In shifting markets, we’re taking the long view, so you can seize the moment — now and for years to come.

EDITORIAL

Editor

Debra Hazel

Director of Communications and Marketing

Penelope Herrera

Director of

Newsletter Division

Cheri Phillips

PRESIDENT/CEO

Jeff Mann

ART

Art Director

Caroline Thomas

Cover Photography Courtesy of Macklowe

Frank DeLucia

David Faber

Ed Hanley

Merilee Kern

Kris Kiser

Bob Knakal

Mark Plechaty

Gustavo Rusconi

Stuart Saft

Carol A. Sigmond

Technology Consultant Eric Loh

Distribution Mitchell’s Delivery Service

DIGITAL MEDIA

Designers

Caroline Thomas

Editors

Debra Hazel

Penelope Herrera

Cheri Phillips

Web Developer CS Designworks

West Coast Office: 578 Washington Blvd., Suite 827

Marina Del Rey, CA 90292 866-306-MANN (6266) mannpublications.com

East Coast Office: 450 7th Ave, Suite 2306

New York, NY 10123 212-840-MANN (6266)

Spring is finally here, a time of renewal and rebirth.

That’s why April is the perfect month for our Renovation Issue, and I’m especially excited that in our cover feature, we’re showcasing the work DeSimone Consulting Engineering has done to convert One Wall Street into a spectacular residential building.

We all talk about the need for more housing, and the need to renovate older office buildings to today’s standards. Sometimes, the two converge, as at One Wall Street — despite some major difficulties. My thanks to DeSimone’s Mark Plechaty for his detailed description of the challenges in this extraordinary redevelopment, which makes us appreciate the achievement even more, and provides some serious guidance for other companies looking at conversions.

The National Realty Club also held the first Fireside Chat of the year, featuring my old friend (and this magazine’s very first cover subject), broker extraordinaire Bob Knakal. A sold-out audience heard about Bob’s storied history, including founding and selling Massey Knakal Realty services, work with other major firms and, now, his pioneering new company BK Real Estate Advisors, an investment sales and capital markets brokerage firm that is exploring new technological paths. A fine time was had by all, as you’ll see in the photos in these pages.

See you next month!

“If we had no winter, the spring would not be so pleasant: if we did not sometimes taste of adversity, prosperity would not be so welcome.” — Anne Bradstreet

by Adrian

MONDAY

May 5, 2025

El Caballero Country Club Tarzana, California

SPONSORSHIPS

David Sonnenblick Chair

Anthony Behrstock

Zach Brandler

Maxx Cohen

Steven Cohen

Charles Eberly

Ron Friedman

Carrie Jenkins

Jake Kushner

Jason Mandel

Je Mann

Deborah Medway

Eric Nelson

Danielle Weiser

Matthew Winnick

Ongoing

Strictly Contingent

An older city means a lot of things — mature neighborhoods, sophisticated transportation — and some really old buildings that need to be modernized for users today. That’s why we’re highlighting Renovations in this April issue.

Our cover story discusses the details behind one of the most elaborate renovations in New York City — the conversion of storied One Wall Street from offices into a decidedly posh residential and retail project. I once had offices nearby, and it’s a thrill to see the final result of all that scaffolding I navigated for years.

But we also focus on smaller projects, as well. In a conversation with Jon Grishpul of greatbuildz.com, our friend Merilee Kern offers advice that agents can pass on to clients who are renovating a home for a sale. Also look at the ins and outs of demolition — there’s a lot more to it in a densely packed city.

Meanwhile, others are growing, as you’ll see in our feature on the newly created Goetz Platzer LLP, formed by the merger of two boutique law firms whose complementary strengths now expand their reach.

Welcome spring, and see you next month!

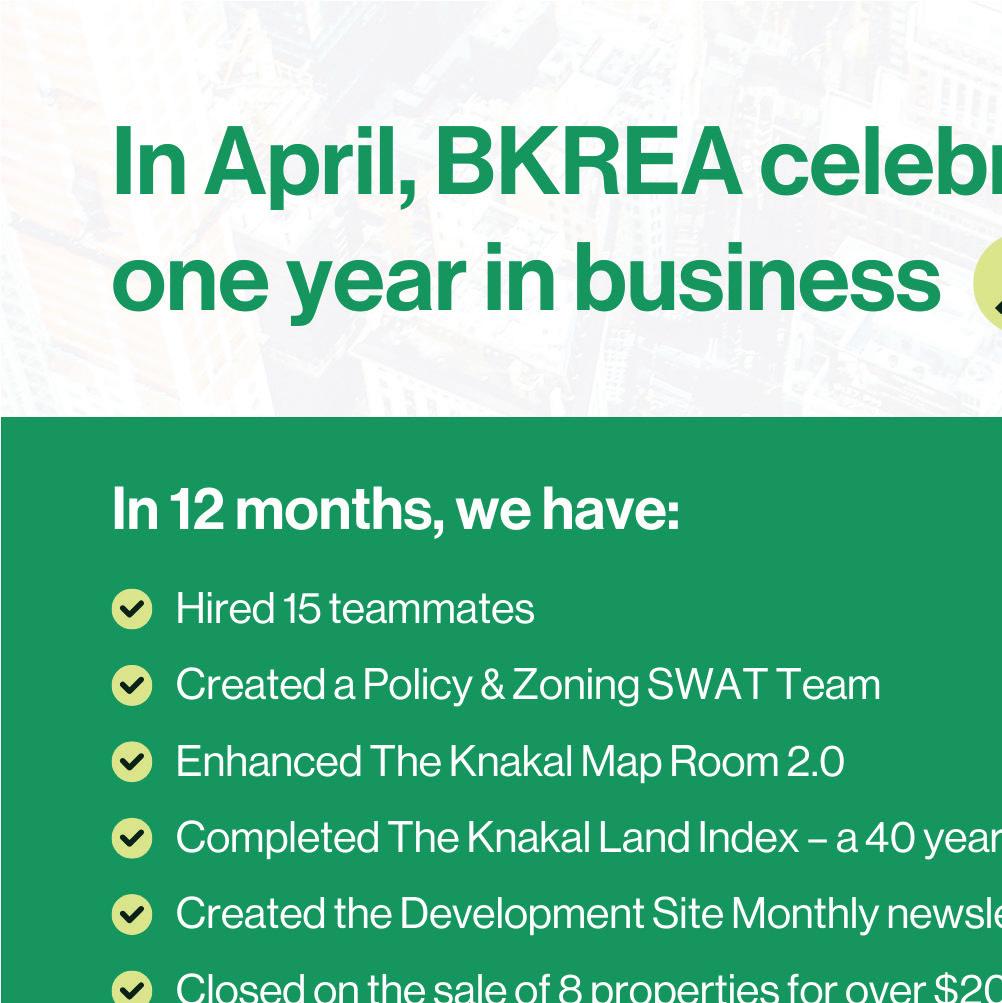

The National Realty Club Foundation hosted its first Fireside Chat of 2025 with old friend Bob Knakal discussing his newest venture. Held at the recently renovated Versa, on the seventh floor of the Renaissance Hotel, the event brought together more than 100 real estate professionals for networking, canapés and cocktails.

Knakal, founder of BK Real Estate Advisors (BKREA), has been a member of the National Realty Club from his early career, learning from industry legends. Now, he shared his own experience. He discussed moving from a major brokerage to co-founding and operating Massey Knakal Realty Services. For 26 years, he focused on intensely training his team until selling the firm in 2014. Today, there are 29 companies, or divisions of companies, that are either owned or run by, former Massey Knakal professionals. After stints with Cushman & Wakefield and JLL, he founded BKREA, an investment sales and capital markets brokerage firm in New York City which blends best-in-class analog datasets with AI technologies to create a new brokerage firm for a new era.

“Bob is the epitome of what the NRC is all about — learning from industry leaders who shared their experience and wisdom and then, eventually, becoming the person passing on knowledge,” said Jeffrey Mann, president of the National Realty Club Foundation. “We thank our corporate sponsors Lighthouse Living Realty, Goetz Platzer, Hub International, Kaufman Organization and Kramer Levin for the support of this event, and are already planning our next, with details to be announced soon.”

Rosenberg & Estis P.C. Founding Member and Chairman Gary Rosenberg was recently honored as 2025 Professional of the Year at the Torch Foundation’s 35th Annual Monte Carlo Night held at Chelsea Piers in Manhattan. Laura Bush, regional director, NYC Metro of Consigli Construction Co. Inc., was also recognized. The event drew members of New York’s real estate and construction community to support the work of the evening’s designated charity, Memorial Sloan Kettering Pediatric Center, and the Torch Foundation’s ongoing mission to raise funds for children’s charities and medical organizations that provide services for those in need of special medical care.

