w/ SEASONAL Unlimited Wash Passes w/ SEASONAL Unlimited Wash Passes

2

w/ SEASONAL Unlimited Wash Passes w/ SEASONAL Unlimited Wash Passes

2

Wealth is more than numbers on a balance sheet— it’s the ability to create, sustain, and innovate in an ever-changing world. This month, Fort Collins City Lifestyle explores the intersection of money, innovation, and market strategy, equipping you with insights to navigate today’s financial landscape with confidence.

We are living in a time of rapid transformation. Markets shift, industries evolve, and traditional investment strategies are being challenged. Whether you're a seasoned investor, an entrepreneur seeking new opportunities, or simply someone who wants to take control of your financial future, understanding these changes is essential.

In this issue, we dive into the power of innovative wealth-building strategies, offering expert advice on navigating market volatility, smart investing, and financial growth in uncertain times. From cutting-edge tech investments to the art of balancing risk and reward, our curated content aims to empower you to make informed decisions about your money.

True wealth isn’t just about accumulation—it’s about legacy, security, and the freedom to live life on your terms. Our goal is to bring you the knowledge and inspiration to build a future that reflects your ambitions and values.

Cheers to smart moves, bold investments, and financial confidence in 2025 and beyond.

JAHNA EICHEL, PUBLISHER @FORTCOLLINSCITYLIFESTYLE

PUBLISHERS

Jahna Eichel | jahna.eichel@citylifestyle.com

Jason Eichel | jason.eichel@citylifestyle.com

EDITORIAL COORDINATOR

Griffin Garner | fortcollins@citylifestyle.com

SOCIAL MEDIA COORDINATOR

The Creative Agency | hello@thecreativeagencyco.com

CEO Steven Schowengerdt

COO Matthew Perry

CRO Jamie Pentz

CTO Ajay Krishnan

VP OF OPERATIONS Janeane Thompson

VP OF SALES Andrew Leaders

AD DESIGNER Josh Govero

LAYOUT DESIGNER Kelsi Southard

QUALITY CONTROL SPECIALIST Marina Campbell

1-7: Hope Lives! adds quality of life to breast cancer patients by offering integrative support services and products that help manage the physical, emotional, social & financial side effects of breast cancer treatment. Their 2025 Gala, Hearts For Hope was an evening of celebration and giving. Donate today by visiting hopelives.org

8-17: Layman Lewis Financial Group hosts Lunch and Learn Educational events for their clients each quarter. Topics, presented by Financial Analyst Joshua Lewis, range from Cyber Security to China’s Economy and the Red Sea. Each quarter Josh talks about current events and their impacts on the Market. On March 5th, Josh educated clients about Tariffs, Taxes and Trade Wars.

ARTICLE BY JOSHUA LEWIS

In the ever-evolving world of technology stocks, investors continue to ride the highs and lows with a mix of excitement and trepidation. The sector has long been a magnet for growth- oriented portfolios, but with rapid innovation comes unpredictable market swings. While companies like Nvidia have made headlines with their meteoric rise (and occasional stumbles), the broader tech landscape presents opportunities and challenges that require careful navigation.

The technology sector remains a driving force in the market, fueled by advances in artificial intelligence, cloud computing, and semiconductor development. Despite economic uncertainty, many tech giants continue to post impressive earnings, even as valuations stretch into speculative territory. The Nasdaq-100, heavily weighted with tech stocks, has seen both record highs and abrupt pullbacks in the past year. Companies like Microsoft, Apple, and Alphabet remain dominant players, while newer AI-focused firms seek to carve out their own niches. At the same time, concerns over regulation, supply chain disruptions, and market saturation keep investors on their toes.

Another key factor impacting tech stocks is the Federal Reserve's stance on interest rates. Higher interest rates tend to hurt growth stocks, as they make future earnings less attractive. With inflation still a concern, the Fed's monetary policy decisions could have an outsized impact on tech valuations. Investors should watch for signals from policymakers regarding rate cuts or hikes, as these could cause swift market movements. Nvidia’s Role in the Tech Frenzy While not the sole story in tech, Nvidia has played a significant role in shaping recent market trends. The company's success in AI-driven chip development has propelled it

into the spotlight, with revenue surging due to demand for its advanced processors. However, the stock market’s recent fluctuations highlight the risks associated with lofty valuations and market speculation.

As I see it, Investors with tech-heavy portfolios should take note: while Nvidia's growth prospects remain strong, much of its valuation is tied to future earnings that may or may not materialize as expected. This phenomenon extends beyond Nvidia, with other tech stocks also pricing in aggressive expansion—sometimes beyond what fundamentals can justify. Another notable trend is the battle between semiconductor giants. Companies like AMD and Intel are fiercely competing with Nvidia in AI and high-performance computing. As AI adoption accelerates, demand for these chips will continue to be a crucial factor influencing stock prices. Investors should keep an eye on shifts in market share, product innovation, and supply chain constraints that could shape the industry's future.

