Garden Club of the Upper Keys

Develop, promote, protect and conserve the natural beauty of the Upper Keys.

See photos from the member In Motions hosted by the Garden Club on page 7.

Develop, promote, protect and conserve the natural beauty of the Upper Keys.

See photos from the member In Motions hosted by the Garden Club on page 7.

Understanding Corporate Transparency Act PAGE 4

Members in Motion PAGE 7

Event Calendar PAGE 8

Chamber Directors PAGE 10

Celebrating Small Businesses PAGE 11

Grant Funding for Flood Mitigation PAGE 12

Luncheon Happenings PAGE 13

FKEC Residential Rebates PAGE 16

Credits:

Key Largo Chamber of Commerce

Market Design Connect with Nikki Dunn Cullen

Join the Chamber's exclusive Legacy Member 100K Club to help raise $100,000 to pay off the chamber's mortgage and bolster reserves. The Key Largo Chamber is seeking 100 sponsorships of $1,000 per business or individual. Thank you to:

X Henry Quintana

X HNO Productions

X Michael Rojewski Realtor

X Gretchen Holland

X Coral Reef Title

X Arla Marr

X Borland & Associates, Roberto & Ana Alonso

Come out and experience the ultimate celebration of freedom at our annual 4th of July extravaganza! As always, it promises to be spectacular, marking the 48th year of the Key Largo Parade. Following the parade, the festivities continue with family fun at Rowell's Waterfront Park and a dazzling display of fireworks over Blackwater Sound.

The Chamber Events Committee is working hard to bring you an unforgettable day you and your family will surely enjoy! While we are still finalizing all the details, we can give you a sneak peek of what's in store. Get ready for live entertainment that will keep you on your feet, mouthwatering food, vendors that will satisfy all your cravings, refreshing beverages to quench your thirst, a VIP area to make you feel like royalty, and unique attractions for the little ones. We are almost there and can't wait to release more exciting information. There will be no entrance fee to watch the fireworks from Rowell's Waterfront Park. However, coolers and picnic

baskets will not be allowed. Participants are welcome to bring lawn chairs and blankets to be comfortable. Off site parking will also be provided for your convenience.

We are counting on the support of our local community to make the July 4th celebration a success. The stunning fireworks display and all the exciting entertainment come with a considerable expense, and we are looking for the support of businesses like yours. If you're interested in becoming a sponsor, entering a float, or learning more about the event, please don't hesitate to contact the Key Largo Chamber at 305-451-1414. We will be happy to provide you with all the necessary information.

