Committed to bringing you the most professional, informative, trustworthy & dedicated service.

My responsibility is protecting the interests of my clients in every transaction.

Committed to bringing you the most professional, informative, trustworthy & dedicated service.

My responsibility is protecting the interests of my clients in every transaction.

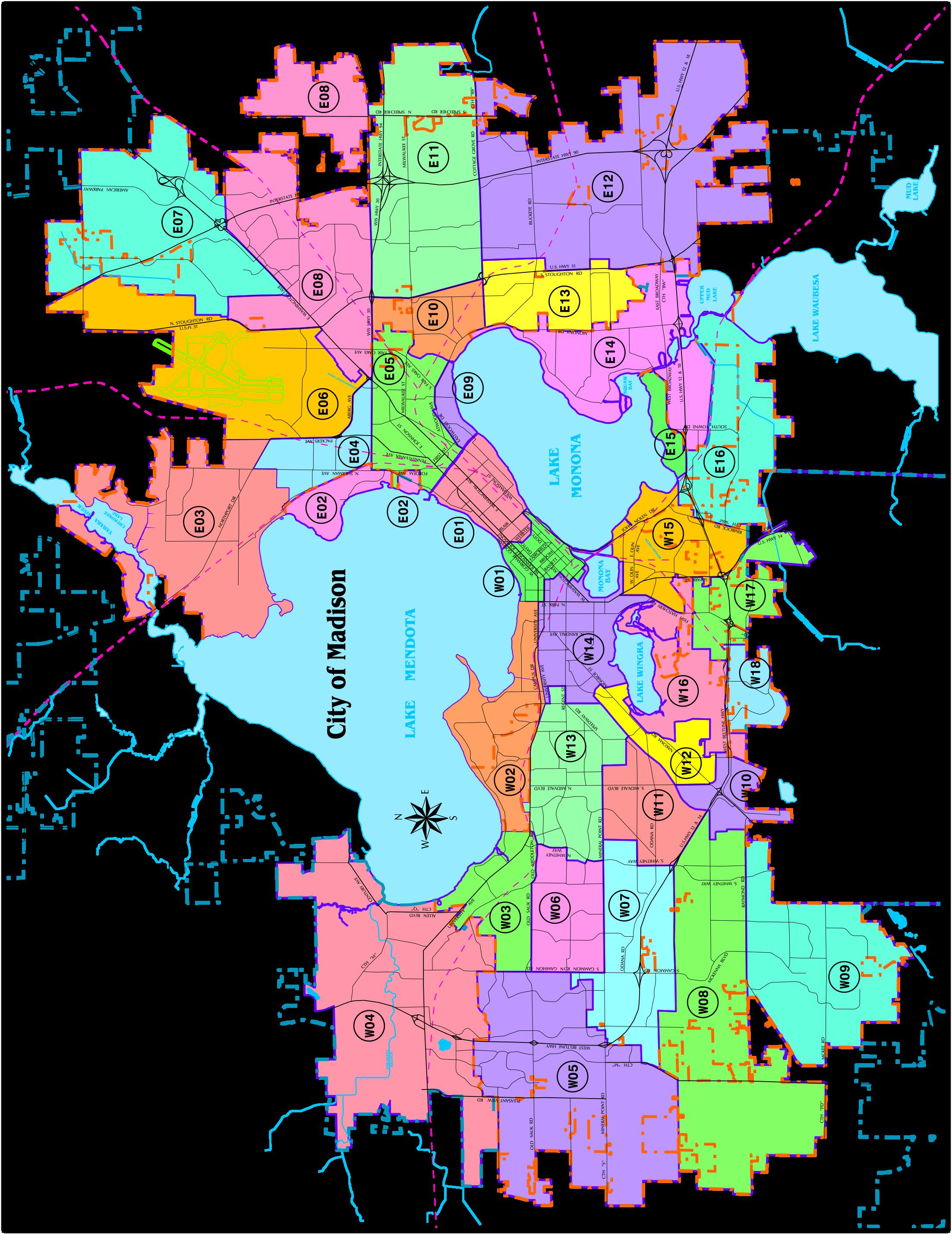

Lauer Realty Group is a full-service residential brokerage, specializing in home sales in the most desirable neighborhoods in Madison, Dane County and beyond. It takes more than a computer and MLS access to move you when and where you want to go. The best real estate transactions happen with a great realtor at your side, and gives you the edge in the process. We bring our clients the latest information, technology, and our mastery of the industry In using our expertise, you ’ re tapping into the top performing 1% of realtors in Dane County for over a decade.

At your side and on your side Our Madison real estate agents live, work, and play right here in the Madison area and are deeply tied to the communities where you ’ re looking to purchase. We know the perks and quirks of each neighborhood, and we’ll work hard to honor the unique hopes and dreams you bring to the table when searching for a home.

At Lauer Realty Group we believe that being the best isn’t something you say, it’s something you are. We believe the most important thing is that we listen to our clients’ wants, needs, and expectations and deliver on them every single time Thank you for your interest in our firm and we look forward to delivering a superior real estate experience that exceeds your every expectation.

