My program for:

BUYER

By: Martine Charest

By: Martine Charest

Mahadéo

- The HBP 2022 version

- The integrated renovation loan

- The 5% down payment financed by CMHC

- What is CMHC? And the table of premiums VS downpayments

- Homeownership programs

Currentandfuturebudget

Feestoexpect whenbuyingaproperty

Building inspection Notary fees Allocations and adjustments Transfer taxes mutation T

TABLE OF CONTENTS

PURCHASING PROCESS

The financing Mortgage Pre-Approval Homeownership Programs

need

ithout

-Properties on Centris With the purchase brokerage contract - -PropertiesonCentris - -Allexistingproperties Real estate alerts and client portal Visits Advice during visits Draftingofthepromisetopurchaseanddeterminationoftheconditions Determine the price according to:

- The

of the mar

et

- The

of

- Competition and

heresearch Define the

W

a purchase brokerage contract

-

evolution

k

-

study

comparables -

scarcity Deposit in trust Financing or proof of cash

Thelegallink iscreated DateofdeedandpossessionDayofsale-documentstobe broughtTransferofutilityresponsibilities Thelegallink iscreated Notes 2 2 2 2 3 3 3 3 4 5 5 5 5 6 8 8 8 8 9 9 9 9 9 9 10 10 10 10 10 10 10 11 12 13 13 13 13 14 15

Building inspection Examination of the certificate of location and documents

THE FINANCING

MortgagePre-Approval"Agoodnegotiationtool"

Starting the financing process as soon as possible can only be beneficial. You will know your borrowing capacity and will be able to do your research in a price range that will be realistic and respect your budget. By getting preapproved by a bank, you guarantee a rate that will be protected from increases for a period of 90 to 130 days depending on the banking institution. Pre-approval will speed up the process when applying for final approval and will make you more attractive to a seller, which becomes an added advantage in the case of multiple promises to purchase. The proof of pre-approval will support the credibility of the promise to purchase filed.

Homeownershipprograms

The HBP 2022 version

The Federal Home Buyers' Plan allows you to withdraw up to $35,000 from RRSPs that you have contributed to or would have been eligible to contribute to since 1994, to allow you to have a larger down payment.

For more information, please visit the following address: https://www.cmhc-schl.gc.ca/fr/media-newsroom/news-releases/2019/federal-government-makes-easier-buy-first-home

Theintegratedrenovationloan

The integrated renovation loan

You've found a property that matches the area you're looking for and the space you want, but it needs some renovations to bring it up to date. You can obtain a renovation loan that will be integrated with your mortgage. The down payment will be calculated on the total price (purchase price + amount for renovations).

The renovation loan brings you the following advantages: a house that is located where you want it, that offers you the desired surface and that is personalized to your taste.

5% down payment financed by CMHC

With a 5% down payment, CMHC can also lend you, without interest, 5% of the purchase price of your property to help you save on your monthly mortgage payments.

To consult CMHC's offers, we invite you to visit the following address : https://www.cmhc-schl.gc.ca/fr/nhs/first-time-home-buyer-incentive

