Javier Raventós

Javier Raventós

Javier Raventós

Javier Raventós

Este libro se terminó de imprimir en Colombia en junio de 2022

Primera Edición

This book has? was? fnished printing in Colombia in June 2022

First edition

CREDITS

AUTHOR / Javier Ignacio Raventós Núñez

EDITORIAL COORDINATOR / Javier Ignacio Raventós Núñez

DESIGN / Beatriz Osuna Patiño

WRITING AND STYLE CORRECTION / Kevin Monzón, Javier Raventós

PRODUCTION DIRECTOR / Germán Izquierdo Orejuela

DIGITAL PRE PRESS / One Services

PRINT / Promograf S.A.S.

EDITORS / José María Raventós – Javier Ignacio Raventós Núñez

STOCK IMAGES / Freepik

Páginas: 10, 13, 17, 19, 20, 22, 24, 26, 35, 43, 53, 60, 187, 191, 193

ISBN / 978-628-95029-1-6

All rights reserved; reproduction prohibited in whole or in part without the express approval of the author.

This book has fnished printing in Colombia in June 2022

First edition

Juan

Juan Diego Osman, CEO Sistepagos

21 TRANSFORMACIÓN DIGITAL, RETOS, OPORTUNIDADES Y DESAFÍOS EN EL SECTOR FINACIERO

Gabriel Alzáte, Senior Consultant in Innovation and Digital Transformation, VP of Innovation at Red5g 23

37 FROM WORDS TO DEEDS: EVOLVING CORRESPONDENT BANKING IN THE SERVICE OF DIGITAL FINANCIAL INCLUSION

Sandra Rubio DaCosta, CEO & Cofounder of Imix

41 HOW TO ATTRACT INVESTORS TO A FINTECH

Camilo Zea, CEO - Pronus

45 MUJERES EN FINTECH

50 LEGAL ASPECTS OF FINTECH INVESTMENT IN COLOMBIA

Alexandra Baquero Neira, Sigma Partner

54 ININVESTORS WITH A FINTECH FOCUS

Silvia Flórez, Endeavor

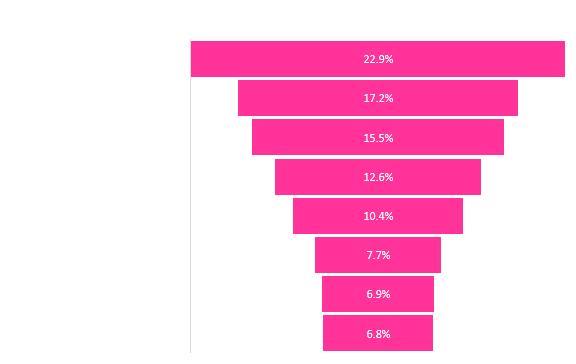

60 FINTECH FIGURES IN COLOMBIA

Colombia Fintech

63 FROM THE TECHNOLOGICAL REVOLUTION TO THE DIGITAL REVOLUTION

Daniel Materón, CEO Rapicredit

27

Mayra Granada, CEO Wiipol

Ana Maria Prieto, Deputy Director, Ministry of Finance, Financial Regulatory Unit

30 BLOCKCHAIN: THE BANKING KILLER

Daniel Navarro, CEO & Founder of Nimmök

33 FINANCIAL INCLUSION IN COLOMBIA

Luis Carlos Ramos, General Manager Fintech in Sured

CONTENT CONTENT | 3 4 PRESENTATION Andrés Albán, CEO and CoFundador Puntored 6 FOREWORD Academic and Innovation Director JMR Comunicaciones 8 CROWDFUNDING IN COLOMBIA Erick Rincón Cárdenas, Associate Professor and Director of Tic-Tank at Universidad del Rosario 12 ATTRACTING FINTECH INVESTMENT Guillermo Guzmán, Director of AsoStartups 14 TOWARDS EFFECTIVE FINANCIAL EDUCATION FROM THE FINTECH MOVEMENT

Camilo

CEO & Founder Figuro 16 FINTECHS UNDER THE VENTURE CAPITAL SPOTLIGHT

& Alliances Colombia, México and Perú

González,

Mike Simmons, Scouting

18 “FINANCIAL INCLUSION”: A PROCESS THAT MUST TRANSCEND A TOPICAL CONCEPT

THE

TALENTS...

FINTECH SECTOR, FROM EMERGING TO CONSOLIDATED Esteban Velasco, CEO and Co-founder of Sempli 25 BUILDING TECH

OPEN FINANCE: A NEW COMPETITIVE CONTEXT

66 IRIS 74 SISTECREDITO 82 FONDO NACIONAL DE GARANTIAS 90 TRII 98 FLOID 106 LUEGOPAGO 114 NIMMÖK 122 MOVII 130 NUBLOQ 138 SUMUP 146 EPIK 154 RAPICREDIT 162 INFOBIP 170 METAMAP 178 LATAM TRADE CAPITAL 189 ECOSISTEMA DE AFILIADOS 194 AGRADECIMIENTOS

PRESENTATION

ANDRÉS ALBÁN CEO AND CO-FOUNDER PUNTORED

4 | FINTECH COMPANIES IN COLOMBIA ΙΙΙ

The number of Fintech companies has doubled in recent years and Colombia is one of the leading countries in the sector, being attractive for investors, foreign companies and startups that join this ecosystem that is trending globally. In the third edition of Fintech Companies in Colombia III: Their challenges and achievements; Javier Raventós continues the analysis of the sector with new companies and opinion leaders of the diferent Fintech verticals: digital payments, digital credit, personal fnance and crowdfunding to name a few.

In our case, Colombia is facing regulatory changes such as the CONPES on Financial Inclusion and the CONPES on Electronic Commerce.

We are the third country in the region to implement an Open Finance scheme and the market in general has been accelerating its transformation process. Although the government’s efforts have been important, there are still pending issues, such as the Open Finance Decree. A collaborative space is needed between the industry and regulatory bodies to strengthen the ecosystem and bet on training talent that responds to the needs of a changing market where the user will be at the center of decision making.

This book addresses issues related to fnancial inclusion, capital raising, financial education and Fintech talent, compiled in articles from the perspective of entrepreneurs, founders and industry leaders in the country. This will allow the reader to understand regulatory perspectives, trends, and to analyze the market in order to understand where the industry is and where it will move.

Additionally, a brief analysis of Colombia Fintech is included as a sample of the road traveled over the years; for its part, the Association has positioned itself as one of the most infuential in the region and that is why by December 2021 there were more than 290 companies that were part of it. Digital credit was the most representative vertical of the ecosystem, followed by digital payments and corporate finance; in addition, the Fintech industry achieved a record figure of 3.7 trillion pesos by 2021, representing 0.31% of the GDP of the Colombian economy.

We hope you enjoy this volume and have an approach to the trends of the Fintech industry in Colombia, you will find from the hands of leaders and entrepreneurs in Colombia how they join eforts to not only grow the industry, but continue contributing to the financial inclusion of Colombia.

ANDRÉS ALBÁN | 5

FOREWORD

JAVIER RAVENTÓS ACADEMIC AND INNOVATION DIRECTOR JMR COMUNICACIONES

The Fintech ecosystem in Colombia is becoming more robust every year. With a consolidated growth year after year, as we will see later in the article on Fintech fgures prepared by Colombia Fintech. We also see every day how the diferent Venture Capital are betting on investing in this ecosystem and each time with more and more important investments.

In this third issue of the book, we wanted to give special emphasis to fnancial inclusion, human talent, education and capital raising, among other topics. To this end, prominent professionals participate in this third edition, contributing their knowledge and experience, which will surely be of great value and contribution to the Fintech community and to professionals and companies that are not part of the ecosystem but that follow up on it. In this edition are the following cracks: Andrés Albán, Erick Rincón,

Juan Camilo González, Guillermo Guzmán, Mike Simmons, Juan Diego Osma, Gabriel Alzate, Ana María Prieto, Esteban Velasco, Mayra Granada, Silvia Flórez, Luis Carlos Ramos, Daniel Navarro, Sandra Rubio, Alexandra Baquero, Camilo Zea, Daniel Marterón, Carolina Vélez and the Fintech women in Colombia.