Interested in supporting the events? Call 305-451-1414

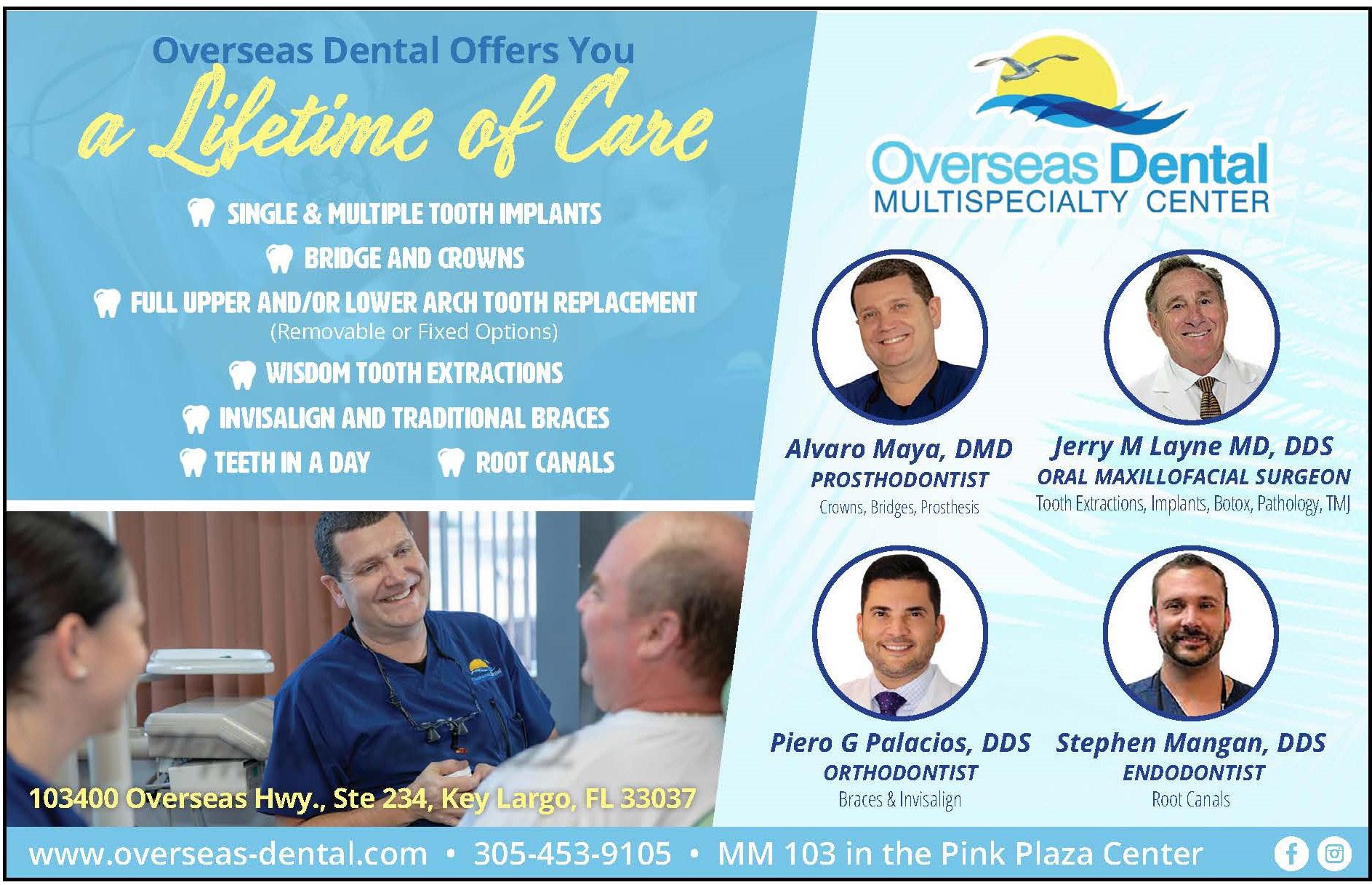

Are you an LLC? S-Corp? Partnership? C-Corp? Have less than 20 full-time employees and earned less than $5,000,000? Then you need to know about the Corporate Transparency Act.

The Corporate Transparency Act (CTA), enacted in 2021, aims to help prevent and combat money laundering, terrorist financing, corruption, tax fraud, and other illicit activity.

Under the Act, many businesses are required to begin reporting Beneficial Ownership Information (BOI) to the U.S. Treasury Financial Crimes Enforcement Network.

Understanding what the Department of Treasury’s Financial Crimes Enforcement Network (FinCEN) requires in the Beneficial Ownership Information (BOI) Report is essential for certain small businesses to avoid criminal or civil penalties for not filing or updating this report.

Is your business impacted by the CTA’s BOI reporting requirements? What are these requirements? What do you need to do if your business is

impacted by these requirements?

1. What the CTA is and why it was Enacted: The CTA was put in place to prevent the misuse of corporate structures by requiring certain U.S. and foreign entities to report their beneficial ownership information to FinCEN. It's a step toward transparency to combat activities like tax evasion, fraud, and money laundering.

2. Who FinCEN is: The Financial Crimes Enforcement Network (FinCEN) is a Bureau of the U.S. Department of the Treasury, responsible for collecting and analyzing information about financial transactions to combat domestic and international money laundering, terrorist financing, and other financial crimes.

