LUXURY MARKET REPORT & FORECAST

Western North Carolina | Q2 2025

The Western North Carolina region closed the second quarter of 2025 with a mixture of resilience and recalibration Despite some year-over-year declines in the luxury and ultra-luxury brackets, the underlying strength of Western North Carolina’s housing economy remains intact

Asheville (City, North)

Downtown Asheville Condos Buncombe County Arden

Biltmore Forest

Henderson County Haywood Fairview/Fletcher Foothills

Looking ahead to the third quarter, the Western North Carolina region remains well-positioned to benefit from seasonal strength and recovering national interest

From market forecasts, interviews, and house marketing ideas, join the team at Ivester Jackson Blackstream I Christie's for the latest in Carolina’s luxury real estate content

The Western North Carolina region closed the second quarter of 2025 with a mixture of resilience and recalibration. As the area continues to recover from the lingering impacts of Hurricane Helene, sustainable tourism numbers and a renewed national spotlight have buoyed consumer interest and reinforced long-term confidence in the market. Elevated mortgage rates are still creating friction in the middle tiers, but lifestyle-driven demand continues to power transactions, particularly in neighborhoods and communities that offer charm, convenience, or seclusion. Despite some year-over-year declines in the luxury and ultra-luxury brackets, the underlying strength of Western North Carolina’s housing economy remains intact.

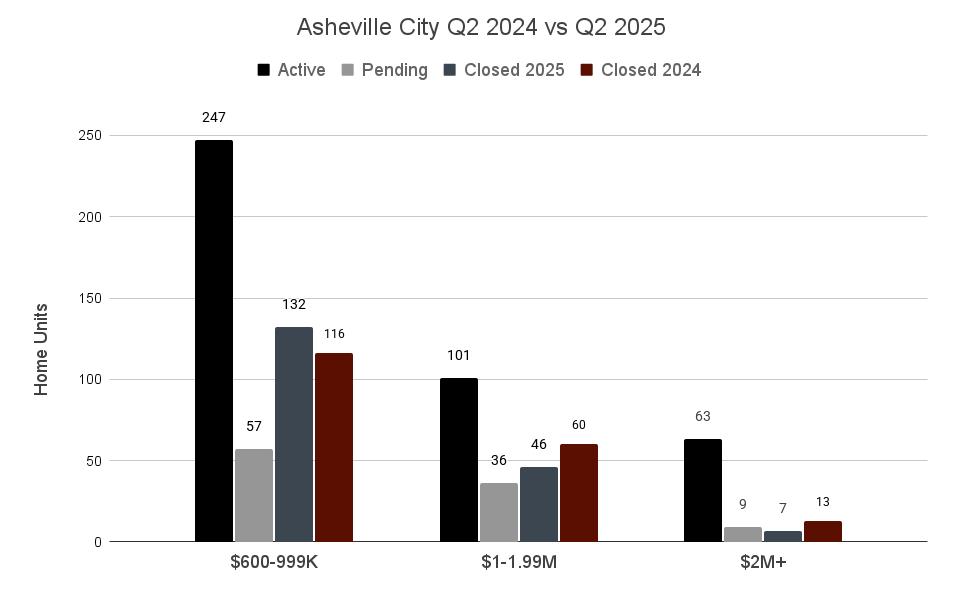

The city of Asheville posted a strong quarter in the mid-market segment $600K–$999K, with 132 closed sales compared to 116 in the second quarter of 2024 The luxury market $1M-$1 99M cooled slightly, with 46 closings, down from 60 the year prior While ultraluxury $2M+ closings dipped from 13 to seven, a high number of homes under contract at quarter’s end points to renewed interest from affluent buyers Asheville’s enduring cultural appeal and national recognition as a lifestyle destination continue to anchor long-term demand

North Asheville experienced a cooler quarter overall, with year-over-year declines across all three monitored price brackets Mid-market closings dropped from 52 to 37, and the luxury tier saw 13 closings compared to 19 last year The ultraluxury segment remained flat with two $2M+ sales in both the second quarter of 2024 and 2025 Despite the slower pace, the area ’ s historic character, proximity to downtown, and treelined residential appeal continue to draw steady buyer interest

