The Investment Issue!

FINANCE + LEGAL SERVICES

FINANCIAL LITERACY FOR KIDS

HOME + DESIGN

MAXIMIZE YOUR HOME'S VALUE

HEALTH + WELLNESS

INVEST IN YOUR HEALTH

FINANCE + LEGAL SERVICES

FINANCIAL LITERACY FOR KIDS

HOME + DESIGN

MAXIMIZE YOUR HOME'S VALUE

HEALTH + WELLNESS

INVEST IN YOUR HEALTH

April 2024

PUBLISHER

Amy Sousa | Amy.Sousa@citylifestyle.com

MANAGING EDITOR

Matt Sousa | matthew.sousa@citylifestyle.com

Investing, whether in finances, health, or personal development, is critical for holistic growth and security. Financial investing involves allocating resources into assets like stocks, bonds, or real estate to generate returns over time, securing financial stability and future goals like retirement or education. Beyond finances, investing in health encompasses physical, mental, and emotional well-being. Prioritizing exercise, nutrition, and mental health practices fosters longevity and vitality, enhancing overall quality of life. Similarly, investing in personal development entails continuous learning, skill acquisition, and self-improvement endeavors. Cultivating emotional intelligence, communication skills, and resilience empowers individuals to navigate challenges effectively and seize opportunities for advancement.

The importance of investing lies in its transformative potential. Financial investments grow wealth, health investments enhance vitality, and personal development investments refine capabilities and perspectives. Moreover, investing cultivates discipline, patience, and foresight, essential attributes for navigating life's uncertainties and realizing aspirations. By investing wisely across these domains, individuals lay the groundwork for enduring prosperity, well-being, and fulfillment, ensuring a balanced and prosperous existence in the long run.

This month we talked to Tony Gaffney of Pedego Twin Cities about electric bikes which can be a great investment to commute to work or just take time for yourself. Ann Schreiber, a finance blogger, gives her advice on helping children become financially literate no matter what stage of life they are in. Melissa Clawson from Clawson Home Group gives her recommendations on the best places to spend money on your home to elevate its value. Josiah Parker and Jeremy Jackson, financial advisors with Thrivent’s Pattern Wealth Group, provide information on using tax diversification to efficiently manage your financial assets. Jake Berg from Relive Health talked to us about investing in your health and developing a tailored success plan to maximize each of his clients’ well-being. Karen Mackey from the Dakota County Public Library provided a list of great reads and talks about how the library can help you invest in yourself.

As always, I would like to thank all of Eagan City Lifestyle’s sponsors. Their generous support enables us to get our magazine directly into our readers’ homes. Please don’t hesitate to contact me (amy.sousa@citylifestyle.com) if you have a story to share or a business to recommend.

PUBLISHER ASSISTANT

Madeline O'Neil | madeline.oneil@citylifestyle.com

STAFF PHOTOGRAPHER

Lisa Cline | cline.lisa.marie@gmail.com

STAFF WRITER

Ann Schreiber | copywritingforyoucorp@gmail.com

COPY EDITOR

Judy Sousa

SOCIAL MEDIA COORDINATOR

Jacqueline Elizabeth jacki@ascendanceproductions.com

SALES MANAGER

Nikki Roberts | nikki.roberts@citylifestyle.com

CONTRIBUTING WRITERS

Karen Mackey, Bill Scheller

CHIEF EXECUTIVE OFFICER Steven Schowengerdt

CHIEF OPERATING OFFICER Matthew Perry EXECUTIVE DIRECTOR OF

DIRECTOR OF FIRST IMPRESSIONS Jennifer Robinson

Dunn Brothers Eagan location provides a welcoming environment, whether you are dining in or taking your coffee to go. This locally owned location strives to provide a place for the community to connect over a cup of fresh, locally roasted coffee and delicious made-to-order food. Dunn Brothers customer service and high standards will keep you coming back time and time again.

Life moves in one direction – forward. No matter what each person’s circumstances are, SYNERGY HomeCare steps in with effective, comforting, life-affirming care that moves people, and their loved ones, emotionally and physically forward. From personal assistance and companionship to live-in and end-of-life comfort care, we provide the extra help needed to propel everyone safely and confidently to their fullest potential. To learn more, contact SYNERGY HomeCare of Eagan today at 651-905-5500.

Scan to read more

No more excuses.

Too many hills, too long a ride, tough pedaling – all those excuses, familiar to so many cycling enthusiasts, vanish when you hop on an electric bicycle, or e-bike.