3. Registration with the Dept. of Treasury: Reporting companies will need to provide information about their beneficial owners (those with 25% or more ownership or substantial control over the

company) and company applicants (those who file the creation or registration documents).

4. Who Must Register: This generally includes corporations, LLCs, and other entities that are created by filing a document with a Secretary of State or similar office. However, 23 types of entities are exempt from the definition of a reporting company, including certain trusts not created by such a filing.

5. Exemptions from Filing: Many entities are exempt, including larger companies that are already heavily regulated and certain trusts. Regarding nonprofits, since they often have a different structure and regulatory requirements, they might be exempt, but this will depend on specific criteria set by FinCEN. (See below).

6. Timelines and Frequency of Filings: Existing companies as of January 1, 2024, have one year to file their initial report. New companies created after this date must file

within 90 days of their creation or registration. Effective January 1, 2025, new companies created must file within 30 days of their creation or registration.

7. Deadlines for Filing: Reporting is ongoing from the commencement dates mentioned above. This is not just a one-time reporting requirement. A company, beneficial owner or company applicant must report any changes to reported information to FinCEN. For updates, the 30 days start from when the relevant change occurs. For corrections, the 30 days start after becoming aware of, or having reason to know of, an inaccuracy in a prior report. There are no safe harbors for filing an incorrect report.

8. Penalties for Late Filing: Civil penalties can reach up to $500 per day for continuing violations, and criminal penalties include fines up to $10,000 and/or imprisonment up to two years.

Business owners can go to the BOI E-Filing website (https://boiefiling. fincen.gov) to file their reports. It's important for business owners to be aware of potential fraudulent activities, as there are scams targeting entities with false claims of requiring payment for BOI filing, which is free when done directly through FinCEN's official channels.

For detailed guidance, FinCEN has provided a Small Entity Compliance Guide and FAQs that can help businesses understand and comply with the requirements. These resources can be invaluable in helping business owners navigate the new requirements and can be accessed through FinCEN's official website.

For further details and assistance, business owners can refer to the following resources:

• FinCEN's beneficial ownership

information reporting page: FinCEN BOI Reporting

• The Small Entity Compliance Guide: https://www.fincen. gov/boi/small-entity-compliance-guide FAQs on the Corporate Transparency Act: CTA FAQs https://www.fincen.gov/ sites/default/files/shared/BOI_ FAQs_Q&A_01.2024_FINAL.pdf It is advisable for businesses to consult these resources or seek guidance from a professional if they are unsure about their status. Additionally, keeping abreast of any updates to the Act or related legal interpretations is crucial, as ongoing legal challenges and rulings may affect the implementation of the CTA and the exemption status of entities.

What information is required before you file? Reporting companies created before January 1, 2024, must provide information about the company and its beneficial owners.

Reporting companies created on or after January 1, 2024, must provide information about the company, its beneficial owners, and its company applicants.

A. Company Information: The reporting company must provide its name and any alternative names, the address of its principal place of business, the state of formation, and its taxpayer identification number.

B. The Identities of the “Beneficial Owners”: A beneficial owner is anyone who owns at least 25 percent of the reporting company or ‘exerts substantial control over it.’ Each beneficial owner of a reporting company must furnish their full legal name, date of birth, residential address, and an identification number from a driver’s license, passport, or other state-issued identification

(ID), along with a copy of the ID document. Note that while a trust is not a reporting company, it may be subject to reporting information as a beneficial owner if ownership interests in a reporting company are held in trust.

C. What is a “Company Applicant?”

A company applicant is the person who files the business entity’s creation documents, as well as the person who directs this action. This could include the business owner(s), a lawyer, a CPA, other advisors, and potentially their assistants and staff. A company applicant is required to submit the same information as a beneficial owner.

If you fail to file is there a penalty?

Yes, there are penalties, and penalties are steep, at $591 per day up to $10,000, as of this writing.

I keep seeing offers from companies to file the report for me. Should I go this route?

