The UK’s Number One Landlord & Property Investment Exhibition has 3 Shows Remaining in 2025. Register now for your FREE show tickets and secure your place while spaces are still available!

The UK’s Number One Landlord & Property Investment Exhibition has 3 Shows Remaining in 2025. Register now for your FREE show tickets and secure your place while spaces are still available!

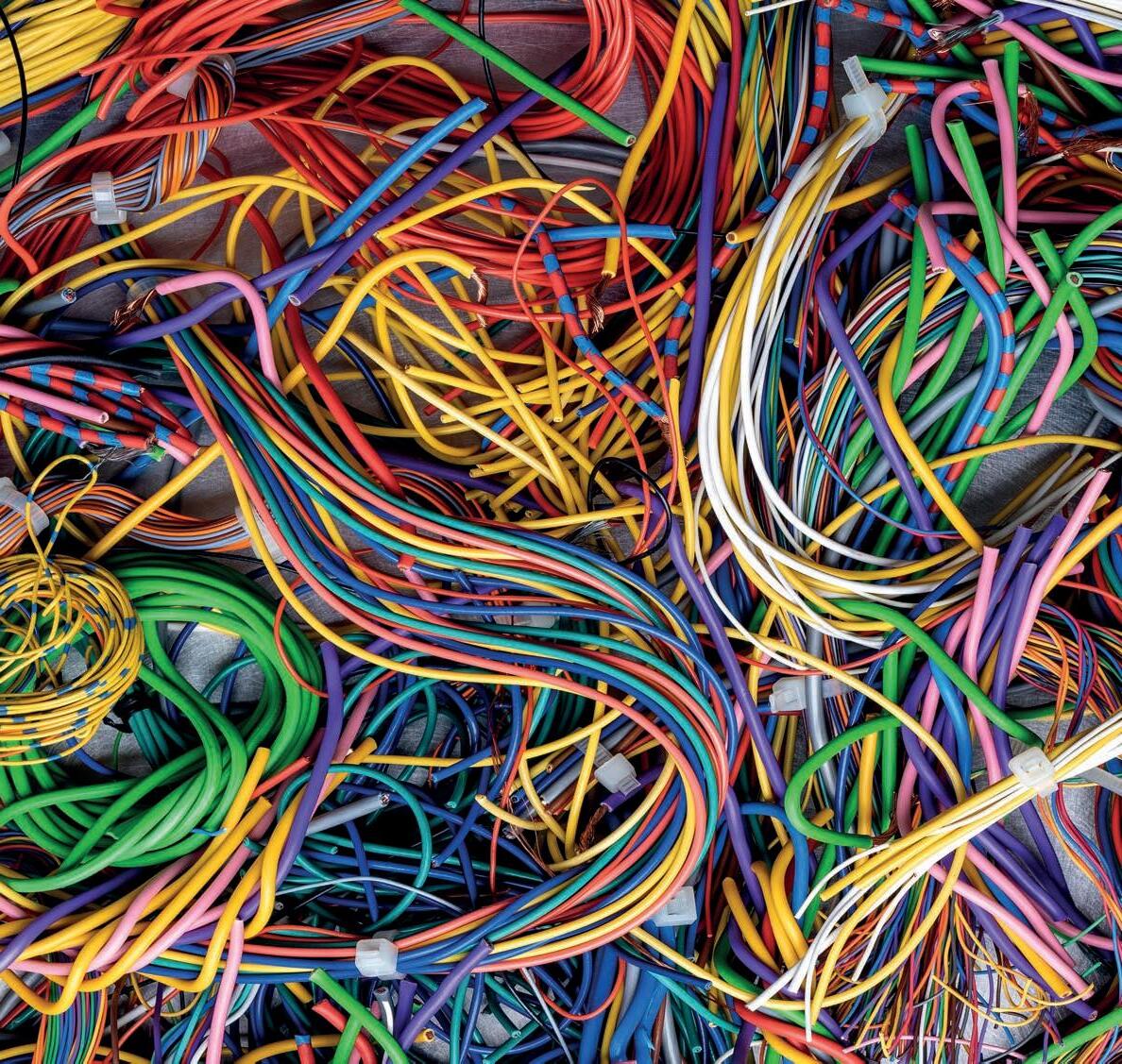

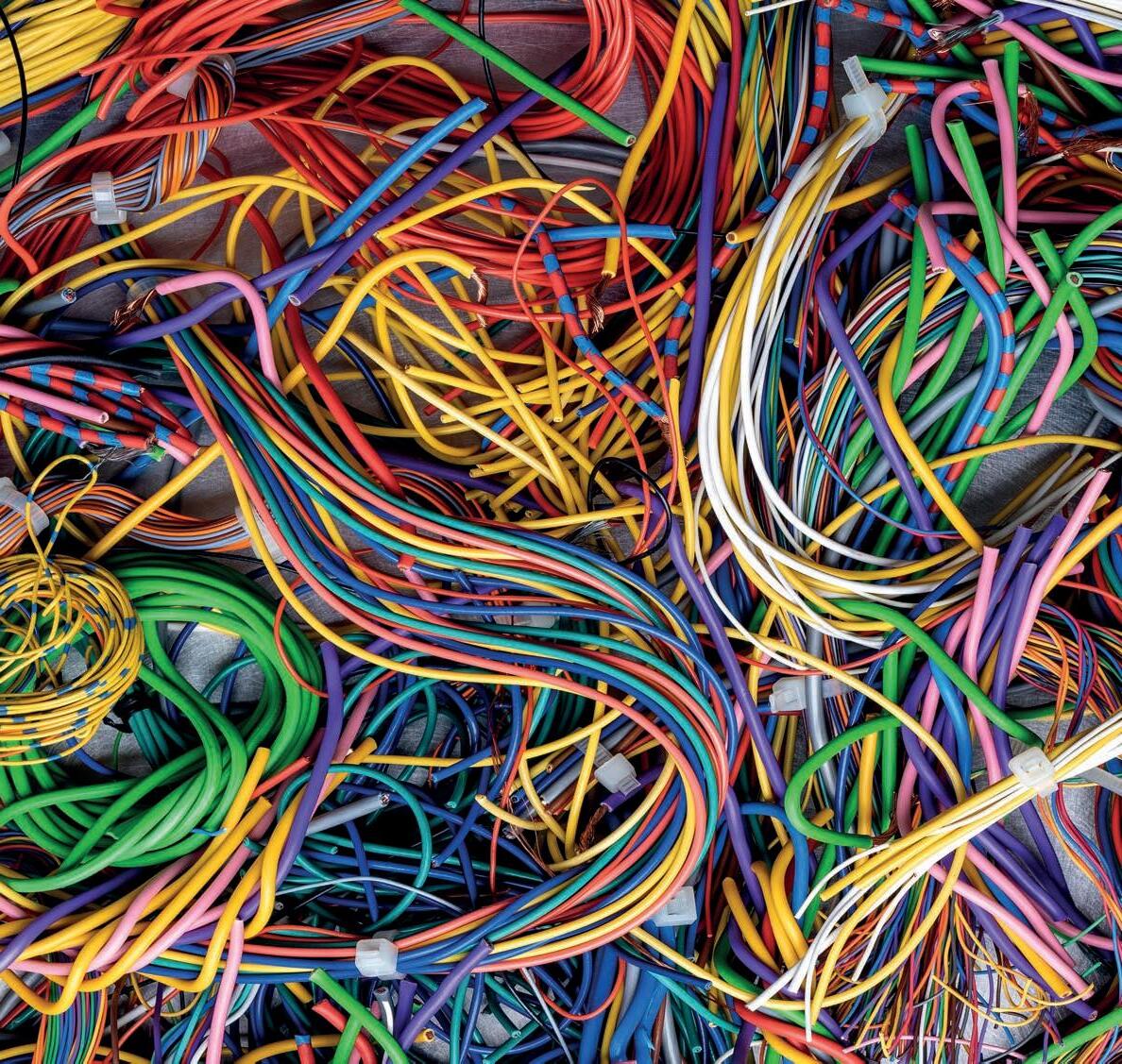

Welcome, and as the cover highlights, the Renters’ Rights Bill is the central focus of this issue. With legislation on track to become an Act of Parliament before the year is out, landlords and investors alike are facing a wave of uncertainty — and a host of unanswered questions. As always, our goal is to provide clarity through expert insight and guidance, and this issue is no exception, with 80+ pages of in-depth content to explore, plus details of our three upcoming live shows this October — where you’ll find valuable opportunities to connect with the professionals who can help you navigate the changes. You can find more information in Show Update (P6). For now, thank you for reading — and a huge thank you to all our fantastic contributors for making this issue possible. Wishing you continued success on your property investment journey. TH

Show Update | Tracey Hanbury The Future is Community

Social Impact | Kate Faulkner OBE

Spending review - Hope for UK Property Market?

