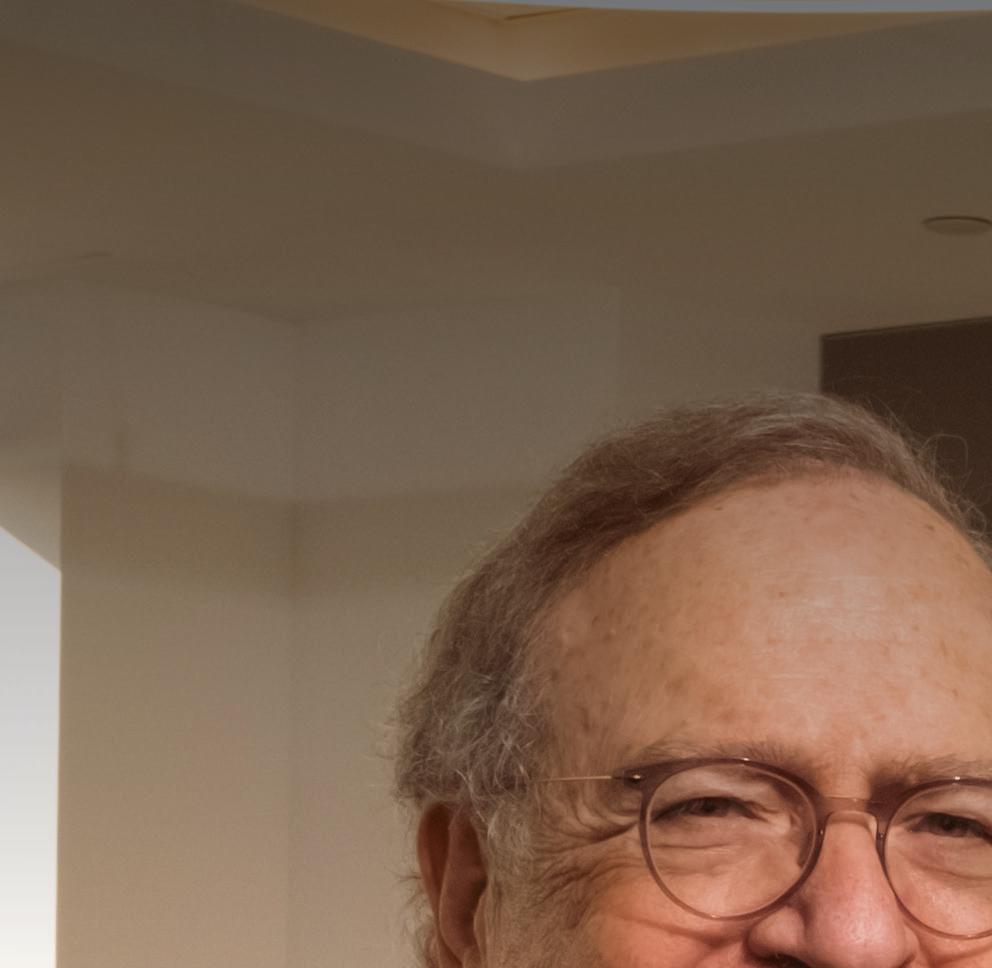

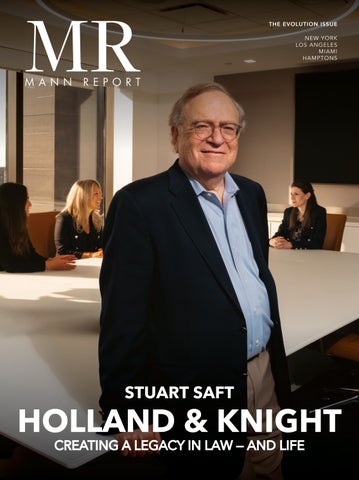

STUART SAFT

For decades, we have built a real estate practice unparalleled in the US. Now, as the global legal powerhouse HSF Kramer, we are so much more. As the only law firm ranked in Chambers Band 1 in the US, the UK and Australia, we continue to transform skylines and reshape landscapes. Please visit our website to learn more. Kramer Levin is now HSF Kramer

Holland & Knight’s New York Real Estate Practice Group and Real Estate Capital Markets Practice Group successfully closed deals worth more than $11.35 billion in 2024. From acquisitions, dispositions, development, condominium and cooperative formation and operation to hospitality, financing, leasing, land use and real estate capital markets, our attorneys do their utmost to deliver clients with exceptional results across all sectors.

Acquisitions and Dispositions: $1.93 billion

Financing: $4.1 billion

Leasing: $3.2 billion

Land Use: $290 million

Defaulted Loans, Workouts and Liquidations: $1.83 billion

www.hklaw.com

Stuart M. Saft, Partner | Real Estate Practice Group

Keith M. Brandofino, Partner | Real Estate Capital Markets Practice Group New York, NY | +1.212.513.3200

EDITORIAL

Editor

Debra Hazel

Director of Communications and Marketing

Penelope Herrera

Director of

Newsletter Division

Cheri Phillips

PRESIDENT/CEO

Jeff Mann

ART

Art Director

Virginia Sanchez

Cover Photography

Isaiah Gill

Marshal Cohen

Frank DeLucia

Peter Dixon

Matt Ellis

Craig Gillespie

Kris Kiser

Bob Knakal

Ira Meister

Jose Reyes

Carol A. Sigmond

Amanda Stanaway

Bentley Zhao

Technology Consultant Eric Loh

Distribution Mitchell’s Delivery Service

DIGITAL MEDIA

Designers

Virginia Sanchez

Editors

Debra Hazel

Penelope Herrera

Rose Leveen

Cheri Phillips

Web Developer

CS Designworks

West Coast Office: 578 Washington Blvd., Suite 827

Marina Del Rey, CA 90292 866-306-MANN (6266) mannpublications.com

East Coast Office: 450 7th Ave, Suite 2306

New York, NY 10123 212-840-MANN (6266)

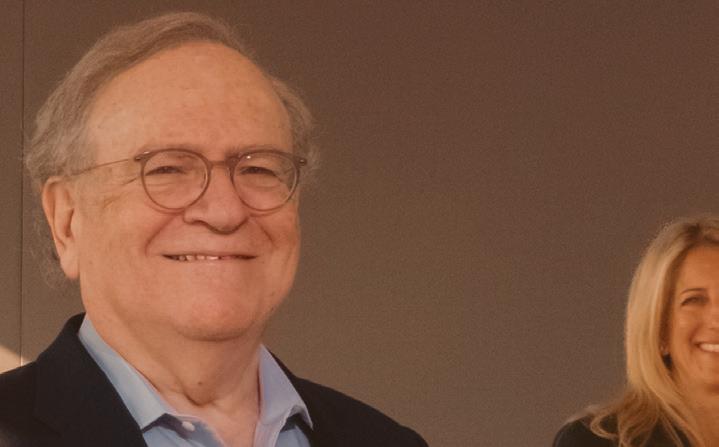

In this letter, I want to pay tribute to some of the good guys of our industry. Stuart Saft is such a mensch that it can be hard to remember that he’s one of the most influential real estate lawyers in New York City. His practice at Holland & Knight is proof of both, doing billions in billings, while also providing a haven for his associates. In what can be a cut-throat business, Stuart has established a collaborative atmosphere that is family-friendly, and one where attorneys stay.

Our cover feature is like sitting at lunch with an old friend. Enjoy.

I hope you will join us at the Fresh Meadow Country Club and enjoy a day of golf, fine dining and networking at the annual golf outing that this year will benefit two foundations close to my heart — The Mann Charitable Foundation and the National Realty Club Foundation — on October 6. Monies raised will support causes including Alzheimer’s Disease, Crohn’s and Colitis, Lymphoma and Macular Degeneration, as well as organizations such as the Bronx Historical Society, Community Mainstream, National Jewish Museum, Jewish National Fund, Catholic Faith Network and Nassau County Law Enforcement Exploring, among others. Our honorees are Martin Efron, managing director at White Oak Commercial Finance, and Jaimee L. Nardiello, partner at Zetlin & De Chiara LLP.

For more information about tickets and sponsorships, please contact Penelope Herrera at pherrera@themanncharitablefoundation.com or penny@ nationalrealtyclub.org.

And to conclude, I want to pay tribute to another good guy — my childhood and lifelong friend Michael Kerr of M&R Management, who left us last month, way too soon. Annie, our industry and I will miss him. His memory already is a blessing.

“Nice guys finish first. If you don't know that, then you don't know where the finish line is.” — Garry Shandling

8:30 AM Arrival and Registration

9:00 AM Breakfast/Brunch

11:00 AM Call to Carts

11:15 AM (Sharp) Shotgun Start

5:00 - 6:00 PM Hors d’Oeuvres and Cocktails

6:00 - 7:00 PM

Dinner and Presentation of Golf Winners and Honorees

Join Jeff Mann, The Mann Charitable Foundation and the National Realty Club Foundation as we are having a joint golf outing this year. On October 6, 2025, be prepared for another stellar annual golf outing. This outing will support causes such as Alzheimer’s disease, Crohn’s and Colitis, Lymphoma, Macular Degeneration along with raising money for the areas of NYC that need support including Bronx Historical Society, Community Mainstream, National Jewish Museum, Jewish National Fund, Catholic Faith Network, Nassau County Law Enforcement Exploring, among other areas.

