SOCIAL SECURITY

SOCIAL SECURITY CELEBRATES 90 YEARS OF SERVICE TO THE AMERICAN PEOPLE

COURTESY WIKIMEDIA COMMONS

President Franklin D. Roosevelt signs Social Security Act, at approximately 3:30 pm EST on 14 August 1935. Standing with Roosevelt are Rep. Robert Doughton (D-NC); unknown person in shadow; Sen. Robert Wagner (D-NY); Rep. John Dingell (D-MI); Rep. Joshua Twing Brooks (D-PA); the Secretary of Labor, Frances Perkins; Sen. Pat Harrison (D-MS); and Rep. David Lewis (D-MD).

T

he Social Security Administration (SSA) proudly commemorates its 90th anniversary, marking its unwavering commitment to the financial security and dignity of millions of Americans. Since President Franklin D. Roosevelt signed the Social Security Act into law on August 14, 1935, the program has grown into one of the most successful and trusted institutions in American history. At a ceremony in the Oval Office today, President Trump signed a presidential proclamation reaffirming his commitment to protect Social Security and celebrating the customer service improvements that have occurred at the agency during his presidency.

“For 90 years, Social Security has stood as a promise kept, ensuring that older Americans, people with disabilities, and families facing loss have the support they need,” said Commissioner Frank J. Bisignano. “As we honor this legacy, we are also building a future where service

is faster, smarter, and more accessible than ever before. Through President Trump’s vision, we are protecting and preserving Social Security by delivering extraordinary customer service through technological improvements and enhanced process engineering.”

This year, 72 million beneficiaries will receive over $1.6 trillion in payments—making Social Security a lifeline for retired workers, survivors, and people with disabilities and a cornerstone of retirement security across generations.

Since his swearing-in on May 7, 2025, Commissioner Bisignano has led a bold digital-first transformation of SSA’s operations, guided by a vision to make the agency a premier service organization. Within 100 days as Commissioner of the agency, he has led SSA to achieve significant improvements in service delivery for the American people:

• Giving Americans 24/7 access to their personal my Social Security account, allowing more than half a million transactions to take place in the first three weeks, when previously the website was down 29 hours a week.

• Reducing average wait time on the National 800 Number from 30 minutes last year to single digits last month.

• Shortening field office wait times by 30%, and booking more appointments than ever before.

• Upgrading phone systems in all field offices, allowing for 30% of all calls to be handled instantaneously through technology.

• Enabling 90% of calls to be resolved via self-service or convenient callbacks.

• Reducing the initial disability claims backlog by 26%, from 1.2 million to 940,000 cases.

• Decreasing disability hearing wait times by 60 days, reaching historic lows.

• Sending over 3.1 million payments totaling $17 billion to eligible beneficiaries five months ahead of schedule under the Social Security Fairness Act.

Commissioner Bisignano’s modernization agenda emphasizes operational agility, data-driven performance, and a digital-first

approach. His leadership has prioritized:

• Integration of technology to streamline phone inquiries and reduce errors.

• Strengthening of data security following past breaches, with firm commitments to safeguard beneficiary information and eliminate fraud, waste, and abuse.

• Workforce optimization to increase frontline capacity while maintaining service excellence.

“Our strategy is clear: serve customer needs quickly and completely, no matter how they contact us,” said Commissioner Bisignano. “We are empowering our workforce and embracing innovation to ensure Social Security properly supports the American people and remains strong for the next 90 years.”

As SSA celebrates this milestone, it remains focused on its mission of delivering benefits accurately, efficiently, and timely. The agency continues to work with Congress, outside advocates, and the American public to strengthen Social Security, and deliver on President Trump’s mandate to protect and preserve for generations to come.

Local Legacy

Family-run

COURTESY

President Donald J. Trump and SSA Commissioner Frank J. Bisignano in the Oval Office as President Trump issues a presidential proclamation honoring the 90th anniversary of the Social Security Act..

HOW DO I APPLY FOR SOCIAL SECURITY?

If you’re thinking about signing up for Social Security benefits, the good news is—it’s actually a pretty straightforward process. You’ve got a couple of options: you can either call the Social Security Administration at (800) 772-1213, or reach out to your local Social Security office to schedule a phone appointment. If you’d rather handle things online (like many of us prefer these days), you can apply directly at: www.ssa.gov/apply

Before you apply online, though, you’ll need to set up your personal “my Social Security” account at: www.ssa.gov/myaccount/

It only takes a few minutes, and once your account is up and running, you’ll be able to apply for benefits and also get a personalized look at what our estimated benefits will be at different retirement ages.

