Entrepreneurs in Lawrence and Douglas County have created jobs,

To support more local, small businesses – as well as create greater equity for minority entrepreneurs – The Chamber and EDC of Lawrence and Douglas County have created a loan fund that makes access to start-up capital for BIPOC entrepreneurs less of a barrier to business ownership.

The idea for a low-interest, low-barrier loan fund for minority-owned businesses has been explored for years and emphasized by the City of Lawrence’s strategic plan, Douglas County’s Community Health Plan, and the Chamber’s “Rising Together” Capital Campaign. By mid-2023, this idea became a real opportunity for entrepreneurs when the Chamber completed Diversify Douglas County – A MinorityOwned Business Loan Program (DDC). Now aspiring BIPOC business owners can access up to $15,000 at a simple 4% interest rate to get their businesses going.

Access to capital for minority entrepreneurs is a challenge that isn’t easily resolved. Many of the requirements for traditional commercial loans –especially collateral and credit – have created inequitable and systemic impediments for many who seek to own and grow a business. The Chamber engaged BIPOC entrepreneurs and entrepreneurial support organizations in Lawrence to customize many elements of the DDC to fit the needs of the local community it serves.

The primary requirements for accessing DDC funds are a great idea demonstrated in a business plan and financial projections that support the business’s ability to sustain success.

Use Funds for:

Building Purchase | Working Capital | Repairs

Equipment | Infrastructure | Inventory

Tamara Cash, Ph.D., Educational Consultant, had these remarks regarding the DDC Loan Fund. “Diversify Douglas County (DDC) Loan Fund is helping to break down the barriers to success typically experienced by aspiring business entrepreneurs of color. The DDC was established through a collaborative effort among community stakeholders, local business professionals and regional advisors with the intention of creating financial support and positive outcomes for minority entrepreneurs, allowing them to take advantage

of resources that often already exist for others in the community. The DDC seeks to provide a firm financial foundation for minority business start-ups and expansions, making it possible for historically marginalized communities who have not benefited from generational wealth to establish successful business ventures and, in the process, to contribute to our local tax base.”

Article by Joshua Falleaf Director of Economic Development for The Chamber & EDCThis past November, the DDC Financial Review Board approved and closed its first loan, with others working on their application package now.

Welcome to this month's theme "Investment," where we delve into the concept of investment locally. However, our journey this time extends beyond the familiar terrain of stocks and bonds; we explore the profound investments in family, friends, history, home, business, and health—each of which shapes our lives and impacts our own returns.

Investment, at its core, is about allocating resources with the expectation of positive returns. Financial investment typically comes to mind—placing capital in ventures, stocks, or real estate, anticipating future financial growth. Yet, the concept of investment is greater than monetary measurement. It encompasses our time, effort, and emotions, directed towards various aspects of our lives that we cherish and wish to flourish.

Family and friends represent our most personal investments. The time and energy we devote to building and nurturing these relationships creates the fabric of our support systems. Like any long-term investment, family and friends require patience, understanding, and periodic reassessments to grow stronger and more resilient over time.

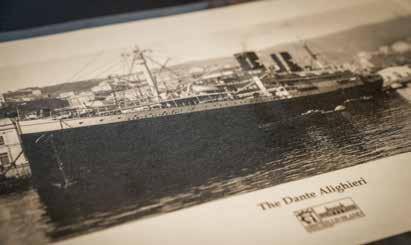

Investing in history—our own and the world's—enables us to understand our roots and the legacies that have shaped the world. Many of us are fortunate to explore our own history to know where we came from, our history, impacts on lifestyle, culture, family, and approach to life. This understanding fosters a sense of identity and continuity, allowing us to learn from past mistakes and successes and shape our future.

Our homes and our businesses provide sanctuaries, creating our livelihood, safety, and comfort space that reflects our personalities and meets our evolving needs. Where and how we invest can shape our day-to-day life and provide a place for creativity, growth, and exploration.

Lastly, but perhaps most importantly, is the investment in our physical, mental, and emotional health. Prioritizing health is the ultimate long-term investment. Being our best enables us to engage more fully with all other aspects of our lives, from enjoying moments with loved ones to pursuing our career ambitions.

In this edition, we delve into each of these investment areas, exploring stories about Cottonwood Inc., our Chamber, homes and financial investment, Genealogy, and investments in health. We share insights and ideas to help you cultivate a balanced portfolio of investments that are not just financially rewarding but also enriching to your life.

