BREAKING THE ICE

How industry initiatives are solving regulatory challenges

IN FINE FETTLE

Why the global scrubber market is flourishing

ALTERNATIVE OUTLOOK

What are the fuels coming to the fore in the race to net zero?

How industry initiatives are solving regulatory challenges

Why the global scrubber market is flourishing

What are the fuels coming to the fore in the race to net zero?

With exhaust gas cleaning, waste heat recovery, and green propulsion. The entire set of technologies are supported by ME Productions worldwide, world-class service.

Convert to a smart scrubber solution

ClearSmart Emission Guard is our next generation of high quality, carbon-capture-ready scrubber systems, which are available for retrofit, newbuilding and conversions. The system is designed for reliability and come outfitted with a cutting-edge sensors package, and intuitive controls to ensure maximum performance, reliability, and environmental compliance. Choose between open, closed or hybrid loop configuration, and in-line or u-type construction.

The smarter heating solution

The HeatSmart solution is not just an eco-friendly upgrade to your vessel; it is a strategic asset. By reclaiming waste heat energy from running systems, the solution aims to eliminate the use of oil-fired boilers in port. The system reduces base-operation cost of the vessel, while contributing to a greener industry. Reducing emissions significantly will improve your green profile, while lowering operational costs including ETS tax. Improving the vessels environmental profile and translates directly to better marketability.

Sandra Speares Editor, Clean Shipping International

Coming up with new approaches to ease the maritime industry’s transition to a more sustainable future has never been easy. However, it is encouraging to see the vast amount of innovative approaches and products out in the market aiming to help the industry achieve its net-zero aims.

Emission concerns have led many shipowners and operators to install exhaust gas cleaning systems, or scrubbers, on their vessels – indeed, as a report by Precedence Research details on page 20, the global marine scrubber market is in good health. The dry technology segment, in particular, is showing significant growth.

Other operators are investigating the use of low-sulphur fuel or fuel alternatives. Although some of these are still in the experimental stage and may take a while to roll out in sufficient quantities, others such as liqufied natural gas and methanol are enjoying a boost in popularity, with money being invested in infrastructure to support their roll-out.

Ship design is another area that is undergoing huge change, with operators going back to the drawing board to improve the performance and eco-efficiency of their vessels. Digital innovations are playing a huge part in today’s state-of-theart ships, improving everything from weather reporting to fuel consumption.

In the meantime, new and improved regulatory requirements and deadlines are looming, and maritime organisations are working hard to tackle the issues these bring in good time. As ever, it remains the case that it is not just a question of a few good operators spending the time and money exploring alternatives to meet requirements, but what all industry players are doing to address the problems and meet the deadlines.

We hope that you enjoy this edition of Clean Shipping International and reading of some of the innovations – and opinions – within the sector.

BRITISH RED ENSIGN

SAME DAY & OUT OF HOURS REGISTRATION WORLD CLASS TECHNICAL EXPERTISE REMOTE SURVEYS

Editor: Sandra Speares speares1@aol.com

Project Director: Jonathon Ferris jonathon.ferris@ cleanshippinginternational.com

Sub-editor: Samantha Robinson sam.robinson.journalist@ gmail.com

Publisher: Bill Robinson production@ cleanshippinginternational.com

Designer: Justin Ives justindesign@live.co.uk

Published by Maritime AMC, Clean Shipping International supports Clean Shipping Initiatives.

The views expressed in Clean Shipping International are not necessarily those of Maritime AMC unless expressly stated as such and disclaim any responsibility for errors or omissions or their consequences or for advertisements contained in this magazine and has no legal responsibility to deal with them.

Sandra Speares on how shipowners and operators are stepping up to the plate to meet environmental rules

Don Gregory, Director, Exhaust Gas Cleaning Systems Association 09

All the latest news and views from across the globe 16

Clean Shipping International catches up with Flexx Groep Founder Sander Castel

A new report shows the global scrubber market in good health, particularly those using dry technology

Paints and coatings have a key role to play as the industry seeks efficient solutions to boost their compliance with new regulations

Keeping things simple is a key component of moves to tackle decarbonisation issues, a move adopted by many organisations

Shipowners and operators need to be aware of new rules for the use of electronic ballast water record books

As the industry seeks a cleaner propulsion solution, there are many initiatives underway aiming to achieve that goal

46 Viewpoint: GAC Sweden

As well as eco-efficiency, ensuring the safety of crew is of paramount importance in today’s state-of-the-art ship designs

In its transition to clean shipping, the maritime industry is tackling an enormous number of challenges – but help is at hand

60 Viewpoint: Cathelco

Today’s innovative solutions provide not just sustainability, but also compliance with new regulations

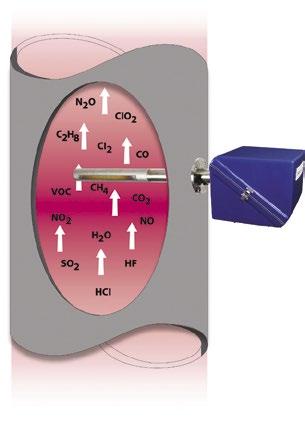

Protea manufacture the equipment and supply qualified engineers to carry out the on board testing.

Emissions Testing using the latest Protea Transportable FTIR

• Know your ship gaseous emissions

• Verify your continous emission monitoring system

• Verify your Exhaust Gas Cleaning Systems (EGCS) performance

• Data contributes to engine efficiency checks

• Emissions Testing

UK Maritime and Coastguard Agency

European Commission Directive 2008/67/EC of 30th June 2008, amending Council Directive 96/98/EC on marine equipment (4th Amendment) Annex 2, A2/2.1On board NOx monitoring and recording devices, MARPOL 73/78 Annex VI regulation 13 and the NOx Technical Code.

ATEX Protea P2000

Certficate Number:

Baseefa 18 ATEX 0060X

Markings: II 2 G Exdb IIBT* Gb

Certificate of Design Assessment

Protea P2000

RINA Rules for the Classification of Ships - Part C “Machinery, Systems and Fire Protection”, Chapter 3, Section 6, Tab.1 and IMO Res. MEPC.259(68) Chapter 6 “Emission Testing” as well as the relevant requirements of Revised MARPOL Annex VI and NOx Technical Code 2008.

Lloyd’s Register - Type Approval Certificate

Protea P2000

T6 Ta -20˚C – +40˚C

T4 Ta -20˚C – +60˚C

IEC Protea P2000

Certificate Number:

IECEx BAS 18.0040x

LR Rules & Regulations for the classification of ships (July 2014) LR Test Spec No.1 (2015)

Markings: Ex db IIB T*Gb

IMO Resolution MEPC 184(59) - 2009 Guidelines for exhaust gas cleaning systems

IMO NOx Technical Code (2008)

International Association of Classification Societies

Concerning Electrical InstallationsIACS E10 Test Specification for Type

MCERTS Protea P2000

MCERTS Performance Standards for Continuous Emission Monitoring Systems

Product Conformity Certificate No: Sira MC 050060/12

Don Gregory Director,

Exhaust Gas Cleaning Systems Association

One of the jobs I really enjoy is undertaking work on board ships. It provides the opportunity to travel and also provides me with real insight into the day-to-day operations of ocean-going commerce, observing the reality on board merchant ships and how things are changing – if at all – in the battle to reduce emissions, especially those that result from the burning of fossil sourced carbon.

It is apparent that operations go on, pretty much divorced from what we read or hear in the press or at the International Maritime Organization (IMO). The relevance of this is that there are serious targets – or perhaps we should call them ambitions – emanating from IMO and from the EU Commission of greenhouse gas (GHG) reductions of between 20% and 30% within five years.

How can more than 50,000 ocean-going vessels reduce GHG emissions when it is apparent that little is presently happening to give confidence that the ambition can be met? An analogy could be stating that the world will eradicate cancer within five years despite not having the solutions to achieve it.