Cheers,

Liz Lauer

FINDTHERIGHTAGENT

PREPAREFINANCES

GETPRE-APPROVED

STARTHOMESHOPPING

MAKEANOFFER

ORDERANINSPECTION

NEGOTIATEFINALOFFER

APPRAISALORDERED

SCHEDULETHEMOVE CLOSINGDAY

Buying a home is one of the most significant purchases in a lifetime. It is essential to have an experienced agent in your corner, always looking out for your best interest A buyer agent’s fiduciary responsibility is to represent the buyer and to ensure that they are protected

After all, a seller has someone in their corner. A listing agent has an allegiance to the seller Their goal is to get the seller top dollar for their home. There is incredible value in having someone working for YOUR best interests when buying a home.

Wewillnarrowdownthehomesthatfityouruniquewantsandneedsandgetyouinthedoor!Ilookatdozensofhomesevery week,andIcanhelpyouidentifypotentialproblemswithinahome

Whenrepairsorchangesinpriceneedtobemade,Iwillbeyourguideandhandlerequestinganyrepairsorchangesinpriceto thesellers

Buyingahomeinvolvesmanytypesofdocumentation.Ihavetheexperienceandknowledgetonavigaterealestatecontracts. Ensuringthatnothingisoverlooked,andthatyoutrulyunderstandwhatapapermeansbeforeeversigningonthedottedline

Abuyer’sagentwillrepresentyourbestinterests.Withapulseonthelocalmarketandasoundunderstandingofhowvarious amenitieseffectthevalueofahome,wewillmakesurewesubmitacompetitiveofferontherighthouseforyou.

Iworkdailyinneighborhoodswithinspectors,contractors,andnegotiatingwithsellers Ihavethemarketknowledgeyouneedtoget youthehomeofyourdreamsatthebestprice!Understandingthelocalrealestatemarketisessentialwhenitcomestimetomakean offeronahouse

Iwillworkhardtoprotectallofyourinterestsandtakeonanyissuesthatmayarisethroughouttheentireprocess Iwork tirelesslytomakesurebuyingahomeisafunandstress-freeprocess

Thesellertypicallypaysthecommissionforboththeseller’sagentandthebuyer’sagent

P R E P A R I N G f o r a h o m e l o a n

Mortgage lenders recommend you do not buy a home that is more than 3 to 5 times your annual household income If you are not purchasing a home with cash, you will need a mortgage pre-approval provided by your mortgage lender A lender will work with you to get a loan that meets your needs Some buyers are concerned with keeping their monthly payments as low as possible, others want to make sure that their monthly payments never increase

A mortgage requires a good credit score You can improve your score by:

●Paying down credit card balances

●Continuing to make payments on time

●Avoid applying for a new credit card or car loan until you have been approved

●Avoid making big purchases until you have been approved

●If possible, avoid job changes until you have been approved

In order to make your dream of buying a home a reality, you will need to save cash for your down payment, earnest money, closing costs & home inspector

●A Down Payment is typically between 35% & 20% of the purchase price

●Earnest Money is money you put down to show you ’ re serious about purchasing a home It’s also known as a good faith deposit

●Closing Costs for the buyer run between 2% & 5% of the loan amount

●A Home Inspection costs $300 to $500

Being pre-approved, unlike being pre-qualified, means you've actually been approved by a lender for a specific loan amount You will need to provide documented financial information (income, statements, assets, debt & credit reports etc ) to be reviewed & verified by the lender

W-2 Income/Salary

Income from part-time jobs

Income from a second Job

Overtime & Bonuses

Seasonal jobs

Self-employed Income

Alimony & child support (Documentation required)

Income from the lottery Gambling

Unemployment pay

Single bonuses

Non-occupying co-signer income

Unverifiable income

Income from rental properties

W2’S FROM THE PAST 2 YEARS 3 MONTHS WORTH OF PAY-STUBS BANK

S T A R T s h o p p i n g

Time to start shopping! We will take notes on all the homes we visit It can be hard to remember all the details of each home, so take pictures or video to help you remember each home, and review the notes you have written Once we have found THE house for you, we will present an appropriate offer based off of recent sales and current buyer activity in the area, as well as the value of the property in it’s current condition Negotiations may take place after the offer is presented

Evaluate the neighborhood and surrounding areas

•Are the surrounding homes well maintained to your liking?

•How much traffic is on the street, does it matter to you?

•Is it conveniently located to schools, shopping, restaurants, & parks?

M A K E A N o f f e r

WHENTOMAKEANOFFER:

So you have found THE house! Congrats! In today’s market when the demand is higher than the amount of homes available it is important to act fast!

