Baby Product Trends: Nursery Necessities

Explore Jungle Scout Cobalt data that shows which nursery products are most popular within Amazon’s Baby category, what shoppers are searching for most, and which brands are leading in rankings and market share.

Market Trends: Year-over-Year

Landscape

view of “nursery” products within Amazon’s Baby category includes baby monitors, glider chairs, rocking chairs, ottomans,

nests,

changing

dressing furniture, nursery storage products, clocks, lamps, mobiles, night lights, picture frames, wall decor, rugs, pillows, window treatments, and miscellaneous nursery decor items.

This

cribs, bassinets, cradles, baby

nursery

and

Competitive

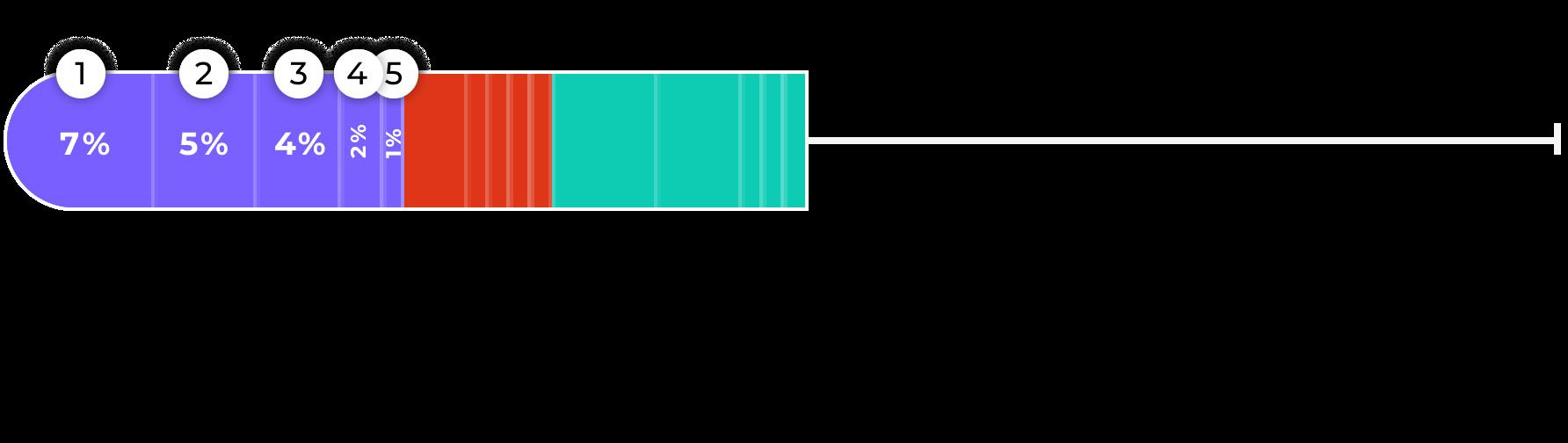

Revenue First-party (1P) vs third-party (3P) sellers Sales Top five products by unit sales: past 90 days Nicetown Thermal Blackout Curtains KeaBabies Toddler Pillow with Pillowcase Lilly’s Love Stuffed Animal Storage Hammocks Indressme XXXL Cotton Rope Basket Bernhard Products Silent Wall Clock Competing brands Revenue Competing products Median price Reviews ↑ 2% 3K ↑ 3% YoY ↓3% 19K ↑ 3% YoY ↓5% ↑ 18% Best-Selling Products 1P 1P 3P 3P 14% ↓ 10% YoY 86% ↓ 1% YoY Sales ↑ 143% Sales ↑ 159% Sales ↓ 19% Sales ↑ 13% Sales ↑ 7%

Market Share Dynamics

Market trends data in this report was gathered using Cobalt’s Market Intelligence feature, which brands use to track market share, research competitor performance, benchmark performance, and more on Amazon.