Some will say that of course there are solutions; it is just that, as usual, shipping is burying its head in the sand and not taking responsibility to invest in the solutions.

There are a few, and it is probably the minority, that have done some level of assessment and concluded the solutions simply don’t stack up as viable, long term or sustainable. They are biding their time for sense to reach the market and the regulators.

So what of the majority – the engine builders, the classification societies, the lubricant additive suppliers, the policy makers, the law makers and the public? They do seem to believe it can be done and will in many cases repeat what they have read or heard. They will perhaps mention, that there is non-carbon ammonia fuel, or there is green methanol, or the option to use liquefied natural gas as a transition fuel, and so on. The responses appear to be opinion based and not grounded in any sound empirical assessment.

How are these opinions formed? This is extremely important as it appears that opinions and beliefs are driving business decisions that will impact economic growth

and ultimately people’s standard of living. Are opinions formed by hearing what others are saying, or by reading the marine press? Do we simply accept what we are told or do we apply logic to the information before accepting it? Is that logic as simple as recognising something similar and transposing that to the new information? So, for example, when I have observed or heard of something similar, I have observed an outcome I am comfortable with. So, in that case this new information should also be valid and result in a similar outcome that I would be comfortable with.

Do we think scientifically or with an engineering hat on? Or do we simply take an emotional driver to acceptance? Do we weigh up the significance of the information in terms of its relative impact? For example, are the benefits of 10% to 20% reduction in CO2 emissions from utilising residual fuels much greater than a very insignificant discharge into sea water from an exhaust gas cleaning system? All activity has an environmental impact, but many are sustainable and do not cause short- or long-term or irreparable damage.

There is a very interesting article in Nature magazine entitled ‘The fragility of opinion formation in a complex world’. It reports on a study of the reliability of our opinions. This quantitative research evaluated the “opinion formation mechanism whereby an uninformed observer gradually forms opinions about a world composed of subjects interrelated by a signed network of mutual trust and distrust”.

Perhaps unsurprisingly, formed opinions are highly inconsistent and can be unstable. The inconsistency and instability increase with the breadth of complexity of the subject matter. That is the number of subjects and their interactions. The paper notes that “humans tend to be rather driven by simple heuristics when forming opinions about complex topics, sometimes reaching opinions that violate basic logic rules”.

To add to the weakness of opinion formation, the researchers also noted that there are significant limits to human cognition that can have important consequences: “For example, the susceptibility to partisan fake news was recently found to be driven more by

‘lazy reasoning’ than by partisan bias”. The authors state: “Identifying potential mechanisms behind the formation of opinions in society is vital to understand how polarisation emerges in society, how misinformation spreads and can be prevented, and how science can be effectively communicated to the public.”

The study was driven by the concern around public polarisation and trends such as anti-vaccination attitudes and the risk of epidemics returning to a world where we currently have the knowledge and technology to prevent many of these diseases.

In shipping, we must worry about mis-information, both emotional propaganda and evocative information. We also must worry about the limits of human cognition and lazy reasoning.

There appear to be two sources of some of the opinions that have also become de-facto solutions. They have emanated from a small group of nongovernamental organisations (NGOs) and from the EU Commission, probably influenced by that same group of NGOs.

In some respects, they have added value to society. They have rightly set the challenge for shipping to make its contribution to cutting GHG emissions. The problem is they then extend their remit to prescribe the solutions – an area entirely outside their knowledge set and completely divorced from any responsibility they would have for the consequences of their prescriptions.

This behaviour also departs from the IMO’s policy of technology neutral and goal-based solutions. In the spirit of the goal-based approach the technology neutral statement should be extended to an independent solution approach, as the challenge of reducing GHG emissions is global and holistic.

That means in a hard-to-abate sector there should be an option to undertake the abatement outside the sector if that is more effective. This approach also follows the economic principle of return of investment. Can $100 reduce more GHG emissions if invested in a non-shipping activity than investing in a ship-based solution?

There is absolutely no doubt that if the billions of dollars currently being invested in ship-based abatement were re-directed to other GHG abatement projects there would be earlier and

higher reductions in GHG emissions, which would likely exceed the 30% reduction by 2030 that has been internalised by IMO into ocean freight.

Nobody would argue more reductions and earlier reductions is not the nirvana. However, it seems opinions and beliefs are prevailing over sound logic. “Ships must make their contribution to GHG emissions reductions” is the stock answer with most of the people I ask if shipping should be allowed to offset their emissions outside the sector. It seems that logic has been superceded by opinions seeded by NGOs and the EU Commission.

The irony of these illogical and costly opinions directed at shipping is that the EU’s data centres have been recently been advising that current conditions make it difficult to achieve rapid decarbonisation. Achieving decarbonisation has become increasingly dicey, as despite the urgency of environmental goals, cost and commercial viability remain the top priorities for data centre executives. Only 12% of data centre CEOs ranked speed of decarbonisation as their primary objective. The majority prioritise reducing energy costs and achieving a commercial advantage.

Given the massive power usage of data centres and their critical requirement in our modern world, it seems that economic and commercial reality are overruling opinions and beliefs – maybe not ideal, but probably the only sensible outcome given the lack of an increasing source of reliable and carbon free electricity in Europe.

One wonders if the huge investments being made by the engine builders and ships that are announced as dual-fuel ready were re-directed to the supply of renewable electricity and energy storage on-shore there would not be a better outcome for the achievement of lower GHG emissions. Thus, some of shipping’s GHG emissions would be offset by financial mechanisms of investment ashore.

Is it not time to shelve the beliefs that all the fossil carbon GHG emissions can and MUST be achieved on board ships? Let the industry with regulatory guidance seek other acceptable methods such as investing in shore-based wind

farms or solar farms or hydraulic energy storage. It is highly unlikely that these alternative investments will not provide a better return on GHG reductions than the current limited choice of alternative fuels.

There are still developments that ships can and should do: continue with energy efficiency measures and engine efficiency improvements; use the fuel that is widely available and with the lowest fossil carbon footprint and look to capture some of that carbon with on-board carbon capture. Such an approach would allow economic ship operations to continue, keeping a cap on the cost of ocean transportation and avoiding unnecessary and wasteful stranded investments in alternative fuels and dual fuel engine development.

I would ask the reader to consider if he or she believes that any of the alternative fuels are really viable and achieve real and sustainable GHG emissions reductions for shipping? If you do believe they are the future, can you say with conviction and evidence that your opinion is based on sound science, sound engineering, sound economic and sound sustainabilitybased approach to decision making? If you can’t say that, then how was your positive opinion for alternative fuels formed and is it still valid?

We should all consider how our opinions are formed and if they are really sound. But more than that we should ask ourselves if really important decisions in GHG reduction options be the outcome of prevailing opinions or do these sorts of decisions call for an extremely thorough science and engineering-based review of all aspects of each option, weighting the certainty, impact and economic consequences. If we don’t, ocean-going shipping will be soon sending out warnings like the data centres that decarbonisation is proving impossible and is dropping off the industry priority list.

It is worth considering if we are making very serious future decisions based on illogical opinions and unsound beliefs or on thorough evaluation. After all, you would not expect a medical team to treat you for an ailment with anything but the most well used and researched medical interventions.

Wishing you a thoughtful and a successful 2025.

News from across the globe, including World Energy Outlook 2024 projections and how ballast water failures are causing concern, plus an overview of plastic pollution in the world’s oceans

World Energy Outlook 2024 shows critical choices facing governments and consumers, as a period of more ample supplies nears and surging electricity demand reshapes energy security.