For investors who have benefited from the strong performance of tech stocks, one important consideration is how to manage potential capital gains. Selling appreciated assets can lead to notable tax implications, so it may be helpful to explore strategies that could help manage the impact. I recommend Tax-Advantaged Accounts – Retirement accounts such as Roth IRAs and 401(k)s allow investments to grow tax-free or tax-deferred, making them ideal for high-growth assets. An option to consider is Tech-Focused ETFs – Exchangetraded funds (ETFs) like the Technology Select Sector SPDR (XLK) or Vanguard Information Technology ETF (VGT) offer exposure to top tech companies with built-in tax efficiency. Tax-Loss Harvesting – Strategy where investors sell investments that have declined in value to potentially offset capital gains from other sales.

While it’s easy to get caught up in tech momentum, maintaining a diversified portfolio can help smooth out volatility and optimize tax outcomes. The bottom line here is to not subject yourself to the “fear of future regret” and never take profits.

Do not let a tax bill hold your positions hostage. Tax mitigation strategies can help overtime, but I believe investors don’t sell their winners because they don’t want to pay the taxes and hold onto them until they eventually become losers.

It’s often used as part of broader tax planning, and investors may want to consider how it could impact their overall portfolio diversification and investment goals. Long-Term Holding Strategy – Stocks held for more than a year qualify for lower long-term capital gains tax rates. While it may be tempting to cash in quickly, patience can lead to significant tax savings. Diversification and Rebalancing – While it’s easy to get caught up in tech momentum, maintaining a diversified portfolio can help smooth out volatility and optimize tax outcomes.

The bottom line here is to not subject yourself to the “fear of future regret” and never take profits. Do not let a tax bill hold your positions hostage. Tax mitigation strategies can help overtime, but I believe investors don’t sell their winners because they don’t want to pay the taxes and hold onto them until they eventually become losers.

Artificial intelligence has been the dominant theme driving tech stocks over the past year, with companies scrambling to capitalize on the AI boom. Microsoft’s heavy investment in OpenAI, Google’s development of Gemini AI, and Amazon’s push into machine learning all

highlight the growing importance of AI in the tech sector. However, investors should remain cautious. Hype cycles tend to create market bubbles, and while AI is a transformative technology, not every company touting AI will be a long-term winner. The dot-com bubble of the early 2000s serves as a stark reminder of what happens when speculative investments outrun actual earnings potential. There are a few strategies to gain AI exposure without betting on a single company. Using a diversified approach can be helpful, such as spreading risk through AI-focused ETFs or mutual funds.

I believe Tech stocks will likely remain at the forefront of market discussions for years to come. While innovation continues to drive growth, investors must remain vigilant about valuation risks and tax implications. Strategies like tax-efficient investing and portfolio rebalancing can help tech enthusiasts maintain a strong position while helping to minimize unnecessary tax burdens. Additionally, geopolitical risks cannot be ignored. U.S.-China tensions over chip manufacturing, data privacy concerns, and potential antitrust regulations all pose potential headwinds for the sector. Understanding these macroeconomic factors will be crucial for investors navigating the choppy waters of tech investing.

CONTINUED >

Saturday, May 3, 2025

Registration at 7:30 am

Walk starting at 8:30 am

Family-friendly walking 5K Fundraiser for Hope Lives!

2915 Rocky Mountain Avenue (with the course on nearby Centerra trails)

Individual Adult Registration: $50

Youth Registration (12 and under): $25

Team Registration (per person, teams of 4 or more): $45

For questions about registration or event sponsorship contact: Elise Carver 970-225-6200 or email elise@hopelives.org

In the end, navigating the tech sector requires a balanced approach - staying informed, staying diversified, and knowing when to take profits without handing too much over to the IRS. The tech sector may be a roller coaster, but with a solid strategy, you can help mitigate risk and work toward your goals.

Sources

• Nasdaq-100 Market Performance

• Nvidia's Earnings Report

• Technology Select Sector SPDR ETF (XLK)

• Vanguard Information Technology ETF (VGT)

• IRS Capital Gains Tax Information

• Federal Reserve Interest Rate Policy

• AI Market Trends and Investment Risks

This article is meant to be general and is not investment or financial advice or a recommendation of any kind.Please consult your financial advisor before making financial decisions. Investment advisory products and services made available through AE Wealth Management, LLC (AEWM), a Registered Investment Adviser. Investing involves risk, including the potential loss of principal. Past performance is no indication of future results. Investors should consider the investment objectives, risks, charges, and expenses carefully before investing. Neither the firm nor its agents or representatives may give tax or legal advice. Individuals should consult with a qualified professional for guidance before making any purchasing decisions. Layman Lewis Financial Group is not affiliated with the U.S. government or any governmental agency. 2911686 - 2/25

I believe Tech stocks will likely remain at the forefront of market discussions for years to come. While innovation continues to drive growth, investors must remain vigilant about valuation risks and tax implications. Strategies like tax-efficient investing and portfolio rebalancing can help tech enthusiasts maintain a strong position while helping to minimize unnecessary tax burdens.