We will also fnd the story of important companies in the ecosystem that are doing an impressive job and where we fnd an impressive passion, innovation, development and great products/ services. Iris Bank, a bank that was born 100% digital, becoming the great ally of companies in Colombia, with easy and very agile procedures, with an annual growth rate of 40%. Luegopago. com: The frst “Buy now, pay later” market place in Latin America, empowering digitally consumers who want to have greater fnancial control. Floid: Pioneer in Open Banking; I could summarize

6 | FINTECH COMPANIES IN COLOMBIA ΙΙΙ

them as in all sources of information in a single API. FNG - Fondo Nacional de Garantías: which has facilitated access to fnancing for diferent Fintechs in Colombia. Today 13 Fintechs have a guarantee value quota that varies between 600 million and 77 billion. Nimmök: a large international consulting firm, expert in the development and co-creation of digital fnancial services businesses. Sistecrédito: 25 years, connecting people to their dreams. They have made it possible for more than 4 million people to access credit and fulfill their dreams. Trii: democratizing the stock market, with an app to invest in shares, easy and safe. Rapicredit: in just a few years it has managed to provide more than 4 million loans, making fnancial inclusion a reality for many Colombians. Movii: humanizing the Colombian fnancial system. A non-bank to move money. Sumup: which through its mobile data phones allows all types of businesses to

accept credit and debit cards, anywhere, easily. Nubloq: helping companies to offer financial products to their customers easily and securely. Epik: with its digital financial solutions, fast and secure, innovating in digital credit models and cobrand cards in Colombia and Central America. Metamap: building trust between companies and customers, verifying, evaluating and incorporating new customers in the blink of an eye. Latam Trade Capital: the fnancial ally of companies.

I hope you enjoy this work, as much as I have enjoyed doing it, learning from all these professionals and companies that are very very cracks. What they do is more and more impressive.

JAVIER RAVENTÓS | 7

CROWDFUNDING IN COLOMBIA

ERICK RINCÓN CÁRDENAS ASSOCIATE PROFESSOR AND DIRECTOR OF TIC-TANK AT UNIVERSIDAD DEL ROSARIO.

Crowdfunding obeys a collaborative economy model, which aims to achieve a better distribution of resources through a technology-driven exchange. In this way, using digital platforms, a democratized exchange has been promoted as a new alternative fnancing modality, which has managed to address the inequality and limited access that a large part of the population has to the fnancial system, as well as to generate a greater availability of resources in the country.

Collaborative fnancing is structured under the basic pillars of exchange, enabling interaction between users who have interests that can be reciprocally satisfed by meeting in a digital

space, that is, through the intermediation of a digital platform that serves as a communication channel between the parties. These platforms provide exposure to diferent productive projects that require fnancing, facilitating relationships between the owners of a project and investors or lenders who see in it an opportunity to increase their income or obtain another type of beneft.

These alternative financing platforms are an innovative mechanism for finding different sources of funding, generating possibilities of acquiring economic resources without facing the various entry barriers imposed by the traditional fnancial system. This is an attractive alternative

8 | FINTECH COMPANIES IN COLOMBIA ΙΙΙ

for small, medium-sized, and new companies that do not have the possibility of acquiring credit easily and, additionally, do not have sufficient exposure to attract investors to promote their projects.

At the same time, these platforms have represented greater competition in various economic sectors, since different actors are integrated and develop their projects leveraged by this method of financing, furthermore, generating more employment in the country and stimulating the national economy. Likewise, Crowdfunding manages to reduce costs since its operation is leveraged by technology and digitalization, which reduces operating costs and allows transactions to be carried out easily and quickly.

On the part of the contributors, the benefts are also evident, since they can expand their investment portfolio, have the possibility of investing in diferent projects that are advertised on the Crowdfunding platform, maintain the value of their money over time, and even obtain profts above infation. In addition, the integration of new participants is enabled, since small investments can be made in diferent projects, so it is not necessary to have large amounts of money to join this activity or assume large risks in a single investment project.

Crowdfunding identifies four main categories of globally recognized funding:

Loans: Borrowers agree to pay the loan to the lender, plus interest on a predetermined date;

Equity: Investors ofer capital in exchange for a stake in a company;

Donations: Financing of social or charitable projects, without expecting money or a reward in return; and

Rewards: A product or service is ofered in return for each person’s contribution to the project, i.e., a non-monetary consideration is obtained.

This new fnancing model is attractive, which is why countries such as Colombia have had the task of regulating its operation to provide greater legal certainty to this activity. Such regulation is based mainly on Article 335 of the Colombian Constitution, which states that any activity related to the management, use, and investment of the resources collected by the public must be exercised with prior authorization by the State and in accordance with the law. The collection of funds from the public is subsequently established as a crime penalized by Article 316 of the Colombian Penal Code, therefore, in order to allow this model to operate in Colombia without incurring the criminal type described in Decree 1981 of 1988, it has had to be integrated as a regulated and supervised fnancial activity.

For its part, the Securities Market Law (Law 964 of 2005) states that any entity that issues and ofers securities shall be subject to State supervision, mainly because securities are negotiable rights whose purpose is to raise funds from the public. In addition, Decree 2555 of 2010 determines that the public ofering of securities requires, in addition to the authorization of the Colombian Financial Superintendency, registration in the National Registry of Securities and Issuers.

Thus, in line with the activities to promote fnancial inclusion carried out by the Colombian National Government, Decree 1357 of 2018 is issued with the purpose of making access to financing products viable for certain sectors of the economy that have particular needs on this front, such as small and mediumsized enterprises (PYMES) and establishing a regulatory framework for the operation of collaborative financing of productive projects through securities.

This Decree defnes crowdfunding as an activity carried out through an electronic infrastructure, in which a plural number of contributors are put in contact with a recipient that requests financing in its own name to allocate it to a productive investment project. Under this regulation, only two types of financing are allowed, through debt securities and equity securities. However, the exclusion of the other

ERICK RINCÓN | 9

categories of Crowdfunding does not imply that these operations cannot take place in the country, being their operation viable, although no regulation provides regulatory structure to these operations beyond general rules, such as those relating to the raising and public ofering of securities.

Likewise, to operate as a crowdfunding company it is necessary to be incorporated as a corporation authorized by the Financial Superintendency of Colombia to carry out this activity and to be registered in the National Registry of Securities Market Agents. In addition, stock exchanges

and securities trading or registration systems authorized by the Financial Superintendency of Colombia may also carry out this financing activity.

These authorized entities, in the development of their operations, must comply with the rules of disclosure of information, operating standards and functioning of the infrastructure that the activity entails, the mechanisms for the protection of recipients and contributors of fnancing, as well as rules for the prevention of money laundering and management of conficts of interest, among others. In addition, they must

10 | FINTECH COMPANIES IN COLOMBIA ΙΙΙ

ensure that each project has a maximum term for obtaining resources, which in no case may exceed 6 months from the date of publication of the project, time in which the minimum percentage that makes the respective fnancing viable must be reached, promoted by a plural number of contributors.

Finally, this Decree reiterates the intermediary status of these companies by prohibiting them from providing advisory services related to productive projects, directly managing the resources of the productive projects fnanced, ensuring returns or yields on the investment made, and acting as recipients or contributors.

Recently, in order to give greater applicability to this model, Decree 1235 of 2020 was issued, which enables the realization of Crowdfunding operations by donation, by determining that such platforms may allow or facilitate the delivery of donations to promote diferent projects.

On the other hand, this new Decree increased the maximum amount of fnancing, specifying that each recipient may receive a maximum of 58,000 legal monthly minimum wages (previously limited to 10,000) from qualified contributors and 19,000 legal monthly minimum wages (previously limited to 3,000) from non-qualifed contributors.

Thus, these platforms are currently empowered mainly to advertise collaborative financing projects, implement channels to facilitate the delivery of information on the productive projects to the contributors, and enable the necessary tools to execute the operations that formalize the fnancing of the productive project, collect resources through entities supervised by the Financial Superintendency of Colombia other than the crowdfunding entities themselves, provide additional collection services, manage systems for registering transactions on the crowdfunding securities that have been issued through the crowdfunding platform itself, and also provide services that allow recipients registered in the platform to receive donations.

