Monthly Market Monitor

October 2022

Our view on the markets

04

Taking the pulse of economic activity

Notes from the Investment Committee

Green investments in the political crossfire

Geopolitical heat map

Seasonalities – beware: fast food!

Asset classes & agenda 16

Double bottom or new lows?

Double bottom or new lows? That’s the question facing the equity market heading into the fourth quarter. A retest of the year-to-date lows at the least would be more the historical norm than the exception. Slowing world economic activity and persistent rampant inflati on soon look destined to exert downward pressure on corporate earnings and profit margins. A scenario of an earnings recession of more than 20% would necessitate a further downward adjustment to stock prices.

Central banks have stepped up the rate-hiking pace again lately. The fight against inflation has the upper most priority at the moment, and collateral damage to the economy is being tolerated in the battle. Europe in particular faces a tough winter – let’s hope that, for once, it won’t be a particularly cold one. Germany’s national economy will be hit especially hard and can hardly escape a recession at this point.

Geopolitical developments do not stop at the ga tes of the financial markets. On the contrary, they have become an increasingly important influencing variable in recent years. The conflict in Ukraine has illustrated this more than powerfully in recent

months. But there are developments to keep a close eye on also in Asia, the Middle East and America. We take a look at the major hotspots at the moment and their implications.

Seasonalities – beware: fast food!

Charts on seasonalities and market cycles belong to the daily routine on the financial scene these days. But on closer observation, they mostly tend to be fast-food items that are quickly consumed and hard to digest, because although playing with historical time-series data provides plenty of fodder for con versation, it delivers little added value for investors. They are better advised to concentrate on a longterm investment strategy and to regard historical time-series analyses solely as an amusement.

The dividing line between proponents and critics of ESG in the USA is increasingly the same one running between Democrats and Republicans. However, re solutions by some “red” states to bar their pension funds from taking climate risks into account in the investment process are doubly detrimental because they harm both returns and our environment. Me anwhile, Wall Street is exploiting the political pola rization in its own special way.

Many people’s current feelings of insecurity about macroeconomic prospects and their personal eco nomic outlook are literally palpable and can also be depicted graphically. The economic policy uncertain ty indices compiled by Baker, Bloom & Davis count up the number of news articles in leading national newspapers containing the words “uncertainty,” “economy,” and one or several other economic po licy terms. The news fever curves constructed in this manner are spiking massively at the moment, par ticularly in the case of Germany because the eco nomic titan of Europe is grappling with much more than “just” optimal room temperatures for this co ming winter. Germany’s economic model, which was already ravaged by the pandemic, is coming under additional pressure due to soaring natural gas and electricity prices and is currently in an acute crisis.

US inflation figures for the month of August were disillu sioning and remained stuck at a persistently high level, contrary to expectations. Even though this is partially attributable to exceptional (statistical) factors, as it is in the case of rent prices for example, the bottom line re mains the same: inflation is far too high at present, and the anticipated pullback could take a long time to materi alize. Europe, in the meantime, still hasn’t reached peak inflation yet. The Bundesbank now projects that even Germany will soon see double-digit inflation rates. The prices of more and more goods and services are up more than 2% even in Switzerland and are thus rising faster than the Swiss National Bank (SNB) would like.

Central banks are responding to the inflation challenge with ever larger interest-rate hikes. Sweden’s Riksbank even raised its policy rate in mid-September by a whop

GDP growth (in %)

Switzerland 2.3

Eurozone 2.9

UK

USA

China

Inflation (in %)

Switzerland 2.9

Eurozone

UK

USA

China

Switzerland

USA

China

Switzerland

Eurozone

UK

USA

China

Sources: Bloomberg, Kaiser Partner Privatbank

ping 100 basis points (bp). The interest-rate screw was likewise tightened vigorously by the US Federal Reserve (75 bp), the Bank of England (75 bp) and the SNB (75 bp). Meanwhile, a stifling of economic growth dyna mics to a level below the soft landing that was being aimed for is now being taken into account. A soft lan ding is hardly realistic any longer in the United Kingdom and parts of the Eurozone, and a recession is highly li kely in those places. If central bankers do not alter their restrictive course soon, policy rates look set to lie far above “neutral” interest-rate levels in the near future. The market is already pricing in a policy-rate level above 4% in the USA by year-end. There is a continued high risk of a monetary policy mistake that will have to be corrected by means of interest-rate cuts next year.