Here's to thinking about investment and what that means to each of us every day.

DENISE DETOMMASO, PUBLISHER @LAWRENCEKSCITYLIFESTYLEApril

PUBLISHER

Denise DeTommaso

EDITOR

Linda Ditch | linda.ditch@citylifestyle.com ACCOUNT MANAGER

McCormick meredithe.mccormick@citylifestyle.com

SOCIAL MEDIA COORDINATOR

Nathan Hutchcraft | nathan@fabuluxmedia.com

CONTRIBUTING WRITERS

Linda Ditch, Denise DeTommaso, Brian Abbott

Anthony Fergola, Kristol Kumar

On West 31st Street is a 66,000-squarefoot production facility buzzing with employees hard at work. This is Cottonwood Industries (CWI), a division of Cottonwood, Inc. Since 1972, Cottonwood has partnered with businesses nationwide to provide

When we asked her what she liked about working at CWI, she says, “What everyone thinks of as disabilities, Cottonwood sees as abilities.”

A conveyor belt full of red fabric poppies assembled for Veterans of Foreign Wars (VFW) for distribution

high-quality, cost-effective, light industrial services such as assembly, packaging, warehousing, and mailing.

Cottonwood, Inc. offers quality supports and services to people with both intellectual and physical disabilities. CWI provides both a paycheck and skills that can be utilized for employment outside the facility. Currently, they work for approximately twenty business partners on various projects.

On a recent afternoon, one large production area was busy assembling cargo tie-down straps for the U.S. Department of Defense, a contract Cottonwood Industries has had for 24 years. The DOD has recognized the facility for superior product quality, on-time delivery, superior customer service, reliability, dependability, consistency, and accuracy.

Anne Kennedy works at putting the clasps on the straps. She has worked at Cottonwood for three years, both in sewing and quality control.

this Memorial Day is humming along in another work area. Karrie Metzger is busy placing the stems through the fabric flower and then sending them along the belt to be finished and packaged for shipping. When she’s not at Cottonwood, she is at Target, where she’s worked for 20 years.

Also in production that day are parts for pumps used by municipal water systems and plastic cups covered with comic characters being packaged for sale at party stores. Another area is set up to sew boots for McFarlane Aviation Products.

Cottonwood Industries works as a partner for businesses that need a job done but find it’s not cost-effective for them to do it in-house. Duane Turnbull, Director of Cottonwood Industries, says, “We’re looking for opportunities where we can partner with local businesses, using our workforce, and warehouse space, giving people with disabilities an opportunity for meaningful work, earn a

paycheck and learn valuable skills. We are a great business partner.”

Robert Bieberle, Business Development Manager, explains, “Sometimes businesses cannot get people to do the work. Sometimes, it’s a limitation of space. We have the space. We have the people, and we do the training and the quality control. When the product leaves here, it’s complete and can go on their shelf.”

“Look at it like this,” says Turnbull: “McFarlane Aviation used to sew their steering boot internally until recently. We are now capable of doing those types of things, so we’re trying to find new partners to bring in more business so we can help teach even more job skills to the people we have employed.”

He adds, “The great thing right now is, when Robert goes out into the community with a lead, probably seven times out of ten, it’s due to an inability to hire people. We have a ready-made workforce here that wants to come to work every day.”

That workforce is driven by personal choice. Each employee can choose how much time they spend working. For example, some work half a day and then go to other activities Cottonwood offers. Others go home for half the day, while some, like Karrie Metzger, work at jobs elsewhere in the community.

Anne Kennedy makes cargo tie-down straps for the U.S. Department of Defense

Senior Production Coordinator Steve Steinbach says, “The folks who choose to work at Cottonwood Industries are focused and really enjoying it. The pace is a little quicker, and there’s a really good positive momentum. It just feels like a busy, happy workplace.”

Businesses interested in partnering with Cottonwood Industries can learn more at CottonwoodIndustries.com or contact Robert Bieberle at 785.842.0550 and rbieberle@cwood.org.

“Locally in Lawrence, I want to change the thought process of people that drive by here and wonder what this building is,” Turnbull says. “We want to become a business partner—a subcontractor for local businesses. We don’t want to be looked at as just a place doing something nice by giving jobs to people with disabilities. That’s not what we’re about. We are a subcontractor that happens to employ people with disabilities.”