PURCHASING PROCESS

2

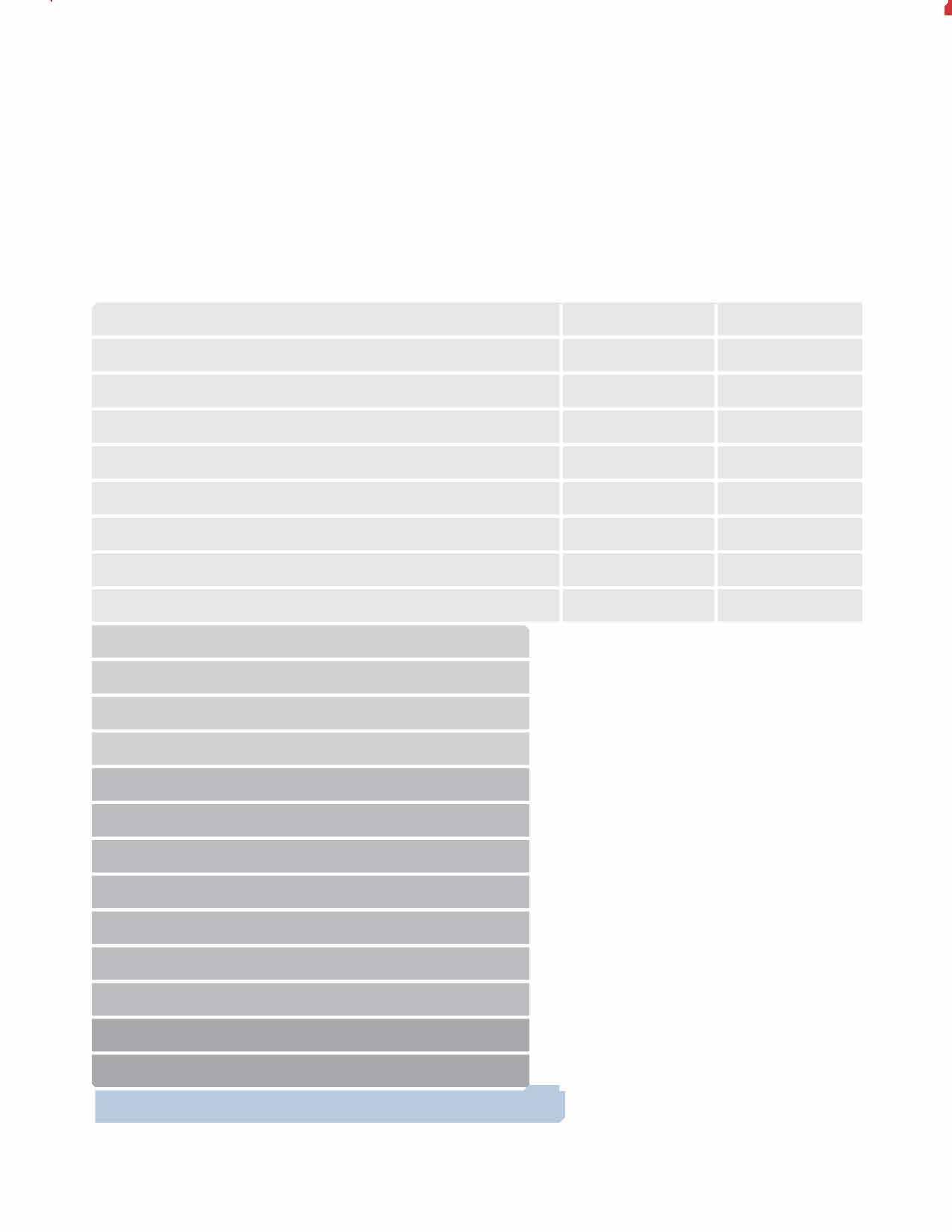

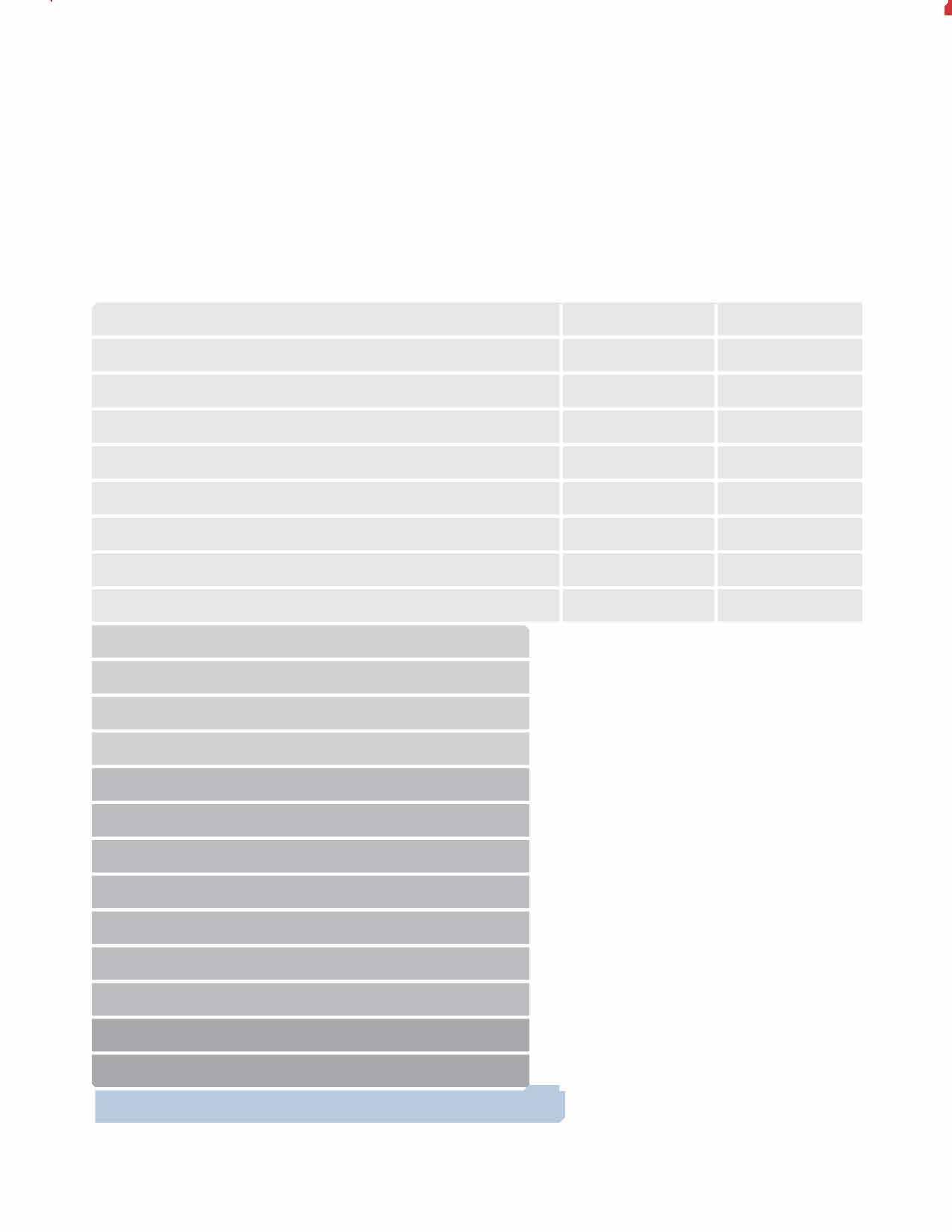

What is CMHC? And the table of premiums VS down payments

CMHC is a federal agency that allows you to purchase a home with a down payment of less than 20% by providing mortgage loan insurance for the benefit of lenders. This mortgage loan insurance is usually required by lenders when the borrower makes a down payment of less than 20% of the purchase price of the home. This insurance protects lenders in the event of default by the borrower and allows consumers to purchase a home with a minimum down payment of 5%*, while enjoying the same interest rates as households with a larger down payment. To obtain mortgage default insurance, the lender must pay a premium to CMHC and this premium is paid by the borrower. The amount of the premium is based on the loan-to-value ratio (mortgage amount divided by the purchase price). The premium can be paid in one lump sum or it can be added to the mortgage amount and included in the monthly payments. Please note that there is a 9% tax to be paid on the premium and this tax cannot be added to the mortgage. It must therefore be paid by the buyer at the time of the deed of sale.

The table below gives a general idea of the premiums collected by CMHC*. The exact amount of the premium will be calculated when you apply for your mortgage. Premium

*Please note that a 9% tax is applicable on the CMHC fees and is payable at the time of the notarial act

City Homeownership Program

Various programs and subsidies exist to allow you to access property more easily and thus benefit from significant discounts.

You can consult the websites of the different municipalities to find out about the programs available.

PURCHASING PROCESS

THEFINANCING(CONTINUED)

rate for a regular purchase loan Loan to value ratio 65% orless 0,60% 1,70% 2,40% 2,80% 75% or less 80% or less 85% or less 90% orless 3,10% 4,00% 95% or less (traditional source of funds) 95% or less (non-traditional source of funds) 4,50%

