LANDLORD INVESTOR LANDLORD | PROPERTY | INVESTMENT 72ND EDITION | 2023 Find us on... AUTUMNAL BOOST SEE PAGE 6 Autumnal Boost | LIS Awards Return | Buy, Sell, Hold or HODL? | Losing Interest In Buy To Let? How to Navigate Rising Mortgage Costs | Volatility Creates Opportunity | Research is Everything

A warm welcome to the 72 ND Edition of Landlord Investor Magazine.

A very warm welcome to the 72nd edition of Landlord Investor Magazine. It’s been quite a year for the landlordinvestor community; the Renter’s Reform Bill is taking shape as it creeps through Parliament and spiraling interest rates is putting huge financial pressures on Landlords and their assets. As we head into the autumnal months the Landlord Investment Show offers a boost with major shows in Elstree, Manchester and London, plus the return of Landlord Investor

Show Update Autumnal Boost

Show Update LIS Awards Return for 2023

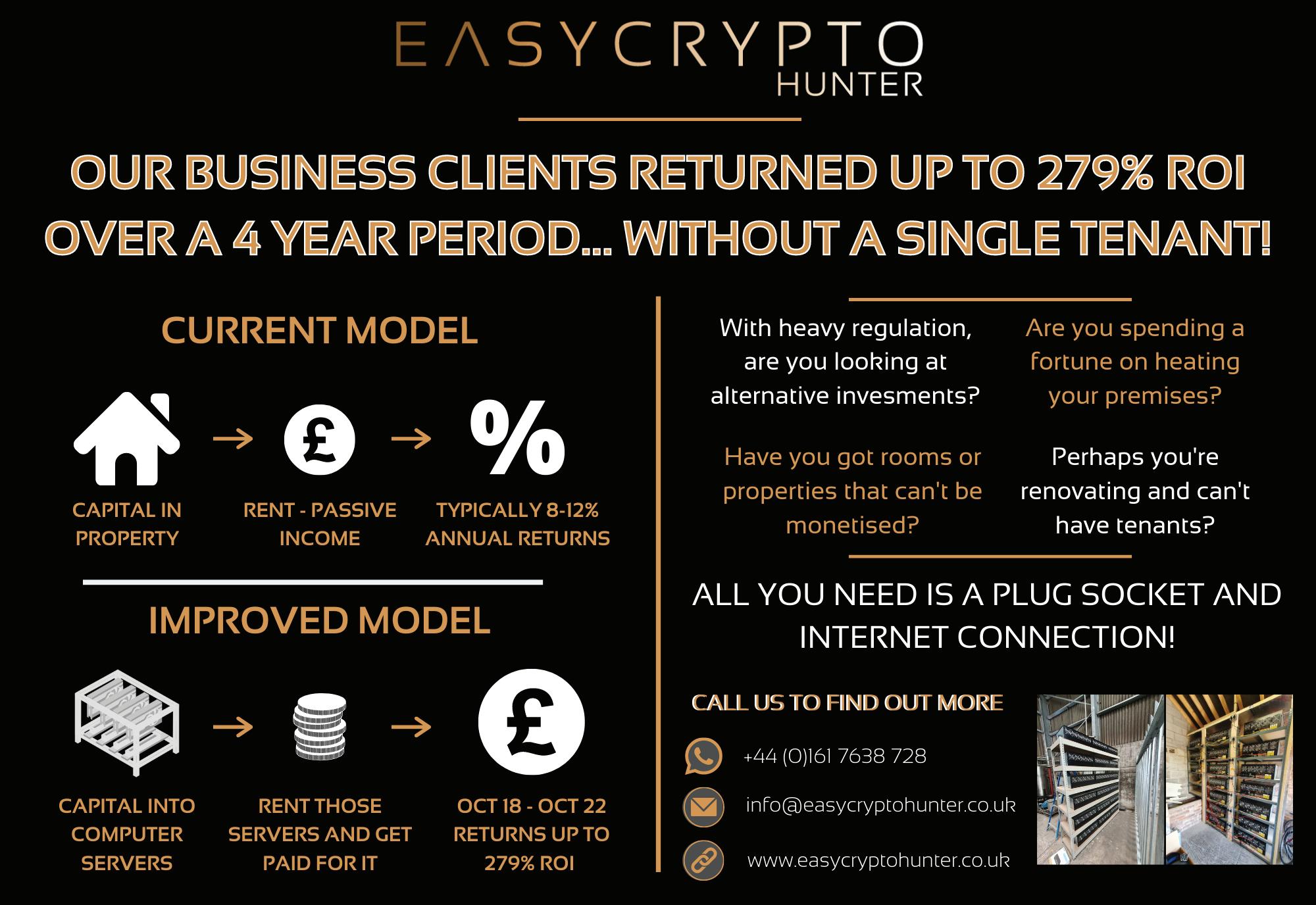

Taxation Buy, Sell, Hold or Hodl?

Investment Losing Interest in Buy to Let?

Investment Novyy Acquires 50 Student Rooms in Coventry

Club and the LIS Awards at the end of the year. This issue of LI Magazine is absolutely packed with useful content, so once again I’ve been asked to keep it short given space is a little tight. I'll leave it there and hope you find this issue helpful and informative. Wishing you all the very best on your property investor journey,

30 32 34

Legal Spotlight

Legal for Landlords

Strategic Spotlight Titlesplit.com

Outlook Landlords in the UK are setting up record numbers of buy to let limited companies

Outlook Research is Everything

Managment Spotlight Venite

Developer Spotlight Host & Stay

Education

5 Tips For Buy-To-Let Investing In 2023

Possession Spotlight AST Assistance

Search landlordinvestmentshow on:

LANDLORD INVESTOR MAGAZINE

Editor Tracey Hanbury

Design

Marc Riley

Photography

Aneesa Dawoojee

Printing

IOP Marketing

PLEASE NOTE: Statements and opinions expressed in articles, reviews and other materials herein are those of the authors and not the editors and publishers of LI Magazine. The content of this publication does not under any circumstances constitute investment or legal advice. While every care has been taken in the compilation of this publication and every attempt made to present up-to-date and accurate information, we cannot guarantee that inaccuracies will not occur. LIS Media, Tenants History Limited and our contributors will not be held responsible for any claim, loss, damage or inconvenience caused as a result of any information within these pages or any information accessed through the promoted links. Published by LIS Media, 27 Stafford Road, Croydon CR0 4NG. www.landlordinvestmentshow.co.uk | info@landlordinvestmentshow.co.uk

TH

Investment How to Navigate Rising Mortgage Costs Investment Volatility Creates Opportunity Investment Why the north east delivers for property investors at all stages of the investment cycle. 04

36 40 42 44 46 10 16 20 22 24 26 28

Meet the team

TRACEY HANBURY CO-FOUNDER / DIRECTOR

Team: Donegal GAA

Song: Galway Girl, Steve Earle

Film: Dirty Dancing

Food: Indian

Likes: A busy show - can’t beat it

Dislikes: Rudeness

Fave thing about LIS: Building client relationships

STEVE HANBURY CO-FOUNDER / DIRECTOR

Team: Crystal Palace

Song: Plastic Dreams, Jaydee (Original)

Film: Goodfellas

Food: Indian

Likes: Team meetings in the pub

Dislikes: Bad manners

Fave thing about LIS: Show day (as anything can happen)

KIERAN MCCORMACK SALES DIRECTOR

Team: Manchester United

Song: Bonkers, Dizze Rascal

Film: American Gangster

Food: Indian

Likes: Family time, Man Utd, golf (not necessarily in that order)

Dislikes: Tinned sweetcorn

Fave thing about LIS: No day is the same (hence the song choice)

CHARLOTTE DYE HEAD OF CLIENT RELATIONS & OPERATIONS

Team: Spurs

Song: The view from the afternoon, Arctic Monkeys

Film: E.T

Food: Chinese

Likes: Anything four legged and furry

Dislikes: Clowns and Spiders

Fave thing about LIS: Office cuddles with Ollie

ALICIA CELA HEAD OF ACCOUNTS

Team: Barcelona FC

Song: Hotel California, The Eagles

Film: Shawshank Redemption

Food: Anything Spanish (I'm very biased lol)

Likes: Cooking great food

Dislikes: Liars. Oh, and liver (can't stand it)

Fave thing about LIS: Socialising with the whole team

MARC RILEY CREATIVE DIRECTOR

Team: Letterkenny Gaels

Song: What’s going on, Marvin Gaye

Film: Anything by the Coen Brothers

Food: Sea

Likes: Clean typography

Dislikes: Paywalls and clickbait

Fave thing about LIS: The website

BEN PAYNE SALES EXECUTIVE

Team: Manchester United

Song: Brown eyed girl, Van Morrison

Film: Meet the Parents

Food: Italian

Likes: Hitting a nice drive on the fairway (not!)

