The strategy going forward for Ireland must be to build a resilient base of domestic SMEs and larger companies to reduce international shock potential. This section outlines key measures to support business and regional economic resilience It calls for a reduction in the tax burden on middle-income earners, broader investment options for workers, and reforms to commercial rates to discourage vacancy and promote active use of space. It also recommends increased supports for SMEs, particularly those not currently eligible for any support

The lack of project specific information in the NDP allows Budget 2026 a perfect chance to plot the course of regional investment. Budget 2026 must focus on accelerating the rollout of essential infrastructure in the regions including much needed investment in water, justice and health to support economic development and regional growth. This chapter highlights the urgent need to increase targeted funding for water and wastewater infrastructure, expanding the prison capacity and supporting Gardaí

Housing policy and budget support must quickly move to promoting additionality within the system Too much focus to date has been on reallocating a static new housing stock amongst different cohorts and increasing competition between the state and owner occupiers. Realistic housing delivery targets down to a local level will go some way to help this, so too will the equalisation of targets between cohorts and support for apartment viability and regenerating brownfield sites

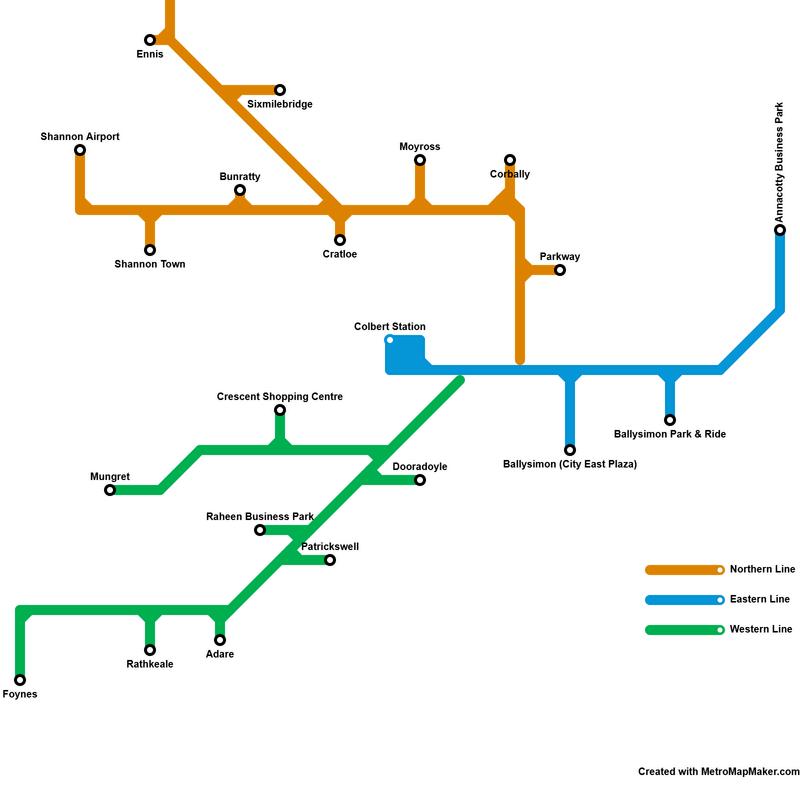

The Mid-West needs investment for a modern, integrated transport system Funding for key road projects as part of Budget 2026 must be delivered. In tandem with this, the acceleration of a Limerick-Shannon metropolitan rail network The strategic importance of aviation cannot be understated, we urge the publication and funding of a new National Aviation Policy that supports regional airports inclusion in the Regional Airports Programme.

Not only is Ireland facing large magnitude fines due to not meeting our climate goals, we are also energy insecure due to our over-reliance on a single source of energy coming from the UK. Budget 2026 must position Ireland to meet its climate goals while enhancing energy security and regional opportunity We are calling for accelerated investment in offshore renewable energy through DMAPs, including enabling infrastructure at Tier 1 ports. We also recommend scaled-up support for biomethane production as well as better alignment with EU energy policy

Mairead Connolly President, Limerick Chamber

Budget 2026 is a defining moment for Ireland. It arrives not only against a backdrop of economic transformation and global uncertainty, but at a time when Government must make decisive investments that determine the country’s ability to meet its climate targets, maintain energy security, and deliver growth that is both regionally balanced and economically sustainable.

We have reached the limits of what policy ambition alone can achieve. The rhetoric of balanced development, climate action and compact growth is no longer sufficient what businesses, families and communities across the Mid-West now need is delivery That delivery must be underpinned by long-term clarity, regional commitment, and fiscal action to ensure our national objectives translate into meaningful infrastructure on the ground

Ireland continues to face major structural challenges: a housing shortage that is pricing people and investment out of regional centres; transport bottlenecks that undermine competitiveness; an energy system overly dependent on imported fuel with a single point of failure being a pipeline from the UK; and an infrastructure pipeline that consistently lacks transparency or momentum. These challenges are amplified in regions like the Mid-West, where uncertainty around project timelines and infrastructure delivery continues to frustrate employers and limit potential.

The revised National Development Plan (NDP) 2025, while welcome in scale, falls short in providing the regional specificity and project-level detail required to give certainty to the business community. It is hugely concerning that in the revised NDP, the only specific project mentioned is the Metrolink in Dublin - with no greater visibility provided for the regions. Combining this with recent research showing the disparity of state investment favouring the east coast, should send alarm bells throughout the system Without clearly defined investment pathways for key regional projects, the Mid-West risks falling further behind in attracting investment, talent, and the economic spillovers needed to sustain growth Budget 2026 is therefore a crucial opportunity to bridge that gap to take the ambition of the NDP and convert it into bankable confidence for communities and industry

The theme of this year’s submission Sustainable Infrastructure, Sustainable Growth reflects a dual urgency First, the need to prepare for a lowercarbon future through strategic investment in infrastructure that supports clean energy, modern mobility, and compact urban development. Second, the need to ensure that this transformation delivers inclusive, regionally balanced economic opportunity, and that it does so at speed, by capitalising on the natural assets we have at a national and regional level.