3

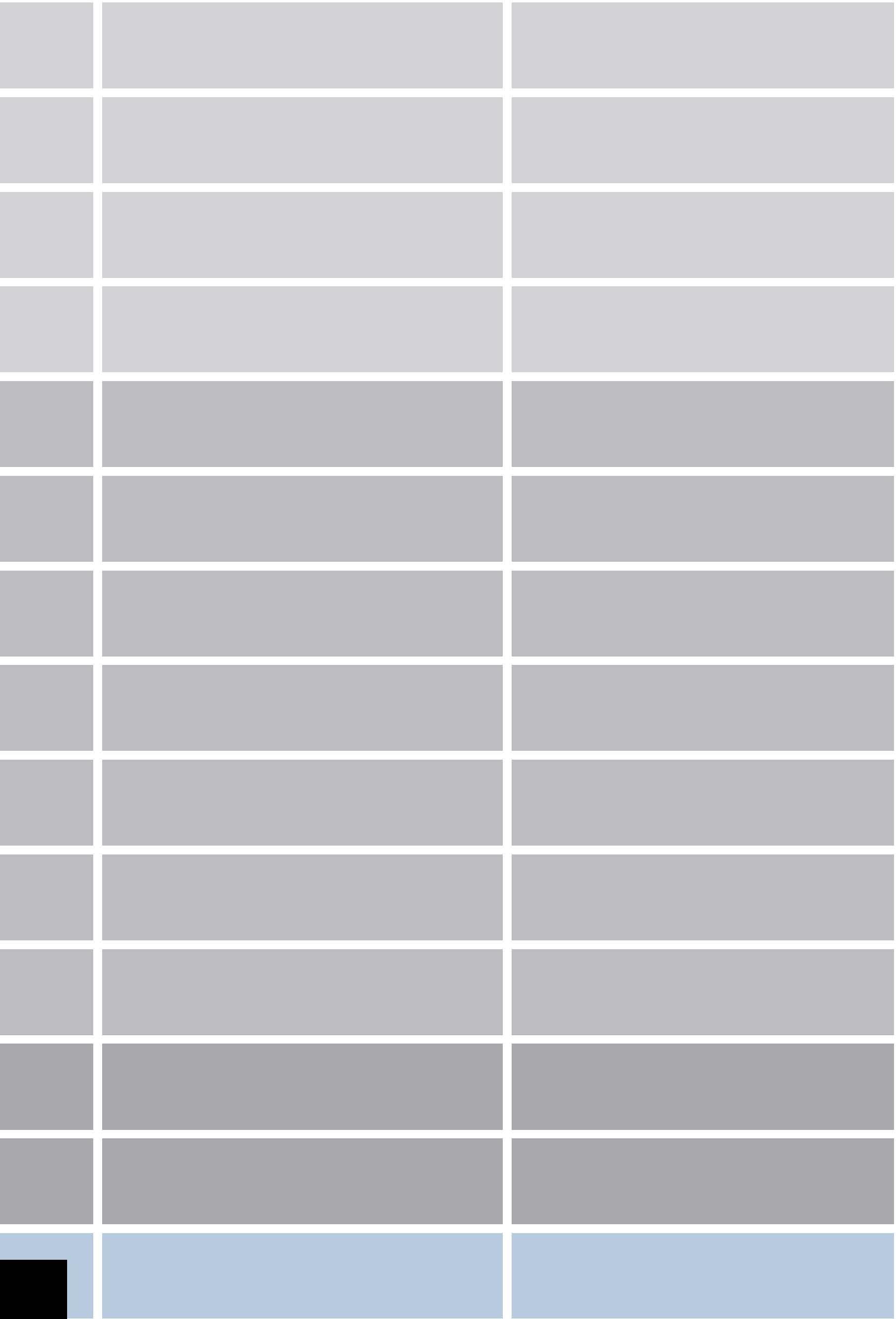

TYPES OF EXPENSES

Rent / Mortgage

Property taxes

Electricity

Gas / Propane

Assurance

Frais de condo

Téléphone, Internet, Câble

Housekeeping

Exterior maintenance (lawn, snow removal, etc.)

Car loan/lease

Gasoline

Maintenance (permits, plates, repairs, etc.)

Public transportation

Loan, credit card

Grocery store

Restaurants

Health (pharmacy, medication, dentist, etc.)

Clothing, footwear

Leisure and vacations

Various (daycare, membership, etc.)

Total monthly expenses

Total monthly income Difference

4

PURCHASING PROCESS CURRENT AND FUTURE BUDGET

ACTUEL / MOIS FUTUR / MOIS

PURCHAS

COSTS TO BE EXPECTED WHEN BUYING A PROPERTY

Inspection: between $500 and $1000

Notary: between $1,100 and $1,700 $

Repartitions:

Adjustment of the taxes of the city of Montreal (ex: if the taxes are paid and the purchase is notarized on August 1st):

August

Municipal taxes: January 1 to December 31

School tax : July 1st to June 30th

5 months of municipal taxes will have to be reimbursed (August 1 to December 31) 11 months of school taxes will have to be paid (August 1 to June 30)

December

Adjustment for fuel

If the seller has an oil tank, it must be filled by the seller and paid for by the buyer or prorated by the notary.

Adjustment for rents

If the current months rent has been collected, it will have to be reimbursed to the buyer on a daily pro rata basis.