Regional conflicts and geopolitical strains are highlighting significant fragilities in today’s global energy system, making clear the need for stronger policies and greater investments to accelerate and expand the transition to cleaner and more secure technologies, according to the International Energy Agency’s (IEA’s) new World Energy Outlook 2024

The latest edition of the World Energy Outlook (WEO), the most authoritative global source of energy analysis and projections, examines how shifting market trends, evolving geopolitical uncertainties, emerging technologies, advancing clean energy transitions and growing climate change impacts are all changing what it means to have secure energy systems. In particular, the new report underscores that today’s

geopolitical tensions and fragmentation are creating major risks both for energy security and for global action on reducing greenhouse gas emissions.

The report’s projections based on today’s policy settings indicate that the world is set to enter a new energy market context in the coming years, marked by continued geopolitical hazards, but also by a relatively abundant supply of multiple fuels and technologies. This includes an overhang of oil and liquefied natural gas (LNG) supply coming into view during the second half of the 2020s, alongside a large surfeit of manufacturing capacity for some key clean energy technologies, notably solar PV and batteries.

“In the second half of this decade, the prospect of more ample – or even surplus – supplies of oil and natural gas, depending on how geopolitical tensions evolve, would move us into a very different energy world from the one we have experienced in recent years during the global energy crisis,” says

IEA Executive Director Fatih Birol. “It implies downward pressure on prices, providing some relief for consumers that have been hit hard by price spikes. The breathing space from fuel price pressures can provide policymakers with room to focus on stepping up investments in clean energy transitions and removing inefficient fossil fuel subsidies. This means government policies and consumer choices will have huge consequences for the future of the energy sector and for tackling climate change.”

Based on today’s policy settings, the report finds that low-emissions sources are set to generate more than half of the world’s electricity before 2030 –and demand for all three fossil fuels – coal, oil and gas – is still projected to peak by the end of the decade. Clean energy is entering the energy system at an unprecedented rate, but deployment is far from uniform across technologies and markets.

In this context, the WEO-2024 also shows that the contours of a new, more electrified energy system are coming into focus as global electricity demand soars. Electricity use has grown at twice the pace of overall energy demand over the past decade, with two-thirds of the global increase in electricity demand over the past 10 years coming from China.

“In previous World Energy Outlooks, the IEA made it clear that the future of the global energy system is electric – and now it is visible to everyone,” says Dr Birol. “In energy history, we’ve witnessed the age of coal and the age of oil – and we’re now moving at speed into the age of electricity, which will define the global energy system going forward and increasingly be based on clean sources of electricity.”

“As with many other global energy trends today, China is a major part of what is happening,” Dr Birol adds. “Whether it’s investment, fossil fuel demand, electricity consumption, deployment of renewables, the market for electric vehicles, or clean technology manufacturing, we are now in a world where almost every energy story is essentially a China story.

“Just one example: China’s solar expansion is now proceeding at such

a rate that, by the early 2030s – less than 10 years from now – China’s solar power generation alone could exceed the total electricity demand of the US today.”

Global electricity demand growth is set to accelerate further in the years ahead, adding the equivalent of Japanese demand to global electricity use each year in a scenario based on today’s policy settings – and rising even more quickly in scenarios that meet national and global goals for achieving net-zero emissions.

For clean energy to continue growing at pace, much greater investment in new energy systems, especially in electricity grids and energy storage, are necessary. Today, for every dollar spent on renewable power, 60 cents are spent on grids and storage, highlighting how essential supporting infrastructure is not keeping pace with clean energy transitions. Secure decarbonisation of the electricity sector requires investment in grids and storage to increase even more quickly than clean generation, and the investment ratio to rebalance to 1:1. Many power systems are currently vulnerable to an increase in extreme weather events, putting a premium on efforts to bolster their resilience and digital security.

Despite growing momentum behind clean energy transitions, the world is still a long way from a trajectory aligned with its net-zero goals. Decisions by governments, investors

and consumers too often entrench the flaws in today’s energy system, rather than pushing it towards a cleaner and safer path, the report finds.

Reflecting the uncertainties in the current energy world, the WEO2024 includes sensitivity analysis for the speed at which renewables and electric mobility might grow, how fast demand for LNG might rise, and how heatwaves, efficiency policies and the rise of artificial intelligence (AI) might affect electricity demand going forward.

Based on today’s policy settings, global carbon dioxide emissions are set to peak imminently, but the absence of a sharp decline after that means the world is on course for a rise of 2.4°C in global average temperatures by the end of the century, well above the Paris Agreement goal of limiting global warming to 1.5°C. The report underlines the inextricable links between risks of energy security and climate change.

In many areas of the world, extreme weather events, intensified by decades of high emissions, are already posing profound challenges for the secure and reliable operation of energy systems, including increasingly severe heatwaves, droughts, floods and storms.

A new energy system needs to be built to last, the WEO-2024 emphasises, one that prioritises security, resilience and flexibility, and ensures that benefits of the new energy economy are shared and inclusive. In some regions of the

world, high financing costs and project risks are limiting the spread of costcompetitive clean energy technologies to where they are needed most.

This is especially the case in developing economies where these technologies can deliver the biggest returns for sustainable development and emissions reductions. Lack of access to energy remains the most fundamental inequity in today’s energy system, with 750 million people –predominantly in sub-Saharan Africa – without access to electricity and more than two billion without clean cooking fuels.

To address the evolving energy challenges faced by countries around the world, the IEA is convening an International Summit on the Future of Energy Security in the second quarter of 2025. Hosted by the UK government in London, the Summit will assess the existing and emerging risks facing the global energy system, focusing on solutions and opportunities.

More than 30% of all installed ballast water treatment systems (BWTS) fail Port State Control D-2 compliance inspections despite 95% of systems having successfully passed commissioning tests.

Information submitted by Global TestNet to the International Maritime Organization’s Marine Environment Protection Committee MEPC82, which took place in October 2024, revealed that 29% to 44% of operational systems are failing to remove invasive species in the >50µm range, with more than 100 organisms of this size routinely found in every 1m3 of treated water.

The D-2 standard of the Ballast Water Management (BWM) Convention, which entered fully into force on 8 September, requires ships to discharge ballast water with fewer than 10 viable organisms per 1m3 that are at least 50µm in size.

Global TestNet – an association of testing organisations set up in 2010 under the GloBallast Partnership –also reported instances where more organisms were found in discharged water than in inlet water.

According to the findings, the most common reasons for non-compliance were contamination of the ballast water tank from mixing treated and untreated waters or improperly opening/closing valves; organism regrowth due to insufficient and infrequent cleaning of the ballast water tanks; and human error due to insufficient system knowledge, maintenance, and training.

“These results show that even if a vessel with a type-approved ballast water treatment system passes initial commissioning tests, the BWM system alone cannot assure against non-compliance,” says Charlène Ceresola, BIO-UV Group’s Ballast Water Treatment Project Manager, who is currently participating in the BWM Convention Review as a member of the French delegation to the IMO Ballast Water Review Group.

“When a BWMS is properly installed, a high efficacy in removing organisms is achieved (99.9%), but IMO MEPC reports have acknowledged that this efficacy may not be sufficient to constantly meet the D-2 discharge standard,” she says. “Compliance tests often fail due to the presence of organisms in the tank or water

contamination. If operators do not fully understand the impacts of BWM on board, and if bypassing cleaning procedures for ballast tanks occurs frequently, non-compliance will be unavoidable.”

The most frequent deficiencies reported by the Paris Memorandum of Understanding on Port State control also related to poor ballast water record book-keeping, inadequate crew training, system unfamiliarity, and invalid or missing certificates.

Of the 907 ballast water noncompliance deficiencies reported by the Paris MoU in 2023,760 related to record-keeping and administration (58%), BWTS system and system knowledge (16%), and certification (16.9%), resulting in 33 ship detention. This year to date, 505 ballast water management deficiencies have been reported, resulting in 17 ship detentions.

Regarding the record-keeping and reporting to administrations, BIO-UV Group is now advising ship operators that IMO has updated Appendix II of the BWM Convention (form of BWRB) to clarify entries to be recorded (see page 36 for more information).

