TokyoOffice MarketSummary

Vacancy Rates Decline, Rents Turn Positive for the First Time in Four Years

Economy

AccordingtotheTankanSurveyinMarch,the diffusionindexoflargemanufacturerswas11, thefirstdeclineinfourquartersduetostalled productionintheautosector.Theindexoflarge non-manufacturerswas34,whichmarkedan eighthquarterlyincreaseinarowtoa33-year recordhighduetorecoveryofinbounddemand.

DemandandSupply

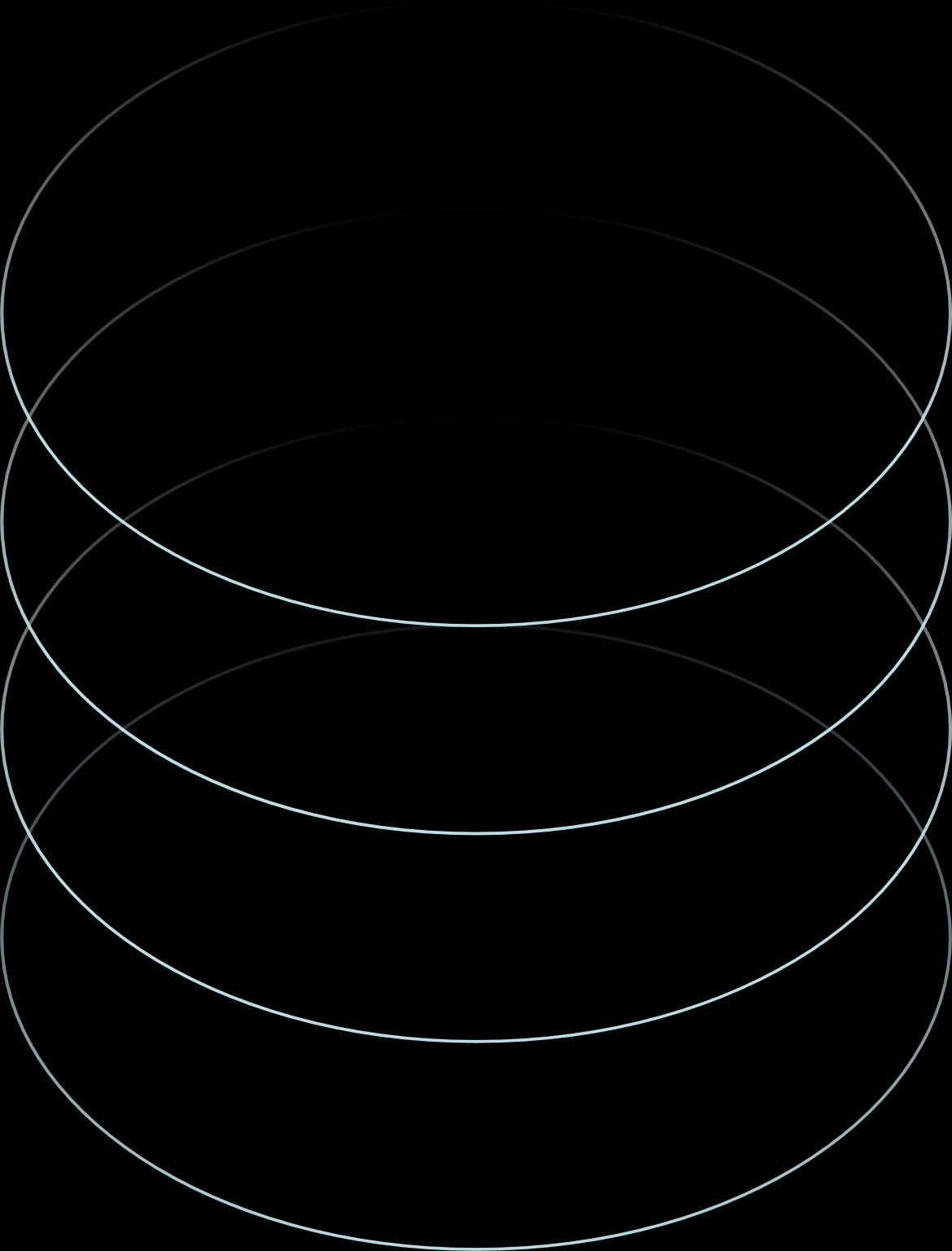

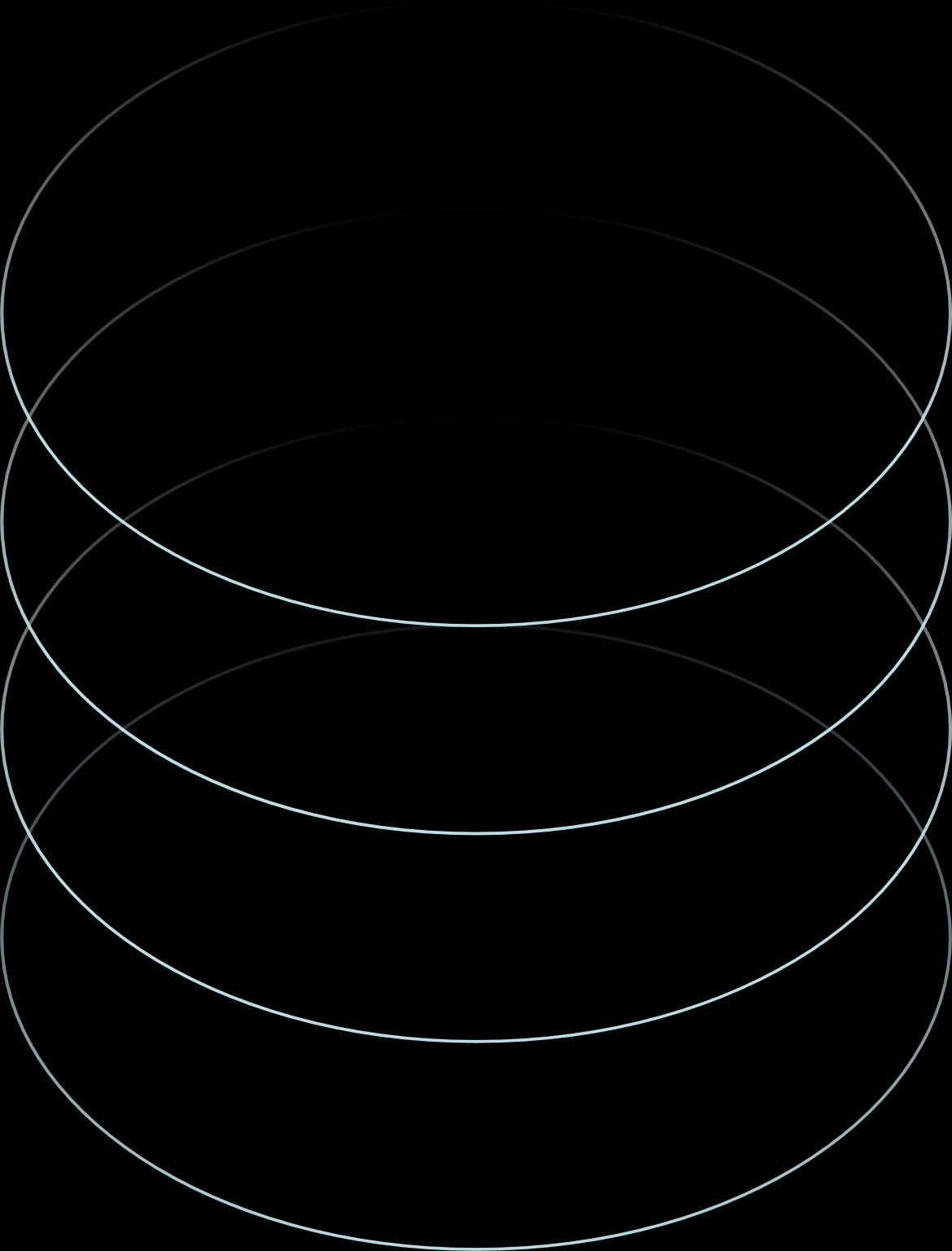

In1Q24,netabsorptionintheGradeAoffice marketinTokyowas49,700sqm. Eventhough therewerenocompletionsthisquarter,take-up inexistingbuildingswasseenasdemandfor officeisrobust.