Ireland’s exposure to energy insecurity is now abundantly clear. Overreliance on the UK leaves us vulnerable to geopolitical shocks beyond our control. We must reduce that dependence and replace it with a robust, indigenous supply including through the scaling up of biomethane, offshore wind, and the development of Tier 1 ports like Shannon Foynes that can serve as national energy and logistics hubs To progress this investment, DMAPS needs to ensure that it focuses on specific rather than broad areas, accounting for relevant on land and port infrastructure

Delays in these areas are not merely technical they carry direct financial consequences Ireland is on track to miss critical climate targets, exposing the Exchequer to EU compliance fines potentially reaching €28 billion, while simultaneously missing out on job creation and long-term energy independence

Unlocking the full potential of the Mid-West and cities like Limerick requires Government to back up its strategic planning with targeted and regionally distributed capital. This means:

Accelerating delivery of a Limerick Metropolitan Rail Network, strategic roads and BusConnects; Investing in housing viability through better cost-rental thresholds, apartment viability supports, and scaled-up use of schemes like Croí Cónaithe and the Living Cities Initiative; Supporting regional airports like Shannon Airport, which are essential not only for tourism but for international business connectivity and trade diversification

A cohesive transport system, a diversified energy base, and vibrant urban centres are the foundation of future growth But they are also the conditions for building resilience ensuring that regional economies like Limerick’s can thrive in the face of climate disruption, economic uncertainty, and global competition

This Budget must not become another moment of delayed potential. It must send a clear message to businesses and investors that Ireland is serious about its transition, its infrastructure, and its regions That message must come not just through vision documents, but through multi-year capital commitments, implementation timelines, and delivery accountability

The tumultuous global economic environment should be a warning sign that Ireland must do better to support indigenous SMEs to ensure diversity in our economic environment Enabling indigenous SMEs to develop, grow and scale, allows them to become greater drivers of a stronger proportion of our economy and tax base, reducing our over-reliance on a small number of multinational companies.

Across the Mid-West, we are seeing growing appetite for investment in clean energy, advanced manufacturing, housing delivery, and international trade. But without a functioning pipeline of enabling infrastructure from roads to rail, ports to planning that ambition will remain unrealised.

Limerick Chamber and our 400+ member organisations urge Government to seize this opportunity. Budget 2026 is more than a financial exercise it is a national statement of intent. Let it be the budget that delivers infrastructure certainty, supports Ireland’s transition, and ensures that the regions are not passengers, but full partners in sustainable national growth.

To drive national prosperity and economic security, Ireland must support the regions that power its growth. Limerick and the Mid-West are home to high-performing SMEs and global employers alike Budget 2026 must enable business to scale, invest, and compete through talent pipelines, reduced cost burdens, and policy certainty Budget 2026 must support those indigenous business that make up the economic foundation of the nation. A key aspect of enabling competitiveness is ensuring retention and attraction of employees with the relevant skills. Enabling advancement of skills into green technology is a proactive investment that must be pursued and supported to encourage growth potential in these sectors and thus avoid penalties By budget 2026 enabling indigenous SMEs to develop, grow and scale, they will become greater drivers and a stronger proportion of our economy and our tax base, reducing over-reliance on a small number of multinationals

The special assignee relief program (SARP) allows for executives that are coming to Ireland for the purpose of employment to avail of a tax relief whereby 30% of their earnings above €100,000 up to €1m is ignored for Irish income tax. One of the conditions is that the individual has been employed by the company or a related company overseas. This condition of overseas employment within the same company is not one that many Irish indigenous companies can meet. Removing the precondition for overseas employment prior to accessing relief would allow for a level playing field between fully indigenous and multi national companies, ensuring that key talent can be sourced from overseas regardless of employment history. The right key employee will help to drive growth and value for indigenous companies

In terms of building up skills in particular sectors, a super deduction for companies could be considered, e g if employing AI or green tech specialists, a corporation tax deduction of 150% of qualifying payroll costs to support growth in those sectors

The key employee engagement program (KEEP) allows for share awards to be made to employees subject to conditions, and for the capital gains tax rate (currently 33%) to be applied rather than effective income tax rates of up to 52% It was introduced to level the playing field between multinationals and SMEs and therefore help SMEs retain key talent It is currently quite difficult to satisfy the conditions in practical terms, however, as if certain filings are made late, or there are issues with the company valuations (which by their nature are highly subjective anyway), the relief can be denied

It would be more appropriate for a fixed penalty to be levied instead of outright denial of relief in the event of compliance shortfalls, as the denial of relief falls on the individual and is disproportionate. The possible denial of relief is acting as a disincentive to business engagement with the relief on an overall basis, as it's viewed as excessively risky. The shares held through the regime should also be capable of qualifying for the 10% entrepreneur rate of CGT.

The lifetime limit on KEEP shares, currently €300,000 per individual, should be increased. The KEEP regime is stated as expiring on 31/12/25. It should be extended for a meaningful period to underpin business confidence e g to end 2030

A more streamlined and accessible investment process is needed for those seeking to invest beyond property and pensions. Current regulatory barriers and cost burdens - particularly around instruments like Exchange-Traded Funds (ETFs)make it unnecessarily difficult for individuals to build wealth through diversified investment options. The current deemed disposal rules put Ireland at odds with other countries. Making it easier and more efficient to invest in Ireland will help attract and retain talent needed

Middle-income earners form the backbone of the Irish economy but are increasingly squeezed earning too much to qualify for state supports, yet too little to maintain a comfortable standard of living Reducing their tax burden would reward productivity, improve take-home pay, and enhance Ireland’s competitiveness in attracting and retaining skilled talent Automatic indexation of tax bands is also essential to ensure that income growth is not eroded by fiscal drag, thereby supporting long-term income stability. This should be bolstered by indexation of income tax credits.

Budget 2026 should raise the thresholds for Capital Acquisitions Tax (CAT) to reflect sustained price increases in assets and family homes and reduce intergenerational barriers to home ownership. Current tax thresholds have not kept pace with rising property prices, resulting in disproportionately high tax liabilities for individuals inheriting or transferring family homes. This can force beneficiaries - often adult children - to take on significant debt simply to retain the property Updating CAT and CGT limits would ease this financial pressure, support generational home ownership without distorting the broader property market Lastly, carving out principle private residences from general thresholds would allow family homes to stay within the family

Budget 2026 should enhance Ireland’s childcare system by increasing the universal subsidy and income threshold under the National Childcare Scheme to improve affordability. It should also boost core funding for small and medium providers to expand capacity and invest in supports and training for children with additional needs.

