Compliments of

Core Values

Welcome

Our Story

Our Road to Success

Meet the Team

Representation Options

Everyone has advice

Dual Agent

Question

Buyer Broker Commission

Answer: Absolutely Not!

One Line-Item Additional Expense?

Proprietary Tools

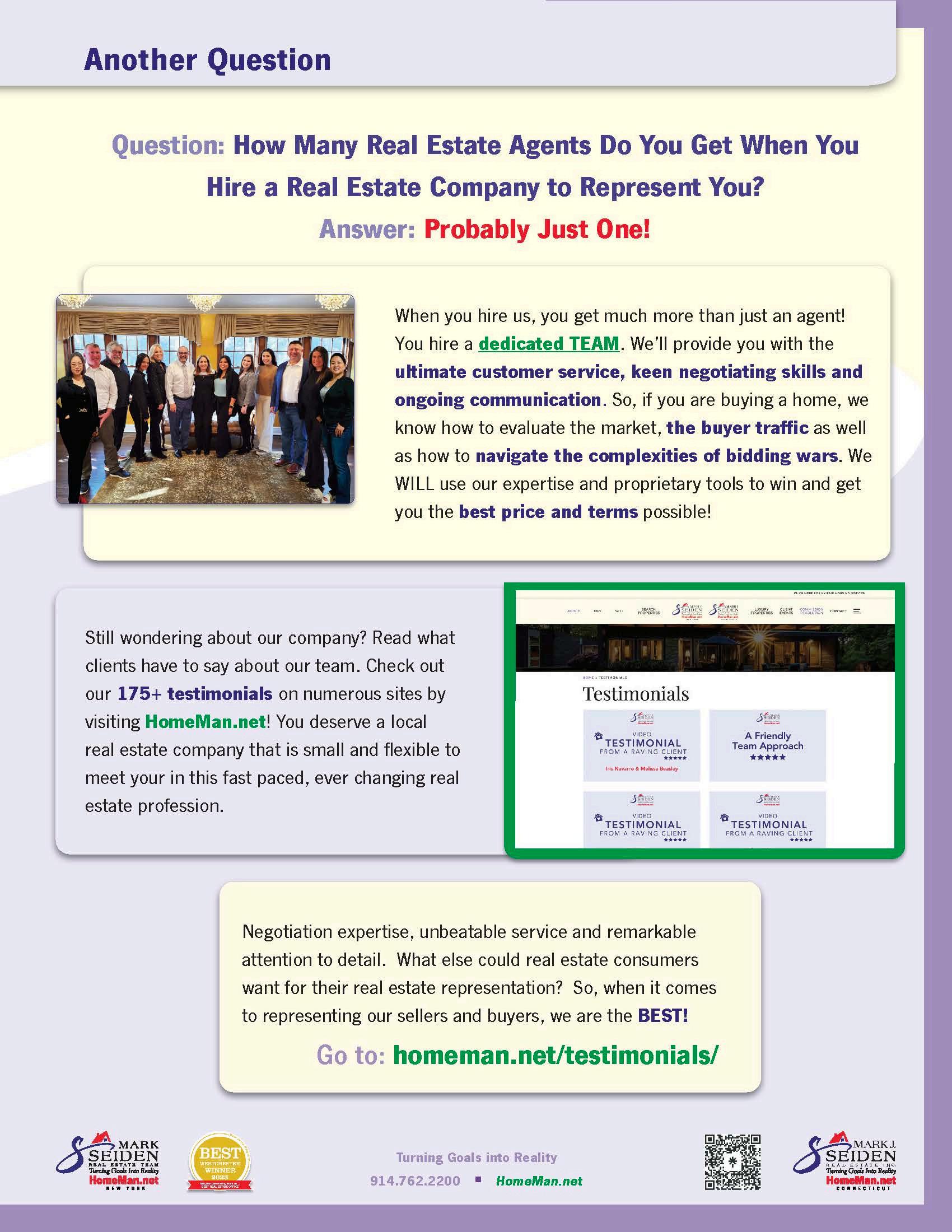

How Many People Does it Take?

Celebrate our Clients

27 Seiden+Solar

Mark in the community

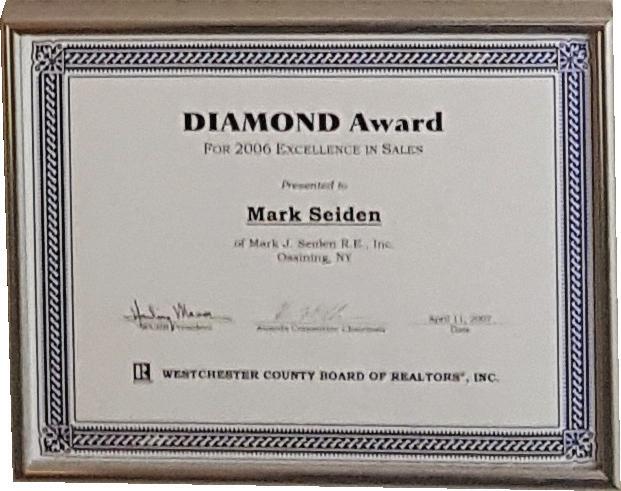

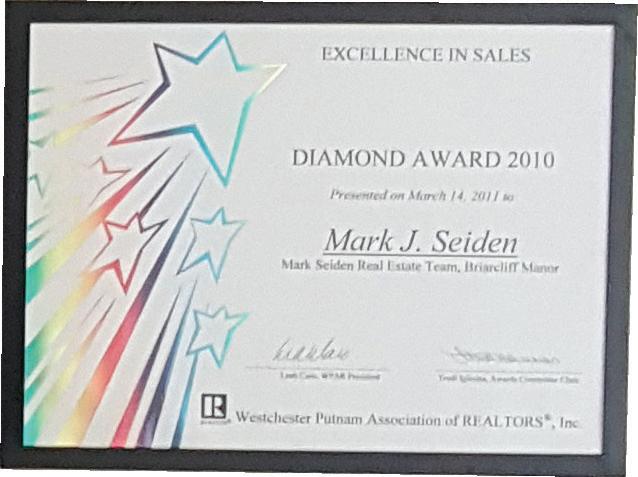

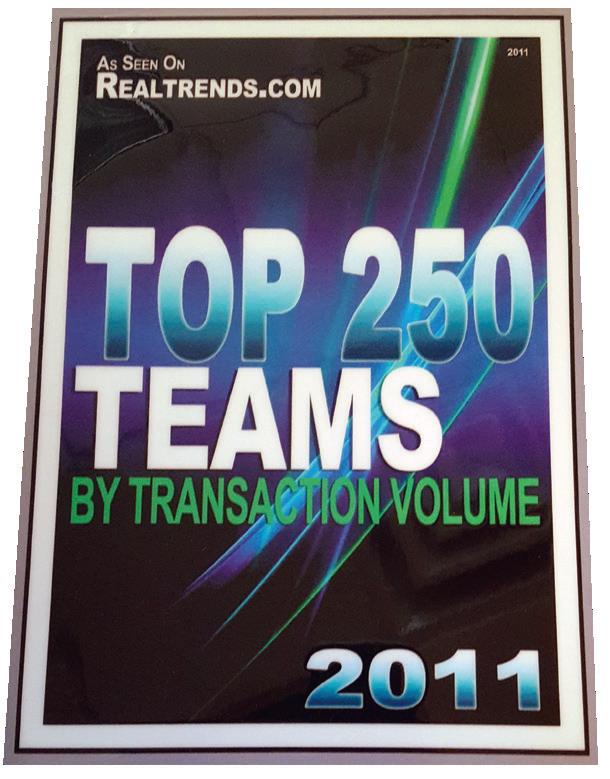

Mark’s awards

Mark in the news

Mark’s reports

Remarkable Properties for Buyers

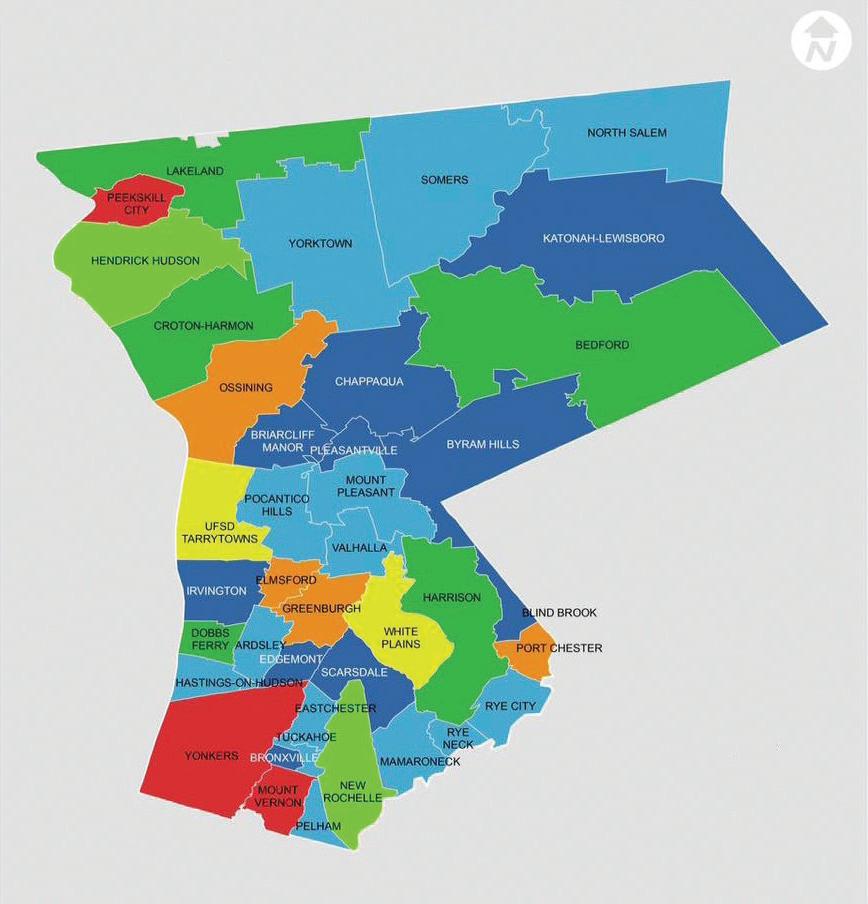

Westchester School Districts

Search Globally

Search Locally

Buyer bill of rights

Due diligence

Estimated purchase costs

Frequently Used Mortgage Terms

Tools to make purchase easier

Home Owners Warranty

Property Condition Disclosure

Explanation

Federal Title X Lead

The Buying Process and Offer

Steps to Successfully Purchasing a Home

The Value of a Property

Online Home Values

Comparable Market Analysis

What is a Bona Fide Offer?