Dislikes: Salad

Fave thing about LIS: Meeting new clients and building rapport

OLLIE HANBURY ENTERTAINMENT & SECURITY MANAGER

Team: Crystal Palace

Song: Who let the dogs out

Film: 101 Dalmatians

Food: Roast Dinners

Likes: Walkies

Dislikes: Poo in bags left on branches

Fave thing about LIS: Getting all the attention

SUBSCRIBE FREE TO LANDLORD INVESTOR MAGAZINE ONCE MORE UNTO THE [ DIGITAL Find us on... Two sides of the same coin Opportunity Knocks Once more unto the (digital) breach BUT ARE LIVE EVENTS NOW BACK ON THE HORIZON? SEE PAGE 6 What do do if I'm a student landlord? landlords during the pandemic LANDLORD INVESTOR LANDLORD PROPERTY INVESTMENT 55 EDITION 2020 LANDLORD SURVIVAL GUIDE III & Taxation INTERESTED IN ADVERTISING? FIND OUT MORE

04 LANDLORD INVESTOR 72ND EDITION

WWW.LANDLORDINVESTMENTSHOW.CO.UK Find us on... CO SPONSOR CO SPONSOR MEDIA PARTNER N LONDON/HERTS ELSTREE DOUBLE TREE 27 SEPTEMBER 2023 The National Landlord Investment Show connects thousands of property professionals throughout the UK and is a beacon for anyone with an interest in managing or investing in private rental property. The UK’s number one landlord & property investment exhibition lands in Elstree. + 50 plus exhibitors + 25 plus seminars + Investment opportunities + Expert speakers + Extensive landlord networking

TRACEY HANBURY EDITOR & SHOW FOUNDER

AUTUMNAL BO ST

06 LANDLORD INVESTOR 72ND EDITION SHOW UPDATE

With Q3 of the financial year already upon us it’s time to take stock of where we are. The first cut of the Renters Reform Bill was published on the day of our Birmingham Show back in May. Now on its second reading, the Bill was expected to be debated and pass through both houses and become an Act of Parliament by the close of 2023. However, the cogs of Westminster move slowly and the Bill missed its slot prior to the summer recess and remains at the earliest stages of its journey through Parliament. In short this means the earliest it could conceivably be approved is early 2024, although even when it receives Royal Ascent it will still take a minimum of six months to come into force.

The delays may be frustrating, but it does at least afford greater time to prepare. Detail may be a little thin on the ground, but we at least know the salient points and at the general shape of it, and as such think it prudent for everyone with an interest to begin making preparations and seeking advice where necessary.

Elstree, Manchester and London.

Since day one the goal of our shows and media has been to provide an unrivalled platform that educates, connects, and empowers property investors and landlords. With 3 major shows remaining this year we remain committed to supporting the sector.

First stop is Elstree Hilton Double Tree on September 27 for our show focused on the thriving housing market in the North of London and Hertfordshire. Registrations for this show are already flying and will be a busy day, packed with helpful suppliers and expert seminars.

Next we head North to Manchester on October 10 for our 9th return to Old Trafford, the home of Manchester Utd FC. This is always a hugely popular show

and again will be packed to the rafters with helpful products, services and seminars.

On November 1 return home to London for our season finale at Old Billingsgate. We already have a fantastic range of exhibitors and seminar speakers booked, and are just working on a stellar line-up for the panel sessions - so keep an eye on our website and register for media updates if you've not already.

Registration for all three shows is open, again just visit www. landlordinvestmentshow.co.uk to reserve your place.

Learn. Network. Invest.

After a considerable hiatus post lockdown, Landlord Investor Club (LIC) returns in the 3rd quarter of the year. LIC offers members entry to exclusive panel sessions and private seminars presented by some of the property sector's most sought-after experts. LIC members are offered privileged access to a hand-picked selection of speakers discussing some of the hottest subjects for UK landlords, Investors and property professionals. Join the next LIC event to hear valuable expert advice regarding property investment, financial advice, wealth management, build-to-rent, taxation and legal, plus access to exclusive offers and opportunities.

We’re delighted to confirm the National Landlord Investment Show Summer Spectacular in London was another stunning success. Marking our 80th live show to date, the day was absolutely buzzing with landlords and investors in search of advice and assistance. A huge thank you to the sponsors, exhibitors, speakers, staff and of course, guests who always make the day so great. See overleaf for a superb snapshot of the day.

Safety in numbers

Whether speaking financially or figuratively our shows provide a platform for making connections and cultivate an environment of support and collaboration. Attendees can share experiences, learn from one another's challenges or successes, and collectively explore strategies to thrive in the evolving rental market. Such networking opportunities enable landlords to stay abreast of industry developments, exchange best practices, and build a robust network of contacts. Now, more than ever, it is essential for stakeholders to come together, share insights, and explore innovative approaches, and as change looms on the horizon the National Landlord Investment Show remains a beacon for anyone with an interest in managing or investing in private rental property.

www.landlordinvestmentshow.co.uk

SHOW UPDATE

As we head into the autumnal months the Landlord Investment Show offer a boost with major shows in Elstree, Manchester and London, plus the return of Landlord Investor Club.

Whether speaking financially or figuratively our shows provide a platform for making connections and cultivate an environment of support and collaboration.

07 LANDLORD INVESTOR 72ND EDITION

08 LANDLORD INVESTOR 72ND EDITION SHOW UPDATE

09 LANDLORD INVESTOR 72ND EDITION SHOW UPDATE

LIS AWARDS RETURN

SPONSORED BY:

SHOW UPDATE

10 22

2023 LANDLORD INVESTOR 72ND EDITION

TRACEY HANBURY EDITOR & SHOW FOUNDER

NOVEMBER

As the leader paragraph says, we are absolutely delighted to announce the National LIS Awards will return on Wednesday 22nd November 2023 at the stunning De Vere Grand Connaught Rooms in Central London.

Conceived to celebrate the shining stars of the landlord & property investment sector, this year's LIS Awards has 19 categories in order to accommodate the rapidly expanding disciplines which comprise our sector. Encompassing everything from finance, legal & tax, through to letting agents, online agents, auction houses, local authorities, landlord insurance, proptech, innovation and landlord associations we're sure that anyone wishing to enter will find a home.

At the time of writing nominations for the awards submission window had been extended and will now close on September 8th at 5pm. The awards are completely free to enter and you can submit up to three categories per company, providing they are in by the closing date.

The winners will be decided based upon a combination of votes achieved from your own marketing campaigns and points awarded by judges.

You can see our past winners on the dedicated Awards website (see end of article). If you have any questions please drop us a line, and again you can submit your nominations before 5pm on 8th September 2023. Please remember if you are short-listed you must commit to attending the awards ceremony.

Award categories include...

• Best Accounting and Tax Services for Landlords

• Best Landlord Insurance Provider

• Best Landlord Legal Services Provider

• Property Developer of the Year

• Best Lettings Agency Sponsored by TDS

• Best Online Agency

• Specialist Finance Provider of the Year

• Best Property Education Provider

• Proptech Company of the Year

• Best Product for Landlords

• Best Short-Term Letting Agent

• Best Alternative Property Investment Provider

• Best Property Investment Provider

• Best Buy-to-Let Mortgage Broker

• Outstanding contribution to the Private Rented Sector

• Best HMO Services Provider

• Best Property Management Provider

• Best Buy-to-Let and Commercial Lender

• Best Development of the Year

To submit you entry and find out more about booking seats, tables and sponsorship please visit our dedicated LIS Awards website - www.national-lisawards.co.uk.

Join us for a stunning evening to celebrate the very best our sector has to offer. See you on November 22nd.

SHOW UPDATE

Conceived to celebrate the shining stars of the landlord & property investment sector, this year's LIS Awards has 19 categories in order to accommodate the rapidly expanding disciplines which comprise our sector.

