STM PARTNER P

POWERING GROWTH THROUGH BUILDER & LENDER COLLABORATION

LET'S WORK TOGETHER!

In today’s dynamic new construction market, aligning with a strategic lending partner is essential. At Southern Trust Mortgage, we specialize in supporting builders with marketing, financing strategies, and white-glove service to move more homes faster. This guide outlines our comprehensive builder support program designed to help you sell inventory, attract qualified buyers, and deliver an exceptiona e process.

MARKETING FOR GROWTH

STM PARTNER PROGRAM

TURNKEY MARKETING FOR MODEL HOMES, NEW COMMUNITIES, AND INCENTIVES

Leverage the power of digital platforms with our targeted online campaigns:

Promote new communities, spec homes, and incentive programs

Facebook/Google ads targeted at buyers seeking new construction

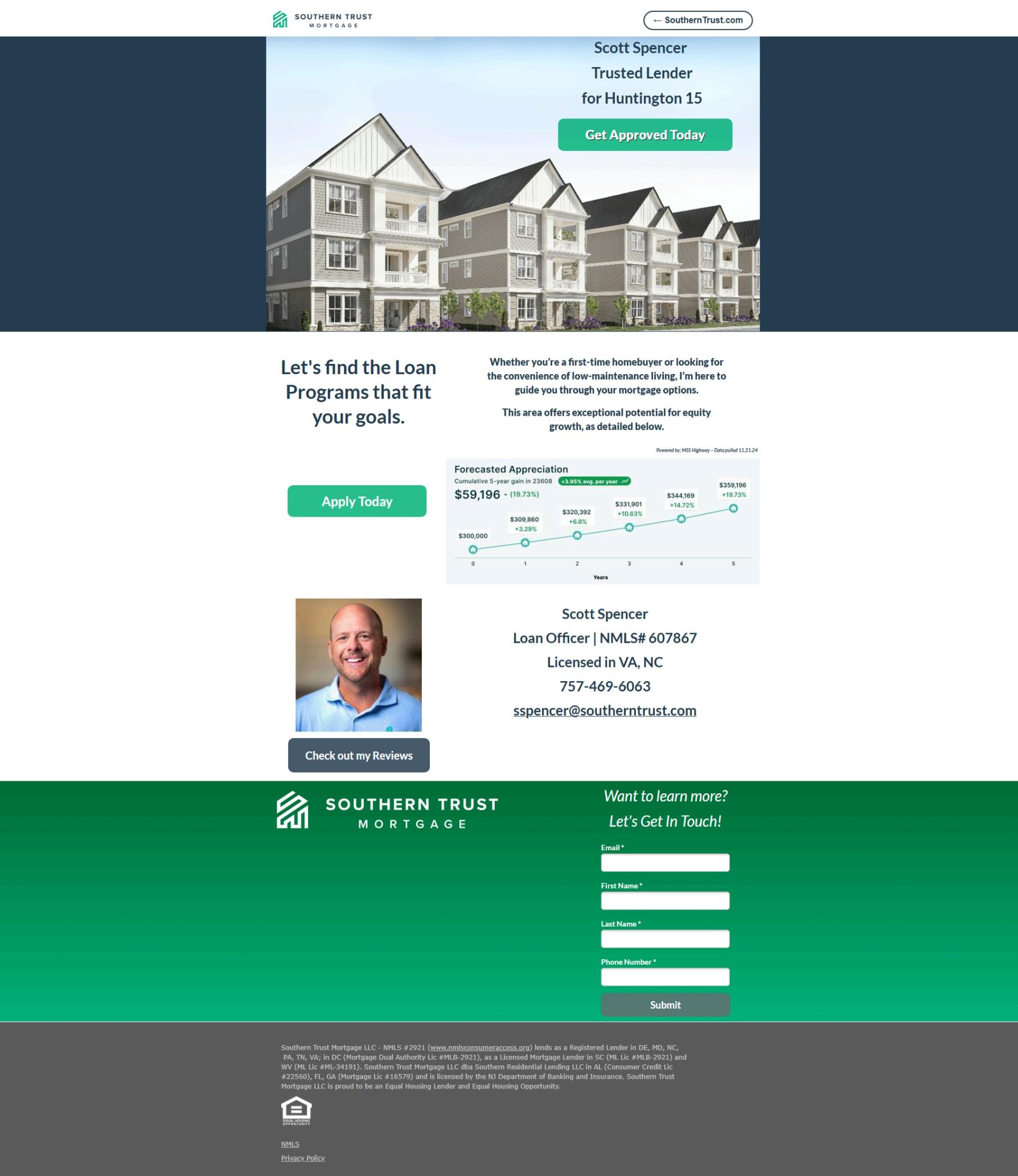

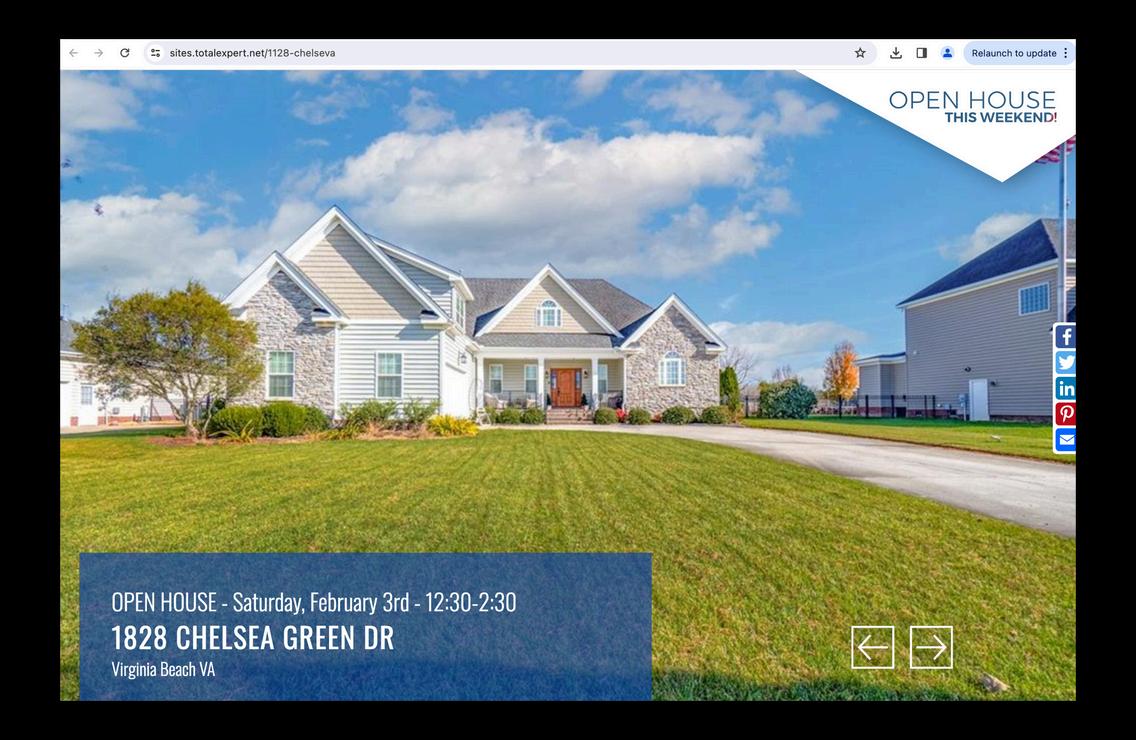

Dedicated landing pages for model homes or phases

READY TO MOVE INVENTORY AND GROW YOUR COMMUNITY FASTER? LET’S CREATE A CUSTOM MARKETING AND FINANCING STRATEGY THAT HELPS YOU MEET SALES GOALS AND BUILD STRONGER BUYER EXPERIENCES.