New York City’s largest firm specializing in real estate, representing owners, developers and other entities in all aspects of real estate, Rosenberg & Estis P.C. is a long-time supporter of the foundation and its work, sponsoring events including the annual Monte Carlo Night and Charity Golf Outing.

“I’m truly honored to be recognized by the Torch Foundation for supporting its incredible mission,” Rosenberg said. “The work they do to raise funds for children’s charities and medical organizations is life-changing, and I’m grateful to play a small part in it. My team and I remain committed to helping in any way we can.”

Senior Director Mitsui Fudosan America

Gala Chair

JENNIFER L. WIDAY Kaback Service, Inc.

Chairs Emeriti

KATHY A. CHAZEN, CLU, ChFU Trustee, National Jewish Health

ROGER A. SILVERSTEIN Silverstein Properties, Inc. Trustee, National Jewish Health

THURSDAY, MAY 1, 2025 | 7 p.m. Ascent Lounge New York

REGISTER AT njhealth.org/NYAir or contact Mattie Shepheard: ShepheardM@njhealth.org or 212.297.0857 @ nyair society

• Anti-odor StayFreshTM treament by Polygiene®

• Durable ripstop polyester with water resistant coating

• Front quick-access zippered pocket

• Anti-wrinkle garment bars

• Full-length middle and bottom zippered opening

• Two internal mesh zippered pockets

• Internal adjustable hanging loop secures multiple hangers

• Multi-use carry handle for hanging

• Bi- or tri-fold carry/packing options

• Two seperated slip-through openings for additional hanging options

• Gusseted sides

Marx Realty, a New York-based owner, developer and manager of office, retail and multifamily properties across the United States, and French Maison Baccarat announced the official unveiling of their collaboration at 545 Madison. The building, colloquially known as the Baccarat Building, is located on Madison Avenue between 54th and 55th Streets. The completion of its 10,000-square-foot penthouse headquarters and mezzanine — complemented with Baccarat masterpieces throughout — marks Baccarat’s expansion into a full suite of luxury lifestyle offerings beyond the home.

Opulent chandeliers grace the lobby, while crystal barware enhances the Leonard Lounge and bold statement pieces are displayed in the namesake penthouse showroom and office.

“Marx and Baccarat’s collaboration represents an evolution of our hospitality-infused aesthetic and approach,” said Craig Deitelzweig, president and CEO of Marx Realty. “With Baccarat’s essence throughout 545 Madison, we’ve seamlessly blended the lines between elegant workspaces and luxury-branded hospitality. The combination of these two iconic brands has created a one-of-a-kind experience for our tenants and their guests.”

Baccarat’s new office space features floor-to-ceiling windows, warm white oak wood floors, sliding glass walls and a private terrace that offers a seamless indoor/outdoor experience. A central, light-filled staircase

— augmented with blonde wood and copper finishes — connects the two-story space, enhancing the open and airy atmosphere.

Located on the building’s eighth floor, the Leonard Lounge offers a café and landscaped terrace, as well as featuring Baccarat fixtures, barware and accessories. Even the building’s house car, a sleek electric Rivian, carries the Baccarat experience, with the brand’s signature scent infused into its ventilation system.

“We’re thrilled to bring Baccarat’s art de vivre to 545 Madison,” said Adam Banfield, president and CEO of Baccarat North America. “This collaboration is an exciting step in our journey to creating captivating worlds beyond living spaces and hospitality. Infusing Baccarat into this stunning office space in New York City — a strategic hub for Baccarat in the U.S. — provides an important step in our evolution as a lifestyle house.”

The Domain Companies announced new retail leases with Gowanus Marketplace and Hey Clay at 420 Carroll, the first mixed-income building developed through the 2021 Gowanus Neighborhood Rezoning. Slated to open on 420 Carroll’s ground floor, the two businesses will offer a robust retail environment for residents and the Gowanus neighborhood.

Adam Joly at Igloo NYC brokered both leases on behalf of ownership, and the businesses will open this year.

“Our mission is to help facilitate the connection of business and community,” said Joly, a principal at Igloo. “The combination of a fresh, accessible food grocer and a community-centric space for art is representative of this connection — businesses that promote holistic well-being for the residents and neighborhood while championing the character of the Gowanus community. Gowanus represents a unique opportunity for new retail concepts. We believe that Hey Clay and Gowanus Marketplace will both be wonderful additions.”

Gowanus Marketplace, a premier grocery store owned operated by Shogy Saleh, has signed a lease for approximately 2,250 square feet. The store will offer building residents and other locals a wide variety of local and organic foods, handcrafted sandwiches, salads, freshly squeezed juice, smoothies and a full café.

Hey Clay, which has signed a lease for approximately 1,750 square feet, is a modern pottery studio with a mission to promote community wellbeing by expanding access to the mindful practice of pottery. The studio, founded by Cauvery Patel, will offer classes and memberships for new and seasoned potters.

“I have lived in Gowanus and the neighboring areas for the last six years,” said Patel. “I love living here. The unpredictability of the neighborhood is attractive to me — you never know what you might find around the corner. I also appreciate its industrial history and its transformation into a hub for artists and makers.”

In addition to the retail space now occupied by the marketplace, 420 Carroll recently launched its affordable housing lottery for 90 homes reserved for families between 40% and 100% of the area median income, which is 25% of the total 360 apartments in the development.

Located at 420 Carroll St. on the Gowanus waterfront, the development will include a 21-story tower and an adjacent 16-story tower connected by a subterranean tunnel so residents can access amenities in both buildings.

Residents will have access to “The Shop,” Domain’s third location offering 14,000 square feet of coworking and affordable art studios, a lounge, multiple outdoor greenspaces including a public plaza, a fullyequipped fitness center, a children’s playroom, on-site bike storage and the MyDomain suite of resident services that is offered at all Domain properties.

Designed by FXCollaborative and with interiors by Alan Mainer Studios, the project began construction in May 2022.

JLL announced that it has has leased an additional 19,000 square feet of office space at the recently repositioned 5 Penn Plaza, which continues strong leasing momentum after 70,000 square feet of new leases were announced in January.

In the largest transaction, NY E-Health Collaborative leased 15,000 square feet of office space on the 12th floor. The non-profit organization that works in partnership with New York State Department of Health to connect healthcare professionals was represented by Joe Speck and Reid Longley from Colliers.

Tech company Dynatrace also signed a new lease to occupy 4,000 square feet on the 24th floor of the building, which features a private wraparound terrace and sweeping views of the city. The tenant was represented by Reeves McCall and Taylor Walker from CBRE.

The transactions follow a major repositioning to upgrade the historic property owned by 5 Penn Plaza LLC, a firm led by investor Stephen Haymes. Other new tenants include digital health company Noom, real estate tech company Altus, trading advisory Octaura and engineering services leader Dewberry.

“5 Penn has been powerfully repositioned to meet modern office demand and we are thrilled to welcome two more new tenants to the property,” said JLL’s Mitch Konsker, who leads the exclusive agency team that includes Christine Colley, Kristen Morgan, Greg Wang, Kate Roush and Dan Turkewitz.

Located in the epicenter of Hudson Yards on Eighth Avenue between West 33rd and 34th streets, 5 Penn’s recent redevelopment included

of New York’s Hospitality Division Honors Ian

a new Gensler-designed lobby and amenity center paired with a conference center that provides a hospitality-level experience and a dog-friendly roof deck with 360-degree views.

Second-floor hospitality suites named “Print & Press” feature a highend fitness center with showers and lockers, a library with fireplace, expansive lounge space with open seating, a podcast room, golf simulator and grab-and-go food experience on the ground floor.

“5 Penn has been a hub of collaboration, communication, and technology for the world’s leading companies for over a century,” Haymes said. “Our continued investment in the property ensures that it remains a leading destination address for businesses seeking an elevated office experience in the heart of Manhattan.”

SH Hotels & Resorts, the parent company of brands including 1 Hotels, Baccarat Hotels and Treehouse Hotels, celebrated its 10th anniversary by officially rebranding as Starwood Hotels, reviving the global brand created nearly 30 years ago by Barry Sternlicht. In addition, Starwood Hotels is poised for significant growth in 2025, with more than 40 properties open or in development across its three brands on four continents.