Now, here’s something you might not know: 65 is not considered your full retirement age (FRA) for Social Security. If you were born in 1960, your FRA is actually 67. That’s the age when you’re entitled to receive 100% of the benefits you’ve earned over your working life. If you start collecting at 65, your monthly benefit will be permanently reduced—to about 87% of what you’d get if you waited until age 67.

And if you’re still working when you start collecting early? That’s where the Annual Earnings Test (AET) comes into play. For 2025, if you earn more than $23,400, Social Security will temporarily withhold $1 in benefits for every $2 you go over that amount.

(Don’t worry, though—they don’t take that money forever. It gets adjusted in future payments.) Once you hit your full retirement age, you can earn as much as you want without any penalty.

So yes, you can absolutely apply for your benefits now—online or by phone—but just be aware of how your age and income can affect what you receive.

One more important thing: since you’re 65, you’re likely thinking about Medicare too. Just so you know, you don’t have to start Social Security in order to enroll in Medicare. You can sign up for Medicare on its own, either by calling Social Security or going online. If you’re looking to enroll in just Medicare, the easiest place to start is here:

MEDICAID FACTS

FACT

Many People who require nursing home care cannot afford to pay the costs.

Because of the high costs, a high percentage of residents that live in nursing homes rely on Medicaid to pay for their care. Today, an estimated four percent of the over 65 age population lives in a nursing home. As the proportion of the older people increases due to longer life expectancies, it is likely that more and more people will need nursing home care.

By definition, Medicaid is a jointly funded program managed by both state and federal governments. Medicaid offers medical treatment, including nursing home care for low-income individuals who are 65 or older, blind or disabled.

The rules for qualifying for Medicaid change often and vary state to state and from country to country. Medicaid is not considered an entitlement program like Social Security; rather it is a needsbased program. Because it is based on the need, a person is not eligible to receive Medicaid benefits as a matter of right. Each person must make himself or herself eligible.

As a component of qualifying for Medicaid, a person must have limited assets. To limit assets, a person may be required to “spend down” his or her assets to a level as determined by the appropriate regulatory agency in his or her area. The concept of “spending down” is simple. Essentially, the Medicaid agencies will provide funding for nursing home care only once a person’s assets have been reduced to the specified limits.

FACT

There are several methods to “spend down” assets, one of which is to prepay funeral expenses.

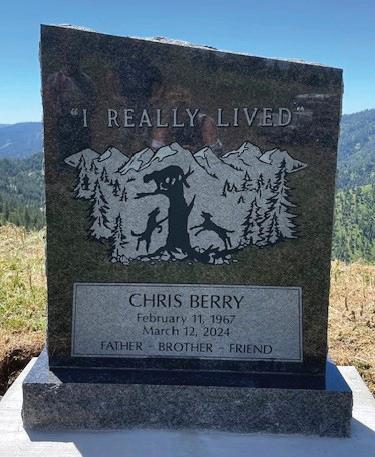

If a person’s assets exceed the specified limits, then he or she may have to use his or her own assets to pay for his or her care in a nursing home. There are several methods to “spend down” assets, one of which is to prepay funeral or cremation expenses. Most agencies will exclude a prepaid funeral plan (within limits) when determining eligibility for assistance.

MEDICAID ELIGIBILITY

The qualifications for Medicaid eligibility vary from state to state and from country to country. An attorney who understands Medicaid should be contacted before attempting to qualify for Medicaid coverage. In order to qualify, you typically need to meet the following requirements:

• Be a U.S. citizen living in the U.S.

• Be over 65, disabled or blind

• Have a “medical necessity”

Social Security won’t cover everything.

Do

you have a plan?

When it comes to funeral costs, Social Security pays very little, leaving your family with unexpected payments.

Pre-planning provides you with the time needed to make practical, detailed decisions that reflect your standards, lifestyle, taste and budge t. We can advise you of the total cost, and the funds you set aside today can help your family in the future.

Mountain View Funeral Home & Crematory

Merchant Funeral Home

Richardson-Brown Funeral Home

Lewis Clark Memorial Gardens

Courtesy of Merchant Funeral Home

COULD YOU SPOT A GOVERNMENT IMPOSTER SCAM?

S cammers are getting trickier by the day so it’s more important than ever to stay one step ahead. These criminals are constantly coming up with new ways to try to steal your money and personal information.

