P.O. Box 10188

Van Nuys, CA 91410-0188 RETURN SERVICE REQUESTED

P.O. Box 10188

Van Nuys, CA 91410-0188 RETURN SERVICE REQUESTED

We’ll securely dispose of or recycle your items. Full details: lapfcu.org/shred.

Saturday, May 10 | 8:00 – 11:00 a.m.

LAPD’s Valley Traffic Division

Saturday, May 31 | 8:00 – 11:00 a.m.

West Covina Police Department

*Event dates, times, and location subject to change or cancellation without notice. May end early if shredding truck reaches capacity.

Owning a car is more expensive than ever. Fortunately, LAPFCU offers competitive refinance options designed to lower your payments and put more money back in your pocket. For a limited time, get $250 when you refinance any vehicle or personal loan, or credit card balance from another lender.

This is a good opportunity to refinance your auto, motorcycle, RV, boat, or watercraft loan. Refinance personal loans and credit card balances to save even more!

May not be combined with any other offers. Other restrictions may apply. Please ask for complete details.

²Applies to both auto loans and personal closed-end loans. Number of total payments on your auto loan and/or personal closed-end loan remains the same, and interest continues to accrue during deferred payment months. Deferring an auto loan payment may void your GAP insurance. Consult your insurer for details.

³APR = Annual Percentage Rate. Effective rate as of March 11, 2025.To qualify for 4.740% fixed APR for 60 months requires a FICO score of 760 or greater and member must qualify for Member Benefits. Actual APR offered may be higher depending upon applicant’s credit rating and other underwriting factors (Member must participate in automatic payment program and qualify for Member Benefits program at time of funding). Go to lapfcu.org/member-benefits/ for complete details. 60-month term payment example: A 5-year loan at 4.74% fixed APR with zero down payment will have 60 monthly payments of $18.75 per each $1,000 borrowed. All rates, terms, and promotional offers are subject to change without notice. Cannot be combined with any other offer. Restrictions may apply, ask for complete details.

⁴APR = Annual Percentage Rate. Effective rate as of March 11, 2025. Minimum loan amount of $10,000 (to qualify for the “Get $250!” promotional offer) and the maximum

Sometimes, it can be hard to keep up with the myriad changes happening all around us from one day to the next. The pace and scale of change keep increasing, often making it difficult to get your bearings. Moreover, changes may be even more daunting when they’re outside of your control. This is when it becomes important to focus on what matters and what you can control – the fundamentals – and to stick to your plan.

LAPFCU is here for you to help you maintain that focus, cover the basics, and stick to your plan. Regardless of what’s happening in the world, we remain a steadfast, dependable partner you can count on to be there for you.

As a member, you can rest assured that your daily banking needs will be met. You have one less thing to worry about knowing all your financial information is at your fingertips on our app or a simple phone call away. Our branches always provide friendly, personal, inperson service. Credit and debit card transactions go smoothly, bills are paid automatically, and money moves seamlessly. If that doesn’t happen, we’ll make it right. Fast. Meanwhile, we vigilantly watch your back by monitoring for fraud. And, if there’s ever an issue, we’re here to assist you.

If you need a little help when it comes to creating and managing a budget, no problem. Our financial education partner, BALANCE, can set you up with a personal coach to help you master your finances, develop positive habits, and improve your credit.

With daily needs met, you can concentrate on meeting your financial objectives. It starts with the basics: low or no fees for services, competitive rates on a wide variety of savings products, and straightforward, transparent financing for important necessities or milestones like a first car, college, wedding, or buying a home. We also have flexible loans and lines of credit to assist you with unexpected expenses that come up along the way.

We consistently exceed the National Credit Union Administration’s definition of a well-capitalized institution. Deposit funds are federally insured up to $250,000 per account, plus an additional $250,000 in private insurance. You’ll have peace of mind knowing that your money is safe and sound with us.

When it comes to creating a plan for financial success, CUSO Financial Services’ Advisors* have you covered. They will take the time to meet with you, understand your priorities and goals, provide

ANDRE PLUMMER | CHAIR

guidance and suggestions, and help you develop custom shortterm, medium-term, and long-term strategies. Life sometimes throws you curve balls and sometimes plans change. But your Financial Advisor will be there every step of the way to help you stay focused.