“Reintroducing the Starwood Hotels name is personally very exciting for me. It’s a tribute to a legacy that millions of people know and trust and it comes at a decisive moment in our company’s history,” said Sternlicht, founder and chairman of Starwood Hotels and chairman of Starwood Capital Group. “Over the past decade, SH Hotels & Resorts has built three extraordinary brands, including the missiondriven 1 Hotels, which demonstrates how guests can live a luxurious, sustainable life without sacrifice. I didn’t want to do another typical hotel brand after W. The world doesn’t need another brand, it needs a Starwood Hotels name, we aim to marry this trusted legacy of youth, innovation and guest focus with our modern, tech-enabled, personalized approach to hospitality. As we take this next step, we’re doubling down on our mission to inspire, innovate and make a difference — for our guests, our partners and the planet.”

Greece),

and

Following the success of its flagship property — Baccarat Hotel New York — the brand will expand into Rome and Florence, Italy, Riyadh, Dubai and the Maldives in coming years.

The year will bring global growth, including the debut of flagship Melbourne and Copenhagen, as well as further Middle East and Southern Europe.

Treehouse Hotels, the newest of Starwood’s three brands, will expand to Manchester U.K. and Silicon Valley this spring. Additional hotels in the pipeline include Adelaide (Australia), Riyadh and Brickell (Miami).

In 2025, 1 Hotels & Homes will new locations in Seattle, Melbourne, Copenhagen and Tokyo. Openings beyond 2025 include Cabo San

“Our journey has just begun,” said Sternlicht. “As we embrace bold ideas, expand into new markets and continue to reinvent the hospitality landscape, we hope to build a legacy that will inspire future generations. The best is yet to come.”

MONDAY, AUGUST 4, 2025

The Seawane Club | Hewlett Harbor, NY

Rockaway Hunting Club | Lawrence, NY

Hempstead Golf & Country Club | Hempstead, NY

Sunrise Day Camp–Long Island is the world’s first full-summer day camp for children with cancer and their siblings, provided completely free of charge.

Sunrise Day Camp–Long Island is a proud member of the Sunrise Association, whose mission is to bring back the joys of childhood to children with cancer and their siblings worldwide. Sunrise accomplishes this through the creation and oversight of welcoming, inclusive summer day camps, year-round programs and in-hospital recreational activities, all offered free of charge. Sunrise Day Camp–Long Island is a program of the Friedberg JCC, a beneficiary agency of UJA-Federation of New York.

International real estate brokerage network Forbes Global Properties has welcomed Carolwood Estates, recently ranked the No. 1 boutique residential brokerage in Los Angeles, to its ranks. Carolwood will exclusively represent the brand in Los Angeles.

Founded in 2022, Carolwood Estates quickly grew to 180 associates representing a portfolio of some of the most sought-after properties in the area. Carolwood Estates’ commitment to offering a personalized approach to every transaction has translated into a 35% market share in the $20 million-plus residential market and a 27% share in the $10 million-plus sector.

“We are thrilled to welcome Carolwood Estates to our network of best-inclass real estate partners,” said Michael Jalbert, CEO of Forbes Global Properties. “Their exceptional track record, commitment to excellence and dedication to serving the unique needs of their clients make them a perfect fit for our global platform.”

“At Carolwood Estates, we believe that exceptional service, innovative marketing and deep market knowledge are the cornerstones of our success,” said Drew Fenton, CEO of Carolwood Estates. “Partnering with Forbes Global Properties enhances our ability to present our exclusive listings to an international audience, offering even more opportunities to our clients.”

The exclusive worldwide residential real estate partner of Forbes, Forbes Global Properties provides branding and marketing services to the world’s premier real estate firms and is now represented by real estate agents across 26 countries in more than 600 locations.

As members of this exclusive network, Carolwood Estates will benefit from Forbes’ engaged audience of more than 167 million to connect,

inspire and inform affluent potential homebuyers and sellers about the finest properties for sale globally, the company said.

“The collaboration with Forbes Global Properties strengthens our position at the forefront of high-end real estate marketing,” said Ed Leyson, CMO and co-founder of Carolwood Estates. “Through Forbes’ powerful digital platform and authentic global presence, we can ensure maximum exposure for our listings and access to the most discerning buyers in the market.”

Homes are presented across Forbes and Forbes Global Properties print, digital and social media channels. Carolwood Estates’ prime residential listings will also be showcased on forbesglobalproperties. com, a curated collection of high-value, quality home listings.

Urban Capital Group and Prosper Property Group have completed the acquisition of 34 Walker St., finalizing the assemblage of 32 and 34 Walker St. into a corner mixed-use development in Tribeca.

Backed by a $32 million acquisition and construction loan from Kriss Capital, the 30,000-square-foot project will introduce a boutique condominium featuring five luxury loft residences and ground-floor retail. The building is approved by the Landmarks Preservation Commission (LPC) and was designed to preserve and integrate the historic castiron textile warehouse at 34 Walker St. with a contextual and elegant new structure at 32 Walker St. GRA Equities, led by Gary Romaniello, and PZ Realty Investments, led by Peter Zuccarello, are partners on the project. The financing was arranged by Andy Iadeluca, principal, New Development Capital.

“Our goal from the start was to acquire both sites at 32 and 34 Walker Street and seamlessly merge old and new,” said Eddie Bender, principal and CFO, Prosper Property Group.

Designed by Soma, in collaboration with Turett Collaborative, the development will offer a modern, amenitized living experience while respecting Tribeca’s historic character. The existing historic façade will feature preserved cast iron elements alongside a new natural limestone façade, ensuring an elegant blend of heritage and contemporary design. The general contractor is First Standard Construction.

The project will rise seven stories, offering three- and four-bedroom full-floor residences spanning 3,500 square feet and more. Homes

will feature 12- to 16-foot ceilings, abundant natural light and layouts designed to evoke true Tribeca loft living, a rarity for new developments in the historic district.

“We studied the neighborhood and collaborated closely with our architectural team, our historic consultant Higgins Quasebarth and the Landmarks staff to craft a design and asset that embodies modern Manhattan living while honoring Tribeca’s rich history,” said Cedric Abboud, principal, Urban Capital Group, in the announcement.

“Securing an LPC approval with strong support by the Community Board is a testament to our team’s dedication to thoughtful, contextual development and embracing its surroundings. We are now on the ground and commencing work immediately.”

Project completion is expected in the second quarter of 2026.

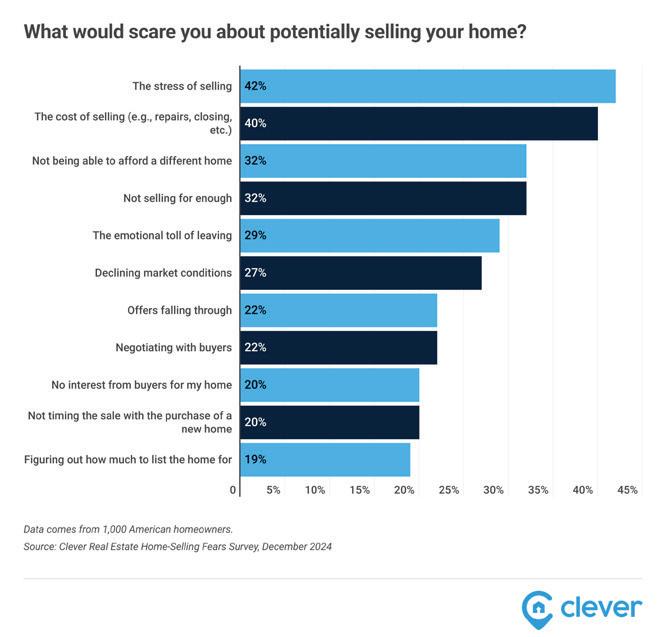

Nearly nine in 10 homeowners (88%) have fears about selling their homes, according to new reports on home-selling stress and where homes take the longest to sell from Clever Real Estate, a St. Louisbased real estate company.

A survey of 1,000 homeowners revealed that the top selling-related fears are: the stress of the sale (42%), selling costs (40%), not being able to afford a different home (32%) and not being able to sell for enough money (32%).

The biggest worry for 85% of homeowners is that they’ll feel pressured to accept a lowball offer. Many also worry about buyers demanding too many concessions (72%) or backing out at the last minute (70%). Among those with mortgages, nearly half (47%) locked in an interest rate under 4% and 30% fear losing their current rate.