What Do These Scams Look Like?

Government imposter scams often use a similar tactic. The scammer pretends to be from Social Security—or another government agency—and tells you there’s something wrong with your Social Security number or benefits. They might even say your SSN has been linked to a crime. Their goal? To scare you into acting fast. They might threaten you with arrest or legal action if you don’t send money or give them your personal info right away.

Sometimes, they’ll even promise to boost your benefits if you pay a fee.

But here’s the truth: that’s not how Social Security—or any government agency— works.

If You Get a Suspicious Call or Message:

• Hang up immediately or delete the message.

• Never share personal information, like your SSN or bank account.

• Don’t send money—not by gift card, wire transfer, cryptocurrency, or cash.

• Report the scam to the Office of the Inspector General at oig.ssa.gov.

Here’s What Social Security Will & Won’t Do: If you ever owe money to Social Security, we’ll let you know by mail—with clear information about payment options and

how to appeal.

We only accept payments through:

• Pay.gov

• Online Bill Pay

• By check or money order sent to one of our offices.

We will never:

• Threaten you with arrest or legal trouble over payment.

• Ask for gift cards, wire transfers, or cash in the mail.

• Promise extra benefits in exchange for money.

Scams can happen to anyone—even the most tech-savvy among us. That’s why it’s so important to talk to your family, friends, and neighbors about these tricks. If someone you know has already been targeted or scammed, remind them: there’s no shame in reporting it. What matters most is stopping the scammer before they hurt anyone else. Together, we can protect our communities—and stop scams for good.

TIME TO CHECK IN ON YOUR RETIREMENT SAVINGS

Saving for retirement can feel easy to put off—but the sooner you start, the better. Even small steps now can lead to big rewards later.

Here are a few simple tips to help you get on track:

Start Small

Saving just $5 a day can add up over time, especially with compound interest. Start with 1% of your income, and increase it gradually.

Get Free Money

If your employer offers a match, contribute enough to get it—it’s free money added to your retirement account. If you’re 50+, look into catch-up contributions to save even more.

Make

It Automatic

Set up automatic contributions through your employer or bank. Keep a separate emergency fund so you’re not tempted to dip into your retirement savings.

Have a Plan

Think about what kind of retirement lifestyle you want and how much you’ll need. Need help? Check out our guide:

6 Steps to Jumpstart Your Retirement Journey

• Take the America Saves Pledge

• Make a savings plan and get support to stick with it.

• Take the pledge today

• Check Your Social Security

• Your my Social Security account shows how much you could receive in retirement.

It’s never too late to start. Share this with friends and family—and let’s build a secure future together!

A Strategy to Save for Retirement

RETIRING EARLY: WHAT IT MEANS FOR YOUR SOCIAL SECURITY

If you start taking Social Security before your full retirement age (FRA)—which is 67 for most people—your monthly benefit will be permanently reduced.

For example:

• If your FRA benefit is $1,343 and you claim at age 65, you’ll receive about $1,164 a month (a 13% reduction).

• If you wait until 66, you’ll get around $1,253 per month.

What About Spousal Benefits?

You may be eligible for a spousal benefit if 50% of your husband’s FRA benefit is more than your own FRA benefit. If that’s the case, Social Security will automatically apply a “spousal boost” when you claim.

Important: If you claim before your FRA, both your own benefit and the spousal boost will be reduced.

Still Working Before FRA? There’s an Earnings Limit

If you claim benefits before your FRA and keep working, Social Security may reduce your payments if you earn too much. In 2025, the earnings limit is $23,400.

If you earn more than that, Social Security will temporarily withhold some of your monthly checks.

Once you stop working or reach FRA, this no longer applies. Good news: If you’re fully retired when you start benefits, this earnings limit doesn’t matter.

Survivor Benefits Aren’t Affected by When You Claim Now

If your husband passes away before you, you may qualify for a survivor benefit based on what he was receiving at the time of his death.

If you claim that survivor benefit at or after your FRA, you’ll get the full amount.

If you claim it before FRA, the survivor benefit will also be reduced. Your decision about when to claim your own Social Security retirement benefit doesn’t affect your future survivor benefit.

Jessica Riehle

Advisor

FOUR SOCIAL SECURITY MISTAKES

A

2024 survey by Nationwide Financial found that nearly half (49%) of Social Security recipients don’t know how to make the most of their benefits. Another 33% said they weren’t sure when they become eligible for full retirement or whether they should claim benefits early or delay them.