“We are encouraging BIO-SEA system operators to refer to the new guidance on ballast water record-keeping and reporting (due to enter into force on 1 February 2025), published in BWM.2/Circ. 80 to safeguard against port delays and detentions,” says Ceresola. “While there remains a two-year grace period for treatment performance issues, ships can still be delayed for poor administration.

Maintenance and crew training are also areas where ships can be detained. “There is certainly a need for strengthening maintenance and system knowledge, and this will be part of the package of amendments IMO is preparing.

“Shipowners want their systems to be in good working order, but how do you ensure this once the manufacturer has installed the system and left the ship, or is no longer in the market?

“Fit and forget is certainly not a BIO-UV Group policy, of course,” she adds. “But there is agreement among ship operators and regulators that routine compliance checks are required. It is essential to assess whether systems efficiently prevent harmful aquatic organisms and pathogens from being discharged into the oceans.”

The IMO’s Convention Review Plan for the BWMS experience-building phase aims to address the 13 priority issues identified at MEPC80. The amendments package is expected to be completed by the end of 2026, with implementation taking place 12 to 18 months afterward.

“The primary focus areas include BTWS maintenance, crew training, and addressing challenging water conditions.

SaaS provider Coach Solutions has upgraded its Valid Voyage optimisation solution to include live weather conditions and forecasts.

The Weather Viewer functionality is available to both crew onboard ship and shoreside managers simultaneously. Data is included in a live map view and can also be accessed as a PDF if

the ship is operating in a low bandwidth environment.

Users can also step forward in time to explore potential risks based on forecast weather conditions up to 10 days in advance.

Weather conditions continue to play a key role in the execution of a safe and efficient voyage. The data provided by Coach is sourced from the National Oceanic and Atmospheric Administration and includes pressure lines, cyclones, wave height and direction.

Access to real-time weather data along the vessel track ensures that both the master and the vessel manager are on the same page, improving teamwork and reducing potential operational misunderstandings. It also empowers the vessel master to make better-informed decisions more quickly, without having to wait for onshore support.

Coach Solutions’ Valid Voyage solution utilises proven fuel models to ensure accurate speed and consumption profiles for all vessels, improving accuracy of voyage estimates, even on short-term and voyage charters.

Using the Valid Voyage solution means that each voyage can be instructed on optimal speed, fixed ETA or against warranted speed and consumption figures, enabling operators to select the optimal strategy for each voyage while complying with relevant emissions regulations.

“We are able to predict the majority of vessel performance parameters with increasing accuracy, but weather is the one factor that shipowners cannot completely plan for,” says Christian Rae Holm, CEO, Coach Solutions.

“Adding Weather Viewer to the Valid Voyage module provides crews and vessel operators with an additional tool to improve transparency that can drive safety and greater efficiency.”

Kawasaki Kisen Kaisha (K Line) has decided to conduct a trial of a new network service NexusWave, launched by Inmarsat Maritime on its fleet.

Launched in May this year, NexusWave is a unique bonded multi-dimensional network, offering high-speed connectivity, unlimited data, global coverage, and ‘secure by design’ infrastructure.

The service seamlessly integrates multiple high-speed networks in real time – Global Xpress (GX) Ka-band, low-Earth orbit (LEO) services, and as-available coastal LTE service –enhanced by an L-band layer for resiliency, to deliver fast, always-on connectivity. NexusWave also features enterprise grade firewall security.

K Line says that it will continue to strengthen both onboard and ship-toshore tele-communication systems, creating a safe and comfortable working environment for seafarers, ultimately leading to the provision of higher quality maritime transportation.

By 2050, there could be more plastic than fish in our oceans, and while regulations exist to tackle plastic pollution from the maritime industry, they must be iterated upon and enforced more stringently, says Emma Forbes-Gearey, Loss Prevention Officer at West P&I Club.

The vast proportion – 80% – of marine plastic pollution originates from land-based sources such as commercial waste and consumer litter. Meanwhile, the remaining 20% of plastic comes from the intentional or accidental discharge of ship waste and the loss of fishing gear. While 20% may seem a relatively low percentage of the total plastic pollution problem, that still amounts to a major amount of waste.

This plastic pollution wreaks havoc on the marine environment and finds its way into the food chain with the capability of impacting human health. It also affects maritime industries, such as legitimate and sustainable fishing operations.

Looking at shipping, the effects are less, but not inconsequential. Lost fishing gear, also known as ghost gear, can cause navigation hazards and lead to delays. Plastic can get caught in rudders, propellors and thrusters of a ships, with delays causing a knock-on effect to shipping supply chains.

Many plastics float and therefore drift with the prevailing currents and winds. This means they accumulate in common locations and form vast islands of floating plastic like the ‘Great Pacific Garbage Patch’ –which is roughly 4.5 times the size of Germany.

Concerningly, floating plastic is only the tip of the iceberg when it comes to marine plastic. The United Nations Environment Program estimates that only 15% of marine litter floats on the sea surface, another 15% stays in the water column, and the rest remains on the seabed damaging marine ecosystems.

As reported by the National Oceanic and Atmospheric Administration, a plastic bottle may also take up to 450 years to decompose, while a fishing line could last for 600 years. Most plastics are non-biodegradable and can endure for decades. Over time, these plastics fragment into tiny particles known as microplastics (less than 5mm), which are readily consumed by marine animals.

The United Nations Environment Programme estimates that at least 51 trillion microplastic particles could already be in the oceans. These can also absorb up to a million times more toxic chemicals than the surrounding water. Research indicates that toxic chemicals from plastics have already entered the human food chain.

Plastic pollution is a major environmental and potential health hazard that must not be overlooked, so what does the regulatory landscape look like?

For almost 30 years, the International Convention for the Prevention of Pollution from Ships (MARPOL) Annex V has prohibited rubbish disposal from all ships. Recognising that more was needed to address ship-sourced litter, the IMO adopted an action plan to improve the effectiveness of port reception facilities. Furthermore, guidelines for MARPOL Annex V to address singleuse plastics onboard ships were developed and adopted in 2017.

Besides MARPOL, another significant regulatory framework is the London Dumping Convention 1972. It aims to prevent the intentional dumping of waste or other

substances from ships into the sea, except for those on the ‘reserve list’, which excludes persistent plastics.

In a separate development, the IMO has agreed on draft recommendations for transporting plastic pellets on ships. These considerations were submitted to the Marine Environment Protection Committee for approval in its next meeting.

In March 2022, the UN Environment Assembly also came together to create new international legislation that would be legally binding on plastic pollution, with sections focusing on the marine environment. The completion date for the treaty negotiations should be December 2024, although details regarding the final contents are unknown.

These regulations do cover many key bases, however monitoring their implementation and effectively enforcing them presents major challenges. Flag states need more incentives to monitor regulatory compliance, and there are no particularly compelling reasons to prompt commercial deep-sea ships to retrieve plastic or abandoned gear encountered.

Plastic pollution from shipping or fishing gear continues to pose a threat to marine ecosystems and potentially human health, and a strong argument could be made that this is as damaging, if not more damaging, than oil pollution incidents, largely because most plastic does not break down for decades and centuries.

It is not all doom and gloom, however. It is positive to see that marine plastic pollution is on the mind of regulators, the shipping industry and society.

The Isle of Man Ship Registry (IOMSR) is celebrating its 40th anniversary with a series of events this year as it seeks to cement its position as one of the world’s most progressive flag states.

The IOMSR has hosted signature events during the Isle of Man’s Maritime Conference in July, and at Trinity House in London in September to thank its clients and partners, and present its vision for the future.

IOMSR director Cameron Mitchell said “it is vital the registry continues

to lead by example as a Category 1 member of the Red Ensign Group, representing more than a third of tonnage under the famous Red Ensign. He said safety, seafarer welfare and decarbonization are the pillars of future growth.”

