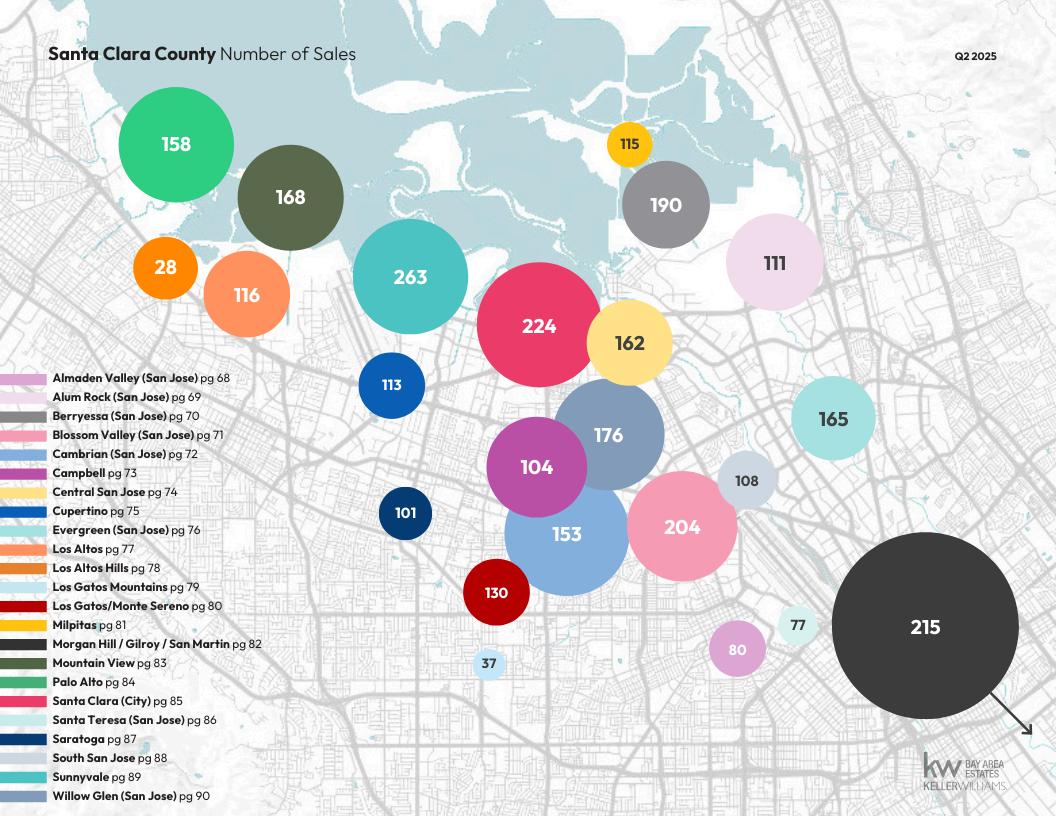

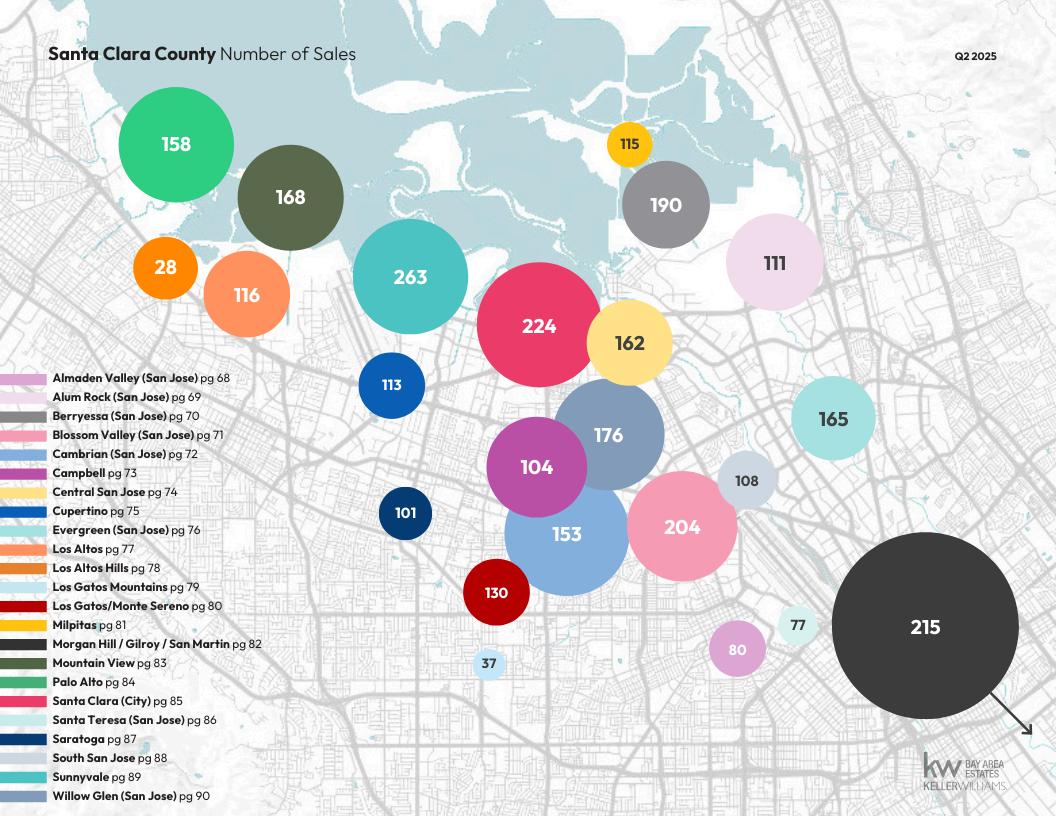

Santa Clara County

Jump to Santa Clara County Report

San Mateo County

Jump to San Mateo County Report

Alameda County

Jump to Alameda Report

Contra Costa County

Jump to Contra Costa Report

Santa Cruz County

Jump to Santa Cruz County Report

Monterey County

Jump to Monterey County Report

Almaden Valley (San Jose)

Jump to Almaden Valley (San Jose) Report

Alum Rock (San Jose)

Jump to Alum Rock (San Jose) Report

Berryessa (San Jose)

Jump to Berryessa (San Jose) Report

Blossom Valley (San Jose)

Jump to Blossom Valley (San Jose) Report

Cambrian (San Jose)

Jump to Cambrian (San Jose) Report

Jump to Campbell Report Campbell

Central San Jose

Jump to Central San Jose Report

Cupertino

Jump to Cupertino Report

Evergreen (San Jose)

Jump to Evergreen (San Jose) Report

Los Altos

Jump to Los Altos Report

Los Altos Hills

Jump to Los Altos Hills Report

Los Gatos Mountains

Jump to Los Gatos Mountains Report

Los Gatos/Monte Sereno

Jump to Los Gatos/Monte Sereno Mountains Report

Milpitas

Jump to Milpitas Report

Morgan Hill/Gilroy/San Martin

Jump to Morgan Hill/Gilroy/San Martin Report

Mountain View

Jump to Mountain View Report

Palo Alto

Jump to Palo Alto Report

Santa Clara City

Jump to Santa Clara City Report

Santa Teresa (San Jose)

Jump to Santa Teresa (San Jose) Report

Saratoga

Jump to Saratoga Report

South San Jose

Jump to South San Jose Report

Sunnyvale

Jump to Sunnyvale Report

Willow Glen (San Jose)

That's really the question you should be asking yourself.

Our market is incredibly diverse, and rapidly changing. Values vary not just by neighborhood, but by street. Your home isn't necessarily worth what your neighbors’ home is. At the end of the day, it’s the current market that sets the value of your home.

So, do you know what your home is worth in today's market?

I can help...

Contact me for a confidential, no obligation assessment of your home's value.