Social Impact | Kate Faulkner OBE Landlords Can Influence Government Policy according to Eddie Hughes!

Social Impact | Kate Faulkner OBE An insight into the Student Property Market 2025

Investment | Amy Smith Why Invest in Bristol?

Investment | Kate Faulkner OBE Is Now a Great Time to Invest & Buy Property?

Investment | Jeni Browne What’s the cut-off age for buy-to-let mortgages?

Investment | Peter Littlewood August Brought Encouraging News for the Property Market

Investment | Reece Mennie Why it’s time for Landlords to diversify their investment portfolio

Investment | Aneisha Beveridge Buy-to-let: Reinvention, not retreat

Investment | Simon Zutshi Still worth investing in 2025?

Investment | LIS Media Team Is Buy-to-Let in London Still Worth It?

Investment | LIS Media Team

Here’s Why the Bristol Property Market is Emerging as a UK Buy to Let Hotspot

Editor

Tracey Hanbury

Design

Marc Riley

Social Media

Charlotte Dye

Printing

IOP Marketing

Investment | LIS Media Team

Guide to Buy to Let in Manchester for Landlords

Investment | LIS Media Team

5 Key Takeaways from the New Investor Masterclass

Proptech | Daniel Little Not Another Dashboard?

Taxation | Simon Howitt What the Chancellor Might Do Next –And Why Landlords Should Care?

Taxation | Craig Ogilvie Making Tax Digital for Income Tax: What you need to know

Renters’ Rights | Kate Faulkner OBE Renters’ Rights Bill – Timeline and Impact

Renters’ Rights | Sean Hooker Section 21’s end: What the Renters’ Rights Bill means for landlords and pets

Renters’ Rights | LIS Media Team It’s Time to Act on the Renters’ Rights Bill, Not Fear It

Renters’ Rights | Paul Pybus What does the Renters’ Rights Bill mean for you as a landlord?

Exhibitor Spotlight | Denis Shail Q&A: Building Successful Portfolios with Horizon

Hot Topics | LIS Media Team Build to Rent for Private Landlords: Is it Worth it?

Exhibitor Spotlight | Mike Bains Risk: The One Word Every Landlord Should Be Talking About

| Follow us on...

PLEASE NOTE: The National Landlord Investment Show, LIS Media and Landlord Investor Magazine are content aggregators only. Views, statements and opinions expressed in articles, reviews and other materials herein are those of the authors, exhibitors and third-party contributors and not the editors and publishers of LI Magazine. Under no circumstances does the content of this publication constitute investment or legal advice. We do not undertake to advise individuals or organisations upon investment strategy. All investments should be approached with caution under professional guidance. While every care has been taken in the compilation of this publication and every attempt made to present up-to-date and accurate information, we cannot guarantee that inaccuracies will not occur. LIS Media Limited and our contributors will not be held responsible for any claim, loss, damage or inconvenience caused as a result of any information within these pages or any information accessed through the promoted links. Published by LIS Media, Registered address: Foresters Hall, 25-27 Westow Street, London SE19 3RY. © 2024 LIS Media Ltd.

Kate Faulkner OBE

Leading UK Property Analyst

Sean Hooker

Property Redress & Total Property

Peter Littlewood Director, iHowz

Jeni Browne

Business Development Director, MFB

Reece Mennie CEO, HJ Collection

Craig Ogilvie Director of Making Tax Digital

HM Revenue and Customs (HMRC)

Simon Zutshi

property investors network (pin)

Paul Pybus Director, Centurion

Simon Howitt

Senior Partner, Acuity Professional

Aneisha Beveridge

Head of Research, Hamptons

Amy Smith

Financial Services Director, CJ Hole

Daniel Little

Regional Director, Aico

Denis Shail Director, Horizon

Staff Editorial Team

In-house Content by LIS Media

TRACEY HANBURY CO-FOUNDER / DIRECTOR

Team: Donegal GAA

Song: Galway Girl, Steve Earle

Film: Dirty Dancing

Food: Indian

Likes: A busy show - can’t beat it

Dislikes: Rudeness

Fave thing about LIS: Building client relationships

KIERAN MCCORMACK SALES DIRECTOR

Team: Manchester United

Song: Bonkers, Dizze Rascal

Film: American Gangster

Food: Indian

Likes: Family time, Man Utd, golf

(not necessarily in that order)

Dislikes: Tinned sweetcorn

Fave thing about LIS: No day is the same (hence the song choice)

CHARLOTTE DYE OPERATIONS DIRECTOR

Team: Spurs

Song: The view from the afternoon, Arctic Monkeys

Film: E.T

Food: Chinese

Likes: Anything four legged and furry

Dislikes: Clowns and Spiders

Fave thing about LIS: Office cuddles with Ollie

NICOLE BONNER CONTENT, EDITOR & PR EXECUTIVE

Team: Crystal Palace

Song: Take It Easy by the Eagles

Film: The Devil Wears Prada

Food: Indian

Likes: Travel, photography & cooking

Dislikes: Tinned tuna & snakes

Fave thing about LIS: The innovative and fast-paced nature of the business.

ALICIA CELA HEAD OF ACCOUNTS

Team: Barcelona FC

Song: Hotel California, The Eagles

Film: Shawshank Redemption

Food: Anything Spanish (I'm very biased lol)

Likes: Cooking great food

Dislikes: Liars. Oh, and liver (can't stand it)

Fave thing about LIS: Socialising with the whole team

STEVE HANBURY CO-FOUNDER / DIRECTOR

Team: Crystal Palace

Song: Plastic Dreams, Jaydee (Original)

Film: Goodfellas

Food: Indian

Likes: Team meetings in the pub

Dislikes: Bad manners

Fave thing about LIS:

Show day (as anything can happen)

MARC RILEY CREATIVE DIRECTOR

Team: Letterkenny Shamrocks

Song: What’s going on? Marvin Gaye

Film: On The Waterfront

Food: Sea

Likes: Clean typography

Dislikes: Last minute edits

Fave thing about LIS: The website

JACOB HANBURY SALES EXECUTIVE

Team: Crystal Palace

Song: Michael Bibi - Got the Fire

Film: Step Brothers

Food: Sunday roast

Likes: Skiing, Gym, Crystal Palace

Dislikes: Dirty finger nails

Fave thing about LIS: Great atmosphere at the shows

LEWIS HANBURY CONTENT CREATOR

Team: Crystal Palace

Song: Fire in Cairo, The Cure

Film: Star Wars, A New Hope

Food: Pasta

Likes: Filming

Dislikes: Editing

Fave thing about LIS: My colleagues

OLLIE HANBURY ENTERTAINMENT & SECURITY MANAGER

Team: Crystal Palace

Song: Who let the dogs out

Film: 101 Dalmatians

Food: Roast Dinners

Likes: Walkies

Dislikes: Poo in bags left on branches

Fave thing about LIS: Getting all the attention

TRACEY HANBURY EDITOR & SHOW FOUNDER

As 2025 draws to a close and we enter the fourth quarter of the year, one message has become impossible to ignore: landlords and property investors must be prepared for the biggest era of change the Private Rented Sector (PRS) has ever seen. The industry is dominated by talk of the Renters’ Rights Bill, which promises to reshape how landlords operate and the normal rules of operating within the PRS, but this is just the tip of the iceberg.

From rumours of NI taxes on rental income to planning reforms, EPC rating updates, and the mandatory shift to digital taxation through ‘Making Tax Digital’, the landscape is evolving rapidly. Couple these regulatory shifts with a persistent housing supply crisis, and it’s clear that resilience isn’t optional, it’s essential. So, how can landlords not just survive but thrive amid these changes? While no one has a crystal ball about the future of the sector, one message echoes loud and clear: resilience is built through community, collaboration, and education. At the National Landlord Investment Show, that has always been, and will continue to be, our mission. Our shows in 2025 and in the previous years have proven that staying connected, informed, and adaptable is the key to navigating changes ahead and working within the sector in the future. I’m a strong believer that resilience within the sector comes from building landlord and investor communities.

One thing we’ve consistently observed over the years running the National Landlord Investment Show is that the industry is always evolving with new regulations, laws, and changes appearing regularly from all types of governments. Some of these were not planned for, such as the COVID-19 pandemic. Yet, as a community,

we’ve always approached these shifts proactively, adapting as they come. The upcoming changes are no different, and once again, the power of community is more important than ever.

