The LiFT Institute at Southeastern University exists to equip individuals and families with the tools they need to thrive financially, professionally, and personally. Rooted in biblical values and committed to community transformation, the Institute empowers people through practical financial literacy and leadership development.

Our mission is to foster sustainable growth, informed stewardship, and meaningful collaboration by meeting learners right where they are from the earliest grades through adulthood. Through our four pillars Financial Stewardship, Workforce Development,

Nonprofit Sustainability, and Organizational Excellence we provide programs that build confidence, character, and capability

This curriculum reflects our belief that it’s never too early to learn wise money habits and that every child has the potential to be a faithful steward By combining age-appropriate lessons with real-world application and biblical truth, we aim to lay the foundation for a future marked by financial responsibility, generosity, and purpose.

Welcome to the journey!

Objectives:

Students will be able to demonstrate that money comes from working Students will be able to demonstrate the difference between needs and wants.

Students will be able to apply that knowledge to use their money for God’s glory.

Students will be able to define integrity.

But Jesus looked at them and said, “With man this is impossible, but with God all things are possible.” (Matthew 19:26)

Money

Work

Integrity

Something generally accepted as a medium of exchange for good or services

To perform work or fulfill duties regularly for wages or salary.

Doing the right thing, even when no one is watching by being honest and making good choices.

Saving

Putting some of your money away so you can use it later.

Needs

Wants

Things we must have to survive, like food, water, and a place to live.

Things we would like to have, but we don’t need them to live, like eating out, candy or shopping

Home Connection Sheets - to be printed (pg. 132)

** Digital Links available at www.liftinstitute.org/digitalresources **

Facilitator Guide

Student Workbooks

Pencils

Easel w/Chart Paper

Markers (for Easel)

Bible

Home Connection Sheets - Week 1

Dear God, thank You for giving us everything we need Help us learn how to be wise, share what we have, and take care of the money You give us Teach us to be thankful and to trust You with all we have We love You and want to honor You in all we do Amen.

But Jesus looked at them and said, “With man this is impossible, but with God all things are possible” (Matthew 19:26)

1.

Introduce Yourself! (5-Minutes)

As students arrive, greet them and invite them to take a seat

Once everyone is settled, begin with a friendly introduction. Share a bit about who you are your name, what you do for work or in a volunteer role, and what led you to be part of this class

Then, briefly tell them about your faith journey and how your relationship with God has shaped the way you view and manage money. Consider sharing a personal story or example of how you’ve learned to use your finances to honor God and serve others.

Let your introduction set the tone for the class: open, encouraging, and grounded in biblical principles.

2.

Play music and have students walk around the room until the music stops. Whoever they are standing closest to they will pair up with

Ask: Share one fun fact about yourself!

Students will take turns telling each other something about themselves. Let them share. Once they finish sharing, play music and mix around the room again When the music stops, students should pair with a DIFFERENT partner and share another fun fact Have them do this a total of three times. Be sure to tell them not to go to the same person more than once.

Once you come back together, have some volunteers share a name of someone they met and one thing they learned about them

Pass out the Where Does Money Come From? Worksheet. Give students a few minutes to write down some answers.

Ask the question: Where does money come from? Write down their answers on chart paper Have an open discussion about their answers.

Now, explain: Money comes from working! In order to have money and have our needs met we must work.

Read 2 Thessalonians 3:6-12 and discuss:

In the name of the Lord Jesus Christ, we command you, brothers and sisters, to keep away from every believer who is idle and disruptive and does not live according to the teaching you received from us For you yourselves know how you ought to follow our example. We were not idle when we were with you, nor did we eat anyone’s food without paying for it. On the contrary, we worked night and day, laboring and toiling so that we would not be a burden to any of you. We did this, not because we do not have the right to such help, but in order to offer ourselves as a model for you to imitate For even when we were with you, we gave you this rule: “The one who is unwilling to work shall not eat.” We hear that some among you are idle and disruptive. They are not busy; they are busybodies. Such people we command and urge in the Lord Jesus Christ to settle down and earn the food they eat (2 Thessalonians 3:6-12)

The Bible is divided into two main parts: the Old Testament and the New Testament. Each book within the Bible was written by different authors, inspired by God, and directed toward a specific audience with a particular message or purpose. While the Bible can sometimes feel overwhelming or confusing, it is filled with powerful stories, timeless truths, and practical wisdom. Through it, we can learn more about who God is and how to live in a way that honors Him in our daily lives even in how we manage money.

Ask: What are your thoughts about what these verses from Thessalonians mean?

Ask: What are your thoughts on working?

Allow students to answer

The Apostle Paul wrote to the Thessalonians—a group of believers in the city of Thessalonica, located in Greece. In these verses, Paul was encouraging them about the importance of work. He reminded them not to place the burden of responsibility on others while expecting to receive what they needed or wanted. Instead, they were called to contribute and work together.

This applies to us too: if we want to earn money, we need to work for it. We can’t depend on our parents, siblings, or others forever. God has given us the ability to work—and that ability is a blessing!

Have students write down what their goals are for their future in their Student Workbooks; what they would like to do after they graduate and what job they are interested in.

Play music and have students walk around the room until the music stops Whoever they are standing closest to they will pair up with.

Ask: What is your dream car?

Play music and mix around the room again between each question When the music stops, students should pair with a DIFFERENT partner answer the next question.

Ask: What is your favorite restaurant?

Ask: What kind of house do you want to live in one day?

Ask: What is your favorite pair of sneakers?

Bring students back together Have students use their phones or you can display your computer on the SmartBoard or use your computer to Google the cost of the following items: BMW, Audi

Trending Sneakers: Hoka, Reebok, Nike

Trending jeans: 7 For All Mankind, Levi’s, Arie Students will know this better than you. You could take their answers over the ones listed above.

Ask: Are these cars, sneakers or clothes a need or a want?

Though the brand name items are nice, they aren’t a necessity. How can we spend less on these items? Let’s brainstorm some cost-effective items.

Go over some items or different brands of these items that they could save money on

On Chart paper, write out the definition of needs and wants. Explain that needs are what is essential for us to survive, while wants aren’t necessary for our daily lives.

Just like we talked about cars or clothing brands, you don’t need the most expensive item! You may need transportation, but you don’t need the newest car. You need clothes, but don’t need the name brand or priciest items.

Have students go online and plan a dinner menu for one week, using a total food budget of $100. The goal is to spend as little as possible while still creating a full week's worth of dinners. Encourage students to be creative and think about how to stretch their ingredients across multiple meals At the end, compare plans and see who was able to create the most costeffective and balanced menu within the budget!

It is important to look at prices as you shop. You need to feed yourself on a budget and practice patience and self control.

But the fruit of the Spirit is love, joy, peace, patience, kindness, goodness, faithfulness, gentleness, self-control; against such things there is no law. (Galatians 5:22-23) 22 23

Come back together and have each student share what meals they planned for the week

Ask: Did you find coupons from any stores?

Ask: How did you budget?

Ask: What favorite meals did you plan?

Ask: Did anyone have money leftover?

Once done with the discussion, talk about the importance of community with your students.

Be in community! Why? Because you can share meals, recipes, clothes and rides. Plus, you can do life together! We were meant to live this way and help each other. Just being here and sharing how we used our money is being in community.

Here are a couple of Bible verses that remind us of the importance of community:

Therefore encourage one another and build each other up, just as in fact you are doing. (1 Thessalonians 5:11)

9 12

Two are better than one, because they have a good return for their labor Though one may be overpowered, two can defend themselves A cord of three strands is not quickly broken.

(Ecclesiastes 4: 9,12)

As iron sharpens iron, so one person sharpens another. (Proverbs 27:17)

On chart paper have students brainstorm free or inexpensive ways to enjoy entertainment. We need to enjoy our friends, but it doesn’t have to cost money. Decide what is a need and what is a want.

Ask: How can we build community and help each other?

Example: You don’t need to go to the movies this week Movies are expensive. How can you enjoy some free time (and you should enjoy some down/free time) without spending lots of money?

Talk to the students about the importance of having our money lined up with God and His Word to the students.