The Skin Lounge,

Non-Invasive Skin tightening

Microneedling

Radio Frequency

Jett Plasma

Restorative Full body Massages

Lymphatic Detox Treatments

Oxygen Therapy

LED light Therapy Treatments

Microcurrent Facials

Chemical peels

Lymphatic Massage

Sports Massage

Rain Drop Therapy

TMJ- Jaw and Buccal Massage

Crafting a Bespoke Life

Prosperity isn’t measured solely in dollars—it’s measured in freedom. The freedom to focus on what truly matters: time. True luxury isn’t about the price tag; it’s about value—the value of an intentional, well-curated life designed to enhance your well-being and elevate your everyday experiences. Fort Collins: Where Elevated Living Comes Naturally Living in Fort Collins means you already understand the balance between ambition and quality of life. Whether it’s morning walks along the Poudre River, evenings enjoying craft cocktails in Old Town, or weekends exploring Horsetooth Reservoir, you know that time well spent is the ultimate luxury. But a bespoke lifestyle isn’t about cramming in more—it’s about refining what you already love, optimizing your day so you can be fully present in every experience. The Art of Intentional Living Consider something as routine as keeping your home and car spotless. Instead of spending valuable hours on upkeep, a curated service ensures everything is handled seamlessly. Imagine this: After a packed day—whether it’s client meetings, hiking in Lory State Park, or unwinding at a local brewery—you step outside to a freshly waxed car, its sleek surface gleaming in the late afternoon sun. You slide into a perfectly detailed interior, a subtle reminder that the small details of your life are taken care of. You arrive home to a pristine space—floors gleaming, countertops spotless, fresh flowers replenished just as you like them. No stress, no chores—just a sanctuary that welcomes and restores you. This isn’t indulgence; it’s the art of intentional living. More than just convenience, this way of life fosters peace of mind. It eliminates decision fatigue and allows you to devote your energy to what truly fulfills you. Maybe that’s growing your business, deepening relationships, or simply savoring a quiet morning with a cup of locally roasted coffee. By outsourcing the unnecessary, you reclaim time for what truly matters. Elevate, Don’t Accumulate Those who thrive in Fort Collins understand that success isn’t about accumulating more—it’s about curating better. It’s about investing in services and systems that grant you the ultimate luxury: the ability to be fully present in your life. Whether it’s a personal

assistant orchestrating your schedule, a private chef crafting meals that nourish and energize you, or a trusted concierge anticipating your needs before you even voice them, every detail is fine-tuned to support your lifestyle. A bespoke lifestyle isn’t about spending more—it’s about spending wisely. Prioritizing quality over quantity. Choosing experiences that yield long-term value. Designing a world where your time, energy, and resources harmonize to create an existence that feels effortless, abundant, and deeply fulfilling. In Fort Collins, where innovation meets relaxation, this approach isn’t aspirational—it’s expected. Residents here don’t just work hard; they embrace a lifestyle that values well-being, creativity, and efficiency. Whether it’s access to world-class outdoor recreation, a thriving cultural scene, or a community that values sustainability and forward-thinking living, everything about this city encourages a more intentional way of life. You chose Fort Collins for a reason— because life here is about more than just living; it’s about thriving. When your lifestyle is intentionally designed to fit you perfectly, every day feels limitless.

Wealth isn’t about what you spend—it’s about what you gain. A bespoke lifestyle curates services that free your time, ensuring your days are spent on what truly fulfills you. From scheduled home and car care to personal assistants and private chefs, investing in convenience isn’t indulgence— it’s the key to living with clarity, freedom, and purpose.