There are many companies offering filing software, and costs range from $100 to as much as $1,000. As the FinCEN database is easy to use and free, there appears to be no benefit to using third party software. Seeking advice (but not using third party software) may be necessary in complicated cases, such as when beneficial owner information cannot be obtained by the person filing the report. Consult with your CPA or attorney if you have questions about filing the report.

I’ve been told by my CPA they could not assist in filing this report. What do I do?

Originally, CPAs were cautioned not to file BOI reports, as it could be seen as practicing law. The largest carrier of CPA professional liability insurance, CNA, recently determined that CPAs

Continued on page 6

Continued from page 5 would be covered when assisting clients with BOI.

How can a business determine if it is exempt from the reporting requirements under the CTA?

A business can determine if it is exempt from the reporting requirements under the Corporate Transparency Act (CTA) by referring to the exemptions outlined in the Act itself, as well as in the implementing regulations provided by FinCEN. The rule identifies twenty-three types of entities that are exempt, generally

based on the premise that these entities are already subject to certain regulatory disclosure requirements or provide other guarantees of transparency.

Exemptions include certain regulated entities such as:

• Banks and credit unions

• Securities brokers and dealers

• Investment companies and investment advisers

• Insurance companies

• State-regulated insurance producers

• Registered public accounting firms

• Public utilities

• Tax-exempt entities

• Large operating companies (meeting specific criteria)

• Subsidiaries of certain exempt entities

Additionally, certain trusts are exempt, notably those that are not created by a filing with a secretary of state or similar office. It's important for each

business to review the detailed list of exemptions which are described in the regulations to understand if they apply to their specific circumstances.

Entities created prior to January 1, 2024, have until January 1, 2025, to file an initial report; reporting companies created after January 1, 2024 and before January 1, 2025, will have 90 days after creation to file an initial report. Entities created on or after January 1, 2025 will have 30 days to submit an initial report to FinCEN.

The content provided is for informational purposes only.

Bonnie E. Barnes, Marketing Specialist

Florida Small Business Development Center at Florida International University.

Bonnie.Barnes@FloridaSBDC.org

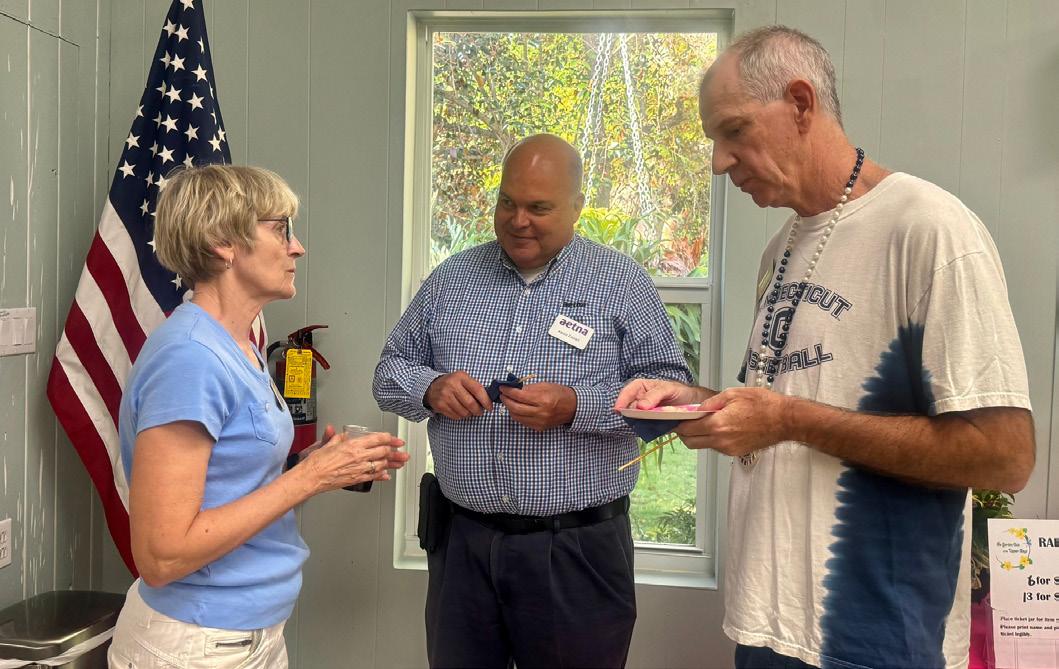

Thank you Garden Club of the Upper Keys for hosting our recent networking event.