We are called to practice patience and self-control—especially when it comes to spending money. These are not always easy to do, but God can help us. The Bible tells us to ask, and we will receive when what we ask for lines up with His will.

Ask and it will be given to you; seek and you will find; knock and the door will be opened to you (Matthew 7:7)

This doesn’t mean we can ask for anything—like money, fame, or things—and expect to get it. God is not like a genie. He wants us to have a relationship with Him first. When we’re close to Him, our desires start to match His desires. That includes how we handle our money and the choices we make with it.

God wants us to take care of the things He’s given us—including our finances. That means making wise choices, learning to say no to wants, and focusing on what we truly need.

As you read the following Bible verses, talk about how each one relates to making wise spending decisions

Ask: How do these verses help us choose between a need and a want?

If you believe, you will receive whatever you ask for in prayer (Matthew 21:22)

Jesus said this after performing a miracle, but it doesn’t mean we get everything we ask for. If we truly believe and trust God, we will start asking for what honors Him not just what we want. Even then, God sometimes says “no” or “not yet.”

For the word of God is alive and active Sharper than any doubleedged sword, it penetrates even to dividing soul and spirit, joints and marrow; it judges the thoughts and attitudes of the heart.

(Hebrews 4:12)

God’s Word helps us see what’s really going on in our hearts. It can guide us when we’re not sure if we’re making a wise decision or just following a selfish desire.

If any of you lacks wisdom, you should ask God, who gives generously to all without finding fault, and it will be given to you.

(James 1:5)

When you’re unsure about a decision like whether to buy something ask God for wisdom. He promises to help!

Ask: This week, how can we be more thoughtful about our spending?

Ask: What are some ways we can pause and ask ourselves, “Is this a need or a want?” before making a purchase?

Dear God, Thank You for giving us everything we have, including our money. Help us use it in ways that make You happy like helping others, saving for what we need, and giving back to You. Teach us to be wise and thankful with every penny We want to use our money to show love and make good choices Amen

To keep students learning before the next class, have them talk about the importance of being intentional with the curriculum at home and on their own.

We all have habits some good, some not so good! One way to build better habits is by continuing to learn and practice them at home.

This week, when you’re about to spend money, let’s take a moment to pause and pray. Ask God, “Do I really need this or do I just want it?”

If you realize it’s just a want, ask God to help you practice self-control Instead of focusing on what you don’t have, take time to thank God for what you do have Gratitude helps us stay content and avoid spending just to feel better

Next week, we’ll talk about a time you were tempted to buy something and the outcome of that scenario. Be ready to share your story!

Objectives:

Students will be able to demonstrate their knowledge of how to wisely use their money

But Jesus looked at them and said, “With man this is impossible, but with God all things are possible.” (Matthew 19:26)

Spender

Someone who pursues the greatest possible present consumption, even if mindful of the need to save some.

Saver

Servant

Strives to limit consumption to some extent, focusing instead on increased wealth accumulation.

Orients their life around limiting both consumption and wealth-building, focusing instead on giving the most money they can toward blessing other people

Jesus’ Perspective on Wealth by the Bible Project Video (pg. 117)

Money Uses Chart (pg. 120)

Game of Life Presentation (only available digitally)

Home Connection Sheets - to be printed (pg. 133)

** Digital Links available at www.liftinstitute.org/digitalresources

Facilitator Guide

Student Workbooks

Pencils

Easel w/Chart Paper

Markers (for Easel)

Bible

Envelopes

Play Money ($100 per group)

Home Connection Sheets - Week 2

References

Book - God and Money by John Cortines and Gregory Baumer

Dear God, thank you for showing us You are with us Help us to learn to manage our money wisely When we fail, thank You that You pick us back up to start again anew We love and honor You Amen.

But Jesus looked at them and said, “With man this is impossible, but with God all things are possible.” (Matthew 19:26)

Greet students as they come in and chat with them about their week.

Begin the lesson talking to them about their needs and wants over the past week.

Ask: Did learning about how needs and wants affect how you spent your money at least give you pause before you bought something?

Ask: Did you have a moment where you were tempted to buy something this week? What happened?

You can visit for a bit and let them share a bit about their week even if they don’t talk about money topics.

We want everything we do to be rooted in Christ Watch the video: Jesus’ Perspective on Wealth in 6 Minutes by the Bible Project. Afterwards, read the following verses and then discuss the video and following questions.

Do not lay up for yourselves treasures on earth, where moth and rust destroy and where thieves break in and steal, but lay up for yourselves treasures in heaven, where neither moth nor rust destroys and where thieves do not break in and steal. For where your treasure is, there your heart will be also. (Matthew 6:19-21)

Ask: What treasures do you have?

Ask: What do you consider treasure?

Ask: How can we take care of our treasure right now?

Talk to the students about the importance of evaluating our own hearts. Even though we may have treasures on earth, we can find our true treasure in Jesus! It is not bad to have treasures, but we shouldn’t have it all for our own selves. Everything we do should be for the Lord. We want to be good stewards of what He has given us.

Rather than using our money for selfish gain, let’s learn how to manage our money for God’s glory!

1.

Last week, we talked about where money comes from. Who can tell me where?

How will you use the money earned from your hard work?

On chart paper, draw this brainstorming map (Money Uses) Have students share all the things they can do with money. As they share, write their answers on the brainstorming map or chart paper.

Some examples to include if they don’t: Save it Give it Spend it

Think for a minute about how you feel and think about money. When you get money whether through work or as a gift, what do you want to do with it? What have you done with it?

Share your experience as the facilitator with money from an early age. This often shapes how you spend money as an adult.

On chart paper write the following questions: How does money make you feel? When you get a little bit of money what do you do with it? Do you think about your future with money?

Have students talk in groups. Come back together. Ask volunteers to share with the class.

2.

Let’s put some words to our thoughts about money.

In the book God and Money by John Cortines and Gregory Baumer they put people into three categories according to how to use their money: Spenders, Savers, and Servants

Write the following definitions for each on chart paper: Spender: represented by most people in the Western world, is someone who pursues the greatest possible present consumption, even if mindful of the need to save some Saver: strives to limit consumption to some extent, focusing instead on increased wealth accumulation. Servant: orients their life around limiting both consumption and wealth-building, focusing instead on giving the most money they can toward blessing other people

As we look at these three thoughts about money, which do you want to be? Let’s talk about it. What is your “money mindset”?

Have a discussion with students about what this means and where they think they are

Have students pull out their goal from last week. When we think of being a person that uses our money for God’s glory, which do you think demonstrates that life?

Ask: Is saving your money a bad thing?

Ask: Is spending your money a bad thing?

The answer to both is no, but spending and saving in excess is not what God asks us to do. If we spend it all we can’t give. If we save it all we can’t give.

Use the Game of Life Presentation to facilitate this activity

Give students three envelopes, labeling them: Give, Save, and Spend

Students will start out with $100 They are to choose what to do with the money after each given scenario and put the money in the envelope chosen. They can’t open the envelope once chosen. Whoever has the most money at the end saved wins.

Ask: How has this lesson caused you to think differently about money?

Ask: Does evaluating how you are with money feel difficult? In what way?

Ask: Does managing money feel possible? How?

Dear God, Thank You for giving us everything we have, including our money Help us use it in ways that make You happy like helping others, saving for what we need, and giving back to You. Teach us to be wise and thankful with every penny. We want to use our money to show love and make good choices. Amen.

To keep students learning before the next class, have them talk about the importance of being intentional with the curriculum at home and on their own

We all have habits some good, some not so good! One way to build better habits is by continuing to learn and practice them at home.

Think about the relationship you want to have with money as a Spender, Saver or Servant. This week, when you’re about to spend money, take a moment to pause and pray. Ask God, “Do I really need this or do I just want it?”

If you realize it’s just a want, ask God to help you practice self-control. Instead of focusing on what you don’t have, take time to thank God for what you do have. Gratitude helps us stay content and avoid spending just to feel better

Objectives:

Students will be able to demonstrate how to create a monthly budget

But Jesus looked at them and said, “With man this is impossible, but with God all things are possible.” (Matthew 19:26)

Budget

Someone who pursues the greatest possible present consumption, even if mindful of the need to save some.

