FukuokaOffice MarketSummary

Robust demand decrease vacancy rate despite large supply

Economy

TheMarchTankanSurveyforKyushuand Okinawaregionshowedthatbusiness sentimentdroppedto7pointsfrom17forlarge manufacturersandto32pointsfrom36forlarge non-manufacturers.

DemandandSupply

Netabsorptiontotalled+23,000sqmin1Q24. Therewasaseriesofpositiveactivityby companiesforbusinessexpansion,including relocationsexpansioninthesamebuildings, andconsolidationoflocationsthroughbuilding upgrades.

Onenewprojectenteredthemarketin1Q24, namelyConnectSquareHakata.The12-storey buildinghasaGFAof21,000sqm,withoffice spaceonthe2nd-3rdfloorsoccupiedbythe Hakataregionalofficetaxationdivisionandon 4th-12thforgeneraltenants.

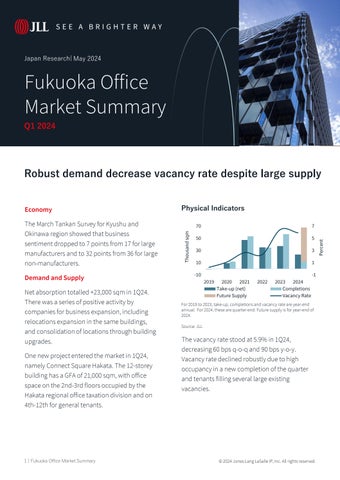

Physical Indicators

(net) Completions FutureSupply VacancyRate

For2019 to2023,take-up,completionsandvacancyrateareyear-end annual. For2024,thesearequarter-end.Futuresupplyis foryear-endof 2024.

Source:JLL

Thevacancyratestoodat5.9%in1Q24, decreasing60bpsq-o-qand90bpsy-o-y. Vacancyratedeclinedrobustlyduetohigh occupancyinanewcompletionofthequarter andtenantsfillingseverallargeexisting vacancies.

Investorspositivelycontinuetoseekopportunities

AssetPerformance

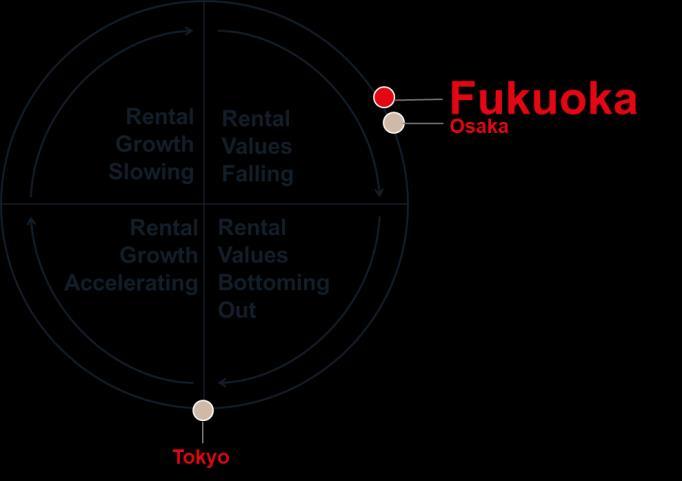

AveragemonthlygrossrentpertsubowasJPY 20,049pertsubopermonthattheendof1Q24, increasing0.4%q-o-qand1.0%y-o-y.The upwardwasduetosomelandlordsofexisting buildingwithfewervacanciesraising,aswellas anewcompletionwithabovethemarket average.

Capitalvaluesincreased1.1%q-o-qand0.7% y-o-yin1Q24,reflectingtherentalincreases. Caprateswereflat.

InvestmentMarket

Theofficeinvestmentvolume inFukuokaPrefecturein1Q24was JPY33.5billion,anincreaseof37.5%y-o-y. TherewerenotransactionsforGradeAoffice buildingsduringthequarter.

Outlook

AccordingtotheOxfordEconomicsforecastin March,realGDPinFukuokaCityisexpectedto growby1.0%in2024and0.6%in2025. Downsideriskstodomesticdemandinclude risesofrawmaterialpricesandlabour shortages.

Intherentalmarket,althoughdemandfor locationimprovementsandupgradesbasedon businessexpansionislikelytocontinue, projectednewsuppliesfortheendoftheyear areexpectedtobecompletedwithlarge vacanciesasrentsareneartheupperendof themarket.Withlooseningsupply-demand balance,landlordswiththebuildingsofupper rentrangearelikelytolowerrents.

Intheinvestmentmarket,althoughinvestors areseekingopportunitiestoacquire competitiveassets,therewillbelimited transactionsduetofewsellingassets.

KeyPerformanceIndicators Occupationalmarket

Source:JLL,Q12024

jll.com

JonesLangLaSalleK.K.

Tokyo Headquarters KioiTower, Tokyo Garden Terrace Kioicho 1-3Kioi-cho Chiyoda-ku, Tokyo 102-0094 +81343611800

FukuokaOffice

DaihakataBldg. 2-20-1Hakata-ekimae, Hakata-ku,Fukuoka-shi Fukuoka812-0011 +81922336801

OsakaOffice Nippon Life

Yodoyabashi Building 3-5-29KitahamaChuo-ku, Osaka541-0041 +81676628400

NagoyaOffice

JPTowerNagoya 1-1-1Meieki, Nakamura-ku,Nagoya-shi

Aichi450-6321 +81528563357

Contact

TakeshiAkagi HeadofResearch Research -Japan takeshi.akagi@jll.com

TakeshiYamaguchi ResearchDirector Research -Japan takeshi.yamaguchi@jll.com

YukiMatsumoto Manager Research -Japan yuki.matsumoto@jll.com

About JLL

For over 200 years, JLL (NYSE: JLL), a leading global commercial real estate and investment management company, has helped clients buy, build, occupy, manage and invest in a variety of commercial, industrial, hotel, residential and retail properties. A Fortune 500® company with annual revenue of $20.8 billion and operations in over 80 countries around the world, our more than 108,000 employees bring the power of a global platform combined with local expertise. Driven by our purpose to shape the future of real estate for a better world, we help our clients, people and communities SEE A BRIGHTER WAYSM. JLL is the brand name, and a registered trademark, of Jones Lang LaSalle Incorporated. For further information,visit jll.com

AboutJLLResearch

JLL’sresearchteamdeliversintelligence,analysisandinsightthrough marketleadingreportsandservicesthatilluminatetoday’scommercialreal estatedynamicsandidentifytomorrow’schallengesandopportunities.Our morethan550globalresearchprofessionalstrackandanalyzeeconomicand propertytrendsandforecastfutureconditionsinover60countries, producingunrivalledlocalandglobalperspectives.Ourresearchand expertise,fueledbyreal-timeinformationandinnovativethinkingaroundthe world,createsacompetitiveadvantageforourclientsanddrivessuccessful strategiesandoptimalrealestatedecisions.