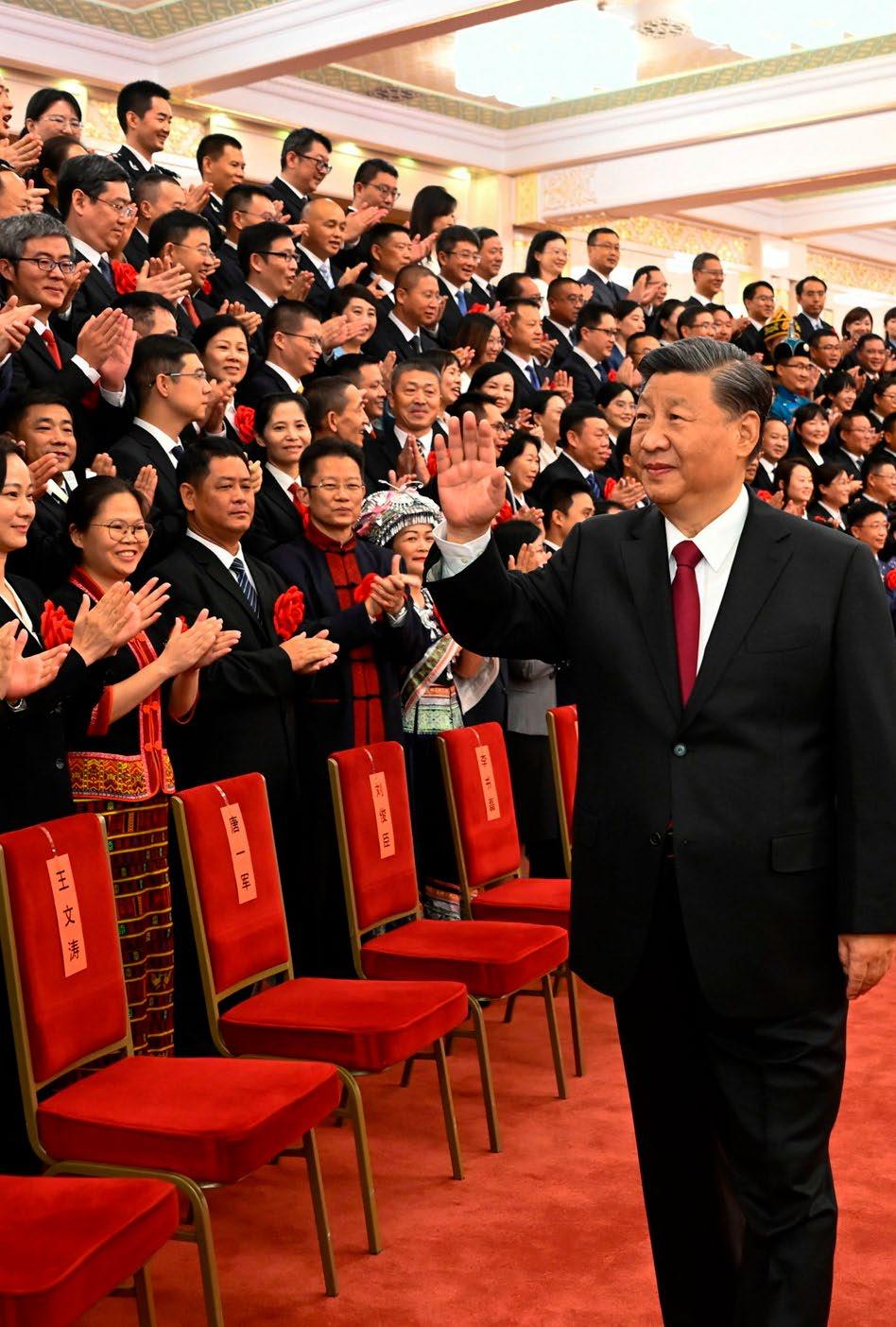

China before and after the party congress China’s government and central bank have resorted only to carefully dosed easing measures in the runup to the start of the National Congress of the Commu nist Party in mid-October. Stimulus hasn’t been served up with a big ladle thus far. It is estimated that China’s zero-COVID policy has thus far cost the country four to five percentage points of its annual economic out put, and part of that is likely to be lost forever even after the policy is lifted. Such a reopening is bound to be carefully choreographed as is usual in China and could be delayed until the second quarter of 2023. So, noticeable growth impetus for the world economy is unlikely to be felt, at least not in the near term.

Central banks have stepped up the rate-hiking pace again lately. The fight against inflation has the uppermost priority at the moment, and collateral damage to the economy is being tolerated in the battle. Europe in particular faces a tough winter – let’s hope that, for once, it won’t be a particularly cold one.

All

the same

Bank

Japan ISM

Sources: Bloomberg, Kaiser Partner Privatbank

Geopolitical developments do not stop at the gates of the financial markets.

On the contrary, they have become an increasingly important influencing variable in recent years.

Our Satellite View takes a look at the major hotspots at the moment and assesses their (long-term) implications.

Vladimir Putin’s war against Ukraine is first and foremost a humanitarian crisis, but is also increasingly turning into an economic war between Russia and the European Union. Economic policy uncertainty has increased con siderably in Western Europe and especially in Germany, whose economic model is being called into question.

Hotspot

China wants to subjugate Taiwan, and its behavior to ward the island is becoming ever more aggressive – Chi na is unwilling to accept Taiwan’s independence mo vement. The risk of a miscalculation by either side and of a military conflict erupting with the involvement of the USA will further increase in the years ahead.

• EU countries and industries that consume enor mous amounts of energy will remain dependent on the goodwill of (partially autocratic) energy-expor ting nations and will be at a perennial disadvantage against energy-independent countries like the USA.