A Little Humor

Notes

Additional Services

Preferred Service Providers

Credit Repair and Monitoring

Short-Selling for the Financially Distressed El Sueño Americano

Jack Castaneda — 5 ★

We have worked with the Mark Seiden Real Estate Team since 2001, first as a purchaser of our home in Briarcliff Manor and then as a seller this year. Both times, Mark Seiden’s team came through with flying colors. As buyers, he found us the perfect house in a great neighborhood with an excellent school system for our family while quickly selling our townhouse in Dobbs Ferry. Thanks to Mark’s knowledge and expertise, the closing and move went through smoothly without any problems. When it came time to sell my house in Briarcliff Manor this year, we knew he was the Realtor for us. If you are buying or selling any real estate in Westchester County, this is the best company in New York.

Jack and Janet Castaneda, November 6

Michael Turco 5 ★

Michael Turco — 5 ★

After 3 frustrating years of attempting to sell our home with other agencies, we hired Mark and his team and had an accepted offer within 4 weeks. We were thrilled with the results Mark and Allyson got. Our home sold quickly and we got significantly more than any of the offers we had gotten in the past. Mark’s team was exceptionally professional and helped us navigate a difficult real estate market.

Trust Mark and his team to work quickly, getting you top value on your home with state-of-the-art marketing systems, strategies and techniques. Mark is also a shortsale and distressed property expert.

szavo54 reviewed Mark Seiden Helped me sell a home

Mark and the team sold our house and helped us buy our new home. Mark and the team really worked hard and it shows in the quality of work that was performed. Dedication and experience no matter the price of the home. We are the perfect example and I am always telling people our story and experience using the Mark Seiden team.

Mark and the team sold our house and helped us buy our new home. Mark and the team really worked hard and it shows in the quality of work that was performed. Dedication and experience no matter the price of the home. We are the perfect example and I am always telling people our story and experience using

We were sellers and words cannot describe the incredible experience my family had with Mark Seiden and his entire group of professionals. There aren’t enough adjectives in the dictionary. From start to finish it’s nothing but the best service throughout your purchase or sale. It starts with a friendly face and a genuine desire to help; honesty & integrity; local knowledge and how to prepare your home for sale. The process is simple and if you follow it, you will sell your home quickly and at the top of the market. And if you’re a buyer, he will negotiate the best price and terms to save money. The follow up attention is out of this world and is second to none, and the team as a whole, is excellent! I spent 36 years in the corporate world and haven’t seen this type of dedication from Fortune 500 companies and other Blue Ribbon firms. There are Realtors® and then there is Mark Seiden, the “Gold Standard” in the industry. The choice is yours, we couldn’t be happier!

Go to: HomeMan.net

Welcome [wel-kuh-m]

verb

Greet (someone arriving) in a glad, polite, or friendly way

As one of the top three out of over 13,000 agents in our “MLS” for over 25 straight years, and being one of the top three teams in Westchester and Putnam Counties, we certainly sold, and continue to market, a large number of properties for sale. And that clearly is the result of our efforts for our clients.

But those “sales and signs” mean more than just marketing houses for sale or selling a buyer a home. All of our clients are, or were, going through major life transitions each and every day during every transaction, whether the transition was desired or unfortunately forced upon them! It’s not just about “buying or selling a home.” It never is.

We strive to listen to and understand our clients’ unique situations. We want to know their hopes, dreams and even fears. We guide people through their transition in life as everyone needs help during change!

No one should do it alone and without the knowledge and experience to move forward. That is what we do.

We feel privileged to share in some of the most important moments of our clients’ lives. We appreciate their faith in us and strive to create an experience for them that is authentic, honest and inspiring.

Because, we must be successful to assist our clients through their major life transitions . . . Failing to do so, is just not an option!

Mark, Allyson and Amy did a terrific job helping us sell our home. It takes strategic thinking, street smarts, local knowledge, patience and creativity to get a deal done. And Mark and his team have it all. From day one they were attentive, focused and always a pleasure to deal with. Issues will always arise, and Mark was always ready to jump in and find solutions. Their attention to detail as we got ready for closing was off the charts helpful — highly recommended . . . thanks Mark and team.

– Stuart and Adrienne Gruskin

Our

story

. . .

As a true pioneer in his field, Mark was the “first” in so many respects in Westchester County and the surrounding counties. In the 1990’s, Mark was the first Realtor® to place his photo on a business card, put his contact information on a “for sale” sign so buyers could get answers quickly to their questions, use “virtual tours” on the internet and print color postcards to mail out to procure buyers for his sellers, despite the prohibitive expense of printing in color at that time.

Go to: homeman.net/testimonials/

Starting in early 2000, while other brokerages continued to advertise using “old fashioned print media,” Mark had the vision to realize the buyers weren’t looking in newspapers anymore, but were searching on the internet. Mark made the switch from “print to digital” and never looked back. The interesting thing is . . . , all the chain and regional real estate brokerages scoffed and ridiculed his approach. Yet, within just a year or two after Mark implemented his innovative marketing strategy, the other brokerages all followed suit. Do you know of any brokerage today where agents are not putting their color photos on marketing, using online advertising, etc.? Mark prides himself on forging new ground, embracing technology and leveraging his creativity and imagination.

Throughout this presentation, you’ll gain a better understanding of our team approach and the role that cutting edge marketing plays in the sale of your home.

1961 Mark Seiden is born.

1978 Lois Seiden Real Estate is founded.

1994 Mark joins Rotary Club of Briarcliff Manor.

1997 Lois Seiden Real Estate sells to Coldwell Banker.

1979 Mark graduates from Ossining High School.

1993 Mark Seiden starts real estate career, joins Lois Seiden Real Estate.

1983 Mark graduates from Cornell University.

1992 Mark and Amy get married.

2002 Mark is #1 Coldwell Banker Westchester Agent for fifth straight year.

2015 Mark receives his 100th online testimonial on Zillow.

2003 Mark leaves Coldwell Banker to open Mark J. Seiden Real Estate, Inc.

2014 Mark sells his 1,500th home.

2013 Mark celebrates 20 years selling real estate.

2016 Mark becomes National Coach with Workman Success Systems.

2021 Mark Seiden expands to Connecticut.

2004 Mark opens El Sueno Americano Division.

2005 Allyson Davidov joins the Team.

2006 Mark receives IFCA Outstanding Community Service Award.

2009 Mark obtains CDPE designation and moves into larger office in Briarcliff Manor.

MARK J.

2008 Mark changes company name to Mark Seiden Real Estate Team. Mark sells his 1,000th home.

2023 Voted BEST REAL ESTATE OFFICE for Westchester Magazine’s Best of Westchester.

2023 Mark is selected as one of Westchester’s Top Real Estate Agents according to Westchester Magazine.

Mark Seiden, Rainmaker/Director of Team Operations

Mark Seiden was born to become a real estate leader and professional coach. As a graduate of Cornell University with post-graduate credentials from the University of California–Berkeley, he began his career in 1993 at Lois Seiden Real Estate of Westchester County, New York, and was the agency’s top agent each year until it was sold in 1997. He continued his ascent by earning a position as the Number 1 Agent for all of Westchester County at Coldwell Banker Residential Brokerage for five consecutive years (1997-2002). In 2003, he founded Mark J. Seiden Real Estate, Inc., rebranding it as the Mark Seiden Real Estate Team in 2008.

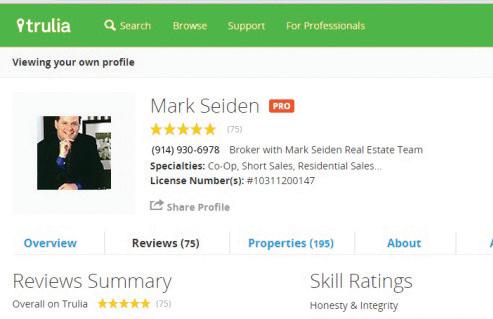

Since 2004, Mark was and continues to be ranked among the Top 3 Agents for selling single-family homes in all of Westchester/Putnam Counties (over 13,000 agents) — ranking Number 1 in 2008, 2014 and 2015.

A natural mentor and gifted communicator, Mark and his work have been featured in articles in the New York Times, New York Post, Real Estate In-Depth, Westchester Magazine and numerous other publications. In 2016, Mark was recruited by Verl Workman of Workman Success Systems, who is recognized by Inman as one of the top 25 coaches. Mark’s role is to coach other Realtors, sharing his own experiences so that others may benefit. 2023 proved to be a busy year! Mark received 2 accolades from Westchester Magazine! He was selected as one of Westchester Top Real Estate Agents and his office was voted BEST REAL ESTATE OFFICE! In his spare time, Mark loves to cook, play tennis, travel the world and spend time with his family.

In 30+ years Mark has sold over 2,600 properties and counting . . . R

Allyson Davidov, Listing Partner

Allyson joined the Mark Seiden Real Estate Team in 2005. As the Team’s Listing Partner, Allyson has led the sellerrepresentation side of the Team and has been the driving force in closing over 750 properties, establishing Mark J. Seiden as a Top 3 Agent in all of Westchester County.

Proficient in the art of selling, negotiating, problem-solving and closing deals, Allyson makes the process smooth and seamless. When it comes to selling homes, Allyson uses her natural energy and enthusiasm to make her clients the happiest sellers in the world.

Allyson is active in the local real estate environment, participating in seminars, networking events and community outings in order to meet new people and build enduring relationships.

A long-time resident of Ossining, Allyson has lived in the metropolitan New York area for about 40 years. She received her undergraduate degree from the University of Vermont and a master’s degree from New York University. Allyson grew up in Massachusetts and is a lifelong Patriots and Celtics fan, but somehow shed her Boston accent and raised a family full of NY Knicks fans. She enjoys reading, playing tennis, movies and 70’s music.

In 20+ years Allyson has sold over 750 properties and counting . . .

Allison Imondo, Senior Buyer’s Partner

I epitomize professionalism and integrity, while providing the most efficient service in the industry. My strong negotiating abilities and first-rate communication skills are what my clients value and appreciate the most.

Michele L. Hamburg, Esq., Buyer’s Partner, Hablo Español

I am driven by a desire to help my clients find their dream home, while making the process as seamless as possible. I bring a wealth of knowledge, integrity and attention to detail to all my transactions. Creating lasting relationships is very important to me, as I strive to get to know my clients and their dreams.

George Gabor, Buyer’s Partner

Being a 30 year resident of this area, I am known to be a strong negotiator who understands the unique complexities of the real estate transaction from beginning to end. I use my expertise to educate and guide my clients through the entire process to a successful conclusion.