“E-bikes eliminate all the things that keep people from getting out and enjoying a ride,” says Tony Gaffney, owner of Pedego Twin Cities . The Mendota Heights and Eden Prairie dealerships carry the full line of e-bikes by Pedego, one of America’s leading brands. “Hills disappear and miles traveled aren’t a problem anymore. People say, ‘Where else can we go today?’ They’re proud of being able to take longer trips than they ever could before.”

At first glance, an e-bike looks like a slightly chunkier version of a conventional bicycle – pedals, chain, handlebar – they’re

all there. The big difference is that there is a compact battery, mounted either on the frame or behind the seat, and a small motor mounted at the hub of the rear wheel. (Many European e-bikes and some mountain bikes mount the motor midway, between the pedals’ crank arms; all Pedego models have hub-mounted motors.)

On an e-bike, the battery-powered motor shares the work with the rider – and the rider decides just how much sharing is involved. “All of our models are equipped with an independent throttle,” says Tony. “The rider uses the throttle with as much or as little pedal assist as desired. To get across an intersection quickly, you can use the throttle for a fast start without any pedal assist at all.” The throttle alone can get the bike up to 20 mph, the motor’s governed top speed.

ARTICLE BY BILL SCHELLER | PHOTOGRAPHY BY LISA CLINEIt’s possible to stay with the throttle and not pedal at all, although that will drain the battery more quickly. Ideally, a rider finds the right match between motor power and pedal assist. As on a conventional bike, pedaling effort is also regulated by shifting gears.

“Most of our bikes have eight gears,” Tony explains, “and there are 10 on the higher-end Platinum models. You shift the same way you would on a regular bike – all the controls, including the throttle, are on the handlebar.”

How far can you ride on a battery charge?

“It depends a lot on how much you pedal,” says Tony, “and on how flat the terrain is. Pedego bikes use Samsung lithium-ion batteries, in ranges from 36 volt/10.5 amp up to our biggest battery, 52 volt/17.5 amp.” For the smallest batteries, figure on a 15-to-30-mile range, with a reasonable amount of pedal assist. Bigger batteries can keep an e-bike going upwards of 60 miles, again depending on rider effort. “And watch your tire pressure,” Tony advises. “Check before taking your ride. Underinflated tires make more work for you and the motor.”

Depending on size, an e-bike battery will charge in two to six hours. “If you’re in a hurry, though, you can partially charge,” Tony advises. “It’s a good idea to unplug when you reach full charge, although it’s OK to leave it on the charger overnight. Just don’t leave it on all weekend.”

How long will a battery last? “It depends on how many miles you travel a year, and how many charge cycles the battery runs through per year. Seven to ten years is average,” according to Tony.

E-bike prices at Pedego Twin Cities range from around $2,000, for an entry-level Comfort Cruiser, to the $4,500 range for one of the Platinum models. Those are equipped

with front suspension forks, seat posts with suspension, and torque sensors that match motor input to pedaling effort. The dealer’s currently most popular bikes are two “step-through” models, the Interceptor and Boomerang, priced at around $3,000, with an additional $1,000 for the Platinum upgrade. “Step-through” refers to the frame style that once characterized what were called “girls” bikes, a concept that’s nowadays been put to rest. “Both men and women like stepthroughs,” says Tony, “especially if they plan on keeping their bikes for a long time. They’re easier to get on and off.”

Tony reports that the biggest e-bike market is the over-55 set, including “anyone who wants to keep up with a partner who rides a regular bike. We’ve even retaught people how to ride a bike.” Pedego Twin Cities is also starting to see interest among younger buyers, as cargo and child-carrying accessories are available. Some enthusiasts use their e-bikes to commute, including hardy types who ride in snow. Winter riders usually use wider tires – and, Tony adds, “you can even get studs.”

Want to try before you buy? Pedego Twin Cities offers rentals, hourly and up. The dealer also runs guided tours and group rides. They’re mainly for folks who already have an e-bike, but rentals are available for friends and spouses who want to join in. “There are lots of trails in our area,” says Tony, “especially in Dakota County.” And they’re all accessible to e-bikes.

Pedego Twin Cities’ Mendota Heights location is located at 1355 Mendota Heights Road, Suite 180; their Eden Prairie store is located at 9719 Valley View Road. You can learn more about all they have to offer by calling (612) 8275000 or visiting pedegoelectricbikes.com

NEW PACKAGES BOOKING 2023-2024

AVAILABLE!

WEDDINGS, GRAD PARTIES, PRIVATE PARTIES, CORPORATE EVENTS, & MORE!