With over 75 years of experience and deep understanding of industry challenges, IDB’s Commercial Real Estate team supports property owners, developers and builders across every type of financing requirement. We can help you keep pace with changes in the marketplace, while maintaining high credit quality levels and providing the personalized service, efficiency and flexibility to fit your specific needs. For more information about financing solutions that meet your specific needs, visit idbny.com.

At Peninsula Property Management (PPM), we do more than manage properties—we elevate them. With a leadership team that is deeply involved, hands-on, and responsive, PPM is redefining the standard for property management in New York City. Our mission is simple: deliver results with integrity, precision, and a hospitality-first approach.

Proactive Management

Stop issues before they start — from Local Law 97 to vendor oversight.

Financial Clarity

Clean, timely financials. No surprises –just strategic planning and transparency.

NYC Compliance Expertise

DOB, HPD, LL88, LL97, FISP we navigate every regulation so you don’t have to.

New Development Services

Schedule B, TCO phasing, hiring of staff, punch-list, insurance implementation.

Smart Cost Control

Energy savings, bulk contracts, vendor negotiations we cut waste, not corners.

Real-Time Technology

Track requests, tasks, and reports live through our integrated digital platform.

Welcome back and welcome to our Evolution Issue. What’s so interesting, and even fun, about real estate is that it is constantly changing. This month, we learn about these shifts from some true experts.

As cloud usage grows, one of the most-needed development categories is data centers. AO’s Jose Reyes gives us a primer on how to design and build one of these often-massive projects cost-effectively. ERA-co’s Amanda Stanaway offers a view on how “workplace character” will encourage employees back to the office and to peak productivity. Craig Gillespie, CEO of Airtower Networks, describes how connectivity will be the greatest amenity in the workplace, and could become a critical part of leasing negotiations. Meanwhile, Bentley Zhao of New Empire Corp. updates us on Queens and we learn a bit more about Los Angeles-based Cityview’s plan to expand on the East Coast.

As always, our columnists provide great insight into such diverse topics as the Energy Star program, the taxation of multifamily and the implications of a possible Mamdani term as mayor. It’s a pleasure to highlight them all.

Enjoy the rest of the summer!

Herbert Smith Freehills

Kramer hosted its annual Real Estate and Land Use Cocktail

Reception at the iconic Bryant Park Grill, welcoming a full house of industry professionals to mark the start of summer — and a new chapter for the

firm. This year’s event was the first held under the new HSF Kramer name, following the recent combination of Herbert Smith Freehills and Kramer Levin. The evening drew a who’s who of New York’s real estate scene.

Real estate professionals from across New York recently gathered in Midtown East, Manhattan, for Jewish National Fund-USA’s annual Leonard Litwin New York City Real Estate Tree of Life Gala, which honored two industry professionals for their outstanding leadership, generosity and philanthropic support of the land and people of Israel.

Co-chaired by Glen Weiss of Vornado Realty Trust and last year’s honoree Neil J. Goldmacher of Newmark, the annual celebration honored Simon J. Elkharrat, partner at Fried, Frank, Shriver & Jacobson LLP as the 2025 Tree of Life Award recipient, and Jay Miller, founder and managing Partner of BayBridge Real Estate Capital, with the Gregory A. Davis Leadership Award, which recognizes exceptional young philanthropists between the ages of 22 and 40.

Elkharrat represents leading players in commercial real estate. His fi rm is known for its prestigious clientele and strong commitment to philanthropy, including its long-standing support of Jewish National Fund-USA. In 2021, The Legal Aid Society of New York honored him with its annual Pro Bono Publico Award for outstanding service to Legal Aid and its clients.

“I think we can all agree that what makes our industry so fun is the tangible nature of real estate — you can see and feel the deals we

work on,” said Elkharrat. “That is why our industry has always been a huge supporter of Jewish National Fund-USA. The organization reminds us that supporting the people of Israel starts with the land. That our connection to Israel isn’t just symbolic, it’s tangible.”

Miller has received numerous accolades, including Dealmaker of the Year from the 2024 South Florida Structures Awards. He also brings a wealth of expertise to Jewish National Fund-USA as co-chair of the organization’s New York Real Estate Cabinet and member of the New York Regional Board of Directors.

“One of the reasons that I am such a proud Zionist is that I believe that not only is Israel our holy land, but I believe that as Jews we need to protect our existence,” said Miller. “By having modernday Israel, we have a seat at the table on the world stage, the world does business with us, we have political allies, and a military to defend ourselves. I believe that one of the reasons we live free, in places like America, is because we have the counterbalance of Israel in the world. I believe that all Jews have to do their part to support Israel and us in the diaspora, which means giving money, time and resources.”

This year’s celebration not only honored industry excellence but reinforced the values that unite Jewish National Fund-USA and the real estate community.

The International Facility Management Association (IFMA) Greater NYC Chapter Awards for Excellence, honoring individuals and corporations who have demonstrated exceptional achievements within the industry, took place at The Pierre. The association recognized excellence across a variety of categories, celebrating the hard work, innovation and leadership that continue to elevate facility management.

From left: Raymond Pezzuti, Fried Frank; Danijel Pocanic, Nelson Worldwide; Michael Schwartzberg, Steinway Moving and Storage; Tim Burdge, Syska Hennessy Group; Jessica Bogdan, Haworth; Rick Malan, Telecom Infrastructure Corp.; Janine Brennan, AllSeating; Alexandra Liz, Blackstone; Peter Lorenz; Helena Loman, Formcraft; Jennifer Kramer, Millerknoll; Yale Stogel, Alan Margolin & Associates and Carmen Sanchez Miller, GenMab

The Breath of Life New York Golf Tournament brought together friends and business leaders for networking and friendly competition to benefit National Jewish Health, the leading respiratory hospital in the nation.

More than 80 golfers shrugged off the day’s drizzle to play the course at Old Oaks Country Club in Purchase, N.Y.

The event, which raised $173,000, was chaired by Roger Silverstein, executive vice president of Silverstein Properties Inc. and a member of the National Jewish Health Council of Trustees.

“The generosity of our sponsors and players truly makes a

difference in the lives of millions of children and adults around the world who benefit both directly and indirectly from the research and care of National Jewish Health,” he said. The Denver-based medical center is a global health leader specializing in lung, heart, immune and related conditions.

Chairs emeriti of the event were Robert Helpern of Tannenbaum Helpern Syracuse & Hirschtritt LLP; Samuel Lewis and Stephen Siegel of CBRE Inc., who are also members of the Council of National Trustees. Top-level sponsors included 1251 Avenues of the Americas; CBRE; Greenberg Traurig; founders of the Fund to Cure Asthma golf tournament Marjorie and Stephen Raphael, a trustee and Wilk Auslander.

"The generosity of our sponsors and players truly makes a difference in the lives of millions of children and adults around the world who bene t both directly and indirectly from the research and care of National Jewish Health"

Roger Silverstein

Bottomless Closet hosted its Annual Spring Luncheon at Cipriani 42nd Street, bringing together more than 400 guests to celebrate women’s empowerment and honor individuals advancing equity in the workplace. Emceed by PIX11’s Monica Morales, the event highlighted this year’s theme, “From Obstacles to Opportunities,” through powerful stories of transformation and impact.

Honorees included tennis icon and entrepreneur Venus Williams (Game Changer Award), Manuel Chinea of Popular Bank (Male Ally Award), Stacey Dackson of Structure Tone (Inspiration Award), longtime board member Anne Blackman (Distinguished Leadership Award) and volunteer Stefanie Steel (Luise Kleinberg Volunteer Award).

A panel of clients reflected on how the organization helped them build confidence, find purpose and set meaningful goals. Client Dianette Caraballo shared her emotional journey from homelessness to employment, calling Bottomless Closet a turning point in her life.

Founded in 1999, Bottomless Closet provides free career coaching, resume preparation, interview training, and professional attire to help women in need secure employment and achieve financial independence. Executive Director Melissa Norden announced plans to expand services by 32% in 2025. Proceeds from the luncheon will support these critical programs.

National Jewish Health Hosts 32nd Annual

Nearly 200 guests gathered for The Sky’s the Limit New York Air Society Gala to honor Slater B. Traaen, senior director of Mitsui Fudosan America. Since 1991, the New York AIR Society has supported research and care of asthma, immunology and respiratory (AIR) medicine at National Jewish Health.

The event, held at Ascent Lounge New York, raised more than $230,000 and was chaired by Jennifer Widay, vice president of Kaback Service Inc.

“Slater Traaen is a truly incredible individual who leads by example in his service to business, community and philanthropy,” said Widay.

Traaen was honored with the Irving Borenstein Memorial

Award in recognition of his passion for giving back and fostering meaningful impact in the community. The award was presented by chair emeritus of the event, Roger Silverstein, executive vice president of Silverstein Properties, who is a national trustee of the National Jewish Health Council.

Dr. David Beuther, pulmonologist and chief medical information officer for National Jewish Health, gave a hospital update. Additional leadership included Kathy Chazen, chair emerita of this event and a trustee of the hospital. Top-level sponsors included The Cheryl and Edward S. Gordon Foundation, Silverstein Dream Foundation, ABM, Kathy Chazen and Larry Miller, Newmark and Carrie and Brian Packin.

Meridian negotiates and closes more than $1 billion in underlying cooperative loans and lines of credit annually

Fisher Brothers, a fourth-generation real estate company that owns, manages and operates unique spaces across the country, announced that funds affiliated with Blackstone Real Estate acquired a 46% jointcontrol interest in 1345 Avenue of the Americas at a full capitalization of $1.4 billion. Fisher Brothers, investing alongside Blackstone, also increased its majority ownership as part of the transaction. In addition, Fisher Brothers and Blackstone have completed a $850 million CMBS refinancing provided by Morgan Stanley, JP Morgan Chase and Citibank.