Regarding the presence of Crowdfunding companies in Colombia, it is worth mentioning

that this activity is incorporated as a sector of the Fintech industry, as it integrates a branch of fnancing methods leveraged by technology. However, considering the 36% growth of the industry from 2017 to 2020, according to the Fintank Sector Report conducted by Colombia Fintech (2020), the percentage of entities that develop crowdfunding is significantly lower, as out of a total of 322 financial technology companies consolidated in the country, only 3.73% dedicate their eforts to Crowdfunding.

Some of the Crowdfunding platforms in Colombia along with some representative figures of the deployment of their activity:

The a2censo platform of the Colombian Stock Exchange allows its participants to make debt and equity investments from low amounts. To date, this crowdfunding platform reports 7,056 investors, 26,154 investments, 36,638 fnanced, and 94 successful companies.

Agrapp is an application through which contributors finance farmers obtaining an expected return of 18.5% E.A., reporting to date more than 399 investment partners that support 72 agricultural entrepreneurs in the country and a sum of more than 3.2 billion pesos available for fnancing the rural sector.

Help is a foundation aimed at fnancing studies and education projects in Colombia, which has collected more than 130 million pesos in micro-donations through crowdfunding, planted 1,100 trees, delivered more than 1,600 markets, and painted a school in Ciudad Bolivar.

Finally, it should be noted that Crowdfunding generates a competitive business environment in the country and represents benefits for both contributors and those financed. However, despite being an attractive sector for representing an alternative financing model, Decree 1357 of 2018 failed to promote this type of platforms, therefore, Decree 1235 of 2020 is issued, which modifes and adds certain aspects to encourage the incorporation and deployment of crowdfunding in the country.

ERICK RINCÓN | 11

ATTRACTING FINTECH INVESTMENT

GUILLERMO GUZMÁN DIRECTOR OF ASOSTARTUPS

By December 16, 2021, Latin American startups raising venture capital had raised $14.8 billion across 772 deals as recently reported by PitchBook.

That fgure, with reference to the state of venture capital investment, known two weeks from the end of 2021 represented by far a record amount of investment that in a single year totaled far more than the combined sum of total capital invested in the region from 2014 through 2020. Of that large annual amount invested by venture capital that triples the previous 2019 record of $4.8 billion, 42% was invested in fntech.

This report leads us to conclude without equivocation, and in spite of the catastrophic consequences that the COVID-19 pandemic has had on our region, that Latin America has defnitively and forcefully entered the radar of international investors, who additionally see, together with the venture capital investment funds of our region, that the fnancial technology sector is the one that has more potential to positively impact a market of hundreds of millions of people who share basic fnancial pains and problems magnifed by the quarantines of the past years 2020 and 2021, as well as by the fall in the performance indicators of our region, the potential to positively impact a market of hundreds of millions of people who share basic fnancial pains and problems magnifed by the quarantines of the past years 2020 and 2021, as well as by the fall in the performance indicators of our economies.

From the lack of fnancial inclusion to the low access to credit at reasonable interest rates for our Spanish-speaking people, 95% of the population in communities south of the dollar, which if addressed by agile, creative and well-

funded startups could be a definitive and key factor in meeting the 2030 sustainable development goals set by the UN.

Colombia in particular managed during 2021 to consolidate the growth of its fntech ecosystem in terms of the turnover of its startups, the number of jobs generated by these companies and the amount of investment, which as we have already mentioned, set record fgures in its annual fundraising. LAVCA reported that by the frst half of 2021, private equity investments in Colombia exceeded $1.3 billion dollars.

In view of the fgures we have on the table and in view of the immediate future of our economy, which is facing an increase in infation fgures, a

12 | FINTECH COMPANIES IN COLOMBIA ΙΙΙ

sustained devaluation and a stock market that has yet to take of, Colombia must take the route of adopting regulatory measures and other activities that will lead to the materialization of open banking and from there to a consistent evolution towards open finance, as has been the trend in other geographies, in order to open up opportunities for economic and social development.

If Colombia and its creative force as a whole intend to reduce unemployment and increase productivity within the framework of observing sustainable development standards as highlighted by the recent 2021 United Nations Climate Change Conference (COP26), new fintechs aimed at creating products and services that help consumers and businesses meet environmental goals must emerge in our country:

Green loans, Carbon footprint tracking, Asset tokenization, and New applications and protocols on distributed databases (known as blockchain).

Colombia in particular managed to consolidate the growth of its fntech ecosystem during 2021 in terms of the turnover of its startups, the number of jobs generated by these companies and the amount of investment, setting record fgures in its annual collection.

These new technologies, new standards and new applications and business models are the validators on which our entrepreneurs should ride to guarantee in the long term to Colombia and Latin America to maintain a generous fow of investment of entrepreneurial capital, and the strengthening of our technological, fnancial and business ecosystems.

GUILLERMO GUZMÁN | 13

TOWARDS EFFECTIVE FINANCIAL EDUCATION FROM THE FINTECH MOVEMENT

JUAN CAMILO GONZÁLEZ CEO & FOUNDER FIGURO

The last two years have seen an acceleration in financial products and services supply through digital channels. As of November 2021, investments in fintech had grown by 173% compared to 2020, according to Boston Consulting Group. In Colombia alone, the Association of Fintech Companies expected a 30% growth in the number of start-ups in this sector.

However, this boom in the supply of new digital fnancial products and services has brought a key question for the industry's future: how prepared are users to use these solutions efectively, and what role do fntechs play in this preparation?

Colombia is a country with enormous challenges in terms of financial education. According to CAF (2021), half of those surveyed in their study believe in ofers that guarantee them to multiply their money quickly. In addition, no population group in the country has high fnancial well-being scores.

According to the OECD (2020), only 28.8% of adults in Colombia reach the minimum desired financial knowledge score (the lowest score among all participating countries). In addition, the country has the lowest percentage of active savers and the fourth-lowest fnancial well-being score within the sample of countries belonging to this organization.

14 | FINTECH COMPANIES IN COLOMBIA ΙΙΙ

In 2022, there is no doubt that the use of digital platforms to deliver fnancial services to individuals and businesses is a promising and efective tool for promoting fnancial inclusion. The rapid growth of these solutions -in line with the trend of giving consumers more access and power- has made users increasingly responsible for their own fnancial planning. The multiplication of alternatives to pay, save, take credit, invest, or protect themselves has led the fntech movement to understand that fnancial education is a central axis of its success and consolidation. Traditional fnancial institutions understood this more than a decade ago. Law 1328 of 2009 made the development of fnancial education programs by credit institutions in the country mandatory. Although great initiatives have been developed in the last decade, many of these actions faced the immense difculty of making them massive and efective in physical offices, face-to-face workshops, primers, and fyers.

Today, fintechs are not only creating more convenient and diversifed channels to access better fnancial products and services but also better fnancial education vehicles.

One of the most signifcant advantages fntechs have over the traditional industry is the ability to educate in real-time, in the same place, and at the same time as the fnancial decision or interaction with the platform. Several fntechs are already recognizing this advantage in the country. The offerings are becoming increasingly varied from free personal fnance courses ofered by companies like Figuro (Insurtech), Tributi (PFM), and Tyba (Wealth Management) to webinars on specifc topics such as investments ofered by Trii (Wealth Management) or debt management at Linxe (Lending). Many others provide tips, notifications, and explanations throughout the use of their tools, like Habi (Proptech) with online appraisals, Nequi, or Nubank when depositing money or applying for a credit card. Even companies outside the fntech ecosystem understand the importance of promoting

fnancial education, as demonstrated by Platzi's School of Personal Finance for its students.

Consumers will have access to specialized fnancial programs and content in the coming years. For example, instead of a single fnancial institution trying to teach them everything about money management, they can learn protection strategies from an insurtech, budgeting from a neobank, and investing from a wealth management fntech. However, for these eforts to have a real impact, it will be necessary for these actors to collaborate amongst themselves and with inter-sectoral and national strategies for fnancial and digital education so that more people can beneft from fntech and true fnancial inclusion can be achieved.