ING PROCESS

5

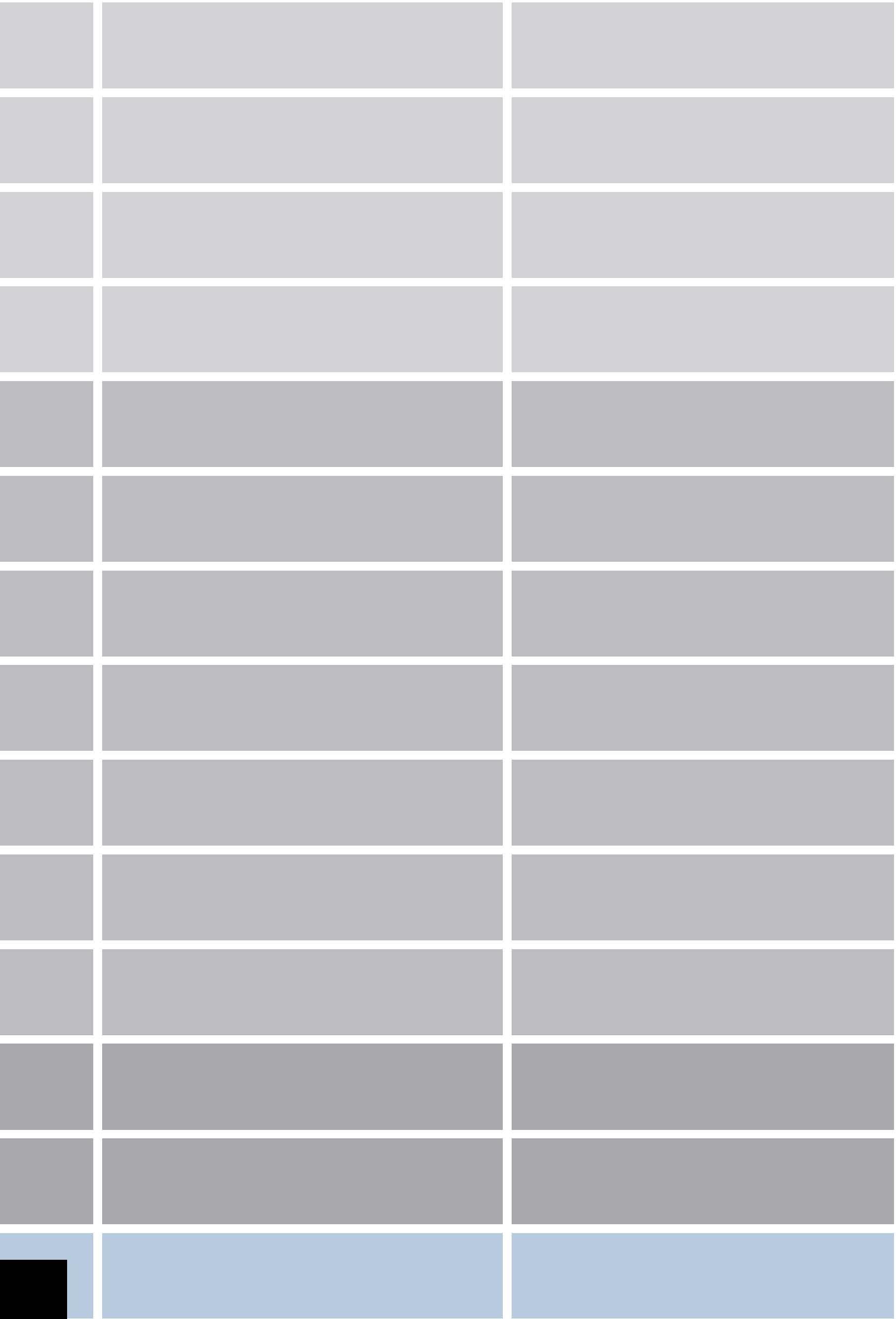

COSTS TO BE EXPECTED WHEN BUYING A PROPERTY

Yes does not exceed $51,700

Yes exceeds $51,700 but does not exceed $258,600

Yes exceeds $258,600 but does not exceed $517,100

Yes exceeds $517,100 but does not exceed $1,034,200

We multiply $51,700 by 0.5%.

Then multiply $206,900 by 1.0%.

Then multiply $258,500 by 1.5

Finally, we multiply $272,900 by 2.0%.

