24/7 BANKING AT YOUR FINGERTIPS

The LAPFCU app is like having a branch in your pocket! Right from your smartphone, you can securely view account balances and statements, pay bills, transfer funds, accept loan pre-approval offers, apply for a loan, deposit checks, and so much more. If you need in-person services, you can also use the app to locate the nearest CO-OP ATM or Shared Branch nationwide.

Download the LAPFCU app today and log in using your PATROL Online Banking credentials. Not set up on PATROL? Visit lapfcu.org, click LOGIN, and select Enroll. For assistance, call (877) 695-2732

(877) 695-2732 • lapfcu.org Visit lapfcu.org/home-equity-offer or scan the QR code to learn more.

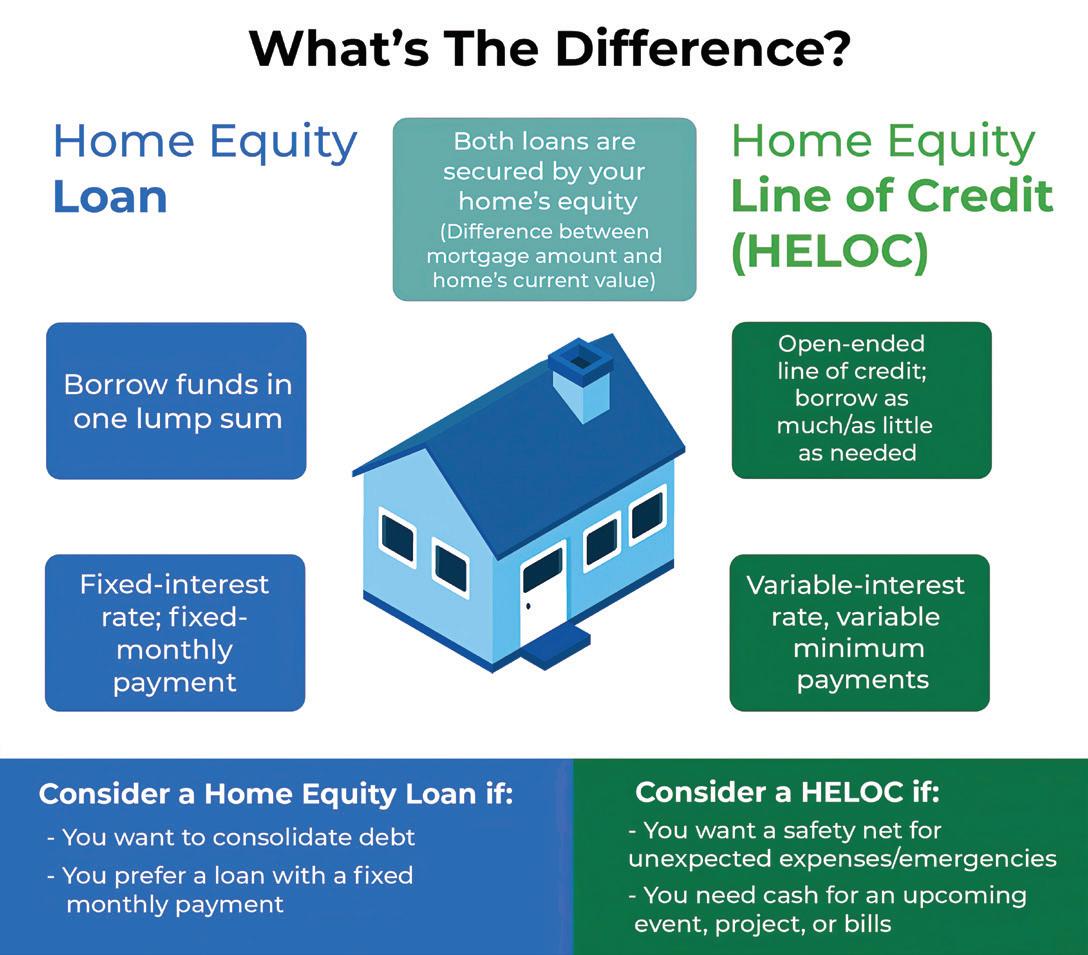

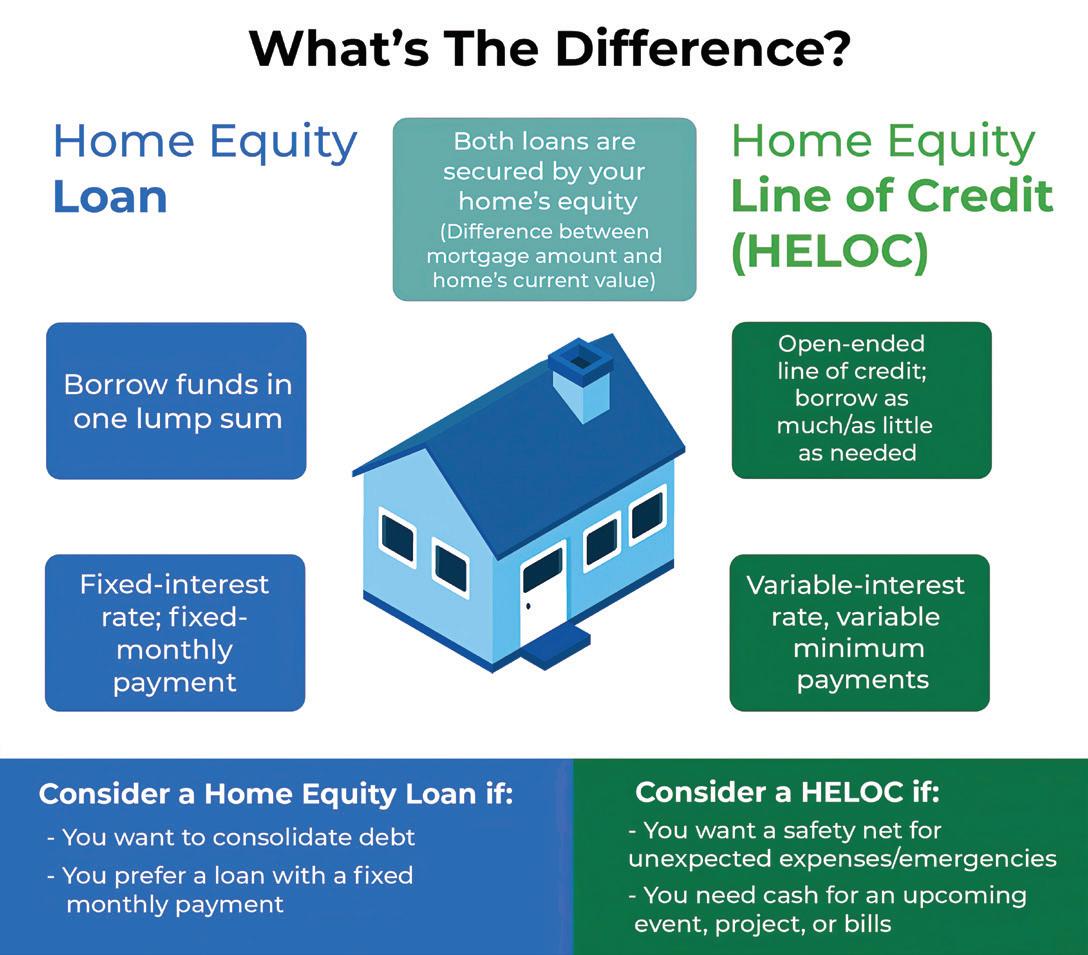

Turn dreams into realities with a low-interest home equity loan or line of credit: consolidate debt, remodel your home, or fund an education. Interest rates as low as 5.75% APR.1 1APR = Annual Percentage Rate. 5.75% fixed APR is based on a loan term of up to 84 months. Minimum loan amount $25,000. Maximum loan-to-value is 80% for owner occupied properties, and 70% for non-owner occupied properties. Maximum term on owner occupied properties is 20 years, and 15 years on non-owner occupied properties. Loans available on 1-4 family dwellings. Property hazard insurance is required. Home Equity Loans are available for properties located in California, Arizona, Colorado, Idaho, Montana, Nevada, Oregon, and Utah. 7-year rate term payment example (effective date December 27, 2022): $35,000 loan with 5.75% fixed APR for 84 months would cost $14.49 per $1,000 borrowed. All loans are subject to credit approval and applicable LAPFCU policies. All advertised rates and terms are subject to change without notice. Your actual payment may vary. Restrictions apply, ask for complete details.

GO AHEAD, START PLANNING RESOLVE TO MAKE BIG IDEAS HAPPEN!