Need

A physiological or psychological requirement for the well-being of an organism (food, clothing, shelter)

Want

Income

Have a desire to possess or do (something); wish for. (not necessary to life)

Money received, especially on a regular basis, for work or through investments.

Expense

The cost required for something; the money spent on something.

Budget Worksheet (pg. 121)

Home Connection Sheets - to be printed (pg. 134)

** Digital Links available at www.liftinstitute.org/digitalresources **

Facilitator Guide

Student Workbooks

Pencils

Easel w/Chart Paper

Markers (for Easel)

Bible

Home Connection Sheets - Week 3

Dear God, thank you for your guidance as we learn how to manage our finances Help us to have patience and self control as we take one step closer to our savings goals We thank you for your help We love and honor You Amen

But Jesus looked at them and said, “With man this is impossible, but with God all things are possible” (Matthew 19:26)

Greet students as they come in and chat with them about their week.

You can begin the lesson talking to them if they thought this past week about spending their money wisely.

Ask: Did you think about spending money? If so, what happened?

Ask: How can we continue to be intentional about spending wisely and thinking before spending?

You can visit for a bit and let them share a bit about their week even if they don’t talk about money topics.

No matter what we do, we want everything we do to point us back to Jesus, even planning for the future Read the following verse to the group.

The plans of the diligent lead to profit as surely as haste leads to poverty. (Proverbs 21:5)

Ask: What plans do you have for your future?

Ask: Do your plans line up with what God has planned for you?

Ask: How can we plan our finances and also trust in God?

Talk to the group about a time where you planned your life one way but God had another plan. Remind them that we can trust in God always!

It can be tempting to go from one extreme to another, from planning everything on our own to being indifferent with what happens. It’s important to remember that God has entrusted us with what we have, while also wanting us to trust and follow Him. He doesn’t want us to do everything on our own.

Let’s remind ourselves that we can participate and trust God with all that He has given us, including our money.

1.

Start by asking students: What is a budget? Discuss answers with the group.

A budget is like your financial Bible a guide that helps you make wise decisions with your money. Without a budget, it’s nearly impossible to manage your finances well. To make your money work for you, you first have to look at what you have and create a plan.

The goal is for YOU to control your money not let your money control you! Budgets aren’t meant to be rigid—they're fluid, because life changes. But they should be responsibly fluid, not recklessly flexible. That means adjusting when necessary, while still making thoughtful, wise choices.

Walk through developing a budget with your students with the following steps:

Start from the top: I make $1000 a month, so I add $1,000 to start. Then, I will subtract cost for each monthly bill or regular expense.

Have students give suggestions about what else they can spend their money Take brainstorming notes on chart paper Be sure to remind students to consider which expenses are needs and which expenses are wants.

Display this Budget Worksheet on chart paper or the SmartBoard. Walk them through the following salary and monthly expenses They will fill in their paper budget

Give a fictional annual salary of $39,000

Make sure they know that taxes are taken out of their salaries.

On a $39,000 salary the following will be taken out:

$2900 for social security and medicare tax

$2500 federal income tax

You are left with $33,600 for the year That gives you $2,800 a month to spend The dollar amount you are working with for your budget today is $2,800.

Using the budget worksheet, students will independently fill in what they have to start with and list items they think they will need to spend on a monthly basis

Come back together and check their work on your chart or SmartBoard.

You can give a sample of how you would do it below:

Pay yourself first Put money in savings: $100 a month

Electricity: $260

Gas: $240

Car payment: $250

Rent: $900

Groceries: $500

Water: $100

Giving: $50

$400 leftover for emergencies and anticipating future problems ( i.e. car repairs and maintenance that *should* be $50).

You are left with $400. How do you wisely spend the money left over? Have a class discussion about how you should spend the remaining money or savings.

You will have other expenses that are not accounted for in your budget or unforeseen expenses. You will not be able to save the entire amount. You can’t just spend it because you have it. This is where we pray about what God would have us do with it and how to spend or save it wisely.

Thinking back to what your money mindset is. What would the servant do and how would a servant use this money for God’s glory?

Remember that you can do all things through Christ. It will be very hard not to spend the leftover $400 that you see in your account. Pray for strength, patience, and self control. You are not alone! God is with you every step of the way. Everything He calls you to He will help you accomplish.

Reflection 1.

Ask: Why is it important to create a budget for your money?

Ask: How can using a budget help you make wise choices with what God has given you?

Ask: Does managing money feel possible? How?

Dear God, Thank You for teaching us how to plan our money with a budget. Help us to make wise choices, remember our needs, and honor You with everything You’ve given us. When it feels hard, remind us that with You, all things are possible Thank You for being with us and helping us every step of the way Amen.

Students should complete research a career to determine the average income. They will then use the average income to complete the Budget Worksheet.

Upon determining their career they need to research rent/mortgage payments, estimated electric and water bills. They will need to find a car that they would like to purchase and how much the monthly payment would be.

Electricity: Gas: Car payment:

Mortgage/Rent:

Groceries: Water: Giving:

The Budget Worksheet can be found in their Student Workbooks on pg. 31. If they are not taking Student Workbooks home, you can print a copy of the Budget Worksheet (Found in Teacher Reor email students a copy.

Objectives:

Students will demonstrate how to save their money and honor God doing it

Students will demonstrate how to honor God with their spending, saving, and giving.

But Jesus looked at them and said, “With man this is impossible, but with God all things are possible.” (Matthew 19:26)