“Since establishing in 1984 we have grown by being a quality flag of choice,” he said. “Today, quality is constantly being tested by advanced technology and pressures being exerted on the maritime industry. Shipowners and Operators as a result need more from

their flag states particularly in how we care for our seafarer’s mental health and well-being. Without ensuring the psychological and physical safety of our seafarers our industry will struggle to implement effective Equality, Diversity and Inclusion standards, goals, policies and procedures. Meeting the IMO 2050 GHG targets will require greater data transparency and collaboration across maritime. Flag states cannot be passive bystanders we must be at the heart of taking positive action as a dynamic partner. In recent years,

IOMSR has grown into one of the highest ranked flags in the world by building trusted relationships

Cameron Mitchell

we have continued our commitment to innovation, becoming the first flag state to offer reduced registration fees for ships deploying green technology. We are the first flag state to join the Getting to Zero Coalition which is driving the decarbonisation agenda.”

“We are also the first flag state to launch a seafarer welfare app with partners like Stella Maris, Nautilus International and the International Seafarers Welfare and Assistance Network (ISWAN). Seafarer wellbeing is very important to me and my predecessor Dick Welsh, as former seafarers ourselves. We have more than 7,000 seafarers on IOMSR vessels. It is our duty to ensure that seafarer and vessel safety, whilst embracing the latest technological advances including alternative fuels for ships, remains paramount.

Mr. Mitchell said “the IOMSR has grown into one of the highest ranked in the world by building trusted relationships with its clients.”

“The Red Ensign due to its track record and heritage is synonymous

with the highest standards of safety, engineering and navigation in the global maritime industry,” he said. “We never forget this and take this responsibility very seriously. We thank all our shipping line clients who we work so closely with providing that 24/7 service as a trusted partner and part of their team. That has been the key to our success and what we intend to celebrate and build on this year as we mark our 40th anniversary.”

Mr. Mitchell also paid tribute to the Isle of Man’s vibrant maritime industry.

“The last 40 years has seen the IOMSR diversify and grow along with the Isle of Man Maritime cluster around us,” he said. “Our growth would not have been possible without the support of countless people and businesses who make up the island’s maritime centre of excellence including ship and yacht management, crew management, insurance, IT, law, cyber security, professional services and finance. The Isle of Man gets maritime and is always open to welcome more maritime business from around the world.”

The Isle of Man became an International Register of Ships in 1984 with the creation of the Isle of Man Marine Administration. The International Register was established to provide a high quality alternative British Register for British and European Ship Owners and Operators.

The Isle of Man Government established the Marine Administration to diversify the Island’s economy. The creation of the Marine Administration acted as nucleus for maritime business in the Isle of Man, with many of the Internationally respected blue chip Ship Owners and Operators relocating parts of their respective organisations to the Isle of Man, recognising the key benefits the island nation had to offer.

As shipowners and operators look for solutions to meet environmental demands, Flexx Groep Founder Sander Castel explains why he has the answers

Coming up with solutions to meet everstricter emissions regulations continues to pose problems for the maritime industry. Equipment innovator Flexx Groep, based in the Netherlands, believes it has the answer.

Following our article in the Autumn edition of CleanShippingInternational earlier this year, we caught up with Flexx Groep Founder Sander Castel on the progress the firm has been making in the market with its next-generation technology that helps scrubber owners, ferries and all other vessels comply with International Maritime Organization (IMO) regulations.

The direct discharge of harmful substances has long been a concern, leading to disruptions in the pH levels of marine environments and threatening marine life.

Recognising the urgency of the situation, industry leaders are exploring well-proven alternatives. One such is Flexx Groep, which develops environmentally friendly, sustainable technical solutions that focus on the shipping industry. Coming under the

Flexx Groep umbrella is SodaFlexx, which has designed N-Flexx, an innovative exhaust gas cleaning system that neutralises sulphur oxide emissions and prevents acidification. N-Flexx measures the ratio between SOx (sulphur) and CO2 in the exhaust gas flow coming from the engines on-board, based on the geographical location the ratio needs to be below 23.7 (this is outside SECA –Sulphur Emission Controlled Areas) or below 4.3 (inside SECA zones)

N-Flexx acts as an alternative to a traditional scrubber. No water is being used; instead sodium bicarbonate (baking soda) is blown into the existing exhaust lines, which then reacts with the sulphur component in the exhaust gases and neutralises the sulphur below the limits set by the IMO.

As there is no use of water, N-Flexx is allowed in regions and ports where scrubbers may not be used anymore.

We asked Castel how the industry had reacted to the product. “Very positively. The N-Flexx technology is a valid alternative

for wet scrubbers as there is no wastewater – in fact there is no water at all. The N-Flexx technology is seen as a sustainable future-proof solution as an alternative to scrubbers or as an add-on to an existing scrubber to make the open-loop system hybrid.”

So does this mean that companies can avoid the whole problem of high sulphur and continue to use highsulphur products if the equipment has been fitted? “Yes absolutely,” says Castel. “Our customers can use high sulphur fuel oil (HSFO) and still be compliant with the IMO rules and regulations as our technology reduces the sulphur below the limits required.

“In addition, we are seeing more and more SECA zones, which also makes it interesting to operate on very low sulphur fuel oil (VLSFO) with only 0.5% sulphur – bringing this down to the limit, it should be within the SECA restrictions.

“It has been confirmed that our technology, as a side effect, also reduces nitrogen oxides, which also benefits the operator.”

As there is no use of water, N-Flexx is allowed in regions and ports where scrubbers may not be used anymore. Castel says the technology has

received approval from flag states including Denmark and France, as well as other EU countries, “which indicates that our N-Flexx technology is accepted as a valid technology to proceed using HSFO and VLSFO”.

When it comes to the expense of fitting the technology, Castel says: “The price depends on the type of vessel and its trading pattern. Commercially, it is very attractive with an average return on investment of less than six months after installation on-board. It can be used on any age of vessel, including older vessels that only have a few years to go.”

He continues: “We do believe our N-Flexx technology extends the transition period to alternative fuels or energy sources by 10 to 15 years. For this period of time, it makes sense to use conventional fuels together with an exhaust gas cleaning system.

“However, moving towards the future, alternative energy sources and fuels will also be needed. We innovating, though, and set up HydroFlexx under the Flexx Groep umbrella. Within HydroFlexx, we have developed a technology that makes it possible to store, transport and use hydrogen in a powder.”

Hydrogen is seen as one of the most promising alternative fuels, particularly for the shipping industry. However, as a result of its low energy density, hydrogen needs to be compressed to high pressures or it needs to be cooled to a very low temperature. Both options need a large amount of energy and could potentially be dangerous.

Castel explains: “With the technology from HydroFlexx, cooling and compressing is not needed as we store the hydrogen in a solid powder. With this powder we can store the same amount of energy in 1m3 as which is available in 1m3 of HSFO. Without compressing and without cooling, the hydrogen can easily be released and as a result of regeneration, the powder can be reused creating a circular solution.

“This is not only reducing the cost to the same price level as conventional fuels, it also means that there is no additional storage space needed on-board compared with conventional fuels.”

Maritime’s future as a sustainable industry is looking very promising thanks to the continuous innovative work of Flexx Groep.

When properly maintained, a scrubber system not only provides reliable performance throughout your ship’s lifetime but also reduces operational expenses. A PureteQ pre-drydocking inspection can help you achieve this at lowest possible cost

PureteQ specialises in designing and maintaining scrubber systems. With established offices in Europe and Asia, PureteQ is a leading service provider for all brands of scrubbers worldwide, backed by extensive expertise in exhaust gas cleaning. PureServ, PureteQ’s certified service organisation,

supports shipowners and operators in ensuring the continuous operation, reliability and MARPOL compliance of scrubbers through a dedicated team of experienced marine engineers.