WINTER 2023

10 WAYS TO IMPROVE YOUR FINANCIAL WELLBEING IN 2023

It’s a new year, and with it come new opportunities to get the most out of your LAPFCU membership. Your Credit Union is much more than a place for checking, savings, and loans. We encourage you to fully explore your membership benefits and take advantage of everything we have to offer. Our mission is to enhance the law enforcement community’s quality of life. With that as our focus, we’ve assembled an array of resources to better your financial position. So, we present 10 things that can help you get ahead in 2023.

1. Discover a wealth of personal financial management education that can help you manage expenses, identify goals, pay down debt, sharpen your saving skills, and more with BALANCE, a free program for LAPFCU members. You can even work with your own one-on-one coach! Get started at lapfcu. balancepro.org.

2. Check the events calendar on lapfcu.org for upcoming financial education webinars where we’ll teach you how to make better informed decisions, avoid costly pitfalls, save money, and more. Don’t forget to visit LAPFCU on YouTube to access our library of previous webinar recordings on a variety of topics.

3. Put your education into action. Inside online and mobile banking is a free, powerful personal financial management tool that can help you create and track progress towards goals, automatically organize and monitor expenses, analyze spending habits, manage your budget, and much more. Click or tap on Manage Money and choose Money Management for a complete picture of your finances, including accounts you have elsewhere.

4. Schedule an appointment with an experienced Financial Services Advisor.1 They can help you discover beneficial investment options and pathways for achieving your financial goals. Visit lapfcu. cusonet.com for more information.

5. If you have a loan or line of credit with LAPFCU, you have free access to your FICO® Score in online banking and on our app. See your score and learn how it’s calculated, view changes over time, get personalized recommendations for increasing your score, and more. A higher FICO® means more favorable rates on loans, plus other perks. Go to Manage Money, View My FICO® Score at lapfcu.org or on the LAPFCU mobile app.

6. Keep that FICO® Score in tip top condition with our free automatic bill pay service and you’ll never have a late or missed payment. Just set it and forget it! Download our free mobile banking app from your app store to get started.

7. Let LAPFCU provide some breathing room in your budget after the holidays. Our skip-a-loanpayment program allows you to defer up to two nonconsecutive eligible loan payments per year to help you recover from expensive months.

8. If you’re feeling squeezed by monthly payments on your home, vehicles, and credit cards and don’t know where to turn, fear not. We specialize and excel in helping our members consolidate debt and save Call us and an experienced LAPFCU Loan Officer will take the time to review your debt and make recommendations that truly benefit you. Remember, we’re a not-for-profit cooperative, so we won’t offer you anything that isn’t in your best interest.

9. You’re paying as much as 30% interest on your credit cards!? It’s time to transfer your balances to one of our credit cards for a low intro rate that will enable you to pay off your debt faster. Plus, LAPFCU’s Platinum Rewards Visa® features a highly competitive reward points program.

CHAIR AND PRESIDENT’S MESSAGE

2

ANDRE PLUMMER | CHAIR EDWIN W. HADA | PRESIDENT/CEO

continued...

10. A free insurance review from LAPCUSO Insurance Services2 will reveal whether you’re overpaying for coverage or paying for coverage you don’t need. Plus, if you haven’t updated your policies in a while, it may be time to make some changes to ensure you’re fully protected. Call (818) 373–8384 for a free quote.

Here’s one final bonus tip: now is a great time check out our savings accounts. Interest rates are up, so consider our share certificate and money market accounts. Open an account and watch your money grow!

From all of us at LAPFCU, we hope you find these tips helpful, and we wish you and yours a prosperous 2023.

NEW

YEAR’S

RESOLUTION: TAKE CONTROL OF YOUR FINANCES

PAY DOWN DEBT THIS YEAR!

Consolidate debt and pay down balances fast with an LAPFCU personal loan. Rates are as low as 7.49% fixed APR.

LET LAPFCU HELP YOU

For maximum savings, let our experts review all your loans and lines of credit and make recommendations that can save you even more! They may be able to unlock hidden savings you haven’t considered. Call us at (877) 695-2732 to speak with a dedicated Loan Officer who will help find a solution that works for you.

RATES AS LOW AS 7.49% APR* FOR 48 MONTHS

EFFECTIVE RATE DATE: November 30, 2022

*APR = Annual Percentage Rate. Minimum loan amount of $500 and the maximum loan amount of $100,000. To qualify for 7.490% fixed APR for 48 months requires a FICO score of 760 or greater and member must qualify for Member Benefits. Actual APR offered may be higher depending upon applicant’s credit rating and other underwriting factors (Member must participate in automatic payment program and qualify for Member Benefits program at time of funding). Go to https://www.lapfcu.org/member-benefits/ for complete details. 48-month term payment example: A 4-year loan at 7.490% fixed APR will have 48 monthly payments of $24.17 per each $1,000 borrowed. All rates, terms, and promotional offers are subject to change without notice. Cannot be combined with any other offer. Restrictions may apply, ask for complete details.