11 LANDLORD INVESTOR 72ND EDITION

Celebrating the shining stars of the landlord & property investment sector, we are absolutely thrilled to announce the return of the National LIS Awards for 2023.

TH

"Are you in the Best Possible position to save tax?"

lesstaxforlandlords.co.uk 0203 735 2940

"Would a business restructure benefit you?"

Income Tax

1 2 3 4

Are you paying higher rate tax on property profits when you could be paying 50% less?

Capital Gains Tax

Could a business restructure slash your CGT bill by re-basing your purchase costs?

Corporation Tax

Could you be allocating profits to lower rate taxpayers to save on the corporation tax increase?

Dividend Tax

Could you be withdrawing your hard earned capital tax-free, rather than getting caught in the double tax trap?

Find out by taking our Free Initial Assessment l t 4 l . c o . u k / a u t u m n 2 3

BUY, SELL, HOLD OR HODL?

TAXATION | LESS TAX 4 LANDLORDS 14 LANDLORD INVESTOR 72ND EDITION

LESS

BEN ROSE

TAX 4 LANDLORDS

Landlords

From grand Victorian townhouses to modern urban developments, the property market has been an integral part of British culture and investment for centuries.

But in recent years, government policy (both local and national) has been focussed on regulation and taxation that make BTL property ownership more complicated, driving huge concern within the private landlord community – and driving many landlords out of the market.

And yet – Zoopla confirms that the number of privately rented homes remains broadly unchanged since 2016 thanks to investments from institutional investors and corporate landlords.

As always, with adversity comes opportunity.

These days though, it seems all anyone wants to talk about is reasons why landlords should get out...

So our first category of landlords are looking to:

SELL

And I could write a whole article on each of the following reasons landlords are giving to liquidate their portfolios:

Evolving Taxation Landscape:

• Section 24 and its impact on mortgage interest relief

• Stamp Duty Land Tax (SDLT)

• Reduction in Capital Gains Tax (CGT) allowances

• Changes to repairs allowance

Increasing Administrative Burden:

• Mandatory licensing and compliance requirements

• Energy Performance Certificate (EPC) standards

• The Renters Reform Bill & Scrapping of Section 21

Economic Uncertainties

• Brexit aftermath and rental market volatility

• Pandemic-related challenges and rent payment issues

• War in Europe, inflation and rising rates

• Fear of rent controls

Ultimately, if half your wealth (or more) is tied up in one or two rental properties, that can feel like a very big risk. Too much for some.

TAXATION | LESS TAX 4 LANDLORDS 15 LANDLORD INVESTOR 72ND EDITION

take their position in a changing UK market.

And plenty more

The data it seems, shows that ‘accidental’ or smaller portfolio landlords make up the bulk of this category.

Ultimately, if half your wealth (or more) is tied up in one or two rental properties, that can feel like a very big risk. Too much for some.

Not surprising and in contrast then that the professional portfolio landlord and corporate landlord sector is actually growing – as they can more easily spread cost and risk across a larger more diversified (and taxefficient) portfolio. In short, these landlords want to:

BUY (or build)

The property market bull believes property investment to be a sustainable, wealth-building strategy and takes a long-term investment outlook, mitigating the short-term ups and downs through strategic planning.

For some this means peer to peer property investment, for others it means building, running and growing a professional property business.

Bullish landlords and investors doing this well are applying their

due diligence, researching potential property acquisitions meticulously, assessing location, demand, and potential rental income.

They are getting smart with professional management, whether going it alone or partnering with reputable property management companies - ensuring efficient maintenance, making use of new technology, prioritising tenant relations, and ensuring legal compliance.

These landlords are also likely identifying underperforming properties for potential sale, restructuring to reduce capital gains tax, and reallocating resources to create or purchase higher-yield and/or more attractive long-term properties.

Landlords can of course still sell whilst growing overall, however they may decide to:

HOLD

Many established portfolio landlords are doing just that, perhaps paying down debt before their rates rise – but knowing that in a capitalist market –rent rises surely will continue to follow.

Property is no longer so easy to acquire as any first-time buyer will tell you.

So the holders say –“If you have it, keep it.”

Which brings us to the fourth and final category. Those who might think they probably should be selling, but at the same time believe this will ultimately be a mistake:

HODL

Anyone familiar with crypto currency and Reddit, will know this stands for: “Hold On for Dear Life”

If we can just get through this… we’ll pull through the other side.

After all, what goes down must surely go back up? And no matter what they throw at us – it will all be right in the end.

Whatever stance you are taking right now, if the thought of owning a professional property business doesn’t have you running for the nearest paper bag, there’s a chance Less Tax 4 Landlords can help you.

All it takes to find out is a free initial assessment. No obligation, simply call 0203 735 2940, email info@lesstaxforlandlords.co.uk, or go to https://lt4l.co.uk/myposition

TAXATION | LESS TAX 4 LANDLORDS 16 LANDLORD INVESTOR 72ND EDITION

Many established portfolio landlords are doing just that, perhaps paying down debt before their rates rise – but knowing that in a capitalist market – rent rises surely will continue to follow.

WWW.LANDLORDINVESTMENTSHOW.CO.UK Find us on... CO SPONSOR MEDIA PARTNER The

Landlord

UK and is a beacon for

with an interest in managing or investing in private rental property.

National

Investment Show connects thousands of property professionals throughout the

anyone

The UK’s number one landlord & property investment exhibition lands in Manchester.

REECE MENNIE FOUNDER & CEO, HJ COLLECTION

LOSING INTEREST IN BUY TO LET?

INVESTMENT | HJ COLLECTION

18 LANDLORD INVESTOR 72ND EDITION

2023 has been less than kind to UK landlords. Throughout the course of the year, we’ve seen a series of Bank of England rate hikes that have decimated fixed-rate offers for buy-tolet mortgage customers, with the average five-year deal now pushing 7%. Upcoming changes to EPC laws are only fanning the flames, with questions of profitability vs effort beginning to rise.

Although these short-term challenges have their solutions – be it gradually implementing energy upgrades or biding your time and tightening your belt until the economy improves – not all investors are willing – or financially able – to put in more effort whilst sacrificing returns. It’s all leading to buy-to-let burnout, with an increasing number of rental owners cutting their losses and selling up before the situation gets worse.

Understandably, not everyone will want to follow in their footsteps. With the right foresight, finances and forbearance, rental properties can still prove a lucrative option – especially if you’re willing to get stuck in and grab some ‘fixer-uppers’ at auction. If money is tight or you lack the time or desire to personally navigate an increasingly complex market, however, it may be best to embrace alternative property investment options.

Property bonds provide welcome relief from the strenuous buy-tolet landscape, allowing small-time investors and high-budget venture capitalists alike to optimise returns on their available assets. By entrusting their capital to an experienced property developer, investors are

immediately released of the burden of balancing profits with complex location decisions and property management issues. Better still, they’re guaranteed stable monthly returns on their portfolios, allowing them to remain in property without the risk of being run down by a volatile market.

The more eco-conscious and socially minded among you will benefit, too. By investing in an ethical development company that focusses on urban regeneration, you’ll be promoting both the recycling of materials and the creation of affordable living spaces – expanding your property portfolio beyond the traditional rental market without any of the landlord-tenant stigma.

HJ Collection is a nationwide developer with a professionally managed property bond. With a growing development portfolio in tier 2 and 3 cities across the UK, we boast extensive experience in delivering a wide range of meritorious projects that allow investors to turn stable profits from mutual interests, rather than letting interest rates run their rentals to ruin.

For more information, visit: www.hjcollection.co.uk

INVESTMENT | HJ COLLECTION

19 LANDLORD INVESTOR 72ND EDITION

By investing in an ethical development company that focusses on urban regeneration, you’ll be promoting both the recycling of materials and the creation of affordable living spaces – expanding your property portfolio beyond the traditional rental market without any of the landlordtenant stigma.

