Japan MarketDynamics

Japanese offices with current green building certifications may still become strandedassetsduetolenient energy standards.

Author Research

SeniorManager

TomomiKemmochi

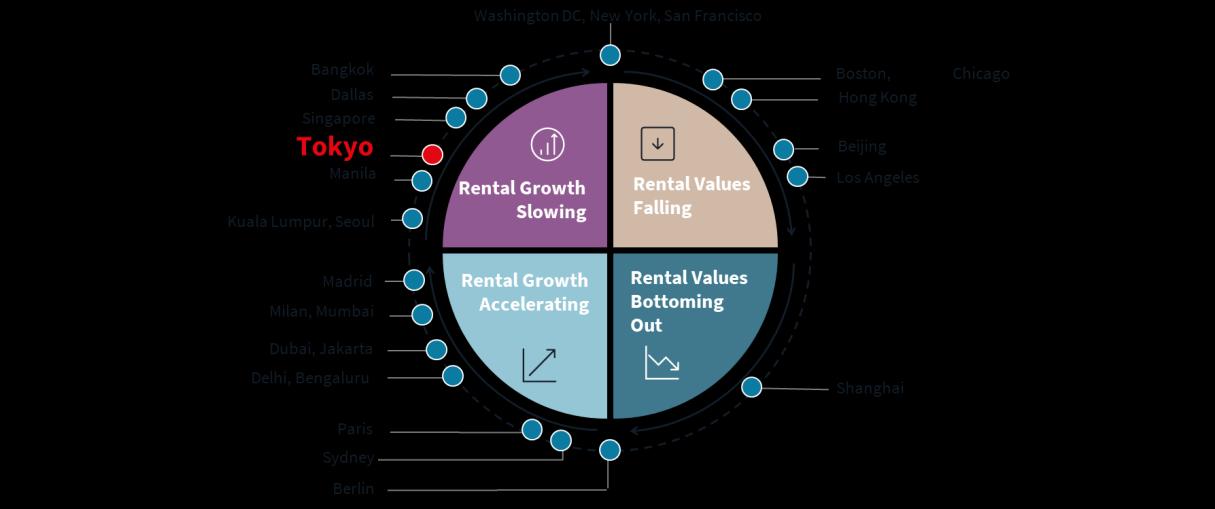

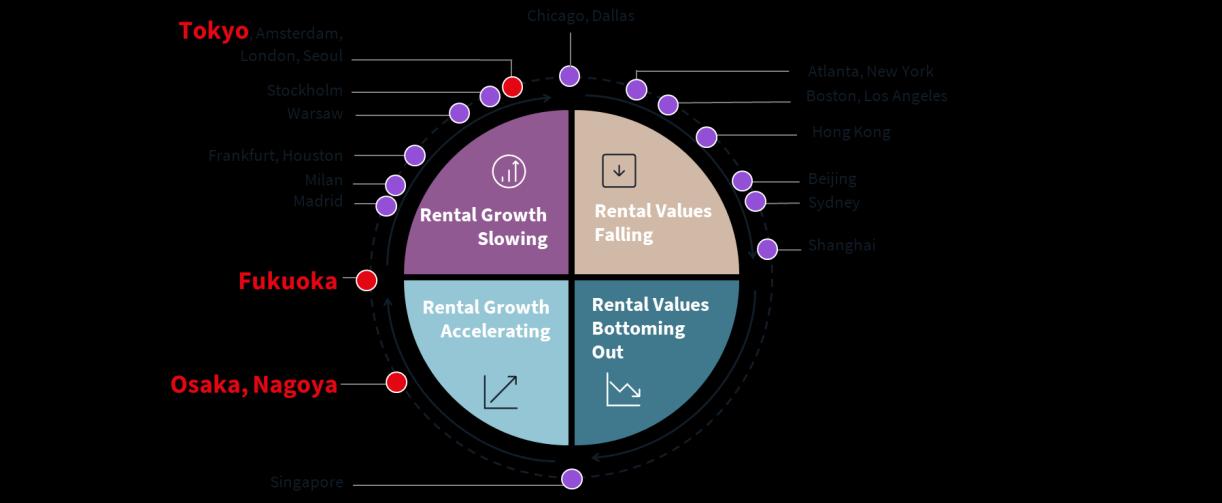

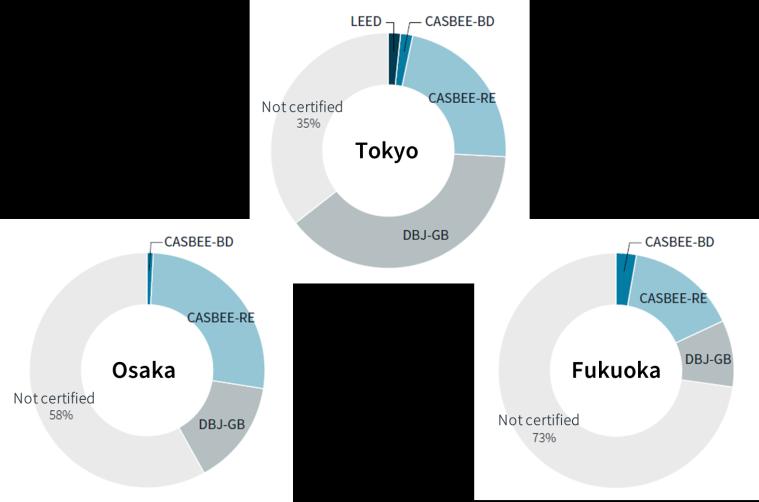

Green building certifications are attracting increasing attention, partly due to the need to accelerate CO2 emissions reduction in the real estate sector, which contributes approximately one-third of Japan’s total CO2 emissions. Large office buildings have witnessed a significant increase in green building certifications in recent years, with 65% of buildings in Tokyo, 42% in Osaka, and 27% in Fukuoka having some kind of certification as of the end of 2024

Analysis of adoption rates by certification system reveals that DBJGB (DBJ Green Building) is the predominant certification in Tokyo, actively promoted by major developers, while CASBEE-RE (CASBEE for Real Estate) holds the largest share in Osaka and Fukuoka. However, the adoption of more stringent certification systems remains limited across Japan, according to JLL Japan’s latest report on sustainability of real estate. Only 3% of buildings in Tokyo and Fukuoka, and none in Osaka, have acquired LEED certification (internationally recognised but challenging to obtain) or the highest rank (S) of CASBEE-BD (CASBEE for Buildings) (the mostrigorousdomestic system).

orhigher.