Over time, there’s often been fear that new regulations might force landlords and property investors to exit the market, with media-grabbing headlines. So far, that hasn’t happened, and based on the optimism we’ve seen at our shows and from talking to the professional calibre of landlords within our community, I don’t expect it to. Industry experts speaking at the show have made it clear: while the Renters’ Rights Bill introduces some of the most significant changes yet, landlords who operate professionally and prepare for these updates will find the impact manageable. Certain sectors, such as HMOs or student lettings, may experience more significant effects, but for most, being proactive is key.

Being part of a community rich in education, insights, and expert voices is crucial during times of change. That’s why our free LIS membership community remains an essential resource, providing landlords and investors with the knowledge and support they need to navigate this evolving landscape with confidence, no matter where they are on the journey. For existing portfolio landlords, it will mean changing the way of work, but for new investors, it will be about starting their investment journey rooted in compliance and knowledge of growth.

Being part of a community rich in education, insights, and expert voices is crucial during times of change.

That’s why our free LIS membership community remains an essential resource, providing landlords and investors with the knowledge and support they need to navigate this evolving landscape with confidence.

Being part of a landlord community, such as the LIS community, provides invaluable support through knowledge sharing and peer collaboration. Our live shows are a clear testament to this. At our July event, we hosted five expertled panels covering key topics such as the Renters’ Rights Bill, PropTech, Rent for Good, New Investor Masterclass, and Making Tax Digital. All headline panels drew in thousands of landlords eager to learn and stay ahead.

Beyond the panels, the exhibition floor offered countless opportunities for landlords and property investors to connect with peers and engage with expert service providers, fostering a community that thrives on shared insight and practical advice. Research indicates that landlords who actively participate in professional networks are better informed and more compliant. According to the English Landlord Survey 2024, research shows that “Demonstrating good practice” landlords (30%) were most likely to ‘get information from a landlord organisation and use this to ensure compliance, showing a clear concern for legislative changes that may affect letting practices’.In contrast, “Lower Compliance & Awareness” landlords (11%) primarily relied on ‘informal sources, leaving them at greater risk of non-compliance and missed legislative updates’.

This data highlights a simple truth: going it alone and isolating yourself in the PRS increases risk, while being part of a connected, informed community strengthens resilience, compliance, and confidence. Even speaking to a landlord at our latest show in London back in July 2025, I asked Ash from London how she felt after attending our live in-person show. She described the event as ‘highly informative’ and left with a renewed sense of confidence in ‘having all her ducks in a row’ when being compliant with the Renters’ Rights Bill. She also learnt of some new opportunities she could explore through social housing through the new rent for good initiative panel discussion, which launched at the show. Conversations like these and knowledge sharing wouldn’t be possible without a sense of community.

Building Community through the National Landlord Investment Show

Our core mission at the National Landlord Investment Show has always been to harness the power of community through free education, ensuring landlords can operate professionally and stay ready for the changes ahead. Since our inception in 2013, we’ve created countless opportunities for knowledge sharing and peer support, proving that while regulatory and market changes are a constant in the PRS, a connected community makes navigating them far more manageable.

Building on this mission, we’re excited to introduce the LIS Membership Community Hub and call everyone within our network and beyond to join this community for free. While it continues what we’ve always done, which is bringing landlords and investors together to learn and network, the hub centralises everything on one comprehensive platform.

Through the community, you can continue to attend our free live UK property exhibitions, access expert digital resources, including the latest property market reports from leading UK Property Analyst Kate Faulkner OBE and exclusive guides on preparing for the Renters’ Rights Bill from Suzanne Smith, The Independent Landlord. In addition, you can join educational webinars and digital events, network with key industry experts in tax, financing, insurance, property management, proptech, legal advice, and more. Being part of the community also helps you be part of new initiatives and conversations within the industry, such as alternative investment options through Rent for Good schemes, and stay ahead with the newest digitalisation tools from PropTech providers. Join our community by registering for free here

The hub is designed to extend the power of community beyond our live shows, giving landlords and property investors the tools, insights, and connections they need to remain resilient and thrive in a constantly evolving market in a digital world.

Our core mission at the National Landlord Investment Show has always been to harness the power of community through free education, ensuring landlords can operate professionally.

It’s clear that collective knowledge sharing, expert-led education, and peerto-peer networking are vital for preparing landlords and property investors for the future of an evolving property market. Being part of a community builds confidence across the sector, and the overall resilience of the UK property market increasingly depends on landlords and investors learning, sharing, and collaborating.

For UK landlords and property investors, the message is clear: the strength and resilience of the UK PRS relies on building strong communities and approaching changes together with guidance from industry experts and service providers. Our upcoming events in October 2025 in Bristol on 1st October, Manchester on 14th October and London on 29th October offers the UK landlord and investor community opportunities to experience knowledge sharing and communitybased networking in action. Don’t miss out, register for your tickets today

Meanwhile, stay informed beyond our live exhibitions by registering to become a member of our free LIS Community, where you can access exclusive expertled content, including the latest property market insights, guidance on navigating the Renters’ Rights Bill, and much more. TH

KATE FAULKNER OBE LEADING UK PROPERTY ANALYST

Chancellor Rachel Reeves’ Spending Review on June 11th marked a clear pivot toward regional investment, infrastructure renewal, and social welfare – all of which will have a meaningful impact on the UK property market, both in the short and long term. Here’s a breakdown

of how the announcements could shape different aspects of the property sector:

1. Boost to Social Housing

This review sets out an annual increase in funding for social housing from £2.3bn to £3.9bn between 2026 and 2036. The impact of this investment will be positive for renters, as more affordable homes may reduce pressure on the private rental sector, particularly in high-demand urban areas. In the longer term, the increase in supply could help ease overall housing shortages, though the scale still falls short of meeting the needs of the 1.3 million people currently on waiting lists.

Impact:

Positive for renters: More affordable homes may reduce pressure on the private rental sector, especially in highdemand urban areas.

Long-term supply benefit: Could ease overall housing shortages, though the scale still falls short of the 1.3 million people on waiting lists.

2. Transport Infrastructure Investment – £15.6bn (2027–2031)

This proposal sets out an investment of £15.6bn between 2027 and 2031, with a focus on regions outside London. The programme includes the Transpennine Route Upgrade to deliver improved Manchester–Leeds links, the East West Rail to support growth in the Oxford–Cambridge corridor, £240m for Leeds Station to reduce congestion and improve capacity, and £300m for Welsh rail improvements across key upgrades. The impact is expected to include capital growth potential, as improved connectivity boosts buyer interest and developer activity in

regional areas. There are also buy-tolet opportunities, with the potential to influence yields.across key upgrades.

Impact:

Capital growth potential: Improved connectivity boosts buyer interest and developer activity in regional areas.

Buy-to-let opportunities: Potential impact on yields

3. Local Government and Community Investment

The review promises funding for 350 community projects, including parks, pools, and youth centres. It also confirms an approved 5% Council Tax rise. The impact is twofold. Area uplift is expected, as enhanced amenities can increase local desirability and property values. At the same time, there is Council Tax caution, with increased costs for both homeowners and renters, especially in lower-income areas.

4.Sizewell C Nuclear Power Station – Suffolk

The review proposes a governmentbacked project near Aldeburgh and Southwold. The impact includes a short-term construction boost, with a surge in local housing demand from workers. In the long term, stable employment from the project could support sustained property demand in the area.

This Spending Review signals a real effort to improve house building and particularly for regional investment and affordable housing. While it won’t solve the housing crisis alone, the emphasis on infrastructure and

social housing lays foundations for more balanced growth outside London, stronger investor confidence, and longer-term affordability improvements.

I think the Spending Review showed some real understanding of how to boost housing supply in England. We need better transport access to build more homes without causing more congestion. A great place to show how this works is the A14 between Peterborough and Cambridge. This has dramatically increased the capacity of the A14, reduced delays and enabling access to new build areas such as Trumpington, Cambourne and Alconbury. However, it’ll be interesting to see what happens in the next budget to taxes, as all of this spending will either have to be funded through growth or increased taxes.

Kate Faulkner OBE

The emphasis on infrastructure and social housing lays foundations for more balanced growth outside London, stronger investor confidence, and longer-term affordability improvements.

KATE FAULKNER OBE LEADING UK PROPERTY ANALYST

Eddie Hughes, former Conservative MP for Walsall North and Housing Minister, recently addressed these frustrations at the London Landlord Investment Show in July, offering practical advice on how landlords can actively contribute to shaping government policy, even without direct access to the housing minister.

Step 1: Identify and Contact Your Local MP

Find your MP: Visit the Members of Parliament website and enter your postcode. You'll receive your MP’s name, contact details, and website: members. parliament.uk/members/commons

Contact Methods: You can reach out by writing a letter, sending an email, or by attending a local MP “surgery” (a dropin meeting for constituents).