Thank you to our hosts

Saturday, April 20

For event details visit wwww.web.keylargochamber.org/events

The Keys Players presents Jimmy Buffets ™ Escape to Margaritaville! 7:00 PM

Tuesday, April 23 Full Moon Kayak Tour 6:00 PM

Thursday, April 25

Friday, April 26

Saturday, April 27

Sunday, April 28

Tuesday, May 14

Members in Motion "An Evening of Networking at Florida Bay Outfitters" 5:30 PM

The Keys Players presents Jimmy Buffets ™ Escape to Margaritaville! 7:00 PM

The Keys Players presents Jimmy Buffets ™ Escape to Margaritaville! 7:00 PM

Ending the Silence 10:00 AM

The Keys Players presents Jimmy Buffets ™ Escape to Margaritaville! 7:00 PM

The Keys Players presents Jimmy Buffets ™ Escape to Margaritaville! 7:00 PM

REEF Fish & Friends — Mission: Iconic Coral Reefs”

Empowering Divers and Snorkelers to Support Coral Reef Restoration 6:15 PM

Wednesday, May 22 Full Moon Kayak Tour 6:45 PM

Thursday, May 23

Members in Motion

"An Evening of Networking at Keys Deep Apparel" 5:30 PM

Aquanauts to Astronauts Featured Exhibit

History of Dive Museum Now through December 31, 2023

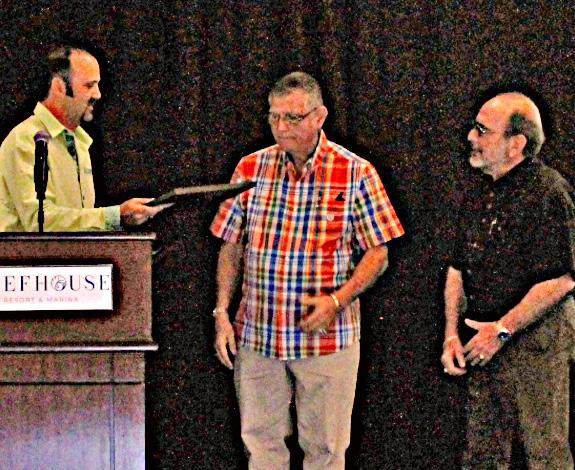

Board of Directors Installation & Awards

Members Networking Luncheon

January 11—11:30 Pilot House

Key

K

ey

Members in Motion

January 25th —5:30 PM Italian Food Company

Henry Menendez

2024 - 2026 Chairman of the Board of Directors

HNO Productions – Owner/Operator

Angie Alvarez (2024 -2026)

Centennial Bank Branch Manager

Manuel Alvarez (2024-2026)

Verdeja, De Armas & Trujill CPA

Berta Bravo (2024 – 2026)

SBI Windows & Doors Proprietor

Spencer Bryan (2023-2025)

Monroe County Sheriff’s Office

Captain

Kevin Donlan (2024-2026)

Publix Supermarkets, Inc District Director

Melissa Fernandez (2023-2025)

All Keys Concrete Communications & Sales

Cathy Gahagen (2024-2026)

The Catch Proprietor

Manuela Mobley (2024 – 2026)

Keys Weekly Director of Sales

Henry Quintana (2024 -2026)

Henry Quintana Realty, Inc Owner/Operator

Michael Rojewski – Chaiman Elect (2023–2025)

Rojewski & Rebl Group Realtor

Stephanie A. Russo (2023 - 2025)

Russo Law and Mediation Attorney

Cari Sanders (2024-2026)

Vital Signs Proprietor

Ruth Schrader-Grace (2024 - 2026)

Keys Core Fitness Owner/Operator

Blaine Vernicek (2023 - 2025)

The Structure Group Manager

Small businesses are the backbone of the American economy. As we approach National Small Business Week, which runs from April 28th to May 4th, let us take a moment to recognize and celebrate the significant contributions of entrepreneurs and small business owners across the United States.