• Since energy security has top priority for Europe, green ambitions are being put on the back burner for now, causing climate targets to move ever fart her out of reach.

• The world is increasingly bifurcating into a Western bloc and an Eastern bloc, and developing countries are caught in the middle. Geopolitics is becoming ever more complex.

• The West will step up its efforts to build up its own state-of-the-art microchip production capabilities in order to reduce its dependence on Taiwan in this vital industry.

• Since China is increasingly becoming an “insecure” location for their business operations, Western com panies are trying to diversify their production chains and to switch to other Asian countries like Vietnam and/or to withdraw from China.

• Military spending and efforts to strengthen defense capabilities will increase in the Asia-Pacific region.

Efforts to revive the 2015 nuclear accord have not borne any fruit to date because Iran and the USA are both unwil ling to make necessary concessions. Even if an agreement can be reached in the months ahead, it will probably me rely postpone the emergence of another nuclear state.

Political polarization in the USA continues to widen. This weakens the United States’ standing as a leading political and economic world power. A comeback by Donald Trump would particularly pose a risk.

• Any potential deal would probably have only a short half-life, which means that an easing of the tight global petroleum market would arguably be only of relatively short duration.

• Since the Middle East is turning back into a hotbed of instability, the USA cannot completely withdraw from the region and concentrate on its rival China.

• Another Donald Trump presidency could deal a re newed blow to trust in US institutions and could re-weaken solidarity and cohesion between Wes tern countries.

• A comeback by Trump could lead to a partial roll back of Joe Biden’s green agenda. This would send a negative signal to developing countries, which possibly would see no need to press ahead on their own environmental targets.

Double bottom or new lows? That’s the question facing the equity market heading into the fourth quarter. A retest of the year-to-date lows at the least would be more the historical norm than the exception.

