All materials and information received or derived from Robert Bruni DRE# 00986763, KW Commercial DRE# 01499010 and Martina Nilchian DRE #01456416 KW Advisors, its directors, officers, agents, advisors, affiliates and/or any third party sources are provided without representation or warranty as to completeness, veracity, or accuracy, condition of the property, compliance or lack of compliance with applicable governmental requirements, develop-ability or suitability, financial performance of the property, projected financial performance of the property for any party’s intended use or any and all other matters.

Neither Robert Bruni, and Martina Nilchian, officers, agents, advisors, or affiliates makes any representation or warranty, express or implied, as to accuracy or completeness of the any materials or information provided, derived, or received. Materials and information from any source, whether written or verbal, that may be furnished for review are not a substitute for a party’s active conduct of its own due diligence to determine these and other matters of significance to such party. Robert Bruni and Martina Nilchian will not investigate or verify any such matters or conduct due diligence for a party unless otherwise agreed in writing.

EACH PARTY SHALL CONDUCT ITS OWN INDEPENDENT INVESTIGATION AND DUE DILIGENCE. Any party contemplating or under contract or in escrow for a transaction is urged to verify all information and to conduct their own inspections and investigations through appropriate third party independent professionals selected by such party. All financial data should be verified by the party including by obtaining and reading applicable documents and reports and consulting appropriate independent professionals.

Robert Bruni and Martina Nilchian make no warranties and/or representations regarding the veracity, completeness, or relevance of any financial data or assumptions. Robert Bruni and Martina Nilchian do not serve as a financial advisor to any party regarding any proposed transaction. All data and assumptions regarding financial performance, including that used for financial modeling purposes, may differ from actual data or performance.

Any estimates of market rents and/or projected rents that may be provided to a party do not necessarily mean that rents can be established at or increased to that level. Parties must evaluate any applicable contractual and governmental limitations as well as market conditions, vacancy factors and other issues in order to determine rents from or for the property. Legal questions should be discussed by the party with an attorney. Tax questions should be discussed by the party with a certified public accountant or tax attorney.

Title questions should be discussed by the party with a title officer or attorney. Questions regarding the condition of the property and whether the property complies with applicable governmental requirements should be discussed by the party with appropriate engineers, architects, contractors, other consultants and governmental agencies. All properties and services are marketed by KW Commercial-Santa Monica in compliance with all applicable fair housing and equal opportunity laws.

Broker Associate

Meet Agent Name, raised in Los Angeles, CA. Our resident expert on the Southern California commercial real estate market and franchise owner of four Keller Williams branches. Starting out in 1988, he joined Keller Williams Commercial on the Westside in 2008. If you're looking for someone to analyze investment properties, and identify value added real estate opportunities, Robert is your guy. He's detail oriented and takes pride in exceeding client’s expectations. Sami's an extremely effective problem solver and has a keen eye for opportunity. On his days off he loves caring for animals and has an affinity for cars and yachts.

123 Anywhere l St, Anytown

Each Office is Independently Owned and Operated

Broker Associate

Agent Name began her Real Estate career in 2005. In 1983 her family moved from Hamburg, Germany to Los Angeles, CA. She has a background in Finance Education. Inspired by her big change, she worked in the legal department to help others achieve their hopes of moving to this Land of Opportunity. Deeply inspired by her experience of the American dream, she realized the next step in her career was to help people achieve their own dreams. She wanted to help others manifest their own destinies by finding their forever homes, and making strategic investments. She joined Keller Williams Advisors on the Westside in 2008. Honest, patient, and tri-lingual (speaking Farsi, German, and English), she approaches each client with the utmost care, and consideration. She loves cooking and enjoys going for walks out in nature.

123 Anywhere l St, Anytown

Each Office is Independently Owned and Operated

DRE #01234567 (123) 456-7890

AgentName@Email.com www.AgentName.kw.com

Zimas Information

05 Property Overview

Subject Property Details

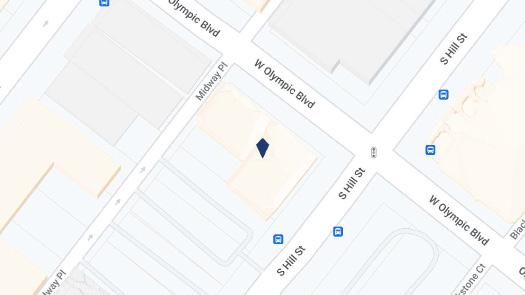

Site Plan

Aerial View

19

12 Demographics

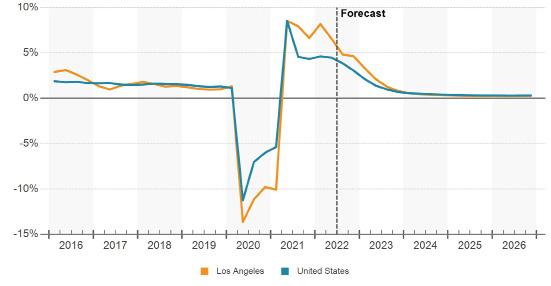

Demographics Traffic Control Site Attractions 10 Area Highlights Area Highlights 16 Los Angeles Economic Summary Economic Summary

