The UK’s Number One Landlord & Property Investment Exhibition has 3 Shows Remaining in 2025. Register now for your FREE show tickets and secure your place while spaces are still available!

The UK’s Number One Landlord & Property Investment Exhibition has 3 Shows Remaining in 2025. Register now for your FREE show tickets and secure your place while spaces are still available!

A very warm welcome to Issue 79 of Landlord Investor Magazine. You might notice we’ve made a few exciting changes to the magazine, and this issue is absolutely packed with valuable content from start to finish. In fact, it’s so full, I’ve only been given a tiny space for my welcome note! You can catch more from me in Show Update, but for now, I just want to say how much I hope you enjoy reading – and offer a huge thank you to all our fantastic contributors. Wishing you every success on your property investment journey. TH

Show Update

Knowledge is Power: Landlords, are you ready for change?

Education

Unlock essential landlord insights with a free LIS membership

Social Impact

Are we running out of homes in the UK?

Social Impact

Housebuilding is still heading away from the 1.5 million target

Social Impact

£39 billion for social housing – But where does that leave the private rented sector?

Social Impact

Q&A: Who is living redefined and how do they assist landlords?

Renters’ Rights

Will the Renters Rights Bill change rental practices?

Renters’ Rights

Renting rewritten: How the landscape is changing

Renters’ Rights

What the Renters’ Rights Bill means for landlords – And why It could be a positive shift

Renters’ Rights

The Renters' Rights Bill: What the next stage means for landlords and why compliance cannot wait

Renters’ Rights

Renters’ Rights Bill 2025: Impact on

Editor

Tracey Hanbury

Design

Marc Riley

Social Media

Charlotte Dye

Printing

IOP Marketing

Renters’ Rights

Can landlords refuse pets? Advice for landlords and tenants

Renters’ Rights

Student Landlords: How could the Renters' Rights Bill affect you?

Investment

Now the Government wants our help?

Investment

Investing in homes that change lives

Investment

Converting the UK rental sector: the new trend replacing buy-to-let

Investment

2025 Guide: How to set up a property investment company in the UK

New Investment Hub

Your essential buy-to-let property

glossary: Key terms for successful property investing

Finance

Alternative deposit schemes: A smart move for landlords

Finance

Baby Boomer landlords face a mortgage crisis: The ticking time bomb of rising rates and ageing assets

Finance

10 Questions with Pauzible

Hot Property Topics

Making Tax Digital for landlords: how to prepare for changes

Hot Property Topics

Bromford wins Aico's Smart Social Spaces competition

| Follow us on...

PLEASE NOTE: The National Landlord Investment Show, LIS Media and Landlord Investor Magazine are content aggregators only. Views, statements and opinions expressed in articles, reviews and other materials herein are those of the authors, exhibitors and third-party contributors and not the editors and publishers of LI Magazine. Under no circumstances does the content of this publication constitute investment or legal advice. We do not undertake to advise individuals or organisations upon investment strategy. All investments should be approached with caution under professional guidance. While every care has been taken in the compilation of this publication and every attempt made to present up-to-date and accurate information, we cannot guarantee that inaccuracies will not occur. LIS Media Limited and our contributors will not be held responsible for any claim, loss, damage or inconvenience caused as a result of any information within these pages or any information accessed through the promoted links. Published by LIS Media, Registered address: Foresters Hall, 25-27 Westow Street, London SE19 3RY. © 2024 LIS Media Ltd.

Kate Faulkner OBE

Leading UK Property Analyst

Paul Shamplina

Landlord Action & Total Property

Jeni Browne

Business Development Director, MFB

Prateek Solapurker

Co-founder, Pauzible

Max Grey

Senior Account Executive, Arthur

Simon Howitt

Senior Partner, Acuity Professional

Oli Reid

Founder, Living Redefined Peter Littlewood Director, iHowz

David Smith

Economics Editor, The Sunday Times

Ellie Bardwell Lettings Director, CJ Hole

Susie Crolla Guild of Letting & Management

Paul Pybus Director, Centurion

Reece Mennie CEO, HJ Collection

Peter Licourinos Director, Project Homes

Staff Editorial Team

In-house Content by LIS Media

TRACEY HANBURY CO-FOUNDER / DIRECTOR

Team: Donegal GAA

Song: Galway Girl, Steve Earle

Film: Dirty Dancing

Food: Indian

Likes: A busy show - can’t beat it

Dislikes: Rudeness

Fave thing about LIS: Building client relationships

KIERAN MCCORMACK SALES DIRECTOR

Team: Manchester United

Song: Bonkers, Dizze Rascal

Film: American Gangster

Food: Indian

Likes: Family time, Man Utd, golf

(not necessarily in that order)

Dislikes: Tinned sweetcorn

Fave thing about LIS: No day is the same (hence the song choice)

CHARLOTTE DYE OPERATIONS DIRECTOR

Team: Spurs

Song: The view from the afternoon, Arctic Monkeys

Film: E.T

Food: Chinese

Likes: Anything four legged and furry

Dislikes: Clowns and Spiders

Fave thing about LIS: Office cuddles with Ollie

NICOLE BONNER CONTENT, EDITOR & PR EXECUTIVE

Team: Crystal Palace

Song: Take It Easy by the Eagles

Film: The Devil Wears Prada

Food: Indian

Likes: Travel, photography & cooking

Dislikes: Tinned tuna & snakes

Fave thing about LIS: The innovative and fast-paced nature of the business.

ALICIA CELA HEAD OF ACCOUNTS

Team: Barcelona FC

Song: Hotel California, The Eagles

Film: Shawshank Redemption

Food: Anything Spanish (I'm very biased lol)

Likes: Cooking great food

Dislikes: Liars. Oh, and liver (can't stand it)

Fave thing about LIS: Socialising with the whole team

STEVE HANBURY CO-FOUNDER / DIRECTOR

Team: Crystal Palace

Song: Plastic Dreams, Jaydee (Original)

Film: Goodfellas

Food: Indian

Likes: Team meetings in the pub

Dislikes: Bad manners

Fave thing about LIS:

Show day (as anything can happen)

MARC RILEY CREATIVE DIRECTOR

Team: Letterkenny Shamrocks

Song: What’s going on? Marvin Gaye

Film: On The Waterfront

Food: Sea

Likes: Clean typography

Dislikes: Last minute edits

Fave thing about LIS: The website

JACOB HANBURY SALES EXECUTIVE

Team: Crystal Palace

Song: Michael Bibi - Got the Fire

Film: Step Brothers

Food: Sunday roast

Likes: Skiing, Gym, Crystal Palace

Dislikes: Dirty finger nails

Fave thing about LIS: Great atmosphere at the shows

LEWIS HANBURY CONTENT CREATOR

Team: Crystal Palace

Song: Fire in Cairo, The Cure

Film: Star Wars, A New Hope

Food: Pasta

Likes: Filming

Dislikes: Editing

Fave thing about LIS: My colleagues

OLLIE HANBURY ENTERTAINMENT & SECURITY MANAGER

Team: Crystal Palace

Song: Who let the dogs out

Film: 101 Dalmatians

Food: Roast Dinners

Likes: Walkies

Dislikes: Poo in bags left on branches

Fave thing about LIS: Getting all the attention

As legislation evolves and tenant expectations shift, it’s never been more important to stay informed. Whether you’re a seasoned landlord or just starting out, navigating the rental landscape can be complex.

Delivered by LRG’s network of trusted London brands, our Renters’ Rights Health Check is designed to help landlords:

Understand upcoming legal changes

Ensure full compliance with current regulations

Protect your property and your income

Get expert, jargon-free advice tailored to you

Book your FREE Renters’ Rights Health Check today.

Visit lrg.co.uk/rentersrights or call 01344 205 799 to speak with our local experts.

Part of

TRACEY HANBURY EDITOR & SHOW FOUNDER

Landlords across the UK are being urged to prepare for a transformation of the Private Rental Sector (PRS), as the government moves forward with significant reforms, including the Renters’ Rights Bill, Making Tax Digital, and a digital transformation of the property market through Proptech.