DEVELOPING SPACES INTO DYNAMIC PLACES

G E T T O K N O W U S

" A d o m i n a t i n g d e v e l o p e r w i t h a r o o t e d p u r p o s e t o c o n t r i b u t e t o e a s i n g t h e h o u s i n g s h o r t a g e t h r o u g h g r e e n e r p u r p o s e s . "

H J C o l l e c t i o n i s a s p e c i a l i s t d e v e l o p e r w h i c h s p e c i a l i s e s i n l e v e r a g i n g P e r m i t t e d D e v e l o p m e n t R i g h t s t o t r a n s f o r m u n l o v e d c o m m e r c i a l b u i l d i n g s i n t o s o u g h t - a f t e r r e s i d e n t i a l d e v e l o p m e n t s w i t h i n t i e r 2 a n d 3 c i t i e s a c r o s s t h e U K . H J C o l l e c t i o n h a s e v o l v e d i n t o a r e p u t a b l e a n d d e p e n d a b l e p r o p e r t y d e v e l o p e r w i t h a p r o v e n t r a c k r e c o r d o f s u c c e s s .

Up to 17% passive returns pa

Fixed-term

Fixed-returns

No fees

FCA-regulated security trustee

UK asset-backed

Phone: 0207 117 2583 Website: www hjcollection co uk UK: Level 7, One Canada Square, Canary Wharf, London, E14 5AA USA: One World Trade Center, 85th Floor, New York, NY 10007 0207 117 2583

W W W . H J C O L L E C T I O N . C O . U K TOTAL GDV £80m TOTAL

AVERAGE UPLIFT

UNITS 650+

46%

Real Investors think in Decades of Cash Flow Call : 020 3677 3333

ASHISH SARAFF FOUNDER & CEO, NOVYY TECHNOLOGIES LTD

NOVYY ACQUIRES 50 STUDENT ROOMS IN COVENTRY

INVESTMENT | NOVYY 22 LANDLORD INVESTOR 72ND EDITION

In the ever-evolving landscape of real estate investment, one company has caught our attention with a strategic move that showcases both vision and adaptability. Novyy, a platform for fractional ownership in the real estate sector, has recently achieved a noteworthy milestone by acquiring 50 student rooms in the vibrant city of Coventry. This move not only marks a significant turning point for Novyy but also speaks volumes about the changing dynamics in the world of property investment.

The student housing industry, often underestimated, has emerged as a powerhouse of opportunity. Novyy's acquisition of these 50 student rooms in Coventry serves as a calculated response to the surging demand for high-quality accommodations tailored to the needs of the ever-expanding student demographic. As universities resume classroom trainings after the tumultuous pandemic, students are actively seeking comfortable and conducive living spaces that foster personal and academic growth.

Ashish Saraff, the Founder and CEO of Novyy, shares his insights on the driving force behind this strategic decision. The shifting landscape of student housing preferences, influenced by budget constraints and rising living costs, has paved the way for innovative housing models like Houses in Multiple Occupations (HMOs). Novyy's foray into Coventry's student housing sector isn't just

about investment; it's a commitment to addressing the changing needs of students and investors alike.

Beyond the pragmatic considerations, Novyy's step into the student housing market echoes a broader societal shift. With international student enrollments in the United Kingdom witnessing a remarkable surge, the need for diverse and affordable housing alternatives is more pronounced than ever. Novyy's approach, which emphasises on affordability without compromising on quality, resonates with students who are seeking value for their money.

The financial prospects of student housing investment are as promising as the academic prospects for students themselves. With an average gross return rate of c. 8%, investing in student housing is not just a prudent move but a financially sound one. Novyy's strategic acquisition aligns seamlessly with the larger goal of mitigating the anticipated shortage of student housing by 2025, showcasing their commitment to providing intelligent investment solutions.

As Novyy expands its footprint in the student housing market, it opens doors for investors to tap into a specialised market segment that was previously unexplored by institution grade investors. Novyy's passive investment strategy, characterised by efficient property management, positions it as an attractive choice for those seeking steady revenue streams with minimal effort.

Novyy's recent milestone in student housing investment isn't merely a business move; it's a statement about the convergence of education and real estate. By aligning with the changing aspirations of students and the evolving dynamics of the investment landscape, Novyy exemplifies how visionary thinking can reshape traditional paradigms. As we observe this transformative journey, one thing becomes evident: Novyy is not just investing in properties; it's investing in the future of education and the prosperity of its stakeholders.

As universities resume classroom trainings after the tumultuous pandemic, students are actively seeking comfortable and conducive living spaces that foster personal and academic growth.

INVESTMENT | NOVYY

Novyy steps into Student Housing with the acquisition of 50 rooms in Coventry and launches Novyy Rooms.

23 LANDLORD INVESTOR 72ND EDITION

JENI BROWNE, SALES DIRECTOR MORTGAGES FOR BUSINESS

HOW TO NAVIGATE RISING MORTGAGE COSTS

24 LANDLORD INVESTOR 72ND EDITION

INVESTMENT | MORTGAGES FOR BUSINESS

Like many other landlords, you may be nearing the end of your fixed-rate term, likely having enjoyed a now historicallylow interest rate that we all grew accustomed to. Now, however, you face potentially significant increases to your monthly mortgage repayments, putting your buy to let income at risk.

It’s more important than ever to take stock of your property investment plans and see how you can boost your portfolio – it may be easier than you think.

Review your property portfolio

Your first step should be to complete a property portfolio review with the help of your broker. By providing all your up-to-date property and loan details, your broker will better understand the types of property finance options you can explore.

Conducting these portfolio health checks can help you spot new ways to maximise your cash flow. For example, you may be able to release equity from one of your existing properties to fund a deposit for a new purchase, allowing you to diversify into a higher-yielding property investment type. Or, capital raise sufficient funds to pay off one of your properties on a higher mortgage interest rate to reduce your overall monthly payments.

These are just a few examples that your broker may be able to recommend, so

it’s essential to get in touch with an expert to explore the best options for your circumstances.

Should I remortgage now?

Rising interest rates have many landlords, understandably, delaying their next remortgage. However, lender Standard Variable Rates (SVRs) currently range between 7.5%-11%, which is still higher than you will likely secure with a new mortgage product.

Don’t forget that you can take advantage of today’s rates and secure a new deal, sometimes up to six months in advance. If, like other landlords, you want to wait and see if rates come down before locking into a new deal, remember that most (although not all) lenders allow you to switch to a better rate before completion if one becomes available. This gives you extra financial security regardless of whether rates increase or decrease before you complete.

Is a product transfer a better option?

Depending on your circumstances, a product transfer (where you stay with your existing lender) could be an option for you. While the process of a product transfer is much quicker than a standard remortgage, you may not be able to access the most competitive deals. A whole-of-market broker is best placed to help you see which option is more cost-effective.

Your next steps

Plenty of useful tools available online can help you calculate your mortgage repayments and see what types of rates you can access, and these can be a great way to help you plan your property finances. The best advice I can give is to speak to an experienced whole-of-market broker. As mentioned, there are plenty of ways you can look to mitigate rising mortgage costs and secure your buy to let income. And like they say, there’s no time like the present!

As a landlord, I know that rising mortgage interest rates remain our community’s leading cause of concern. Therefore, I’d like to offer some helpful advice for those concerned about your buy to let finance options and how you can navigate rising mortgage rates.

25 LANDLORD INVESTOR 72ND EDITION INVESTMENT | MORTGAGES FOR BUSINESS

It’s more important than ever to take stock of your property investment plans and see how you can boost your portfolio.

SCOTT MARSHALL MANAGING DIRECTOR, ROMA FINANCE

VOLATILITY CREATES OPPORTUNITY

INVESTMENT | ROMA FINANCE

LANDLORD INVESTOR 72ND EDITION 26

Moreover, ongoing supply chain issues and rising interest payments have made it challenging for property investors to safely grow a portfolio and navigate an uncertain market.

Now, more than ever it is important for investors to lay strong foundations to ride the waves. Zoopla’s July house price index reported an 18% decrease in demand over the past two months, highlighting some of the struggles that investors are facing.

On a local level, inflation has cooled slightly and, as the terminal base rate approaches, many investors are looking to capitalise on a possibly very lucrative opportunity. If the Bank of England can successfully control inflation in the coming months, they are likely to pivot and reduce the interest rate, enabling them to reduce the risk of deflationary pressures. This would result in a boost in demand for borrowing and a price reversal in the housing market. In the event that this was to occur, purchasing at the current discounted rate and then refinancing later down the line could be a very fruitful opportunity.

Whilst most agree that the pre-Covid levels are unlikely to be seen again, global economic uncertainties have left some speculating on upcoming volatility. We are in a counter-cyclical market and despite the challenges presented over the last three years and the continuous black swan events, volatility does create opportunity.