Byindustry,thefigurewasdrivenbyinformation andcommunications,energy,financeand insuranceandmanufacturing.

Physicalindicators

For2019 to2023,take-up,completionsandvacancyrateareyear-end figures.Futuresupply reflectsfiguresfor2024.

Source:JLL,Q12024

Tokyo’s vacancy rate in the Grade A office market in 1Q24 averaged 4.2%, a 40-bps q-o-q decrease and no change on a y-o-y basis. This was the third consecutive decline in vacancy rates By sub-market, the vacancy rate fell in Otemachi/Marunouchi, while unchanged in Akasaka/Roppongi

©2024 JonesLangLaSalleIP,Inc.Allrightsreserved. 1 | Tokyo Office Market Summary

Japan Research|

-1 0 1 2 3 4 5 6 7 8 -100 0 100 200 300 400 500 600 700 800 2019 2020 2021 2022 2023 2024 Percent (%) Thousand sqm Take-up(net) Completions FutureSupply VacancyRate

Q1 2024 May 2024

Capital Values Increase Due to Positive Rental

Growth

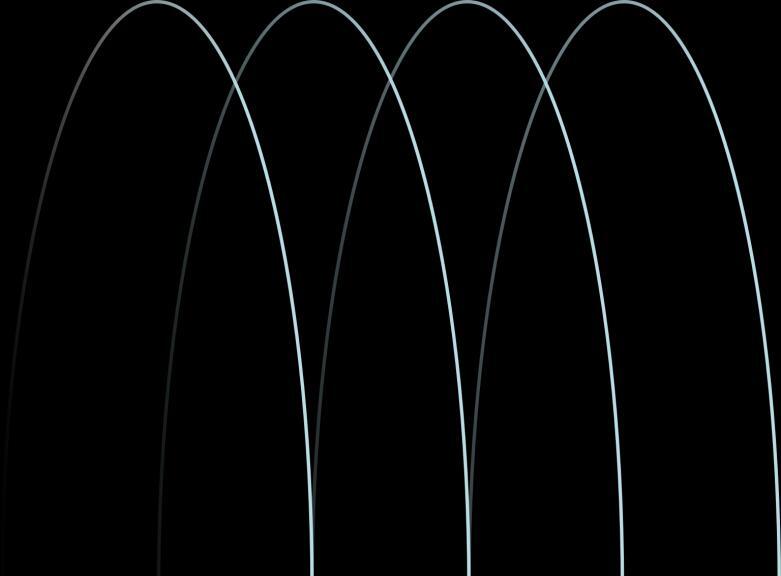

AssetPerformance

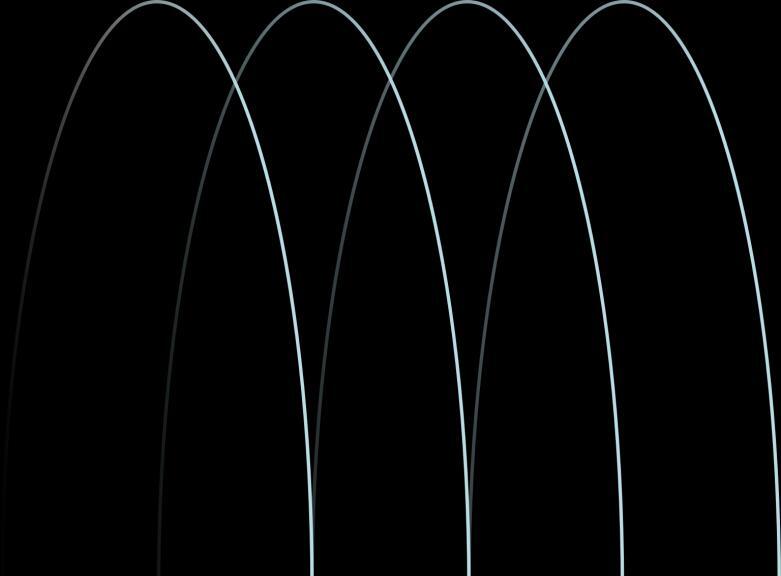

Rents in Tokyo’s GradeA office market averaged JPY 33,860 per tsubo, per month, at the end of 1Q24, rising 09% q-o-q and falling 1 3% y-o-y Rents rose for the first time in 16 quarters In terms of submarkets, rents fell in Otemachi/ MarunouchiandroseinAkasaka/Roppongi

Capital values in 1Q24 rose for the first time in four quarters up 2 1% q-o-q and down 1 4% y-oy This reflected positive rent growth while cap ratesremainedstable

InvestmentMarket

The office investment volume in Tokyo was JPY 700 billion in 1Q24. This was a 1,079% q-o-q increase and up 50% y-o-y Notable Grade A office transactions this quarter included the acquisition of a strata of Toranomon Hills Business Tower by United Urban Investment Corporation for JPY 8 billion at an expected NOI of3 3%

FinancialIndices

Source:JLL,Q12024

Outlook

According to Oxford Economics’ forecast as of March 2024, the real GDP growth for full year 2024 is 0.5% and the forecast for CPI is 1.9%. Risks include additional interest rate hikes by the BOJ, a downturn in overseas economies, inflation,andvolatilityinfinancialmarkets

Leasing volumein 2024 is expected to slow from the prior year as relatively few projects are scheduled for completion However, since a large amount of new supply will be completed in2025, leasing volumesareexpectedtorecover from the latter half of 2024 Also, due to decline of vacancy, rents are expected to gradually recover

Capital values, with rents projected to rise and capratesunchanged,willgraduallyincrease