PureteQ Maritime Scrubber Systems are known for their high-energy efficiency. Even less efficient systems can be fine-tuned to reduce energy consumption associated with over scrubbing.

To accommodate this, PureteQ

offers all shipowners, with a service agreement, access to Pure-SPOT, a web-based Scrubber Performance Optimisation Tool designed to reduce energy consumption across all scrubber systems. Data is automatically uploaded to a cloudbased platform, enabling optimised environmental performance reporting for scrubber-equipped ships. This tool facilitates reduced operating costs, and improved Carbon Intensity Indicator (CII) rating.

Reducing carbon intensity in shipping is critical to combatting

A simple solution to a global challenge

climate change and transitioning to a more sustainable, low-carbon future. Many ships are now slowing down and derating engines to save costs and reduce carbon emissions. Prioritising energy efficiency is essential, as the cost of all energy is high, with low-carbon fuels being even more expensive. Since alternative fuels and onboard carbon capture technologies are still years away from widespread availability, maximising energy efficiency is the best approach for today.

A PureteQ Service Agreement provides everything needed to maximise the potential of your scrubber system. Tailored to fit each ship’s operational pattern and crew skill level, it includes, but is not limited to:

» 24/7/365 hotline service

» Spare parts management

» Crew training, offered on-site or remotely via our Internet for Remote Assistance Services (IRAS) – a complete hardware and software

installation providing shipwide WiFi access and real-time support

» Operational advice and reporting

» Certified calibration and sensor replacement programme. A scrubber’s pH sensor requires calibration every three months, while gas analysers need it annually. Our sensor replacement programme notifies you in advance of calibration needs, delivering a newly calibrated sensor before the old one is sent to us for refurbishment.

Scrubbers installed around 2018 have accumulated thousands of operating hours, meaning motors, dampers, sensors and moving parts may now require overhauls or replacements. The most cost-effective solution is to inspect, replace or refurbish these components. Since some parts have long lead times, scheduling a pre-drydocking inspection well in advance of drydocking is wise. This inspection evaluates all components and structural conditions to create a

detailed work scope for the yard, crew, suppliers and stakeholders. PureteQ offers these inspections worldwide, customised to meet the needs of shipowners.

PureServ is a registered trademark and certified service organisation providing maintenance and support for all scrubbers and sensors. This includes the shipment of critical spare parts and replacement of compliance equipment, such as continuous emission monitoring systems and water monitoring systems.

For more information, contact: PureteQ A/S, Sverigesvej 13, 5700 Svendborg, Denmark CEO: Anders Skibdal

Email: anders@pureteq.com Tel: (+45) 40 17 14 00 pureteq.com

A new report shows the global scrubber market in good health, particularly those using dry technology

The global marine scrubber market size was US$5.90bn in 2023, calculated at $6.73bn in 2024 and is expected to be worth around $24.98bn by 2034, according to a report by Precedence Research. The market is slated to expand at 14.02% compound annual growth rate from 2024 to 2034.

Key findings from the report include:

» Asia- Pacific dominated the marine scrubber market with the largest market share of 32% in 2023.

» North America shows a significant growth in the marine scrubber market during the forecast period.

» By technology, the wet technology segment generated the biggest market share of 91% in 2023.

» By technology, the dry technology segment shows a significant growth in the market during the forecast period.

» By application, the bulk carriers segment recorded the highest market share of 33% in 2023.

» By installation, the retrofit segment contributed the biggest market share of 79% in 2023.

» By installation, the new build segment shows a significant growth in the marine scrubber market during the forecast period.

According to the report, artificial intelligence contributes to scrubber system optimixation through real-time operation adjustments, increased fuel economy and reduced energy usage.

“AI-powered algorithms ensure the scrubber runs as efficiently as possible while

generating the least waste by monitoring and adjusting parameters like temperature, chemical usage, and water flow rates,” the report says.

“AI makes it possible to remotely monitor and manage scrubber systems. Fleet managers may now oversee numerous boats from one place, which enhances operational management. Faster reaction times to anomalies or inefficiencies are also made possible by real-time data and AIdriven analysis.”

As far as market growth factors are concerned, the report outlines that:

» Scrubber technology is constantly evolving, creating more eco-friendly and efficient systems, making them a more appealing choice for the maritime sector.

» Marine scrubbers enable ships to use more affordable, higher-sulphur fuels, which can help reduce fuel use. This financial benefit is a big motivator for shipping businesses.

» A larger fleet of ships due to increased international trade has raised the need for marine scrubbers to comply with pollution laws.

» Government subsidies and incentives are provided in some areas to promote the use of marine scrubbers, which propels industry expansion.

As the report points out: “Scrubber retrofitting is a costly and technically difficult process for already-built boats. The ship’s construction frequently needs to be altered to install the scrubber system. This may entail rearranging the engine room, cutting and rewelding portions of the ship, and

strengthening other locations.

“These adjustments must be made precisely to guarantee that the scrubber interfaces with the vessel’s current systems without generating operational concerns. Because of this, shipowners must pay more for labour, engineering, and occasionally drydocking the vessel, which drives up the installation’s entire cost.”

The wet technology segment dominated the marine scrubber market in 2023, according to the report while the dry technology segment shows a significant growth in the marine scrubber market during the forecast period.

“Dry scrubbers use solid absorbent materials like lime or sodium bicarbonate to remove sulphur and other contaminants from exhaust gases. Dry scrubbers use fewer resources than wet scrubbers, which need sophisticated wastewater treatment facilities and water. Lower operational costs, including lower energy use and maintenance expenditures, result from this. Dry scrubbers simplify operation and minimise maintenance downtime

because they do not require handling significant volumes of water, eliminating the need for complex pumps or wastewater management systems,” the report says.

“Dry scrubbers are becoming increasingly popular in the market. They save shipping firms money by eliminating the need to manage tainted water systems.

“The bulk carriers segment dominated the marine scrubber market in 2023. Large ships make up bulk carriers, some of which are among the most significant ship classes in the world (such as panamax and capesize vessels). The larger the ship, the more fuel it consumes.

“Larger ships with scrubbers may burn high sulphur fuel oil for less money, which accelerates the return on investment for installing scrubbers when compared to smaller vessels with lower fuel use.

“The segment’s dominance in the marine scrubber industry has been further cemented in recent years with the inclusion of scrubbers in the design of many new bulk carrier purchases.”

The report says the retrofit segment

dominated the marine scrubber market in 2023. “Due to shipyard backlogs, building new vessels might take many years, particularly if demand spikes suddenly following International Maritime Organization regulations.

“Refitting already-built ships offered shipowners a quicker way to comply with laws and avoid fines for fuelrelated delays or outages. Retrofitting makes sense for older ships with a good amount of operating life left. It allows shipowners to keep making money from aging ships without buying new tonnage or decommissioning them early.

“The new build segment shows a significant growth in the marine scrubber market during the forecast period. Pressure from shipping companies to use greener technologies to cut emissions is growing. Scrubber integration into new constructions guarantees adherence to both present and future laws. Additionally, it increases the vessels’ appeal to operators and charterers who value sustainability highly. Scrubberequipped vessels are in high demand as a result of this.”

The need to improve sustainability in the shipping industry is accelerating. The global industry must cut carbon emissions, protect marine biodiversity and leverage the use of data for smarter decision making.

With nearly 100 years of experience of charting through unknown waters, Jotun is committed to continuously innovate and develop advanced products and solutions designed to protect biodiversity and cut carbon emissions to support global sustainability ambitions and achieve cleaner operations for all industry players.

Paints and coatings have a key role to play as the industry seeks more efficient and eco-friendly solutions that boost their compliance with new regulations

Marine coatings supplier Nippon Paint Marine has recently published its white paper, Breathing life into science; creating the next generation of hull coatings using biomimetics, detailing the role that biomimetics has played in the development of the company’s patented HydroSmoothXT technology.