+

Cash Equities

Fixed Income Global

Sovereign bonds Switzerland

Corporate bonds Europe

Microfinance UK

Inflation-linked bonds USA

High-yield bonds

Emerging-market bonds

+

Emerging markets

Alternative Assets

Insurance-linked bonds Gold

Convertible bonds

Real estate

Duration Hedge funds

Currencies

US dollar

Swiss franc

Euro

British pound

Equities: Double bottom or new lows?

• In typical autumn fashion, equity markets sho wed off their volatile side in September. The sur prisingly sticky US inflation data dashed market participants’ hopes that central banks will soon decelerate their aggressive rate-hiking campaigns. Investor sentiment accordingly remained gloomy. This malaise is visible not just in the continued streak of bearish sentiment surveys of retail and wholesale investors, but also in fund managers’ high allocations to cash. The hard facts from the IPO market also clearly indicate that the invest ment climate has cooled down considerably since the start of this year: the volume of new initial pu blic offerings in the USA in the first nine months of 2022 was down more than 90% compared to the prior year. The IPO pipeline has particularly stalled in the technology sector. The current dry spell of more than 250 days without a noteworthy IPO has already lasted for longer than the droughts that ensued after the bursting of the technology bubb le or during the Great Financial Crisis.

• Double bottom or new lows? That’s the question facing the equity market heading into the fourth quarter. A retest of the year-to-date lows at the least would be more the historical norm than the exception. The potential cause of a few more weeks of stock-market weakness is obvious: cor porate earnings are coming under pressure. The profit warning issued in mid-September by US lo

Structured products

Private equity

gistics giant FedEx may have been the proverbi al canary in the coal mine in this regard. Slowing world economic activity and persistent rampant inflation soon look destined to exert downward pressure on earnings and profit margins. Although the market most likely is already pricing in a 10% to 15% contraction in corporate profits, a scenario involving a bona fide earnings recession of more than 20% would necessitate a further downward adjustment to stock prices. To brace themselves for this eventuality, investors should continue to use hedging strategies to protect their portfolios.

Macro Monetary/fiscal policy

Corporate earnings

Valuation

Trend

Investor sentiment

Fixed income: High correlations

+

• Yields on the fixed-income markets have surged upward again in recent weeks. If this momentum continues, the 4% “sound barrier” could even move into view soon for 10-year US Treasury notes. The high volatility of market interest rates reflects no thing other than the equally fast pace at which cent

ral banks around the world are taking action at the mo ment. By the end of this year, investors and economic actors could already be facing policy-rate levels that two months ago were not “scheduled” to be reached until mid-2023. The harsh price declines that bonds experience in the midst of rising yield levels aren’t the only source of pain from an investor’s perspecti ve. Investors still also need to get used to the current high correlation between bond yields and stock prices because it had hardly been observable in recent ye ars. This high correlation leads to synchronous gains or losses in both asset classes and causes the defensi ve properties of fixed-income securities to go missing precisely when they actually would be needed to act as a shock absorber for an investment portfolio.

• However, investors with an elevated exposure to bonds should keep a cool head precisely in these trying times because despite stinging (book) losses, rising yields also have a beneficial side – they make the fixed-income asset class more attractive again now. This particularly applies to sovereign bonds, which may soon be back in demand if central banks vigorously tighten the interest-rate screw and the entire Eurozone (not just individual European coun tries) and the USA tumble into a recession. If this were to happen, continued caution toward corporate bonds would be advisable, in contrast, because credit spreads would not yet have reached their peak.

