Patio, Lawn, & Garden: Container Gardening Market Spotlight

With the spring gardening season fully underway, data from Jungle Scout Cobalt reveals a corresponding surge in demand for patio and outdoor garden containers, planters, and raised beds. In this report, we’ll dive into the trends, insights, and competitive dynamics shaping this niche segment of Amazon’s broader Patio, Lawn, and Garden category. Read on to see current market share leaders, top products, and the keyword search trends that illustrate opportunities for brands and retailers looking to navigate this specialized market.

90-Day Market Trends

to learn

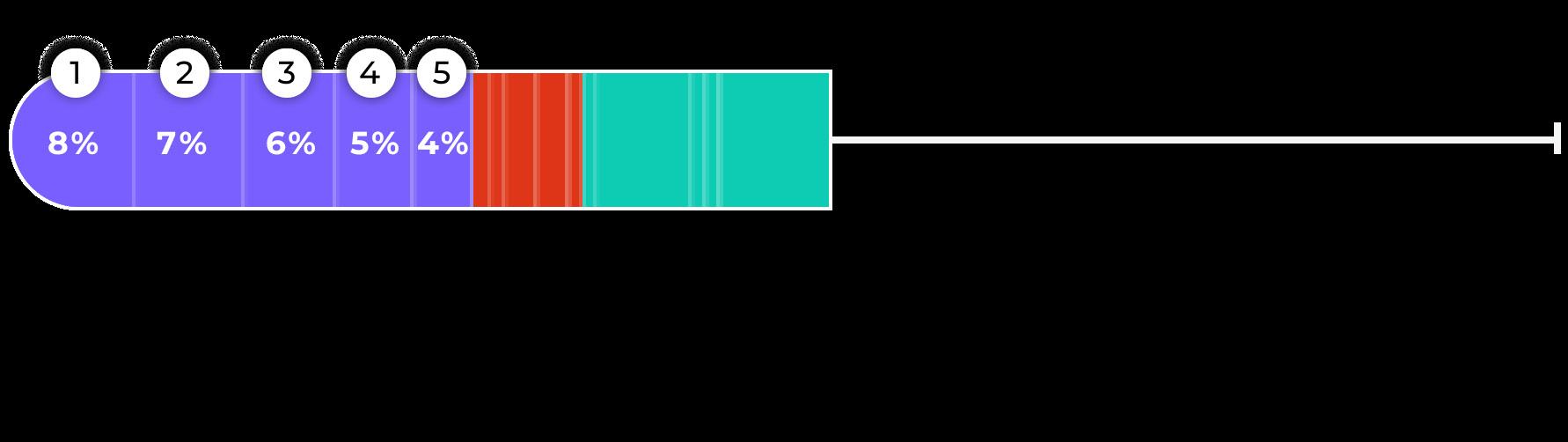

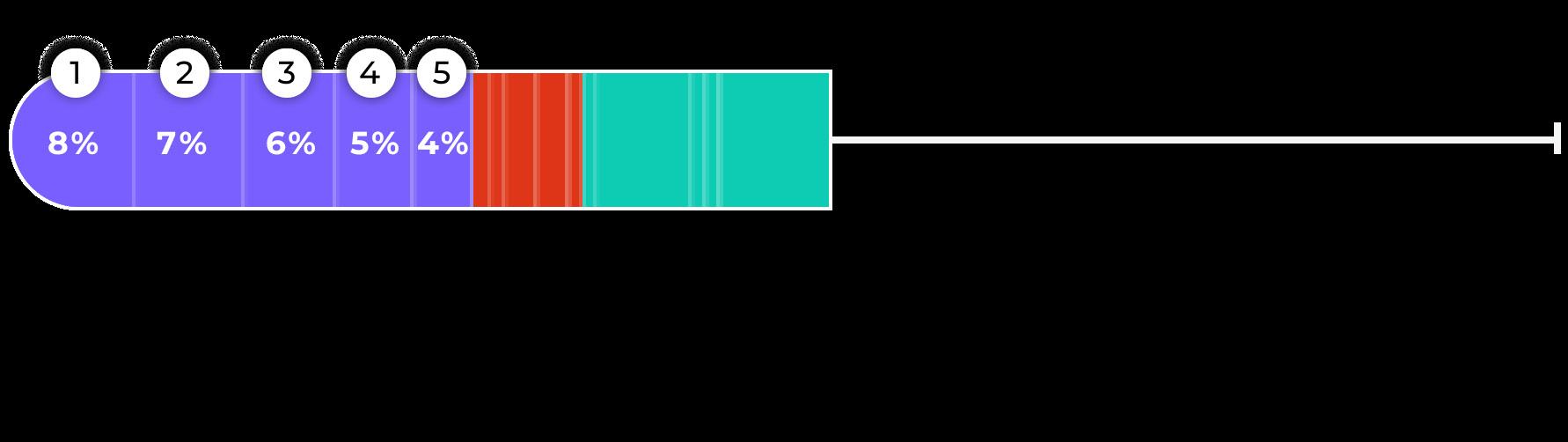

Competitive Landscape Revenue First-party (1P) vs third-party (3P) sellers Sales Top five products by revenue Land Guard 8×4×1 ft Galvanized Raised Garden Bed Kit Best Choice Products 34x18x30in Raised Garden Bed Veradek V-Resin Indoor/ Outdoor Taper Planter Kante 18 Inch Dia Round Concrete Planter Vego Garden Raised Garden Bed Kits Competing brands Revenue Competing products Median price Reviews ↑ 33% 848 ↑ 8% YoY ↑ 81% 4,776 ↑ 15% YoY ↑ 1% ↑ 2% 6-Month Product Trends 1P 1P 3P 3P 15% ↓ 2% YoY 85% ↑ 4% YoY Revenue ↑ 100% Revenue ↓ 15% Revenue ↓ 33% Revenue ↑ 41% Revenue ↑ 165%

demo

Want

how Cobalt can help you gather market intelligence like this for any Amazon category? Schedule a demo here. Book a