A specialist team from Nippon Paint Marine’s R&D programme, which included experts in polymer science, biochemistry, fluid dynamics and marine science, studied the natural characteristics of marine life to inform the development of the HydroSmoothXT technology that would be used in coatings. This approach to technology development, of imitating nature, is known as biomimetics. The performance of Nippon Paint Marine’s antifouling coatings range – which include LF-Sea, A-LF-Sea, and Fastar – has been enhanced using this technology, the company says, and has been applied to more than 5,000 vessels.

By replicating the natural surficial film found on the skin of marine life, company

researchers have been able to develop coatings that minimise friction, reduce fuel consumption, and lower vessel emissions.

In collaboration with institutions including Kobe and Osaka Universities, the project team focused on replicating these natural characteristics to aid in the development of specifically designed hydrogels for paints; the scientific theory being that a hull coating could be created that essentially ‘traps’ a layer of seawater against the surface membrane, which increases the boundary layer around a vessel’s hull, and reduces friction. Subsequent products such as LFSea and A-LF-Sea, which incorporated this enhanced performance hydrogel, generated fuel and emissions savings of up to 12.3%.

The development in Nippon Paint Marine’s antifouling range involved the introduction of nanotechnology. The Fastar product range uses a unique hydrophilic and hydrophobic nanodomain resin structure to achieve unparalleled antifouling performance, which can deliver fuel savings of more than 14% thanks to an average speed loss of just 1.2%

over a 60-month period, compared with the market average speed loss of 5.9% over a similar time period, according to company statistics.

Nippon Paint Marine recently announced the successful application of Aquaterras, Nippon Paint Marine’s biocide-free, low-volatile organic compound (VOC), SPC solution, to a Wan Hai vessel, in China.

The Aquaterras coating provides sustainable protection for the hull from fouling to deliver fuel savings of up to 14.7% over 60 months compared with the market average speed loss, while also reducing carbon emissions, the company says.

In July 2024, Wan Hai Lines’ 71,336dwt container vessel, Wan Hai 613, entered Zhou Shan Chang Hong Shipyard, China, for scheduled ship repair and maintenance. During the dry-docking, Nippon Paint Marine applied a full coating with a newly developed low-VOC Aquaterras SPC solution.

Aquaterras is an SPC coating that protects the marine environment by eliminating the elution of biocides into our seas and avoiding harm to untargeted marine life. The low friction coating protects marine life while achieving significant improvements in carbon reduction and fuel efficiency, compared with the market average, with effective fouling protection.

Kazuaki Masuda, Corporate Officer, Technology Division Director at Nippon Paint Marine, says: “The first application of Aquaterras in China is a significant milestone in our product development and we are thrilled to take this step forward with our longstanding customer and trusted partner, Wan Hai Lines.

“The incorporation of low-VOC technology into the coating builds on Aquaterras’ legacy of protecting our marine environment, while also maintaining the industry standard in antifouling performance.”

AkzoNobel’s International® marine coatings brand has unveiled updates to its digital forecasting tool, Intertrac® Vision.

These new features include the ability to predict Carbon Intensity Indicator (CII) ratings, assess the financial impact of the EU’s Emissions Trading System (ETS), and provide detailed cost-saving insights over multiple dry-dockings. These improvements are designed to help vessel operators make smarter, datadriven decisions about their fouling control coatings.

Intertrac Vision draws from a database, analysing more than 200,000 drydocks and 10,000 vessel operations. It combines this historical data with cutting-edge machine learning to forecast the impact of coatings on a vessel’s performance. The tool offers insights into how specific coatings will perform over the vessel’s operational lifespan, allowing operators to evaluate their return on investment based on the vessel type and operational scenarios.

The tool is invaluable for making informed decisions that reduce fuel consumption and CO2 emissions. A new update now provides a total cost of ownership summary, breaking down the cost contributions of each stage in the drydocking cycle.

Additionally, users can now forecast over a 120-month cycle – either as two consecutive 60-month dockings or one continuous period – giving vessel owners a long-term view of the benefits of proper coating selection.

With stricter regulations such as the EU ETS (starting in January 2024) and FuelEU regulation (effective from January 2025), vessel operators need reliable data to guide operational decisions. More than ever, there’s a demand for insights that help vessels stay compliant and efficient.

According to a recent Lloyds List survey, more than 59% of shipowners believe coatings are one of the most effective ways to meet the International Maritime Organization’s carbon reduction targets, such as the CII and Energy Efficiency Existing Ship Index (EEXI).

Barry Kidd, Vessel Performance Manager at AkzoNobel, says: “Intertrac was designed to give shipowners and operators customised insights to improve vessel performance. With our team’s technical expertise and the advanced capabilities of Intertracs Vision, vessel operators can identify areas for operational improvement, leading to smarter investment decisions.

“This latest version of Intertracs Vision gives even deeper insights, helping customers navigate the everchanging regulatory landscape.”

Earlier this year, AkzoNobel showcased Intertrac Vision’s predictive accuracy in a white paper. The tool was able to forecast the performance of a globally trading very large crude carrier over five years, with results coming within 1% of actual performance figures, measured according to ISO19030 standards.

Xiamen Minhua Shipping has specified a Steelpaint corrosion protection system for a trio of newbuild multipurpose cargo ships building at Fujian Shipbuilding’s yards in China.

The order marks the Germany-based coatings specialist’s first newbuilding contract with a Chinese shipowner.

The first vessel in the series, the 12,000dwt Min Hua 9 delivered from the Fujian Hengsheng shipyard in June, is now operating with a StelpantPU-Zinc universal primer protecting steel cargo holds, hatch covers, decks, topsides and hatch coamings against corrosion.

The polyurethane and zinc-based primer will also protect sisterships Min Hua 15 and Min Hua 16, both of which are under construction at the Fujian Donghai Shipyard, with deliveries scheduled for December 2024 and November 2025.

Li Jianbin, Xiamen Minhua Shipping’s General Manager, says: “The operational profile of these multipurpose cargo carriers required a longlasting, fast-drying, and easy-to-apply primer that could be relied upon. After experience with conventional epoxies failing to properly protect cargo holds against impact damage and corrosion, we found Stelpant-PU-Zinc to have better impact resistance.

“It is too early to confirm, but we expect the primer will reduce throughlife coating repair and maintenance costs by about 50% compared to previous applications.”

With its high-solid formulation and finely meshed zinc pigments, StelpantPU-Zinc can be applied in temperatures ranging from -5°C to +50°C, and with a relative humidity level as high as 98%.

For tank tops and lower stools/ hoppers, Steelpaint recommends a film thickness of 2 x 80µm after grit blasting to Sa2.5, while other areas need only one 80µm coat before a 120µm application of a conventional topcoat epoxy.

Dmitry Gromilin, Steelpaint’s Chief Technician, says: “This contract represents a significant milestone for Steelpaint in China. While we have corrosion protection systems on a number of Chinese-built vessels, this is our first newbuilding specification for a Chinese shipowner.

“The success of the first application aboard Min Hua 9 will help further establish our presence in China and open the door to more shipowners across the Asia-Pacific region.”

Compatible with most top-coats without the need of a tiecoat, the high zinc content of Stelpant-PU-Zinc provides cathodic protection and can be applied on the outer hull areas preventing corrosion damage. The zincrich primer can be easily recoated over the vessel’s lifetime, affording smart repair at dry-docking.

A Chinese bulk carrier operator is currently trialling Stelpant-PU-Zinc on

a 100m2 test patch in the cargo hold of one vessel. Another operator is also trialing the corrosion resistant coating on a ship’s hull (topside) and crane.

With the launch of the industry’s first and only CX-rated anti-corrosive powder coating solution, industries now have access to proven technologies to protect critical equipment operating in the most challenging environments, Jotun says in an opinion piece.

