Japan Research|

May 2024

May 2024

2024

isstrongandthereisnosenseofexcesssupply, andtherearelowvacancies.

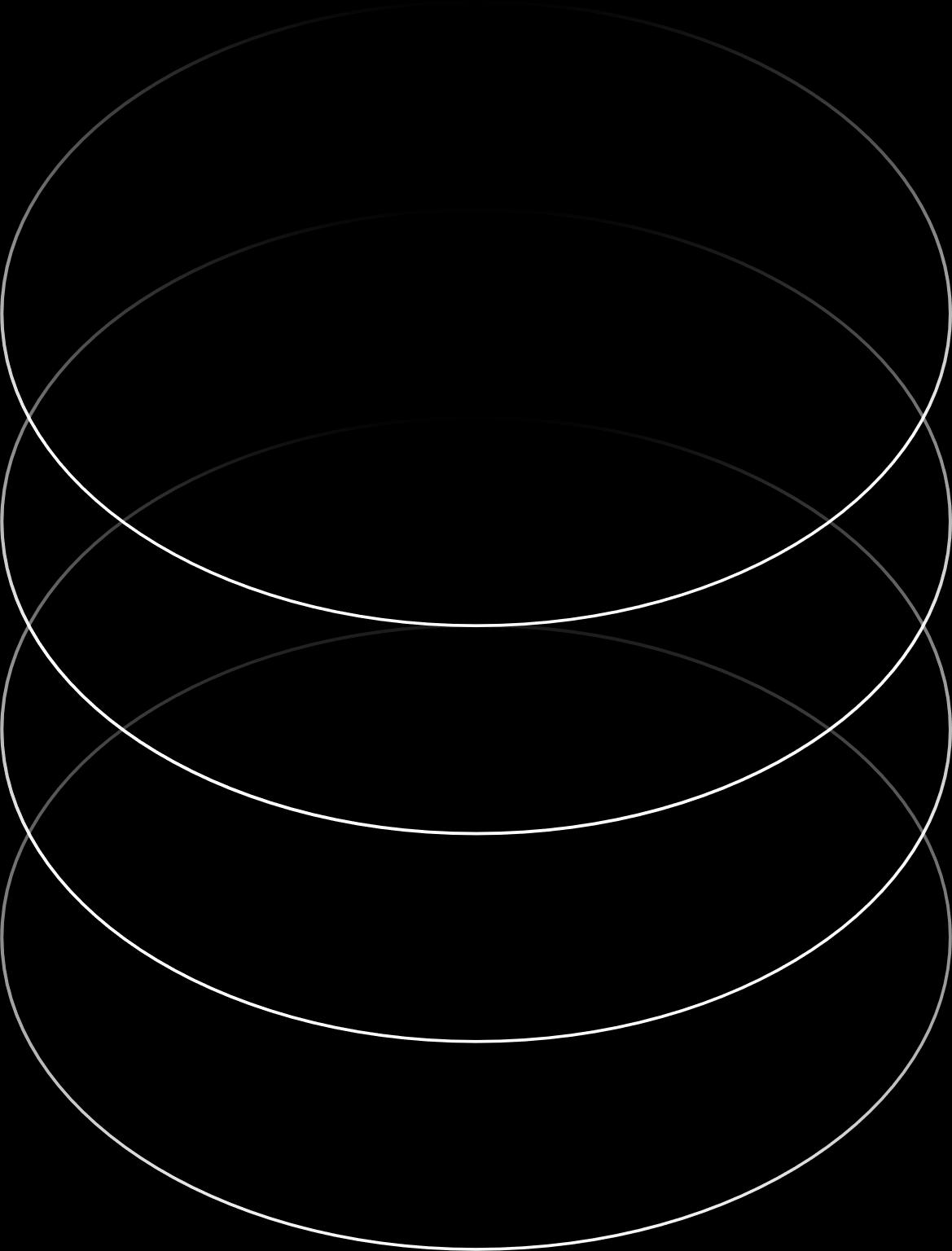

DemandandSupply

Demandremainedstrongin1Q24,withnet absorptionof167,000sqm,drivenbydemand forexistingpropertiesandnewcompletions.

