team has a playbook: a guide that defines the strategies, principles, and habits required to achieve victory. In the world of automotive retail, a salesperson’s playbook is no different. With vehicles evolving in design, technology, and price, customers expect more than product knowledge. They demand trust, solutions, and value.

To deliver consistently, every successful automotive salesperson must anchor themselves in four primary behaviors: proactivity, tenacity with knowledge, a clear game plan, and a positive attitude. Together, these create the foundation for not just making a sale, but also building long-term relationships that fuel referrals, repeat customers, and lasting success.

Proactivity is about taking the initiative before opportunities slip away. In automotive sales, it means reaching out to prospects before they step foot on the lot, following up after service visits, and anticipating customer needs rather than reacting to them. A proactive salesperson does not wait for the customer to ask about lease options; they highlight them upfront. They do not wait until a buyer expresses concern about fuel efficiency; they prepare with comparisons that ease concerns before they arise.

Consider the buyer researching SUVs online. A proactive salesperson identifies these digital leads, reaches out with per-

sonalized messages, and offers to schedule a test drive. In the showroom, they guide the conversation by asking thoughtful questions such as, “How will you be using this vehicle day-to-day?” or “What is most important to you: safety, technology, or towing capacity?” These proactive moves uncover needs the customer may not have fully articulated, giving the salesperson the advantage of shaping the decision process early.

In automotive sales, playing defense leads to being outpaced by competitors. Playing offense with proactive effort secures opportunities before they are gone.

Tenacity is persistence, but persistence without knowledge is like running in circles. The real difference-maker is tenacity with knowledge: the determination to continually learn, research, and master every detail of the product lineup, financing structures, and competitive advantages. A tenaciously knowledgeable salesperson does not simply memorize specs; they understand the “why” behind them.