HOWMUCHTOOFFER:

We will sit down and look at recent sales and current buyer activity in the area, as well as the value of the property in it’s present condition Putting all this information together, we will determine the price that you would like to offer

SUBMITTINGANOFFER

There are some components to an offer that makes it more appealing to the sellers

•PutYourBestFootForward

We will work together to discuss your options and create your very best offer Depending on the circumstances, you may have only one chance to make a good impression

•PutDownanEarnestDeposit

A healthy earnest money deposit written into the offer shows the seller you are serious

•CashTalks

A transaction that is not dependent on receiving loan approval is often more attractive to a seller

•ShorterInspectionPeriods

Try shortening the inspection period to 10 days

•Contingencies

If the market is very competitive we may discuss the needed contingencies vs what to expect if you choose to exclude any

•OffertoCloseQuickly

Many sellers prefer to close within 30 days

AFTERYOUSUBMITANOFFER

THESELLERCOULD

•ACCEPTTHEOFFER

•DECLINETHEOFFER

This happens if the seller thinks your offer isn’t close enough to their expectations to further negotiate

•COUNTER-OFFER

A counter-offer is when the seller offers you different terms If this happens, you can:

•ACCEPTTHESELLER’SCOUNTER-OFFER

•DECLINETHESELLER’SCOUNTER-OFFER

•COUNTERTHESELLER’SCOUNTER-OFFER

You can negotiate back and forth as many times as needed until you reach an agreement or someone chooses to walk away

OFFERISACCEPTED-CONGRATS!

You will sign the purchase agreement and you are now officially under contract! This period of time is called the contingency period Now inspections, appraisals, or anything else built into your purchase agreement will take place

During the inspection period, you will schedule an inspection with a reputable home inspector to do a thorough investigation of the home. Once this is complete, the inspector will provide us with a list of their findings You can take the issues as-is or request the seller to address some or all of the findings We will be mindful and reasonable on smaller items, while being very cautious and vigilant of potentially significant issues

Issues typically arise after the home inspection, and those issues tend to result in another round of negotiations for credits or fixes.

1. Ask for a credit for the work that needs to be done. Likely, the last thing the seller wants to do is repair work.

2. Think “big picture” and don’t sweat the small stuff. Tile that needs some caulking, or a leaky faucet can easily be fixed Repairs are still up for negotiation and perhaps a small credit would help with closing costs.

3.Keep your poker face. Typically it's just you and the inspector present during inspections, however occasionally the seller and/or list agent may be present. Revealing your comfort level with the home could come back to haunt you in further discussions or negotiations

Your lender will arrange for a third party appraiser to provide an independent estimate of the value of the house you are buying The appraisal lets all parties involved know that the price is fair The loan file then moves on to the mortgage underwriter

If approved you will receive your final commitment letter that includes the final loan terms & percentage rates

This ensures that the seller truly owns the property, and that all existing liens, loans or judgments are disclosed

You'll need insurance for the new home prior to closing This will protect against things like fire, storms and flooding

•FINALIZE MORTGAGE

•SCHEDULE HOME INSPECTION

•Declutter! Sort through every drawer, closet, cupboard & shelf, removing items you no longer need or like. Donate or sell items that are in good condition

•Make sure to have copies of all important documents and have them safely stored to easily find when needed

•Create an inventory of anything valuable that you plan to move

•Get estimates from moving companies

WEEKS

•Give 30 days notice if you are currently renting

•Schedule movers/moving truck

•Buy/find packing materials

•START PACKING

WEEKS TO MOVE 2 WEEKS TO MOVE

•ARRANGE APPRAISAL

•COMPLETE TITLE SEARCH (TITLE COMPANY WILL DO THIS)

•SECUREHOMEWARRANTY

•GETQUOTESFORHOMEINSURANCE

•SCHEDULETIMEFORCLOSING

•Contactutilitycompanies(water,electric,cable)

•Changeaddress:mailing,subscriptions,etc.

•Minimizegroceryshopping

•Keeponpacking

1 WEEKS TO MOVE

•OBTAINCERTIFIEDCHECKSFORCLOSING

•SCHEDULEANDATTENDFINALWALKTHROUGH

•Finishpacking

•Clean

•Packessentialsforafewnightsinnewhome

•Confirmdeliverydatewiththemovingcompany Writedirectionstothe newhome,alongwithyourcellphonenumber