Jennifer Picucci, Sales Associate

I have extensive experience in customer service, sales, and marketing, with a genuine passion for real estate. I love helping my clients achieve homeownership, supporting and educating them through every step of the process. I focus on building strong relationships with my clients. From the big questions to the little details, I’ve got you covered!

Eiddie Baret Executive Assistant Showing Specialist

Alyssa Nealon Director of Fun Times

Stephanie Tapia Field Services Coordinator, Hablo Español

Rob DeCourcey Open House Assistant

Amy Seiden Director of Community Philanthropy

Angel Diego Transaction Coordinator

Angeli Sediego Client Care Coordinator

Representation [re-pri-zen-tā-shen ] verb, present tense

the action of speaking or acting on behalf of someone or the state of being so represented

requires real estate licensees who are acting as agents of buyers or sellers of property to advise the potential buyers or sellers with whom they work of the nature of their agency relationship and the rights and obligations it creates. This disclosure will help you to make informed choices about your relationship with the real estate broker and its sales agents.

Connecticut law requires all real estate brokerage firms and their affiliated licensees (“licensee”) to perform certain basic duties when dealing with a buyer, seller, landlord or tenant. Until you enter into a written brokerage agreement with the licensee for clientlevel representation you are considered a “prospective party” and the licensee is NOT your agent.

Is there a benefit for a Buyer to purchase a property directly from the Listing Agent or with a Brokerage that claims to have the most number of Listings for sale?

Some Agents and Brokerages may reduce their Commission to the Buyer for “double-ended deals,” and the Buyers love that!

And some Brokerages pay their Agents a bonus for “double-ended deals,” and the Agents love that!

But the Buyers LOSE their Brokerage’s and Agent’s Fiduciary Duties of Full Disclosure and Undivided Loyalty!

The Brokerages and the Buyer’s Agents have a CONFLICT OF INTEREST with their own Buyers!

Pure Buyer’s Agent

Fulland Undivided FiduciaryDuties totheBuyers!

Buyer’sAgent ABCRealty

ListingAgent ABCRealty

Designated or Pure Dual Agent

Limited Fiduciary Duties to the Buyers!

Can’t give advice! Can’t disclose! It’s against the law!

Dual Agent with Designated Sales Agents

... A designated sales agent cannot provide the full range of fiduciary duties to the landlord or tenant. A designated sales agent cannot provide full range of fiduciary duties to the buyer or seller. The designated sales agent must explain that like the dual agent under whose supervision they function, they cannot provide undivided loyalty. A buyer or seller should carefully consider the possible consequences of a dual agency relationship with designated sales agents before agreeing to such representation.

Did the Listing Agent, Buyer’s Agent, or the Brokerages who claim to have the most number of Listings tell you this?

Answer: Obviously NOT!

Let’s ask this question about another profession—

Are all lawyers the same? The law is the law and it is the same for everyone, correct?

And, the law is written somewhere that all the Judges and Lawyers use, yes?

Does that mean all lawyers win the same number of cases, represent clients and litigate in court in the same way?

They all have the identical license, but does every lawyer have the exact same talent . . . and winning results?

Isn’t that the same for real estate agents too? Don’t they all have the same license and work with the same homes on the MLS, buyers, sellers and other agents?

So, does that mean that each agent will have the same results in this market? Let’s see . . .

If you need to buy or sell a home, do you think you will buy or sell a home for the same price no matter which real estate agent you select? Do you think that out of over 13,000 agents that work in Westchester County, that all agents have the same strategic pricing, marketing, negotiating and deal making skills? Your agent is responsible for successfully coordinating, managing and negotiating with a multitude of professionals. And, you need the best in the business!

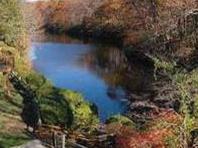

Buyers must now sign a Buyer's Brokerage Agreement to work with Buyers' Agents regarding Buy-Side paid Commissions. So, how will the Buyers’ Agents get paid?

TheBuyerswillpaytheBuyers’Brokeragesdirectlyatclosing... TheBuy-SideCommissionsmaybeincludedintothesales price,wherebytheSellerswillpay-outthe Buyers’BrokeragesCommissionsfrom theSellers’proceeds.

Must Sellers offer and obligate themselves to pay-out a Buy-Side Broker’s Commission when they sign a Listing Agreement with a Brokerage?

Agents and Brokerages are panicking!

Answer: Absolutely Not! MODE

Agents are stating that if Sellers offer a reduced or no Commissions, the Buyers’ Agents won’t show the properties!

That is NOT True!

That’s a breach of an Agent’s Fiduciary Duties!

And Buyers should NEVER limit the number of properties they see based on whether Sellers are offering reduced or no Commissions! Why, you ask?

Because Buyers are not precluded from presenting offers to the Sellers, that include a Seller paid Buy-Side Commission to the Buyer’s Brokerage.

The Sellers may entertain offers from any ready, willing, and able Buyers. The Sellers will then evaluate each individual offer based on the Net price after Commissions and the terms of each offer.

Why are agents protecting their Commissions instead of their client’s money?

The Sellers will decide which offer or offers, if any, are best to either counteroffer, or if there's one offer the Sellers will accept.

If the BEST offer submitted includes a Seller paid Buy-Side Commission request, which still Nets the Seller the most money, then the Seller will most likely take that offer.

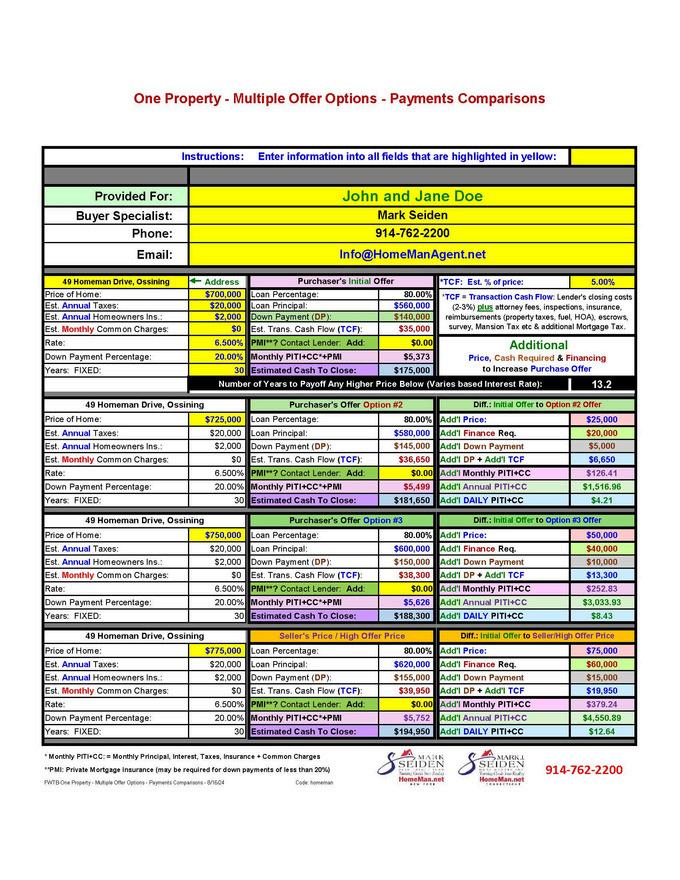

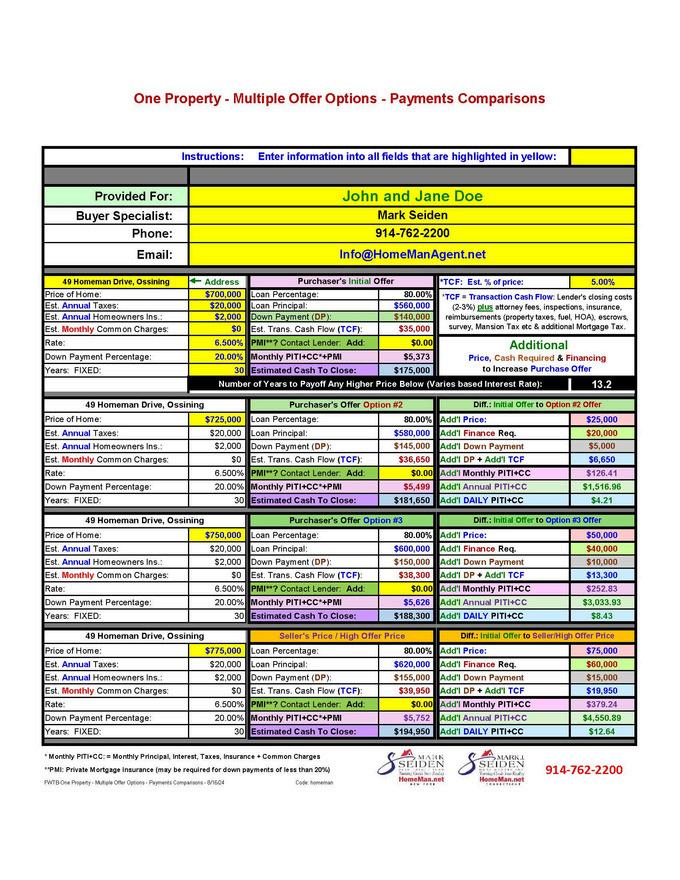

What is the Value of a Real Estate Agent? Are Real Estate Agents all the same? Are they all ju One Line-Item Additional Expense

Question:

How does a Real Estate Agent EARN a Commission?

Answer:

w you how the al Estate Team is m Additional Expense a property...

Save more money for the Buyer than the expense of the Commission, that’s how! It’s called ROI!

DoesthelowestCommissionanAgentchargesequatetothebestdealfortheBuyer?

IfoneAgent’sCommissionishigherthananother’s,isitpossiblethatoneAgenthas moretalent,skillsandtoolstosaveaBuyerTWO,THREE,FIVEpercentorMOREontheir purchase?Inotherwords,wouldyoupay$10,000ormoretosave$30,000,$50,000, $75,000ormore?Doesthatmathwork?

Inthismarket,wheremostpropertiesexperiencea"biddingwar,"howwillyoubethe BuyerthatWINS?

WhatBuyersdon'trealizeisinabiddingwar,it'snot"oneBuyerwon"and"hey,Ilost "It's thefive,seven,10ormoreBuyerswhoalsolostinthatbiddingwar So,whenthenext propertygoesonthemarket,won'tthoseBuyersbebiddingonthatpropertytoo?Ifso, whatarethestrategyandtoolsyourAgentwillprovideyouto"winthatbiddingwar?" There are approximately 13,000 Real Estate Agents

We give our Buyers the “strategic edge” in this market to save MORE money purchasing a property than our competitors can. And we have the proprietary tools to PROVE it. Can other Brokerages’ Agents prove that?