The Cottonwood Industry team is ready to help local businesses with their production needs.

Robert Bieberle, Cottonwood Industries Business Development Manager, show some of the products assembled at the facility.

The Cottonwood Industry team is ready to help local businesses with their production needs.

Robert Bieberle, Cottonwood Industries Business Development Manager, show some of the products assembled at the facility.

Spring is considered the start of the home-buying season. If you are planning to buy a new house, Lawrence City Lifestyle got some critical information from McGrew Real Estate Associate Broker/Realtor Kimberly Williams and Fairway Independent Mortgage Corporation branch manager Diane Fry to help smooth your way forward.

LCL: Why should a home buyer work with a buyer’s agent instead of just using the seller’s agent?

Williams: In Kansas, there are three types of brokerage relationships: a buyer’s agent, a seller’s agent, and a transaction broker. A transaction broker is not an agent for either party and does not advocate either party’s interest. For me, personally, I believe a first-time home buyer should have a Buyer’s Agent to be able to get advice from an experienced agent. All agents and transaction brokers have a duty to, among other things, disclose all known adverse material facts of the property.

LCL: What is a potential home buyer’s first step?

Williams: Contacting a lender to get pre-approved for a mortgage is the first step because you need to know what your money is worth in the current real estate market and what your payments could be.

Fry: Do your pre-approval first! It makes sure you’re looking at the right sales price! Let’s say your looking at a $520,000 house, but the max you qualify for is $400,000. We typically want to make sure you are comfortable with the payment.

LCL: What information will the buyer need to get pre-approved?

Fry: The last two years of W-2s and 30 days’ worth of pay stubs. If they’re self-employed, they need to bring two years of taxes and two months’ bank statements so we can see that they have the funds to close. If they’re retired, we might need to see their Social Security awards letter. They need to show all incomes used to qualify.

LCL: How much of a down payment should they expect to pay?

Fry: It depends on the loan type. There are 100-percent loan programs. If you’re buying in the county, USDA is a 100-percent program based on area and income restrictions. VA is a 100-percent program. There are three-percent conventional loan with one person in the transaction being a first-time home buyer. FHA is three and a half percent. There are lots of options for a down payment. You can get a down payment from a tax return. Borrow from a 401K, savings, or checking, gift from a family member. It’s super easy.

LCL: What type of credit score will they need?

Fry: 580 for an FHA loan, 620 for a conventional loan. The absolute worst thing you can do is be maxed out on your credit cards.

LCL: Are there other costs to expect?

Williams: Not only does a buyer have a down payment to come up with, but there are also the closing costs, appraisal, and inspections.

Fry: There’s title work, credit checks, flood certification, and setting up your escrow account. Homeowners insurance requires that you pay 12 months in advance.

LCL: What’s the industry’s feeling about the direction mortgage rates will take in the coming year?

Fry: Experts say 2025 the rates will be back in the five-percent range, but there are a lot of variables when it comes to mortgage rates.

Williams: But don’t wait to buy until rates go down because, in Lawrence, home prices are still going up. If you wait for the interest rate to go down, home prices will be even higher.

Fry: And then you’ll be in the middle of a frenzy. You’ll have 15 people trying to buy the house, and you’ll be paying more than the one you’ll buy now.

LCL: What are some mistakes people make that can delay or jeopardize closing on their new home?

Williams: Buying anything that requires a loan that makes their debt-to-income ratio go wrong. Buying a car or furniture.

Fry: Just communicate with your lender and Realtor. Seven days before closing, we call to verify employment. Also, some loans require us to do what’s called a soft pull on your credit to see if there’s anything new. And sometimes life happens, and you have to change jobs or buy a car. Again, communication. If we know that’s happening, we can help you.

LCL: Is there anything else you would like readers to know?

Fry: Shop local for your lender and your Realtor. Get somebody who knows the market. That is really, really important. And if you have a pre-approval from a lender in Lawrence, your pre-approval means more because they know if there’s an issue, they can sit in someone’s office. So local is really, really important.

Williams: Also, go local because there’s a higher likelihood of getting an actual Lawrence appraiser. The majority of issues I’ve had are appraisers who come from Kansas City. They work in Lawrence, but their main market is Kansas City, so they don’t know our market as well.