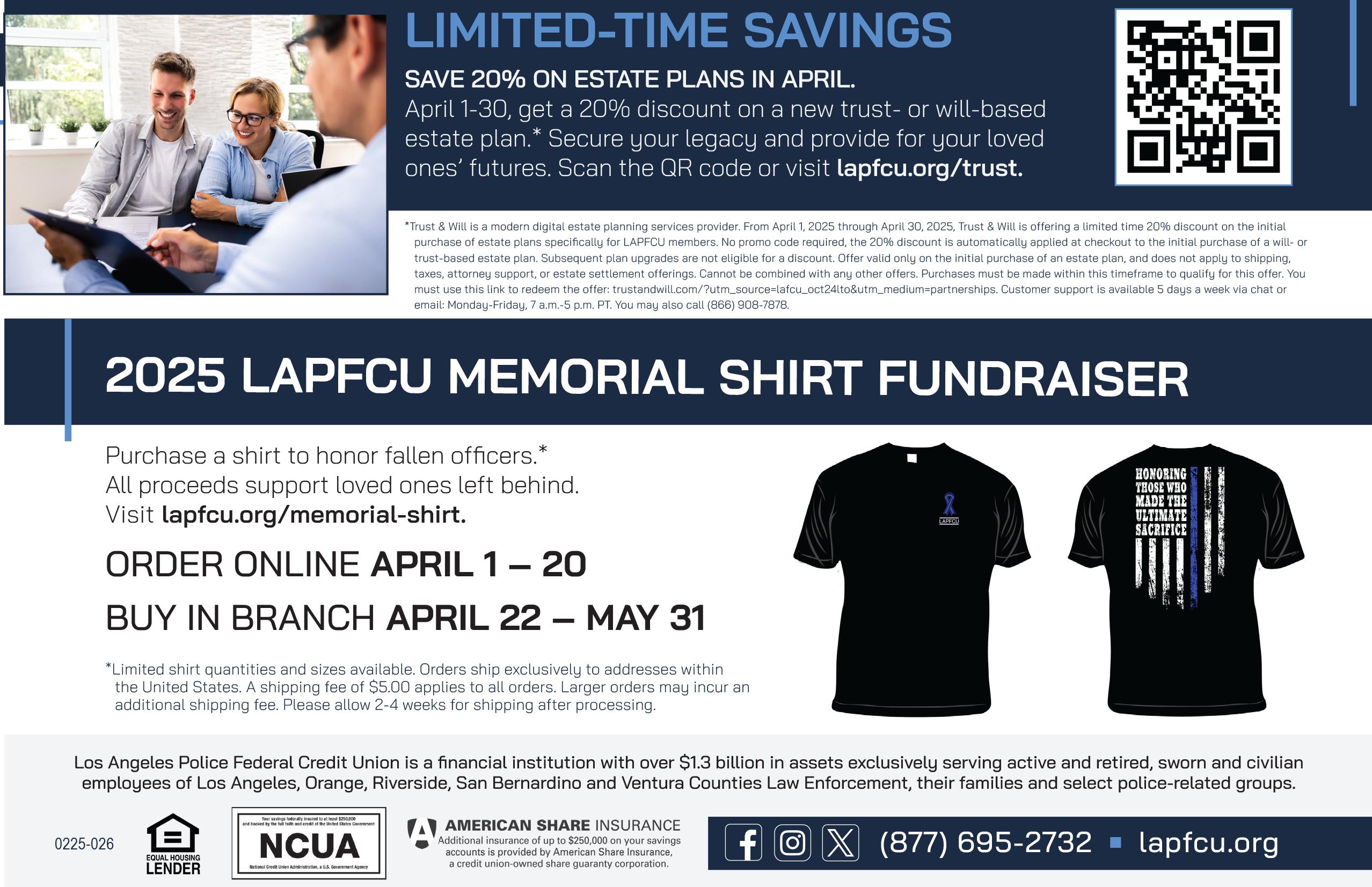

Next, protect what matters most. Take advantage of exclusive insurance savings on auto, home, life, and more. Sworn members can safeguard their LAPFCU loans with End of Watch debt protection at no cost. They can also receive free online privacy services via our Guardian Checking account. And all members can take advantage of discounted fraud prevention and ID theft monitoring services. Don’t forget that we also offer significant member-only discounts on trusts and wills.

Life sometimes throws you curve balls and sometimes plans change. But your Financial Advisor will be there every step of the way to help you stay focused.