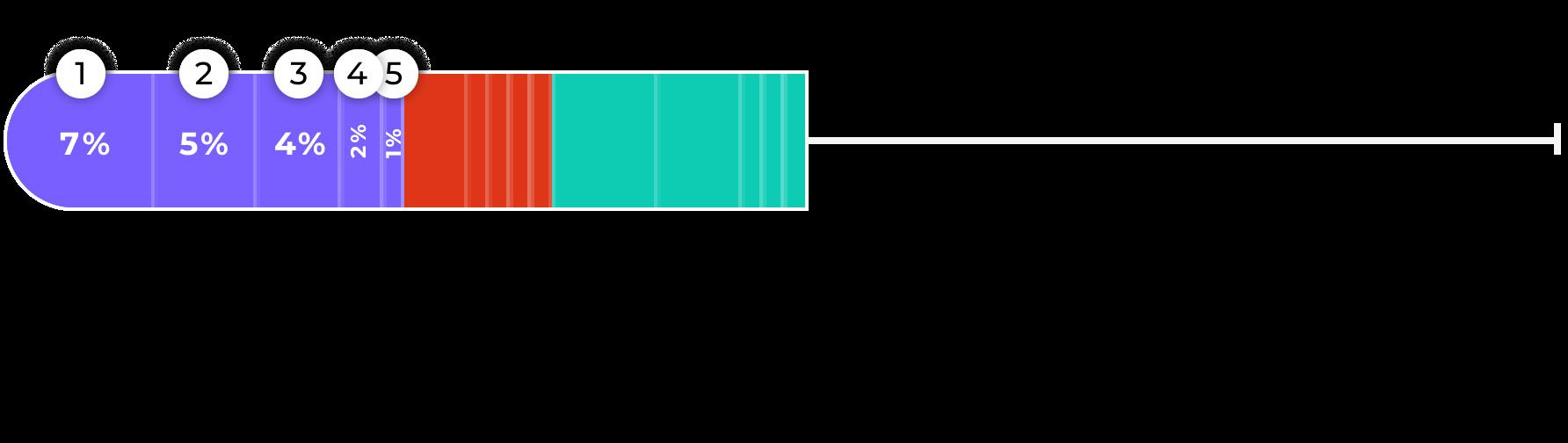

Market share leaders

Top five brands by market share

Note: Market share trends reflect each brand’s market share within

2 Amazon Market Watch

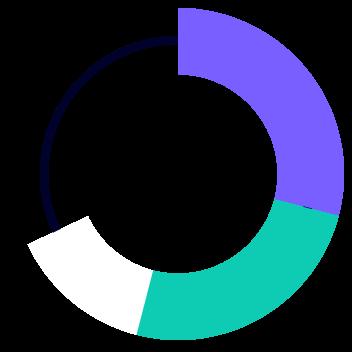

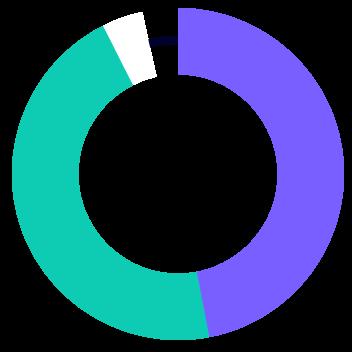

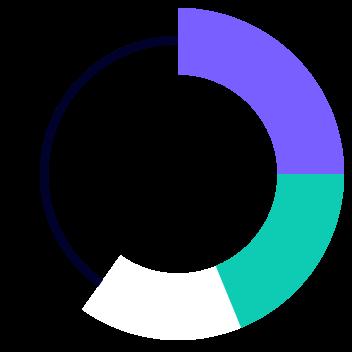

Market share movers Largest YoY market share growth Largest YoY market share decline

Boon Baby Care

Safavieh

Pagisofe Amdrebio 5% market share ↑ 2% YoY 4% market share ↑ 1% YoY 1% market share ↑ 1% YoY 1% market share ↑ 1% YoY 1% market share ↑ 1% YoY 3% market share ↓ 6% YoY <1% market share ↓ 1% YoY 1% market share ↓ 1% YoY <1% market share ↓ 1% YoY <1% market share ↓ 1% YoY YoY revenue trend YoY revenue trend YoY revenue trend YoY revenue trend YoY revenue trend YoY unit sales trend YoY unit sales trend YoY unit sales trend YoY unit sales trend YoY unit sales trend Average price Average price Average price Average price Average price ↑ 22% YoY ↑ 58% YoY ↓ 71% YoY ↑ 21% YoY ↑ 55% YoY ↑ 43% YoY ↑ 59% YoY ↓ 69% YoY ↑ 27% YoY ↑ 55% YoY $193.93 ↓ 6% YoY $25.18 ↑ 5% YoY $25.43 ↓ 1% YoY $27.32 ↓ 2% YoY $23.51 ↓ 10% YoY 1 2 3 4 5

Storkcraft KeaBabies OIAHOMY

Nicetown

DaVinci

→ COBALT IN ACTION

products

only.

the nursery

niche

Keyword Trends

Most-searched keywords | Past 30 days

Keyword

Nursery

Newborn

Nursery

Baby

Baby

Baby

Baby

Diaper

Baby

The keyword and share of voice data shown here comes from Cobalt’s Digital Shelf Analytics feature, which provides brands with a detailed picture of how consumers search on Amazon and how competitors rank for important keywords.