• The price of gold lastingly fell in September below the USD 1,700-per-ounce mark, which had previously been retested several times lately. Bullion’s plunge to its lowest price level in 30 months has further worse ned gold’s technicals. If the price of gold doesn’t claw its way back soon to its previous support level, further declines appear inevitable. The strong US dollar and particularly the recent surge in real interest rates are the causes of the yellow precious metal’s slump. The 10-year real yield in the USA currently stands at abo

Although this month’s Chart in the Spotlight isn’t about financial markets, there is a (clear) upward trend in outcome odds on the betting market for the upcoming US midterm elections in November: the Democrats have gained significant ground in recent weeks, and a dual majority for the Republicans in both chambers of Congress is no longer a foregone conclusion. The now more likely gridlock scenario would have straightfor ward consequences according to history books: the re would be no more large-scale economic stimulus packages, and there would arguably be only limited fiscal stimulus even in the event of a recession. Major regulatory exploits and further tax hikes would like wise largely be off the table under the influence of the Republicans. Volatility on the equity market could pick up around the election date, but whichever party ends up holding majority power in Congress does not have any effect on long-term returns.

0

ve 1%, its highest level since year-end 2018. At that time, Federal Reserve Chairman Jerome Powell had to backpedal and abort the rate-hiking cycle in view of plummeting stock prices. This scenario could repe at itself in the months ahead because the Fed may be making a monetary-policy mistake again. For gold bulls, this would be a rosy scenario that could spark a gold revival.

• EUR/USD: The euro currently finds itself at a 20-year low against the US dollar at an exchange rate close to parity. The greenback’s lofty valuation, though, is the only argument at the moment against the US currency. The USA’s interest-rate and economic growth advantages compared to the Eurozone are the relevant near-term factors. Now that the turning point in US monetary policy has been postponed in all probability until next year, the “cheapness argu ment” in favor of the euro is unlikely to gain lasting traction for the time being.

• GBP/USD: The British pound remains the ugly duck ling among the G10 currencies. The combination of the highest inflation rate and at the same time the lowest economic growth mixed with a spiraling cur rent-account deficit and a soon-to-be-soaring public budget deficit is a recipe for a persistently weak ster ling exchange rate. The upcoming interest-rate hikes by the Bank of England are unlikely to be a strong enough antidote to alter this outlook at all.

• EUR/CHF: Switzerland’s roughly six-percenta ge-point policy-rate advantage over the Eurozone after inflation is subtracted stands at a historically high level and will probably remain a core driver of a strong franc in the near future. The Swiss National Bank will likely continue to countenance this. The risk of the SNB intervening has reversed in the me antime compared to previous years – the SNB now might actually buy up francs on the market in the event of an excessively weak domestic currency.

Tight election race | Not such a sure thing after all?

Market-based probability of US midterm election outcome

Predictit, Kaiser Partner Privatbank

Charts on seasonalities and market cycles belong to the daily routine on the financial scene these days. But on closer observation, they mostly tend to be fast-food items that are quickly consumed and hard to digest, because although playing with historical time-series data provides plenty of fodder for conversation, it delivers little added value for investors. They are better advised to concentrate on a long-term investment strategy and to regard historical time-series analyses solely as an amusement.

Picturesque, but often not more than that Historical time-series comparisons have long since be come part of the standard repertoire of financial mar ket observers, are regularly added bonuses in market analyses, and haunt us on social media every day. Since they are often very vividly illustrative, they are accor dingly popular and have thus sometimes also been pre sent in our commentaries on the markets. But now and again the (high) correlations presented lack correspon ding causality, so some jumbles of data served up may deliver anecdotes, but give investors little added value.

Gruesomely alluring | Crash comparisons arouse only attention Stock-market crash overlay: 2022 vs. 2008 (June 5, 2008 = August 19, 2022)

CorrelationSources: Bloomberg, Nautilus Investment Research, Kaiser Partner Privatbank

The summer rally of 2022… | …was not on the schedule US presidential cycle and S&P 500 index

One, of course, always has to differentiate, though. Many historical findings are definitely useful to an in vestor. For example, it is helpful to know that the US yield curve in the past has habitually inverted a few quarters before the start of each recession and that the equity market usually finds a floor a few months before the end of a recession. But alongside the useful information, there is also less useful data confusion. Besides obviously arbitrary time-series overlays wi thout any contextual connection like the crash com parisons, for example, that gladly get shown over and over again, the “nice chart, but what now?” category also includes two seasonality classics: the US presi dential cycle and the summer/winter seasonality (sell in May…) on the US equity market.