You can obtain more information about any of the services above at lapfcu.org or by calling us at (877) 695-2732.

Things are always changing, and that goes for us, too. We must keep up with member demands for new programs, speed, and convenience and sometimes navigate through unforeseen events. But no matter how much some things change; some things will always stay the same. We continue to maintain our focus on exclusively serving the law enforcement community. We remain committed to improving your quality of life and providing you with specialized programs that cannot be found elsewhere. We’re here to provide you with the knowledge, tools, and services you need to maintain your focus, and remain successful.

*Non-deposit investment products and services are offered through CUSO Financial Services, LP (“CFS”), a registered broker-dealer (Member FINRA/SIPC) and SEC Registered Investment Advisor. Products offered through CFS: are not NCUA/NCUSIF or otherwise federally insured, are not guarantees or obligations of the credit union, and may involve investment risk including possible loss of principal. Investment Representatives are registered through CFS. The Credit Union has contracted with CFS for investment services. Atria Wealth Solutions, Inc. (“Atria”) is a modern wealth-management solutions holding company. Atria is not a registered broker-dealer and/or Registered Investment Advisor and does not provide investment advice. Investment advice is only provided through Atria’s subsidiaries. CUSO Financial Services, LP is a subsidiary of Atria.

JOHN ROEMER | PRESIDENT/CEO

Beware of calls from scammers impersonating LAPFCU Associates. We will NEVER call you to request personal information. Stay alert—never share your details with callers. Visit lapfcu.org/security.

Maximizing your investments requires strategic planning and professional insight. Our newest wealth management professional, Sevada Zadooryan, available through CUSO Financial Services, L.P. (CFS)* can help you:

n Develop a personalized financial plan

n Identify market opportunities

n Optimize savings and investments

n Manage deferred compensation plans

n Plan for a secure retirement

Schedule a complimentary financial consultation with Sevada at our Van Nuys and Santa Clarita branches or by phone.

SEVADA ZADOORYAN

Financial Advisor

CUSO Financial Services, L.P. CA Dept. License #0M60310 (818)464-1784 szadooryan.cfsinvest@lapfcu.org

*Non-deposit investment products and services are offered through CUSO Financial Services, LP (“CFS”), a registered broker-dealer (Member FINRA/SIPC) and SEC Registered Investment Advisor. Products offered through CFS: are not NCUA/NCUSIF or otherwise federally insured, are not guarantees or obligations of the credit union, and may involve investment risk including possible loss of principal. Investment Representatives are registered through CFS. The Credit Union has contracted with CFS for investment services. Atria Wealth Solutions, Inc. (“Atria”) is a modern wealth-management solutions holding company. Atria is not a registered broker-dealer and/or Registered Investment Advisor and does not provide investment advice. Investment advice is only provided through Atria’s subsidiaries. CUSO Financial Services, LP is a subsidiary of Atria.

With the recent Southern California wildfires and rising construction costs, ensuring your home is adequately insured is more important than ever. Rebuilding expenses are increasing, and without the right coverage, you could be left paying thousands out of pocket.

Let the experts at LAPCUSO Insurance Services* review your homeowners’ policy to ensure you have the protection you need. LAPCUSO has served the law enforcement community for decades, providing our members with exclusive savings and trusted service.

Schedule a free, no-obligation policy review today with our in-house specialist, Maria. Ask about special law enforcement discounts!

Maria goes above and beyond and treats her clients like family. I often seek out and trust her recommendations when shopping around for insurance. I wish all agents had her knowledge and integrity!

-Eric M.

MARIA ASCENCIO

Insurance Specialist LAPCUSO Insurance Services (818)373-8384 • cuso@bisins.com

*Insurance services provided by Bichlmeier Insurance Services, Inc., California license #OB26427. Insurance products offered are not sold or guaranteed by LAPFCU. They are not deposits, are not federally insured, are not protected by the NCUA and may be subject to risk. Any insurance required as a condition of an extension of credit by LAPFCU need not be purchased from the Credit Union and may be purchased from an agent or an insurance company of the member’s choice. Business conducted with Bichlmeier Insurance Services, Inc. is separate and distinct from any business conducted with LAPFCU.

n Monday, May 26, Memorial Day; Thursday, June 19, Juneteenth.

Late Opening Wednesday, May 7: 11 a.m., All-Associate Training. ATMs and mobile/online banking available 24/7.