Step 2: Writing to Your MP

Know Your Audience: Research your MP’s background. Look up their experience in property, past statements on housing, voting record, and any election promises on local or housing issues.

Crafting Your Message:

Clearly outline your concerns or propose a new policy idea.

Share real-life impacts, explaining how current policies e.g., Section 24 affect not just you as a landlord, but also your tenants and local housing stability.

Be concise—present headline points, then specify what you want your MP to do, providing feedback and champion your idea by considering promoting it more widely.

Follow Up: After any interaction—be it by mail or a meeting—send a thank you letter and any promised additional information.

Step 3: Attending an MP Surgery

What is a Surgery? Local MPs typically hold regular public drop-in sessions at accessible venues like libraries.

How it Works:

Sessions may be “drop-in” or require booking in advance—call or email your MP’s constituency office to find out how you can attend a surgery.

Make sure to consult your own MP (from your home address), not the MP of the area where you own let properties.

Discussion Tips: Be organised and specific about the issues you want to raise. Bring documentation or evidence, and, if possible, coordinate with other landlords who share your concerns to demonstrate broader support.

Step 4: Requesting a One-to-One Meeting

When to Request: If surgery times are inconvenient or your issue is complex, you can ask for a dedicated meeting—possibly online, depending on circumstances.

Meeting Strategy:

Clearly state your issue and objective for the meeting.

Provide specific examples (e.g., a tenant losing their home due to recent changes in benefit rules or Section 24 impacts).

Collaborate with others to strengthen your case and show it's not a unique circumstance.

After the Meeting: Always follow through as agreed—with a thank you and further information as needed.

Engaging with your MP is one of the most direct and influential ways landlords can help shape the laws and regulations affecting the rental sector. Preparation, clarity, and follow-up are key to making your voice heard and possibly influencing housing policy at both the local and national levels.

Eddie Hughes comments:

“Many people don't even know the name of their local MP and have never contacted them. Yet, MPs are the best way to share your views on planned legal changes and help shape the ones that may impact you most. This stepby-step guide is essential for anyone wondering how to make that contact”

Kate Faulkner OBE

Be organised and specific about the issues you want to raise. Bring documentation or evidence, and, if possible, coordinate with other landlords who share your concerns to demonstrate broader support.

KATE FAULKNER OBE LEADING UK PROPERTY ANALYST

The UK student property market in 2025 faces ongoing supply shortages despite rising demand, driving rents upward. While

some cities see easing demand, the struggle to secure affordable, quality accommodation continues, highlighting critical challenges for students and landlords alike.

To understand today’s student accommodation challenges, it’s helpful to look back at how the market has evolved post-pandemic. A Savills report, drawing on data from the Higher Education Statistics Agency (HESA), highlighted just how sharp the rise in student demand was as the UK’s full-time student population grew by 8% (202/21), with over 560,000 acceptances, the second-highest on record.

This surge created a significant shortage of beds, with Savills noting: “this is equivalent to around three students per available bed in purposebuilt student accommodation”.

This supply/demand tightening supported rents rising sharply, albeit not just in the student sector, but resulting in forcing universities into what Savills described as “extreme action”:

“The University of York and the University of Bristol have housed students in neighbouring towns and cities, the University of Edinburgh has converted common rooms into dorms with bunk beds, and the University of Glasgow has put students in hotels. Meanwhile, students in Durham queued overnight outside lettings agents to secure accommodation.”

Savills further reported that out of the 44 UK cities with more than 15,000 full-time students, 24 recorded rental growth above 7% in September 2022. Looking at the statistics closer, it found that cities London, Manchester, and Salford saw a massive growth of over 15%. Even cities with falling student numbers, such as Nottingham, Reading and Bath, still saw rental growth above 7% due to proportional drops in available rental listings.

Source: www.savills.co.uk

What’s happening in 2025?

Against this backdrop of high demand and restricted supply, Knight Frank’s latest research suggests that overall, fundamental challenge of supply versus demand for student accommodation remains:

“UK students are struggling to find housing, and demand for accommodation is soaring. Supply is failing to keep up, causing rents to rise on average by around 8% this year”

From the Knight Frank report, the June 2025 UCAS deadline confirmed rising student applications:

• Applicant numbers up 1.3% yearon-year

• U K 18-year-olds and overseas students both up 2.2%

• Chinese applications up nearly 10%

• The US and Turkey showed growth of 13.9% and 23.6% respectively

• N on-EU applications only rose at “higher tariff universities” (+7.4%)

While new supply is emerging— “London, Nottingham and Leeds are expected to see the largest increases in supply….. but with less than 60,000 beds presently under construction across the UK, the misalignment between demand and supply remains”—the gap between need and availability persists.

Source: Knight Frank Student Market Update Q2 2025

Signs of a Turning Point?

HESA data hints that demand growth may be plateauing as 2,904,425 students were enrolled in 2023/24, which was a 1% fall from the previous year. Overall, the first annual decrease in a decade.

So the conclusion is that the student market remains strong but may have reached its peak. Even so, supply shortages mean demand is still outstripping housing availability in many cities.

Against this backdrop of high demand and restricted supply, Knight Frank’s latest research suggests that overall, fundamental challenge of supply versus demand for student accommodation remains.

There are only a few PBSA schemes which are lower in rent than onstreet HMOs and in these cases, it is only part of those schemes which are lower in price.

Nottingham— considered a longstanding buy-to-let hotspot— does appear to be experiencing a shift which goes against the ‘national’ student accommodation picture.

A recent in-depth report on the student market by Nottingham City Council shows rising vacancies in Purpose Built Student Accommodation (PBSA):

• 2024/25 PBSA vacancy rate: 11.2%, up from 3.5% the year before

• Cluster flats and studio vacancy rates now equal (11.2%)

Within this report, StuRents data confirms that this fall in demand is across the wider student housing market:

“As of April 2025, leasing of student accommodation for 2025/26 was considerably lower than that of April 2024, which indicates that vacancy rates may be even higher in the next academic year. Some providers may consider lowering rents further due to this softening demand.”

A key reason for the shift in demand versus supply of homes for students is the huge increase in accommodation to date, and forecast of purpose-built student housing. As the chart shows, this is expected to lead to a doubling of the number of student beds available since 2016/17 by 2026/7 and it’s clear to see that this is expected to substantially reduce the number of beds needed by private landlords.

The report concluded:

• Full-time student numbers in Nottingham have fallen since their 2020/21 peak

• Net reduction of ~7,450 students needing accommodation since 2022/23

• A growing share of students are East Midlands locals, reducing rental demand

Source: Nottingham City Council Student Accommodation Report, June 2025

Perhaps the most striking insight from the Nottingham report is: “There are only a few PBSA schemes which are lower in rent than on-street HMOs and in these cases, it is only part of those schemes which are lower in price”

This suggests the policy drive to push students into PBSA has had unintended consequences, ultimately resulting in higher living costs for students.

Supporting this, StuRents data reported in Landlordzone found that in Manchester, the average rent of a room in PBSA was £255/week. In comparison, the average rent of an HMO room in Manchester was reported as £150/week. The research showed that PBSA costs 50% more than HMO accommodation in this city.

This poses a big question for student living. Is it better to have purposebuilt student accommodation at a higher price, or would they prefer to live a bit more frugally in cheaper accommodation typically provided by individual private landlords?

Kate Faulkner OBE

Helping landlords build insurance policies that can protect their portfolios is what we do best.

We know what matters to landlords. When you need us, we’ll help you tackle it one thing at a time.

SMITH

HOLE

city built on community, culture, and connection –and a future full of opportunity.

At CJ Hole, we’ve called Bristol home since 1867. With nearly 160 years of helping people move, settle, and invest here, we’ve seen what makes this city stand out. Bristol isn’t just somewhere to live – it’s somewhere to belong. And that’s exactly why it’s not just a great place to live – it’s a city with soul, substance, and long-term investment potential.

Bristol regularly ranks among the UK’s most desirable places to live and invest – and it’s not hard to see why. With a thriving economy, a growing population, and a reputation for innovation and creativity, the city continues to attract people and businesses from across the UK and beyond.

From a strong tech and green energy scene to world-class universities and a vibrant cultural offering, Bristol offers a rare combination of economic opportunity and lifestyle appeal. That drives both demand for homes and confidence in the city’s future.

Whether you're targeting students, professionals, families or downsizers, Bristol’s market offers broad and sustained demand. Key neighbourhoods like Bedminster, Bishopston, and Brislington are gaining traction with buyers and renters alike, thanks to regeneration projects and improved infrastructure.

Rental properties see high occupancy and strong yields, supported by a mix of young professionals, graduates staying in the city, and new arrivals seeking a better work-life balance outside London.