The presidential cycle is particularly back on everyone’s lips at the moment in view of the upcoming midterm elections in November. But precisely what this pattern didn’t even remotely foresee was this year’s summer rally, which was one of the strongest of all time, mind you. With a little goodwill, the nadir in late June at least would fit with the historical pattern. The adage “sell in May and go away…” would have spared an in vestor from a few turbulent weeks and an intermittent drawdown of around 10% this year. But whether this will still pay off when the investor returns to the equity market at the end of September (“…but remember to come back in September”) or on Halloween (the Ame rican variant) as the maxim prescribes remains to be seen, because although the summer months are in fact a bit weaker on average than the winter months, on the bottom line they nonetheless historically have deliver ed positive returns. So, whoever wasn’t invested in the summer months gave up some performance.

Viewed over a very long-term time frame, the sum mer/winter seasonality almost completely disappears. The more years that get included in the analysis and seasonality chart, the more the average annual price evolution smooths out. If you examine the performan ce of the S&P 500 index over the last 70 years, what’s left in the end is an almost continually ascending line that almost resembles a straight line. It takes a ma gnifying glass to detect more granular patterns such as a bigger-than-average positive April or a phase of weakness in September/October.

Sources: Bloomberg, Kaiser Partner Privatbank

However, this knowledge has limited practical utility. This becomes obvious when one compares a few ran dom years with a multiyear average, because an indi vidual year can deviate enormously from the average and doesn’t follow a set timetable. So, it is best to use knowledge about historical tendencies in combination with many other “tactical” observations such as chart, sentiment, capital-flow, and other similar analyses –and even then this is more an art than a science that is best left to trading-oriented hobbyists and pros and in stitutional market participants. An investor whose goal

Under the microscope… | …only minimal seasonal tendencies

Monthly performance of S&P 500 index since 1950

is “only” to preserve the value of his or her assets or even to earn a good risk-adjusted return should shun such temptations due to the low prospects of success and should view seasonality and cycle analyses solely as an amusement in the daily financial boulevard press. Continually sticking to a chosen investment strategy the whole year round will reward this investor with a higher return in the long run.

1 2 3 4 5 6 7 8 9 10 11 12

1950s 1.2% -0.5% 1.6% 2.1% 0.6% 0.9% 3.8% -1.4% 0.3% 0.0% 2.5% 2.5%

1960s 0.9% -0.6% 1.0% 1.8% -1.2% -1.9% 0.5% 0.8% -0.4% 1.7% 1.7% 0.6%

1970s 1.2% 0.1% 1.4% -0.1% -1.5% 0.6% -0.3% 0.2% -0.8% -0.5% 0.3% 2.3%

1980s 3.4% 0.6% 0.3% 1.7% 0.8% 1.6% 0.6% 2.5% -1.3% 0.4% 1.8% 0.9%

1990s 1.6% 1.5% 0.8% 1.3% 2.4% 0.6% 1.3% -2.2% 0.8% 1.8% 2.3% 2.9%

2000s -1.7% -2.9% 1.4% 2.3% 1.3% -1.5% -0.5% 0.9% -2.4% 0.1% 0.9% 0.6%

2010s 1.2% 2.3% 1.7% 1.2% -1.2% 0.3% 2.2% -1.3% 0.7% 2.3% 1.6% 0.5%

since 1950 1.0% 0.0% 1.1% 1.5% 0.2% 0.0% 1.3% 0.1% -0.5% 0.9% 1.7% 1.5%

Sources:

The more years… | …the more average Seasonality of the S&P 500 index over different time periods

Random walk | Individual years do not follow a pattern Annual evolution of S&P 500 index from 2015 through 2019

Sources: Bloomberg, Kaiser Partner Privatbank

Sources: Bloomberg, Kaiser Partner Privatbank

The dividing line between proponents and critics of ESG in the USA is increasingly the same one running between Democrats and Republicans. However, resolutions by some “red” states to bar their pension funds from taking climate risks into account in their investment processes are doubly detrimental because they harm both returns and our environment. Meanwhile, Wall Street is exploiting the political polarization in its own special way.