24

Peer Properties Summary

Peer Locations

Peer Properties Summary

Overall Construction Summary

Overall Construction Summary

Site Attractions

27 Investment Trends

Sales Comparables Summary Statistics

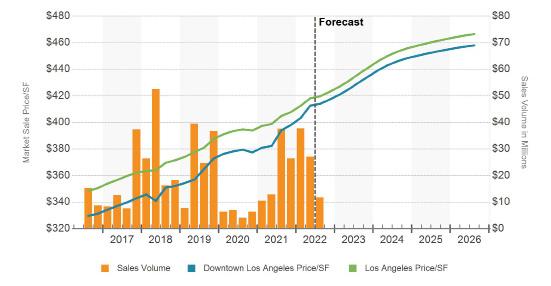

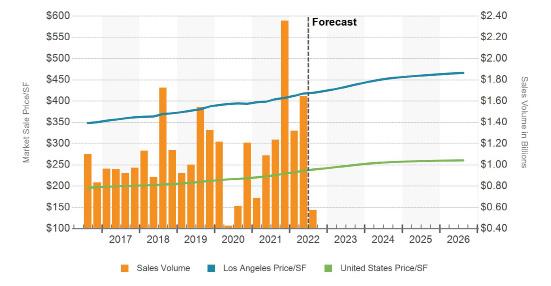

Los Angeles Investment Trends

Downtown Los Angeles Investment Trends

123 ANYWHERE, ST, ANYTOWN

Community Plan Area Central City

Area Planning Commission Central

Neighborhood Council Downtown Los Angeles

Council District CD 14 - Kevin de León

Census Tract # 2079.02

LADBS District Office Los Angeles Metro

PLANNING

Zoning

Zoning Information (ZI)

Zoning Information (ZI)

Zoning Information (ZI)

Zoning Information (ZI)

[Q]R5-4D-O

ZI-2452 Transit Priority Area in the City of Los Angeles

ZI-2385 Greater Downtown Housing Incentive Area

ZI-2374 State Enterprise Zone: Los Angeles

ZI-2488 Redevelopment Project Area: City Center

General Plan Land Use High Density Residential

General Plan Note(s) Yes

Adaptive Reuse Incentive Area Adaptive Reuse Incentive Area

Affordable Housing Linkage Fee

Residential Market Area Medium-High

Non-Residential Market Area High

Transit Oriented Communities (TOC) Tier 3

RPA: Redevelopment Project Area City Center

Central City Parking Yes

Downtown Parking Yes

Building Line 20

Address

123 ANYWHERE, ST, ANYTOWN

123 ANYWHERE, ST, ANYTOWN

123 Anywhere, St, Anytown

Source: Oxford Economics

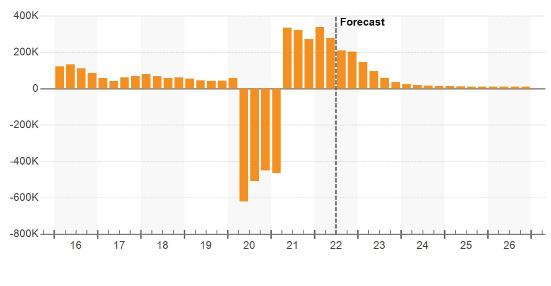

UNEMPLOYMENT RATE (%)

NET EMPLOYMENT CHANGE (YOY)