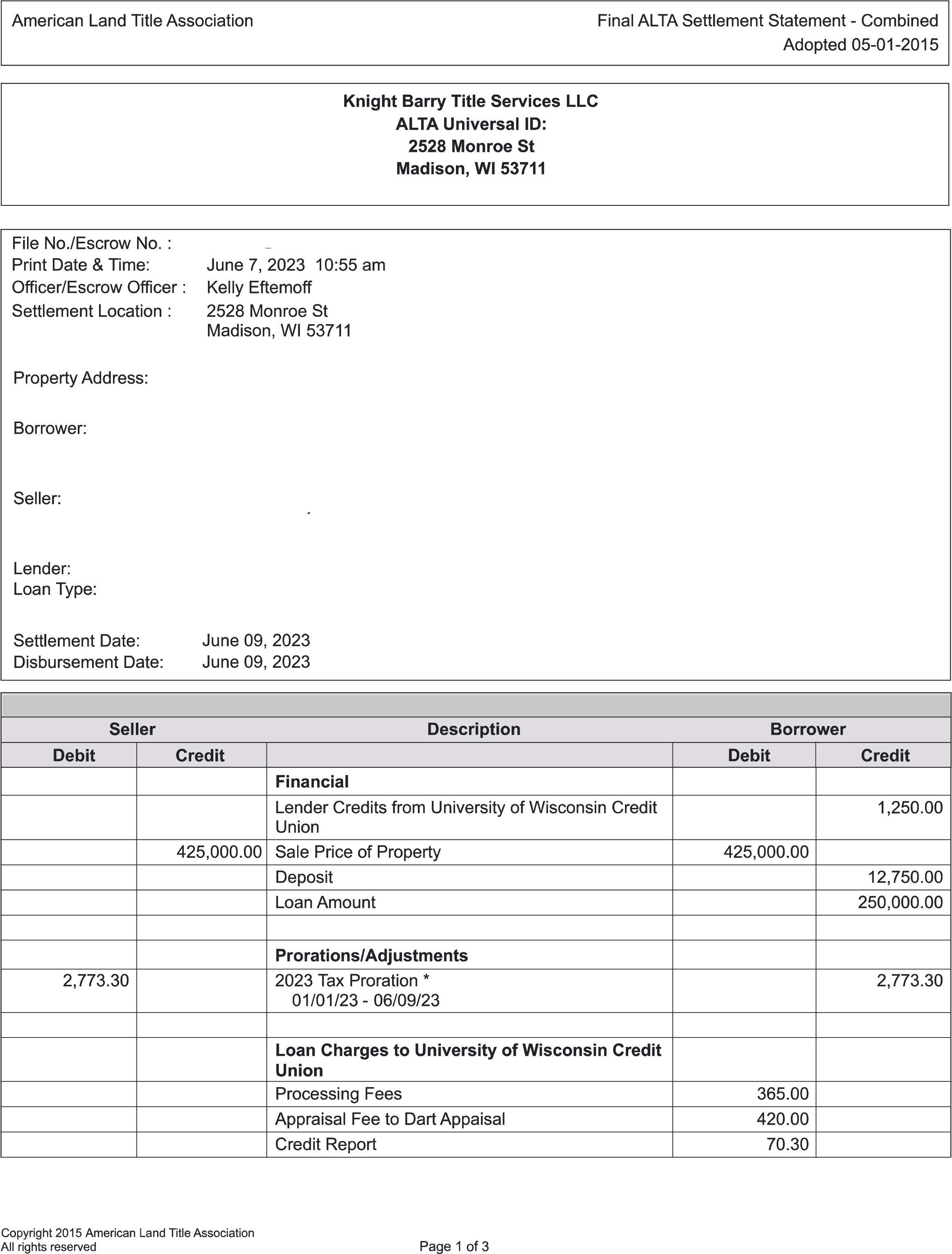

Closing is when you sign ownership and insurance paperwork and you receive your new home’s keys! Typically, closing takes four to six weeks During this time, make sure to make no big purchases or job changes that could affect your loan approval prior to closing day. Funds are brought the day of to complete the purchase.

Lenders are required to provide you with a closing disclosure, at least three days before closing This will show you what your final loan terms and closing costs will be. You will have three days to review the statement. This is done to ensure that there are no surprises at the closing table. If there is a significant discrepancy between the loan estimate and the closing disclosure, we must notify your lender and title company immediately.

We will do a final walk through the home within 3 days of closing to check the property’s condition. This final inspection takes about an hour. We will make sure any repair work that the seller agreed to make has been done

We will be sure to:

• Make sure home is clean

• Seller removed any and all personal property that was not discussed in offer

• Any included items in offer have remained on property

Who will be there:

• Your agent

• The seller

• The seller’s agent

• A title company representative

• Your loan officer

• Any real estate attorneys involved in the transaction

The closing typically happens at the title company You will be signing lots of paper work so get your writing hand warmed up! Some of the papers you will be signing include: the deed of trust, promissory note, and other documents.

Closing costs can vary depending on your home’s purchase price and where you are located Your lender should be able to help determine the closing costs as well You can generally expect your closing costs to be around 2% to 5% of the home’s sales price.

• Government-issued photo ID

• Homeowner’s insurance certificate

• A certified check for the rest of your down payment and closing cost (personal checks are not accepted at closings)

Congratulations! It was a lot of hard work but you are now officially home owners!! Time to throw a party and get to know your new neighbors!

L E N D E R S & I N S P E C T O R S

DON’T buy or lease a new vehicle.

DON’T quit your job to change industries, start a company or go into business for yourself.

DON’T switch from a salaried job to a commission job or a 1099 independent contractor position.

DON’T transfer large sums of money between bank accounts.

DON’T forget to pay your bills, even ones in dispute

DON’T open new credit cards.