These sweeping changes, combined with the ongoing housing supply crisis and a need for property investment, make one thing crystal clear: landlords and property professionals need education now more than ever. Stay informed and register for your free ticket here for our Summer Spectacular Show on 9th July in London, Old Billingsgate, for a day of education.

The UK’s PRS provides homes to more than 11 million people, and it’s undergoing a fundamental shift aimed at tightening professionalism across the sector. The era of the so-called "amateur landlord" has long gone, and for good reason. At the National Landlord Investment Show, our mission has always been to ensure that landlords, property investors, and anyone accountable for providing housing have access to the knowledge and expert resources they need to stay compliant and professional. If you're going to be responsible for providing homes, you need to be professional in doing so.

This mission takes us back to the roots of why we founded the National Landlord Investment Show.

Back in 2013, Steve Hanbury and I were young landlords, navigating the challenges of managing our property business. We quickly realised we lacked the knowledge and access to expert services necessary to grow and run our portfolio professionally. It became clear that staying informed and connected to industry professionals was not optional; it was essential for managing and thriving within the UK property sector. And so, the National Landlord Investment Show was born and with it was our growing community of landlords and property professionals who have grown with us over the years.

Applying a theory of change, the first step in adapting is understanding what’s changing. It’s difficult to adjust your property business practices and strategy without first being fully informed. That’s why the theme for our upcoming 9th July Show at Old Billingsgate, London, is focused on providing free, expert-led education to help landlords and property professionals stay up to date and better equipped to respond to change. Register for your free ticket to secure your place today.

In line with the theory of change, once you have access to the right information, you’re in a stronger position to make informed decisions and take appropriate steps to adapt.

This will be our biggest and most dynamic show yet, with one powerful objective: “To provide property professionals with the education, support, and community needed to prepare for the sector's future.”

The National Landlord Investment Show Summer Spectacular is not just another property exhibition; it’s a hub of education and empowerment for landlords and property professionals, offering:

The UK’s PRS provides homes to more than 11 million people, and it’s undergoing a fundamental shift aimed at tightening professionalism across the sector.

• Free access to 50+ seminars led by top property professionals

• 5 expert panel debates tackling the most critical changes affecting the PRS

• A dedicated Landlord & Property Education Hub with exclusive insights and resources to support your journey well beyond the show itself

Stay Informed with our Expert Panels.

We are delving into the biggest changes within the private rented sector through our 5 leading expert panel debates focused on the following core topics:

Brace for Impact: Plan, Prepare & Comply for the Renters’ Rights BillThe UK housing sector is preparing for seismic change. This must-attend panel will examine how the upcoming reforms will impact landlords on the ground.

Hosted by Ian Collins (Journalist, TalkTV) with expert panel speakers: Allison Thompson (National Lettings MD of Leaders Roman Group, LRG), David Smith (Economics Editor of the Sunday Times), Suzanne Smith (The Independent Landlord), Paul Shamplina (Landlord Action/ Total Property), Susie Crolla (Guild of Letting & Management) and Eddie Hughes (Former Housing Minister).

Rent for Good: Supported Letting & Social Impact

With social housing in crisis, this indepth panel will explore how private landlords can be part of the solution through supported letting and longerterm investment strategies.

Hosted by Kate Faulkner OBE (UK Property Analyst) with expert panel speakers: David Smith (Economics Editor of the Sunday Times), Susan Aktemel (Founder, Homes for Good Social Business Group), Ben Rayner (Good Place Lettings), Oli Reid (Founder, Living Redefined), Tracey Hanbury (Co-Founder and Director, National Landlord Investment Show), Eddie Hughes (Former Housing Minister) and Russell Anderson (Commercial Director, Paragon Bank)

Proptech and AI: The Future of Property Investing -

Hosted by Paul Conway (Founder & CEO, Yuno) with expert panel speakers: Vicky Dring (Strategic Digital Consultant), Christian Balshen (Director of Agent Partnerships, Rightmove) and Sam Cope (Founder, August).

Future-Proof Your Finances: Embracing Making Tax Digital

A practical session to help landlords prepare for HMRC’s mandatory digital tax systems – with tools, tips and expert advice.

With expert panel speakers: Manoj Varsani MBE (Founder & CEO, Hammock), Marco Ferrari (Co-Founder & COO, Hammock), Sumit Agarwal (Founder & MD, dns accountants) and HMRC (Speaker TBC).

New Investor Masterclass -

A comprehensive masterclass for firsttime landlords or those looking to start their portfolio in 2025.

Hosted by Jacob Hanbury with expert panel speakers: Josh Turner (LRG), Heather Smail (Heather Smail Property Group Ltd), Simon Zutshi (pin), and Kane Andrews (Rockstar Property Partners) and Sagheer Malik (Group Chief Commercial Officer and MD Retail Finance, Offa) .

Stay Connected with Expert Service Providers.

Staying informed means staying connected. At the National Landlord Investment Show, we bring together 100+ expert property service providers who are at the forefront of industry changes based on their expertise. These professionals offer guidance across every aspect of running a property business, from preparing for Making Tax Digital, to selecting the right property management and letting agents in line with the Renters’ Rights Bill, or for strategies to plan your investment as a new investor.

Whether you’re looking for partners to support with legal matters, mortgage

and financing, tenant/ property management, or wanting to get involved with socially responsible initiatives like ‘rent for good’ in social housing or supported accomodation, you’ll have the opportunity to meet with a wide range of specialists to support with every aspect of running your property business.

Stay Educated through our Landlord & Property Education Community Hub.

As we approach our 93rd live show, we’re proud of the community of property professionals we've built, one that continues to grow and evolve with the sector. Recognising the pace of change and the impact of the digital era, we’ve launched a new membership hub to support landlords and property professionals on demand. The membership community offer a comprehensive platform with exclusive content to navigate the evolving landlord landscape in the form of UK property news, expert market analysis reports, housing policy updates and events designed for your success as a landlord and property investor. So, stay connected beyond our live inperson shows and register to become a member of our free LIS membership community.

Stay Ahead.

To stay ahead of upcoming changes, register for your free ticket to the National Landlord Investment Show on 9th July at Old Billingsgate, London. This year’s Summer Spectacular will be our biggest and most dynamic event to date, and an essential opportunity for any landlord or property investor preparing for the transformative changes within the Private Rented Sector (PRS).

In a time of transformation, education and knowledge aren’t optional; they’re essential. As the saying goes: knowledge is power.

As always, we wish you the very best on your property investor journey.

TH

2025 continues to be a busy year for the National Landlord Investment Show. Just as the first half, the year has been jam-packed, the momentum isn’t stopping. Towards the second half of the year, we're landing in multiple other locations across the UK in 2025, including London, Bristol and Manchester. Attendee registration is open for all 2025 show dates.

Are you a property service provider and wanting to connect with 1000’s of UK landlords, investors and property professionals? Contact the team today to find out more about how to be involved in our live shows or LIS brands, including UK Property News, Property Notify,

TRACEY HANBURY EDITOR & SHOW FOUNDER

Register to join our LIS Membership Community today – a FREE and EXCLUSIVE community membership hub designed for landlords, investors, and property professionals looking to stay informed and ahead of an evolving property market landscape.

The LIS Membership Community offers exclusive access to UK property expert insights and analysis, industry news, education, training and events, ensuring that members can stay informed, empowered, and ahead in the UK Private Rental Sector (PRS) and be part of a community navigating change.

Empowering UK Landlords, Investors and Property Professionals

Established in 2013, the National Landlord Investment Show has been a trusted platform for landlords, investors and property professionals to connect, network and learn. The launch of the LIS Membership Community is a natural evolution of this mission, offering a comprehensive digital hub to support members in navigating the complexities of the UK Property Market beyond the live exhibitions.

Key Benefits of the LIS Membership Community:

• Access to the Members’ ONLY portal – Exclusive access to market reports, expert advice, investment trends and strategies.

• U K Property News – Stay updated on the latest property industry developments, policy & legal changes, and investment opportunities.