If you’ve been putting off buying a home because you thought getting approved would be too hard, know this: qualifying for a mortgage is starting to get a bit more achievable, but lending standards are still strong.

Lenders are making it slightly easier for well-qualified buyers to access financing, which is opening more doors for people ready to make a move.

So, if strict requirements were holding you back, this shift could be the opportunity you’ve been waiting for, without repeating the risky lending practices that led to the housing crash back in 2008.

The latest data from the housing market indicates a resilient and active landscape across Single Family Homes, Condos, and Townhomes. With 3,378 closed sales recorded during the reporting period, the market continues to exhibit robust performance, demonstrating sustained demand among buyers. The median price for these properties stands impressively at $1.7 million, underscoring their desirability and the overall strength of the market, especially in serving upscale clientele.

Moreover, the market saw a total of 5,277 new listings, indicating healthy inventory levels and providing buyers with a diverse range of options to consider. This influx of listings reflects positively on the market's capacity to accommodate varying preferences, contributing to its dynamism and attractiveness.

A particularly notable metric is the average duration properties spend on the market before sale, which stands at 19 days without price reduction. This indicates a swift turnaround time for properties, suggesting high buyer interest and competitive conditions within the market.

Additionally, the average price per square foot remains high at $1,124, emphasizing the premium nature of the properties available and attracting buyers seeking upscale residences with superior features and amenities.

Overall, these indicators paint a picture of resilience and continued vitality in the housing market. Despite external factors, the market for Single Family Homes, Condos, and Townhomes appears well-positioned for sustained growth and stability in the foreseeable future.

Joe Han | General Manager & Senior VP

5,277

+4.5% Year-over-Year

Average Price Per SqFt

$1,124 New Listings

+0 5% Year-over-Year

3,378

Year-over-Year

$1.7M

8% Year-over-Year

19 $7.1B Average Days-on-Market Total Volume +26.7% Year-over-Year -4 0% Year-over-Year

Data includes all single family, townhome, and condominium sales in Santa Clara County sourced from MLS Listings The most recent month’s data is based on available numbers, but may change with late reported activity Data from sources deemed reliable but may contain errors and are subject to revision

The market for Single Fam 2,448 closed sales at a m $2 1M There was a total listings with an average o market without price redu average price per square With a total volume of $6.

The market for Townhomes & Condominiums saw 930 closed sales at a median price of $998K There was a total of 1,705 new listings with an average of 24 days on the market without price reduction and with an average price per square foot of $804. With a total volume of $1B.

The latest data from the housing market indicates a resilient and active landscape across Single Family Homes, Condos, and Townhomes. With 1,438 closed sales recorded during the reporting period, the market continues to exhibit robust performance, demonstrating sustained demand among buyers. The median price for these properties stands impressively at $1.7 million, underscoring their desirability and the overall strength of the market, especially in serving upscale clientele.

Moreover, the market saw a total of 2,143 new listings, indicating healthy inventory levels and providing buyers with a diverse range of options to consider. This influx of listings reflects positively on the market's capacity to accommodate varying preferences, contributing to its dynamism and attractiveness.

A particularly notable metric is the average duration properties spend on the market before sale, which stands at 24 days without price reduction. This indicates a swift turnaround time for properties, suggesting high buyer interest and competitive conditions within the market.

Additionally, the average price per square foot remains high at $1,134, emphasizing the premium nature of the properties available and attracting buyers seeking upscale residences with superior features and amenities.

Overall, these indicators paint a picture of resilience and continued vitality in the housing market. Despite external factors, the market for Single Family Homes, Condos, and Townhomes appears well-positioned for sustained growth and stability in the foreseeable future.

Joe Han | General Manager & Senior VP

2,143

$1,134 New Listings

Average Price Per SqFt +12.3% Year-over-Year -1 4% Year-over-Year

1,438

$1.7M

4% Year-over-Year

Year-over-Year

24 $3.3B Average Days-on-Market Total Volume

4% Year-over-Year

Data includes all single family, townhome, and condominium sales in San Mateo County sourced from MLS Listings The most recent month’s

The market for Single Fam 1,122 closed sales at a m There was a total of 1,596 an average of 20 days on price reduction and with a square foot of $1,223. Wi $3B.