If you’re a parent, you know that there are so many things that we need to teach our children. From teaching them how to bathe, brush their teeth, comb their hair, tie their shoes, and so much more, it’s an endless journey full of major milestones. But one thing that can be easy to toss to the wayside is teaching kids about money management. And believe it or not, this education can start as soon as they’re old enough to walk!

Did you know that 62% of Americans are living paycheck to paycheck? Or, how about the average American has $59,580 in debt spread across mortgages, credit cards, and student loans? And while by no means are we suggesting this is bad, it does bring to light an important question: how do we stand as a country regarding financial literacy? And what are we doing to teach our kids about money and how to be financially secure as adults?

These are great questions. What many parents don’t realize, however, is that financial literacy needs to start when kids are young. When they’re little, their minds are able to grasp far more than we often give them credit for. Not only that, but kids are like sponges, soaking up information along the way to help them later in life.

Further, have you ever noticed how kids pick up your bad behaviors? Well, they pick up your good behaviors, too (even though you might not always see it right away). So, let’s look at some things that we can do as parents to help build financial literacy and good spending habits in our kids now so that they’ll be financially savvy later.

LEARNING ABOUT MONEY: TODDLER TO PRESCHOOL YEARS (AGES 1-5)

Can I really teach my toddler and preschooler about money? The answer is yes! Here's how you can start laying the groundwork for financial literacy in these early years:

AND IDENTIFYING COINS

• Begin by introducing your child to the concept of counting. You can count toys, snacks, or even steps as you walk together.

• Show them different coins and teach them their names and values. Use simple language like "This is a penny; it's worth one cent."

HANDS-ON LEARNING: UTILIZING PLAY MONEY AND SIMPLE SAVINGS JARS

• Use play money to make learning about coins and their values fun and interactive. You can play pretend store or restaurant and practice "buying" items.

• Introduce a simple savings jar where your child can deposit coins they receive or earn. Make it a colorful and exciting activity by letting them decorate the jar with stickers or markers.

• Assign your child age-appropriate tasks around the house and offer small rewards for completing them. This could include putting away toys, helping set the table, or feeding a pet.

• Praise your child for their efforts and accomplishments. Positive reinforcement, just as it sounds, helps reinforce positive behaviors and teaches the value of hard work.

• As your child grows into the elementary school years, it's time to level up their money smarts! Here are some practical ways to continue building their financial literacy:

ESTABLISHING CHORES FOR EARNINGS: CHORES VS. ALLOWANCES

• Now that your child is older, you can introduce the concept of earning money through chores. Explain the difference between chores, which are tasks they're expected to do as part of the family, and earning money for extra tasks.

• This distinction teaches responsibility and the value of hard work, setting a strong foundation for their understanding of earning and spending money.

What many parents don’t realize, however, is that financial literacy needs to start when kids are young.

We know that parents have a lot on their plate. But building financial literacy in kids will pay off over time!

• Help your child understand the difference between needs (like food, shelter, and clothing) and wants (like toys or treats). Encourage them to prioritize their spending based on these categories.

• Introduce the idea of budgeting by giving them a set amount of money for discretionary spending, such as allowance or money earned from chores. This teaches them to make choices and prioritize their wants.

• Encourage your child to set savings goals for things they want to buy in the future. Whether it's a new toy or a special outing, help them create a plan to save up for it.

• Take your child with you to the bank to open a savings account in their name. This hands-on experience teaches them about banking and the importance of saving for future goals.

• As your child enters the middle school years, it's time to take their financial literacy to the next level! Here are some key steps to help them understand more advanced concepts:

• At this age, your child may start to become more independent with their spending. Introduce them to the concept of debit cards, which allow them to make purchases using money from a linked bank account.

• It's important to note that minors under 18 are typically not permitted to open checking accounts in their name. However, young adults over 13 can often get a debit card with the help of an adult. These teen debit cards are usually connected to a joint bank account that both parents and teens can access.

• Help your child understand the concept of borrowing money by allowing them to borrow from you for a purchase, such as a video game or clothing item.

• Set up a repayment plan with your child, including a small amount of interest. This could be as simple as adding a few extra dollars to the amount they borrowed.

• By experiencing borrowing and repaying with interest, your child learns about the responsibilities and costs of borrowing money.

• As your child progresses through the high school years, it's time to empower them with the tools they need for financial success. Here's how to set them on the right path:

• Teach your child how to create a budget by tracking income from their first job and allocating funds for expenses like entertainment, transportation, and savings.

• Discuss the responsibilities and risks of credit cards, and guide them in choosing their first card when they turn 18. Emphasize the importance of paying bills on time and avoiding high interest rates.

