New highs for capital values and rents.

Remarkably solid longer-term outlook.

NEW

Space and efficiency in whatever style you prefer.

New highs for capital values and rents.

Remarkably solid longer-term outlook.

NEW

Space and efficiency in whatever style you prefer.

Sales volumes are above average and country house prices are expected to continue to grow. Given current economic concerns, how is this so?

At the time of writing, the OECD expects 2023 GDP and consumer spending to remain at, or fractionally above, 2022 levels. Alongside, the likes of Hometrack, EY and others are making similarly unexciting predictions for average house prices: they will probably rise next year, but not by much. Having endured a summer of dire economic warnings, such flat forecasts look positively benign. For owners in the middle and upper country house markets, our data is encouraging and the outlook for them, looks more positive still. This is especially so when taking into account the new stamp duty cut for first time buyers, which will help to underpin the market. So where is it all going right?

Towards the end of the holiday season, our Exeter office had so many registered would-be buyers, they decided to make a team effort to physically speak to as many of them as possible, to confirm that they were indeed still looking. Overwhelmingly, the response they got was, ‘Yes, we are’. Many had missed out on several properties. Just as many again felt that they’d not found anywhere because so little had come

to market. This was a sentiment with which our director at Exeter, Richard Addington, had much sympathy:

“It felt like that to me, because we were always short of stock. Only when I looked back was I reminded that sales volumes have been remarkably high, all year. It’s just that everything sold so quickly, we never had much on the shelf.”

The picture is similar across the country. Such uniformity is very much a post-lockdown phenomenon. Historically, the nature of the infamous ripple effect was that demand was always strong in some places and weak in others. Yet our offices, from Kent to Cornwall, Norfolk to North Yorkshire and the Lancashire coast, have experienced a highly competitive market, simultaneously.

It is true that average times to exchange have increased, though this simply reflects a more normal market in which a higher proportion of sales involve a chain. Also true, is that the property portal websites are reporting an increase in the number of price cuts. However, in the middle and upper areas of the market in which we operate, it’s

Right: Cornwall £1,500,000 guide (Truro)

"Sales volumes have been remarkably high, all year. It’s just that everything sold so quickly, we never had much on the shelf."

clear that the only cuts are to prices that were clearly unrealistic in the first place. In the absence of rapid price growth to bail you out, this is inevitable: in property sales, it’s much easier to go up from a sensible price, than to come down from a silly one. It’s all about generating competition. Finally, whilst Land Registry figures indicate

that sales volumes further down the market are a little below pre-pandemic levels, our volumes are well up. Some of this is due to increased market share, but that does not account for it all, by any means. So what is insulating our clients and buyers, from the tougher economic conditions? Essentially, it comes down to money, though the Work From Home phenomenon has played a role, too

A high proportion of Jackson-Stops buyers are moving from town to country, selling one house they own, to buy another. Often, they don’t need a mortgage. And when they do, the loanto-value ratio tends to be low, so they get the best rates (this is true even amongst the young families buying). Thus mortgage rates have less impact on affordability and demand, whilst also making other cost of living increases, more affordable. This is also why higher interest rates are unlikely to increase supply: unmortgaged country house owners are less vulnerable to the hardship which forces people to sell. Buyers do ask about fuel costs, usually in conjunction with checking out the potential for installing renewable energy sources. With money now, you can save much more money, over time.

Working from home has been a factor in the even distribution of demand. The extent varies

according to location, but the majority of those buying through us (who have not retired) now intend to work at least partly from home. This is putting previously inaccessible areas within reach of commuters, insulating sellers from normal fluctuations in demand. Indeed, whilst the WFH/office balance will take years to find its long-term norm, the effect on the prosperity and social life of our small market towns and of the villages around them, has begun. We believe it will grow in significance and be permanent, particularly if additional first time buyers can afford to buy in more rural areas. Demand and volumes in the middle and upper residential market thus remain remarkably strong, with price growth likely to exceed that of lower market levels, for the foreseeable future.

Surrey

Anglesey £1,700,000 guide (Chester)

Opposite page, top: Surrey £5,500 pcm (Oxted)

Bottom: Kent £2,850 pcm. Re-let for in excess of this asking rent, achieving an increase of 27% on the previous rental (Tunbridge Wells).

The price gap between rents agreed for new tenancies and those for renewals, is unusually high and demand far exceeds supply. Why don’t more landlords tell existing tenants to pay in full, or leave?

The HomeLet Index of new tenancy agreements puts UK average rental inflation for the 12 months to the end of July, at 9.5%. The ONS Rental Index of Private Housing Prices, which tracks only renewals, reports average UK rental increases of just 3%, for almost the same period. The true picture varies greatly from region to region but, without exception, there is an unusually large price gap at the moment between rents agreed for new lets, and on renewal.