A studybyJLL JapanEnergy& SustainabilityServices has revealed that some properties with the highest rank (S) in the CASBEE-RE are either currently classified as stranded assets by the Carbon Risk Real Estate Monitor (CRREM) Pathway or are projected to become so within the next few years[1]. Stranded assets are properties that will be increasingly exposed to the risk of early economic obsolescence due to climate change because they will not meet (potential) future regulatory efficiency standards or marketexpectations

This finding underscores a crucial consideration: while green building certification systems assess comprehensive environmental performance, not all systems are equally stringent Consequently, even properties with the highest rating under a local green certification system with comparatively lenient energy

① Integrativeprocesscredits

② Location&transportation

③ Sustainablesites

④ Waterefficiency

⑤ Energy&atmosphere

⑥ Material&resources

⑦ Indoorenvironmentalquality

⑧ Innovation

⑨ Regionalprioritycredits

Environmentalquality:

① Indoorenvironment

② Qualityofservice

③ Outdoorenvironmentonsite

Enviornmentalloadreduction:

④ Energy

⑤ Resources&materials

⑥ Off-siteenvironment

performance criteria may still be inadequate to achieve sufficient CO2emissionsreduction tomeettheParisAgreement targets.

Given these considerations, stakeholders should strategically decarbonise and improve the environmental performance of office buildings in Japan. Ideally, they should aim for LEED certification, as it continuously strengthens its evaluation standards, particularly regarding energy efficiency and greenhouse gas emissions reduction At a minimum, if LEED certification is not feasible, they should strive for high rankings in energy performance certifications to complement local green building certifications. This comprehensive strategy would position Japanese office buildings more favourably in the global sustainable real estate market, potentially mitigating future risks fromstranded assetsandregulatorycompliance.

① Energyuse/GHGemissions

② Wateruse

③ Material/Safety

④ Biodiversity/Landuse

⑤ Indoorenvironment

SimplerthanCASBEE-BD

① Energy&resources

② Well-being

③ Resilience

④ Community&diversity

⑤ Partnership

Note: Large office buildings here are defined as leasable office buildings located in the CBDs of Tokyo, Osaka, and Fukuoka, completed in or after 1990. These buildings have a total floor area of 30,000 sqm or more in Tokyo, or 15,000 sqm or more in Osaka and Fukuoka.

[1] CRREM is the leading global initiative for establishing targets for operational carbon emissions for standing real estate investments consistent with the ambitions of the Paris agreement

Author Research

Manager YokoYamada

Once a major industry hub in Southern Japan, Kitakyushu City in Fukuoka Prefecture is experiencing renewed growth In 2024, Kitakyushu Port and Airport handled their highest-ever annual cargo volume (Figure 1) The city is evolving further, benefiting from its geographical advantage as a gateway to Mainland Asia as well as integrated land, sea, and air transportation infrastructure

The Greater Fukuoka logistics market has seen rental increases exceeding even those of Tokyo and Osaka over the past decade (Figure 2), with the Tosu submarket playing a pivotal role in driving this growth The e-commerce boom and Kyushu's burgeoning semiconductor industry have helped Tosu become a crucial widearea distribution hub for the entire Kyushu region, located at the nexus oftheKyushuandNagasakiExpressways.

In contrast to Tosu, which manages land-based logistics within Kyushu, Kitakyushu is strengthening its role as both an international logistics hub and a key gateway connecting Honshu (Japan’s main island), and Kyushu. Kitakyushu leverages its wellestablished port capabilities. Kitakyushu Port boasts one of Japan's largest cargo handling volumes, solidifying its position in trade with Asia, particularly in the movement of raw materials and finished goods. A robust system of domestic ferry and RORO (rollon/roll-off) lines connects the port to the key commercial centres of Tokyo, Osaka, and Nagoya. This system, specifically designed to facilitate the transport of entire truck units, gives Kitakyushu an exceptionally user-friendly domestic maritime transport environment. Consequently, logistics providers are increasingly adopting a maritime modal shift, recognising the advantages of using Kitakyushu Port as a central gateway for sea-based distribution The improvements in the working environment,

including shorter working hours for truck drivers, are further contributing, reinforcing Kitakyushu Port’s likely lead in Kyushu’s maritimetransportation

Kitakyushu’s infrastructure also provides advantages. These includeamaritimeairport operating24hours aday,oneof thefew railway freight terminals in Japan capable of handling 40ft containers, and a location at the junction of key highways such as the Kyushu Expressway, the Higashi-Kyushu Expressway, and the Chugoku Expressway. Plans are underway to enhance the city’s potential as alogistics hub. These include extending the runway at Kitakyushu Airport and developing a new route connecting HonshuandKyushu,calledthe"Shimonoseki-Kitakyushu Road."

The limited availability of large-scale logistics facilities presented a past challenge. However, Kitakyushu is rapidly overcoming this. Tobata Logistics, a local enterprise, launched operations at the

city's largest logistics facility in 2024. Moreover, Kyushu Electric Power intends to complete a modern, multi-tenant logistics complex by summer 2027, and several developers are actively investigating new logistics facility ventures in Kitakyushu City. In addition, Kitakyushu City's administrative authorities are proactively fostering the creation of a major logistics hub through their comprehensive 'Logistics Base Concept,' offering supportive measures like land acquisition assistance and development incentives, which are expected to drive substantial market expansion.