A strong, well-funded further and higher education sector is essential to Ireland’s competitiveness and balanced regional growth The post-secondary education system is central to delivering highdemand skills, applied research, and enterprise collaboration across key sectors such as clean energy, advanced manufacturing, and digital health Budget 2026 must commit to increased investment in education to address Ireland’s long-term skills needs and safeguard its competitive edge A skilled, adaptable workforce is central to Ireland’s economic value proposition, particularly in highgrowth sectors such as green energy, life sciences, construction, and advanced manufacturing Increased and sustained funding is needed to expand access, modernise training infrastructure, and ensure learners are equipped with the futurefocused skills that will underpin sustainable economic growth and regional development.

Budget 2026 should prioritise the advancement of legislation that enables all Technological Universities to borrow to directly invest in and develop their own infrastructure. Granting TUs greater autonomy to plan and fund capital projects will allow them to scale and expand to market requirements.

Budget 2026 should provide targeted investment in education and training infrastructure across the Mid-West to ensure a pipeline of skilled workers for priority sectors including energy, construction, healthcare, and transport. This includes potentially expanding capacity at existing facilities and scaling programmes aligned with future industrial and regional needs.

The RDTC rate of relief should be increased from 30% to 35% combined with an increase in the first year payment threshold for the RDTC, increasing to a minimum of €75,000 from €50,000 to provide further cash flow support to SMEs.

Introduce a Trading Interruption Waiver on local authority rates to support businesses significantly affected by planned or unforeseen disruptions to customer access that extend beyond agreed timelines such as prolonged public realm works or road projects exceeding agreed timelines This measure would directly cushion impacted businesses from the financial strain of delayed capital projects and encourage the timely delivery of such projects

Provide targeted financial support for businesses seeking to scale their e-commerce capabilities Assistance should go beyond online-only retailers and include bricks-andmortar businesses aiming to enhance their digital presence. This dual-channel approach will expand market reach and strengthen both online and in-store trade for local enterprises. Existing supports are only available to those that trade online.

We welcome the extension of the waiver for outdoor dining for the remainder of 2025 and the first three quarters of 2026.

Increase accelerated capital allowances for all plant and machinery purchases from 12.5% to 25% per annum against Corporation Tax and Rental Income. Ireland’s capital allowances regime plays a key role in incentivising business investment, yet it has remained largely unchanged for decades. The current 8-year write-down period no longer reflects the rapid pace of technological advancement and equipment obsolescence. Updating the framework would encourage greater investment, particularly from indigenous businesses, and align with Priorities 4 to 7 of the White Paper on Enterprise 2022–2030 Existing 100% accelerated allowances for energy-efficient equipment and company-provided crèche or gym equipment should be retained without change

With many Irish SMEs still recovering from recent global shocks and facing rising energy costs, longterm support provides stability and encourages investment This extension would also align with the State’s commitment to ensuring businesses can adapt sustainably while protecting jobs and competitiveness.

The revised entrepreneur relief, which accords a 10% rate of CGT for entrepreneurs disposing of particular investments up to a cap of €1 million over a lifetime, should be enhanced Increasing the lifetime limit to €5m /€10m would support the entrepreneurial activities that create employment locally in the indigenous sector People won't take the risk of entrepreneurial activities without suitable reward and the €1m lifetime limit is in place for almost a decade at this juncture. Given the need to strengthen indigenous businesses, entrepreneurs will play a key role in supercharging the domestic economy.

Budget 2026 must expand the offering available through Local Enterprise Offices (LEO). Currently, much for the support is available for businesses with 10 or fewer employees. Furthermore, much of the support is also only available to those businesses operating in the manufacturing or services space that can, or are on a journey to

Certain

Infrastructure is not a cost it is a strategic asset and investment. In the Mid-West, constraints in transport, housing, health, water and energy are stalling investment and growth. This budget must prioritise timely infrastructure delivery to unlock capacity, drive productivity, and support targets. Time and again Ireland has failed to adequately deliver infrastructure Not only is this harming Ireland’s competitiveness, attractiveness and growth but it is also dampening quality of life potential. Budget 2026 must rapidly intervene in our declining infrastructure and provide a plan for regional infrastructure investment, this is of particular importance due to the complete lack of detail within the revised National Development Plan.

Limerick Chamber’s submission to the 2025 review of the National Development Plan (NDP) sets out a clear, progressive agenda for unlocking the economic and social potential of the Mid-West through targeted infrastructure delivery, energy investment, and regional development. The NDP submission aligns closely with Budget 2026’s focus on infrastructure and sustainability, offering delivery-focused recommendations that support enterprise, boost competitiveness, and ensure Ireland’s infrastructure keeps pace with demographic and economic growth.

The key objectives of Limerick Chamber’s NDP submission closely follow our Budget 2026

Submission:

Delivery & Accountability: The submission calls for the NDP to be judged on its capacity to deliver timely, high-impact projects and to build accountability into all capital investments.

Balanced Regional Growth: It highlights the persistent under-delivery of infrastructure in the Mid-West and calls for parity with the East Coast in project prioritisation and funding.

Housing & Infrastructure Bottlenecks: Proposals include fast-tracking LDA activity in Limerick, addressing water service capacity, and introducing realistic density standards tailored for smaller cities.

Energy & Climate Resilience: The Chamber urges explicit support for Offshore Renewable Energy (ORE) at the Shannon Estuary and a pragmatic approach to LNG as part of a secure energy mix.

Strategic Transport Links: Investment in metropolitan rail, Shannon Airport, Foynes Port, the N/M20, and BusConnects is framed as essential to enhancing national and regional productivity.

Urban Core Revitalisation: The submission advocates for a modernised Living Cities Initiative, expanded healthcare facilities, and a national capital programme for city centre renewal.