Market Share Dynamics

Top five brands by market share

2 Amazon Data Download: Iconic Brands on Amazon

Market share movers Largest YoY market share growth Largest YoY market share decline

Quarut The HC Companies Vego Garden Oouz Land Guard Mueller Classic Home & Garden La Jolie Muse Costa Farms Quictent 1% market share ↑ 226% YoY 6% market share ↑ 178% YoY 1% market share ↑ 126% YoY 1% market share ↑ 87% YoY 7% market share ↑ 83% YoY 1% market share ↓ 87% YoY 1% market share ↓ 25% YoY 2% market share ↓ 24% YoY 2% market share ↓ 21% YoY 1% market share ↓ 21% YoY YoY revenue trend YoY revenue trend YoY revenue trend YoY revenue trend YoY revenue trend YoY unit sales trend YoY unit sales trend YoY unit sales trend YoY unit sales trend YoY unit sales trend Median price Median price Median price Median price Median price ↑ 31% YoY ↑ 162% YoY ↑ 22% YoY ↑ 72% YoY ↑ 73% YoY ↑ 50% YoY ↑ 58% YoY ↑ 22% YoY ↑ 71% YoY ↑ 73% YoY $77.49 $104.99 $20.14 $102.33 $89.99 1 2 3 4 5

Market share leaders

Keyword Trends

Top generic search terms by volume | Past 30 days

Keyword

Planters

Garden Planters

Gardening

Planter

Planter

Garden

Flower

Top generic search terms by growth trend | Past 30 days

to rank represents how easy it is for a new product to rank for the specified keyword

Data reflects the top 10 broad match keywords related to the term “garden containers”

*Note: Ease

Note:

Raised garden bed

for outdoor plants

outdoor

Raised garden beds

boxes outdoor

Strawberry planter

bed

pots outdoor

clearance

bed garden planters Planters boxes outdoor Raised garden bed clearance

raised garden bed

garden bed

planters for patio

raised garden bed

for plants outdoor Self watering planters for outdoor plants Cedar planter boxes outdoor raised Search trend +413% +333% +281% +272% +200% +175% +157% +150% +141% +139% Search volume 778,239 491,236 419, 136 369,393 286,349 231,725 173,181 142,161 142,029 130,943 107,013 Search volume 18,621 5,037 60,977 58,131 1,668 4,668 10,478 4,321 6,423 3,386 Ease to rank* Very difficult Easy Easy Very difficult Somewhat difficult Difficult Easy Very difficult Somewhat difficult Very difficult Easy Ease to rank* Easy Easy Easy Easy Easy Easy Easy Easy Easy Easy

Search trend +25% +50% +15% +29% +30% +22% +111% +23% +25% -19% +58%

Keyword Raised

Clearance

Tin

Tomato

Deep

Pot

Product Trends

Share of voice (SOV) leaders

Keyword: Raised garden bed

Keyword: Planters for outdoor plants

Keyword: Planters

Top Brands Top Brands Top Brands Top Products Top Products Top Products Top brands and products by share of voice* Best Choice Products Best Choice Products Utopia Home Land Guard Mueller Land Guard Rakukiri Garden Elements La Jolie Muse 42% SOV 26% SOV 24% SOV 19% SOV 18% SOV 20% SOV 11% SOV 15% SOV 14% SOV

Land Guard Galvanized Raised Garden Bed Kit, Oval

Land Guard Galvanized Raised Garden Bed Kit, Oval

Best

The

Utopia

7/6.6/6/5.3/4.8

Land Guard Galvanized Raised Garden Bed Kit, Oval

Choice Products 48x24x30in Raised Garden Bed

HC Companies 8 Inch Caribbean Planter

Home - Plant Pots with Drainage -

Inches Best Choice Products 6x3x2ft Outdoor Metal Raised Garden Bed

Veradek V-Resin Indoor/ Outdoor Taper Planter

*Data reflects weighted SOV; products with an Amazon Choice Badge and higher position on page receive more share of voice

Veradek V-Resin Indoor/ Outdoor Taper Planter

Product Trends

Share of voice (SOV) leaders

Top brands and products by share of voice*

Pots for plants outdoor

Keyword:

Keyword: Window boxes

Keyword:

Keyword: Window boxes

Top

Top

Top

Top

Top

Top

Lucnc Hananojia Pure Garden Classic Home

Garden The HC Companies Worth 59% SOV 37% SOV 24% SOV 11% SOV 19% SOV 21% SOV 10% SOV 13% SOV 18% SOV

Keyword: Patio pots

Brands

Brands

Brands

Products

Products

Products The HC Companies Mayne La

Jolie Muse

and

Quarut 3 Pack 10 inch Plant Pots, Whiskey Barrel Planters with Drainage Holes

Mayne Fairfield 3ft Window Box

Pure Garden Planters Box - 14.75in Lattice Flower Box Plant Pot

The HC Companies 14 Inch Round Classic Planter, Sandstone 8pcs Window Box Planter, 17 Inches Flower Window Boxes

Classic Home and Garden Honeysuckle Resin Flower Pot Planter

The HC Companies 8 Inch Caribbean Planter, Dusty Teal

CobraCo 36-Inch English Horse Trough Planter

9/8/7 Inch Set of 3 Flower Pots Indoor Outdoor Plastic Planters *Data reflects weighted SOV; products with an Amazon Choice Badge and higher position on page receive more share of voice

Vanavazon Plant Pots

Key Takeaways

Market share

Established brands like Best Choice Products, Land Guard, and The HC Companies hold top positions, and have seen significant growth in both unit sales and revenue, indicating successful market penetration strategies. Still, emerging competitors — such as Rakukiri and Quarut — have made notable strides in market share growth over the past year, suggesting room for new players looking to enter or expand their footprint.