CONTENT & BRANDING CO-MARKETING CAMPAIGNS

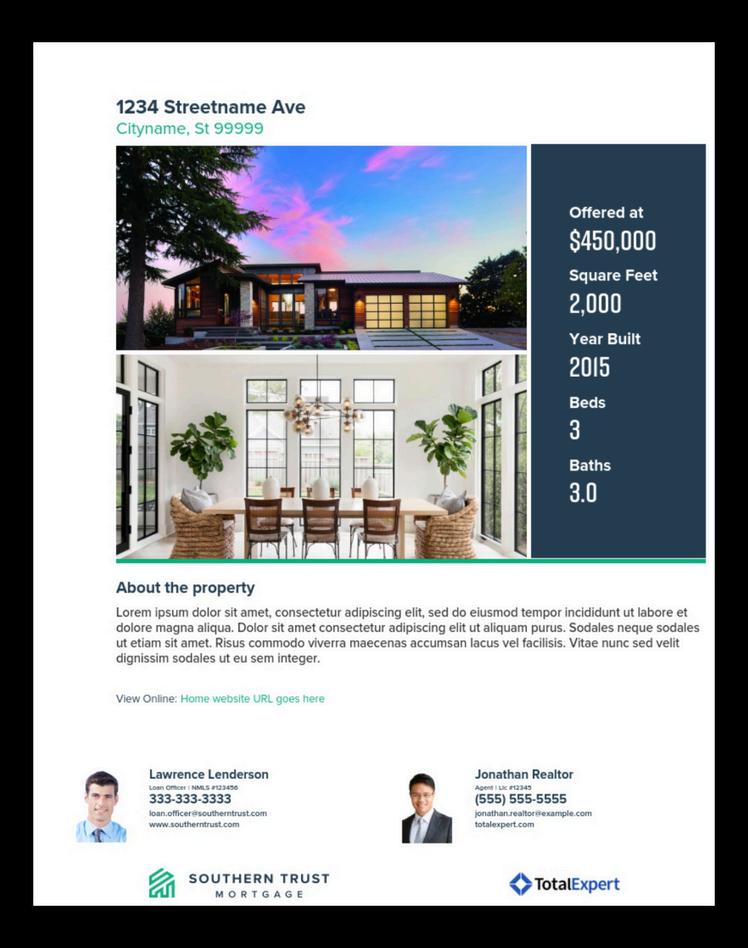

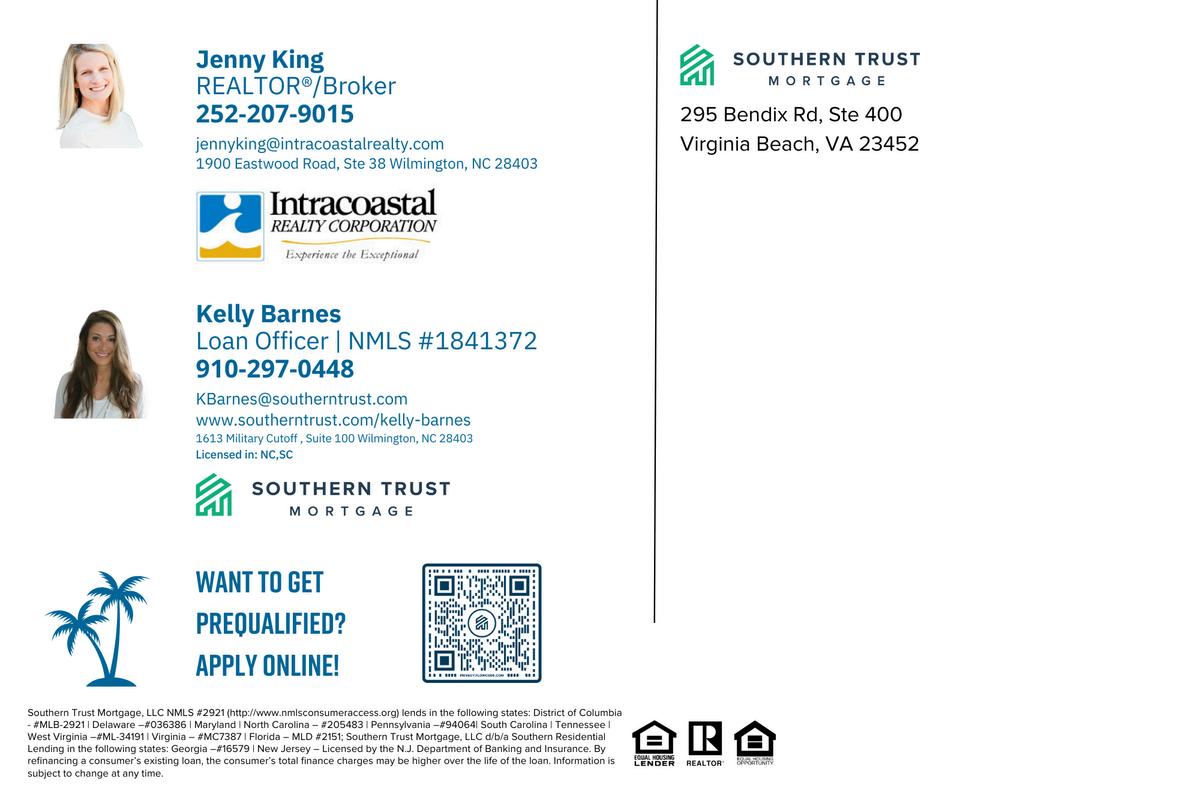

Build credibility and engagement through high-quality content: Co-Branded Flyers & Brochures: Professionally designed materials for open houses and mailers.

Personalized Video Marketing: Short, engaging videos featuring both you and your STM loan officer.

Blog & Newsletter Features: Cross-promote on each other’s platforms to expand your audience.

GHOST WRITING, ANIMATED VIDEOS, QUICK REEL TEMPLATES, MATERIALS FOR YOUR LISTINGS CREATED WITH YOUR BRAND IN MIND.