Contact Kimberly Williams at McGrew Real Estate, 785.312.0743, kimberly@kiwilliams.com , and Diane Fry at Fairway Mortgage Co., 785.423.6721, dianef@fairwaymc.com.

In the world of investment, diversification isn’t just a strategy; it’s a necessity. Bonds have traditionally been viewed as the less glamorous cousin of stocks, and play a pivotal role in the balanced financial portfolio. We would like to discuss why incorporating bonds into your investment strategy can provide stability, income, and a counterbalance to the volatility of the stock market. Bonds are heading into a historic time, something we haven’t seen in decades. Bonds aren’t just for people who are retired anymore…they can fit in any portfolio.

ADVANTAGES:

1. Stability: Bonds TYPICALLY offer a stable and predictable income stream through regular interest payments.

2. Risk Mitigation: They generally present lower risk compared to stocks, making them a safer investment for conservative investors.

3. Diversification: Including bonds in a portfolio can help diversify and reduce overall investment risk.

4. Capital Preservation: They are ideal for those prioritizing the preservation of capital over high returns.

5. Income Generation: Bonds can provide consistent income, which is particularly beneficial for retirees.

6. Priority in Bankruptcy: If a company goes bankrupt, bondholders are paid before stockholders.

DISADVANTAGES:

1. Lower Returns: OVER TIME bonds typically yield lower returns compared to stocks, especially in low-interest-rate environments.

2. Interest Rate Risk: When interest rates rise, bond prices fall, which can lead to losses if the bonds are sold before maturity.

3. Inflation Risk: If the inflation rate exceeds the interest rate on bonds, it can erode the purchasing power of the income received.

4. Credit Risk: There’s a risk that the issuer may fail to make payments on time or default on the debt.

5. Long-Term Commitment: Some bonds, especially those with higher yields, may require a longer investment period, locking up funds.

6. Liquidity: While most bonds are fairly liquid, some types, like municipal bonds, may be harder to sell quickly without a loss.

Advisory services through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Cambridge and The Capital Concierge are not affiliated. Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

“WHILE STOCKS MAY OFFER THE ALLURE OF HIGH RETURNS, BONDS’ BENEFITS MAKE THEM AN INDISPENSABLE PART OF A WELL-ROUNDED FINANCIAL PLANNING PORTFOLIO.”

Bonds offer a level of predictability and safety that is hard to find in other investment vehicles. When you purchase a bond, you’re essentially lending money to an entity - be it a corporation, municipality, or the government - which in return promises to pay you back the principal amount on a specified maturity date along with periodic interest payments. This predictable income stream has been appealing for those nearing retirement or investors who prefer a steady cash flow.

Another significant benefit of bonds lies in their ability to reduce portfolio risk. The markets can be tumultuous, with equity investments subject to dramatic swings. Bonds, however, are generally less volatile than stocks, providing a stabilizing effect on your portfolio. During periods of stock market downturns, bonds often perform better, thereby cushioning the impact on your overall investment portfolio. The next few years, this will be especially true based on the historic inflation and Fed rate hikes we have experienced.

Diversification is a key tenet of sound financial planning, and bonds allow investors to achieve a more balanced investment mix. By allocating assets across different types of investments, you can mitigate the risk of significant losses. Bonds come in various forms, including government, municipal, and corporate bonds, each offering different levels of risk, return and taxation. This variety enables investors to tailor their bond investments to match their risk tolerance and financial goals.

In conclusion, while stocks may offer the allure of high returns, the benefits of bonds - stability, income, risk reduction, and diversification - make them an indispensable part of a well-rounded financial planning portfolio. As we navigate the complexities of the financial markets, incorporating bonds into your investment strategy can provide a safety net, ensuring that your portfolio is equipped to withstand market fluctuations and safeguard your financial future. Remember, in investment as in life, balance is key.

GENEALOGY IS A JOURNEY INTO THE PAST FOR OUR FUTURE

“Genealogy provides individuals with...identity and belonging by uncovering stories, struggles, and achievements of their ancestors.”

Genealogy, the study of family ancestries and histories, is an invaluable discipline that extends far beyond mere hobbyist interest. Its significance lies in connecting individuals with their past, informing their present, and shaping the legacy they leave for future generations.