• Expert Market Analysis reports by Kate Faulkner OBE, leading UK Property Analyst.

• Renters’ Rights Hub wth exclusive expert reports by Suzanne Smith, The Independent Landlord‘lawyer turned landlord’. other leading industry experts.

• Online & In-Person Events – Gain access to live exhibitions across the UK and exclusive networking Landlord Investor Club (LIC) events.

• Training & Education – Enhance your expertise with expert masterclasses, workshops, and tailored learning content.

Join the LIS Membership Community Today!

There is no fee to join the LIS Membership Community. It is open to all property professionals looking

to stay informed and ahead of the evolving UK Property Market.

Register here to become a member today to access exclusive content, expert insights, and network as part of the LIS Membership community.

Established in 2013, the National Landlord Investment Show has been a trusted platform for landlords, investors and property professionals to connect, network and learn.

KATE FAULKNER OBE

LEADING UK PROPERTY ANALYST

This might seem a bit of a dramatic title, but for the first time, I am really worried. With councils under unprecedented financial strain, homelessness figures rising, and intense competition across both the rental and homeownership sectors, the evidence points to a horrendous housing crisis that can no longer be ignored

According to housing charity Shelter, as of last Christmas, an estimated 354,000 people in England were experiencing homelessness, including over 161,000 children. This represents a 14% year-onyear increase. The breakdown reveals an escalating emergency:

• 326,000 people in temporary accommodation (a 17% annual rise), most of whom are families with children

• 3 ,900 rough sleepers on any given night (up 27%)

• 1 6,600 single people in hostels or homeless accommodation

Moreover, over 1.3 million households remain stuck on social housing waiting lists due to the chronic shortage of genuinely affordable homes for rent.

The Local Authority Dilemma: Councils Running on Empty

With local councils’ budgets stretched to the brink, the usual fallback that is placing homeless families in hotels or B&Bs is becoming increasingly unsustainable. Add to this the government’s statutory obligation to provide housing for asylum seekers, and the system is under severe pressure:

• A s of December 2023, the UK was supporting over 106,500 asylum seekers, including 45,800 in hotel accommodation.

• This figure had only recently dropped from a peak of 56,000 in September 2023, highlighting the scale of the burden on available housing stock.

The Private Rented Sector often the only viable alternative for many is also under immense stress. Despite the UK population growing by over 3 million since 2015, the number of privately rented homes has remained stagnant at around 4.5 million.

With the pressures of trying to house those on social housing waiting lists, there has been additional pressure to house migrant workers coming to the UK, who typically rent in the PRS before settling down and buying a home. And as the following chart shows the PRS was under considerable pressure during 23 and 24, hence rents rising, supported by growth in wages.

Currently it’s estimated by Zoopla that “12 renters are currently chasing each

home for rent. This is down 42% on 2022-24 levels but still higher than prepandemic levels”. Source: https://www. zoopla.co.uk/discover/property-news/ rental-market-report/

And worse still, this level of competition isn’t just at the ‘affordable’ end of the market. I am getting reports that tenants with budgets of £2000+ a month are struggling to find a property to rent, especially if they have children and need to be near to schools and family or other supporting services.

So we now have a housing crisis in the rental sector too, although it’s important to be aware that doesn’t exist everywhere across the UK, some more rural areas especially don’t have the same level of competition and it can take a month or more to let a property.

Source: https://migrationobservatory.ox.ac.uk/resources/briefings/long-term-internationalmigration-flows-to-and-from-the-uk/

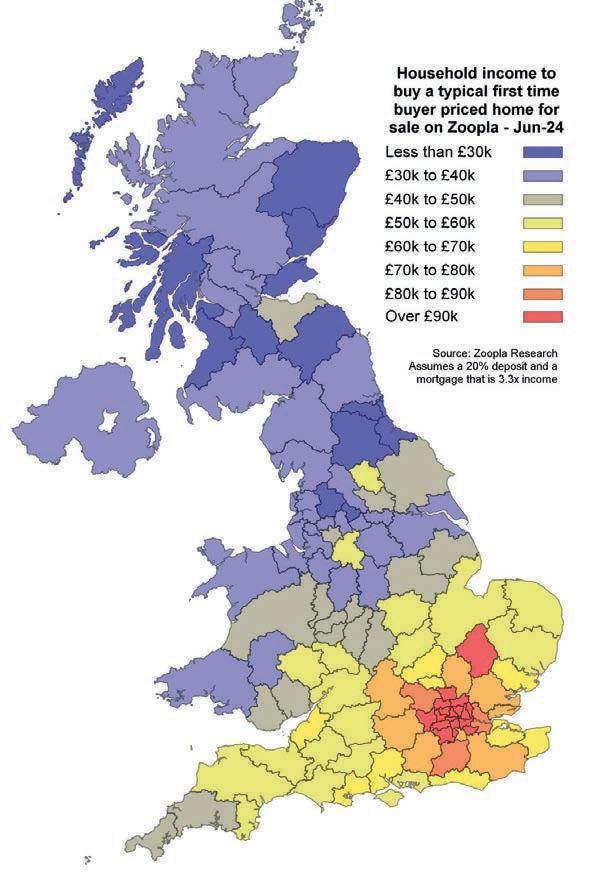

What about the buying and selling market?

As with the rental market, this can vary by area, but there are definitely many areas where we have issues, especially from an affordability perspective.

Work by Richard Donnell at Zoopla shows the areas where first time buyers “could afford to buy a third of homes for sale on Zoopla – with a 20% deposit. The following map shows the percentage of all homes for sale where the mortgage repayments per month would be below the average level of rents in the same area”.

As this map shows, it’s pretty difficult for first time buyers to purchase a property too, although on the other end of the scale, with over 50% of those that own a home, owning outright, in the home ownership market, apart from areas like London, Bristol and other areas in the South and East, there is less of a strain on supply and demand than in the social and PRS tenures.

What do you think? What’s happening in your area?

So for me, I think we are heading to a serious crisis of homes available, and indeed in some areas we are already in it, and with the Renters’ Rights Bill coming in, that could make things a lot worse too if landlords continue to sell off their investments.

Source: https://www.linkedin.com/posts/richard-donnell_ftb-housing-mortgages-activity7209453976927227904-slxi

DAVID SMITH ECONOMICS EDITOR, THE SUNDAY TIMES

1.5 MILLION TARGET

Later this month, on June 20, the government will release official data for housebuilding over the latest 12 months, the 2024-25 fiscal year. They will provide an important staging post in relation to the official target of delivering an extra 1.5 million new homes this Parliament.

There are two important things to bear in mind about that target. The first is that it applies to England only, not the whole of the UK. The second is that it is defined in terms of net housing additions, not traditional housing completions.

What this means is that as well as new housing as usually defined, the target incorporates conversions, such as when larger houses are converted into smaller units, such as flats, something that has happened for as long as anybody can remember.

It also includes conversions from retail, office or other commercial use into residential. The decline of the high street and the increase in workingfrom-home appeared to suggest that this would be quite a rich vein of new housing supply, though the numbers remain relatively low.

We will get the big picture, as I say, on June 20, but the government has already attempted to produce some estimates. Using data from energy performance statistics, which is available weekly, together with building control and other data, officials estimate that net housing additions in 2024-25 (up to March 23) were 199,100. They may go up a bit when the final few days of the fiscal year are added in, but it looks as if we are looking at a figure of about 200,000.

Net housing additions in the period since Labour was elected in July last year, up to March 23 this year, are estimated to have been 142,800.

But, staying with that figure of roughly 200,000 for 2024-25, what does it tell us? It tells us, for a start, that net additional dwellings are still falling.

Net housing additions in the period since Labour was elected in July last year, up to March 23 this year, are estimated to have been 142,800.

The 2024-25 estimate compares a 2023-24 figure of 221,070 net additional dwellings, so implying a fall of nearly 10 per cent. Nor was 2023-24 a vintage year. Net additions then were 6 per cent lower than in the previous year, 2022-23, when the housing market was pulled up sharp by the Liz Truss-Kwasi Kwarteng “mini” budget in September 2022.

