Guiding the needs of health and life insurance agents

Table of Contents

Medicare

What’s Your 311 Medicare Plan?

Medicare Delay Period Ends

Group Benefits

PreferredOne Group Benefits

Insurance Marketing

1st Dollar Coverage Gaining Interest

PHE Unwind Steps and How Brokers Play a Roll in Supporting it

Events

April 2023

In this, our third edition of the Boost Monthly newsletter, we’re highlighting the most important articles from the Boost Weekly newsletters from the last month.

This month, we’ll discuss how your Medicare plan needs to be active for the 311 days outside of AEP, the end of the Medicare Delay Period and how brokers and agents play a huge part in the PHE unwind.

Likewise, we’ve relayed a change in PreferredOne Group Benefits and provided information on a new security question tool UnitedHealthCare has introduced.

Finally, check out the Events page later in the publication. There are still four Driven Roadshows left as well as several other training opportunities coming.

And, remember, you can still access previous Boost Weekly issues in the Agent Portal. Simply click on the Education tab and then ‘Boost Newsletter Archives.’

If you have any questions, please do not hesitate to call us at 651.739.2010!

1

What is Your 311 Medicare Plan?

There are 311 days each year outside of the Annual Enrollment Period. One of the things you can do to really boost your business and your reputation with your customers is to use those very important 311 non-AEP days to maintain contact with customers and let them know you are there for them. Yes, open enrollment time is critical and it’s when you do a lot of your hands-on work, but having a presence throughout the year through cards or emails goes a long way in showing your customers how important they are to you.

Birthdays

The simple step of sending an email, or even better, mailing a card to them on their birthday shows you care and you’re thinking of them. Almost everyone likes to get recognition on their birthday, so sending a message is great for building a relationship. However, it is best to keep it as a birthday message. Don’t make it into a selling attempt.

Similarly, Independence Day, July 4, is also a perfect opportunity. Not many people get messages commemorating America’s birthday, especially a card in the mail. It can be a really effective way to stand-out.

Anniversary

A message recognizing that you’ve been working together for x number of years, thanking them for trusting you with their insurance needs and letting them know that you provide other services than what they are using could lead to further discussions. Unlike with a birthday greeting, since this is recognizing an existing business relationship, it is certainly appropriate to touch on products and services, as well as looking for referrals.

Holidays/New Year

Holidays can also be a good chance to reach out to people. It is best to focus on non-religious dates, such as New Year’s Day, rather than traditional Christian holidays. A Valentine’s Day card or email can also be a really nice touch. It’s the perfect opportunity to express how much you love working with them.

Also, sending a message thanking service members on Veteran’s Day or Memorial Day are definitely appropriate and even non-service members understand thank you messages coming out on those days.

Email

Finally, sending an occasional email to your customers is a great way to maintain contact, let them know of new products or services, provide friendly tips on healthy living or just to let them know you’re thinking of them.

continued on next page

2

311 Medicare Plan (continued)

And, if those customers have friends or families that may need insurance help, those good impressions you make with regular contact could lead to referrals.

Don’t have a 311 plan? No worries. It’s never too late to get started. You can find many tools and resources to help on our Agency Marketing Platform (AMP) found on the Agent Portal.

If you have questions on creating a plan or how to effectively reach out to customers, feel free to contact us at 651.739.2010.

Medicare Delay Period Ends

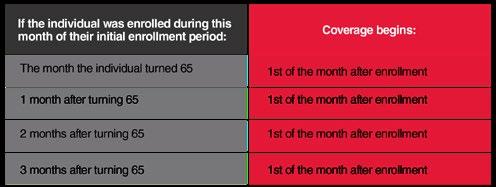

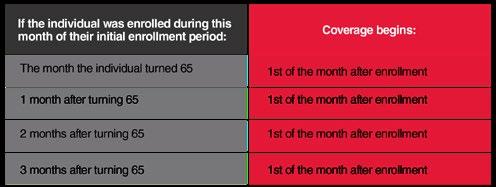

Effective January 1, 2023, the Medicare Part B delay period ended, and the enrollment effective date changed to the first of the month after enrollment.

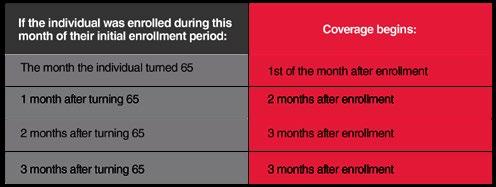

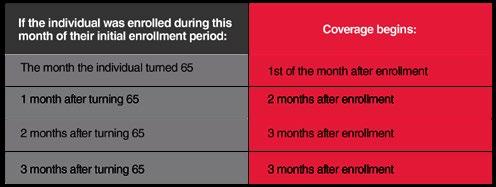

Prior to this change, there was often a two or three month delay from the month in which the individual turned 65 and when his or her coverage actually began.