• Introduce your child to the concept of taxes and help them understand how to calculate and manage their tax obligations from their job earnings.

• Encourage your child to save for college tuition by setting aside a portion of their monthly income.

• Involve your child in purchasing their first car and teach them about ongoing expenses like gas and insurance. Empower them to make responsible financial decisions and learn from the outcomes.

We know that parents have a lot on their plate. But building financial literacy in kids will pay off over time (pun intended)! We hope these tips can help you and your child become financially savvy for today and tomorrow, and all the years to come!

Here’s to smart spending and saving!

Are you familiar with the old adage “Don’t put all your eggs in one basket?” This phrase is often used to reinforce why it’s important to diversify your investments to help reduce the risk of losses.

But the wisdom of diversification extends beyond retirement savings, too. Did you know it’s also wise to apply this principle to your tax strategy? You can position the money you’re saving (or have already saved) to be more income tax-efficient by allocating your assets across three buckets: tax now, tax later, or tax never. Doing this can potentially increase your total spendable income when you need it most.

Below is a quick guide to help familiarize you with the different tax buckets.

1. Tax now: These are the savings accounts where any potential interest, dividends, and gains that you earn are taxed immediately. Typically, accounts like checking, savings, certificates of deposit, and mutual funds are in this category. While these gains are taxed annually, both the contributions and potential gains are readily available for a rainy day. The money in many of these accounts also doesn’t fluctuate with the market.[1]

2. Tax later: Money in these accounts, which includes 401(k)s, 403(b)s, and traditional IRAs, are funded with pre-tax dollars and can grow tax deferred. This means you pay the income tax on both your contributions and any potential gains when you withdraw the funds. These assets are generally earmarked for longer-term needs, like retirement and college funding.[2,3,4]

3. Tax never:[5] Roth IRAs and Roth 401(k)s,[6] municipal bonds,[7] and life insurance with cash value[8] are the most common accounts in the tax-never basket. With these accounts, the gains you may get may not be taxed – you generally don’t get taxed annually and you may avoid taxation when you take the money out.

Want to get started? A good first step is to meet with a financial professional to go over your savings accounts. They’ll ask about your objectives, learn about your risk tolerance, and help you develop a strategy that ensures your investments are in the appropriate types of accounts.

As you consult with your financial professional, you may also want to ask them about the tax implications of individual stocks, Roth conversions, Social Security, and estate planning. Depending on the complexity of the tax questions you’re dealing with, you may need to reach out to a tax advisor for additional guidance.

Whether you’re just starting in your career, planning for the future, or already in retirement, thinking about tax diversification is important. Having a thoughtful strategy will help ensure you can get the most out of the assets you’ve worked so hard to earn so you can live a life of meaning and gratitude.

This article was prepared by Thrivent for use by Eagan City Lifestyle by Josiah Parker, Financial Advisor, and Jeremy Jackson, CIMA®, FIC, Wealth Advisor. Josiah can be reached at 612-990-4125 or Josiah.parker@thrivent. com. Jeremy can be reached at 763-330-2905 or jeremy. jackson@thrivent.com. You can also visit their website at https://connect.thrivent.com/pattern-wealth-group

Thrivent is a diversified financial services organization that helps people achieve financial clarity, enabling lives full of meaning and gratitude. Thrivent and its subsidiary and affiliate companies serve more than 2.3 million clients, offering advice, insurance, investments, banking, and generosity products and programs over the phone, online, as well as through financial professionals and independent agents nationwide.

Thrivent is a Fortune 500 company with $162 billion in assets under management/advisement (as of 12/31/20).

Thrivent carries an A++ (Superior) rating from AM Best, a credit rating agency; this is the highest of the agency’s 16 ratings categories and was affirmed in June of 2020. Rating based on Thrivent’s financial strength and claims-paying ability. Does not apply to investment product performance. For more information, visit Thrivent.com . You can also find us on Facebook and Twitter.

1. Any interest, dividends or capital appreciation is subject to taxation when realized.

2. Gains subject to income tax when withdrawn.

3. Generally funded with pre-tax dollars.

4. Distributions prior to age 59½ may incur a 10% premature distribution penalty.

5. The withdrawal of dividends or the amount of a loan or partial surrender may be subject to ordinary income taxes.

6. Funded with after-tax dollars, qualified distributions of gains are penalty and tax-free.

We’re celebrating 20 incredible years of smiling out loud in Eagan with a BIG announcement! Dr. Jennifer Orthodontics is proud to begin a new chapter in industry-leading orthodontic care as Lakeside Orthodontics. Our new name and logo reflect the heart of what we do—we make the Twin Cities smile.