$2,050,000

Condominiums saw 316 c median price of $922k Th

547 new listings with an a on the market without pri with an average price per $815. With a total volume

The latest data from the housing market indicates a resilient and active landscape across Single Family Homes, Condos, and Townhomes. With 2,794 closed sales recorded during the reporting period, the market continues to exhibit robust performance, demonstrating sustained demand among buyers. The median price for these properties stands impressively at $1.1 million, underscoring their desirability and the overall strength of the market, especially in serving upscale clientele.

Moreover, the market saw a total of 4,896 new listings, indicating healthy inventory levels and providing buyers with a diverse range of options to consider. This influx of listings reflects positively on the market's capacity to accommodate varying preferences, contributing to its dynamism and attractiveness.

A particularly notable metric is the average duration properties spend on the market before sale, which stands at 25 days without price reduction. This indicates a swift turnaround time for properties, suggesting high buyer interest and competitive conditions within the market.

Additionally, the average price per square foot remains high at $744, emphasizing the premium nature of the properties available and attracting buyers seeking upscale residences with superior features and amenities.

Overall, these indicators paint a picture of resilience and continued vitality in the housing market. Despite external factors, the market for Single Family Homes, Condos, and Townhomes appears well-positioned for sustained growth and stability in the foreseeable future.

Joe Han | General Manager & Senior VP

4,896

+4.8% Year-over-Year

Average Price Per SqFt

$744 New Listings

2,794

$1 1M Closed Sales Median Sale Price -3.2% Year-over-Year

25

Average Days-on-Market Total Volume +38.9% Year-over-Year

$3 5B

The market for Single Fam 2,173 closed sales at a me $1 3M There was a total o listings with an average o market without price redu average price per square f a total volume of $3.1B.

The market for Townhomes & Condominiums saw 621 closed sales at a median price of $710K There was a total of 1,311 new listings with an average of 35 days on the market without price reduction and with an average price per square foot of $605. With a total volume of $469M.

The latest data from the housing market indicates a resilient and active landscape across Single Family Homes, Condos, and Townhomes. With 2,650 closed sales recorded during the reporting period, the market continues to exhibit robust performance, demonstrating sustained demand among buyers. The median price for these properties stands impressively at $825k, underscoring their desirability and the overall strength of the market, especially in serving upscale clientele.

Moreover, the market saw a total of 4,652 new listings, indicating healthy inventory levels and providing buyers with a diverse range of options to consider. This influx of listings reflects positively on the market's capacity to accommodate varying preferences, contributing to its dynamism and attractiveness.

A particularly notable metric is the average duration properties spend on the market before sale, which stands at 27 days without price reduction. This indicates a swift turnaround time for properties, suggesting high buyer interest and competitive conditions within the market.

Additionally, the average price per square foot remains high at $564, emphasizing the premium nature of the properties available and attracting buyers seeking upscale residences with superior features and amenities.

Overall, these indicators paint a picture of resilience and continued vitality in the housing market. Despite external factors, the market for Single Family Homes, Condos, and Townhomes appears well-positioned for sustained growth and stability in the foreseeable future.

Joe Han | General Manager & Senior VP

market for Townhomes

Condominiums saw 550 closed s median price of $545k There wa 999 new listings with an average on the market without price reduc with an average price per square $506. With a total volume of $35

1Q25 2Q25

The latest data from the housing market indicates a resilient and active landscape across Single Family Homes, Condos, and Townhomes. With 491 closed sales recorded during the reporting period, the market continues to exhibit robust performance, demonstrating sustained demand among buyers. The median price for these properties stands impressively at $1.1 million, underscoring their desirability and the overall strength of the market, especially in serving upscale clientele.

Moreover, the market saw a total of 957 new listings, indicating healthy inventory levels and providing buyers with a diverse range of options to consider. This influx of listings reflects positively on the market's capacity to accommodate varying preferences, contributing to its dynamism and attractiveness.