Digital and financial literacy must also be closely linked. This is essential to prevent users from making inadequate financial decisions because they assume that their profciency with technology also indicates a high level of fnancial skills, or conversely, users with strong fnancial knowledge miss out on the benefts of fntech because of a lack of digital skills.

If the fintech industry wants to empower consumers, we must promote truly digitally and fnancially skilled and educated consumers. This is the only way we can realize the dream of the next decade: democratizing, personalizing, and decentralizing fnance and technology.

JUAN CAMILO GONZÁLEZ | 15

There are users with very good fnancial knowledge and capabilities who miss out on the benefts of Fintech because they do not have better digital skills.

FINTECHS

UNDER THE VENTURE CAPITAL SPOTLIGHT

MIKE SIMMONS SCOUTING & ALLIANCES COLOMBIA, MÉXICO AND PERÚ

Venture capital firms aim to obtain exorbitant returns for their investors while collaborating in the formation of an increasingly robust entrepreneurial ecosystem.

To achieve their objective, the frms analyze a series of factors of all the projects that come into their hands:

1 the capabilities of the founding team (undoubtedly the most relevant factor in early stage projects);

2 the identifcation of a substantial problem

3 the quality of the solution found;

4 the existence of a sufciently large market; and

5 the quality, capacity and scalability of the competition.

Many others could be mentioned, but their importance will depend on the stage of the project. In addition to the above analysis, a particularly relevant aspect should be studied when the project in question is a FinTech: the promotion of fnancial inclusion. To the extent that a Startup pursues fnancial inclusion, it will not only be impacting the lives of thousands and millions of people, but will also be building its own customer base, which in many cases will be accessing fnancial services for the frst time in their lives.

Latin America has around 70% of its population underbanked (including the unbanked). This highlights the size of the opportunity that FinTechs have in front of them.

While there are many factors that contribute to fnancial inclusion, I would like to focus on what I personally consider to be its two main pillars:

Credit Scoring:

Credit scoring consists of assigning a score to potential borrowers. In other words, it is an attempt to measure the repayment capacity of those who will become debtors. The credit scoring algorithms of traditional financial institutions have proven to be highly inefective, since they analyze limited factors such as:

1 delinquent status (payment of debts and taxes);

2 banked salary, corresponding to a formal job; and

3 bank account withdrawals.

As a consequence of the application of faulty scoring algorithms, a large percentage of the

16 | FINTECH COMPANIES IN COLOMBIA ΙΙΙ

LATAM population is classifed as ineligible for credit (“credit invisible”). This category usually includes freelancers , gig economy workers and, of course, the “unbanked” (even when they have a stable job).

However, there are many (insurgent) startups working on highly creative credit scoring mechanisms that analyze factors such as: call records, location of residence, and number of restaurants, ATMs or paved streets in the vicinity of the individual’s home. All of these data (and many, many others), analyzed together, allow for predictions of delinquency.

The above, which was unthinkable for the incumbent and traditional institutions, allows to:

1 credit the “credit invisible”, so that they can access fnancing for the frst time, and

2 enrich the information of many other borrowers in order to reduce the interest rate paid by them.

Education

No fnancial service could exploit its full potential without fnancial education of end users. It allows users to learn about sustainable consumption habits, and achieve savings capacity to eventually

be able to invest and make informed decisions.

Startups focused on promoting education can already be found in the market.

Entry level (whose audience is the unbanked population, who seek to learn about the diferent fnancial services available, and learn basic spending and saving behaviors);

Intermediate level (whose public is the banked population but without technical knowledge, generally seeking to take their frst steps in basic investments); and

Higher level (whose public is the banked population with previous technical knowledge, seeking to learn about sophisticated investments).

Over the next few years, it will be extremely inspiring to see how the unbanked of 2022 become credit takers and eventually sophisticated investors. Simultaneously, startups will upsell with their own customers: from wallet to credit services, and from credit to investment services. With a clear roadmap of the above, FinTechs pursuing fnancial inclusion will start of on the right foot when it comes to raising their first rounds of investment from institutional funds.

MIKE SIMMONS | 17

“FINANCIAL INCLUSION”: A PROCESS THAT MUST TRANSCEND A TOPICAL CONCEPT

JUAN DIEGO OSMAN CEO SISTEPAGOS

Surely we have had the opportunity to read countless articles, economic reports, statistical balances, about “financial inclusion”. It is a term that in recent years has gained relevance in the feld of fnancial services and, especially, in the Fintech sector. According to the World Bank’s defnition1 , “People and businesses have access to useful and afordable fnancial products and services that meet their needs: transactions, payments, savings, credit and insurance, delivered in a responsible and sustainable way”.

1 The Drive for Financial Inclusion: Lessons of World Bank Group Experience June 30, 2021

This is a defnition that brings us closer to the concept on which we have been working for many years on several fronts: government, fnancial system, Fintech sector. According to the Quarterly Finan cial Inclusion Report of Banca de las Oportunidades, as of March 2021 the indicator of access to financial products and services was 89.4% (more than 32 million adults have at least one savings or credit product).

However, it is essential to analyze whether we have really advanced in the process (based on the ofcial fgures we know, we should conclude that we defnitely have). In order to achieve an

18 | FINTECH COMPANIES IN COLOMBIA ΙΙΙ

adequate answer, it is necessary to carefully study the numbers provided regarding the result of the multiple strategies adopted to develop a satisfactory financial inclusion process whose positive impact on society is refected in benefts for the intervening parties and the economy in general.

From various sectors, multiple alternatives have been built that have made financial services more dynamic, allowing them to be available to users under more flexible and agile linkage conditions through the adoption of digital tools and channels.

The work goes beyond complying with statistics and the results expected from the governmental sphere.

The great challenge for the Fintech sector is to ensure that a process that is so necessary in countries in the region, especially ours, transcends fgures and quantitative objectives and becomes an engine for building solutions within everyone’s reach, generating permanence, recurrence and something even more important: “belonging”. When we feel that we belong to something, we develop loyalty, we express what we think, we contribute to the collective construction. It is this

spirit that should move us to reach thousands and thousands of Colombians (as we already do today), but with clear objectives: to reduce inequality, generate value in society and allow free access to multiple services with the most important challenge we could have: at afordable costs for millions of people.

We are facing a reality whose figures reveal that there is still an enormous amount of work to be done by all the actors of the national economy. According to DANE fgures about the labor market in Colombia 2 , as of November 2021 the percentage of informality was 47.3%, that is to say, about 5,485. 000 people were considered informal workers (according to the report, “the defnition adopted by DANE for the measurement of informal employment refers to the ILO’s 15th ICLS resolution of 1993 and to the recommendations of the DELHI group -a group of experts convened by the United Nations to measure the informal phenomenon- in which it is stated that a worker is considered informal if he/she works in an establishment with up to five workers, excluding independent workers engaged in his/her trade and government employees”).

JUAN DIEGO OSMAN | 19

2 Mercado Laboral. Principales resultados enero a noviembre de 2021. DANE

It is these fgures that should lead us to focus our eforts on providing access to those who, due to their activity, encounter enormous obstacles to access fnancial services.

In an interesting report by Credicorp Capital Group about the Financial Inclusion Index 3 , there is a data that illustrates the current situation.

It states that 7 out of 10 Colombians do not use any fnancial product per month (in percentage terms, 72%).

The sector has grown signifcantly. Investments in companies in the sector have increased in the last two years. Verticals such as credit and digital payments continue to be very relevant and their participation in the ecosystem is fundamental. However, it is necessary to continue working together in order to ensure that low-income people can have real access to fnancial services, to a broad portfolio and within their reach. We must decentralize the operation that will allow us to advance in meeting the challenge of fnancial inclusion at a national level. Statistics show that there is still a high concentration of users in the country’s main cities. According to a report by Banca de las Oportunidades in March 20214 , the percentage of adults with an active or current fnancial product (usage indicator) at that date

3 Índice de Inclusión Financiera IIF, Grupo Credicorp Capital. Año 2021

4 Reporte trimestral de inclusión fnanciera, Banca de las

was 74.4%. However, it is important to highlight that, according to this study, the access indicator is definitely much higher in the cities (above 98%), on the contrary, in rural areas it does not exceed 70% and, in the so-called dispersed rural municipalities, it is 57%. Possibly, access to internet or connectivity, use of new technologies, knowledge of digital tools, constitute an entry barrier to new options that allow access to fnancial services. However, it is essential to work hand in hand with all market players if better results and penetration in remote areas are to be achieved.

