Introduction

Powered by Jungle Scout Cobalt data, this report offers an analysis of advertising spend and return on ad spend (RoAS) within Amazon’s Automotive category. Find out which bidding and targeting strategies are driving the most growth so you can make data-driven optimizations to your own campaigns.

Key takeaways

Aligning ad type with product price drives results.

In the Automotive category, Sponsored Products deliver 50% higher RoAS for items priced over $200, while Sponsored Display tends to perform better for lower-priced products. Brands should adjust ad strategies to match product pricing for maximum returns.

Rule-based bidding carries more volatility.

Rule-based bidding strategies showed the largest fluctuations in RoAS, with returns dropping by 21% from Q2 to Q3. Brands relying on this strategy may need to monitor performance closely to avoid dips in profitability.

Dynamic bids offer stable performance.

Dynamic bids (down only) consistently outperform other bidding strategies, offering higher RoAS with less than 2% fluctuation between Q2 and Q3. This makes them a reliable choice for brands aiming for stable and predictable returns.

Advertising Spend

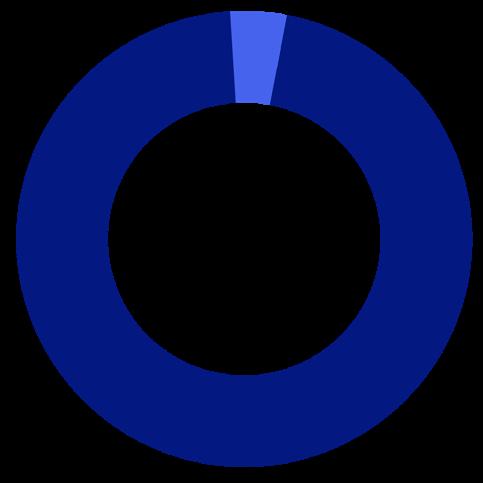

Share of Advertising Spend by Product Price

While Automotive brands spent more than $100 million on Amazon advertising in the first half of 2024, Jungle Scout Cobalt data shows that this is a nearly 40% drop in spend year-over-year.

From Q1 to Q2 2024, ad spend grew by nearly 30%.

Analysis of a selection of Sponsored Display and Sponsored Products campaigns shows that Sponsored Products account for a majority of ad spend, underscoring their value in driving product discoverability.

Ad spend distribution reflects the category’s higher price points, with more than a quarter (28%) of PPC ad spend focused on items over $200.

Return on Ad Spend (RoAS)

RoAS grew by nearly 30% from Q1 to Q2, but RoAS during both quarters was lower than the year-ago quarter.

Additional insights from Jungle Scout provide clarity on how RoAS fluctuates by ad type and product price within the Automotive category. These trends can help you benchmark the success of your campaigns and guide decisions about new optimizations.

• Sponsored Products and Sponsored Display are delivering similar returns, with average 14-day RoAS for Sponsored Products just 4% higher.

• RoAS was at its highest for both ad types in Q2. From Q2 to Q3, average RoAS fell by 10% for Sponsored Display and 28% for Sponsored Products.

• Sponsored Products deliver 50% higher RoAS for items priced over $200, while Sponsored Display delivers greater returns for lowerpriced products.

Sponsored Products Spotlight: Bidding and Targeting

A closer look into a subset of Sponsored Products campaigns shows how targeting type and bidding strategy can impact RoAS.

RoAs by Targeting Type

Automatic targeting in Sponsored Products campaigns yields approximately 8% higher RoAS than manual targeting. This suggests that automatically adjusting campaigns based on real-time data captures more relevant traffic and optimizes performance better than manual strategies in this category.

RoAs by Bidding Strategy

• Dynamic bids (down only) outperform other strategies, offering higher RoAS with greater stability. Brands using this approach saw returns fluctuate by less than 2% between Q2 and Q3, making it a dependable option for consistent performance without the volatility of other bidding strategies.

• Rule-based bidding strategies led to the most quarter-over-quarter fluctuation in RoAS, with returns dropping 21% from Q2 to Q3 and 17% from Q1 to Q2.

Expert Advice: Advertising Optimization for Automitive Brands

Leverage automatic targeting for popular items.

Automatic campaigns generate higher RoAS than manual ones, making them an effective choice for brands selling widely searched or fast-moving products in the Automotive category. Using this method, brands can optimize traffic acquisition without investing heavy resources in manual keyword selection.

Capitalize on mid-priced product campaigns.

Products priced between $50 and $200 see strong RoAS, making this price range a sweet spot for advertising spend. Brands in this range should capitalize by scaling up campaigns and maximizing spend during key promotional events.