Invest with the Mark Seiden Real Estate Team! We will save you More Money than the One Line-Item Additional Expense of the Broker’s Compensation! Don’t Just Spend Money to Buy! Invest in a Master Negotiator and Save Big on your Purchase! An Agent and a Brokerage must EARN their Commission. The Buyer must EARN a “Return on the Buyer’s Commission Investment!”

What if the Mark Seiden Real Estate Team makes your offer stand out, among all the multiple offers by other Buyers, whereby:

your offer waives any Commissions offered to the Buy-Side by the Sellers, so the Sellers may keep that money, Netting the Sellers more than other Buyers’ offers

you finance the Buy-Side Commission to the Buyer's Brokerage you don't have to spend much more out of your bank account to pay-out a Buy-Side Commission and the purchase price of the property is NOT increased to pay-out any Commissions, which keeps your property taxes lower for the entire time you own the property...

Wouldn'tyouhavetheBESTchanceofwinningabiddingwarsoyou don'tneedtospendmoreandmoreandmoreonthenextnegotiations?

Wehavemanyotherproprietarytoolstoo.Forexampleinabiddingwar,ifyouneedtoincreaseyouroffer priceby let'ssay$25000 thatmayreallyonlyincreaseyourdownpaymentby$5,000(if20%down)and anadditional$4.21aday...taxdeductible! orethan4bucksaday,taxdeductible?

Then what are they telling you and showing you for them to EARN a Commission and not just be a One Line-Item Additional Expense to help you purchase a property? and if you are financing...

Do you think the only thing a Real Estate Agent will do is “put the seller’s home on the computer” or “unlock the door to show a buyer a home?”

The fact is, your Real Estate Agent is responsible for successfully coordinating, managing and negotiating with everyone who is shown on the following lists, which is based on a typical transaction.

Your Agent’s responsibility is to make sure every participant gets the job done!

# of People Type/Title/Profession of Participant

2 Sellers’ Real Estate Agent & Broker/Manager of office (follow Policies/Procedures/Ethics and Law)

2 Buyers’ Real Estate Agent & Broker/Manager of office (follow Policies/Procedures/Ethics and Law)

2 Sellers (Privately owned, Estate, Foreclosure-Bank Owned, Short-Sale, etc.)

3 Sellers’ friends/family/work associates who provide advice/counsel

2 Buyers

3 Buyers’ friends/family/work associates who provide advice/counsel

1 Home Inspector (general inspection)

1 Specialty Inspector (termite, septic, buried oil tank, well, pool, HVAC, etc. inspection)

1 Radon Lab Technician to analyze test sample

3 Mortgage Lending Institution: Representative/Agent/Broker, Processor and Underwriter

1 Property Appraiser selected by Mortgage Lending Institution

2 Sellers’ Attorney with a legal assistant (includes secretarial, administrative and paralegal)

2 Buyers’ Attorney with a legal assistant (includes secretarial, administrative and paralegal)

1 Bank Attorney

2 Title Insurance Researcher/Clearance Officer plus representative at closing

1 Building Inspector to verify any C of O, open permit, expansion items (Title company performs a municipal search)

1 Tax Assessor to provide and explain “Property Card” (Title company researches during municipal search)

1 Tax Receiver to verify all property taxes have/have not been paid by sellers

2 Homeowners’ Insurance: Representative/Broker/Agent and Underwriter

But if everything is not in order or more complicated, you may have to add . . . 33

# of People Type/Title/Profession of Participant

3 If property is rented: Tenants (A property may have more or less tenants)

2 If Homeowner/Condo Association: “Board member/Management company administrator: write letter of ‘Right of first refusal’”

5 If Co-Op: Co-Op Board members for interview process (A Co-Op board may have more or less members)

3 If other inspection conditions/upgrade items need to be evaluated/proposed: Additional “Trades/Professionals” (Plumber, Electrician, Architect, Roofer, Contractor, Painter, Basement Water Mitigation Contractor, Heating/Air Conditioning, Landscaping, Swimming Pool, Well Water Lab Technician, etc. . . .)

1 If require electrical additions/changes for C’s of O/Permits: NY State Electrical Inspector

1 If require “ceiling height variance” for basements: C’s of O/Permits: NY State Building Inspector/Code Enforcer

1 If Lending Institution requires new/updated survey: Surveyor

1 If property is “over-assessed:” Property Tax Assessment Reduction Specialist

1 If mortgage is for more than 80% financing: PMI Underwriter

1 If Sellers or Buyers purchase a Homeowners’ Warranty: Home Warranty Processor

1 If there are any Wood Destroying Insects: Exterminator

1 If Buried Oil Tank fails vacuum/soil tests: Buried Oil Tank Remediation company

1 If Buried Oil Tank has or needs “Oil Tank Insurance:” Buried Oil Tank Insurance company

1 If Mold is present in the property: Mold/Environmental Specialist

1 If Radon Gas valuation exceeds 4.0 pCi/L in lowest level: Radon Mitigation Installation company

1 If Well Water valuations exceeds legal limits: Well Water system company

1 If property has or is in need of a Water Treatment System: Water Treatment System installer/service provider

4 If Short Sale: Loss Mitigation representative, the “investor" (owner of loan), plus 2 Broker Price Opinion Agents

And still counting, because sometimes there are even more people involved . . .

Five times a year, The Mark Seiden Real Estate Team hosts events for our past and current clients to thank them for their business and awesome referrals!

Held at our office, we host a shredding event! Now you may safely dispose old or unwanted confidential documents. And, the best news: the shredding company will recycle 100% of the paper that is shredded. Recycling one ton of paper saves 17 mature trees! Light refreshments provided. Open to our clients and the public for a $20 donation. All donations will go to The Ossining Food Pantry.

Held on a spring evening, we host a wine tasting event at The Briarcliff Manor! Our clients sample some wonderful wines and delicious fare all while enjoying an adult evening!

For more information about our Client Appreciation Events, Go to:

homeman.net/client-events/

We host a private screening of a newly released movie! This event is FREE to our clients and is open to the public. Refreshments are available.

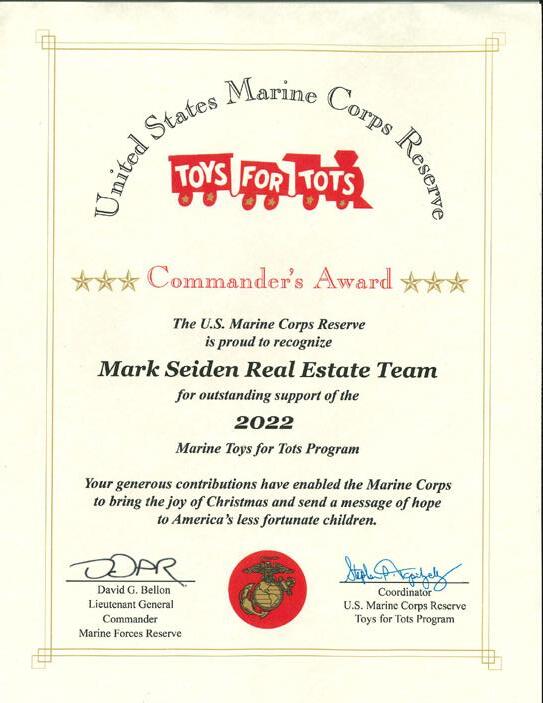

To show our gratitude, we offer FREE pies to our clients. Last year, we gave away over 250 pies! We host a sweater/coat drive, (donated to local organizations) and serve as a drop off center for the U.S. Marines Toys for Tots Campaign!

Client Testimonial:

From start to finish Mark Seiden, Allyson Davidov and the entire team were professional, helpful and caring in what could have been a very stressful process for my wife and me. After getting a new job opportunity across the country we were in a tough situation of having to move before selling our home. Selling your home can be scary and overwhelming but the team was there to answer every question we had and took us through the entire process one step at a time. From staging, to photos, open houses, advertising, offers and closing they were able to guide and us and get us to the end point. HIGHLY RECOMMENDED.

Z. Gill, 47 Justamere Drive, Ossining

How is the Team helping the world right now?

In the summer of 2011, we installed solar panels on the Briarcliff Manor real estate office building. We are pleased about being more environmentally conscious, aside from any possible future financial benefits.

Solar energy is SUSTAINABLE and RENEWABLE so we’ll never run out of it and that’s a GREAT thing! Here’s to creating a greener planet for our friends, neighbors, children and our children’s children!

The Team lives in and is part of this community!

Mark values the importance of business community involvement, demonstrated by his activities and his commitment to local organizations. He participates in many local events such as village and town fairs. He demonstrates his commitment to his

community through sponsoring local little league teams, high school productions, education foundations and new initiatives such as the Ossining BELL Equity Fund. These two pages are just a sampling of his involvement!

Throughout the past 30+ years, Mark, with his Team, has received many, many awards recognizing his multi-million dollar sales. Additionally, he has received many awards recognizing his community service including

the prestigious Rotary Paul Harris Fellow award and the IFCA Executive Director’s Outstanding Community Service Award. Here is just a sampling of the recognition he’s received from the real estate industry and the local community!

Extra, Extra, Read All About Us!

Many prestigious publications—international, national and local—including The New York Times, the New York Post, Reuter’s News and Westchester Magazine, have reached out to Mark for his real estate expertise over the

years. He has been featured in numerous publications, TV, video spots and radio covering many topics from market conditions to foreclosure to general real estate trends. Here is just a sampling of the print press coverage!

Buyers and sellers have vast differences in experiences and success buying and selling real estate. That is why we’ve created many reports, concerning many very specific areas of real estate, in order to help our diverse “know-how” of consumers. If you have a need

Go to: homeman.net/a-little-advice/

or desire to learn more about “how something works” regarding real estate sales, we can help. Just tell us what your needs are . . . and we’ll provide you the report, and guidance, to help you understand the process.

Buy [bahy]

verb, present tense Obtain in exchange for money

Smart [smahrt] adjective

Shrewd or sharp, as a person in dealing with others or as in business dealings

Many buyers feel that buying a home is just calling an agent and then seeing the inside of a home. Unfortunately, that is far from how it really works. How do buyers know which houses to see? How do buyers remember one home from another? What do buyers need to ask to ensure they are making the right purchase at the right price? When YOU find the home YOU want . . . what’s next?!

We created a process and step-by-step guide to ensure that your home purchase is organized so you have all the information you need to make the right decision . . . and to ensure we promote you, in the most positive way possible, to convince the sellers to take YOUR offer as close to Your price and Your terms.