Even though the numbers show great progress in terms of access to fnancial products by the adult population of this country, we are still far from the main purpose, which is the one that refers to indicators of access, use of financial products, expansion of new solutions to rural and remote areas, access to fnancial products based on a cost scheme that is not exclusive, training in fnancial education for users, design and implementation of digital solutions that are easy to use and access.

The construction of alternatives must continue to advance. The articulation of efforts by the national government and the fnancial and Fintech sectors is essential. It is necessary to carefully analyze the opportunities for improvement and develop strategies that lead to results that allow us to conclude that fnancial inclusion is not just a current concept.

20 | FINTECH COMPANIES IN COLOMBIA ΙΙΙ

Oportunidades, primer trimestre 2021

DIGITAL TRANSFORMATION, CHALLENGES,

OPPORTUNITIES AND CHALLENGES IN THE FINANCIAL SECTOR

GABRIEL ALZÁTE SENIOR CONSULTANT IN INNOVATION AND DIGITAL TRANSFORMATION, VP OF INNOVATION AT RED5G

A few years ago we started talking about TD, some companies have taken it with great responsibility and others are just understanding the great opportunity they have, today it is not who is the biggest, it is who generates more value and how fast they can move.

Fintechs have managed to change the customer experience in the financial sector, they have listened to the customer and their needs, payments, transfers, remittances, etc., they

managed to penetrate non-bank markets, use technology as a means to help innovation in service and design of new products. These companies, most of them born from passionate entrepreneurs and with an extraordinary business vision, have captured the attention of large fnancial businesses, that is what it is all about, to be able to work together and take advantage of good ideas and not have to invent the wheel.

GABRIEL ALZÁTE | 21

The financial sector begins to have new challenges, cryptocurrencies, NFT (non fungible touches) and the metaverse are trends that are beginning to show runa reality, for example in the metaverse that surely we are a few years away from its reality and today we fnd platforms like Decentralan that although they are a beginning of what is really this new parallel universe is still much fabric to be cut. But today we already see how in digital games, in the same Decentralan to acquire goods such as houses. Lots, digital clothing, etc., are paid with cryptocurrencies and the fnancial sector can not be oblivious to this happening.

Fintechs are already being created focused on metaverse as well as on the management of NFTs, cryptocurrency wallets to make sales of these non-fungible assets, so it is important for companies in the fnancial sector to start managing these trends.

There are many ventures that require budgets to run their minimum viable products, it is difficult for these entrepreneurs to access credit many times, there are fintechs that leverage this efort with loans even being part of the project as partners, this is the dynamics of the new world, do not see the competition, but rather see the opportunity to grow together and achieve the goals.

One of the challenges for governments is to streamline the new laws that allow the continuity of fntechs in their innovation processes, many times technology goes faster than laws, we cannot aford to lose great innovative proposals because we do not have adequate legislation for this new world. We cannot aford to lose great innovative proposals because we do not have adequate legislation for this new world.

The great challenge for the financial sector is to achieve open banking, that is, to share information in order to decentralize, this could be used by fntechs to create new products and services of value that allow a bank with better indicators of satisfaction and use.

Some traditional banks are doing very well the intra-entrepreneurship to achieve “Fintech” as spin offs that allow them to move faster in the market, to be able to launch more fexible products and compete in the market with other fintechs, these actions allow to have parallel business models seeking sustainability in the future of banks. Therefore the importance of continuing to create fnancial startups supported by technology that are achieving great results and most importantly are impacting in a good way the lives of consumers. The most important thing is that they are impacting the lives of consumers in a good way.

22 | FINTECH COMPANIES IN COLOMBIA ΙΙΙ

THE FINTECH SECTOR, FROM

EMERGING TO CONSOLIDATED

ESTEBAN VELASCO CEO AND CO-FOUNDER OF SEMPLI

Recently, fintech was seen as an emerging industry with multiple startups entering the competitive arena. To speak of “emerging” is an understatement when looking at the dynamics and evolution of their business and value proposition. We see an industry growing with two purposes:

1 generate access to financial products and services in segments with low penetration or underserved segments; and

2 to ofer agile, simple and close experiences to customers. Along these lines, fntechs have become one of the most important market triggers to promote the financial inclusion

necessary for the development of Latin America, both for individuals and companies.

So what’s next for fntechs?

Today there are complementary challenges that will allow the industry to mature at the pace and rhythm that characterizes them.

With regard to the market, fintechs must provide scenarios of greater trust for segments of customers not yet served or simply awaken greater security and certainty in segments that maintain exclusive relationships with traditional or incumbent players.

ESTEBAN VELASCO | 23

The emergence of guarantee seals, affiliation groups, greater positioning and brand recognition, and even the entry of more highly regulated products, will lead to greater market confidence in fintechs. In a complementary manner, it is necessary to work hard on issues related to fnancial education, with the objective of enabling greater knowledge about the diferent options that clients have to adequately manage their fnancial products and to do so in such a way that access is amplified in a responsible manner.

In the face of the competitive environment, fntechs have several challenges to overcome on three fronts.

First, attracting high-value talent with experience in a disruptive sector is vital to continue the accelerated growth of this profle of companies. Diverse talent that combines market, commercial, operations, regulatory and financial knowledge with the creative explosion of dynamic technology, data and automation environments. The attraction of talent must of course be complemented by maintaining the high motivation and consequent retention of people who value the efervescent environments of fntech.

Secondly, generating levels of scale is imperative for the viability and sustainability of fntechs. This scale should be seen both in terms of a greater volume of clients or

revenues, and in the possibility of generating operating leverage that allows them to do more with an optimal and efficient use of resources, an issue that all fintechs will have to go through if they want to reach the economic fundamentals of balance between market acquisition and proftability.

Finally, there is investment or fnancing. We have witnessed an explosion of fundraising by fintechs, becoming in recent years the startup vertical with the highest attraction of venture capital profile funds, which has been quite positive for the development of the industry.

This will continue to be a constant in regions where the gaps in fnancial inclusion are still wide, so liquidity and availability of resources will remain in force.

In any case, fntechs will have to be vigilant of possible excess inflation in valuations and/or the respective investment terms and return expectations required in this type of operations.

Finally, the whole must be greater than the sum of its parts, so collaboration spaces between the diferent players will be fundamental for the industry to continue to stand out as it has been doing.

24 | FINTECH COMPANIES IN COLOMBIA ΙΙΙ

BUILDING TECH TALENTS...

MAYRA GRANADA CEO WIIPOL

Today we talk about innovation, digital transformation, user-centric service experience, technology, the tech era and other issues to be taken into account for a company to be successful. Most of us leaders have even questioned whether human talent will be necessary in the future or whether it will be easily replaced by machines.....

Today, I want to tell you a little about what I think and more than what I think, what I feel, vibrate and live daily in the great challenge of building teams that are result-oriented and passionate about what they do. I am totally convinced that human talent is the most important and valuable thing that an organization has, and that one of the most relevant challenges we leaders face in

today’s world is the ability to shape, build and develop teams that do not work only for a salary, but for passion, that every day when they wake up they feel joy and gratitude for having a company to go to, perform their duties with dedication, giving their best and that this is reflected in extraordinary results for the company.

During my career as a professional in the fnancial world I have had the opportunity and blessing to meet different types of leaders, with their example I have learned that I can replicate and defnitely not. There are the traditional ones who still lead with strict compliance with schedules, long working hours, perfect protocol of clothing, building long and tedious processes, only their ideas are good and become reality and the

MAYRA GRANADA | 25

organization where they are today is their only world, for them all people are easily replaceable, because they never want someone better. I have also had leaders with essence, who let you be as you are, let you do and fail to learn, who support ideas, make them come true, are committed to your growth and create a culture of innovation and discipline that the only thing they end up getting are positive results, those leaders who surround themselves with the best talent and are not afraid of anything, because they feel safe, they shine with their own light.