Every year, trillions of dollars is spent to fight steel corrosion. And according to Harshad Gawande, Jotun’s Global Category Manager for Functional Powder Coatings, corrosion risk is higher for energy companies, especially those operating in aggressive environments.

“In addition to costs related to maintenance, protecting steel can reduce risk of equipment failure that can lead to downtime, or worse, an accident,“ he says. “To help manage these challenges, Jotun has developed the industry’s first anti-corrosive powder coatings solution specifically engineered to protect steel used in the most extreme environments.”

The ISO 12944 Standard specifies atmospheric corrosion categories from C1 (very low) to C5 (very high). In 2018, the standard was revised to include CX, a rating that applies to highly aggressive environments such as offshore assets exposed to high salinity, or industrial areas located in subtropical areas with extreme humidity.

In 2023, Jotun introduced Jotun Primax Coating Solutions, a powder coatings system that is Qualisteel compliant and has been independently tested to meet ISO 12944 CX requirements.

“Primax Coating Solutions was engineered to protect steel used in critical machinery, such as generators, transformers, electrical cabinets, cranes, and other equipment operating in aggressive environments,” says Gawande. “The solution is a twolayer anticorrosive steel protection system, involving primers and a premium topcoat, Jotun Super Durable. Jotun Super Durable has a proven track record of resisting

extreme temperature fluctuations, high humidity, acid rain UV protection to retain colour and gloss in the building construction industry.

“Our assortment of primers, such as Primax Xtend and Primax Protect, have also been proven effective in other industries, but achieving a CX rating required a lot of work.”

Because surface preparation is critical to performance, Jotun primers have been independently tested using different surface cleaning methods and steel thickness.

“We are the only coatings supplier that can provide third-party documentation for surfaces that are blast cleaned, galvanised or chemically treated with zinc phosphates,” he says. “We are also the only company that works with approved applicators to offer a product guarantee, supported by our dedicated technical support teams.”

While Gawande acknowledges that the steel found in equipment or machinery represents a modest fraction of the steel used in any major on or offshore energy facility, he notes that using powder coatings to protect these critical assets also has environmental benefits.

“The Worldsteel Association estimated that steel production is responsible for between seven and nine per cent of global emissions, representing about 3.5 billion tonnes of CO2 per year. Providing long-term protection reduces the need for replacement steel, and because powder coatings is applied in controlled environments, the risk of application errors are eliminated. And for companies seeking to comply with emerging regulations on the use of VOCs, powder coatings are solvent free,” says Gawande.

According to Gawande, there is no anti-corrosive solution available to the market today that better protects critical machinery in aggressive environments.

“There are other systems out there, but none of them have been independently rated CX or can offer technical, commercial and performance advantages of Jotun Primax Solutions,” he says: “And we have the documentation to prove it.”

The shipping industry, responsible for transporting approximately 90% of the world’s goods, is a fundamental part of the global economy. Yet it also contributes significantly to climate change and the transfer of invasive species.

To address this during the United Nations Climate Change Conference, COP29, in Baku, Azerbaijan, Jotun took part in a panel discussion titled “Navigating the Future: Bridging Shipping, Biodiversity, and Decarbonisation”. The importance of hull performance and marine coatings in driving sustainable change within the shipping industry got its needed attention.

Dr Christer Øpstad, Global R&D Director of Fouling Protection in Jotun was invited to participate in this important conversation due to its nearly a century of exploring and disrupting how vessels perform in water.

This long-standing commitment has positioned the company at the forefront of efforts to reduce shipping’s carbon emissions and protecting biodiversity.

During COP29, Jotun and other participants got the invaluable opportunity to educate, spread awareness and inspire global, national and local communities, as well as organisations, the shipping industry and policy makers.

“From our perspective, biodiversity and climate are directly interlinked through biofouling,” said Øpstad in Baku.

Biofouling can result in the introduction of invasive species that threaten local ecosystems. According to recent studies, up to 70% of bioinvasions are connected to fouled ship hulls. Invasive species, such as the Pacific Oyster, have already caused significant harm to local marine life, especially along the coast of Norway, where Øpstad grew up.

“When I grew up on the coast of Norway, we used to play in the shallows without worry, but today,

A commitment to be a clear voice and educate, as well as creating awareness

children can no longer run into the water barefoot. They need to wear protective shoes because of razorsharp mussels everywhere, a result of the Pacific Oyster’s invasion,” he said. This example underscores the need to address biofouling not just as an environmental issue, but as one that affects local communities.

In addition to posing a biosecurity risk, biofouling can also increase a ship’s carbon emissions. The International Maritime Organization (IMO) has reported that even small amounts of fouling can increase emissions by up to 19%.

“Considering that shipping accounts for about 3% of global emissions, this is a major concern. By keeping hulls clean, we can largely avoid these additional emissions and biosecurity risks,” Øpstad emphasised.

The panel discussion was held at the Ocean Pavilion in the Blue Zone at COP29. The panel was moderated by Simon Walmsley from the UN Foundation, and besides Jotun it also included Anna Larsson from the World Shipping Council, Rakhi Kasat from The National Oceanic and Atmospheric Administration (NOAA) and Noelle Young from Island Innovation’s Caribbean Climate Justice Leaders Academy.

The mixture of organisations as well as different competences and perpectives in the panel, brought a wider understanding of both issues and solutions to the table. The importance of shipping, both economically and socially, was agreed on, and from that basis the conversation investigated the possibilities that lays both above and below the water surface.

“We can’t change shipping, but we can change the impact of what shipping does, both in terms of climate change and biodiversity,” Øpstad noted.

According to Øpstad, the key to this change lies in collaboration across the industry, as well as raising awareness about the consequences of biofouling. According to a recent study conducted by Jotun, two-thirds of industry stakeholders lack awareness about the real-world impacts of biofouling.

“It just shows that in addition to developing technologies and solutions, we also need to work together in raising the awareness, ensuring stakeholders understand the consequences and how they fit into the bigger picture.”

The shipping industry operates on various scales – from global and regional shipping routes to local operations. And the local perspective is a bit underspoken in terms of how the shipping industry is spreading invasive species, according to Øpstad.

“The example with the Pacific Oyster, and also the spread of Sea Vomit in Norway, has had a dramatic impact on local communities. The most significant vector for the spread of invasive species is local operations, but regulations can’t fix this problem because it’s already in our local waters. We need to work with local players as local commercial and private operators are key to preventing further spread.

“Ensuring that vessels are kept clean and that operators take responsibility for their role in preventing biofouling is critical, and we need to ensure that operators are aware of the role they play and that they can take steps to mitigate further spread”.

The challenges posed by biofouling, emissions, and biodiversity are complex and require multifaceted solutions. Øpstad highlighted that no single technology or solution will suffice. “We cannot solve this with one technology or one single solution. We need to work across a variety of different technologies and options.”

The need for cross-sector collaboration was a recurring theme at COP29. Øpstad noted that bringing together industry players, policymakers and academics is essential for driving real change. “Innovation and technology development in the industry are focused on end-user perspectives, but academia often takes a broader, more fundamental approach,” he said.

By combining the expertise of these two sectors, Øpstad believes that

creative power and innovative strength can be harnessed to accelerate progress. He explained: “When we combine the practical needs of industry with the broader perspectives of academia, we can advance much faster and address big problems more effectively.”

Moreover, he highlighted the importance of connecting students and future professionals to real-world challenges. “We need to motivate those who will be the future scientists and professionals to be part of the change.” Engaging the next generation is vital for ensuring that the industry remains committed to sustainability long-term.

“COP29 was an absolute fantastic event – in terms of both the size and the ripple effects it has on the climate discussions. It has always been on our radar, of course, as the most pivotable climate change conference that is. The diverse panel really gave us some interesting perspectives, and we feel inspired after the event and are looking forward to continuing these conversations,” says Jessica Doyle, Global Sales Director Shipping,Jotun.