The US midterm elections will soon enter the home stretch. Their outcome could turn out tigh ter than long suspected because voter sentiment in the United States remains very polarized. This is exemplarily evidenced not least by the recent episode centered around former US President Do nald Trump and his taking of top-secret documents with him when he vacated the White House. In the slugfest between “blue” (Democratic) and “red” (Republican) politicians and their tussling for he gemony over public opinion, the color “green” has also increasingly come into play lately because ob servations in recent weeks have revealed that the dividing line between proponents and critics of the sustainability (ESG) investment style is increasingly the same one running between Democrats and Re publicans. Two “red” US southern states specifical ly made headlines in this context in August.

Florida Governor Ron DeSantis passed a resolution ordering the state’s pension funds to invest public money in a manner that exclusively prioritizes earning the highest return on investment for Florida’s taxpay ers and retirees without taking the “ideological agen da” of the (ESG) movement into consideration. The

Nothing more than a marketing gag | Only an expensively acquired underperformance thus far MAGA, VICE and BAD vs. SPY (S&P 500 ETF)

resolution explicitly directs state pension funds to no longer factor environmental, social and governance issues and corresponding ESG risks into their invest ment decisions. That State of Texas, in turn, published a list of ten publicly traded financial institutions that (allegedly) “boycott” fossil fuels. It’s a stigmatizati on that could force Texan pension funds to sell their shareholdings in the cited companies (in accordance with a state law passed in 2021). Alongside nine as set managers located in Europe, the list included only one US-based institution, but a gigantic one: Black Rock, the world’s largest asset manager, with more than USD 10 trillion of assets under management. BlackRock quickly responded with a written defense that denounced the politicization of state pension funds. It’s a valid criticism considering that BlackRock, among other things, is the second-largest sharehol der in Texas-based oil giant ExxonMobil and has in vested a total of over USD 100 billion in Texan energy companies. Rivals of BlackRock such as asset manager Invesco and the banks JPMorgan and Goldman Sachs, which likewise have been declared “hostile” to the oil and gas industry by the State of Texas, did not turn up on the final red list. The ten institutions on the list now have time until the end of November to convince the State of Texas to change its mind.

Partner Privatbank

"Explicitly requiring asset managers to intentionally disregard climate risks harms returns on investment in all probability (and thus hurts investors) and definitely harms our climate in any case."

It is understandable that not just investors, but also politicians call ESG principles into question and/or reject some of them because establishing a univer sally valid and (internationally) binding framework continues to be a work in progress. And a frequent strength of the political structure in the USA is that it allows local policy experimentation to take place. But (Republican) politicians ought not ban ESG concepts, but instead could just simply ignore them. In any event, explicitly requiring asset managers to intentio nally disregard climate risks harms returns on invest ment in all probability (and thus hurts investors) and definitely harms our climate in any case.

The (US) financial industry wouldn’t be the (US) fi nancial industry if it didn’t cash in on the stark po litical polarization of the country. Some providers of exchange-traded equity funds (ETFs) have discovered an untapped market niche precisely here. They have created products that deliberately go against the ESG mainstream and thus are likely to tend to appeal to conservative (voter) groups (but not necessarily to

conservative investors). ETFs with tickers like VICE or MAGA (Make America Great Again) make it evi dent straightway in which industries or in accor dance with which political coloration their mana ged assets get invested. Even a God Bless America ETF (YALL) is slated to be launched soon. But the one that really takes it to extremes is the BAD ETF, which invests exclusively in gambling, alcohol, drugs and other so-called “sin” sectors. The ima ginative ingenuity and business acumen of the ETF sponsors appear to know no limits thus far, but that could change in the future if some recent proposals put forth by the US Securities and Exch ange Commission get put into practice. ETF pro viders would then have to prove that at least 80% of the portfolio assets packaged in their exchan ge-traded funds are aligned with their ETFs’ res pective names. In other words, they would have to prove that an ETF’s contents match its label. This would likely make substantial portfolio res huffling necessary for some of the ETFs cited abo ve and would inevitably cause headaches for the product managers of VICE, MAGA, YALL and BAD because it might be difficult for them to furnish the required proof. Most investors, however, are unlikely to care much about this sideshow anyway because judging by their puny fund sizes, the pro ducts cited above haven’t progressed beyond a marketing-gag stage thus far.