Habit

Savings

Investment

An acquired mode of behavior that has become nearly or completely involuntary

Money put by the excess of income over consumption expenditures

The action or process of investing money for profit or material result

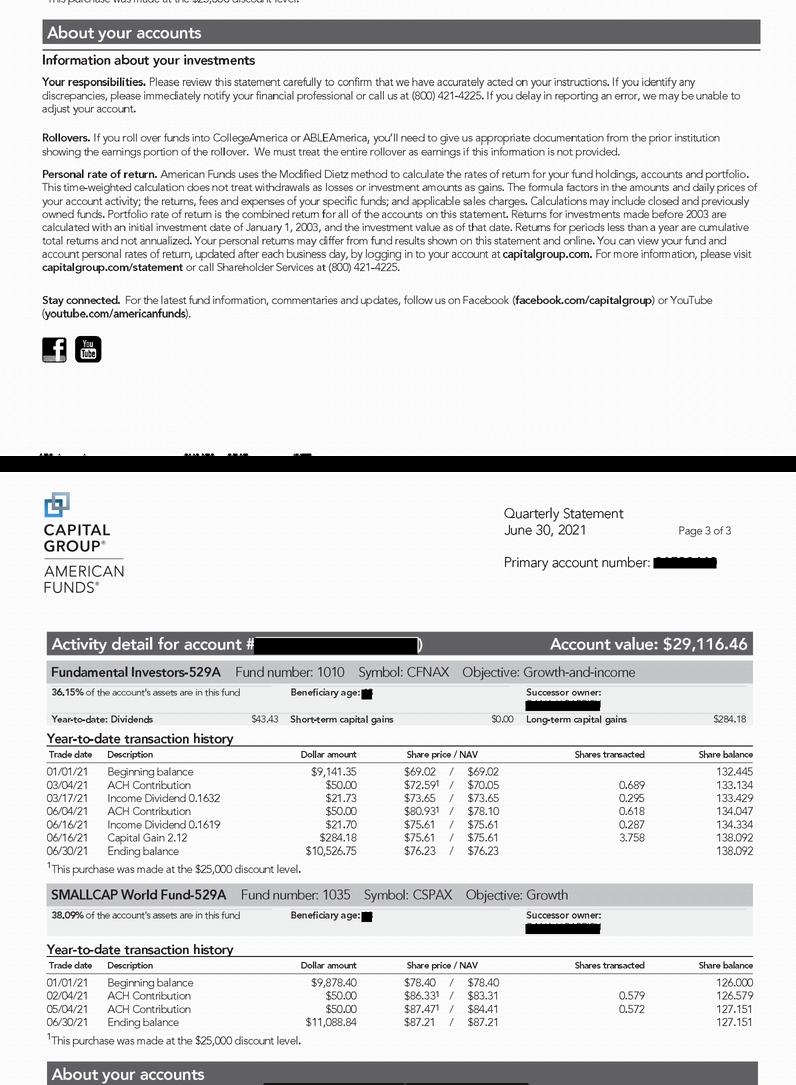

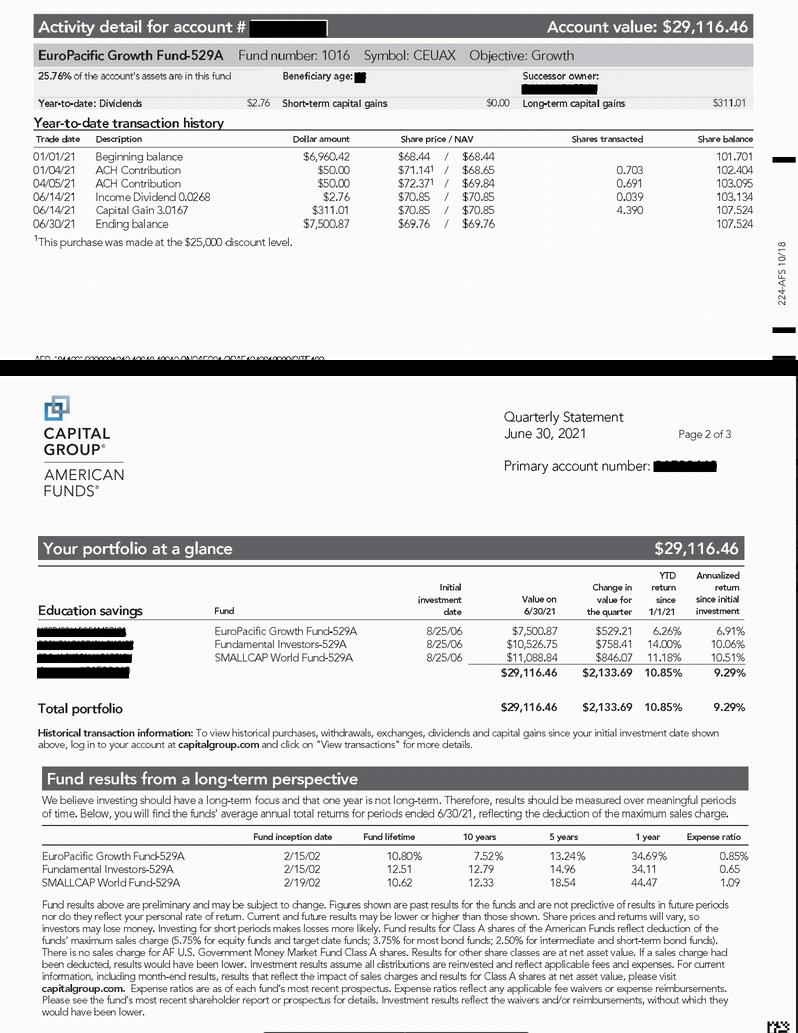

529 Plan

Also called a Qualified Tuition Program, is a tax-advantaged investment vehicle in the United States designed to encourage saving for the future higher education expenses of a designated beneficiary.

Savings Goals Worksheet (pg. 122)

Investment Calculator (pg. 119)

529 Plan Example (pg. 123)

Home Connection Sheets - to be printed (pg. 135)

** Digital Links available at www.liftinstitute.org/digitalresources **

Facilitator Guide

Student Workbooks

Pencils

Easel w/Chart Paper

Markers (for Easel)

Bible

Home Connection Sheets - Week 4

Article - Breaking and creating habits on the working floor: A field-experiment on the power of Implementation Intentions by Holland, Aarts, and Langendam

Dear God, Thank You for the chance to learn more about how to use money in a way that honors You Today, help us understand how saving can be a smart way to manage what You’ve given us Teach us to be wise with our spending, faithful in our giving, and intentional with our saving Show us how to honor You in every financial decision we make. Amen.

But Jesus looked at them and said, “With man this is impossible, but with God all things are possible” (Matthew 19:26)

After students arrive, take some time to have volunteers share what they found in researching Florida averages for mortgage/rent and utilities

Ask: What were you surprised to learn?

Ask: Do you see a need to save and spend wisely?

No matter what we do, we want everything we do to point us back to Jesus, even planning for the future Read the following verse to the group.

I have fought the good fight, I have finished the race, I have kept the faith. (2 Timothy 4:7)

You want to keep the faith. Fight for savings and finish strong. You CAN do anything with God’s help. He can provide you with the persistence and self control that you need. A growing faith in God changes your desires into his desires for your life.

7 8

Ask, and it will be given to you; seek, and you will find; knock, and it will be opened to you For everyone who asks receives, and the one who seeks finds, and to the one who knocks it will be opened. (Matthew 7:7-8)

Have a volunteer read the two verses. Have a class discussion about what they think this verses means Be sure to guide the discussion

As our faith in Christ grows, we ask God to change our hearts for his glory. Our desires become his desires. Remember Matthew 7:7!

1.

Think about a habit you have in your life. Could be a good habit or a bad habit

Do you bite your nails?

Do you clear your throat?

Do you eat comfort food when you are sad or anxious?

Do you make up your bed when you wake up?

Do you put your plate in the dishwasher when you are finished?

Think of habits in your life and share. Saving your money each month has to become a habit. It has to be something you do each month.

Read the following paragraph from the article Breaking and creating habits on the working floor: A field-experiment on the power of Implementation Intentions on creating habits.

“conscious planning. Strikingly resembling habitual processes, recent studies have shown that after forming an implementation intention, a goal-directed behavior becomes strongly linked to situational cues and becomes automatically activated because of these situational cues. The processes underlying effects of planning suggest that the formation of implementation intentions may be a strong tool in order to break habitual behavior and create new habits” (Holland et al, 2006)

First, let’s commit to creating healthy saving habits. We have to be focused and intentional about saving. It has to be a plan. It will not just happen. Save on purpose!! People in your life may not understand what you are trying to do. Stay committed and stay the course.

Have students break into small groups of four or less and brainstorm how they can make personal, intentional and purposeful habits to save and change their behaviors They should include accountability partners in their lives

Using chart paper come back together and share their ideas with the whole group.

Have students write down their personal goals for achieving healthy, intentional habits

When you know things are going to happen you need to plan for them.

For example, saving for Christmas. It comes each year and we will have an account specifically for Christmas This keeps you from putting Christmas on a credit card and accumulating debt

Saving for emergencies, things we don’t know will happen. Emergencies do happen even if we don’t know what they will be. It could be a medical emergency, an emergency with your car, or even the air conditioner with your house

Set the tone for yourself. We are making ourselves do something. Putting action behind our words.

So, How do we Save?

We made a budget, included in that budget was paying yourself or putting money into savings.

1.

Give the students a scenario where they are saving for Christmas. They need to decide right how much they would like to have in their Christmas account by December. They will need to figure out how much they will need to save each month to accomplish that goal with their “salary” in mind

Pass out the Savings Goals worksheet. In each box the students should include how much money they would like to have in the Christmas savings account at the end of the year. They will use the budget they did last week with $39,000 and the amount left to be placed in savings

After this activity they may see that they have to put less in their Christmas account. This is where patience, self control and perseverance come into play.

Ask students to get into groups of three and discuss what they will do if they can’t save the expected amount for Christmas. They should commit today to not putting anything on a credit card. To decide today to have less at Christmas remembering that Christmas is about much more than what they can get. They may realize at this time that they don’t have enough money to save for Christmas and pay their bills What should they do?

On chart paper: Have a class discussion about what they can do to start saving.

Things might include:

Selling your car and buying a cheaper car

Turning the a/c off during the day to save energy and lower electric bill

Carpooling to work or school to save on gas Plan weekly meals and make a list before going grocery shopping

Make cheap meals that last

Ask: What can you give up to to build your savings?

Allow students to brainstorm ideas together.

Once you have a healthy savings account you can begin thinking about investments.

Investment Calculator (Found in Teacher Resources pg. 119)

529 Plan (Found in Teacher Resources pg. 123) show students the 529 Plan as a real world example of what an investment looks like

Have students sign the Commitment to Save Contract in their Student Workbooks, committing to sticking to their budget with the goal of saving so that they can be servants with their money NOT servants TO their money

We are learning that to be happy we don’t need things. We have to trust that God will provide us with what we need like he provided mana to the Israelites. We don’t have to live like we have to buy it today because we might not be able to tomorrow. Trust God will provide. There will always be something to buy, but we have to be intentional about saving.