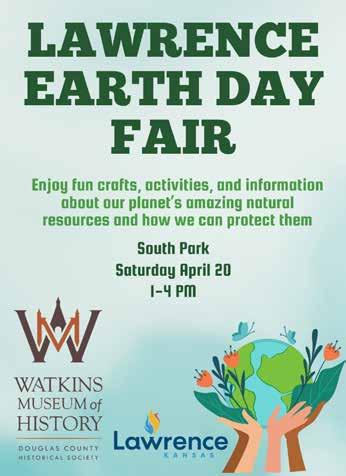

Genealogy expert Alysa Branham teaches beginning classes at the Watkins Museum of History. Courses like this one are offered regularly throughout the year, allowing the general public to learn how to study their ancestry and format and share this information with loved ones. Moreover, integrating genealogical research with fields like genetics has revolutionized our understanding of human history and individual identity.

“Genealogy provides individuals with a sense of identity and belonging by uncovering the stories, struggles, and achievements of their ancestors,” says Branham. “By examining historical records, such as birth certificates, wills, and census data, genealogists can construct family trees that reveal connections and patterns across generations. This historical context offers a unique perspective on individual and collective identities, shaping how people understand their place in the world.”

Beyond personal enlightenment, genealogy has practical applications in medicine, genetics, and heritage conservation. By tracing genetic traits and health conditions through generations, individuals can gain valuable insights into their genetic predispositions and take proactive health measures. Additionally, genealogical research is critical in legal contexts, such as establishing inheritance rights and verifying familial relationships in immigration cases.

Genealogical research plays a crucial role in preserving cultural heritage and collective memory. Preserving ancestral knowledge strengthens

community bonds and fosters a deeper appreciation for diverse backgrounds and histories.

My children live in Europe. After the Covid pandemic kept me from visiting them, I looked closer at my genealogy. Studying my family roots helped me understand that I qualify for a passport in Italy as a dual citizen. After digging into our family, I identified my path to an Italian passport and should have that fully completed this year. This will allow me to be present in the USA or Europe for work, to live, or simply to remain if that need arises, such as another pandemic that threatens to keep me from my children.

The advent of DNA testing has transformed genealogical research, allowing individuals to trace their ancestry beyond the limits of written records. Genetic genealogy uses DNA samples to uncover ancestral origins, trace migration paths, and connect with biological relatives. It can be invaluable for individuals who do not know who their parents and ancestors are and for finding family they previously did not know.

Engaging in genealogical research also allows individuals to leave a legacy for their descendants. Documenting family histories, stories, and genetic information provides future generations with a tangible connection to their past. This legacy empowers descendants with knowledge, enabling them to preserve their heritage and make informed decisions about their futures.

“Genealogy is more than the study of family trees,” notes Branham. “It is a journey into the past that informs our present and shapes our future.”

The Watkins Museum has a list of families who have genealogical information (books, family trees, etc.) in the Kramer Research Room. To learn more about their resources, go to WatkinsMuseum.org/research.

Genealogy is more than the study of family trees. “ ”

ARTICLE BY LINDA DITCH | PHOTOGRAPHY BY KRISTOL KUMAR

ARTICLE BY LINDA DITCH | PHOTOGRAPHY BY KRISTOL KUMAR

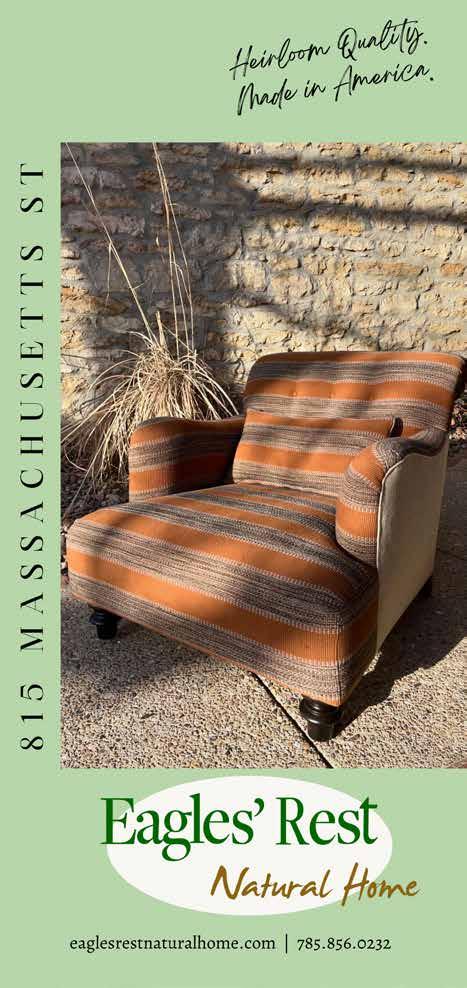

While a house is the most significant life investment for most people, what you put inside to make it your home is also an investment. For 15 years, Eagle’s Rest Natural Home has guided homeowners in selecting quality furnishings that will last generations.