I want to tell you that I have found it vital in the conformation of the team for Wiipol, Fintech that I currently lead:

To hire human beings with well-formed values and principles from home, to inquire about their family life, their education, with whom they have lived and also to understand their context, what makes them happy and what does not.

In this sense, each person should be allowed to show and act with their essence, this will allow them to be happy in their actions. Generate spaces and teach different methodologies that allow creating and

implementing ideas that beneft the process of each collaborator, of the area and that are focused on the user. It is important that people are allowed to make mistakes and that everything is used as learning for the implementation of new projects.

Autonomy in their position and inclusion in decision making are important for the team to feel committed and valued by their superiors. The creation of a benefts portfolio focused on the user, i.e. knowing what the current employee likes.

Generate trust and respect between the team and their superiors, this will allow to generate stronger relationships.

As leaders, we must be aware that one of our greatest responsibilities is to train people of integrity who can occupy different positions and face diferent challenges with frmness and judgment, contributing to the company’s results and to having a better society.

I hope my short but substantial experience will help you in your daily challenges. Best regards!

26 | FINTECH COMPANIES IN COLOMBIA ΙΙΙ

OPEN FINANCE: A NEW COMPETITIVE CONTEXT1

ANA MARIA PRIETO DEPUTY DIRECTOR, MINISTRY OF FINANCE, FINANCIAL REGULATORY UNIT

Digitalization in the provision of fnancial services

New technologies and digitalization have transformed the dynamics of communication and interaction and consequently have impacted the way payments are made and the way goods and services are accessed in the economy. The increased connectivity of the population and the efects of the pandemic have accentuated these efects.

In terms of financial activity, this new reality has led consumers to demand higher levels of convenience, efciency and quality of services (Mckinsey Company, 2021 (a)). In response, the industry has transformed its ofering with new products, speed and greater added value in the provision of its services. Doors have also opened

to new players, some highly specialized and digital, such as neobanks, and others, such as bigtechs, with operating models in which their main activity is complemented with financial products provided by financial institutions under collaborative schemes.

The open finance 2 scheme enables these dynamics, not only because greater access to data makes it possible to deepen user profling and thus add value with other related services, but precisely because it facilitates opportunities for collaboration between the diferent actors (BIS, 2020). The impact of open fnance over the next decade is estimated at 1.5% of GDP in the

ANA MARIA PRIETO | 27

1 Extracto del documento técnico Arquitectura fnanciera abierta en Colombia publicado por la URF en Octubre de 2021.

2 Entendido como la práctica bajo la cual las entidades fnancieras habilitan a otras entidades o a terceros, acceder a la información de los consumidores previa autorización de los mismos.

The regulation of opoen banking around the world

European Union and the United States, and up to 4% in emerging countries (BIS, 2020). (Mckinsey Company, 2021 (b)).

Regulatory response in the world, in the region and in the region

The implementation of open fnance has taken place under different regulatory approaches. Some countries, such as the United Kingdom, define it as a mandatory activity with specific operational standards that banks must comply with for the exchange of information. Others, such as Hong Kong 3 , have proposed a voluntary adoption, under the data protection regime and introducing general information security principles. Finally, there are countries such as the United States where implementation has been driven by industry. Regardless of the model, there is consensus on the need to seek the greatest degree of openness and interoperability in the scheme.

In the region, Brazil and Mexico have been making progress in open banking through mandatory models. In the frst case, the Central Bank defned phases and cycles through which the applicable information has been expanded, starting with that of banking channels in February 2021 until open fnance in December of the same

year. In Mexico, the model originated with the Fintech Law of 2018 4 , in June 2021 it began its regulation with public data and is expected to continue advancing until it reaches transactional information.

The evolution of open finance has generated relevant regulatory discussions (OECD, 2020). Under what rules is it possible to create collaborations between financial and non-financial entities, what activities can be carried out by one or the other, and what are the responsibilities and duties that each one assumes, according to the nature of each agent, their economic function and their legal authorization. It has also generated a refection on the need to authorize financial entities to ofer technological and infrastructure services, related to fnancial services, in schemes known as banking as a service, given the recognition of the new competitive and digital context faced by the sector. In some markets the authorities have been enabling the new schemes on a case-by-case basis; in others, the need to make adjustments to the regulatory framework has arisen (ECB, 2021).

Figure 1 Overview of the regulation of open fnance Source: BBVA (2020)

3 Hong Kong Monetary Authority. Open API Framework for the Hong Kong Banking Sector. 2018.

28 | FINTECH COMPANIES IN COLOMBIA ΙΙΙ

4 Cámara de Diputados del Honorable Congreso de la Unión –Estados Unidos Mexicanos. Ley para regular las instituciones de tecnología fnanciera – DOF 09-03-2018. Artículo 76 y concordantes.

Colombia on the way to an open fnance scheme

Public and private actions have allowed Colombia to make progress in fnancial inclusion in recent years; according to figures as of March 2021, 87.8% of the adult population has at least one fnancial product. However, there are still sectors of the population with obstacles to enjoying these services on a daily basis and a large part of the transactions in the country are still carried out in cash, which perpetuates the environment of informality and operating cost overruns for the population.

Open finance emerges as an instrument to promote efficiency and competition in the industry and facilitate the use of financial products. Since 2020 the National Government has made progress in the regulation of such standard, for which the Financial Regulation Unit has published documents and convened market players to workshops and discussion tables. In October 2021 it presented a draft decree whose fnal issuance is expected for the second quarter of 2022.

The proposed regulation has followed a voluntary approach, and two reasons underlie the decision to follow such an approach. The frst is due to the policy objective to be achieved, which is none other than to expand the provision of fnancial services. It is therefore up to the institutions authorized to ofer such services to fnd in open fnance a sustainable business case for renewing their products, channels and models.

The second focuses on the powers of the current legal framework and, at the same time, the need for a timely regulatory response to the speed with which the market is being transformed. In efect, obliging access to data would require the use of regulatory powers not provided for in the current legal framework, and concentrating the initiative on a legal reform could affect the opportunity to define rules conducive to innovation.

For this reason, and under the general enabling of information processing provided for in the data protection regime, the URF published a draft

decree that encourages the access and use of fnancial consumer information and promotes the development of digital ecosystems and the commercialization of technology and fnancial infrastructure by supervised entities.

Complementarily, the project regulates the initiation of payments as a new activity of the low-value payment system. This addition would allow users to initiate payments and transactions from their accounts through third parties other than their fnancial institution. These schemes are provided by agents participating in the payment systems, focused on broadening acceptance and transactional interoperability, without managing deposits.

With the implementation of this regulation, Colombia becomes the third country in the region to implement an open fnance scheme that brings benefits to all. To consumers, by making it easier for them to have their information available to expand their fnancial alternatives and products, to the industry by expanding its strategies and coverage to provide more and better financial services, and to the market in general by accelerating its transformation process.

Bibliography

URF (2021) Arquitectura fnanciera abierta en Colombia.

Mckinsey Company (2021 (a)) Financial services unchained: The ongoing rise of open fnancial data.

McKinsey Global Institute (2021 (b)) Financial data unbound: The value of open data for individuals and institutions.

BIS (2020) Enabling open finance through APIs.

OECD (2020) Digital Disruption in Banking and its Impact on Competition.

ECB (2021) The rise of non-bank finance and its implications for monetary policy transmission.

ANA MARIA PRIETO | 29

BLOCKCHAIN: THE BANKING KILLER

DANIEL NAVARRO CEO & FOUNDER OF NIMMÖK

“Capitalism is a process of creative destruction, a process where technological change and entrepreneurial initiative cause the death of old industries and the birth of new activities.”

- 1883-1950

This phrase explains many of the past and present industrial revolutions. The new world order began in 1989 when Tim Berners- Lee created the World Wide Web, just as the Berlin Wall was falling, giving rise to the greatest economic transformation known to date, affecting all industries. Google, Facebook and Twitter disrupted the media. Mercado Libre, Rappi and Amazon transformed commerce. Uber and Airbnb changed the way we travel. The Internet broke the power of old intermediaries.