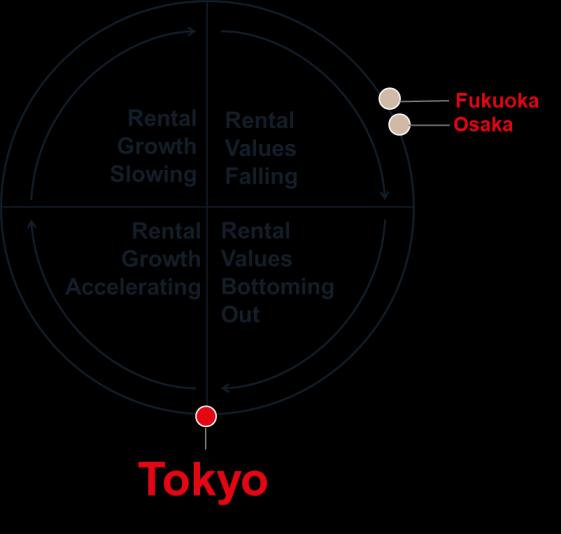

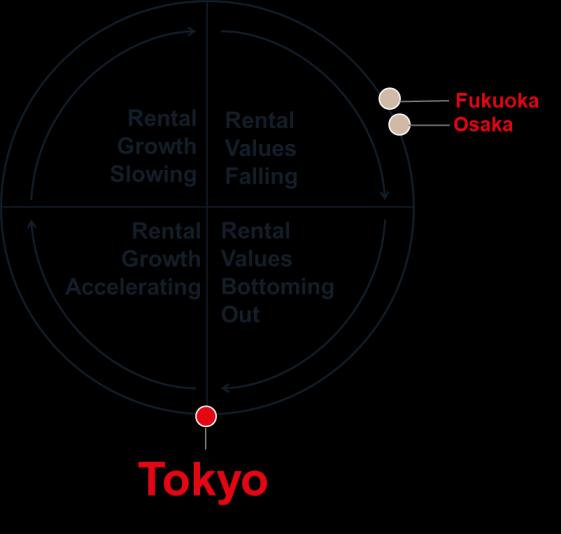

Property Clock

Source:JLL,Q12024

©2024 JonesLangLaSalleIP,Inc.Allrightsreserved. 2 | Tokyo Office Market Summary 80 90 100 110 4Q19 4Q20 4Q21 4Q22 4Q23 4Q24F 4Q19 = 100 RentalValueIndex CapitalValueIndex

KeyPerformanceIndicators

Source: JLL,Q12024

Note1:VacancyrateandrentsrefertoTokyoGradeAofficemarket.The definitionofGradeAisasbelowthetable.

Note2:PropertyclockbasedonrentsforGradeAspaceinCBDor equivalent.

Note3:InvestmentvolumereferstoTokyoprefecture’sofficedirect commercialrealestateinvestmentvolume.

TokyoGradeAofficedefinition Area

DesignatedascentralTokyo businessdistrict(Chiyoda,Minato, Chuo,ShinjukuandShibuyawards)

©2024 JonesLangLaSalleIP,Inc.Allrightsreserved. 3 | Tokyo Office Market Summary

Vacancyrate Q-o-Q Y-o-Y GradeAoffice 4.2% -40bps 0bps Rents pertsubopermonth Q-o-Q Y-o-Y GradeAoffice JPY33,860 +0.9% -1.3% Occupationalmarket Investment volume Q-o-Q Y-o-Y TokyoOffice Q12024 JPY700.6 billon +1,079% +50% Investmentmarket

Grossfloorarea 30,000 sqm(9,075tsubo)ormore Typicalfloorplate 1,000sqmormore BuiltYear Since1990

jll.com

JonesLangLaSalleK.K.

Tokyo Headquarters KioiTower, Tokyo Garden Terrace Kioicho 1-3Kioi-cho Chiyoda-ku, Tokyo 102-0094 +81343611800

FukuokaOffice

DaihakataBldg. 2-20-1Hakata-ekimae, Hakata-ku,Fukuoka-shi Fukuoka812-0011 +81922336801

OsakaOffice Nippon Life

Yodoyabashi Building 3-5-29KitahamaChuo-ku, Osaka541-0041 +81676628400

NagoyaOffice

JPTowerNagoya 1-1-1Meieki Nakamura-ku,Nagoya-shi

Aichi450-6321 +81528563357

Contact