Landlords and property investors who want to expand their property portfolio can still do so in this climate. With reduced buyer demand, investors are able to buy better and also build better. There are significant opportunities to be had in the refurbishment and conversion arenas. Commercial and semi-commercial

property, for example, presents a fantastic opportunity for investors to capitalise and create a solid long term investment while continuing to address the shortage of housing in this country. It is however, extremely important to have a contingency plan, not just one, but possibly two or three just to ensure the viability of a solid exit whether that be refinance, sale or another option.

To maximise opportunities within property, just in like any other industry, communication and surrounding yourself with the right team is imperative. Ensuring you have the right conveyancers, builders, architects and a transparent supportive lender is the key to success.

How do you do your due diligence when choosing a lender?

1. Look at the leadership

Understand who is running the lender. If the management has a strong background in lending, their business strategy is likely to be focused on ensuring that their loans perform, through careful underwriting and customer care that’s focused on helping you redeem on time and in full.

If the leadership team has a background in property, that could be useful if you need hands-on support with your project. They’ll have a good understanding of the challenges commonly faced and be geared towards helping the project succeed.

For example, the management team at Roma has extensive lending and property development experience. Our absolute priority is to help borrowers redeem their loans on time by creating prosperity from property. Plus, we have the practical experience to help them overcome any challenges. We never want to repossess a property.

2. How are

they funded?

Next, you want to know how the lender gets their funding. If they have just one or two funding sources, perhaps be cautious. We’ve seen how quickly funding markets can dry up, especially in challenging economic conditions.

If you choose a lender with multiple funding lines from institutionalised banks and building societies, you have more confidence their funding is secure. Lenders have to go through the mill to be given certain funding lines in the first place, so you can be reassured that due diligence has been done on its systems and lending strategy.

At Roma we have nine diverse funding lines, from small building societies to large institutions and the British Business Bank, giving us more flexibility to lend as well as stability of funding.

3. Do your detective work

Thirdly, research your lender. You can do this in many ways, such as looking at social media for reviews or comments in forums, to give you a flavour of how they behave. Understand the level of defaults the lender has. Importantly, speak to your peers; ask other investors about their experience using a lender.

Finding a reliable, consistent and competitive bridging and development lender helps borrowers form a successful relationship for their property project, so it makes sense to put in some work to get it right.

All these points will help you choose the right lender who you can build a solid and honest partnership with, enabling you to create success and prosperity from property.

INVESTMENT | ROMA FINANCE 27

The current property market has evolved significantly over the last few years with substantial ups and downs. As rising interest rates, rising costs and falling demand has made life tough, the Bank of England base rate has crept up to non-committal 5.25% while the Monetary Policy Committee (MPC) try to tussle with inflation.

LANDLORD INVESTOR 72ND EDITION

WHY THE NORTH EAST DELIVERS FOR PROPERTY INVESTORS AT ALL STAGES OF THE INVESTMENT CYCLE

INVESTMENT | HORIZON PROPERTY 28

N S E W LANDLORD INVESTOR 72ND EDITION

Some investors want the ‘hands-off’ approach. Working with an experienced partner to guide them through the process. Managing everything including sourcing the property, arranging finance, overseeing the legal process, undertaking refurbishment works and retaining the property for management.

Others may want to build their own portfolio but need to source the relevant skills and knowledge to get started.

Alternatively, a joint venture might be the preferred approach. Though often the sums available aren’t extensive enough to take a project forward. This is where investment in the North East becomes a really compelling, viable proposition.

Traditionally, investment in the capital was the panacea for building a profitable property portfolio. However, despite house prices in London typically being the highest in the country, rental yields can be average.

Lower capital entry, higher yields and high demand is turning buyers towards regional areas to achieve maximum results.

Why the North East?

The North East of England, particularly Teesside which covers Middlesbrough, Stockton, Hartlepool, Redcar, Sunderland, Darlington and Durham, poses fresh opportunities for investors.

Here, rental yields are much higher than other parts of the UK. Private rental yields are consistently more than 7% Net. Buy smart and 8-9% is quite normal. Our own serviced

accommodation units across the region currently yield well over 13%.

So far in 2023 mortgage rates have been quite erratic due to market changes and increases with the Bank of England Base Rate. Presently clients are arranging mortgages on a 5-year fix between 4.65% & 5.99%. When calculating yields and income, this needs to be taken into consideration. It’s realistic to expect a return on capital of 10%+ on a mortgage of 75% Loan to Value forecasting.

Take property in London as an example. Many properties yield around 4%. However, the outcome isn't favourable when working with a mortgage rate of 5%.

Here in the North East, the governments’ levelling up programme, alongside projects like Teesworks; the UK’s largest and most connected industrial zone, has had a positive impact on the surrounding real estate market. Good capital appreciation is expected over the coming years despite other parts of the country seeing a downturn.

Getting the Right Support

Setting realistic expectations is a challenge for landlords. Information shared on social media or during unreliable property training courses is often shrouded in misconception and leads to unrealistic confidence.

That’s why choosing the right property investment partner is so important.

Horizon Property service the needs of property investors, at all stages of the investment cycle. We’re a high street estate agent that also source a lot of

stock that may not be on our books, actively investing ourselves in varying forms.

Our management propositions include private rental, serviced accommodation and social housing, or supported living leases.

In 2021 we expanded our wraparound sourcing and management proposition for clients wanting hands-off investment in serviced accommodation.

Today we have three distinct propositions for our clients:

Portfolio Building

Working with clients on a hands-off basis, helping them build a profitable property portfolio that we can manage.

Property Training

2-day training course programme in Middlesbrough. Aimed at clients wanting a ‘hands-on’ approach to building their portfolio. A realistic approach to getting started.

Joint Ventures

Range of options including a mechanism allowing multiple investors to joint venture with us, with investment starting at just £10,000. Similar to crowdfunding, this property bond is backed up by 1st charge security with an FCA Regulated Trustee.

Work with Horizon Property to build your portfolio, upgrade your knowledge or lend capital towards our own projects for a fixed return.

For more information please visit horizonpropertypro.co.uk

INVESTMENT | HORIZON PROPERTY 29

The property investment market in the UK is not a ‘one size fits all’ proposition. As there are distinctive stages of the investment cycle, client needs differ greatly.

LANDLORD INVESTOR 72ND EDITION

FREE LANDLORD CLINIC AND COMPLIANCE REVIEWS

LEGAL SPOTLIGHT | LEGAL FOR LANDLORDS

LEGAL SPOTLIGHT 30 LANDLORD INVESTOR 72ND EDITION

Unlocking Peace of Mind for UK Landlords: Discover LegalforLandlords at the Landlord Investment Show.

As the dynamic landscape of property ownership continues to evolve, being a landlord in the UK can be both rewarding and complex. That's where LegalforLandlords comes in –your steadfast partner in navigating all the intricacies of being a landlord.

Expertise and Insight at Your Fingertips

LegalforLandlords was built by landlords, for landlords, so when it comes to navigating the intricacies of property management, can be relied upon as your trusted partner. With a legacy spanning over 14 years, the award-winning team has helped thousands of landlords across the UK, specialising in professional services, landlord insurance and referencing. Are you grappling with tricky tenants? Struggling to find the right insurance fit for your portfolio? Seeking guidance on ever-evolving compliance and regulations? Rest assured, LegalforLandlords’ expert team can help.

Discover the Landlord Clinic: Your One-Stop

Solution

Sleepless nights and propertyrelated concerns – LegalforLandlords understands, and will be running an expert "Landlord Clinic” at the show. This is your chance to receive free, personalised guidance and tailored solutions. Have questions about tenancy agreements? Need to stay up-to-date with the latest regulations? LegalforLandlords’ Propertymarkqualified team will be there to provide clarity and peace of mind.

Also on offer at the show will be indepth compliance reviews, ensuring that your property practices align with current regulations. Whether you're a seasoned landlord or just starting out,

the comprehensive review will assist you in making informed decisions. To book your free clinic slot in advance please contact Rebecca.perry@ legalforlandlords.co.uk

What else can LegalforLandlords help you with?

Professional Services for Landlords: evictions and beyond.