DR. JENNIFER EISENHUTH DR. CHAD RASMUSSENNon-qualified distributions prior to age 59½ may incur a 10% premature distribution penalty; all distributions may incur surrender charges.

7. Interest is free from federal income tax; may be subject to state income tax, federal alternative minimum tax and capital gains tax.

8. The primary purpose of life insurance is for the death benefit protection. Withdrawals may be available income-tax-free to the extent of basis. Lifetime distributions of the cash value are subject to possible income taxation and penalties, could reduce the death benefit, and could cause the contract to lapse.

While diversification can help reduce market risk, it does not eliminate it. Diversification does not assure a profit or protect against loss in a declining market. Funded with after-tax dollars, qualified distributions of gains are penalty and tax-free. Non-qualified distributions of gains prior to age 59½ may incur a 10% premature distribution penalty and are taxable. Thrivent financial professionals have general knowledge of the Social Security tenets. For complete details on your situation, contact the Social Security Administration. Thrivent and its financial professionals do not provide legal, accounting or tax advice. Consult your attorney or tax professional.

Thrivent is the marketing name for Thrivent Financial for Lutherans. Insurance products issued by Thrivent. Not available in all states. Securities and investment advisory services offered through Thrivent Investment Management Inc., a registered investment adviser, member FINRA and SIPC, and a subsidiary of Thrivent. Licensed agent/ producer of Thrivent. Registered representative of Thrivent Investment Management, Inc. Advisory services available through investment adviser representatives only. Thrivent.com/disclosures

Have you ever wondered how many homes are bought and sold in Minnesota each day? While we don’t have the exact number, I can tell you, it’s a lot! People are always buying and selling homes, whether for relocation, to upsize, to downsize, or anything in between. Yet regardless of the reason for selling, one thing remains constant—the need to ensure your home has the proper improvements so that not only will you love where you live, but your home has the best possible value if and when the time comes to sell.

APPEAL FOR LONGTERM INVESTMENT AND

"IF YOU'RE NESTING FOR DECADES, INDULGE IN WHAT YOU LOVE, BUT IF IT'S ABOUT INVESTMENT, APPEAL TO THE BROADER MARKET."

And in this crazy world of real estate, few names resonate with the blend of expertise, innovation, and client-centered service quite like Melissa Clawson, the driving force behind Clawson Home Group. With over a decade of experience under her belt and a year into her venture with eXp Realty, Melissa has become a source of knowledge and inspiration for homeowners looking to elevate their property's value, whether for the long haul or a swift sale.

At the heart of Melissa's advice is a simple truth: not all home updates are created equal. The path you choose should mirror your intentions—crafting a personal haven or staging a market-ready asset. "If you're nesting for decades, indulge in what you love," Melissa advises. "But if it's about investment, appeal to the broader market."

Are you looking to sell your home? Consider these recommendations from Melissa on where to start and where to spend your money.

1. Hardware Updates: A minor change with major impact. Melissa shares the power of cohesive hardware to transform a space. "Matching doorknobs, cabinet handles, and light fixtures can significantly enhance your home's aesthetic," she points out. And not only is matching important, but if those hardware items are outdated, now is the time to update and modernize.

2. Maintenance and Repairs: Don't overlook the basics. "Living with a broken fixture isn't just inconvenient—it's a red flag to potential buyers," Melissa warns, urging homeowners to embrace their inner handyman.

3. Bathroom Renovations: The crown jewel of home improvements. Melissa places a premium on the primary bathroom, recommending updates from vanity refreshes to luxurious tiles, turning this private space into a selling point.

CONTINUED >

Melissa Clawson was raised in Eagan, and she currently resides in Minneapolis. She focuses on delivering personalized services and constant communication to keep her clients happy! Currently, she is licensed with eXp Realty and has taken on the responsibility of team lead at the Clawson Home Group. Originally coming from a career in education, she enjoys focusing her efforts on informing and teaching her clients about the entirety of the housing transaction. In her spare time, she enjoys traveling, spending time with friends and family, and trying and reporting on new dishes and dining experiences throughout the Twin Cities Metro foodie scene. Her passions include volunteering with Boulder Options and Pancreatic Cancer Action Network.

The Clawson Home Group with eXp Realty has been serving the Twin Cities for over 11 years! They focus on creating an environment of meeting expectations for clients and constant communication to achieve everyone’s housing goals. The Clawson Home Group specializes in first time buyers, diversifying a real estate investment portfolio, and with families transitioning from home to home.