A major economic downturn is the top reason sellers would delay plans (29%), while a property tax increase would be Americans’ No. 1 motivator to sell faster (43%).

Nearly half would feel more confident about selling if they already secured a new home (45%), received a cash offer (44%) or had a trusted agent (43%).

Americans’ home-selling concerns may be warranted in the slowest markets, where homes sit for a median of 57 days — well above the national average of 37 days.

Additionally, these 10 cities have an oversaturated market with about

courtesy of PRNewswire

3.5 months’ worth of housing inventory, compared to just 2.8 months on a nationwide basis.

The slowest-selling housing markets are: Miami (69 days); Austin, Texas (66 days); Jacksonville, Fla. (63 days); San Antonio, Texas (62 days); Birmingham, Ala. (57 days); Nashville (56 days); Pittsburgh (55 days); New York (55 days); Phoenix (54 days) and Chicago (53 days).

Conversely, the fastest-selling markets are: Grand Rapids, Mich. (13 days); Buffalo, N.Y. (14 days); Seattle (15 days); San Jose, Calif. (16 days); Richmond, Va. (18 days); Boston (21 days); Indianapolis (21 days); Sacramento, Calif. (23 days); San Diego (23 days) and Fresno, Calif. (23 days).

California’s housing market rebounded in February as statewide home sales reached the highest level in more than two years amid declining mortgage rates at the start of the year, said the California Association of Realtors (C.A.R.).

“California home sales rebounded strongly in February after a sluggish start to the year, supported by increased buyer activity and more available homes on the market,” said C.A.R. President Heather Ozur, a Palm Springs realtor. “Lower borrowing costs made homeownership more accessible to buyers who were previously sidelined by affordability challenges, while the rise in available inventory will help ease some of the competitive pressures that have defined the market in recent years and set a positive tone for the market for the rest of the year.”

Closed escrow sales of existing, single-family detached homes in California totaled a seasonally adjusted annualized rate of 283,540 in February, according to information collected by C.A.R. from more than 90 local Realtor associations and MLSs statewide. The statewide annualized sales figure represents what would be the total number of homes sold during 2025 if sales maintained the February pace throughout the year. It is adjusted to account for seasonal factors that typically influence home sales.

February’s sales pace surged 11.6% from the 254,110 homes sold in January and was up 2.6% from a year ago. The February sales level was the highest since October 2022. Although home sales have rebounded strongly, they have remained below the 300,000 mark since September 2022. With uncertainty remaining the theme for at least the first half of this year, housing sentiment could be negatively impacted and home sales, as a result, could remain soft in the upcoming months, the association said.

Statewide pending sales in February dipped from last year’s level for the third consecutive month, but the drop was much smaller than the decline observed in January. The sales dip of homes in escrow could

be due in part to a jump in mortgage rates at the beginning of February, but the public’s growing concern of a recession may also have played a role in the slowdown in housing demand in recent weeks. The ongoing policy and economic uncertainties have weighed on consumer confidence and have created instability in the financial market in the past few weeks. With mortgage rates expected to remain volatile in the near term, pending sales could continue to fluctuate as the market enters the spring homebuying season.

The February statewide median price increased on a year-over-year basis for the 20th straight month, but the gain recorded was the smallest since July 2023. On a month-to-month basis, the February median price dipped from the prior month, and the monthly drop was larger than the 10-year historical average dip of -0.7% recorded between the two months. The downward trend in the statewide median price will likely reverse in the coming months, however, as home prices typically begin rising in March and continue climbing until the end of the homebuying season in August.

OneService Commercial Building Service & Security announced the expansion of its commercial office cleaning services throughout New York City and Nassau and Suffolk Counties in New York.

Ronkonkoma, N.Y.-based OneService’s office cleaning services include standard cleaning tasks such as regular disinfecting, dusting and trash removal, as well as specialized services like floor care and window cleaning.

The company prioritizes eco-friendly cleaning products and advanced technologies to ensure a thorough and sustainable cleaning process. This approach supports a healthier workplace, benefiting both employees and visitors.

A well-maintained office can enhance employee satisfaction, minimize the risk of illness and contribute to an overall productive atmosphere. Their professional cleaning services are designed to alleviate the burden of daily cleaning tasks, allowing businesses to focus on their operations and growth, the company said.

The Center for Green Schools at the U.S. Green Building Council (USGBC) announced the 2025 Best of Green Schools Awards recipients, recognizing top schools, school districts, lawmakers and others who work to advance safer and more resilient schools across communities.

The annual recognition was announced at the 2025 Green Schools Conference in Orlando, Fla. in collaboration with the Green Schools National Network.

“This year’s Best of Green Schools awardees are individuals and organizations dedicated to improving our schools and creating healthy and resilient learning environments,” said Anisa Heming, director at the Center for Green Schools. “The awards are an opportunity to spotlight how anyone can make an impact in their community and support students and educators. We are grateful for all those who believe in our mission and join us in achieving it.”

This year’s recipients are:

K-12 School — Rochester School in Colombia, which has achieved over 70% energy savings and 40% potable water savings compared to a conventionally-built school of the same size. The campus features a solar aquatic center, intelligent classroom hubs and other campus features that serve as a living textbook for the curriculum.

Ambassador — Lauren Click from Arizona, who is transforming food waste education in public schools. In 2024, Let’s Go Compost, which provides hands-on composting educational tools, expanded from a single school to 111 public schools, 75% of which are Title I.

School System — Denver Public Schools, which has worked on sustainability initiatives since 2009, focusing on environmental protection, economic prosperity and social development.

Student Leader — Molly and Emma Weber, from Boulder, Colo., who have spearheaded a local campaign for climate justice in their school district and later expanded to a statewide movement. They built a network of over 60 students in their school district, won a first-of-itskind Green New Deal for Schools resolution through their school board

and are currently working with state senators and representatives to pass legislation.

Business Leader — Texas Disposal Systems, whose education program Eco Adademy is designed to help minimize waste in Central Texas schools by educating K-12 students about trash, recycling and composting options on their campuses.

Policy Maker — U.S. Rep. Robert C. “Bobby” Scott (D-Va.) and U.S. Senator Jack Reed (D-RI), who have introduced the Rebuild America’s Schools Act, which, if passed, would invest $130 billion in school buildings.

K-12 Educator — Erin Stutzman, an educator in the Boise School District, who empowers students through community outreach and project- and place-based learning, helping them use their voices to create meaningful change at local, state and national levels.

In collaboration with Nez Perce youth and tribal elders in Lapwai, Idaho, Stutzman’s students secured rooftop solar panels through grant writing, advocated for climate action in schools and supported the nationally recognized Save Our T-Pack initiative to protect Idaho’s wolves.

School District Champion — Darien Clary, the director of sustainability at Austin Independent School District, who has led efforts to integrate sustainability across 130 facilities, serving 73,000 students and 10,000 staff since 2016.

RICHARD SIMON, ESQ. | PARTNER CHAIR, BANKING AND FINANCIAL SERVICES

JEFFREY ROSENTHAL, ESQ. | PARTNER CHAIR, BANKRUPTCY AND CREDITORS RIGHTS

Since 1930, Mandelbaum Barrett PC has prioritized providing clients with proactive legal protection spanning over 30 practice areas:

Alternative

Appellate

Banking

Banking

Cannabis

National commercial general contractor Hitt announced the acquisition of Central Consulting & Contracting, a healthcare construction firm based in the New York metropolitan area. The move strengthens Hitt’s presence in the Tri-State area of New York, New Jersey and Connecticut while reinforcing its commitment to delivering high-quality healthcare construction solutions that support patient-centered care. By combining Central’s deep industry experience with Hitt’s national resources, the firm is well-positioned to meet the growing demand for complex medical facilities, Hitt said.

“For more than 30 years, Central has been a trusted leader in healthcare construction, earning a strong reputation across the New York region. We’re proud to welcome their team of experts to Hitt,” said Hitt Vice President and New York Office Leader Andre Grebenstein in the announcement. “Their specialized industry knowledge, commitment to quality and strong relationships will be invaluable as we continue to expand in this key market.”

The acquisition positions Hitt to meet increasing demand for medical facilities in one of the largest and fastest-growing healthcare markets in the U.S. Central brings an longstanding relationships with major healthcare institutions, including Englewood Health, Montefiore Health System and St. Barnabas Health System Bronx.

Central’s Founder and CEO Richard Simone has joined Hitt’s New York team as vice president, bringing decades of experience and deep industry relationships. He will work closely with Hitt’s New York leadership to ensure a seamless transition while maintaining the high standards of quality and service that clients and partners have come to expect.