As a first time home buyer, I experienced the problems, brutal inspection issues and the trauma of a negotiation whereby possibly, not buying the home my wife (who had just given birth to our first child months earlier) really, really wanted. In this day and age, there are so many people out there that claim to be real estate agents. Why would I want to trust my first time home buying experience to someone who works in real estate part time? This is why I decided to use the Mark Seiden Real Estate Team in helping me buy my first home. Even though Mark’s office is in Briarcliff Manor, Westchester County and the home I bought is in Dutchess County, he is a full time Realtor that knows his stuff! And negotiation skill is negotiation skill no matter where the best agent is! Buying a home was such a scary process for us! And with the very thought of how much money everything was going to cost, I had to have someone knowledgeable on my side and holding my and my wife’s hands through the whole process. It made our very first purchase a lot easier. Mark is a no nonsense kind of guy and really explained things in ways I can appreciate and understand. His sales staff put together an “attack plan” for searching for a home and within a few short months I had my dream house and property. And when it came to the negotiations, this is where Mark really shined. We never thought we’d get the home at the price we paid. I definitely recommend anyone looking for a Realtor to call Mark and his team. He and his team just get it done!

– Brian and Christina Lufker

Distinctive, Exceptional and Luxury Homes

We sell Estates, Hudson−River−View Properties, Horse Properties, Antique and Historic Homes, New–Construction−Estate Homes, Penthouses and more, like no other Brokerage in Westchester County!

The Mark Seiden Team evaluates a home’s value so as to be able to procure the home quickly at the best price the market will bear. Each buyer is provided a unique and unparalleled evaluation program tailored specifically for each buyer’s needs.

There are 44 School Districts in Westchester County!

We put together a “Buyer’s Bill of Rights” so you, the consumer, will know exactly what you may expect from your Mark Seiden Real Estate Team Buyer’s agent, how we are allowed to assist you and with what certain information we are not allowed to provide to you “by law.” So, please take the time to familiarize yourself

with these “rights” and “checklists” as we take them very seriously. We want to ensure your experience in finding a property with us will be the best possible. And be assured, we will absolutely do much, much MORE than what is listed here… but we had to start somewhere!

Your Buyer’s Agent along with the support and assistance of our team will . . .

1. Act in accordance with the Realtor Code of Ethics at all times.

2. Assist you to ensure you are “pre-qualified” with a lending institution to purchase a property.

3. Give you, without limitation, undivided loyalty, obedience, full disclosure, confidentiality, duty to account and exercise reasonable care. (In a “Dual Agency” or “Conflict of Interest” situation, there are limits to some of these duties.)

4. Disclose all facts known to me materially affecting the value or desirability of a property, except as otherwise provided by law.

5. Follow the rules and regulations of the all Federal, State, County, City, Town and Village “Fair Housing laws” that pertain, as per the location of the property.

6. Treat you with utmost courtesy and consideration.

7. Educate and counsel you on the process of the home sale process.

8. Ensure that you are ready, willing and able to make a purchase.

9. Show you houses based on your needs and wants, except as provided by law.

10. Provide a “comparable market analysis” to provide you with an estimated “fair market value” price range for any property of interest.

11. Submit all offers and communicate all counter-offers accurately, timely and diligently.

12. Negotiate with best efforts to attain a price and terms of a deal that are acceptable to you and the seller.

13. Answer all your questions and concerns, or assist in finding a resource for you, in a prompt manner.

14. Assist you to verify taxes and legal “heated square footage,” and to assist you to ensure “Certificates of Occupancy/Completion” are on file with the building department.

15. Assist to obtain utility, maintenance costs and other vital information for any property of interest.

16. Keep you informed in a timely basis as to the status of your transaction.

17. Coordinate any/all inspections of a property and assist in evaluating and providing resources to determine the costs and severity on any reported defects found on a property.

18. Follow-up with your lending institution’s mortgage representative to assist in ensuring that the mortgage process runs smoothly to attain a “mortgage commitment” and a “clear to close.”

19. Monitor and be available for assistance and counsel during the attorney review process to expedite attaining executed contracts.

20. Follow-up on any issues that survive closings, i.e., escrowed issues, until all matters are resolved.

Your Buyer’s Agent will not . . .

1. Violate the Realtor Code of Ethics.

2. Guarantee or Warranty any opinions given by any inspector, counselor, website, etc. provided to you during the home sale process.

3. Show homes according to the racial, religious or ethnic characteristics of the neighborhood.

4. Give you any opinion or statistic regarding the demographics, school system or crime rate of any particular neighborhood.

5. Hide from a seller any facts that will affect the buyer’s ability and/or willingness to perform-infull, a contract-of-sale to acquire seller’s property that are not inconsistent with my fiduciary duties to the buyer.

6. Offer advice as to what price to pay for a property or to advise where to start or end an offer.

We put together a “Buyer’s Due Diligence Checklist” in order to provide a “checklist” of the top 12 items to research when purchasing a property. Buyers must not solely rely on any verbal information provided by agents, sellers, neighbors, non-licensed “experts,” etc. or any

1. BUILDING CODE/ZONING COMPLIANCE: Consult with the local building department to assure that the intended use of the Property will comply with local zoning requirements and with any recorded restrictive covenants and conditions. Determine whether a certificate of occupancy has been issued for the Property and if building permits and final inspections were obtained for any remodel work at the Property, if applicable.

2. HAZARDOUS WASTE AND TOXIC SUBSTANCES: Consult with appropriate professionals regarding the possible existence of hazardous wastes and toxic substances on the Property, including, but not limited to, asbestos, radon gas, lead, lead-based paint, mold or any illegal substances including methamphetamines.

3. SURVEYING AND STAKING: Procure a survey, if it exists. Without an accurate survey of the Property, a Buyer cannot be certain as to the boundaries of the Property, or that any improvements on the Property are not encroaching upon adjoining parcels of property, or that improvements located on adjoining parcels of property do not encroach onto the Property.

4. FLOOD ZONE AND INSURANCE: If the Property is located in a “Flood Zone” as identified as a Special Flood Zone Hazard Area (SFHA), the mortgage lender may require that Buyer obtain and pay for flood insurance on the Property and its improvements.

5. HOMEOWNERS INSURANCE: Consult directly with insurance companies of Buyer’s choice regarding the availability and costs of homeowner’s insurance for the Property.

6. TITLE ISSUES/HOMEOWNER’S ASSOCIATION: Title insurance companies offer a variety of title insurance policies that provide different levels of coverage. A buyer should carefully review with legal counsel and with the title insurer: (a) the available title insurance coverage; (b) the contents of any Commitment for Title Insurance on the Property; and (c) the contents of all documents affecting the Property that are a matter of public record, including, but not limited to and any restrictive covenants or a Homeowners Association (“HOA”). Inquire directly with the HOA regarding all matters that may affect the Property, including, but not limited to, existing and proposed budgets, financial statements, present and proposed assessments, dues, fees, rules and meeting minutes.

7. PHYSICAL CONDITION: Hire a licensed home inspector to examine all physical aspects of the Property, including, but not limited to: built-in appliances; plumbing fixtures and systems; heating, air conditioning systems and components;

printed materials provided that are not verified from an official government, legal or licensed professional source.

Please review the following items with the appropriate professionals before proceeding with any real estate transaction.

electrical wiring, systems, foundation; roof; structure; exterior surface (including stucco), exterior features and equipment; pool/spa systems and components; any diseased trees or other landscaping; past use of the Property; and moisture seepage and damage from roof, foundation or windows. Also, regarding possible geologic conditions at or near the Property which may include, but are not limited to, soil and terrain stability, the existence of wetlands, and drainage problems.

8. SQUARE FOOTAGE/ACREAGE: Verify the square footage or acreage through any independent sources, local building departments or means deemed appropriate by Buyer. In the event the Company provides any numerical statements regarding these items, such statements are approximations only and are not warranted.

9. UTILITY SERVICES: Investigate the location of utility service lines and the availability and cost of all utility services for the Property including, but not limited to, sewer, natural gas, electricity, telephone, and cable TV. The Property may not be connected to public water and/or public sewer, and applicable fees may not have been paid. Septic tanks may need to be pumped. Leach fields may need to be inspected. Contact the water service provider for the Property and with other appropriate professionals regarding the source, quality, and availability of water for the Property; and regarding all applicable fees and costs (including, without limitation, connection fees, stand-by fees and service fees), use and regulatory restrictions and ownership of water rights and water system. A well and well system may require inspection.

10. HOUSING COMPLIANCE: Consult with appropriate professionals regarding neighborhood or property conditions including, but not limited to: schools; proximity and adequacy of law enforcement; proximity to commercial, industrial or agricultural activities; crime statistics; fire protection; other governmental services; existing and proposed transportation; construction and development; noise or odor from any source; and other nuisances, hazards or circumstances.

11. PROPERTY/SCHOOL TAXES: Verify all property taxes, including School, Village, Town, City, County and State, and to investigate the existence of any tax exemptions. Buyer is also advised to research as to any impending tax assessment increases or decreases due to any reassessment on the subject property or Town/City wide. If the Buyer has any questions regarding property tax requirements, consult directly with the Town and/or City Tax Assessor’s Office.

12. INCOME TAX/LEGAL CONSEQUENCES: This transaction has tax and legal consequences. Consult with appropriate legal and tax advisors regarding any real estate transaction.

These estimates are not warranted or guaranteed costs. This list is compiled only as

a guideline to assist the Purchaser in estimating costs. Actual costs may be significantly higher or lower depending on the Purchaser’s specific terms of sale. A more accurate estimate, based on the Purchaser’s actual transaction, is available from the lending institution processing the actual loan.

Approximately: NY - 5% - 8.5% / CT - 4% - 7.5%

(Rule of Thumb: Calculate 10% of the Purchase Price to have available as cash to close)

1. Standard Bank Closing Costs: Including Appraisal, Title Insurance, Mortgage Insurance, Bank Attorney, plus many other fees (Approximately 2% - 3% on its own)

2. Non-Bank Closing Costs: Buyer’s Attorney Fee, Inspection, Homeowner, Insurance

3. Commission to Buyer’s Brokerage: Full Commission or Differential: This amount may vary greatly depending on whether the buy-side commission will be partially or fully paid directly by the seller or not.