All things considered, Kitakyushu, or "Kitakyu", is positioned to emerge as a major logistics hub in the Greater Fukuoka logistics realestatemarket.

Investmentexpandsasborrowingcosts decline

Globalrealestateinvestmentvolumecontinuesto expandduetodeclininginflationrateand borrowingcosts.Bysector,industrialrealestate suchaslogisticsfacilitiesfacesawait-and-see approachduetouncertaintiesincludingUStariff policy.Officeinvestmentisexpanding,particularly intheAsia-Pacificregion.

Strongdemandabsorbsincreasedsales volume.

Theevolvingeconomicenvironment,including risingprices andinterestrates,isprompting investorsto reviewtheirportfoliosandcompanies tomodifytheirrealestatestrategies,leadingto increased propertysales.Supportedbyfinancial institutions'proactivelendingstance,thereal estateinvestmentmarketcontinuestothrivedue torobustinvestmentdemandfromdiverse domesticandinternationalinvestors.

Japan’sinvestment volumeexceedsJPY threetrillioninfirsthalf.

Followingastrongfirstquarter,multiplelargescalepropertytransactionsdroveJapan's transactionvolumeaboveJPYthreetrillioninthe firsthalf thefirsttimesince 2007.Large-scale officeandmultifamilyportfoliotransactionswere seen incentralTokyo,propellingTokyotofirst placeamongglobalcitiesforinvestmentvolume.

ThegrowinguncertaintyfromUStariffpolicyhas littleimpactonJapan'srealestateinvestment market.Consideringrecentdevelopments regardingtariffsanddomesticcorporate responses, theimpactisexpected toremain limited.Duetoincreased investment opportunitiesandsustainedstrongdemand,real estateinvestmentvolumein2025isprojectedto exceed 2024levelsandreachnearlyJPYsixtrillion.

• In1H25,domestic realestateinvestment volume was up11%q-o-q and22%y-o-y toJPY3,193.2billion (USD21.3billion,up23%y-o-y).

• Duetotransactionsinthefirstquarterinvolving large officebuildingssuchasTokyo GardenTerrace Kioicho andmajorretailfacilitiessuchasTokyuPlaza Ginza,thehalf-yearinvestment volume exceeded JPY threetrillionforthefirsttimesincethesecond halfof 2007.

Source:JLL

• Theshareofofficeinvestment reached JPY1,703.7 billionin1H25,accounting for53%.Thisexpanded from44%inthesameperiod lastyearandmarked thefirsttimethefirsthalfexceeded 50%since2018.

• Retailexpanded from8%inthesameperiod lastyear to12%.Meanwhile,logisticsfacilities,hotels,and multifamilyhousingdecreased fromthesameperiod lastyearto11%,10%,and13%,respectively.

• Tokyo CBD,whichsawmultiplelarge-scaleofficeand retailtransactionsinthefirstquarter,accounted for 56%ofthetotaldomesticinvestmentvolumein1H25, exceeding 50%forthefirsttimesince1H18.

• TheshareofGreaterTokyo (excluding Tokyo), comprising Chiba,SaitamaandKanagawa prefectures, whichsawtransactionsincluding YokohamaPlazaBuildingandmultiplelarge-scale logisticsfacilities,expanded from8%inthesame period lastyearto11%.

• TheshareofGreaterOsakaremained atonly10% despite multiplelargeofficetransactions,contracting significantlyfrom21%inthesameperiod lastyear.

Source:JLL

TokyoCBD(5-ku)

GreaterOsaka

Other

Tokyo(Excluding5-ku)

GreaterNagoya

GreaterTokyo(ExcludingTokyo)

GreaterFukuoka

Note:TokyoCBC(5-kus)referstoChiyoda-ku,Chuo-ku,Minato-ku,Shinjuku-kuandShibuya-ku;GreaterTokyoreferstoTokyo,Chiba,SaitamaandKanagawa;GreaterNagoyareferstoAichi, GifuandMie;GreaterOsakareferstoOsaka,Hyogo,KyotoandNara; GreaterFukuokareferstoFukuoka,Saga,Nagasaki,Kumamoto,Oita,Miyazaki,KagoshimaandOkinawa.

• Steady tenant demand whilevacancyratesremainlimitedandnetabsorptionispositivealthoughlimitednew supplywas completed thisquarter

• Rents riseforthesixthconsecutive quarter

• Furtherdecline invacancy rateswithalmostnoremaining spaceinOtemachi/Marunouchi

According totheTankanSurveyinJune, thediffusionindex oflarge manufacturersrose1point to13,thefirstriseintwoquartersdueto solidrecovery intheironandsteelsector.Theindex oflargenonmanufacturersfell1point to34duetoinbound demand. Strong demand forofficesisseenduetoheadcount increasesandflight-toqualityrelocations. Netabsorptionwasaround 30,800sqminQ2 2025.Byindustry,thefigurewasdriven byinformation services, wholesaleandretailtrade,andprofessional services.

Onenew GradeAofficebuildingwascompleted inQ22025.Tokyo's vacancy rateintheGradeAofficemarketinQ2averaged 2.4%andfell 10bpsq-o-q and120bpsy-o-y. Bysubmarket,thevacancyratefor Otemachi/MarunouchiandAkasaka/Roppongi submarketsfurther compressed, withsub-1%levels seenintheformer.

Rents averaged JPY36,237pertsubo,permonth, up2.0%q-o-q and 5.9%y-o-y byendQ22025.Rents inbothAkasaka/Roppongi and

Otemachi/Marunouchisubmarketswereupaslandlord-favourable marketconditions continue duetotightsupplyanddemand. Capital valuesinQ22025wereup2.9%q-o-q and9.5%y-o-y, reflecting the continualriseinrents andunchanged capratesfrom theprevious quarter.Anotabletransactionannounced thisquarterwasthe acquisitionofAkasakaParkBuildingbyMitsubishiEstate.