While the Internet was doing away with old intermediaries, it was replacing them with new, much more powerful ones.

For example, with more than 2 billion users, Facebook controls a large part of the world’s information and communication; it even replaces functions traditionally performed by states, such as identity registration.

DIGITAL REVOLUTION

The fip side was a formidable concentration of power and wealth. It is the users who publish Facebook content and drive Uber vehicles, but it is the middlemen who reap the lion’s share of the profts. The digital revolution democratized access to computing and communications,

Joseph Schumpeter - Austrian economist

30 | FINTECH COMPANIES IN COLOMBIA ΙΙΙ

promising to free us from the tyranny of middlemen; however, it generated the greatest accumulation of power and income. A market where few keep everything and where wealth accumulates in the richest 1%.

Today, we rely entirely on large intermediaries - banks, governments, large social media companies, credit card franchises, retail chains, supermarkets, etc. - to establish trust in the economy. These intermediaries perform the logic of business, transactions, identification and authentication of individuals, and carry out clearing, settlement and record keeping. They do a good job, but there are growing problems, such as the fact that they are centralized and can be hacked and their information breached: JP Morgan, the US Government, FB, LinkedIn, Home Depot, several Latin American banks and others found out the hard way.

CREATION OF WEALTH, BUT WITH GROWING SOCIAL INEQUALITY

Banking continues to be the most delayed in evolving along with technology, thus slowing down the fow of the economy, progress and inclusion. Financial transactions are just numbers (it’s just information, bits); however, to operate they need thousands of people, expensive buildings and giant data centers.

The centralizing entities take our data, meaning we cannot monetize it or use it to better manage our lives.

to better manage our lives. They have appropriated the bounty of the digital age asymmetrically. We have wealth creation, but with growing social inequality.

What if there were an internet of value? A kind of distributed, vast, global ledger, running on millions of computers and available to all. What if every asset could be stored, moved, transacted, exchanged and managed without powerful intermediaries? What if there were a native medium for value? The technology that enables this, and that will perhaps have the greatest impact in the coming decades, has arrived.

It’s not social media, big data, robotics, 5G, or AI. It is the technology underlying digital currencies.

In 2008, an anonymous individual invented the technology called “Blockchain”, whose first application was a digital currency called bitcoin, officially launched in 2009. We all became obsessed with cryptocurrencies, while something much more powerful and devastating was being developed: the blockchain, a technology capable of disrupting all digital industries and creating a democratic internet “of the people, for the people and by the people”.

We are facing a revolution that will change the lives of people and organizations completely. Bitcoin is not a fiat currency controlled by a nation-state. The blockchain makes it possible to establish trust and make transactions without a third party, without an intermediary. This seemingly simple act sparked a spark that ignited the world.

A REVOLUTION BASED ON TRUST

For the frst time in history, people, regardless of their geolocation, can trust each other and make an end-to-end transaction. Trust is not established by a large institution, but by collaboration, through cryptography and intelligent code. And since trust is native to this technology, it was called “Trust Protocol”.

The Blockchain brings back the human aspect by providing privacy and security to users rather than making corporations more powerful than ever.

Industries that function as intermediaries between producers and consumers of goods are at risk of being de-intermediated and replaced by P2P systems. This seriously threatens banks, the big bit intermediaries in a world where money is a record in a database. The fnancial industry is being taught a lesson by players such as Nu Bank, Movii and UALA. And they don’t want to be the next fntech morsel.

In a world where 2 billion people lack a basic bank account, blockchain comes with the promise of

DANIEL NAVARRO | 31

creating a global system for savings, payments, investment and credit. A system that allows capital to circulate at close to zero cost, which anyone can access from their mobile anywhere. A true democratization of fnance.

FALSE DISCOURSE OF DIGITAL TRANSFORMATION.

Bank executives need to end their digital transformation charades and recognize that while what they call “digital transformation” may be benefcial to their short-term performance, it is not transformative for the times we live in.

For many banks, their so-called digital transformation eforts are not strategic. In fact, in many institutions, the digital transformation strategy is not even part of the organization’s overall strategic planning process. That doesn’t make any sense.

Underlying the shortcomings in banks’ digital transformation eforts is this problem: few are transforming for the future of the industry, most are transforming for yesterday’s industry.

In other words, banks are simply playing catchup, making investments and changes they should have made years ago.

The future of banking is uncertain and its end seems near, but there are trends that the fnancial system should take advantage of and not fear:

1) Integrated finance. The integration of fnancial services into nonfnancial websites, mobile applications and business processes will help banks generate huge banking-as-aservice (BaaS) revenues. However, few banks have identifed BaaS as a strategic priority for their organization.

2) DeFi. In its definition of decentralized finance (DeFi), ethereum.org, says DeFi “uses cryptocurrencies and smart contracts to provide services that don’t need

intermediaries.” When it comes to funding real-world lending activity, DeFi outperforms traditional financial institutions. A DeFi protocol makes true P2P loans. It never holds the asset; it simply sets the price between borrowers and lenders. It performs the core function of lending at ultra-low cost because it has near-zero fxed costs. In essence, DeFi could cut out the middleman. You have yet to hear of a bank’s digital transformation initiative thinking about how DeFi will afect their institution’s place in the world.

3) Metaverse. The metaverse will change banking in several ways. Games and attractions become a source of banking trafc. A bank could open branches on Aconcagua, in the Orinoco Basin, in the Rocky Mountains or in the Sahara Desert and fully customize its users’ experience based on location.

BLOCKCHAIN TO GET OUT OF THE ICU.

The question remains: are banks, their boards of directors and executives willing to give up the old and decadent to bet on the new blockchain economy, or do they prefer to wait for its end lying in the intensive care unit where they are today?

32 | FINTECH COMPANIES IN COLOMBIA ΙΙΙ

Yes, the future is uncertain, that is why at Nimmök we assist entrepreneurs, organizations and governments to strategically adapt to the new world order and successfully execute the transition.

FINANCIAL INCLUSION IN COLOMBIA

LUIS CARLOS RAMOS GENERAL MANAGER FINTECH IN SURED

In this new reality where the digital transformation of companies was driven by the crisis generated after the Covid 19 pandemic, the presence of fnancial products that allow to digitize money and make transactions in the virtual world with security and ease, using cell phones and internet access to make transactions without the need for travel and at lower costs for the end customer, has taken great relevance. This high growth in the use of digital technologies has brought great challenges to fnancial institutions, which have had to adjust their innovation processes in order to develop new business models, which are signifcantly diferent from traditional banking models. But it is important to see that the challenge has not been only for financial institutions, as all the players in the ecosystem have been afected, from technology providers, traditional financial institutions, fintech companies, neobanks, transactional platforms, telecommunications companies, payment

networks, the regulator and the national government have had to develop capabilities to manage the crisis and meet the needs of the post-pandemic world.

Several studies have been conducted in Latin America, which have shown that the efforts made by the government and the private sector to increase the rate of fnancial inclusion, allowing the low-income population to access and use fnancial products, will improve their quality of life, increase their opportunities for economic development and improve social equity.

According to figures from Banca de las Oportunidades, by June 2021 more than 32.9 million Colombian adults had at least one formal fnancial product, with savings accounts, deposits and credit cards being the products with the highest participation. This fgure places the indicator of access to fnancial products at

LUIS CARLOS RAMOS | 33

89.4%, which is a very interesting fgure. However, the usage indicator shows a different picture, reaching 74.6% in the same period, which means that of the 32.9 million adults with a formal fnancial product registered, 27.4 million had one of these products active.

The Colombian government, through the National Financial Inclusion Strategy, has implemented a series of public policies aimed at improving the fnancial inclusion indicator with the Banking of Opportunities program, which seeks to promote and develop capacities in fnancial institutions, the cooperative sector, microcredit NGOs, supervised and non-controlled microfinance institutions and now Fintechs, to bring fnancial products and services closer to the low-income population and thus integrate them into their daily economic activities.