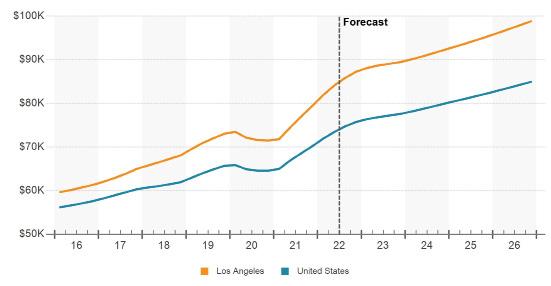

MEDIAN HOUSEHOLD INCOME

POPULATION GROWTH (YOY %) NET POPULATION CHANGE (YOY) POPULATION GROWTH

FORCE GROWTH

GROWTH

$2.98 NNN Market Rent/SF 11.8% Availability Rate 10.8% Vacancy Rate

1053-1065

123 Anywhere, St, Anytown

1336 S LOS ANGELES ST, LOS ANGELES, CA 90015

1154-1158 WALL ST, LOS ANGELES, CA 90015

1515 S MAIN ST, LOS ANGELES, CA 90015

123 Anywhere, St, Anytown

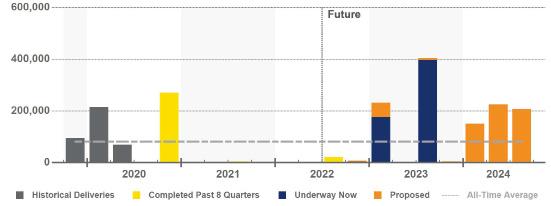

PAST 8 QUARTERS DELIVERIES, UNDER CONSTRUCTION, & PROPOSED

PAST & FUTURE DELIVERIES IN SQUARE FEET

326,668 All-Time Annual Avg. SF

295,465 Delivered SF Past 8 Qtrs

575,611 Delivered SF Next 8 Qtrs

654,285 Proposed SF Next 8 Qtrs

Retail property transactions on a dollar basis totaled $6.4 billion during the past 12 months have been robust and compare favorably to historical sales levels. Recent activity demonstrates investors are focused on varying strategies and risk appetites.

Opportunistic buyers see opportunities to acquire assets on sites ripe for redevelopment or reinvigoration of centers. One of the largest recent sales closed in April 2022, when Bridge Group Investments purchased from institutional investor UBS portions of the Shops at Montebello for $86.9 million. Bridge purchased with the intention to redevelop the mid-tier mall. Concrete plans have yet to be disclosed. The sale included all portions of the center except for the JCPenney and Macy's, which the department stores own.

In July 2022, Massachi Industries purchased 8025 Santa Monica Blvd. in West Hollywood, a 4,200-SF former bank branch on a half acre, from Bank of America for $13.6 million ($26.7 million/acre). Massachi purchased with the intent to redevelop the high-profile site into a 120- to 130-unit multifamily community.

On the other side of the risk spectrum, investors are focused on acquiring high-quality, well-leased properties. In June 2022, Felson Companies acquired 64-68 W Colorado Ave. from JV partners Aurora Capital Associates and Rockwood Capital for $52.25 million ($1,840/SF). Tenants in the 28,400-SF property include Crate & Barrel, Tiffany, and House of Hoops, with inplace income from the tenants equating to a 5.5% inplace cap rate.

The property last traded in December 2014 for $52.3 million ($1,840/ SF), essentially the same price Felson paid eight years later. The sale demonstrates that even top-tier retail assets have witnessed little to no appreciation in recent years, standing in stark contrast to the run-up in pricing seen in industrial and multifamily properties during this time.

The average modeled price per SF currently stands at $420, well above the national retail average of $240/SF. Average market cap rates, presently 5.2%, are far below the national average of 6.8%. Average market pricing flatlined through 2020 and 2021, although recent quarters have seen modest asset price growth. The outlook calls for continued modest gains for at least the near to midterm.

With an average modeled price per SF of $410 and a market cap rate of 5.0%, the Downtown Los Angeles Submarket offers retail asset pricing similar to metro averages. However, the proximity to public transportation and significant multifamily construction offer plenty of upside, especially for redevelopment sites. Sales volume during the past 12 months, $118 million, compares to the submarket's five-year average of $84.3 million.

In June 2022, a consortium of individuals purchased 614 S Mateo St., a 5,600-SF freestanding building in the Arts District, from Inception REIT for $6 million ($1,070/SF). Inception REIT is the first REIT formed by a leading cannabis firm, The Inception Companies. The property was 100% leased to Sweet Flower, a cannabis retailer, with eight years remaining on the lease term, plus two five-year extension options. Income from the lease at the property equated to a 9% cap rate at the time of sale.

In February 2022, Reliable Properties purchased Washington Plaza, along with an adjacent industrial property at 425 E 20th St., from a private seller for $44.75 million. The 71,000-SF neighborhood center at 408 E Washington Blvd. was fully leased to long-term tenants that include 99 Cents Only and Rite Aid. Inplace income at the properties equated to a 5.2% inplace cap rate.