But what truly sets Bristol apart is its community feel. This is a place where tenants often become homeowners, and homeowners become long-term residents – creating stronger roots and longer-term value for investors.

At CJ Hole, we believe culture adds capital. That’s why we created Bristol Built, our Instagram-led campaign that celebrates the people, places, and independent businesses that give the city its unique identity.

Rather than just selling homes, we highlight the communities behind them –from the creativity of Stokes Croft to the energy of North Street. Because cities that prioritise character and creativity aren’t just good places to live – they’re smart places to invest.

Bristol is a city that values sustainability, innovation, and doing business differently – and we’re proud to reflect that. Last year, we retired hundreds of thousands of printed leaflets and shifted to digital marketing, building stronger connections with local audiences and reducing our carbon footprint.

Our focus on community-first storytelling, not just property listings, has helped us grow engagement, deepen trust, and support the kind of businesses that make Bristol special.

Investing in Bristol Means More

Bristol isn’t just growing – it’s evolving. From major regeneration at Temple Quarter to ongoing investment in transport, housing, and climate-friendly development, the city is shaping a future that’s inclusive, forward-thinking, and full of opportunity.

At CJ Hole, we know this city – its streets, its stories, its people. And whether you're looking for returns, relevance, or something more meaningful, we’re here to help you find it in Bristol.

Markets shift. Trends change. But cities built on purpose, culture, and community stand the test of time. Bristol is one of them.

Bristol

is a city that values sustainability, innovation, and doing business differently – and we’re proud to reflect that. Last year, we retired hundreds of thousands of printed leaflets and shifted to digital marketing, building stronger connections with local audiences and reducing our carbon footprint.

KATE FAULKNER OBE LEADING UK PROPERTY ANALYST

When considering the best time to buy and invest in property, there are various conditions that are worth looking at and currently, the economic and property market conditions suggest it could be a great time to search for a bargain to buy!

Stability: The UK housing market in the summer of 2025 shows that key economic indicators are stable. Inflation hovers a little above the government’s 2% target (now just over 3%) but is projected to fall closer to target over the next 12 months, boosting the chances of interest rates falling.

Interest Rates: Inflation influences the Bank of England base rate (BBR) which is currently 4.25%. Market forecasters widely expected at least one cut later in 2025, which met predictions of Capital Economics taking place in August with a cut to 4%. Further predictions are that interest rates may even sub this level by the end of the year. This would be significant as it will help to support increased property activity.

When investing in buy-to-let, it’s important to consider securing some mortgage finance to help boost your investment returns. As with the economic conditions, financing is getting easier too.

Improved Product Availability:

Rachel Springall, finance expert at Moneyfactscompare.co.uk explains that “Landlords searching for a new buyto-let mortgage may be pleased to see a rise in product availability, with the choice of deals soaring to its highest point on record. Borrowers concerned about interest rates may also find it encouraging to see the average two-year fixed buy-to-let rate has fallen below 5% for the first time since September 2022 and both the two- and five-year fixed rates have fallen for the fourth consecutive month.”

Buy-to-Let Market: Lenders are competing for business, leading to more favourable terms and the broadest product choice in years, making it more

feasible for landlords and investors to "stack deals" for rental yields than it has been in recent periods.

House price trends show that UK house prices are up by 1-2% compared to a year ago, according to a range of property price indices. Meanwhile at a local level property markets are showing different trends which could mean it’s easier in some places to find a bargain to buy just now, before more buyers return to the market.

For example, flats in London in particular have stagnated or even softened a little. The average flat price has remained relatively stable over the past few years, offering potential value opportunities for long-term investors.

Currently some markets like this are potentially in a bit of ‘sweet spot’ –depending on local market dynamics. The reason being is that we are seeing some of the highest levels of property stock available for sale than we have seen for some years.

According to data compiled by Chris Watkin using TwentyEA data as the graphs below show that in the last nine years properties for sale are nearly 15% higher than the annual average over this time

Stock Levels and Bargains: The number of homes available for sale is at its highest in years—as much as 15% above the nine-year average. More homes for sale means sellers are competing for buyers, leading to increased price reductions and higher potential for negotiating bargains.

Transaction Volumes: While overall transactions peaked and then dipped around stamp duty land tax changes, the market has since rebounded and is returning to more typical levels, indicating a healthy and active property market with more choices for buyers.

However, perhaps of the most interest to property investors (or buyers) is the last graph, which shows that when there are high numbers of listings, property price reductions can reach their peak as sellers compete for buyers, allowing them to move on with their lives.

This means there may well be some bargains for sale!

However, it’s essential to check what’s happening locally.

Local Market Dynamics: Trends are not uniform across all locations. For example, while big cities like London may offer better value on flats right now, the North East and Scotland have seen the most resilient price growth recently.

Rental Demand and Yields: With rents still rising the buy-tolet sector may offer sustainable returns if you buy wisely and target high-demand areas.

This period offers an opportunity to invest in property for those positioned to take advantage of more competitive mortgage products, ample listing stock, and softening prices in certain sectors (notably flats in major cities). However, successful investment in 2025 will require:

• C arefully researching local market conditions

• S ecuring the best possible mortgage terms (considering deposit size and personal circumstances)

• Factoring in persistent but slowing rent inflation

This period offers an opportunity to invest in property for those positioned to take advantage of more competitive mortgage products, ample listing stock, and softening prices in certain sectors.

It’s a promising time for informed investors— but do remember that UK property is always a local game, and averages conceal great variations across neighbourhoods and property types! Staying informed and educated is key when it comes to making investment decisions, which is why upcoming events like the National Landlord Investment Shows are crucial to attend.

The upcoming shows are taking place in October 2025 in Bristol, Manchester and London, all you need to do is register for your free ticket here

Kate Faulkner OBE

Do you want both stable cash flow and secure equity growth in your portfolio?

Want to diversify your investments, ensure a stable future, and maximise returns?

Are you looking to turbocharge your cash flow and achieve financial security in today's market?

Access the FREE Title Split Video here. Scan the QR code to download.

JENI BROWNE BUSINESS DEVELOPMENT DIRECTOR, MFB

Is there a maximum age limit for getting a buy to let mortgage? And what mortgage options are available to older landlords?

Did you know the average UK landlord is 59? And 65% are aged 55 or over. That’s a big chunk of the market, and it’s often the older landlords who hold the larger portfolios too.

Even so, this group doesn’t always get the support it deserves. But here’s the good news: there are more mortgage options for older landlords than you might expect.

Buy to let for older landlords

Now, when I say ‘older landlords’, I’m talking 65+, those of you approaching retirement age. For landlords in this bracket, you may be looking to:

• Remortgage to stay on the best rate

• Top up your retirement income with your rental earnings

• Invest Inheritance in buy to let property

Can I get a mortgage once I’ve retired?

Absolutely. The only issues you could face will be raised by lender assessments rather than a general criteria issue with retirees.

That’s to say, your being retired isn’t the issue, but perhaps your lower pension income might mean you no longer meet affordability checks. If a lender is concerned that your pension couldn’t cover a rental void period, that’s when you’ll run into issues.

Of course, many lenders don’t have a minimum income requirement but instead rely on their rental coverage stress tests. Speak to a broker and we’ll point you in the right direction.

Do I need a bigger deposit?

Not always! If you meet the criteria, your deposit will be the same as any other borrower's.

That said, some lenders tighten their LTV ratios as you get closer to 70. So, if you're in that age bracket, it might be worth reducing your overall portfolio borrowing to unlock better rates.

As a first-time landlord, borrowing more to grow your portfolio quickly can make sense. However, as you approach retirement age, reducing your risk means your portfolio can keep performing, without costing you more in interest.

So, what’s the age limit?

Nowadays, most lenders set their upper age limit between 79 and 85 at the time of application. Currently, 14 lenders will even let you go up to 85 at the end of the mortgage term.

Some lenders don’t set an age cap at all when you apply, whether you’re

investing in your own name or through a Limited Company. It’s all about finding the right fit, and that’s where a good broker (that’s us) comes in. We can help you explore what rates and options are out there for your situation.

Lenders tend to be more relaxed about age when you apply through a Limited Company, especially if it's set up as an SPV (Special Purpose Vehicle), as succession planning is much easier.

If you’ve got family or trusted partners you’d like to pass your portfolio on to one day, you can make them shareholders or directors now. That way, the mortgage and ownership are already sorted if anything happens to you.

So, if you’re an older landlord wondering whether it’s still possible to grow your portfolio, the answer is a resounding yes. You’ve got options, and we’re here to help you find them.

As a first-time landlord, borrowing more to grow your portfolio quickly can make sense. However, as you approach retirement age, reducing your risk means your portfolio can keep performing, without costing you more in interest.