The other thing to note about the 200,000 figure is that it is well short of the 300,000 a year average that the government needs to meet its target of 1.5 million new homes during this Parliament. It is, as you will have noticed, just two-thirds of that target. At the current rate, and on the current trajectory, it looks as if the government will be lucky to get to a million.

That things were likely to get worse before they got better was perhaps inevitable. The response of the housebuilders to the crisis of autumn 2022 was to rein back sharply, delaying work on new sites and pausing it on part-completed ones.

That hangover is now lifting, but it is doing so only slowly. The end of the stamp duty reduction in April, the one

welcome legacy of that September 2022 mini budget, has added to the mood of caution.

Most housebuilders are setting increased targets for the coming year, but they are adopting a cautious approach. They welcome the government’s promise of planning reform but want to see action rather than the words that we have mainly had so far.

There are also issues about whether the industry has the workforce to ramp up the supply of new homes to the point where they are consistent with the government’s 1.5 million target. Tighter visa restrictions on foreign building workers, as part of the prime minister’s migration clampdown, will make that even harder.

So, it looks as if so far at least, the supply of new homes has been heading in the wrong direction. There may be a small increase in net housing additions this year, 2025-26, but it is unlikely that this will transform the situation. Only an optimist would think that the government will get close to its 1.5 million target. The question is how big a miss it will be.

PETER LITTLEWOOD DIRECTOR, IHOWZ

£39 BILLION FOR

SOCIAL HOUSING – BUT WHERE DOES THAT LEAVE THE PRIVATE RENTED SECTOR?

The Labour Government has unveiled a £39 billion commitment to build and upgrade social and affordable housing over the next decade, marking one of the most significant state interventions in the housing market since the post-war era.

Described by ministers as a “once-in-a-generation opportunity”, the announcement aims to deliver up to 1.5 million new homes through councils, housing associations, and registered providers (RPs). But while the ambition is grand, the rollout is already exposing mounting tension between the social housing agenda and the increasingly beleaguered private rented sector (PRS).

With new renters entering the market, rising demand, and further legislation on the horizon, landlords are asking: Are we part of the long-term plan – or being priced and regulated out of it?

Hotel Closures Shift Pressure to PRS

One of the most headline-grabbing measures is the planned closure of all asylum-seeker hotels. Individuals granted the right to remain will now be expected to find housing via the PRS.

This policy shift adds thousands more households to an already underpressure rental system. However, PRS supply is moving in the opposite direction: landlord numbers are falling, rents are rising, and regulatory burdens are intensifying.

Crucially, this policy assumes that PRS landlords will absorb these new tenants, without offering meaningful incentives, guarantees, or additional support. With costs rising – from capital upgrades to EPC compliance – this expectation may be dangerously optimistic.

Vagrancy Law Repealed: What Now?

As part of broader housing reforms, the Government is also repealing the 200-year-old Vagrancy Act,

decriminalising rough sleeping. While widely welcomed by campaigners, this move implies a larger responsibility for local councils and landlords to accommodate vulnerable people.

But the question remains: where will they go? Emergency housing stock is limited, councils are stretched, and parts of the PRS are already under strain.

Social Housing Boost Faces Practical Barriers

Despite the record-breaking investment, delivery in the social housing sector faces serious challenges:

• Repairs backlogs and maintenance failures in housing association stock remain widespread

• Awaab’s Law, due possibly in October 2025, will introduce strict new timeframes for tackling damp and mould

• Local Housing Allowance (LHA) remains frozen, reducing affordability for low-income renters

• S everal registered providers (RPs) have collapsed in recent years –including Home REIT and Social Housing REIT – exposing financial instability in the sector

• C ouncil tax rises are increasingly likely, as local authorities seek to fill funding gaps

Even with new capital commitments, some housing experts warn the sector lacks the delivery capacity and resilience needed to scale at speed. Investor confidence in the RP model has also taken a hit, following high-profile failures and governance concerns.

Regional

Amid the challenges, opportunities remain – particularly around infrastructure-led regional growth. Strategic landlords are already tracking developments that may boost rental demand, including:

• Oxford–Cambridge Arc: long-term housing and transport corridor

Even with new capital commitments, some housing experts warn the sector lacks the delivery capacity and resilience needed to scale at speed.

• Lower Thames Crossing: a key link between Essex and Kent

• Sizewell C Nuclear Power Station: major construction workforce demand in Suffolk

• H ospital and school upgrades: part of the Government’s public services overhaul

These projects are expected to generate employment-driven demand for rental accommodation, particularly in regions traditionally underserved by institutional landlords.

The Government appears to be leaning heavily on the PRS to support its wider housing goals – including absorbing new migrants, key workers, low-income households, and those priced out of ownership. Yet landlords report a widening gap between the expectations placed upon them and the support they receive.

While social housing and first-time buyers receive direct state funding, PRS landlords must navigate increasing regulation, higher interest rates, and

reduced tax relief – all while shouldering the risks of complex tenancies.

The upcoming Renters’ Rights Bill –with its abolition of Section 21 and enhanced tenant protections – may improve standards in theory, but many landlords see it as another blow to their autonomy, especially in cases involving antisocial behaviour or unpaid rent.

Landlords across the UK continue to voice frustration that, despite providing housing for over 20% of UK households, they receive little formal recognition in national housing strategy.

For a balanced housing market, policymakers will need to include PRS landlords in the long-term plan. Potential interventions could include:

• C apital gains rollover relief for reinvestment into rental property

• Grants or tax offsets to help meet EPC and Decent Homes requirements

• Fast-track tribunals for possession disputes under the new Section 8 regime

• Digital tools for simplified licensing, compliance, and landlord registration

• Dialogue with industry bodies to improve regulation design and enforceability

Without these kinds of reforms, further attrition from the PRS seems inevitable – just as demand peaks.

The £39 billion social housing programme is a bold, necessary investment in the UK’s long-neglected affordable housing infrastructure. But without a parallel commitment to the viability of the private rented sector, it risks deepening existing imbalances.

Landlords and letting agents remain a critical part of the UK’s housing landscape. Ignoring their challenges now could severely limit the success of broader housing policy goals.

The solution is not binary. Both social housing and the PRS must be supported, modernised, and sustained. One cannot flourish while the other withers.

TRACEY HANBURY EDITOR & SHOW FOUNDER

OLI

REID FOUNDER, LIVING REDEFINED

Our director, Tracey Hanbury of the National Landlord Investment Show, had the pleasure of interviewing Oli Reid, Founder of Living Redefined, for a Q&A session. During the conversation, they explored the origins of Living Redefined, its core mission and purpose, and the innovative ways the organisation works alongside landlords and communities to address and prevent homelessness.

Who is Living Redefined, and how do we assist landlords?

Living Redefined is all about connecting landlords to Social Housing Providers. Think of us like mortgage brokers, but instead of lending, it’s leases. We noticed a gap some years ago, we found that Providers were quite uncommercial, lacked the skills to attract and negotiate with landlords, and equally, landlords found it difficult to find providers.

Living Redefined handles the entire process for both parties from onboarding and negotiation to compliance and posthandover support. We make the entire process simple and structured.

What is Social & Supported Housing, and why is it the way to go?

It’s all about providing accommodation to those who can’t procure it or maintain it on their own. Instead of renting directly to a tenant, you rent to a Charity or a Council, which in turn rents it to occupiers who likely need support.

For landlords, it’s a practical alternative to the increasingly regulated private rental market. With social housing, you get longer leases, reliable rent (often backed by public funding), and fewer voids - all without the hassle of managing tenants yourself.

Why is there a growing demand for supported housing?

I think it’s two-fold, firstly there’s a super high demand for Social & Supported Housing right now, Prisons are full, 6.3 million people on NHS Waiting Lists, 38k Asylum Seekers in Hotels, etc – it’s sort of the perfect storm.