3

continued on next page

Medicare Delay Period (continued)

This process has been greatly simplified. Regardless of when the individual turns 65, overage now starts the first of the month after the individual enrolls:

This change is only applicable to Medicare Part B. There is no change for those who qualify for Medicare Part A. This coverage begins the month the person turns 65 (for those with a birthday on the first of the month, coverage begins the month before he or she turns 65).

Also, your Medicare Part B clients will see a slight decrease in premiums and deductibles in 2023. The Part B premium will be $164.90 in 2023, down from $170.10. This is the first decrease since 2012. Likewise, the annual deductible will drop $7 from the $233 in 2022 to $226 in 2023.

On the other hand, the Part A premiums and deductibles are going up a slight amount next year. However, it’s important to note that 99% of Medicare recipients don’t have to pay anything for Part A because they’ve worked 40 calendar quarters (10 full years) while paying Medicare taxes.

Finally, Medicare enrollments happen throughout the year. As people reach age 65, they are still applying for Medicare benefits. Medicare Connector is your best option to get material submitted on time.

Medicare Connector is our online, single sign-in quote and enroll tool for Medicare to help you better serve your clients while staying compliant. If you have questions about Medicare Connector, reach out to your SRM!

You must be appointed with LeClair for each carrier you would like access to for quoting and enrolling on Medicare Connector. If you would like more information regarding appointment consolidation or adding a new appointment, please fill out the Appointment Interest Form

If you have questions, please contact our Medicare team at 651.739.2010.

4

PreferredOne Group Benefits Transferred

Effective October 1, 2022, PreferredOne group benefits transferred to United HealthCare.

We know there are still questions as this process continues with group renewals and LeClair is happy to be your partner of choice to help. All group benefit packages that would have renewed with PreferredOne since October 1, 2022 have, or will, receive a United Healthcare Renewal quote.

• The UHC renewal quotes will match the PreferredOne plan designs as best as possible, although SuperTier through PreferredOne is not offered through UHC

• UHC may also send renewal proposals from their partially self (level) funded option, AllSavers

• These quotes are pre-approved with no underwriting

• Current and new members will be accepted to the plan with no health questions asked

• UHC will passively roll over all currently enrolled PreferredOne members to the suggested plan and current enrolled members will not have to complete an enrollment form

Lastly, to maintain your agent of record, you must be appointed with both United Healthcare and AllSavers. If you need help with this process, LeClair is here to help!

To learn more about the carrier transition or request your appointment, please reach out to us at 651.739.2010.

5

Interest Growing for 1st Dollar Coverage

First dollar coverage is a policy that pays out to cover your deductible and out of pocket expenses before your health insurance policy kicks in. With Deductibles as high as $9,100 for individuals and $18,200 for families no wonder people are looking for affordable ways to reduce the financial risk of an unexpected accident or hospitalization. An accident or hospital indemnity plan might only cost $30 per month to protect your clients from a financial risk they may not be able to afford.

UnitedHealthCare (GoldenRule) is the leading carrier for 1st dollar accident, indemnity and ancillary benefits.

Now, to make it even easier to work with UnitedHealthCare and utilize their 1st dollar coverage strength, they recently introduced a Security Question Option that allows agents to enroll clients quickly and easily with UHOne’s affordable ancillary benefits. The new enrolment process for UHOne’s benefits portfolio makes the application process easier and more secure. Brokers can now submit applications on behalf of the customers by providing answers to two unique security questions, removing the e-sign barrier for application submissions.

• Allows the broker to submit the application on behalf of their client

• Validates that your clients are allowing you to sign for them by providing answers to two unique security questions

• Removes the e-sign barrier for application submissions

To help brokers learn this new tool, UnitedHealthCare created a training video. It’s a great way to see how this new process supports your 1st dollar coverage growth.a

Reach out to LeClair at 651.739.2010 or sales@leclairgroup.com to learn more and get contracted with UHOne.

States Begin PHE Unwind Steps

As the Public Health Emergency (PHE), many of the states in our area are announcing plans and policy updates. Minnesota, Wisconsin, Iowa and North and South Dakota have all released information on the transition from the end of the PHE back to pre-COVID methodology.

Minnesota

In Minnesota, the renewal process has begun as a cohort-based model, with a notice about restarting

continued on next page

6

Unwind Steps (continued)

renewals sent in March. Twelve monthly cohorts of Medical Assistance renewals, based on the enrollees’ initial application date will take place. The first cohort is scheduled to be completed June 30 and the entire process to get back to normal operations should be done by June, 2024.