But the fruit of the Spirit is love, joy, peace, patience, kindness, goodness, faithfulness, gentleness, self-control; against such things there is no law (Galatians 5:22-23)

When you invest YOU are the equivalent of the lender because it is working for you and you aren’t having to do anything. This is where real wealth is made.

Ask: How can saving money help you honor God and make wise choices for the future?

Ask: What are some ways you can start saving now, even with a small amount of money?

Ask: Why is it important to have a plan for your money instead of just spending it right away?

Prayer 2.

Dear God, Thank You for teaching us how to be wise with the money You’ve given us. Help us to remember that saving is a way we can honor You and prepare for the future. Give us the selfcontrol to save, the generosity to give, and the wisdom to spend in a way that reflects Your love. Thank You for always guiding us and providing for us Amen

As you go through your week take time each day to connect with God asking Him to help you on your saving journey. Ask God to show you what you need to surrender and how you can be obedient to His will and not your own.

It would also be helpful to research some ways to be an intentional saver. We will share next week.

Objectives:

Students will demonstrate an understanding of creating a budget

Students will demonstrate an understanding of a rainy day savings account/emergency fund by creating this emergency fund.

Students will demonstrate the need for a rainy day fund.

But Jesus looked at them and said, “With man this is impossible, but with God all things are possible.” (Matthew 19:26)

Delayed Gratification

Emergency

The ability to resist temptation of an immediate reward in favor for a longer lasting reward

A serious, unexpected, and often dangerous situation requiring immediate action.

Emergency Fund

Money saved for later in case of an unexpected expenses or financial emergency

Growth Mindset

A mindset that sees opportunities for growth and to learn

Fixed Mindset

A mindset that is stuck, is afraid to fail and avoids problems

Growth Mindset vs. Fixed Mindset Video (pg. 117)

Home Connection Sheets - to be printed (pg. 136)

** Digital Links available at www.liftinstitute.org/digitalresources **

Facilitator Guide

Student Workbooks

Pencils

Easel w/Chart Paper

Markers (for Easel)

Bible

Home Connection Sheets - Week 5

Article - Don’t Expect Instant Gratification from Your ‘Quiet Time’ by Jen Wilkin (pg. 118)

Dear God, Thank You for always taking care of us and giving us what we need Today, help us learn how to be prepared for the unexpected by saving for a rainy day Teach us how to make a good budget and build an emergency fund so we can be wise with our money Help us to trust You and use what You’ve given us in ways that honor You Amen.

But Jesus looked at them and said, “With man this is impossible, but with God all things are possible” (Matthew 19:26)

When students arrive and get settled, talk about how their week has gone

Ask: Have there been areas you realized you spent money in places you didn’t need to, but wanted to?

Ask: Were there places you realized you shouldn’t have spent?

Ask: If you did not spend your own money, was there something that you asked a parent/guardian to purchase that you really did not need, but wanted?

As the facilitator, be honest with yourself and the group You sharing your struggle may be helpful to others who find sharing difficult. It is a helpful way to hold yourself accountable as well as others in the group.

Let’s start our session watching a video about a Growth Mindset vs a Fixed Mindset.

Break students into groups of 2-4 depending on your class size. Have them discuss the questions asked at the end of the video with their partner or group

Bring students back together.

Ask: How can you apply a growth mindset to saving?

Have a student from each group write their answer on the chart paper so that ideas can be shared and discussed.

Save for an emergency fund, and do not touch it unless you have prayed about it to determine if it is really an emergency

Ask: What constitutes an emergency in your daily life, when it comes to saving?

An emergency fund is planning for uncertainty. It is insurance or “just in case money” You would rather have it and not need it than

to need it and not have it.

Establish your emergency fund first You realistically want or need $1000 in your emergency fund. And, you should really have enough in your emergency fund for three to six months.

Ask: What are some things you would rather have and not need than need it and not have it?

On Chart paper write student responses. This can be a class discussion. Ask them if these are truly things they need and should save for or if there is anything listed they can do without.

Emergencies are unexpected. You don’t have a year to save for your emergency fund. You have to be radical to get there. You have to change your behavior. You can’t keep doing what you have been doing.

Ask: Other than saving your money each paycheck, how can you make money to fund your emergency fund?

Take student responses then follow up with this: Save $5 a day. That means when you pack your lunch you don’t go to lunch at McDonald’s or go to Starbucks/Dunkin for your coffee. Make your coffee at home. For 90 days you have to be radical! Cut out everything extra.

Have students write down things they can radically cut out each day to save $5 a day. What can they do without? There are a lot of things we can live without even if we don't WANT to live without them

Put your emergency fund in an account that is NOT attached to your checking account or easily accessible to you. It should not be easy to withdraw money from.

It is hard to save this and not touch it now, but it is beneficial to you in the long run. We live in a society of instant gratification, an ‘Amazon’ society. We want it and it is here the next day and sometimes even by the end of the day We need to delay gratification, which is the point of a rainy day fund! Delay your gratification today so that you will be taken care of later.

Ask: How does this (delaying gratification) follow God’s will for our lives?

Review the following quote from Jen Wilkin:

“One of the most common frustrations I hear is that, despite daily quiet times, Christians feel God is distant. And judging from the pervasiveness of Bible illiteracy in the church, our daily quiet times may not be yielding the formative effect we hope When we think of quiet time as transactional, we treat Scripture as a debit account that offers us meaning or feeling on our timetable. Each day we insert our debit cards and withdraw 15 minutes of inspiration. Instead, we should take a savings account perspective, where we make faithful deposits, investing ourselves over days and weeks and years without expecting immediate emotional or intellectual yield If we stick to a debit account approach, we will studiously avoid the parts of Scripture that take longer to understand, or we will misinterpret them to meet our wrong expectation that they serve our timetable. We will gravitate toward devotional reading over straightforward Bible

reading. By contrast, a savings account mentality understands how to wait It is steadfast and patient It knows faithful daily deposits will absolutely yield fruit in season. At just the right time. If you have ever walked through the valley of trial, you know what it is like to find years of faithful deposits bearing dividends. A patient, long-term approach is key. The Book of Ezekiel may not fix your day, but it may just sustain you in a lengthy trial if you give it your quiet times The formational profit of spending time in the Word is more likely to emerge over 15 years than 15 minutes Time in the Word is meant to be not merely informational or inspirational, but relational. It trains us to listen to the voice of God in his Word, and it teaches us who he is. It is God inviting us into conversation for the purpose of relationship.” (Don’t Expect Instant Gratification from Your ‘Quiet Time,’ nd)

After reading this quote, talk about how we live our lives for instant gratification. Instant gratification doesn’t help us save or build an emergency fund.

Have students discuss in small groups what emergencies could happen This may be something they have personally experienced or something they consider an emergency.

Ask: What do you want to save money for in an emergency?

On chart paper or a Smart Board write down student responses

We have talked about how to save our money through budgeting and ‘paying ourselves’ in our budgets. The reason we are saving is for emergencies or a rainy day.

Save for an emergency fund and do not touch it unless you have

prayed about it to determine if it is really an emergency.

Ask: What constitutes an emergency in your daily life, when it comes to saving?

Give examples of an emergency:

No running water in your house.

No electricity in your house

Your car will not run Illness can't work/hospitalization/ER

Ask: Why is it important to have a rainy day or emergency fund?

Ask: How can creating a budget help you plan for unexpected expenses?

Ask: What are some emergencies or surprises that you might need to save for in the future?

Dear God, Thank You for teaching us the importance of being prepared Help us to remember that saving for a rainy day is one way we can be wise and honor You with what we have Give us the discipline to budget, the wisdom to plan ahead, and the faith to trust You in every situation. Thank You for always providing for us and being with us through every storm. Amen.