Justice & Public Safety: A call is made for expanded prison capacity and a more visible justice infrastructure to enhance community security and economic resilience

There is a clear need for boosting of Local Authority revenue to better invest in towns and cities. Local Authorities are limited in their revenue raising measures to local property tax, development levies and commercial rates. Budget 2026 must begin the process of investigating alternative funding models. While many businesses are still struggling with costs and a tumultuous economic and global environment, businesses cannot be expected to perpetually absorb increases in local taxes, particularly around commercial rates While it is important that businesses contribute locally, it is also important that Local Authority income is not overly concentrated on the growth of commercial rates unless it is through the natural process of increasing the number of businesses Not only does this put Local Authorities at risk of economic shocks, but perpetual increases make area uncompetitive

As part of Budget 2026, Government should prohibit Local Authorities from granting commercial rate exemptions for vacant properties in cities, towns, and villages. Allowing rate relief on vacant commercial premises disincentivises occupancy and results in underutilised space. It also creates an uneven playing field for active businesses that pay full rates.

URDF should be expanded into a more permanent funding stream for regeneration of city centre projects. However, there must be strict monitoring of delivery of the project, which to date has been poor

Establish a dedicated, front-loaded funding programme for water and wastewater infrastructure in the Limerick-Shannon Metropolitan Area, with specific capital allocations to Irish Water to accelerate delivery. Targeted investment is essential to unlock housing supply, enable mixed-use regeneration, and support economic growth in the Mid-West. Increased and ring-fenced funding will allow Irish Water to expand capacity, reduce connection delays, and lower costs for developers ensuring infrastructure keeps pace with national and regional development priorities under the NDP

Allow developers to construct temporary wastewater treatment plants in areas where existing infrastructure is at full capacity but scheduled for upgrade within five years Government or Irish Water should cover the associated installation and maintenance costs This interim solution would prevent unnecessary delays to housing developments caused by capacity constraints It enables continued delivery while long-term infrastructure upgrades are underway, supporting economic activity and addressing urgent housing needs.

As part of the stage one planning for the Eastern and Midlands Water Supply Project, Budget 2026 should mandate an independent taskforce to review the proposed pipeline to assess ecological impacts on the Shannon catchment, evaluate regional-growth implications to ensure the project does not constrain future Mid-West expansion; and analyse alternative siting options including locating key infrastructure closer to the water source in the Mid-West

Reinstate the Uisce Éireann rebate scheme on a time-limited basis to offset water connection costs for SME builders, particularly in county towns and rural areas. The high cost of water connections is a significant barrier to housing delivery for smaller developers. A targeted rebate would improve project viability, stimulate residential construction in under-supplied areas, and support broader housing and regional development goals under the National Development Plan

Budget 2026 must fund a time-bound plan to expand Ireland’s prison capacity, including the immediate upgrade of overcrowded facilities such as Limerick Prison (Male and Female Prisons), and explore the development of a new national prison to meet long-term needs Investing in costeffective, modern facilities is essential not just for incarceration, but for maintaining social stability and community safety. Budget 2026 must take a balanced approach pairing infrastructure expansion with increased support for communitybased alternatives and diversionary programmes that address the root causes of crime. This is both a justice and societal priority, requiring urgent and sustained government action.

Gardaí Expenditure

Combined with this, Budget 2026 needs to ensure that current spending is available to boost Garda numbers outside the Greater Dublin Area, but also that overtime for existing Gardaí is protected and expanded – without an adequate overtime budget, city centre policing will become increasingly difficult However, Garda overtime is only a temporary measure for city centre policing with a longer term solution being provided by the allocation of Gardaí based off need and population. There also needs to be adequate performance management and efficacy analysis to ensure that Gardaí allocation within divisions is efficient, overall this should help improve accountability around Gardaí allocation at a national and regional level.

There are also proven crime deterrents such as a Community Engagement Van for Limerick City, that must be supported as part of Budget 2026. Gardaí allocation needs to be based off both a needs and population based model.

Budget 2026 must provide the current expenditure funding necessary for courts service to hire private security so that Gardaí currently working in the courts can be reallocated to on the beat visible policing

Current funding for the CCTV centre in Limerick is required past September 2025, we ask that Budget 2026 deploys multi-year funding to ensure adequate continuation of service for the CCTV centre.

To improve health outcomes and ensure equity in healthcare access, Budget 2026 must commit to significant investment in the Mid-West's acute care infrastructure The HIQA report “Independent review to inform decision-making around the design and delivery of urgent and emergency healthcare services in the mid-west region of Ireland” needs to be urgently published (originally due to be published Summer 2025) This review needs to inform capital and current spend for healthcare in the Mid West as part of Budget 2026 Investment is urgently needed to address persistent overcrowding and capacity shortfalls at University Hospital Limerick (UHL), as evidenced by recent HIQA and INMO reports

Recent analysis as part of the South East Economic Monitor reveals stark findings with regards to the disparity in major capital spend per capita in Ireland Including the metro project, the major capital spend per capita in Dublin is €23,817excluding the metro, the major capital spend per capita in Dublin is €8,683 Meanwhile, the same figure for the Mid-West is €3,389. The report further highlights “Dublin, with 28% of the population, is in the process of receiving 56% of capital spending even excluding Metro North that is more than double its proportional share.”

The EU Regional Competitiveness Index highlights how this underinvestment can translate into competitiveness challenges at a European level. The EU27 index average is equal to 100. Meanwhile, the infrastructure index for Eastern and Midland (underpinned by Dublin) is 115.2, the Southern Region is 50.7 and the Northern and Western Region is 34.1.

The Regional Infrastructure Tracker published by the Northern and Western Regional Assembly highlights that between 2016 and 2024 the Eastern and Midland Region accounted for 66.5% of published public tenders worth over €1 million. When examining published public tenders over €20 million, the Eastern and Midland share ballooned to 75% of the overall share.