Central’s team members have also officially joined Hitt, expanding the firm’s local presence to more than 70 New York-based team members.

“Joining forces with Hitt marks an exciting new chapter for Central and our clients,” Simone said. “Our shared values, dedication to quality, and passion for healthcare construction make this a perfect partnership.”

Top executives from some of the nation’s largest construction companies and unions hosted the inaugural CEO Advisory Council meeting focused on preventing suicides in the construction industry. Members of the CEO Advisory Council gathered to evaluate current initiatives, discuss industry-wide strategies and establish goals to lower suicide rates and improve mental health across the construction industry. The meeting was hosted by the American Foundation for Suicide Prevention (AFSP), and executives attended from Bechtel, Fluor, Turner Construction, North America’s Building Trades Unions (NABTU), Kiewit, Clark Construction and Skanska.

“The suicide rate in construction is more than double the national average across industries. In fact, the suicide fatality is more than five times the rate of workplace fatalities. Our focus on workplace safety needs to be applied to mental health,” said George Pfeffer, CEO, DPR Construction. “Construction is seen as a tough industry, but we’re all just people at the end of the day, and sometimes we need extra help and support. This council is about tackling an issue that has been overlooked for too long.”

“As leaders, it’s our shared responsibility to help the construction professionals building our country get the resources and support they need to thrive,” said Brendan Bechtel, Bechtel chairman and CEO. “The high rate of suicide in the construction community demands that we find new and better solutions that prioritize mental health as much as we do physical safety. The partnership between CEOs from some of the industry’s biggest and best companies, along with AFSP, will help us all achieve this goal faster and more effectively.”

The council set clear goals for collaboration and outlined next steps to drive progress in reducing suicide rates within the construction industry. In the near term, efforts will focus on evaluating the impact of current initiatives and developing targeted education and support programs to address challenges such as cultural and communication barriers and resource gaps.

“Although the industry has experienced a higher rate of suicide, we know through research that there are effective educational strategies and sound interventions that can curb this trend,” said Robert Gebbia, AFSP CEO. “With the support of Bechtel and commitment from other leading and dynamic industry leaders, we know we can make mental health on job sites as important as physical safety — and we are going to pave the way forward together to support construction workers now and in the future.”

Together, the group represents more than three million construction and union workers across the U.S. This effort will bring resources and support to them and also aims to reach construction workers and companies of all sizes nationwide.

“The well-being of our workforce is at the core of everything NABTU does, and NABTU is honored to serve on this CEO Advisory Council to better address the unique risks in our industry and develop comprehensive solutions that protect our workforce,” said Sean McGarvey, NABTU president. “We thank Brendan Bechtel for his leadership in putting this together. The construction industry has long prioritized occupational safety and health, but we are now placing equal emphasis on mental health. Addressing the crisis of suicide in construction requires taking critical steps together as an industry to ensure that every worker has access to the resources, education and support they need. Together, we will build a culture that fosters mental well-being and saves lives.”

Procurement and vendor management platform VendorPM has launched its Contract Management module, making it the only industry solution to unify vendor credentialing, e-tendering and contract management into a single, streamlined workflow, eliminating the inefficiencies of fragmented systems and multiple logins, the company said.

Property management professionals have long struggled with disconnected point solutions and manual processes when managing vendor relationships, leading to unnecessary risk exposure, inefficient processes and an overall lack of visibility and governance. VendorPM’s new Contract Management module addresses these challenges by centralizing contract storage, automating renewals and AI-driven analysis to drive costs down within one platform.

“Our mission since day one has been to modernize and streamline vendor management for property managers across North America,” said Emiel Bril, CEO and co-founder of VendorPM. “With the launch of our Contract Management module, property managers no longer have to juggle multiple logins, disparate systems and manual workflows. From vendor onboarding to contract management and compliance tracking, everything is now accessible in one seamless experience.”

The announcement follows a year of enhancements by VendorPM, including Yardi ERP Integration; AI-Procurement CoPilot; RFX Templates (reusable, customizable RFP/RFQ templates to streamline procurement processes, ensure consistency and save time across all tendering activities) and scalability for enterprise clients.

Hive MLS has announced an investment and long-term partnership with SourceRE, a provider of multiple listing service (MLS) data infrastructure. Using SourceRE, Hive MLS plans to achieve seamless integration between current and future front-end vendor systems.

“This collaboration sets a new benchmark for what MLS organizations can achieve with a data exchange,” said Bill Fowler, president of SourceRE. “With Hive MLS’s forward-thinking leadership and SourceRE’s advanced technology, we are creating a future where MLSs manage their own data stewardship and innovation.”

This initiative signals a broader industry shift toward MLSs taking proactive control of their data ecosystems, Hive MLS said. Rather than relying on a small group of third-party solutions and major public entities with competing interests, Hive MLS and SourceRE are working together to build an MLS data exchange without vendor-specific constraints, technical dependencies or timeline limitations.

“MLSs must be proactive in shaping their technology outcomes,” said Andrew Coca, CEO of Modern.tech, parent company of SourceRE. “We are demonstrating that MLSs can execute upon the conversations the industry has been having for years around data independence.”

The partnership’s primary focus is creating improved data accuracy that enhances listing visibility and sales performance for agents and brokers for Hive MLS’s brokers and agents. Interoperability between MLS front-end systems allows brokers to better manage their data and streamline operations across multiple MLS markets and geographies.

“Our partnership with SourceRE is founded on synergy,” said Daniel

Jones, CEO of Hive MLS. “Hive’s investment reaps greater returns when SourceRE grows. SourceRE benefits from the value of our data when Hive grows. This synergy is further strengthened as SourceRE becomes Hive’s technology division. Together, our vision is to enable a seamless data interchange between all our MLS partners.”

Hive MLS’s investment in SourceRE allows it to fast-track its technical advancements without the traditional overhead of building an in-house engineering team.

Real estate investment and deal management platform Dealpath has formed a strategic partnership with CBRE Capital Markets to accelerate investment sales opportunities with prospective buyers through Dealpath Connect.

All deals visible on CBRE Deal Flow will be available on Dealpath Connect, ensuring that relevant investment opportunities are served in real time to institutional investors. With this partnership, Dealpath Connect has created the only investment platform directly integrating listings from the largest real estate brokerage firms, including CBRE and JLL, the company said.

“Dealpath’s deep integration into the investment workflows of over 300 institutional buy-side clients uniquely positions us to partner with CBRE,” said Mike Sroka, CEO and co-founder of Dealpath. “Together, we’re empowering the fantastic teams at CBRE to seamlessly surface high-quality opportunities and deliver a white-glove client experience to these leading investors — driving greater efficiency and velocity in institutional real estate transactions.”

Dealpath Connect is a unified, integrated listings and deal management platform which standardizes and extracts data from key brokerage partners, providing clients with real-time access to investment opportunities. Listings are enriched with critical market intelligence including sales and lease comparables, demographic insights and other key data, creating a centralized repository of information to drive more informed investment decisions.

“We’ve worked closely with Dealpath over the past year and have seen firsthand how Dealpath Connect and CBRE Deal Flow Sync provide certainty that deals were received, routed and reviewed by

the right individuals at target investment firms,” said Bryan Doyle, managing director of capital markets and head of the Private Client program at CBRE. “We’re excited for this big step forward and to work with Dealpath, a preferred partner, to bring digital transformation to commercial real estate capital markets and add a significant capability that brings exceptional outcomes to our shared clients.”

With Dealpath Connect, sell-side broker partners are seeing more than an 80% gain in the visibility of their opportunities with top institutional clients and a 30%-plus increase in confidentiality agreements signed, the company said. The investment teams that are leveraging the platform are achieving more than a 200% increase in relevant deals screened and a 30% decrease in errors in underwriting, diligence and deal execution.

Exergio, a company specializing in artificial intelligence (AI)-driven energy management tools for commercial buildings, will begin training its first humanoid robot, powered by Nvidia’s Gr00t system, to improve management, detect faults and enhance real-time system monitoring in commercial buildings.

While most humanoid robots today are designed for general purpose tasks such as aiding in household chores, according to Donatas Karčiauskas, CEO of Exergio, the industry needs to break this pattern and start using humanoids in professional use-cases, such as energy management in commercial buildings.