Newsupply ofonefacilitytotalled132,000 sqmin1Q24,increasingthestock(total leasablearea)by10%q-o-qto1,410,000sqm.

Thevacancyratestoodat5.5%atend-1Q24, decreasing330bpsq-o-qandincreasing330 bpsy-o-y.

Physicalindicators

For2019to 2023, take-up, completionsandvacancy rate are year-end annual.Future supply reflects figures for2024.

Source: JLL

AssetPerformance

RentsaveragedJPY3,441pertsuboper monthatend-1Q24,increasing2.7%q-o-q and4.1%y-o-y.Thehigh-level rentsofnew completionscontinuedtodrivetherentsof existingpropertiesandcontinuedtopushup overallrents.

InvestmentMarket

CapitalvaluesinGreaterFukuoka continued toincrease,reflectingcapratecompression andstablerentgrowth.

Althoughlarge-scalenewcompletionswere supplied, pre-commitmentratewashigh upon completionandthevacancyratedeclined.The numberofvacantpropertiesislimited,and manyexisting propertiescontinuetohavehigh occupancy.Therecontinuestobeasituation wheretherearealmostnopropertiesavailable fortenantstochoosefrom.

Constructioncostscontinuetorise,anditis expectedthatpropertiescompleteinthefuture will havehigher rentscomparedto surroundingproperties.Newcompletions continuetohavehigh pre-commitmentrate uponcompletion,andoverallrentsare expectedtocontinuetorise.

Althoughtherearefewactualtransactions, investors'interestishigh, partlyduetothe influenceofKumamoto,which attracts attentionofsemiconductorfactories.Itis expectedthatcaprateswill continueto compressbasedonyieldsinGreaterTokyoand GreaterOsaka.

FinancialIndices

GlobalProperty Clock

Source: JLL

Source: JLL USpositions relateto the overall market

TokyoHeadquarters KioiTower, Tokyo GardenTerraceKioicho

1-3Kioi-choChiyoda-ku, Tokyo 102-0094

+81343611800

FukuokaOffice

DaihakataBldg.

2-20-1Hakata-ekimae, Hakata-ku,Fukuoka-shi Fukuoka812-0011

+81922336801

OsakaOffice NipponLife

YodoyabashiBuilding

3-5-29KitahamaChuo-ku, Osaka541-0041

+81676628400

NagoyaOffice

JPTowerNagoya 1-1-1Meieki, Nakamura-ku,Nagoya-shi

Aichi450-6321

+81528563357

Contact

TakeshiAkagi HeadofResearch Research-Japan takeshi.akagi@jll.com

ManabuTaniguchi SeniorDirector Research-Japan manabu.taniguchi@jll.com

TakeshiYamaguchi ResearchDirector

JLLJapanOsakaOffice takeshi yamaguchi@jll.com

EdwardLiang Manager Research-Japan edwardl.liang@jll.com

About JLL

For over 200 years, JLL (NYSE: JLL), a leading global commercial real estate and investment management company, has helped clients buy, build, occupy, manage and invest in a variety of commercial, industrial, hotel, residential and retail properties A Fortune 500® company with annual revenue of $208 billion and operations in over 80 countries around the world, our more than 108,000 employees bring the power of a global platform combined with local expertise Driven by our purpose to shape the future of real estate for a better world, we help our clients, people and communities SEE A BRIGHTER WAYSM JLL is the brand name, and a registered trademark, of Jones Lang LaSalle Incorporated For further information,visit jll com

About JLL Research

JLL’s research teamdeliversintelligence,analysisandinsightthrough marketleadingreportsandservicesthatilluminatetoday’scommercialreal estatedynamicsandidentifytomorrow’schallengesandopportunities.Our morethan 550globalresearch professionalstrackandanalyzeeconomicand propertytrendsandforecastfuture conditionsinover60countries, producingunrivalledlocalandglobalperspectives.Ourresearch and expertise,fueledbyreal-timeinformationandinnovativethinkingaroundthe world,createsacompetitiveadvantageforourclientsanddrivessuccessful strategiesandoptimalrealestatedecisions.