The supply side, you’ve got increasing and largely overbearing regulation in the Renters' Rights Bill, really causing havoc with landlords. So I think you’ve got landlords seeing and hearing more about demand, but are equally running away from the Private Rented Sector (PRS), as it’s just not attractive anymore. So, as an alternative to selling, understandably, landlords are looking at different rental models.

What’s the biggest misconception landlords have about social housing?

Most landlords think social housing is risky - that tenants won’t look after the property or the rent won’t be paid. This is the big difference in the PRS, your occupier is your tenant. In the Social space, your tenant, who pays the rent, is entirely different to the occupier. Don’t get stuck on the occupier; focus on the tenant.

The problem isn’t the model - it’s a lack of education. Sometimes landlords can pre-judge the arrangement before getting into the details.

What services does Living Redefined offer?

We help landlords source suitable properties, match them with vetted housing providers, support lease negotiations, and ensure compliance with safety and regulatory standards. We also offer ongoing education, investment guidance, and access to our online landlord community, where landlords can learn from others and get expert support.

Why do you do this?

Homelessness is something personal to me, not because I’ve been there, but I find it fascinating that it’s 2025, and, at the last count, nearly 5000 people were found rough sleeping in England alone.

I’m a big believer in the market; the market can solve this problem if it wants, and that’s the reason I do it. I believe that with a correctly structured and regulated market, we can end homelessness.

We help landlords source suitable properties, match them with vetted housing providers, support lease negotiations, and ensure compliance with safety and regulatory standards.

How does working with a supported housing provider benefit landlords?

As a landlord, in this arrangement, you’ll likely get long-term leases (3, 5 or sometimes 10-year leases), guaranteed rent and no need to manage tenants or deal with voids. The provider handles day-to-day operations, and the rent is often backed by public funds. It’s a hands-off, stable income model that also happens to have a huge social impact.

How do I assess a supported housing provider?

Look at their track record, funding sources, and who refers tenants to them - councils, the NHS, or the Ministry of Justice, for example. Make sure they

provide proper support services and have policies in place for safeguarding, fire safety, and property upkeep. Every provider that we work with at Living Redefined is vetted, so you know you’ve got confidence when letting them.

What’s the process for renting to a provider?

We try and make it as simple as possible.

You submit your property to us, providing details, pictures, the number of bedrooms, bathrooms, full address, and other relevant information. Our team then works to match it with a provider looking for homes like yours, and we help you agree on the lease terms.

If the property needs any work to meet standards, we support that process. Once everything’s in place, contracts are signed and tenants are placed. You keep ownership, receive rent, and leave the day-to-day to the provider.

How can people find out more about Living Redefined?

Well, the best place for people to look is our new, totally free community. It’s packed with resources, Q&As, and live support – you can join at https://community.livingredefined co.uk. Follow us on social media, or book a call with our team to talk through your options.

Enjoy double-digit returns, without the tenants and toilets.

Invest today in Rockstar Property.

KANE ANDREWS CEO - Rockstar Property Partners

‘Fast becoming the UK’s most trusted property brand’

The Renters’ Rights Bill has been looming over landlords, estate agents, and property managers since the start of 2025. With there being several changes to the way landlords let their properties, will we start to see a fundamental shift in the way rental properties are managed? In this article we’ll look to explore this in more detail.

One of the key points to the Renters’ Rights Bill is to try to put an end to bidding wars, by prohibiting landlords and property managers from accepting rental offers that are higher than the initial advertised price of the property on portals such as Rightmove or Zoopla, or the agency’s own website. While it may seem at a first glance that this rule protects tenants, all it may end up doing is allowing landlords to profit further, through means of re-financing their properties due to higher market rates / valuations. It’s a double-edged sword: on one side, it will help tenants know exactly which properties they may be able to rent based on affordability, but on the other side, may also encourage landlords and managers to advertise properties at severely inflated rates, bringing the cost to rent up even further.

Another key element of the Renters’ Rights Bill is to do with removing fixed-term tenancies. No more 12-month tenancy agreements; if the bill gets passed, a tenant will be able to rent a property from a landlord on a periodic (monthly rolling) basis, and will also be able to end their tenancy with only 2 months’ notice. The reason for this is to prevent tenants being trapped in unfavorable tenancy

agreements, however from another perspective, it may actually make it more difficult for tenants to rent a property in the first place. Since the COVID-19 pandemic, landlords have seen a meteoric rise in the number of applicants for each advertised property, and have been accustomed to overbidding by applicants who want to rent the property. However, with this new legislation, landlord’s will not be looking to attract applicants with the highest rental offer. Instead, they will want to know they are getting the highest quality tenant. What may come from this is more landlords being super diligent in their tenant checks, which may in fact slow down the rental market entirely.

The Renters’ Rights Bill will do one of two things: either the bill will push hundreds of landlords to sell their properties due to fines ranging from £7,000 to £40,000 for noncompliance to the rules, making it even more difficult for tenants to find rental properties, or the bill will cause the initial applicant process to become much more thorough, leading to a shortage of properties for tenants that aren’t provably trustworthy. Although the bill is seen to be a positive for tenancies, it could have the complete opposite effect in the long run.

While it may seem at a first glance that this rule protects tenants, all it may end up doing is allowing landlords to profit further, through means of re-financing their properties due to higher market rates / valuations.

LANDLORD ACTION & TOTAL PROPERTY

We are now at a pivotal point in the reform of renting in England. The Renters’ Rights Bill is at Committee Stage in the House of Lords, where every clause is being picked over in detail. The direction is cleartenants will gain more rights and protections, while landlords face greater responsibility and risk.

One of the most significant changes, of course, is the end of Section 21. I remember writing a piece ten years ago advising landlords dealing with arrears to use Section 21. It was faster, simpler, and cheaper than the alternatives. Landlords have long relied on this, not always to evict ‘good tenants’ as is often portrayed, but because Section 8 is complex, slow, and expensive.

What, in my opinion, has been massively underreported is how often Section 21 was used to end tenancies that had gone wrong, allowing tenants to walk away from arrears with no legal consequences. So yes, scrapping Section 21 is a blow for landlords - but tenants will feel the effects too, even if most don’t realise it yet. Now, landlords will need a valid legal ground to regain possession. Many already did but opted for the simpler route that avoided costly delays and legal complexity, and who can blame them? But that choice is going. There is absolutely no room for error under Section 8.

Delays will already be significant, but if you get the paperwork wrong, you could wait months, incur costs, and still lose your case. At Landlord Action , we have seen many cases thrown out over simple mistakes. This is not something to do alone. Unless you're legally trained, I strongly advise against it.

But this is not just about possession routes, it’s a full reset of how renting works, so let’s look at other changes.

All tenancies will become periodic. Tenants can leave with two months’ notice at any time, while landlords face a stricter process to recover properties. The predictable 12-month cycle, which

many landlords have used to plan around mortgage deals, tax planning, or refurbishments, is being phased out. Landlords are losing the ability to plan with confidence.

Most landlords I meet, especially self-managing ones, take a hands-on, practical approach. If a tap leaks or a boiler breaks, they fix it. That kind of responsiveness is exactly what the new Private Rented Sector Ombudsman is there to support, not to punish.

Personally, I support this change. Redress raises standards. Good landlords who do the right thing have nothing to fear, in fact, they will benefit. The ombudsman offers an impartial platform where both sides present evidence. For landlords who document and handle issues properly, it’s a way to protect their reputation and resolve disputes fairly.

The new Private Rented Sector Database is another major shift. Just as the ombudsman sets clearer dispute standards, the landlord register will formalise who operates in the sector, raise entry standards, and help remove rogue operators. Unregistered landlords may lose the ability to serve notice, regardless of the circumstances. However, if the aim is truly to create a fair and balanced system, shouldn’t there also be a national tenant register? If landlords are held to account, tenants should be too.

Extending the Decent Homes Standard to the private sector is another welcome move. Mould, damp, and electrical hazards won’t be optional fixes, they will become legal obligations. For landlords who already maintain high standards, it simply reinforces good practice.