4. Garage Door Replacement: An exterior facelift with function. "A carriage house-style garage door adds a touch of elegance," Melissa notes, enhancing both curb appeal and perceived value. And while you’re in the process of replacing that garage door, consider a fresh coat of paint for the perimeter. The harsh Minnesota weather conditions can wreak havoc on your exterior paint.

5. Kitchen Remodeling: A study not too long ago suggests that Americans spend at least 67 minutes daily in their kitchen. That’s a lot of time when you think of it. As such, the heart of the home deserves attention. "Invest in your kitchen as early as possible," she suggests, advocating for natural wood tones and hardware updates to rejuvenate this central space.

Beyond structural enhancements, Melissa champions a clutter-free and clean home environment, not just for its marketability but for the well-being it brings to its inhabitants. In fact, it’s well-known that clutter can decrease your productivity, increase your stress, make you feel more isolated, and even impact your sleep.

By regularly decluttering your home, not only can you help yourself feel better, but you can ensure your home is ready to list when you’re ready. So, it’s a win-win situation!

With a team of six dedicated agents, Clawson Home Group specializes in seamless transitions, offering specialty financing programs that cater to the unique needs of moving homeowners. "Our goal is to make each transaction smooth and profitable," Melissa states, reflecting on the group's commitment to education and client satisfaction.

“We have a specialty financing program for those selling their home and purchasing a new home. It’s a great way to maximize the two transactions and ensure you have the funds for a remodel at the time of closing,” she shares.

As for the housing market, Melissa shifts the focus from interest rates to inventory. "A healthy market thrives on available properties," she explains, reminding us of the lasting value real estate offers as an investment.

For those looking to navigate the complexities of home improvement, buying, or selling, Melissa Clawson and her team at Clawson Home Group stand ready to guide you through. Their expertise, rooted in genuine care and strategic insight, promises not just a transaction but a journey toward maximizing your home's value and your satisfaction as a homeowner.

4 INDOOR PICKLEBALL COURTS... Join The Fun!

THE BURROW IS YOUR NEIGHBORHOOD GAMING DEN WITH ENDLESS GAMING OPTIONS. COME CHECK OUT OUR HOMEMADE PIZZAS, GOURMET BURGERS AND 32 LOCAL TAPS AND CRAFT COCKTAILS.

WWW.THEBURROWMN.COM

OAKDALE + VICTORIA, MN

“I love taking things that are taboo to others and educating people on how these treatments can be effective.

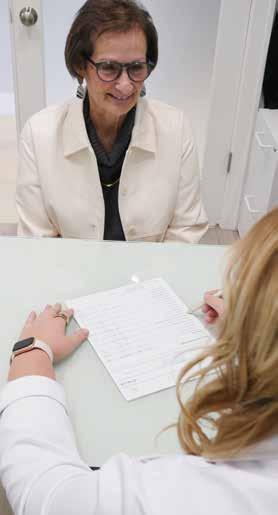

In the world of healthcare, where large corporate clinics see hundreds of clients daily, there's a hidden gem nestled just a stone's throw away from Eagan in Lakeville, MN. Relive Health isn't your average medical clinic; it's a sanctuary for those seeking comprehensive, quality care in a serene environment.

I recently had the privilege of sitting down with Jake Berg, a passionate advocate for health and wellness and one of the driving forces behind Relive Health, to hear firsthand what makes this establishment unique.

Jake Berg, the owner of the Lakeville franchise, originally pursued an education in criminal profiling and justice. And while he found the field fascinating, he discovered along the way that his interests were less about criminal intent and more about the human psyche and what makes people tick.

He later found his calling in health and wellness over a decade ago. "I like people. The human brain is fascinating to me. I like understanding the whys behind human behavior," he shares. Since then, he's immersed himself in the world of health and wellness, dedicating himself to helping individuals take control of their well-being.

Relive Health opened its doors in Lakeville in August 2018 with a mission to renew health through a holistic approach to modern medicine. "We help people take control of their health through personalized health and wellness solutions," Jake explains. Their focus isn't just on treating symptoms. It’s about identifying underlying causes and developing tailored success plans for each individual.

One of the standout features of Relive Health is its commitment to optimal health. Unlike traditional clinics, Relive Health goes beyond standard blood

work, offering a comprehensive analysis of 85 health markers. Patients receive personalized attention from nurse practitioners who meticulously review lab results line by line, ensuring no detail is overlooked.