Search terms with growing popularity | Past 30 days

Keyword Baby

Baby

Baby

Woven

Data

reflects keywords related to the term “nursery” within the Baby category. Competition represents the level of competition for the keyword based on factors such as the number of sellers and product listings competing for visibility.

reflects keywords related to the term “nursery” within the Baby category. Competition represents the level of competition for the keyword based on factors such as the number of sellers and product listings competing for visibility. Ranked by total search volume Ranked by 30-day search growth trend

Data

must haves

decor

nursery

organizer

storage

decor

organizer

room

nursery

Girl

furniture sets for nursery

nursery decor for boys

clothing dividers

Woodland

Baby

nursery furniture set

stuff organizer

diaper caddy with dividers

baby

Size dividers

clothes

nursery must haves Egg light for nursery Search trend +62% +58% +48% +44% +41% +41% +40% +38% +36% +34% Search volume 923,206 417,183 326,999 194,507 191,715 160,342 153,062 146,580 94,476 76,692 Search volume 1,952 1,690 2,907 1,026 540 540 540 1,050 14,160 7,399 Competition* Low Low Low Low Low Low Low Low Low Moderate

Baby nursery storage Baby

Search trend -2% -2% +4% +1% -1% -4% -3% -5% +1% +8% Competition* Very High Low High Moderate Low Low Low Moderate Low Low

→ COBALT IN ACTION

Product Trends

Share of voice (SOV) leaders

Top brands and products by share of voice*

Brands and retailers use Cobalt’s Ad Accelerator feature to optimize their Amazon advertising campaigns with advanced targeting and automation that enables them to put keywords and share of voice insights into action.

Keyword: Nursery decor

Top brands

Keyword: Baby nursery must haves

brands

Keyword: Baby organizer

brands Top ranking products

ranking products

Top

Top

Top

Top

ranking products

Kibaga

Pampers

Mr. Pen

Vasagle

Univivi

Dr. Talbot’s Veronly 29% SOV 26% SOV 26% SOV 25% SOV 18% SOV 21% SOV 14% SOV 15% SOV 19% SOV

Munchkin

Zicoto

Mirolam Stuffed Animal Storage Net

Univivi Hanging Nursery Organizer

Volnamal Baby Diaper Caddy

Zicoto Floating Shelves Set

Munchkin Diaper Change Organizer

Mr. Pen Baby Diaper Caddy Organizer

Klogtsind Magnetic Curtain Tiebacks

Bagail Velvet Infant/Toddler Clothes Hangers

higher

on page

more share of voice.

Munchkin Diaper Change Organizer

*Data reflects weighted SOV; products with an Amazon Choice Badge and

position

receive

→ COBALT IN ACTION

Product Trends

Share of voice (SOV) leaders

Top brands and products by share of voice*

Keyword: Baby nursery furniture set

Keyword: Baby clothing dividers

Keyword: Egg light for nursery

Top brands Top brands Top brands Top ranking products Top ranking products Top ranking products

Sorelle Furniture

Pro Goleem

Child Craft 3 Sprouts MediAcous Delta Children Kibaga Anico 47% SOV 25% SOV 45% SOV 46% SOV 19% SOV 20% SOV 4% SOV 16% SOV 11% SOV

Jolywell

Sorelle Furniture Palisades Nursery Set

3 Sprouts Baby and Toddler Hanger Closet Dividers

Jolywell Portable Egg Night Light

Sorelle Furniture 3-Piece Nursery Set

Giftacity Baby Closet Dividers

MediAcous Baby Night Light

Child Craft Scout 3-Piece Nursery Set

Pro Goleem Baby Closet Organizers

*Data reflects weighted SOV; products with an Amazon Choice Badge and higher position on page receive more share of voice.

ZuzuKid Touch Control Baby Night Light

Key Takeaways

Prices are trending down.