“Application of humanoid robots can be used beyond household tasks. They have plenty of potential in professional environments,” Karčiauskas said. “Managing energy in commercial buildings is complex. It’s not just about turning off lights or adjusting the thermostat. It requires real-time monitoring, predictive analysis and the ability to act fast. AI-powered humanoid robots can process vast amounts of sensor data, identify ineffi ciencies and respond instantly to anomalies. For example, a robot can detect an overheating component before it fails or pinpoint false alarms that would otherwise waste time and resources.”

The humanoid robots used by Exergio will be equipped with Nvidia’s Gr00t system, which has an advanced AI framework designed to enhance perception and motor skills.

Unlike proprietary humanoid AI models, Gr00t offers open accessibility, and allows companies to train and adapt robots for their specific needs.

“We chose the Nvidia Gr00t platform because it provides the adaptability necessary in real-world industrial applications,”

explained Karčiauskas. “With Gr00t, we can train robots to conduct on-site equipment inspections, detect early signs of system failures and respond to alerts faster than human operators. In theory, such robots can verify false alarms, analyze inefficiencies in HVAC systems and even assist in emergency scenarios by guiding personnel to safe exits. We’re here to train them.”

Exergio’s AI-based solutions applied in shopping mall Ozas in Vilnius, Lithuania, helped reduce energy waste by 29% and save more than €1 million.

The first training phase for Exergio’s humanoid robots is beginning this month.

Pronto Housing, an affordable housing Software-as-a-Solution (SaaS) and services platform, has announced a partnership with AppFolio, the property management software provider. Pronto provides AppFolio customers with affordable housing consulting services and compliance automation software that delivers additional value to those managing affordable housing units with AppFolio’s platform.

“We’ve had a chance to get to know the AppFolio Affordable Housing team and have seen firsthand their commitment to the space,” said Christine Wendell, Pronto Housing CEO and co-founder. “We’re excited to complement their offerings with our expertise. This partnership empowers AppFolio customers to simplify, streamline and outsource their affordable housing compliance with confidence.”

Pronto joins the AppFolio Stack Marketplace as a new solution partner focused on full-service affordable housing compliance. Pronto’s solution allows on-site property managers to manage more units, lease faster and improve the resident experience, the company said. By harnessing intuitive technology and user-centric design, AppFolio aims to remove barriers by simplifying complex compliance requirements, allowing property managers to focus on serving their communities.

“At AppFolio, we’re deeply committed to doing our part in improving housing affordability,” said Josefin Graebe, vice president, productdomains, AppFolio. “By partnering with Pronto Housing, we’re able to offer a unique solution that combines our streamlined property management approach with their compliance expertise. Together, we simplify the experience of managing Affordable Housing while creating a better experience for everyone involved.”

Lee & Associates has expanded its Nevada presence with the opening of an office in Las Vegas. The office will specialize in industrial owner/ tenant representation, investment sales and land sales, with plans to strategically recruit teams to grow their capabilities in the office, retail and multifamily sectors.

The Lee & Associates Las Vegas team will be led by John Sharpe, SIOR, CCIM, LEED-AP as president. The founding team includes Danielle Steffen, SIOR and Geoffrey West, both as principals in the office. The team will also include April Wesley as office manager.

“John has been a champion of the Lee & Associates broker-owned model for years, and his leadership, vision and experience make him the ideal choice to lead our new Las Vegas offi ce,” said Jeffrey Rinkov, CEO of Lee & Associates. “Under his leadership, supported by our collaborative national platform, this offi ce will bring the exceptional service and expertise that clients have come to expect from Lee & Associates.”

Sharpe is a seasoned commercial real estate professional with nearly three decades of industry experience specializing in industrial and investment sales, leasing and land transactions. In 2002, he cofounded Lee & Associates of Illinois, growing it into a full-service brokerage with more than 50 professionals. He currently serves on the Lee & Associates board of directors and as the firm’s expansion chair, leading strategic growth initiatives on a national scale. A graduate of Indiana University with a degree in finance and real estate, he holds professional licenses in Illinois, Indiana, Wisconsin and Nevada.

Real estate investment firm Arch Street Capital Advisors, in partnership with Artemis Real Estate Partners, has acquired a 2.4 million-squarefoot industrial portfolio located in the Kansas City metropolitan area.

“We are delighted to expand our industrial footprint with this highquality portfolio in partnership with Artemis,” said Gautam Mashettiwar, executive vice president of Arch Street. “Their strategic approach and thoughtfulness make them an ideal partner, and we look forward to pursuing more compelling investment opportunities together.”

The portfolio consists of four Class A industrial properties, all fully leased to a tenant roster that includes several investment-grade, Fortune 500 companies. The assets are strategically positioned near the BNSF intermodal facility, a modern, 443-acre logistics hub providing direct rail access and both domestic and international intermodal services.

“We are excited to partner with Arch Street and look forward to identifying additional strategic investment opportunities together,” said Michael Vu, senior managing director at Artemis. “This portfolio aligns well with our focus on institutional-quality industrial assets in supply chain-critical locations.”

Arch Street manages a diverse portfolio of investments across multiple sectors, including industrial, office, multi-family, single-family,

hospitality, retail, health care, student housing and land. Artemis has raised over $11 billion of capital across core, core plus, valueadd and opportunistic strategies. The firm makes equity and debt investments in real estate across the United States, with a focus on residential, industrial, seniors housing, medical outpatient, selfstorage, hospitality, retail and office.

Real estate law firm Belkin Burden Goldman LLP (BBG) has established a Tax Exemptions and Zoning Incentives Department with the addition of five attorneys from Seiden & Schein P.C. The new practice group will be led by Partners David Shamshovich and Jason C. Hershkowitz, joined by Associates Brenda J. Slochowsky, Camila Almeida and Frank Baquero.

“With this new team, BBG cements its position as the go-to law firm for real estate developers looking to maximize available tax benefits and housing incentives,” said Jeffrey L. Goldman, co-managing partner and co-founding partner of BBG.

The new practice group will provide counsel on critical tax incentive programs driving New York real estate development, including:

• 485-x (Affordable Neighborhoods for New Yorkers Program);

• 421-a (Affordable New York Housing Program);

• 467-m (Commercial-to-Residential Conversions Tax Incentives) and

• ICAP (Industrial and Commercial Abatement Program).

The team will also guide developers through residential zoning bonus programs such as the newly enacted Universal Affordability Preference

(UAP) Program and the now-expired Voluntary Inclusionary Housing Program, as well as fulfilling the affordable housing requirements under the Mandatory Inclusionary Housing (MIH) Program. These zoning programs are designed to work in tandem with the tax exemption programs, requiring a sophisticated legal strategy to fully capture financial benefits while ensuring regulatory compliance, a hallmark of BBG’s new team.

By Mark Plechaty, PE, Managing Principal –DeSimone Consulting Engineering

The constant transformation of the city over time barely elicits notice from New York City urbanites these days. But, even for those inured to the ebb and flow of buildings and lots across the vast grid of city streets, the office-toresidential conversion of the landmarked One Wall Street stands out as an exceptional feat of engineering innovation.

The transformation of this Art Deco masterpiece to residences — the largest such historic conversion in New York City when completed — was far from business as usual. As the lead structural engineer, I’ve never been involved in a project quite like it.

Located in the heart of lower Manhattan’s Financial District, the original 1931 office tower and its 1965 annex were transformed into luxury condominiums through the vertical addition of six floors at the top and 175,000

square feet of retail at its street-level base — and so much more. While this may sound simple, only a great measure of technical ingenuity, in balance with a deep respect for architectural heritage, could make the reimagining and retrofit of One Wall Street a reality.

Like so many other iconic, early 20th century New York City office buildings, One Wall had become an outdated behemoth that had ceded its market edge to newer, shinier towers in lower Manhattan. The original, 50-story, limestoneclad tower and its 30-story steel-framed annex totaled 1.6 million square feet over a full city block — including five basement levels that once guarded gold bullion in a massive vault 72 feet below the building.

But in 2014, developer Harry Macklowe, owner of Macklowe Properties, purchased One Wall with a laser-focused vision to convert its many

office floors into the highest-end residential units and luxe retail — and give the landmark a brilliant, age-defying second act.

The challenges to moving forward, however, were many. For starters, the NYC Landmarks and Preservation Commission had imposed restrictions on exterior modifications when it designated the original tower, designed by Ralph Walker for the Irving Trust Bank, as a landmark back in 2001. While the extensive redesign of most of the building’s interior remained in play, the protected status of its fluted exterior added a significant layer of complexity to the project.