According toOxfordEconomics' forecastasofJune 2025,theGDP growthforyear-end 2025is0.8%andtheCPIis2.8%.Risksinclude theimpactoftariffsoncorporate activityandadownturn inoverseas economies. Leasingvolumesareexpected tostaysolidinthesecond halfoftheyearasdemand forexistingbuildingsisvery robustdueto strongappetite fromcorporates. Capitalvaluesarealsoexpected to risehigherasrentincreasesexceed projections.

Note:Financialandphysical indicatorsareforthe5KusGradeAofficemarket.Datais onanNLAbasis.

• Demand remains strong, andvacancies innewsupplybuildingsin2024intheUmeda areaarefillingupfast.

• “YodoyabashiStationOne” wascompleted, andthevacancyrateroseonly0.2%fromtheprevious quarterto3.3%.

• Highrentcontracts aresupporting atrend towardraisingrentlevelsfurther.

TheJulyTankanSurvey forGreaterOsakashowedthatbusiness sentiment roseto14pointsfrom10forlargemanufacturersandrose to33points from30forlargenon-manufacturers. Netabsorption totalled+28,000sqminQ22025.Demand forofficefacility improvement remains highduetobusinessacceleration, aswellas thecontinuing return-to-office trend. Thisquartertherewereseveral consulting serviceproviders thatmoved forexpansion.

Onenew building(YodoyabashiStation One), byChuoNittochiand KeihanHoldings, completed inthequarter, withaGFAof73,000sqm and31storeys.Bank/financialcompanies andlawfirmsrelocated to thisbuilding.TheQ22025vacancy rateroseto3.3%,anincreaseof20 bpsq-o-q andadecrease of80bpsy-o-y.

Theaveragemonthly grossrentpertsubowasJPY24,623,anincrease of3.5%q-o-q and8.5%y-o-y. Buildingscompleted in2024inthe Umeda areahaveachieved highrentincreases,pushingupasking rentsforOsakamarket Capitalvaluesincreased by4.4%q-o-q and

11.8%y-o-yinQ22025,driven bycurrentrenttrends. Caprates remained stablefromtheprevious quarter.

According totheJuneOxford Economics forecast,OsakaCity'sreal GDPisprojected togrow by0.4%in2025butremainflatin2026.The rental marketmayaccelerate ascompanies viewworkplacesasa strategytoattracttalentratherthanascostcentres, withlow vacanciesinexistingbuildings.Ownersareexpected tocontinue to raiserents,encouraged bycontracts signed athighrents.Owner dominance willbeparticularlypronounced forprime spaceinprime locationsfavored bytenants, andrentsareunlikelytofall.There will beone more project thatcontributes tonewsupplyin2025. Investment marketvolume likelytodecrease despite strongbuyer demand duetolimited sellingactivity.InQ22025,therehavebeen severalCRE(corporate realestate)salesbycompanies, andthereare expectations forfurtherexpansion inthefuture.

s.m.

Note:Financialandphysical indicatorsareforthe5KusGradeAofficemarket.Datais onanNLAbasis.

• Strong relocation demand coming fromvarioussectorsdrivesrobustnetabsorption

• Despiterisingoccupancy innew buildings,vacancyratesreachthe8%range, reflecting spaceavailabilityinmajornewsupply

• Rents continue agradualupwardtrend, driven bynew supplyandselectexistingbuildingsacrossthemarket

TheKyushu-OkinawaTankansurveyinJune2025was30,showinga 4-pointdecrease inDIforbusinesssentiment foralllargeenterprises; manufacturing deteriorated by4points, whilenon-manufacturing wasstable.Theemployment situationcontinued toshow movements ofimprovement. Demand remained robustin2Q25,with sectorsincluding construction, finance &insuranceandrealestate leasingservicesdrivingrelocations andnew officesetups.This increased occupancy innew buildingsandnewsupply. Net absorptionreached 23,000sqm, up22,000sqmy-o-y, bringing 1H25 totalto29,000sqm,anincreaseof14,000sqmy-o-y.

Thestockincreasedby8%q-o-q in2Q25.Tenjin Sumitomo LifeFJ BusinessCenter (NLA23,000sqm)andTenjin BrickCrossNorthTower (17,000sqm)entered themarket.Thevacancyrateincreased to8.7%, increasing280bpsq-o-q and310bpsy-o-y. Despitegradually decreasing vacancies innew buildings,thevacancyraterose, reflecting theavailablespaceinthenewsupply.

Rentsaveraged JPY21,573pertsubo,permonth in2Q25,increasing 1.5%q-o-q and6.9%y-o-y. Newsupplywasadriving factor,while soliddemand prompted upwardrentrevisionsinexistingbuildings acrossthemarket. Capitalvaluesincreased2.3%q-o-q and8.2%yo-y. Withinvestment yieldsremaining flat,theincreasesprimarily reflected risingrents.NoGradeAofficetransactionswereconfirmed duringthequarter.

Oxford Economics forecastsFukuokaCity’srealGDPgrowthfor2025 at0.7%inJune, aslightupwardrevisionfrom March.Risksinclude theimpactoftradepoliciesinforeign economies.

Intheleasingmarket,robustdemand facesheadwindsfrom significantnew supply,whichisexpected tolimitvacancy improvements. Rents shouldremain stable,inpartreflecting new supply,butmaysoftenifvacanciesincrease. Theinvestment market outlookremainspositive, withsteadyyieldsexpected andpricesthat followrenttrends.

Fundamentals

Note: FinancialandphysicalindicatorsareforFukuoka’sGradeAofficemarket. DataisonaNLAbasis.