“This transaction reflects the tremendous value that premier, highly amenitized office buildings continue to offer to leading institutional investors, such as Blackstone,” said Winston Fisher, partner at Fisher Brothers, in the announcement. “The completion of the $850 million refinancing package enables us to continue to strategically invest in

the asset, while simultaneously increasing our ownership stake in the building. We remain bullish on the long-term Manhattan investment opportunity, which has been the hallmark of our family’s business for more than a century.”

Standing 50 floors above Midtown Manhattan and spanning two million square feet, 1345 Avenue of the Americas is 92% leased, with nearly 1.1 million square feet of leases signed since 2023 including the largest commercial office lease of 2023 when Paul, Weiss, Rifkind, Wharton & Garrison LLP took 765,000 square feet.

“Midtown Manhattan is the best-performing office market in the country, and we are excited to partner with Fisher Brothers in this trophy asset investment,” said David Levine, co-head of Americas acquisitions for Blackstone Real Estate.

In 2021, Fisher Brothers completed a $120 million large-scale capital improvement project with the help of Skidmore, Owings & Merrill, which included upgrades to the building’s exterior and lobby and a new amenity floor designed by Rockwell Group, @Ease 1345.

In both the acquisition and refinancing, legal representation for Fisher Brothers was Paul Hastings LLP, and Blackstone was represented by Fried Frank. Eastdil Secured LLC represented the joint venture in the refinancing. Lenders Morgan Stanley, JPMorgan Chase and Citibank were represented by Dechert LLP. Morgan Stanley also served as financial advisor to Fisher Brothers in connection with the acquisition.

units for low-income households, as well as two units for the building’s supers. The development features modern amenities, sustainable building practices and community-focused spaces designed to foster connection and well-being. Building E will include a telescope remotely controlled by Bronx High School of Science on the rooftop while a large central courtyard surrounded by the La Central apartment buildings will also be completed in this phase.

New York City Mayor Eric Adams, BRP Companies, Hudson Companies, J.P. Morgan and project partners broke ground on the second and final phase of the La Central housing development to bring 420 new affordable homes to the Melrose neighborhood of the Bronx.

Phase II will include a range of unit types from studios to four-bedroom apartments as well as 63 supportive housing units for formerly homeless New Yorkers. The new phase is expected to cost $343 million, with the Adams administration contributing over $137 million through the New York City Department of Housing Preservation and Development (HPD).

Phase II will include 13,000 square feet of community facility space, 1,500 square feet of retail and 7,000 square feet of new public gardens.

Upon completion in 2028, Phase II will offer a mix of affordable apartments reserved for households earning between 30% and 80% of the area median income. It will include 114 units for extremely lowincome households, 106 units for very low-income households and 198

“As we embark on bringing Phase II to fruition and move towards final completion of the La Central project, over 1,000 vitally needed affordable residences will have been created for the South Bronx as we strive to help fill the void in housing offerings across the city,” said Andy Cohen, managing director, BRP Companies.

The La Central development, comprised of five distinct buildings, delivers over 1,000 affordable housing apartments to the Bronx community. La Central Buildings A and B, which opened in 2021, are fully affordable, mixed-income, mixed-use developments with nearly 500 apartments. Building A is also home to a state-of-the-art YMCA. Building D, completed in 2019, provides 160 supportive and low-income apartments. La Central participates in the NYSERDA Multifamily Performance Program and LEED for Homes. The two new buildings created through the final phase will be designated Building C and Building E.

“Today’s groundbreaking marks a major milestone in our long-standing commitment to bringing much-needed affordable and supportive housing to the South Bronx and New York City,” said Marlee Busching-Truscott, managing director of development, Hudson Companies. “La Central has been over a decade in the making and will ultimately deliver over 1,000 high-quality and sustainable homes through an inclusive, communityfocused development.”

Kaufman Leasing Company consists of highly qualified professionals with a thorough knowledge and understanding of the New York City office, retail and specialty-use real estate sectors.

155 West 23rd Street

450 Seventh Avenue

100-104 Fifth Avenue

27-35 West 24th Street

13-15 West 27th Street

45-47 West 27th Street

19 West 24th Street

119-125 West 24th Street

111 West 19th Street

212 West 35th Street

132 West 36th Street

242 West 36th Street

237 West 35th Street

275 West 39th Street

462 Seventh Avenue

470 Seventh Avenue

519 Eighth Avenue

22 West 19th Street

www.kaufmanorganization.com

democracy, community center, locally focused retail and two hotels from Mohegan and the owners of the Banyan Tree hotels and resorts, complete with entertainment and modern gaming options for those 21 and over.

Freedom Plaza, a new civic and cultural plan for Midtown Manhattan’s East Side, officially submitted its license application to the New York Gaming Facility Location Board. With a projected $11.1 billion in total investment, Soloviev Group and its partner Mohegan are advancing a project that they say will transform Manhattan’s East Side while generating $3.2 billion in annual economic output.

The developers said the plan delivers more affordable housing than any other Manhattan proposal and is the only Manhattan project to offer open green space.

“This application represents years of meaningful listening and collaboration, and it will uniquely deliver what New Yorkers need most: accessible green space, housing that working families can afford and well-paying union jobs,” said Michael Hershman, CEO of Soloviev Group. "With ongoing input from our neighbors, labor partners and faith and civic leaders, we remain committed to building a project that creates lasting value for the community and all of New York City.”

Freedom Plaza will include 1,049 new residential units, including 513 units that working families can afford, and approximately five acres of public park space designed by OJB Landscape Architecture. The plan will also feature a food market, daycare, museum dedicated to

“Freedom Plaza reflects the core values that define us at Mohegan, including inclusion, opportunity and a deep commitment to the wellbeing of the local community,” said Ray Pineault, CEO of Mohegan. “With a centuries-long legacy of stewardship and community-building, we’re proud to partner with the Soloviev Group and collaborate with New York’s diverse civic, labor and faith leaders to help shape a destination where people can come together, thrive and share in lasting prosperity. We know New York City, we’ve been engaged in this market for decades and look forward to expanding our footprint and delivering a transformative experience for Midtown East.”

Designed by Big-Bjarke Ingels Group, the mixed-use development will be built entirely with union labor and directly support the creation of 17,000 high-quality, full- and part-time union jobs during construction and operations, with nearly 40,000 jobs supported overall throughout the economy. Project labor costs during construction are projected to generate approximately $1.5 billion alone. Thereafter, thousands of permanent careers in operations, hospitality, retail and entertainment will be sustained once open.

To ensure long-term, shared prosperity, the project introduces community-first investment models designed to keep financial benefits rooted in New York. Ownership in the proposed gaming facility will be opened to New York City residents, giving individuals the opportunity to share in the project’s long-term economic success. In addition, eligible New York state and city employee-related pension funds will receive preferential access to investment opportunities, enabling broader public participation in the economic upside of the development. The investment opportunities for New York City residents and these pension funds would commence no earlier than 2027.

The DOT will utilize the premises for warehouse and industrial space, vehicle and equipment storage, administrative offices and vehicle parking. The agency had previously occupied the space on a monthto-month license agreement while awaiting full approvals from the city. As part of the newly executed lease, the building will undergo significant capital improvements tailored to the city’s operational needs.

The New York City Department of Transportation (DOT) has signed a long-term lease at HUB LIC, located at 47-25 34th St. in Long Island City, N.Y., announced Joseph A. Farkas, CEO and founder of Metropolitan Realty Associates LLC (MRA). The 21-year lease covers 212,094 square feet across the entire ground floor, the entire second floor and a portion of the building’s exterior parking lot.

HUB LIC is owned in a joint venture between MRA and Nuveen as part of a long-term industrial investment strategy. The property was acquired in August 2016.

The 343,407-square-foot multi-level industrial building currently houses four tenants and is now 78% leased. Other tenants include TEC Systems, Satis&Fy, Metropolitan Office & Computer Supply Co. and Charles R. Gracie & Sons.

“The building’s strategic location for the Department of Transportation’s operations and the unique physical attributes of the property, including a one-acre parking lot, multiple loading docks and drive-in access with curb cuts, made HUB LIC the right ‘deal’ for DOT, and we welcome them

CBRE’s John Reinertsen, Yun Park, Doug Holowink, Josh Leibowitz and Michael Lee represented the Department of Citywide Administrative Services (DCAS) in the transaction. Scott Klau and Ryan Gessin of Newmark represented the landlord.

77% of future sellers believe they won’t need to drop their price, with nearly all (92%) saying they are certain their home will generate strong interest from buyers. However, just 77% of past sellers say their home generated strong buyer interest, and nearly a quarter (23%) say they received just a single offer on their home. Notably, just 5% of future sellers say they expect just one offer.

Dream on — nearly three-quarters of Americans who plan to sell their home in the next year (72%) are confident they will receive offers above their asking price, despite just 42% of recent sellers reporting this was the case, according to a report from Clever Offers, a Clever Real Estate platform that allows home sellers on tight timelines to explore their selling options.

In reality, 43% of recent sellers had to lower their asking price. Still,

Seller optimism is high: 93% believe they’ll price their home correctly, compared to 85% of past sellers who think they hit the mark. Likewise, 91% are certain they’ll choose the right agent — a stark contrast to the 74% of past sellers who feel they did. However, not every expectation is inflated. While 40% of past sellers accepted an offer within two weeks, only 18% of future sellers expect such a fast sale.