Despite this, most landlords are reluctant to tell an existing tenant to ‘Match the market or leave’. When they ask us if they should, we consider four basic points. The quality of the current tenant, what a new one might pay and what costs will be involved, are simple enough. Harder, is judging what the market will be like, when you get vacant possession.

Contradicting the Rachmanite stereotype, even when the net financial gain is both substantial and near-certain, the great majority of our landlord clients choose not to push out good tenants

(and most are good) via demands for rents they cannot pay. In part, this is commercially sensible: landlords recognise the value of having reliable people looking after their asset. Good, long-term tenants bring extra value and will agree a fair extra rent. But it’s also because they are human: many landlords know and like their tenants and want to see them prosper. They are not greedy.

Of course, if you are renting and know that you are a ‘problem tenant’, the position is rather different. Your landlord will need to make a judgement about what the market will be like when you have to leave (usually two months). This introduces some uncertainty, but he or she will know that the overall stock of private rental properties is falling and that, right now, new lets are rarely on the market for more than a day or two. With big gains being achieved in some instances (see below), upping the rent could get rid of a problem tenant and secure a windfall. If you are that tenant, it might be time to dig out the suitcases – or turn over a new leaf.

A small selection of some of the more eye-catching country houses that we have sold over recent months.

£3,195,000

£2,800,000

Opposite

£3,500,000 guide (Woking)

West Sussex

£3,400,000 guide (Midhurst)

Gloucestershire

£1,100,000 guide (Chipping Campden)

Surrey £2,950,000 guide (Dorking)

With buyers and tenants returning in force, demand to live in London is reaching new highs.

After what has been an exceptionally busy 12 months, it is exciting to see just how well the market has continued to perform. Confidence in our great city is strong and our network of London offices are experiencing the same level of heightened activity in Greater London as we are in prime central London. However, supply is struggling to meet the appetite of buyers and tenants, as we experience the busiest period we have seen since 2014.

Pent-up demand is coming from both UK and international buyers. With price growth having tripled in the last 20 years, it is predicted that values will continue to rise over the next decade, so buyers remain motivated to make long-term purchases. Mortgage rates remain

historically low compared to previous decades and for those who do not require borrowing, the London economy is globally regarded as a safe investment.

This has already translated into some impressive sales this year, Tim Firth, Sales Director of Weybridge explains, “We recently sold a detached, five bedroom house on St Georges Avenue. Our hard work resulted in achieving multiple offers within the first week of marketing. In a busy market, we have to act promptly for our clients.”

For super prime property, sellers at the very top end of the market are also feeling optimistic. Jackson-Stops Pimlico was recently entrusted

with the sale of the original family home of Thomas Cubitt, renowned for building parts of the Grosvenor Estate and Royal residences. Warwick Lodge on St George’s Drive has come to the market with a guide price of £10,000,000. Harry Buchanan, Pimlico Sales Director says, “This historically significant property has received interest from a range of buyers, all looking for a central location with plenty of outdoor space”.

Super prime tenants are also looking for a stake in the capital with a noticeable resurgence in relocators returning in vast numbers.

Our Corporate Lettings and International Relocation team have been especially busy

and provide excellent tenants, working alongside blue-chip companies, embassies and individuals from around the world, many of whom chose to work exclusively with JacksonStops.

“We worked with our in-house team finding a corporate tenant for a stucco-fronted villa on Holland Park within 24-hours of the property coming back on to the market,” explains Lettings Director Susannah Massey. “We achieved over the asking price of £14,000 per month by pulling all of our resources together to ensure a positive outcome.”

Our tenants and landlords are supported by

our Property Management team, who are never more than 15 minutes away to ensure a rapid response, should an issue arise. With regular changes in legislation, more and more of our landlords are now opting for our fully managed service. Our proactive approach prevents rent arrears, maintains a better relationship with the tenant, and helps them to look after the property.

We know we work most effectively when we work together, which is why our national network of offices is so vital to our success. Whether you are looking for a pied-à-terre in the city, or a second home in the country, we are

sure to help. This partnership recently resulted in a successful sale when the Chichester office contacted the Pimlico office regarding their seller in Suffolk, with a property to sell in Chelsea. “We had a specific buyer who wanted to live in that particular development in Chelsea and we were able to piece together a seamless transaction, which the seller was extremely impressed with,” explains Harry. Our clients understand that London property remains a brilliant investment and we are here to support them throughout their property journey. Regardless of the ever-changing economic climate, London remains a great place to live and we look forward to an exciting year ahead.