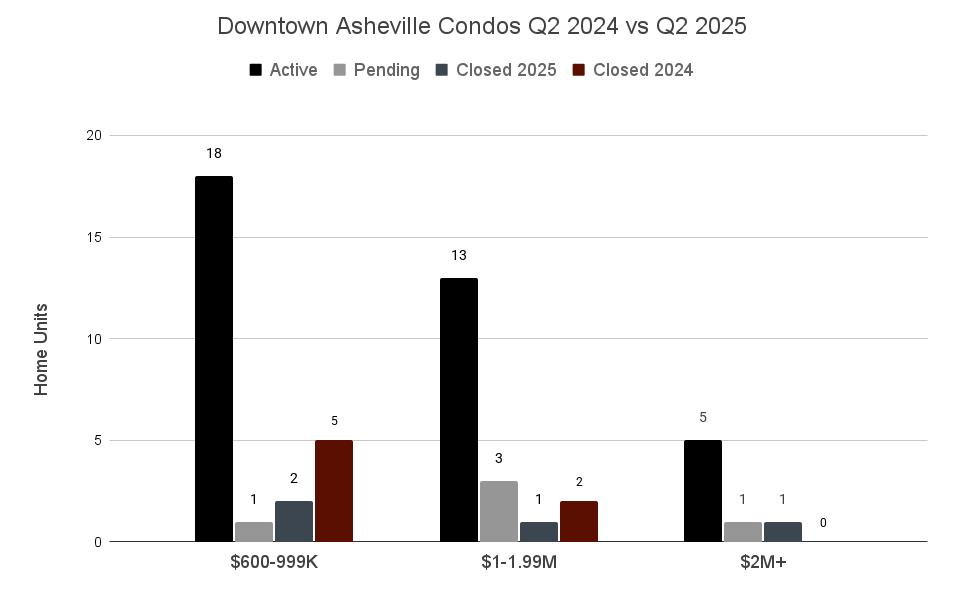

Downtown Asheville’s condo market remained relatively quiet this quarter, reflecting both limited new inventory and tempered demand in the current rate environment The mid-market tier saw just two sales, down from five last year, while the luxury segment recorded a single closing The $2M+ category posted a closing downtown, signaling continued confidence in long-term value As travel and tourism rebound, downtown’s desirability is expected to slowly regain momentum heading into the third and fourth quarters

Across greater Buncombe County, the market delivered steady mid-market performance, though activity in the $2M+ tiers declined from a robust second quarter in 2024 There were 235 closed sales in the $600K–$999K range, down slightly from the prior year, and 73 sales in the $1M–$1 99M range, compared to 103 last year Ultra-luxury transactions fell from 26 to 13, with a corresponding rise in available inventory While pricing may need to adjust in some segments, the region’s blend of convenience, nature, and quality of life keeps it on buyers’ radars

Biltmore Forest recorded a balanced and active quarter, especially given its small footprint. Four homes sold in the $2M+ category, up from three last year, alongside movement in both the mid and luxury tiers. The area remains a top choice for buyers seeking prestige, privacy, and architectural character. With limited inventory, well-positioned properties in Biltmore Forest are likely to remain competitive heading into the late summer and fall

Arden’s mid-market and luxury segments saw modest growth year-over-year, with 21 and 4 closings, respectively In contrast, the ultra-luxury tier experienced a dip, with just 3 sales this quarter compared to 8 during the same period last year he community’s schools, shopping, and accessibility continue to drive local demand

As interest in suburban living endures, Arden remains well-positioned for renewed activity in the back half of the year.

Fairview and Fletcher posted mixed results, with the mid-market segment recording 20 closed sales, down from 32 a year ago The $1M–$1 99M range remained stable, with 11 sales versus 12 in the second quarter of 2024, while the ultra-luxury market softened from four closings to just one. Demand remains steady in this corridor thanks to its blend of rural charm and easy access to Asheville and Hendersonville Limited pending activity may suggest a slower third quarter ahead, unless new inventory emerges