Additionally, although 56% of recent sellers spent less than $1,000 on unexpected costs, 82% of those preparing to sell are setting aside more. Only 31% of past sellers reported making unexpected concessions — yet 80% of future sellers say they’re prepared to compromise with buyers. Despite nearly all future sellers (94%) worrying they’ll make a mistake during their sale, just two-thirds of recent sellers (66%) actually did.

On a scale of one to 10, 63% of future sellers anticipate stress levels of seven or higher, while just 54% of recent sellers actually experienced that level of pressure.

“The 74 is a rare opportunity for buyers who want the best of Manhattan living: timeless design, privacy and a sense of community in the city’s most desirable neighborhood,” said Russo, who serves as director of sales for The 74.

Developer Elad Group, along with Douglas Elliman Development Marketing, announced that closings are underway at The 74 condominium, located on the Upper East Side.

Designed by Pelli Clarke & Partners with interiors by AD100 alumni designer Rafael de Cárdenas, The 74 offers full-floor layouts with 360-degree Central Park and skyline views, a duplex penthouse with expansive terraces and a singular townhome. Strong sales at The 74 reflect the demand for high-quality, contemporary residences on the Upper East Side, the team said.

“The 74 is designed to meet the expectations of today’s most discerning buyers and the lifestyle they want on the Upper East Side,” said Elyse Leff, executive vice president of marketing and sales at Elad Group. “We are delivering striking modern homes paired with the perfect suite of amenities.”

Douglas Elliman Development Marketing’s Barbara Russo, Danielle Englebardt, Elena Sarkissian and Christopher Salierno have been tapped to drive sales.

The tower’s pleated white terracotta façade and bronze-framed windows create a striking, contemporary silhouette that pays homage to New York’s Art Deco heritage. Inside, de Cárdenas’ interiors feature European White Oak flooring in an oversized parquet pattern, custom millwork and floor-to-ceiling windows by Polito Serramenti.

Kitchens are appointed with ash cabinetry, bianco ice marble countertops and backsplashes and fully integrated Miele appliances. Primary bathrooms offer Calacatta Vagli marble, custom Sycamore vanities and Dornbracht fixtures, while powder rooms are finished with Pink Namibia marble and brushed platinum accents.

The full-floor residences boast spectacular views of Central Park and the midtown skyline, with light streaming in from four exposures to create a bright, airy ambiance throughout the day. With total privacy and direct access to all of the building’s world-class amenities, these homes are a true rarity in Manhattan’s competitive real estate market.

Almost all of The 74’s amenities are positioned on the 17th floor to maximize natural light and city views. The fitness center, Pilates studio and lounge with wet bar offer residents inspiring views of the city skyline. The powder room on this level is bathed in natural light, underscoring the building’s commitment to elevating the resident experience.

Residents also enjoy a discreet lobby, private garden, library lounge and a children’s playroom.

Prices range from approximately $2.995 million for a two-bedroom to $13.55 million for a full-floor five-bedroom with Central Park views.

Incoco Capital, along with developers Tavros and Charney Companies, announced that Madison Realty Capital, Kushner Companies and OneIM have provided significant construction loan financing for its development of 24-19 Jackson Ave. and 45-03 23rd St. in Court Square, a 55-story condominium skyscraper which will begin rising in Long Island City.

The project is being financed with $425 million in backing from Madison Realty Capital, a vertically integrated real estate private equity firm, along with $100 million from Kushner, a multi-generational real estate development and management firm, and OneIM, a global alternative investment manager and Kushner’s capital partner.

It will bring 636 new units to Long Island City.

“We have successfully carried out numerous projects in New York in partnership with proven developers and global institutional investors, including Korea,” said Fa Park, chairman and founder of Incoco Capital. “We are also exploring EB-5 investment opportunities, given the project’s potential for job creation and broad economic impact.”

The project site was completed in 2022 when Incoco Capital acquired additional land from Japanese hotel chain Toyoko Inn for approximately $68.5 million, doubling the size of the original site, which had been assembled by Tavros and Charney since 2016.

“We’re very excited to commence construction on our Court Square building, which is set in a spectacular location with wide ranging views of Manhattan, Brooklyn, Queens, the East River and its bridges,” said Nicholas Silvers, founding partner of Tavros. “This is an extremely exciting time for us, and we’re grateful to both Madison Realty Capital and to Kushner for sharing in this exhilarating project.”

The architectural design is being led by FX Collaborative, and the residential offerings will include a diverse mix of units, ranging from studios to one- to four-bedroom residences. In addition to offering a premier amenities package, Chelsea Piers Fitness will occupy the building’s podium for 30 years, joined by Whole Foods for 15 years.

While economic uncertainties and stock market fluctuations may create strategic opportunities for sophisticated investors, the wealthiest U.S. households continue to see the greatest real estate gains, according to Sotheby’s International Realty in its recently released “2025 Mid-Year Luxury Outlook” report.

Beyond market dynamics, the report also delivered intelligence on financing strategies and natural disaster impacts on property values, and identified five emerging and re-emerging luxury property markets.

“The luxury real estate landscape continues to evolve at an unprecedented pace, creating opportunities for homebuyers and sellers with the right market knowledge,” said Bradley Nelson, chief marketing officer, Sotheby’s International Realty. “This report is designed to empower both homebuyers and sellers with the strategic intelligence needed to make informed real estate decisions throughout the remainder of the year.”

The report draws on insights from Sotheby’s affiliated agents worldwide who specialize in transactions in the US$10 million and up price category. Their expertise is complemented by data and analysis from UBS, J.P. Morgan, Moody’s, McKinsey and Company, Bain and Company, Cotality (formerly CoreLogic), the National Association of Realtors and the National Association of Home Builders.

Despite concerns about tariff impacts and economic uncertainty, May 2025 inflation data released by the Bureau of Labor Statistics beat economists’ expectations, said the New York Times. Sales of properties at US$10 million and above soared between February 1 and May 1, 2025, compared to that same period in 2024, according to analysis published in May 2025 by The Wall Street Journal.

In the U.S., the top half of the wealthiest households saw the biggest gains in real estate value among all homeowners in 2024, according to an April 2025 report by realtor.com.

Renewed confidence and momentum in San Francisco are driving sales. Sotheby’s International Realty–San Francisco brokerage closed several transactions over US$20 million in 2024, topping previous records. Puerto Rico’s highest recorded property sale grew from US$2 million to $30 million in a decade, according to local property records. The post-disaster market is experiencing increased interest, particularly where there are opportunities for rebuilding or new construction.

An April 2025 report by The Wall Street Journal found that wealthy individuals continue to move to locations that are at risk of climate events and are “setting home price records when they get there.”

“Ultra-high-net-worth individuals continue to view real estate as an essential portfolio component,” said Philip White, president and CEO, Sotheby’s International Realty. “Even amid economic uncertainty, the resilience of the luxury housing market provides compelling opportunities for strategic homebuyers and sellers.”

MONDAY, AUGUST 4, 2025

The Seawane Club | Hewlett Harbor, NY

Rockaway Hunting Club | Lawrence, NY

Hempstead Golf & Country Club | Hempstead, NY

Sunrise Day Camp–Long Island is the world’s first full-summer day camp for children with cancer and their siblings, provided completely free of charge.

Sunrise Day Camp–Long Island is a proud member of the Sunrise Association, whose mission is to bring back the joys of childhood to children with cancer and their siblings worldwide. Sunrise accomplishes this through the creation and oversight of welcoming, inclusive summer day camps, year-round programs and in-hospital recreational activities, all offered free of charge. Sunrise Day Camp–Long Island is a program of the Friedberg JCC, a beneficiary agency of UJA-Federation of New York.

Jamestown announced that Levi’s Plaza, a nearly one million-squarefoot office campus located on San Francisco’s Embarcadero, has officially achieved net-zero operational carbon. The milestone makes Levi’s Plaza the first existing, large-scale commercial campus in San Francisco to achieve net-zero carbon operations.

“Net zero operational carbon isn’t just an environmental milestone — it’s a competitive positioning strategy,” said Michael Phillips, president of Jamestown. “Modern companies are actively seeking places that align with their own ESG goals, and our work at Levi’s Plaza positions the property to meet that desire. As we see more AI startups and innovation companies choosing the northern waterfront, this investment ensures we’re aligned with the businesses that will be significant players in San Francisco’s next economic chapter.”

The clean energy transition at Levi’s Plaza was achieved through a more than $50 million property retrofit that included several key measures. Fossil fuel-powered heating systems, including boilers and natural gas HVAC systems, were replaced with energy-efficient electric heat pumps and other electric alternatives as part of comprehensive electrification upgrades. In partnership with Wunder, Levi's Plaza installed on-site solar infrastructure totaling over 200kW of power across three buildings.

The campus also sourced 100% clean energy from CleanPowerSF, which provides electricity entirely from renewable energy projects such as solar or wind in the Bay Area and across California, as well as via

renewable energy credits using National Green-e Certified Wind RECs generated in the U.S. Remaining emissions were offset through highquality carbon offsets via the HFC Refrigerant Reclamation Project.

By removing its onsite reliance on fossil fuels, transitioning heating systems to electric alternatives and offsetting remaining emissions, Levi’s Plaza is fully aligned with San Francisco’s climate goals, including net-zero greenhouse gas emissions by 2040. Jamestown reaffirmed its commitment to the decarbonization of commercial properties globally.