Therefore, for a tax base of $790,000, the total duty will be 11 663,00$

PROCESS

PURCHASING

Thresholdforfiscalyear2021: Rates 0,5% 1,0% 1,5% 2,0% 2,5%

Transfertaxes(welcometax)-Montreal(Within30daysofpurchase)

Taxable base bracket

Yes exceeds

but does not

$2,000,000 Yes exceeds $2,000,000 3,0% Here

o

$790,000: 258,50$ 2 069,00$ 3 877,50$ 5 458,00$

$1,034,200

exceed

isanexampleofacalculationwithataxbase

f

6

THE RESEARCH

Before starting your search it is important to define your needs and establish your search criteria.

Defining your needs

In order to identify the properties that are most likely to interest you, it is essential to identify the criteria that are important to you.

1.The place (city/ district/ neighborhood)

2.The approximate budget______$

3.The type of property □ Single-family home □ Condo □ Land □ Income property □ Others

4.The characteristics bedroom bathroom Garage Parking Balcony Land Pool others

5.State of the place □ □ □ □ □ □ □ □ □ □ □ 10/10 (Renovated, New)

5/10 (Habitable) 1/10 (To be renovated)

6. Acceptable compromises

PURCHASING PROCESS

7

RESEARCH (CONTINUED)

When you choose to work with a real estate broker for the purchase of a property, you will benefit from a wide range of information that will help you ensure that you pay the right price thanks to the Matrix database, jlr and the real estate barometer. The legal aspect of the transaction will be secured and the conditions will be fulfilled during the purchase process which will be concluded on the day of the deed of sale at the notary.

The purchase brokerage contract; THE KEY THAT OPENS ALL DOORS AND PROTECTS YOU!

The brokerage contract gives the broker the mission to protect and promote the interests of buyers. Since June 10, 2022, the OACIQ has established that a written purchase brokerage contract must be signed with the buyer to represent him, defend his interests, negotiate the best price and the best conditions for his client. Without a buyer's contract, the broker cannot represent the client and cannot defend his interests.

It is also the only possibility to be represented by his broker on all existing properties. The buyer's brokerage contract allows the broker to have free rein and to specifically target all properties that may correspond to the buyer's needs, whether they are on Centris or not, whether they are for sale without a broker or not for sale at all.

Specific solicitation and prospecting blitzes can be set up to find a type of property or a sought-after area. Telephone solicitation, canvassing and door-to-door canvassing are often used as search methods.

The purchase contract is a commitment to proactivity. The trust granted by the contract-purchase ticket provides very interesting advantages for the client who is assured of a guarantee of services.

Real estate alert

The Real Estate Alert is a tool that sends you, by email and in real time, the new listings that are put up for sale by brokers and that correspond to the criteria that you have established. This allows you to be the first to know when a property that matches your criteria arrives on Centris.

The client portal allows you to classify properties by interest. It is also possible to enter notes in order to compare the properties visited and remember the particularities that interested you during the visits. The goal is to make an informed choice.

Visits

When a property interests you, it is important to notify your broker quickly.

Responsiveness often creates opportunity. There is no need to be in a hurry, but if the opportunity arises, you must be ready. In a seller's market where there is little inventory and a lot of demand, the most desirable properties stay on the market for only a few days and are often sold with multiple promises to purchase and at a price that exceeds the asking price.

Sometimes a buyer sees a property that he is interested in and his broker has not offered it to him. Often it is because it has just come on the market or does not meet the initial search criteria, which is why constant communication between the buyer and his broker during the purchase process is very important because the criteria can change during the search.

The broker who represents you takes care of the appointment requests, organizes the agenda and accompanies you during the visits. Once you have found the property that suits you, the broker begins the purchasing process: drafting the promise to purchase, negotiating, verifying and coordinating the fulfillment of the conditions.

ING

PURCHAS

PROCESS

8

PURCHAS

RESEARCH (CONTINUED)

It is very important that the broker representing the buyer contact the broker representing the seller in all cases, because if the buyer calls the seller's broker directly without going through his broker, he will become the client of the seller's broker and the broker representing the buyer will not be entitled to his compensation.

For a broker, buying without a brokerage contract limits his freedom of action and thus restricts him to proposing an inventory that is limited to what is for sale on the Centris network.

The broker works on a basis of trust and without a safety net, which requires mutual loyalty and commitment because he invests real time, energy and money for a probable income.

Open Houses

It is always preferable to be accompanied by your broker in order to benefit from his or her opinion and advice. However, if you decide to attend an open house, you must advise your broker so that he or she can announce your arrival to the seller's broker. Always advise the broker on site that you are represented by presenting your broker's business card.

