2 minute read

TRUST DEED UP TO SPEED

Monday, January 30th 2023 marks the two-year anniversary of the ‘new’ Trusts Act 2019. Despite it already being two years since the Trusts Act came into effect, we are still seeing Trusts where no action has been taken to bring the Trust up to speed. To ensure your Trust is fit for purpose and to limit your personal liability as a trustee, get in contact with the Tavendale and Partners (TP) team.

The Act provides us with a list of trustee duties that must be adhered to. These duties are intended to protect beneficiaries, help provide consistency in Trust administration, and from them, we have built best practice standards.

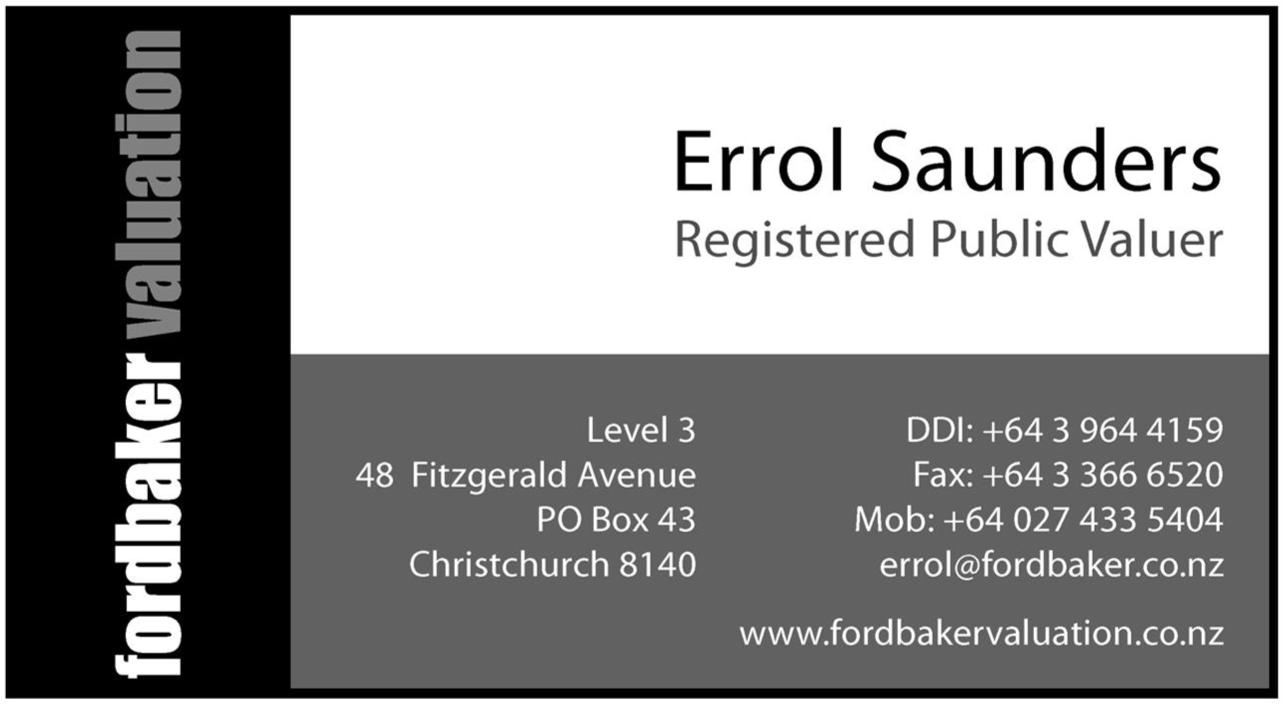

Advertisement

The mandatory duties for trustees are that they must:

• Know the terms of the Trust.

• Act in accordance with those Trust terms.

• Act honestly and in good faith.

• Act for the benefit of beneficiaries or the Trust’s purpose.

• Exercise their powers for a proper purpose.

In addition to the mandatory trustee duties, the Act sets out a list of default duties that apply to trustees unless they are specifically excluded by the Trust Deed. The default duties are as follows:

• Exercise reasonable skill and care.

• Invest prudently.

• Do not exercise trustee powers for their own benefit.

• Consider actively and regularly whether the trustee should be exercising one or more of the trustee’s powers.

• Do not bind or commit trustees to a future exercise of discretion.

• Avoid conflicts of interest.

• Act impartially.

• Do not profit from their position.

• Do not act for reward.

• Act unanimously. We are often asked about beneficiary disclosure obligations and whether trustees should maintain a Trust or whether it should now be wound up. The answer to these questions is, of course, very specific to the particular Trust and set of circumstances. Our advice, on whether a Trust remains worth retaining, will, among other things, take into account what the Trust was settled for - what was its purpose? Is this purpose still valid? Is the Trust still an effective tool in meeting this objective?

Our team takes an individualised approach to meet your needs when it comes to your Trust, ensuring that it is managed effectively to fulfil your objectives and it remains robust and compliant.

See advertisement alongside for contact details.

Kate Warren, Senior Associate, Tavendale & Partners.

Please contact us to make an appointment in one of the four convenient office loca ons.

Mobile: 027 384 3054

Email: kate.warren@tp.co.nz Rolleston & Darfield: 03 317 9099 Christchurch: 03 374 9999 Ashburton: 03 308 4188

New Darfield office open: Mon & Thurs, 9 - 5pm or by appointment

ASHBURTON ROLLESTON CHRISTCHURCH

Conveyancing, Refinancing, Leasing & Property Transac ons, Land Acquisi ons, Boundary Adjustment & Subdivision, Insurance Law, Occupa on Right Agreements, Estate & Succession Planning, including Enduring Powers of A orney, Trusts & Wills.