“Dynamic bidding is proving to deliver stronger RoAS for products priced over $200 in this category. For brands selling high-ticket items – like specialty automotive tools or equipment – this strategy can help optimize ad spend and drive more valuable sales.”

Use automatic campaign data to refine manual campaigns.

Use Cobalt’s dashboards to visualize performance and SOV data from automatic campaigns, helping you pinpoint high-performing keywords for manual targeting. Then, enhance your strategy with Cobalt’s ad automations, adjusting bids based on metrics, time of day, and other factors to keep your campaigns efficient and competitive.

EVA HART

Brand Owner, Couple’s Coffee, Fantaswick, and Fox & Farrow

Jungle Scout: Leading Amazon Market Intelligence Tools

Over the past decade, Jungle Scout has gathered a wealth of data points through continuous monitoring and analysis of Amazon. The tools used to build this report are the same ones that 1 million+ sellers, enterprise brands, retailers, and agencies use daily to make confident decisions and develop effective strategies on Amazon. Get a personalized demo to see how our tools can help your business grow.

FOR ESTABLISHED SELLERS AND BRAND OWNERS

FOR BRANDS, RETAILERS, AND AGENCIES

FOR BIG BOX RETAILERS AND INVESTORS

Jungle Scout's Competitive Intelligence helps sellers and brand owners identify and outperform key competitors on Amazon, ensuring that every minute and dollar invested in their business is focused on effectively increasing sales. From competitor analysis to targeted keyword insights, this tool ensures that sellers can confidently:

• Benchmark their position in the market

• Gain insights into competitors' market share and strategies

• Successfully launch and enhance products

Optimize advertising campaigns and listings

• Gauge broad category and subcategory trends

Get Started with Competitive Intelligence COMPETITIVE INTELLIGENCE

Jungle Scout Cobalt empowers brands and retailers with a powerful suite of ecommerce tools designed to drive growth on Amazon. Comprehensive data analytics, built-in advertising automation, and intuitive visualizations turn insights into action. Cobalt is trusted by brands and retailers worldwide to:

• Track and grow market share

• Gauge market trends and competitor performance

• Analyze performance data

Optimize ad campaigns

• Measure share of voice and discover keyword trend

Book a demo

Jungle Scout Data Cloud offers scalability and flexibility by providing retailers a way to get Jungle Scout’s industry-leading data, with the ability to analyze and visualize that data using the tools of their choice. It provides a comprehensive view of Amazon market dynamics by allowing retailers to:

• Access millions of data points

• Extract insights using tools like Snowflake, Azure, and others

• Analyze trends in consumer demand

Investigate third-party sellers

• Create custom visualizations with PowerBI, Tableau, and similar tools

Try Data Cloud with

Snowflake

G2 awards

“Cobalt provides me full visibility of how our business performs on the Amazon marketplace against our competition, providing the knowledge needed to execute our strategy and meet company KPIs. It is the main tool I use for market analysis and research.”

Laura Taylor National Account Coordinator, Wahl

“Cobalt is an essential part of our day, we use Cobalt data across multiple departments in our business. We are very impressed with the support team. Every question we have is answered promptly, and every training session is customized to suit our needs. I cannot praise them enough.”

Nick Swartenbroux Ecommerce Trading Manager, Nuby

“Cobalt data has been fantastic for when we need to provide answers to internal stakeholders about competitors, entering a new market, or when our executive team is going through an acquisition. It gives us the exact size of the market on Amazon and ASIN-level details that we need for forecasting.”

Elliot Frey

National Account Manager - Amazon, Rawlings Sporting Goods

About this report

Analysis and findings included in this report are based on Amazon advertising data for Q1 - Q3 2024 from Jungle Scout Cobalt. Data represents the U.S. marketplace and includes 500+ distinct brands and 11,000+ unique advertising campaigns from large ecommerce enterprises. Trends reflect data for PPC campaigns within the Automotive category only.

We encourage you to share, reference, and publish this report’s findings with attribution to “Jungle Scout Cobalt” and a link to this page.

For requests or media assets, contact press@junglescout.com.

Get more data on Amazon Keyword & Market Trends

Amazon Advertising Report

See how brands and sellers are advertising across all of Amazon’s product categories in 2024, and which strategies result in the greatest RoAS.

Seasonal Amazon Advertising Trends

Dive deeper into advertising trends –including campaign spend, consumer engagement, and RoAS – around key events like Prime Day, Black Friday, and more.

Advanced Amazon Advertising Strategies

Learn about new and emerging advertising strategies for high-growth brand in this virtual panel featuring leaders from across the ecommerce industry.