While the NPF aims to bring parity with the Dublin, the Greater Dublin Area, and the rest of the country there is very little to suggest that this is happening in reality This will be compounded by the fact that the Review of the National Development Plan provides no details regarding regional or project level investment, with the only specific project mentioned being the Metrolink project in Dublin This is wholly unacceptable and provides no assurances to the development of the regions

Ireland’s housing challenge remains rooted in a fundamental lack of supply, and policy must now shift decisively toward additionality delivering more homes overall, not just reallocating a static or declining stock between different cohorts Croí Cónaithe Cities and the Living City Initiative have a valuable role to play in delivering homes in regional cities - but only if the appropriate changes are brought forward. Ireland’s ability to tackle the housing crisis is directly negatively impacting our competitiveness and ability to attract and retain talent. Budget 2026 must take the necessary measures needed to deliver homes in regional cities - one size fits all policy making will not work, and has not worked to date

Estimates within the Housing Commission report suggest that the Mid-West will need between 4,300 and 6,500 homes per year to 2050. Given current pace of delivery, that would mean an estimated shortfall of between 61,000 and 120,000 homes by 2040.

We welcome the publication of NPF Implementation: Housing Growth Requirements, however, we fear that it may not zone enough land for the demand seen across the Mid-West The underlying research supporting the NPF targets are population assumptions in the ESRI Report Population Projections, the Flow of New Households and Structural Housing Demand, this report does not account for existing pent up demand within the system with the ESRI study citing “factoring in prevailing pent-up household demand is beyond the scope of this research” we do note, however, that the revised NPF makes an effort to account for “unmet demand” In the case of Limerick, when comparing the revised NPF to the Housing Commission report the lower level of housing requirement in the revised NPF could mean a potential shortfall of c. 1,550 - 1,700 per annum. Accounting for the ability for a Local Authority to zone +50% in excess, would still result in a deficit of c. 400 homes per year. This is of particular concern, not only to Limerick, but to the entire region considering Limerick is expected to deliver 68% to 90% of new housing stock per year for the Mid-West.

Budget 2026, along with the Government’s plan for housing, must make the +50% additional zoning a floor, and not a ceiling. Mandating all Local Authorities to automatically zone +50%, with the potential for increased additional zoning in city based local authorities. Lastly, while new targets are welcome, we must now turn to who will deliver these targets at a local level, and what percentage will be delivered by the public and private sectors.

National targets have a large influence on local and regional targets. There needs to be equalisation of affordable homes to an equal playing field of social homes. For example, as part of Housing for All, the yearly Housing Need Demand Assessment targeted 31.5% of output for social housing, meanwhile just 12.5% was targeted for affordable - the targets for social housing are 2.5 times greater than affordable. Over the lifetime of the plan, Government aimed to deliver 90,000 social homes (29% of total homes), but just 54,000 affordable homes (17% of total homes)

Increase the Rent-a-Room Relief threshold, which has remained static at €14,000 for almost a decade, to reflect current rental market conditions and better incentivise participation.

Overall, Budget 2026 must increase investment in cost rental housing to increase the scale of provision, and speed at which it is delivered Currently, the number of cost rental homes to be delivered is meagre compared to actual demand

Basing new cost rental monthly payments on existing market rents is flawed unless market rents are adjusted for quality. For instance, a new cost rental apartment might not be feasible if it must undercut existing market rents by 25%, even though it would be of higher quality and energy efficiency compared to older, less efficient apartments from the 1980s. This misalignment hinders the development of cost rental housing. While Limerick Chamber supports reducing new rents to below market rates, the calculation must be adjusted to encourage the increased provision of cost rental housing.

The income thresholds for cost-rental housing should be expanded to reflect the realities of average dual-income households, particularly those earning around the industrial wage Under current rules, many middle-income couples are excluded from both cost-rental schemes and market-rate housing effectively locking them out of affordable housing options Without reform, the model continues to overlook a significant segment of the population in genuine need of support Combined with this, Budget 2026 needs to ensure indexation of income requirements for cost rental to inflation to ensure a more permanent affordable solution for workers

Brownfield Site Development

Introduce accelerated, time-limited tax reliefs for designated city centre brownfield sites to incentivise high-density development This should include targeted reductions in construction levies and duties for qualifying projects Unlocking underutilised urban land is critical to addressing housing supply and revitalising city centres

Tailored tax incentives can catalyse development where viability is constrained Additionally, Capital Gains Tax rollover relief should be made available to businesses disposing of real estate in the designated area and reinvesting in replacement commercial properties This would help free up strategically located land for residential development, while allowing businesses to relocate to more appropriate premises without punitive tax consequences.

Enhancements to the Derelict Sites Act 1990 should include more robust enforcement mechanisms, increased transparency in the Derelict Sites Register, and targeted financial incentives or penalties to encourage the repurposing of underutilised land.

The lack of apartment construction in Limerick and similar cities raises broader questions about the appropriateness of current density guidelines Oftentimes we see the only entities in a position to purchase these homes are either state entities or Approved Housing Bodies (AHBs) While developers are obligated to adhere to these density standards, rising costs often mean the land might be better utilised for other forms of housing to ensure a more appropriate tenure mix To address this, Budget 2026 should prioritise a comprehensive review of density guidelines for Limerick and smaller cities to align them with local economic and social realities.

There remains a concern of how much nonhousehold entities are interfering in the purchase of market homes In the first quarter of 2025 nonhousehold entities were responsible for 49% of new home transactions - non-household entities are normally housing bodies and local authorities. In essence this creates another layer of competition with workers not only competing against each other, but also competing against the state. Budget 2026 must bring forward plans to decrease this interference.

Budget 2026 must ensure adequate tenure mix across all development sizes, currently developments under 40 units have no tenure mix requirement and often all the homes in a development can go to social housing, or housing for at risk persons, cutting out workers and affordable housing.

Furthermore, tenure mix in core city centres should be cognisant of the wider tenure mix of an area While a new development might have an adequate mix when accounting for other developments in the area there may be a wholly inappropriate mix and skewing city centres

Current Croí Conaithe rules are calibrated for Dublin and Cork, leaving regional projects unviable and stalling apartment supply. Tailored supports and right-sized density standards would close the viability gap, stimulate compact growth, and diversify tenure options in smaller cities advancing National Planning Framework objectives while ensuring public funds drive delivery where it is most needed.

Budget 2026 should Establish a scaled-down Croí Conaithe programme for regional cities such as Limerick, Galway and Waterford, with: Relaxed minimum criteria – fewer storeys, lower density thresholds, and smaller scheme sizes as well as up-front eligibility confirmation before planning submission to cut financial risk.

A parallel review of national apartment-density guidelines to align viability targets with regional market realities.