DON’T make big purhcases on existing credit cards. (Buy furniture and appliances AFTER you own the home.)

DON’T close any credit card accounts.

DON’T accept a cash gift without filing the proper “gift” paperwork.

DON’T make random, undocumented deposits into your bank account

DON’T spend the money you have set aside from closing.

DON’T omit debts or liabilities from your loan application.

DON’T do things that cause inquiries into your credit score This includes test driving cars (they sometimes pull your credit)!

DON’T co-sign a loan for someone. This debt will change the ratios that qualified you for your loan.

Should circumstances arise where you need to engage in these activities, consult your Lender first.

The following Lenders are recommended by previous clients. You are not required to choose from this list and are encouraged to do your own research to determine the best Lender for you

Johnson Financial Group

Office: 608-250-7234

Mobile: 608-225-0642

Email: mlandphier@johnsonfinancialgroup.com

UW Credit Union

Office: 608-232-9000 x2138

Mobile: 608-590-6105

Email: rcourtier@uwcu.org

Educated Mortgage Services

Office: 608-834-5000

Email: dan@edumtg.com

UW Credit Union Office: 608-232-5000 x2015

Email: rmckinley@uwcu.org

Bell Bank Mortgage Office: 608-598-2283

Mobile: 608-234-0689

Email: adenoble@bell.bank

Farmers & Merchants State Bank

Commercial Lender Office: 608-655-1473

Email: scochems@fmsbwm.com

When you are purchasing a property we highly recommend that you have a Professional Home Inspector conduct a thorough inspection

The inspection will include the following:

*Appliances

*Plumbing

*Electrical

*Air Conditioning (weather permitting) and Heating Systems

*Ventilation

*Roof and Attic (if accessible)

*Foundation

* General Structure

The inspection is not designed to identify every minor problem or defect in the home. It is intended to report on defects that, at the time of the inspection, are identified as causing health or safety risks, or that affect the resale value of the property Should serious problems be found, the Inspector will recommend that an additional inspection be done by a Qualified Professional (i e Electrician, Plumber, Roofer, ect)

Your home cannot “pass or fail” an inspection and your Inspector will not tell you whether they think the home is worth the money you are offering, or if you should or should not buy the home. The Inspector’s job is to make you aware of repairs that are recommended or necessary.

As a guideline, the Seller may be willing to negotiate;

a.)The completion of repairs

b )A credit for the completion of repairs

In addition to the overall inspection, you may wish to have separate tests conducted (i e well water, septic system or the presence of Radon gas).

When choosing a Home Inspector, be sure to select one that has been certified as a qualified and experienced member by a Trade Association.

We strongly recommend being present at the inspection. This is to your advantage, as you will be able to clearly understand the inspection report and know exactly which areas need attention. Plus, you can get answers to many questions, tips for maintenance, and general information that will help you once you move into your new home. Most importantly you will see the home through the eyes of an independent third party.

The following inspectors again are recommended from previous clients, as well as being inspectors we know are thorough and professional. Again, you are not required to use an inspector on this list and are welcome to do your own research and pick an inspector of your choice.

AmeriSpec

Office: 608-276-8060

Email: mike.hoeser@amerispec.net

HomeStart Inspections

Cell: 608-609-0369

Email: kyle@homestart.pro

Inspection 360 Pros

Office: 608-492-0360

Email: pjskeffington@gmail.com

Premier Inspection & Consulting Office: 608-845-9300

Email: brian@premierhomeinspector.com

Madison Home Inspection Office: 608-395-9689

Email: madisonhomeinspectionllc@gmail.com

New Roots Home Inspections Office: 608-354-5366

Email: Newrootshomeinspection@gmail.com

A B O U T U S

My story is a classic Madison tale I grew up in St Paul, MN where my father was a scientist at the U of M and my mother was a Realtor®. I came to the UW for college and quickly grew roots in this community, falling in love with the city and its people.

I knew this city was home from the very beginning of my time here How could I not when I enjoyed all it had to offer? Winter and summer recreation, intelligent and hard working people, and cultural activities and entertainment In college I worked for a developer who owned and managed downtown Madison rental properties. Upon graduation, I started purchasing, rehabbing and managing income properties in the downtown and near east side of Madison

In 1998 I got my real estate license and this quickly grew beyond the personal and into a service career, where I was able to work with people to achieve their real estate goals It was never just about getting a home sold or a buyer into a new home, it was so much more than that. My mission was to help people understand their own needs and desires in a home and neighborhood, to identify a property’s full potential, and to help my clients crunch numbers and budgets to make an informed financial decision This committment to my clients is what has made me a top Realtor® in Madison since 1998 Every day in the field I use my years of diverse experiences and knowledge to help clients realize their dreams

In 2001 I started Liz Lauer & Associates, a collective within a larger real real estate firm. This become the brokerage of Lauer Realty Group® in 2015, giving our agents the freedom to practice real estate in a small, tight-knit community of professionals Our mission is to maintain a supreme level of service while providing masterful marketing and helping our “nation” or Madison neighborhoods flourish I am truly proud of the agents in our collective and know your experience with Lauer Realty Group will be powerful results from these real people.