(thousands)

• Robustdemand comes fromindependent international brands.

Grossrent

99,810pertsubop.m.

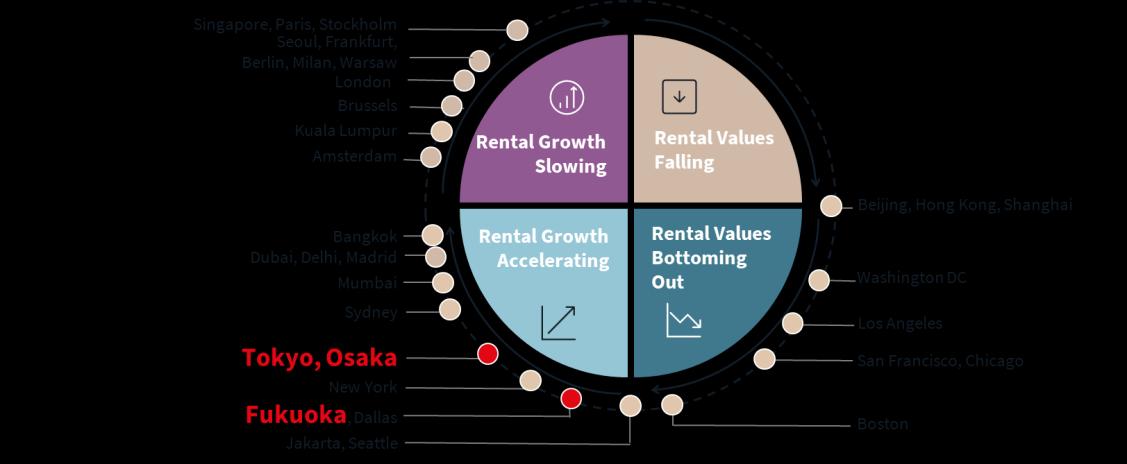

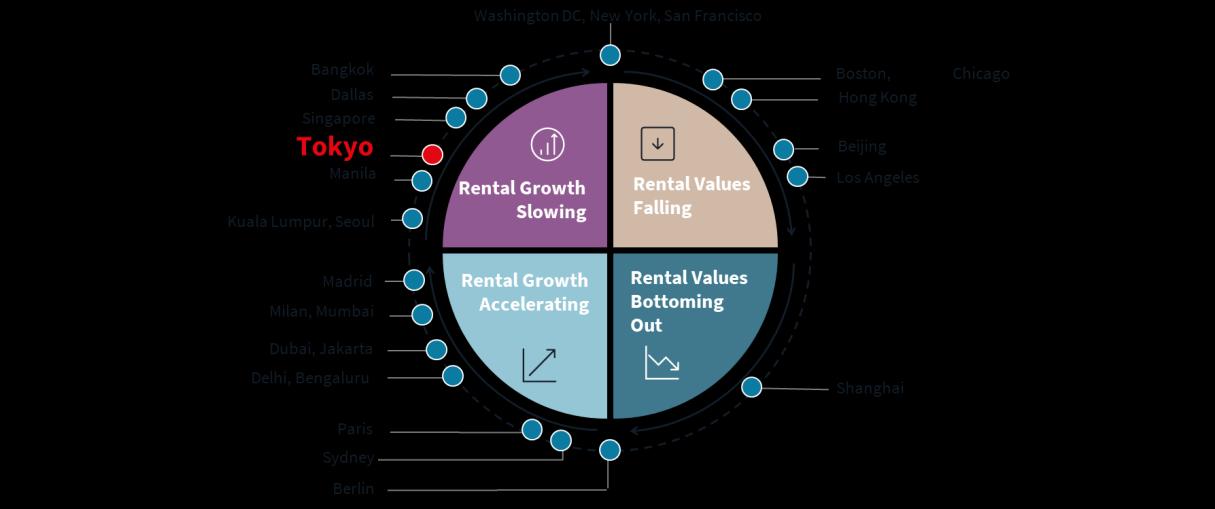

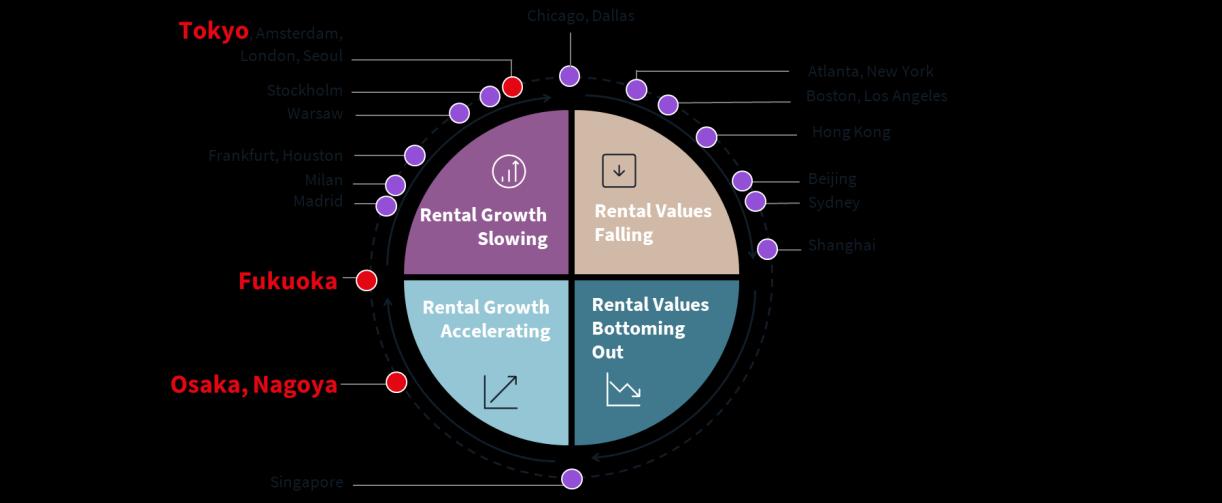

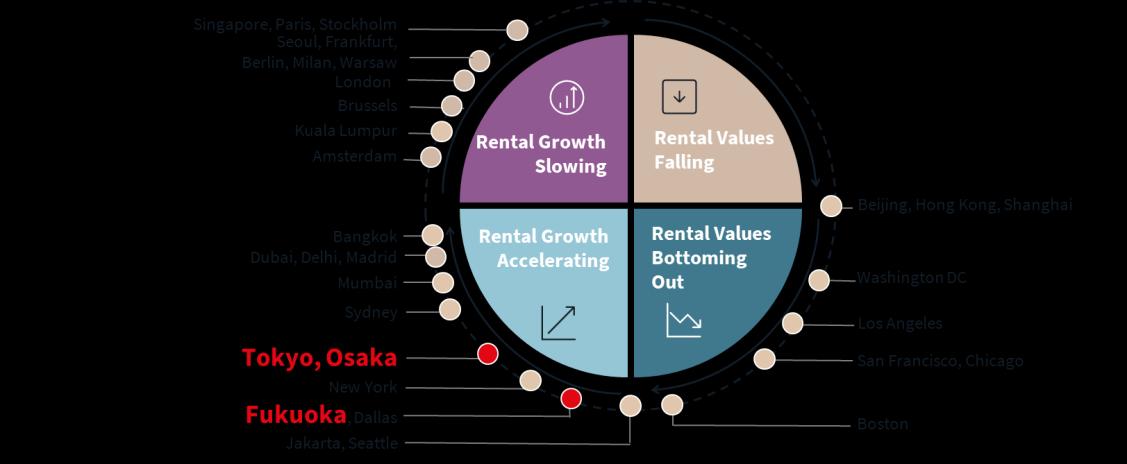

Rentgrowth Y-o-Y 5.4% Stage inrental cycle

• TheHulicAoyamaBuildingRedevelopment Projectcommences construction alongside Omotesando.

• Capitalvaluegrowthdecelerates, reflecting stableground-floor rent growth.

Despiteweakening consumersentiment, overallconsumption showedsignsofrecovery inMay,supported byimproving employee income. Inbound consumption rose30%y-o-yinQ12025,driven bya record number offoreign visitorarrivals.Demand fornewopenings remained robustinQ2,driven byhigh-performing independent international brands,whileappetite frommajorinternational brand groupsmoderated astheyfinalisedspaceneeds. Newopenings in thequarterincluded OnitsukaTigerinOmotesando andEmporio ArmaniinGinza.

Construction commenced ontheHulicAoyamaBuilding redevelopment project, a9,600sqmGFAproject inaprime Omotesando location inQ2.Thebuilding, dueinMay2028,has alreadysecuredtenantsforitsretailspaceandwillalsofeatureoffice andF&Bservices.TheGinza6-ChomeMiyuki-doridevelopment project hasbeenconfirmed. Redeveloped together withtheadjacent former BrioniGinzaBuilding,thiswillbearetailbuildingwithaGFAof 5,700sqm,dueinthesummerof2028alongside Sotobori-dori.

Rentsaveraged JPY99,810pertsubo,permonth inQ22025, increasing0.2%q-o-q and5.4%y-o-y. Moderated rentgrowthwas driven byupper floorswhileground floorsremained stable.This markedthe13thconsecutive quarterofincreases.Tokyo's prime retailmarketsawcapitalvalueswerestableq-o-q andup6.2%y-o-y inQ22025,driven byrent growth. MitsuiFudosan'sacquisitionof Ginza'sMarugen31Building,slatedfordemolition, presentsa redevelopment opportunity.