There is a growing concern regarding the number of inactive planning permissions, particularly those held by smaller SME builders. Budget 2026 must deploy funding to activate these permissions, ensuring that they must have been idle for a certain number of years, or are facing significant financial constraints, in order to reduce interference in developments that would have taken place without intervention. The first iteration of Project Tosaigh by the LDA was successful in this regard.

Budget 2026 should deliver on the Government’s commitment to establish a national procurement framework for off-site manufactured housing This framework must include multi-annual funding and fixed annual delivery targets to provide certainty, drive scale, and support consistent demand for modular housing solutions

The state needs to ensure an adequate pipeline of land at the local level to ensure that housing targets, particularly affordable housing targets, can be met

However, the need to support strategic landbanking, goes beyond housing. There is a need to ensure adequate landbanking is available for the provision of SME focused business parks and warehousing, for energy storage and provision, and for future MNC investment. Budget 2026 must allocate the resources required to advance these projects in regions.

Unlock derelict and under-used housing stock in regional cities by overhauling the Living Cities Initiative (LCI) and aligning it with today’s market realities, construction costs and urban-renewal goals. Given the static stock of buildings eligible to avail of the LCI, this measure is a once off intervention to regenerate city centres and provide homes aligning with the goals of Project Ireland 2040. There is not a consistent need for capital investment once take up has reached a certain point. However, some changes need to be made to the existing scheme. Budget 2026 should earmark a modest but ring-fenced allocation to implement these reforms.

1. Broaden Eligibility

Extend qualifying build date from pre-1915 to pre-1945, adding c 550 extra homes in Limerick alone and widen Special Regeneration Areas (SRAs) to capture more viable city-centre streets

2. Enhance Financial Incentives

Increase relief to 20 % of qualifying costs per annum

3 Accelerate Cash-Flow Relief

Allow tax relief to be claimed from the year renovation starts by allowing for the throw back of 20% of qualifying expenditure to the prior tax year to trigger a refund This would essentially be a retrospective mechanism akin to Help-to-Buy, easing upfront costs. Introduce a provision whereby any unused relief transfers to a new owner once the first owner-occupier has met a minimum residency period.

4. Support Phased & Higher-Standard Works

Permit a second LCI claim for staged refurbishments within a set cut-off period Include non-essential extensions at a reduced 7 5 % per-annum rate (capped at 50 % of spend)

Allow full “stacking” of LCI with SEAI and heritage grants

5. Target Owner-Occupiers & Affordable Rentals

Require a long-term, material interest in the dwelling; organisations may only claim if the property is ring-fenced for long-term affordable rent or owner occupiers

6. Unlock Financing

Mandate HBFI and Local Authority Home

Loans to fund purchase-plus-renovation packages for qualifying projects

Adapt the First Home shared-equity scheme to bridge renovation funding gaps Facilitate mortgages for mixed-use buildings and extend LCI relief to the commercial portion when the owner lives on-site (“above-the-shop” living)

7 Extension of LCI

The current scheme is due to end in 2027 Budget 2026 should provide certainty to those looking to invest through the scheme by extending it out past 2030, combining this with the enhancements outlined above should boost take up of the scheme.

A modern, efficient transport system is vital to Ireland’s regional growth and competitiveness. Budget 2026 must prioritise delivery of road, rail, and public transport infrastructure to support connectivity and balanced development Investment in a Limerick metropolitan rail network will enable sustainable urban growth and reduce congestion. Key road upgrades, including the N/M20, are critical for enterprise access and regional mobility. Aviation remains essential to economic development in regional cities, with airports like Shannon serving as international gateways. Strengthening aviation ties enhances trade, investment, and talent attraction. Targeted support for regional airports and route development must form part of a cohesive national transport strategy

While we understand preparatory work is underway for the publication of a new National Aviation Plan Budget 2026 needs to ensure adequate funding is attached to the plan The renewed NAP must establish a definitive framework for allocating multi-year funding for capital expenditure, operational expenditure, and marketing initiatives. The Strategy must provide robust support to airports, such as Shannon Airport, which is critical to the regional growth goals outlined in Project Ireland 2040. The policy should prioritise safeguarding existing routes and facilitating the establishment of new business routes to strategic areas, reducing the overreliance of Dublin. These efforts will be pivotal in supporting tourism, economic growth and attractiveness in the regions.

The aviation strategy should focus on regional development and align with both Project Ireland 2040 and enterprise policies to foster growth in specific business sectors while enhancing connectivity and boosting the attractiveness and retention capabilities of the regions The NAP can be one of the policy tools whereby it is used to reach the goals outlined in Project Ireland 2040

Targeted investment in Ireland’s airport network is essential to preserving and expanding international connectivity an economic cornerstone for trade, tourism, and foreign direct investment In an increasingly uncertain global environment, a resilient and well-funded aviation system is vital for maintaining Ireland’s competitiveness

Budget 2026 should formally include Shannon Airport in an expanded Regional Airports Programme Aligning with EU State aid rules for airports under 3 million passengers, this inclusion would allow Shannon to receive operational and capital funding for safety and security related projects and activities, and support sustainability initiatives. Accessing the RAP will ensure that Shannon Airport can continue to grow connectivity and deliver real benefits for Ireland.

Budget 2026, through the renewed National Development Plan, must allocate a dedicated multiyear capital envelope to begin developing a metropolitan rail network Budget 2026 should ring-fence funding for the Limerick–Shannon Metropolitan Rail Programme as a flagship regional-mobility project, citing: 1) National Connectivity: Dual-tracking Colbert–Junction fulfils LSMATS and NTA commitments and removes a critical single-line bottleneck on the Dublin–Cork–Limerick spine 2) Balanced Growth: A commuter network underpins compact housing delivery, labour mobility and Project Ireland 2040’s

Mid-West population targets and 3) Climate & Competitiveness: An airport rail link cuts carbon-intensive car trips for commuters, supports enterprise and tourism, and enhances FDI appeal.

Budget 2026 must support:

Dual-track Limerick Colbert Limerick Junction design, construction and signalling

Deliver a Limerick-Shannon commuter rail network

New stations at Moyross and Ballysimon

Deliver ongoing stops along Northern, Eastern and Western lines Including the conversion of the Foynes freight line to mixed passenger–freight use

Advance the Shannon Airport Rail Link to shovel-ready stage, in line with the All-Island Strategic Rail Review target year 2030.