Negotiating in your interest

When you authorize a purchase brokerage contract, you delegate the responsibility of negotiation to a professional whom you mandate to work in your best interest. When you work with the listing broker, the contractual relationship is between the seller and his broker. It is normal that he works in the interest of the seller.

Adviceduringvisits:

■ Always be respectful and save your comments for the visit recap

■ Make yourself at home, open the closets and storage (except for the dresser drawers). Take the time to imagine yourself living there.

■ A recap will be done outside the property after the tour is complete.

ING PROCESS

9

DRAFTING OF THE PROMISE TO PURCHASE AND DETERMINATION OF THE CONDITIONS

Determining the price

Several methods are used to determine the market value of a property. This study will allow us to target a price range that is realistic to pay. Real estate appraisal is not an exact science, several factors, such as scarcity or strong competition, economic issues in the sector, the general condition of the property, the conditions of the promise to purchase are specific factors that influence the price.

■ The evolution of the market since the acquisition is a good indicator of theoretical value

■ The study of comparables sold can also be a good indicator of market value

■ Competition: the scarcity or abundance of properties for sale on the market is an important factor to consider.

A deposit in trust - CREDIBILITY

A significant deposit in trust can have a lot of influence when presenting a promise to purchase. It gives credibility and confirms the seriousness of the approach. The deposit and the pre-qualification are a winning combination in negotiations. The deposit always remains the property of the buyer and is immediately refundable if the promise to purchase becomes null and void.

Financing or proof of cash - MAXIMUM OF 14 TO 21 DAYS FOR THE MORTGAGE

In order to ensure that a financial institution will accept to finance the property, a financing condition will be part of the promise to purchase. The buyer has a period of 14 to 21 calendar days following acceptance of the promise to purchase to provide the seller with unconditional proof of financing.

Proof of down payment can come from the sale of a house or a bank account - A short period of time (e.g. 5 days) will be given to the buyer to provide proof that he has the necessary funds to close the transaction.

PURCHASING PROCESS

10

DRAFTING THE PROMISE TO PURCHASE AND DETERMINING THE CONDITIONS (CONTINUED)

Building Inspection - HIGHLY RECOMMENDED

Although the inspection is not mandatory, it is strongly recommended. The inspection allows the buyer to have the property checked by a building inspector in order to know its condition. It allows the buyer to plan a schedule of maintenance to be done over time to ensure the longevity of the building. The inspection should be carried out within 3 to 7 calendar days following the acceptance of the promise to purchase, then the buyer will have an additional 4 days to read the report. If this inspection reveals the existence of a factor relating to the immovable that could significantly reduce its value or increase its expenses, the buyer may render the promise to purchase null and void by notifying the seller in writing and giving him the inspection report within the accumulated time limit. In the event that the buyer does not notify the seller in the manner provided for, he shall be deemed to have accepted the inspection to his entire satisfaction.

Be prepared for the inspection! A used property was built according to the national building code in effect at the time, so it is normal that it does not meet today's standards. From Moreover, since the building is second hand, it will require maintenance in the short, medium and long term, in the same way that a new property will require maintenance as well. recommendations that will normally represent a % of maintenance that will be proportional to the age of the property. proportional to the age of the property. The seller's declaration is a good guide, the inspector will be able to the inspector will be able to target the areas where he should pay particular attention. It is also the buyer's responsibility to to read the seller's declaration before writing the promise to purchase because the situations to be corrected already identified are part of the selling price and the buyer cannot invoke a problem already known to renegotiate or to renegotiate or withdraw from the promise to purchase.

PURCHASING PROCESS

11

DRAFTING THE PROMISE TO PURCHASE AND DETERMINING THE CONDITIONS (CONTINUED)

Examination of documents and invoices - MAXIMUM OF 5 DAYS AFTER OBTAINING THEM

Depending on the type of building, there are sometimes important documents to verify: declaration of co-ownership, minutes, financial statement and income statement, proof of insurance, etc. (exhaustive list of types of documents for each market segment). Verification of risk areas, such as pyrite, radon, iron ochre, former landfill sites, etc*.

Date of notarized deed and taking possession - RECOMMENDED FAST NOTARIZED DEED

The seller proposes a time frame within which he is comfortable for the signing of the deed of sale. However, this time frame is often flexible and can be part of the negotiations to satisfy the parties to the transaction. When making a promise to purchase, it is important to define your expectations.