Mortgage Finance Brokers (MFB) is a mortgage broker specialising in buy to let finance, homebuyer and commercial mortgages, and short-term finance. Registered office 17 Kings Hill Avenue, Kings Hill, West Malling, ME19 4UA. Company registered in England and Wales No. 2502713. Mortgage Finance Brokers Limited is authorised and regulated by the Financial Conduct Authority (313537) to transact regulated mortgages.

PETER LITTLEWOOD CEO, IHOWZ

The first few days of August brought a burst of optimism across the UK property market, hinting at a more confident autumn ahead. From rising house prices to improved transaction volumes and mortgage expectations, the signs point to a market that, while not running hot, is certainly warming up. At the same time, the latest data from the English Housing Survey offers critical insight into the private rented sector (PRS), helping landlords, agents, and policymakers prepare for the changes ahead.

According to the Nationwide House Price Index, UK house prices rose by 0.6% between June and July, pushing the annual growth rate to 2.4%. This brings the average UK house price to £272,664, reversing some of the subdued performance seen earlier this year.

Commenting on the figures, Nationwide’s Chief Economist Robert Gardner noted that “activity appears to be holding up well,” with mortgage approvals for June broadly in line with pre-pandemic norms. This points to a market that is not only stabilising but beginning to respond positively to improving conditions.

Supporting this view, HMRC data shows that residential transactions jumped by 13% in June, reaching 93,530 on a seasonally adjusted basis. This increase in transaction volumes suggests that buyer and seller confidence is gradually returning.

One of the biggest factors buoying the market was the Bank of England’s Monetary Policy Committee decision to cut the base interest rate, which saw a reduction from 4.25% to 4% . A reduction is highly welcomed with positivity by the UK property industry.

While lenders had already begun pricing in anticipation of the change, the confirmed cut sent a strong signal of support to borrowers.

Mark Harris, Chief Executive of SPF Private Clients, explains that overall, the “base rate reduction encourags activity and enable borrowers to plan ahead with more confidence.”

Mortgage brokers are reporting improved borrowing power, with homebuyers now able to borrow up to 20% more at the same interest rate than they could just a few months ago. This is opening doors for many previously priced-out buyers and improving affordability across the board.

On the ground, estate agents are seeing continued activity despite the traditional summer slowdown. Jeremy Leaf, a North London agent, said: “Transactions are holding together relatively well,” with the potential for a “modest improvement all round.” Amy Reynolds of Richmond-based agency Antony Roberts echoed the sentiment, noting that agents are “seeing full diaries of viewings and off-market sales.”

While lenders had already begun pricing in anticipation of the change, the confirmed cut sent a strong signal of support to borrowers.

The Guild of Property Professionals’ Iain McKenzie describes the market as “responding logically to improved conditions,” underscoring that this is not a boom, but a return to healthier, more stable activity levels.

Recent analysis from Zoopla offers further insight into the shifting landscape. According to their latest report:

• Buyer demand is up 11% year-onyear

• Agreed sales have risen by 8%

• Housing supply has increased by 12%, giving buyers more choice and contributing to a "buyers' market" dynamic

However, national house price growth has slowed to 1.3%, down from 2.1% six months ago. Zoopla has revised its 2025 house price forecast down to 1%, citing rising supply and the end of temporary stamp duty reliefs as key factors.

While challenges remain—especially around regional disparities and affordability pressures in the South—the market is showing signs of resilience and logical adjustment.

Regional Disparities Remain

The picture isn’t uniform across the UK. While the Midlands, North, Wales, and Northern Ireland are seeing healthier price growth (2–3%) and greater momentum, London and the South East are facing affordability constraints and higher stamp duty costs. This has dampened buyer appetite and restricted price growth in those regions.

As we approach the end of the year, the anticipated Autumn Budget may inject further uncertainty into the market. Some buyers are likely to hold off on major decisions until more is known about the Government’s fiscal plans.

Spotlight on the English Housing Survey: What It Means for the PRS

Alongside the latest market data, the recently released English Housing Survey (EHS) offers vital intelligence for those operating in or engaging with the private rented sector (PRS). Conducted annually by the Department for Levelling Up, Housing and Communities (DLUHC), the EHS provides the most comprehensive overview of housing conditions, affordability, and tenure in England.

Key Findings for the Private Rented Sector

The PRS now accommodates approximately 4.6 million households, representing 19% of all housing stock – a slight dip from recent years.

While average rents have risen, overall housing quality continues to improve.

However, 13% of PRS homes still fail to meet the Decent Homes Standard, particularly due to damp, mould, and poor energy efficiency.

Tenants in the PRS are more mobile than in other tenures, often moving due to affordability, tenancy insecurity, or dissatisfaction with property conditions.

The survey captures critical data on overcrowding, energy performance, and safety compliance, which will directly inform emerging policy.

This rich data source is central to current and future reforms, including:

Development of the new PRS Database, which will register landlords and properties

Introduction of updated minimum standards for housing quality

Support for enforcement strategies by local authorities

For professionals and organisations working in housing, the EHS is a valuable tool that can guide strategic decisions, inform investment, and support better service delivery. The full dataset and summary reports are available here: English Housing Survey Collection – GOV.UK

The start of August was marked by a clear upswing in sentiment across the property sector. While challenges remain—especially around regional disparities and affordability pressures in the South—the market is showing signs of resilience and logical adjustment.

With mortgage rates easing and a potential base rate cut on the horizon, many will be watching closely to see whether these early green shoots translate into sustained recovery this autumn.

For those operating in the PRS, the English Housing Survey offers both encouragement and a call to action. The data reinforces the need for quality improvements, greater transparency, and more effective regulation—many of which are on the horizon via the Renters’ Rights Bill and wider housing reforms.

In the meantime, landlords, agents, and housing professionals are encouraged to stay informed, participate in consultations, and make full use of available resources to prepare for what promises to be a pivotal period for the sector.

Peter Littlewood

REECE MENNIE FOUNDER AND CEO, HJ COLLECTION

It’s a tumultuous time for the property sector, and landlords have a lot to contend with.

In a survey carried out by the Property Redress Scheme last year, only 43.3% of landlords felt the sector was fit for purpose, while only 51.7% were happy with their financial return in 2023.

Adding to this, 61.9% of landlords felt they were not supported by the government, and 67.5% indicated legislation was the biggest challenge they were facing in the sector.

Whether it’s economic uncertainty or legislative changes, landlords are set to face even more challenges over the next 12 months, likely to impact their profitability. This is where alternative investment – and the option of being a ‘Lender not a Landlord’ - may just have the answer.

Expected to come into force in 2026, The Renters’ Rights Act 2025 will overhaul the tenancy system for landlords, with the system of Assured Shorthold Tenancies set to be replaced with new Assured Tenancies.

The changes mean fixed term tenancies will no longer be possible, and tenants will be able to terminate any tenancy with at least two months’ notice, to expire at the end of a rent period. This is risky for landlords signing up new tenants on 12-month fixed term this year, as they will likely be able to terminate the contract before it ends.

The abolition of Section 21 ‘no fault’ evictions is another key component of the act, meaning landlords will no longer be able to remove tenants without providing specific legal reasons using the new grounds under Section 8. This is a concern for landlords who may need to regain possession of their properties in cases where tenants have failed to pay rent, for instance.

Changes to Stamp Duty and economic pressures

Stamp Duty Land Tax (SDTL) increased again in April 2025 for all those buying a property over £250,000, and for first-time buyers who buy a property for more than £300,000.

A permanent cut to stamp duty in 2022 meant it would not be payable on the first £250,000 of a property’s value, but a ‘sunset clause’ for the higher thresholds came to an end in March 2025. This means that SDLT on properties up to the value of £250,000 has increased, so investors are paying out more.

This increase is leaving many landlords questioning the value of a property portfolio against a backdrop of economic uncertainty, and it’s easy to see why.

Is alternative investment the way forward?

Given ongoing challenges, it’s wise for investors to consider alternative options.

To generate income from property without having to navigate everchanging legislation, investors can look to explore property bonds. This approach enables individuals to benefit from investing in a property-backed asset, with a hands-off approach and above-average returns.

Ultimately, alternative investments can negate many of the current struggles impacting Landlords. It may not be a risk-free approach, but investing in property bonds may just be the answer to both short and long-term success.

Reece Mennie

The changes mean fixed term tenancies will no longer be possible, and tenants will be able to terminate any tenancy with at least two months’ notice, to expire at the end of a rent period. This is risky for landlords signing up new tenants on 12-month fixed term this year, as they will likely be able to terminate the contract before it ends.

ANEISHA BEVERIDGE HEAD OF RESEARCH HAMPTONS

It’s hard to overstate how much the UK’s rental landscape has shifted since the invention of the buy-to-let mortgage in the mid-1990s. Before then, being a landlord was largely the preserve of the wealthy. But buyto-let finance opened the door to a new breed of middle-class investors, fuelling two decades of growth in the private rented sector.