The Bill also tackles discrimination. Rejecting tenants solely because they claim benefits or have children will become unlawful. Bidding wars, where applicants offer more than the asking rent, will be banned. That will be a tough shift for many landlords in a competitive market, but setting the right price upfront, and using reputable letting agents, will help.

We are already seeing the impact of all these changes. Many landlords are worried about the unpredictable length of tenancies, both too long and too short, rising costs, and the growing burden of regulation. Some are reviewing their strategy, others are leaving the sector. A recent Total Property survey showed that around a third of landlords are thinking of selling up. As they go, the supply crunch deepens, which helps no one. 88% of tenants in the same survey said rising rents are their biggest challenge. The market is going to take some time to adjust, and frankly, no one can yet predict how it will play out.

All tenancies will become periodic. Tenants can leave with two months’ notice at any time, while landlords face a stricter process to recover properties.

For tenants, affordability is already stretched. According to the Total Property survey, over two-thirds of tenants spend between 31% and 70% of their income on rent while 10% spend more than 71%, putting many at risk of arrears. For landlords, this makes rent collection more volatile. Under the new rules, acting on rent arrears through Section 8 will take longer and require stricter thresholds. Legal expenses and rent protection policies, like those offered through Total Landlord, will become more important than ever for managing that risk.

Then there is the issue of pets. Tenants will gain the right to request a pet, and

landlords will need a valid reason to refuse. Honestly, I don’t think it’s a priority for most tenants, but understandably, some landlords, especially those with furnished properties, are worried about damage. The insurance industry is adapting. Pet damage cover is now available as an optional extra on some landlord insurance policies, like Total Landlord’s. This offers protection for both single incidents and ongoing wear and tear. It’s about managing risk because now, you cannot just avoid it.

We are not dealing with small print here. This is a fundamental rewrite of how the rental sector works. It is not just about tenants gaining rights

but about landlords needing to run their portfolios in a more professional, accountable, and risk-managed way.

This is no longer a sector you can dabble in. From insurance to documentation, complaint handling to possession proceedings, landlords must be ready. You can access Renters’ Rights Bill courses for free by joining LandlordZONE’s forum

Those who adapt now can come out stronger but those who wait are far more likely to come unstuck.

The game has changed, it is time to play smart.

ELLIE BARDWELL LETTINGS DIRECTOR, CJ HOLE

As the Renters’ Rights Bill moves through Parliament, there’s been no shortage of debate – especially around how it impacts tenants. But what does it really mean for landlords? We sat down with Ellie Bardwell, Lettings Director at CJ Hole, to discuss how the proposed changes could affect landlords – and why many of the reforms

may actually work in their favour.

Q: There's been a lot of focus on how the Bill protects tenants. Should landlords be worried?

A: It's natural for any major reform to create a bit of uncertainty. But this Bill isn't about punishing landlords. In fact, for those who already operate professionally, it introduces structure, transparency, and stability that could be really beneficial.

Q: Let’s talk about that structure. How will the Bill create a more stable market?

A: The Bill aims to raise the standard of the private rental sector across the board. With better regulations and oversight, rogue landlords who cut corners will find it harder to compete. This levels the playing field and gives reputable landlords a fairer shot in the market.

Q: And what about the relationship with tenants? How does that change?

A: Modern tenants are increasingly seeking ethical, transparent landlords. The Bill helps landlords demonstrate that they meet high standards. That transparency builds trust, which can lead to longer tenancies and fewer disputes. Over time, that means fewer voids and better relationships.

Q: The abolition of Section 21 has made headlines. Is that as bad as it sounds for landlords?

A: It’s a significant shift, but not necessarily a negative one. Landlords will still be able to regain possession through what is expected to be an improved Section 8 process which will include clearer grounds for eviction – like selling the property, needing it for a family member, rent arrears, or anti-social behaviour. One key product that all Landlords should be considering is Rent and Legal Protection. This will protect landlords against situations that may arise where the absence of a Section 21

notice could cause issues (to be clear Section 21’s aren’t foolproof, and this level of protection is great to have in the current climate as well). However, with the Bill around the corner, providers have significantly improved their offerings, with comprehensive products now available at more competitive prices. If Landlords decide to go with a management service, agents will often be able to add this to most managed packages for a competitive price.

Q: What about tenancy structures –will landlords need to learn a whole new system?

A: Actually, it could be considered to simplify things. The Bill proposes a single tenancy model, replacing the current Assured and Assured Shorthold Tenancies and gives landlords a clear framework to operate within. Additionally, agents up and down the country are learning this new structure for Landlords so they can take the brunt of it – Landlords need to take advantage of this and really consider a full management service.

Q: There’s also talk about a new portal and ombudsman. How will these help landlords?

A: The new Private Rented Sector Portal will help landlords stay up to date on their responsibilities and legal obligations. It takes away a lot of the guesswork. Meanwhile, the Private Renters’ Ombudsman scheme offers an affordable, faster alternative to courts for dispute resolution. That’s a win for landlords who want to protect their business without getting bogged down in legal battles.

Q: Looking ahead – is the Bill something Landlords should be scared of?

A: Whilst it may seem scary, in the long run I believe the Bill will support a professional and sustainable rental market. If you’re managing your

properties well and maintaining good tenant relationships, the Bill should reinforce your business model. It should attract long-term tenants and help eliminate rogue landlords being an imbalance in the market.

Q: Final thoughts – what should landlords take away from all this?

A: Change is never easy, and we are obviously yet to see what the final Bill is going to look like, but it’s important to see the Renters’ Rights Bill as an opportunity, not a threat. It is coming whether we like it or not and Landlords who act ethically and professionally have a lot to gain, from improved support to fewer voids. Everyone will need to adapt, and I think that is key; attempting to run things as you always have done and not try to move with the changes will inevitably lead to a tougher time. This is a sector-wide shift, and it’s essential that all landlords begin preparing their strategy now. At CJ Hole, we intend to take full advantage of all the positive changes this will bring and mitigate the few less favourable changes by adapting and ensuring we are ahead of the curve with products/ software and AI help on the market.

The Bill aims to raise the standard of the private rental sector across the board. With better regulations and oversight, rogue landlords who cut corners will find it harder to compete.

SUSIE CROLLA BA HONS LLB MPHIL MANAGING DIRECTOR, GUILD OF LETTING & MANAGEMENT

As the Renters' Rights Bill continues its passage through Parliament, landlords in England must begin preparing for the imminent legislative changes.

With the next parliamentary stage announced for 1st July 2025, the direction of Bill is now clear. For landlords, the time to act is now – not once Royal Assent is granted, not once regulations are published.

Many landlords may feel nervous, frustrated, or even overwhelmed. However, this moment also offers a clear opportunity: to modernise practices, protect investments, and avoid enforcement action. Compliance will no longer be optional or reactive. It will be central to successful property management. The key areas requiring review and planning include:

Landlords must revisit and revise existing tenancy agreements to ensure they are fully aligned with the new legislative framework. Clauses that assume fixed-term security via Section 21, or restrict pets without proper justification, will be unenforceable

With the abolition of Section 21, landlords will need to rely on specific and evidenced grounds under Section 8. This makes thorough record-keeping and accurate documentation more vital than ever. Landlords must understand the new grounds (e.g., for selling a property or landlord's family use) and the notice periods.

The Government will introduce a centralised digital database where landlords must register their properties and demonstrate compliance with legal standards (such as gas safety, EPCs, electrical reports, etc). Failure to register will result in financial penalties.

All landlords will be required to join a redress scheme – something previously only mandatory for letting agents and estate agents. This means that unresolved complaints from tenants may now result in binding decisions and compensation awards.

Delaying preparation until legislation is enacted is a high-risk strategy. When new laws come into force, regulators and local authorities will have the power to issue civil penalties, improvement notices, or even banning orders. Non-compliant landlords may also face reputational damage, loss of rental income, or enforcement via First-tier Tribunal proceedings.

Being ahead of the curve not only ensures compliance but also enhances your professionalism, attracts higher quality tenants, and reduces the likelihood of disputes.

Now is the time to engage in professional development.