But Relive Health isn't just about diagnostics, either; it's about offering a diverse array of treatments to address a wide range of health concerns. Relive Health provides a holistic approach to wellness that extends from the inside out, from medical weight loss programs to fertility support and innovative therapies like ozone therapy

During our conversation, Jake’s face lit up as he discussed ozone therapy, an alternative approach to healthcare that has been shown to have numerous benefits, including improved oxygen levels, reduced inflammation, and revitalization of major organs. "I love taking things that are taboo to others and educating people on how these treatments can be effective," Jake remarks.

For those not in the know, this cutting-edge treatment utilizes medical-grade ozone produced by specialized ozone generator devices. This therapy elevates your body's oxygen levels, potentially bolstering your immune system and fostering healing. By stimulating cell regeneration, ozone therapy facilitates the replacement or repair of damaged cells, promoting overall well-being and vitality.

As shared above, Relive Health offers various innovative therapies to enhance overall health and wellness. Among its diverse offerings, hormone replacement therapies for both men and women are an increasingly popular choice. Tailored to meet the unique hormonal needs of each individual, these therapies are designed to restore balance and vitality, addressing symptoms related to hormonal imbalances such as fatigue, mood swings, and brain fog.

Beyond hormonal health, Relive Health also specializes in medical weight loss programs. These are not one-size-fits-all solutions but comprehensive, scientifically-backed plans that include personalized nutrition and exercise guidance, alongside medication management if necessary. This holistic approach ensures that weight loss goals are not only achieved but maintained long-term, promoting a healthier lifestyle.

Additionally, IV vitamin therapy at Relive Health offers an immediate boost to one’s health. By delivering essential vitamins and minerals directly into the bloodstream, this therapy ensures optimal absorption, providing benefits such as increased energy, improved immune function, and enhanced hydration. Each IV therapy session is customized to the individual's health needs, supporting everything from recovery from illness to ongoing wellness maintenance.

What sets Relive Health apart from the crowd and other approaches to medicine is its commitment to individualized care and its dedication to helping patients achieve their health goals. "No patient is treated exactly the same," Jake emphasizes. “Whether you're struggling with weight gain, anxiety, or poor sleep, Relive Health offers a personalized approach to address your unique needs.”

Beyond its clinical offerings, Relive Health is deeply invested in the well-being of its patients. "Everyone who works at the clinic is invested in health and wellness, minimizing toxins," Jake explains. This dedication to holistic wellness extends to the clinic's expansion plans, with a vision to bring their unique approach to health to more communities in the Twin Cities area.

Jake remains committed to changing lives and helping people feel better as Relive Health grows. "It's so rewarding to see the impact we can have on our patients' lives," he reflects. From offering innovative therapies to fostering a culture of wellness, Relive Health is not just a clinic; it's a beacon of hope for those seeking to renew their health and reclaim their vitality.

In a world where health care can feel impersonal and overwhelming, Relive Health is a place where individuals can find personalized care, holistic solutions, and a renewed sense of well-being.

So, if you're ready to take control of your health and embark on a journey toward wellness, why not take the first step with Relive Health? After all, your healthspan is worth investing in, and at Relive Health, they're here to help you live your healthiest, happiest life possible. Contact Relive Health today at (952) 595-6061 or book an appointment at https://relivehealth.com/lakeville-mn/

TECHNOLOGY BASED TRAINING FOR ALL FITNESS LEVELS

ARTICLE BY MATTHEW SOUSA

ARTICLE BY MATTHEW SOUSA

Getting fit takes effort, discipline, and time. Today, with so many people having hectic schedules, time to work out is often hard to come by. BODY20, now open on Vikings Parkway in Eagan, offers revolutionary, technology-based training that gives you the results you want in a fraction of the time.

BODY20 utilizes personal trainer-led programs in combination with electro-muscular stimulation (EMS) training to help their clients reach their fitness goals. EMS uses painless electrical impulses to stimulate muscle contractions and can be done with or without weights. In a typical 20-minute session, your body will experience more than 150 times more muscle contractions than a conventional workout. Cutting-edge, bio-impedance technology allows BODY20 members to track and monitor their results. It’s not cheating – it’s just a more efficient way of working out.

Training at BODY20 offers numerous results. The lack of heavy weights or pounding on a treadmill enables a high-intensity workout that is low-impact on joints, bones, nerves, and muscles. The extra stimulation given to muscles during a BODY20 session leads to a quicker increase in muscle mass. Workouts also promote the circulation of blood throughout the muscles, which helps to release muscular tension and knots.