It is recommended to sign the deed of sale quickly, even if there are several months between the deed of sale and the date of occupancy, in order to reduce the risks of withdrawal, death, serious illness, legal incapacity or change of status. The seller will pay the buyer a financial compensation at the notary's office so that the latter can meet his financial obligations and thus secure the transaction for both parties.

*Clauses 9.1 - 12.1

ING PROCESS

PURCHAS

12

PURCHAS

THE LEGAL RELATIONSHIP IS CREATED

Acknowledgements, expiration dates and notices of completion of conditions seal the sale and make it final.

After all conditions have been met, except the signing of the deed, the legal bond is created. It is at this point that the listing broker puts up the sold sign.

■ You must find an insurer before the date of signing the deed. This is because the notary will need to communicate the information about the coverage to your creditor.

■ You need to find a notary who can instrument and then notify your broker to ensure that the sellers, creditors, surveyor and insurer send the documents to the broker to have the sale coordinated. The notary will contact you for two appointments: the first, to have you sign the mortgage documents and the second, to sign the sale documents with the seller.

Through my many partners, I can refer you to the professionals you need throughout the buying process.

For the day of the sale, cheques and 2 pieces of photo identification are required.

Depending on the date of occupancy, make sure to transfer responsibility for Hydro-Quebec, Gaz Métropolitain, the alarm system, etc. Also, you will have to contact the syndicate of co-ownership in case of purchase of a condo, to announce yourself and to verify if there are specific rules for the move. Don't forget the keys and, if applicable, the tenants' cheques with the tenants' contact information.

ING PROCESS

13

PURCHASING PROCESS

MAKE YOUR MOVE A SUCCESS

TWO MONTHS BEFORE THE MOVE, NOTIFY:

Governmentandpublicservices

D Telecommunication service: Internet, telephone, television

D Heating oil company

D Hydra-Québec

D Post office

D Société d'assurance automobile du Québec (SAAQ)

D Revenu Canada et Revenu Québec

D Régie des rentes du Québec

D Social plans concerned

ProfessionalServices

D Physician

D Dentist

D Optometrist

D Lawyer

D Notary

D Veterinarian

Insurers

D Life and accident insurance

D Automobile insurance

D Home insurance

D Dental and medical insurance

Others

D Parents and friends

D Subscriptions of all kinds

D Financial institutions

D Schools and daycares

D Public library

D Clubs or associations

D Car dealerships

D Employers and unions

D Home delivery or service companies

HERE ARE SOME USEFUL LINKS:

A FEW DAYS BEFORE MOVING

D Book a daycare center

D Group boxes and other items to be moved in one room, preferably in the same room, preferably on the first floor

DConfirm agreements with movers: date, price, insurance, arrival time and directions to your residence. Leave a phone number where they can reach you in case of unforeseen circumstances.

THE DAY BEFORE MOVING

D Unhook curtains and blinds

D Clear the entrance and passages used by the movers

D Identify the boxes and items to be moved as well that the equipment you move yourself

ON MOVING DAY

D Take note of the meter readings (electricity, oil, etc.)

D Bring your telephone

D Inspect each room to make sure you haven't forgotten anything

D Before you leave, hand over the keys to the right person

D Keep all important documents with you: cheques, moving contracts and invoices, etc.ment, etc.

ONCE AT THE DESTINATION

D Note any breakage that may have occurred during transport

D Write down any lost or damaged items on your movers' delivery slip any lost or damaged items on your movers' delivery slip

D Record the meter readings

■ Moving Waldo allows you to make all your address changes in 5 minutes with over 500 providers: https://www.movingwaldo.ca/fr/

■ Canada Post provides tips for changing your address: http://www.canadapost.ca/cpo/mdpersonal/productsservices/receive/coapermanent.jsf

■ The Government of Quebec offers a service to notify six departments and agencies in one step: http://www.adresse.gouv.qc.ca/

■ Hydro-Ouébec allows you to easily change your address online: http://www.hydroquebec.com/residentiel/espace-clients/demenagement/

14

ING PROCESS NOTES 15

PURCHAS

willbewithyou before,duringandafteryour acquisition!

CharestMahadéoyourRealEstateBroker martineavoscles.com

438.725.4040

I

Martine

mcm@martineavoscles.com

Turning dreams into addresses, one key at a time !

By: Martine Charest

By: Martine Charest