4 minute read

CONTRADICTING THE STEREOTYPE

The price gap between rents agreed for new tenancies and those for renewals, is unusually high and demand far exceeds supply. Why don’t more landlords tell existing tenants to pay in full, or leave?

The HomeLet Index of new tenancy agreements puts UK average rental inflation for the 12 months to the end of July, at 9.5%. The ONS Rental Index of Private Housing Prices, which tracks only renewals, reports average UK rental increases of just 3%, for almost the same period. The true picture varies greatly from region to region but, without exception, there is an unusually large price gap at the moment between rents agreed for new lets, and on renewal.

Despite this, most landlords are reluctant to tell an existing tenant to ‘Match the market or leave’. When they ask us if they should, we consider four basic points. The quality of the current tenant, what a new one might pay and what costs will be involved, are simple enough. Harder, is judging what the market will be like, when you get vacant possession. Contradicting the Rachmanite stereotype, even when the net financial gain is both substantial and near-certain, the great majority of our landlord clients choose not to push out good tenants

(and most are good) via demands for rents they cannot pay. In part, this is commercially sensible: landlords recognise the value of having reliable people looking after their asset. Good, long-term tenants bring extra value and will agree a fair extra rent. But it’s also because they are human: many landlords know and like their tenants and want to see them prosper. They are not greedy.

Of course, if you are renting and know that you are a ‘problem tenant’, the position is rather different. Your landlord will need to make a judgement about what the market will be like when you have to leave (usually two months). This introduces some uncertainty, but he or she will know that the overall stock of private rental properties is falling and that, right now, new lets are rarely on the market for more than a day or two. With big gains being achieved in some instances (see below), upping the rent could get rid of a problem tenant and secure a windfall. If you are that tenant, it might be time to dig out the suitcases – or turn over a new leaf.

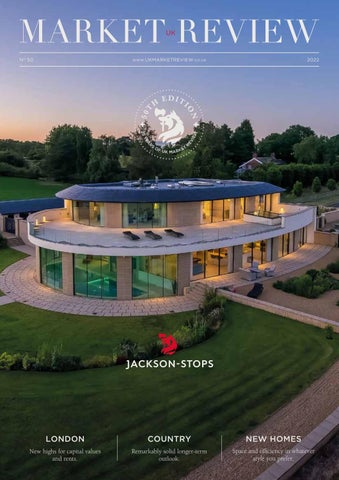

A small selection of some of the more eye-catching country houses that we have sold over recent months.

Above: Essex £3,195,000 guide (Chelmsford)

Right: Cheshire £2,800,000 guide (Alderley Edge)

Opposite page, clockwise from the top: Surrey £3,500,000 guide (Woking)

West Sussex £3,400,000 guide (Midhurst)

Gloucestershire

£1,100,000 guide (Chipping Campden)

Surrey £2,950,000 guide (Dorking)

London Market Comment

With buyers and tenants returning in force, demand to live in London is reaching new highs.

After what has been an exceptionally busy 12 months, it is exciting to see just how well the market has continued to perform. Confidence in our great city is strong and our network of London offices are experiencing the same level of heightened activity in Greater London as we are in prime central London. However, supply is struggling to meet the appetite of buyers and tenants, as we experience the busiest period we have seen since 2014.

Surge In Demand

Pent-up demand is coming from both UK and international buyers. With price growth having tripled in the last 20 years, it is predicted that values will continue to rise over the next decade, so buyers remain motivated to make long-term purchases. Mortgage rates remain historically low compared to previous decades and for those who do not require borrowing, the London economy is globally regarded as a safe investment.

This has already translated into some impressive sales this year, Tim Firth, Sales Director of Weybridge explains, “We recently sold a detached, five bedroom house on St Georges Avenue. Our hard work resulted in achieving multiple offers within the first week of marketing. In a busy market, we have to act promptly for our clients.”

Super Prime

For super prime property, sellers at the very top end of the market are also feeling optimistic. Jackson-Stops Pimlico was recently entrusted

Below: Chertsey Road, TW11 £2,995,000 (Weybridge)

Right: Holland Park, W11 £14,083 pcm (Holland Park)

Below left: Victoria Road, TW11 £1,675,000 (Teddington)

Below right: Warwick Square, SW1V £2,650,000 (Pimlico) with the sale of the original family home of Thomas Cubitt, renowned for building parts of the Grosvenor Estate and Royal residences. Warwick Lodge on St George’s Drive has come to the market with a guide price of £10,000,000. Harry Buchanan, Pimlico Sales Director says, “This historically significant property has received interest from a range of buyers, all looking for a central location with plenty of outdoor space”.

Super prime tenants are also looking for a stake in the capital with a noticeable resurgence in relocators returning in vast numbers.

Our Corporate Lettings and International Relocation team have been especially busy and provide excellent tenants, working alongside blue-chip companies, embassies and individuals from around the world, many of whom chose to work exclusively with JacksonStops.

“We worked with our in-house team finding a corporate tenant for a stucco-fronted villa on Holland Park within 24-hours of the property coming back on to the market,” explains Lettings Director Susannah Massey. “We achieved over the asking price of £14,000 per month by pulling all of our resources together to ensure a positive outcome.”

Our tenants and landlords are supported by our Property Management team, who are never more than 15 minutes away to ensure a rapid response, should an issue arise. With regular changes in legislation, more and more of our landlords are now opting for our fully managed service. Our proactive approach prevents rent arrears, maintains a better relationship with the tenant, and helps them to look after the property.

Country Connections

We know we work most effectively when we work together, which is why our national network of offices is so vital to our success. Whether you are looking for a pied-à-terre in the city, or a second home in the country, we are sure to help. This partnership recently resulted in a successful sale when the Chichester office contacted the Pimlico office regarding their seller in Suffolk, with a property to sell in Chelsea. “We had a specific buyer who wanted to live in that particular development in Chelsea and we were able to piece together a seamless transaction, which the seller was extremely impressed with,” explains Harry.

Our clients understand that London property remains a brilliant investment and we are here to support them throughout their property journey. Regardless of the ever-changing economic climate, London remains a great place to live and we look forward to an exciting year ahead.