EVENTS & NETWORKING

STM works hand-in-hand with builders to craft engaging events that attract buyers, build relationships, and accelerate sales.

Event planning strategy sessions

Custom flyers, signage, and digital invites

Paid ad support (Meta, Eventbrite, Google)

On-site lender support for pre-approvals

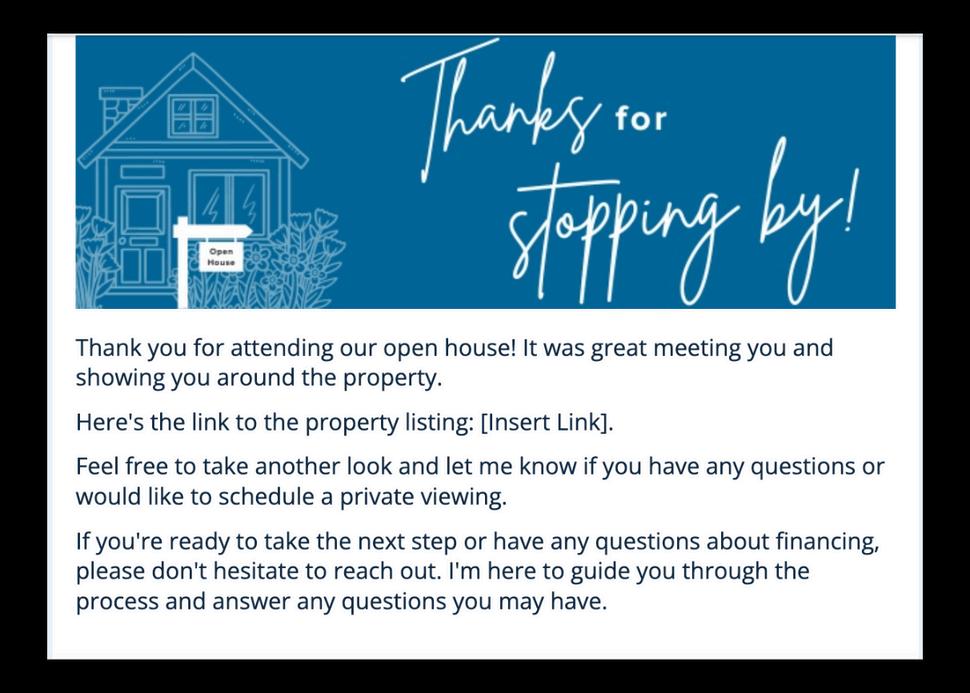

Post-event lead follow-up and analytics

PROPERTY FLYER

SOCIAL GRAPHIC SIGN IN QR CODE

WHETHER IN PERSON, VIRTUAL OR A GRAND OPENING- STM PROVIDES THE SUPPORT NEEDED TO MAKE EVERY EVENT SPECIAL & SUCCESSFUL.