LegalforLandlords doesn't just provide advice, providing a comprehensive suite of professional services and products designed to ease your landlord journey. From handling complex evictions to offering strategic guidance and recovering rent arrears, their team of Propertymark-qualified experts will guide you through, every step of the way.

Building & Contents Insurance: Protecting What Matters

Secure your investments with LegalforLandlords' Building & Contents Insurance policies. Tailored to the unique needs of landlords, their insurance packages offer comprehensive protection, allowing you to focus on what truly matters –growing your property portfolio. Join LegalforLandlords at the show to learn more about how LegalforLandlords insurance can safeguard your assets.

Exclusive Offers and Unbeatable Discounts

Visit

Join LegalforLandlords at the National Landlord Investment Show on 1st November at Old Billingsgate, stand 51b, and learn how to enjoy stressfree property management. Engage with experts who understand your challenges, discover innovative solutions and position yourself for success.

LegalforLandlords: trusted by landlords since 2009.

Property-rental expertise with a friendly voice.

0344 567 4001

31 LANDLORD INVESTOR 72ND EDITION

LEGAL SPOTLIGHT | LEGAL FOR LANDLORDS

LegalforLandlords was built by landlords, for landlords, so when it comes to navigating the intricacies of property management, can be relied upon as your trusted partner.

LegalforLandlords isn't just about providing exceptional services – it's about building lasting relationships. Attendees of the Landlord Investment Show will be offered exclusive discounts and perks on products and services. Take advantage of this opportunity to experience the LegalforLandlords difference firsthand. LegalforLandlords at the Landlord Investment Show

www.legalforlandlords.co.uk

TITLESPLIT.COM

STRATEGIC SPOTLIGHT | TITLESPLIT.COM

Rachel Knight

Property Investor & Title Split Coach

STRATEGIC SPOTLIGHT 32 LANDLORD INVESTOR 72ND EDITION

Portfolio developers are diversifying away from HMO’s and single lets as this strategy is enabling them to secure long-term equity and cashflow by Title Splitting apartments, commercial properties, and land.

Why is this Title Splitting so profitable?

1. High cash-flow, just like an HMO, from multiple tenants in the same building.

2. Individually saleable units (at any time you like once split).

3. Tenants pay their own bills, saving you money.

4. Higher valuations for your individual units, than for your commercially valued HMOs and blocks. We call this the ‘Split Value’. This means you will get more of your money out of the deal every time (MIMO).

5. MIMO (Money In Money Out) from Title Splits. This is so simple you will not believe it when we share how with you.

6. You can buy one unit and create many units in one go. This grows your cashflow and equity position faster.

7. Title Splitting gives you access to the highest capital growth for your properties, year after year.

8. This strategy is perfect for holiday lets.

Why this strategy has been under-utilised for decades?

You may have thought about implementing this strategy before, but when you find a great property to work with, you suddenly find that the ‘experts’ are not available to help you. Finding experts for this strategy is nearly impossible. You may even be told that it cannot be done, it is too expensive or, why don’t you leave it until you sell it.

NOOOO this is not right! It can be done and TitleSplit.com help our clients to Title Split and make huge profits by doing so. We even introduce our clients to tried and tested power team members who understand how to support you.

Who is TitleSplit.com?

Rachel Knight, Property Developer since 2005, and Title Splitting Expert, has been proving that Title Splits make huge profit for portfolio landlords, since 2017. Today, Rachel shares her knowledge and skills with fellow property investors, simplifying this strategy and supporting clients, step by step.

TitleSplit.com was formed so that other developers can learn this very valuable strategy from people experienced in exactly how to do this.

STRATEGIC SPOTLIGHT | TITLESPLIT.COM

Rachel Knight, Property Developer since 2005, and Title Splitting Expert, has been proving that Title Splits make huge profit for portfolio landlords, since 2017. Today, Rachel shares her knowledge and skills with fellow property investors, simplifying this strategy and supporting clients, step by step.

33 LANDLORD INVESTOR 72ND EDITION

Title Splitting (or splitting leasehold from freehold) is the most lucrative strategy being implemented by savvy property developers and landlords in the 2020’s.

MARCO FERRARI

CO-FOUNDER & COO, HAMMOCK

LANDLORDS IN THE UK ARE SETTING UP RECORD NUMBERS OF BUY TO LET LIMITED COMPANIES

OUTLOOK | HORIZON

34 LANDLORD INVESTOR 72ND EDITION

Landlords in the UK are setting up record numbers of buy to let limited companies: Since tax relief rules changed in 2020, more and more landlords have been moving to a limited company structure. In 2021 alone, 47,400 buy to let limited companies were set up in the UK. This is because it’s now often more tax efficient to run properties through a limited company, however, this may not always be the best route for all landlords.

What are the potential benefits?

Tax relief: since the changes introduced with Section 24, private landlords have only been able to claim a tax credit based on 20% of their mortgage expenses. When you let properties through a limited company, you can claim mortgage interest as a business expense.

Tax rates: higher rate taxpayers can find that the corporation tax rates are more favourable than the personal ones:

• 19% on profits between £0£50,000

• 26.5% on profits between £50,001 - £250,000

• 25% on profits over £250,000

It’s important to note that you still need to pay tax on the money you earn from or take out of the company. How much depends on whether you take a salary, dividends, or a combination of the two.

Paying yourself a salary: this will be taxed based on the personal income tax rates, and will be subject to National Insurance contributions.

What’s your plan?

Taking dividends: dividends are taxed at a lower rate than salaried income –you get £2000 tax-free, then you pay 8.75% for basic rate, 33.75% for higher rate and 39.35% for additional rate. They aren’t subject to National Insurance contributions.

Inheritance Tax: Passing your property or properties down to family members through a limited company gives you more options to mitigate inheritance tax.

And what about the downsides?

Choice of mortgages: there are generally less mortgage products available for limited companies than private landlords. And interest rates are usually higher, too.

Tax implications of salary vs dividends: If you take a salary from your company this will be subject to income tax and National Insurance. But you can claim any salary paid by your company as a business expense. Dividends are subject to lower tax rates and no NI – but they do not count as a business expense for your company. If you plan on leaving your rental profits in your company, this isn’t really a problem, but if you live off your rental income, things can get a bit more complicated.

Cost of transferring property: if you’re looking to transfer property you already own to a limited company, you will have to “sell” them to your company – which comes with all the usual costs:

• Capital Gains Tax

• Stamp Duty Land Tax (more on this below)

• Conveyancing and solicitor fees

• Potential mortgage repayment fee

Stamp Duty on transfer of property to a limited company: when you transfer a property to a limited company, you’ll need to pay Stamp Duty Land Tax.

More responsibilities: there are certain responsibilities attached to being the director of a limited company, which you don’t have as a private landlord. And there’s more paperwork to fill out through the year, too.

This is a short summary of the points to consider, you can find the full article on usehammock.com. If you want to explore setting up a limited company, we always recommend consulting your accountant or business advisor.

The great news is that Hammock can help you manage your rental income and expenses, for all the properties you own either as an individual, through limited companies or both!

OUTLOOK | HORIZON

35 LANDLORD INVESTOR 72ND EDITION

Landlords have been moving to a limited company structure. In 2021 alone, 47,400 buy to let limited companies were set up in the UK.

AMY COWAN HEAD OF ACQUISITIONS & TENANCY SUSTAINMENT CAPITAL LETTERS (LONDON) LTD.

RESEARCH IS EVERYTHING

OUTLOOK | CAPITAL LETTERS 36 LANDLORD INVESTOR 72ND EDITION

It’s why references are so important, and why you have to give so much detail to the bank for a mortgage, and why you ask for deposits, it’s all research that everything is working, that your tenant can afford the rent, that the bank isn’t going to lose money, that your property won’t get damaged.

We at Capital Letters have jointly commissioned Savills and the LSE to research what it’s really like being a landlord in London, what are the challenges and what are the issues, so that we have the research on hand to help you.

The research launched at the beginning of July looked at the numbers in the Private Rented Sector (PRS) but it also looked at “sentiment”, and you know what? Smaller landlords in London (and we can probably use this for a lot of other places) feel under pressure…

It’s not easy being a smaller landlord. Yes, average rents have risen by 20% since COVID, but mortgage rates have also risen and the ending of Mortgage Interest Tax Relief means the costs hit harder.

