Osaka

• Demand remains strong, andvacancies innewsupplybuildingsin2024intheUmeda areaarefillingupfast.

• “Yodoyabashi StationOne” wascompleted, andthevacancyrateroseonly0.2%fromtheprevious quarterto3.3%.

• Highrentcontracts aresupporting atrend towardraisingrentlevelsfurther.

TheJulyTankanSurvey forGreaterOsakashowedthatbusiness sentiment roseto14pointsfrom10forlargemanufacturersandrose to33points from30forlargenon-manufacturers. Netabsorption totalled+28,000sqminQ22025.Demand forofficefacility improvement remains highduetobusinessacceleration, aswellas thecontinuing return-to-office trend. Thisquartertherewereseveral consulting serviceproviders thatmoved forexpansion.

Onenew building(YodoyabashiStation One), byChuoNittochiand KeihanHoldings, completed inthequarter, withaGFAof73,000sqm and31storeys.Bank/financialcompanies andlawfirmsrelocated to thisbuilding.TheQ22025vacancy rateroseto3.3%,anincreaseof20 bpsq-o-q andadecrease of80bpsy-o-y.

Theaveragemonthly grossrentpertsubowasJPY24,623,anincrease of3.5%q-o-q and8.5%y-o-y. Buildingscompleted in2024inthe Umeda areahaveachieved highrentincreases,pushingupasking rentsforOsakamarket Capitalvaluesincreased by4.4%q-o-q and

11.8%y-o-yinQ22025,driven bycurrentrenttrends. Caprates remained stablefromtheprevious quarter.

Outlook

According totheJuneOxford Economics forecast,OsakaCity'sreal GDPisprojected togrow by0.4%in2025butremainflatin2026.The rental marketmayaccelerate ascompanies viewworkplacesasa strategytoattracttalentratherthanascostcentres, withlow vacanciesinexistingbuildings.Ownersareexpected tocontinue to raiserents,encouraged bycontracts signed athighrents.Owner dominance willbeparticularlypronounced forprime spaceinprime locationsfavored bytenants, andrentsareunlikelytofall.There will beone more project thatcontributes tonewsupplyin2025. Investment marketvolume likelytodecrease despite strongbuyer demand duetolimited sellingactivity.InQ22025,therehavebeen severalCRE(corporate realestate)salesbycompanies, andthereare expectations forfurtherexpansion inthefuture.

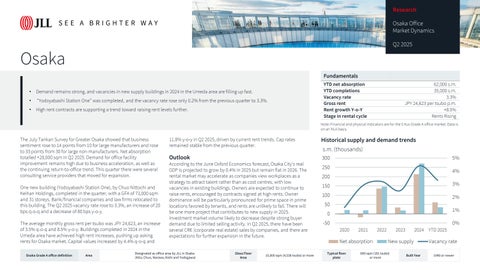

Fundamentals

Note:Financialandphysical indicatorsareforthe5KusGradeAofficemarket.Datais onanNLAbasis.

Historicalsupplyanddemandtrends

(thousands)

COPYRIGHT ©JONESLANGLASALLEIP,INC.2025

Thisreport hasbeenprepared solelyforinformation purposesanddoesnotnecessarilypurport tobeacomplete analysisofthetopics discussed,whichareinherently unpredictable. Ithasbeen basedonsourceswebelievetobereliable,butwehavenotindependently verifiedthosesourcesandwedonot guaranteethattheinformation inthe report isaccurateorcomplete. Anyviewsexpressed inthereport reflect ourjudgment atthisdateandaresubjecttochange withoutnotice. Statements thatareforward-looking involve known andunknown risksanduncertaintiesthatmaycausefuturerealitiestobemateriallydifferent fromthoseimplied bysuchforward-looking statements.Advice wegive toclients inparticularsituationsmaydifferfromtheviewsexpressed inthisreport. Noinvestment orotherbusinessdecisions shouldbemadebasedsolelyon theviewsexpressed in thisreport.