The track access charge for rail freight acts as a disincentive and drives more HGV traffic to roads This must be reduced as part of Budget 2026, as per the findings of the All Island Strategic Rail Review

Budget 2026 must prioritise funding to fast-track the delivery of Limerick BusConnects and prevent further delays beyond the current 2027 timeline Delays to this project risk undermining the development of a modern, reliable public transport network essential for regional economic growth. Continued congestion, limited mobility options, and longer commutes will negatively affect productivity, business operations, and the region’s ability to attract and retain talent and investment. Early delivery of BusConnects is critical to improving accessibility, supporting compact urban growth, and enhancing the overall competitiveness of the Mid-West.

Immediate upgrades are needed at the Mackey (Newport) Roundabout to address traffic bottlenecks at the National Technology Park and M7 exit Safety improvements, a slip road, and junction works are vital to supporting business growth in this high-employment area Budget 2026 should also fund the proposed park-and-ride facility in line with LSMATS and future LNDR planning

Despite being in discussion since 1998, the N / M20 remains undelivered an unacceptable delay for a vital route between Ireland’s second and third largest cities This missing link hinders balanced regional growth and national competitiveness Budget 2026 must prioritise this project as a key strategic investment to improve connectivity and unlock economic potential across the region

Budget 2026, along with the renewed National Development Plan, must allocate and approve the funding required to deliver key road network upgrades across Limerick:

While works on the Adare Bypass are underway, the remaining 26 km of the N21 / N69 route urgently requires Gate 2 funding in Budget 2026. This road is critical to unlocking economic growth in West Limerick and supporting the expansion of Foynes Port and Offshore Renewable Energy infrastructure Timely delivery of the full route is essential to national transport and energy objectives

The N19 plays a pivotal role as the key access route to Shannon Airport and surrounding region. It is strategically significant in supporting international travel, tourism and commercial activity. With design and planning for the upgrade already in progress funding must be made available to advance the project to its next stage.

The EU have launched a plan for competitiveness and decarbonisation The CID aims to outline concrete actions to turn decarbonisation into a driver of growth for European industries, including lowering energy prices, creating quality jobs and the right conditions for companies to thrive

To support the CID, the EU launched the Clean Industrial Deal State Aid Framework (CISAF) to enable member states to push forward the development of clean energy, industrial decarbonisation and clean technology. The framework is in place until December 2030 and simplifies state aid rules in five main areas:

The roll-out of renewable energy and lowcarbon fuels

Temporary electricity price relief for energyintensive users to ensure the transition to lowcost clean electricity

Decarbonisation of existing production facilities

The development of clean tech manufacturing capacity in the EU

The de-risking of investments in clean energy, decarbonisation, clean tech, energy infrastructure projects and projects supporting the circular economy

Carbon Intensity Labels: The CID prioritises building a business case for decarbonised products

The proposed Industrial Decarbonisation Accelerator Act will introduce resilience and sustainability criteria, including a voluntary carbon intensity label for industrial products

Affordable Energy: Through CID, in the short term, member states are encouraged to cut electricity taxes, including removing levies used to fund nonenergy initiatives. The Commission will issue guidance on reducing electricity taxation costeffectively.

Financing: The CID aims to mobilise public and private capital, the CID proposes capitalising the Industrial Development Bank up to €100 billion, enable an EU competitiveness fund for clean tech, infrastructure and industrial decarbonisation and a Tech EU programme to close the financing gap for innovative clean tech and energy storage

Accompanying this are recommendations from the EU for member states to accelerate depreciation for clean tech assets and tax credits for strategic clean transition sector

Ultimately, the CISAF allows for state aid across a wide array of decarbonisation technologies such as electrification, hydrogen, biomass, carbon capture utilisation and storage Most importantly, CISAF allows for more support for projects in less advantaged regions, making the Shannon Estuary and ideal place for investment.

Budget 2026 is a prime opportunity for Government to begin to plan to utilise both the CID and CISAF to ensure adequate investment across businesses and the production of energy to not only ensure we decarbonise businesses and remain attractive.

The utilisation of CID and CISAF will allow Ireland to avoid financial penalties, reported to range between €8 billion to €28 billion, because of its failure to meet climate targets.

Enabling the transition to a low-carbon economy requires targeted investment in strategic infrastructure. Budget 2026 must prioritise support for offshore renewable energy, with a focus on timely delivery of the Designated Marine Area Plan (DMAP) and grid-ready Tier 1 ports like Shannon Foynes These ports are essential to unlocking offshore wind capacity and reducing emissions from supply chains Support for biomethane is also critical by scaling production, grid access, and incentives, Ireland can decarbonise heat and transport while supporting rural economies. To meet climate targets and seize emerging industrial opportunities, Budget 2026 must align infrastructure, planning, and energy investment with the net-zero transition. Of course, there is also the financial incentive to invest now, rather than paying hefty financial penalties, reported to be between €8 billion and €28 billion, later

Budget 2026 must prioritise sustained capital investment in Shannon Foynes Port and its enabling infrastructure such as the N21/N69 Limerick to Foynes Road Scheme to support Ireland’s offshore renewable energy (ORE) ambitions, strengthen national trade capacity, and advance the Climate Action Plan Shannon Foynes Port is uniquely positioned to become a hub for offshore wind development due to its deepwater access, proximity to world-class Atlantic wind resources, and strategic plans for expanded unitised shipping services As a Tier 1 Port of National Significance and part of the EU TEN-T Core Network, the Port is essential to achieving national economic and climate targets.