Attend accredited landlord training courses, review updated legal guidance, and seek independent legal advice where needed. Organisations such as The Landlord Investment Show offer valuable resources, so take advantage of the support available and on offer.

Attend accredited landlord training courses, review updated legal guidance, and seek independent legal advice where needed.

The upcoming Renters' Rights Bill is set to reshape the UK rental landscape, and while much of the focus has been on landlords, tenants - all 4.7 million households in England's Private Rented Sector, according to Statista - are facing big changes too.

While the Renters' Rights Bill aims for a fairer rental sector, offering tenants greater security and rights, it also introduces potential hurdles. Reduced flexibility and the possibility of stricter referencing requirements mean renters should pay close attention to how the upcoming changes will affect their living arrangements.

In this feature, we explore the key changes and discuss whether the knock-on effect of some aspects of the bill may actually leave tenants facing more challenges than landlords in the long term.

For an in-depth analysis of the Renters' Rights Bill, watch UK Property Market Expert Kate Faulkner's insights on Episode 3 of UK Property News, available on YouTube.

For tenants, the Renters' Rights Bill's key promise is the end of Section 21 ‘no-fault’ evictions. This change fundamentally alters the power dynamic, requiring landlords to have legitimate reasons for eviction. Prior to this, renters faced the potential threat of being asked to leave with just two months' notice, regardless of their actions, creating a sense of uncertainty for renters.

Recognising that landlords' circumstances can also change, the Renters' Rights Bill includes provisions allowing property reclamation for legitimate reasons, such as sale or personal occupancy. To safeguard tenants, a 12-month protection period at the tenancy's start prevents these evictions. Landlords must provide four months' notice in such cases, offering tenants more time to secure alternative housing.

While the abolition of Section 21 is the headline change, renters need to understand the other ways this bill will affect them.

One of the most significant changes coming into play is the mandatory 12-month minimum tenancy. This seemingly simple rule throws a spanner into the works when it comes to more flexible tenancies that many renters rely on.

This rigid structure ignores the reality of many renters' lives, including those on temporary work assignments, those relocating for specific projects, or those seeking short-term accommodation while settling into a new area or even between moving houses.

For example, even if a tenant wants to secure a six-month contract and the landlord is happy with the length of a short-term tenancy, it would not be allowable under the proposed rule change.

While aiming for stability, this could limit flexibility for tenants needing shorter-term accommodation. Plus, an overall lack of reliable data on short-term rentals further complicates the issue, highlighting a potential disconnect between policy and reality.

While intended to shield tenants, the ban on taking rent in advance could unintentionally shut doors for those with unconventional financial situations.

This could disproportionately affect tenants with fluctuating incomes, those returning from abroad without established credit histories, or those who previously relied on paying rent upfront.

This restriction is also causing apprehension among landlords, who will be limited to collecting a deposit in advance, increasing their potential financial risk.

"You've got to agree to sign the property over to somebody without taking any rent in advance," explains property expert Kate Faulkner to UK Property News.

The ban on rent in advance, coupled with the proposed three-month delay for eviction proceedings due to nonpayment, introduces a level of risk many landlords will find unacceptable.

Landlords will naturally seek to safeguard their rental income due when letting their properties out, which will likely see a significant tightening of referencing, potentially limiting access for a significant portion of tenants.

Balancing tenant protection against the unintended exclusion of renters with unconventional finances poses a long-term challenge for tenants and landlords alike.

While the Renters' Rights Bill aims for a fairer rental sector, offering tenants greater security and rights, it also introduces potential hurdles.

The combination of these changes could lead to a decrease in available rental properties. As landlords grapple with increased regulations and financial pressures, some may choose to exit the market altogether.

Less available properties on the rental market, coupled with the potential for stricter referencing, could create a more competitive and challenging environment for tenants.

And, whilst the Renters' Rights Bill aims to eliminate rental bidding wars, instead setting fixed asking rents to protect tenants from being outbid, the bill's broader impact could create a double-edged sword for renters.

Landlords may compensate by setting higher fixed rents, potentially pushing affordable housing further out of reach for tenants.

Despite its tenant-friendly focus, the Renters' Rights Bill carries potential drawbacks. The risk of landlords leaving the market, shrinking the rental pool, and the rigidity of 12-month tenancies could negatively impact certain renter demographics.

While the Renters' Rights Bill aims to protect tenants, it is essential to understand the potential consequences. Landlords will adapt, but tenants could face increased competition and stricter requirements.

Moving forward, the Renters' Rights Bill aims to create a fairer rental market, but tenants should be proactive in understanding how these changes will affect them.

For tenants and landlords alike, staying informed and seeking professional guidance, renters navigate the evolving landscape and protect their rights.

As landlords grapple with increased regulations, some may choose to exit the market altogether.

Bromley Council’s lettings service takes the stress out of finding you tenants while saving you money.

We are looking for properties across London and surrounding areas.

We have a range of attractive lettings services to tailor to your needs. Join the scheme and you’ll receive a cash incentive alongside access to a range of other benefits.*

Benefits include:

• free support throughout the duration of the tenancy from highly experienced staff • no fees

• free photographic inventory

• free tenancy agreement

*Subject to terms and conditions

The UK is a nation of animal lovers, and with 51% of adults across the country owning pets, it’s understandable that demand from tenants seeking pet-friendly accommodation is on the rise.

In this article, we explore the rights of tenants requesting pet-friendly rentals and how landlords can accommodate requests for animal companions while protecting their Buy-to-Let properties.

Can landlords stop you from having pets?

In short, landlords cannot unreasonably stop tenants from having pets; however, this is not automatic approval. While tenancy agreements may restrict pets, outright bans could be "unfair" under the Consumer Rights Act 2015

Good news for tenants: landlords cannot "unreasonably" refuse if permission is required. However, there are scenarios that may be acceptable grounds for refusal. If the tenancy agreement in place does not mention pets, it makes it harder for landlords to object.

Importantly for both tenants and landlords, pet fees and deposit hikes breach the deposit cap requirements in the Tenant Fees Act 2019.

Moving forward, the upcoming Renters' Rights Bill, currently being considered by the UK Parliament, aims to make it easier for tenants to keep pets in rental properties.

Reasons landlords can refuse pets

There are several reasons landlords can refuse pets; however, what constitutes a "reasonable" refusal is based on specific circumstances and will vary depending on the situation at hand.

For those wondering what basis can landlords refuse pets, here are some examples which could be accepted.

Landlords should be able to refuse permission in circumstances like a

request for a large dog in a small apartment, for instance, could be deemed reasonable to refuse. Similarly, exotic or potentially dangerous animals might also warrant refusal.

If the landlord has valid reasons to believe a specific pet is likely to cause significant damage beyond fair wear and tear, refusal might be justifiable. However, this should be based on more than just general assumptions about certain types of animals.

Health and safety rules also come into play. If a property has shared areas and a pet poses a legitimate health or safety risk to other residents (e.g., allergies, documented aggressive behaviour), refusal could be reasonable.

If the rental property is a leasehold, there may be restrictions on pets in place and similarly, a landlord's insurance policy might have specific exclusions related to certain types or sizes of animals.

While these reasons landlords can refuse pets, tenants should have an open conversation with their landlord about renting with their animal companion.

With the Renters' Rights Bill a key consideration, remaining open to tenants with pets is increasingly important for landlords. Evaluate each pet request individually, considering the animal's type and size, alongside the tenant's history of responsible pet ownership.

If you have concerns, discuss them and potential conditions, for example, ensuring the tenant has specific pet insurance for the rental agreement. Just as you would seek references for tenants, consider asking for a reference from a previous landlord regarding the pet's behaviour.

Many landlords, being pet owners themselves, understand the importance of pet-friendly housing and the responsibilities involved. Regardless of your comfort level, clearly documented the agreed conditions of allowing pets is essential.

Finally, it’s important to check that your landlord's insurance policy permits pets and to fully understand any associated limitations or obligations. Contact your insurance provider for clarification if needed.

For renters who have pets or are planning to add one to their family, the initial step, whether for a new or current tenancy, is to carefully review the tenancy agreement and understand any clauses related to keeping animals.