That growth, however, hasn’t come without growing pains. By 2016, policymakers were becoming uneasy about investors crowding out first-time buyers. A raft of tax changes followed— higher stamp duty and less generous mortgage interest relief—designed to level the playing field. Then came the interest rate hikes of 2022, which forced many landlords to reassess whether property investment still stacked up. The looming Renters’ Rights Bill and new EPC standards have added further pressure.

Yet, despite the headwinds, the sector is proving more resilient than many expected.

According to UK Finance, 58,347 new buy-to-let mortgages were approved in Q1 2025—up 39% year-on-year. Loans for new purchases surged by 61%, albeit from very low levels. While buy-to-let purchases still make up a modest share of overall transactions (9.4% in Q2 2025), the market hasn’t ground to a halt.

This resilience is also reflected in incorporation numbers. A record 33,598 buy-to-let companies were set up in the first half of 2025, with around three-quarters of new buy-tolet purchases now going into a limited company. Incorporation has long been a strategy to mitigate higher personal taxes, but the timing is telling. Even after April’s stamp duty surcharge increase, incorporations rose 18% in May and 21% in June compared to last year’s levels, suggesting landlords aren’t just restructuring, they’re actively expanding.

And they’re doing so for good reason. Gross yields on new purchases have climbed to an average of 7.1% across

England and Wales, with one in four achieving double-digit returns. In the North East, yields average 9.3%, while even in London— historically the lowest yielding region—returns have risen from 4.1% in 2020 to 5.7% this year. These stronger returns help landlords absorb higher costs, from mortgage payments to maintenance and tax.

The investor profile is shifting too. Since 2016, the proportion of newly incorporated buy-to-let companies with at least one non-UK shareholder has climbed from 13% to 20%. Indian and Nigerian nationals now top the list of international investors. While London remains the epicentre of overseas activity, foreign ownership has more than doubled in the East and West Midlands and Scotland over the past decade.

So what’s driving continued investment?

Partly, it’s the appeal of bricks and mortar. With savings rates falling and stock markets wobbling, property offers a stable, income-generating alternative. And with house prices forecast to rise faster than rents, we may be nearing the peak for yields—prompting some investors to act now.

Crucially, falling mortgage rates this year have helped the sums stack up again. For a sector where investors often rely heavily on leverage, even small rate cuts can boost profitability. This easing in financing pressure has been a key factor behind the recent uptick in buy-to-let activity.

But it’s also about supply and demand. The UK continues to face a structural shortage of rental homes, and younger generations—struggling to get onto the

housing ladder—are renting for longer. At the same time, they’re unlikely to become landlords themselves, meaning demand is rising while supply remains constrained. While rental growth has slowed, this imbalance is likely to support rents and yields in the medium term. We expect rents to rise 3.5% in 2026 and 3.0% in 2027.

Overall, a gradual consolidation is underway: fewer landlords, but with larger, more professional portfolios. The sector is evolving—driven by shifting demographics, greater regulation, and a renewed focus on returns. Buy-tolet may no longer be the gold rush it once was, but for those willing to adapt and take a long-term view, it remains a compelling investment.

Since 2016, the proportion of newly incorporated buy-to-let companies with at least one non-UK shareholder has climbed from 13% to 20%. Indian and Nigerian nationals now top the list of international investors.

SIMON ZUTSHI PROPERTY INVESTORS NETWORK (PIN)

This is an important question being asked by many property investors right now, so we thought we would ask property mentor Simon Zutshi, author of Amazon bestseller Property Magic and founder of the property investors network (pin), to share his thoughts on this.

Thanks to Simon’s network of over 45 property networking meetings all around the UK every month, he is in the unique and fortunate position of having his ear to the ground, which means he knows exactly what is happening at a grassroots level all over the UK, often months before anyone else.

Here are Simon’s thoughts:

I can confirm that most property investors, both new and experienced, are currently not investing because they are waiting to see what happens.

They are waiting to see what happens with the Renter’s Rights Bill, which may finally come into force in April 2026. They are waiting to see if the Bank of England base interest rate comes down further in 2025 so that they will be paying less monthly interest on mortgages. They are waiting to see what surprises might happen in the next Labour Government budget. Ultimately, they are waiting to see if there will be a property market crash caused by some of these already mentioned concerns.

You can understand why many investors are holding back and not investing in 2025, preferring to wait until 2026. That is exactly the reason why, in my opinion, you should be investing now, because there is very little competition from other investors. I cannot remember another time during my 30 years of property investing when there have been so few buyers in the market, apart from during the last big property crash in 2008 and 2009.

However, there are still plenty of people who need to sell their property and some of these sellers are becoming more and more motivated. This is a very good reason why you should be investing in property right now and for the rest of 2025, because there is not much competition.

These motivated sellers need speed and certainty, which means you can either pay less for every property you buy or the seller might be more flexible on the terms of the sale, in other words, when you actually pay them for the property. This means we can make more use of powerful investing tools such as Vendor (seller) Finance and Purchase Lease Options.

So which strategy is best for the current market?

Personally, I think high-end co-living HMOs can be an excellent investment because there will always be a demand for affordable shared accommodation. There are more and more specialist HMO letting agents who you can pay to look after the property and tenants for you, which gives you time to focus on the things you want to do.

There are also more landlords than ever before wanting to sell their portfolios and retire, which means you can pick up very standard, tired HMOs that can be turned into desirable co-living properties with minimal spend, especially if you are acquiring them with Purchase Lease Options. With this approach, you can gain monthly cash flow and long-term capital growth on properties that you do not own, which means you do not need big deposits or even mortgages until you buy in a few years’ time, when and if you decide to exercise your Purchase Lease Option.

I am very excited about all the opportunities over the next few months in the UK property market.

I will be speaking at all three of the Landlord Investor Shows in October (Bristol, Manchester and London), so why not come and listen to my presentation if you want to find out more about how you can make the most of the last few months of 2025 and put yourself in the best position moving into 2026.

If you want to grab a copy of my new book Lease Options Magic, just click here or scan the QR code to secure your copy and hundreds of pounds of bonus training, which I am giving away during the launch.

I hope this has inspired you to get out there and make the most of the last few months of 2025, while most property investors will unfortunately miss this incredible buying opportunity.

Invest with Knowledge, Invest with Skill.

Best wishes,

Simon Zutshi

Founder, property investors network Author, Property Magic Founder, Property Mastermind Programme

There are also more landlords than ever before wanting to sell their portfolios and retire, which means you can pick up very standard, tired HMOs that can be turned into desirable co-living properties with minimal spend.

With regional property hotspots outpacing London’s growth, is London still a good location for buy-to-let investment?

It is no secret that London is home to one of the world’s most sought-after housing markets. Its reputation for attracting a diverse mix of residents, investors, and businesses makes it a natural choice for property investment. In recent years, the emergence of regional property hotspots like Manchester and Birmingham has highlighted the potential of investment outside of London. However, despite recent challenges, London’s unique position in the market still offers significant opportunities for securing value and long-term growth—if you know where to look. Which, in this market, is easier said than done. Staying informed and educated about the market is essential, which is why you can’t miss out on securing your free ticket here to the National Landlord Investment Show in London, Old Billingsgate, on 29th October 2025.

After all, London's property market is vast and complex, spanning 32 distinct boroughs and a population of nearly 9.8 million. For both new and experienced investors, finding the right buy-to-let opportunity can feel daunting. This article provides an in-depth look at the London market, examining the key drivers behind rental demand, as well as an overview of house prices and rental trends to help you on your buy-to-let journey.

One of the defining characteristics of this market is its diversity. From historic townhouses in established neighbourhoods to contemporary flats in up-and-coming districts, London offers housing options to suit a wide range of preferences and budgets. However, the ever-changing economic landscape, coupled with regulatory shifts, adds layers of intricacy that those considering investing should not overlook.

Given the economic and political headwinds of the last few years, the current environment reflects both resilience and a period of adjustment. Broader economic pressures, such as rising interest rates and tax changes, are influencing investor decisions, while a growing population fuels consistent demand for housing. This double-edged sword creates both opportunities and pressures, particularly in the rental sector, where affordability remains a concern for tenants.

Alongside rising demand, a lack of affordable new-build housing has struggled to keep pace with the city's growing housing requirements. The limited supply of new homes reinforces the importance of strategic investments, rewarding those who carefully navigate the market with a clear understanding of its nuances.

As 2025 draws to a close, the London property market is in a new phase of evolution. A decade ago, it was defined by rapid, often double-digit price gains. Today's reality is different, with growth rates that are more modest and localised.