A particularly notable metric is the average duration properties spend on the market before sale, which stands at 29 days without price reduction. This indicates a swift turnaround time for properties, suggesting high buyer interest and competitive conditions within the market.

Additionally, the average price per square foot remains high at $811, emphasizing the premium nature of the properties available and attracting buyers seeking upscale residences with superior features and amenities.

Overall, these indicators paint a picture of resilience and continued vitality in the housing market. Despite external factors, the market for Single Family Homes, Condos, and Townhomes appears well-positioned for sustained growth and stability in the foreseeable future.

Joe Han | General Manager & Senior VP

Listings Average

Year-over-Year

The market for Single Family Homes saw 390 closed sales at a median price of $1.3M. There was a total of 770 new listings with an average of 27 days on the market without price reduction and with an average price per square foot of $842. With a total volume of $578M.

The market for Townhomes & Condominiums saw 101 closed sales at a median price of $840K There was a total of 187 new listings with an average of 40 days on the market without price reduction and with an average price per square foot of $690. With a total volume of $89M.

The latest data from the housing market indicates a resilient and active landscape across Single Family Homes, Condos, and Townhomes. With 540 closed sales recorded during the reporting period, the market continues to exhibit robust performance, demonstrating sustained demand among buyers. The median price for these properties stands impressively at $899k, underscoring their desirability and the overall strength of the market, especially in serving upscale clientele.

Moreover, the market saw a total of 799 new listings, indicating healthy inventory levels and providing buyers with a diverse range of options to consider. This influx of listings reflects positively on the market's capacity to accommodate varying preferences, contributing to its dynamism and attractiveness.

A particularly notable metric is the average duration properties spend on the market before sale, which stands at 44 days without price reduction. This indicates a swift turnaround time for properties, suggesting high buyer interest and competitive conditions within the market.

Additionally, the average price per square foot remains high at $778, emphasizing the premium nature of the properties available and attracting buyers seeking upscale residences with superior features and amenities.

Overall, these indicators paint a picture of resilience and continued vitality in the housing market. Despite external factors, the market for Single Family Homes, Condos, and Townhomes appears well-positioned for sustained growth and stability in the foreseeable future.

Joe Han | General Manager & Senior VP

799

+2.3% Year-over-Year

Average Price Per SqFt

$778 New Listings

540

Median Sale Price -0.2% Year-over-Year

$899K Closed Sales

Average Days-on-Market

44

Total Volume +29.4% Year-over-Year

$780M

The market for Single Family Homes saw 479 closed sales at a median price of $909K. There was a total of 697 new listings with an average of 43 days on the market without price reduction and with an average price per square foot of $792. With a total volume of $727M.

The market for Townhomes & Condominiums saw 61 closed sales at a median price of $716K There was a total of 102 new listings with an average of 57 days on the market without price reduction and with an average price per square foot of $667. With a total volume of $52M.

$465K $4.8M $2,451

Being an independently owned and operated franchise of Keller Williams, KW Bay Area Estates has the position as the Bay Area’s foremost luxury real estate services firm with the execution of best-in-class customer service. KWBAE’s unparalleled team consists of more than 250 associates and professionals strategically located in Los Gatos and Saratoga. Under the same ownership, we have our division of KW South Bay Commercial.

With uncompromising principles, KW Bay Area Estates has established a new standard of excellence within the industry. The company’s growth has been strategic and exciting. Since its inception, the team has successfully represented more than 10,000 transactions, totalling more than $13 billion in closed sales volume.

Dedicated to upholding unparalleled standards for integrity and client care, they strive to create a culture where agents thrive while developing their own businesses to their maximum potential. KW Bay Area Estates has distributed to their associates over $2.7 million in profit share.

16780 Lark Ave, Los Gatos, CA, 95032

Phone: 408.560.9000

12820 Saratoga-Sunnyvale Rd, Saratoga, 95070

Phone: 408.418.3911