Even though we don’t want to ever have an emergency, it’s important to be prepared in case one happens Ask God to help you as you set money aside to plan for your future

Remember to hold yourself accountable and ask close loved ones to help you save! Even starting small is helpful for you in the long run

Taking good care of what God has given us

Objectives:

Students will be able to demonstrate how to be good stewards of what God has given them

Students will be able to demonstrate using the resources God has given them wisely and obediently.

But Jesus looked at them and said, “With man this is impossible, but with God all things are possible.” (Matthew 19:26)

Stewardship The careful and responsible management of something entrusted to one's care

Steward An “overseer” or “manager” over someone else's matters.

Home Connection Sheets - to be printed (pg. 137)

** Digital Links available at www.liftinstitute.org/digitalresources **

Facilitator Guide

Student Workbooks

Pencils

Easel w/Chart Paper

Markers (for Easel)

Bible

Medium Sized Ball

Home Connection Sheets - Week 6

Dear God, Thank You for all the blessings You’ve given us—our time, talents, money, and possessions Today, help us learn what it means to be good stewards and to take care of everything You’ve trusted us with Teach us to use our resources wisely and obey You in how we manage them We want to honor You with our choices and be faithful with all that You’ve given. Amen.

But Jesus looked at them and said, “With man this is impossible, but with God all things are possible” (Matthew 19:26)

Gather together as a group and talk about their week. They can talk about anything that has been covered over the last several weeks.

Ask: How have you implemented strategies and where have you struggled?

It is ok to struggle, but surrender it and ask God and the people around you for help. It is important to share wins AND struggles. Progress over perfection!

1.

Share the following quote:

“How we view money is indicative of where we’ve placed our faith and trust. If you want to grow in your faith, wrestle with stewardship.” - Brandon Fremont

Play music and have students walk around the room until the music stops Whoever they are standing closest to they will pair up with

Ask: What do you think stewardship means?

Play music and mix around the room again between each question When the music stops, students should pair with a DIFFERENT partner answer the next question

Ask: What do you think this quote means?

Ask: How does it apply to you?

Come back together with the whole group and have students share some of their responses with the group.

Let’s look at the definition of stewardship.

Have students complete What is Stewardship? in their Student Workbooks

2.

This is designed to be a brain break while practicing teamwork to steward!

You’ll only need a medium-size ball to play a quiet ball game. The game’s goal is for students to pass the ball around without noise or dropping it This will take teamwork and non-verbal communication to ensure the ball doesn’t get dropped.

To make the game a little more challenging, you can ask the boys to pass to girls and vice versa. The student left holding the ball is the winner

Depending on how well students keep the ball moving, you may be able to play a few rounds. Try to increase the length of time before dropping the ball with each round.

Bring students back together to debrief

Ask: How did you rely on each others to keep the ball in the air and moving?

Ask: Are there things you are responsible for stewarding that require you to rely partially on someone else?

Ask: How do you ensure you are doing your part in stewardship when others are involved?

Ask: What does it mean to be a good steward of the things God has given you?

Ask: How can you use your time, money, or talents in a way that honors God?

Ask: Why is it important to manage God’s gifts wisely and obediently, even in small things?

Dear God, Thank You for all the gifts You’ve given us our time, money, talents, and more. Help us to be wise and obedient with everything You’ve trusted us to manage Show us how to use what we have to serve others and bring glory to You May we always be faithful stewards, honoring You in all that we do. Amen.

Think of one thing God has called you to steward well. Ask God to help you steward it well this week Ask him to tug at your heart when you choose not to He is always faithful

Objectives:

Students will demonstrate how to give what they have to help others

But Jesus looked at them and said, “With man this is impossible, but with God all things are possible.” (Matthew 19:26)

Stewardship The careful and responsible management of something entrusted to one's care

Steward An “overseer” or “manager” over someone else's matters.

The French Fry Tax Video (pg. 117)

Ted Talk on Giving Video (pg. 117)

Home Connection Sheets - to be printed (pg. 138)

** Digital Links available at www.liftinstitute.org/digitalresources **

Facilitator Guide

Student Workbooks

Pencils

Easel w/Chart Paper

Markers (for Easel)

Bible

Book - What Is Given From the Heart by Patricia C. McKissak.

Home Connection Sheets - Week 7

Dear God, Thank You for being generous and for giving us everything we need Today, help us learn how to use what we have—our time, money, and talents to help others Teach us to give with kind and joyful hearts, just like You do Show us how our giving can make a difference and bring glory to Your name Amen

But Jesus looked at them and said, “With man this is impossible, but with God all things are possible.” (Matthew 19:26)

Gather as a group Take this time to check in for the week

Ask: Share where you felt you were a good steward of what God has given you this week and share areas you felt you could have done better.

Remember this is progress over perfection The idea is that they are learning something new and learning how to apply it to their lives as believers.

Open today’s lesson with the The Widow of Zarephath:

Then the word of the Lord came to him, “Arise, go to Zarephath, which belongs to Sidon, and dwell there. Behold, I have commanded a widow there to feed you” So he arose and went to Zarephath. And when he came to the gate of the city, behold, a widow was there gathering sticks And he called to her and said, “Bring me a little water in a vessel, that I may drink” And as she was going to bring it, he called to her and said, “Bring me a morsel of bread in your hand” And she said, “As the Lord your God lives, I have nothing baked, only a handful of flour in a jar and a little oil in a jug. And now I am gathering a couple of sticks that I may go in and prepare for myself and my son, that we may eat it and die.” And Elijah said to her, “Do not fear; go and do as you have said. But first make me a little cake of it and bring it to me, and afterward make something for yourself and your son. For thus says the Lord, the God of Israel, ‘The jar of flour shall not be spent, and the jug of oil shall not be empty, until the day that the Lord sends rain upon the earth.’” And she went and did as Elijah said. And she and he and her household ate for many days. The jar of flour was not spent, neither did the jug of oil become empty, according to the word of the Lord that he spoke by Elijah (1 Kings 17: 8-16)

Have students review the 1 Kings 17:8-16 worksheet

Pair students together as partners to discuss the worksheet for 10 minutes. Then they will fill out the worksheet answering the questions after they have talked about them together.

The widow was faithful and gave to Elijah when she had nothing. Her faithfulness and willingness to help Elijah was a beautiful picture of stewardship. Ultimately, stewardship is loving others more than you love yourself.

1. Remember the Fruits of the Spirit

22 23

But the fruit of the Spirit is love, joy, peace, patience, kindness, goodness, faithfulness, gentleness and self-control. Against such things there is no law. (Galatians 5:22-23)

Ask: Which of these did the widow exhibit?

Think for a moment about the weight of what she did. She wasn’t just trying to feed herself, she was also trying to feed her son.

Ask: What do you think you would have done in the situation?

Write students' answers on chart paper.

Watch one or all of the following videos:

The French Fry Tax Video

Ted Talk on Giving Video

If time allows, read What Is Given From the Heart by Patricia C. McKissak.

If you choose to read What is Given From the Heart, trust that it is still a good book to share with middle and high schoolers despite being a picture book. It has a great message and can lead to lots of discussion! Stop on pages that can lead to a good conversation before finishing the book.

Ask: What is something you could do that would be similar today?

Another fun and interactive game is the “Would you rather” game Students line up in a straight line The facilitator asks the following questions. Students will step to the left for the first answer or right for the second.

Would you rather buy a new sports car and have a large monthly payment or buy a used car that fits your needs?

Would you rather put money aside each month for your college fund or pay a large amount once a year?

Would you rather have no ac in your house or no hot water?

Would you rather grab fast food for dinner a few times a month or eat at home and save the money for a nice meal out?

Would you rather cook a new meal every day or prepare meals that last a few days?

Would you rather donate money to a charity or provide community service hours to an organization?

Would you rather buy new clothes or second hand clothes from a thrift shop?

Would you rather car pool or take public transportation?

Would you rather receive a gift of something you need or give a gift to someone in need?

Ask: Why is it important to give and help others with what you have?

Ask: What are some ways you can be generous, even if you don’t have a lot of money?

Ask: How does giving to others help you grow in your relationship with God?

Dear God, Thank You for reminding us that everything we have comes from You Help us to be generous and willing to share with others, no matter how big or small the gift. Show us how to use our time, money, and talents to make a difference and bring Your love to those around us. Thank You for giving to us so we can give to others. Amen.