It's time to celebrate and give a big round of applause to the invaluable role played by our businesses in the Key Largo Chamber! With great pride and joy, the chamber acknowledges each of the 449 members who form the backbone of this vibrant community. But wait, there's more!

We are thrilled to thank our top 50 revenue companies who have exceeded their membership dues by taking on additional marketing opportunities and sponsorships and signing up for events. We cannot thank them enough for their unwavering support and commitment.

Let's toast these outstanding companies and all they do for the Key Largo Chamber of Commerce!

Are you interested in obtaining grant funds to elevate, demolish/reconstruct, or sell your home that is below base flood elevation, at risk of flooding, or has flooded before with a National Flood Insurance Program (NFIP) flood insurance claim?

If so, Monroe County is participating in a national grant program known as Flood Mitigation Assistance (FMA) to help with the costs of elevating, or demolishing and reconstructing your

home. Buying out your home is also an eligible grant activity. This program is available to all Monroe County homeowners. The program cannot buy any properties that are condominiums or cooperatives or have common area maintenance requirements. Mobile homes do not qualify for the elevation program.

Monroe County is accepting applications for the fiscal year 2024 FMA grant program. The deadline to

apply through the county application process will close Oct. 30, 2024.

This is a federal program administered by the State of Florida in partnership with Monroe County; therefore, it can be a timely process with slow turnaround times to move forward with projects.

If you have any questions, contact program administrator Mike Lalbachan at 305-453-8796 or visit www.monroecounty-fl.gov/fma.

They got the memo!

FKEC has added two new rebates to our Residential Rebate Program.

Florida Keys Electric Cooperative has updated our residential rebates and added a Smart Thermostat and an Electric Vehicle (EV) Charger rebate to the program. Since implementing the Residential Rebate Program in 2014, FKEC has continually evaluated and revised the offer to align with our members’ interests and needs.

To benefit as many members as possible, FKEC offers a wide range of qualified rebates, from significant energy-saving improvements like investing in a new air conditioner to minor yet impactful improvements like reflective roof coating. Rebates range from $25 to $500, with a $500 limit per member per calendar year.

Eligibility

To be eligible, you must meet the program’s criteria and apply for the rebate within 60 days of completion of the energy-saving improvement in the same calendar year.

Our Electric Vehicle Charger Rebate does differ because it allows members who installed a UL-certified Level 2 charger at their home on or after July 1, 2019, to apply.

Interesting in Applying?

To apply for an FKEC Residential Rebate, start by reviewing the criteria for the energy-saving improvements at www.FKEC.com and call Member Service at 305-852-2431.

Co-op members interested in conserving energy and saving money at home can make energy-efficient improvements that also qualify for an FKEC Residential Rebate. Florida Keys Electric Cooperative offers the program to encourage members to invest in decreasing their energy consumption.

X Central A/C Rebate — 30% up to $500.00 – SEER2 15.3 or more

X Ductless Mini Split A/C Rebate — 30% up to $400.00 – SEER 18 or more

X Room A/C Rebate — 30% up to $100.00 – EER2 11.00 or more

X Insulation Rebate — 30% up to $300.00

X Window Film or Solar Screen Rebate — 100% up to $200.00

X Caulk/Weather-stripping Rebate — 100% up to $100.00

X Cool/Reflective Roof Coating Rebate — $25.00 per 5-gallon bucket

X Smart Thermostat Rebate — up to $100.00

X Electric Vehicle Charger — up to $350.00 — UL-certified Level 2