Timely investment in port infrastructure including deepwater berths, marshalling yards, and hinterland connectivity is critical to accommodate ORE activity, attract investment, and deliver long-term competitiveness. Delays risk jeopardising both climate goals and national logistics resilience, as outlined in the 2023 Irish Port Capacity Study. Aligning with Vision 2041 and the Shannon Integrated Framework Plan, this investment will unlock the full potential of the Shannon Estuary as a Strategic Development Zone, drive regional job creation, and ensure Ireland remains globally competitive in the emerging green energy economy

Budget 2026 must allocate dedicated funding estimated at €50 million to ensure the timely delivery of the Designated Marine Area Plan (DMAP) by 2027, and to support the assessment and planning of critical onshore infrastructure, particularly deepwater ports and grid connectivity at locations like Shannon Foynes

The DMAP is a cornerstone of Ireland’s offshore renewable energy (ORE) strategy Delivering it on schedule is essential for meeting national targets for energy security, decarbonisation, and economic competitiveness However, offshore planning cannot succeed in isolation It must be integrated with parallel investment in essential onshore assets such as marshalling areas, grid infrastructure, and sheltered deepwater access.

Shannon Foynes Port, as a Tier 1 Port and part of the TEN-T Core Network, is well-positioned to serve as a national ORE hub. Yet current uncertainty over future Ports Policy and the absence of detailed funding mechanisms in the National Development Plan (NDP) puts timely delivery at risk. Key current measures for Budget 2026 should include:

Secure a ring-fenced budget for DMAP delivery, including onshore infrastructure assessments.

Define location-specific investment pathways for ORE-aligned port development

Recognise floating wind as a proven and deployable technology, consistent with international best practice

Budget 2026 must deploy the current and capital funding required to bring Ireland in line with EU energy policy, particularly focusing on REPower EU and the use of biomethane and Liquefied Natural Gas (LNG) RePowerEU was launched in response to the energy market disruption caused by the invasion of Ukraine The purpose of the plan was to provide energy savings, diversification of energy supplies, and accelerate the roll-out of renewable energy As part of the plan the EU worked with international partners to secure record levels of LNG Combined with this the EU taxonomy designated anaerobic digestion and the integration of biomethane into gas grids as sustainable activities, while designating LNG as a sustainable transitionary fuel Ultimately, within an EU sense both fuel sources are labelled lower carbon alternatives. With regards to the implementation of both these fuel sources, Ireland is lagging behind European counterparts.

Under the National Biomethane Strategy, Government has committed to supporting the delivery of up to 5.7 TWh of indigenously produced biomethane by 2030. Meanwhile, the policy environment is playing catch-up for the implementation of a hydrogen ready LNG plant, despite a private operator willing and able to bring it forward, we urge Government to adopt and align to the EU approach to LNG.

The Assessment of Costs and Benefits of Biogas and Biomethane (2017) study produced by the SEAI highlights the huge benefit of wide adoption of biogas and biomethane in Ireland predominantly through renewable energy production and carbon reduction The study further highlights that the utilisation of food wastes, waste from food processing and animal wastes in anaerobic digestion would deliver a net benefit to society, but that such plants may require financial support and / or policies put in place to remove non-financial barriers to encourage the development of such plants.

Lastly, considering inputs to biogas production, the study highlights that use of grass silage for biogas production would substantially increase biogas production beyond that which can be achieved by anaerobic digestion of waste, and is essential if the full potential of AD and the carbon savings it can deliver are to be achieved

A more recent report by Gas Networks Ireland (GNI), the Biomethane Energy Report (2023), suggests that Ireland has the potential for 14.8TWh of biomethane production per annum potentially removing 3.94 million tones of carbon dioxide. In this report GNI provide a county-by-county breakdown of the request for information process by biomethane production, this outlined that Limerick was capable of producing 14% of national biomethane output, making it the potentially third largest county by output. Therefore, along with the other energy projects potential in Limerick, there is large potential for biogas & biomethane clustering. However, some of the challenges that need to be removed to adequately grow the industry is lack of technical knowledge amongst some potential providers, lack of awareness amongst the public, lack of financial mechanisms, well developed sectors in other EU countries detracting investment from Ireland, need for landbanking for larger sites or in densely populated areas

Budget 2026 must begin to implement the National Biomethane Strategy and remove these barriers

Budget 2026 should allocate dedicated funding and regulatory support to ensure that Local Development Plans (LDPs) and Climate Action Plans (CAPs) are fully aligned with national climate and renewable energy targets Local planning must not be a bottleneck to achieving climate targets Ensuring alignment, capacity, and forward planning at local level is essential to accelerating renewable energy deployment and unlocking regional economic benefits.

Mandate zoning of adequate lands within LDPs and CAPs to meet renewable energy deployment targets, ensuring timely delivery of national policy objectives.

Integrate forward-looking grid and infrastructure planning into all local plans to support the connection of low-carbon electricity generation and large energy users. Prioritise the repowering and life-extension of existing wind assets, recognising their importance in meeting near-term decarbonisation targets

Fund specialist planning capacity in Local Authorities, ensuring dedicated teams with the technical expertise to assess and support renewable energy developments as the sector scales and evolves

Strengthen and modernize Ireland’s grid infrastructure under Price Review 6 (PR6) through early-stage, front-loaded investment to support the country’s growing renewable energy capacity. Proactive grid enhancements are essential to unlocking the full potential of clean energy sources. These upgrades must be scaled to accommodate projected increases in demand driven by population growth and expanding industrial needs. By boosting the grid’s capacity and resilience, we can ensure the efficient integration and transmission of renewable energy, enabling Ireland to fully realize the benefits of a sustainable energy future.

Budget 2026 must do more to support the transition of businesses to less carbon heavy operations

Allow for full corporate tax write off of the cost of assets acquired for green energy development purposes

Remove the requirement in the existing regime that assets are registered with the SEAI in order to avail of 100% deduction on assets viewed as "energy efficient " as this is cumbersome and the acquiring company is dependent on the seller having registered the asset. Furthermore, the relief should be extended until at least 2030 to enhance confidence in decision making in this area, it is currently due to expire at the end of 2025.

Introduce tax incentives or a grant program for companies seeking to supply the renewable energy, particularly offshore wind and biomethane, and retrofit sectors allowing them to upskill employees.

The reduced rate of benefit in kind on electric vehicles is due to expire at end 2027 but should also be extended to 2030.

A reduction in the rate of VAT applying to bikes and e-bikes, to encourage more take up of active travel

A higher rate of R&D tax credit for research activities specifically geared at renewable energy generation and supporting businesses should be implemented With a suitable targeted approach, this enhanced credit could be at a 50% level, strongly incentivising and supporting such activities