TakeshiAkagi HeadofResearch Research -Japan takeshi.akagi@jll.com

TomoyoNakamaru AssistantManager Research -Japan tomoyo.nakamaru@jll.com

YutoOhigashi Senior Director Research-Japan yuto.ohigashi@jll.com

About JLL

For over 200 years, JLL (NYSE: JLL), a leading global commercial real estate and investment management company, has helped clients buy, build, occupy, manage and invest in a variety of commercial, industrial, hotel, residential and retail properties. A Fortune 500® company with annual revenue of $20.8 billion and operations in over 80 countries around the world, our more than 108,000 employees bring the power of a global platform combined with local expertise. Driven by our purpose to shape the future of real estate for a better world, we help our clients, people and communities SEE A BRIGHTER WAYSM. JLL is the brand name, and a registered trademark, of Jones Lang LaSalle Incorporated. For further information,visit jll.com

AboutJLLResearch

JLL’s research team delivers intelligence, analysis and insight through marketleading reports and services that illuminate today’s commercial real estate dynamics and identify tomorrow’s challengesand opportunities. Our morethan550globalresearchprofessionalstrackandanalyzeeconomicand property trends and forecast future conditions in over 60 countries, producing unrivalled local and global perspectives. Our research and expertise,fueledbyreal-timeinformationandinnovativethinkingaroundthe world, creates a competitive advantage for our clients and drives successful strategiesandoptimalrealestatedecisions.