Add to these issues the changing regulatory context, and the public narrative around poor landlord practices (the bad few affecting the good majority) causes anxiety and can negatively influence landlords’ thinking around whether to remain in the sector and which parts of the sector they want to operate in.

Higher taxes, the push for rent control and criticism of landlords can particularly affect those smaller landlords that tend to deal with local authorities. Against the backdrop

of increased operating costs due to inflation, mortgage interest rates, and some regulatory requirements, plus a policy environment that promises changes to tenancy law, landlords’ fears around non-payment of rent and damage to property can make smaller landlords less prepared to let in the lower end of the market.

The whole system is under stress, and there needs to be a new appreciation for how landlords help find homes for those low-income families that need them most.

We are owned by London boroughs, and we represent our 10 member boroughs’ interests by calling on government to not only raise LHA rates, but to do that together with the benefit cap – if LHA goes beyond the benefit cap it means that thousands of renters will be at risk of homelessness again.

We are the direct link with landlords and boroughs, we take away the red

tape and make it easy and secure for landlords to let to low-income families. We are focussed on taking away the stress of being a smaller landlord – we work with the borough for you and offer generous incentive payments. We make sure you get a pre checked tenant, void payments whilst the checks are happening, and tenancy support for them and you so you know they are getting the financial help they need and deserve… but even in the bast case things can change which is why we offer Rentsurance, which covers up to £2,500 a month rent payments if your tenant has a change in circumstance, and if the worst were to happen £25,000 legal cover and end to end legal support.

We are here to support you, because we know how hard you work, and we have the research to prove it.

You can find the research here: tinyurl.com/5xe3ex7w

OUTLOOK | CAPITAL LETTERS

As a landlord you can’t do anything without research.

37 LANDLORD INVESTOR 72ND EDITION

The whole system is under stress, and there needs to be a new appreciation for how landlords help find homes for those lowincome families that need them most.

Diversify your property investments and get fixed rate returns from asset classes that would normally only be available to commercial investors. Benefit from high-end and large scale residential assets or the development and trading of famous hotel brands. 01376 319 000 www.propiteercapitalplc.com VCAP Capital Ltd is a limited company (No. 10905629) registered in England and Wales whose registered office is at office Oliver’s Barn, Maldon Road, Witham, Essex. CM8 3HY. VCAP Capital Ltd is authorised and regulated in the UK by the Financial Conduct Authority (FRN: 790419). Don’t invest unless you’re prepared to lose money. This is a high-risk investment. You may not be able to access your money easily and are unlikely to be protected if something goes wrong. Invest in exclusive residential developments & branded hotels Maximise your returns today.

Will your next investment be based on facts or fiction? propertydata.co.uk

VENITE: LEADING STUDENT ACCOMMODATION

MANAGMENT SPOTLIGHT | VENITE LANDLORD INVESTOR 72ND EDITION 40

MANAGMENT SPOTLIGHT

Our mission is to enrich the lives of our clients and employees through respectful and honest service. We prioritise integrity above all else, and are dedicated to providing exceptional value throughout every step of the property journey. Whether our clients are buying, selling or renting, we strive to exceed their expectations with personalised attention, expert guidance, and unparalleled market knowledge

As a business we are in the process of an exciting rebrand and expansion. We will be changing from StudentFM to Venite Property extending our business model to include Residential Sales and Lettings.

StudentFM was established in 2004 with a commitment to providing the highest quality student accommodation in the UK. We will be continuing using this philosophy and highly trained staff to help build the next arm of our business. Every member of our team prides themselves on high levels of professionalism along with that essential, personal touch, from head office staff to our onsite management and student ambassadors. We work closely with our students and investors to ensure complete service satisfaction for the duration of our relationship. Our team of experts currently manage around 1700 beds with the students at the heart of everything we do, we understand what they want, need and even expect from their first home away from home.

As part of our investment arm in the last 20 years we have developed circa 5000 beds with a gross development value of over £200 million. Student property investments typically offer higher yields than other kinds of buyto-let investments offering a good return with a strong demand. In 2022 the PBSA market had a record breaking £7.8 billion of stock traded up which

has increased a massive 89% on 2021, proving that it is still a great time to invest or develop in this market.

When it comes to the management of your investment we offer our landlords a stress free peace of mind service by providing on-site teams which are led by experienced managers and backed by specialised departments at our head office, including technical, accounting, marketing, PR, and legal support.

Alongside this we offer a range of critical property management and accounting functions, including setting service charge budgets, administering tenancy deposit schemes, handling rent and deposit collection and remittance, preparing regular statements and accounts, managing all sub-contractor suppliers, conducting health and safety audits and risk assessments, ensuring compliance with all relevant regulations, employing and managing on-site and regional staff and managers, and procuring necessary insurance coverage. So you can be rest assured that we will look after your valuable investment.

Don’t just take our word for it;

‘The best student accommodation provider I've ever come across.

It's more like a 5* hotel than student accommodation. The staff are friendly and always have time to listen to you and help out. The maintenance issues get fixed within a day or 2. And they always have events going on with free giveaways or competitions. Wouldn't stay anywhere else! Thanks so much’

‘I’ve been living here for almost a year and this has been the best experience I’ve ever had. The team on site is amazingly kind to you and always there to help you with anything. I’m looking forward to more experiences in this place. Truly my home’

As part of our exciting expansion we will be offering an expert hassle free service in;

• Purpose Built Student Accommodation

• HMO Management

• Block Management

• Development

• Residential Sales

• Residential Lettings and Management

Whether you are a landlord looking to market your property, want advice on the best investment opportunities or are a vendor looking to sell a property get in touch with one of our property experts who can discuss how to assist you on your journey.

To find out more visit Venite.com, call our switchboard on 0333 444 1122 or Chris Mcgowan sales manager on 07762 987327

MANAGMENT SPOTLIGHT | VENITE 41

We are an Established Professional Purpose Built Student Accommodation provider, who also offers services in the residential market.

LANDLORD INVESTOR 72ND EDITION

When it comes to the management of your investment we offer our landlords a stress free peace of mind service by providing on-site teams which are led by experienced managers and backed by specialised departments.

THE FASTEST GROWING, FAMILY OWNED HOLIDAY HOME MANAGEMENT BUSINESS IN THE UK RIGHT NOW.

DEVELOPER SPOTLIGHT | HOST & STAY 42

DEVELOPER SPOTLIGHT LANDLORD INVESTOR 72ND EDITION

Do you have a holiday home, or are you looking to enter the short-term holiday let market? Look no further than Host & Stay! This holiday home management company is here to lead the change in an age-old industry.

Born from a love and passion for property, Host & Stay want to help more holiday home owners unlock the potential in their homes. Offering a comprehensive solution to holiday let management, their focus is on maximising your income whilst reducing the stress of self-management. With an industry beating 10% + VAT management charge and the most comprehensive fully managed service in the North of England, Host & Stay offer new methods for new times.

Giving you the ultimate hands-free, stress-free experience, their fully managed service includes a 24/7 guest contact service as well as their very own housekeeping and maintenance teams. Let Host & Stay take of everything so you don’t have to worry about a thing.

Born from a love and passion for property, Host & Stay want to help more holiday home owners unlock the potential in their homes. Providing real-time access to performance reporting, including revenue, rates, and occupancy, holiday home owners can really understand how their property is performing. What’s more, owners have unlimited bookings so you can enjoy your property as much as you want!

When it comes to advertising, Host & Stay deliver the best-in-class

marketing including professional property photography, visual tours and floor plans on every listing. Plus their network of over 60 online platforms, plus their own evergrowing website, ensures your holiday let is globally distributed!

Host & Stay's commitment to guest safety and security is paramount. They offer full guest verification and accidental damage protection on every booking at no extra cost. This added protection gives you peace of mind, knowing that your property is in safe hands.

Don’t want to be tied into a long contract? Host & Stay understand that circumstances can change so they don’t have any long contracts! If you ever need to leave, there is only a 30-day notice period so you have full flexibility.

Whether you’re looking to maximise the income of your holiday home or you’re simply looking to reduce the stress of self-management, Host & Stay is your go-to partner. There’s a reason they’re the fastest growing, family owned holiday home management business in the UK right now.

Earn more with Host & Stay. Head to hostandstay.co.uk/host to get started today.