Above: Longcross Road, KT16 £1,600,000 (Weybridge)

Left: Old Deer Park, TW9 £37,500 pcm (Richmond) Opposite page, top and far right: Norfolk £1,500,000 guide (Norwich) Opposite page, bottom left: West Sussex £2,750,000 guide (Mid Sussex)

Above: Longcross Road, KT16 £1,600,000 (Weybridge)

Left: Old Deer Park, TW9 £37,500 pcm (Richmond) Opposite page, top and far right: Norfolk £1,500,000 guide (Norwich) Opposite page, bottom left: West Sussex £2,750,000 guide (Mid Sussex)

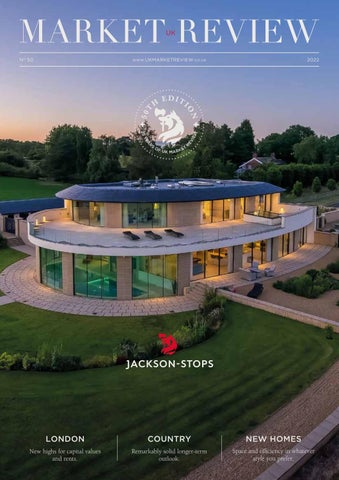

Twenty five years since this publication began, both it and Jackson-Stops have more than doubled in size. But have the period country houses on offer changed? Yes: many are so smart as to match the best in London for glamour – with a country look.

A quarter of a century is no time at all in relation to the age of many of the country houses we sell; barely time for a good rug to show wear, or for a fruit tree to mature. Yet a high proportion have changed more in the last 25 years than the previous hundred, as interior and exterior spaces have been exploited and spruced up with ever-greater verve. What has driven this push for the palatial? Dawn Carritt, Head of the Country Houses office in London throughout this time, sees a convergence of incentives:

“Across all areas, lower mortgage rates plus higher stamp duty (1997 saw the the first of many increases) persuaded owners to improve, not move, going into roof spaces, side passageways and more. At the same time, new lighting and doorway technologies made it possible to create attractive indoor/outdoor spaces, complete with serious outdoor kitchens.

A growing band of TV shows (Grand Designs started in 1999) sparked a taste for drama (and endless bathrooms) whilst the pub smoking ban (2007) opened smoke-free eyes to how outdoor spaces could be transformed and used for much of the year. As expectations climbed higher, so did the desire for the kind of ‘dream country cottage’ creations beloved of users of Airbnb (2008) and those smartening up, to sell (still tax free, on your main home).”

Dawn added that the Covid lockdowns piled on yet more pressure to make the most of whatever space you have. The result is quality and drama as never before. And the next 25 years? Interiors may need more quiet offices, and gardens more spaces to escape the sun, not bask in it. Regardless, Jackson-Stops and perhaps even this publication, will still be here to help with your property interests.

Techniques and technologies have reached the point at which new home buyers can, at a price, enjoy large spaces with small running costs and modern conveniences with whichever style of architecture they prefer.

The Dorset house shown on the previous page was built not in the early 1800s, but in 2022. An authentic Regency design by Peter Thompson Architects of Wimborne, its walls are of hand made brick and knapped flint, under a typical shallow pitched slate roof with wide eaves. The period theme is continued inside where tall hardwood sash windows let light into beautiful reception areas with 11 foot high ceilings. Yet those same walls meet the highest standards of insulation and the shallow roofs have integral solar panels. The interiors have Cat 6 ethernet connections and a sophisticated ventilation heat recovery system with dual air source heat pumps. The large garage has high speed electric car charging points and there is a 10m x 4m electrically heated indoor swimming pool. Yet with an A class energy rating of 93/100, this 6,000 square foot house uses less electricity than an average semi. All houses can be built to this standard. Over time, they are less expensive to own than less efficient ones.

For almost a decade, Help to Buy has been central to the strategy of UK volume house builders, involving up to 48% of their annual sales (National Audit Office, 2018). Introduced in 2013, the end date for new Help to Buy

applications – 31st October 2022 – thus marks the close of a major era for Barratt, Persimmon et al. The market effects of this are hard to predict, but the impact on the businesses which have relied upon the scheme is likely to be significant. Over 355,000 purchases have been made using it, with the total of government loans now exceeding £22 billion.

Further down the volume scale, any effect of the ending of Help to Buy, should be slight. Most smaller house builders, build bigger houses. They are not aimed at the first time buyers who accounted for over 80% of Help to Buy purchasers. These developers are also much more led by customer demand, than government policy, in relation to both style and standards. New building materials such as beams made of glass or ultra-thin aluminium, windows which minimise solar gain as well as heat loss, and technologies such as underfloor heating, have led to an unprecedented variety

Above: Cheshire £2,200,000 guide (Alderley Edge)

Below left: Northamptonshire £825,000 guide (Northampton)

Below right: Suffolk £525,000 guide (Ipswich)

in the architectural options on offer and everhigher building standards. Such new homes are exciting and enjoyably practical places to live.