Prices are down 5% in this market overall, and four of the top five market share leaders have decreased their prices in the past year. Brands selling in this niche should keep a close eye on pricing trends to ensure they are responding to consumers’ cost expectations without devaluing their products by dropping lower than their lowest-priced competitors.

Keyword research can pay off big in this niche.

While this market boasts high search volume for various terms, the level of competition for those terms varies widely, leaving brands with an opportunity to discover, target, and rank for new keywords. Look for long-tail keywords that highlight a unique feature or theme of your product (e.g., woodland nursery decor or nursery decor for girls).

Product trends: Toy bins and night lights

Among and beyond the best-selling products in this niche, specific trends are emerging. The top five search terms in this market related to organizational bins for nursery items like toys and blankets have garnered more than 15M searches in the last 30 days. Though not as high-volume, searches for night lights are also ramping up: In the last 30 days, all of the top-five branded search terms are for night lights.

Get more data on Amazon’s Baby category:

Amazon Category Snapshot: Toys, Games, and Baby Products

Learn which brands, products, and searches are leading in Amazon’s Toys & Games and Baby categories.

Amazon Data Download: Baby Products

Explore seasonality in Amazon’s Baby category and learn about the biggest factors that influence sales in this market.

5 Best and 5 Worst Categories on Amazon

See where the Baby category ranks in our list of the best and worst categories to sell in on Amazon.

Jungle Scout: Leading Amazon Market Intelligence Tools

Over the past decade, Jungle Scout has gathered a wealth of data points through continuous monitoring and analysis of Amazon. The tools used to build this report are the same ones that 1 million+ sellers, enterprise brands, retailers, and agencies use daily to make confident decisions and develop effective strategies on Amazon. See how our tools can help your business grow with a demo.

Jungle Scout Cobalt Jungle Scout Data Cloud

Jungle Scout Cobalt empowers brands and retailers with a powerful suite of ecommerce tools designed to drive growth on Amazon. Comprehensive data analytics, built-in advertising automation, and intuitive visualizations turn insights into action. Cobalt is trusted by brands and retailers worldwide to:

• Track and grow market share

• Analyze performance data

• Gauge market trends and competitor performance

• Optimize ad campaigns

• Measure share of voice and discover keyword trends

• Investigate third-party sellers FOR BIG BOX RETAILERS AND INVESTORS FOR BRANDS, RETAILERS, AND AGENCIES

Book a demo

Jungle Scout Data Cloud offers scalability and flexibility by providing retailers a way to get Jungle Scout’s industry-leading data, with the ability to analyze and visualize that data using the tools of their choice. It provides a comprehensive view of Amazon market dynamics by allowing retailers to:

• Access millions of data points

• Extract insights using tools like Snowflake, Azure, and others

• Create custom visualizations with PowerBI, Tableau, and similar tools

• Analyze trends in consumer demand

Try Data Cloud with Snowflake

G2 awards

“Cobalt data has been fantastic for when we need to provide answers to internal stakeholders about competitors, entering a new market, or when our executive team is going through an acquisition. It gives us the exact size of the market on Amazon and ASIN-level details that we need for forecasting.”

Elliot Frey National Account Manager - Amazon, Rawlings Sporting Goods

“Cobalt is a unique, innovative tool that we use regularly to improve our business processes on Amazon. With the ability to quickly identify specific high-performing products and categories and growth opportunities, we’ve experienced great success with Cobalt.”

Seth Troyer Ecommerce Manager, Weaver Leather

“Cobalt is a valuable tool for any Amazon brand or vendor. I have been satisfied with the many features that support organic and paid research and actionable insights. We have achieved a boost in relevancy and conversion rates and a 5% share of voice growth since implementing Cobalt.”

Marie Lawson Retail Media Manager, HP

8 Amazon Market Watch

About

This Report

Data represents the U.S. market and reflects estimates based on a sampling of approximately 19,000 products in the specified niche. Year-over-year trends reflect June 8, 2023 - June 6, 2024, compared to June 8, 2022 - June 7, 2023. 90-day trends reflect the period of March 9, 2024 - June 6, 2024, compared to December 9, 2023 - March 8, 2024. 30-day trends reflect the period of May 8, 2024 - June 6, 2024, compared to April 7, 2024 - May 7, 2024.

We encourage you to share, reference, and publish this report’s findings with attribution to “Jungle Scout Cobalt” and a link to this page. For requests or media assets, contact press@junglescout.com.