The program is quite promising; however, for this to happen, there must be a commitment that goes beyond political intention and the desire for fnancial institutions to increase their coverage and capillarity in the supply of their products. For example, it is necessary for fnancial entities to have responsible credit placement policies in order to avoid over-indebting individuals and thus control the punishment of their products and phenomena such as “gota a gota”. It is clear that access to fnancial services must be so broad that it is useful to satisfy the needs of clients, with frequent use in a sustainable and responsible manner.

Hand in hand with credit products, there will always be access to insurance, but for this it is necessary that the supply of insurance and microinsurance has greater coverage and depth in order to generate confdence in the market and ensure that the client can easily and clearly access these products. All this must go hand in hand with fnancial education processes, so that more and more people adopt good practices in the management of their income and expenses, and in this sense, I believe that the National Government must make a change in this context.

It is clear that at the school stage, immersion in quantitative subjects is fundamental in the

development and evolution of logical thinking, criticism, abstraction, the ability to solve problems, to face risks, and in general, in the intellectual development of children, but what about responsible fnances? There is a clear need to include educational lines in schools that guide children and young people in the importance of managing their fnances, in the understanding of the economic dynamics of countries and hopefully also in the dynamics of international markets to understand the global economic environment and thus, take that knowledge to the good management of their resources.

It is also of great importance to expand the channels of access to fnancial services and in this task the fnancial sector has been working constantly for years in the development of channels (formerly called non-traditional) such as banking correspondents and electronic platforms, so that customers of financial institutions can manage their fnancial products without having to go to bank ofces.

Today, we have the presence of the Fintech sector that has managed to reach a signifcant population and that from the development and offer of mobile Apps, web platforms and integrations through API’s, seek to capture that large percentage of customers, some unbanked and many others who are already banked, but in practice do not use their financial services and continue to manage their resources with cash. In this sense, the presence of electronic wallets, which allow customers to make digital payments in stores through OTP (One Time Password) or QR codes, has become important. Likewise, digital credit Fintech, insurtech (digital insurance) and personal fnance and wealtech, have managed to occupy a relevant place in the world of digital fnance.

But will these eforts be enough? All of the above is necessary to reach more Colombians with fnancial services, but there is one factor of great relevance to make these strategies materialize: Telecommunications. It is of utmost importance to allow more Colombians to have access to stable internet plans on their cell phones and in their homes.

34 | FINTECH COMPANIES IN COLOMBIA ΙΙΙ

Today, telecommunications companies offer plans that allow the purchase of data for browsing and also bring these services to homes and businesses, but the fgures are not very encouraging and internet coverage is quite uneven. At the end of 2021, there were more than 70 million active mobile lines in Colombia, of which more than 56 million are prepaid, that is, 2 out of every 10 lines are postpaid. According to the Vice Minister of Connectivity Walid David, “The country reached 32.9 million mobile Internet connections, predominantly prepaid with 18.9 million users, compared to 14.07 million in postpaid” in 2021. Regarding Internet access in homes, the Ministry of ICT has the goal of connecting more than 70% of the country to the Internet by August 7, 2022. This shows great challenges in terms of expanding the coverage of Internet services in Colombia.

Now, it is important to point out that the exclusion rate of the financial sector and the non-use of products is mostly due to distrust in fnancial institutions, the high costs of these operations, the lack of knowledge of the scope of the products and the intention to remain invisible in the market. But we can go beyond the fnancial sector and talk about the Postal sector: The National Government, through Decree 464 of 2020, declared postal services as an essential service, but it has been a sector that has worked tirelessly to accompany all Colombians and send money throughout the national geography for several decades. This sector has always been there, in the most remote areas of the country accompanying the low-income population in its economic development, and today it has a

greater presence and capillarity than any fnancial institution. In fact, thanks to this presence, there have been important alliances, of which I would like to highlight, without going into detail, three of them, perhaps the most important:

I would like to highlight the investment of “SuRed, la red de los colombianos” (Matrix Grupo Empresarial) as majority shareholder in SEDPE Powwi, which has been a milestone for the Postal sector, since it is the frst company in this sector that since December 2020 ofers, through the SuRed App, a fnancial product called MiCuenta SuRed by Powwi in order to accompany the banking and financial inclusion policies of the national government; I would also like to mention Movilred’s efort with SEDPE Movii to reach the unbanked population, and fnally Efecty, which in commercial alliance with Banco Pichincha ofers a fnancial product.

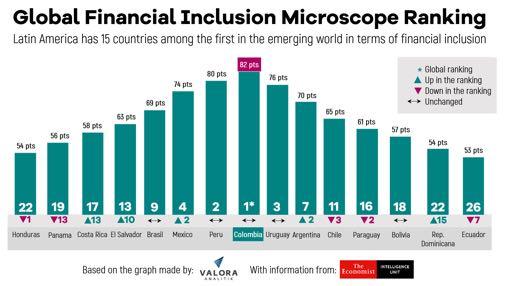

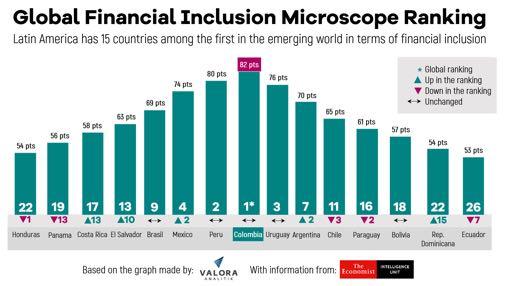

Clearly, these eforts to reach that market partially neglected by traditional banking generate great possibilities to bring Colombians ever closer and help improve their quality of life. According to Economist Impact’s Global Microscope report that assesses the enabling environment for financial inclusion across 5 categories and 55 countries, with the objective of understanding the relationship between the key enablers of fnancial inclusion, namely policy, regulation and infrastructure, and fnancial inclusion outcomes, Colombia ranked first during 2019 and 2020 by showing the greatest improvement in the domains of product and point-of-sale stability and integrity in the domestic fnancial sector.

LUIS CARLOS RAMOS | 35

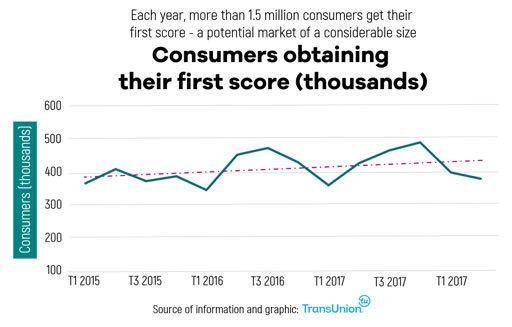

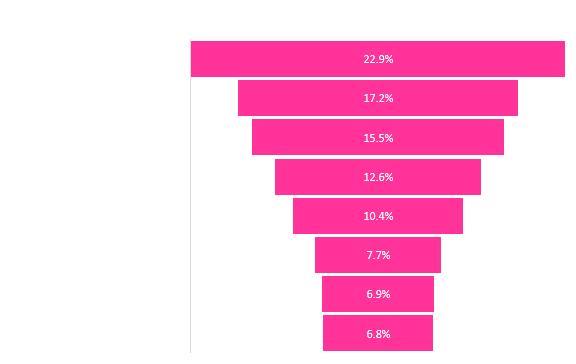

Global Microscope 2020 Scores A. Latin America and the Caribbean

Total score versus digital infrastructure score (Maximum score 100 points)

However, in Colombia there are great challenges for the diferent actors of the ecosystem that force us to continue working to improve the conditions of people at the base of the pyramid. Among them, I consider that the costs of fnancial services are a fundamental factor to improve the levels of inclusion, given that they directly afect the payment capacity of clients and users. On the other hand, the need to work on public policies that help the rural and dispersed rural sectors, to improve the coverage of internet services, to improve the financial depth for the sector, to increase the diversity of financial products according to the needs of the population.

It is necessary for regulation to accompany these eforts with strategies to facilitate and promote the reduction of informality, to allow migrants and refugees access to diferent products and services, as well as to include in its value ofer fnancial education plans to expand knowledge of these, so that customers understand and improve their use.

With the democratization of banking, new players are expected to enter the ecosystem

and their investments are expected to improve the supply of fnancial products at the base of the pyramid and thus improve access, use and cost of operations.