Within this collective, my focus is as a Listing Agent and being able to use my extensive experience and knowledge for you This includes everything from understanding current market conditions and preparing your home, to powerful negotiating and a detailed, specific marketing plan which are all designed to get you the best possible sale terms.

Mark Gladue

BROKER

Tobi Silgman

REALTOR®

Rachel Whaley

REALTOR®

Brett Larson

BROKER ASSOCIATE

Ben Anton

BROKER ASSOCIATE

Asher Masino

REALTOR®

Alejandra Torres

BROKER ASSOCIATE

Kate Weis

BROKER ASSOCIATE

Lindsey Cooper

REALTOR®

Tina Rogers-Frisch

EXECUTIVE ASSISTANT COMPLIANCE BROKER

Toni Kraile

EXECUTIVE ASSISTANT FOR GLADUE TEAM

Minh Nguyen

REALTOR®

Tamara McDougal

REALTOR®

Jon Millard

MARKETING COORDINATOR

Lindsey DeFlorian

Renee Heine REALTOR®

Tom Syring

REALTOR®

Cristina Daza

REALTOR®

Brian Rea

We believe in and are committed to staying connected and involved with our local community. We love to give back and throughout the year we participate, contribute, sponsor, and donate time and resources to many wonderful organizations and causes. You’ll be sure to find us volunteering in neighborhood festivals, walking in a community parade, and supporting local artists. Whether it’s fundraising with the Goodman Center for the Annual Thanksgiving Drive, or working with GSAFE to ensure LGBTQ+ youth and families thrive, we are dedicated and passionate about the community we live in.

R E V I E W S & M O R E

“Liz has helped me buy two houses and sell one, and I’ve referred several people to her A coworker I referred to Liz was very grateful for the reference and spoke very highly of Liz’s work No doubt that referral put me in great standing with this work peer I found Liz’s professionalism to be outstanding and bar-setting for her field. She has great integrity and tact, is always punctual and flexible, and has always been tenacious in working for my best interests If I ever leave the area, I’ll likely have to seaerch long and hard to find a better agent Liz is truly an asset to the community and a personal resource beyond the requirements as a Buyer Agent ”

I was a textbook nervous first-time home buyer, and Liz was really great at reassuring me through every step of the process She listened to my concerns without judgment and laid out manageable action steps that helped me feel confident moving forward with my first home purchase She is a great teacher for newbies, but also has incredibly extensive knowledge of real estate in the Madison area to bring to buyers with more experience Would recommend her hands down!

“Liz is the best! I really enjoyed working with her She knew what we were looking for and hit the jackpot on the 6th or 7th house we looked at She made the enire process extremely easy From finding the right house, to the negotiation process, to the closing She is very trustworthy and honest, a calming presence in a stressful situation, as well as an expert on real estate and all it entails. Plus she is a great listener. I would HIGHLY recommend her to anyone. ”

Liz has (patiently) worked with us for over a year to find just what we wanted. She was always positive, knowledgeable and was very very attuned to what we like and were looking for. We got what we wanted and are very happy. She and Tina were so very easy to work with, and, well, we just love her, and highly recommend her company

“Liz was there for me in every way and is the most knowledgeable realtor I’ve come across She found contractors when I needed them and provided expert opinions to help me get through the stressful process of selling a home Thanks Liz!”

If we could give her ten stars in every category, we would. Her knowledge, expertise, communication, patience, and good-humor were outstanding and so enormously helpful. And if you have to buy a house during a global pandemic, she's the one you want in your court!

These terms represent a small portion of the jargon used in describing the purchase process for Real Estate. An important part of our relationship is making you more familiar with how these terms are part of your puchase and ownership of Real Estate We have provided here a simplified, common language explanation of these terms limited to how they will most likley be used in your home puchase process

Appraisal-An estimate of the quanitity, quality or value of something The process through which conclusions of property value are obtained; also refers to the report that sets forth the process of estimation and conclusion of value (Most Lenders require an appraisal of a property before giving you a loan to confirm that the sale price reflects the market value of the home )

Assessment-The imposition of a tax, charge or levy, usually according to established rates (In Dane County, Real Estate taxes are based on the Municipality’s assessment or financial value assigned to a home and land. Ask us for the current tax rates in the areas you are looking.)