According totheJuneOxford Economics' forecast, private consumption wasunchanged andexpected toincreaseby0.9%in 2025.Consumption isexpected torecover asemployment and income improve. Risksinclude trendsinconsumer sentiment. Rent growthisexpected topersistintheleasingmarket,thoughata slowingrate.Correspondingly, moderate growthincapitalvaluesis projected fortheinvestment market,aligningwithmodest rent increases,ascapratesareexpected toholdsteady.

Note:FinancialindicatorsarefortheprimeretailmarketsofGinzaandOmotesando, whileretailsalesgrowthfiguresareforTokyoPrefecture.DataisonanNLAbasis.

• Demand from3PLsandonline retailerscontinues toexpand.

• Overallvacancy remainsunchanged at10.3%.

• Rent growthtrend continues.

Demand pushednetabsorption to332,000sqminQ22025.Thiswas down 43%q-o-q, primarilyduetoreduced supply.Astransportcosts rise,demand isstrongforproperties closetothecity centre with shorttransportation distances,whileproperties infringeareaswith highertransportcostsarestrugglingtofind favour

Newsupplytotalled 358,000sqminQ22025,increasing totalstockby 1.5%q-o-q. Fourfacilitiesentered themarket.Allfourarelocated in theTokyoInlandarea,withtwolocatedintheKen-OExpresswayarea. ThevacancyrateinGreaterTokyo was10.3%forQ22025,unchanged q-o-q andup64bpsy-o-y. ThevacancyrateintheBayAreafellto 8.4%,adecrease of18bpsq-o-q, whileinTokyo Inlanditremained unchanged at11.0%.

GrossrentsinGreaterTokyo averaged JPY4,704pertsubopermonth inQ2,up0.6%q-o-q andup1.4%y-o-y. Risingconstruction costsare pushinguprentsfornewlysupplied properties, whichinturnis

pushinguprentsforexistingproperties. CapitalvaluesinGreater Tokyo rose0.4%q-o-q and1.1%y-o-yinQ22025,reflecting rent increases.Notablesalestransactionsincluded theportfolio acquired byFortressInvestment GroupandsoldbyGLPJ-REIT.