In a bid to raise minimum standards, new regulations came into force in June 2022 which the Department for Levelling Up, Housing & Communities say ‘mark an important step on our journey towards a cleaner, greener built environment and it supports us in our target to reduce the UK’s carbon emissions to net-zero by 2050’. Key changes include:

• New homes will need to produce at least 31% lower carbon emissions.

• New insulation standards for walls, windows and doors.

• Heating systems must have a maximum flow temperature of 55°C.

• Glazing limits to reduce solar gain.

• Preparatory work for future installation of an electric vehicle charging point.

These sound impressive, but some of the house builders for whom we act have stressed that they were already building to higher overall standards, as exemplified by the Dorset house and others featured here. Central to this is scepticism about how the 31% lower carbon emissions are calculated. The London Energy Transformation Initiative says that the real reductions achieved are likely to be 10% at best.

The new regulations are an interim measure ahead of a new Future Homes Standard being introduced in 2025. This will require new homes to be capable of being net zero in terms of operational carbon when the grid decarbonises (i.e. is free of electricity generated using fossil fuels). The government target date for grid decarbonisation, is 2035.

All lenders are very busy right now. Any problems they have relate to coping with demand, not attracting it. With less pressure to compete on interest rates, their margins will have improved. At the same time, feedback from the interest rate swaps market (which allows lenders to fix the cost of their money for a fixed period) suggests that the base rate will peak in 2023. If so, lenders will be in a position to absorb additional increases in the coming months – though will only do so if they need to get more competitive.

Mortgage offers come with an expiry date: you must take up the offer within a set period. Until around a decade ago, this was normally three months. That shifted to six months partly in response to purchases taking longer, but mainly because interest rates were so stable. Now, to avoid being caught out by unanticipated changes, more lenders are reverting to three months, usually renewable for another three –but with an option to review the rate. Best to check, before you apply.

We have seen a string of lenders enter the 5.5 x income market. The most recent is Accord, who require household earnings of at least £70,000 and a maximum 90% loan to value. In theory, this means that, if you earn £70,000 pa, you could borrow £385,000 on a £427,000 property. In practice, the eligibility criteria for all such loans are so tight, that only those free of other debts and major outgoings, qualify. For the lenders, this is attractive, low risk business.

For independent advice, contact Private Finance on 0870 600 1650 or jackson-stops@privatefinance.co.uk.

Horatio Clare's essays are published in The FT, Daily Telegraph and Condé Nast Traveller, where he is a Contributing Editor. Horatio's BBC radio work includes

‘From Our Own Correspondent’ and annual Christmas Sound Walks. His books include 'Running for the Hills', which won the Somerset Maugham Award, and 'Down to the Sea in Ships', which won the Stanford Dolman Travel Book of the Year. His book for children, 'Aubrey and the Terrible Yoot', won the Branford Boase Award for best debut children’s book.

"I remember your father" said John Webb. Webb’s of Crickhowell, a pretty town in the Black Mountains of Wales, sells everything a home needs. It has done since my father first shopped there in 1971. "He bought an axe and a sledge hammer. I could see he was serious. He was the first." Now, John says, Londoners with second homes in our part of South Wales come to him for many precious things.

‘A man bought a set of garden furniture, asked if I delivered, and ordered an identical set for his place in the Bahamas.’ Second homes remain contentious in Wales, but although my parents meant our house on the mountain to be theirs, Mum fell in love with sheep farming, and out of love with Dad.

Crickhowell are home in a fundamental sense, home is also hotels and places which thump in the heart on first sight. Aberdaron. Algiers. Makoua, a village in Congo-Brazzaville. Marseille. Palermo, where I lived, and Verona, where our son was born.

SINCE 1910

He returned to London. She raised us on the hill. With our home-made haircuts (we saved money on hairdressers) and English accents (we were born in Hammersmith) my brother and I were immigrants who stood out at school. It took years to work out that because home was a mountain farm in Wales, I must be Welsh. I became a travel writer, falling in love with the world professionally. So although our hill and the rumpled treasury of valleys around

‘What are you doing?’ asked the Hull customs officer. I was driving an old Italian Fiat, overloaded. ‘Moving from Verona to Hebden Bridge,’ I said. ‘Why?’ he asked. ‘For the weather,’ I said. ‘You’d better come in,’ he grinned. Actually it was for extended-family reasons, and so for the last nine years this Yorkshire town has been home. I retain my southern accent and my name, which make me feel less at home in the North than almost anywhere. But watching our son grow and shape himself here, among Hebden’s children and their families, has shown me how a deep home is made. Hebden has welcomed us, as it does all comers. In Wales Mum still has the axe and the hammer. One day I hope to move back there, take them up, and put my labour into a home for future generations. The farm is Elizabethan. It should grow families for centuries yet.