Other monumental challenges included determining the limits of these older structures to support six additional residential floors and a rooftop pool, and how to get past those limits. A looming question was whether the existing foundations, steel beams and concrete slabs could withstand the countless invasive interventions needed to radically reshape the interior spaces and base for luxury living and retail. Add to these challenges a tight urban site that itself lay within the boundaries of a historic district, flanked by an active subway station and other landmarked buildings.

Given this array of challenges, my team embraced from the outset that nothing short of creative, out-of-the-box thinking could assure the integrity of the structures, preserve and restore the historic facades, and reimagine One Wall for modern, luxury living.

Structural Modifications to the Tower

We dove in at the deep end. Collaborating closely with Macklowe and SLCE Architects, we focused on the most critical challenge, upon which the project’s success ultimately depended: how to add six new floors and a pool atop the 30th floor of the1965 annex to create a 36-story tower.

Here’s how. The annex building — a steel moment frame with concrete-encased beams and concrete slabs — would become significantly taller and heavier, and needed to meet wind loads under the current code. Combined with the removal of two lower floors, the engineering team needed to significantly fortify the structure, known as stiffening, as additional height was added to the building.

To ensure that the additional height and associated weight did not destabilize the structure, particularly with a weakened base due to the removal of lower floors, the DeSimone structural team designed a stiffening system that incorporated high-performance materials to control the effects of wind sway — and support the added mass at the top.

To meet zoning requirements, the new overbuild levels were required to set back,

referencing the “wedding cake” setbacks of the Art Deco architecture and original annex building just below. But a complication arose. Because of this new setback, none of the new columns in the overbuild would align with those in the existing structure below. In response, we designed a reinforced concrete structural transfer slab to redistribute loads from the new floors to the existing columns in the original structure below.

Standard residential structures utilize flat concrete slabs some 200mm thick. But since the One Wall Street conversion was anything but standard, that approach would add excessive weight beyond the existing structure’s capacity. Instead, DeSimone opted for the innovative use of voided concrete slabs (in this case, a Cobiax product) using a high-strength, lightweight concrete mix.

Essentially, each concrete slab is embedded with a series of hollow, recycled plastic, ellipsoid void formers, which effectively reduce the weight while preserving the existing structure’s integrity. By combining the lightweight mix design and the voids, the overall weight of the concrete slab was reduced by 40%. Better yet, less concrete means less embodied carbon and a more sustainable building solution.

The overall reduction in weight in the overbuild, in turn, reduced the thickness required for the transfer slab, mitigating the need for more extensive column reinforcement — thanks to adding less overall mass to the top of the building.

The resulting structure is a lighter and more flexible structure that meets the performance requirements for wind and seismic forces.

Key to a luxury urban residential high-rise is convenience and the inclusion of luxe retail.

To create the long span spaces needed for highprofile, high-end retailers like Whole Foods, Life Time Fitness and the renowned French department store, Printemps, we created a glass retail addition elegantly cantilevered off the annex building, which also enabled us to avoid drilling into the Wall Street subway station directly below. We removed the entire second floor support structure of the south tower, along with sections of the third floor, redistributing the floor area.

This created a significant interruption in the supporting steel frame, which now needed

reinforcement. Installing a large steel plate truss at the underside of the new third floor did the trick. This truss connected to three new concrete shear walls, which were added to redistribute the loads and increase stiffening at the base of the tower.

The shear walls were designed to resist the loads delivered from the steel plan truss. These walls also provided a much-needed stiffening mechanism, ensuring that the newly added weight and height did not compromise the building’s stability. The decision to use concrete encasement for existing steel elements was also a strategic one. Encasing the steel beams and columns in concrete allowed for greater stiffness and load-bearing capacity, while simplifying construction in areas obstructed by lead paint, rivets or other older construction materials.

The very features of the Wall Street neighborhood that lent it its charm — the crooked, winding streets and landmarked architectural gems, including Trinity Church across the street — added yet more complexity to realizing this intricate conversion. The existence of the Wall Street subway station, just under the sidewalk on Broadway, made structural reinforcement and construction especially fraught, with heightened security measures at the nearby Stock Exchange further complicating site access and logistics.

Where, for example, could a crane be placed? Installing a conventional crane for the overbuild at such a dense site would be nearly impossible. Choosing to use cast-in-place

concrete meant the concrete could be poured with a pump. Formwork and reinforcing bars could be brought up the hoist. A crane was no longer necessary.

Only the spectacular former banking room, known as the Red Room, designated an interior landmark in 2024 for its striking, floor-toceiling terrazzo murals in deep reds and golds, was left completely intact, though restored. Otherwise, the vast interior of One Wall Street experienced a massive restructuring and reimagining to adapt it for not only residential living, but to meet the elevated standards of luxury lifestyle living.

First, we modified the structure to bring as much light as possible into the deepest areas

of this full-block residence. Then we carved out new windows and masonry openings, and converted rooftops into amenity terraces. We punched new openings through existing office floor slabs and severed or removed beams throughout the interior to direct plumbing and utilities to each private living space. We even removed 34 elevators (20 of which had served the upper floors, many of which hugged the perimeter, blocking light to the interior) and 16 escalators. We relocated others, resized shafts, introduced 10 new elevators into the building core and created new staircases, all of which required creative engineering on a mindboggling scale.

To accommodate the depth of a spectacular pool to crown the new addition, we created a long-span, steel structure for a wide-open,

column-free space at the floor below.

Technical Ingenuity in Service to Adaptive Reuse and Luxury Living

One Wall Street exemplifies the complexity and innovation required to undertake large-scale conversions in historic urban environments. The engineering solutions — ranging from lightweight slab design to complex structural reinforcement and logistical coordination — demonstrate not only the need for creative approaches to engineering, but a keen understanding of architectural heritage and modern building performance requirements. Through a combination of innovative materials and adaptive engineering strategies, the project team successfully transformed a revered but hobbled office building into a model for luxury urban living.

OLD

TOURNAMENT CHAIR

Roger A. Silverstein Silverstein Properties, Inc.

Member, National Jewish Health Council of National Trustees

CHAIRS EMERITI

Robert E. Helpern Tannenbaum Helpern Syracuse & Hirschtritt LLP

Member, National Jewish Health Council of National Trustees

Samuel B. Lewis

SBL Property Consultants, LLC

Member, National Jewish Health Council of National Trustees

Stephen B. Siegel CBRE, Inc.

Co-Chair, National Jewish Health Council of National Trustees

Photos courtesy of Spartan Demolition

With the rise of construction in New York City — even beyond pre-pandemic levels — there are more demolition projects than ever. From new and redeveloped housing to hotels, airports, schools, prisons and various other structures, there is a building boom. And most often, what comes up must come down first.

According to the organization Union-Built Matters, several industry watchdogs are predicting that construction in the city will reach $115 billion in 2025, up 32% from prepandemic years. According to IBIS World and State Industry Research reports, the New York City demo market size is $428.1 million.

“Demolishing a building in New York City, a densely populated urban area, is far more complex than knocking down interior walls and clearing debris,” said Marc Alleyne, CEO of Spartan Demolition, which he founded in 2012. “In urban environments, every step — from permitting to community relations — needs to be carefully planned and executed to avoid legal, financial and reputational risks.”

Alleyne’s most recent projects in the Tri-State area include the United Airlines hangar at Newark Airport and work for Hunter College,

St. John’s University, J Lindeberg, Blink Fitness, Winick Realty, RFK Properties, Brown Harris Stevens, Douglas Elliman, Levittown Public Schools and CityMD. Alleyne has worked for the Department of Parks and Recreation, the Metropolitan Transportation Authority, Triborough Bridge and Tunnel Authority, Dormitory Authority of the State of New York, both the City and State Universities of New York. the United Nations and the U.S. Army.

Spartan was voted 2015 Minority Entrepreneur of the Year by the New York Small Business Association and, most recently, Demolition Company of the Year by The Red Awards 2025.

Alleyne said that every real estate developer should review these basics before starting demolition: permits and regulations, assess sitespecific risks, structural and safety precautions, and community environmental responsibilities, insurance and legal protections and stakeholder communication.

Demolishing a building in New York City is nothing like tearing down a structure in other parts of the country, he continued. Whether you are a developer planning a new project, a

townhouse owner considering an expansion, or a neighbor living next to a demolition site, understanding the unique challenges of the process is critical. In New York, every square foot is valuable, every neighbor has a voice, and many city agencies have a say in the process.