Levi’s Plaza is Jamestown’s first net-zero operational carbon asset across its global portfolio.

The New York State Energy Research and Development Authority (NYSERDA) has awarded nearly $7 million to nine projects through the fifth round of the Buildings of Excellence Competition, which aims to advance best-in-class, energy-efficient multifamily buildings in New York. The competition provides financial awards and recognition for zero-emission or carbon–neutral-ready buildings.

“The Buildings of Excellence Competition continues to inspire replicable and scalable solutions, tapping into cutting-edge technologies that transform the way we design and construct buildings,” said NYSERDA President and CEO Doreen M. Harris.

Launched in 2019, NYSERDA’s Buildings of Excellence Competition provides financial incentives and recognition for the design, construction and operation of zero-emission buildings. NYSERDA has awarded 75 new construction and gut-renovation projects over five rounds of competition, with 41 located in disadvantaged communities. More than two-thirds of these new construction buildings serve affordable housing markets.

Seven of the nine buildings to be constructed will serve low- to moderateincome customers; six will serve disadvantaged communities. All of the projects are zero emissions and carbon neutral-ready and are committed to meeting a Passive House standard.

Eight projects incorporate solar generation; one includes energy storage.

Round Five awardees are:

• 77 William St.: BronxPro Group and Safe Harbors of the Hudson, Curtis + Ginsberg Architects in Newburgh, N.Y.

• Chester Agricultural Center Farmworker Housing: Chester

Agricultural Center, Inc, WXY Architecture + Urban Design in Chester, N.Y.

• 280 East 161st St.-West Tower: Gilbane Development Co. and Institute for Community Living, Aufgang Architects in the Bronx

• 475 State St.: Alloy Development, Alloy Architecture LLP and Thornton Tomasetti in Brooklyn, N.Y.

• Building 10 Bio-based Passive House (3989, 3995 Hillman, 4009 Gouverneur Ave.): Amalgamated Housing Cooperative, ZH Architects in the Bronx

• Kissena House: Selfhelp Realty Group, Curtis+Ginsberg Architects, in Flushing, N.Y.

• Powerhouse Apartments: Lemle & Wolff Development Co. LLC and HELP Development Corp. and True Development New York LLC, Ettinger Engineering Associates and STAT Architecture in the Bronx

• Seneca West 110th St.: Infinite Horizons LLC, Urbane Development Group LTD, Lemor Development Group LLC, and L+M Development Partners LLC, Curtis + Ginsberg Architects in New York, N.Y.

• 1707 Hertel Ave.: Forward Development LLC, Line 42 Architecture, PLLC in East Aurora, N.Y.

“It's not every day you have the opportunity to partner with a franchise that has been building trust since 1979,” said Ryan Parsons, CEO of Evive Brands. “Maid Brigade brings strong leadership under Raychel Leong-Sullins, a committed franchisee base and a stellar reputation earned over four decades. Together we see tremendous opportunity — from boosting top-line revenue to amplifying marketing — to help this mature brand keep growing. Even after decades of success, Maid Brigade still has room to become a true household name, and our team is committed to helping it get there.”

Evive Brands, a community of service-oriented franchise brands, has acquired Maid Brigade, a residential and commercial cleaning franchisor with more than 280 franchised locations across the United States and Canada. The transaction further expands Evive Brands’ reach in the home services sector; its portfolio (Executive Home Care, Assisted Living Locators, Grasons and The Brothers That Just Do Gutters) approaches 1,000 franchise locations nationwide.

Maid Brigade will continue to operate under its established name, with President Raychel Leong-Sullins and her leadership team guiding product innovation and franchise growth. Integration efforts will emphasize shared technology, training and marketing resources that should benefit all franchise owners across Evive Brands.

“Our PureCleaning system sets the standard for eco-friendly, peoplefirst cleaning,” said Leong-Sullins. “Partnering with Evive Brands connects our franchisees to additional operational expertise and crossbrand collaboration while allowing us to stay true to our communityfocused values.”

The Building Research Establishment (BRE) recognized significant achievements in the U.S. market at the 2025 BREEAM Awards, which honored the people and projects leading the industry in sustainable building design, development and management. Held in London, the awards brought together leaders from across the global built environment to celebrate accomplishments across BREEAM’s network, reinforcing the role of sustainability strategies in driving long-term value and resilience.

While the following U.S. nominees did not receive the top award in their respective categories, being shortlisted reflects an immense achievement and underscores the caliber of their work in advancing sustainability within the built environment. The 2025 U.S. shortlisted nominees include:

• DWS US Portfolio, GRESB Portfolio Integration Award

• PGIM Real Estate, GRESB Portfolio Integration Award

• CBRE Inc, Best Assessor Company

• Cushman & Wakefield, Best Assessor Company

• GreenGen, Best Assessor Company

• Iron Mountain Data Centers, BREEAM NC Commercial

• Chris Pennington, BREEAM ESG Outstanding Achievement Award.

This year’s U.S. nominees were recognized across several categories, reflecting the growing dominance of BREEAM as a science-driven framework for improving performance, operational excellence and value

creation in U.S. real estate.

“In today’s economic climate, real estate owners, investors and operators are under pressure to demonstrate the value and resilience of their assets,” said Breana Wheeler, U.S. director of operations at BRE. “The projects and professionals recognized at this year’s BREEAM Awards demonstrate what’s possible when sustainability goals are treated as drivers of operational excellence, and we’re proud to celebrate their achievements.”

The event also commemorated a major milestone for BREEAM and CitizenM, with the hospitality brand’s Menlo Park Hotel becoming the first hotel in the U.S. to achieve an Outstanding rating under BREEAM In-Use, the highest level of certification available.

Chosen as the hotel partner for Meta’s campus in Menlo Park, Calif., the Menlo Park property was designed to meet rigorous sustainability, well-being and efficiency goals. The project serves as a benchmark for sustainable hospitality in the U.S., demonstrating how early planning, data-driven decision making and stakeholder alignment enable highperformance outcomes in operational buildings.

These recognitions highlight BREEAM’s expanding U.S. footprint and its position as a trusted method for evaluating and improving building performance across all asset classes and lifecycle stages.

BREEAM has been a global sustainability assessment method for planning projects, infrastructure and buildings for over 30 years. There are now nearly three million BREEAM-registered buildings across 104 countries. In 2024, BREEAM saw robust expansion across North America, including a 43% increase in the total number of assets certified by BREEAM in the region.

BRE’s upcoming Version 7 update to BREEAM is set to drive progress across the commercial real estate sector by advancing sustainability efforts. With expanded carbon benchmarking, full lifecycle coverage and streamlined data collection, the update will allow users greater access to the latest built environment innovations grounded in a rigorous, sciencebased approach.

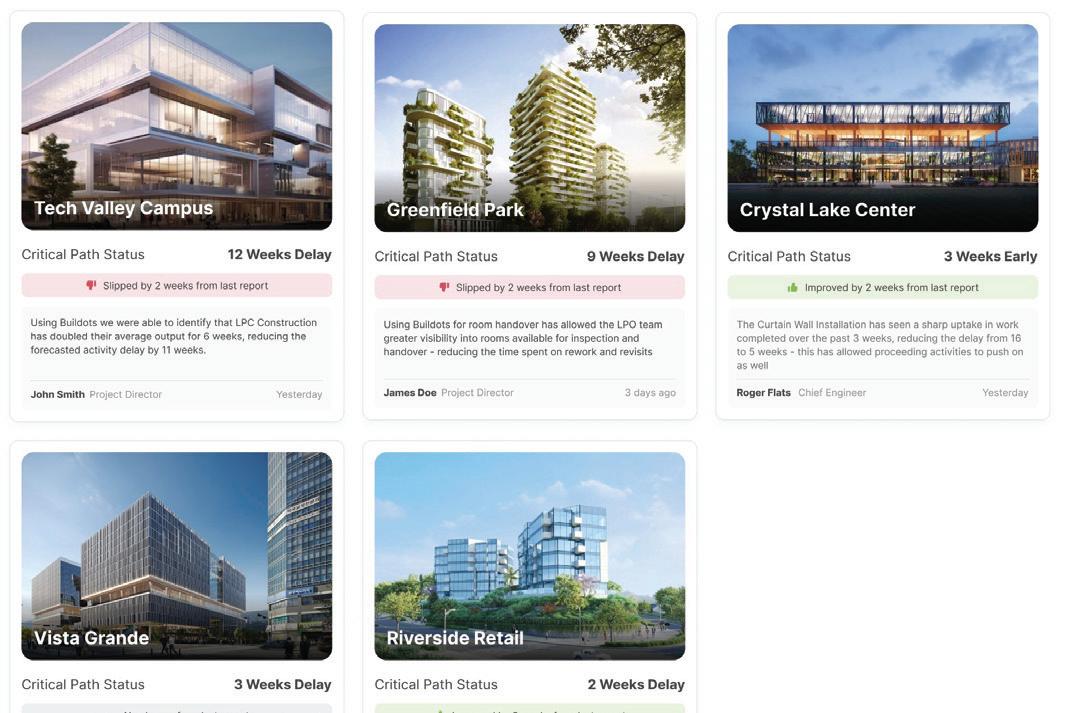

construction executives and their teams to shift from firefighting to foresight, allowing them to work together to more expediently and effectively assess the health of their projects and address issues before they cascade into major problems.”

Multiple subjective, disjointed sources of information and other variables, make understanding the status of projects at a glance difficult. This prevents them from identifying and acting on risks and issues before they become unmanageable and makes effective collaboration with site teams and other stakeholders extremely difficult.