Whatever your age or fitness level, your BODY20 sessions are customized to your specific goals. Whether you want to improve physical strength, boost energy, burn maximum calories to aid weight loss, get rid of stubborn fat, and even reduce cellulite, the team at BODY20 can help you more efficiently achieve your goals.

Mendakota

seven steps to help achieve a more secure retirement.

Light refreshments will be served. Learn

Tuesday, April 30, 2024, 3 p.m and 6:30 p.m.

Eagan Community Center—Oasis Room 1501 Central Pkwy, Eagan, MN 55121

This session is hosted and presented by Jeremy Jackson, Wealth Advisor, CIMA®, FIC and Josiah Parker, Financial Advisor.

No products will be sold.

T To register, scan QR Code or email patternwealthgroup@thrivent.com.

Thrivent is the marketing name for Thrivent Financial for Lutherans. Insurance products issued by Thrivent. Not

Licensed agent/producer of Thrivent. Thrivent.com/disclosures.

APRIL 2024

APRIL 20TH

4425 Sandstone Drive | 10:00 AM Summer will be here before you know it! Stop by the Summer Kick-Off to learn about how Eagan Parks & Recreation can keep everyone busy! From sports to art, fitness to preschool, seniors to community events and so much more! Along with summer program information, there will be a variety of fun activities, giveaways, and light refreshments. See you there!

APRIL 23RD - JUNE 16TH

2400 3rd Ave S, Minneapolis, MN 55404

Children’s Theatre Company’s Tony® Nominated musical A Year With Frog and Toad runs April 23-June 16. Join Frog and Toad, best friends who embark upon a year’s worth of adventures with great merriment, comedic agility, and joyful song-singing. “Chock full of catchy tunes and clever characterizations...Frog and Toad charm[s] wee ones and adults alike!” - Star Tribune For more information visit https://childrenstheatre.org/ whats-on/frog-toad/

APRIL 26TH

1721 County Rd C West, Roseville, MN 55113 | 12:30 PM

Operation Dignity International, a faith-based non-profit organization that works in Ghana, West Africa, is raising $20,000 to support the Ahyiayemu Health Center near the village of Kontonso in Ghana, West Africa. Join us for an afternoon out having fun with friends and colleagues and help ODI get one step closer to providing better healthcare to the people of Kontonso.

Listings were pulled from the NMLS. This reflects a 30-Day time period prior to our print deadline. Information deemed reliable but not guaranteed and not a complete list of activity. *DOM = Days on Market

Investing means putting time or effort toward something with a worthwhile return in mind. Sometimes that “something” is financial, but there are many other ways to invest toward a better future. Perhaps you want to start your own business, change your diet for long-term health, hone your business acumen, or learn a new skill or language.

Let your library provide inspiration and guidance! Wescott Library has an ever-changing collection of books, magazines and DVDs, access to Wi-Fi, on-site classes and events, online books, tools, and resources that can be accessed remotely, and a makerspace – all available free of charge.

Access LinkedIn Learning to refresh your technical, software, and business skills, or use the Mango Languages app to learn a new language like Spanish or Ukranian.

Visit the Wescott Library’s iLab makerspace where you can invest time expanding your knowledge and skills using equipment including 3D printers, sewing machines, an audio production booth, and a photo scanner.

Get started today at www.dakotacounty.us/ library, or contact us at 651-450-2900 to learn more.

RECOMMENDED TITLES:

American Sign Language

Made Easy for Beginners Travis Belmontes-Merrell

Artpreneur:

The Step-by-Step Guide to Making a Sustainable Living from Creativity Miriam Schulman

Change Your Diet, Change Your Mind Georgia Ede, MD

Make: Getting Started with 3D Printing

Liza Wallach Kloski & Nick Kloski

Start Here: Instructions for Becoming a Better Cook Sohla El-Waylly

The 12-Week MBA

Bjorn Billhardt & Nathan Kracklauer

ARTICLE BY KAREN MACKEY, MLI

ARTICLE BY KAREN MACKEY, MLI

Indulge in a rejuvenating spring escape at Omni Viking Lakes Hotel. Whether you’re looking for family fun, a girl’s weekend getaway, or anything in between, we can help you plan the perfect retreat. Take part in Nordic tradition with the ritual of thermotherapy in our full-service Idlewild Spa. Indulge in one of our four restaurant and bar offerings including Kyndred Hearth, James Beard award-winning chef Anne Kim’s take on familiar favorites. Relax in upscale accommodations and enjoy a relaxing break this spring at Omni Viking Lakes.

OMNIHOTELS.COM/VIKINGLAKES