HOLIDAY CLOSURE Branches will be closed

Monday, January 2, in observance of New Year’s Day and Monday, January 16, for Martin Luther King, Jr. Day.

ATMs, online banking, and mobile banking available. 24/7 assistance at (877) 695-2732.

STAY THE COURSE TO FINANCIAL SUCCESS

Begin 2023 with a fresh understanding of your finances and what you want to achieve for the year and beyond. Whether you’re just starting to plan for the future, or you need advice to help keep you on track, a professional advisor can answer all of your questions, guide you, and make the financial planning process a lot less stressful.

Our CUSO Financial Services, L.P.1, in-branch Financial Advisors can help you understand your options in a rapidly changing market, determine how much you should save or invest, plan for important milestones, and potentially save money on taxes. Let a professional help you create a customized plan through tailored investment and insurance strategies to help you accomplish your financial goals.

They specialize in:

n Retirement planning

n Deferred compensation

n DROP rollover options

n Asset diversification

n College savings plans

n Planning for unexpected expenses

n Tax-friendly strategies

n Municipal funds, bonds, and annuities

For a complimentary, no obligation consultation, contact Chris Ellis at (818) 464-2070 / cellis.cfsinvest@lapfcu.org or Patrick Infante at (818) 464-2071 / pinfante.cfsinvest@ lapfcu.org or visit lapfcu.cusonet.com.

1Non-deposit investment products and services are offered through CUSO Financial Services, LP (“CFS”) a registered broker-dealer (Member FINRA/SIPC) and SEC Registered Investment Advisor. Products offered through CFS: are not NCUA/ NCUSIF or otherwise federally insured, are not guarantees or obligations of the credit union, and may involve investment risk including possible loss of principal. Investment Representatives are registered through CFS. The Credit Union has contracted with CFS for investment services. Atria Wealth Solutions, Inc. (“Atria”) is a modern wealth management solutions holding company. Atria is not a registered broker-dealer and/or Registered Investment Advisor and does not provide investment advice. Investment advice is only provided through Atria’s subsidiaries. CUSO Financial Services, LP is a subsidiary of Atria.

3 PRESIDENT’S MESSAGE CONTINUED

code to learn more.

Scan the QR

ANNUAL INSURANCE CHECK UP WITH A TRUSTED EXPERT

Have you recently moved, added a new member to the family, or bought a new car? Many changes can happen within a year. Whether you experienced changes in environment, situations, or needs, the beginning of the year is an ideal time to review your insurance coverage with a professional. You could be overpaying or even paying for coverage you don’t need. An expert eye will help you sort out the fine print and give you peace of mind.

For more than 20 years, LAPCUSO Insurance Services2 has helped thousands of LAPFCU members navigate insurance options for auto, home, life, business, and more. LAPCUSO will save you time by doing all the legwork for you. They’ll take the time to understand and

evaluate your needs and provide a custom plan that clearly explains your best options from the most reputable insurers.

For a free, no-obligation review, call our in-house insurance specialist today! Make sure to ask about exclusive LAPFCU member discounts.2

LAPCUSO INSURANCE SPECIALIST

(818) 373-8384

CUSO@BISINS.COM

2Insurance services provided by Bichlmeier Insurance Services, Inc., California license #OB26427. Insurance products offered are not sold or guaranteed by LAPFCU. They are not deposits, are not federally insured, are not protected by the NCUA and may be subject to risk. Any insurance required as a condition of an extension of credit by LAPFCU need not be purchased from the Credit Union and may be purchased from an agent or an insurance company of the member’s choice. Business conducted with Bichlmeier Insurance Services, Inc. is separate and distinct from any business conducted with LAPFCU. 2Restrictions apply, ask for complete details.

1122-32

P.O. Box 10188 Van Nuys, CA 91410-0188 RETURN SERVICE REQUESTED PRESORTED STANDARD U.S. POSTAGE PAID LOS ANGELES, CA PERMIT NO. 896 (877) 695-2732 • lapfcu.org

MARIA ASCENCIO