AI construction technology provider Buildots announced the launch of Portfolio Dashboard, which it said provides construction firms with a unified, objective view across active projects. The Dashboard will enable construction executives and site teams to work together more effectively, expedite collaborative data-driven decision-making and improve cross-portfolio project outcomes, the company said.

Portfolio Dashboard provides a centralized, high-level view of all projects — combining status updates, trend insights and input from project leads on challenges and resolutions. It gives executives the visibility required to shift from reactive firefighting to confident, proactive portfolio control.

“At Buildots, our mission has always been to transform construction management through data-driven insights,” said Roy Danon, cofounder and CEO of Buildots. “With Portfolio Dashboard, we’re enabling

Portfolio Dashboard helps construction teams address these challenges in three core ways. Objective warning signals weeks or even months before problems escalate allow teams to shape outcomes rather than simply react to issues after they’ve grown too large to ignore. A single reporting format across all projects makes it easier to compare performance, identify outliers and allocate resources more effectively. AI-driven progress tracking provides impartial data on what's been built alongside project team commentary and mitigation plans that shed light on why things are moving or stalled.

The Dashboard provides a clear view of project status, progress trends and concise updates from project leaders. When deeper investigation is needed, teams can work together to see and understand which specific activities are driving delays and determine mitigation plans.

“Portfolio Dashboard gave me instant clarity on project health across the board," said Mark Bessey, regional director at Sir Robert McAlpine. “Instead of waiting on reports or chasing updates, I could see exactly where attention was needed and take action quickly. It helped us shift from reactive management to data-driven leadership.”

Portfolio Dashboard is currently available to select enterprise clients.

move also adds UrbanFootprint’s experienced product, engineering and customer-success teams, including founder and CEO Joe DiStefano.

LightBox, a platform powering location intelligence for the commercial real estate (CRE), lending and infrastructure industries, announced the acquisition of UrbanFootprint, a pioneer in geospatial analytics and scenario-based modeling for infrastructure investment, climate risk and community resilience.

The acquisition expands LightBox’s data portfolio with UrbanFootprint’s nationally modeled layers including demographics, land use, environmental hazards, infrastructure and social-equity indicators. This

“Our customers are navigating increasingly complex, high-stakes decisions about where to invest, build and mitigate risk,” said Caroline Stoll, general manager of data and analytics at LightBox. “By integrating UrbanFootprint’s powerful data assets and scenario-modeling capabilities, decision-makers can see not only what’s on a site today but how climate, demographic and infrastructure forces may reshape it tomorrow.”

Over the coming months, LightBox will weave UrbanFootprint’s models and data across its platform, enhancing site intelligence, underwriting analytics and property-level benchmarking for customers in real estate, finance, infrastructure and government.

“LightBox’s mission to connect commercial real estate through real-time intelligence reflects the vision we built at UrbanFootprint,” DiStefano said. “I’m excited to help carry that vision forward as part of the LightBox platform.”

LightBox, which serves an extensive clientele of over 30,000 customers, will continue to support UrbanFootprint’s utility, finance and government clients while introducing new opportunities across its expanding platform.

increase occupancy, improve resident satisfaction and scale highperformance operations across entire portfolios. The suite is designed to reduce team strain, increase occupancy, improve resident satisfaction and scale high-performance operations across entire portfolios.

The suite delivers intelligent, self-directed digital agents that do far more than automate tasks — they learn, adapt and act with purpose, freeing onsite and centralized teams to focus on what matters most: human connection and operational excellence, the company said.

Betterbot, a multifamily industry artificial intelligence (AI) automation platform, has launched the Betterbot Agentic AI Suite, a platform that introduces the power of agentic AI to marketing, operations and resident engagement. Simultaneously, the company revealed a comprehensive brand refresh that it said repositions Betterbot for its next stage of growth — one rooted in intelligent, proactive and humancentric automation.

The Betterbot Agentic AI Suite is designed to reduce team strain,

“This is not just a product launch — it’s a leap forward in what AI can do for multifamily,” said Zlatko Bogoevski, CEO and co-founder of Betterbot. “We’ve moved beyond reactive automation. The Agentic AI Suite enables proactive, intelligent and measurable performance across every facet of the renter lifecycle and portfolio operations.”

The suite includes three integrated tiers. Agentic Marketing is a fullfunnel leasing engine that powers 24/7 omnichannel engagement, AIgenerated websites and advanced lead intelligence.

Agentic Operations provides intelligent automation across the resident lifecycle, including renewals, maintenance triage, collections and service workflows. Agentic Portfolio offers enterprise-grade insight, custom AI Agent development and white-glove support for data-driven growth at scale.

“BetterBot’s new agentic AI isn’t just a tool — it’s an operational revolution,” said Dana Zeff, managing partner at Unit Leader LLC and a BetterBot investor. “For multifamily operators, this means fewer handoffs, faster leasing cycles and a dramatically leaner team footprint without compromising the resident experience.”

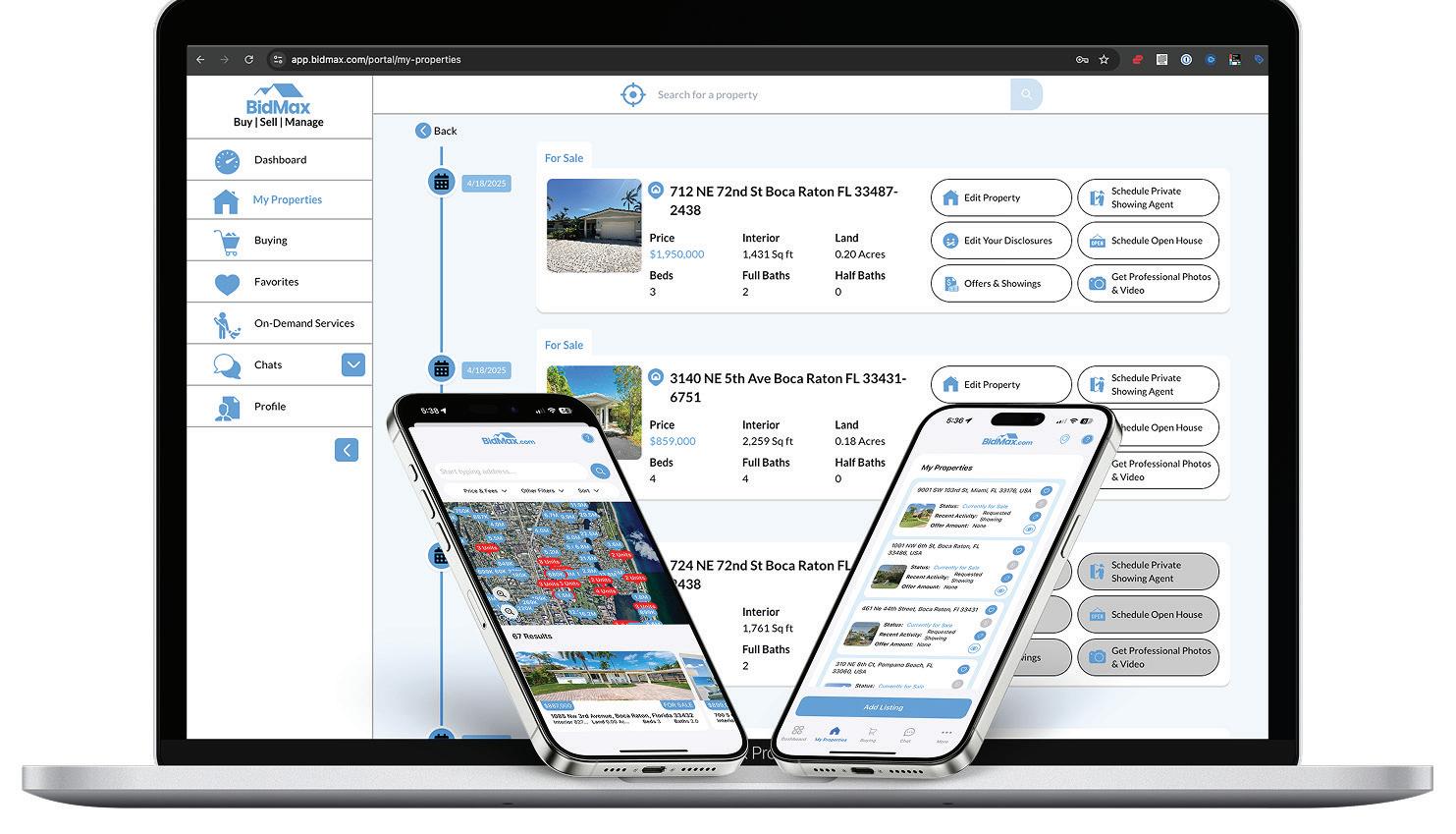

“We deeply understand the financial challenges currently affecting condo and homeowners’ associations throughout South Florida,” said BidMax CEO Richard Saccone. “With increased insurance costs and reserve obligations, many homeowners feel compelled to sell at prices lower than anticipated. Our primary aim is to ease these financial pressures by minimizing transaction costs.”

The service aims to substantially reduce transaction costs for homeowners who face financial pressures from rising insurance rates, reserve requirements and unexpected assessments.

Since launching in 2024, BidMax has streamlined real estate transactions through its fully automated, user-friendly platform. The platform simplifies the entire process, from listing homes on the MLS and syndicated websites, to managing communications, scheduling showings and negotiating offers — all in one digital location.