4. Property Taxes: Bank required Escrow and Reimbursements back to Seller In addition, taxes due to a municipality within 30 -45 days of a closing date may also need to be prepaid at closing

5. Reimbursements to Seller from Buyer: In addition to Property Taxes (as stated above), oil in the oil tank, propane in the propane tank, partial month HOA fees and prepaid expenses from any ongoing service agreements and/or payment plans/contracts

6. Other: Survey, Flood Insurance, Sellers Transfer Tax (If Bank-Owned (REO) or New Construction)

7. HOA Fees (Basic and Common): First Month, Application Fees, Move In Fees, Move In Deposits

Other Expenses/Cash Needed Above and Beyond the 10% available cash from above

8. Down Payment: (Equity contribution towards purchase of property)

9. HOA Fees (Additional): Capital Contribution(s) and/or special assessment(s)

10. PMI: First Month’s Payment

11. Points: (Occasionally required by lender or optional to buy down loan: Interest rate)

12. Mansion Fee (1% of sales price over $1M)

13. Moving Expenses

14. Buyer Paid Repairs: Prior or Post Closing

15. Cash Reserves (Required by lender): Cash Required to Be On-Hand, But Not Paid Out During Transaction/Closing

As of 8/9/24

Adjustable Rate Mortgage (ARM)

– A type of mortgage loan on which payments may be adjusted as frequently as each month based on changes in the ARM interest rate index. (Each individual contract may stipulate interest rate limits and frequency of payment adjustments, known as caps.)

Amortization – The repayment of a debt in a specified number of equal periodic installments that may include a portion of principal and accrued interest.

Annual Percentage Rate (APR) – The annual cost of a mortgage, including interest, loan fees and other costs.

Appraised Value – The estimated value of a home established by a professional who has a knowledge of real estate prices and markets.

Assumability – The ability of a mortgage loan to be taken over by a new borrower.

Debt-to-Income Ratio – The ratio of monthly debt payments to monthly gross income. Lenders use a housing ratio (mortgage payment divided by monthly income) and a total ratio (all debt including the mortgage payment) to determine whether a borrower’s income qualifies him or her for a mortgage.

Deferred Interest – When monthly mortgage payments do not cover all the interest due, the interest not covered is added to the unpaid principal balance. This is also referred to as negative amortization.

Down Payment – The amount of the purchase price a buyer pays, in cash, at the time the loan originates.

FHA Loan – A loan insured by the Department of Housing and Urban Development of the Federal Housing Administration.

Fixed Rate Mortgage – A mortgage loan with a constant interest rate and payment throughout the life of the loan. The interest rate and payment amount are established at the time of origination.

Fully Indexed Interest Rate – This interest rate is the sum of the index on an adjustable rate mortgage plus the margin.

Index – Any number of economic indicators lenders use to calculate interest rate adjustments for adjustable rate mortgages. Examples include the 12-MTA, 11th District Cost of Funds, and LIBOR rates.

Initial Interest Rate – The introductory rate on an ARM, which usually changes at the first rate adjustment.

Interest Rate Cap – The most the interest rate on an ARM can increase or decrease at each adjustment period.

Lifetime Interest Rate Cap – The maximum the interest rate on an ARM can increase or decrease over the life of the loan. Sometimes this is called the “ceiling rate.”

Loan-to-Value – The ratio that the principal amount of the loan has to the property’s appraised value. You may see this represented as an 80% loan or a 95% LTV.

Margin – Margin or spread is the difference between the interest rate charged on a loan and the index. The margin remains fixed over the life of the loan.

Owner-Occupied – A residence lived in by the borrower.

Payment Cap – The limit that the monthly payment can change from one adjustment period to another.

– An insurance policy offered by a private company to protect a lender against loss on a defaulted mortgage loan. Usually, PMI is required only for loans with a high loan-to-value ratio. The borrower usually pays the PMI premiums.

Points – An amount equal to 1% of the principal amount of the mortgage. Points are a one-time charge.

Prepayment Penalty – A fee charged to a borrower who pays a loan before it is due. Not allowed for FHA or VA loans.

Principal – The amount of the mortgage loan.

Purchase Price – The total selling price of the home, which includes the cash down payment and the principal on the loan.

Refinance – Homeowners usually consider refinancing to reduce their monthly mortgage payment or to draw from the equity that has built up over a period of time. This is used to pay off an existing mortgage loan.

Title Insurance – The insurance that protects the lender and the homeowner against loss resulting from any inconsistencies in the title of a property.

VA Loan – A loan that is partially guaranteed by the Veterans Administration and made by a private lender.

How do I keep track of all the houses I saw? What kinds of questions should I ask a seller if I like a house? What should I look for at a home

inspection? We have those answers for you . . . and much, much more!

Subject Property: ________________________________________________________________ Date: ____/____/____

To Listing Agent: ____________________________________ Agency: ______________________________________

Please provide all “Checked off” information:

o Survey Floor plan, if avail. (Condo, Co-Op, New Construction, etc.)

o Town Tax Property Card All “Sq. Ft.”& “C of O”/“Pre-Date” Verifications Yes / No

o NYS PCDS (pls. circle): Yes / No: w/$500 credit at closing / No: exempt

o Any material defect(s) in/on the property that may have an affect as to the value of the property: No / Yes (please

o provide detailed information-use a separate sheet if necessary):___________________________________________

Date: ___/___/___ Purchaser(s) ________________ ___ Time started: : _ __ am / pm

o Costs for (For any costs that are not applicable to this property, write N/A):

MLS#: ___________ Property Address: _________________________________________

o Oil: $______________/year Direct or indirect fill (pls. circle) Age of tank: ________

Buyer’s Specialist: ______________ ______ Showing Specialist: _______________________

Buried oil tank: yes (active or inactive) / no / NA (pls. circle) Date of last fill: ___/___/___

Oil tank cert./insur. yes/no/NA (pls. circle) Provide document

Inspector: __________________ Company: ___________________ Bus. Card: __ Yes No

Oil co. name & phone number: __________________________________________________

Weather: ____________________ List ALL in attendance below (including buyers) #: (DO NOT include Buyer side agent or the inspector on this list)

Size & location of oil tank: _________________________________________________

Name: _____________________ Relationship to buyer(s) ______________ ____________

o Electric/Natural Gas: $___________/year Provider ________________________________________

o Municipal Water: $_________/year

Name: _____________________ Relationship to buyer(s) _________ _________________

Includes Pool/Sprinkler? ____ yes (active or inactive) / no / NA (pls. circle)

Name: _____________________ Relationship to buyer(s) ___________________________

o Propane: $_________/year Purpose: ____________________________________________________

Name: _____________________ Relationship to buyer(s) _________ _________________

Pool Co. & phone number: ________________________________________

Name: _____________________ Relationship to buyer(s) __________ ________________

Name: _____________________ Relationship to buyer(s) ___________________________

$_________/year

o Landscaping: $_________/year Providing: ________________________________________________

Buyers: ___________________ Date: ___ /___ /___ Weather: ______________

o Well: yes/no/NA (pls. circle) Location: __________________________________________________________

Rate: ______g/m Age of Pump: _____ Depth: _____ feet

Inspections Performed: Time completed: _ : __ _ am / pm # of Hours: _ __ __ ___ General ___ Termite ___ Septic System ___ Water Sample Taken ___ Radon Cans (# of cans: __ Date/time pick up: /_ _/___ ___:___ am / pm)

o Septic System/Cesspool (pls. circle): yes / no / NA (pls. circle)

Showing Specialist: _______________ Senior Buyer Specialist: ________________ Rating: 1=Awful 2=Fair 3=Has Potential 4=Liked it a lot 5= Loved it! 1 mls#: Price: Address: Rating: Comments: 2 mls#: Price: Address: Rating: Comments:

Co. & phone number: __________________________________________________________________

Septic Co. & phone number: _____________________________________________________________

Location: ____________________________________________________________________________

List of Concern(s): # of Photos (including inspector’s bus. card) to be emailed: __ _____________________________________ ___________________________________

Date last pumped ____/____/____ BOH: Legal # of bedrooms: ______

o Homeowner’s Association: HOA / PUD / Condo / Co-Op: # of shares: ______

Assessment?: $_________ Ending: ____/____/____ Purpose: ____________________________________

o Alarm Service Co: __________________________________________________________ Rate/mo.$_______

o Parking Spot(s)/Garage #(s): _______ Location(s):__________________________________________________

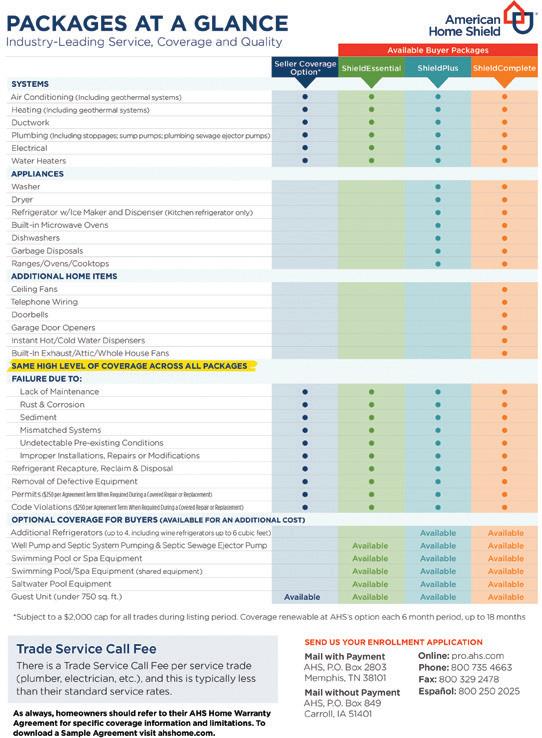

Why should a buyer take advantage of a homeowner’s warranty program?

Many buyers feel that once they accept an offer, “the deal is done.” However, that’s not necessarily the case.

The best way to limit any sort of “expenditures” after the closing is to ensure that there is a HOMEOWNERS’ WARRANTY in place. There are times when we have the opportunity to negotiate with the seller to pay for the warranty program! Otherwise, the buyers may certainly purchase it on their own. And this warranty is worth every penny as it will protect the new homeowners from large expenditures for repairs or replacement costs after they close! Therefore the buyers will not have to ask for large credits of the seller (and possibly be denied by the seller) . . . or have to pay to repair items that are covered by the warranty!

We’ve partnered with American Home Shield, a leading industry expert with over 40 years of experience, to provide this warranty

opportunity. Once ordered, many systems will even be covered for you, the seller, in case something breaks prior to the home being sold! And in addition, the buyers will be covered for an entire year, starting from the closing date of the transaction . . . no matter how long ago you signed up for the program!

You may choose from several coverage options depending on the number of systems that are in your home that you wish to cover. You have the convenience of 24/7/365 service requests and a network of over 10,000 independent, reputable home service professionals. And if something breaks down, you don’t pay for the actual repair or replacement cost for covered items . . . you only pay a small service fee!

And the best part is…there are no upfront costs. You pay for the warranty at closing!

The Homeowners’ Warranty . . . a proven way to protect your price!