DIRECT MAIL & TRADITIONAL MARKETING

Enhance your marketing mix with physical outreach:

Postcards & Mailers: Co-branded real estate updates, farming, prospect retention, and competitive market farming campaigns.

Door Hanger Campaigns: Target specific neighborhoods with a collaborative approach ex. Apartment Complexes.

Join the Client Connection Program: Homeowner retention program for closed buyers with special referral incentives for new buyers.

DID YOU KNOW THAT TRADITIONAL MARKETING HAS A LONG TERM IMPACT ON CLIENT RETENTION? MULTI-TOUCH & MULTI CHANNEL STRATEGY FOR HIGH ROI.

PREFERRED FINANCING SOLUTIONS

YOUR BUYER’S PERKS

PREFERRED LENDER PERKS

POWERFUL FINANCING TOOLS TO SELL MORE HOMES—FASTER

Partnering with Southern Trust Mortgage as your preferred lender means more than just loan approvals. It means unlocking exclusive financing benefits designed to support your sales goals, ease buyer concerns, and streamline the path from contract to close. With our tailored solutions, builders can offer real savings, increase buyer confidence, and keep deals on track no matter the market

LENDER CREDIT

We provide a 1% lender credit toward closing costs for every buyer who uses STM as the preferred lender maximizing affordability and helping you stand out in a competitive market.

SELLER PAID BUYDOWN

Help buyers ease into their mortgage with seller-paid temporary buydowns, including the impactful 3-2-1, 2-1, or 1-0 options lowering payments in the early years when buyers need it most

3-2-1 Buydown: 3% lower interest rate in year one, 2% lower in year two, 1% lower in year three then fixed for the life of the loan

Promote affordability while keeping your pricing intact

PREFERRED REFINANCE PROGRAM

When rates drop, your STM buyers get a head start with our Preferred Refinance Program, which includes:

Discounted lender fees

Streamlined approvals for past clients

Built-in customer loyalty for long-term retention

UPDATED RATES AND NEW PRODUCT OFFERINGS PROVIDED TO SITE AGENTS, AND BUILDERS WEEKLY.

SAMPLE WEEKLY RATE UPDATE

Bonds were higher again today helping with some losses from early in the week As expected, the Fed didn’t cut rates this week, but they did decide to change their balance sheet runoff What does that mean? It means they are only going to allow $5B per month in runoff vs. the previous $25B. They will now have to start purchasing at least $20B a month in treasuries starting next month. The market responded favorably to this news, and this is expected to continue. A few notables coming next week are New Home Sales, Consumer Confidence, Mortgage Apps, and Personal Consumption Expenditures(the Feds favorite measure of inflation). Have a great weekend!

Meet the Experts

Condo Specialist

Over 30 Years of Mortgage Experience

FHA DELRAP Certified

Works directly with Builders for Condo approvals

VA- Full project submissions; End Loan Reviews

Submissions reviewed in 24 Hours.

Credit Expert

Analyzes an average of 25 reports daily for rescores & pricing improvements.

Average rescore 72 Hours & 45 point score increase

Provides homebuyer seminars & continuing education for Realtors

Resolves issues directing with bureaus

income specialist

Self Employed Income Specialist

Reviews Tax Returns and determines income in 24 hours for timely approvals

Provides guidance for product placement to best fit the borrowers financial goals

Loan Product Spotlight

AGENCY GOVERNMENT, STATE BOND & Downpayment assistance

Seller/Lender Funded Buydown

HomeReady/Home Possible

FHLB Grant Funds Available

$17,500 1st Time Buyers

$20,000 Community Partners

Virginia Housing Approved Lender

Capital markets

Overnight Protection

Lock & Shop

Long Term Locks with Float Down

niche products

STM Signature up to 95%

Higher than Conforming Loan Amounts

ARM program with lower than market rates

NO LLPA

FROM THE TEAM OF EXPERTS, CREATING BUYING OPPORTUNITY TO THE OUT OF THE BOX PRODUCT OFFERING, STM PROVIDES CREATIVITY AND PERSONAL

WHITE-GLOVE SERVICE TO GET THE JOB DONE.

making home happen