If your tenancy agreement requires permission, be upfront with full pet details and prepare to address any reasonable concerns. Maintain open communication with your landlord, sharing pet insurance information and references if needed, to demonstrate responsible pet ownership.

According to Rightmove, searches for pet-friendly rental accommodation increased by 120% in 2021 and with the landscape of pets in rental properties continuing to evolve, staying up-to-date with the latest legislation around allowing animals in Buy-to-Lets is essential.

For landlords and tenants alike, a balanced approach that involves open communication, reasonable considerations, and a focus on responsible pet ownership is likely to lead to more positive outcomes for all parties.

HOW COULD THE RENTERS' RIGHTS BILL AFFECT YOU?

The introduction of the Renters' Rights Bill brings significant changes to the rental sector for landlords and property investors. For those operating within niche property sectors like Purpose-Built Student Accommodation (PBSA) and Student Houses in Multiple Occupation (HMOs), it’s essential to establish what these changes will mean moving forward.

One of the key aspects of this reform is the emphasis on safeguarding tenant rights and that extends to student lettings, and understanding how these changes apply to the sector will be important for landlords in ensuring ongoing compliance.

The Abolition of Section 21 ‘No-Fault’ Evictions

Under the Renters’ Reform Bill, to improve tenant security, landlords will only be able to end tenancies under valid grounds.

Switching to rolling contracts from fixed-term leases, as mandated by the Bill offers tenants more flexibility but, for those operating student accommodation, could risk disrupting the established academic rental cycle common to HMOs.

In a bid to reduce financial pressure on tenants, a reduction in the cap on requiring more than one month’s rent is set to be introduced.

The new Bill mandates a two-month notice period for tenants ending tenancies, double the current one month, providing landlords and PBSA operators with increased certainty.

Penalties for tenancy law violations are set to soar, jumping from £7,000 to £40,000, underscoring the critical importance of legislative compliance and robust operational practices.

(PRS)

The introduction of a new PRS Ombudsman will mandate landlord registration, regardless of property management, to enhance accountability and tenant rights.

Homes Standard for PRS

Implementing the Decent Homes Standard in the PRS will significantly improve rental property quality, ensuring minimum standards are met.

For a full breakdown of what to expect, follow the link to the Government’s Re nters’ Right Bill Guidance

Renters’ Reform Bill: Impact on Student Accommodation and HMOs

The UK property market offers diverse rental options, catering to a wide range of needs. Notably, the student housing sector has experienced rapid growth over the last decade, and the upcoming Renters' Rights Bill will certainly impact this dynamic subsector.

The government's Renters’ Rights Bill aims to "transform the experience of private renting" by ending 'no fault' evictions and providing renters with greater security and stability. Many student landlords have raised concerns about the Bill's impact on the student housing market, particularly given the short letting window between academic cycles.

Key concerns for landlords operating student accommodation include the cyclical nature of student lets, which aligns with the academic year, and summer void periods. Currently, fixedterm contracts are standard practice in PBSA and student HMOs, reflecting students' tendency to vacate during summer breaks.

However, there are some exemptions in place for the student rental sector.

University Lettings and PBSA

• Universities maintain exemptions under paragraph 8 of Schedule 1 of the Housing Act 1988 for lettings to students.

The UK property market offers diverse rental options, catering to a wide range of needs. Notably, the student housing sector has experienced rapid growth over the last decade, and the upcoming Renters'

Rights

Bill will certainly impact this dynamic subsector.

• G round 4 possession enables short-term letting to non-students (e.g., summer conferencing).

• Purpose-Built Student Accommodation (PBSA) is exempt, provided providers are registered with government-approved codes and will be governed by the Protection from Eviction Act 1977.

• G round 4A possession allows landlords to regain possession of HMOs let to full-time students for re-letting to new full-time students.

• Landlords must provide written notice of their intention to use this ground before granting the tenancy.

Whilst it’s important to ensure that PBSA developments and individual units within them adhere to the latest regulations, at the time of publication, the Renters’ Rights Bill primarily excludes PBSA operated by providers who are members of a Government-approved Code.

These PBSA providers utilise common law tenancies, which fall outside the scope of the assured tenancies addressed by the Bill. This exemption offers a measure of relief for investors who hold units within PBSA schemes. However, it’s essential to keep track of any potential changes to the law to ensure the accommodation continues to meet regulations and standards.

Landlords are advised to proactively assess their rental portfolios and seek professional guidance to ensure compliance with the Bill's anticipated

2025 implementation. Landlords should allocate sufficient time and resources to comprehend the reforms and their potential impact on business operations. Purpose-Built Student Accommodation

JENI BROWNE BUSINESS DEVELOPMENT DIRECTOR, MFB

At a time when our industry faces more challenges and uncertainty than ever, the Government is turning to landlords for help. Is this the beginning of a reconciliation, and what do you need to consider before taking on a Serco contract?

From my time and expertise in this market (and my personal property investment experience), I know firsthand the invaluable service we landlords provide.

We don’t just offer property; we create opportunities. We provide stable housing for those who can’t afford (or don’t want) to buy, professionals relocating for work, university students, and families seeking safe and comfortable homes. We offer homes suited to their needs.

However, the government doesn’t always seem to recognise the vital service we offer. Instead of recognising our effort, we’re met with increasing regulation and barriers that make property investment less viable.

A relationship on the brink

Over the past few years, our industry has faced several challenges from the government. EPC regulation changes have loomed without substantial guidance or clarity, and will likely implement unrealistic deadlines regardless.

While most Renters’ Rights Bill legislation aims to professionalise our industry, it still poses many challenges, and not all of it appears to have been thought through as thoroughly as required. And let’s not forget Reeves’ surprise Stamp Duty surcharge hike!

Needless to say, few of us have felt supported by those in No.10 as of late.

Landlords are the solution

Now, it seems the government is turning to landlords for help with its latest ‘incentive’ for property investors.

April saw a new record set for the number of small boats arriving in the UK in a day, putting the Home Office under increasing pressure to gain control of asylum seeker migration. One of the many challenges of this issue is where and how to house those seeking refuge in the UK while they go through the asylum process. Currently, the government spends billions per year on hotels.

The proposed solution? Serco, a private contractor working with the Home Office, is offering landlords a 5-year deal to house asylum seekers. This would allow landlords to benefit from 5 years of guaranteed rent funded by taxpayers.

SERCO offers rent on time, full repairs, maintenance, and property management for free, and it would cover any utilities and council tax payments. It’s also much cheaper for taxpayers than hotels, costing £14 a night compared to around £145. This drive is primarily targeted at HMOs.

Should landlords take the deal?

On paper, that sounds like a good deal, right? But unsurprisingly, there are mixed feelings about the scheme. In a recent Telegraph article, landlords found the proposal “immoral” for taking homes away from locals. Another concern is the inability to vet the tenants themselves before they move into the rental homes.

Regardless of your political opinion, you must check your mortgage terms if you are considering a Serco contract (or similar).

Firstly, not all buy to let lenders accept company let agreements. Secondly, of those that do, many have restrictions on the tenants that can live in the properties. Many lenders are uncomfortable with the reputational risk of repossessing properties housing vulnerable tenants. Ultimately, you don’t want to be found in breach of your mortgage terms.

The best move for landlords interested in this option is to speak to a wholeof-market broker (that’s us!). We can talk with specialist lenders and find the best mortgage options for you.

While it feels a little sour that our invaluable service is only being recognised after years of punishment, perhaps this could be the start of a reconciliation?

While most Renters’ Rights Bill legislation aims to professionalise our industry, it still poses many challenges, and not all of it appears to have been thought through as thoroughly as required.

Join iHowz today and get the expert support you need to stay ahead of the changes

The Renters Rights Bill is set to bring the biggest shake-up to the private rented sector in a generation – abolishing Section 21, introducing new grounds for possession, and strengthening tenants’ rights. For landlords, the landscape is changing fast.

Now more than ever, landlords need protection, clarity, and support. That’s why thousands are turning to iHowz.