• Strong relocation demand coming fromvarioussectorsdrivesrobustnetabsorption

• Despiterisingoccupancy innew buildings,vacancyratesreachthe8%range, reflecting spaceavailabilityinmajornewsupply

• Rents continue agradualupwardtrend, driven bynew supplyandselectexistingbuildingsacrossthemarket

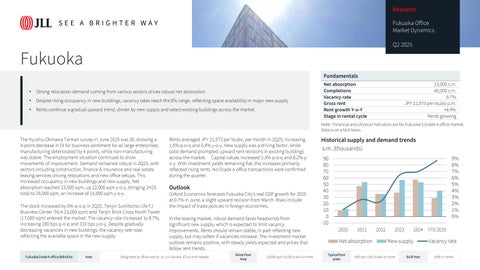

TheKyushu-OkinawaTankansurveyinJune2025was30,showinga 4-pointdecrease inDIforbusinesssentiment foralllargeenterprises; manufacturing deteriorated by4points, whilenon-manufacturing wasstable.Theemployment situationcontinued toshow movements ofimprovement. Demand remained robustin2Q25,with sectorsincluding construction, finance &insuranceandrealestate leasingservicesdrivingrelocations andnew officesetups.This increased occupancy innew buildingsandnewsupply. Net absorptionreached 23,000sqm, up22,000sqmy-o-y, bringing 1H25 totalto29,000sqm,anincreaseof14,000sqmy-o-y.

Thestockincreasedby8%q-o-q in2Q25.Tenjin Sumitomo LifeFJ BusinessCenter (NLA23,000sqm)andTenjin BrickCrossNorthTower (17,000sqm)entered themarket.Thevacancyrateincreased to8.7%, increasing280bpsq-o-q and310bpsy-o-y. Despitegradually decreasing vacancies innew buildings,thevacancyraterose, reflecting theavailablespaceinthenewsupply.

Rentsaveraged JPY21,573pertsubo,permonth in2Q25,increasing 1.5%q-o-q and6.9%y-o-y. Newsupplywasadriving factor,while soliddemand prompted upwardrentrevisionsinexistingbuildings acrossthemarket. Capitalvaluesincreased2.3%q-o-q and8.2%yo-y. Withinvestment yieldsremaining flat,theincreasesprimarily reflected risingrents.NoGradeAofficetransactionswereconfirmed duringthequarter.

Oxford Economics forecastsFukuokaCity’srealGDPgrowthfor2025 at0.7%inJune, aslightupwardrevisionfrom March.Risksinclude theimpactoftradepoliciesinforeign economies.

Intheleasingmarket,robustdemand facesheadwindsfrom significantnew supply,whichisexpected tolimitvacancy improvements. Rents shouldremain stable,inpartreflecting new supply,butmaysoftenifvacanciesincrease. Theinvestment market outlookremainspositive, withsteadyyieldsexpected andpricesthat followrenttrends.

Note: FinancialandphysicalindicatorsareforFukuoka’sGradeAofficemarket. DataisonaNLAbasis.

supplyanddemandtrends

FukuokaOffice MarketDynamics Q22025

Tokyo Headquarters

KioiTower, Tokyo Garden TerraceKioicho

1-3Kioi-cho Chiyoda-ku, Tokyo 102-0094

+81343611800

Kansai

Nippon Life

Yodoyabashi Building

3-5-29KitahamaChuo-ku, Osaka541-0041

+81676628400

Fukuoka

FukuokaDaimyoGardenCity 2-6-50Daimyo, Chuo-ku,Fukuoka-shi

Fukuoka810-0041

+81922336801

Nagoya

JPTowerNagoya 1-1-1Meieki, Nakamura-ku,Nagoya-shi

Aichi450-6321

+81528563357

Formoreinformation,pleasecontact

YutoOhigashi

Senior Director

Research-Japan

yuto.ohigashi@jll.com

COPYRIGHT ©JONESLANGLASALLEIP,INC.2025

Thisreporthasbeenpreparedsolelyforinformationpurposesanddoesnotnecessarilypurporttobeacompleteanalysisofthetopicsdiscussed,whichareinherentlyunpredictable. It has been based on sources we believe to be reliable, but we have not independently verified those sources and we do not guarantee that the information in the report is accurate or complete. Any views expressed in the report reflect our judgment at this date and are subject to change without notice. Statements that are forward-looking involve known and unknown risks and uncertainties that may cause future realities to be materially different from those implied by such forward-looking statements Advice we give to clients in particularsituationsmaydifferfromtheviewsexpressed inthisreport. Noinvestment orotherbusinessdecisions shouldbemade basedsolelyontheviewsexpressed inthisreport.