Asdemand continues togrow andconstruction costsrise,rentsare expected togrow, especiallyforproperties inareaswithgood access.However, given thehighervacancy ratesandincreasesin transportation costs,rentsareunder downward pressureinfringe areas.Interestratesareexpected torisefurther.Nevertheless,thereis stronginvestment demand frombothcore investors, suchas insurancecompanies, andvalue-addinvestors, andinvestment yields areexpected toremainstable.Capitalvaluesofproperties ingood locationsareexpected torise,coupled withgrowing rents.

Note:TokyologisticsreferstotheGreaterTokyoprimelogisticsmarket.Dataisonan NLAbasis.

Historicalsupplyanddemandtrends

(thousands)

• Vacancyrateincreasesduetomultiplenew projects

• Areaexpansion duetoproperty supplyinnewlocations

• Existingproperties havefewvacanciesandrentscontinue torise

In2Q25,strongdemand andsubstantialnew supplyresultedinanet absorptionof236,000sqm.Demand camefromvarioussectors, includinge-commerce companies, 3PLproviders andretailers.In GreaterOsaka,thedifference indemand basedonlocation wasnot considered assignificantasinGreaterTokyo.

Therewasanewsupplyof366,000sqmacrossfourbuildings, bringing thetotalareainstockto7,724,000sqm, a5.0%increaseq-oq.Whilevacanciesinexistingproperties wereabsorbed, newsupply increased theoverallvacantspace. Theoverallvacancy ratein GreaterOsakaroseto4.9%,up152bpsq-o-q and259bpsy-o-y.

GrossrentinGreaterOsakawasJPY4,206,up0.5%q-o-q and2.1%yo-y. Despitenewsupplyinexpanded areascoming inatbelowaveragerents, theoverallaverage increased duetorentgrowthin existingproperties.

Withstableinvestment yieldsandrisingrents,logisticsfacilityprices (perunitarea)inGreaterOsakacontinue totrend upward.

Intheleasingmarket,multiplenew supplyadditions areexpected in thesecond halfof2025,butmanypre-leasing agreements have alreadybeenconcluded, suggestinghighoccupancy ratesupon completion. Thevacancyrateisexpected todecline towardstheend of2025.

Risingconstruction costscontinue todrive rentincreasesfornewly builtproperties. Existingproperties arealsoexpected toseerent increases,pulledupbynew supplyproperties. Whilethereare concerns abouttenants'abilitytobearhigherrents,continued rent growthisexpected acrossGreaterOsakaduetogrowing ecommerce-related demand andthelackofvacancies inexisting properties.

Note:OsakalogisticsreferstotheGreaterOsakaprimelogisticsmarket.Dataisonan NLAbasis.

• Nonewsupplyandstrongdemand pushvacancy rateslower

• Highoccupancy inexistingproperties andhigh-costnew developments driverentsupward

• Newsupplyexpected in2026–2027couldincreasevacancy risks

Steady demand continued, withnetabsorptionreaching26,000sqm in2Q25.

In2Q25,therewasnonew supply,andtotalstockstood at1,608,000 sqm,representing a12.0%increase y-o-y. Thevacancyratein GreaterFukuokafellto3.1%,down 160bpsq-o-q and31bpsy-o-y, as well-located inland areasabsorbedremaining vacancies.

GrossrentinGreaterFukuokawasJPY3,551pertsubopermonth, up 0.2%q-o-q and3.2%y-o-y. Rents fornewly constructed facilities remainelevated, andrenewalsatexistingproperties haveseenrental increase, withsomecasesupbyaround10%.

Reflecting stableinvestment yieldsandrisingrents,capitalvaluesfor logisticsfacilitiesinGreaterFukuokacontinue torise. Investor interestremains strong, butinvestment opportunities are extremely limited.

Inthesecond halfof2025,e-commerce andfood logisticsdemand areexpected toremainstrong, keeping themarkettight. Giventhelimited availabilityofvacantspace,pre-leasing ofnew projects islikelytocontinue, maintaining thelowvacancy ratesinthe near-term. However, new supplyin2026–2027,particularlyinthe Tosuarea,isexpected toexceed 2024levels,whichmayleadto highervacancy rates.

Rentsarelikelytocontinue increasing, supported bystrongdemand andrisingconstruction costs.Newdevelopments areexpected to retainaggressiverentlevels,reflecting highcosts,whileexisting facilitiesarealsoexpected toseerentincreases.

Capitalvaluesareforecasttocontinue risinginlinewithrent growth.

Note:FukuokalogisticsreferstotheGreaterFukuokaprimelogisticsmarket.Datais onanNLAbasis.

• Growthcontinues, driven byrobustinbound tourismdemand.

• Threeluxuryhotelssettoopen inTokyo inthelatterhalfof2025.

• Continued record highperformance.

Inthefirsthalfof2025,thenumberofforeign visitorstoJapan reached 21,518,100,markinga21.0%Y-o-Y increase.According tothe JapanNationalTourismOrganization, inQ12025,thetotalnumber of overnight staysinTokyo increased by5.4%Y-o-Y. Thenumber of foreign overnight guestscontinues toreachrecord highsevery month, whilethenumber ofJapanese guestsistrending downward.

Therewere noopenings ofnew international branded hotelsinQ2 2025.International brandsarestilleagertoopen newhotelsinTokyo. Thesecond halfof2025willseeawaveofluxuryandupscalehotel openings. Fairmont, JWMarriott,1HotelandCaptionbyHyattareall settodebut.

InQ2,Tokyo's hotelsectordemonstrated continued growthacrossall segments intermsoftradingperformance. Theongoing increasein inbound visitorshasdriven asustainedriseinADR,whileoccupancy

hasalsoshownsteadyrecovery. Theluxuryandupperupscale segments continued toshowstrongimprovements compared tothe sameperiod in2024.AsofYTDJune, bothADRandoccupancy increased Y-o-Y. Consequently, RevPAR sawasubstantialgrowthfrom thesametimelastyear.However, occupancy stilllaggedbehind Q2 2019.