“Our advanced automation eliminates tedious busy-work and streamlines logistics,” Saccone added. “The efficiency we gain translates directly into cost savings, which we pass on to our clients, saving the average homeowner tens of thousands per transaction.”

Additionally, BidMax’s integrated partner app dispatches showings and open houses to licensed showing agents, who utilize an Uber-like application and are compensated on an hourly basis.

This approach ensures hands-on service without traditional high commission costs, enhancing the selling experience for homeowners.

performance, rehearsal and studio space for community arts groups.

Gilbane Development, in partnership with Blue Sea Development, Artspace and the City and State of New York, announced $254 million in financing for the Brownsville Arts Center & Apartments (BACA).

Located at 366 Rockaway Ave. in Brooklyn, BACA will deliver nearly 263,000 square feet of residential space and a 28,000-square-foot cultural arts center that will serve as a community hub. BACA will offer a mix of 283 studios to three-bedroom apartments, affordable to households earning between 30% and 70% of the area median income (AMI), including dedicated units for formerly homeless individuals.

Rising on a vacant city-owned lot awarded for development through a competitive New York City Housing Preservation and Development (HPD) RFP process, BACA exemplifies the city’s “Brownsville Plan,” which aims to transform the community by pairing affordable housing with opportunities for cultural expression and community connection.

The financing includes nearly $100 million from the City of New York. At the heart of the cultural arts center is a 3,440-square-foot multipurpose

“Brownsville Arts Center & Apartments is a powerful expression of our commitment to equitable development through design, collaboration and community,” said Yarojin Robinson, senior vice president, affordable and mixed-income housing, Gilbane Development. “This project goes beyond housing — it’s a cultural and residential anchor that will uplift and inspire Brownsville for years to come. ”

Designed as an all-electric building, BACA targets PHIUS (Passive House Institute US) 2021 CORE, LEED Platinum, the Environmental Protection Agency’s (EPA) Energy Multifamily New Construction Program, EPA’s Indoor airPlus and Fitwel certifications, and has been recognized by the New York State Energy Research and Development Authority (NYSERDA) as part of its Buildings of Excellence and Building Cleaner Communities Competitions.

“It means a great deal to all of us at Blue Sea Development and Gilbane Development to be part of a project that treats cultural infrastructure and affordable housing not as separate needs, but as shared pillars of community life,” said Jacob Bluestone, Blue Sea Development Company. “When you pair affordable housing with dedicated cultural spaces to perform, practice and gather, you create more than a place to live — you create a place to thrive.”

Construction started in July 2025 and completion is expected in December 2027.

Gilbane Development, Blue Sea Development and Artspace serve as joint venture development partners, along with Gilbane Building as general contractor and Aufgang as architect.

“Our mission is to make the best risk data easily accessible to decisionmakers,” said Shubharoop Ghosh, vice president of data services at ImageCat. “Green Shield’s Property Guardian insights add a new dimension to our hazard data offerings, especially at a time when wildfire risk is escalating and affecting underwriting decisions across the U.S. and beyond.”

International risk management innovation company ImageCat announced a new partnership with Green Shield Risk Solutions, a provider of wildfire risk analytics and mitigation intelligence, to integrate Green Shield’s proprietary Property Guardian data into ImageCat’s Inhance and FACFinder platforms.

ImageCat serves the global risk and catastrophe management needs of the insurance industry, governments and NGOs. This new partnership will provide (re)insurers, financial institutions and real estate stakeholders with a new lens on wildfire exposure — combining ImageCat’s geospatial analytics with Green Shield’s on-the-ground, parcel-level intelligence.

Green Shield’s Property Guardian product delivers detailed parcellevel wildfire risk and mitigation data, ranging from defensible space assessments to vegetation and structural condition scoring. These insights are critical for evaluating property-level vulnerability and identifying actionable mitigation strategies.

“By embedding Property Guardian data into ImageCat’s platforms, risk managers can transition from general hazard awareness to specific, actionable intelligence,” said Brian Bastian, head of product at Green Shield Risk Solutions. “This partnership allows users to make betterinformed underwriting, investment and mitigation decisions with confidence in the granularity and credibility of the data.”

The integration will support a wide spectrum of users — from insurance underwriters and risk managers to banks and real estate portfolio owners — who rely on ImageCat’s platforms for real-time exposure analytics and high-resolution risk data.

“We cannot predict the future, but we can prepare for it, and that is what Foundations for the Future does,” said CSHL President and CEO Bruce Stillman. “The ongoing expansion will help ensure that CSHL remains at the global epicenter of biology research and education for generations.”

Global construction and development firm Skanska and Cold Spring Harbor Laboratory (CSHL) celebrated the topping out of the Artificial Intelligence and Quantitative Biology (AIQB) building at CSHL. Skanska is providing construction management services for the $248 million, 379,500-square-foot campus expansion, which, upon completion of this first phase, will feature state-of-the-art neuroscience and cancer biology labs, an AI research building and a parking garage.

Phase II of the overall $500 million campaign calls for a new 81,000-square-foot research housing and conference center and a 56,000-square-foot housing and collaborative research center for visiting scientists. The project is supported, in part, by the New York State Empire State Development (ESD), which the lab has leveraged with private funds.

Substantial completion of the Foundations for the Future campaign initiative will be achieved in early 2027. The CSHL campus is recognized on the National Register of Historic Places.

The project involves a phased approach with multiple sub-projects progressing concurrently. The scope of operations includes the construction and fit-out of several key facilities: a 36,000-square-foot neuroscience research complex and a 28,000-square-foot AI and quantitative biology research building. A new, two-story, 90,000-squarefoot parking garage that will provide space for 225 cars is underway, along with the relocation of a campus roadway and existing utility infrastructure, including sewage, natural gas and other utility lines.

The three-story AIQB is built using mass timber glulam columns and beams with cross-laminated timber (CLT) floor decks. The timber used in the AIQB was responsibly sourced from sustainably managed forests in the Southeastern United States, and fabrication waste such as sawdust and scrap material was recycled and repurposed for other applications. The $28 million facility will house four laboratories, 15 principal investigator offices, 96 postdoctoral researcher workstations, seven research administration offices, three administrative offices and 10 meeting rooms.

“With roots dating back to the 1800s, CSHL continues to exemplify a longstanding commitment to progress, innovation, and building for the future,” said Sean Szatkowski, executive vice president, general manager, Skanska USA Building.

The new Life Time will feature:

• A luxurious, co-ed wet suite with steam rooms, saunas, hot tubs, and cold plunges.

Life Time announced a 52,000-square-foot lease agreement with Prop and Building Corp. (PBC) at 10 Bryant, a Class A Midtown Manhattan office tower, with an anticipated opening in early 2027.

The planned Life Time athletic urban country club will be housed within four levels at the 30-story tower at 10 Bryant, located at the corner of 40th Street and Fifth Avenue — directly across from Bryant Park and the New York Public Library.

“Bringing Life Time to 10 Bryant and the Bryant Park area is key as we grow our network of athletic country clubs throughout New York City,” said Parham Javaheri, chief property development officer and president of club operations at Life Time. “This vibrant, high-profile location offers the energy, visibility and accessibility we seek, allowing us to serve even more people with our breadth and depth of experiences from fitness to recovery to community building.”

• An expansive workout floor with top cardio equipment, resistancetraining machines and free weights. A dedicated recovery space will include cold and water massage chairs, whole body compression technology, percussion devices, metabolic testing, recovery treatments and nutrition coaching.

• Six boutique-style studios for group fitness formats including Fight Conditioning, MB360, GTX, Barre, Pilates and more.

• A dedicated Life Time Work Lounge for coworking and productivity.

10 Bryant is owned and managed by Prop and Building Corp., a real estate development and investment firm focused on transformational urban projects.

“Life Time represents a pivotal step in the repositioning of 10 Bryant, further enhancing its status as a premier destination in Midtown,” said Eli Elefant, CEO of Property and Building Corp. “Their commitment to wellness and innovation will not only elevate the tenant experience but also contribute to the building’s transformation into a hub for modern living and working. This partnership aligns seamlessly with our vision for the future of 10 Bryant.”

Life Time operates seven Manhattan locations — Battery Park, Midtown, NoHo, One Wall Street, Penn 1, Sky and 23rd Street — as well as two in Brooklyn at Atlantic Avenue and Dumbo, with more in development including Brooklyn Tower, which is also set for a 2027 opening.

By Debra Hazel

Holland & Knight Partner Stuart Saft didn’t grow up thinking about becoming a lawyer — he didn’t have a plan for his future at all.

But with 50 years as a pioneering real estate attorney, he’s not only built a career, but he’s also building a legacy of teaching and mentoring generations of lawyers — while reminding them that there’s life outside the office.

Saft grew up the son of working-class parents in Brooklyn and Queens and went to Hofstra University.

“In addition to meeting my wife, Stephanie, Hofstra changed my life. I got involved in everything from planning events, creating a student senate, attending meetings with the administrators, arranging for big-name entertainment, writing for the school newspaper, and keeping the school open during the Vietnam protest riots by inviting experts to discuss the war and the Domino Theory,” he said. “It was fabulous — the things I learned at Hofstra are the basis of what I do every day, which is why I say that ‘It all started at Hofstra.’”

Saft had attended college with the help of Army Reserve Officers Training Corp, and his required military service loomed after graduation, during the height of the Vietnam War. Stephanie suggested he go to law school and enter the Army afterward.

“No one in my family had gone to college, let alone law school,” he said. But he listened.