“I’ve always been interested in how things are made,” says owner Diane Gercke. “What’s important to me is what the furniture is made of, who made it, and where it came from. I know all our

manufacturers personally. Most are small family-owned businesses, not giant corporations. It’s just not really our style.”

The furniture Gercke and her staff sell is created with non-toxic fabrics and materials. Many have lifetime warranties on the frame and cushion cores. The customizable mattresses are made with natural latex and certified organic fabrics guaranteed for 20 years.

While the furniture offerings may cost more than what is found online and in discount stores (though probably not as expensive as you might expect), they last for decades. That’s a sharp distinction from cheaper

options made with cardboard frames by underpaid workers overseas.

Gercke points out, “Investing in your home is investing in things that will last. That brings you joy. Non-toxic fabrics and comfort that’s going to last and give you peace of mind that you’ve bought an item of furniture you’re not going to have to worry about changing out because it broke down on you in five to ten years.”

To learn more about the manufacturers behind the furniture sold at Eagle’s Rest Natural, visit EaglesRestNaturalHome.com Better still, stop into the showroom at 815 Massachusetts and try out some pieces for yourself.

I adapted this recipe from the one served at The Mirth Café, a now-closed restaurant once located downtown. This was my favorite order, filled with

• 2 pieces of bread

• Butter

• 1-2 teaspoons pesto, to taste

• 1-2 slices of provolone

• Grated sharp cheddar

• Feta cheese, crumbled

• Baby spinach leaves

three cheeses, some baby spinach leaves, and a smear of pesto.

Serves 1

Preheat a skillet over medium heat. Spread butter on one side of each bread slice. Spread the pesto on the other side of just one bread slice. Place the butter-only bread slice into the skillet, butter side down. Layer cheeses and spinach on top. Finally, place the remaining bread slice on top, pesto side down. Grill each side until bread is browned and cheese is melted.

This soup lives up to its name by taking only 15 minutes to make. I adapted the recipe from one I found in “Autumn” by Susan Branch. Once you make

• 1 tablespoon olive oil

• 2 garlic cloves, minced

• 1 28-ounce can crushed tomatoes (I use Cento brand.)

• 1/2 cup chicken broth

• 1 tablespoon butter

• 1 tablespoon lemon juice

• 2 tablespoons minced fresh basil

• 1/2 cup half and half

• Salt and pepper, to taste

it a couple of times, you can do so repeatedly without looking at the recipe. It’s that easy...and delicious!

Serves 4

Pour the olive oil into a saucepan over medium heat. Add the garlic and sauté for about 30 to 60 seconds, and then add the remaining ingredients except for the half and half. Bring to a simmer and cook for 10 to 15 minutes. Just before serving, stir in the half and half, and then add salt and pepper, to taste.

ARTICLE BY LINDA DITCH

APRIL 2024

APRIL 13TH

Art Auction 2024

Lawrence Arts Center | 5:00 PM

As the primary funding source for the Exhibitions program, the Art Auction keeps exhibits free and accessible to the public. This year, the auction will showcase talented artists from all walks of life, from local preschool children to internationally renowned artists. View all 150+ pieces of art in the galleries from March 8 to April 13. LawrenceArtsCenter.org

APRIL 13TH

Lied Center of Kansas | 10:00 AM

The Annual Powwow, hosted by KU's First Nations Student Association, celebrates diverse Native American cultures in our community through dancing, singing, and honoring the traditions of our ancestors. The Indigenous Cultures festival is a free community event on the day of the FNSA Powwow that features activities such as Indigenous films, educational workshops, and children’s activities.FNSAPowwow.ku.edu

APRIL 16TH

The Robert J. Dole Institute of Politics | 7:00 PM

University of Kansas alumni, journalist, network news anchor, producer, and rancher Bill Kurtis will join Dole Institute Director Audrey Coleman for a discussion of his Kansas roots and the news that shaped the nation over the course of seven decades in journalism. Detailed information on the program can be found at DoleInstitute.org.