Product differentiation

Keyword search trends for this segment suggest brands with unique product offerings or value propositions may be able to gain market share despite strong competition from established players. Containers with unique attributes, labeled for specific purposes (for example, “self-watering” or those designed for strawberries or tomatoes), or made of specific materials (for example, tin or cedar) have seen an increased level of interest from consumers. Deploying a strategy that understands and caters to these trends can help brands and retailers differentiate themselves.

Seasonality

Brands in this segment experience a surge in demand in the spring and summer months, with early spikes seen in products like raised beds as consumers begin their growing season. In the summer, products like planters, window boxes, and hanging baskets are particularly popular as consumers seek to add color and vibrancy to their gardens and patios.

Pricing

Pricing has a nuanced impact on sales and revenue trends within the segment. A relatively small decline in overall median price for the segment (down 4% YoY) may reflect changes in consumer preferences or competitive pricing strategies among brands. Brands that offer competitive pricing relative to market norms may experience increased sales and revenue, while those with higher-priced products may face challenges attracting price-sensitive consumers.

Jungle Scout: Leading Amazon Market Intelligence Tools

Over the past decade, Jungle Scout has gathered a wealth of data points through continuous monitoring and analysis of Amazon. The tools used to build this report are the same ones that 1 million+ sellers, enterprise brands, retailers, and agencies use daily to make confident decisions and develop effective strategies on Amazon. See how our tools can help your business grow with a trial or demo.

Jungle Scout Cobalt Jungle Scout Data Cloud

Jungle Scout Cobalt empowers brands and retailers with a powerful suite of ecommerce tools designed to drive growth on Amazon. Comprehensive data analytics, built-in advertising automation, and intuitive visualizations turn insights into action. Cobalt is trusted by brands and retailers worldwide to:

• Track and grow market share

• Analyze performance data

• Gauge market trends and competitor performance

• Optimize ad campaigns

• Gauge share of voice and discover keyword trends

• Investigate third-party sellers FOR BIG BOX RETAILERS AND INVESTORS FOR BRANDS, RETAILERS, AND AGENCIES

Book a demo

Jungle Scout Data Cloud offers scalability and flexibility by providing retailers a way to get Jungle Scout’s industry-leading data, with the ability to analyze and visualize that data using the tools of their choice. It provides a comprehensive view of Amazon market dynamics by allowing retailers to:

• Access millions of data points

• Extract insights using tools like Snowflake, Azure, and others

• Create custom visualizations with PowerBI, Tableau, and similar tools

• Analyze trends in consumer demand

Try Data Cloud with Snowflake

G2 awards

“Cobalt data has been fantastic for when we need to provide answers to internal stakeholders about competitors, entering a new market, or when our executive team is going through an acquisition. It gives us the exact size of the market on Amazon and ASIN-level details that we need for forecasting.”

Elliot Frey National Account Manager - Amazon, Rawlings Sporting Goods

“Cobalt is a unique, innovative tool that we use regularly to improve our business processes on Amazon. With the ability to quickly identify specific high-performing products and categories and growth opportunities, we’ve experienced great success with Cobalt.”

Seth Troyer Ecommerce Manager, Weaver Leather

“Cobalt is a valuable tool for any Amazon brand or vendor. I have been satisfied with the many features that support organic and paid research and actionable insights. We have achieved a boost in relevancy and conversion rates and a 5% share of voice growth since implementing Cobalt.”

Marie Lawson Retail Media Manager, HP

8 Amazon Data Download: Iconic Brands on Amazon

About This Report

Data represents the U.S. market and reflects estimates based on a sampling of approximately 10,000 products in the specified niche. Year-over-year trends reflect May 4, 2023 - May 4, 2024, compared to May 4, 2022 - May 4, 2023. Six-month trends reflect Oct. 4, 2023 - May 4, 2024, compared to Oct. 4, 2022 - May 4, 2023.

We encourage you to share, reference, and publish this report’s findings with attribution to “Jungle Scout Cobalt” and a link to this page.

For requests or media assets, contact press@junglescout.com

Keyword:

Keyword: Window boxes

Keyword:

Keyword: Window boxes