4 minute read

HAVING IT ALL

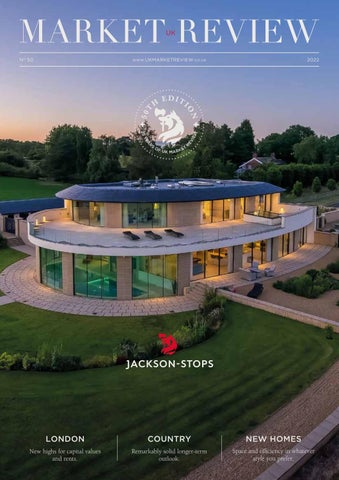

Techniques and technologies have reached the point at which new home buyers can, at a price, enjoy large spaces with small running costs and modern conveniences with whichever style of architecture they prefer.

The Dorset house shown on the previous page was built not in the early 1800s, but in 2022. An authentic Regency design by Peter Thompson Architects of Wimborne, its walls are of hand made brick and knapped flint, under a typical shallow pitched slate roof with wide eaves. The period theme is continued inside where tall hardwood sash windows let light into beautiful reception areas with 11 foot high ceilings. Yet those same walls meet the highest standards of insulation and the shallow roofs have integral solar panels. The interiors have Cat 6 ethernet connections and a sophisticated ventilation heat recovery system with dual air source heat pumps. The large garage has high speed electric car charging points and there is a 10m x 4m electrically heated indoor swimming pool. Yet with an A class energy rating of 93/100, this 6,000 square foot house uses less electricity than an average semi. All houses can be built to this standard. Over time, they are less expensive to own than less efficient ones.

End Of Help To Buy

For almost a decade, Help to Buy has been central to the strategy of UK volume house builders, involving up to 48% of their annual sales (National Audit Office, 2018). Introduced in 2013, the end date for new Help to Buy

RELAX ABOUT RATES (A LITTLE)

each (Chichester) applications – 31st October 2022 – thus marks the close of a major era for Barratt, Persimmon et al. The market effects of this are hard to predict, but the impact on the businesses which have relied upon the scheme is likely to be significant. Over 355,000 purchases have been made using it, with the total of government loans now exceeding £22 billion.

Building To A Higher Standard

Further down the volume scale, any effect of the ending of Help to Buy, should be slight. Most smaller house builders, build bigger houses. They are not aimed at the first time buyers who accounted for over 80% of Help to Buy purchasers. These developers are also much more led by customer demand, than government policy, in relation to both style and standards. New building materials such as beams made of glass or ultra-thin aluminium, windows which minimise solar gain as well as heat loss, and technologies such as underfloor heating, have led to an unprecedented variety

Above:

Below left: in the architectural options on offer and everhigher building standards. Such new homes are exciting and enjoyably practical places to live.

In a bid to raise minimum standards, new regulations came into force in June 2022 which the Department for Levelling Up, Housing & Communities say ‘mark an important step on our journey towards a cleaner, greener built environment and it supports us in our target to reduce the UK’s carbon emissions to net-zero by 2050’. Key changes include:

• New homes will need to produce at least 31% lower carbon emissions.

All lenders are very busy right now. Any problems they have relate to coping with demand, not attracting it. With less pressure to compete on interest rates, their margins will have improved. At the same time, feedback from the interest rate swaps market (which allows lenders to fix the cost of their money for a fixed period) suggests that the base rate will peak in 2023. If so, lenders will be in a position to absorb additional increases in the coming months – though will only do so if they need to get more competitive.

Check The Offer Length

Below right:

• New insulation standards for walls, windows and doors.

• Heating systems must have a maximum flow temperature of 55°C.

• Glazing limits to reduce solar gain.

• Preparatory work for future installation of an electric vehicle charging point.

These sound impressive, but some of the house builders for whom we act have stressed that they were already building to higher overall standards, as exemplified by the Dorset house and others featured here. Central to this is scepticism about how the 31% lower carbon emissions are calculated. The London Energy Transformation Initiative says that the real reductions achieved are likely to be 10% at best.

The new regulations are an interim measure ahead of a new Future Homes Standard being introduced in 2025. This will require new homes to be capable of being net zero in terms of operational carbon when the grid decarbonises (i.e. is free of electricity generated using fossil fuels). The government target date for grid decarbonisation, is 2035.

Mortgage offers come with an expiry date: you must take up the offer within a set period. Until around a decade ago, this was normally three months. That shifted to six months partly in response to purchases taking longer, but mainly because interest rates were so stable. Now, to avoid being caught out by unanticipated changes, more lenders are reverting to three months, usually renewable for another three –but with an option to review the rate. Best to check, before you apply.

High Multiples For Some

We have seen a string of lenders enter the 5.5 x income market. The most recent is Accord, who require household earnings of at least £70,000 and a maximum 90% loan to value. In theory, this means that, if you earn £70,000 pa, you could borrow £385,000 on a £427,000 property. In practice, the eligibility criteria for all such loans are so tight, that only those free of other debts and major outgoings, qualify. For the lenders, this is attractive, low risk business.

For independent advice, contact Private Finance on 0870 600 1650 or jackson-stops@privatefinance.co.uk.