During the week find opportunities where you could give instead of taking. How did it make you feel when you gave instead of received?

8

8

Objectives:

Students will demonstrate how to tithe 10% of their wages

Students will be able to explain why God calls us to tithe our money to the church.

But Jesus looked at them and said, “With man this is impossible, but with God all things are possible.” (Matthew 19:26)

Stewardship The careful and responsible management of something entrusted to one's care

Steward

An “overseer” or “manager” over someone else's matters.

Tithe

Obedience

A tenth part of something paid as a voluntary contribution or as a tax especially for the support of a religious establishment

An act or instance of obeying

Where is Your Treasure? Worksheet (pg. 126)

Home Connection Sheets - to be printed (pg. 139)

** Digital Links available at www.liftinstitute.org/digitalresources **

Facilitator Guide

Student Workbooks

Pencils

Easel w/Chart Paper

Markers (for Easel)

Bible

Home Connection Sheets - Week 8

Dear God, Thank You for providing everything we need Today, help us understand why tithing is important and how we can give back to You by giving to the church Teach us to be cheerful and faithful givers, and to trust You with the money You’ve given us Help us to honor You with our giving and remember that everything we have belongs to You. Amen.

But Jesus looked at them and said, “With man this is impossible, but with God all things are possible” (Matthew 19:26)

Open with free conversation about the week.

Ask: How have you tried to incorporate stewardship into your daily lives?

Review stewardship in community and how to use what God has given us wisely and for His glory, not our own.

Remind students that all we have is from God above

Read the following quote:

“Faithfulness in stewardship is not so much about where we are financially, but more about being obedient with God’s resources in that situation.” (Wheeler, 2022)

Have students gather in groups of 3 and discuss.

Ask: What comes to mind when you hear this quote?

Each person in the group should have an opportunity to share their thoughts. If you notice one person taking up all the time, it is a good idea to encourage others to speak so that everyone has a chance to share.

Come back together as a group and have students share their thoughts with the whole group. On chart paper or a Smart Board write down student responses.

Tithing to the church is more about trusting God with your money than anything else.

Think about a time they were fearful of doing something because you didn’t know how it would turn out.

It might help for you to share first.

Share this quote by John Piper and Bible verse.

“The possession of money in this world is a test run for eternity. Can you pass the test of faithfulness with your money? Do you use it as a means of proving the worth of God and the joy you have in supporting his cause? Or does the way you use it prove that what you really enjoy is things, not God?” (Bloom, 2015)

For where your treasure is, there will your heart be also. (Luke 12:34)

Direct students to the Where is Your Treasure? Worksheet in their Student Workbooks. Give them some time to respond in journal-like fashion to the John Piper quote and Luke 12:34. They should work independently.

After they complete the worksheet, have students share their thoughts to the group. This should be like sitting on the couch talking to a friend, type of discussion.

Share the following verses and give (depending on how many students you have) each student a verse or divide the class into groups and give each group a different verse. Read the verse and discuss how it calls upon us to tithe.

It is important to tithe because God calls us to tithe. The following Bible verses tell us this:

Honor the Lord with your wealth and with the firstfruits of all your produce 10 then your barns will be filled with plenty, and your vats will be bursting with wine. (Proverbs 3:9-10)

Tithing helps the local church and the global church spread the Good News of Jesus Christ.

As soon as the order went out, the Israelites generously gave the firstfruits of their grain, new wine, olive oil and honey and all that the fields produced. They brought a great amount, a tithe of everything (2 Chronicles 31:5)

Jesus sat down opposite the place where the offerings were put and watched the crowd putting their money into the temple treasury. Many rich people threw in large amounts. But a poor widow came and put in two very small copper coins, worth only a few cents Calling his disciples to him, Jesus said, “Truly I tell you, this poor widow has put more into the treasury than all the others. They all gave out of their wealth; but she, out of her poverty, put in everything all she had to live on.” (Mark 12:41-44)

Will man rob God? Yet you are robbing me. But you say, ‘How have we robbed you?’ In your tithes and contributions You are cursed with a curse, for you are robbing me, the whole nation of you. Bring the full tithe into the storehouse, that there may be food in my house. And thereby put me to the test, says the Lord of hosts, if I will not open the windows of heaven for you and pour down for you a blessing until there is no more need. I will rebuke the devourer[a] for you, so that it will not destroy the fruits of your

soil, and your vine in the field shall not fail to bear, says the Lord of hosts Then all nations will call you blessed, for you will be a land of delight, says the Lord of hosts (Malachi 3:8-12)

We know God calls us to tithe because the Bible tells us this. The Bible is God’s word. And God’s word is true. We have talked about where our treasures are where our hearts are because our money is all given to us by God. Let us give back to Him what he asks us.

Ask: Why do you think God asks us to give 10% of what we earn back to Him?

Ask: How does tithing show our trust in God and our thankfulness for what He’s given us?

Ask: What can happen in your heart and in your community when you give faithfully to your church?

Dear God, Thank You for teaching us about tithing and why it’s important to give back to You. Help us to always be thankful for what we have and to give with joyful and generous hearts. Teach us to trust You with our money and to remember that giving to the church helps share Your love with others Thank You for providing for us and for helping us honor You in all we do. Amen.

As you go through this week ask God to show you areas that hold your treasure over God. When you realize what it is, go to God and thank Him for showing you and ask for the Holy Spirit to change your heart. Ask God this each day and see how he changes your heart.

LESSON 9 LESSON 9

Objectives:

Students will be able to identify different types of banks, learn the difference between credit and debit cards, and how loans work

But Jesus looked at them and said, “With man this is impossible, but with God all things are possible.” (Matthew 19:26)

Credit Card A card authorizing purchases on credit.

Credit The provision of money, goods, or services with the expectation of future payment.

Debit Card

A card like a credit card by which money may be withdrawn or the cost of purchases paid directly from the holder's bank account without the payment of interest to the Financial Institution or Bank: a company that deals with money (as a bank, savings and loan, credit union, etc.)

Loan Money lent at interest.

Mortgage

An agreement between you and a lender that gives the lender the right to take your property if you fail to repay the money you've borrowed plus interest.

Bank Type Pros and Cons (pg. 127)

Types of Banking Institutions Worksheet (pg. 130)

Home Connection Sheets - to be printed (pg. 140)

** Digital Links available at www.liftinstitute.org/digitalresources **

Facilitator Guide

Student Workbooks

Pencils

Easel w/Chart Paper

Markers (for Easel)

Bible

Home Connection Sheets - Week 9

Credit Card Calculator

https://wwwcalculatornet/credit-card-calculatorhtml

Credit Card Payoff Calculator

https://creditorg/calculators/credit-card-pay-off-calculator

Auto Loan Calculator

https://wwwcalculatornet/auto-loan-calculatorhtml

Car Depreciation Calculator

https://caredge.com/depreciation

Mortgage Calculator

https://www.mortgagecalculator.org/

Dear God, Thank You for giving us the opportunity to learn how to be wise with money Today, help us understand how banks work, the difference between credit and debit cards, and how loans should be used carefully Give us wisdom to make good choices with the resources You’ve given us, and guide us to use them in ways that honor You. Amen.

But Jesus looked at them and said, “With man this is impossible, but with God all things are possible” (Matthew 19:26)

1.

When students are seated begin the lesson talking about their week and how they practiced stewardship

Ask: Where do you keep your money?

Ask: Which type of Bank would you keep your money in?

Ask: Did you know there are different types of banks?

Today we will learn about the different types of banks. You will be able to tell them apart and give examples of each type of bank.

On chart paper write the following:

National Bank

Credit union

Community Bank

Ask: Do you know some differences between the types of banks?

Let students talk about their ideas about what each type is.

Before the lesson have the pros and cons of each bank written on chart paper or displayed on a Smart Board. They can also be found in Teacher Resources pg. 127) At this time show the pros and cons of each.

Offer banking services, loan services and savings

Credit unions usually have a better idea of the local economy and understand consumer habits of consumer and business owner habits. They know their community members and what they are coming in for

Provide youth savings accounts which offer paying interest back to you at a better rate than another financial institution.

Can keep a minimal amount of $5 in savings and checking accounts without penalties.