Buyer Agency Agreement-An agreement which allows a REALTOR® to represent the best interests of a Buyer throughout the search, negotiations, and purchase process

Capital Gain-Profit earned from the sale of an asset

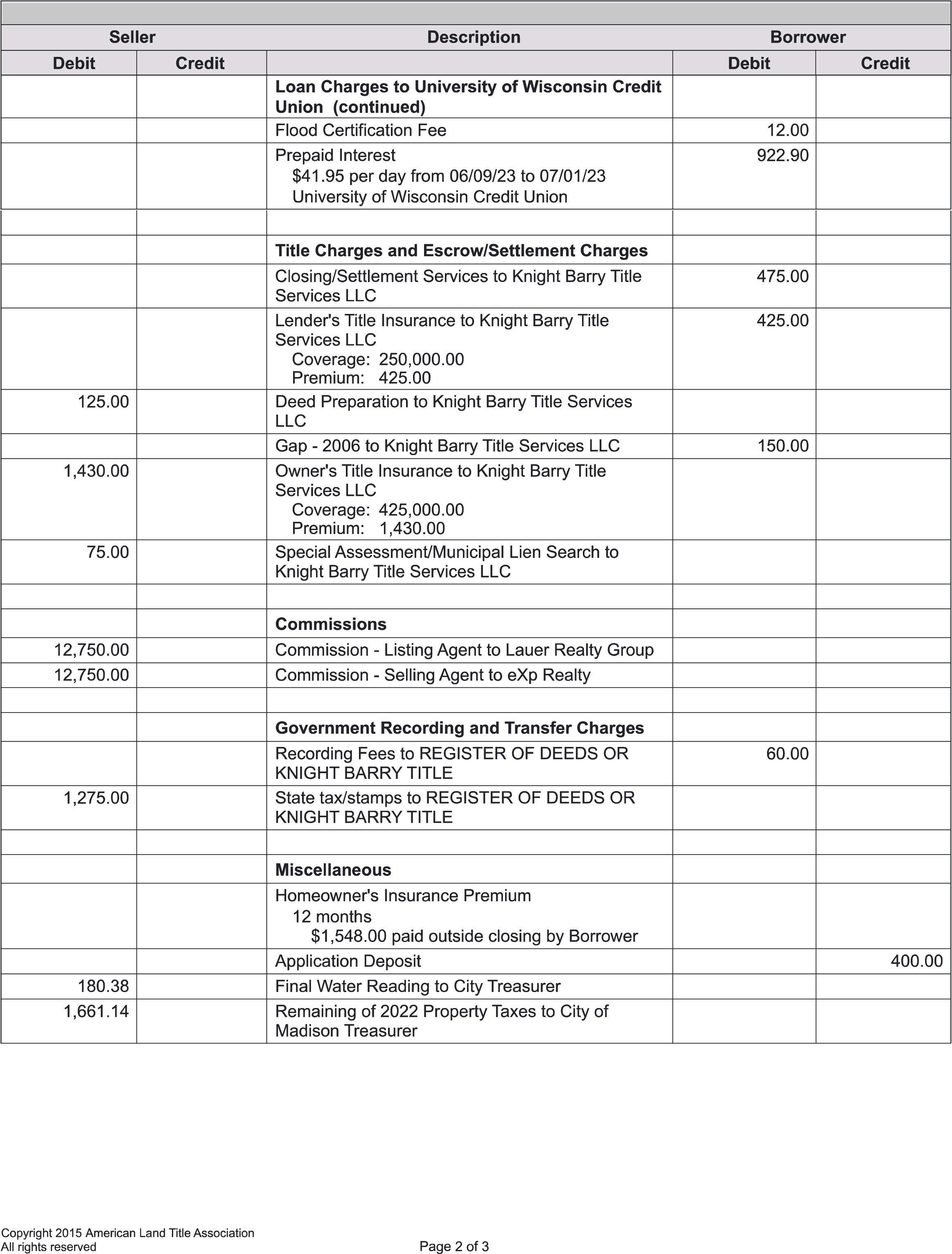

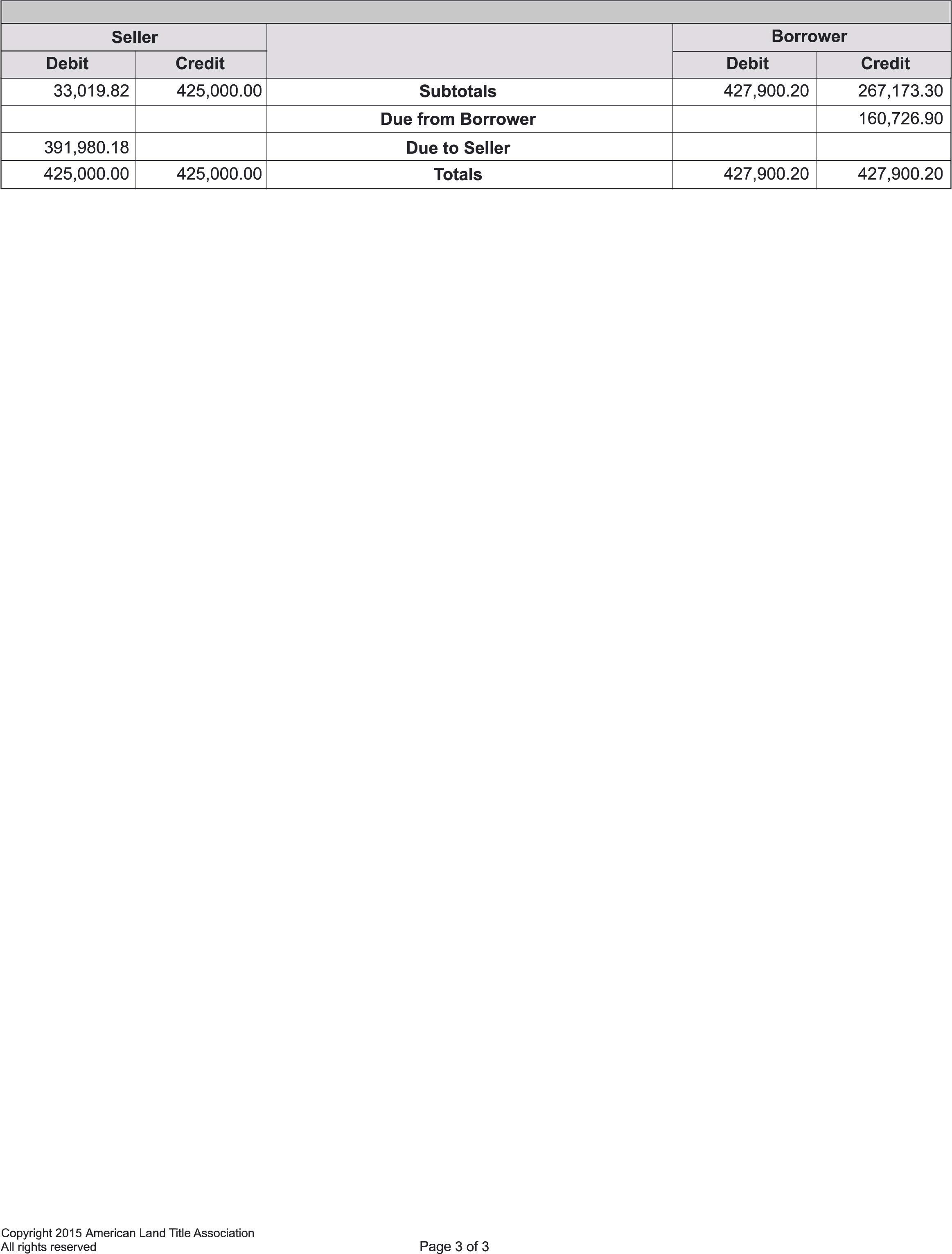

Closing Statement-A detailed accounting of a Real Estate sale showing all cash received, all charges and credits accounted for, and all cash paid out in the transaction This is the standardized form which is used as the final accounting at time of closing to determine the amount of funds due at the time of closing (Also known as a Settlement Statement or ALTA )

Competitive Market Analysis (CMA)-A comparison of the prices of recently sold homes that are similar to a particular home in terms of location, style and amenities (When we find you a home that you are going to make an offer on, we will look at the sale prices of comparable properties to help determine an offer price )

Earnest Money-Money paid by a Buyer under the terms of an offer contract, held by the Listing Broker during the term of the contract, and credited back to the Buyer at time of closing. This money is understood to be forfeited if the Buyer defaults on their offer contract.

Easement-A right to use the land of another for a specific purpose, such as for a right-of-way or utilities. An easement can stay in place beyond the sale of a property, therefore any Buyer will receive Title Insurance to discover any recorded easements that will stay with the property

Equity-The interest or value that the owner has in proeprty over and above any indebtedness

Escrow-The closing of a transaction through a third party called an Escrow Agent, or escrowee, who receives certain funds and documents to be delivered upon the performance of certain conditions outlined in the escrow instructions (Brokerage companies, i e Lauer Realty Group Inc, acts as an Escrow Agent while holding earnest money )