YORK STATE: YOUR RIGHTS AS PURCHASER OF RESIDENTAL REAL PROPERTY UNDER REAL PROPERTY CONDITION DISCLOSURE LAW [REAL PROPERTY LAW §462(2)]

As the buyer of residential real property, you are entitled by law to receive from the seller a signed Property Condition Disclosure Statement as prescribed by New York Real Property Law §462(2) prior to your signing of a binding contract of sale. A copy of the Property Condition Disclosure Statement containing the signatures of both the buyer and seller must be attached to the real estate purchase contract. You are also entitled to receive a revised

Property Condition Disclosure Statement as soon as practicable in the event that the seller acquires knowledge, which renders materially inaccurate a Property Condition Disclosure Statement previously provided to you. You will not be entitled to receive a revised Property Condition Disclosure Statement after the transfer of title from the seller to you or after you have commenced occupancy of the property.

14. Have you ever received assistance, or are you aware of any previous owners receiving assistance, from the Federal Emergency Management Agency (FEMA), the U.S. Small Business Administration (SBA), or any other federal disaster flood assistance for flood damage ❒Yes

to the property? If yes, explain below ……………………………………………….

the

• For properties that have received federal disaster assistance, the requirement to obtain flood insurance passes down to all future owners. Failure to obtain and maintain flood insurance can result in an individual being ineligible for future assistance.

15. Is there flood insurance on the property? If yes, attach a copy of the policy • A standard homeowner’s insurance policy typically does not cover flood damage. You are encouraged to examine your policy to determine whether you are covered.

16. Is there a FEMA elevation

Have you ever filed a claim for

● Private or public poles?

or fuses?

● Any known material defects? If yes, explain below

38. Are there any flooding, drainage or grading problems that

such as from heavy rainfall, coastal storm

for line extensions, special assessments or home- or other association fees that apply to the property? If yes, describe

the property been tested for indoor mold? If yes, attach a copy of the report

28. Is there any rot or water damage to the structure or structures?

9. Are there certificates of occupancy related to the property? If no, explain below

ENVIRONMENTAL

explain below

29. Is there any fire or smoke damage to the structure or structures? If yes, explain below

30. Is there any termite, insect, rodent or pest infestation or damage? If yes, explain below

of sale. Purpose of Statement: This is a statement of certain conditions and information concerning the property known to the seller. This Disclosure Statement is not a warranty of any kind by the seller or by any agent representing the seller in this transaction. It is not a substitute for any inspections or tests and the buyer is encouraged to obtain his or her own independent professional inspections and environmental tests and also is encouraged to check public records pertaining to the property.

Note to Seller: In this section, you will be asked questions regarding petroleum products and hazardous or toxic substances that you know to have been spilled, leaked or otherwise been released on the property or from the property onto any other property. Petroleum products may include, but are not limited to, gasoline, diesel fuel, home heating fuel, and lubricants. Hazardous or toxic substances are products or other material that could pose short or long-term danger to personal health or the environment if they are not properly disposed of, applied or stored. These include, but are not limited to, fertilizers, pesticides and insecticides, paint including paint thinner, varnish remover and wood preservatives, treated wood, construction materials such as asphalt and roofing materials, antifreeze and other automotive products, batteries, cleaning solvents including septic tank cleaners, household cleaners pool chemicals and products containing mercury and lead and indoor mold Note to Buyer: If contamination of this property from petroleum products and/or hazardous or toxic substances is a concern to you, you are urged to consider soil and groundwater testing of this property.

10. Is any or all of the property located in a Federal Emergency Management Agency (FEMA) designated floodplain? If yes, explain below

A knowingly false or incomplete statement by the seller on this form may subject the seller to claims by the buyer prior to or after the transfer of title.

31. Has the property been tested for termite, insect, rodent or pest infestation or damage?

If yes, please attach report(s)

“Residential real property” means real property improved by a one to four family dwelling used or occupied, or intended to be used or occupied, wholly or partly, as the home or residence of one or more persons, but shall not refer to (a) unimproved real property upon which such dwellings are to be constructed or (b) condominium units or cooperative apartments or (c) property on a homeowners’ association that is not owned in fee simple by the seller.

Instruction to the Seller:

What is the type of roof/roof covering (slate, asphalt, other)?

Any known material defects?

a. Answer all questions based upon your actual knowledge.

How old is the roof?

b. Attach additional pages with your signature if additional space is required.

c. Complete this form yourself.

11. Is any or all of the property located wholly or partially in the Special Flood Hazard Area (“SFHA”; “100–year floodplain”) according to the Federal Emergency Management Agency’s (FEMA’s) current flood insurance rate maps for your area? If yes, explain below

● Is there a transferable warranty on the roof in effect now? If yes, explain below

d. If some items do not apply to your property, check “NA” (Non-applicable). If you do not know the answer check “Unkn” (Unknown).

12. Is any or all of the property located wholly or partially in a Moderate Risk Flood Hazard Area (“500–year floodplain”) according to FEMA’s current flood insurance rate maps for your area? If yes, explain below

Seller’s Statement: The seller makes the following representations to the buyer based upon the seller’s actual knowledge at the time of signing this document. The seller authorized his or her agent, if any, to provide a copy of this statement to a prospective buyer of the residential real property. The following are representations made by the seller and are not the representations of the

33. Are there any known material defects in any of the following structural systems: footings, beams,

girders, lintels, columns or partitions? If yes, explain below

13. Is the property subject to any requirement under federal law to obtain and maintain flood

insurance on the property? If yes, explain below

tidal inundation or river overflow? If yes, explain below …………………………………………………………………….

Note to buyer – If the structure

• Homes

34. What is the water source? (Check all that apply)

● If municipal, is it metered?

DOS-1614-f (Rev. 01/24)

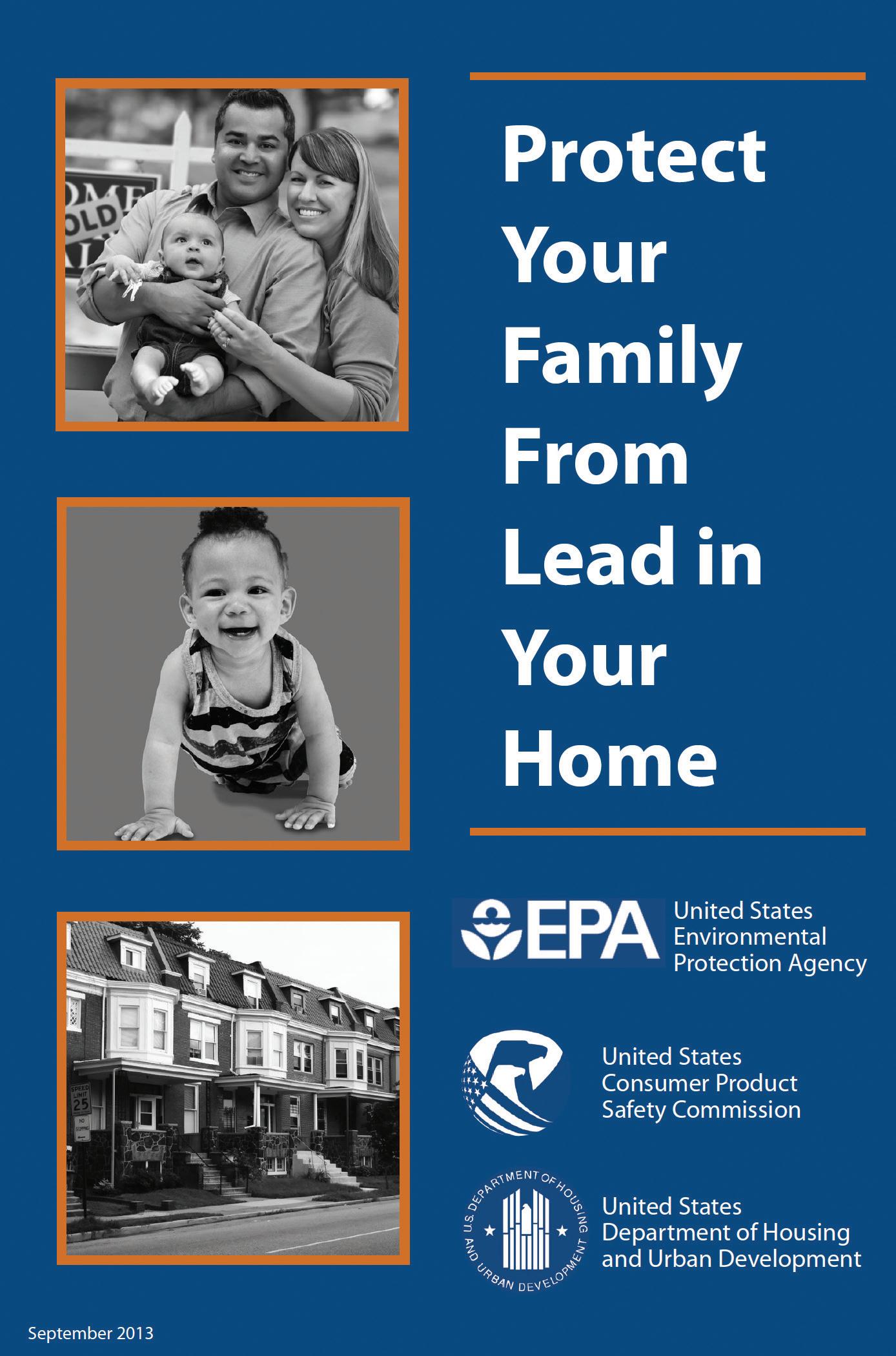

Every purchaser of any interest in residential real property on which a residential dwelling was built prior to 1978 is notified that such property may present exposure to lead from lead-based paint that may place young children at risk of developing lead poisoning. Lead poisoning in young children may produce permanent neurological damage, including learning disabilities, reduced intelligence quotient, behavioral problems, and impaired memory. Lead poisoning also poses a particular risk to pregnant women. The seller of any interest in residential real property is required to provide the buyer with any information on lead-based paint hazards from risk assessments or inspections in the seller’s possession and notify the buyer of any known lead-based paint hazards. A risk assessment or inspection for possible lead-based paint hazards is recommended prior to purchase.

Disclosure of Information on Lead-Based Paint and/or Lead-Based Paint Hazards

Lead Warning Statement

Every purchaser of any interest in residential real property on which a residential dwelling was built prior to 1978 is notified that such property may present exposure to lead from lead-based paint that may place young children at risk of developing lead poisoning. Lead poisoning in young children may produce permanent neurological damage, including learning disabilities, reduced intelligence quotient, behavioral problems, and impaired memory. Lead poisoning also poses a particular risk to pregnant women. The seller of any interest in residential real property is required to provide the buyer with any information on lead-based paint hazards from risk assessments or inspections in the seller’s possession and notify the buyer of any known lead-based paint hazards. A risk assessment or inspection for possible lead-based paint hazards is recommended prior to purchase.