Knowing when and how to claim Social Security is one of the most important decisions for your retirement. Common Mistakes That Can Cost You

1. Misunderstanding Your Full Retirement Age (FRA)

Your Full Retirement Age (FRA) is when you’re entitled to 100% of your Social Security benefit.

• If you were born between 1943–1954, your FRA is 66.

• If you were born in 1960 or later, it’s 67. Claiming before your FRA will reduce your monthly benefit permanently. On the other hand, delaying benefits up to age 70 will increase your monthly payment.

2. Claiming Benefits Too Early

You can start claiming benefits at age 62, but doing so means you’ll receive a reduced amount for life. The earlier you start, the smaller your monthly check will be.

3. Not Considering Your Life Expectancy

Delaying Social Security boosts your monthly benefit—but only if you live long enough to make up for the missed payments. Think about your health, family history, and financial needs when deciding when to claim.

4. Lacking a Basic Understanding of the System

Many people don’t realize how complex Social Security rules can be.

Starting benefits too early could cost you—and your spouse—tens of thousands of dollars over time. Your decision should factor in:

• Marital status and spousal benefits

• Work plans after age 62

• Survivor benefits

• Tax implications

Bottom Line

Social Security isn’t one-size-fits-all. Taking time to understand your options—and the consequences of claiming too early—can have a major impact on your retirement income.

C HECK

MEDICARE

CLINIC DOCTOR HEALTH CARE INSURANCE COSTS MEDICINE EMERGENCY

BEFORE YOU JOIN A MEDICARE ADVANTAGE PLAN:

• Find and compare Medicare health plans in your area using Medicare’s Plan Finder.

• Visit the plan’s website to see if you can join online.

• You can also call Medicare at 800-MEDICARE (800-633-4227). When you call, please have your Medicare number and the date your Part A or Part B coverage started. You can find this information on your Medicare card.

When can I join,

switch, or un-enroll in a Medicare Advantage

Plan?

Initial Enrollment Period. When you first become eligible for Medicare, you can join a Medicare Advantage Plan during your Initial Enrollment Period.

General Enrollment Period. If you have Part A coverage and you get Part B for the first time during the General Enrollment Period, you can also join a Medicare Advantage Plan at that time. Your coverage may not start until July 1.

Open Enrollment Period. From October 15 – December 7 you can join, switch, or un-enroll in a Medicare Advantage Plan. Your coverage will begin on January 1 (as long as the plan gets your request by December 7).

You can learn more about Medicare, including how to apply for Medicare and get a replacement Medicare card, by reading our publication Medicare. You can also visit our website.

WHAT IS A BURIAL FUND?

A burial fund is money set aside specifically to pay for your burial or funeral. It can be kept in a bank account, financial instrument, or prepaid funeral plan. Some states allow you to pre-pay funeral costs directly with a funeral home—check with your local Social Security office for details.

Does a Burial Fund Affect SSI?

• You and your spouse can each set aside up to $1,500 for burial expenses.

• This money usually does not count toward the SSI resource limit.

• But if you also have life insurance or other burial arrangements, some of the burial fund may count toward SSI’s resource limits ($2,000 for an individual, $3,000 for a couple).

What About Interest on the Burial Fund?

Any interest earned on your burial fund does not count as income or a resource for SSI—as long as you leave it in the fund.

How to Set Up a Burial Fund

To make sure your burial fund is excluded from SSI resources, you need to:

• Title the account as a burial fund, or

• Provide a written statement with:

• How much money is set aside

• Whose burial it’s for

• How the money is held

• The date you set it aside

Important: Only Use It for Burial Costs

If you spend burial fund money on non-burial expenses, you may face a penalty.

Arnone Wealth Management

Social Security + smart planning

The power of a coordinated retirement strategy

Your Social Security benefits are just one part of your retirement picture. With a thoughtful plan, you can make the most of those benefits while aligning your financial strategy for the future you want. Let your team at Arnone Wealth Management help create a plan that works for you.

Arnone Wealth Management 302 Fifth St., Suite 1 Clarkston, WA 99403 509-758-8119

Team members (L to R): Dena Brigham, senior branch office administrator; Jeremy Druffel, financial advisor; Nicole Malm, senior branch office administrator; Brady S. Arnone, financial advisor; Scott W. Arnone, financial advisor; Trevor E. Arnone, financial advisor; Sherry Rigney, senior branch office administrator; and Debra Gill, senior branch office administrator.