Most employees live and work in the communities they live in They know their community.

Members of the credit union are considered owners and have a vote in who runs the bank

Limited to their geographic area. They are not throughout the state or the United States. If traveling you could pay a fee to get money out of an ATM.

Products they offer their customers are less than the products offered by a national big bank.

They don’t have a big presence in larger communities. They are in nonmetropolitan areas

Similar to a credit union in that the people that work in these banks live in the same communities they are working at.

Have a good idea of what the community needs.

They are more hands-on through business transactions walking you through next steps in face to face meeting and telephone calls. Rather than automated banking.

If you have a problem you can actually speak to the person who helped you open your account. They work on personal relationships with their customers.

Fewer products than a national bank

Apps are not going to be as robust as a national bank.

They are not throughout the state you live in or throughout the United States.

If you are traveling out of state or out of town you will be charged a banking fee to get your money out of an ATM that is not associated with the community bank.

You will find a branch in your town and know the people you are banking with.

Receive full services from a bank that you would need

After giving students the differences in the different types of banks and the pros and cons, the students break into groups of four and research (on their phones or computers) the different banks in their communities and label them as Community Bank, Credit Union, or National Bank.

After students have completed this task, have them come back together with the whole group. On chart paper or SmartBoard display the Types of Banking Institutions worksheet (Found in Teacher Resources pg. 130). Have one student from each group come up and write down where they put each bank they found in their community

Plastic: Credit v. Debit 2.

Now let’s talk about the difference in credit and debit cards.

Ask: Do you know the difference between a credit card and a debit card?

Allow students to share their ideas

Credit Card Chaos 3.

Share the following scripture:

The rich rule over the poor, and the borrower is the slave of the lender. (Proverbs 22:7)

Use this verse to begin a conversation about credit cards.

Ask: Do you think credit cards are good or bad? Why or why not?

Ask: So what is a credit card?

A credit card is a line of credit, or amount indicated by the bank, that they are willing to loan you for purchases. Some credit cards have annual fees that are charged which allow you access to the line of credit. Buying on credit means that you buy something without having the money and promise to pay for it over time.

Sounds like a great idea, right?!

You will never just pay the purchase price. You will also pay something called interest. You pay interest unless you pay it off as soon as you get the bill. If you can do that, why not just pay up front with cash?

You should never have a credit card. If you can’t pay cash for it then you do not need it.

If you have a sufficient amount in your emergency fund and continue adding to it, you should be able to pay for your life.

Credit cards are so tempting and their companies tempt you constantly. When you go to college or turn 18, credit card companies will specifically target you. They will tell you that you need the credit card to improve your credit score. You will feel like you have hit the jackpot because you can buy something even if you don’t have the money for it. Enticing, right?

Show students an example below of typical credit card interest rates:

A typical credit card interest rate is 29.99%. That means that if you charge $100 you will have to pay $2.50 per month (if you do not pay it off immediately). If you do not pay it off in a year you will spend $130 on a $100 item.

Could you pay off the $100 this month? Odds are that you can’t, if you didn’t have the money to begin with! What if you use it again next month, but charge $300 this time? Now, you have $400 on your credit card with interest. The credit card companies tell you only to pay the minimum amount, which sounds like a great deal, but paying only the minimum amount each month will double the amount of time to pay it off (and you pay more for the item in the end).

It can quickly become overwhelming and stressful. They aren’t worth the stress!

DO NOT be tempted to take out a credit card. It is too tempting to charge things on your card and tell yourself you will pay it off later. The odds are you will not.

Use credit.org to calculate your monthly payments so see how quickly you can become overwhelmed with debt and unable to pay it off.

** Use a new cell phone as an example to demonstrate to students before they begin. **

Student will select 3 different big-ticket items they are interested in purchasing

Have student look up the cost for each item. Students will look up and use the current average interest rate to calculate what they would pay for each item

They will then use a credit card calculator to: Calculate monthly payments and how much interest they would pay over 1 year, 3 years and 5 years. Add the interest and balance to determine the total they will end up paying to pay off the item.

Ask: Is a credit card the same as a debit card?

A debit card, in most cases, looks just like a credit card. It will have the Visa or MasterCard logo on it, but this card is issued by your bank and is attached to your checking account.

Purchases made on your debit card come directly out of your bank account. In most cases, if you don’t have the funds available in your checking account to cover the purchase, your card will be declined at the time of the sale and you will not be allowed you to finish the transaction or make your purchase.

Some banks though do offer overdraft protection or a funds transfer from a savings account. The transfer from your savings will incur a small fee, but you are still spending the money that you have.

Overdraft protection is a line of credit offered by the bank, and will cover that transaction with a fee In order to keep using your checking/debit account you then need to bring the balance back to a positive amount.

Buy now, pay later

Interest on balances carried after bill’s due date

Fees: annual, late payment, foreign transaction, balance transfer, cash advance

Buy now, pay now

No interest charges

Fees: monthly, overdraft, ATM, foreign transaction

Can build credit Can’t build credit

Limited liability for fraud Can have full liability for fraud

Before talking about loans, share Proverbs 22:1-16 on chart paper or a SmartBoard.

A good name is more desirable than great riches; to be esteemed is better than silver or gold. Rich and poor have this in common:

1 2 The Lord is the Maker of them all The prudent see danger and take refuge, but the simple keep going and pay the penalty Humility is the fear of the Lord; its wages are riches and honor and life. In the paths of the wicked are snares and pitfalls, but those who would preserve their life stay far from them. Start children off on the way they should go, and even when they are old they will not turn from it The rich rule over the poor, and the borrower is slave to the lender Whoever sows injustice reaps calamity, and the rod they wield in fury will be broken. The generous will themselves be blessed, for they share their food with the poor. Drive out the mocker, and out goes strife; quarrels and insults are ended. One who loves a pure heart and who speaks with grace will have the king for a friend The eyes of the Lord keep watch over knowledge, but he frustrates the words of the unfaithful. The sluggard says, “There’s a lion outside! I’ll be killed in the public square!” The mouth of an adulterous woman is a deep pit; a man who is under the Lord’s wrath falls into it. Folly is bound up in the heart of a child, but the rod of discipline will drive it far away One who oppresses the poor to increase his wealth and one who gives gifts to the rich—both come to poverty

22:1-16)

Bad debt is considered debt that depreciates over time or decreases. Bad debt would be a credit card or car payment. What you bought today and put on your credit card is not worth tomorrow what you paid today. When you purchase a car with a

loan, the car depreciates in value over time. Due to the loan you took out, when you add the interest back in you paid more than the car was originally worth.

Have students research the type of car they would like to own and find the purchase price of the vehicle Then have them use an auto loan calculator to see how much the vehicle will end up costing after interest, taxes and fees. Now have them look at how much the vehicle would be worth at the end of their loan by using a Car Depreciation Calculator. How much money did they lose?

Every time that you use your money it should be for a purpose. Have you prayed about it? Have you taken into consideration your money supply or budget? Always consider your budget. Do not deviate from your budget! Be radical in your thinking when using your money!

All debt is not bad. Most people will have a mortgage which is considered debt. However, you are building wealth. You will have something to show for your monthly mortgage payment. Good debt is associated with those things that increase in value over time. Historically, real estate has appreciated or increased in value over time. Which considers it “good debt.”

Mortgages are typically paid over 30 years. Whatever mortgage you take out you are committed to that for 30 years. That is a long time.

Have students think about what kind of house they need vs what they want. Let them share what kind of house they WANT to live in. Then have students research (on their phones or a computer) the

cost of that kind of house so they have an idea of what it costs.

Have students put the home price into a mortgage calculator to have a real example of how much they would pay over the course of 30 years

Now think of our first lesson on needs and wants. Do we NEED a big house with a big mortgage or do we WANT one. The truth is we can live in a smaller, more affordable house and be happy and content. This is an example of finding joy and peace in the Lord not in a big house. That house will not give you lasting joy. Your joy comes from the Lord.

Ask: What is the difference between a credit card and a debit card?

Ask: Why is it important to understand how loans work before borrowing money?

Ask: How can knowing about banks, cards, and loans help you make wise choices with your money?

Prayer 2.