The first difference is the web of permits and approvals required before demolition can begin. In many cities, a single demolition permit may suffice. In New York, developers must navigate multiple layers of oversight from agencies such as the Department of Buildings (DOB), the Department of Environmental Protection (DEP) and the Landmarks Preservation Commission (LPC). If asbestos, lead or other hazardous materials are present, environmental clearances are mandatory. If the building sits in a historic district, the LPC’s approval is needed before even minor demolition work can begin.

There are also regulations related to noise mitigation, sidewalk protection, rodent control and dust suppression. Missing a single permit or failing to follow one of these requirements can result in immediate stop-work orders, significant fines and long project delays.

Another unique feature of demolition in

New York is the intense relationship between developers and neighbors. In this densely built city, what happens on one property inevitably affects the structures next door. Before any demolition begins, developers are required to conduct a pre-construction survey of neighboring properties and submit plans for protecting shared or party walls. This is particularly relevant for townhouse owners, many of whom live in buildings dating back more than a century, where brick walls and foundations may be fragile. Communicating proactively with neighbors — explaining timelines, safety measures and work hours — is not only good practice but essential for avoiding legal disputes and complaints to the DOB, Alleyne said.

Space constraints create another layer of complexity. In many parts of the country, demolition contractors have the luxury of setting up large equipment yards and keeping debris containers nearby. In New York, space is at a premium. Buildings are often just inches apart, and the streets are crowded with pedestrians, cyclists and delivery trucks. As a result, demolition contractors must rely on carefully coordinated site logistics, including the use of scaffolding, protective sidewalk sheds and cranes. Trucks for debris removal must adhere to strict delivery windows to avoid blocking traffic, and crews must secure additional permits for any street or sidewalk closures.

Noise and dust, inevitable byproducts of demolition, become hot-button issues in residential neighborhoods. In New York, where people live directly adjacent to construction sites, complaints to 311 can trigger inspections and penalties. The city requires developers to actively suppress dust, often through misting systems, and to control noise with barriers and limited work hours. Most demolition work is restricted to weekdays during daylight hours. Developers who ignore these rules risk not only fines but the wrath of community boards and neighborhood associations — groups with the power to block or delay future permits.

Beyond regulatory hurdles, New York City’s history adds another layer of complexity. Beneath the city’s streets and behind its walls are unexpected hazards, from abandoned oil tanks to lead pipes and asbestos insulation. Attention to safety is paramount.

“I practice what I preach,” said Alleyne. “Spartan has a pristine safety record of no accidents or injuries.”

Demolition teams must be prepared for environmental remediation, which can add significant time and cost to projects, he explained.

“In historic districts, the process becomes even more delicate,” Alleyne said. “Even if a building is not officially landmarked, its architectural features — such as cornices or decorative facades — may require careful documentation and preservation. In some cases, developers must restore these features once construction is complete, adding another wrinkle to the process.”

Despite these challenges, the potential rewards of redevelopment in New York remain unmatched. For townhouse owners, replacing an aging rear extension or gut-renovating a structurally compromised building can significantly increase property value. For developers, demolishing underutilized lowrise buildings to create larger, mixed-use developments can unlock tremendous financial potential, particularly in neighborhoods with high demand for housing.

Ultimately, demolishing a building in New York is not just a technical exercise — it is a high-stakes negotiation involving city agencies, neighbors, community groups and environmental regulators. Each of these parties has a voice, and successful developers

understand how to manage these relationships while adhering to the city’s complex rules.

“If you are considering demolition in New York, working with experienced architects, engineers, legal counsel and demolition contractors familiar with the city’s unique rules is essential,” Alleyne advised. “This is not the place to learn on the fly. Preparation and expertise can make the difference between a smooth project and one mired in costly delays.”

Everyone knows there are no guaranties in life. When it comes to business, business owners can take concrete steps to secure their current operations while facilitating growth. This is exactly what the attorneys of Goetz Fitzpatrick LLP and Platzer, Swergold, Goldberg, Katz & Jaslow LLP did by joining to form Goetz Platzer LLP on January 1, 2025.

Goetz Platzer doubled the size of each firm to a total of 40 attorneys, propelling growth and collaboration in their core practice areas of construction law, finance, real estate, commercial litigation, commercial collections, bankruptcy and trusts and estates.

Goetz Fitzpatrick LLP (Goetz) was founded in 1967 as a boutique law firm focusing on construction law, building a practice that served national and international owners, contractors, subcontractors, lenders, design firms in dispute resolution and litigation. Founders Peter Goetz and Gerry Fitzpatrick grew the firm, with continued expansion through the years, including bringing on Donald J. Carbone in the 1980s. Goetz died in May 2024, and Carbone remains an active pillar of the firm today.

Meanwhile, Platzer, Swergold, Goldberg, Katz, & Jaslow LLP (Platzer), also a boutique law firm more than 50 years old, had focused on bankruptcy law, secured transactions, general corporate law, litigation, commercial collections and more. The firm had established a reputation for excellence in the fields of bankruptcy law, debtor and creditor rights, insolvency, secured transactions, general corporate and commercial law, litigation and related legal matters.

“We have an opportunity to exponentially expand the platforms of the firms,” said

Aaron Boyajian, co-managing partner of the newly combined law firm and equity partner of Goetz since 2018. “We have the ability to really grow.”

Platzer’s Cliff Katz serves as co-managing partner of Goetz Platzer with Boyajian.

The law firms had much in common despite offering client services in different practice areas, Boyajian said. Both firms were about 50 years old, were based in Manhattan, and serve the New York metropolitan area. And both faced the challenges of boutique firms in terms of efficiency and offering full services to their clients.

“We started talking with Howard Jaslow and Cliff Katz about two years ago,” Boyajian said. “They helped clients navigate finance issues, particularly clients in the garment industry. We found that their focus and ours were very complementary. There was a great potential integration there.”

Previously, Goetz would need to refer a client elsewhere for certain financing matters; Platzer would do the same on construction matters. Now, Goetz Platzer can simply bring someone in from down the hall at One Penn Plaza, Goetz’s longtime headquarters, which welcomed the Platzer team in late 2024. “Now we can keep it all under one roof and keep all our expenses under one roof, Boyajian said.

“While we’ve been attending to the succession of our own business, we are simultaneously helping our clients with their own business succession planning,” said Alison Arden Besunder, chair of the Trusts & Estates and Fiduciary Litigation practices. “Business succession requires intentionality of its owners. My partners and I have applied that to grow Goetz Fitzpatrick to the second generation, and now to a third act as Goetz Platzer. Our own experience with business succession informs our advice to our valued clients.”

Howard Jaslow, the senior equity partner from the original Platzer firm agreed with both Boyajian and Besunder. “There was a clear synergy between the two firms, which we hope will benefit the new entity and both existing and new firm clients,” he said.

“We went from a construction law boutique to a well-rounded law firm doing things outside construction law,” Boyajian recalled.

A 1999 merger with another law firm had brought in labor and employment practices to Goetz Fitzpatrick LLP. That was the last real growth until 2019 when Besunder joined

the Goetz Fitzpatrick as an equity partner, after founding her own firm Arden Besunder PC in 2009. She added a significant expansion to the existing trusts and estates practice.

“We have a full team of attorneys and staff, offering services from basic planning to very thorough advanced succession needs,” Boyajian said.

Succession planning is a key component of estate planning for business owners and has resonance with nearly all of Goetz Platzer’s clients, the two said.

Planning for what happens to a company when current ownership or management retires or dies is never easy, Besunder noted. It is not as simple as directing that a business be left to the next generation. A business owner must consider how to maintain the continuity of business operations, maintain key employees and continue the flow of servicing the clients and customers. These are complexities that need to be resolved for owners who are too busy running their core businesses to become experts in other fields.

“We help business owners navigate the maze

of business succession so that they can focus on their business and have peace of mind that their business will continue,” she said.

“The approach to business succession depends on the core business. A real estate holding company can easily be left to second- or third-generation heirs who then hire people to manage it for them. They can remain largely hands-off if they wish,” Boyajian observed.

The fashion industry, which manufactures tangible goods and has direct relationships with textile providers and more that cannot be outsourced, is different.

“There is tangible product,” Boyajian explained. “There are more personal touches on the manufacturing side than on the real estate side. A fashion company may not make it to the next generation unless the owner fosters the continuity of the relationship to the next generation.”

Because the personal business relationships matter, succession planning is as much an art as it is applying the law, Besunder observed. It can be a very emotional process for a business owner as with many estate planning clients. This is especially true of companies that may be small entities without sophisticated business coaching.