Seller’s Disclosure

(a)Presence of lead-based paint and/or lead-based paint hazards (check (i) or (ii) below):

(i) ______Known lead-based paint and/or lead-based paint hazards are present in the housing (explain).

(ii) _____Seller has no knowledge of lead-based paint and/or lead-based paint hazards in the housing. (b)Records and reports available to the seller (check (i) or (ii) below):

(i) ______Seller has provided the purchaser with all available records and reports pertaining to leadbased paint and/or lead-based paint hazards in the housing (list documents below).

(ii) _____Seller has no reports or records pertaining to lead-based paint and/or lead-based paint hazards in the housing.

Buying [bahy-ing]

verb, present tense

Obtain in exchange for money

Process [pros-es]

noun

A series of actions or steps taken in order to achieve a particular end

Offer [aw-fer]

noun

A proposal or bid to give or pay something as the price of something else

For buyers, finding “the right” property can be tedious. It may be found by the Realtor®, the buyers directly driving by a for-sale sign or searching on the internet. Searching, going to open houses, passing by homes and then actually going into the homes will definitely result in the buyers finding the home that they wish to buy. The question is, what’s next and how do the buyers come up with a price that the sellers will take, which would also be acceptable to the buyers? That’s what we’re here for!

Mark and his team, specifically Allison Imondo and Leon Stokes, are truly the dream team to have in real estate. We used them to purchase our first home and the service, trust, attention and genuine excitement for us was unmatched. Allison and Leon were so responsive to our inquiries and questions and guided us as we navigated offers and the purchase of our home. The knowledge and expertise they brought to submitting offers, writing conditions, walking through homes, the closing process and the follow up was top notch. Down the road when we are ready to sell and purchase a new home, we will definitely be coming back to the Mark Seiden Team!

— Chelsea and Steven Morgan

Since there is a possibility that you may want to bid on a property on which there are multiple offers, you have to be pre-approved and have your team pre-assembled in order to make sure you can work quickly and efficiently. If not, you may have to try to search for a member of your

1. Mortgage Pre-Approval: First things first . . .

team during the purchasing process, which will lengthen the time to put your deal together. Always remember, the longer it takes for the deal to be in contract, the more at risk you are of losing the house to another buyer! So, here are the steps for a successful purchase.

GET PRE-APPROVED! (Or provide a POF (Proof of funds) for an all cash purchase.) If you do not have a “mortgage lender,” we have awesome lenders that we work with on a daily basis who will assist you in getting pre-approved very quickly.

2. Assemble The Team: If you already know and trust someone who is on these lists, then start with that team member. However, if you don’t know anyone, we have a full resource directory to provide you any of these well qualified team members.

MANDATORY IMMEDIATELY

a. Realtor® (Coordinator)

b. Home Inspector/Engineer

c. Mortgage Broker/Banker

d. Real Estate Attorney

e. Non-profit financial aid consultant for some first time home buyers (if necessary/applicable)

OPTIONAL

f Appraiser (usually supplied from the Mortgage Representative)

g Accountant

h Financial Planner

i. Decorator

j. Architect

k. General Contractor

AFTER SIGNED CONTRACTS

l. Insurance Company

m Surveyor

n Title Company (usually supplied by the Real Estate Attorney)

3. Shop for the Property: This is the most time consuming part of the whole home purchase process.

4. Putting in a Bid: The Negotiation Process . . . It’s not just “throwing in an offer.”

5. Accepting an Offer: a. Inspecting the Property b. Attorney Review and Executing Contracts

6. After Executed Contracts: Mortgage Process

7. Setting Up the Closing: The ultimate goal!

8. Closing and Moving: Our service does not stop here! If you need anyone to help you with anything, we are here!

Make sure you read our “The Home Buying and Selling Process” report where we delve into detail of each of these steps. It’s not just “seeing the inside of homes . . . ” It’s all about the “What’s Next” after we find the home you want to buy!

In a neighborhood of similar homes, why is one worth more than another?

That’s a question that’s befuddled buyers and sellers for ages, but the answer is simple. Every home is different. When a home is sold, a willing seller and a willing buyer have just announced to the world the value of that home. From there, other similar homes are benchmarked, but other factors come into play. The most important are:

Location: The closer a home is to jobs, parks, transportation, schools and community services, the more desirable it is.

Size: Square footage impacts home values because they’re built using more materials. Larger lot sizes may mean more privacy.

Number of bedrooms and baths: Over time, median homes have grown larger. Decades ago, household members shared bedrooms and baths without complaint. But today, families want more privacy. The median home purchased today is a three-bedroom, two-bath home.

Features and finishes: Features such as outdoor kitchens and spa baths make a home more luxurious. A home finished with hardwood floors and granite countertops is going to sell for more than a home with carpet and laminate countertops.

The closer in age a home is to new construction, the more it will retain its value. It’s perceived as more modern, up to date, and perhaps safer. Homes that are not updated or in poor repair sell for less. It’s a good idea for homeowners to keep their homes as updated and in top repair as possible.

Curb appeal: From the street, the home looks clean, fresh and inviting. Crisp landscaping with flowers won’t change the size or location, but it certainly adds charm.

When two homes are identical in the same neighborhood, a higher price may come down to something as simple as views, or paint colors or the overall taste of the homeowner.

Valuing a home will never be an exact science, but if you buy wisely, keep your home updated and in good repair, you should recoup most, if not all, of your investment, or maybe even make a lot of money when you eventually sell!

Have you ever checked your property value online?

Plenty of sellers have visited online home valuation sites such as Zillow, Trulia, eAppraisal, and others only to be shocked at the value of their homes.

Estimating a home’s market value is far from an exact science. What these sites attempt to do is provide greater transparency to homebuyers and sellers by making data derived from public records more . . . public. They publish what you paid for your home and how much you pay in taxes. Many have satellite views so accurate they can spot your cat laying on the front porch.

How do they do it? Home valuation sites contract with major title companies to obtain county tax roll data. All property is registered with the county for property taxing purposes. They also find ways to become members of local Multiple Listing Services, which are either subsidiaries of real estate associations or owned by local real estate brokers. That way, they have access to listing data.

Most sellers are pleased when the values appear higher than they expected, but many online valuations come in far lower.

Between tax roll data and listing data, home valuation sites apply their own secret sauce, or algorithm to come up with “Zestimates” or approximate values of what homes are worth.

Sometimes the results are spot on, but they can also be terribly inaccurate. First, transaction data has to be recorded with the county, which could take weeks. But, what alters the algorithm most is that properties not currently on the market are also included in the data. The algorithms can’t possibly show whether or not a home has been updated, how well it’s maintained or esoteric values such as curb appeal and views.

For that reason, online valuations should be used only as one of many tools to estimate a home’s value.

Ask the Mark Seiden Real Estate Team for their expert analysis! Please take a look at the comparative market analysis, or CMA, we will provide for you. There you will find the most recent listings and sold comparables, accurate to within hours or a few days at most.

What is a CMA? No two homes are identical, which is why choosing a sales price or offer price for a home can be challenging. That’s where the comparable market analysis, or CMA, can be useful.

The CMA is a side-by-side comparison of homes for sale and homes that have recently sold in the same neighborhood and price range. This information is further sorted by data fields such as single-family or condo, number of bedrooms, number of baths, school districts and many other factors. Its purpose is to show fair market value, based on what other buyers and sellers have determined through past sales, pending sales and homes recently put on the market.

How accurate are CMAs? The CMA is a here-and-now snapshot of the market, based on the most recent data available, but it can instantly be rendered obsolete by a new listing, or a change of status in a home with the same criteria. Why? The market is constantly changing due to new listings, pending sales, closed sales, price reductions and expired listings.

CMAs will vary widely, depending on the knowledge and skill of the person inputting the search parameters to the software as well as the number and type of data fields that are chosen. That means some features may not be included.

As informative as the CMA is, it should only be used as a tool and should not substitute for the Mark Seiden Real Estate Team’s professional knowledge and advice.

How is the CMA created? CMAs are generated by a computer program supplied by a real estate agent’s office using the Multiple Listing Service (MLS). The MLS is available to licensed members only, including brokers, salespeople and appraisers, who pay dues to gain access to the service’s public and proprietary data, including tax roll information, sold transactions and listings input by all cooperating MLS members.

Listing agents generate CMAs for their sellers, and buyers’ agents create them for their buyers so both sides know what current market conditions are for the homes they’re interested in comparing.

CMA results may vary even between identical homes. One property may simply offer better drive-up appeal or is in better condition than the other, and that will be reflected in the sales price.

Lastly, buyer and seller motivation can’t be quantified. You don’t know why sellers agreed to take less for their home or why a buyer paid more for another home. Family problems, corporate relocations and other reasons all play a role. What you can learn from the CMA is how long the home took to sell. If it was quick, the seller was highly motivated. If it didn’t, it was probably overpriced.

Many buyers feel that when it is time to submit an offer on a property, the only thing they need to do is “throw in an offer and we’ll see what the sellers say.” Unfortunately, that is probably the worst strategy that a buyer or buyer’s agent

can use. Simply stated, the more confident a seller is that the home will actually close with a particular buyer . . . that buyer will procure the home at a lower price or win a bidding war. Here is the best example . . .

An All Cash Buyer: This buyer has a bank account full of cash, almost always with a balance far exceeding the purchase price of the home. What that means to the seller: With an all cash buyer, the seller knows that there will be NO mortgage contingency, therefore NO risk of the buyer not closing on the home due to failed financing. So, since the buyer has all this cash in the bank . . . does the seller expect that the buyer will pay “a premium” for the property? Or, is the “all cash buyer” going to procure the property for some sort of “discount” because there is a lower risk of a deal failure to the seller? You are correct . . . The “all cash buyer” usually gets a discount . . . or at least wins the “bidding war” against other buyers . . . because the better the terms the buyer presents, the “risk to the seller of a home not closing is reduced”

1. Price: Obviously, a main term for the seller to consider.

:

• Does the buyer have to sell a property before one is able to purchase?

+ If so, is there already a deal on that property? If so, how qualified is the buyer’s buyer on the property the buyer is selling?

– If not, is the purchaser renting? If so, is there a lease ending date to discuss?

So, what does this mean to you? Is the “price” the most important part of an offer to a seller? Or are the “terms” of the offer as, or even more important, than the price?”

Fact: The buyer that shows the strongest terms, meaning the least amount of risk to the seller that the deal will fail to close, will almost always “purchase the property at the most reasonable price.” So, when submitting an offer, we will ALWAYS ensure that we have ALL the terms at hand to provide the STRONGEST offer possible.

• Is the purchaser all cash or financing the purchase?