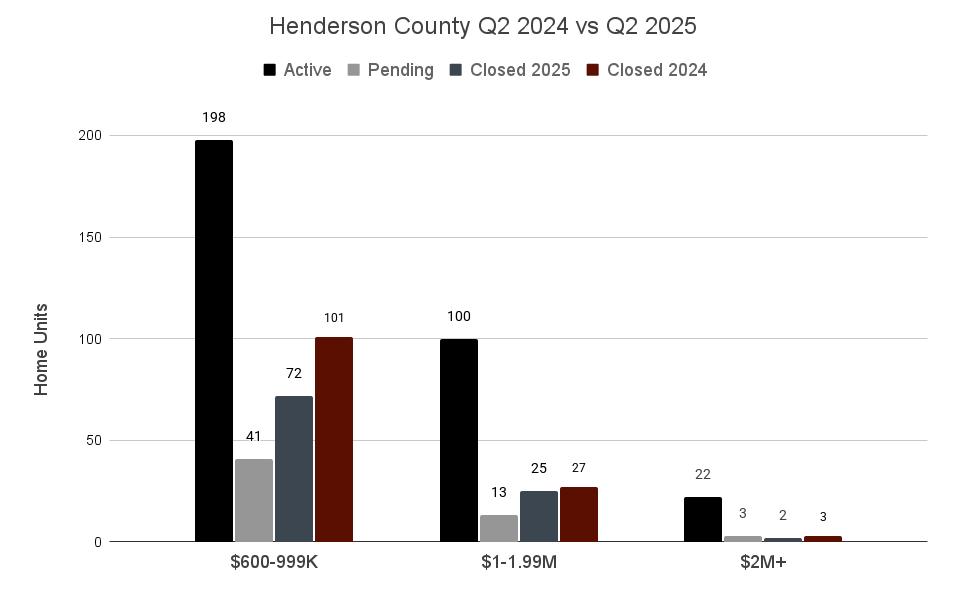

While the mid-market experienced a dip in closed transactions, the overall market remains consistent, particularly in the higher price points The luxury and ultra-luxury segments remained fairly steady with 25 and 2 closings, respectively Meanwhile, the mid-market range, saw a decline in activity with 72 sales, down from 101 in the second quarter of 2024. The area continues to appeal to retirees, second-home buyers, and families drawn to its small-town character and proximity to nature. With strong fundamentals in place, demand is expected to remain stable as we head into the late summer and fall

Haywood County experienced a moderate slowdown in the $600K–$999K segment, with 29 closed sales, down from 45 in the second quarter of last year The luxury tier experienced slight growth with seven closings versus five in the second quarter of 2024, while the ultra-luxury segment closed out the quarter with a single closing The region’s mix of mountain views, small-town charm, and recreational access continues to make it attractive to lifestyle buyers. With inventory remaining moderate, well-priced homes are still drawing interest.

The Foothills region had a quieter second quarter, particularly in the upper price ranges Mid-market closings fell to 29 from 39 a year ago, while the luxury and ultraluxury categories posted just one sale each Although the pace has slowed, the area remains attractive to buyers seeking value and privacy, along with close larger cities such as Greenville and Charlotte The coming months will test pricing flexibility, especially in the high-end inventory that has lingered on the market

Looking ahead to the third quarter, the Western North Carolina region remains well-positioned to benefit from seasonal strength and recovering national interest While elevated mortgage rates continue to moderate demand in certain price segments, lifestyle buyers, particularly those in the $2M+ bracket, are showing renewed confidence, as evidenced by rising pending activity. The area ’ s recovery from Hurricane Helene, combined with an uptick in tourism and continued inbound migration, should bolster momentum across key neighborhoods. As inventory builds and consumer expectations reset, sellers who respond to market conditions with realistic pricing and quality presentation are likely to find success through the rest of 2025

Asheville Office - Ivester Jackson Blackstream

18 S Pack Square

Asheville, NC 28801

828-367-9001

Highlands-Cashiers

210 North Fifth Street

Highlands, NC 28741

828-482-5022

Wilmington Office - IJ Coastal

527 Causeway Drive

Wrightsville Beach, NC 28480

910-300-5140

Charlotte Office

1515 Mockingbird Lane Suite 900

Charlotte, NC 28209

704-817-9826

Lake Norman Office

21025 Catawba Ave #101

Cornelius, NC 28031

704- 655-0586

Lake Norman North Shore Office

350 Morrison Plantation Parkway, Suite C1

Mooresville, NC 28117

980-435-5169