CHF

1 Month 1 Year 3 Years

0.0% -0.5% -1.9%

EUR 0.0% -0.4% -1.3%

USD 0.2% 1.0% 2.4%

Sovereign bonds -2.9% -10.6% -9.4%

Corporate bonds -3.6% -18.0% -9.5%

Microfinance 0.3% 2.1% 7.6%

Inflation-linked bonds -4.0% -10.4% -1.1%

High-yield bonds -3.4% -10.6% 0.2%

Emerging-market bonds -1.3% -21.3% -15.1%

Insurance-linked bonds 0.9% 3.3% 15.3%

Convertible bonds 0.1% -19.4% 25.9%

Global -3.5% -11.3% 32.1% Switzerland -3.1% -12.0% 12.7%

Europa -5.0% -15.4% 9.2%

UK -1.3% 9.2% 13.5%

USA -4.0% -13.5% 39.8%

Emerging markets

Alternative assets

0.0% -24.0% 1.0%

Commodities -0.2% 26.7% 58.0%

Gold -3.1% -5.7% 12.5%

Real estate Switzerland -1.0% -12.5% 9.6%

Hedge funds 1.2% -3.7% 10.2%

Currencies

EUR/USD -1.6% -14.9% -8.5%

EUR/CHF 1.0% -9.1% -9.7%

GBP/USD -4.5% -15.5% -4.4%

Stubbornly high inflation data sent the US stock market tumbling in September. The October inflation stati stics also look set to be a market mover. Price increases in the USA actually should cool down in the months ahead, but there have been heaps of surprises to the upside lately.

The upcoming National Congress of the Communist Party of China will once again see a lot of new personnel get appointed to many key political positions. Meanwhile, President Xi Jinping will remain in office contrary to the existing rules and will likely continue to put his personal stamp on China’s domestic and foreign policies over the next five years.

Whoever enjoys rigatoni, capellini and pappardelle will love this day of celebration. World Pasta Day gives lovers of carbohydrates a special reason to fill their plates. This delicious day has been in existence since 1995, the year that 40 pasta manufacturers convened for the inaugural World Pasta Congress.

This document constitutes neither a financial analysis nor an advertisement. It is intended solely for informational purposes. None of the information contained herein constitutes a solicitation or recommendation by Kaiser Partner Privatbank AG to purchase or sell a financial instrument or to take any other actions regarding any financial instruments. Furthermore, the information contained herein does not constitute investment advice. Any references in this document to past performance are no guarantee of a positive future performance. Kaiser Partner Privatbank AG assumes no liability for the completeness, correctness or currentness of the information contained herein or for any losses or damages arising from any actions taken on the basis of the information in this document. All contents of this document are protected by intellectual property law, particularly by copyright law. The reprinting or reproduction of all or any parts of this document in any way or form for public or commercial purposes is expressly prohibited unless prior written consent has been explicitly granted by Kaiser Partner Privatbank AG.

Publisher:

Kaiser Partner Privatbank AG Herrengasse 23, Postfach 725 FL-9490 Vaduz, Liechtenstein HR-Nr. FL-0001.018.213-7

T: +423 237 80 00, F: +423 237 80 01 E: bank@kaiserpartner.com

Editorial Team: Oliver Hackel, Senior Investment Strategist Roman Pfranger, Head Private Banking & Investment Solutions

Design & Print: 21iLAB AG, Vaduz, Liechtenstein