Althoughstrongperformance trends continued throughQ22025, escalatinggeopolitical risksandgrowing globalinstabilitycreated uncertainty. Itwillbecrucialtocloselymonitor theimpact ofthese factorsontheperformance ofthesecond halfof2025.Inthefirsthalf of2025,exchange ratefluctuationshadno impactonactualhotel performance. Ontheotherhand, department storerevenues fellY-oYforfiveconsecutive months fromFebruary2025,indicating a change inthecomposition ofconsumer spending byforeign visitors toJapan.

Note:TokyoHotelsrefertoTokyo'soverallhotelmarket. Source:JLL,industrysources,STR

• CASBEE-REexpands rapidlyinmulti-familysector.

• Wellness certificationgrowthisslowing.

• Green-certified largeofficebuildingshareincreasesslightlyinTokyo.

• TheJapaneseversion ofSustainabilityMarketDynamics featuresrenewable energy certificatesandcarbon credits.

LEED: Seventeen projects acquired certification in 2Q25, bringing the total number of certified projects since 2009 to 332, representing a5.4%q-o-q.

CASBEE-BD: Twenty-six projects acquired certification in 2Q25, however, the total number of CASBEE-BD-certified projects decreased by0.4%q-o-q to524.

CASBEE-RE: Certification was acquired by 193 projects in 2Q25, predominantly in the multi-family sector, increasing the total numberofCASBEE-RE-certified projects by79%q-o-q to2,568

WELL: One project acquired certification in 2Q25, raising the total numberofWELL-certifiedprojects by1.7%q-o-q to61.

Fitwel: No projects acquired certification in 2Q25, leaving the total number of Fitwel-certified projects unchanged at five for the fifth consecutive quarter

CASBEE-WO: Ten projects acquired certification in 2Q25, including one recertification, increasing the total number of CASBEE-WOcertified projects by 29% q-o-q to 179, indicating a slight recovery ingrowth. rate

Tokyo:Theshareofgreen-certifiedlarge officebuildings increased by2pts q-o-qto68%in2Q25, whiletheshare ofwellness-certified buildingsremained unchanged at6%

Osaka: The share of green-certified large office buildings in 2Q25 remained stable at 45%, while the share of wellness-certified buildingsdecreased by1ptq-o-q to9%

Fukuoka: The share of green-certified large office buildings decreased by 1 pt to 29% in 2Q25, while the share of wellnesscertified buildingsremained unchanged at9%.

Under the global target of tripling renewable energy generation capacity and doubling energy efficiency improvement rates by 2030, regulations on renewable energy certificates and carbon credits are becoming increasingly stringent both domestically and internationally In decarbonizing real estate, companies should not rely excessively on certificates and credits, but rather prioritize implementing steady energy conservation measures to achieve more substantialgreenhouse gasemissionreductions.

Note:LEED,WELLandFitwelrefertoallratings.CASBEE-BD,CASBEE-REand CASBEEWOrefertoB+andabove.

Source:JLL,USGBC,IBECs,IWBI,Fitwel

Historicalvalidgreencertificationbycertifiedyear

Tokyo Headquarters

KioiTower, Tokyo Garden Terrace Kioicho

1-3Kioi-cho Chiyoda-ku, Tokyo 102-0094

+81343611800

Fukuoka

FukuokaDaimyoGardenCity

2-6-50Daimyo, Chuo-ku,Fukuoka-shi

Fukuoka810-0041

+81922336801

Kansai

Nippon Life

Yodoyabashi Building

3-5-29KitahamaChuo-ku, Osaka541-0041

+81676628400

Nagoya

JPTowerNagoya

1-1-1Meieki, Nakamura-ku,Nagoya-shi

Aichi450-6321

+81528563357

JLL’s research teamdelivers intelligence, analysisand insight through marketleading reports and services that illuminatetoday’scommercialrealestatedynamicsandidentifytomorrow’schallengesandopportunities Our more than 550 global research professionals track and analyze economic and property trends and forecast future conditions in over 60 countries, producing unrivalled local and global perspectives Our research and expertise, fueled by real-time information and innovative thinking around the world, creates a competitive advantageforourclientsanddrivessuccessfulstrategiesandoptimalrealestatedecisions

For over 200 years, JLL (NYSE: JLL), a leading global commercial real estate and investment management company,hashelpedclientsbuy,build,occupy,manageandinvestinavarietyofcommercial,industrial,hotel, residential and retail properties A Fortune 500® company with annual revenue of $234 billion and operations in over 80 countriesaroundthe world, our more than 112,000 employees bring the power of a global platform combined with local expertise Driven by our purpose to shape the future of real estate for a better world, we help our clients, people and communities SEE A BRIGHTER WAYSM JLL is the brand name, and a registered trademark,ofJonesLangLaSalleIncorporated Forfurtherinformation,visitjllcom

This reporthasbeenpreparedsolelyforinformationpurposesanddoesnotnecessarilypurporttobeacompleteanalysisof thetopicsdiscussed, whichareinherentlyunpredictable.Ithasbeenbasedonsourceswebelieve tobereliable,butwe havenotindependentlyverified thosesourcesandwedonotguaranteethattheinformationinthereportisaccurateor complete.Anyviewsexpressed inthereportreflectourjudgmentatthis dateandaresubject tochangewithoutnotice. Statementsthatareforward-lookinginvolveknownandunknownrisks anduncertaintiesthatmaycausefuturerealitiesto bemateriallydifferentfromthoseimpliedbysuchforward-lookingstatements.Advice wegivetoclientsinparticular situationsmaydifferfromtheviews expressedinthisreport.Noinvestmentorotherbusinessdecisionsshouldbemade basedsolelyontheviewsexpressedinthisreport.