To succeed in this market, it's essential for landlords to adapt their property strategy. Whether your focus is on capital appreciation, generating strong rental yields, or long-term portfolio growth, a clear view of the current landscape is key.

To give you the competitive edge, get to know local estate agents in the areas you’re considering investing in. They specialise in the local market and will be able to give you a clear picture of the area's performance, including property values, rental demand, and the type of properties that will appeal to tenants in the area. They'll also be able to provide you with an idea of rental prices.

Significant variations in property values and rental yields across the city mean some areas hold stronger appeal depending on your investment goals. More affluent locations often command higher prices, reflecting their prestige, while outer boroughs may offer more attainable options with potential for growth.

For example, a report by Kate Faulkner OBE (exclusively available in the LIS Community portal) highlights the vast differences in house prices across boroughs. Average house prices in Kensington and Chelsea can exceed £1 million, while in Barking and Dagenham, they stand at around £355,000. Interestingly, this vast difference doesn't always translate to the same extreme gap in rental income.

The average rent in Bexley, at approximately £1,411 per month, shows a less dramatic disparity when compared to the £3,615 average in Kensington and Chelsea. This shows that a borough-byborough analysis is essential for finding value.

Whilst the entry-level price of the property and rental values are key pieces of the investment puzzle, ensuring that you align your budget with your investment goals will significantly shape where you can invest in London. As long as your goals are aligned with today’s market conditions, a well-positioned rental property in London has the potential to provide a stable return on investment.

Whilst overall it is encouraging that property values are expected to rise over the next five years, those looking to boost their return on investment will need to adopt a local approach, focusing on the specific dynamics of individual boroughs rather than relying on city-wide averages.

Rental demand in London continues to grow, driven by economic factors and the city’s enduring appeal. With rising house prices and increasing interest rates, many prospective buyers are priced out of the market, leading to a growing reliance on rental accommodation.

According to Rightmove, there are around eight enquiries per available listing and with Government data showing that the number of private rented homes in London fell by 6% from 1,136,000 to 1,069,000 between 2023 and 2024, the demand for rental property is likely to continue to outstrip supply.

Population growth also continues to be a significant driver of demand. Projections suggest the capital’s population could reach nearly 10 million by 2043 (Statista). This influx adds further pressure to an already competitive market, amplifying the need for quality rental properties across the city.

The city’s diverse population requires a broad range of housing to meet varying needs and budgets. From young professionals seeking flats in vibrant neighbourhoods to families looking for homes with more space in quieter areas, the demand spans all corners of the capital. This reinforces the importance of offering properties that align with the requirements of the local demographic. Seeking advice from a local estate agent could help you determine the most suitable rental property type for the area.

The rate at which properties are leaving the rental market is just one challenge for Londoners. While new developments

are a key part of addressing the housing shortage, the pace of construction is struggling to keep up with the city’s growing population and demand.

CBRE’s London Residential New Build Market Report has shown that London's new build housing supply has hit a critical low. The rolling number of new construction starts plummeted to just 11,700 in the third quarter of 2024, marking a 13% annual drop and a staggering 65% decrease from the 2014 peak. This is the first time annual construction starts have fallen below 12,000 since 2012, highlighting a severe and worsening housing crisis.

Despite a significant increase in planning applications (up 78% year-on-year in Q3 2024), this rise comes from a historically low base. Total applications remain 46% below the peak and are still well below the level needed to address the housing shortage.

The viability of many new projects has been jeopardised by a combination of rising interest rates and inflationary pressures, which have significantly increased the costs of materials and labour.

As these financial pressures show no signs of easing, the continued imbalance between supply and demand will most likely push property prices and rental values higher.

While recent data from Savills has suggested that property values in London may rise at a slower rate of 15.3% over the next five years, compared to the UK average of 24.5%, this outlook provides a broad overview of where

average London values could be heading in the next five years.

For those seriously considering investing in London, it’s important to remember that the city is huge and is home to 32 boroughs, all with their own unique market conditions.

An exclusive report by Kate Faulkner OBE, "7 Things All Landlords Should Know About The London Property Market", which is available in the LIS Community Portal, highlights that the top performer based on price data for 2024 and 2023 was Greenwich, where property values increased by 8.8% yearon-year. When compared to some of the prime markets, which are struggling to recover from shockwaves caused by Brexit and higher Stamp Duty Land Tax, to name a few, property values in Kensington and Chelsea and the City of Westminster were down nearly 23% over the same period.

Whilst overall it is encouraging that property values are expected to rise over the next five years, those looking to boost their return on investment will need to adopt a local approach, focusing on the specific dynamics of individual boroughs rather than relying on citywide averages.

Ultimately, is London buy-to-let still worth it? For savvy landlords who are willing to navigate the complexities and take a highly localised approach, the answer is still yes. The upcoming National Landlord Investment Show in Old Billingsgate on 29th October 2025 is essential to attend to stay informed and educated about the state and future of the London & wider UK property market beyond the capital. Secure your free ticket today

One of the defining trends in UK property in recent years has been the steady rise of regional cities, with economic hubs seeing strong growth and demonstrating that the country's housing market is about much more than London.

Whilst Manchester and Birmingham tend to grab the headlines, Bristol is one of the most exciting regional cities to emerge as a buy to let hotspot. This thriving destination has plenty going for it, including a strong economy, a solid track record for price growth and big-city appeal, which helps to ensure steady demand for homes in the private rented sector.

In this feature, we take a look at the appeal of buy to let properties in Bristol for landlords.

Want to connect with property professionals in Bristol? Register for your free ticket to the National Landlord Investment Show in Bristol, held at the Ashton Gate Stadium on the 1st October 2025.

A strong local economy and consistently high rates of employment are positive signs for buy to let investors. Growing businesses and employment opportunities increase demand for private rental sector property, which can lead to a steady rental income stream and reduce the risk of void periods.

Bristol has clearly demonstrated its strength in terms of economic development and job generation in recent years. Data from the Centre for Cities has shown that Bristol's economy is one of the fastest-growing in the UK. Bristol’s economy went from 1.3% of UK GDP to 1.5% in 2022, with the number of jobs in the city up by 21% since 2009. It is also home to one of the strongest clusters of high-growth companies outside London, according to Barclays

The city’s commitment to innovation and infrastructure improvements plays a pivotal role in its ability to attract businesses and residents. Investment projects include the Bristol Airport 2040 Master Plan, which is set to create

over 1,000 new jobs and is forecast to generate £3 billion in Gross Value Added (GVA).

Bristol also boasts a well-connected transportation network and its proximity to London boosts its appeal as a location for businesses and professionals alike. Employment opportunities across a wide range of industries contribute to a dynamic job market, drawing in workers who, in turn, drive demand for housing.

For those considering buy to let properties Bristol, the city’s solid economic foundation supports its reputation as a vibrant and desirable place to live and invest, keeping demand for housing consistently high in both the sales and rental markets.

If long-term capital growth is one of your top property investment goals, you'll want to know more about recent house price trends in the destination you're considering.

Data from Land Registry has shown that average property values in Bristol have increased from £210,475 in January 2015 to £354,699 in January 2025, marking a significant increase over a 10-year period. Source: Land Registry

More recent data has shown that Bristol housing prices continue to report steady growth, with the Office for National Statistics reporting a 2.7% increase in May 2025 compared to May 2024.

Bristol also outperformed the broader South West region, where growth was recorded at 1.9% during the same period. First-time buyers are particularly impacted by rising values, with the average price for this group rising from £305,000 in May 2024 to £313,000 in May 2025 by the same 2.7% increase

Looking to the future, Savills forecasts a stable 20.4% house price growth for

the South West region over the next five years, giving investors strong reasons to feel positive about capital gains potential.

For those considering investing in a buy to let property in Bristol, one of the main considerations will be the demand from tenants, since this factor underpins rental yields and growth potential.

Interestingly, in 2024, ITV reported that Bristol saw the second biggest increase in private rents in the UK, with the average cost of renting in the city increasing by 62.9% between August 2015 and August 2019. This trend reflects the high demand for rental property among tenants across the city.

Today, the rental market in Bristol has shown varied trends over the past year, with private rents experiencing a modest decline. As of June 2025, the average monthly rent was £1,753, marking a 1.1% drop from £1,773 in June 2024, which demonstrates the city's nuanced rental dynamics.

Despite this slight reduction, Bristol remains a sought-after location and, as with any rental market, will see fluctuations throughout the year.

According to the ONS, rental prices in the city vary widely based on property size, with one-bedroom units averaging £1,138 according to June 2025 figures while two-bedroom properties are typically around £1,435. Larger homes with three bedrooms command approximately £1,629, and properties with four or more bedrooms average £2,385 per month.