Fixture-An item of personal property that is attached to the Real Estate property or function of the property in such a way that it is considered part of that Real Estate (i e light fixtures, floorboards, furnace, water heater, doorknobs

Lien-A right given by law to certain creditors to have their debts paid out of the debtor’s property This is a debt that must be paid by the Seller prior to receiving any proceeds on the sale of a home and includes any debts for which the property is put up as collateral (a mortgage).

PITI-Principle, Interest, Taxes and Insurance. This amount makes up the monthly payment normally due monthly to the home owner’s mortgage company.

Private Mortgage Insurance (PMI)-Insurance provided by private carrier that protects a Lender against a loss in the event of a foreclosure and defi ciency. This is usually required when a loan amount exceeds 80% of the value of the property Ask about loan program options that avoid PMI

Special Assessment-A tax or levy customarily imposed against only those specific parcels of Real Estate that will benefit from a proposed public improvement like a street or sewer (It is important in a Real Estate transaction to determine who will be paying the balance if a special assessment is upcoming or currently due )

Title Insurance-A policy insuring the owner or mortgagee against loss by reasons of defects in the title (ownership) of a parcel of Real Estate, other than encumbrances, defects and matters specifically excluded by the policy It is also provided as proof of ownership of the property, usually provided by the Seller to a Buyer, which also shows any other liens or encumbrances which are attached to a property