After graduating from Columbia Law School, Saft entered the Army, serving in Newport News, Va. On leaving the Army as a captain, most of his classmates were already well into their careers, while he was just starting. He started at a small Wall Street firm where he focused on corporate and securities law.

“In those days, no one was thanking us for our military service. At that time, Wall Street firms did not do real estate transactions,” he said. After four years, a client asked him to represent them in making a second mortgage loan secured by a shopping center.

“I did not have a mentor but used my corporate skills to prepare and close the loan,” he continued. “I must have handled it correctly because the client kept sending me real estate transactions.”

Arriving early to one closing, Saft, representing the lender, sat with the borrower, a former Yale tax professor who was inventing the real estate tax shelter, and his experienced lawyer.

The borrower asked his attorney a question — and received an answer that sent Saft reeling.

Saft took the LSAT, sitting with students whose parents were

Saft took the LSAT, sitting with students whose parents were lawyers and had planned on being lawyers from childhood. (“I was too naive to be nervous about the LSAT,” he said.) He never imagined that he’d place in the 98th percentile.

“If the lawyer’s answer was right, everything I’d done as a real estate lawyer was wrong. So, I questioned him and he brushed me off,” Saft related.

Also a differentiator is how Saft’s practice focuses on work/life balance for its relatively young team — except for Saft, nearly everyone is under 50 years old.

Saft is determined to bring creativity and mentorship to new generations of real estate lawyers and personally trains young associates, considering it to be the most important work he does. “We have a collaborative practice.”

The former professor, however, wanted to know why Saft disagreed. After he explained his position, the professor agreed with Saft and asked his lawyer for his reasoning. “To this day, the lawyer gave the stupidest answer I’ve ever heard — he responded that he didn’t look at the documents until he put the closing report together.”

The next day the professor hired Saft to handle complex acquisitions, financings and leasing and structuring the tax aspects. Eventually, word got around that Saft was a young real estate attorney who understood tax law. Saft worked on over 150 tax shelter transactions until the laws changed, and all of his deals held up on audit.

Because so little was written about complex real estate transactions, Saft started writing about them, eventually publishing 100 articles about real estate, tax, economics and finance. Writing books was an accident. He was approached by a publisher to write a book about tax shelters, but Saft demurred and convinced the publisher that what was needed was a book explaining real estate transactions with forms and analysis.

As a result, Saft wrote “Commercial Real Estate Forms,” which started at three volumes, grew to 11, and which he has updated and supplemented for 37 years. He then wrote and supplemented “Commercial Real Estate Transactions,” “Commercial Real Estate Leasing,” “Commercial Real Estate Workouts,” “Real

Estate Investors Survivors Guide” and “Real Estate Development: Strategy for Changing Markets.” Since 2019, he has also been writing Client Alerts about the unintended consequences of legislation and regulations affecting real estate.

He represented Aetna and Chase in construction and permanent financing and then in a recession, his practice turned to workouts and bankruptcy. He then represented Tony Goldman, a visionary, in Goldman’s work reinventing Soho with loft conversions.

“One day Tony walked into my office to negotiate a ground lease, and we started to talk about reusing older buildings,” Saft said.

“In a sense, he taught me what has become ‘adaptive reuse,’ and I started doing the offering plans.”

A stint serving as president of his own co-op board led Saft to the board of the Council of New York Cooperatives and Condominiums. He then worked with then-Congressman Chuck Shumer assisting low and moderate-income co-ops in Brooklyn, and with Queens Borough President Claire Shulman and Manhattan Borough President Virginia Fields saving affordable co-ops from foreclosure. This led to his friendship with Chuck Synder, the president of the National Co-Op Bank (NCB). Saft served on NCB’s board of directors for 12 years including three years as a chairman. He did the debt restructuring of Co-Op City, and the rebuilding of 12,000 apartments in Parkchester.

When another recession hit, Saft started working with developers. He was the proponent of the Chapter 11 plan to get Cityspire out of bankruptcy and completed its construction including crawling around the roof of the building seeking the source of a whistle that was heard around the city. He completed the workout and completion of Worldwide Plaza, including climbing onto the parapets on the 45th floor seeking the cause of spalling bricks.

“I wound up representing the developers because I understood their business and was committed to writing plans that facilitated the sale and the operation of the building and found I loved the development side because it unleashed my creativity,” he said.

He became a partner in his first law firm after five years and left two years later to launch his own firm with two colleagues, which eventually grew to 25 lawyers. After another recession, he built a real estate practice within a larger firm. A need for a larger platform led him to LeBouef Lamb, which then merged with Dewey Ballantine. Ultimately, Saft became Dewey & LeBouef’s global head of real estate.

At home, his civic work continued, including serving as president of the NYC Private Industry Council (formed under the federal Job Training Partnership Act) and then working with the federal government to establish the Workforce Investment Act. He formulated New York’s Workforce Investment strategy and chaired NYC’s WIB Board for 12 years under Mayors Guiliani and Bloomberg.

The day after 9/11, he held a meeting in his midtown office with city, state and federal workforce officials to plan for the anticipated job losses from the terrorist attack. A week later, Mayor Guiliani sent him to DC to meet with New York’s Congressional delegation. After a three-hour meeting with Senator Hillary Clinton, she and Senator Schumer were able to obtain a $20 billion commitment from President Bush to rebuild New York City. Saft received commendations from the National Association of Workforce Boards and Mayor Bloomberg for his work.

While building his practice, Saft honed the training philosophy and program he uses today — one in which his door is always open, questions are welcomed and young attorneys’ work/life balance is supported. Much of it was based on his own personal experience, from the lack of support his banker wife experienced when their sons were young. He brought that philosophy to Holland & Knight in 2012. In 13 years, he helped build Holland & Knight’s New York City real estate practice from five lawyers to 60, working on $11 billion in transactions in 2024.

Saft is determined to bring creativity and mentorship to new generations of real estate lawyers and personally trains young associates, considering it to be the most important work he does. “We have a collaborative practice.”

Also a differentiator is how Saft’s practice focuses on work/life balance for its relatively young team — except for Saft, nearly everyone is under 50 years old. Approximately half of the attorneys are women, and Saft ensures that new parents don’t lose their work while on maternity or paternity leave. The rest of the team divides the work until their colleague returns, and the returning attorney gets back their entire portfolio of work.

“I learned with my own children that they are young for only a brief period of time so if you miss it, there is not another chance,” Saft continued. “There will always be another deal. I want the parents to spend time with their kids, attend their games and meet their teachers.”

Saft arrives at the office at 6:30 a.m., leaves at 6:30 p.m. and has no intention of retiring, ever. One other note: no one has ever heard Saft scream at anyone, ever, although there is a lot of laughter coming from the 30th floor of 787 Seventh Ave.

There’s a picture of one more child in Saft’s office — one of himself as a 10-year-old Cub Scout.

“I keep this picture of myself to remind me who I really am,” he said. “If you are successful, you can easily forget who you are. Young Stuie keeps me grounded so I never forget who I am and whence I came. I may be older, but I will always be that kid from Brooklyn and Queens who went to Hofstra.”

In today’s fast-moving and increasingly complex financial environment, successful business owners need more than just an advisor—they need a trusted partner who sees the full picture, anticipates change, and integrates every facet of their financial world. For over 30 years, Louis C. Ciliberti & Associates has delivered exactly that.

We are a full-service financial firm and multi-family office that helps the most financially successful individuals and privately held companies in the nation. At Louis C. Ciliberti & Associates, we don’t just provide advice—we orchestrate and execute a total wealth strategy that aligns with our clients’ business goals, family needs, and long term vision.

By Craig Gillespie, CEO of Airtower Networks

The remote work standard was short-lived. But it wasn’t long ago, in the early days of the COVID-19 pandemic, that companies were giving up their leases, canceling their landline phones and moving to a fully remote workforce; a workforce with BYOD (bring your own device) phones and laptops that was fluid and dynamic, capable of working at any time and any place.

In the post-pandemic era, CEOs have rapidly concluded that a fully remote workforce lacks the ability to creatively problemsolve and work efficiently as teams. The productivity gains from the dynamism of working anytime and anywhere were offset by the sheer lack of presence and real-time interactions.

Recently viewed as the future of the working world, remote work policies have once again taken a back seat to the more traditional, in-office model.

Heading into 2025, we saw more companies and organizations — from Fortune 500s to the U.S. federal government — rolling back remote work approaches and bringing employees back to the workplace, either on a full-time or a hybrid schedule.

In 2024, companies with fully remote policies dropped to 25% (from 31% the year before), while the average number of days required to be in office increased to 2.78 per week, according to a Forbes report.

As the return-to-office boom continues, companies are finding communication technologies from the pre-pandemic world to be archaic. Cable modems, SIP trunking and PBX phone lines are being phased out, as businesses refocus their IT stack on more modern in-building connectivity solutions that complement a hybrid workforce. These include fast fiber, pervasive Wi-Fi and expansive cellular coverage that enables sales calls to be made, whether in the parking garage or the conference room.

It is in this context that connectivity has taken on the role as the “fourth utility” — but unlike a utility, it can sometimes be unclear where responsibilities lie between the owner/occupier from both an operational as well as economic perspective. Where it has become common for the responsibilities of other utilities to be called out in lease agreements as gross, triple net, etc., connectivity often falls through the cracks and can create friction in the owner/occupier relationship.

As office leasing evolves, strong connectivity has become a key factor in tenant decisions and retention. Ensuring reliable connectivity is no longer the sole responsibility of tenants, landlords or brokers — it’s a shared effort.