The Minnesota Department of Human Services is working to keep the public informed as this unprecedented process begins. Information for enrollees and community partners, like brokers, is available on their “Renew My Coverage” webpage [Renew my coverage / Minnesota Department of Human Services (mn.gov)]. The site includes general information, a timeline for the renewal process, examples of notices being mailed to enrollees, communication toolkits and a renewal dashboard.

Wisconsin

The Wisconsin Department of Health Services has also prepared a 13-month effort to return to routine eligibility and enrollment processes for the BadgerCare Plus and Wisconsin Medicaid programs when the federal COVID-19 PHE ends. Efforts to support this transition include consulting with the Centers for Medicare & Medicaid Services (CMS), extensive planning with partners, preparing robust communications for members, ensuring readiness to process an increased number of reapplications and renewals, and making system enhancements to facilitate the full spectrum of unwinding activities.

Their goal is to work with partners, members and others to keep members covered, avoid disruptions, collaborate with stakeholders and comply with state and federal policy requirements.

Iowa

The Health and Human Services Division in Iowa has also been working on an unwind plan for several months. March represents the last month of the continuous coverage requirement and most review forms will be received in households in Iowa. In April, the return to normal operations will begin as forms are reviewed as early as April 5, 2023 and the first discontinuities will occur, effective the following month. Reviews will continue through March, 2024.

North Dakota

Likewise, the Medical Services Division of North Dakota’s Human Services Department has developed a 12-month plan to communicate with members, revert IT systems to make renewals easier, transfer information from Medicaid to Marketplace and submit monthly data on the related processes. continued on next page

7

PHE Unwind Steps (continued)

Although it is still finalizing its plan, North Dakota anticipates the unwinding period to take approximately 12 months over a 14-month timetable. The difference is determined by when the unwinding period begins: two months prior to the end of PHE, one month prior to the end or after the PHE ends.

South Dakota

In February 2023, South Dakota began processing redeterminations, a function it historically has carried out every month prior to the COVID pandemic. If a recipient is found to no longer be eligible through the redetermination process, Medicaid coverage for recipients may be terminated beginning April 2023. South Dakota anticipates completing this process in 9-12 months.

All options prioritize cases for review focusing first on cases most likely to be ineligible based on those who no longer meet a coverage group, aged out of a coverage group, a coverage group time limit has expired, or income has increased.

Other States

As part of the end of the PHE, all 50 states, plus the District of Columbia, have establish Unwind Plans. Although most are fairly similar in nature, there are, obviously, subtle differences. For links and information regarding all of the plan summaries, Georgetown University’s Center for Children and Families as put together an outstanding Unwinding Tracker

Moving Forward

Brokers can support the processes by emphasizing some key messages with clients:

• Update your address, email and phone number if there have been changes in the past year. DHS has a website with more details on how to report changes: https://mn.gov/dhs/mycontactinfo/

• Open and read all mail. All official notices will come through the mail, so it is important that enrollees are paying attention and carefully read any information.

• Respond promptly to all notices. Completing and returning renewal paperwork quickly will help ensure a more timely completion of their eligibility determination.

As always, if you have questions on the unwinding steps, please reach out to us at 651.739.2010 or sales@leclairgroup.com.

Finally, Benafica is hosting a webinar on April 20, 2023 at 10:00 AM Central Time to discuss easy and profitable partnerships for small, medium and large groups that want a tax free defined contribution model for their benefits. To learn more about the webinar, Benafica created a short video, and to register, click here

8

Events

LeClair is sponsoring the following events in the coming weeks. To see the full list of upcoming events and to register, please visit the Agent Portal

Driven Roadshows | April 11, St. Cloud | April 12, Fargo | April 13, Bemidji | April 14, Duluth | Register

Agent Breakfast Club | May 3, 2023 | Register

8:30 am - 11:00 am

LeClair Office

D-SNP with UCare | May 9, 2023 | Register

8:30 am - 12:00 pm

Midland Hills Country Club

Life Insurance and DI | May 17, 2023 | Register

8:30 am - 12:00 pm

Midland Hills Country Club

Ethics with Richard | May 25, 2023 | Register

8:30 am - 12:00 pm

Midland Hills Country Club

Healthapalooza | July 24-25, 2023 | Register

Registration Now Open

Mystic Lake Center

Our Mission: To ensure that every person in every community across America has a well-trained, well supported health and life insurance agent to guide their needs.

Our Vision: To be your partner of choice in serving your communities need for health and life insurance.

10

LeClair 6701 Upper Afton Road Saint Paul, MN 55125 651.739.2010 sales@leclairgroup.com LeClairGroup.com