ARTICLE BY KRISTY BELLEY

The drink that makes you look forward to TAX DAY

• 1½ oz. Gin

• ¾ oz. Dry Vermouth

• ¾ oz. Sweet Vermouth

• ¾ oz. Freshly Squeezed Orange Juice

• 2 Dashes Angastura Bitters

• Orange Twist

• Glass Type: Coupe

1. Squeeze your OJ.

2. Add everything to your shaker with ice.

3. Shake.

4. Pour into your coupe.

5. Twist your orange peel again, like you did last summer.

6. Garnish.

7. Enjoy being done with taxes.

8. And a good cocktail.

The Income Tax Cocktail likely popped up during the Prohibition party scene of the 1920s. Its exact origin story remains a bit blurry, but it was definitely a hit in speakeasies. The name? Well, it's like a cheeky nod to the idea that sipping on this cocktail might be more fun than paying actual taxes! Made with gin, sweet vermouth, orange juice, and a dash of bitters, it's like a boozy adventure for your taste buds, with hints of citrus and herbs. Despite its vintage roots, the Income Tax Cocktail still brings the party vibes, transporting you back to the roaring '20s.

ARTICLE BY MEGAN HOBAN

As consumers, we are constantly being enticed to buy. Whether it’s the jewelry we can’t live without, concert tickets to a show we don’t want to miss, or that favorite pair of shoes calling our name, we buy what we love, and art should be no different.

If you are new to acquiring original art, you may find it daunting, but it shouldn’t be. It is a special purchase that forces you to dig deep and discover a bit more about yourself. At first, many people shy away from buying original art because of the commitment. It’s a big decision after all, and how do you really know when it’s the “perfect” piece? Because art is subjective, part of the process is learning what style of art is the best fit for you. Is it colorful and energetic abstracts, or soothing landscapes that catch your eye? Maybe you are drawn to local photography, or even figurative works. There is no wrong answer, and maybe it’s a mix of several styles that creates your unique collection. The best way to find out your “art personality” is to get out and visit your local galleries. Consider making it a tradition to visit galleries while traveling or buy a piece of art as a gift on special occasions. In the gallery setting you can explore various art styles, mediums, and even learn more about the talented artists who create those works.

With the purchase of original art comes other considerations. Often, we have clients who need direction figuring out what size of art they need and its placement in the design of their space. If you find a piece of art you love, you will always find a spot for it. Ask the gallery if they offer in-home art consultation services to see the piece in your setting. Great custom framing is key, and well-designed framing is the jewelry to a great piece of art. Quality archival framing protects your art from UV rays that can damage a piece over time. Original art should last generations.

I’m often asked, should I buy art for investment? There is a place for investment art, but I don’t believe in buying art with the pretense that it will go up in value. There is no guarantee it will and to me, good investment art brings different riches to your life. Art that brings you joy, adds personality to your space, and makes your home original is an investment in you. The best art investment should be the feeling you experience gazing into an oil painting that perfectly captures a warm sunset over the prairie, or the texture created by a palette knife on the abstract that seems to pop off the canvas. That is what makes investing in original art priceless.

Art that brings you joy, adds personality to your space, and makes your home original is an investment in you.

THESE INVESTMENT BOOKS CAN HELP YOU STAY UP-TO-DATE ON THE LATEST FINANCIAL TRENDS

ARTICLE BY SUSAN LANIER-GRAHAM

Investing in your future is critical yet complicated. While reaching out to qualified professionals is vital— whether you’re building your business, investing in your financial security, or planning for retirement— doing some of your own research is often helpful. We checked out some of the top investment books that help you better understand how to invest in your future and build wealth.

One Up On Wall Street: How to Use What You Already Know to Make Money in the Market by Peter Lynch with John Rothchild. Peter Lynch explains average investors’ advantages over professionals and how they can use these advantages to achieve financial success.

How to Invest: Navigating the Brave New World of Personal Investment, part of Economist Books, by Peter Stanyer, Masood Javaid, and Stephe Satchell. A dynamic new guide to personal investment for the era of cryptocurrencies and personal trading platforms.

Power Your Profits: How to Take Your Business from $10,000 to $10,000,000 by Susie Carder. While not a traditional book on investments, Power Your Profits helps you discover how to take your business from startup mode to the multi-million-dollar mark.

The Wealth Decision: 10 Simple Steps to Achieve Financial Freedom and Build Generational Wealth by Dominique Broadway. A roadmap for becoming a millionaire and building the foundation of generational wealth from a self-made, first-generation multimillionaire.

The Wolf of Investing: My Insider’s Playbook for Making a Fortune on Wall Street by Jordan Belfort. From the investment guru and author of The Wolf of Wall Street, this is a witty and clear-eyed guide for anyone who wants to play the stock market to their advantage and learn the secrets of a top Wall Street investor.

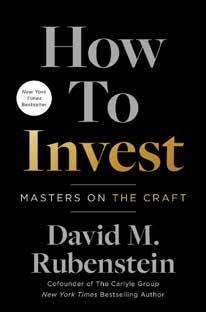

How to Invest: Masters on the Craft by David M. Rubenstein. This book is a master class on investing, featuring conversations with the biggest names in finance. Brought to you by the legendary cofounder of The Carlyle Group, David M. Rubenstein.