DEVELOPER SPOTLIGHT | HOST & STAY 43

LANDLORD INVESTOR 72ND EDITION

Host & Stay's commitment to guest safety and security is paramount. They offer full guest verification and accidental damage protection on every booking at no extra cost. This added protection gives you peace of mind, knowing that your property is in safe hands.

5 TIPS FOR BUY-TO-LET

INVESTING IN 2023

EDUCATION | PREMIER PROPERTY KAM DOVEDI FOUNDER PREMIER PROPERTY GROUP 44 LANDLORD INVESTOR 72ND EDITION

These economic changes that are being experienced right now are already ones that we at Premier Property had planned for as we like to examine the market in 1, 3, 5 and 10 year phases. There's 5 key ways in which the rise of interest rates have affected the UK Property Industry, and we explore them in this article.

#1 More traditional stock coming back on to the market.

At the moment, buy to let investors have been hit hard, as rising rates mean their profit margins are squeezed, which ultimately leaves them with two options, sell on, or adapt. At Premier Property we've noticed a number of traditional and seasoned landlords selling up, meaning there's more traditional stock available for you to buy right now, and in many cases at a great price. That's because unfortunately those landlords who haven't upskilled have been hit my a number of changes targeted at the property industry, ranging from tax hikes, to legislation, to stress tests and now increasing rates.

#2 a shift in the type of housing.

As rates rise, profits are being diminished. As you know, profit is revenue minus costs and one of the biggest methods of revenues for property investors is rental. So how do you increase rental? By using a strategy called HMOs. By implementing the HMO Strategy you are able to increase cashflow significantly, especially during these challenging times and you are also tapping in to an increasing rental demand market as more tenants are moving in to HMOs

From the experience of housing 100s of HMO tenants, There's 3 tenant types

that we believe are the best at Premier Property and those are:

1. Students - reliable and predictable stay

2. Keyworkers (especially NHS Staff) - longevity

3. Young professionals who have recently graduateduse to HMO's as students

#3 Developers need to derisk more than usual.

At the moment because of where we are in the property market cycle, in my opinion larger developments consisting of building more than 10 units or development projects which can last over 18 months need to be monitored more closely. This is because by the time the project is done, the market maybe in a completely different place, so you may find profits being wiped out completely, and in many cases make a loss. Aim to target development deals which can be done quickly in this current climate, which have a clear exit and also commercial to residential projects that have a short time line. Because as rates change this will effect your in and out with development.

#4 Increased foreign investment.

It's a well known fact that when interest rates increase, foreign investment also increases. So for the property industry, you will notice increased competition for projects from foreign nationals as they see the UK as a safe haven for their money.

#5 with rising rates, it's definitely still worth investing in property.

The fact is property has been and always will be one of the best asset

classes to be investing in. If you assess the worlds wealthiest people, they all have property portfolios.

To add to that, if we are assessing property over a 10 year time frame, there's a number of tangible factors at play that work to your advantage, and one of those is inflation. On average, in the UK inflation is around 5% (not right now, but if we look at an average spanning many decades).

Inflation, although it has a negative effect on other parts of the economy, as a property investor is has a huge benefit. Over a 10 year period, inflation compounded at 5% means: 1) an increase in property price by 63% 2) an increase in rental by 63% 3) loan reduction in real terms by 63%.

To add to this, there is a fundamental lack of supply of housing in the UK, and in economics the principle of supply and demand means prices go up. To add to that the government's levelling up scheme and bettering of infrastructure means that for a new investor it's time to get in, and if you're an experienced investor it's time to derisk and scale.

At Premier Property, we provide tried, tested and tactical information to help landlords to start and scale in property, especially in a challenging market like we are in right now. We have created a set of resources we can send out to you for FREE as your are a Landlord Investment Show Subscriber.

Email

EDUCATION | PREMIER PROPERTY

With the Bank of England increasing interest rates yet again to help control inflation and the cost of living crisis, the property market is being affected.

hello@premierproperty. co.uk and with subject 'landlord resources' and we will send them across. 46 LANDLORD INVESTOR 72ND EDITION

AST ASSISTANCE, ON THE SIDE OF LANDLORDS

POSSESSION SPOTLIGHT | AST ASSISTANCE 46

LANDLORD INVESTOR 72ND EDITION

POSSESSION SPOTLIGHT

With a wealth of experience under their belt, they've positioned themselves as top specialists in the field of tenancy management, ready to help with any challenges that landlords may face.

The company was founded by Mark Dawson, an expert in the property sphere. With 15 years of hands-on experience, including time spent as a landlord himself, Mark knows the ins and outs of the industry. It is this deep understanding that led him to set up AST Assistance, with a clear goal: to support landlords all over England and Wales.

Fast forward to today, and the team is a dedicated group, all specialising in property and tenancy law. Their combined knowledge ensures they're well-equipped to handle any situation. Whether it's a tricky legal question or a challenge with a tenant, they've got the expertise to help.

Ensuring the smooth running of your property portfolio

One of the biggest challenges for landlords is keeping up with the ever-changing rules and regulations. It can feel like just as you've got your head around one set of rules, they change. But that's where AST Assistance shines; we are always one step ahead, making sure they're up to date with the latest changes. This means they can guide landlords through their duties, ensuring they're always on the right side of the law. Plus, with their deep understanding of property law, they offer advice on

the best ways to manage properties, ensuring everything runs as smoothly as possible.

But it's not just about the big picture - the business prides itself on offering tailored advice. They understand that every landlord is different, with unique needs and challenges. Whether it's a large property portfolio or just a single flat, they offer the same high level of service. This dedication to their clients has seen them grow rapidly, both in terms of their team and their reputation.

Managing properties isn't always plain sailing. There can be bumps along the way, from unexpected maintenance issues to challenges with tenants. AST Assistance understands this. That's why they've designed their service to fit seamlessly into landlords' existing operations. Their team of consultants is always ready to jump into action, tackling challenges head-on and ensuring everything runs smoothly. Stemming from breaches of the tenancy agreement, rent arrears and disputes, to eviction, every service is delivered efficiently to have the smallest impact on the landlord possible.

AST Assistance is a trusted partner for landlords nationwide. With a deep understanding of the property world, a dedicated team, and a commitment to top-notch service, they are chosen by countless in the property sector to help the management of their portfolio.

To find out more visit www.ast-assistance.com

POSSESSION SPOTLIGHT | AST ASSISTANCE 47

Navigating the world of property and tenancy law can be tricky. That's where AST Assistance comes in.

LANDLORD INVESTOR 72ND EDITION

With 15 years of hands-on experience, including time spent as a landlord himself, Mark knows the ins and outs of the industry. It is this deep understanding that led him to set up AST Assistance, with a clear goal: to support landlords all over England and Wales.

AN

NATIONAL LIS AWARDS 2023

OUT MORE

BECOME

AWARDS SPONSOR

FIND

WWW.LANDLORDINVESTMENTSHOW.CO.UK Find us on... SCAN TO FIND OUT MORE & BOOK YOUR FREE SHOW TICKETS Find everything you need to boost your property investment journey. SHOW SPONSOR CO-SPONSOR MEDIA PARTNER

Do you need a rebuild valuation for your buildings insurance?

A Reinstatement Value is what it would cost to entirely replace your property in a total loss scenario. This figure forms the basis from which your insurance premium is calculated.

Without an accurate Reinstatement Valuation, your entire buildings insurance may be inaccurate. Set it too high and you could be overpaying on your insurance premium. Too low and your insurer may not fully cover the cost of a claim in the event of a loss.

How we can help

BCH have been supporting landlords to accurately insure their investment properties since 2006. RICS regulated, BCH are experts in this field. Getting a valuation needn’t be costly or time-consuming; our remote solution, Benchmark by BCH is an eValuation service that promptly and accurately provides a Reinstatement Valuation.

Benchmark by BCH is suitable for single buildings with a maximum current sum insured of £5m and a maximum listing of Grade II. For all instructions outside these parameters we recommend an attended Reinstatement Cost Assessment.

To instruct a Benchmark eValuation of a property today, simply scan the QR code or visit bch.uk.com. Get your eValuation today Only £125 + VAT

2023 EXHIBIT WITH US IN 2023 EXHIBIT WITH US IN Scan code to find out more ELSTREE DOUBLE TREE N LONDON/HERTS 27 SEPTEMBER OLD TRAFFORD MANCHESTER 10 OCTOBER OLD BILLINGSGATE LONDON 1 NOVEMBER